Description of the LTIP

A summary description of the material features of the LTIP, as amended to reflect the LTIP Amendment, is set forth below. This summary does not purport to be a complete description of all the provisions of the LTIP or the LTIP Amendment and is qualified in its entirety by reference to (i) the LTIP, which was filed as Exhibit 4.3 to our Form S-8 Registration Statement (File No. 333-218043) filed with the SEC on May 16, 2017 and is incorporated by reference herein, and (ii) the LTIP Amendment, which is attached as Appendix B to this Proxy Statement and is incorporated by reference herein. The purpose of the LTIP is to provide incentives to our employees, non-employee directors and other service providers in order to induce them to work for the benefit of, and to promote the success of, the Company and its affiliates and to attract, reward and retain key personnel.

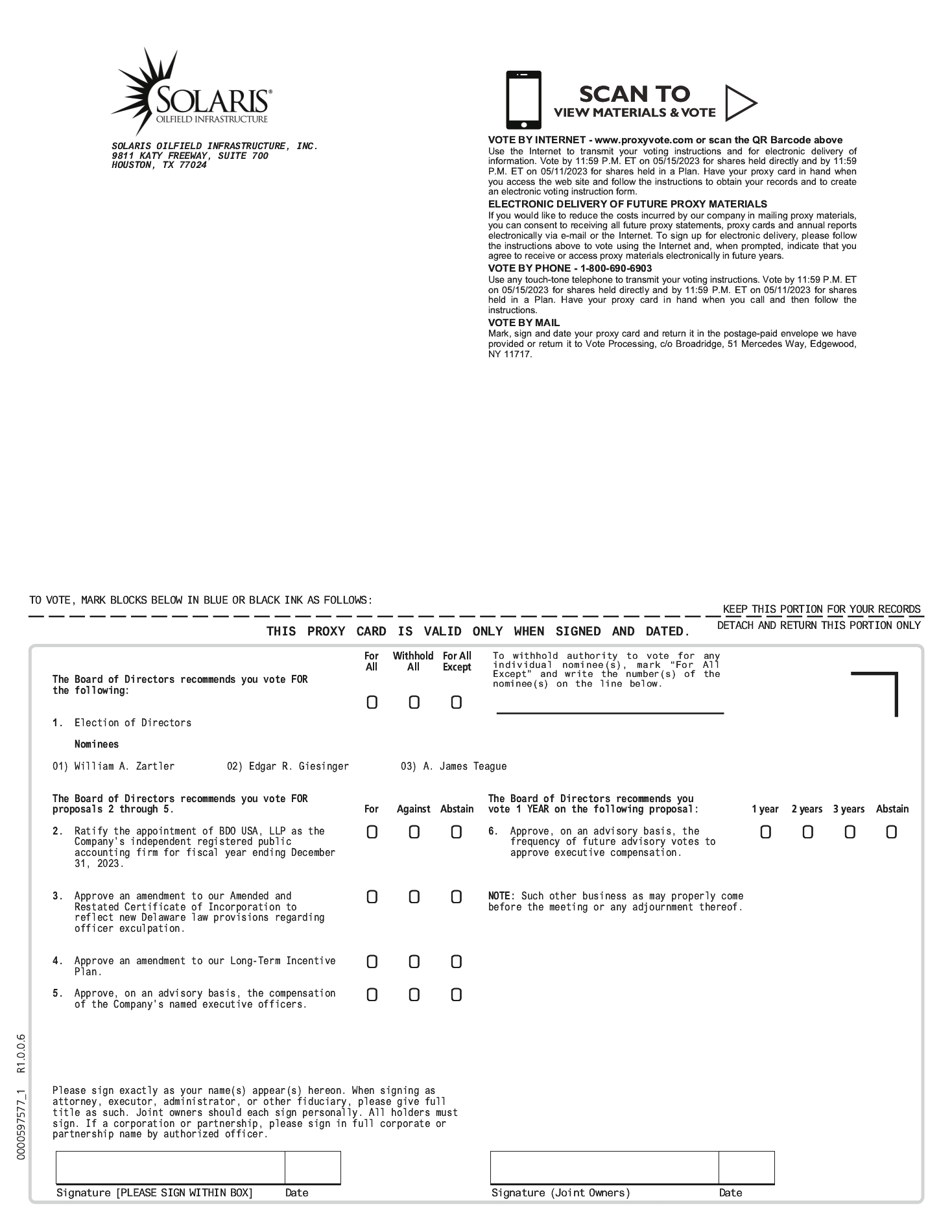

LTIP Share Limits. As noted above, as of March 3, 2023, only 653,392 shares of our common stock remained available out of the 5,118,080 shares originally authorized for issuance under the LTIP (assuming maximum payout of currently outstanding awards). The LTIP Amendment would increase the number of shares of our common stock available for awards under the LTIP by 4,700,000 shares (the “Additional Shares”). Accordingly, a total of 5,353,392 shares of our common stock would be authorized to be issued under the LTIP, which number also represents the maximum aggregate number of shares of common stock that may be issued under the LTIP through incentive stock options. As noted above, this number represents approximately 11.3% of our outstanding common stock as of March 3, 2023. The closing price of a share of our common stock, as quoted on the NYSE on March 3, 2023 was $10.12.

The aggregate grant date fair value of all awards granted under the LTIP to each non-employee director in any calendar year may not exceed $750,000, in each case multiplied by the number of full or partial calendar years in any performance period established with respect to an award, if applicable; provided, that, for the calendar year in which a non-employee director first commences service on the Board only, the foregoing limitation shall be doubled. In addition, the foregoing limitation does not apply to awards granted to a non-employee director during any period in which such individual was an employee or service provider other than in the capacity of a non-employee director.

If stockholders approve the LTIP Amendment, we intend to file, pursuant to the Securities Act a registration statement on Form S-8 to register the Additional Shares.

Administration. The LTIP is administered by our Compensation Committee, except to the extent the Board elects to administer the LTIP (the “administrator”). The administrator has broad discretion to administer the LTIP, including the power to determine the eligible individuals to whom awards will be granted, the number and type of awards to be granted and the terms and conditions of awards. The administrator may also accelerate the vesting or exercise of any award and make all other determinations and take all other actions necessary or advisable for the administration of the LTIP.

Eligibility. Any individual who is our officer or employee or an officer or employee of any of our affiliates, and any other person who provides services to us or our affiliates, including members of our Board, are eligible to receive awards under the LTIP at the discretion of the administrator. We currently have six executive officers, 350 other employees and seven non-employee directors, all of whom are eligible to receive awards under the LTIP.

LTIP Awards. The LTIP provides for the grant, from time to time, at the discretion of our Board or a committee thereof, of stock options, stock appreciation rights (“SARs”), restricted stock, restricted stock units, stock awards, dividend equivalents, other stock-based awards, cash awards, substitute awards and performance awards.

Stock Options. The administrator may grant incentive stock options and options that do not qualify as incentive stock options, except that incentive stock options may only be granted to persons who are our employees or employees of one of our subsidiaries, in accordance with Section 422 of the Code. The exercise price of a stock option generally cannot be less than 100% of the fair market value of a share of our Class A common stock on the date on which the option is granted and the option must not be exercisable for longer than ten years following the date of grant. In the case of an incentive stock option granted to an individual who owns (or is deemed to own) at least 10% of the total combined voting power of all classes of our capital stock, the exercise price of the stock option must be at least 110% of the fair market value of a share of our Class A common stock on the date of grant and the option must not be exercisable more than five years from the date of grant.