Overview of the ConvergeOne Business Combination with Forum Merger Corporation December 1, 2017 Confidential Exhibit 99.2

About this Presentation This presentation (the “Presentation”) contemplates the purchase by Forum Merger Corporation (“Forum”) of C1 Investment Corp. (“ConvergeOne” or the “Company”) by which ConvergeOne will become a subsidiary of Forum (the “Transaction”). No Offer or Solicitation This Presentation is for informational purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities or the solicitation of any vote in any jurisdiction pursuant to the proposed Transaction or otherwise, nor shall there be any sale, issuance or transfer or securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Forward-Looking Statements This Presentation includes “forward‐looking statements” regarding ConvergeOne, its financial condition and its results of operations that reflect ConvergeOne’s current views and information currently available. This information is, where applicable, based on estimates, assumptions and analysis that ConvergeOne believes, as of the date hereof, provide a reasonable basis for the information contained herein. Forward‐looking statements can generally be identified by the use of forward‐looking words such as “may”, “will”, “would”, “could”, “expect”, “intend”, “plan”, “aim”, “estimate”, “target”, “anticipate”, “believe”, “continue”, “objectives”, “outlook”, “guidance” or other similar words, and include statements regarding ConvergeOne’s plans, strategies, objectives, targets and expected financial performance. These forward‐looking statements involve known and unknown risks, uncertainties and other factors, many of which are outside the control of Forum, ConvergeOne and their respective officers, employees, agents or associates. Actual results, performance or achievements may differ materially, and potentially adversely, from any projections and forward‐looking statements and the assumptions on which those vary from forward‐looking statements are based. There can be no assurance that the data contained herein is reflective of future performance to any degree. You are cautioned not to place undue reliance on forward‐looking statements as a predictor of future performance as projected financial information, cost savings, synergies and other information are based on estimates and assumptions that are inherently subject to various significant risks, uncertainties and other factors, many of which are beyond our control. All information herein speaks only as of (1) the date hereof, in the case of information about ConvergeOne, or (2) the date of such information, in the case of information from persons other than ConvergeOne. ConvergeOne undertakes no duty to update or revise the information contained herein. Forecasts and estimates regarding ConvergeOne’s industry and end markets are based on sources we believe to be reliable, however there can be no assurance these forecasts and estimates will prove accurate in whole or in part. Use of Projections This Presentation contains financial forecasts with respect to, among other things, ConvergeOne’s revenue, Adjusted EBITDA, Pro Forma Adjusted EBITDA, Free Cash Flow and certain ratios and other metrics derived therefrom for the fiscal years 2017 and 2018. These unaudited financial projections have been provided by ConvergeOne’s management, and ConvergeOne’s independent auditors have not audited, reviewed, compiled, or performed any procedures with respect to the unaudited financial projections for the purpose of their inclusion in this Presentation, and accordingly, do not express an opinion or provided any other form of assurance with respect thereto for the purpose of this Presentation. These unaudited financial projections should not be relied upon as being necessarily indicative of future results. The inclusion of the unaudited financial projections in this Presentation is not an admission or representation by ConvergeOne or Forum that such information is material. The assumptions and estimates underlying the unaudited financial projections are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the unaudited financial projections. There can be no assurance that the prospective results are indicative of the future performance of Forum or ConvergeOne or that actual results will not differ materially from those presented in the unaudited financial projections. Inclusion of the unaudited financial projections in this Presentation should not be regarded as a representation by any person that the results contained in the unaudited financial projections will be achieved. Industry and Market Data The information contained herein also includes information provided by third parties, such as market research firms. None of Forum, Forum Investors I, LLC, the sponsor of Forum, ConvergeOne, Clearlake Capital Group L.P. (“Clearlake”), and their respective affiliates and any third parties that provide information to Forum, such as market research firms, guarantee the accuracy, completeness, timeliness or availability of any information. None of Forum, ConvergeOne, Clearlake and their respective affiliates and any third parties that provide information to Forum, such as market research firms, are responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or the results obtained from the use of such content. None of Forum, ConvergeOne, Clearlake and their respective affiliates give any express or implied warranties, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use, and they expressly disclaim any responsibility or liability for direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs expenses, legal fees or losses (including lost income or profits and opportunity costs) in connection with the use of the information herein. Non-GAAP Financial Measures This Presentation includes certain financial measures not presented in accordance with generally accepted accounting principles (“GAAP”) including, but not limited to, Adjusted EBITDA and Pro Forma Adjusted EBITDA and certain ratios and other metrics derived therefrom. These non‐GAAP financial measures are not measures of financial performance in accordance with GAAP and may exclude items that are significant in understanding and assessing ConvergeOne’s financial results. Therefore, these measures should not be considered in isolation or as an alternative to net income, cash flows from operations or other measures of profitability, liquidity or performance under GAAP. You should be aware that ConvergeOne’s presentation of these measures may not be comparable to similarly‐titled measures used by other companies. You can find the reconciliation of these measures to the nearest comparable GAAP measures elsewhere in this Presentation. ConvergeOne believes that these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to ConvergeOne’s financial condition and results of operations. ConvergeOne’s management uses these non-GAAP measures to compare ConvergeOne’s performance to that of prior periods for trend analyses, for purposes of determining management incentive compensation, and for budgeting and planning purposes. These measures are used in monthly financial reports prepared for management and ConvergeOne’s board of directors. ConvergeOne believes that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends. Management of ConvergeOne does not consider these non-GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. Additional Information; Participants in the Solicitation This Presentation does not contain all the information that should be considered concerning the proposed business combination. It is not intended to form the basis of any investment decision or any other decision in respect to the proposed business combination. In connection with the proposed business combination between Forum and ConvergeOne, Forum intends to file with the SEC a preliminary proxy statement/preliminary prospectus and will mail a definitive proxy statement/final prospectus and other relevant documentation to Forum stockholders. Forum stockholders and other interested persons are advised to read, when available, the preliminary proxy statement/preliminary prospectus and any amendments thereto, and the definitive proxy statement/final prospectus in connection with Forum’s solicitation of proxies for the special meeting to be held to approve the Transaction because these materials will contain important information about Forum, ConvergeOne and the Transaction. ConvergeOne, Clearlake, the sponsor of ConvergeOne, Forum and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from Forum’s shareholders in connection with the Transaction. Information about Forum’s directors and executive officers is set forth in Forum’s Registration Statement on Form S-4 in connection with the Transaction, which was initially filed with the SEC on November 30, 2017. These documents are available free of charge at the SEC’s web site at www.sec.gov. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to Forum’s shareholders in connection with the Transaction will be set forth in the definitive proxy statement/final prospectus. Additional information regarding the interests of participants in the solicitation of proxies in connection with the Transaction will be included in the definitive proxy statement/final prospectus. The definitive proxy statement/final prospectus will be mailed to Forum stockholders as of a record date to be established for voting on the Transaction when it becomes available. Forum’s stockholders will also be able to obtain a copy of the preliminary proxy statement/preliminary prospectus and definitive proxy statement/final prospectus, without charge, at the SEC’s website at http://www.sec.gov or by directing a request to: Forum Merger Corporation, 135 East 57th Street, 8th Floor, New York, NY 10022. DISCLAIMER

TODAY’S PARTICIPANTS ConvergeOne Management Team 1 Forum Management Team John McKenna Chairman & CEO Jeff Nachbor CFO Marshall Kiev Co-CEO & President David Boris Co-CEO & CFO Over 30 years of industry experience Former CEO of Siemens IT Solutions and Services Former CEO, Entex Served variety of roles, IBM Over 25 years of experience Former SVP of Finance & Chief Accounting Officer, Cricket Communications Former SVP & Controller, H&R Block Former CFO and Treasurer, The Sharper Image Former SVP and Corporate Controller, Staples Former VP of Finance, Victoria Secret Brand, Victoria’s Secret Variety of finance roles at Limited Brands, YUM! Brands, PepsiCo, and PwC Over 25 years of alternative investing experience Former Director of Cohen Private Ventures, a family office investing in direct private investments and other opportunistic transactions Former Chief of Staff at S.A.C. Capital Advisors Former President of Alternative Investments at Family Management Corporation Former Partner at Main Street Resources Member of Young Presidents’ Organization Over 30 years of Wall Street experience in mergers and corporate finance Has been involved in more than 13 SPAC transactions Former SMD and Head of IB, Pali Capital, Inc. Former founding member and MD of Morgan Joseph & Co. Inc. Former President of Ladenburg Thalmann Group Inc. Member of Young Presidents’ Organization Stephen Vogel Executive Chairman Over 40 years of operating and private equity experience Former President, CEO and Co-Founder of Synergy Gas Corp., a retail propane distribution company Prior board member of Netspend (NASDAQ: NTSP), a leader for prepaid stored value platforms Former CEO of Grameen America, the fastest-growing not-for-profit micro-finance company

TABLE OF CONTENTS Investment Thesis ConvergeOne Overview Growth Avenues Financial Overview Transaction Summary Appendix Section I II III IV V Note, the TOC page can be generated using FactSet. If FactSet doesn’t check the slides for you, select the dividers manually. ü ü

INVESTMENT THESIS

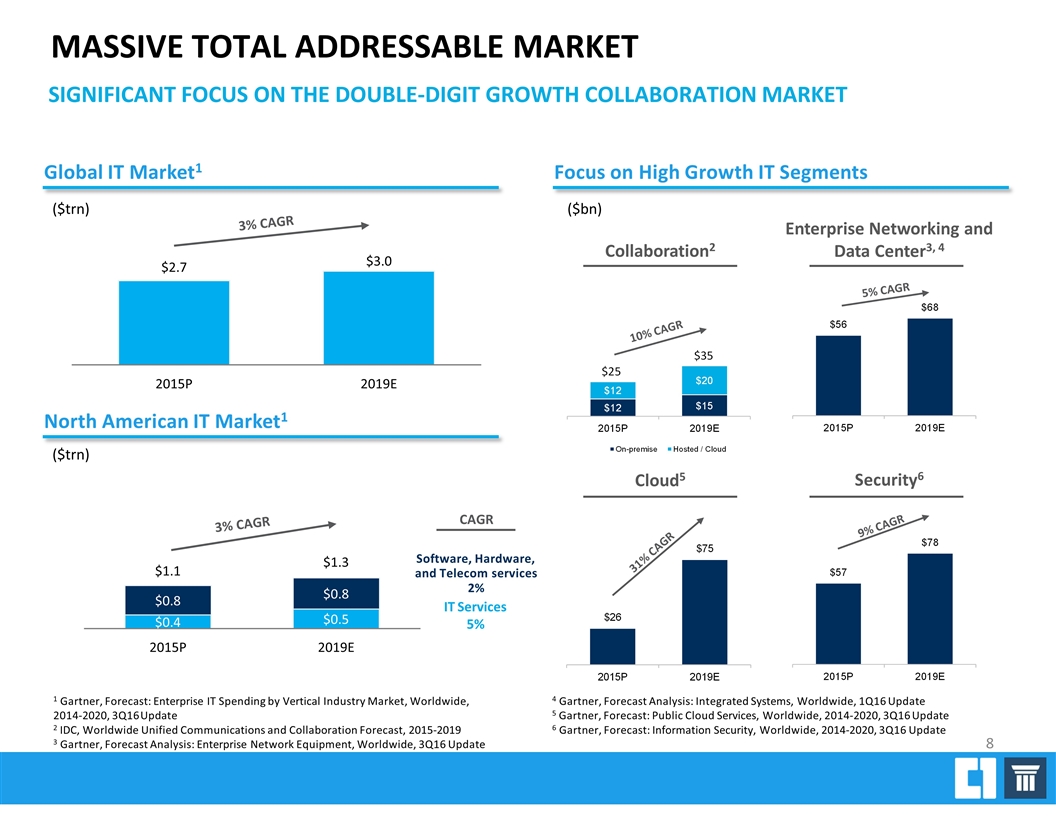

90% MC&M Services Renewal Rate2 $1.2bn Revenue 32% Gross Margin 12% Adj. EBITDA Margin 91% Revenue from Clients Served in a Prior Year2 Deeply Entrenched Clients $144mm Adj. EBITDA Scale Player Differentiated Margin Structure Services‐led, Recurring Model 53% Revenue from Services Contracted Managed, Cloud and Maintenance (“MC&M”) Revenue 57 of Fortune 100 Companies Enterprise Client Base 61 Net Promoter Score3 69% Revenue from Collaboration Offerings Revenue from Enterprise Networking, Data Center, Cloud and Security Offerings Attractive End Markets INVESTMENT THESIS Services‐led approach and comprehensive engagement model across all of ConvergeOne’s core markets 2 $256bn1 2019E TAM 12% CAGR1 From 2015-2019 Large, Growing TAM Growing Cloud Pipeline & Security Practice Material Organic Growth Prospects Geographical Expansion Opportunity Domestically and Internationally CEO: 30+ Years Industry Experience Experienced Management Team CFO: 25+ Years Experience Including in Public Companies 8.4x4 2018E adj. EBITDA Compared to 10.5x for Top Solutions Providers5 and 10.3x for BPO Services / Integrators6 Attractive Valuation 1.0% Dividend Yield (Dividend Paying Peers7 Trading at 11.0x 2018E adj. EBITDA) 12 Acquisitions since 2009 Platform for M&A 3 Acquisitions in 2017 Industry Valuation Company 35% 31% Note: Unless otherwise stated, financial performance based on 2018E figures. See Appendix for a reconciliation of adj. EBITDA to net income. Market data as of 11/27/17 1 Based on estimates on aggregating Collaboration Market (IDC, Worldwide Unified Communications and Collaboration Forecast, 2015-2019), Enterprise Networking and Data Center Market (Gartner, Forecast Analysis: Integrated Systems, Worldwide, 1Q16 Update and Gartner, Forecast Analysis: Enterprise Network Equipment, Worldwide, 3Q16 Update), Cloud Market (Gartner, Forecast: Public Cloud Services, Worldwide, 2014-2020, 3Q16 Update) and Security Market (Gartner, Forecast: Information Security, Worldwide, 2014-2020, 3Q16 Update) 2 Based on 2016A figures of ConvergeOne 3 Net Promoter Score data based on a third‐party survey conducted in 2016 4 Implied multiple for investors after including the effects of PIPE shares, Forum management shares, Forum public rights, Forum private placement shares, Forum private placement rights and EarlyBirdCapital shares 5 Solutions Providers include CDW, PSDO, PLUS 6 BPO services / integrators include ACN, CAP, CGI, PRFT, HCKT, CTSH, WIT 7 Only includes companies that pay dividends: CDW, ACN, CAP, HCKT, CTSH, WIT

CONVERGEONE OVERVIEW

LEADING PROVIDER OF COLLABORATION SOLUTIONS Leading, independent provider of services and Collaboration Solutions Addresses complex collaboration challenges of large and global companies Deep relationships with all of the industry leading technology partners across the collaboration market Guided its enterprise clients through multiple collaboration technology evolutions 1970s 1990s 2000s Today Less complex More complex ON ‐ PREMISE CLOUD‐BASED IP‐BASED 2010s 1980s Chat Video Email Conferencing Presence Capital expense Technology-centric Operating expense Solution-centric Founded in 1993 Complexity and functionality VM + Email IVR PBX $834mm1 Total Collaboration Revenue 69%1 Collaboration Revenue % of Total Revenue $523mm1 Collaboration Service Revenue Expected end market business mix shown for 2018E ConvergeOne has a 20+ Year Focus on Collaboration Large Scale Collaboration Platform 3

DELIVERS STRATEGIC VALUE THROUGH AN EXTENSIVE PORTFOLIO OF SERVICES AND SOLUTIONS OUR SERVICES AND TECHNOLOGY OFFERINGS 4 Note: Expected revenue mix and margins for 2018E Contractual services, which typically have multi-year contractual terms and high renewal rates 24x7x365 remote monitoring, Level 3 engineer support, and management Offerings include end-point management, third-party maintenance, incident avoidance and preventive monitoring via proprietary OnGuard software Predictable, scalable monthly costs, lower total cost of ownership Assist enterprise clients with cloud migration strategy $424mm revenue 41% gross margin Managed, Cloud, and Maintenance Services Over 100 technology partners – providing the optimal solution for complex, multi‐vendor environments Partner with five of the six leaders in the Magic Quadrant for collaboration $570mm revenue 24% gross margin Technology Offerings Consultation, design, integration and implementation, application development, and program management of customized solutions $207mm revenue 35% gross margin Professional Services Services Offerings 53% of Total Revenue Data Center Security Cloud Enterprise Networking Collaboration Design Implement Operate Optimize Consult Core Technology Markets 47 Managed, Cloud, and Maintenance Services 35% of Total Revenue

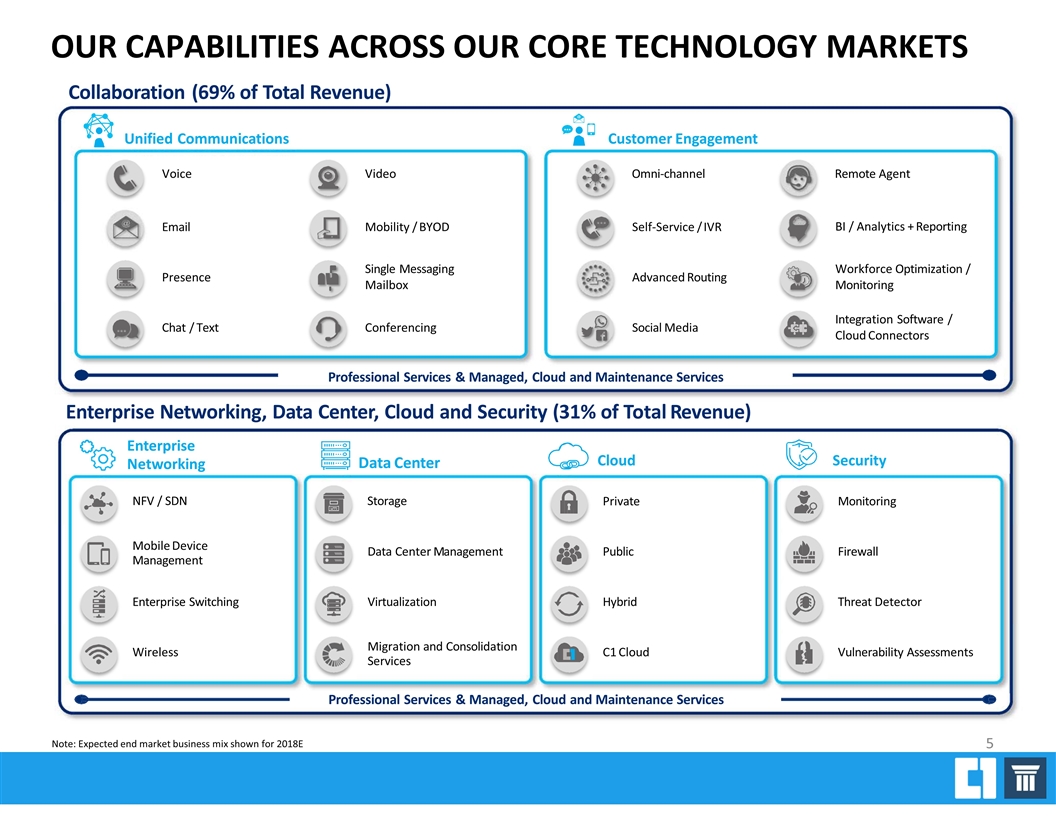

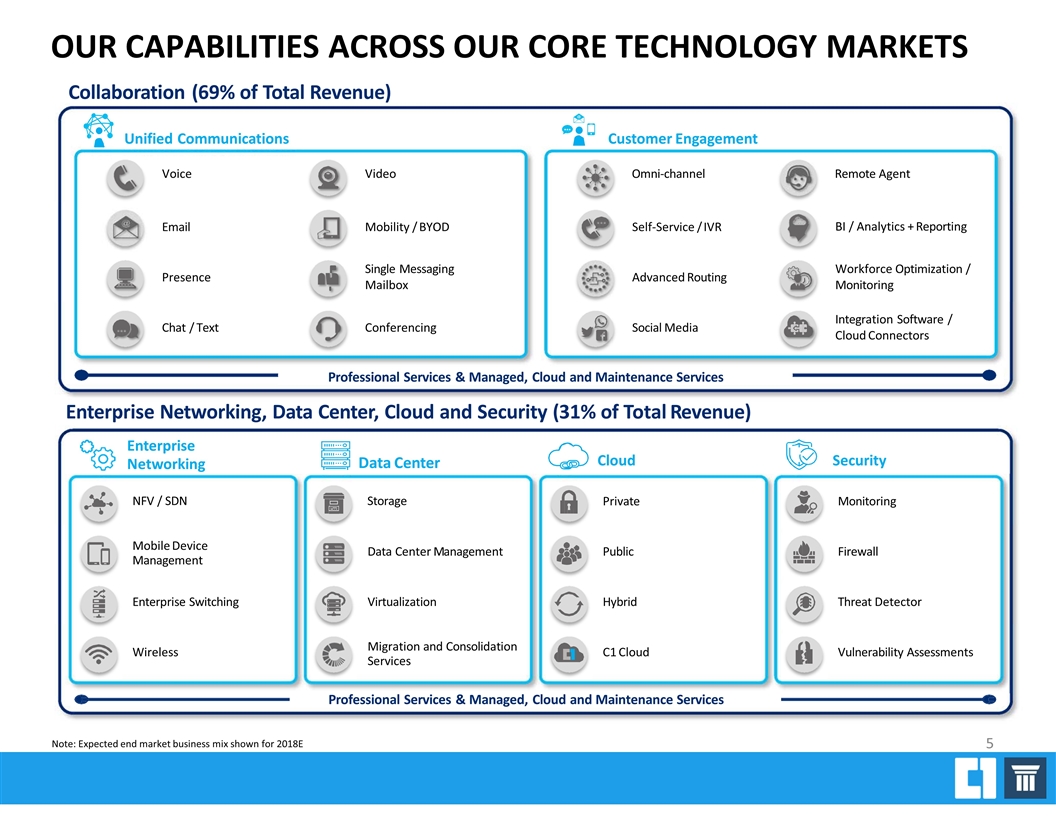

Customer Engagement Email Presence Chat / Text Mobility / BYOD Single Messaging Mailbox Conferencing Cloud Security Data Center Management Virtualization Migration and Consolidation Services Mobile Device Management Wireless Enterprise Switching Private Public Hybrid C1 Cloud Monitoring Firewall Threat Detector Vulnerability Assessments OUR CAPABILITIES ACROSS OUR CORE TECHNOLOGY MARKETS Professional Services & Managed, Cloud and Maintenance Services Self‐Service / IVR Advanced Routing Social Media Workforce Optimization / Monitoring BI / Analytics + Reporting Integration Software / Cloud Connectors Professional Services & Managed, Cloud and Maintenance Services Enterprise Networking, Data Center, Cloud and Security (31% of Total Revenue) Enterprise NetworkingData Center NFV / SDNStorage Unified CommunicationsCustomer Engagement VoiceVideoOmni‐channelRemote Agent Collaboration (69% of Total Revenue) Note: Expected end market business mix shown for 2018E 5

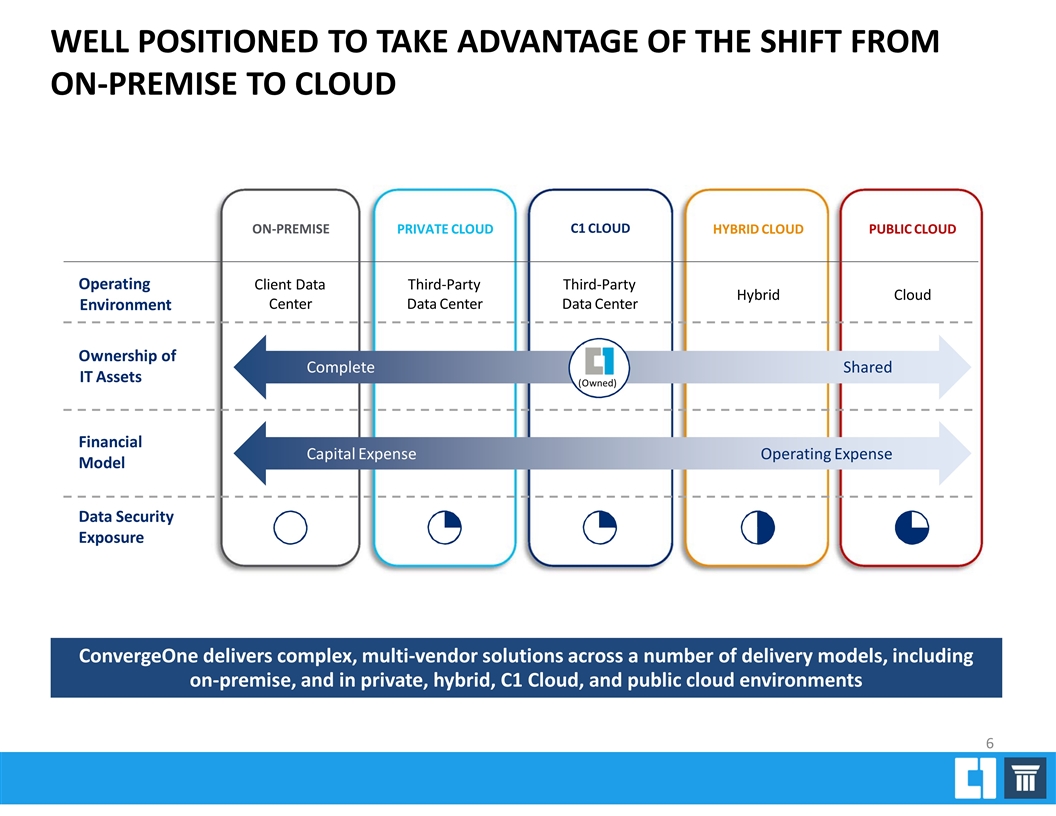

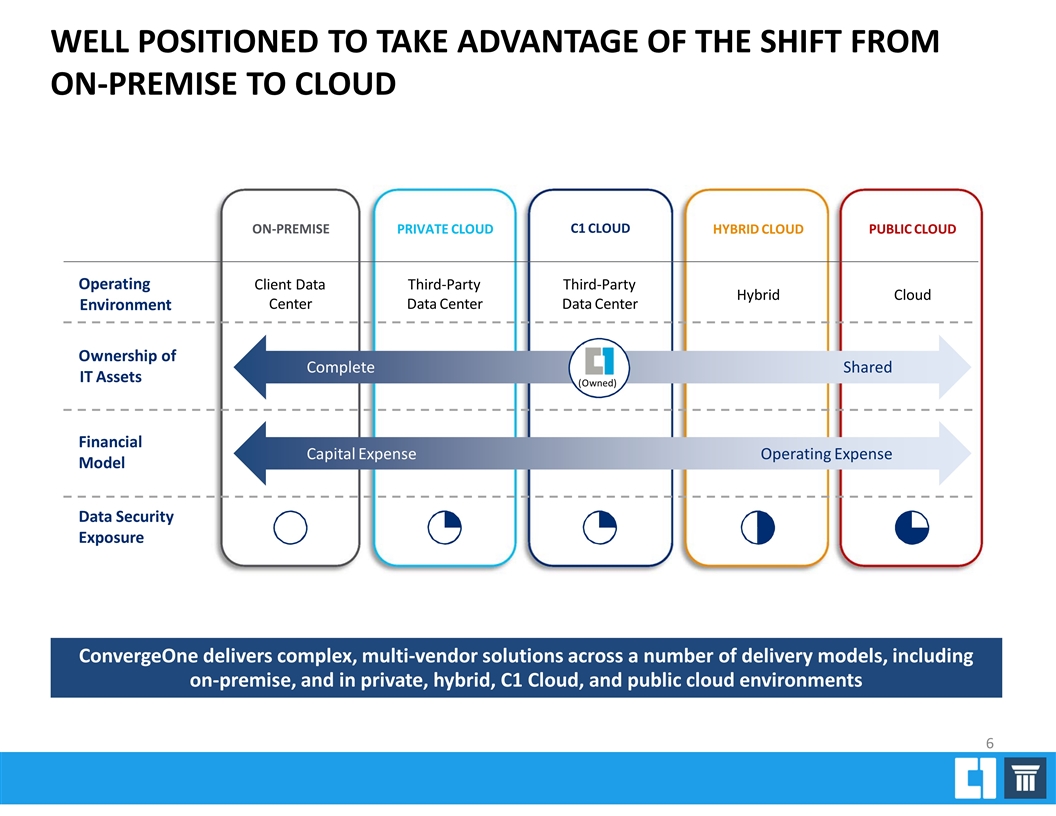

ON-PREMISE HYBRID CLOUD PUBLIC CLOUD PRIVATE CLOUD C1 CLOUD Operating Environment Client Data Center Hybrid Third-Party Data Center Third-Party Data Center Cloud Data Security Exposure Complete Shared Ownership of IT Assets Capital Expense Operating Expense (Owned) ConvergeOne delivers complex, multi‐vendor solutions across a number of delivery models, including on‐premise, and in private, hybrid, C1 Cloud, and public cloud environments Financial Model 6 WELL POSITIONED TO TAKE ADVANTAGE OF THE SHIFT FROM ON‐PREMISE TO CLOUD

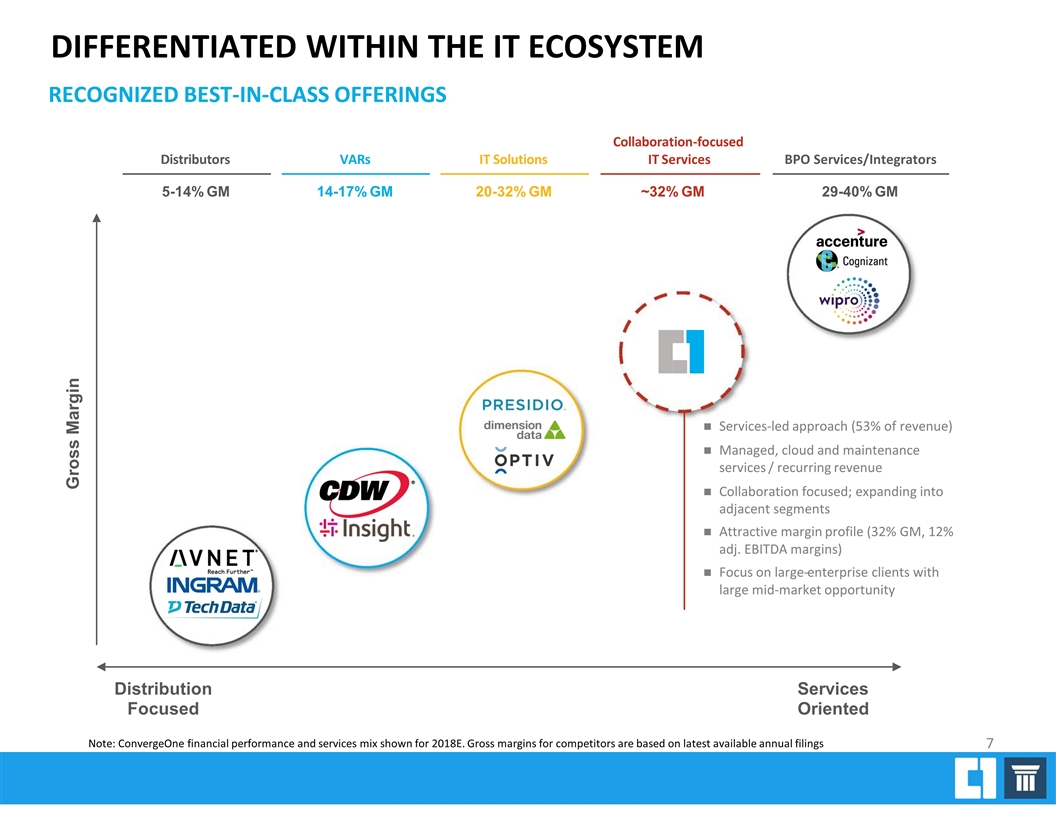

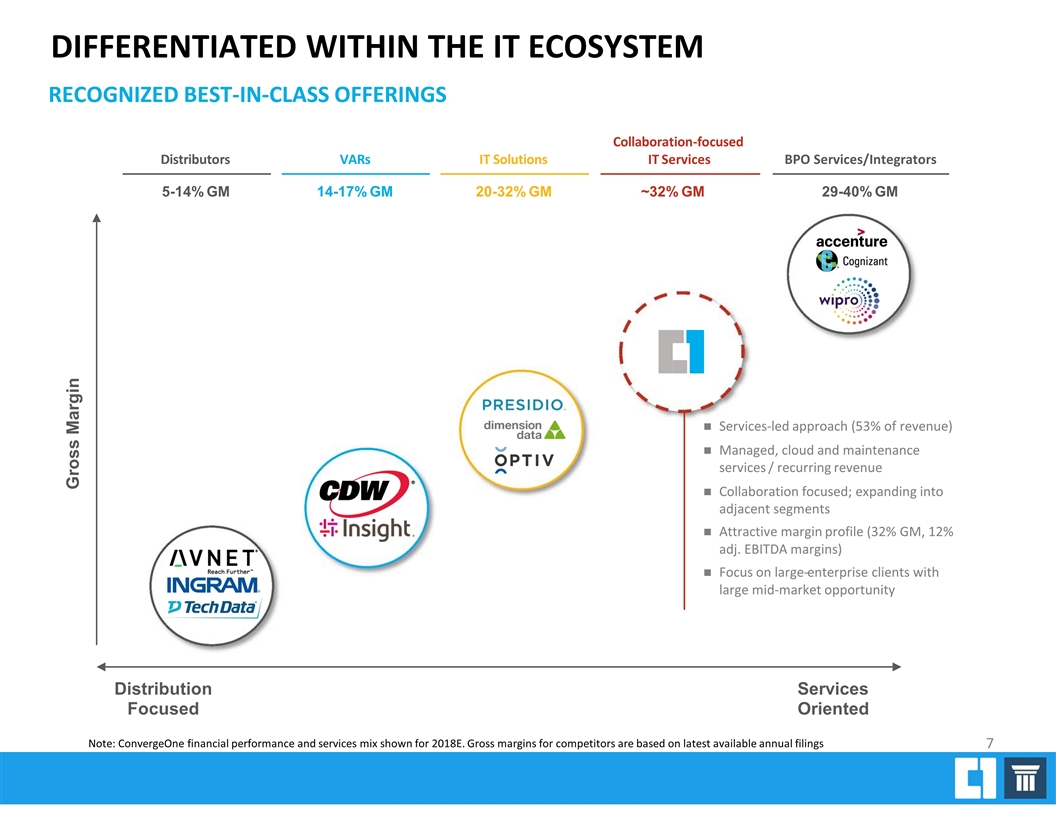

Gross Margin Distribution Focused Services Oriented Distributors VARs IT Solutions Collaboration‐focused IT Services BPO Services/Integrators 5-14% GM 14-17% GM 20-32% GM 29-40% GM ~32% GM Services-led approach (53% of revenue) Managed, cloud and maintenance services / recurring revenue Collaboration focused; expanding into adjacent segments Attractive margin profile (32% GM, 12% adj. EBITDA margins) Focus on large-enterprise clients with large mid-market opportunity RECOGNIZED BEST‐IN‐CLASS OFFERINGS DIFFERENTIATED WITHIN THE IT ECOSYSTEM Note: ConvergeOne financial performance and services mix shown for 2018E. Gross margins for competitors are based on latest available annual filings 7

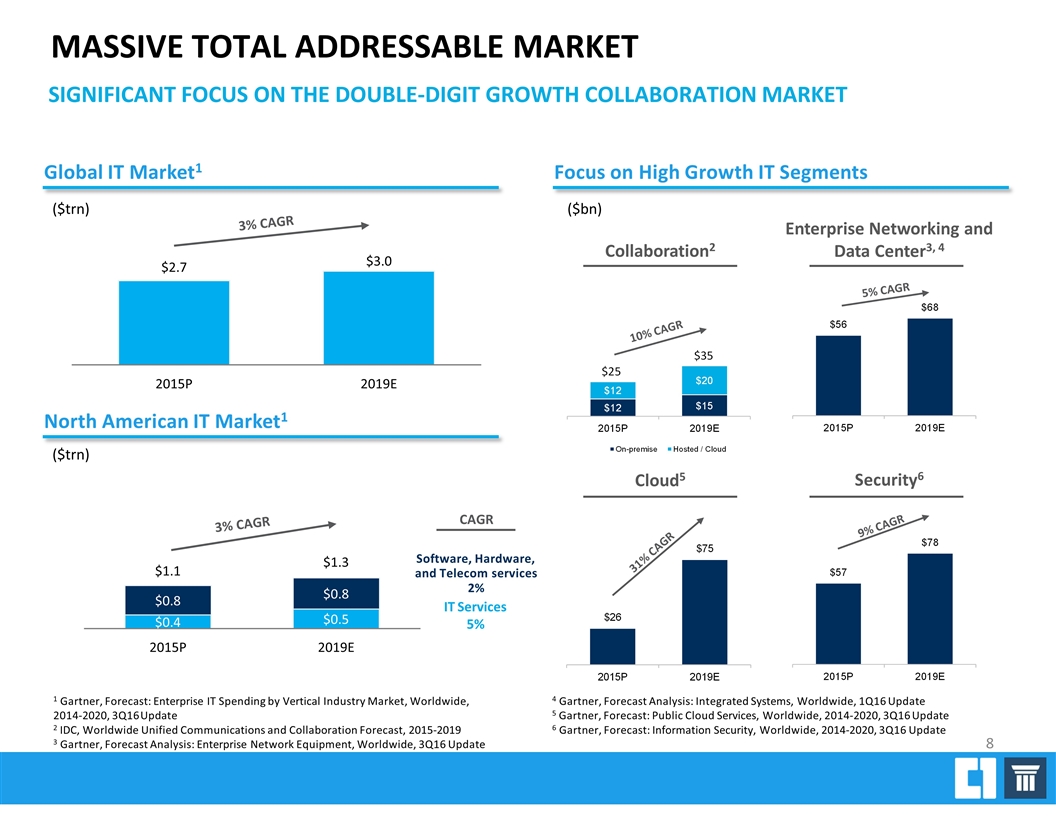

$0.8 $0.8 1 Gartner, Forecast: Enterprise IT Spending by Vertical Industry Market, Worldwide, 2014‐2020, 3Q16 Update 2 IDC, Worldwide Unified Communications and Collaboration Forecast, 2015‐2019 3 Gartner, Forecast Analysis: Enterprise Network Equipment, Worldwide, 3Q16 Update 4 Gartner, Forecast Analysis: Integrated Systems, Worldwide, 1Q16 Update 5 Gartner, Forecast: Public Cloud Services, Worldwide, 2014‐2020, 3Q16 Update 6 Gartner, Forecast: Information Security, Worldwide, 2014‐2020, 3Q16 Update CAGR Software, Hardware, and Telecom services 2% IT Services 5% SIGNIFICANT FOCUS ON THE DOUBLE‐DIGIT GROWTH COLLABORATION MARKET MASSIVE TOTAL ADDRESSABLE MARKET 3% CAGR 3% CAGR Global IT Market1 Focus on High Growth IT Segments North American IT Market1 ($trn) ($trn) 8 ($bn) Collaboration2 Enterprise Networking and Data Center3, 4 Cloud5 Security6

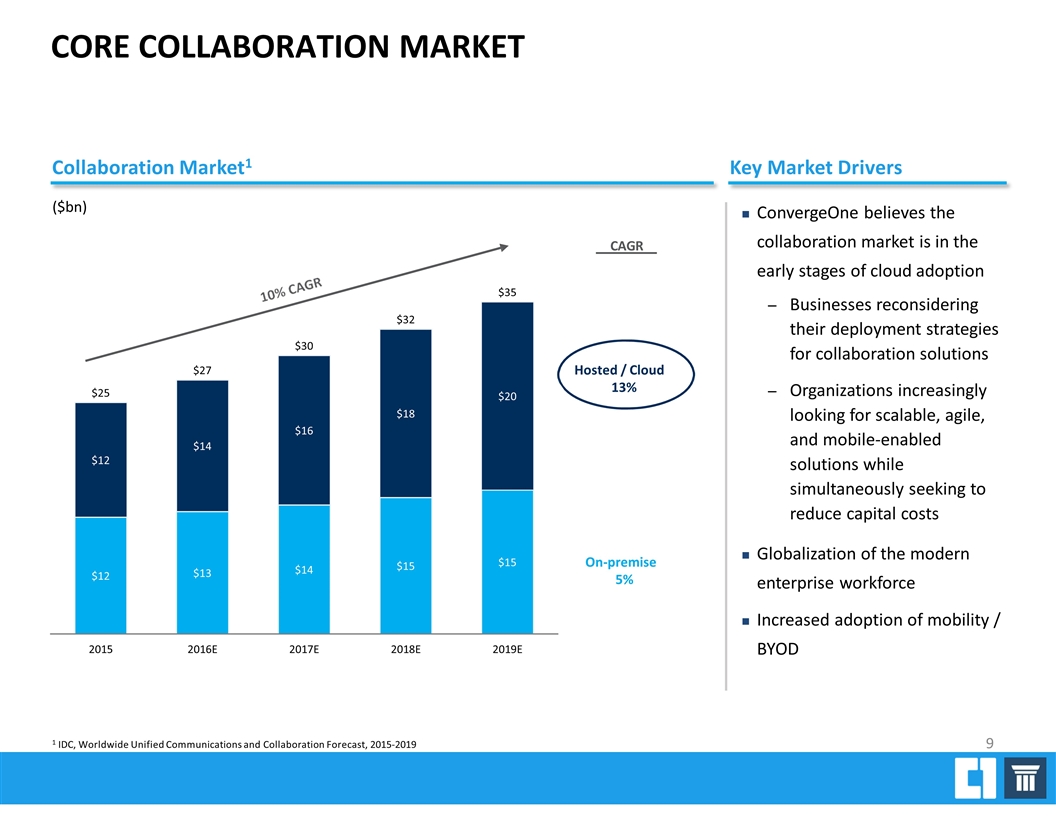

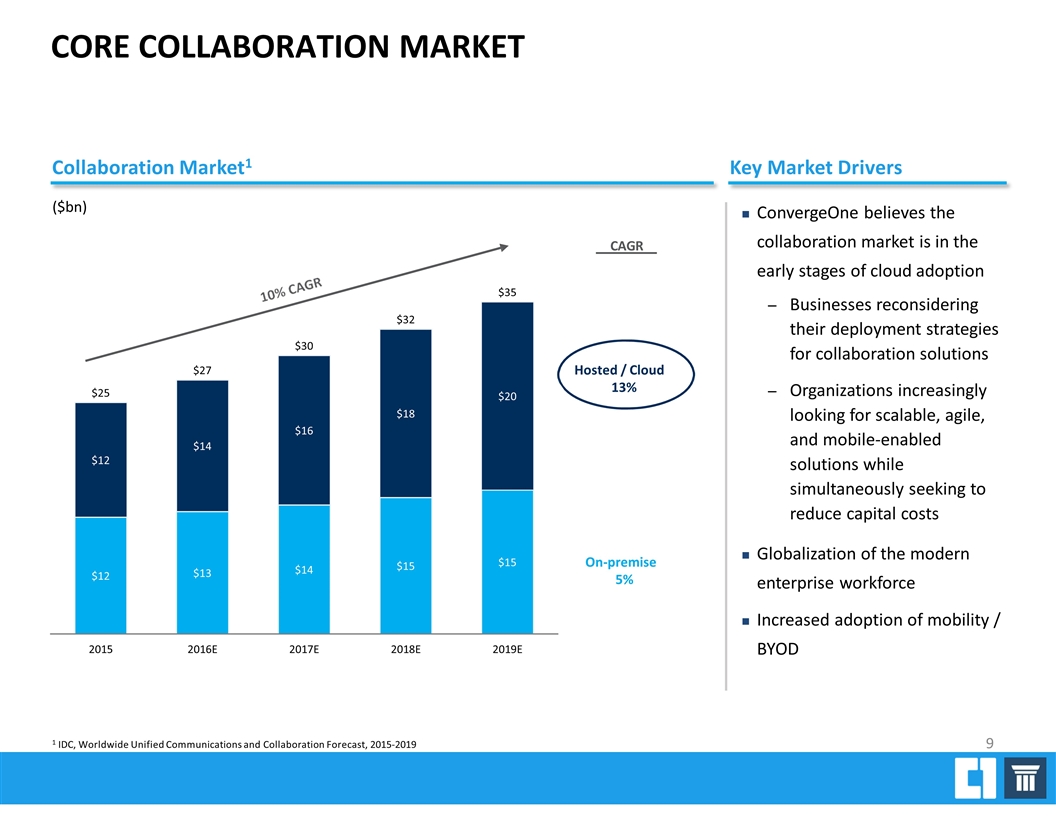

ConvergeOne believes the collaboration market is in the early stages of cloud adoption Businesses reconsidering their deployment strategies for collaboration solutions Organizations increasingly looking for scalable, agile, and mobile‐enabled solutions while simultaneously seeking to reduce capital costs Globalization of the modern enterprise workforce Increased adoption of mobility / BYOD $12.4 $13.0 $13.7 $14.5 $15.3 $12.2 $14.0 $15.9 $17.9 $20.0 1 IDC, Worldwide Unified Communications and Collaboration Forecast, 2015‐2019 CAGR Hosted / Cloud 13% On-premise 5% CORE COLLABORATION MARKET Collaboration Market1 Key Market Drivers ($bn) 9

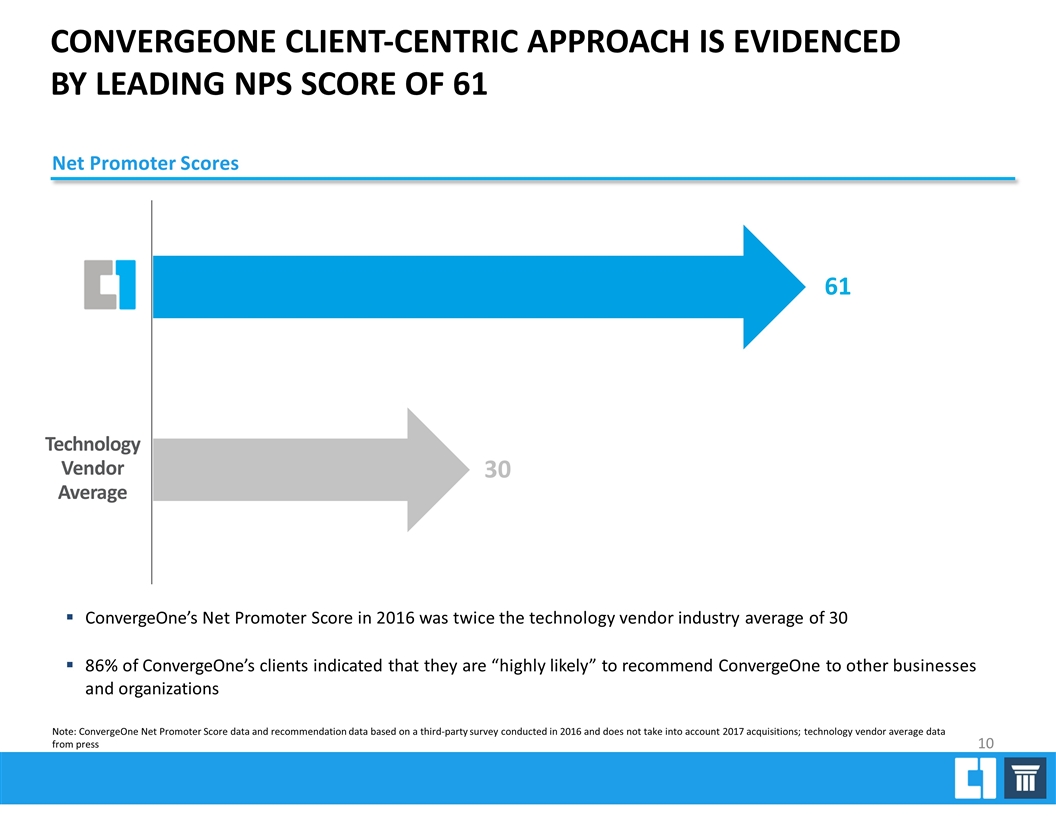

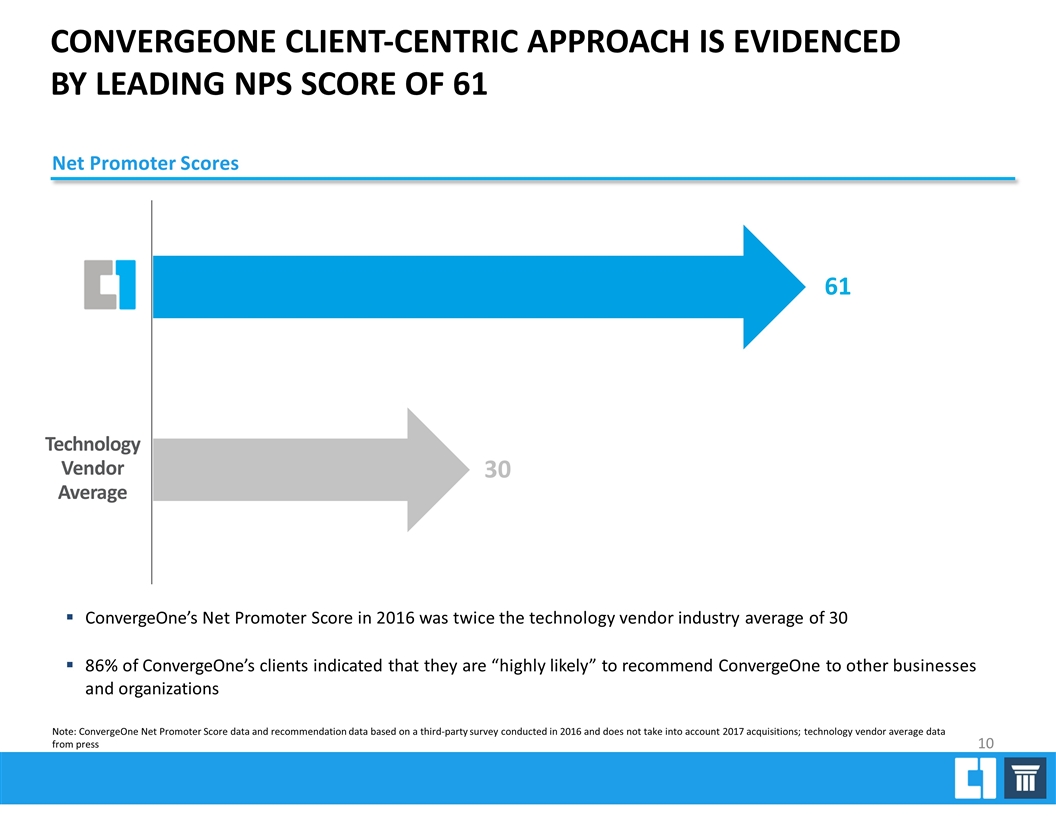

ConvergeOne’s Net Promoter Score in 2016 was twice the technology vendor industry average of 30 86% of ConvergeOne’s clients indicated that they are “highly likely” to recommend ConvergeOne to other businesses and organizations Note: ConvergeOne Net Promoter Score data and recommendation data based on a third‐party survey conducted in 2016 and does not take into account 2017 acquisitions; technology vendor average data from press Net Promoter Scores 10 Technology Vendor Average 30 61 CONVERGEONE CLIENT‐CENTRIC APPROACH IS EVIDENCED BY LEADING NPS SCORE OF 61

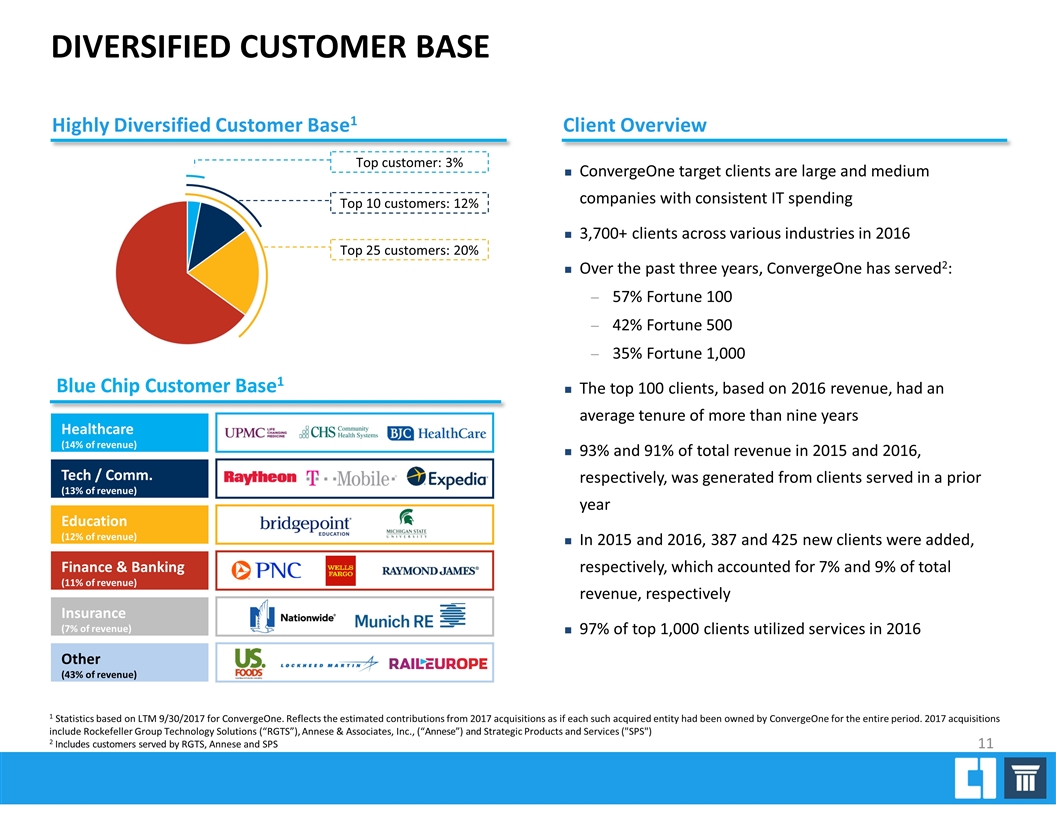

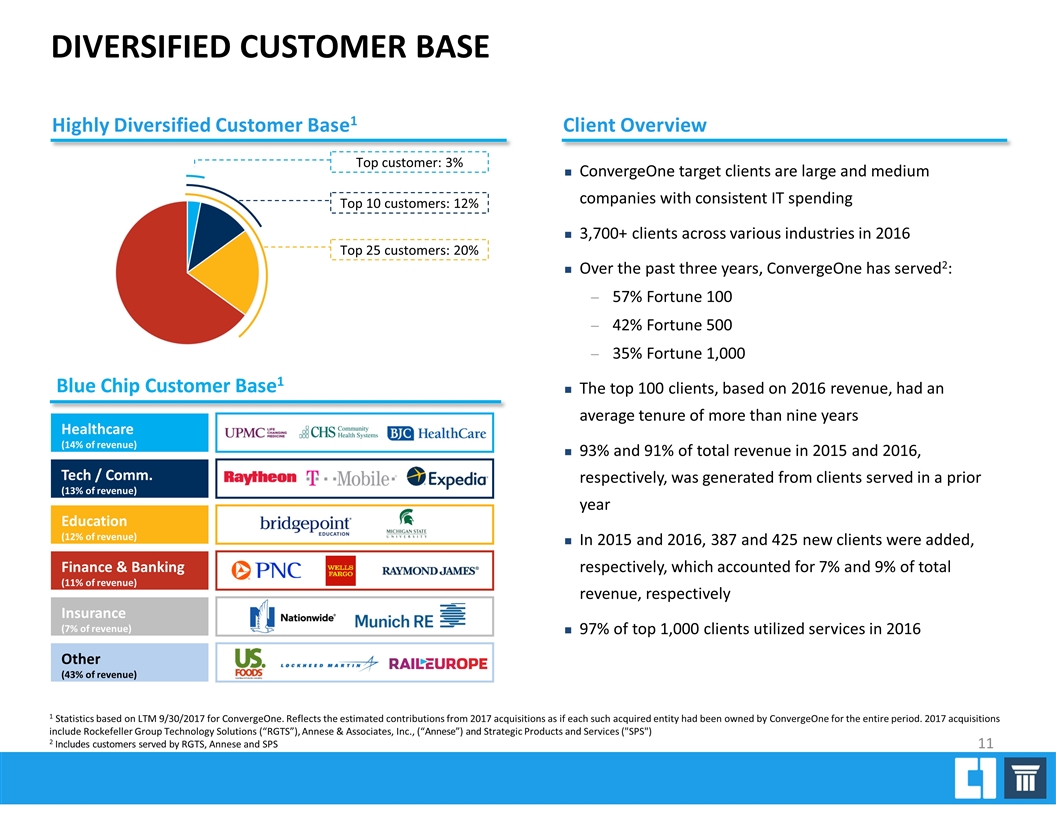

DIVERSIFIED CUSTOMER BASE ConvergeOne target clients are large and medium companies with consistent IT spending 3,700+ clients across various industries in 2016 Over the past three years, ConvergeOne has served2: 57% Fortune 100 42% Fortune 500 35% Fortune 1,000 The top 100 clients, based on 2016 revenue, had an average tenure of more than nine years 93% and 91% of total revenue in 2015 and 2016, respectively, was generated from clients served in a prior year In 2015 and 2016, 387 and 425 new clients were added, respectively, which accounted for 7% and 9% of total revenue, respectively 97% of top 1,000 clients utilized services in 2016 Top customer: 3% Top 10 customers: 12% Top 25 customers: 20% Blue Chip Customer Base1 1 Statistics based on LTM 9/30/2017 for ConvergeOne. Reflects the estimated contributions from 2017 acquisitions as if each such acquired entity had been owned by ConvergeOne for the entire period. 2017 acquisitions include Rockefeller Group Technology Solutions (“RGTS”), Annese & Associates, Inc., (“Annese”) and Strategic Products and Services ("SPS") 2 Includes customers served by RGTS, Annese and SPS Highly Diversified Customer Base1 Client Overview 11 Healthcare (14% of revenue) Tech / Comm. (13% of revenue) Education (12% of revenue) Finance & Banking (11% of revenue) Insurance (7% of revenue) Other (43% of revenue)

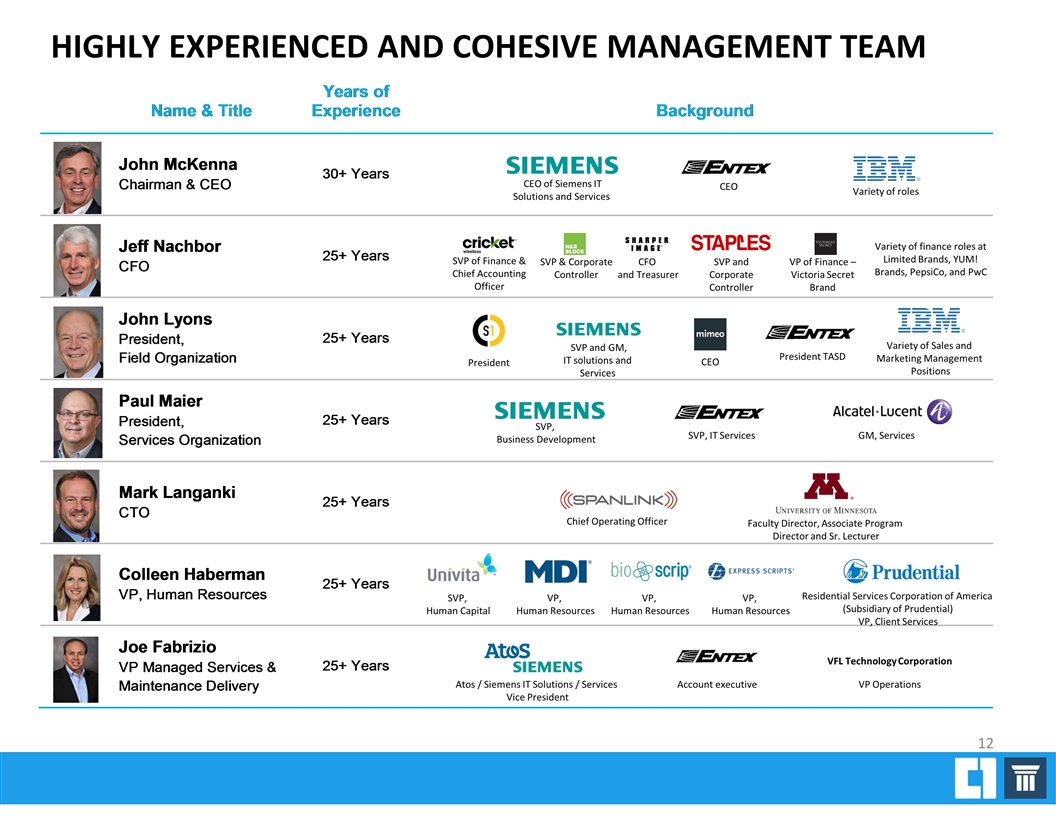

HIGHLY EXPERIENCED AND COHESIVE MANAGEMENT TEAM 12 President CEO Variety of Sales and Marketing Management Positions Variety of finance roles at Limited Brands, YUM! Brands, PepsiCo, and PwC VP of Finance – Victoria Secret Brand SVP and Corporate Controller CFO and Treasurer SVP & Corporate Controller SVP, IT Services SVP, Business Development Atos / Siemens IT Solutions / Services Vice President Account executive VP Operations VFL Technology Corporation Chief Operating Officer Variety of roles CEO of Siemens IT Solutions and Services CEO SVP and GM, IT solutions and Services President TASD SVP of Finance & Chief Accounting Officer Faculty Director, Associate Program Director and Sr. Lecturer GM, Services Residential Services Corporation of America (Subsidiary of Prudential) VP, Client Services VP, Human Resources VP, Human Resources VP, Human Resources SVP, Human Capital Name & TitleYears of ExperienceBackgroundJohn McKennaChairman & CEO30+ YearsJeff NachborCFO25+ YearsJohn LyonsPresident,Field Organization25+ YearsPaul MaierPresident,Services Organization25+ YearsMark LangankiCTO25+ YearsColleen HabermanVP, Human Resources25+ YearsJoe FabrizioVP Managed Services &Maintenance Delivery25+ Years

GROWTH AVENUES

Increase / Cross-Sell Services and Solutions Offerings Expand Geographical Footprint Expand Through Strategic Acquisitions Well established platform poised for continued growth executing proven strategy MULTIPLE AVENUES FOR GROWTH 13 Managed Services Cloud Security Domestic Expansion International Expansion Offering Breadth Geographic Expansion Opportunistic Tuck-ins 2 3 1

Managed Services Cloud Security DELIVERS STRATEGIC VALUE THROUGH A COMPLETE PORTFOLIO OF SERVICES AND SOLUTIONS MULTIPLE AVENUES FOR GROWTH – SOLUTIONS AND SERVICES 1 14 IT Security sub-segments are among the fastest growing in IT industry Revenue in 2016 tracked significantly above expectations 2016 Cisco Security Partner of the Year Well positioned to take advantage of shift to cloud Delivers complex-multi vendor solutions across a number of delivery models C1 Cloud ConvergeOne Private Cloud ConvergeOne & the Public Cloud Increased sell-through of managed services High NPS reflects strength and knowledge in the marketplace

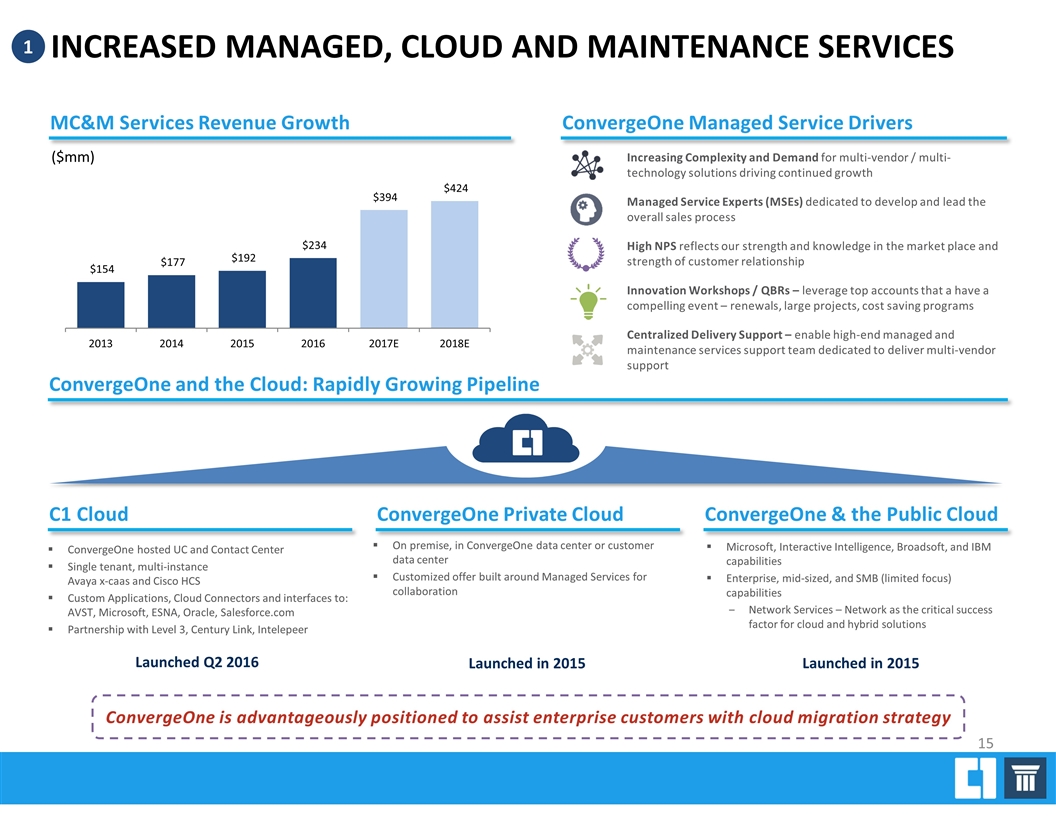

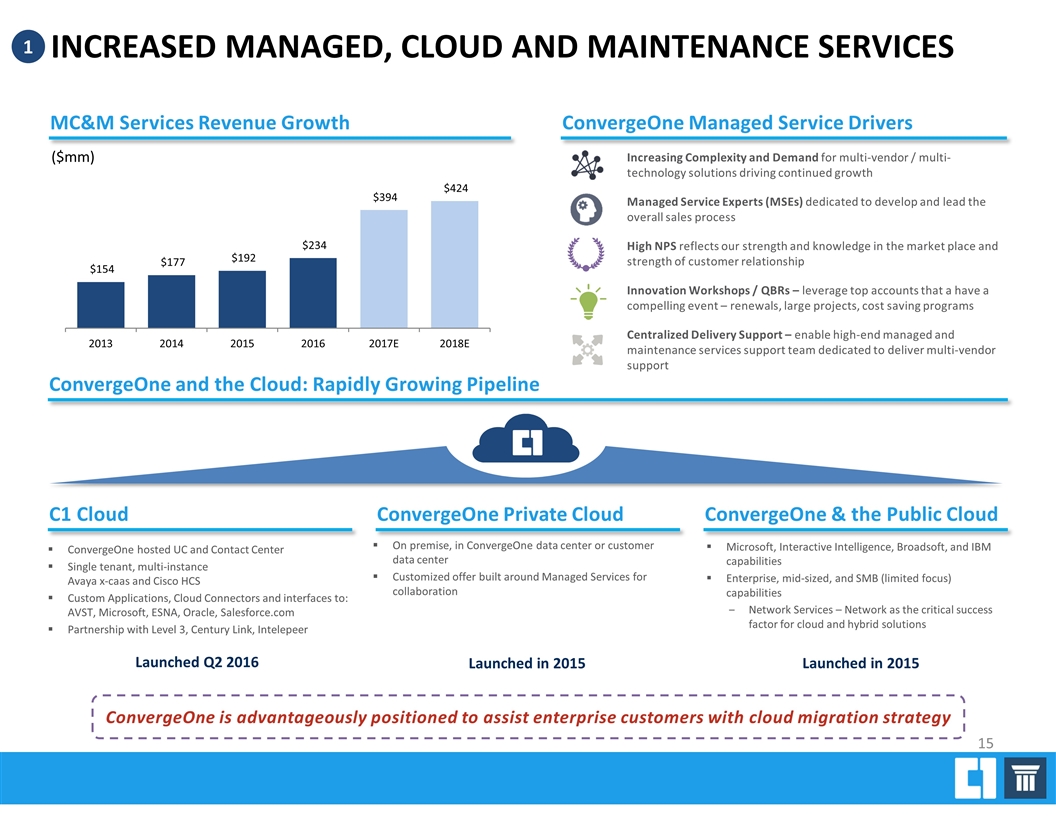

Increasing Complexity and Demand for multi-vendor / multi-technology solutions driving continued growth Managed Service Experts (MSEs) dedicated to develop and lead the overall sales process High NPS reflects our strength and knowledge in the market place and strength of customer relationship Innovation Workshops / QBRs – leverage top accounts that a have a compelling event – renewals, large projects, cost saving programs 1 ConvergeOne hosted UC and Contact Center Single tenant, multi-instance Avaya x-caas and Cisco HCS Custom Applications, Cloud Connectors and interfaces to: AVST, Microsoft, ESNA, Oracle, Salesforce.com Partnership with Level 3, Century Link, Intelepeer Microsoft, Interactive Intelligence, Broadsoft, and IBM capabilities Enterprise, mid-sized, and SMB (limited focus) capabilities Network Services – Network as the critical success factor for cloud and hybrid solutions On premise, in ConvergeOne data center or customer data center Customized offer built around Managed Services for collaboration ConvergeOne is advantageously positioned to assist enterprise customers with cloud migration strategy Launched Q2 2016 Launched in 2015 Launched in 2015 Centralized Delivery Support – enable high-end managed and maintenance services support team dedicated to deliver multi-vendor support ConvergeOne Managed Service Drivers MC&M Services Revenue Growth ConvergeOne and the Cloud: Rapidly Growing Pipeline C1 Cloud ConvergeOne Private Cloud ConvergeOne & the Public Cloud ($mm) INCREASED MANAGED, CLOUD AND MAINTENANCE SERVICES 15

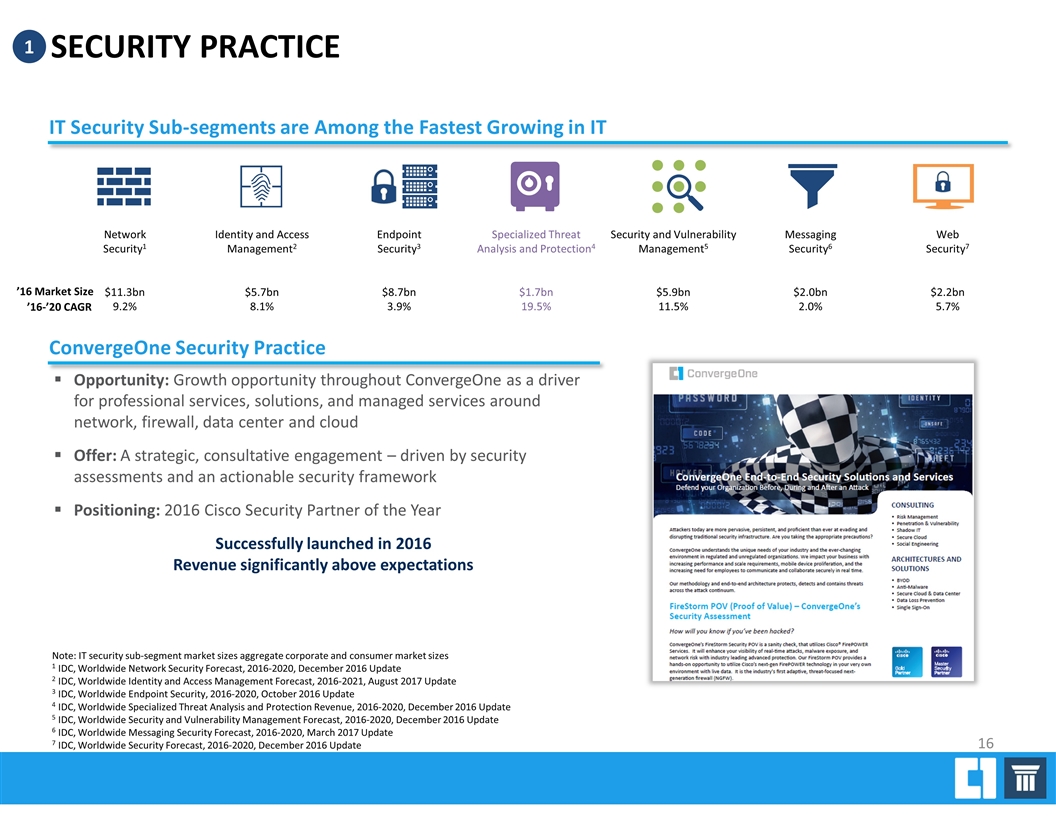

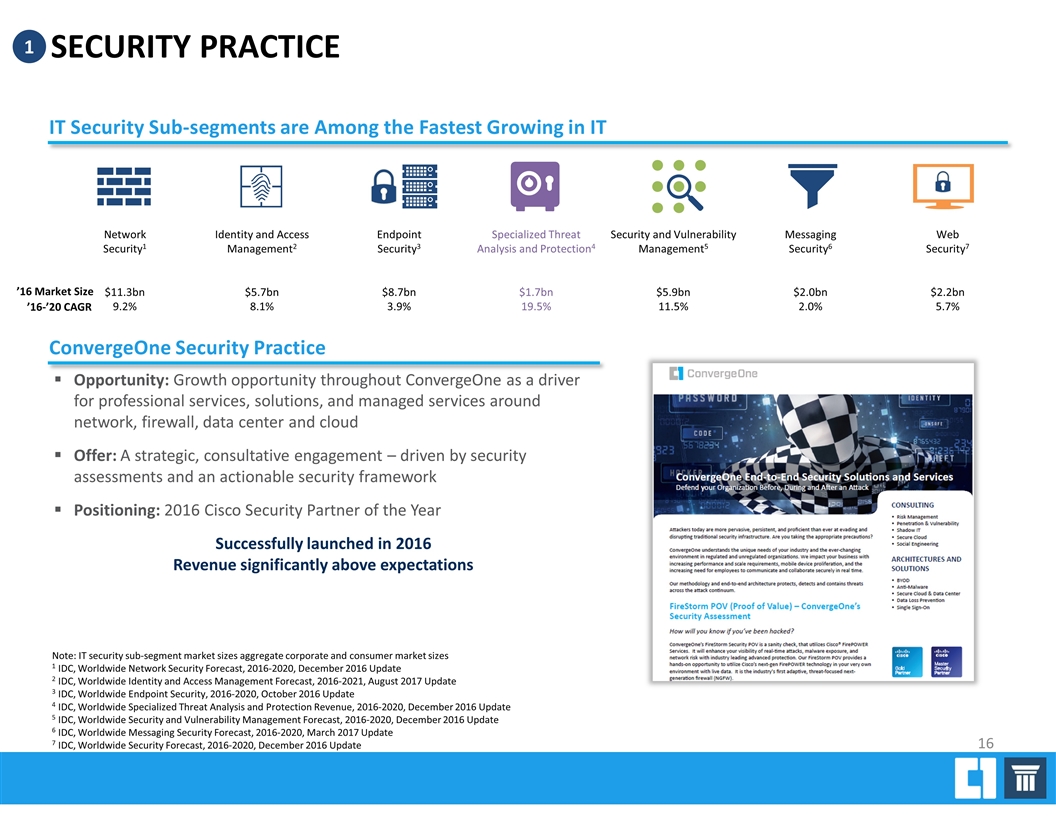

Network Security1 $11.3bn 9.2% Identity and Access Management2 $5.7bn 8.1% Endpoint Security3 $8.7bn 3.9% Specialized Threat Analysis and Protection4 $1.7bn 19.5% Security and Vulnerability Management5 $5.9bn 11.5% Messaging Security6 $2.0bn 2.0% Web Security7 $2.2bn 5.7% Opportunity: Growth opportunity throughout ConvergeOne as a driver for professional services, solutions, and managed services around network, firewall, data center and cloud Offer: A strategic, consultative engagement – driven by security assessments and an actionable security framework Positioning: 2016 Cisco Security Partner of the Year Successfully launched in 2016 Revenue significantly above expectations 1 IT Security Sub-segments are Among the Fastest Growing in IT ConvergeOne Security Practice SECURITY PRACTICE 16 Note: IT security sub-segment market sizes aggregate corporate and consumer market sizes 1 IDC, Worldwide Network Security Forecast, 2016-2020, December 2016 Update 2 IDC, Worldwide Identity and Access Management Forecast, 2016-2021, August 2017 Update 3 IDC, Worldwide Endpoint Security, 2016-2020, October 2016 Update 4 IDC, Worldwide Specialized Threat Analysis and Protection Revenue, 2016-2020, December 2016 Update 5 IDC, Worldwide Security and Vulnerability Management Forecast, 2016-2020, December 2016 Update 6 IDC, Worldwide Messaging Security Forecast, 2016-2020, March 2017 Update 7 IDC, Worldwide Security Forecast, 2016-2020, December 2016 Update ’16-’20 CAGR ’16 Market Size

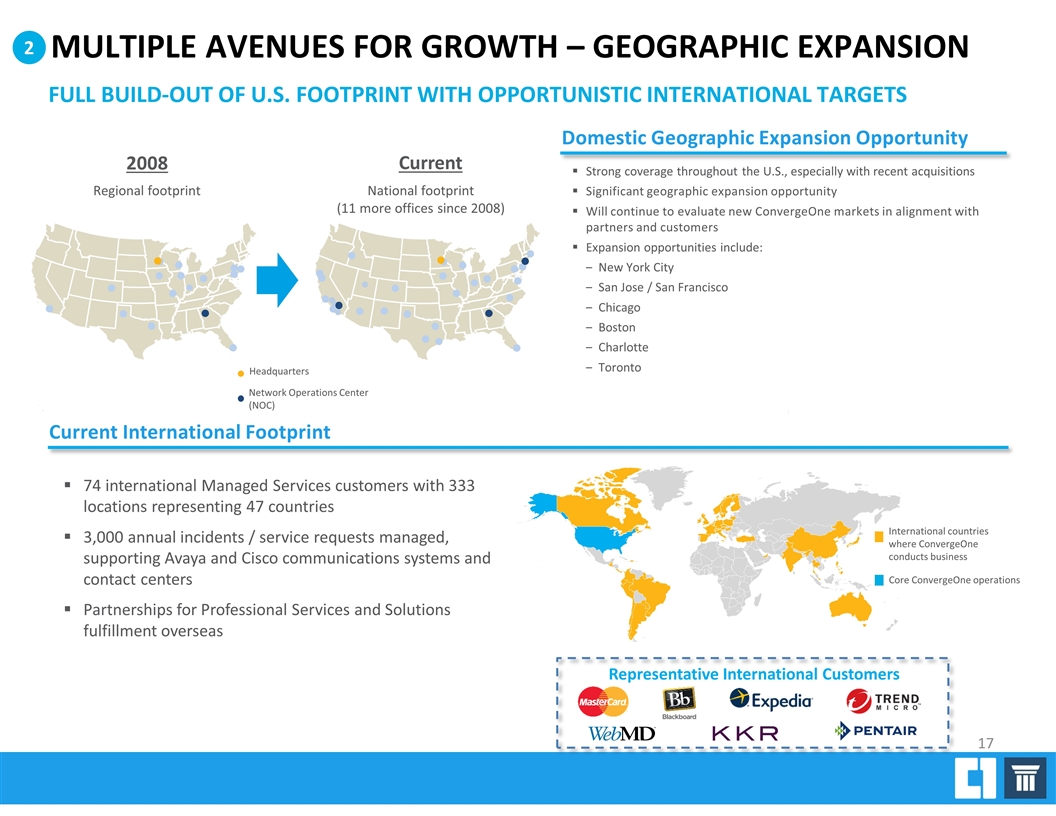

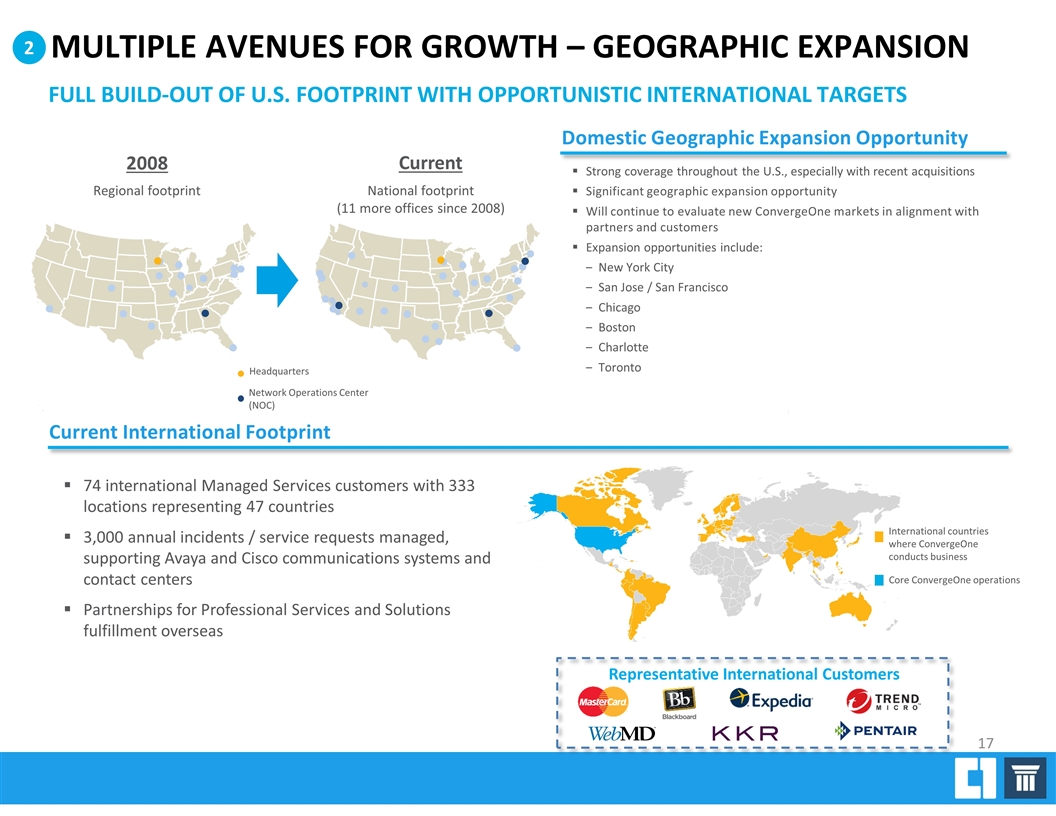

Core ConvergeOne operations International countries where ConvergeOne conducts business 74 international Managed Services customers with 333 locations representing 47 countries 3,000 annual incidents / service requests managed, supporting Avaya and Cisco communications systems and contact centers Partnerships for Professional Services and Solutions fulfillment overseas 2 Current National footprint (11 more offices since 2008) 2008 Regional footprint Strong coverage throughout the U.S., especially with recent acquisitions Significant geographic expansion opportunity Will continue to evaluate new ConvergeOne markets in alignment with partners and customers Expansion opportunities include: New York City San Jose / San Francisco Chicago Boston Charlotte Toronto Current International Footprint Domestic Geographic Expansion Opportunity Network Operations Center (NOC) Headquarters FULL BUILD-OUT OF U.S. FOOTPRINT WITH OPPORTUNISTIC INTERNATIONAL TARGETS MULTIPLE AVENUES FOR GROWTH – GEOGRAPHIC EXPANSION 17 Representative International Customers

MULTIPLE AVENUES FOR GROWTH – M&A - 2 1 3 - 1 1 1 3 Pipeline of Actionable Acquisition Opportunities # of Acquisitions Total: 12 Opportunity to further accelerate services growth and leverage ConvergeOne’s robust Managed and Cloud Services platform Enhance solutions offering and further platform transition Value accretive opportunity to acquire collaboration businesses at attractive valuations Successful track record of acquiring and integrating technology service and solution providers – 12 acquisitions since 2009 2010 2012 2014 2015 2016 2013 2011 2009 YTD 2017 3 18

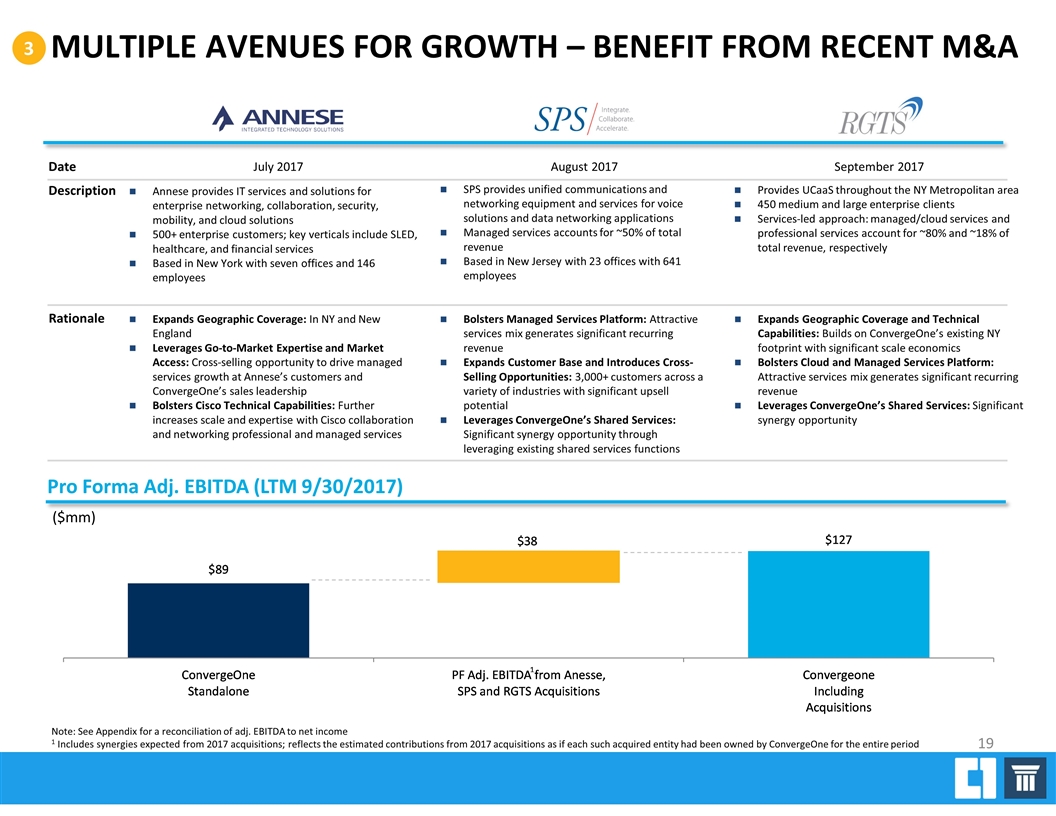

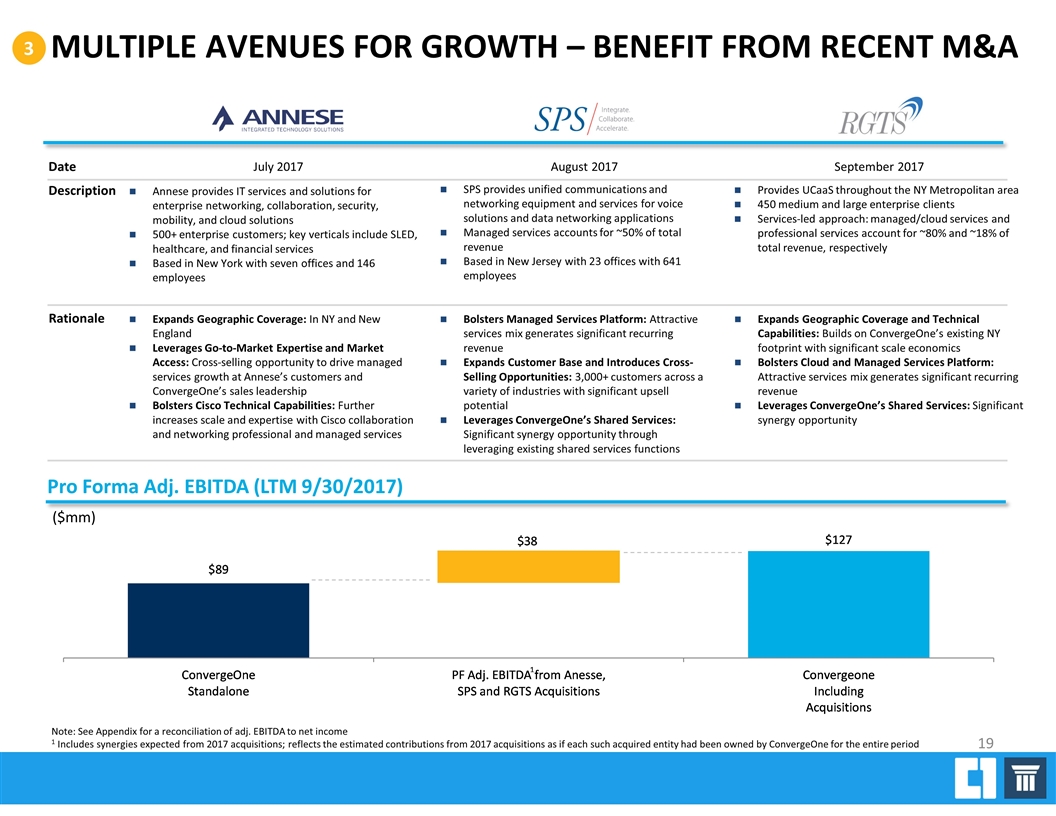

3 MULTIPLE AVENUES FOR GROWTH – BENEFIT FROM RECENT M&A 19 Note: See Appendix for a reconciliation of adj. EBITDA to net income 1 Includes synergies expected from 2017 acquisitions; reflects the estimated contributions from 2017 acquisitions as if each such acquired entity had been owned by ConvergeOne for the entire period Expands Geographic Coverage and Technical Capabilities: Builds on ConvergeOne’s existing NY footprint with significant scale economics Bolsters Cloud and Managed Services Platform: Attractive services mix generates significant recurring revenue Leverages ConvergeOne’s Shared Services: Significant synergy opportunity Expands Geographic Coverage: In NY and New England Leverages Go-to-Market Expertise and Market Access: Cross-selling opportunity to drive managed services growth at Annese’s customers and ConvergeOne’s sales leadership Bolsters Cisco Technical Capabilities: Further increases scale and expertise with Cisco collaboration and networking professional and managed services Bolsters Managed Services Platform: Attractive services mix generates significant recurring revenue Expands Customer Base and Introduces Cross-Selling Opportunities: 3,000+ customers across a variety of industries with significant upsell potential Leverages ConvergeOne’s Shared Services: Significant synergy opportunity through leveraging existing shared services functions Provides UCaaS throughout the NY Metropolitan area 450 medium and large enterprise clients Services-led approach: managed/cloud services and professional services account for ~80% and ~18% of total revenue, respectively Annese provides IT services and solutions for enterprise networking, collaboration, security, mobility, and cloud solutions 500+ enterprise customers; key verticals include SLED, healthcare, and financial services Based in New York with seven offices and 146 employees SPS provides unified communications and networking equipment and services for voice solutions and data networking applications Managed services accounts for ~50% of total revenue Based in New Jersey with 23 offices with 641 employees September 2017 July 2017 August 2017 Rationale Description Date Pro Forma Adj. EBITDA (LTM 9/30/2017) ($mm)

FINANCIAL OVERVIEW

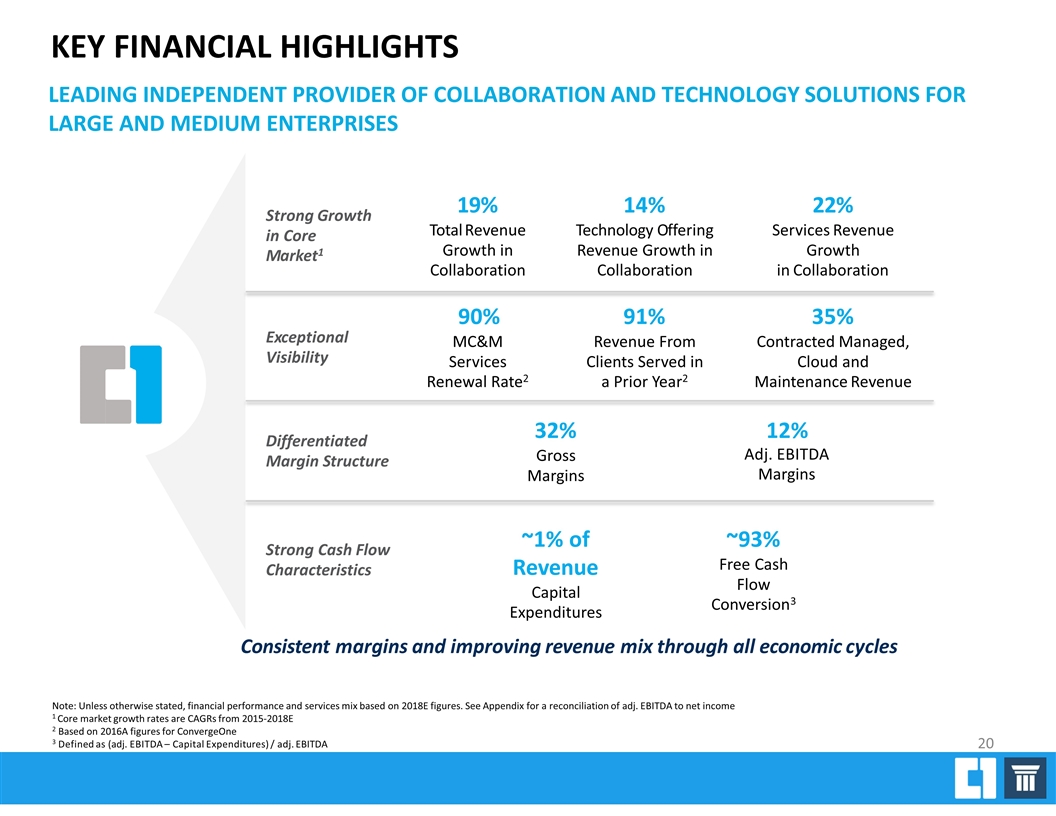

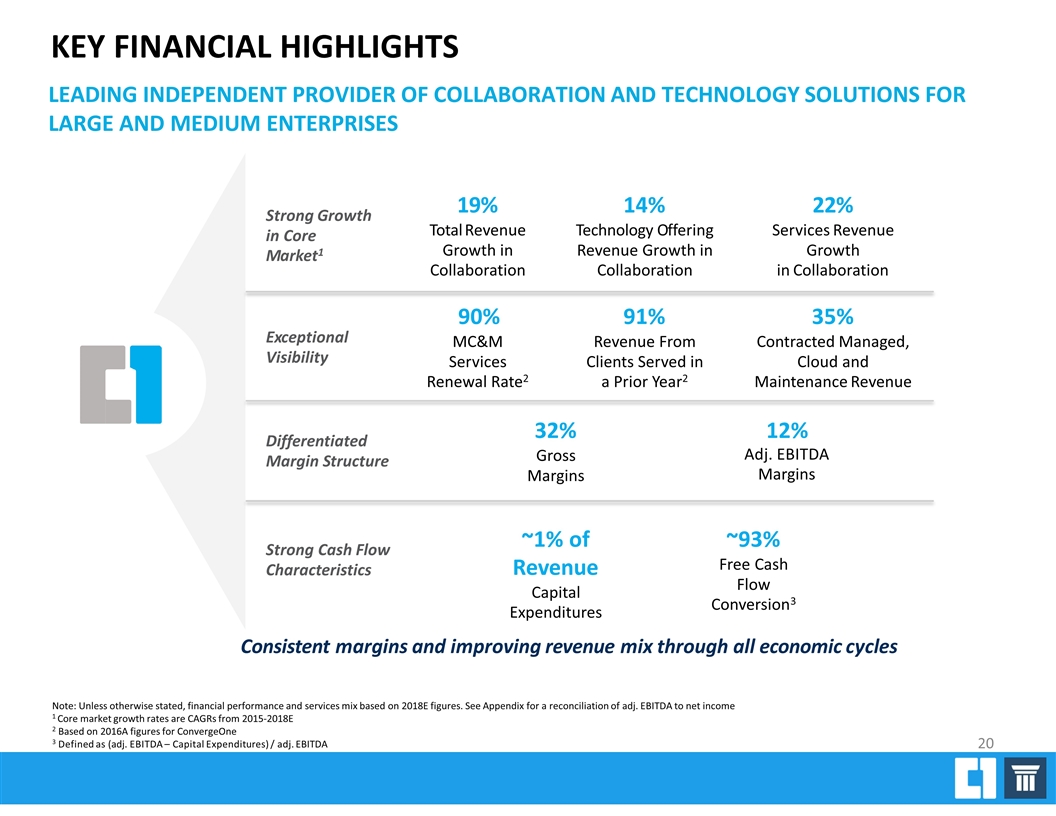

19% Total Revenue Growth in Collaboration 90% MC&M Services Renewal Rate2 32% Gross Margins 12% Adj. EBITDA Margins ~93% Free Cash Flow Conversion3 91% Revenue From Clients Served in a Prior Year2 ~1% of Revenue Capital Expenditures 22% Services Revenue Growth in Collaboration Strong Growth in Core Market1 Exceptional Visibility Differentiated Margin Structure Strong Cash Flow Characteristics Consistent margins and improving revenue mix through all economic cycles LEADING INDEPENDENT PROVIDER OF COLLABORATION AND TECHNOLOGY SOLUTIONS FOR LARGE AND MEDIUM ENTERPRISES KEY FINANCIAL HIGHLIGHTS 35% Contracted Managed, Cloud and Maintenance Revenue 14% Technology Offering Revenue Growth in Collaboration Note: Unless otherwise stated, financial performance and services mix based on 2018E figures. See Appendix for a reconciliation of adj. EBITDA to net income 1 Core market growth rates are CAGRs from 2015-2018E 2 Based on 2016A figures for ConvergeOne 3 Defined as (adj. EBITDA – Capital Expenditures) / adj. EBITDA 20

FINANCIAL PERFORMANCE Note: For the period (2013-2014 and 2017E), the amounts adjusted to include the pre-acquisition results for all entities in the year acquired to reflect a full year of ownership. The 2013 amounts reflect the pre-acquisition results of Itrus (purchased December 2013), the 2014 amounts reflect the pre-acquisitions results of Spanlink (purchased September 2014), and the 2017E amount reflects the pre-acquisition results of RGTS (closed in September 2017), Annese (purchased July 2017) and SPS (purchased August 2017). 2015-2016 & 2018E numbers shown on a GAAP basis 1 See Appendix for a reconciliation of adj. EBITDA to net income Pro Forma Adj. EBITDA1 Total Revenue ($mm) ($mm) 21 2007-2018E Revenue CAGR of 13% and Adj. EBITDA CAGR of 14%; strong pipeline and visibility into the remainder of 2017 and 2018

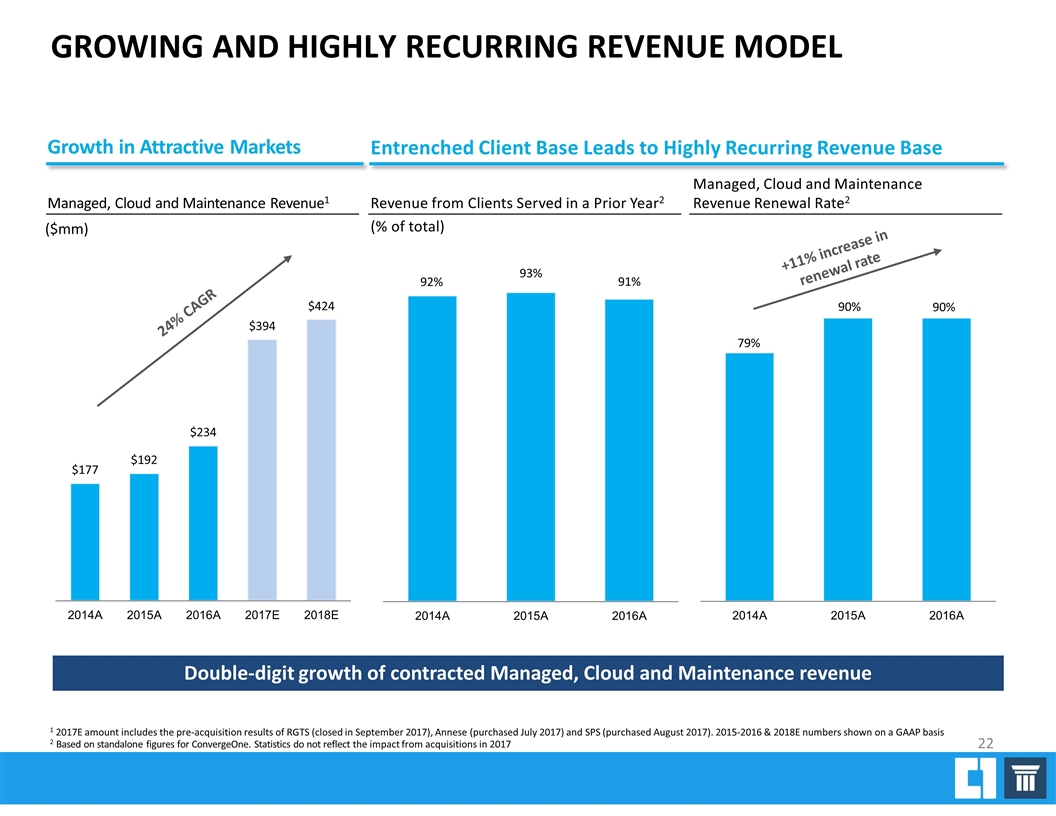

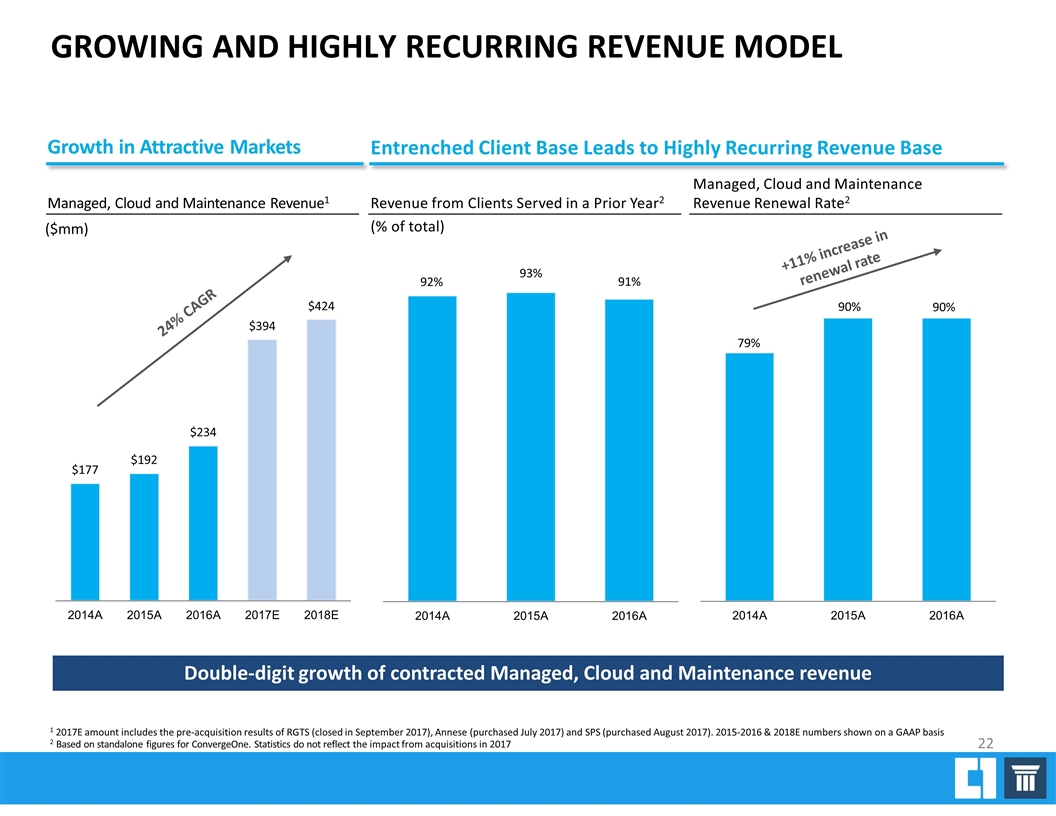

GROWING AND HIGHLY RECURRING REVENUE MODEL Double-digit growth of contracted Managed, Cloud and Maintenance revenue 24% CAGR +11% increase in renewal rate Revenue from Clients Served in a Prior Year2 Managed, Cloud and Maintenance Revenue1 ($mm) 22 Entrenched Client Base Leads to Highly Recurring Revenue Base Growth in Attractive Markets Managed, Cloud and Maintenance Revenue Renewal Rate2 (% of total) 1 2017E amount includes the pre-acquisition results of RGTS (closed in September 2017), Annese (purchased July 2017) and SPS (purchased August 2017). 2015-2016 & 2018E numbers shown on a GAAP basis 2 Based on standalone figures for ConvergeOne. Statistics do not reflect the impact from acquisitions in 2017

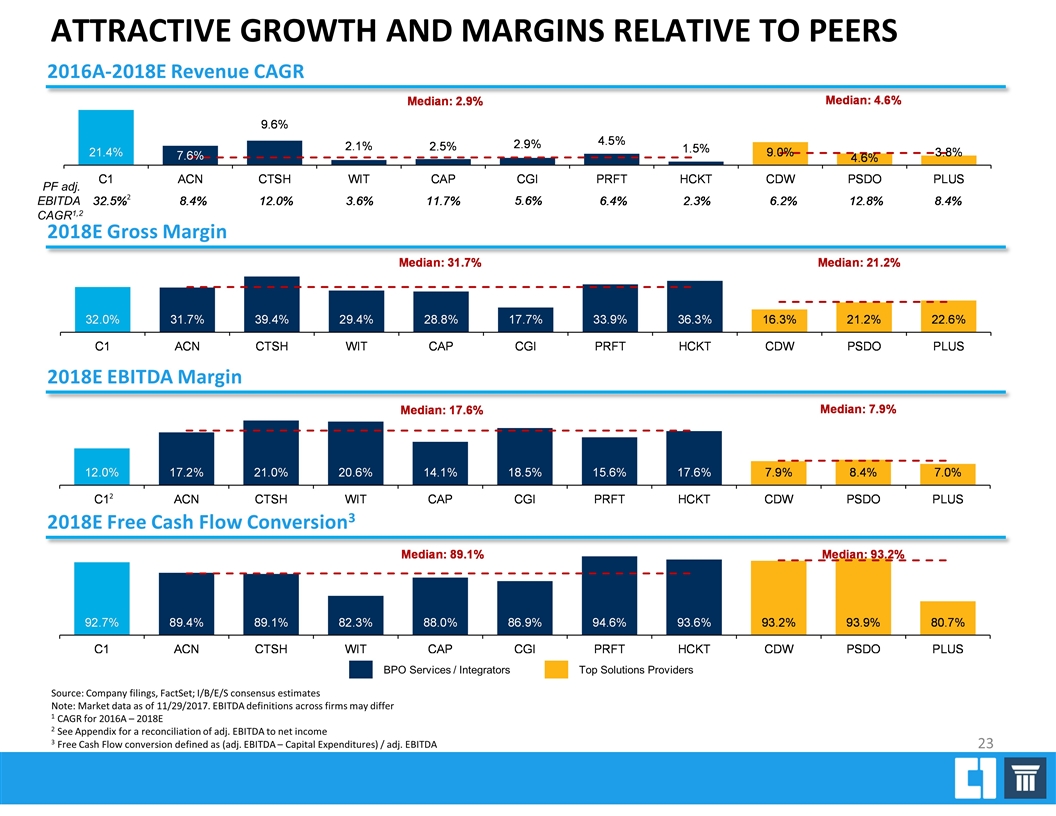

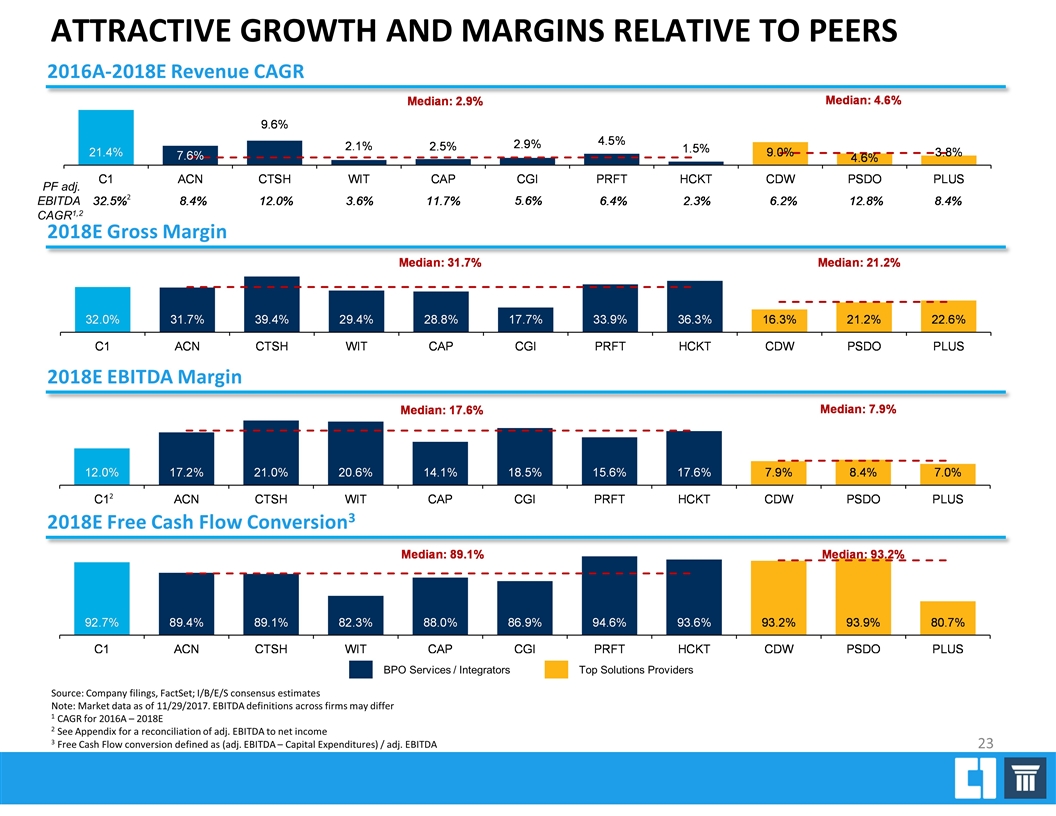

ATTRACTIVE GROWTH AND MARGINS RELATIVE TO PEERS Source: Company filings, FactSet; I/B/E/S consensus estimates Note: Market data as of 11/29/2017. EBITDA definitions across firms may differ 1 CAGR for 2016A – 2018E 2 See Appendix for a reconciliation of adj. EBITDA to net income 3 Free Cash Flow conversion defined as (adj. EBITDA – Capital Expenditures) / adj. EBITDA 2018E EBITDA Margin 2016A-2018E Revenue CAGR 2018E Free Cash Flow Conversion3 2018E Gross Margin Top Solutions Providers BPO Services / Integrators PF adj. EBITDA CAGR1,2 23 2 2

TRANSACTION SUMMARY

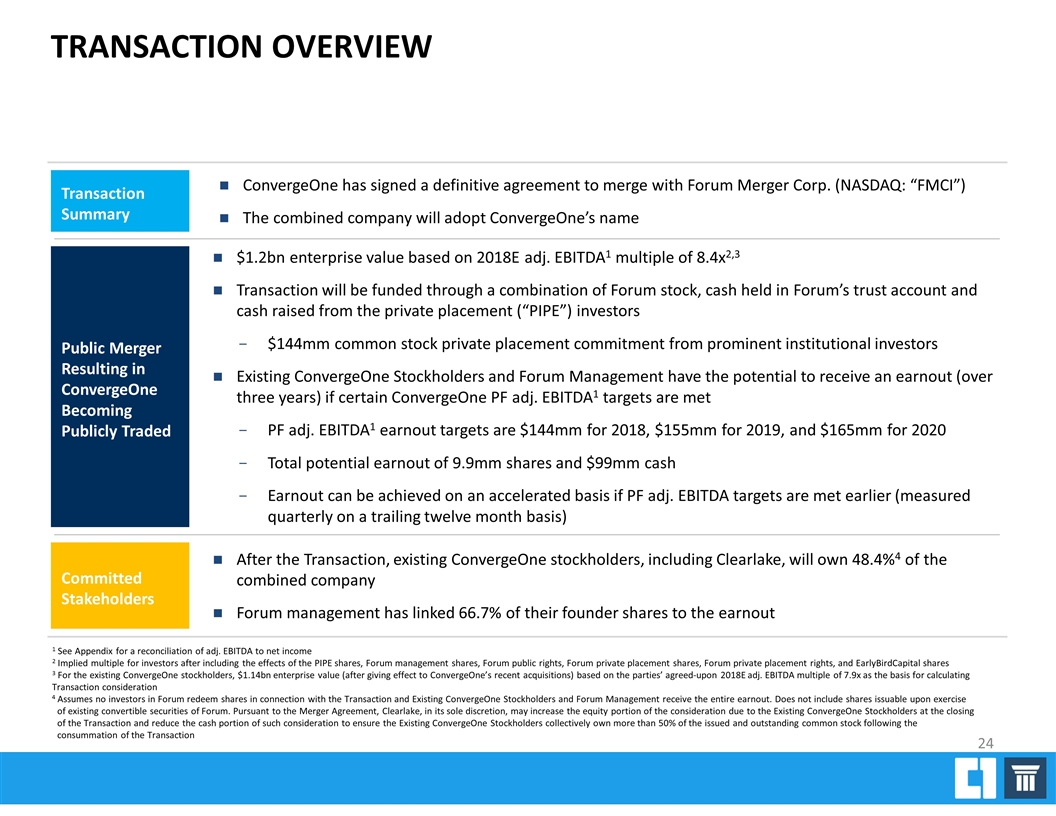

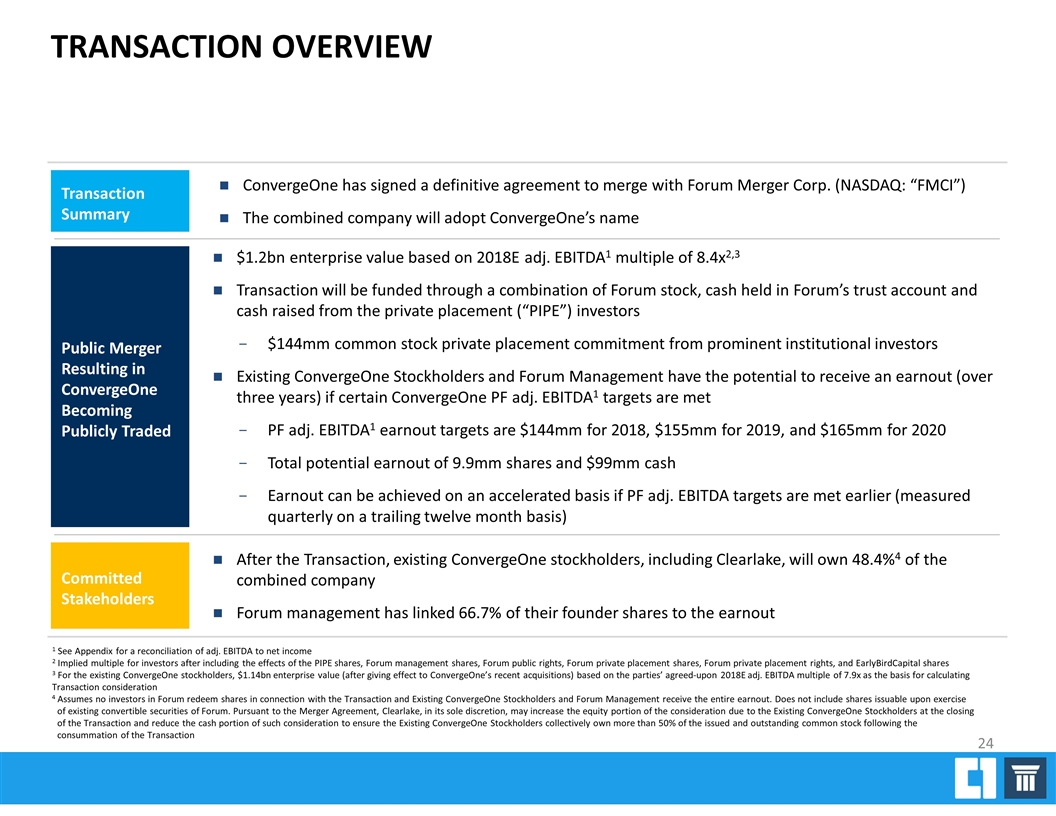

1 See Appendix for a reconciliation of adj. EBITDA to net income 2 Implied multiple for investors after including the effects of the PIPE shares, Forum management shares, Forum public rights, Forum private placement shares, Forum private placement rights, and EarlyBirdCapital shares 3 For the existing ConvergeOne stockholders, $1.14bn enterprise value (after giving effect to ConvergeOne’s recent acquisitions) based on the parties’ agreed-upon 2018E adj. EBITDA multiple of 7.9x as the basis for calculating Transaction consideration 4 Assumes no investors in Forum redeem shares in connection with the Transaction and Existing ConvergeOne Stockholders and Forum Management receive the entire earnout. Does not include shares issuable upon exercise of existing convertible securities of Forum. Pursuant to the Merger Agreement, Clearlake, in its sole discretion, may increase the equity portion of the consideration due to the Existing ConvergeOne Stockholders at the closing of the Transaction and reduce the cash portion of such consideration to ensure the Existing ConvergeOne Stockholders collectively own more than 50% of the issued and outstanding common stock following the consummation of the Transaction TRANSACTION OVERVIEW 24 Transaction Summary Public Merger Resulting in ConvergeOne Becoming Publicly Traded Committed Stakeholders ConvergeOne has signed a definitive agreement to merge with Forum Merger Corp. (NASDAQ: “FMCI”) The combined company will adopt ConvergeOne’s name $1.2bn enterprise value based on 2018E adj. EBITDA1 multiple of 8.4x2,3 Transaction will be funded through a combination of Forum stock, cash held in Forum’s trust account and cash raised from the private placement (“PIPE”) investors $144mm common stock private placement commitment from prominent institutional investors Existing ConvergeOne Stockholders and Forum Management have the potential to receive an earnout (over three years) if certain ConvergeOne PF adj. EBITDA1 targets are met PF adj. EBITDA1 earnout targets are $144mm for 2018, $155mm for 2019, and $165mm for 2020 Total potential earnout of 9.9mm shares and $99mm cash Earnout can be achieved on an accelerated basis if PF adj. EBITDA targets are met earlier (measured quarterly on a trailing twelve month basis) After the Transaction, existing ConvergeOne stockholders, including Clearlake, will own 48.4%4 of the combined company Forum management has linked 66.7% of their founder shares to the earnout

TRANSACTION TERMS 25 Sources & Uses Pro Forma Ownership (with Full Earnout)1,5 Valuation4 1 2 1 Assumes no redemptions by Forum’s existing stockholders 2 The actual amount of cash payable to the existing stockholders of ConvergeOne, including Clearlake, shall be calculated based on the number of shares of Forum common stock tendered for redemption in connection with the Transaction, the parties’ fees and expenses of the Transaction and the PIPE for the agreed-upon working capital requirements of the combined company and the net proceeds of the PIPE, and may change as a result of redemptions by Forum stockholders. Pursuant to the Merger Agreement, Clearlake, in its sole discretion, may increase the equity portion of the consideration due to the Existing ConvergeOne Stockholders at the closing of the Transaction and reduce the cash portion of such consideration to ensure the Existing ConvergeOne Stockholders collectively own more than 50% of the issued and outstanding common stock following the consummation of the Transaction 3 Operating cash will be used to pay for the expenses of the Transaction and the PIPE; ConvergeOne also has access to a $150mm ABL revolver (drawn $25mm at 9/30/2017) 4 Does not include earnout to existing ConvergeOne Stockholders and Forum management. Assumes no redemptions by Forum’s existing stockholders 5 Excludes (i) warrants to purchase 8,936,250 shares of Class A Common Stock of Forum issued in the Forum IPO (“Forum IPO”) and (ii) an Unit Purchase Option to purchase 1,125,000 units consisting of one share of Forum Class A Common Stock, one right and one-half of one warrant. Each right entities the holder thereof to receive one-tenth (1/10) of one share of common stock on the consummation of an initial business combination. Each whole warrant entitles the holder to purchase one share of Forum Class A Common Stock 6 The percentages presented for Other Public Investors are estimates only. The actual number of Forum Class A Common Stock issuable will be determined based on the redemption value upon closing of the Transaction ($mm) ($mm, except per share data) 3 6

ATTRACTIVE VALUATION RELATIVE TO PEERS 2018E TEV / Adj. EBITDA 2018E TEV / Free Cash Flow2 Top Solutions Providers BPO Services / Integrators Dividend Paying Peers3 Source: Company filings, FactSet; I/B/E/S consensus estimates Note: Market data as of 11/29/2017. EBITDA definitions across firms may differ 1 See Appendix for a reconciliation of adj. EBITDA to net income; implied multiple for investors after including the effects of PIPE shares, Forum management shares, Forum public rights, Forum private placement shares, Forum private placement rights and EarlyBirdCapital shares. Forum and Clearlake’s agreed upon 2018E adj. EBITDA multiple for calculating merger consideration is 7.9x 2 Free Cash Flow defined as adj. EBITDA-Capital Expenditures 3 Peers include ACN, CTSH, WIT, CAP, HCKT, and CDW 26 1 1

APPENDIX

SPONSOR OVERVIEW 27 Private investment firm founded in 2006 with a sector-focused approach, including deep experience in technology investing Over $3.5bn of assets under management Senior investment principals have led or co-led over 100 investments History of building long-term strategic partnerships with world-class management teams to transform companies through organic and inorganic growth strategies Conservative leverage levels across the portfolio Consistent execution of buy-and-build strategies across the technology landscape Representative technology portfolio: Clearlake Overview Special Purpose Acquisition Company formed for the purpose of merging with an operating company Completed IPO in April 2017 on the NASDAQ (Ticker: “FMCI”) Headquartered in New York, NY $175mm held in Trust Team of experienced public market professionals with exposure across industries Stephen A. Vogel (Executive Chairman) President, CEO, and Co-Founder of Synergy Gas Prior board member of Netspend (NASDAQ: NTSP) Marshall Kiev (Co-CEO & President) Previously a Director of Cohen Private Ventures Previously Chief of Staff at S.A.C. Capital Advisors David Boris (Co-CEO & CFO) Involved in 13 SPAC transactions Previously SMD and Head of IB at Pali Capital Forum Overview

EBITDA RECONCILIATION 28 ($mm) 2015A 2016A LTM as of 9/30/17 Net Income $4 $8 ($11) Depreciation and Amortization 24 29 32 Interest and Other (Income) / Expense 23 31 54 Income Tax Expense 4 7 (5) Share-based Compensation Expense 0 1 1 Purchase Accounting Adjustments (1) (0) 3 Transaction Costs 6 6 7 Other Costs 3 2 3 Adjusted EBITDA $63 $84 $83 Board of Directors Related Expenses 0 1 0 One-Time and Non-Recurring Adjustments 4 1 4 Pro Forma Synergies1 3 2 2 Pro Forma EBITDA Impact of 2017 Acquisitions2 - - 38 Pro Forma Adjusted EBITDA3 $70 $88 $127 Pro Forma Adjusted EBITDA 1 Synergies related to pre-2017 acquisitions 2 Reflects the estimated contributions from 2017 acquisitions as if each such acquired entity had been owned by ConvergeOne for the entire period; includes synergies expected from 2017 acquisitions 3 Pro Forma Adjusted EBITDA is adjusted to reflect any pro forma adjustments pursuant to the calculation of Consolidated EBITDA (including all “add-backs” and adjustments provided therein) set forth in ConvergeOne’s Term Loan Agreement