[Farmers and Merchants Bancshares, Inc. Letterhead]

April 7, 2017

VIA EDGAR

Christian Windsor, Esquire

Special Counsel, Office of Financial Services

Division of Corporation Finance

U.S. Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

| Re: | Farmers and Merchants Bancshares, Inc. |

| | | Registration Statement on Form 10 |

| | | Filed March 8, 2017 |

| | | File No. 000-55756 |

Dear Mr. Windsor:

On behalf of Farmers and Merchants Bancshares, Inc. (the “Company”), please find below responses to the comments provided to the Company by the staff of the Commission (the “Staff”) in a letter dated April 4, 2017 (the “Letter”) relating to the Company’s Registration Statement on Form 10, filed on March 8, 2017 (the “Registration Statement”). The responses are keyed to the numbering of the comments in the Letter and appear following the comments which are restated below in italics.

The Company expects to file an Amendment No. 1 on Form 10/A to the Registration Statement on or about April 10, 2017, which will reflect its responses to the Staff’s comments set forth herein.

Management’s Discussion and Analysis of Financial Condition

Financial Condition

Loans, page 24

| 1. | We note your disclosure on page 27 that a nonaccrual loan is returned to current status when the prospects of future contractual payments are not in doubt. Please tell us and revise future filings to disclose in greater detail how you determine that the prospects of future contractual payments are not in doubt in order to return a nonaccrual loan to accrual status. |

| | Christian Windsor, Esquire April 7, 2017 Page 2 |

Response:

The Company returns a nonaccrual loan to accruing status when (i) the loan is brought current with the full payment of all principal and interest arrearages, (ii) all contractual payments are thereafter made on a timely basis for at least six months, and (iii) management determines, based on a credit review, that it is reasonable to expect that future payments will be made as and when required by the contract.

The Company will revise the Registration Statement to disclose this policy and will include that discussion in future filings.

Interest Rate Risk, page 38

| 2. | We note your Economic Value of Equity analysis presented for both 2015 and 2016. In that simulation it appears that you are exposed to both an increase as well as a further decrease in interest rates. Please tell us the particular aspects of your assets and liabilities, including any particular maturity gap, which might cause you to be at risk in both a rising and falling environment. Consider changes to the Management’s Discussion, as well as the second risk factor on page 13 based on your response. |

Response:

The Company’s loan portfolio accounts for 78% of its assets and is comprised primarily of loans with interest rates that reset every five years. The investment portfolio accounts for 13% of the Company’s assets and has a modified duration of 4.5 years. The Company’s deposits are comprised primarily of checking, savings, and money market accounts and short-term certificates of deposit. Other borrowings have maturities of three years or less. Because of this structure, the Company is liability-sensitive, meaning that its cost of funds on deposits and borrowings would rise more quickly than yields on assets in a rising interest rate scenario.

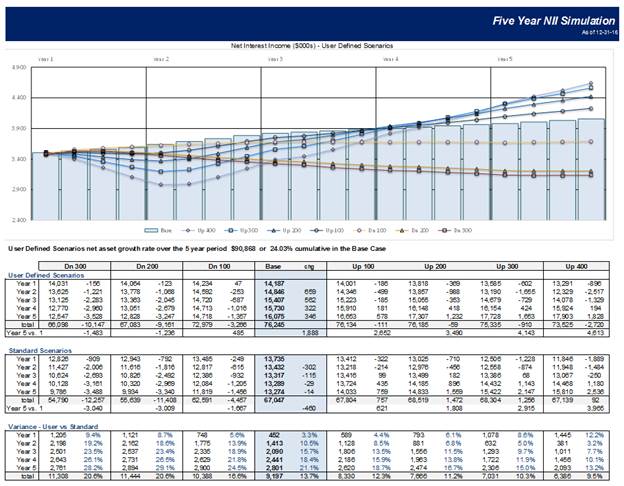

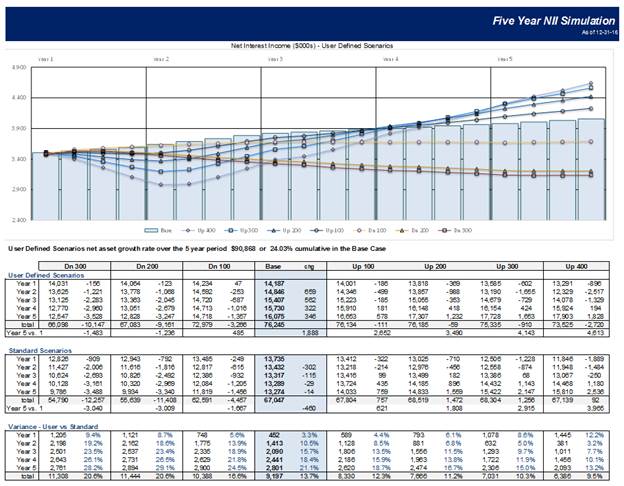

The chart below provides a five-year projection for net interest income (“NII”) and indicates that NII in rising rate scenarios would decline in comparison to the base case scenario over the first 15 months and then begin to improve in year two until it exceeded the base case in year four. The Company’s five-year NII simulation has essentially looked the same for the past seven years.

| | Christian Windsor, Esquire April 7, 2017 Page 3 |

With respect to a falling rate scenario, because rates are currently at or near historical lows, the Company believes that the cost of funds cannot fall significantly lower, but that yields on assets can do so. However, given the current economic conditions, the Company believes that the likelihood of falling rates is currently low.

In light of the foregoing, the Company believes that it is not necessary to revise the Management’s Discussion and Analysis of Financial Condition or the second risk factor on page 13 of the Registration Statement.

Please note that the information presented under the heading “2016” in the table on page 39 of the Registration Statement, showing changes in NII, is actually the 2015 information, and the information presented under the heading “2015” is actually the 2016 information. The Company will revise that table to correct the mistake.

| | Christian Windsor, Esquire April 7, 2017 Page 4 |

Recent Sales of Unregistered Securities, page 55

| 3. | Please tell us whether the company has continued to issue shares under its dividend reinvestment plan since the holding company reorganization. If the company plans to continue to offer the reinvestment plan, please tell us whether you plan to register the offer and sale of shares under the plan, or provide us with your analysis as to the exemption from registration you plan to rely on for those sales. |

Response:

The Company does not maintain a dividend reinvestment plan and has not issued any shares of common stock other than to stockholders of Farmers and Merchants Bank (the “Bank”) in connection with the holding company reorganization (the “Reorganization”). Prior to the Reorganization, the Bank maintained a dividend reinvestment plan relating to shares of its common stock, but that plan was terminated in connection with the Reorganization and the Company did not adopt a successor plan.

Once the Company’s Form 10 is effective, the Company intends to adopt its own dividend reinvestment plan and file a Registration Statement on Form S-1 under the Securities Act of 1933, as amended, to register the offer and sale of shares under that plan.

Notes to Consolidated Financial Statements

Note 15. Fair Value, page 88

| 4. | We note your disclosure on page 89 that you have other real estate owned and impaired loans that are based on Level 3 fair value measurements on a non-recurring basis for the periods presented. Please include information about the valuation technique(s) and significant unobservable inputs used in the fair value measurement in accordance with ASC 820-10-50-2(bbb). In addition, please indicate the frequency of appraisals and whether they are conducted by internal or third parties. |

Response:

The Company believes that Note 15 to the consolidated financial statements does include information about the valuation techniques and significant unobservable inputs used in the fair value measurement. Specifically, that note states, “Since the market for OREO is not active, OREO subjected to nonrecurring fair value adjustments based on the current appraised value of the real estate are classified as Level 3.” A similar statement is included for impaired loans. The Company will revise the Registration Statement to provide the following clarification with respect to the frequency of appraisals and significant unobservable inputs for both OREO and impaired loans: “The appraised value is obtained annually from an independent third party appraiser and is reduced by expected sales costs, which has historically been 10% of the appraised value.”

| | Christian Windsor, Esquire April 7, 2017 Page 5 |

We trust that this letter addresses the Staff’s comments. If the Staff should have any questions or further comments, please do not hesitate to contact the undersigned at 410-374-1510 or jim.bosley@farmersandmerchantsbk.com.

The Company hereby acknowledges that:

| · | the Company is responsible for the adequacy and accuracy of the disclosure in the filing; |

| · | Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| · | the Company may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

| | Sincerely yours, |

| | |

| | /s/ James R. Bosley, Jr. |

| | |

| | James R. Bosley, Jr. |

| | President and Chief Executive Officer |