UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14C

(RULE 14C-101)

SCHEDULE 14C INFORMATION

INFORMATION STATEMENT PURSUANT TO SECTION 14(C) OF

THE SECURITIES EXCHANGE ACT OF 1934

Check the appropriate box:

| [X] | Preliminary Information Statement |

| | |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-5(d) (1)) |

| | |

| [ ] | Definitive Information Statement |

STEM HOLDINGS, INC.

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required |

| | |

| Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11. |

| | |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| | |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| | |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| | |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| | |

| | |

| (5) | Total fee paid: |

| | |

| | Fee previously paid with preliminary materials. |

| | |

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a) (2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | |

| (1) | Amount Previously Paid: |

| | |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| | |

| (3) | Filing Party: |

| | |

| | |

| (4) | Date Filed: |

| | |

STEM HOLDINGS, INC.

7777 Glades Road, Suite 203,

Boca Raton, FL 33434

(561) 948-5410

June 1, 2018

Dear Shareholder:

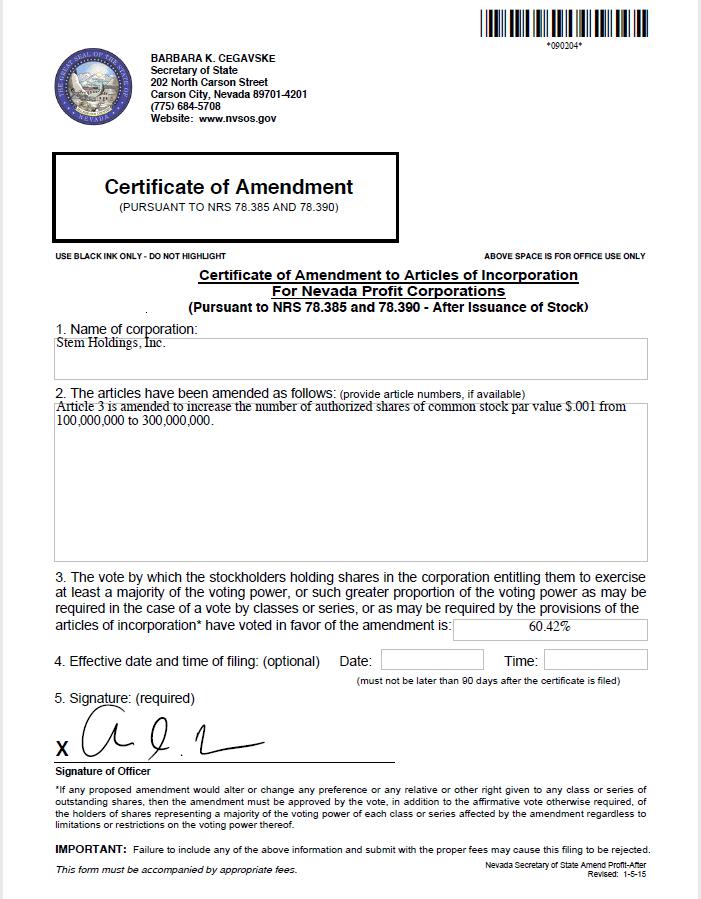

This Information Statement is furnished to holders of shares of common stock, $.001 par value (the “Common Stock of Stem Holdings, Inc. (the “Company”). We are sending you this Information Statement to inform you that on May 31, 2018, the Board of Directors of the Company unanimously adopted a resolution seeking shareholder approval to amend the Company’s Articles of Incorporation to increase the number of authorized Company Common Shares from 100,000,000 to 300,000,000. Thereafter, on May 31, 2018, pursuant to the By-Laws of the Company and applicable Nevada law, shareholders holding in excess of fifty percent (50%) of the votes entitled to be cast on the aforementioned matter (identified in the section entitled “Voting Securities and Principal Holders Thereof”) adopted a resolution to authorize the Board of Directors, in its sole discretion, to increase the number of authorized shares of Company Common Stock from 100,000,000 to 300,000,000.

The Board of Directors believes that the proposed increase in authorized capital is beneficial to the Company because it provides the Company with the flexibility it needs to raise additional capital consistent with its Business Plan.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE NOT REQUESTED

TO SEND US A PROXY

The enclosed Information Statement is being furnished to you to inform you that the foregoing action has been approved by the holders of a majority of the outstanding shares of our Common Stock. The resolutions will not become effective before the date which is 20 days after this Information Statement was first mailed to shareholders. You are urged to read the Information Statement in its entirety for a description of the action taken by the Board of Directors and the consent of shareholders of the Company holding a majority of the shares entitled to vote on the matter.

This Information Statement is being mailed on or about June 15, 2018 to shareholders of record on May 31, 2018 (the “Record Date”).

| | /s/ Adam Berk |

| | Adam Berk, Chief Executive Officer |

STEM HOLDINGS, INC.

7777 Glades Road, Suite 203,

Boca Raton, FL 33434

(561) 948-5410

INFORMATION STATEMENT

PURSUANT TO SECTION 14(C)

OF THE SECURITIES EXCHANGE ACT OF 1934

AND RULE 14C-2 THEREUNDER

NO VOTE OR OTHER ACTION OF THE COMPANY’S SHAREHOLDERS IS REQUIRED IN CONNECTION WITH THIS INFORMATION STATEMENT.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY

The Company is distributing this Information Statement to its shareholders in full satisfaction of any notice requirements it may have under Securities and Exchange Act of 1934, as amended, and applicable Nevada law. No additional action will be undertaken by the Company with respect to the receipt of written consents, and no dissenters’ rights with respect to the receipt of the written consents.

Expenses in connection with the distribution of this Information Statement, which are anticipated to be approximately $5,000.00, will be paid by the Company.

ABOUT THE INFORMATION STATEMENT

What Is The Purpose Of The Information Statement?

This Information Statement is being provided pursuant to Section 14 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) to notify the Company’s shareholders, as of the close of business on May 31, 2018 (the “Record Date”), of corporate action taken pursuant to the consent or authorization of certain shareholders of the Company. Shareholders holding the power to vote in excess of a majority of the Company’s outstanding common stock have acted upon the corporate matters outlined in this Information Statement, consisting of the following:

To amend the Company’s Articles of Incorporation to:

(1) increase the number of authorized Company Common Shares from 100,000,000 to 300,000,000.

The Company will refer to this action as the “Proposal”.

Who Is Entitled To Notice?

Each holder of an outstanding share of common stock or voting preferred stock of record on the close of business on the Record Date will be entitled to notice of each matter voted upon pursuant to consents or authorizations by certain shareholders who, as of the close of business on the Record Date, were entitled to cast in excess of fifty percent (50%) of the votes entitled to vote in favor of the Proposal. Under Nevada corporate law, all the activities requiring shareholder approval may be taken by obtaining the written consent and approval by the holders of fifty percent (50%) of the votes entitled to be cast on the matter in lieu of a meeting of the shareholders. No action by the minority shareholders in connection with the Proposal is required.

What Corporate Matters Did the Majority of the Shareholders Vote For And How Did They Vote?

As of May 31, 2018, the Company received executed consents from shareholders entitled to in excess of fifty percent (50%) of the total eligible votes, which means that a majority of the votes entitled to be cast on the Proposal were in fact cast. The Shareholders provided consent with respect to the following matters:

To amend the Company’s Articles of Incorporation to:

(1) increase the number of authorized Company Common Shares from 100,000,000 to 300,000,000.

What Vote Is Required To Approve The Proposal?

With respect to the Proposal, the affirmative vote of a majority of the votes entitled to be cast on the Proposal was required for approval of the Proposal. Certain of the Company’s shareholders have voted in favor of the Proposal and these shareholders represented in excess of fifty percent (50%) of the votes entitled to be cast on the Proposal. These shareholders were entitled to cast fifty percent (50%) of the votes eligible to be cast on the Proposal. Accordingly, these shareholders had sufficient voting shares to approve the Proposal.

Shareholders Who Voted In Favor Of The Proposal

The table below indicates all of the holders of shares of the Company’s Common Stock that have voted in favor of the Proposal. On the Record Date, 8,845,360 votes were eligible to be cast on the Proposal.

Shares of Common Stock

| Shareholder | | Votes | | Percent |

| | | | | |

| 1025 ASSOCIATES INC. | | | 146,000 | | | | 1.651 | % |

| ADAM BERK | | | 314,866 | | | | 3.560 | % |

| ALLISON DEROSE | | | 100 | | | | 0.001 | % |

| ALLISON DEROSE AMO TRUST | | | 5,000 | | | | 0.057 | % |

| ANDREW BLOOM | | | 20,833 | | | | 0.236 | % |

| ARLENE PERRY | | | 2,291 | | | | 0.026 | % |

| ATG CAPITAL LLC | | | 104,167 | | | | 1.178 | % |

| BRONFMAN FAMILY INVESTMENTS PARTNERSHIP | | | 104,166 | | | | 1.178 | % |

| CAPLAN FAMILY INVESTMENTS LLC | | | 10,000 | | | | 0.113 | % |

| CARSON REED ADDISON TRUST PETER DALRYMPLE TTEE | | | 100 | | | | 0.001 | % |

| CMT VENTURES LLC | | | 31,250 | | | | 0.353 | % |

| DANK INVESTMENTS LLC | | | 41,667 | | | | 0.471 | % |

| DRAPER BENDER | | | 85,891 | | | | 0.971 | % |

| DYNAMIC HEMP LLC | | | 100,000 | | | | 1.131 | % |

| ERIC WALLBERG | | | 214,866 | | | | 2.429 | % |

| FABRIZIO BALESTRI | | | 10,000 | | | | 0.113 | % |

| FLYING HIGH FINANCIAL CORPORATION | | | 833,334 | | | | 9.421 | % |

| GARRETT BENDER | | | 128,974 | | | | 1.458 | % |

| GB LENDING LLC | | | 100 | | | | 0.001 | % |

| GB LIVING TRUST | | | 100 | | | | 0.001 | % |

| GB STORAGE II LLC | | | 100 | | | | 0.001 | % |

| GB STORAGE LLC | | | 100 | | | | 0.001 | % |

| GERALD HANNAHS | | | 170,000 | | | | 1.922 | % |

| GREG BELZBERG | | | 8,533 | | | | 0.096 | % |

| HANNAHS VALUE INVESTORS LLC | | | 184,776 | | | | 2.089 | % |

| JACK ZEMER | | | 25,000 | | | | 0.283 | % |

| JAMES ORPEZA | | | 299,447 | | | | 3.385 | % |

| JEAN HANNAHS | | | 100 | | | | 0.001 | % |

| JESSICA M FEINGOLD | | | 10,416 | | | | 0.118 | % |

| JOY BERK | | | 100 | | | | 0.001 | % |

| KEVIN R. CONTRERAS FAMILY TRUST | | | 41,666 | | | | 0.471 | % |

| LAURIE O'NEAL | | | 100,000 | | | | 1.131 | % |

| LINDY L SNIDER | | | 41,666 | | | | 0.471 | % |

| ROBERT AND SUSAN DEROSE TRUST | | | 60,000 | | | | 0.678 | % |

| ROBERT DEROSE | | | 10,100 | | | | 0.114 | % |

| ROSALINDE AND ARTHUR GILBERT FOUNDATION | | | 104,166 | | | | 1.178 | % |

| SPH INVESTMENTS | | | 100,000 | | | | 1.131 | % |

| SPH INVESTMENTS P/S PLAN FBO STEPHEN HARRINGTON | | | 100 | | | | 0.001 | % |

| SPRING CREEK | | | 166,666 | | | | 1.884 | % |

| STETSON CAPITAL INVESTMENTS INC | | | 125,000 | | | | 1.413 | % |

| STEVE HUBBARD | | | 68,333 | | | | 0.773 | % |

| SUSAN AND ROBERT DEROSE FAMILY TRUST | | | 50,000 | | | | 0.565 | % |

| SUSAN DEROSE | | | 100 | | | | 0.001 | % |

| THE DEROSE FOUNDATION | | | 10,000 | | | | 0.113 | % |

| THE HUSSEINI GROUP | | | 83,333 | | | | 0.942 | % |

| TRAV IS MACKENZIE | | | 299,447 | | | | 3.385 | % |

| VISION 4U LLC | | | 273,433 | | | | 3.091 | % |

| WILTAIN INVESTMENTS LLC | | | 116,000 | | | | 1.311 | % |

| WI LTAIN INVESTORS LLC | | | 71,333 | | | | 0.806 | % |

| R.B. PRICE AND COMPANY | | | 40,000 | | | | 0.452 | % |

| RARICK FAILY TRUST | | | 8,333 | | | | 0.094 | % |

| RB PRICE TRUSTEE | | | 20,833 | | | | 0.236 | % |

| LPD INVESTMENTS | | | 350,000 | | | | 3.957 | % |

| LPD INVESTMENTS LTD. | | | 20,000 | | | | 0.226 | % |

| LYNNE ROSNER | | | 50,000 | | | | 0.565 | % |

| LYNNEITE HANNAHS | | | 100 | | | | 0.001 | % |

| MARK BENTSEN | | | 177,638 | | | | 2.008 | % |

| R B PRICE AND COMPANY DEFINED BENEFIT | | | 62,501 | | | | 0.707 | % |

| MARYANNE CONTRERAS TRUSTEE | | | 41,666 | | | | 0.471 | % |

| | | | | | | | | |

| Total | | | 5,344,691 | | | | 60.42 | % |

BACKGROUND

Corporate Structure

Stem Holdings, Inc. was organized on June 7, 2016 as a Nevada corporation under Chapter 78 of the Nevada Revised Statutes. The Company’s principal office is located at7777 Glades Road, Suite 203, Boca Raton, FL 33434. The Company has one subsidiary, Patch International, Inc., which is wholly-owned by the Company. Patch International, Inc. has no business operations at this time.

Overview of the Business

The Company was formed to purchase, lease and improve certain real estate properties (the “Properties”), initially in the State of Oregon, which are or will be utilized as either state-licensed cannabis selling retail establishments or state-licensed cannabis growing facilities. The Company operates as a real estate holding company, with a direct focus on providing properties advantageous to growers and sellers in the regulated cannabis industry, and does not intend to initially engage in any direct operations with respect to its properties other than activities related to the leasing of properties, funding of capital improvements and administration of its leases and provision of financing to certain lessees. As such, its revenues will only comprise passive rental and interest income and its operating expenses will be limited to the general and administrative expense associated with such activity.

For further information related to the Company’s business, please see the Company’s Form 10-K for the period ended September 20, 2017 and Form 10-Q for the period ended March 31, 2018, and reladed filings, filed with the U.S. Securities and Exchange Commission.

The Board of Directors believes that the proposed increase in authorized shares of Common Stock is beneficial to the Company because it provides the Company with the flexibility it needs to raise additional capital consistent with its Business Plan and engage in potential acquisition transactions.

No further action on the part of shareholders will be required to either implement or abandon the increase in authorized capital. The Board of Directors reserves its right to elect not to proceed, and abandon, the increase in authorized capital if it determines, in its sole discretion, that this proposal is no longer in the best interests of the Company’s shareholders.

ADVANTAGES AND DISADVANTAGES OF INCREASING AUTHORIZED COMMON STOCK

There are certain advantages and disadvantages of increasing the Company’s authorized common stock. The Company believes that the impact of increasing its authorized capital is largely mitigated by increased ability of the Company to raise capital for the future growth of the Company consistent with its Business Plan. As a result of the increase in authorized capital, authorized but unissued Company Common Shares are increased from 91,154,640 to 291,154,640. The current number of authorized but unissued shares does not include shares which are reserved for issuance in the event of the exercise of certain warrants and options which required to be reserved.

The Company believes that this increased number of authorized but unissued Common Shares will facilitate:

| | ● | The ability to raise capital by issuing capital stock under future financing transactions, if any. |

| | | |

| | ● | To have shares of common stock available to pursue business expansion opportunities, if any. |

| | | |

| | ● | The issuance of authorized but unissued stock could be used to deter a potential takeover of the Company that may otherwise be beneficial to shareholders by diluting the shares held by a potential suitor or issuing shares to a shareholder that will vote in accordance with the desires of the Company’s Board of Directors, at that time. Notwithstanding, a takeover may be beneficial to independent shareholders because, among other reasons, a potential suitor may offer Company shareholders a premium for their shares of stock compared to the then-existing market price. The Company does not have any plans or Proposal to adopt such provisions or enter into agreements that may have material anti-takeover consequences. |

Disadvantages of this action include the following:

| | ● | The issuance of additional authorized but unissued shares of Common Stock could result in decreased net income per share which could result in dilution to existing shareholders. |

| | ● | In the long run, the Company may be limiting the number of authorized but unissued shares it can issue in the future without a further amendment of its Articles of Incorporation. Notwithstanding, the Company believes that maintaining 291,154,640 authorized but unissued Common shares will cover all of its reasonably foreseeable requirements. |

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

The following table sets forth certain information with respect to the beneficial ownership of our voting securities by (i) any person or group owning more than 5% of any class of voting securities, (ii) each director, (iii) our chief executive officer and president and (iv) all executive officers and directors as a group as of May 31, 2018. Unless noted, the address for the following beneficial owners and management is7777 Glades Road, Suite 203, Boca Raton, FL 33434.

| Title of Class | | Name and Address of Beneficial Owner | | Amount and Nature of Beneficial Owner (1) | | | Percent of Class | |

| Common Stock | | Adam Berk (2) | | | 364,866 | | | | 4.1 | % |

| Common Stock | | Steven Hubbard (3) | | | 168,333 | | | | 1.8 | % |

| Common Stock | | Garrett M. Bender (4) | | | 178,974 | | | | 2.6 | % |

| Common Stock | | Lindy Snider (5) | | | 91,666 | | | | 1.0 | % |

| Common Stock | | Jessica M. Feingold (6) | | | 91,666 | | | | 1.0 | % |

| Common Stock | | Rajiv Rai | | | 0 | | | | | - |

| Common Stock | | All executive officers and directors as a group | | | 895,505 | | | | 9.8 | % |

| Common Stock | | Flying High Financial Corporation (5% holder) (6)

445 W. 40th Street

Miami Beach, FL 33140 | | | 833,334 | | | | 9.0 | % |

| | (1) | In determining beneficial ownership of our Common Stock, the number of shares shown includes shares which the beneficial owner may acquire upon exercise of debentures, warrants and options which may be acquired within 60 days. In determining the percent of Common Stock owned by a person or entity on May 31, 2018, (a) the numerator is the number of shares of the class beneficially owned by such person or entity, including shares which the beneficial ownership may acquire within 60 days of exercise of debentures, warrants and options; and (b) the denominator is the sum of (i) the total shares of that class outstanding on May 31, 2018 (8,845,360 shares of Common Stock) and (ii) the total number of shares that the beneficial owner may acquire upon exercise of the debentures, warrants and options. Unless otherwise stated, each beneficial owner has sole power to vote and dispose of its shares. |

| | | |

| | (2) | Includes 314,866 shares and options to purchase 50,000 shares. |

| | | |

| | (3) | Includes 68,333 shares and options to purchase 100,000 shares |

| | | |

| | (4) | Includes 128,974 shares and options to purchase 50,000 shares |

| | | |

| | (5) | Includes 41,666 shares and options to purchase 50,000 shares |

| | | |

| | (6) | Includes 41,666 shares and options to purchase 50,000 shares |

| | | |

| | (7) | The beneficial owner of Flying High Financial Corporation is Mark Groussman, President. |

INTEREST OF CERTAIN PERSONS IN OR IN OPPOSITION TO MATTERS TO BE ACTED UPON

No director, executive officer, associate of any director or executive officer or any other person has any substantial interest, direct or indirect, by security holdings or otherwise, in the proposal to amend the Articles of Incorporation and take all other proposed actions which is not shared by all other holders of the Company’s Common Stock.

OTHER MATTERS

The Board knows of no other matters other than those described in this Information Statement which have been approved or considered by the holders of a majority of the shares of the Company’s voting stock.

IF YOU HAVE ANY QUESTIONS REGARDING THIS INFORMATION STATEMENT, PLEASE CONTACT:

Robert L. B. Diener

Law Offices of Robert Diener

41 Ulua Place

Haiku, HI 96708

Telephone: (808) 573-6163

BY ORDER OF THE BOARD OF DIRECTORS OF STEM HOLDINGS, INC.

EXHIBIT A