The information contained in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated ______________

PROSPECTUS

$950,000

KORTH DIRECT MORTGAGE, LLC

6.00%

KDM 2017-N002

Mortgage Secured NotesSM

Dependent Upon and Secured by

KDM 2017-L002

A Multiple Rental Property First Mortgage Loan

Korth Direct Mortgage, LLC (“KDM”) is issuing Mortgage Secured Notes Series KDM 2017-N002 (the “Notes”). The offering will commence on the effective date of the registration statement of which this prospectus is a part. The Notes are limited obligations of KDM and are secured by, and dependent upon, KDM’s receipts from a corresponding first mortgage commercial loan titled KDM 2017-L002 owned and serviced by KDM (the “CM Loan”).

The Notes will have a stated interest rate of 6.00%. Interest on the Notes will be paid monthly and will mature on December 12, 2020 See “Description of the Notes.” The Notes are subject to immediate prepayment by KDM in the event the CM Loan is prepaid. Proceeds of the sale of Notes offered hereby will be used to redeem notes designated KDM 2017-N002PP that were sold on a Regulation D private placement basis for purposes of funding the CM Loan on December 21, 2017. The notes to be redeemed have no prepayment penalty. The purchasers of the privately placed notes will receive cash of 100% of the outstanding principal amount, plus any accrued interest, for their privately placed notes.

We will offer the Notes through the Placement Agent referred to below. The Placement Agent may offer all or a portion the Notes through other broker-dealers (the “Selling Group.”) The Placement Agent and Selling Group members will offer and sell Notes on a “best efforts, all or none” basis.

Proceeds from the sale of Notes will be deposited in a segregated account at J. P. Morgan Chase until the offering is fully subscribed. This account is under the control of KDM. Funds held in this segregated account will be returned to investors if all of the Notes are not sold by March, 26, 2018. Proceeds received from the sale of the Notes will be used to redeem KDM2017-N002PP.

The Placement Agent has advised us it may purchase and sell Notes in the secondary market, but it is not obligated to make a market in the Notes.

Investing in Notes has certain risks. See “Risk Factors.”

| | Price to Public | Underwriting Discounts and Commission | Proceeds to KDM |

| Per Note | $1,000.00 | $00.00 | $1,000.00 |

| Total | $950,000.00 | $00.00 | $950,000.00 |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Placement Agent

J W KORTH & COMPANY

The date of this Prospectus is February 28, 2017.

| 1 |

| 2 |

| 2 |

| 2 |

| 4 |

| 6 |

| 11 |

| 12 |

| 12 |

| 12 |

| 13 |

| 19 |

| 26 |

| 26 |

| 26 |

| 32 |

| 34 |

| 34 |

| 35 |

| 39 |

| 40 |

| 40 |

| F-1 |

| 41 |

| 41 |

This prospectus describes our offering of our Mortgage Secured Notes, Series KDM2017-N002, which we refer to in this prospectus as the “Notes.” This prospectus is part of a registration statement filed with the Securities and Exchange Commission (the “SEC”). This prospectus, and the registration statement of which it forms a part, speak only as of the date of this prospectus.

Unless the context otherwise requires, we use the terms “KDM”, the “Company,” “our company,” “we,” “us” and “our” in this prospectus to refer to Korth Direct Mortgage, LLC, a Florida limited liability company.

The Notes might not be offered or sold to residents of every state. Our Placement Agent will inform all Selling Group members the states where Notes are available.

WHERE YOU FIND MORE INFORMATION

We have filed a registration statement on Form S-1 with the SEC in connection with this offering. You may read and copy the registration statement and any other documents we have filed at the SEC’s Public Reference Room at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the Public Reference Room. Our SEC filings are also available to the public at the SEC’s internet site at http://www.sec.gov.

This prospectus is part of the registration statement and does not contain all of the information included in the registration statement and the exhibits, schedules and amendments to the registration statement. Some items are omitted in accordance with the rules and regulations of the SEC. For further information with respect to us and the Notes, we refer you to the registration statement and to the exhibits and schedules to the registration statement filed as part of the registration statement or incorporated therein by reference. Whenever a reference is made in this prospectus to any of our contracts or other documents, the reference may not be complete and, for a copy of the contract or document, you should refer to the exhibits that are a part of the registration statement.

You may request a copy of any or all of the reports or documents that are described in this prospectus. They will be provided to you at no cost, by writing, telephoning or emailing us. Requests should be directed to Customer Support, 2937 SW 27th Avenue, Suite 307, Miami, Florida 33133; telephone number (786) 567-3117; or emailed to info@KDMinvestor.com.

FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements that involve substantial risks and uncertainties. All statements, other than statements of historical facts, included in this prospectus regarding KDM borrowers, credit scoring, FICO scores, our strategy, future operations, future financial position, future revenue, projected costs, prospects, property values, plans, objectives of management and expected market growth are forward-looking statements. The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “will,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements may include, among other things, statements about:

| · | the status of borrowers, the ability of borrowers to repay CM Loans, and the plans of borrowers; |

| · | expected rates of return and interest rates; |

| · | the commercial real estate market; |

| · | the attractiveness of our CM Loan and Notes; |

| · | our financial performance; |

| · | the availability of a secondary market for our Notes; |

| · | our ability to retain and hire competent employees and appropriately staff our operation; and |

We may not actually achieve the plans, intentions or expectations disclosed in forward-looking statements, and you should not place undue reliance on forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in forward-looking statements. We have included important factors in the cautionary statements included in this prospectus, particularly in the “Risk Factors” section, that could cause actual results or events to differ materially from forward-looking statements contained in this prospectus.

You should read this prospectus and the documents that we have filed as exhibits to the registration statement, of which this prospectus is a part, completely and with the understanding that actual future results may be materially different from what we expect. We do not assume any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

| Issuer | Korth Direct Mortgage, LLC |

| | |

| CM Loan Borrower | RZ Group Inc. |

| | |

| Designation of Mortgage Secured Note | KDM2017-N002 (“Notes”) |

| | |

| Designation of Corresponding CM Loan | KDM2017-L002 (“CM Loan”) |

| | |

| CM Loan Amount | $950,000 |

| | |

| Notes Amount | $950,000 |

| | |

| No Listing | KDM does not anticipate that the Notes will be listed on any securities exchange or that the Note will be traded on any other trading platform. |

| | |

| Offering Price | 100% |

| | |

| Denominations | $1,000 and multiples of $1,000 |

| | |

| CUSIP Number | 50067AAD4 |

| | |

| Settlement Date | March 15, 2018 |

| | |

| First Coupon Date | April 25, 2018 |

| | |

| Maturity | December 12, 2020 |

| | |

| Interest and Repayment of Principal | The Notes are interest only. Principal will be paid at the maturity date or an earlier redemption of the Notes. Interest on the Notes will be paid monthly on the twenty-fifth day of each month or the next business day. Such payment will depend upon, and be subject to, receipt of CM Loan proceeds received at least four business days prior to the payment date. |

| | |

| Interest on the Notes | 6.00% 1 |

| | |

| Redemption and Prepayment | Notes will be redeemed immediately if the CM Loan is redeemed. The CM Loan borrower has the option to prepay the CM Loan, subject to a penalty. Should the borrower prepay the CM Loan prior to maturity, in addition to principal the borrower must pay all the amount of interest that would have been paid through December 1, 2019 (the “Interest Guarantee”). There is no prepayment penalty if the borrower prepays the CM Loan on or after December 1, 2019. Please “Summary of Terms- Call Schedule.” The prepayment interest penalty is payable to the Noteholders when received by KDM. |

| | |

| Security for the Notes | Pursuant to the Trust Indenture and Security Agreement, KDM Mortgage Secured Notes (sometimes referred to in this prospectus as “MSN Notes”) will be senior to all other indebtedness of KDM and separate and distinct from each other. MSN Notes are secured special obligations of KDM. The security for each series of Notes is the mortgage, the loan, and the proceeds that KDM receives from the corresponding note and first mortgage obligation of a borrower. The Notes are not directly secured by a property; rather, they are secured by the CM Loan, which is secured by property. This security is made under “Security Interest,” Section 3.8 of the Indenture. A key part of the security arrangement under the Indenture is that each series of notes is separately secured by the CM Loan that corresponds to that series. Therefore, the security for the Notes offered herein is specifically the CM Loan described herein. |

| Assignment of Rents | Should the CM Loan borrower default, KDM, as lender and pursuant to an Assignment of Rents, will require that the renters of the CM Loan properties pay their rents directly to KDM. In these cases KDM will pay each Noteholder its pro-rata share of the rents collected less any out-of-pocket costs, such as legal expenses. Any assignment of rents should not curtail or delay a foreclosure and subsequent sale on the property to recover the principal on the CM Loan. KDM’s Service Fee applies to payments on Notes distributed from an Assignment of Rents. |

| | |

| Ratings | Egan-Jones has given the Note a provisional rating of “A-”. Egan Jones is a Nationally Recognized Statistical Rating Organization. KDM has rated this loan “BBB+”. See “The KDM CM Loan Rating Program.” |

| | |

KDM Debt | As of the date of this prospectus, KDM had no outstanding debt other than Mortgage Secure Note KDM 2017-N001 in the principal amount of $1,059,000 and KDM 2017-N002PP in the principal amount of $950,000, the latter of which will be redeemed from the proceeds of the sale of the Notes. The Indenture specifies that KDM may not incur debt other than the Mortgage Secured Notes except compensation owed to employees, rent for offices, or obligations to utility and informational services, and any other services which assist it in carrying out its mortgage lending, mortgage servicing, and MSN Note servicing functions. There are no other financial covenants limiting KDM’s activities. |

| | |

| KDM Right to Adjust the CM Loan | KDM has the right to make adjustments to the terms of the CM Loan in order to help prevent a foreclosure if it believes those adjustments to be in the best interest of the Noteholders. Such changes may reduce interest payments, suspend interest payments, lengthen the time when principal may be received or change other terms of the CM Loan which could reduce the expected benefits of the CM Loan to the Noteholders |

| | |

| Servicing Fee | Our Servicing Fee is the difference between the interest rate received on the CM Loan and the interest rate stated for the Notes. The Servicing Fee for the Notes is .50%. |

| | |

| Placement Agent Fee | The Placement Agent will be paid a placement agent fee of up to 0.00% of the Notes that it sells. This fee will be paid by the investors in the Notes, if they are purchased at a premium. |

| | |

Call Schedule | Pursuant to the Interest Guarantee provision of the CM Loan, the call schedule is as follows: |

| | 1/10/2018 | 111.46% | 3/10/2019 | 105.78% | |

| | 2/10/2018 | 111.06% | 4/10/2019 | 105.37% | |

| | 3/10/2018 | 110.66% | 5/10/2019 | 104.96% | |

| | 4/10/2018 | 110.25% | 6/10/2019 | 104.55% | |

| | 5/10/2018 | 109.85% | 7/10/2019 | 104.14% | |

| | 6/10/2018 | 109.44% | 8/10/2019 | 103.73% | |

| | 7/10/2018 | 109.04% | 9/10/2019 | 103.32% | |

| | 8/10/2018 | 108.63% | 10/10/2019 | 102.90% | |

| | 9/10/2018 | 108.23% | 11/10/2019 | 102.49% | |

| | 10/10/2018 | 107.82% | 12/10/2019 | 102.08% | |

| | 11/10/2018 | 107.41% | 1/10/2020 | 101.66% | |

| | 12/10/2018 | 107.01% | 2/10/2020 | 101.25% | |

| | 1/10/2019 | 106.60% | 3/10/2020 | 100.83% | |

| | 2/10/2019 | 106.19% | 4/10/2020 | 100.42% | |

An investment in the Notes involves risks. Before making an investment decision, you should carefully consider the risks and uncertainties described in this prospectus and the registration statement of which this prospectus is a part. The underlying loan upon which your payment depends, as well as our business, financial condition, operating results and cash flows can be impacted by these factors, any one of which could have a material adverse effect on the value of the Notes you purchase and could cause you to lose all or part of your initial purchase price or adversely affect future principal and interest payments you expect to receive.

You may lose some or all of your investment in the Notes.

The regular payment of the Notes depends entirely on payments to KDM of the borrower’s CM Loan. The Notes are special, limited obligations of KDM payable only from KDM’s receipts of CM Loan proceeds, net of KDM’s servicing Fee and cost of collection. If the borrower defaults on the CM Loan, Noteholders will be dependent on proceeds from the Assignment of Rents held by KDM and on the proceeds if any, from foreclosure of the CM Loan mortgage for payments on the Notes. The failure of the borrower to repay the CM Loan is not an event of default by KDM. Notes are suitable purchases only for investors of adequate financial means who, in the event of a default on the underlying CM Loan, may have to wait for a foreclosure to recover some or all of the principal invested in their Note.

We rely on third-party appraisals to value the property securing the CM Loan, and information from the borrower on cash flow and profitability of the income property.

While we make every effort to engage responsible licensed third-party appraisers, we cannot be certain that the information and presentations they make are reliable. Appraisals are subject to mistakes that could affect the value of a property. Further, appraisers may make judgments of value based on cash flow presented by borrowers. If a borrower were to falsify its cash flow, it could affect the value shown in the appraisal. To verify cash flows, we receive bank statements from borrowers. KDM is not responsible for mistakes or fraudulent activities of borrowers or appraisers.

We rely on industry default and recovery rates for underwriting our CM Loans. Our default rates are untested against industry rates and may be higher.

Due to our limited operational and origination history, we do not have significant historical performance data regarding borrower performance and we do not yet know what our long-term CM Loan loss experience may be. It is possible that our default rates may be higher than the industry averages and our recovery rates may be lower than the industry averages.

If we believe it is in the best interest of the Noteholders, we have the right to adjust the terms of a CM Loan.

It is possible that due to natural disasters, local disruption of services, political unrest, changes in local laws, market competition or disruptions and other unforeseen events that affect the property pledged under a CM Loan or affect the borrower’s ability to make its CM Loan payments, it might be in the best interest of the Noteholders to provide a borrower with an accommodation regarding loan terms rather than be forced to foreclose on a loan. If we adjust a CM Loan, it may reduce interest payments, suspend interest payments, lengthen the time when principal may be received or change other terms of the CM Loan which could reduce the expected benefits of the CM Loan to the Noteholders.

There may be a default on the CM Loan.

CM Loan default rates may be significantly affected by general economic conditions beyond our control and beyond the control of the individual borrower. Default on the CM Loan is subject to many factors, such as prevailing interest rates, the rate of unemployment, the level of consumer confidence, residential or commercial real estate values, the value of the U.S. dollar, energy prices, changes in consumer spending, the number of personal bankruptcies, disruptions in the credit markets, and other factors, none of which can be predicted with certainty.

The credit information we use may be inaccurate or may not accurately reflect the creditworthiness of the person whose credit information we use, which may cause you to lose part or all of the purchase price of the Notes.

While we primarily focus on the underlying property and its cash flow to repay Notes, we may obtain borrower credit information from consumer reporting agencies, such as TransUnion, Experian, or Equifax. A credit score may not reflect the actual creditworthiness of the borrower or individual on whose credit we rely (whom we refer to below as the “Principal”) because the credit score may be based on outdated, incomplete or inaccurate consumer reporting data, and we do not verify the information obtained from the borrower’s credit report. Additionally, there is a risk that, following the date of the credit report that we obtain and review, a borrower or Principal may have:

| · | become delinquent in the payment of an outstanding obligation; |

| · | defaulted on a pre-existing debt obligation; |

| · | taken on additional debt; or |

| · | sustained other adverse financial events. |

Investors in the Notes will not have access to financial statements of the borrower or Principal or to other detailed financial information about the borrower or Principal. Accordingly, prospective investors will not be able to assess the creditworthiness of the CM Loan borrower or Principal. See “The credit rating that we use in our rating system for our mortgages may not be the credit rating of the borrower, any guarantor, or anyone having personal liability for payment of the mortgage loan,“ below.

Information supplied by the borrower could be inaccurate or intentionally false.

While we perform due diligence on each borrower, receive credit reports, and verify property ownership, rent collections, property values, coverage ratios and other appropriate due diligence materials, a borrower could present us with false information which we may not discovered through our due diligence process.

We do not monitor our borrowers’ use of funds.

It is possible the borrower may not use the funds for the purposes it has asserted, for example, to improve the property. Additionally, the borrower could potentially misuse the proceeds it receives from the loan in a way that negatively impacts their ability to make timely payments on the CM Loan, their credit, or the value of the underlying property.

The credit rating that we use in our rating system for our mortgages may not be the credit rating of the borrower, any guarantor, or anyone having personal liability for payment of the mortgage loan.

KDM includes a credit score in our internal rating system. The credit score we use may not be the credit score of the borrower or, if the loan is guaranteed, of the guarantor, or of any individual who is personally liable for the payment of the CM Loan. Our borrowers are typically single-purpose entities created to own the mortgaged property. Some single-purpose entities may in turn be owned by a trust, a partnership, or another form of entity. If a loan is guaranteed, the credit score we use may not be that of the guarantor, as the guarantor be an entity and not an individual.

The person whose credit score we use to rate a CM Loan (whom we refer to as the “Principal”) is the individual that we consider most responsible for the mortgaged property, collection of rents and making payments to KDM on the CM Loan. We consider the credit score of the Principal as a measure personal responsibility and financial experience. The Principal may not be personally liable for payment of the CM Loan.

CM Loan Guarantees May Not Be Collectable

Some CM Loans may have a personal guarantee. We may ask for guarantees from the owners, or the owners of the owner, if the owner is not an individual. Because we primarily focus our underwriting on the value of the mortgaged property, the loan to value ratio, and the debt service coverage ratio, we generally do not investigate the net worth of the borrowers, and therefore, the ultimate value of the guarantee on a CM Loan, if any. In the event a CM Loan goes into foreclosure and the money realized in the foreclosure does not pay off the entire principal owed on the CM Loan, investors should not count on the guarantee being collectible. Should such a situation arise, investors may not see repayment of the entire principal amount of their Notes.

If payments on the CM Loan becomes more than 30 days overdue, you may not receive the full principal and interest payments that you expect to receive on the Notes.

Payment to holders of the Notes is completely dependent on payments received from the CM Loan. If the borrower fails to make a required payment on the CM Loan within 30 days of a due date, we will pursue reasonable collection efforts in respect of the CM Loan. Referral of a delinquent CM Loan to an attorney on the 31st day of its delinquency will be considered reasonable collection efforts. If we refer a CM Loan to an attorney, we will monitor that CM Loan until the property is foreclosed and resold and investors are paid. We may also handle collection efforts in respect of a delinquent CM Loan directly. In the case of collection efforts, the costs of attorney fees will be charged against the CM Loan and will reduce your net payments on your Note.

The CM Loan underlying the Notes is payable on an interest-only basis until maturity, at which time the entire principal balance is due. Therefore, borrowers may have to refinance to pay off a balloon payment on the CM Loan.

If a borrower must refinance to pay off a CM Loan, such refinancing could be impossible due to market conditions or other factors. In such a case, the CM Loan would default. Such a default could reduce or eliminate principal payment of the Notes.

The CM Loan may be prepaid at any time. Borrower CM Loan prepayments will reduce payments of interest on the Notes.

The borrower may prepay some or all of the principal amount of the CM Loan. A borrower may decide to prepay all, or a portion of, the remaining principal at any time. Notwithstanding the prepayment of all or a portion of the CM Loan, the borrower must pay all of the interest that would be due on the principal amount of the CM Loan until the expiration of the Interest Guarantee. Noteholders will receive such prepayment, net of our servicing fee. Interest will not accrue after the date on which the CM Loan is paid in full. If the borrower prepays a portion of the remaining unpaid principal balance on the CM Loan, we will reduce the outstanding principal amount and interest will cease to accrue on the prepaid portion. On an amortizing loan, we will require the borrower to pay the same amount on the CM Loan as the borrower paid prior to any partial repayment of principal. As a result of the combination of the reduced principal amount and the unchanged monthly payment, the effective term of the CM Loan will decrease. On an interest only CM Loan, the monthly payment you receive will be reduced proportionally by the amount of principal repaid. If the borrower prepays the CM Loan in full or in part, you will, in all probability, not receive all the interest payments that you expected to receive on the Notes.

Prevailing interest rates may change during the term of the CM Loan on which your Note is dependent.

If the CM Loan is prepaid, Noteholders may be unable to invest prepaid Note proceeds at a rate comparable to the interest payable on the Notes. Further, if interest rates rise, there is a market for the Notes, and a Noteholder decides to sell a Note prior to maturity, the Noteholder may receive a discounted return on the Note.

Investor funds in a KDM segregated account do not earn interest.

Proceeds of the sale of the Notes will be held in a non-interest bearing segregated account pending completion of the Note Offering and investment in the Notes. Further, we place borrower loan payments in a segregated account under our control and pay all loan payments collected from the prior payment date at least four business days prior to the payment date on the twenty-fifth day of each month, with an extension to the next business day if required. Funds held in segregated accounts do not earn interest. These segregated accounts are held at JP Morgan Chase and are managed by KDM. There is no escrow agreement with the bank

The Notes will not be listed on any securities exchange, and it is unlikely that a trading market for the Notes will develop. The Placement Agent may make a market in the Notes, but is not obligated to do so.

There can be no assurance that a market for Notes will develop or that there will be a buyer for any particular Notes offered for resale. Therefore, investors must be prepared to hold their Notes to maturity.

We have a limited operating history.

Our operating history is very limited and there can be no assurance that we will remain in business for the full term of the Notes. Should we cease operations, we expect that our Notes would be serviced by another company, but there is no assurance that another real estate and mortgage servicer will agree to service the Notes and the CM Loan. In this unlikely event, there could be delays in payments of interest and principal on your Notes.

We may have to constrain our business activities to avoid being deemed an investment company under the Investment Company Act.

In general, a company that is or holds itself out as being engaged primarily in the business of investing, reinvesting or trading in securities may be deemed to be an investment company under the Investment Company Act of 1940, as amended (Investment Company Act). The Investment Company Act contains substantive legal requirements that regulate the manner in which “investment companies” are permitted to conduct their business activities. We believe we are excluded from registration by Section 3(c)(5)(c) of the Investment Company Act and have conducted, and we intend to continue to conduct, our business in a manner that does not result in our company being characterized as an investment company. This section of the Investment Company Act contains an exemption for companies that make mortgages and do not issue redeemable shares. To avoid being deemed an investment company, we may not be able to broaden our offerings, which could require us to forego attractive opportunities. If we are ever deemed to be an investment company under the Investment Company Act, we may be required to institute burdensome compliance requirements and our activities may be restricted, which could materially adversely affect our business, financial condition, and results of operations.

Funds Received for all CM Loans are commingled in a Segregated Account.

We hold all funds received from CM Loans in a segregated account title In-Trust For 2 at JP Morgan Chase bank. We then use our internal accounting system to determine which funds are applied to which Note investors. While our internal accounting system is backed up into separate record keeping systems managed by service providers, should our systems fail and the back-up systems fail for any reason we may have difficulty determining which payments are to be applied to which Note holder and your payments could be delayed until such a determination is made. We also could make an accounting error that would send too much money to one Note holder and leave other Noteholders short of funds until we could recover the erroneous payments through the payment systems we utilize to distribute funds to investors. In such a case, recovery of over payments may not be achieved and it would leave the account permanently short for investors who did not receive the over payments.

KDM deposits all interest and principal payments which it receives on CM Loans in a single segregated bank account, and payments on real tax and insurance escrows in another segregated account, which accounts and the funds deposited in them may be subject to claims of general creditors of KDM in the event of a KDM bankruptcy.

In the event that of a KDM bankruptcy, general creditors of KDM may assert a claim that funds on deposit in the segregated account maintained by KDM for the benefit of Noteholders, and the separate segregated account maintained by KDM for real estate tax and insurance payments, are subject to the claims of general creditors. Principal and interest payments on CM Loans are deposited in a segregated bank account, and payments of real estate taxes and insurance on mortgaged properties are deposited in another segregated account, when and as received by KDM. Receipts deposited in those accounts are disbursed to Noteholders monthly and annually to property insurers and taxing authorities. KDM performs all accounting for these accounts, including sub-accounts for each Noteholder and property, and maintains all accounting records at its principal office. Under the Trust Indenture, the Trustee will have a first lien on the principal and interest account for the benefit of Noteholders. If the bankruptcy court were to determine that the funds in the account were subject to claims of creditors other than Noteholders or the Trustee acting on their behalf, the amount that Noteholders would receive from the account could be adversely affected. Further, amounts on deposit to pay real estate taxes and insurance could be reduced or entirely eliminated if paid to general creditors of KDM in the bankruptcy proceeding. The bankruptcy court could temporarily stay disbursements to Noteholders, taxing authorities and insurers even if the court were ultimately to determine that the funds in the account should be distributed to the Noteholders, the Trustee acting on their behalf, and, also, as appropriate, to taxing authorities and property insurers, resulting in delays to Noteholders in the receipt of payments on their Notes and penalties imposed by insurers and taxing authorities.

If we are unable to increase transaction volumes, our business and results of operations will be affected adversely.

To succeed, we must increase transaction volumes by attracting a large number of borrowers and be able to raise the capital to fund CM Loans through issuance of Notes to investors, in a cost-effective manner. We intend to attract borrowers through a network of mortgage brokers and real estate agents. We will rely on our parent company, J W Korth & Company, to raise capital. It is possible that we will not develop enough of a following either by CM Loan brokers or securities brokers to sell enough CM Loans or Notes to make KDM profitable. Should this occur, we may assign servicing of the CM Loans and Notes to a third-party servicer.

The market in which we participate is competitive and, if we do not compete effectively, our operating results could be harmed.

The commercial mortgage market is competitive and rapidly changing. We expect competition to persist and intensify in the future, which could harm our ability to increase volume.

Our principal competitors include major banking institutions, credit unions, credit card issuers and other consumer finance companies. It is possible that one or more of these companies decide to compete directly with us. The results of such competition could harm our operating results and, in that event, our ability to continue to service the CM Loan and Notes could be adversely affected.

We rely on third-party banks to disburse CM Loan proceeds and process CM Loan payments, and we rely on third-party computer hardware and software. If we are unable to continue utilizing these services, our business and ability to service the CM Loans on which the Notes are dependent may be adversely affected.

We rely on a third-party bank to disburse CM Loan amounts. Additionally, because we are not a bank, we cannot belong to and directly access the ACH payment network, and we must rely on an FDIC-insured depository institution to process our transactions, including CM Loan payments and remittances to holders of the Notes. We currently use J P Morgan Chase for these purposes. We also rely on computer hardware purchased and software licensed from third parties. This purchased or licensed hardware and software may not continue to be available on commercially reasonable terms, or at all. If we cannot continue to obtain such services from this institution or elsewhere, or if we cannot transition to another processor quickly, our ability to process payments will suffer and your ability to receive principal and interest payments on the Notes will be delayed or impaired.

Competition for our employees is intense, and we may not be able to attract and retain the highly skilled employees who we need to support our business.

Competition for highly skilled technical and financial personnel is extremely intense. We may not be able to hire and retain these personnel at compensation levels consistent with our existing compensation and salary structure. Many of the companies with which we compete for experienced employees have greater resources than we have and may be able to offer more attractive terms of employment.

In addition, we invest significant time and expense in training our employees, which increases their value to competitors that may seek to recruit them. If we fail to retain our employees, we could incur significant expenses in hiring and training their replacements and the quality of our services and our ability to service the CM Loans could diminish, resulting in a material adverse effect on our business and our ability to service the Notes.

If we fail to retain our key personnel, we may not be able to achieve our anticipated level of growth and our business could suffer.

Our future depends, in part, on our ability to attract and retain key personnel. Our future also depends on the continued contributions of our executive officers and other key technical personnel, each of whom would be difficult to replace. The loss of the services of any of the executive officers or key personnel, and the process to replace any of our key personnel would involve significant time and expense and may significantly delay or prevent the achievement of our business objectives.

Purchasers of Notes will have no control over KDM and will not be able to influence KDM corporate matters.

Our Notes grant no equity interest in KDM to the purchaser nor grant the purchaser the ability to vote on or influence our management decisions, including forbearance or foreclosure. As a result, our members will continue to exercise 100% voting control over all our company operations, including the election of managers and officers and the approval of significant transactions, such as a merger or other sale of our Company or its assets. Any such actions which we take may adversely affect our business and our ability to service the CM Loan and Notes.

Events beyond our control may damage our ability to maintain adequate records, or perform our servicing obligations. If such events result in a system failure, your ability to receive principal and interest payments on the Notes would be substantially harmed.

If a catastrophic event resulted in an outage and physical data loss, our ability to perform our servicing obligations would be materially and adversely affected. Such events include, but are not limited to, fires, earthquakes, hurricanes, terrorist attacks, natural disasters, computer viruses and telecommunications failures. We store back-up records via cloud storage services via several different companies. If our electronic data storage and back-up storage system are affected by such events, we cannot guarantee that you would be able to recoup your investment in the Notes.

Federal and State regulatory bodies may create new rules and regulations that could adversely affect our business.

In the wake of the last financial crisis, banking and finance regulation continues to evolve, increasing regulation by federal and state governments become more likely. Our business could be negatively affected by the application of existing laws and regulations or the enactment of new laws applicable to lending, mortgages, mortgage servicing, or securities distribution. The cost to comply with such laws or regulations could be significant and would increase our operating expenses, and we may be unable to pass along those costs to our investors in the form of increased fees.

If we discover a material weakness in our internal control over financial reporting, which we are unable to remedy, or otherwise fail to maintain effective internal control over financial reporting, our ability to report our financial results on a timely and accurate basis may be adversely affected.

Should our auditors discover a material weakness in our internal controls, our ability to report our financial results on a timely and accurate basis may be adversely affected.

New Government Regulation may limit our ability to make CM Loans

We do not believe that we are subject to Risk Retention under RR (17 CFR 246), as our entity type is not within scope of the rule according to 12 CFR 244.1(c). However, if we become subject to risk retention rules, we could be required to raise significant capital in order to continue doing business.

Our Proprietary Ratings System is untested and based on broad assumptions for which we have no statistical basis

We created the KDM Ratings System internally, and based it on very broad assumptions and experience of staff members. Our staff members have no experience in creating a ratings system. We are not affiliated with nor do we have experience in creating ratings of debt or mortgage securities. The Ratings have no track record and have not been tested against any known data set. The System is still evolving, and we add items as we add property types. It should not be relied upon as a predictable measure of performance of the underlying CM Loan at this time. We also have conflicts of interest with respect to our Ratings System. Please see “Conflicts of Interest Regarding Our Proprietary Ratings System.”

General

KDM earns money by making and servicing loans. Our parent company, J W Korth & Company (“JWK”), is a broker-dealer that makes money by selling securities. JWK will make money by selling KDM Mortgage Secured Notes as our Placement Agent.

KDM has a financial incentive to make CM loans and distribute Notes based on CM Loans. This incentive may influence its judgment as to the quality of CM Loans it will make. To help control this conflict, KDM has created a rating system for CM Loans and has written underwriting standards. Further our parent company, JWK, will distribute KDM Notes to retail customers and other dealers. Accordingly, JWK has a financial incentive which may influence the underwriting and due diligence required for originating CM Loans.

Some members of the loan origination team are also registered brokers with JWK. Such employees may be paid for both origination and sales of a loan and a Note, respectively. We will mitigate these conflicts of interest with compliance oversight and review of such transactions and compensation.

Conflicts of Interest Specific to the CM Loan

We know of no conflicts of interest regarding the CM Loan or the Notes.

Conflicts of Interest Regarding our Proprietary Ratings System

We have a conflict of interest regarding our proprietary ratings system. The same people doing our ratings may also benefit from the sales of Notes and making new CM Loans. Further we are 100% owned by JWK, which will distribute our Notes and may make a market in them. Ratings will be reviewed periodically and changed as necessary for each CM Loan and the corresponding Notes. If a secondary market were to develop, secondary market prices for our Notes may move up or down if the rating is changed. Therefore, to limit the effect of the conflict of interest between traders making markets and changes in ratings it shall be a strict policy of the Company that the people reviewing ratings may not communicate or socialize with the traders making markets in our Notes and that all changes in ratings will be published as promptly as possible. Another mitigating factor regarding these conflicts of interest is that our ratings are most generally based on verifiable numbers.

We may change any of our procedures regarding managing our conflicts of interest at any time. We also may amend our rating procedure at any time.

FIDUCIARY RESPONSIBILITY OF KDM

KDM as lender to the borrower and issuer of the Mortgage Secured Notes must exercise good faith and integrity in handling all its affairs especially as they relate to collection of CM Loan payments and distribution of those payments to investors in the Notes. Investors who may have questions as to the duties of KDM should consult their counsel.

INDEMNIFICATION OF OFFICERS OF KDM

The KDM Operating Agreement provides for indemnification of the officers for liabilities they may incur in dealings with third parties on behalf of KDM. To the extent that the indemnification provisions may purport to include indemnification for liabilities arising under the Securities Act of 1933, in the opinion of the Securities and Exchange Commission, such indemnification is contrary to public policy and therefore unenforceable.

Overview

KDM originates and funds CM Loans made to individual borrowers and are held by KDM as lender.

Our lending program operates primarily by email and telephone. Our website is only informational in nature. We encourage the use of electronic payments as the preferred means to disburse CM Loan proceeds and remit cash payments on outstanding CM Loans.

We have positioned ourselves in the lending market as a source for commercial real estate loans of higher quality borrowers, and borrowers who may not qualify or may not want to go through the process for bank loans, but whose loans have strong property and mortgage-related metrics. Property metrics depend on the type of CM Loan being offered and are described below.

KDM is currently focused on the market for loans secured by mortgages on apartment buildings, but may fund other types of commercial real estate.

KDM uses email, telephone, advertising and mail and industry sources to identify commercial borrowers who have mortgages with above-market interest rates and who may meet our loan parameters. We believe there are many thousands of apartment buildings which may qualify and desire this type of CM Loan. In addition to this market we believe there are many apartment buildings which may need new financing because their current loans are maturing. Additionally, we seek to identify borrowers who may desire funding to purchase apartment buildings.

CM Loans are secured obligations of individual borrowers that are a single-purpose entity formed to hold the underlying property to be financed.

The KDM Process

When KDM identifies a property proposed for financing, it is screened by KDM’s origination underwriting team. If the proposed financing passes underwriting, KDM creates a summary sheet which it sends to the Placement Agent to gauge an indication of interest. When the Placement Agent believes it has sufficient interest to move forward, it will notify KDM and KDM will complete the loan underwriting and file a registration statement for the series of notes which will fund the CM Loan. The Placement Agent will take orders on a “when, as and if issued” basis. Once the registration statement is effective, KDM will contemporaneously close the loan, orders will be executed and funds will transfer on the settlement date to one of KDM’s segregated accounts. KDM will then fund the CM Loan and issue the notes.

KDM receives monthly interest and principal payments from CM loan borrowers. These payments are generally made by check or Automated Clearing House (“ACH”) collection from the borrower’s account(s). KDM collects its service fee (annualized) of the interest portion of the payment and then disburses the remaining interest and principal via wire transfer or ACH to DTC to credit to investors’ accounts at their respective DTC member or those brokerage firms corresponding with DTC members.

We verify the identity of borrowers, obtain borrowers’ credit characteristics from a consumer reporting agency such as TransUnion, Experian or Equifax, and screen borrowers for eligibility. When dealing with a new loan, we also verify the income from the underlying property by comparing the bank account statements of borrowers with the incoming rents received, the debt service coverage and the loan to value using independent appraisers. We service CM loans on an ongoing basis.

We may offer CM loans to borrowers throughout the United States. As of the date of this prospectus, we were not dependent on any single party for a material amount of our revenue.

Borrowers who use us must identify their intended use of CM Loan proceeds in their initial CM Loan request. We do not verify or monitor a borrower’s actual use of funds following the funding of a CM Loan.

Step One: Identify Loan Parameters

KDM, through market research, identifies CM loan parameters and related investor parameters that it expects will be of value to both borrowers and investors. It then uses its network of mortgage brokers, real estate agents, and lending platforms to identify properties that potentially meet these parameters. The parameters identified will include the loan type, expected interest rate, maturity, pre-payment terms, loan-to-value, minimum debt service coverage ratio, borrower credit score, and basic loan structure.

Step Two: Identify and Screen Property

The KDM origination team works to bring in leads on new properties on which KDM can potentially lend. The team has a network of mortgage brokers, real estate agents, lending platforms, as well as lead generation databases that it uses on a daily basis to identify potential loans. Once the team finds a potential property it creates a deal scorecard that identifies critical preliminary underwriting information, including potential loan value-to-cost ratio, debt service coverage of the proposed loan, borrower credit score, real estate comparison prices, last appraised value, and estimated current value, along with information about the property and location, including city, neighborhood, number of units, and use of proceeds.

Step Three: Create a Summary Sheet

KDM creates a deal summary sheet for the Placement Agent to use to gauge interest from selling group members. The Placement Agent uses its network of selling group members to assess whether there is adequate investor appetite for the terms of a proposed note. If there appears to be sufficient interest, then the Placement Agent will communicate that to KDM.

Step Four: Complete Underwriting and File Registration Statement

Once KDM reasonably believes that the CM loan can be funded by the proceeds of a note, it will execute a commitment letter with a borrower (subject to funding). When the borrower executes the commitment letter, it pays KDM a processing fee, KDM then orders an appraisal and a subsequent appraisal review. Simultaneously, we will prepare and file a registration statement for Notes that we will issue to fund the CM loan.

Step Five: Placement Agent and Effective Order

The Placement Agent takes “when, as and if issued” orders for a series of our MSN Notes. Once the SEC declares the registration statement for a series of MSN Notes effective, the Placement Agent will distribute the offering prospectus and confirm final orders with other dealers and clients. The Placement Agent will then execute orders according to a mutually agreed upon trade date with KDM.

Step Six: Funding the Note, Closing the CM Loan

KDM will schedule closing for the CM Loan on or before the trade date of the Notes. Within one business day of the settlement date, funds, net of selling concession, will be wired by the Placement Agent to KDM’s segregated account for loan funding. KDM will schedule wire funds for the CM Loan closing as soon as practicable after receipt.

Once funds are collected, the CM Loan will be closed with documents filed in the proper jurisdiction showing KDM as mortgagee. At the same time, KDM will create and execute a physical Note for issuance to Cede & Company and delivery to Depository Trust Company (“DTC”), or its agent. DTC will credit each participating dealer with the appropriate face amount of the Note for further credit to each of its participating client accounts. Also, as soon as possible, but in no case more than five business days, copies of the loan closing documents will be filed with the Trustee.

How KDM operates if KDM Acquires Existing CM Loans and Issues Corresponding Notes

When KDM acquires an existing CM Loan and issues corresponding Notes, the Notes sale and CM Loan closing process is the same as above, except that KDM will purchase the CM Loan from a third party. Information about the borrower of an existing loan may be more limited and appraisals may be less current than for a loan originated by KDM. In such instances, an estimate of value from a local expert may be required to bolster an appraisal. A history of CM Loan payments will be included in the registration statement for the notes to be issued to purchase an existing CM Loan. It is possible that existing CM loans may be purchased by KDM directly and that KDM will subsequently file a registration statement for the principal amount of notes necessary to purchase the loan from KDM. In this case the price and yield of the CM Loan at acquisition by KDM as well as the net mark-up of the CM Loan in the form of the corresponding Notes will be disclosed in the registration statement.

CM Loans may also be acquired by purchasing a participation in CM Loans from another lending institution. In these cases, the pricing of the participation and the net mark-up or down of the CM Loan in the form of the corresponding Note will be fully described to investors as well as a detailed description of the financial institution selling the participation interest(s).

How KDM Prices CM Loans and Corresponding Notes

Note maturities and yields to investors must be competitive with other options they have for secured investments. Notes are not guaranteed by any federal agency, so they must be competitively priced when compared with other types of lower-risk debt, such as lower investment grade corporate bonds or other mortgage loans. Borrowers may have other options for acquiring new mortgage funding. KDM must be competitive with these options in order to acquire new CM Loans. The dynamic between these two marketplaces is a principal factor in the determination of the terms of the KDM notes.

How our Servicing Fee Applies

KDM services the underlying CM Loans and manage the distribution and payment of interest and principal on the corresponding Notes. For these services it charges an annual fee targeted at 1.00%; but it could be lower or higher for a given CM Loan based on that CM Loan and the corresponding Note’s terms, as disclosed in the prospectus for each Note. The Servicing Fee accrues to KDM, and is paid by the borrower from the mortgage CM Loan interest payments. It therefore creates a lower net interest on the underlying note to the investor. The Servicing Fee is applied to every interest payment received on the underlying CM Loan. Therefore, if we receive 7.00% interest annually from the underlying CM Loan and the Servicing Fee is 1%, your payments will be 6.00% annually, barring any other expenses.

Verification of Property and Investor Information

Notwithstanding KDM’s due diligence examination of the information provided to KDM by a borrower, there can be no assurance that the information provided to us, and, on which we rely, could accordingly be false.

CM Loan Servicing

KDM is responsible for servicing all the loans it makes to mortgage borrowers and collecting payments from those borrowers and delivering payments to investors on its Notes. KDM has limited experience in loan servicing but has staff with extensive back office and accounting experience and has purchased servicing software. Personnel at KDM and its parent also have extensive experience in management of property loans.

KDM does not plan to make advances of funds to any party as a servicer.

KDM has custodial responsibility for the CM Loans and pursuant to the Trust Indenture for the Notes must provide electronic copies of all CM Loan documents to the Trustee.

There are no limitations in KDM’s liability as servicer of its loans.

KDM retains a Servicing Fee for each CM Loan and this charge is described in “About the CM Loan Covered by this Prospectus.” Should KDM cease operations as Servicer, it is highly likely that a new Servicer could be engaged using the Servicing proceeds provided by the Servicing Fee for each loan. Currently there are no specific arrangements for a back-up servicer.

KDM or its affiliates may retain an interest in a CM Loan pursuant to compliance with applicable law.

CM Loan payments are deposited or transmitted via ACH to the KDM In Trust For 2 Segregated Account. This segregated account collects payments from all CM Loans, and is segregated from the KDM operating funds. Individual loan payment receipts are commingled in the segregated account and this account disburses the respective payment on the Notes to DTC for credit to each participating broker dealer’s account. Broker-dealer participants then make further credit to customer accounts of Note holders. We also debit this account for our Servicing Fee as described above.

CM Loans may also have retention of an impound amount for taxes and insurance and a replacement reserve for roof repairs or other items necessary to the proper functioning of the property. These impounded funds are currently in the KDM In Trust For 1 Segregated account.

In the event it becomes necessary to expend funds for the collection or protection of the CM Loan, or for the preservation or protection of the Property, including the institution of foreclosure proceedings, such expenses will initially be covered by (to a maximum of $10,000), from funds provided from the Servicing Fee, or from J. W. Korth & Company, pursuant to the Support Agreement. After discussions with attorneys we believe $10,000 is sufficient to engage a counsel who will pursue a foreclosure to its end and defer his final payments to the proceeds received at the ultimate disposition of the property. Ultimately, all costs and expenses will be funded (or reimbursed to us) from the proceeds of any foreclosure or settlement. Including reimbursement to us of any expenses we have disbursed toward collection of the CM Loan. These expenses may reduce your interest payments or principal payments on your Note. See “Risk Factors.”

We disclose on our website regarding borrowers’ payment performance on our CM Loans. We have also made arrangements for collection procedures in the event of borrower default. When a CM Loan is past due and payment has not been received, we contact the borrower to request payment. After a 10-day grace period, we may, in our discretion, assess a late payment fee. This fee may be charged only once per late payment. Amounts equal to any late payment fees we receive are paid to holders of the Notes. We may not assess a late payment fee when a borrower promises to return a delinquent CM Loan to current status and fulfills that promise. Each time a payment request is denied due to insufficient funds in the borrower’s account or for any other reason, we may assess an unsuccessful payment fee to the borrower in an amount of $35.00 per unsuccessful payment, or such lesser amount as may be provided by applicable law. We retain 100% of this unsuccessful payment fee to cover our costs incurred due to the denial of the payment.

If the CM Loan becomes 31 days overdue, we will identify the CM Loan as “Late (31-120),” and we may refer the CM Loan to a real estate attorney for foreclosure proceedings. In these cases, the interest rate on the CM Loan is increased to the highest legal rate in the state in which the property is located. The costs from a foreclosure and resale of a defaulted CM Loan and mortgaged property against the proceeds to Noteholders. If funds remain after the property is resold and all expenses are paid, they will be distributed to Noteholders on a pro-rata basis.

Definition of Accounts

Delinquent Accounts are defined as more than 31 days overdue. Charge Offs are defined as the unpaid principal balance of a specific CM Loan minus the expected recovery based on current market conditions for the foreclosed property. Uncollectable Accounts are defined as those CM Loans where no recovery is expected to be made. These definitions are regardless of any grace period, re-aging, restructure, or partial payments received. A CM Loan that was categorized as a Delinquent Account could be re-categorized as current if the borrower brought all payments up to date. Charge offs will be adjusted for properties in foreclosure based on an annual review of the current market conditions for the geography of the property. Uncollectable Accounts will be reviewed quarterly and could be reclassified as Collectible if market conditions changed for the property subject to the mortgage and foreclosure.

Material Information Regarding Delinquencies by Pool Asset Type

As of the date of this prospectus we have no delinquent CM Loans and therefore nothing material to report.

Summary of How KDM Fees Affect Return on the Notes

The following table summarizes the fees that we charge and how these fees affect Noteholders:

Description of Fee | | Servicing Fee Amount | | When Fee is Charged | | Effect on Investors |

| Servicing Fee on CM Loan | | A percent 1of the interest and late fees received by KDM from borrowers in respect of each corresponding CM Loan. | | At the time of any payments on the Notes, including Note payments resulting from prepayments or partial payments on corresponding CM Loans. | | Noteholders will be paid the interest paid on the CM Loan minus KDM’s servicing fee. |

| | | | |

| CM Loan late fee | | Assessed at our discretion; if assessed, the late fee is specific to each CM Loan. | | At our discretion, when a CM Loan is past due and payment has not been received after a 15-day grace period | | Distributed on a pro-rata basis to holders of the Note corresponding to the CM Loan |

| | | | |

CM Loan unsuccessful payment fee | | $35.00 per unsuccessful payment, or such lesser amount as may be provided by applicable law | | May be assessed each time a payment request is denied, due to insufficient funds in the borrower’s account or for any other reason | | Noteholders do not share in this fee |

| | | | | | | |

| CM Loan collection fee | | Only charged after a CM Loan becomes 31 days overdue if the collection agency or KDM is able to collect an overdue payment; collection fee is up to 35%, excluding litigation. | | At the time of successful collection after a CM Loan becomes 31 days overdue | | Foreclosure fees charged by us or independent attorneys will reduce payments and the effective yield on the related Notes; Foreclosure fees will be retained by us or the independent attorney as additional servicing compensation |

| | | | | | | |

| Check processing fee | | $15.00 per check processed for any payments made by check | | At the time a payment by check is processed | | We retain 100% of this check processing fee to cover our costs |

| | | | | | | |

| Default Interest Servicing | | Proportional share of interest equal to the same proportion of Servicing Fee on the CM Loan to Stated Interest paid on the Notes. | | Upon collection of default interest, before such interest is paid to Noteholders. | | Noteholders will receive the interest paid on the CM Loan less the default interest servicing fee |

| | | | | | | |

| Foreclosure Fees | | Legal fees will be charged at cost. KDM will charge a fee of eight times the Servicing Fee on the CM Loan balance, if any, received in foreclosure after payment to Noteholders. | | Upon completion of foreclosure in the event that there is profit after liquidation of the property. | | This fee will reduce the total cash distributed to investors in a profitable foreclosure. This will only reduce a premium earned, as this fee will not be charged until after investors are made whole. |

| 1 | Servicing Fee can range from 0.25% to 1.00% and will depend on factors such as the size and complexity of the CM Loan. The Servicing fee for the Notes is stated Summary of Terms. For this Note, the Servicing Fee is .50%; higher Servicing Fees may apply to offerings in the future. |

Participation in the Funding of CM Loans by KDM and Its Affiliates

From time to time, qualified CM Loan requests may not be fully committed to by investors. To address these situations, KDM may fund portions of certain CM Loan requests. If we fund CM Loans, we will issue Notes to KDM for that portion of the CM Loan we fund.

Our affiliates, including our executive officers and members, may fund portions of CM Loan requests from time-to-time. Since inception, these affiliates have funded $1,059,000 of new CM Loan requests.

Historical Information about our CM Loans

Loan Category: Multi-Family

SUMMARY OF THE TERMS OF THE CM LOAN

The following summary sets forth the principal terms of the CM Loan underlying the Notes.

| Loan Designation | KDM2017-L002 |

| | |

| Issue Date | December 21, 2017 |

| | |

| Maturity | December 12, 2020 |

| | |

| Interest | 6.50% |

| | |

| Interest Guarantee | 24 months |

| | |

| Amortization | None. This is an interest-only loan. Entire principal is due as a balloon payment at maturity. |

| | |

| Prepayment and Penalty Interest | If the CM Loan is prepaid in whole or in part before December 1,2019, the borrower must pay the difference between 24 months of interest and the total interest paid as of the payoff date. Should the borrower prepay all or a portion of its loan, then the amount pre-paid and the penalty will be paid on the next payment date to the Noteholders. |

| | |

| Redemption | Inception through November 30, 2019: $950,000 plus Penalty Interest. December 1, 2019, through December 12, 2020: $950,000 |

| | |

| CM Loan Payment Dates | Payments of interest are due on the first day of each month. |

| | |

| Ratings | A- Egan Jones, BBB+ KDM Rating |

| | |

| Real Property Collateral | 3 rental properties: 445 SW 78th Place, Miami, FL 33144 (Duplex) 7992 SW 4th St, Miami, FL 33144 (Single Family) 8400 Grand Canal Drive, Miami, FL 33144 (Single Family) |

| | |

| Years Constructed | Property 445 was built in 1958, Property 7992 was built in 1954, & 8400 was built in 1986. The owner/operators have recently invested $300,000.00 into the three properties to update the kitchens and the roofs. |

| | |

| Property Stabilization | Each property received a new roof in 2017 and slow-paying tenants were replaced. |

| | |

| Credit Score of Principal* | 651 |

| | |

| Combined Appraised Value of Both Properties | $1,605,000.00 (Appraised March 2017) Property 445: $590,000.00 Property 7992: $390,000.00 Property 8400: $625,000.00 |

| | |

| Debt Service Coverage Ratio | 1.27 (See Debt Service Coverage Analysis below) |

| Occupancy | The buildings comprise a total of 4 units. Each building has a no vacancy. The overall occupancy is 100%. |

| | |

| Rent Payments | Rents are paid monthly and are collected in the checking account of the manager. KDM acquired the checking account statements and verified the rents |

| | |

| Loan to Combined Appraised Values | 59.2% |

| | |

| Experience of Property Manager | The property will be managed by the borrowers. The borrowers are owner/operators and have been managing residential income producing properties since 2000. |

| | |

Appraisals of Value | KDM received independent appraisals for the three properties. These appraisals were provided by a licensed appraiser chosen by KDM. |

| | |

| Review of Appraisals | KDM also received a review of each appraisal provided by a second licensed appraiser chosen by KDM. |

*The Principal may not be the borrower, a guarantor of the CM Loan, or have any personal liability for the CM Loan. See “Risk Factors-The credit rating that we use in our rating system for our mortgages may not be the credit rating of the borrower, any guarantor, or anyone having personal liability for payment of the mortgage loan.” For this CM Loan, KDM pulled the credit scores of each of the two owners of the borrower. The score displayed is the lower of the two.

CURRENT STATUS OF CM LOAN

As of December 26, 2017, the principal balance of the CM Loan was $950,000.00. This CM Loan was made by KDM to the borrower on December 21, 2017. KDM placed the payments into a segregated account and has made payments to Mortgage Secured Noteholders on time.

DIRECTORY FOR LOAN

Mortgaged Property | 445 SW 78th Pl, Miami, FL 33144 Find on Public Records: http://www.miamidade.gov Folio Number: 30-4003-001-3570 7992 SW 4th St, Miami, FL 33144 Find on Public Records: http://www.miamidade.gov Folio Number: 30-4003-001-4090 8400 Grand Canal Dr, Miami, FL 33144 Find on Public Records: http://www.miamidade.gov Folio Number: 30-4003-006-2230 |

| | |

| Borrower | RZ Group Inc. This company is owned by Rolando and Zonia Penate, 50/50 split. |

| | |

| Lender | Korth Direct Mortgage, LLC 2937 SW 27th Avenue Miami Florida 33133 Contact: James W. Korth Tel: 305-668-8485 Email: jwkorth@jwkorth.com |

| Placement Agent | J.W. Korth & Company Limited Partnership 6500 Centurion Drive, Suite 200 Lansing, Michigan 48917 Website: www.jwkorth.com Contact: James W. Korth, Holly MacDonald-Korth Tel: 305 668 8485 Email: info@jwkorth.com |

| Appraiser | Appraisal First, LLC 1444 Biscayne Blvd, Miami, FL 33132 Tel: 305-470-2129 |

| | |

| Appraisal Reviewer | Collateral Evaluation Services LLC (“CES”) 590 Colonial Park Dr.

Roswell, GA 30075

Tel: 678.580.6200 |

CM Loan Underwriting

Property and Operational Analysis

The Borrower has owned and operated 445 SW 78th Pl, Miami, FL 33144 since 1/17/2017, 7992 SW 4th St, Miami, FL 33144 since 12/30/2016, and 8400 Grand Canal Dr, Miami, FL 33144 since 2/14/2017. Since purchase, they have been operated exclusively as rental properties and have not had any periods of minimal occupancy. Updating of units has been completed on a per-unit basis upon unit vacancies. The borrower has invested $300,000.00 into the three properties in the last 12 months, updating the kitchens and roof.

Unaudited profit and loss statements were received from, and signed by, the borrower. Data from these statements were used to complete KDM’s debt service coverage and operating analysis. Rent rolls were also submitted along with checking account statements from the borrower. Rent rolls were verified by analyzing the checking account statements of the borrower

From these statements we created the following tables and calculated the debt service coverage ratio (“DSCR”) for the properties using the formula below.

Net Operating Income / Debt Service = Debt Service Coverage Ratio

The debt service is equal to the mortgage payment for the CM Loan. The Net Operating Income is derived from the profit and loss and detailed in the tables below.

CM Loan Property Specifics: The DSCR for the CM Loan is 1.27.

Unaudited Profit and Loss Information

As part of the CM Loan underwriting process, KDM collects profit and loss information via a form provided to the borrower. This form collects both per-unit rental information (referred to as the “rent roll”) as well as a detailed list of expenses for the prior two years as well as the current partial year, if applicable. The borrower signs and certifies the accuracy of the information. Data from this form is used to create an unaudited profit and loss statement.

CM Loan Property Specifics: The Borrower purchased all three of these properties within the last 13 months (7992 SW 4th St: 12/30/2016, 445 SW 78 Pl: 1/17/2017, 8400 Grand Canal Drive: 2/14/2017). The information provided below is from purchase date through November 2017, Due to the recent purchase dates, a full year’s expenses are not available. Further, tenants pay all utilities and routine maintenance (yard, etc) on their rental units. Landlord’s only expenses are major improvements, taxes, and insurance. Major renovations and upgrades were completed on each of the properties after purchase, totaling $300,000 for the three properties. Due to the extensive upgrades and renovations, we deem the properties substantially updated to current style, as well as not needing new major repairs during the loan lifetime. Actual numbers in the analysis below are for taxes, insurance, and income. Vacancy rate, management fee, and capital reserves are estimates included in the KDM underwriting process to create a more conservative debt service analysis.

Expenses

A table of monthly expenses appears below. The tax and insurance expenses were verified by the tax and insurance bills. All of the other expenses were provided by the borrower. The property appraisals use market-based estimates of standard expense categories. The expense information provided by the borrower is compared to the appraisal expense categories and if, in our judgement, there is no significant deviation, the borrower expenses are accepted for the calculation of the Net Operating Income and presentation in the tables below.

Reserves for Capital Expenditures

Some borrowers include a replacement and repair reserve in the profit and loss statements. If we receive such numbers from borrower, then actual reserve numbers will be included. Otherwise, replacement reserve is generally estimated at $200-$300 per unit per year for multifamily properties, or 2-3% of revenue for other rental properties.

CM Loan Property Specifics: The borrower replaced the roof on all three properties. This capital expenditure is usually considered a one-time expense. The borrower also installed new kitchens and flooring in each property. Although we do not expect any major capital expenditures during the life of the loan, we have included a repair and maintenace reserve at 2.5% for the debt service coverage analysis. This amount is the midpoint for the range and was chosen due to the recency of major improvements combined with the ages of the property.

Vacancy Rate Estimate

Based on various real estate industry information sources vacancy rates range from 4% to 7%. The vacancy rate shown in the Debt Service Coverage Ratio analysis below was calculated by using the actual vacancy rate at the time the loan was underwritten, plus adding an additional 4%.

CM Loan Property Specifics: The current vacancy rate of the properties is 0%. Vacancy rates for single family homes and duplexes in this area are 3% or lower, per appraiser. In our underwriting analysis we used the conservative estimate of 4%.

Management Fee

If there is a property manager, we include the actual management fee in our analysis. If the property does not currently have a property manager, we include a property management fee estimate as part of our underwriting analysis to conservatively estimate the debt service coverage should the owner/borrower decide to hire a property manager during the life of the loan.

CM Loan Property Specifics: These properties do not currently have a property management company. The property management fee is a KDM estimate based on management fees for rental properties in the area, as indicated on the appraisal. KDM adds this number to its underwriting of debt service in the event the borrower may choose to elect a property manager during the life of the loan.

Verification of Rent Payments

Rent payments in the tables below were verified by matching individual deposits in the Borrower’s checking accounts, to the rent roll. This also allowed KDM to verify the on-time payment history for the tenants for the most recent month, at the time of CM Loan underwriting.

Current Lease Terms

| Unit # | Tenant's

Name | BDR/Bath | Sq Ft

(Approx) | Current

Rent per

month | Original

Occupancy

Date | When does

the lease

expire? | Date of

last Rent

Increase | Section 8

(Y/N) | Rent

Concessions

(Y/N) | Number

of 30 Day

Lates |

| 8400 | Pupo | 4 Bed 3 Bath | 2963 | 3000 | 6/1/2017 | 5/31/2022 | | N | N | 0 |

| 7992 | Echevarria | 4 Bed 3 Bath | 1861 | 2500 | 9/1/2017 | 8/31/2018 | | N | N | 0 |

| 447 | Valdes | 3 Bed 3 Bath | 1718 | 3000 | 5/1/2017 | 4/30/2018 | | N | N | 0 |

| 445 | Cruz | 3 Bed 2 Bath | 1182 | 1900 | 6/10/2017 | 6/9/2018 | | Y | N | 0 |

The information in the tables below is as of 11/20/2017.

| 445 & 447 SW 78 Place | 7992 SW 4th Street | 8400 Grand Canal Drive |

| Revenue | $ 58,800.00 | Revenue | $ 30,000.00 | Revenue | $ 36,000.00 |

| 4% Vacancy Rate | $ (2,352.00) | 4% Vacancy Rate | $ (1,200.00) | 4% Vacancy Rate | $ (1,440.00) |

| Gross Income | $ 56,448.00 | Gross Income | $ 28,800.00 | Gross Income | $ 34,560.00 |

| Expenses | | Expenses | | Expenses | |

| Real Estate Taxes | $ 5,778.00 | Real Estate Taxes | $ 3,835.00 | Real Estate Taxes | $ 8,025.00 |

| Insurance | $ 4,184.00 | Insurance | $ 4,184.00 | Insurance | $ 8,368.00 |

| Management Fee (3%) | $ 1,764.00 | Management Fee (3%) | $ 900.00 | Management Fee (3%) | $ 1,080.00 |

| Repair & Maintenance at 2.5% of Revenue | $ 1,470.00 | Repair & Maintenance at 2.5% of Revenue | $ 750.00 | Repair & Maintenance at 2.5% of Revenue | $ 900.00 |

| Total Expenses | $ 13,196.00 | Total Expenses | $ 9,669.00 | Total Expenses | $ 18,373.00 |

| Net Operating Income | $ 43,252.00 | Net Operating Income | $ 19,131.00 | Net Operating Income | $ 16,187.00 |

| Revenue and Expenses for the 3 properties |

| Revenue | $ 124,800.00 |

| 4% Vacancy Rate | $ (4,992.00) |

| Gross Income | $ 119,808.00 |

| Expenses | |

| Real Estate Taxes | $ 17,638.00 |

| Insurance | $ 16,736.00 |

| Management Fee (3%) | $ 3,744.00 |

| Repair & Maintenance at 2.5% of Revenue | $ 3,120.00 |

| Total Expenses | $ 41,238.00 |

| Net Operating Income (NOI) | $ 78,570.00 |

| Monthly NOI | $ 6,547.50 |

| Monthly Debt Service | $ (5,145.83) |

| Net Profit after Debt Service | $ 16,820.04 |

| DSCR | $ 1.27 |

| DSCR Analysis |

| Monthly NOI = $6547.50 |

| Monthly Mortgage Payment = $5,145,83 |

| NOI / Monthly Mortgage Payment = Debt Service Coverage Ratio |

| $6,547.5 / $5,145.83 = 1.27 |

| DSCR = 1.27 |

Location of Mortgaged Properties

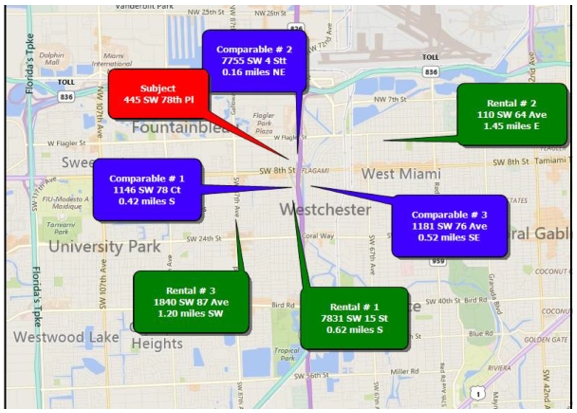

The following map shows the location of the property known as 445 SW 78 Pl, Miami, FL 33144.

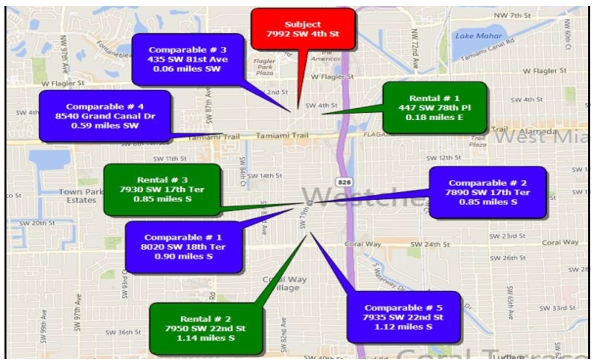

The following map shows the location of the property known as 7992 SW 4 St, Miami, FL 33144.

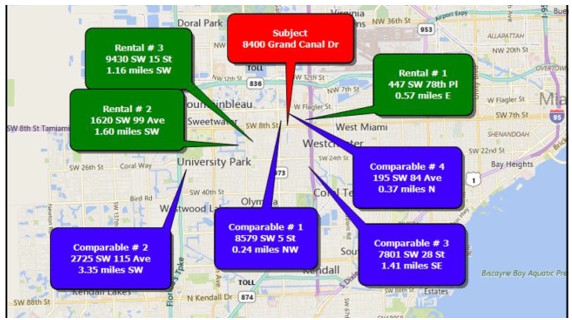

The following map shows the location of the property known as 8400 Grand Canal Dr, Miami, FL 33144.

Copies of the following documents are available upon request to KDM at info@KDMinvestor.com.

The proceeds of the sale of Notes will be used to redeem KDM note (KDM2017-N002PP) in the original principal amount of $950,000 purchased by accredited investors. The proceeds of that note were used to fund the CM Loan. See “Summary of the Terms of the CM Loan” for a description of the CM Loan.