MANAGEMENT'S DISCUSSION AND ANALYSIS

This Management's Discussion and Analysis (MD&A) dated February 27, 2020 is provided to enable readers to assess the results of operations, liquidity and capital resources of AltaGas Ltd. (AltaGas or the Corporation) as at and for the year ended December 31, 2019. This MD&A should be read in conjunction with the accompanying audited Consolidated Financial Statements and notes thereto of AltaGas as at and for the year ended December 31, 2019.

The Consolidated Financial Statements and comparative information have been prepared in accordance with United States (U.S.) generally accepted accounting principles (U.S. GAAP) and in Canadian dollars, unless otherwise indicated. Throughout this MD&A, references to GAAP refer to U.S. GAAP and dollars refer to Canadian dollars, unless otherwise indicated.

Abbreviations, acronyms and capitalized terms used in this MD&A without express definition shall have the same meanings given to those terms in the MD&A as at and for the year ended December 31, 2019 or the Annual Information Form for the year ended December 31, 2019.

This MD&A contains forward-looking information (forward-looking statements). Words such as "may", "can", "would", "could", "should", "will", "intend", "plan", "anticipate", "believe", "aim", "seek", "propose", "contemplate", "estimate", "focus", "strive", "forecast", "expect", "project", "target", "potential", "objective", "continue", "outlook", "vision", "opportunity" and similar expressions suggesting future events or future performance, as they relate to the Corporation or any affiliate of the Corporation, are intended to identify forward-looking statements. In particular, this MD&A contains forward-looking statements with respect to, among other things, business objectives, expected growth, results of operations, performance, business projects and opportunities and financial results. Specifically, such forward-looking statements included in this document include, but are not limited to, statements with respect to the following: expectation that RIPET will be a catalyst for further growth in the Midstream business; expectation that the Townsend 2B expansion, North Pine expansion and the northeast BC pipeline projects will be completed in early 2020; expiration of the Northwest Hydro operating agreement in January 2021; conditions to and timing of the closing of the ACI Arrangement; expected cost savings related to the repayment of debt with proceeds of the December 2019 note offering; funding of the Petrogas put obligations; retirement of Daryl Gilbert from the Board of Directors; AltaGas' strategy for each of its core businesses; plan to focus on capitalization of significant growth potential of the Midstream and Utilities assets; plan to maximize structural advantage of the integrated platform in the Montney region; plan to increase utilization and export volumes at RIPET; expectation that volumes at RIPET will exceed 50,000 Bbls/d by the end of 2020; planned $900 million growth capital program; targeted 10 percent increase in the Utilities rate base; expected annual consolidated normalized EBITDA of approximately $1.275 to $1.325 billion in 2020; normalize earnings per share of approximately $1.20 to $1.30 per share in 2020; expected growth, EBITDA contributions and drivers behind each of the Midstream, Utilities and Power businesses; expectation that overall growth will more than offset lost EBITDA from a full year impact of asset sales completed in 2019; estimated exposure to frac spreads and the propane price differentials; expectation that the majority of the annual capacity of RIPET will be underpinned by tolling arrangements over the next several years; allocation of $900 million capital expenditures among and expected focus of spending within the Utilities, Midstream and Power businesses; expected sources of funding for the committed capital program; the estimated cost, status and expected in-service dates for grown capital projects in the Midstream and Utilities businesses; expected filing, procedure and decision dates for rate cases in the Utilities business; future changes in accounting policies and adoption of new accounting standards; and AltaGas’ long term strategy. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results, events and achievements to differ materially from those expressed or implied by such statements. Such statements reflect AltaGas’ current expectations, estimates, and projections based on certain material factors and assumptions at the time the statement was made. Material assumptions include: assumptions regarding asset sales anticipated to close in 2020, effective tax rate of approximately 22 percent, propane price differentials, degree day variance from normal, the U.S/Canadian dollar exchange rate, financing initiatives, the performance of the businesses underlying each sector; impacts of the hedging program; commodity prices; weather; frac spread; access to capital; timing and receipt of regulatory approvals; timing of regulatory approvals related to Utilities projects; seasonality; planned and unplanned plant outages; timing of in-service dates of new projects and acquisition and divestiture activities; taxes; operational expenses; returns on investments; dividend levels; and transaction costs.

AltaGas Ltd. – 2019 MD&A and Financial Statements - 1

AltaGas’ forward-looking statements are subject to certain risks and uncertainties which could cause results or events to differ from current expectations, including, without limitation: health and safety risks; operating risks; infrastructure risks; service interruptions; regulatory risks; litigation risk; decommissioning, abandonment and reclamation costs; climate and carbon tax risks; reputation risk; weather data; Indigenous land and rights claims; crown duty to consult with Indigenous peoples; changes in laws; capital market and liquidity risks; general economic conditions; internal credit risk; foreign exchange risk; debt financing, refinancing, and debt service risk; interest rates; cyber security, information, and control systems; technical systems and processes incidents; dependence on certain partners; growth strategy risk; construction and development; RIPET rail and marine transport; impact of competition in AltaGas' Midstream and Power businesses; commitments associated with regulatory approvals for the acquisition of WGL; counterparty credit risk; composition risk; collateral; regulatory agreements; non-controlling interests in investments; delays in U.S. federal government budget appropriations; consumption risk; market risk; market value of common shares and other securities; variability of dividends; potential sales of additional shares; volume throughput; natural gas supply risk; risk management costs and limitations; underinsured and uninsured losses; Cook Inlet gas supply; securities class action suits and derivative suits; electricity and resource adequacy prices; cost of providing retirement plan benefits; labor relations; key personnel; failure of service providers; compliance with Section 404(a) of Sarbanes-Oxley Act; integration of WGL; and the other factors discussed under the heading "Risk Factors" in the Corporation’s Annual Information Form for the year ended December 31, 2019 (AIF) and set out in AltaGas’ other continuous disclosure documents.

Many factors could cause AltaGas' or any particular business segment's actual results, performance or achievements to vary from those described in this MD&A, including, without limitation, those listed above and the assumptions upon which they are based proving incorrect. These factors should not be construed as exhaustive. Should one or more of these risks or uncertainties materialize, or should assumptions underlying forward-looking statements prove incorrect, actual results may vary materially from those described in this MD&A as intended, planned, anticipated, believed, sought, proposed, estimated, forecasted, expected, projected or targeted and such forward-looking statements included in this MD&A, should not be unduly relied upon. The impact of any one assumption, risk, uncertainty, or other factor on a particular forward-looking statement cannot be determined with certainty because they are interdependent and AltaGas’ future decisions and actions will depend on management’s assessment of all information at the relevant time. Such statements speak only as of the date of this MD&A. AltaGas does not intend, and does not assume any obligation, to update these forward-looking statements except as required by law. The forward-looking statements contained in this MD&A are expressly qualified by these cautionary statements.

Financial outlook information contained in this MD&A about prospective financial performance, financial position, or cash flows is based on assumptions about future events, including economic conditions and proposed courses of action, based on AltaGas management's (Management) assessment of the relevant information currently available. Readers are cautioned that such financial outlook information contained in this MD&A should not be used for purposes other than for which it is disclosed herein.

Additional information relating to AltaGas, including its quarterly and annual MD&A and Consolidated Financial Statements, Annual Information Form, and press releases are available through AltaGas' website at www.altagas.ca or through SEDAR at www.sedar.com.

AltaGas Organization

The businesses of AltaGas are operated by AltaGas and a number of its subsidiaries including, without limitation, AltaGas Services (U.S.) Inc., AltaGas Utility Holdings (U.S.) Inc., WGL Holdings, Inc. (WGL), Wrangler 1 LLC, Wrangler SPE LLC, Washington Gas Resources Corporation, WGL Energy Services, Inc. (WGL Energy Services), and SEMCO Holding Corporation; in regards to the Midstream business, AltaGas Extraction and Transmission Limited Partnership, AltaGas Pipeline Partnership, AltaGas Processing Partnership, AltaGas Northwest Processing Limited Partnership, Harmattan Gas Processing Limited Partnership, Ridley Island LPG Export Limited Partnership, and WGL Midstream Inc. (WGL Midstream); in regards to the Power business, AltaGas Power Holdings (U.S.) Inc., WGL Energy Systems, Inc. (WGL Energy Systems), and Blythe Energy Inc. (Blythe); and, in regards to the Utilities business, Washington Gas Light Company (Washington Gas), Hampshire Gas Company, and SEMCO Energy, Inc.

AltaGas Ltd. – 2019 MD&A and Financial Statements - 2

(SEMCO). SEMCO conducts its Michigan natural gas distribution business under the name SEMCO Energy Gas Company (SEMCO Gas), its Alaska natural gas distribution business under the name ENSTAR Natural Gas Company (ENSTAR) and its 65 percent interest in an Alaska regulated gas storage utility under the name Cook Inlet Natural Gas Storage Alaska LLC (CINGSA).

2019 Highlights

(Normalized EBITDA, normalized funds from operations, normalized net income, net debt, and net debt to total capitalization ratio are non-GAAP financial measures. Please see Non‑GAAP Financial Measures section of this MD&A.)

Growth and Operational Highlights

| ▪ | In the second quarter of 2019, the Ridley Island Propane Export Terminal (RIPET) was completed, with its first shipment of propane to Asia departing on May 23, 2019. RIPET is the first propane marine export facility in Canada and its completion is expected to be a catalyst for further growth within AltaGas' Midstream business; |

| ▪ | In the fourth quarter of 2019, construction of the Marquette Connector Pipeline (MCP) was completed. The MCP connects the Great Lakes Gas Transmission pipeline to the Northern Natural Gas pipeline in Marquette, Michigan where it will provide system redundancy and increase deliverability, reliability, and diversity of supply to SEMCO Gas’ customers; |

| ▪ | In the Midstream segment, AltaGas made significant progress on its growth capital projects, including the completion of the 50 Mmcf/d (net) Nig Creek gas processing facility in the third quarter of 2019 and expected early 2020 completions of the 198 Mmcf/d Townsend 2B expansion, the 10,000 Bbls/d North Pine expansion, and the northeast British Columbia pipeline projects; and |

| ▪ | In the Power segment, AltaGas announced the successful recontracting of the Blythe facility to Southern California Edison (SCE). Under the tolling agreement, SCE has exclusive rights to all capacity, energy, ancillary services, and resource adequacy benefits from August 1, 2020 to December 31, 2023. California Public Utilities Commission approval was received on January 16, 2020. |

Asset Sales Completed

| ▪ | On September 26, 2019, AltaGas closed the sale of its portfolio of U.S. distributed generation assets held by its subsidiaries WGL Energy Systems, Inc. and WGSW, Inc., to TerraForm Power, Inc., an affiliate of Brookfield Asset Management. Total cash proceeds received were approximately US$735 million and a pre-tax gain on disposition of $168 million was recorded in 2019. There are certain projects for which legal title has not yet transferred as various consents and approvals remain outstanding. These projects remain held for sale at December 31, 2019; |

| ▪ | On November 13, 2019, AltaGas completed the sale of its indirect, non-operating interest in the Central Penn Pipeline (Central Penn) held by its subsidiary WGL Midstream, Inc. to Meade Pipeline Investment, LLC, a subsidiary of NextEra Energy Partners, LP for net cash proceeds of approximately US$611 million, resulting in a pre-tax loss of $11 million; |

| ▪ | On May 31, 2019, AltaGas completed the disposition of WGL Midstream's entire interest in the Stonewall Gas Gathering System (Stonewall) to a wholly-owned subsidiary of DTE Energy Company for total gross proceeds of approximately $379 million (US$280 million), resulting in a pre-tax gain of $34 million; |

| ▪ | On February 1, 2019, AltaGas completed the sale of certain non-core Midstream and Power assets in Canada. Cash proceeds for the portion of the sale that closed in the first quarter of 2019 were approximately $88 million, resulting in a pre-tax loss of $1 million; and |

| ▪ | On January 31, 2019, AltaGas completed the sale of its remaining interest of approximately 55 percent in the Northwest Hydro Electric facilities in British Columbia (Northwest Hydro) for net cash proceeds of approximately $1.3 billion, resulting in a pre-tax gain of $688 million. AltaGas remains the operator of the facilities under an operating and maintenance agreement expiring January 31, 2021. |

Regulatory Developments

| ▪ | On December 6, 2019, the Michigan Public Service Commission (MPSC) issued a Final Order approving SEMCO's settlement agreement in its recent rate case, reflecting a base rate increase of approximately US$20 million effective January 1, 2020; |

AltaGas Ltd. – 2019 MD&A and Financial Statements - 3

| ▪ | On October 15, 2019, the Maryland Public Service Commission (PSC of MD) issued a Final Order approving Washington Gas' settlement agreement in its recent rate case, reflecting a US$27 million base rate increase effective October 15, 2019; and |

| ▪ | In September 2019, the Virginia Hearing Examiner assigned to Washington Gas' Virginia rate case issued a report with findings and recommendations to the State Corporation Commission of Virginia (SCC of VA), including the finding for no incremental revenues. In September 2019, the impact of these recommendations was recorded, resulting in a one-time reduction in normalized EBITDA of approximately $30 million and a reduction of approximately $14 million in net income after taxes. On October 21, 2019, Washington Gas filed comments on and exceptions to the Hearing Examiner's report, recommending the SCC of VA reject certain of the Hearing Examiner's findings. On December 20, 2019, the Commission issued a Final Order adjusting certain of the Hearing Examiner’s findings, some of which are favorable to Washington Gas, resulting in a $8 million increase to EBITDA in the fourth quarter of 2019. In January 2020, Washington Gas filed a petition for reconsideration regarding one of the findings in the Final Order. On January 30, 2020, the SCC of VA denied this request and the rate case is now final. |

Other Highlights

| ▪ | In 2019, AltaGas successfully de-levered its balance sheet, regained financial flexibility, maintained its investment grade credit rating, and repositioned the business to focus on organic growth opportunities in the Utilities and Midstream segments. In addition, AltaGas successfully executed its WGL integration strategy, making significant progress in achieving near- and long-term integration priorities, including strategy, organizational effectiveness, and people and culture; |

| ▪ | On December 17, 2019, AltaGas announced its 2020 guidance and provided an update on its 2020 strategic plan. This included an announcement that the Board of Directors approved the suspension of the Dividend Reinvestment and Optional Cash Purchase Plan (DRIP), with the December dividend (payable January 2020) being the last dividend payment eligible for reinvestment by participating shareholders under the DRIP, until further notice; |

| ▪ | On October 21, 2019, AltaGas Canada Inc. (ACI) announced that the Public Sector Pension Investment Board and the Alberta Teachers' Retirement Fund Board (together, the "Consortium") and ACI had concluded a definitive arrangement agreement (the "Arrangement Agreement") whereby the Consortium will indirectly acquire all of the issued and outstanding common shares of ACI (the "Common Shares") in an all-cash transaction for $33.50 per Common Share by way of arrangement under the Canada Business Corporations Act (the "Arrangement"). On December 19, 2019, the shareholders of ACI approved the Arrangement Agreement. In addition, on December 16, 2019, ACI received a "no-action letter" from the Canadian Competition Bureau confirming that the Commissioner of Competition does not at this time intend to challenge the proposed Arrangement. On December 20, 2019, ACI received the final order from the Court of Queen's Bench of Alberta approving the Arrangement. On February 18, 2020, the Alberta Utilities Commission issued a decision approving the Arrangement. The closing of the Arrangement remains subject to the receipt of approval from the British Columbia Utilities Commission, and the satisfaction or waiver of other customary closing conditions. ACI and the Consortium expect to close the Arrangement in the first half of 2020. AltaGas owns 11,025,000 Common Shares or approximately 37 percent of the total number of Common Shares; |

| ▪ | On September 30, 2019, 1,114,177 of the outstanding 8,000,000 Cumulative Redeemable Five-Year Fixed Rate Reset Preferred Shares, Series G were converted into Cumulative Floating Rate Preferred Shares, Series H; |

| ▪ | On December 16, 2019, AltaGas completed its aggregate issuance of $500 million of senior unsecured medium term notes with a coupon rate of 2.609 percent, maturing on December 16, 2022. The proceeds were used to pay down existing indebtedness under AltaGas' credit facilities and for general corporate purposes. Because the coupon rate is lower than the borrowing rate of the repaid debt, AltaGas expects cost savings of approximately $5 million per annum as a result of the debt repayment; |

| ▪ | On December 20, 2019, all outstanding Washington Gas preferred shares (US$4.25 series, US$4.80 series, and US$5.00 series) were redeemed. A pre-tax gain of $3 million was recognized upon redemption; |

| ▪ | On May 27, 2019, AltaGas announced the appointment of D. James Harbilas as Executive Vice President and Chief Financial Officer of AltaGas, effective June 10, 2019. Mr. Harbilas replaced Timothy Watson, who served as Executive Vice President and Chief Financial Officer until June 9, 2019; |

AltaGas Ltd. – 2019 MD&A and Financial Statements - 4

| ▪ | Effective December 16, 2019, AltaGas appointed Donald “Blue” Jenkins as Executive Vice President and President, Utilities and President, Washington Gas. Mr. Jenkins succeeds Adrian Chapman, who has retired; and |

| ▪ | On December 11, 2019, AltaGas released its inaugural Environmental, Social, and Governance (ESG) Report, highlighting the Company's 2018 performance in several key areas related to the long-term sustainability of its business, and demonstrating its ongoing commitment to transparency. |

Financial Highlights

| ▪ | Normalized EBITDA was $1,271 million compared to $1,009 million in 2018; |

| ▪ | Cash from operations was $616 million ($2.22 per share) compared to cash used by operations of $79 million ($0.35 per share) in 2018; |

| ▪ | Normalized funds from operations were $895 million ($3.23 per share) compared to $657 million ($2.95 per share) in 2018; |

| ▪ | Net income applicable to common shares was $769 million ($2.78 per share) compared to net loss applicable to common shares of $502 million ($2.25 per share) in 2018; |

| ▪ | Normalized net income was $324 million ($1.17 per share) compared to $195 million ($0.88 per share) in 2018; |

| ▪ | Net debt was $7.2 billion as at December 31, 2019, compared to $10.0 billion at December 31, 2018; and |

| ▪ | Net debt‑to‑total capitalization ratio was 49 percent as at December 31, 2019, compared to 57 percent as at December 31, 2018. |

Highlights Subsequent to Year End

| ▪ | On January 2, 2020, AltaGas advised that AltaGas Idemitsu Joint Venture Limited Partnership (AIJVLP) had received notice (the Put Notice) from SAM Holdings Ltd. (SAM) of its exercise of a put option (the Put Option) with respect to SAM's approximately one-third interest in Petrogas Energy Corp. (Petrogas). AIJVLP, a limited partnership owned 50 percent by AltaGas and 50 percent by Idemitsu Kosan Co., Ltd. (Idemitsu), owns the other approximately two-thirds of the outstanding common shares of Petrogas. Pursuant to the Petrogas unanimous shareholders agreement, a valid exercise of the Put Option by SAM after October 1, 2019, triggers a requirement for AIJVLP to purchase SAM's interest in Petrogas at the fair market value thereof, as determined by third-party valuators. AltaGas anticipates funding its portion of any such obligation with internal cash flow, the sale of remaining non-core assets, and debt. Valuations are underway; |

| ▪ | On January 9, 2020, AltaGas announced the appointment of two new independent Directors - Linda Sullivan and Nancy Tower to its Board of Directors. In addition, AltaGas announced the retirement of Daryl Gilbert from the Board of Directors, to be effective following the conclusion of AltaGas' next annual meeting of shareholders in May 2020; |

| ▪ | On January 13, 2020, Washington Gas filed a rate case in the District of Columbia requesting a US$35 million increase in base rates, including US$9 million of annual PROJECTpipes surcharges currently paid by customers for accelerated pipeline replacement. Washington Gas has also requested approval for a Revenue Normalization Adjustment mechanism to reduce customer bill fluctuations due to weather-related usage variations, similar to existing mechanisms in both Maryland and Virginia; and |

| ▪ | In February 2020, following evaluations of the diminished underlying economics for the proposed Constitution pipeline project, the partners of Constitution Pipeline Company, LLC (Constitution) elected not to proceed with the project. AltaGas held a 10 percent equity interest in Constitution. Upon the acquisition of WGL, AltaGas assigned a value of $nil to Constitution. |

AltaGas' Vision and Objective

AltaGas’ vision is to be a leading North American infrastructure company that connects natural gas and natural gas liquids to domestic and global markets. The Corporation strives to improve the lives of customers by safely delivering clean, affordable, and reliable natural gas solutions that meet their evolving energy needs - today and tomorrow.

AltaGas Ltd. – 2019 MD&A and Financial Statements - 5

Strategy

AltaGas' long-term strategy is largely focused on two core businesses - Utilities and Midstream - and is designed to deliver reliable, attractive long-term earnings and the potential for future dividend growth.

With infrastructure assets in some of the fastest growing energy markets in North America including a prominent position in the Montney region and utilities operations in five U.S. jurisdictions, AltaGas is developing an integrated footprint capable of delivering sustained value to stakeholders today and into the future. AltaGas is focused on developing high-quality energy infrastructure underpinned by strong market fundamentals and long-term commercial agreements that provide stable cash flow. AltaGas’ balanced portfolio, including high-growth assets in the Midstream segment combined with predictable and regulated returns in the Utilities segment, provides a resilient and diversified platform for growth.

In 2020, AltaGas plans to focus on capitalizing on the significant growth potential of its Utilities and Midstream assets. Specific priorities include to:

| ▪ | Ensure safe reliable operations, providing effective and cost-efficient service for customers; |

| ▪ | Enhance returns and capital efficiency through base rate cases, and facilitate timely recovery of expenditures and improve safety through increased utilization of accelerated rate recovery programs; |

| ▪ | Enhance the business through asset optimization and operational efficiencies to reduce costs and deliver an improved customer experience; |

| ▪ | Maximize the unique structural advantage within AltaGas' integrated platform in the Montney region; |

| ▪ | Increase utilization and export volumes at RIPET; |

| ▪ | Execute the planned $900 million growth capital program, including a targeted 10 percent increase in the Utilities rate base; and |

| ▪ | Pursue capital efficient organic growth through disciplined capital allocation while improving balance sheet strength and flexibility. |

AltaGas’ Board of Directors is actively engaged in AltaGas’ strategy. The Corporation continually assesses the macro- and micro-economic trends impacting the businesses and seeks opportunities to generate value for stakeholders. The opportunities AltaGas pursues must meet strategic, operating, and financial criteria to ensure they align with the long-term strategy and provide ongoing organic growth potential, favorable risk profiles, and strong risk-adjusted returns.

2020 Outlook

In 2020, AltaGas expects to achieve annual consolidated normalized EBITDA of approximately $1.275 to $1.325 billion, and normalized earnings per share of approximately $1.20 to $1.30 per share assuming an effective tax rate of approximately 22 percent. This range is net of asset sales that are anticipated to close in 2020, including AltaGas' approximate 37 percent interest in ACI.

Growth is expected in 2020 in the Utilities and Midstream segments. The Utilities segment is expected to have the largest contribution to normalized EBITDA, with growth driven primarily by rate base growth and increased spend on accelerated capital programs. Growth in the Midstream segment is anticipated to largely be driven by a full year of contributions from RIPET, and increased volumes at Northeast British Columbia facilities, including North Pine, Townsend, and Aitken Creek, as well as higher expected margins on U.S. Midstream storage and transportation. Normalized EBITDA from AltaGas' remaining Power assets is also expected to grow primarily due to less expected downtime at Blythe. Overall growth is expected to more than offset lost EBITDA from a full year impact of asset sales completed in 2019.

AltaGas Ltd. – 2019 MD&A and Financial Statements - 6

The overall forecasted normalized EBITDA and earnings per share include assumptions around asset sales anticipated to close in 2020, the U.S./Canadian dollar exchange rate, and other financing initiatives. Within each segment, the performance of the underlying businesses has the potential to vary. Any variance from AltaGas’ current assumptions could impact the forecasted normalized EBITDA and normalized earnings per share.

AltaGas estimates an average of approximately 10,000 Bbls/d of natural gas liquids (NGL) will be exposed to frac spreads prior to hedging activities. Pricing risk related to frac exposed propane is mitigated through export and the hedging program in place at RIPET. Hedges are in place for approximately 80 percent of frac exposed butane and condensate volumes.

At RIPET, AltaGas is exposed to the propane price differential between North American Indices and the Far East Index for contracts not under tolling arrangements. AltaGas estimates an average of approximately 30,000 Bbls/d will be exposed to these price differentials in 2020, of which approximately 74 percent have been hedged at an average FEI to Mont Belvieu spread of US$11/Bbl. AltaGas plans to manage the facility such that a majority of annual capacity will be underpinned by tolling arrangements, and expects to reach this objective over the next several years.

Sensitivity Analysis

AltaGas’ financial performance is affected by factors such as changes in commodity prices, exchange rates, and weather. The following table illustrates the approximate effect of these key variables on AltaGas’ expected normalized EBITDA for 2020:

| Factor | Increase or decrease | Approximate impact on normalized annual EBITDA ($ millions) | ||

Degree day variance from normal - Utilities (1) | 5 percent | 8 | ||

| Change in Canadian dollar per U.S. dollar exchange rate | 0.05 | 35 | ||

RIPET Propane Far East Index to Mont Belvieu spread (2) | US$1/Bbl | 4 | ||

AECO/Station 2 gas prices(3) | $0.20/GJ | 3 | ||

| Pension discount rate | 1 percent | 17 | ||

| (1) | Degree days – Utilities relate to SEMCO Gas, ENSTAR, and Washington Gas service areas. Degree days are a measure of coldness determined daily as the |

numbers of degrees the average temperature during the day in question is below 65 degrees Fahrenheit. Degree days for a particular period are the average of degree days during the prior 15 years for SEMCO Gas, during the prior 10 years for ENSTAR, and during the prior 30 years for Washington Gas.

| (2) | The impact on EBITDA due to changes in the spread will vary and is being managed through an active hedging program. |

| (3) | Price risk related to frac exposed propane is mitigated through export and the hedging program in place at RIPET. Butane and condensate are 80 percent hedged. |

Growth Capital

Based on projects currently under review, development, or construction, AltaGas expects net capital expenditures of approximately $900 million in 2020. The majority of capital expenditures are expected to focus on projects within the Utilities business that are anticipated to deliver stable and transparent rate base growth and strong risk-adjusted returns. The Utilities segment is expected to account for approximately 75 to 80 percent of total capital expenditures, while the Midstream segment is expected to account for approximately 15 to 20 percent and the Power and Corporate segments are expected to account for any remainder. Midstream and Power maintenance capital is expected to be approximately $30 to $40 million of the total capital expenditures in 2020.

AltaGas Ltd. – 2019 MD&A and Financial Statements - 7

AltaGas’ capital expenditures for the Utilities segment will focus primarily on accelerated pipe replacement programs, customer growth, and system betterment. In the Midstream segment, capital expenditures are anticipated to primarily relate to the completion of Townsend and North Pine expansions and associated pipeline systems, maintenance and administrative capital, the completion of the Mountain Valley Pipeline expansion project (MVP Southgate), and new business development. The Power segment continues to pursue a capital-light strategy for remaining assets. The Corporation continues to focus on capital efficient organic growth and disciplined capital allocation while improving balance sheet strength and flexibility.

AltaGas' 2020 committed capital program is expected to be funded through internally-generated cash flow and normal course borrowings on existing committed credit facilities.

Growth Capital Project Updates

The following table summarizes the status of AltaGas’ significant growth projects. For further description of these projects please refer to AltaGas' most recent Annual Information Form which is available through SEDAR at www.sedar.com.

| Project | AltaGas' Ownership Interest | Estimated Cost (1) | Expenditures to Date (2) | Status | Expected In-Service Date | |||

| Midstream Projects | ||||||||

| Northeast B.C. Pipeline Projects | 33% to 100% | $75 million | $56 million | The Northeast B.C. Pipeline projects consist of four pipelines: the Inga gas gathering pipeline (33% ownership), the Townsend East NGL pipeline (100% ownership), the Aitken Connector NGL pipeline (100% ownership), and the Gundy lateral pipeline (100% ownership). Construction of all segments is underway. The pipelines are expected to be in-service in the first quarter of 2020. | Q1 2020 | |||

| Townsend 2B Expansion and Mercaptan Treating | 100% | $165 million | $140 million | Field construction activities commenced in the second quarter of 2019 and are progressing according to plan. The expected completion date is the first quarter of 2020. | Q1 2020 | |||

| North Pine Expansion | 100% | $58 million | $44 million | Field construction activities commenced in the third quarter of 2019 and are progressing according to plan. The expected completion date is the first quarter of 2020. | Q1 2020 | |||

| Mountain Valley Pipeline (Mountain Valley) | 10% | US$352 million | US$352 million | Construction is underway. As at December 31, 2019, approximately 90% of the project is complete, which includes construction of all original interconnects and compressor stations. In the third quarter of 2019 there was a voluntary suspension of construction activities in a section of the pipeline and the Federal Energy Regulatory Commission (FERC) issued an order to suspend all construction. As a result, the in-service date is now expected to be late 2020. Despite the delays, AltaGas' exposure is contractually capped to the original estimated contributions of approximately US$352 million. | Late 2020 due to ongoing legal and regulatory challenges | |||

| MVP Southgate Project | 5% | US$20 million | US$3 million | Construction is expected to begin in the fourth quarter of 2020. Expenditures to date relate to land surveys, land acquisition, and obtaining permits and regulatory approvals. | Mid 2021 | |||

AltaGas Ltd. – 2019 MD&A and Financial Statements - 8

| Project | AltaGas' Ownership Interest | Estimated Cost (1) | Expenditures to Date (2) | Status | Expected In-Service Date | ||||

| Utilities Projects | |||||||||

Accelerated Utility Pipe Replacement Programs – District of Columbia | 100% | Estimated US$305 million over the five year period from April 2020 to December 2024, plus additional expenditures in subsequent periods. | $nil (3) | Washington Gas has submitted an application for the second phase of PROJECTpipes to the Public Service Commission of the District of Columbia (PSC of DC). In the interim, Phase 1 has been extended to March 31, 2020 for an amount not to exceed US$12.5 million. | Individual assets are placed into service throughout the program. | ||||

Accelerated Utility Pipe Replacement Programs – Maryland | 100% | Estimated US$350 million over the five year period from January 2019 to December 2023, plus additional expenditures in subsequent periods. | US$57 million (3) | The second phase of the accelerated utility pipe replacement programs in Maryland (STRIDE 2.0) began in January 2019. | Individual assets are placed into service throughout the program. | ||||

Accelerated Utility Pipe Replacement Programs – Virginia | 100% | Estimated US$500 million over the five year period from January 2018 to December 2022, plus additional expenditures in subsequent periods. | US$171 million (3) | The second phase of the accelerated pipe replacement programs in Virginia (SAVE 2.0) began in January 2018. | Individual assets are placed into service throughout the program. | ||||

Accelerated Mains Replacement Programs – Michigan | 100% | Estimated US$50 million over five year period from 2015 to 2020. | US$37 million (3) | The third phase of the Accelerated Mains Replacement Program (MRP3) in Michigan expires in May 2020. A new MRP program was agreed to in SEMCO's recently settled rate case. The new five-year MRP program begins in 2021 with a total spend of approximately US$60 million. In addition to the new MRP program, SEMCO was also granted a new Infrastructure Reliability Improvement Program (IRIP) which is also a five-year program with a total spend of approximately US$55 million beginning in 2021. | Individual assets are placed into service throughout the program. | ||||

| Marquette Connector Pipeline | 100% | US$154 million | US$152 million | The MCP has been completed and is in service. All interconnects have been commissioned and the pipeline is providing gas supply to SEMCO's Marquette service area in northern Michigan. Minor cleanup and restoration will take place in 2020. Community engagement, interaction, and media coverage was positive throughout the project. | Completed December 2019 | ||||

| (1) | These amounts are estimates and are subject to change based on various factors. Where appropriate, the amounts reflect AltaGas’ share of the various projects. |

| (2) | Expenditures to date reflect total cumulative expenditures incurred from inception of the projects to December 31, 2019. For WGL projects, this also includes any expenditures prior to the close of the WGL Acquisition on July 6, 2018. |

| (3) | The utility accelerated replacement programs are long-term projects with multiple phases for which expenditures are approved by the regulators and managed in five year increments. Expenditures to date only include amounts for the current programs described above, and exclude any expenditures made under prior increments of the programs. Actual regulatory filings may differ from reported amounts. |

AltaGas Ltd. – 2019 MD&A and Financial Statements - 9

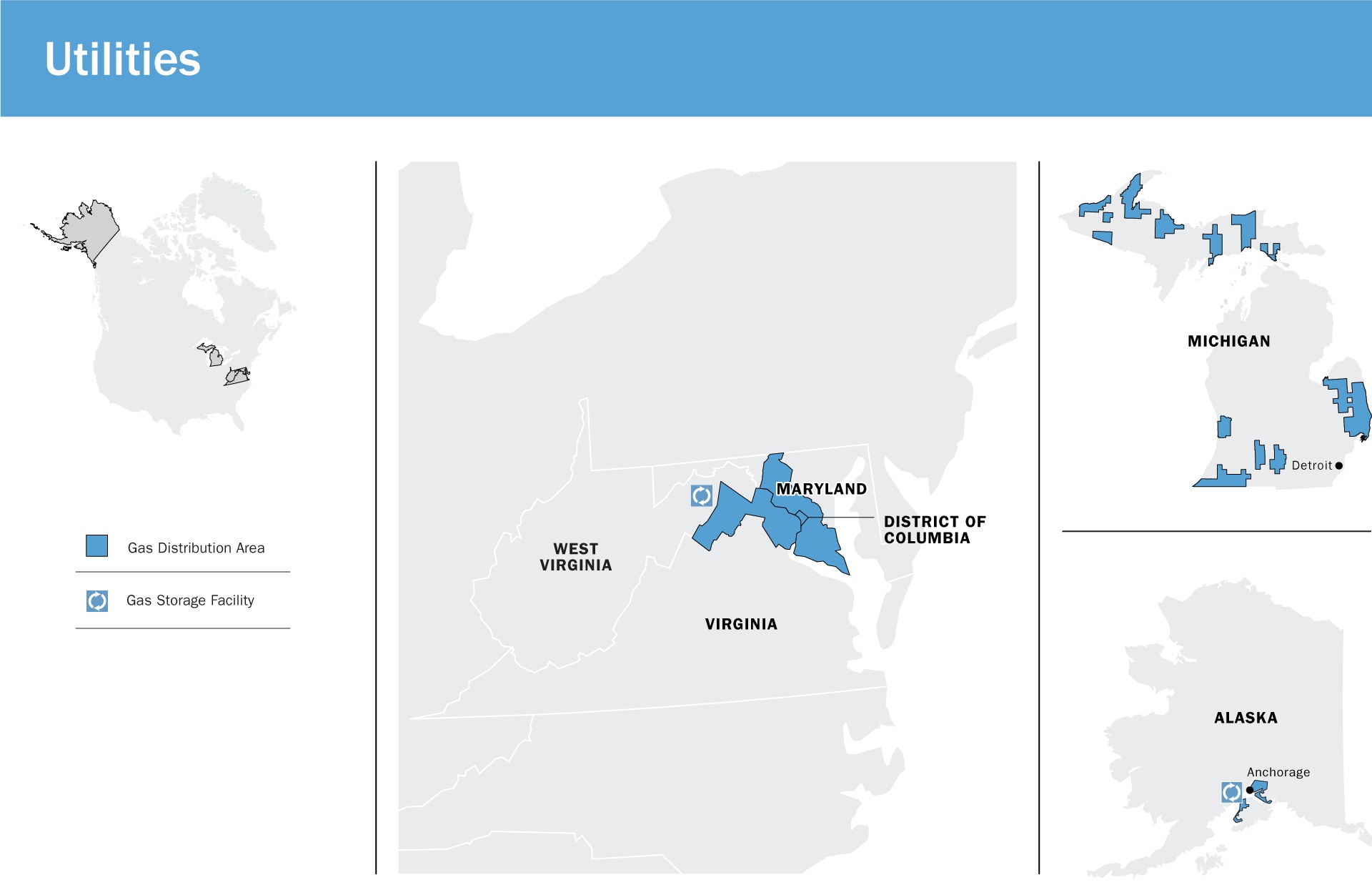

Utilities

Description of Assets

AltaGas owns and operates utility assets that store and deliver natural gas to end-users in the District of Columbia, Virginia, Maryland, Michigan, and Alaska, serving approximately 1.7 million customers and with a combined rate base of approximately US$3.9 billion.

The utilities are underpinned by regulated returns and regulatory regimes that generally provide stable earnings and cash flows. The Utilities segment enhances the diversification of AltaGas' portfolio of energy infrastructure assets and strengthens the Corporation’s business profile, thus allowing the Corporation to meet its objective of generating economic returns by investing in regulated, long-life assets with stable earnings.

The Utilities segment includes:

| ▪ | Washington Gas in Virginia, Maryland, and the District of Columbia; |

| ▪ | Hampshire, providing regulated interstate natural gas storage to Washington Gas; |

| ▪ | SEMCO Gas in Michigan; |

| ▪ | ENSTAR in Alaska; |

| ▪ | A 65 percent interest in Cook Inlet Natural Gas Storage Alaska LLC (CINGSA) in Alaska; and |

| ▪ | An approximate 37 percent interest in ACI. |

AltaGas Ltd. – 2019 MD&A and Financial Statements - 10

All of the utilities are allowed the opportunity to earn regulated returns. This return on rate base is composed of regulator-allowed financing costs and return on equity (ROE). If actual costs are different from those recoverable through approved rates, the utility bears the risk of this difference other than for certain costs that are subject to deferral treatment.

Earnings in the Utilities segment are seasonal, as revenues are primarily based on the demand for space heating in the winter months, mainly from November to March. Costs, on the other hand, are generally incurred more uniformly over the year. This typically results in stronger first and fourth quarters and weaker second and third quarters. In Michigan, Alaska, and the District of Columbia, earnings can be impacted by variations from normal weather resulting in delivered volumes being different than anticipated. Increases in the number of customers or changes in customer usage are other factors that might typically affect delivered volumes, and hence actual earned returns for the Utilities segment. In Virginia and Maryland, Washington Gas has billing mechanisms in place which are designed to eliminate or mitigate the effects of variance in customer usage caused by weather and other factors such as conservation.

Washington Gas

Washington Gas is a regulated public utility has been engaged in the natural gas distribution business since 1848, and provides regulated gas distribution services to end users in the District of Columbia, Virginia, and Maryland. At the end of 2019, Washington Gas had approximately 1.2 million customers, of which approximately 82 percent were residential. The number of customers at Washington Gas increased approximately 1 percent in 2019. The rate base at December 31, 2019 was approximately US$2.9 billion. At the end of 2019, the approved regulated ROE for Washington Gas in its various jurisdictions ranged from 9.2 percent to 9.7 percent based on an equity ratio ranging from 53.5 percent to 55.7 percent.

Washington Gas is regulated by the PSC of DC, the PSC of MD, and the SCC of VA, which approve its terms of service and the billing rates that it charges to customers. The rates charged to utility customers are designed to recover Washington Gas’ operating expenses and natural gas commodity costs and to provide a return on its investment in the net assets used in its firm gas sales and delivery service.

Washington Gas has accelerated pipe replacement programs in place in each of its three jurisdictions. Washington Gas accelerates pipe replacement in order to reduce risk and further enhance the safety and reliability of the pipeline system. Each regulatory commission having jurisdiction over Washington Gas’ retail rates has approved accelerated replacement programs with an associated surcharge mechanism to recover the cost, including a return, on those capital investments. In contrast to the traditional rate-making approach to capital investments, for the accelerated pipe replacement programs, Washington Gas is receiving recovery for these investments through the approved surcharges for each program and is authorized to invest in each of these programs over a five-year period.

Washington Gas’ customers are eligible to purchase their natural gas from unregulated third-party marketers through natural gas unbundling. As at December 31, 2019, approximately 14 percent of its customers have chosen to purchase gas from marketers. This does not negatively impact Washington Gas’ net income as the Corporation does not earn a margin on the sale of natural gas to firm customers, but only from the delivery and distribution of the gas.

Washington Gas obtains natural gas supplies that originate from multiple regions throughout the United States. At December 31, 2019, it had service agreements with four pipeline companies that provided firm transportation and storage services with contract expiration dates ranging from 2020 to 2044. Washington Gas has also contracted with various interstate pipeline and storage companies to add to its storage and transportation capacity. Washington Gas, under its asset optimization program, makes use of storage and transportation capacity resources when those assets are not required to serve utility customers. The objective of this program is to derive a profit to be shared with its utility customers. These profits are earned by entering into commodity-related physical and financial contracts with third parties.

AltaGas Ltd. – 2019 MD&A and Financial Statements - 11

Hampshire

Hampshire owns underground natural gas storage facilities, including pipeline delivery facilities located in and around Hampshire County, West Virginia, and operates these facilities to serve Washington Gas. Hampshire is regulated by FERC. Washington Gas purchases all of the storage services of Hampshire, and includes the cost of the services in the commodity cost of its regulated energy bills to customers. Hampshire operates under a “pass-through” cost-of-service based tariff approved by FERC.

SEMCO Gas

SEMCO owns and operates a regulated natural gas distribution utility in Michigan operating under the name SEMCO Gas and has an interest in a regulated natural gas storage facility in Michigan. At the end of 2019, SEMCO Gas had approximately 307,000 customers. Of these customers, approximately 91 percent are residential. In 2019, SEMCO Gas experienced customer growth of approximately 1 percent reflecting growth in the franchise areas and customer conversions with the favorable price of natural gas. The rate base at year end was approximately US$608 million. In 2019, the approved regulated ROE for SEMCO Gas was 10.35 percent with an approved capital structure based on 49.04 percent equity. For 2020, the approved regulated ROE is 9.87 percent with an approved capital structure based on 45.86 percent equity.

SEMCO Gas is regulated by the MPSC. It operates under cost-of-service regulation and utilizes actual results from the most recently completed fiscal year along with known and measurable changes in its application for new rates.

SEMCO Gas has an Accelerated Main Replacement Program (MRP) surcharge to recover a stated amount of accelerated main replacement capital expenditures in excess of what is authorized in its current base rates. The MRP began in 2011, was expanded in 2013 and renewed for an additional five years in 2015. SEMCO Gas has requested an additional renewal for the five year period beginning in 2020. The anticipated annual average capital spending over the five year period is approximately US$10 million. A new MRP was approved as part of the 2019 rate case. For the years 2021 to 2025 the anticipated annual average capital spending is approximately US$12 million. Additionally, a new Infrastructure Reliability Improvement Program was approved in the 2019 rate case. During the years 2020 to 2025, SEMCO Gas will complete certain projects totaling US$55 million to improve the reliability of infrastructure. Customers will be billed a surcharge beginning in 2021 for the IRIP.

ENSTAR and CINGSA

SEMCO owns and operates a regulated natural gas distribution utility in Alaska under the name ENSTAR. SEMCO, through a subsidiary, holds a 65 percent interest in CINGSA, a regulated natural gas storage utility in Alaska. At the end of 2019, ENSTAR had approximately 147,000 customers including residential, commercial, and transportation, and of these customers, approximately 91 percent are residential. In 2019, ENSTAR experienced customer growth of approximately 1 percent reflecting growth in the franchise areas and customer conversions with the favorable price of natural gas. The rate base at year end was approximately US$258 million for ENSTAR and US$68 million for CINGSA (SEMCO's 65 percent share).

ENSTAR and CINGSA are regulated by the Regulatory Commission of Alaska (RCA) and operate under cost-of-service regulation utilizing actual results from the most recently completed fiscal year along with known and measurable changes in their application for new rates.

ACI

AltaGas owns an approximate 37 percent equity interest in ACI. ACI holds certain assets formerly held by AltaGas, including rate-regulated utility distribution assets in British Columbia, Alberta, and Nova Scotia, minority interests in entities providing natural gas to the Town of Inuvik, a fully contracted 102 MW wind park located in British Columbia, and an approximate 10 percent interest in the Northwest Hydro facilities.

AltaGas Ltd. – 2019 MD&A and Financial Statements - 12

On October 21, 2019, ACI announced that the Consortium and ACI had concluded the Arrangement Agreement whereby the Consortium will indirectly acquire all of the Common Shares of ACI in an all-cash transaction for $33.50 per Common Share. On December 19, 2019, the shareholders of ACI approved the Arrangement Agreement. In addition, on December 16, 2019, ACI received a "no-action letter" from the Canadian Competition Bureau confirming that the Commissioner of Competition does not at this time intend to challenge the proposed Arrangement. On December 20, 2019, ACI received the final order from the Court of Queen's Bench of Alberta approving the Arrangement. On February 18, 2020, the Alberta Utilities Commission issued a decision approving the Arrangement. The closing of the Arrangement remains subject to the receipt of approval from the British Columbia Utilities Commission, and the satisfaction or waiver of other customary closing conditions. ACI and the Consortium expect to close the Arrangement in the first half of 2020.

Capitalize on Opportunities

While providing safe and reliable service, AltaGas pursues opportunities in the Utilities segment to deliver value to its customers and enhance long-term shareholder value. The Corporation’s objectives are to:

| ▪ | Ensure safe, reliable operations and infrastructure, providing effective and cost-efficient service for customers; |

| ▪ | Enhance returns and capital efficiency and more timely recovery of expenditures through rate cases and increased utilization of accelerated rate recovery programs; |

| ▪ | Enhance and grow the business through asset optimization, cost reduction initiatives, and operational efficiencies to reduce costs and deliver an improved customer experience; |

| ▪ | Improve business processes and drive down leak remediation costs, reinvesting savings into improving the customer experience; |

| ▪ | Attract and retain customers through exceptional customer service; |

| ▪ | Grow the consolidated Utilities rate base by a targeted 10 percent in 2020; |

| ▪ | Maintain strong relationships with local communities, Indigenous peoples, governments, and regulatory bodies; and |

| ▪ | Maintain strong community and regulatory relationships while ensuring fair returns to shareholders. |

AltaGas expects to grow its existing utility infrastructure through continued investment and capital improvements in franchise areas, which will result in rate base growth and continued customer growth including the conversion of users of alternative energy sources to natural gas. AltaGas' utilities have had approximately 44 percent rate base growth over the past three years including the addition of WGL’s rate base and after adjusting for the impact of foreign exchange translation. The growth in rate base is a direct result of the WGL Acquisition in 2018, prudent investments in current areas of operations, and the addition of new customers. Customer growth rates for AltaGas’ utilities are moderate, as is typical with mature utilities, with growth rates generally tied closely to the economic growth of the respective franchise regions.

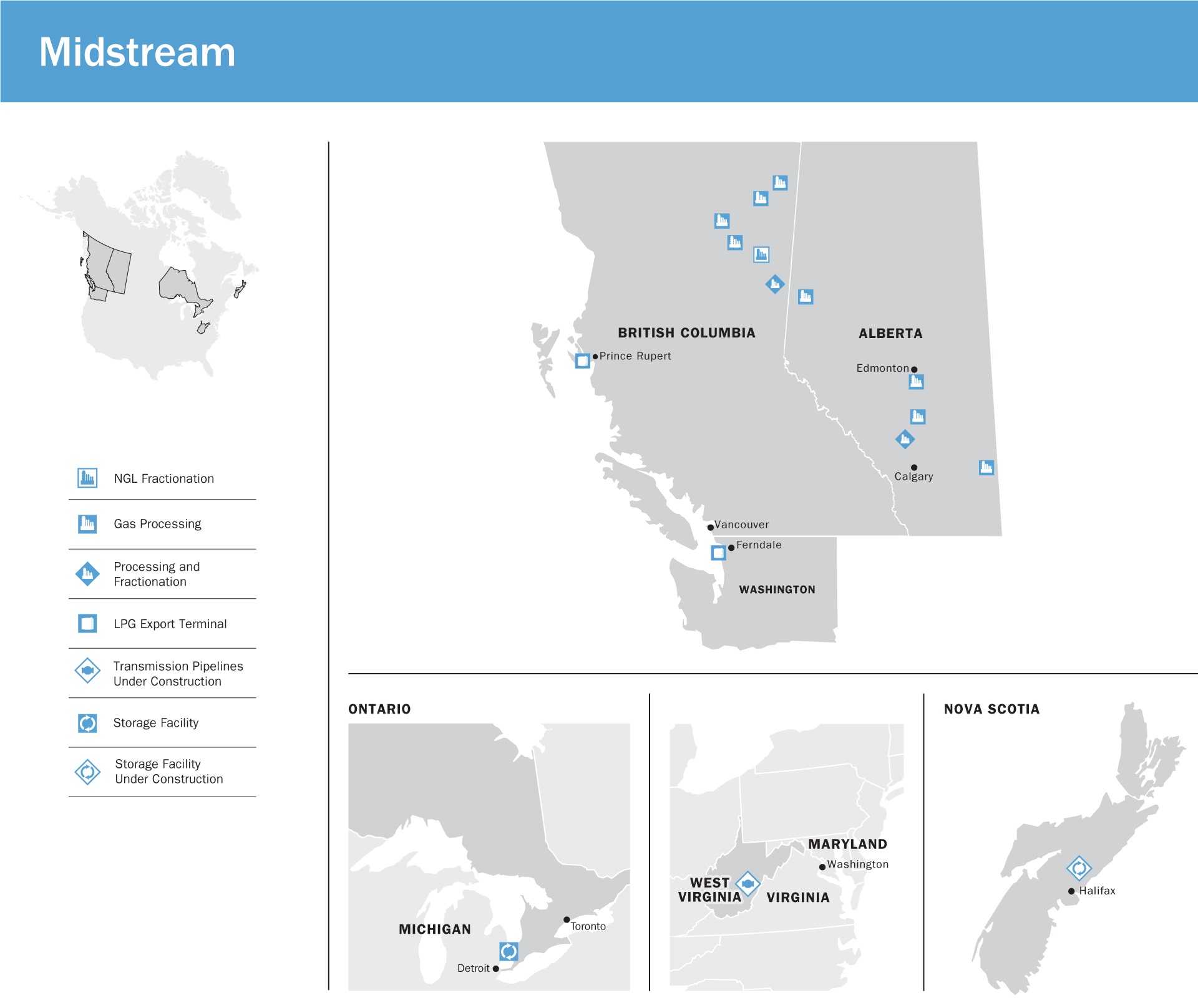

Midstream

Description of Assets

AltaGas' Midstream segment is comprised of global export assets and strategically-located processing, fractionation, and liquids handling infrastructure in Canada that connects Western Canadian producers from wellhead to the coast and to the global export markets, as well as a pipeline investment, the sale of natural gas to retail customers, and underground natural gas storage facilities.

In Canada, AltaGas serves customers primarily in the Western Canada Sedimentary Basin (WCSB) and delivers natural gas into downstream pipeline systems, connecting producers to the global export markets for liquified petroleum gas (LPG). Subsequent to the disposition of the non-core Midstream assets in Canada which closed in February 2019, AltaGas transacts more than 1.4

AltaGas Ltd. – 2019 MD&A and Financial Statements - 13

Bcf/d of natural gas including natural gas gathering and processing, NGL extraction and fractionation, logistics, liquids handling, and global exports. Gas gathering systems move natural gas from producing wells to processing facilities where impurities and certain hydrocarbon components are removed. The gas is then compressed to meet downstream pipelines' operating specifications for transportation. Extraction and fractionation facilities reprocess natural gas to extract and recover ethane and NGL. Subsequent to the sale of the non-core Midstream assets in Canada, AltaGas has a total net licensed processing capacity of approximately 2.2 Bcf/d.

Through RIPET and the indirect interest in Ferndale, AltaGas is able to provide Western Canadian producers global market access and incremental value for Canadian NGLs. The Ferndale terminal is owned and operated by Petrogas, which exports LPG to Asian markets. See Global Exports section below for further details.

Liquids handling services include storage, rail logistics, pipelines, and truck loading as well as natural gas and NGL marketing initiatives. AltaGas identifies opportunities to buy and resell NGLs for producers, and exchange, reallocate, or resell pipeline capacity and storage to earn a profit. With the emergence of the global exports business, liquids handling provides integral support for managing RIPET's ocean and rail logistics as well as marketing the supply and offtake for RIPET. In support of the liquids handling operations, AltaGas manages a rail car fleet of approximately 1,200 rail cars.

In addition, the Midstream segment includes an investment in a pipeline in the northeastern United States, a wholesale gas asset management business, and a retail gas marketing business. AltaGas, through WGL Midstream, indirectly owns a 10 percent equity interest in the Mountain Valley pipeline. AltaGas' retail gas marketing business consists of the operations of WGL Energy Services, which sells natural gas directly to residential, commercial, and industrial customers in Maryland, Virginia, Delaware, Pennsylvania, and the District of Columbia.

The Midstream segment includes expansion and greenfield projects under development or construction, as discussed under the Growth Capital section of this MD&A.

AltaGas Ltd. – 2019 MD&A and Financial Statements - 14

Global Exports

AltaGas’ global export assets include RIPET and Petrogas, which provide Western Canadian producers with global market access and incremental value for Canadian NGLs.

| ▪ | RIPET commenced commercial operations on May 23, 2019, with the first propane shipment departing from the terminal to Asia. RIPET is capable of storing 600,000 Bbls and currently has a propane export license of 40,000 Bbls/d. As AltaGas builds on the operational capabilities and global counterparty networks for RIPET, AltaGas expects to continue to increase throughput from RIPET. In November 2019, AltaGas filed an application to increase RIPET's propane export license to 80,000 Bbls/d. For 2020, AltaGas has in place multi-year agreements for the purchase of approximately 50 percent of the propane expected to be shipped from RIPET; and |

| ▪ | Petrogas is a leading North American integrated midstream company, with an extensive logistics network consisting of over 3,000 rail car leases used entirely to support its transportation needs. Petrogas owns and operates the Ferndale terminal, which is capable of handling LPG exports up to 50,000 Bbls/d with 750,000 Bbls of on-site storage capacity. AltaGas has an approximate one-third indirect ownership interest in Petrogas via its 50 percent interest in AIJVLP, which holds an approximate two-thirds ownership interest in Petrogas. The remaining 50 percent interest in AIJVLP is owned |

AltaGas Ltd. – 2019 MD&A and Financial Statements - 15

by Idemitsu Kosan Co., Ltd. AIJVLP has received a Put Notice from SAM for the purchase of SAM's approximate one-third interest in Petrogas.

Gas Processing

Gas processing activities are comprised of gathering systems that move natural gas from producing wells to processing facilities where impurities and certain hydrocarbon components are removed. The gas is then compressed to meet downstream pipelines' operating specifications for transportation to North American natural gas markets. All AltaGas' processing facilities are capable of extracting NGL. The facilities provide fee-for-service revenues based on volumes processed as well as revenues based on take-or-pay contracts. A significant portion of contracts flow through operating costs to the producers. AltaGas' processing infrastructure includes:

| ▪ | The Townsend facility, a 396 Mmcf/d gas processing facility, along with the related egress pipelines, truck terminal, and NGL treatment infrastructure (the Townsend complex), which is wholly owned by AltaGas. The majority of the processing capacity is contracted with Montney producers in the area under long-term take-or-pay agreements. In 2018, AltaGas entered into definitive agreements with Kelt Exploration Ltd. to provide an energy infrastructure solution for the liquids-rich Inga Montney development located in British Columbia. This project will add a 198 Mmcf/d C3+ deep cut gas processing facility and is expected to be on-stream in the first quarter of 2020. AltaGas is the operator of these facilities; |

| ▪ | The Gordondale facility, which has licensed capacity of 150 Mmcf/d of natural gas and is wholly owned and operated by AltaGas. The Gordondale facility processes gas gathered from Birchcliff Energy Ltd.’s Gordondale Montney development under a long-term take-or-pay contract. The plant is equipped with liquids extraction facilities to capture the NGL value for the producer; |

| ▪ | The Blair Creek facility, which has licensed capacity of 120 Mmcf/d of natural gas and is wholly owned and operated by AltaGas. The facility processes gas gathered from producers in the area. The plant is equipped with liquids extraction facilities to capture the NGL value for the producer; |

| ▪ | The Aitken Creek processing facilities, in which AltaGas has a 50 percent ownership interest. Black Swan Energy Ltd. (Black Swan) owns the remaining 50 percent interest. These facilities include Aitken Creek North, an operating shallow gas plant with a current capacity of 110 Mmcf/d (55 Mmcf/d net), and Nig Creek, a shallow gas plant with capacity of 100 Mmcf/d (50 Mmcf/d net) that came on-stream in the third quarter of 2019. The Aitken Creek processing facilities are located in the liquids rich Montney resource play in Northeast British Columbia (NEBC) and are operated by Black Swan. AltaGas and Black Swan have also entered into long-term processing, transportation, and marketing agreements that will include new AltaGas liquids handling infrastructure in NEBC; |

| ▪ | The Harmattan facility, which has a natural gas processing capacity of 490 Mmcf/d and is wholly owned and operated by AltaGas. Harmattan's natural gas processing consists of sour gas treating, co-stream processing, and NGL extraction. In addition, Harmattan has fractionation and terminalling facilities (see below section on Fractionation and Liquids Handling); and |

| ▪ | Interests in four NGL extraction plants with net licensed inlet capacity of 1.0 Bcf/d. The extraction plants consist of Edmonton Ethane Extraction Plant (EEEP), Joffre Ethane Extraction Plant (JEEP), Pembina Empress Extraction Plant (PEEP), and the Younger extraction plant (Younger). The extraction assets provide stable fixed-fee or cost-of-service type revenues and margin based revenues. The natural gas supply to EEEP, JEEP, and PEEP depends on natural gas demand pull from residential, commercial and industrial usage inside and outside of Western Canada, and gas liquids demand pull from the Alberta petrochemical market and propane heating. Natural gas supply to Younger is dependent on the amount of raw natural gas processed at the McMahon gas plant, which is based on the robust natural gas producing region of northeastern British Columbia. |

AltaGas Ltd. – 2019 MD&A and Financial Statements - 16

Fractionation and Liquids Handling

Fractionation production is a function of NGL mix volumes processed, liquids composition, recovery efficiency of the plants, and plant on-line time. Due to the integration and inter-connectivity of AltaGas' Midstream assets, the fractionation and liquids handling activities provide integral services to the other Midstream businesses and customers by providing access to high value NGL products with access to North American and global markets through rail networks, pipelines, RIPET, and Ferndale.

AltaGas' liquids handling infrastructure consists of NGL pipelines; treating, storage, truck, and rail terminal infrastructure centered around AltaGas’ key Midstream operating assets at RIPET; Harmattan; and, in NEBC, Townsend and North Pine.

AltaGas’ fractionation and liquids handling infrastructure includes:

| ▪ | The North Pine facility, which is the only custom fractionation plant in British Columbia, providing area producers with a lower cost, higher netback alternative for their NGLs than transporting and fractionating in Edmonton. The first train of the North Pine facility is capable of processing up to 10,000 Bbls/d of NGL mix. Construction is ongoing for the second NGL separation train capable of processing up to an additional 10,000 Bbls/d of NGL mix and it is expected to be on-stream in the first quarter of 2020. The North Pine facility is connected to the Townsend truck terminal via the North Pine pipelines, to the Tourmaline Gundy facility, and also has access to the Canadian National rail network, allowing the transportation of propane, butane, and condensate to North American markets and propane to global markets via RIPET; |

| ▪ | The Harmattan gas processing complex, which has NGL fractionation capacity of 35,000 Bbls/d, a 450 Bbls/d capacity frac oil processing facility, and a 200 tonnes/d capacity industrial grade carbon dioxide (CO2) facility. Harmattan is the only deep‑cut and full fractionation plant in its operating area; |

| ▪ | Younger, which has fractionation capacity of 19,500 Bbls/d (9,750 Bbls/d net). Effective April 1, 2018, AltaGas has a 50 percent interest in Younger's fractionation, storage, loading, treating, and terminalling of NGL and Pembina assumed plant operatorship. The remaining interest is held by Pembina; |

| ▪ | A network of NGL pipelines in the NEBC area that connects upstream gas plant producers to the AltaGas North Pine facility. The NEBC NGL pipelines consist of two liquids egress lines, with a third line under construction, that connect the Townsend facility to the Townsend truck terminal on the Alaska Highway (30 km) and AltaGas' North Pine facility (70 km); |

| ▪ | NGL and spec propane lines currently under construction to connect the Townsend complex, in the North, to the Aitken Creek facilities through a 60 km NGL pipeline (Aitken Connector) and to the Tourmaline Gundy facility, in the West, through a 15 km spec propane line. The NGL and propane pipelines are currently under construction and are expected to be fully operational by the first quarter of 2020; |

| ▪ | A rail logistics network consisting of approximately 1,200 rail cars that AltaGas manages to support LPG and NGL handling; |

| ▪ | 50 percent ownership of the 5.3 Bcf Sarnia natural gas storage facility connected to the Dawn Hub in Eastern Canada; and |

| ▪ | The Alton Natural Gas Storage Project under construction. |

In addition to supporting the other Midstream activities within AltaGas, the liquids handling business identifies opportunities to buy and resell NGLs for producers, and exchange, reallocate or resell pipeline capacity and storage to earn a profit. Net revenues from these activities are derived from low risk opportunities based on transportation cost differentials between pipeline systems and differences in commodity prices from one period to another. Margins are earned by locking in buy and sell transactions in compliance with AltaGas’ credit and commodity risk policies. AltaGas also provides energy procurement services for utility gas users and manages the third-party pipeline transportation requirements for many of its gas marketing customers.

AltaGas Ltd. – 2019 MD&A and Financial Statements - 17

Pipeline Investments

AltaGas has a 10 percent equity interest in Mountain Valley. The proposed pipeline will transport approximately 2.0 Bcf/d of natural gas and is expected to be placed into service in late 2020. In April 2018, AltaGas entered into a separate agreement to acquire a 5 percent equity interest in a lateral project to build an interstate natural gas pipeline (MVP Southgate) which will receive natural gas from Mountain Valley. The MVP Southgate pipeline is expected to be placed into service in mid-2021.

AltaGas also held a 10 percent interest in the Constitution pipeline through a 10 percent equity investment in Constitution Pipeline Company, LLC. The natural gas pipeline venture was proposed to transport natural gas from the Marcellus region in northern Pennsylvania to major northeastern markets. In February 2020, following evaluations of the diminished underlying economics for the proposed Constitution pipeline project, the partners of Constitution Pipeline Company, LLC elected not to proceed with the project.

Retail Energy Marketing

AltaGas’ retail gas marketing business sells natural gas directly to residential, commercial, and industrial customers in Maryland, Virginia, Delaware, Pennsylvania, and the District of Columbia. AltaGas provides natural gas and NGL marketing and gas transportation services to optimize the value of the infrastructure assets and meet customer needs. Specifically, AltaGas provides natural gas related solutions to its customers and counterparties including producers, utilities, local distribution companies, power generators, wholesale energy suppliers, LNG exporters, pipelines, and storage facilities. In addition, AltaGas also contracts for storage and pipeline capacity in its trading activities through both long-term contracts and short-term transportation releases.

Capitalize on Opportunities

To take advantage of opportunities such as continued Montney LPG growth and the increasing Asian demand for LPG, AltaGas plans to grow its Midstream business by expanding and optimizing strategically-located assets as well as its global export business. New infrastructure is expected to be larger scale facilities supporting the vast reserves in North America and growing the footprint and integration of AltaGas' existing assets. While providing safe and reliable service, AltaGas pursues opportunities in the Midstream segment to deliver value to its customers and enhance long-term shareholder value. The Corporation's objectives are to:

| ▪ | Maximize and grow the unique structural advantage within AltaGas' integrated platform in the Montney region, leveraging RIPET and the integrated value chain to attract volumes; |

| ▪ | Increase utilization and export volumes at RIPET, continuing to build on export competency, with volumes expected to be in excess of 50,000 Bbls/d by the end of 2020; |

| ▪ | Develop high quality assets that enhance the integrated Midstream offering and connect producers to the global markets; |

| ▪ | Consolidate its position in key markets to deliver optimal growth over the long-term; |

| ▪ | Provide a fully-integrated Midstream service offering including gas processing and NGL extraction, fractionation, liquids handling facilities, and transportation and marketing services to customers across the energy value chain, with higher producer netbacks resulting from global export access to higher value global markets, including Asia; |

| ▪ | Maintain strong relationships with Indigenous peoples, regulators, customers, partners, and service providers; |

| ▪ | Optimize existing rail infrastructure to gain scale and efficiencies; |

| ▪ | Increase utilization and throughput at existing facilities while maintaining top tier operating costs, high reliability and NGL recovery, highly efficient business administration, and effective safety and environmental programs; |

| ▪ | Mitigate commodity risk through effective hedging programs and risk management systems; |

AltaGas Ltd. – 2019 MD&A and Financial Statements - 18

| ▪ | Mitigate volume risk through contractual structures, redeployment of equipment, and expansion of geographic reach; and |

| ▪ | Mitigate counterparty risk through customer base growth and diversification. |

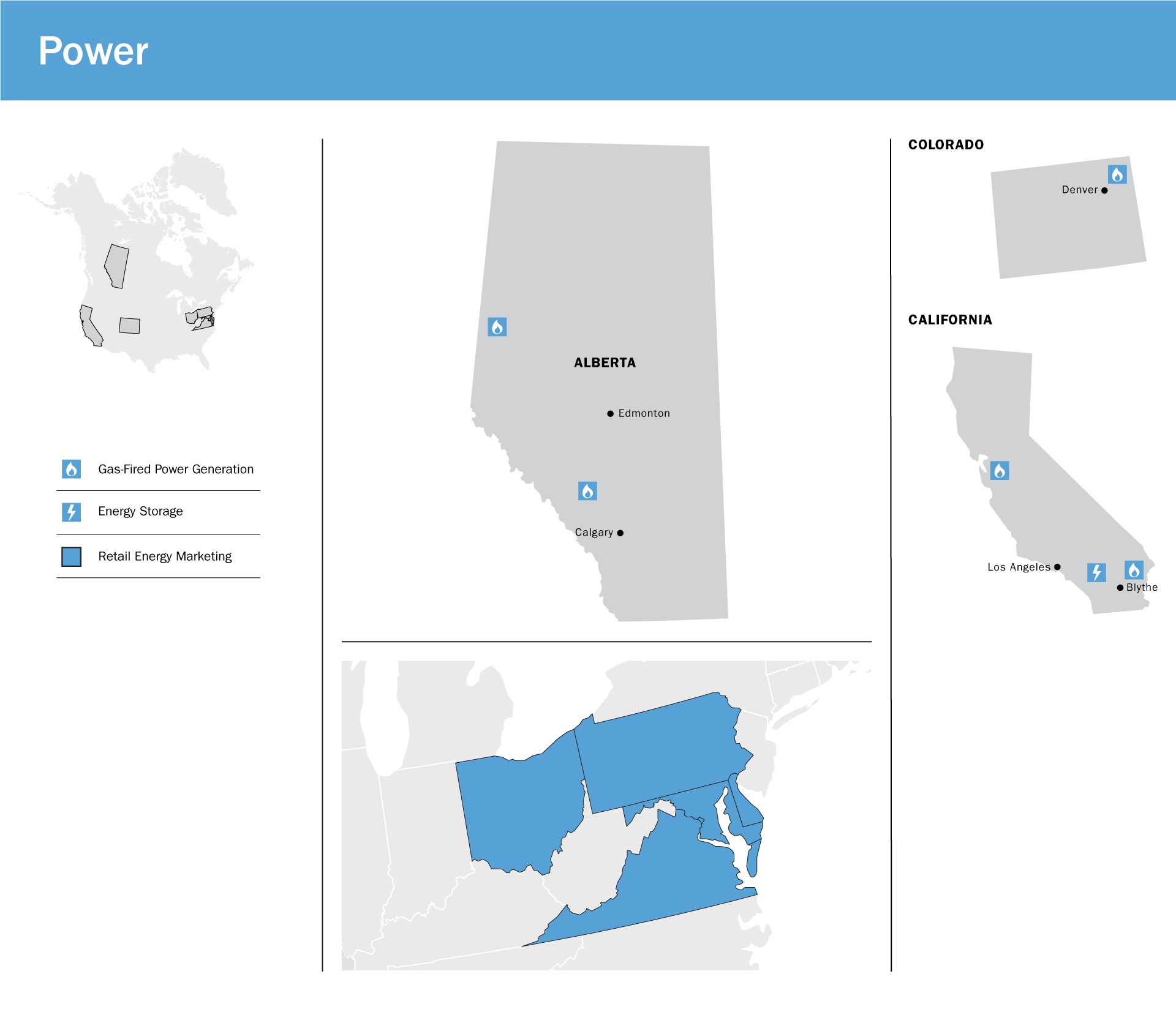

Power

Description of Assets

AltaGas' Power segment includes 710 MW of operational gross capacity from natural gas-fired, distributed generation, and energy storage assets, certain of which are pending sale, located in Alberta, Canada, and the United States, primarily in California and Colorado. The Power business also includes WGL’s retail power marketing business. Throughout 2018 and 2019, AltaGas has disposed of the majority of the assets in the Power segment and continues to operate under a capital-light power strategy.

AltaGas Ltd. – 2019 MD&A and Financial Statements - 19

Specifically, the Power segment includes:

| ▪ | Three natural gas-fired plants with 627 MW of generating capacity in the United States, including the 507 MW Blythe Energy Center (Blythe) and the 50 MW Ripon facility, located in California, and the 70 MW Brush II facility (Brush) in Colorado. Blythe is under a Power Purchase Arrangement (PPA) with a creditworthy utility; |

| ▪ | 45 MW of cogeneration and 3 MW of gas-fired peaking plant capacity in Alberta; |

| ▪ | 20 MW of lithium ion battery storage in Pomona, California, with a 10-year agreement for capacity under contract with SCE; |

| ▪ | WGL’s retail power marketing business, which sells power directly to residential, commercial, and industrial customers in Maryland, Virginia, Delaware, Pennsylvania, Ohio, and the District of Columbia; and |

| ▪ | Certain remaining distributed generation assets. |

In southern California, the 507 MW Blythe Energy Center utilizes gas-fired generation to produce power and serves the transmission grid operated by the California Independent System Operator (CAISO) to cover periods of high demand primarily driven by the Los Angeles area. Due to the structure of the long-term PPA with SCE, the majority of the revenue from the facility is derived from being available to produce and not from actual production, therefore providing stable cash flow. The facility is directly connected to a Southern California Gas Company natural gas pipeline for its supply and has reactivated an El Paso Gas Company connection as a second supply source, and interconnects to SCE and CAISO via a 67‑mile transmission line also owned by Blythe and is part of the Blythe Energy Center. In 2019, AltaGas announced the successful recontracting of the Blythe facility to SCE. With the approval of the new PPA with SCE by the California Public Utilities Commission in January 2020, the Blythe Energy Center is contracted under a PPA until December 31, 2023. Under the tolling agreement(s), SCE has exclusive rights to all capacity, energy, ancillary services, and resource adequacy benefits during the PPA term.

Ripon, a natural gas-fired power asset, was acquired in early 2015. The PPA contract expired May 31, 2018, following which AltaGas negotiated bilateral Resource Adequacy (RA) contracts that included the remainder of 2018, as well as the majority of 2019 and 2020. AltaGas retains the rights to the energy and ancillary service attributes of the facility, which are sold on a merchant basis into the CAISO.

In early 2015, AltaGas acquired Pomona, which is strategically located in the east Los Angeles basin load pocket. AltaGas constructed, owns, and operates a 20 MW (80 MWh) lithium-ion battery storage facility at the Pomona site (the Pomona Energy Storage facility) which entered service in December of 2016 and is under contract for 20 MW of resource adequacy capacity with SCE under a 10-year energy services agreement. AltaGas retains the rights to the energy and ancillary service attributes of the facility, which are sold on a merchant basis into the CAISO. In addition, AltaGas is in the initial stages of permitting a new 40 MW stand-alone energy storage project in Goleta, California.

The U.S. retail power marketing business sells power to end users in Maryland, Virginia, Delaware, Pennsylvania, Ohio, and the District of Columbia. This area is served by the PJM Interconnection (PJM), a regional transmission organization that regulates and coordinates generation supply and the wholesale delivery of electricity in the states and jurisdictions where WGL operates. Electricity is purchased with the objective of earning a profit through competitively priced sales contracts with end users. Requirements to serve retail customers is closely matched with commitments for electricity deliveries, and thus, a secured power supply arrangement expiring in 2022 has been entered into with Shell Energy North America (US), L.P. for the majority of electricity requirements to service end users, which also reduces credit requirements.

AltaGas Ltd. – 2019 MD&A and Financial Statements - 20

Consolidated Financial Review

| Three Months Ended December 31 | Year Ended December 31 | |||||||

| ($ millions except where noted) | 2019 | 2018 | 2019 | 2018 | ||||

| Revenue | 1,534 | 1,727 | 5,495 | 4,257 | ||||

Normalized EBITDA (1) | 425 | 394 | 1,271 | 1,009 | ||||

| Net income (loss) applicable to common shares | (103 | ) | 174 | 769 | (502 | ) | ||

Normalized net income (1) | 186 | 120 | 324 | 195 | ||||

| Total assets | 19,795 | 23,488 | 19,795 | 23,488 | ||||

| Total long-term liabilities | 9,301 | 11,746 | 9,301 | 11,746 | ||||

| Net additions (dispositions) of property, plant and equipment | 240 | 16 | (1,090 | ) | 573 | |||

Dividends declared (2) | 67 | 121 | 266 | 463 | ||||

| Cash from (used by) from operations | 16 | (60 | ) | 616 | (79 | ) | ||

Normalized funds from operations (1) | 332 | 255 | 895 | 657 | ||||

Normalized adjusted funds from operations (1) | 307 | 255 | 835 | 626 | ||||

Normalized utility adjusted funds from operations (1) | 241 | 192 | 573 | 460 | ||||

Normalized effective income tax rate (%) (1) | 12.2 | 13.1 | 15.4 | 14.0 | ||||

| Three Months Ended December 31 | Year Ended December 31 | |||||||

($ per share, except shares outstanding) | 2019 | 2018 | 2019 | 2018 | ||||

| Net income (loss) per common share - basic | (0.37 | ) | 0.64 | 2.78 | (2.25 | ) | ||

| Net income (loss) per common share - diluted | (0.37 | ) | 0.64 | 2.77 | (2.25 | ) | ||

Normalized net income - basic (1) | 0.67 | 0.44 | 1.17 | 0.88 | ||||

Normalized net income - diluted (1) | 0.67 | 0.44 | 1.17 | 0.87 | ||||

Dividends declared (2) | 0.24 | 0.45 | 0.96 | 2.09 | ||||

| Cash from (used by) from operations | 0.06 | (0.22 | ) | 2.22 | (0.35 | ) | ||

Normalized funds from operations (1) | 1.19 | 0.94 | 3.23 | 2.95 | ||||

Normalized adjusted funds from operations (1) | 1.10 | 0.94 | 3.01 | 2.81 | ||||

Normalized utility adjusted funds from operations (1) | 0.87 | 0.71 | 2.07 | 2.06 | ||||

| Shares outstanding - basic (millions) | ||||||||

During the period (3) | 278 | 272 | 277 | 223 | ||||

| End of period | 279 | 275 | 279 | 275 | ||||

| (1) | Non‑GAAP financial measure; see discussion in the Non-GAAP Financial Measures section of this MD&A. |

| (2) | Dividends declared per common share per month: $0.1825 beginning on November 27, 2017, and $0.08 beginning on December 27, 2018. |

| (3) | Weighted average. |

Three Months Ended December 31

Normalized EBITDA for the fourth quarter of 2019 was $425 million, compared to $394 million for the same quarter in 2018. Factors positively impacting normalized EBITDA included contributions from RIPET which was placed into service in May 2019, higher contributions from Washington Gas' utilities primarily due to Virginia and Maryland rate cases, higher margins from WGL's retail gas and power marketing businesses, higher transportation and storage spreads from WGL Midstream assets, higher Allowance for Funds Used During Construction (AFUDC) related to Mountain Valley, higher NGL marketing EBITDA due to a strong spot market, and higher equity earnings from Petrogas primarily due to higher export volumes and domestic margins. These were partially offset by the impact of asset sales, including the U.S. distributed generation assets in September 2019, the San Joaquin facilities in the fourth quarter of 2018, the Northwest Hydro facilities in January 2019, WGL Midstream's indirect non-operating interest in Central Penn in November 2019, WGL Midstream's interest in Stonewall in May 2019, the initial public offering (IPO) of ACI in October 2018, and certain non-core Midstream and Power assets in February 2019. Other factors decreasing EBITDA in the fourth quarter of 2019 included higher operating costs at Washington Gas, the impact of CINGSA's rate case decision received in the third quarter of 2019, and higher corporate employee costs primarily due to incentive plans. For the three

AltaGas Ltd. – 2019 MD&A and Financial Statements - 21

months ended December 31, 2019, fluctuations in the Canadian/U.S. dollar exchange rate resulted in a $1 million decrease in normalized EBITDA.

Net loss applicable to common shares for the fourth quarter of 2019 was $103 million ($0.37 per share), compared to net income of $174 million ($0.64 per share) for the same quarter in 2018. The decrease was mainly due to provisions recorded in the fourth quarter of 2019 and higher unrealized losses on risk management contracts, partially offset by the same previously referenced factors impacting normalized EBITDA, lower depreciation and amortization expense, lower interest expense, and gains on the sale of assets.