- ARGX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

FWP Filing

argenx SE (ARGX) FWPFree writing prospectus

Filed: 16 May 17, 12:00am

Filed pursuant to Rule 433 of the Securities Act of 1933

Issuer Free Writing Prospectus dated May 16, 2017

Relating to the Prospectus dated May 8, 2017

Registration Statement No. 333-217417

This free writing prospectus relates to the initial public offering of the American Depositary Shares (the “ADSs”), of argenx SE and should be read together with the preliminary prospectus dated May 8, 2017 (the “Preliminary Prospectus”) that was included in Amendment No. 2 to the Registration Statement on Form F-1 (File No. 333-217417) relating to the initial public offering of the ADSs contemplated therein. On May 16, 2017, we filed Amendment No. 3 to the Registration Statement on Form F-1 relating to the initial public offering of the ADSs (“Amendment No. 3”) which may be accessed through the following link:

https://www.sec.gov/Archives/edgar/data/1697862/000104746917003435/a2232157zf-1a.htm

The information set forth below from Amendment No. 3 supplements and updates the information contained in the Preliminary Prospectus. All page number references refer to Amendment No. 3.

Update to cover page

The disclosure set forth on the cover page of the Preliminary Prospectus has been updated in its entirety to read as follows:

5,000,000 American Depositary Shares

Representing 5,000,000 Ordinary Shares

This is our initial public offering in the United States. We are offering 5,000,000 American Depositary Shares, or the ADSs. Each ADS will represent one ordinary share with a nominal value of €0.10 per share.

Our ordinary shares are listed on Euronext Brussels under the symbol “ARGX.” On May 15, 2017, the last reported sale price of our ordinary shares on Euronext Brussels was €15.15 per share, equivalent to a price of $16.62 per share, based on an exchange rate of $1.0972 to €1.00. We expect that the initial public offering price for the ADSs will not be more than 10% below the closing price of our ordinary shares on Euronext Brussels on the day we price the offering.

We have received approval to list the ADSs on the NASDAQ Global Select Market under the symbol “ARGX.”

We are an “emerging growth company” under the applicable Securities and Exchange Commission rules and will be subject to reduced public company reporting requirements for this prospectus and future filings. See “Prospectus Summary—Implications of Being an Emerging Growth Company.”

Our business and investment in the ADSs involves risks that are described in the “Risk Factors” section beginning on page 15 of this prospectus.

Neither the Securities and Exchange Commission nor any U.S. state or other securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

|

| Per |

| Total |

| ||

Initial public offering price |

| $ |

|

| $ |

|

|

Underwriting discounts and commissions(1) |

| $ |

|

| $ |

|

|

Proceeds, before expenses, to argenx SE |

| $ |

|

| $ |

|

|

(1) �� We refer you to “Underwriting” beginning on page 293 of this prospectus for additional information regarding underwriting compensation

The underwriters may also purchase up to an additional 750,000 ADSs from us at the initial public offering price, less the underwriting discounts and commissions, within 30 days from the date of this prospectus.

The underwriters expect to deliver the ADSs against payment in New York, New York on or about , 2017.

Cowen and Company | Piper Jaffray |

JMP Securities | Wedbush PacGrow |

Update to “Presentation of Financial Information” on page iii

The second sentence of the fourth paragraph of the section of the Preliminary Prospectus captioned “Presentation of Financial Information” has been revised as follows:

For the convenience of the reader, some euro amounts have been translated into U.S. dollars at the rate of $1.00 to €0.9114, the official exchange rate quoted as of May 15, 2017 by the European Central Bank, unless otherwise noted.

Update to “The Offering” on pages 11-12

The disclosure set forth in the section of the Preliminary Prospectus captioned “The Offering” has been updated in its entirety to read as follows:

Issuer |

| argenx SE |

ADSs offered by us |

| 5,000,000 ADSs |

Underwriters’ option to purchase additional ADSs |

| 750,000 ADSs |

Ordinary shares to be outstanding immediately after this offering |

| 25,126,479 ordinary shares |

The ADSs |

| Each ADS represents one ordinary share, nominal value of €0.10 per share. |

|

| ADSs may be evidenced by American Depositary Receipts, or ADRs. The depositary will hold the ordinary shares underlying your ADSs. You will have the rights of an ADS holder as provided in the deposit agreement. You may cancel your ADSs and withdraw the underlying ordinary shares. The depositary will charge you fees for, among other acts, any cancellation of ADSs and any charges and taxes payable upon the transfer of the ordinary shares. We may amend or terminate the deposit agreement without your consent. If you continue to hold your ADSs, you agree to be bound by the terms of the deposit agreement then in effect. |

|

| To better understand the terms of the ADSs, you should carefully read the section in this prospectus entitled “Description of American Depositary Shares.” You should also read the deposit agreement, which is an exhibit to the registration statement of which this prospectus forms a part. |

Depositary for the ADSs |

| The Bank of New York Mellon |

Use of proceeds |

| We estimate that our net proceeds from this offering will be approximately $74.1 million (or approximately $85.7 million if the underwriters exercise their option to purchase additional ADSs in full), assuming an initial public offering price of $16.62 per ADS, based on the closing price of our ordinary shares on Euronext Brussels and the exchange rate on May 15, 2017, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds from this offering, together with cash, cash equivalents and current financial assets on hand, to fund research and development efforts for our product candidates, for our other current and future research and development activities, to progress technology development and for working capital and other general corporate purposes. See “Use of Proceeds” for a more complete description of the intended use of proceeds from this offering. |

Risk factors |

| Investing in the ADSs involves a high degree of risk. See “Risk Factors” and the other information included in this prospectus for a discussion of factors you should consider before deciding to invest in the ADSs. |

NASDAQ symbol |

| “ARGX” |

Euronext Brussels trading symbol |

| “ARGX” |

The number of our ordinary shares to be outstanding after this offering is based on 20,126,479 ordinary shares outstanding as of December 31, 2016, but excludes 2,293,636 ordinary shares issuable upon the exercise of share options outstanding as of December 31, 2016 at a weighted average exercise price of €7.72 per share.

Unless otherwise indicated, all information contained in this prospectus assumes no exercise of the underwriters’ option to purchase up to 750,000 additional ADSs from us.

Update to “Summary Consolidated Financial Data” on page 14

The disclosure set forth in the fourth paragraph and accompanying table of the section of the Preliminary Prospectus captioned “Summary Consolidated Financial Data” has been updated in its entirety to read as follows:

The following table sets forth our summary consolidated statement of financial position data as of December 31, 2016 on:

· an actual basis; and

· an as adjusted basis to reflect our issuance and sale of 5,000,000 ADSs in this offering and our receipt of the net proceeds therefrom, assuming a public offering price of $16.62 per ADS, based on the closing price of our ordinary shares on Euronext Brussels and the exchange rate on May 15, 2017, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

|

| As of December 31, 2016 |

| ||||

|

| Actual |

| As |

| ||

|

| (In thousands) |

| ||||

Statement of financial position data: |

|

|

|

|

| ||

Cash, cash equivalents and current financial assets |

| € | 96,728 |

| € | 164,306 |

|

Total assets |

| 105,772 |

| 173,350 |

| ||

Deferred revenue |

| 30,206 |

| 30,206 |

| ||

Total liabilities |

| 42,398 |

| 42,398 |

| ||

Total equity |

| 63,374 |

| 130,952 |

| ||

(1) Each $1.00 increase or decrease in the assumed public offering price would increase or decrease each of as adjusted cash, cash equivalents and current financial assets, total assets and total equity by €4.2 million, assuming that the number of ADSs offered by us, as set forth on the cover page of this prospectus, remains the same. Each increase or decrease of 1,000,000 ADSs in the aggregate number of ADSs offered by us would increase or decrease each of as adjusted cash, cash equivalents and current financial assets, total assets and total equity by €14.1 million, assuming that the assumed public offering price remains the same. The as adjusted information discussed above is illustrative only and will depend on the actual public offering price, the actual number of ADSs offered by us and other terms of this offering determined at pricing.

Update to “Risk Factors”

The disclosure set forth in four risk factors on pages 64, 66 and 67 in the section of the Preliminary Prospectus captioned “Risk Factors” has been updated in its entirety to read as follows:

There is no established trading market for the ADSs.

While our ordinary shares have traded on Euronext Brussels since 2014, this offering constitutes our initial public offering of ADSs, and no public market for ADSs currently exists. We received approval to list the ADSs on the NASDAQ Global Select Market, subject to completion of customary procedures in the United States. Any delay in the commencement of trading of the ADSs on the NASDAQ Global Select Market would impair the liquidity of the market for the ADSs and make it more difficult for holders to sell ADSs.

Even if the ADSs are listed on the NASDAQ Global Select Market, there is a risk that an active trading market for ADSs may not develop or be sustained after this offering is completed. The initial offering price will be based, in part, on the price of our ordinary shares on Euronext Brussels, and determined by negotiations among the lead underwriters and us. Among the factors considered in determining the initial offering price will be our future prospects and the prospects of our industry in general, our revenue, net income and certain other financial and operating information in recent periods, and the financial ratios, market prices of securities and certain financial and operating information of companies engaged in activities similar to ours. Following this offering the ADSs may not trade at a price equal to or greater than the offering price.

Certain significant shareholders will continue to own a substantial number of our securities and as a result, may be able to exercise control over us, including the outcome of shareholder votes. These shareholders may have different interests from us or your interests.

We have a number of significant shareholders. For an overview of our current significant shareholders, please see “Principal Shareholders.” Following the completion of this offering, these significant shareholders and their affiliates, in the aggregate, will own approximately 44.5% of our ordinary shares (including ordinary shares represented by the ADSs).

Currently, we are not aware that any of our existing shareholders have entered or will enter into a shareholders’ agreement with respect to the exercise of their voting rights. Nevertheless, depending on the level of attendance at our general meetings of shareholders, or the General Meeting, these significant shareholders could, alone or together, have the ability to determine the outcome of decisions taken at any such General Meeting. Any such voting by these shareholders may not be in accordance with our interests or those of our shareholders. Among other consequences, this concentration of ownership may have the effect of delaying or preventing a change in control and might therefore negatively affect the market price of the ADSs.

Future sales, or the possibility of future sales, of a substantial number of our securities could adversely affect the price of the shares and dilute shareholders.

If our existing shareholders sell, or indicate an intent to sell, substantial amounts of our securities in the public market, the trading price of the ADSs could decline significantly and could decline below the public offering price in this offering. Upon completion of this offering, we will have 25,126,479 outstanding ordinary shares (including ordinary shares represented by the ADSs), approximately 206,643 of which are subject to a 90-day contractual lock-up. The representatives of the underwriters may permit us and the holders of the lock-up shares to sell shares or ADSs prior to the expiration of the lock-up agreements. See “Underwriting.” After the lock-up agreements pertaining to this offering expire, and based on the number of ordinary shares (including ordinary shares represented by ADSs) outstanding upon completion of this offering, these 206,643 additional ordinary shares will be eligible for sale in the public market, all of which shares are held by directors and certain members of our executive management and will be subject to volume limitations under Rule 144 under the Securities Act of 1933, as amended, or the Securities Act, for sales in the United States. In addition, ordinary shares subject to outstanding options under our equity incentive plans and the ordinary shares reserved for future issuance under our equity incentive plan will become eligible for sale in the public market in the future, subject to certain legal and contractual limitations. We also intend to enter into a registration rights agreement upon the closing of this offering pursuant to which we will agree under certain circumstances to file a registration statement to register the resale of the ordinary shares held by certain of our existing shareholders, as well as to cooperate in certain public offerings of such ordinary shares. In addition, we intend to register all ordinary shares that we may issue under our equity compensation plans. Once we register these ordinary shares, they can be freely sold in the public market upon issuance, subject to volume limitations applicable to affiliates and the lock-up agreements described in the “Shares and American Depositary Shares Eligible for Future Sale” section of this prospectus.

If you purchase ADSs in this offering, you will suffer immediate dilution of your investment.

The initial public offering price of the ADSs is substantially higher than the as adjusted net tangible book value per ADS. Therefore, if you purchase ADSs in this offering, you will pay a price per ADS that substantially exceeds our as adjusted net tangible book value per ADS after this offering. To the extent outstanding options are exercised, you will incur further dilution. Based on the assumed initial public offering price of $16.62 per ADS, you will experience immediate dilution of $10.90 per ADS, representing the difference between our as adjusted net tangible book value per ADS after giving effect to this offering and the initial public offering price. See “Dilution.”

Update to “Currency Exchange Rates” on page 78

The disclosure set forth in the section of the Preliminary Prospectus captioned “Currency Exchange Rates” has been updated in its entirety to read as follows:

The euro is our functional currency and the currency in which we report our financial results. The following table sets forth, for each period indicated, the low and high exchange rates of U.S. dollars per euro, the exchange rate at the end of such period and the average of such exchange rates on the last day of each month during such period, based on the noon buying rate of the Federal Reserve Bank of New York for the euro. As used in this document, the term “noon buying rate” refers to the rate of exchange for the euro, expressed in U.S. dollars per euro, as certified by the Federal Reserve Bank of New York for customs purposes. The exchange rates set forth below demonstrate trends in exchange rates, but the actual exchange rates used throughout this prospectus may vary.

|

| 2012 |

| 2013 |

| 2014 |

| 2015 |

| 2016 |

| 2017* |

|

High |

| 1.3463 |

| 1.3816 |

| 1.3927 |

| 1.2015 |

| 1.1516 |

| 1.0996 |

|

Low |

| 1.2062 |

| 1.2774 |

| 1.2101 |

| 1.0524 |

| 1.0375 |

| 1.0416 |

|

Rate at end of period |

| 1.3186 |

| 1.3779 |

| 1.2101 |

| 1.0859 |

| 1.0552 |

| 1.0895 |

|

Average rate per period |

| 1.2859 |

| 1.3281 |

| 1.3297 |

| 1.1096 |

| 1.1072 |

| 1.0647 |

|

* Through May 5, 2017

The following table sets forth, for each of the last six months, the low and high exchange rates of U.S. dollars per euro and the exchange rate at the end of the month based on the noon buying rate as described above.

|

| November |

| December |

| January |

| February |

| March |

| April |

|

High |

| 1.1121 |

| 1.0758 |

| 1.0794 |

| 1.0802 |

| 1.0882 |

| 1.0895 |

|

Low |

| 1.0560 |

| 1.0375 |

| 1.0416 |

| 1.0551 |

| 1.0514 |

| 1.0611 |

|

Rate at end of period |

| 1.0578 |

| 1.0552 |

| 1.0794 |

| 1.0618 |

| 1.0698 |

| 1.0895 |

|

On May 15, 2017, the exchange rate for the euro was €1.00 = $1.0972 as published by the European Central Bank. Unless otherwise indicated, currency translations in this prospectus reflect the May 15, 2017 exchange rate.

Update to “Market Information” on page 79

The disclosure set forth in the section of the Preliminary Prospectus captioned “Market Information” has been updated in its entirety to read as follows:

Our ordinary shares have been trading on Euronext Brussels under the symbol “ARGX” since July 2014.

The following table sets forth for the periods indicated the reported high and low sale prices per ordinary share on Euronext Brussels in euros.

Period |

| High |

| Low |

| ||

Annual: |

|

|

|

|

| ||

2014 (beginning July 10, 2014) |

| € | 8.75 |

| € | 6.23 |

|

2015 |

| € | 14.27 |

| € | 7.40 |

|

2016 |

| € | 15.99 |

| € | 9.23 |

|

2017 (through May 15, 2017) |

| € | 16.80 |

| € | 14.75 |

|

Quarterly: |

|

|

|

|

| ||

First Quarter 2015 |

| € | 10.15 |

| € | 7.40 |

|

Second Quarter 2015 |

| € | 14.27 |

| € | 8.60 |

|

Third Quarter 2015 |

| € | 11.75 |

| € | 8.46 |

|

Fourth Quarter 2015 |

| € | 11.35 |

| € | 8.71 |

|

First Quarter 2016 |

| € | 11.58 |

| € | 9.23 |

|

Second Quarter 2016 |

| € | 12.34 |

| € | 10.15 |

|

Third Quarter 2016 |

| € | 15.38 |

| € | 11.56 |

|

Fourth Quarter 2016 |

| € | 15.99 |

| € | 12.50 |

|

First Quarter 2017 |

| € | 16.80 |

| € | 14.75 |

|

Second Quarter 2017 (through May 15, 2017) |

| € | 16.75 |

| € | 15.15 |

|

Month ended: |

|

|

|

|

| ||

October 2016 |

| € | 15.40 |

| € | 13.40 |

|

November 2016 |

| € | 14.65 |

| € | 12.50 |

|

December 2016 |

| € | 15.99 |

| € | 14.40 |

|

January 2017 |

| € | 16.80 |

| € | 15.62 |

|

February 2017 |

| € | 16.48 |

| € | 14.75 |

|

March 2017 |

| € | 16.72 |

| € | 15.28 |

|

April 2017 |

| € | 16.75 |

| € | 16.22 |

|

May 2017 (through May 15, 2017) |

| € | 16.70 |

| € | 15.15 |

|

On May 15, 2017, the last reported sale price of our ordinary shares on Euronext Brussels was €15.15 per share.

Update to “Use of Proceeds” on page 80

The disclosure set forth in the section of the Preliminary Prospectus captioned “Use of Proceeds” has been updated in its entirety to read as follows:

We estimate that we will receive net proceeds from this offering of approximately $74.1 million (or approximately $85.7 million if the underwriters exercise their option to purchase additional ADSs in full), assuming a public offering price of $16.62 per ADS, based on the closing price of our ordinary shares on Euronext Brussels and the exchange rate on May 15, 2017, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

A $1.00 increase or decrease in the assumed public offering price of $16.62 per ADS would increase or decrease our net proceeds by $4.7 million, assuming the number of ADSs offered by us, as set forth on the cover page of this prospectus remains the same. Each increase or decrease of 1,000,000 ADSs in the aggregate number of ADSs offered by us would increase or decrease the net proceeds to us by $15.5 million, assuming that the assumed public offering price remains the same. The actual net proceeds we receive will depend on the actual number of ADSs offered by us, the actual public offering price and other terms of this offering determined at pricing.

The principal purposes of this offering are to increase our financial flexibility to advance our clinical pipeline, create a public market for our securities in the United States and facilitate our future access to the U.S. public equity markets. We currently expect to use the net proceeds from this offering as follows:

· approximately $35.5 million to advance clinical development of ARGX-113 for the treatment of autoimmune diseases, which we expect will be sufficient to complete our Phase 2 clinical trials in MG and ITP and start preparations for a potential pivotal trial in one selected indication;

· approximately $10.2 million to advance clinical development of ARGX-110 for the treatment of hematological malignancies, which we expect will be sufficient to complete our Phase 2 clinical trial in CTCL and our Phase 1/2 clinical trial in newly diagnosed AML and high-risk MDS;

· approximately $3.5 million to expand applications of ARGX-113 to develop a subcutaneous formulation and explore additional indications, which we expect will be sufficient to complete a Phase 1 clinical trial in healthy volunteers for a subcutaneous formulation; and

· the remainder to fund other current and future research and development activities and technology development and for working capital and other general corporate purposes.

This expected use of the net proceeds from this offering represents our intentions based upon our current plans and business conditions. We may also use a portion of the net proceeds to in-license, acquire, or invest in additional businesses, technologies, products or assets. We cannot predict with certainty all of the particular uses for the net proceeds to be received upon the closing of this offering or the amounts that we will actually spend on the uses set forth above. Predicting the costs necessary to develop antibody candidates can be difficult. The amounts and timing of our actual expenditures and the extent of clinical development may vary significantly depending on numerous factors, including the progress, timing and completion of our development efforts, the status of and results from preclinical studies and any ongoing clinical trials or clinical trials we may commence in the future, the time and costs involved in obtaining regulatory approval for our product candidates as well as maintaining our existing collaborations and any collaborations that we may enter into with third parties for our product candidates and any unforeseen cash needs. As a result, our management will retain broad discretion over the allocation of the net proceeds from this offering.

Based on our planned use of the net proceeds of this offering and our current cash, cash equivalents and current financial assets, we estimate that such funds will be sufficient to enable us to fund our operating expenses and capital expenditure requirements through at least the next 12 months. We have based this estimate on assumptions that may prove to be incorrect, and we could use our available capital resources sooner than we currently expect.

Pending their use, we plan to invest the net proceeds from this offering in short- and intermediate-term interest-bearing obligations and certificates of deposit.

Update to “Capitalization” on page 83

The disclosure set forth in the section of the Preliminary Prospectus captioned “Capitalization” has been updated in its entirety to read as follows:

The following table sets forth our cash, cash equivalents and current financial assets and our capitalization as of December 31, 2016 on:

· an actual basis; and

· an as adjusted basis to reflect our issuance and sale of 5,000,000 ADSs in this offering and our receipt of the net proceeds therefrom at an assumed public offering price of $16.62 per ADS, based on the closing price of our ordinary shares on Euronext Brussels and the exchange rate on May 15, 2017, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

You should read this table together with our consolidated financial statements and related notes include elsewhere in this prospectus, as well as “Selected Consolidated Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

|

| December 31, 2016 |

| ||||

|

| Actual |

| As adjusted(1) |

| ||

|

| (In thousands) |

| ||||

Cash, cash equivalents and current financial assets |

| € | 96,728 |

| € | 164,306 |

|

Equity: |

|

|

|

|

| ||

Share capital |

| € | 2,012 |

| € | 2,512 |

|

Share premiums |

| 126,358 |

| 193,436 |

| ||

Accumulated deficit |

| (72,492 | ) | (72,492 | ) | ||

Other reserves |

| 7,496 |

| 7,496 |

| ||

Total equity |

| 63,374 |

| 130,952 |

| ||

Total capitalization |

| € | 63,374 |

| € | 130,952 |

|

(1) Each $1.00 increase or decrease in the assumed public offering price of $16.62 per ADS would increase or decrease each of as adjusted cash, cash equivalents and current financial assets, total equity and total capitalization by €4.2 million, assuming that the number of ADSs offered by us, as set forth on the cover page of this prospectus, remains the same. Each increase or decrease of 1,000,000 ADSs in the aggregate number of ADSs offered by us would increase or decrease each of as adjusted cash, cash equivalents and current financial assets, total equity and total capitalization by €14.1 million, assuming that the assumed public offering price remains the same. The as adjusted information discussed above is illustrative only and will depend on the actual public offering price, the actual number of ADSs offered by us and other terms of this offering determined at pricing.

Update to “Dilution” on pages 84-85

The disclosure set forth in the section of the Preliminary Prospectus captioned “Dilution” has been updated in its entirety to read as follows:

If you invest in the ADSs in this offering, your ownership interest will be diluted to the extent of the difference between the initial public offering price per ADS and the as adjusted net tangible book value per share/ADS after this offering. Our net tangible book value as of December 31, 2016 was €63.4 million ($69.5 million), equivalent to €3.15 ($3.46) per share/ADS. Net tangible book value is equal to our total assets less our intangible assets and our total liabilities. Net tangible book value per share is determined by dividing our total assets less our intangible assets and our total liabilities by the number of ordinary shares outstanding as of December 31, 2016. Dilution is determined by subtracting net tangible book value per share/ADS from the initial public offering price per ADS.

After giving effect to our sale of 5,000,000 ADSs in this offering at an assumed public offering price of $16.62 per ADS, based on the closing price of our ordinary shares on Euronext Brussels and the exchange rate on May 15, 2017, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us, our as adjusted net tangible book value as of December 31, 2016 would have been €130.9 million ($143.7 million), or €5.21 ($5.72) per share/ADS. This amount represents an immediate increase in net tangible book value of $2.26 per share/ADS to our existing shareholders and an immediate dilution in net tangible book value of $10.90 per ADS to new investors.

The following table illustrates this dilution on a per ADS basis:

Assumed initial public offering price per ADS |

|

|

| $ | 16.62 |

| |

Historical net tangible book value per share/ADS as of December 31, 2016 |

| $ | 3.46 |

|

|

| |

Increase in net tangible book value per ADS attributable to new investors participating in this offering |

| 2.26 |

|

|

| ||

As adjusted net tangible book value per share/ADS after this offering |

|

|

| 5.72 |

| ||

Dilution per ADS to new investors participating in this offering |

|

|

| $ | 10.90 |

| |

If the underwriters exercise their option to purchase 750,000 additional ADSs in full, the as adjusted net tangible book value per share/ADS after this offering as of December 31, 2016 would have been €5.47 ($6.00), the increase in the as adjusted net tangible book value to existing shareholders would be $2.54 per share/ADS, and the dilution to new investors participating in this offering would be $10.62per ADS.

Each $1.00 increase or decrease in the assumed public offering price would increase or decrease our as adjusted net tangible book value by €4.2 million ($4.7 million), or $0.19 per ADS, and would increase or decrease dilution to new investors participating in this offering by $0.81 per ADS, assuming that the number of ADSs offered by us, as set forth on the cover page of this prospectus, remains the same. An increase of 1,000,000 ADSs offered by us would increase the as adjusted net tangible book value by €14.1 million ($15.5 million), or $0.37 per ADS, and the dilution to new investors participating in this offering would be $10.53 per ADS, assuming that the assumed public offering price remains the same. A decrease of 1,000,000 ADSs offered by us would decrease the as adjusted net tangible book value by €14.1 million ($15.5 million), or $0.40 per ADS, and the dilution to new investors

participating in this offering would be $11.31 per ADS, assuming that the assumed public offering price remains the same.

The following table sets forth, as of December 31, 2016, on the as adjusted basis described above, the consideration paid to us for ordinary shares or ADSs purchased from us by our existing shareholders and by new investors participating in this offering, assuming a public offering price of $16.62 per ADS, based on the closing price of our ordinary shares on Euronext Brussels and the exchange rate on May 15, 2017, before deducting underwriting discounts and commissions and estimated offering expenses payable by us:

|

| Ordinary |

| Total |

| Average |

| ||||||

|

| Number |

| Percent |

| Amount |

| Percent |

| share/ADSs |

| ||

Existing shareholders |

| 20,126,479 |

| 80.1 | % | $ | 147,574,616 |

| 64.0 | % | $ | 7.33 |

|

New investors |

| 5,000,000 |

| 19.9 |

| 83,100,000 |

| 36.0 |

| $ | 16.62 |

| |

Total |

| 25,126,479 |

| 100.0 | % | $ | 230,674,616 |

| 100.0 | % |

|

| |

Each $1.00 increase or decrease in the assumed public offering price per ADS would increase or decrease the total consideration paid by new investors participating in this offering by $5.0 million and, in the case of an increase, would increase the percentage of total consideration paid by new investors by 1.36 percentage points and, in the case of a decrease, would decrease the percentage of total consideration paid by new investors by 1.42 percentage points, assuming that the number of ADSs offered by us, as set forth on the cover page of the prospectus, remains the same and before deducting underwriting discounts and commissions. An increase or decrease in the aggregate number of ADSs offered by us by 1,000,000 ADSs would increase or decrease the total consideration paid by new investors participating in this offering by $16.6 million and, in the case of an increase, would increase the percentage of total consideration paid by new investors by 4.30 percentage points and, in the case of a decrease, would decrease the percentage of total consideration paid by new investors by 4.97 percentage points, assuming that the assumed public offering price remains the same and before deducting underwriting discounts and commissions.

If the underwriters exercise their option to purchase additional ADSs in full, the number of shares held by the existing shareholders after this offering would be reduced to 77.8% of the total number of ordinary shares (including ordinary shares represented by the ADSs) outstanding after this offering, and the number of ADSs held by new investors participating in this offering would increase to 5,750,000 ADSs, or 22.2% of the total number of ordinary shares (including ordinary shares represented by the ADSs) outstanding after this offering.

The table above excludes 2,293,636 ordinary shares issuable upon the exercise of share options outstanding as of December 31, 2016 at a weighted average exercise price of €7.72 ($8.47) per share.

Update to “Business” on pages 122-123

The disclosure set forth in the section of the Preliminary Prospectus captioned “Business — Our Wholly-Owned Programs — ARGX-113 — Clinical Development Plan — Phase 1 Clinical Data — Multiple Ascending Dose” has been updated in its entirety to read as follows:

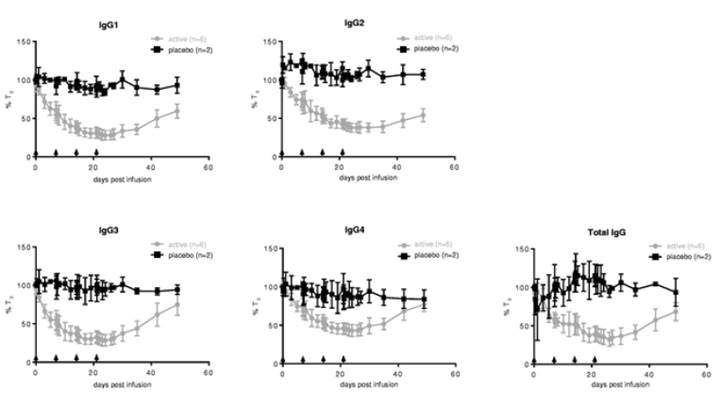

In the multiple ascending dose part of the Phase 1 clinical trial, repeat administration of both 10 mg/kg and 25 mg/kg of ARGX 113 every seven days, four doses in total, and 10mg/kg every four days, six doses in total, was associated with a gradual reduction in levels of all four classes of IgG antibodies by 60% to 85%, with 10 mg/kg dose results shown in Figure 8. For all doses, we observed the reduction in circulating IgG antibody levels to persist for more than four weeks after the last dose with levels below 50% at approximately three weeks, and did not return to baseline levels for more than one month. Pharmacokinetic analysis of serum baseline levels of ARGX 113

indicates that it has a half life of approximately three to four days with no drug accumulation following subsequent weekly dosing. The prolonged activity on the levels of IgG antibodies is consistent with the mechanism of action of ARGX 113 and the effect of the ABDEG technology on increasing the intracellular recycling of ARGX 113. Similar to the single ascending dose part, no significant reductions in IgM, IgA or serum albumin were observed.

Figure 8. Reduction in the levels of four IgG antibody classes and total IgG levels in the multiple ascending dose part of our Phase 1 clinical trial of ARGX-113 in healthy volunteers at a dose of 10 mg/kg every seven days

Administration of multiple ARGX-113 doses of 10 mg/kg and 25 mg/kg were reported to be well-tolerated. One serious adverse event, hyperventilation, was observed in the multiple ascending dose part. This event, which occurred six days after drug administration, was considered by the clinical investigator as unlikely to be related to ARGX-113. Some patients had changes to C-reactive protein levels that were considered clinically significant. The most frequently reported drug-related adverse events included headache, feeling cold, chills and fatigue, all of which were mild or moderate and reported only in the highest dose group of 25 mg/kg.

Update to “Principal Shareholders” on pages 196-198

The disclosure set forth in the section of the Preliminary Prospectus captioned “Principal Shareholders” has been updated in its entirety to read as follows:

The following table sets forth information with respect to the beneficial ownership of our ordinary shares as of May 1, 2017 for:

· each person who is known by us to own beneficially more than 5% of our total outstanding ordinary shares;

· each member of our board of directors and our executive management;

· all members of our board of directors and our executive management as a group.

Beneficial ownership is determined in accordance with the rules of the SEC. These rules generally attribute beneficial ownership of securities to persons who possess sole or shared voting power or investment power with respect to those securities and include ordinary shares that can be acquired within 60 days of May 1, 2017. The percentage ownership information shown in the table prior to this offering is based upon 20,126,479 ordinary shares outstanding as of May 1, 2017. The percentage ownership information shown in the table after this offering is based upon 25,126,479 ordinary shares outstanding, assuming the sale of 5,000,000 ADSs by us in this offering and no exercise of the underwriters’ option to purchase additional ADSs. The percentage ownership information shown in the table after this offering if the underwriters’ option to purchase additional ADSs are exercised in full is based upon ordinary shares outstanding, assuming the sale of ADSs by us in this offering and assuming the exercise in full of the underwriters’ option to purchase additional ADSs.

Except as otherwise indicated, all of the shares reflected in the table are ordinary shares and all persons listed below have sole voting and investment power with respect to the shares beneficially owned by them, subject to applicable community property laws. The information is not necessarily indicative of beneficial ownership for any other purpose.

In computing the number of ordinary shares beneficially owned by a person and the percentage ownership of that person, we deemed outstanding ordinary shares subject to options held by that person that are immediately exercisable or exercisable within 60 days of May 1, 2017. We did not deem these shares outstanding, however, for the purpose of computing the percentage ownership of any other person. The information in the table below is based on information known to us or ascertained by us from public filings made by the shareholders.

Name and address of beneficial |

| Shares beneficially |

| Shares/ADSs |

| Shares/ADSs |

| ||

owner |

| Number |

| Percent |

| Percent |

| Percent |

|

5% or Greater Shareholders: |

|

|

|

|

|

|

|

|

|

LSP IV Management B.V.(1)(2) |

| 1,715,215 |

| 8.52 | % | 6.83 | % | 6.63 | % |

Forbion Capital Fund II Coöperatief U.A.(1)(3) |

| 2,126,243 |

| 10.56 |

| 8.46 |

| 8.22 |

|

Shire plc(1)(4) |

| 1,411,764 |

| 7.01 |

| 5.62 |

| 5.46 |

|

RTW Investments(5) |

| 1,841,731 |

| 9.15 |

| 7.33 |

| 7.12 |

|

Federated Equity Management Company of Pennsylvania(1)(6) |

| 2,090,658 |

| 10.39 |

| 8.32 |

| 8.08 |

|

Perceptive Advisors LLC(1)(7) |

| 1,124,478 |

| 5.59 |

| 4.48 |

| 4.36 |

|

Directors and Executive Management: |

|

|

|

|

|

|

|

|

|

Tim Van Hauwermeiren(8) |

| 220,059 |

| 1.08 |

| * |

| * |

|

Eric Castaldi(9) |

| 159,457 |

| * |

| * |

| * |

|

Peter Verhaeghe(10) |

| 27,085 |

| * |

| * |

| * |

|

David Lacey(11) |

| 20,643 |

| * |

| * |

| * |

|

Werner Lanthaler(12) |

| 22,916 |

| * |

| * |

| * |

|

Donald deBethizy(13) |

| 13,333 |

| * |

| * |

| * |

|

Pamela Klein(14) |

| 13,333 |

| * |

| * |

| * |

|

A.A. Rosenberg |

| — |

| — |

| — |

| — |

|

Nicolas Leupin(15) |

| 24,283 |

| * |

| * |

| * |

|

Hans de Haard(16) |

| 401,598 |

| 1.96 |

| 1.58 |

| 1.53 |

|

Torsten Dreier(17) |

| 388,365 |

| 1.90 |

| 1.53 |

| 1.48 |

|

Debbie Allen(18) |

| 110,344 |

| * |

| * |

| * |

|

Dirk Beeusaert |

| — |

| — |

| — |

| — |

|

All directors and executive management as a group (13 persons)(19) |

| 1,401,416 |

| 6.57 | % | 5.32 | % | 5.18 | % |

* Indicates beneficial ownership of less than 1% of the total outstanding ordinary shares.

(1) Based on the number of shares reported in, and at the time of, the most recent transparency notification.

(2) Consists of 1,715,215 shares beneficially held. The address for LSP IV Management B.V. is Johannes Vermeerplein 9, 1071DV, Amsterdam, the Netherlands.

(3) Consists of 2,126,243 shares beneficially held. The address for Forbion Capital Fund II Coöperatief U.A. is Gooimeer 2-35, 1411 DC Naarden, the Netherlands.

(4) Consists of 1,411,764 shares beneficially held. The address for Shire plc is Zählerweg 10, 6300 Zug, Switzerland.

(5) Consists of 1,266,731 shares held by RTW Fund Group GP, LLC based on, and at the time of, the most recent transparency notification, and 575,000 shares purchased by RTW Master Fund, Ltd. and RTW Innovation Master Fund, Ltd. in a June 1, 2016 financing in the aggregate amount of €30,003,300.00. The address for RTW Investments is 250 West 55th Street, 16th Floor, Suite A, New York, NY 10019.

(6) Consists of (i) 1,792,250 ordinary shares held by Federated Kaufmann Fund, a portfolio of Federated Equity Funds, (ii) 253,414 ordinary shares held by Federated Kaufmann Small Cap Fund, a portfolio of Federated Equity Funds and (iii) 44,994 ordinary shares held by Federated Kaufmann Fund II, a portfolio of Federated Insurance Series (collectively, the “Federated Kaufmann Funds”). The address of the Federated Kaufmann Funds is 101 Park Avenue, Suite 4100, New York, NY 10178.

(7) Consists of 1,124,478 shares beneficially held. The address for Perceptive Advisors, LLC is 51 Astor Place, 10th Floor, New York, NY 10003.

(8) Consists of (i) 33,823 shares and (ii) 186,236 shares issuable upon the exercise of stock options that are immediately exercisable or exercisable within 60 days of May 1, 2017.

(9) Consists of 159,457 shares issuable upon the exercise of stock options that are immediately exercisable or exercisable within 60 days of May 1, 2017.

(10) Consists of 27,085 shares issuable upon the exercise of stock options that are immediately exercisable or exercisable within 60 days of May 1, 2017.

(11) Consists of 20,643 shares issuable upon the exercise of stock options that are immediately exercisable or exercisable within 60 days of May 1, 2017.

(12) Consists of (i) 1,000 shares and (ii) 21,916 shares issuable upon the exercise of stock options that are immediately exercisable or exercisable within 60 days of May 1, 2017.

(13) Consists of 13,333 shares issuable upon the exercise of stock options that are immediately exercisable or exercisable within 60 days of May 1, 2017.

(14) �� Consists of 13,333 shares issuable upon the exercise of stock options that are immediately exercisable or exercisable within 60 days of May 1, 2017.

(15) Consists of 24,283 shares issuable upon the exercise of stock options that are immediately exercisable or exercisable within 60 days of May 1, 2017.

(16) Consists of (i) 85,910 shares and (ii) 315,688 shares issuable upon the exercise of stock options that are immediately exercisable or exercisable within 60 days of May 1, 2017.

(17) Consists of (i) 85,910 shares and (ii) 302,455 shares issuable upon the exercise of stock options that are immediately exercisable or exercisable within 60 days of May 1, 2017.

(18) Consists of 110,344 shares issuable upon the exercise of stock options that are immediately exercisable or exercisable within 60 days of May 1, 2017.

(19) Consists of (i) 206,643 shares and (ii) 1,194,773 shares issuable upon the exercise of stock options that are immediately exercisable or exercisable within 60 days of May 1, 2017.

Each of our shareholders is entitled to one vote per ordinary share. None of the holders of our shares will have different voting rights from other holders of shares after the closing of this offering. We are not aware of any arrangement that may, at a subsequent date, result in a change of control of our company.

Update to “Description of Share Capital” on page 199

The second sentence of the third paragraph of the section of the Preliminary Prospectus captioned “Description of Share Capital — General” has been revised as follows:

We have received approval to list the ADSs on the NASDAQ Global Select Market, or NASDAQ, under the symbol “ARGX.”

Update to “Shares and American Depositary Shares Eligible for Future Sale” on page 259

The disclosure set forth in the section of the Preliminary Prospectus captioned “Shares and American Depositary Shares Eligible for Future Sale” has been revised to reflect the following:

Ordinary shares outstanding immediately after the offering has been increased from 23,726,479 to 25,126,479.

Update to “Certain Material United States, Dutch and Belgian Tax Considerations” on pages 261-290

The disclosure set forth in the section of the Preliminary Prospectus captioned “Certain Material United States, Dutch and Belgian Tax Considerations” has been revised to reflect the following:

We have removed the tax opinion from the Preliminary Prospectus and revised the disclosures on pages 261 through 290.

Update to “Enforcement of Civil Liabilities” on page 291

The second paragraph in the section of the Preliminary Prospectus captioned “Enforcement of Civil Liabilities” has been updated in its entirety to read as follows:

The United States and the Netherlands currently do not have a treaty providing for the reciprocal recognition and enforcement of judgments, other than arbitration awards, in civil and commercial matters. Consequently, a final judgment for payment given by a court in the United States, whether or not predicated solely upon U.S. securities laws, would not automatically be recognized or enforceable in the Netherlands. In order to obtain a judgment which is enforceable in the Netherlands, the party in whose favor a final and conclusive judgment of the U.S. court has been rendered will be required to file its claim with a court of competent jurisdiction in the Netherlands. Such party may submit to the Dutch court the final judgment rendered by the U.S. court. This court will have discretion to attach such weight to the judgment rendered by the relevant U.S. court as it deems appropriate. The Dutch courts can be expected to give conclusive effect to a final and enforceable judgment of such court in respect of the contractual obligations thereunder without re-examination or re-litigation of the substantive matters adjudicated upon, provided that: (i) the U.S. court involved accepted jurisdiction on the basis of internationally recognized grounds to accept jurisdiction, (ii) the proceedings before such court being in compliance with principles of proper procedure (behoorlijke rechtspleging), (iii) such judgment not being contrary to the public policy of the Netherlands and (iv) such judgment not being incompatible with a judgment given between the same parties by a Netherlands court or with a prior judgment given between the same parties by a foreign court in a dispute concerning the same subject matter and based on the same cause of action, provided such prior judgment fulfills the conditions necessary for it to be given binding effect in the Netherlands. Dutch courts may deny the

recognition and enforcement of punitive damages or other awards. Moreover, a Dutch court may reduce the amount of damages granted by a U.S. court and recognize damages only to the extent that they are necessary to compensate actual losses or damages. Enforcement and recognition of judgments of U.S. courts in the Netherlands are solely governed by the provisions of the Dutch Civil Procedure Code.

Update to “Underwriting” on pages 293-294

The disclosure set forth in the section of the Preliminary Prospectus captioned “Underwriting” has been revised to reflect the following:

The underwriters option to purchase additional ADSs has been increased from 540,000 to 750,000 ADSs.

We have received approval to list the ADSs on the Nasdaq Global Select Market under the symbol “ARGX,” subject to notice of issuance.

Update to “Expenses of the Offering” on page 301

The disclosure set forth in the section of the Preliminary Prospectus captioned “Expenses of the Offering” has been updated in its entirety to read as follows:

Set forth below is an itemization of the total expenses, excluding underwriting discounts and commissions, which are expected to be incurred in connection with our sale of ADSs in this offering. With the exception of the registration fee payable to the SEC and the filing fee payable to FINRA, all amounts are estimates.

Itemized |

| Amount |

| |

SEC registration fee |

| $ | 11,076 |

|

NASDAQ listing fee |

| 25,000 |

| |

FINRA filing fee |

| 14,835 |

| |

AFM filing fee |

| 30,913 |

| |

Euronext listing fee |

| 36,471 |

| |

Printing expenses |

| 125,000 |

| |

Legal fees and expenses |

| 1,629,160 |

| |

Accounting fees and expenses |

| 558,513 |

| |

Miscellaneous costs |

| 705,197 |

| |

Total |

| $ | 3,136,165 |

|

The issuer has filed a registration statement including a prospectus with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may obtain these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request them by calling Cowen and Company, LLC, c/o Broadridge Financial Services, at 1-631-274-2806 or Piper Jaffray & Co., Attn: Prospectus Department, 800 Nicollet Mall, J12S03, Minneapolis, MN 55403, or by telephone at (800)747-3924, or by email at prospectus@pjc.com.