Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO THE FINANCIAL STATEMENTS

Table of Contents

Filed Pursuant to Rule 424(b)(3)

Registration Statement No. 333-216725

PROSPECTUS

ARD Finance S.A.

Offer to Exchange All Outstanding

$770,000,000 7.125% / 7.875% Senior Secured Toggle Notes due 2023

€845,000,000 6.625% / 7.375% Senior Secured Toggle Notes due 2023

For an Equal Principal Amount of

7.125% / 7.875% Senior Secured Toggle Notes due 2023

6.625% / 7.375% Senior Secured Toggle Notes due 2023

Which Have Been Registered Under the Securities Act of 1933

We are offering to exchange new 7.125% / 7.875% Senior Secured Toggle Notes due 2023 (the "New Dollar Notes") and new 6.625% / 7.375% Senior Secured Toggle Notes due 2023 (the "New Euro Notes" and, together with the New Dollar Notes, the "New Notes") for our currently outstanding $770,000,000 in aggregate principal amount of 7.125% / 7.875% Senior Secured Toggle Notes due 2023 (the "Old Dollar Notes") and our currently outstanding €845,000,000 in aggregate principal amount of 6.625% / 7.375% Senior Secured Toggle Notes due 2023 (the "Old Euro Notes" and, together with the Old Dollar Notes, the "Old Notes"), respectively, on the terms and subject to the conditions detailed in this prospectus and the accompanying letter of transmittal (the "exchange offers"). The CUSIP numbers for the Old Dollar Notes are 00191A AB2 and L02238 AD2, and the ISINs for the Old Dollar Notes are US00191AAB26 and USL02238AD23. The ISINs for the Old Euro Notes are XS1490152722 and XS1489826195, and the Common Codes for the Old Euro Notes are 149015272 and 148982619.

The Exchange Offers

- •

- The exchange offer for the Old Dollar Notes expires at 5:00 p.m., New York City time, on May 11, 2017 (the "Dollar Expiration Date"), and the exchange offer for the Old Euro Notes expires at 5:00 p.m., London time, on May 11, 2017 (the "Euro Expiration Date" and, together with the Dollar Expiration Date, the "Expiration Dates" and each, an "Expiration Date"), in each case unless extended by us in our sole discretion.

- •

- All outstanding Old Notes that are validly tendered and not validly withdrawn will be exchanged.

- •

- Tenders of Old Notes may be withdrawn any time on or prior to the expiration of the relevant exchange offer.

- •

- To exchange your Old Notes, you are required to make the representations described under "The Exchange Offers—Purpose and Effect of the Exchange Offers," "The Exchange Offers—Procedures for Tendering Old Notes" and "Plan of Distribution" to us.

- •

- If you are eligible to participate in the exchange offers and do not tender your Old Notes, your Old Notes will continue to accrue interest, but you will not have further exchange or registration rights and will continue to hold Old Notes subject to restrictions on transfer.

- •

- The exchange of the Old Notes for New Notes will not be a taxable exchange for U.S. federal income tax purposes.

- •

- We will not receive any proceeds from the exchange offers.

- •

- You should read the section called "The Exchange Offers" for further information on how to exchange your Old Notes for New Notes.

The New Notes

- •

- The terms of the New Notes to be issued are identical in all material respects to the Old Notes, except that the New Notes have been registered under the Securities Act of 1933, as amended (the "Securities Act"), and will not have any of the transfer restrictions, any of the registration rights provisions and certain inapplicable interest provisions relating to the Old Notes. The New Notes will represent the same debt as the Old Notes exchanged therefor and will be issued under the same indenture.

- •

- The New Notes will be our general obligations, rank senior in right of payment to any and all of our future indebtedness that is subordinated in right of payment to the New Notes, rank equally in right of payment with any and all of our future indebtedness that is not subordinated in right of payment to the New Notes, and be effectively subordinated to all of our future indebtedness that is secured by property or assets that do not secure the New Notes to the extent of the value of the collateral securing such indebtedness. The claims of our creditors, including the claims of holders of New Notes, will be structurally subordinated to all existing and future third-party indebtedness and liabilities, including trade payables, of our subsidiaries.

- •

- Currently, there is no public market for the New Notes. Application will be made for listing particulars to be approved by the Irish Stock Exchange and for the New Notes to be admitted to the Official List of the Irish Stock Exchange and admitted to trading on its Global Exchange Market. There is no assurance that the New Notes will be listed and admitted to trading on the Global Exchange Market of the Irish Stock Exchange.

Each broker-dealer that receives New Notes for its own account pursuant to the exchange offers must acknowledge that it will satisfy any prospectus delivery requirements in connection with any resale of such New Notes. The letter of transmittal for the exchange offers states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an "underwriter" within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of New Notes received in exchange for Old Notes where such Old Notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed, subject to certain conditions, that for a period of 180 days beginning when the New Notes are issued to make this prospectus available to any broker-dealer for use in connection with any such resale. See "Plan of Distribution."

If you are an affiliate of ours or are engaged in, or intend to engage in, or have an agreement or understanding to participate in, a distribution of the New Notes, you cannot rely on the applicable interpretations of the Securities and Exchange Commission (the "SEC"), and you must comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale transaction, and you must be identified as an underwriter in the prospectus.

See "Risk Factors" beginning on page 25 for a discussion of risk factors that you should carefully consider before deciding to exchange your Old Notes for New Notes.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

April 13, 2017

Table of Contents

You should rely only on the information contained in this prospectus. We have not authorized any person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We do not take any responsibility for, and can provide no assurances as to, the reliability of any information that others may provide you. We are not making an offer to exchange these securities in any jurisdiction where the offer or exchange is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front of this prospectus.

TABLE OF CONTENTS

| | | | |

| | Page | |

|---|

Prospectus Summary | | | 1 | |

Summary Consolidated Financial and Other Data of ARD Finance S.A. | | | 20 | |

Risk Factors | | | 25 | |

Cautionary Statement Regarding Forward-Looking Statements | | | 54 | |

Exchange Rate Information | | | 56 | |

Use of Proceeds | | | 57 | |

Ratio of Earnings to Fixed Charges | | | 58 | |

Capitalization | | | 59 | |

Selected Financial Information | | | 61 | |

Unaudited Condensed Combined Pro Forma Financial Information | | | 63 | |

Management's Discussion and Analysis of Financial Condition and Results of Operations | | | 74 | |

Business | | | 102 | |

Board of Directors and Executive Officers | | | 119 | |

Certain Relationships and Related Party Information | | | 121 | |

The Exchange Offers | | | 122 | |

Description of Certain Indebtedness | | | 133 | |

Description of the New Notes | | | 140 | |

Book-Entry; Delivery and Form | | | 199 | |

Taxation | | | 204 | |

Plan of Distribution | | | 210 | |

Enforceability of Civil Liabilities | | | 214 | |

Legal Matters | | | 217 | |

Experts | | | 218 | |

Where You Can Find More Information | | | 219 | |

Listing and General Information | | | 220 | |

Index to the Financial Statements | | | F-1 | |

i

Table of Contents

Certain Conventions

ARD Finance S.A. (the "Issuer") is a public limited liability company (société anonyme) incorporated on May 6, 2011 and existing under the laws of Luxembourg, having its registered office at 56, rue Charles Martel, L-2134 Luxembourg, Luxembourg. The Issuer is a holding company whose only significant assets as of December 31, 2016 consist of its direct and indirect interest in the share capital of Ardagh Group S.A. (formerly Ardagh Finance Holdings S.A.), a public limited liability company (société anonyme) incorporated and existing under the laws of Luxembourg, and certain related party receivables. Ardagh Group S.A. has Class A common shares listed on the New York Stock Exchange. The Issuer is a subsidiary of ARD Holdings S.A. (formerly Ardagh Group S.A.) ("ARD Holdings"). Except where the context otherwise requires or where otherwise indicated, all references to "ARD Finance", "Company", the "Group", "we", "us" and "our" refer to ARD Finance S.A. and its consolidated subsidiaries, and all references to "Ardagh" and "Ardagh Group" refer to Ardagh Group S.A. and its consolidated subsidiaries. When we describe herein our business or operations, such business and operations are the business and operations of our subsidiary, Ardagh Group S.A., and its consolidated subsidiaries, since ARD Finance S.A. has no independent operations of its own. Ardagh's operations have the following divisions: "Metal Packaging" and "Glass Packaging".

On March 20, 2017, Ardagh Group S.A. closed the initial public offering of its Class A common shares (the "IPO"). Such Class A common shares began trading on the New York Stock Exchange on March 15, 2017.

Presentation of Financial and Other Data

Financial Statements

This prospectus includes:

- •

- audited consolidated financial statements of ARD Finance S.A. and its subsidiaries as of December 31, 2016 and 2015, and for the three years ended December 31, 2016, prepared in accordance with International Financial Reporting Standards as issued by the IASB ("IFRS");

- •

- audited combined financial statements of certain metal beverage packaging operations of Ball Corporation as of December 31, 2015 and 2014 and for the years ended December 31, 2015, 2014 and 2013 prepared in accordance with U.S. GAAP (the "Ball Audited Combined Financial Statements");

- •

- unaudited combined financial statements of certain metal beverage packaging operations of Ball Corporation as of June 30, 2016 and for the six months ended June 30, 2016 and 2015 (the "Ball Unaudited Combined Financial Statements" and together with the Ball Audited Combined Financial Statements, the "Ball Combined Financial Statements");

- •

- audited combined carve-out financial statements of certain beverage can operations of Rexam PLC for the years ended and as of December 31, 2015, 2014 and 2013 prepared in accordance with IFRS (the "Rexam Audited Combined Carve-Out Financial Statements");

- •

- unaudited combined carve-out financial statements of certain beverage can operations of Rexam PLC as of June 30, 2016 and for the six months ended June 30, 2016 and 2015 (the "Rexam Unaudited Combined Carve-Out Financial Statements, and together with the Rexam Audited Combined Carve-Out Financial Statements, the "Rexam Combined Carve-Out Financial Statements");

- •

- the unaudited condensed combined pro forma income statement information for the year ended December 31, 2016 for ARD Finance S.A., that gives effect to (a) our acquisition (the "Beverage Can Acquisition") of certain metal beverage packaging operations of Ball Corporation (the "Ball Carve-Out Business") and certain beverage can operations of

ii

Table of Contents

Rexam PLC (the "Rexam Carve-Out Business") (the acquired business, the "Beverage Can Business") and the financing for the Beverage Can Acquisition, (b) the repayment in full of the amount outstanding of the 9.250% Senior Notes due 2020 and 9.125% Senior Notes due 2020, (c) the issue in September 2016 of the Old Dollar Notes (€684 million) and the Old Euro Notes (€845 million) and the subsequent redemption of the outstanding balance due of €1.1 billion (including redemption premium) comprising the 8.625% Senior PIK Notes due 2019 (€301 million) and the 8.375% Senior PIK Notes due 2019 (€763 million) (together, the "PIK Notes"), (d) the repayment in full of the principal amount outstanding of Ardagh Group's $135 million 7.000% Senior Notes due 2020 from surplus cash resources arising from the September 2016 transaction (see Note C above), (e) the proceeds of the January 2017 Notes which were used to repay in full the amount outstanding of 6.250% Senior Notes due 2019 and partially repay $845 million of outstanding Senior Secured Floating Rate Notes due 2019 and (f) the proceeds of the March 2017 Notes which were used to repay in full the $663 million Term Loan B Facility, redeem €750 million 4.250% First Priority Senior Secured Notes due 2022, redeem in full $265 million First Priority Senior Secured Floating Rate Notes due 2019 and redeem in full the $415 million 6.750% Senior Notes due 2021, and pay all related accrued interest and applicable redemption premia, as if such transactions and events had occurred on January 1, 2016, and (ii) the unaudited pro forma balance sheet as of December 31, 2016 that gives effect to the issuance of the January 2017 Notes and the use of the proceeds thereof, the issuance of the March 2017 Notes and the use of the proceeds thereof and the IPO and the use of the assumed proceeds thereof, as if they had occurred on the balance sheet date (collectively, the "Unaudited Condensed Combined Pro Forma Financial Information"). There is no effect arising from this offering on the pro forma balance sheet information as of December 31, 2016; and

- •

- the audited consolidated financial statements of Ardagh Group S.A. and its subsidiaries as of December 31, 2016 and 2015, and for the three years ended December 31, 2016, prepared in accordance with IFRS.

The preparation of financial statements in conformity with IFRS and U.S. GAAP requires the use of certain critical accounting estimates. It also requires management to exercise its judgment in the process of applying accounting policies. The areas involving a higher degree of judgment or complexity, or areas where assumptions and estimates are significant to the consolidated financial statements, are disclosed in the financial statements.

The consolidated financial statements for ARD Finance have been prepared based on a calendar year and are presented in euro rounded to the nearest million. The Ball Combined Financial Statements have been prepared based on a calendar year and are presented in U.S. dollars rounded to the nearest million. The Rexam Combined Carve-Out Financial Statements have been prepared based on a calendar year and are presented in pounds sterling rounded to the nearest million. The consolidated financial statements for Ardagh Group S.A. have been prepared based on a calendar year and are presented in euro rounded to the nearest million. Therefore, discrepancies in the tables between totals and the sums of the amounts listed may occur due to such rounding.

Unless stated otherwise, debt balances are presented before deducting deferred financing costs.

Ball Combined Financial Statements

The Ball Combined Financial Statements reflect the financial position, results of operations and cash flows of certain metal beverage packaging operations of Ball Corporation in Brazil, France, Germany, the Netherlands, Poland, Serbia and the United Kingdom in conformity with U.S. GAAP. All significant intercompany transactions and accounts among the carve-out operations have been eliminated. The Ball Combined Financial Statements may not be indicative of the future performance

iii

Table of Contents

of those operations and may not reflect what the combined results of operations, financial position and cash flows would have been had those operations operated as an independent company during all of the periods presented in part because the metal beverage packaging operations of Ball Corporation reflected in the Ball Combined Financial Statements include certain assets (namely, three plants in Europe and certain other ancillary assets) and certain liabilities (namely, certain pension liabilities) that were retained by Ball Corporation and therefore do not comprise part of the Ball Carve-Out Business acquired by us in the Beverage Can Acquisition. For a complete description of the accounting principles followed in preparing the Ball Audited Combined Financial Statements, see Note 1 "Description of Business and Basis of Presentation" and Note 2 "Critical and Significant Accounting Policies" to the Ball Audited Combined Financial Statements included elsewhere in this prospectus.

Rexam Combined Carve-Out Financial Statements

The Rexam Combined Carve-Out Financial Statements reflect certain wholly-owned beverage can operations of Rexam PLC that have not in the past formed a separate accounting group. These businesses do not constitute a separate legal group. The Rexam Audited Combined Carve-Out Financial Statements have been prepared specifically for the purpose of facilitating the divestment of the Rexam Carve-Out Business and on a basis that combines the results and Rexam PLC assets and liabilities of each of the manufacturing plants, warehouses and operations constituting the Rexam Carve-Out Business by applying the principles underlying the consolidation procedures of IFRS 10 'Consolidated Financial Statements'. The Rexam Combined Carve-Out Financial Statements have been prepared on a carve-out basis in accordance with IFRS from the consolidated financial statements of Rexam PLC and include the assets, liabilities, revenues and expenses that management of Rexam PLC has determined are attributable to the Rexam Carve-Out Business.

For a complete description of the accounting principles followed in preparing the Rexam Combined Carve-Out Financial Statements, see Note 1 "Nature of operations and basis of presentation" and Note 3 "Principal accounting policies" to the Rexam Audited Combined Carve-Out Financial Statements included elsewhere in this prospectus. This basis of preparation sets out the method used in identifying the financial position, performance and cash flows in relation to each of the plants that has been included in Rexam Combined Carve-Out Financial Statements. These notes explain that the businesses included in the Rexam Combined Carve-Out Financial Statements have not operated as a single entity. The Rexam Combined Carve-Out Financial Statements are, therefore, not necessarily indicative of results that would have occurred if the Rexam Carve-Out Business had operated as a single business during the periods presented or of future results of the Rexam Carve-Out Business.

Ardagh Group S.A. Consolidated Financial Statements

The Ardagh Group S.A. consolidated financial statements are included in this prospectus pursuant to the requirements of Regulation S-X 3-16 issued by the SEC, due to the fact that the New Notes will initially be secured by liens in the form of share pledges on all issued Class B common shares of Ardagh Group S.A. The principal differences between the consolidated financial statements of ARD Finance and the consolidated financial statements of Ardagh Group S.A. reflect (i) ARD Finance's direct and indirect holding in Ardagh Group S.A. and (ii) the issuance and outstanding liability of the Notes.

iv

Table of Contents

Notes on Defined Terms Used in This Prospectus

The following terms used in this prospectus have the meanings assigned to them below:

| | |

"Bank of America Facility" | | The $200 million loan and security agreement entered into on April 11, 2014, which matures on April 11, 2018. |

"Clearstream Banking" | | Clearstream Banking,société anonyme. |

"Collateral" | | The security interest over all issued Class B common shares of Ardagh Group. See "Description of the New Notes—Security." |

"DTC" | | The Depository Trust Company. |

"Euroclear" | | Euroclear Bank SA/NV. |

"Existing Indentures" | | The indentures governing the Existing Notes. |

"Existing Notes" | | The Existing Senior Secured Notes and the Existing Senior Notes. |

"Existing Senior Secured Notes" | | Each of the following jointly issued by Ardagh Packaging Finance plc ("Ardagh Packaging Finance") and Ardagh Holdings USA Inc. ("Ardagh Holdings USA"): |

| | • the existing €405 million aggregate principal amount of 4.250% First Priority Senior Secured Notes due 2022 that were issued on July 3, 2014; |

| | • the existing $1,000 million aggregate principal amount of 4.625% Senior Secured Notes due 2023 that were issued on May 16, 2016 (the "2023 Dollar Secured Notes"); |

| | • the existing €440 million aggregate principal amount of 4.125% Senior Secured Notes due 2023 that were issued on May 16, 2016 (the "2023 Euro Secured Notes"); |

| | • the existing $500 million aggregate principal amount of Senior Secured Floating Rate Notes due 2021 that were issued on May 16, 2016 (the "2021 Floating Rate Notes" and, together with the 2023 Dollar Secured Notes and the 2023 Euro Secured Notes, the "May 2016 Secured Notes"); and |

| | • the existing €750 million aggregate principal amount of 2.750% Senior Secured Notes due 2024 (the "2024 Euro Secured Notes") and $715 million aggregate principal amount of 4.250% Senior Secured Notes due 2022 (the "2022 Dollar Secured Notes"), in each case that were issued on March 8, 2017 (together, the "March 2017 Secured Notes"). |

"Existing Senior Notes" | | Each of the following jointly issued by Ardagh Packaging Finance and Ardagh Holdings USA: |

| | • the existing $440 million aggregate principal amount of 6.000% Senior Notes due 2021 that were issued on July 3, 2014; |

| | • the existing €750 million aggregate principal amount of 6.750% Senior Notes due 2024 that were issued on May 16, 2016 (the "2016 Euro Senior Notes"); |

v

Table of Contents

| | |

| | • the existing $1,650 million aggregate principal amount of 7.250% Senior Notes due 2024 that were issued on May 16, 2016 (the "2016 USD Senior Notes," and together with the 2016 Euro Senior Notes, the "2016 Senior Notes"); and |

| | • the existing $1,000 million aggregate principal amount of 6.000% Senior Notes due 2025 that were issued on January 30, 2017 (the "January 2017 Notes") and $700 million aggregate principal amount of additional 6.000% Senior Notes due 2025 that were issued on March 8, 2017 (the "March 2017 Senior Notes" and, together with the March 2017 Secured Notes, the "March 2017 Notes", and, together with the January 2017 Notes, the "2025 Senior Notes"). |

"HSBC Securitization Program" | | The trade receivables securitization program entered into by Ardagh Receivables Finance Designated Activity Company ("ARF"), which is a wholly-owned subsidiary of Ardagh Packaging International Services Limited, on March 1, 2012 and amended from time to time, under which ARF may (provided that ARF then has at least the required borrowing base) borrow up to €150 million from Regency Assets Limited, an issuer of asset-backed commercial paper that is sponsored by HSBC Bank plc, secured on certain trade receivables acquired by ARF from certain European operating subsidiaries of Ardagh Packaging Holdings Limited ("Ardagh Packaging Holdings"). The lending commitment from Regency Assets Limited matures in June 2018, when all outstanding loans would need to be repaid if the facility is not extended on or before that date. |

"Unicredit Working Capital and Performance Guarantee Credit Lines" | | Two open lines of credit granted to Heye International GmbH ("Heye International") from UniCredit Bank AG (formerly known as Bayerische Hypo- und Vereinsbank AG). See "Description of Certain Indebtedness—Unicredit Working Capital and Performance Guarantee Credit Lines." |

vi

Table of Contents

Currencies

In this prospectus, unless otherwise specified or the context otherwise requires:

- •

- "$" and "U.S. dollar" each refer to the United States dollar;

- •

- "€", "EUR" and "euro" each refer to the euro, the single currency established for members of the European Economic and Monetary Union since January 1, 1999; and

- •

- "£", "pounds", "sterling" and "GBP" refer to pounds sterling, the lawful currency of the United Kingdom.

We prepare our financial statements in euro.

Industry and Market Data

Metal Packaging

Given the specialized nature of the metal packaging markets in which Metal Packaging operates, there does not exist a relevant and reliable third-party source of much of the relevant market information presented in this prospectus. Therefore, estimates provided by Metal Packaging regarding these markets as set forth in this prospectus, as well as estimated market shares of Metal Packaging or its competitors, are largely based on our knowledge of these markets, developed primarily from analysis of public information, third-party reports to the extent available, competitors' public announcements and regulatory filings and information gathered in the course of acquisitions. The data relating to market sizes, market share and market position are based on the most recent data available. This information has not been confirmed by an independent organization, nor can there be assurance that third parties would arrive at the same results were they to employ different methods for gathering, analyzing and calculating such data. Breakdowns of market shares were established on the basis of Metal Packaging's pro forma consolidated revenues and these data. Market positions and percentage shares are those that we believe we hold in terms of revenues. They are based on industry market sectors on which Metal Packaging's business is arranged.

Certain additional information regarding the global packaging industry, generally, and the metal packaging sector, specifically, has been sourced from Smithers Pira.

Any third-party information described above and included in this prospectus has been accurately reproduced and as far as we are aware and are able to ascertain from the information published by such third parties, the reproduced information is accurate and no facts have been omitted which would render such information inaccurate or misleading. Market share data is subject to change, however, and such third-party information has been prepared for statistical and other informational purposes, which is limited by the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in any statistical survey of market share.

Glass Packaging

Throughout this prospectus, we have used industry and market data obtained from independent industry publications, market research, internal surveys and other publicly available information. In particular, we have obtained information or other statements presented in this prospectus concerning market share and industry data relating to our business from providers of industry data, including the British Glass Manufacturers Confederation, Fachvereinigung Behälterglasindustrie e.V. (Germany), Forum Opakowan Szklanych (Poland) and the European Container Glass Federation.

Industry publications generally state that the information they contain has been obtained from sources believed to be reliable but that the accuracy and completeness of such information is not guaranteed. We have not independently verified such data. Moreover, information and quantitative

vii

Table of Contents

statements in this prospectus regarding our market position relative to our competitors are not based on published statistical data or information obtained from independent third parties. Rather, such information and statements reflect our best estimates based upon our internal records and surveys, statistics published by providers of industry data, information published by our competitors, and information obtained from trade and business organizations and associations and other sources within the industry in which we operate. We are responsible for the industry and market data included in this prospectus and although we believe that our internal data and surveys are reliable, such data and surveys could prove to be inaccurate. We also believe that the information extracted from publications of third parties, including industry and general publications, has been accurately reproduced. However, we do not have access to the facts and assumptions underlying the numerical data and other information extracted from publicly available sources and have not independently verified any data provided by third parties or industry or general publications. In addition, while we believe our internal data and surveys to be reliable, such data and surveys have not been verified by any independent sources.

We refer to "Northern Europe" or the "Northern European market" to include collectively Germany, the United Kingdom, Poland, Belgium, the Netherlands, Luxembourg and the Nordic region. We refer to the "Nordic region" to include collectively Denmark, Finland, Iceland, Norway and Sweden.

viii

Table of Contents

PROSPECTUS SUMMARY

The following is a summary of the information discussed in this prospectus. The summary is not complete and does not contain all of the information you should consider before deciding to participate in the exchange offers and invest in the New Notes. You should read this entire prospectus carefully, including the risks discussed under "Risk Factors" and our financial statements and the Beverage Can Business's financial statements and the related notes included elsewhere in this prospectus, before making an investment decision to invest in the New Notes. Some of the statements in the summary may constitute forward-looking statements. See "Cautionary Statement Regarding Forward-Looking Statements". When we describe herein our business or operations, such business and operations are the business and operations of our subsidiary, Ardagh Group S.A., and its consolidated subsidiaries, since ARD Finance S.A. has no independent operations of its own.

Our Company

We are a leading supplier of innovative, value-added rigid packaging solutions. Our products include metal and glass containers primarily for food and beverage markets, which are characterized by stable, consumer-driven demand. Our end-use categories include beer, wine, spirits, carbonated soft drinks ("CSDs"), energy drinks, juices and flavored waters, as well as food, seafood and nutrition. We also supply the paints & coatings, chemicals, personal care, pharmaceuticals and general household end-use categories. Our customers include a wide variety of leading consumer product companies which value our packaging products for their features, convenience and quality, as well as the end-user appeal they offer through design, innovation, functionality, premium association and brand promotion. With our significant invested capital base, extensive technological capabilities and manufacturing know-how, we believe we are well-positioned to continue to meet the dynamic needs of our global customers. We have mainly built our Company through strategic acquisitions and have established leadership positions in large, attractive markets in beverage cans, food and specialty cans and glass containers. Approximately 95% of our revenue is derived from end-use categories where we believe we hold #1, #2 or #3 positions.

We serve over 2,000 customers across more than 80 countries, comprised of multi-national companies, large national and regional companies and small local businesses. In our target regions of Europe, North America and Brazil, our customers include a wide variety of Consumer Packaged Goods companies ("CPGs"), which own some of the best known brands in the world. We have a stable customer base with longstanding relationships, including an average tenure of over 30 years with our ten largest customers. Approximately two-thirds of our sales are generated under multi-year contracts, with the remainder largely subject to annual arrangements. A significant portion of our sales volumes are supplied under contracts which include input cost pass-through provisions, which help us deliver consistent margins.

We operate 109 production facilities in 22 countries and employ approximately 23,500 personnel. Our plant network includes 74 metal production facilities and 35 glass production facilities. Our plants are generally located in close proximity to our customers, with some located on-site or near-site to our customers' filling locations. Certain facilities may also be dedicated to end-use categories, enhancing product-specific expertise and generating benefits of scale and production efficiency. Significant capital has been invested in our extensive network of long-lived production facilities, which, together with our skilled workforce and related manufacturing process know-how, supports our competitive positions.

We are committed to market-leading innovation and product development and maintain dedicated innovation, development and engineering centers in France, Germany, and the U.S. to support these efforts. These facilities focus on three main areas: (i) innovations that provide enhanced product design, differentiation and user friendliness for our customers and end-use consumers; (ii) innovations that reduce input costs to generate cost savings for both our customers and us (downgauging and

1

Table of Contents

lightweighting); and (iii) developments to meet evolving product safety standards and regulations. Further, our subsidiary, Heye International, is a leading provider of engineering solutions to the glass container industry globally, with significant proprietary know-how and expertise. We also have significant in-house mold-manufacturing expertise in Europe and the United States.

Our leading global positions have been established through acquisitions, with 23 successful acquisitions completed over the past 18 years. Most recently, on June 30, 2016, we completed the Beverage Can Acquisition, comprising 22 beverage can production facilities in Europe, North America and Brazil which, on a combined basis, we believe is the third largest beverage can business globally. Our beverage can operations are particularly well-positioned in the faster-growing specialty, or non-standard sized, product category, which, on a pro forma basis following the Beverage Can Acquisition, represented 37% of total beverage can unit volume for the year ended December 31, 2016.

In addition to organic and acquisitive growth initiatives, we have also expanded our footprint through strategic investments in new capacity. For example, in 2014 we completed a glass furnace investment in the United Kingdom, supported by a long-term contract with a large European customer. In 2015, we completed an investment of approximately $220 million in two new can-making facilities in Roanoke, Virginia and Reno, Nevada, as well as a significant expansion of our Conklin, New York, ends plant. The two new facilities incorporate high-output drawn and wall ironed ("DWI") technology to manufacture two-piece cans, as well as three-piece cans, and the total investment across the three facilities has positioned us to meet substantially all of the U.S. food can requirements of a major U.S. customer pursuant to a long-term contract. These initiatives, as well as other acquisitions and investments over many years, in existing and adjacent end-use categories, have increased our scale and diversification and provided opportunities to grow our business with both existing and new customers.

Our pro forma net loss and Adjusted EBITDA† for the year ended December 31, 2016 were €42 million and €1,333 million, respectively. Our net cash from operating activities, net cash used in investing activities and net cash inflow from financing activities for the year ended December 31, 2016 were €469 million, €3,003 million and €2,707 million respectively. Our Free Cash Flow† for the year ended December 31, 2016 was €151 million, which was impacted by the payment of €184 million cumulative interest on the PIK Notes in connection with the refinancing of the PIK Notes with the Old Notes, as well as €184 million of other exceptional cash outflows.

- †

- For definitions of Adjusted EBITDA and Free Cash Flow, and the reconciliation of profit/(loss) for the period and pro forma net loss to Adjusted EBITDA and pro forma Adjusted EBITDA, as well as the reconciliation of net cash from operating activities to Free Cash Flow, see "—Summary Consolidated Financial and Other Data of ARD Finance S.A.".

2

Table of Contents

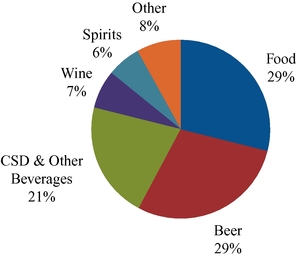

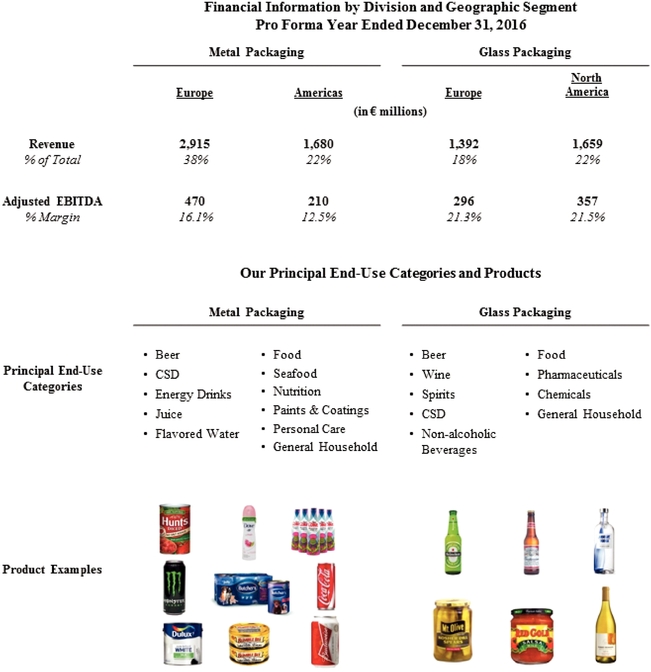

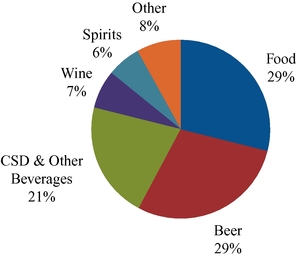

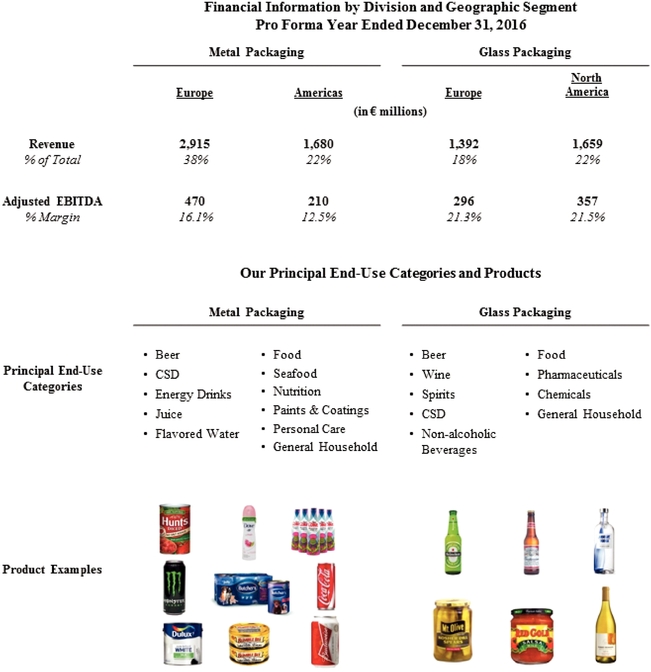

The following charts illustrate the breakdown of our pro forma revenue by end-use category and by destination for the year ended December 31, 2016:

| | |

| Revenue by End-Use Category* | | Revenue by Destination |

|

|

|

- *

- Based on Company estimates.

Our Divisions

The Group was founded in 1932 in Dublin, Ireland, as the Irish Glass Bottle Company. The Group operated a single glass plant in Dublin, largely serving a domestic beverage and food customer base until 1998, when Yeoman International, led by the current Chairman and major shareholder, Paul Coulson, took an initial stake in the Group. Since 1999, we have played a major role in the consolidation of the global metal and glass packaging industries, completing 23 acquisitions and significantly increasing our scope, scale, and geographic presence. Major acquisitions over the past 18 years have included: the acquisition in 1999 of Rockware Glass Limited from Owens-Illinois, Inc., which established the Company as the leading glass packaging producer in the UK and Ireland; the acquisition in 2007 of the European glass packaging business of Rexam PLC, which expanded our glass packaging business and broadened our presence in Continental Europe; the acquisition in 2010 of Impress Group, which diversified our presence into metal packaging; the acquisition in 2014 of Verallia North America (the "VNA Acquisition"), which expanded our glass packaging business in North America and most recently, the Beverage Can Acquisition in 2016, which broadened our metal packaging business into beverage cans.

3

Table of Contents

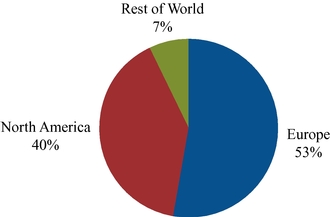

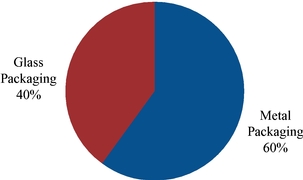

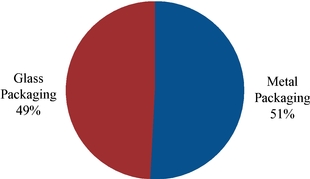

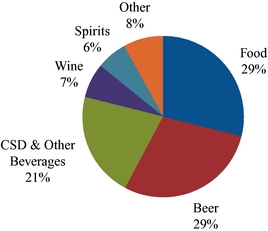

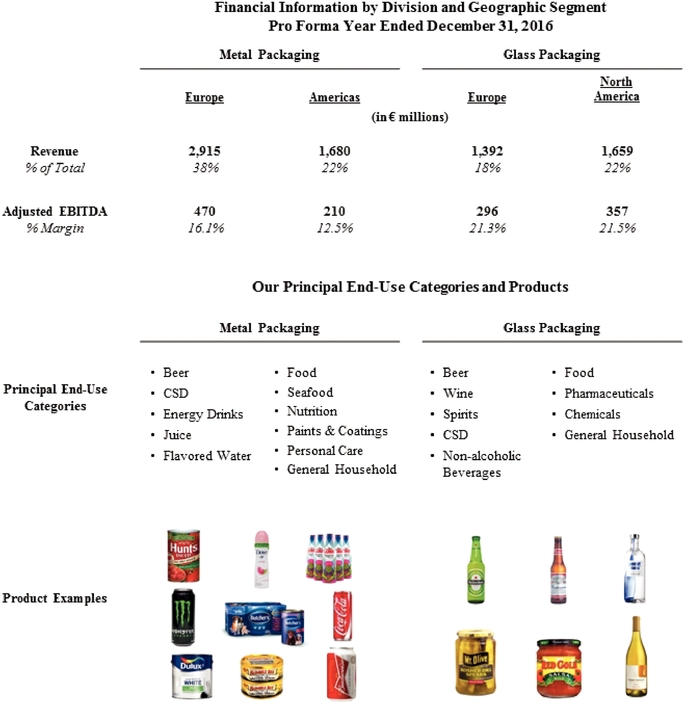

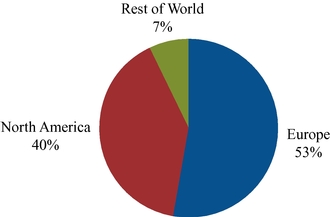

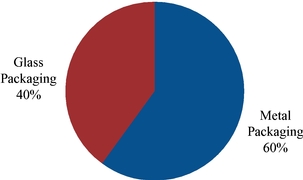

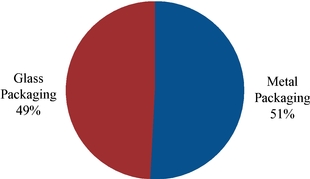

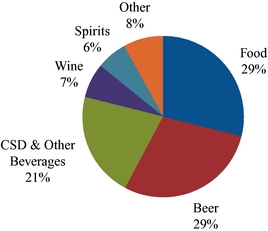

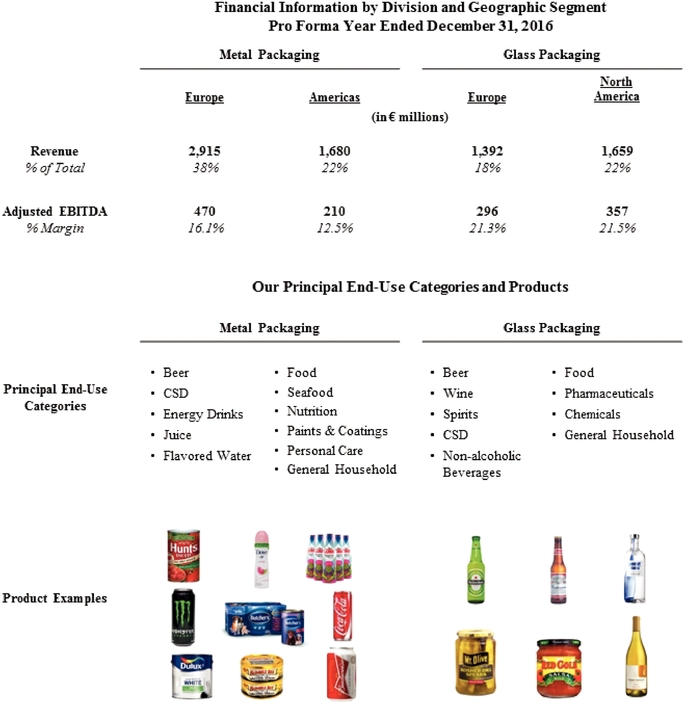

Today, we manage our business in two divisions, Metal Packaging and Glass Packaging. The following charts illustrate the breakdown of our pro forma revenue and pro forma Adjusted EBITDA for the year ended December 31, 2016:

| | |

| Revenue by Division | | Adjusted EBITDA by Division |

|

|

|

We are a leading supplier of innovative, value-added metal packaging for the consumer products industry. We currently supply a broad range of products, including aluminum and steel beverage cans, two-piece aluminum, two-piece tinplate and three-piece tinplate food and specialty cans, and a wide range of can ends, including easy-open and peelable ends. Many of our products feature high-quality printed graphics, customized sizes and shapes or other innovative designs. Our products provide functionality and differentiation and enhance our customers' brands on the shelf. In combination with efficient manufacturing and high service levels, this overall value proposition enables us to achieve margins in Metal Packaging that compare well with other large competitors in the sector.

We manufacture both proprietary and non-proprietary glass containers for a variety of end-use categories, mainly food and beverage. Our proprietary products are customized to the exact specifications of our customers and play an important role in their branding strategies. Our non-proprietary products deliver consistent performance and product differentiation through value-added decoration, including embossing, coating, printing and pressure-sensitive labeling. Our product offerings and continuing focus on operational excellence have enabled us to meet and exceed our customers' requirements and consistently generate margins in Glass Packaging that compare well with other large competitors in the sector.

4

Table of Contents

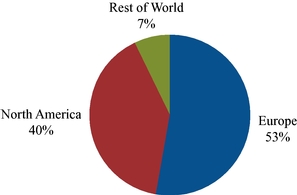

We are organized into four operating and reportable segments, Europe and Americas in Metal Packaging, and Europe and North America in Glass Packaging. Adjusted EBITDA is the performance measure used to manage and assess performance of our reportable segments.

Our Industry

The global packaging industry is a large, consumer-driven industry with stable growth characteristics. We operate in the metal and glass container sectors and our target regions are Europe, North America and Brazil. Metal and glass containers are attractive to brand owners, as their strength and rigidity allows them to be filled at high speeds and easily transported, while their shelf-stable nature means that refrigeration is not required, thereby resulting in further energy savings in the supply

5

Table of Contents

chain. The ability to customize and differentiate products supplied in metal and glass containers, through innovative design, shaping and printing, also appeals to our customers. Both the metal and the glass container markets have been marked by progressive downgauging (metal cans) and lightweighting (glass containers), which have generated material savings in input costs and logistics, while enhancing the consumer experience. This reduction in raw material and energy usage in the manufacturing process has also increased the appeal to end-users, who are increasingly focused on sustainability.

The metal can packaging market represents a $60 billion market that is comprised of beverage cans (50% of the market), food (including seafood) cans (33%), and specialty cans (17%), according to Smithers Pira*, a leading independent market research firm. The beverage can sector is growing in Europe and Brazil, while North America is stable, as growth in beer and energy drinks offsets modest declines in CSD unit volumes. Growth in unit volumes of specialty beverage cans has exceeded growth in standard beverage cans thereby increasing specialty can penetration, a trend that is expected to continue. The food can sector, which includes cans for a variety of food, pet food and seafood end uses, is a stable market. In Europe, the market is characterized by lightweight three-piece and two-piece cans with easy open or peelable ends that are decorated with high quality printed graphics and other innovative designs. In contrast, in the United States, food cans are typically heavier, with more modest levels of decoration, creating a growth opportunity for our products and innovations, including lighter-weight cans incorporating advanced coating solutions. The specialty can sector is characterized by a number of different products and applications, including paints & coatings, aerosol, nutrition and other cans. Our principal competitors in metal packaging include Ball Corporation, Crown Holdings and Silgan Holdings.

The glass packaging market represents a $60 billion market that is comprised of bottles, jars and other products. Glass packaging is utilized in a wide range of end-use categories in the food and beverage market, as well as in applications such as pharmaceuticals, cosmetics and personal care. We principally operate in the food and beverage end-use categories and benefit from the premium appeal of glass packaging to spirits, craft beer, wine and other brand owners, as higher levels of design and differentiation support end-user brand perception and loyalty. In our target regions of Europe and North America, demand is projected to be relatively stable through 2020, according to Smithers Pira†. Our principal competitors in glass packaging include Anchor Glass and Owens-Illinois in North America and Owens-Illinois, Verallia and Vidrala in Europe.

Our Competitive Strengths

We believe a number of competitive strengths differentiate us from our competitors, including:

- •

- Leader in Rigid Packaging. We believe we are one of the leading suppliers of metal and glass packaging solutions, capable of supplying multi-national CPGs, in our target markets.

- •

- We believe that we are the #2 supplier of metal cans by value (meaning total revenue derived from supplying to specific end-markets and end-use categories) in the European beverage can and food can end-use categories, the #1 supplier of metal cans by value in the European seafood, aerosols, paints & coatings and nutrition end-use categories and the #1 supplier of metal cans by value in the North American seafood end-use category. In addition, we believe that we are the #3 supplier of beverage cans by value in the United States and Brazil.

- •

- We believe that we are the #2 supplier of glass packaging by value globally. In the United States, we believe we are the #2 supplier of glass packaging by value, serving the beer, food, wine, spirits and non-alcoholic beverage sectors. In addition, we believe we are the #3

- *

- Source: Smithers Pira—The Future of Metal Packaging and Coatings to 2021 (Nov. 2016).

- †

- Source: Smithers Pira—The Future of Global Packaging to 2020 (Nov. 2015).

6

Table of Contents

supplier of glass packaging by value in Europe and the #1 supplier by value in Northern Europe, Germany, the United Kingdom and the Nordic region, serving the beer, food, wine, spirits, non-alcoholic beverage and pharmaceutical end-use categories.

7

Table of Contents

wide range of shapes and sizes and convenience features, such as easy-open ends and Easy Peel® and Easip® peelable lids, and introduced lightweight aluminum cans. In Glass Packaging, our focus has been on product development, process improvement and cost reduction, which has resulted in progressive advances such as container lightweighting and the increased use of cullet (recycled glass) in the production process. This has delivered significant environmental benefits by reducing the use of raw materials and energy.

- •

- Highly contracted revenue base. Approximately two-thirds of our sales are made pursuant to multi-year contracts, with the remainder largely pursuant to annual arrangements. A significant proportion of our sales volumes are supplied under contracts which include mechanisms that help to protect us from earnings volatility related to input costs. Specifically, such arrangements include (i) multi-year contracts that include input cost pass-through and/or margin maintenance provisions and (ii) one-year contracts that allow us to negotiate pricing levels for our products on an annual basis at the same time that we determine our input costs for the relevant year.

- •

- Attractive growth through acquisitions and strong Free Cash Flow generation. In 1998, under Irish GAAP, our revenue and EBITDA were €51 million and €10 million, respectively. In 2016, under IFRS on a pro forma basis, our revenue and Adjusted EBITDA have grown to €7,646 million and €1,333 million, respectively. We also believe we maintain attractive margins and generate significant Free Cash Flow and returns on capital for our shareholders. For the year ended December 31, 2016, our pro forma Adjusted EBITDA margin was 17.4%. For the year ended December 31, 2016, our net cash from operating activities, net cash used in investing activities and net cash inflow from financing activities were €469 million, €3,003 million and €2,707 million, respectively, and our Free Cash Flow was €151 million.* We believe we can continue to maintain attractive margins and grow Free Cash Flow through business mix optimization, growth with new and existing customers, efficiency gains, cost reduction, working capital optimization and disciplined capital allocation.

- •

- Proven track record of successful acquisitions and business optimization. We have grown through a series of acquisitions, some of which significantly increased the size and scope of our Company and the breadth of our product offering. We have successfully integrated these acquired businesses and realized or exceeded targeted cost synergies, including $60 million in cost synergies announced in conjunction with the VNA Acquisition in 2014. Through the Beverage Can Acquisition, we are targeting operating cost synergies of at least $50 million by December 2018, with projected one-time costs of approximately $20 million to achieve these synergies, although we cannot give any assurances that such synergies will be achieved. We believe we can continue to create value for shareholders through acquisitions, business optimization and synergy realization.

- •

- Experienced management team with a proven track record and high degree of shareholder alignment. We believe our management team is highly experienced, with an average of more than 15 years of experience in the consumer packaging industry. The members of our senior management team have demonstrated their ability to manage costs, adapt to changing market conditions, undertake strategic investments and acquire and integrate new businesses, thereby driving significant value creation. Our board of directors, led by our Chairman, has a high degree of indirect ownership in our Company, which we believe promotes efficient capital allocation decisions and results in strong shareholder alignment and commitment to further shareholder value creation.

- *

- Our Free Cash Flow for the year ended December 31, 2016 was impacted by the payment of €184 million cumulative interest on the PIK Notes in connection with the refinancing of the PIK Notes with the proceeds of the Old Notes, as well as €184 million of other exceptional cash outflows.

8

Table of Contents

Our Business Strategy

Historically, we have created significant shareholder value by acquiring businesses and integrating them to realize synergies and enhance profitability, which, when combined with the application of our operational excellence and best practice initiatives, has enabled us to generate strong growth in revenues and Adjusted EBITDA since 1998. We have deployed our cash flow to grow our businesses and service our debt. In addition, ARD Holdings has also returned over €570 million to its shareholders since January 2010. Our principal objective remains to grow shareholder value by accelerating earnings growth and driving Free Cash Flow generation. In the near-term we intend to deploy our Free Cash Flow primarily to reduce debt, but we will continue to opportunistically engage in strategic capital investments and selective acquisitions that enhance shareholder value. We will continue to pursue these objectives through the following strategies:

- •

- Grow Adjusted EBITDA and Free Cash Flow. We will seek to leverage our extensive footprint, proximity to customers, efficient manufacturing and high level of customer service to grow revenue with new and existing customers, improve our productivity, and reduce our costs. To increase Adjusted EBITDA, we will continue to take decisive actions with respect to our assets and invest in our business, in line with our stringent investment criteria. To increase Free Cash Flow, we will continue to actively manage our working capital and capital expenditures.

- •

- Enhance product mix and profitability. We have enhanced our product mix over the years by replacing lower margin business with higher margin business. For example, we grew our presence in end-use categories such as spirits, invested in our specialty beverage can capacity, expanded our DWI and two-piece food can production capacity and increased our specialty nutrition can capacity. We will continue to develop long-term partnerships with our global customers and selectively pursue opportunities with existing and new customers that will grow our business and enhance our overall profitability.

- •

- Apply leading process technology and technical expertise. Our goal is to be the most profitable producer earning the highest returns on capital in the rigid packaging industry. We plan to achieve this with an attractive and well-balanced business mix, combined with a low cost base, Lean manufacturing, strong technological expertise and a highly motivated workforce. We intend to increase productivity through the deployment of leading technology (including our internal engineering, innovation and design capabilities), and continued development and dissemination of best practices and know-how across our operations.

- •

- Emphasize operational excellence and optimize manufacturing base. In managing our businesses, we seek to improve our efficiency, control costs and preserve and expand our margins. We have consistently reduced total costs through implementing operational efficiencies, streamlining our manufacturing base and investing in advanced technology to enhance our production capacity. We will continue to take actions to reduce costs by optimizing our manufacturing footprint, including through further investment in advanced technology.

- •

- Successfully integrate the Beverage Can Acquisition. We have successfully acquired and integrated a significant number of businesses over the past 18 years. We have proven our ability to create value through integrating acquisitions with our existing operations, for example in connection with the VNA Acquisition in 2014, where we have achieved operating and administrative cost synergies of $60 million announced at the time of the acquisition. We believe we will continue to be effective in integrating our acquisitions and we believe we will achieve at least $50 million of synergies from the recent Beverage Can Acquisition by December 2018, although we cannot give any assurances that such synergies will be achieved.

- •

- Carefully evaluate and pursue strategic opportunities. We have achieved our current market positions by selectively pursuing strategic opportunities. Although our near-term focus is

9

Table of Contents

primarily on de-leveraging our Company, we will continue to evaluate opportunities in line with our objectives, which include the realization of attractive returns on investment and Free Cash Flow generation. We believe there are still significant opportunities for further growth by acquisition and we may selectively explore acquisition opportunities, in line with our stringent investment criteria and focus on enhancing shareholder value. Our acquisition criteria include (i) attractive bolt-on acquisitions in existing markets, (ii) acquisitions that allow us access to critical technology, and (iii) new platform acquisitions that have scale positions and an attractive financial profile.

Risk Factors

There are a number of risks you should consider before deciding to participate in the exchange offers and invest in the New Notes. These risks are discussed more fully under "Risk Factors" beginning on page 25 of this prospectus. These risks include, but are not limited to:

- •

- The Issuer's ability to pay principal and interest on or refinance the New Notes may be affected by our organizational structure. The Issuer is dependent upon payments from other members of our corporate group to fund payments to you on the New Notes, and such other members might not be able to make such payments in some circumstances.

- •

- If certain conditions for the payment of Cash Interest (as defined below) are not met, interest on the New Notes may be paid in PIK Interest (as defined below).

- •

- Holders of the New Notes may have more difficulty protecting their interests than they would as holders of securities of a U.S. corporation.

- •

- The New Notes will be structurally subordinated to the liabilities of the subsidiaries of the Issuer, including the Ardagh Group.

- •

- You may not be able to sell your Old Notes if you do not exchange them for New Notes in the exchange offers.

- •

- As a result of our consummation of the exchange offers, holders of the Old Notes who do not tender their Old Notes will generally have no further rights under the 2016 Registration Rights Agreement (as defined below), including registration rights and the right to receive additional interest under certain circumstances.

- •

- Our primary direct customers sell to consumers of food & beverages, pharmaceuticals, personal care and household products. If economic conditions affect consumer demand, our customers may be affected and so reduce their demand for our products.

- •

- We face intense competition from other metal and glass packaging producers, as well as from manufacturers of alternative forms of packaging.

- •

- Because our customers are concentrated, our business could be adversely affected if we were unable to maintain relationships with our largest customers.

- •

- The continuing consolidation of our customer base may intensify pricing pressures or result in the loss of customers.

- •

- An increase in metal or glass container manufacturing capacity without a corresponding increase in demand for metal or glass packaging could cause prices to decline.

- •

- Our profitability could be affected by varied seasonal demands.

- •

- Our profitability could be affected by the availability and cost of raw materials.

10

Table of Contents

- •

- Currency, interest rate fluctuations and commodity prices may have a material impact on our business.

- •

- Our expansion strategy may adversely affect our business.

- •

- Our business may suffer if we do not retain our executive and senior management.

- •

- It is difficult to compare our results of operations from period to period.

- •

- We are subject to various environmental and other legal requirements and may be subject to new requirements of this kind in the future that could impose substantial costs upon us.

- •

- We may not be able to integrate the Beverage Can Business or any future acquisitions effectively.

- •

- We face costs associated with our post retirement and post employment obligations to employees.

- •

- Organized strikes or work stoppages by unionized employees may have a material adverse effect on our business.

Recent Developments

On January 30, 2017, ARD Finance's indirect wholly owned subsidiaries, Ardagh Packaging Finance and Ardagh Holdings USA, as co-issuers, issued the January 2017 Notes. Proceeds of that offering, together with certain cash, were used to fund the redemption in full of $415 million 6.250% Senior Notes due 2019 and the $845 million partial redemption of the First Priority Senior Secured Floating Rates Notes due 2019, including associated redemption premiums and accrued and unpaid interest to the redemption date.

On March 8, 2017, ARD Finance's indirect wholly owned subsidiaries, Ardagh Packaging Finance and Ardagh Holdings USA, as co-issuers, issued the March 2017 Notes. The proceeds of that offering, net of expenses, were used to redeem €750 million of 4.250% First Priority Senior Secured Notes due 2022, redeem in full the $265 million First Priority Senior Secured Floating Rate Notes due 2019, repay in full the $663 million Term Loan B Facility and redeem in full the $415 million 6.750% Senior Notes due 2021, including associated redemption premiums and accrued and unpaid interest to the redemption date.

Ratio of Earnings to Fixed Charges

The following table sets forth our ratio of earnings to fixed charges for the periods indicated.

| | | | | | | | | | | | | | |

| Year ended December 31, | |

|---|

| 2016 | | 2015 | | 2014 | | 2013 | | 2012 | |

|---|

| | — | (1) | | — | (1) | | — | (1) | | — | (1) | | — | (1) |

- (1)

- For the years ended December 31, 2016, 2015, 2014, 2013 and 2012 we had a €79 million, €77 million, €579 million, €360 million and €297 million deficiency, respectively, of earnings to fixed charges.

The Issuer

The Issuer was incorporated on May 6, 2011 as a public limited liability company (société anonyme) in Luxembourg under registration number B 160806. Its registered and principal executive office is at 56, rue Charles Martel, L-2134 Luxembourg, Luxembourg. Its telephone number is +352 26 25 85 55.

11

Table of Contents

The Exchange Offers

On September 16, 2016, we privately placed $770 million aggregate principal amount of the Old Dollar Notes and €845 million aggregate principal amount of the Old Euro Notes in a transaction exempt from registration under the Securities Act. In connection with the private placement, we entered into a registration rights agreement, dated September 16, 2016 (the "2016 Registration Rights Agreement"), with the initial purchasers of the Old Notes. In the 2016 Registration Rights Agreement, we agreed to offer to exchange Old Notes for New Notes registered under the Securities Act. We also agreed to deliver this prospectus to the holders of the Old Notes. In this prospectus, the Old Notes and the New Notes are referred to together as the "Notes." You should read the discussion under the heading "Description of the New Notes" for information regarding the New Notes.

| | |

The Exchange Offers | | We are offering to exchange up to $770 million aggregate principal amount of the New Dollar Notes and €845 million aggregate principal amount of the New Euro Notes for an identical principal amount of the Old Dollar Notes and the Old Euro Notes, respectively. The New Notes are identical in all material respects to the Old Notes, except that: |

| | • the New Notes have been registered under the Securities Act and will be freely transferable, other than as described in this prospectus; |

| | • the New Notes will not contain any legend restricting their transfer; |

| | • the registration rights relating to the Old Notes do not apply to the New Notes; and |

| | • the New Notes will not contain any provisions regarding the payment of additional interest under certain circumstances. |

| | Based on interpretations by the SEC's staff issued in no-action letters issued to third parties, we believe that New Notes issued in exchange for Old Notes in the exchange offers may be offered for resale, resold or otherwise transferred by you without registering the New Notes under the Securities Act or delivering a prospectus, unless you are a broker-dealer receiving New Notes for your own account, so long as each of the following representations is true, and as a condition to its participation in the exchange offers, each holder of Old Notes participating in the exchange offers will be deemed to represent that: |

| | • any New Notes to be received by it will be acquired in the ordinary course of its business; |

| | • it does not intend to engage in a distribution (within the meaning of the Securities Act) of the New Notes; |

| | • it is not an "affiliate" (within the meaning of Rule 405 under the Securities Act) of the Issuer; and

|

12

Table of Contents

| | |

| | • if such holder of Old Notes is a broker-dealer that will receive New Notes for its own account in exchange for Old Notes that were acquired as a result of market-making or other trading activities, then such holder of Old Notes will deliver a prospectus (or, to the extent permitted by law, make available a prospectus to purchasers) in connection with any resale of such New Notes. |

| | Any broker-dealer and any holder using the exchange offers to participate in a distribution of the New Notes to be acquired in the exchange offers (1) cannot under SEC policy as in effect on the date of the 2016 Registration Rights Agreement rely on the position of the SEC enunciated inMorgan Stanley & Co. Inc., SEC no-action letter (June 5, 1991),Exxon Capital Holdings Corporation, SEC no-action letter (May 13, 1988), as interpreted in the SEC's letter to Shearman & Sterling dated July 2, 1993, and similar no-action letters and (2) must comply with the registration and prospectus delivery requirements of the Securities Act in connection with a secondary resale transaction and be identified as an underwriter in the prospectus. |

No Minimum Condition | | The exchange offers are not conditioned on any minimum aggregate principal amount of Old Notes being tendered for exchange. |

Expiration Dates | | The exchange offer for the Old Dollar Notes will expire at 5:00 p.m., New York City time, on May 11, 2017, and the exchange offer for the Old Euro Notes will expire at 5:00 p.m., London time, on May 11, 2017, in each case unless it is extended by us in our sole discretion. |

Settlement Date | | The settlement date of the exchange offers will be promptly following the Expiration Dates. |

Conditions to the Exchange Offers | | Our obligation to consummate the exchange offers is not subject to any conditions, other than that the exchange offers do not violate any applicable law or applicable interpretations of the SEC staff. See "The Exchange Offers—Conditions to the Exchange Offers." We reserve the right to assert or waive these conditions in our sole discretion. We have the right, in our sole discretion, to terminate or withdraw the exchange offers if any of the conditions described under "The Exchange Offers—Conditions to the Exchange Offers" are not satisfied or waived. |

Withdrawal Rights | | You may withdraw the tender of your Old Dollar Notes at any time at or before 5:00 p.m. New York City time and your Old Euro Notes at any time at or before 5:00 p.m. London time, in each case on the applicable Expiration Date. Any Old Notes not accepted for any reason will be returned to you without expense as promptly as practicable after the expiration or termination of the applicable exchange offer. See "The Exchange Offers—Withdrawal of Tenders." |

13

Table of Contents

| | |

Appraisal Rights | | Holders of Old Notes do not have any rights of appraisal for their Old Notes if they elect not to tender their Old Notes for exchange. |

Procedures for Tendering Old Notes | | See "The Exchange Offers—Procedures for Tender Old Notes." |

Effect on Holders of Old Notes | | As a result of the making of, and upon acceptance for exchange of all validly tendered Old Notes pursuant to the terms of the exchange offers, we will have fulfilled a covenant contained in the 2016 Registration Rights Agreement and, accordingly, there will be no increase in the interest rate of the Old Notes under the circumstances described in the 2016 Registration Rights Agreement. If we consummate the exchange offers and you do not tender your Old Notes in the exchange offers, your Old Notes will remain outstanding and continue to accrue interest, and you will continue to be entitled to all the rights and limitations applicable to the Old Notes as set forth in the indenture governing the Notes (the "Indenture"), except your Old Notes will not retain any rights under the 2016 Registration Rights Agreement, except as otherwise specified in the 2016 Registration Rights Agreement. To the extent that Old Notes are tendered and accepted in the exchange offers, the trading market for Old Notes could be adversely affected. |

Consequences of Failure to Exchange | | All untendered Old Notes will continue to be subject to the restrictions on transfer set forth in the Old Notes and in the Indenture. In general, the Old Notes may not be offered or sold, unless registered under the Securities Act, except pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. Other than in connection with the exchange offers, we do not intend to register the Old Notes under the Securities Act. |

Material United States Federal Income Tax Consequences of the Exchange Offers | | Your exchange of Old Notes for New Notes will not result in any income, gain or loss to you for U.S. federal income tax purposes. See "Material United States Tax Consequences of the Exchange Offers." |

Use of Proceeds | | We will not receive any proceeds from the issuance of the New Notes in the exchange offers. |

Accounting Treatment | | We will not recognize any gain or loss on the exchange of Notes. See "The Exchange Offers—Accounting Treatment." |

14

Table of Contents

| | |

Broker-Dealers | | Each broker-dealer that receives New Notes in exchange for Old Notes, where such Old Notes were acquired by such broker-dealer as a result of market-making activities or other trading activities (other than Old Notes acquired directly from us), must satisfy any prospectus delivery requirements under the Securities Act in connection with any resales of such New Notes received by such broker-dealer in the exchange offers, which prospectus delivery requirement may be satisfied by the delivery of this prospectus, as it may be amended or supplemented from time to time. |

| | Any broker-dealer and any holder using the exchange offers to participate in a distribution of the New Notes to be acquired in the exchange offers (1) cannot under SEC policy as in effect on the date of the 2016 Registration Rights Agreement rely on the position of the SEC enunciated inMorgan Stanley & Co. Inc., SEC no-action letter (June 5, 1991),Exxon Capital Holdings Corporation, SEC no-action letter (May 13, 1988), as interpreted in the SEC's letter to Shearman & Sterling dated July 2, 1993, and similar no-action letters and (2) must comply with the registration and prospectus delivery requirements of the Securities Act in connection with a secondary resale transaction and be identified as an underwriter in the prospectus. |

Information Agent and Depositary Agent | | Global Bondholder Services Corporation is serving as information agent and depositary agent in connection with the exchange offers for the Old Dollar Notes and the Old Euro Notes. Its address, telephone numbers and facsimile numbers are listed in "The Exchange Offers—Information Agent and Depositary Agent."

|

15

Table of Contents

The New Notes

The summary below describes the principal terms of the New Notes. Certain of the terms and conditions described below are subject to important limitations and exceptions. The "Description of the New Notes" section of this prospectus contains a more detailed description of the terms and conditions of the New Notes.

The New Notes are substantially identical in all material respects to the Old Notes, except that the New Notes have been registered under the Securities Act and will not have any of the transfer restrictions, any of the registration rights provisions and certain inapplicable interest provisions relating to the Old Notes. The New Notes will evidence the same debt as the Old Notes exchanged therefor and be entitled to the benefits of the Indenture.

| | |

| Issuer | | ARD Finance S.A. |

New Dollar Notes Offered |

|

Up to $770,000,000 aggregate principal amount of New Dollar Notes in exchange for an identical principal amount of the Old Dollar Notes. |

New Euro Notes Offered |

|

Up to €845,000,000 aggregate principal amount of New Euro Notes in exchange for an identical principal amount of the Old Euro Notes. |

Maturity |

|

September 15, 2023. |

Interest |

|

Interest on the New Notes will be payable semi-annually in arrears from March 15, 2017 or from the most recent interest payment date to which interest on the Notes has been paid or provided for, whichever is the later. Other than the final interest payment made at stated maturity, which will be paid in cash, the Issuer will be required to pay interest on the New Notes entirely in cash ("Cash Interest"), unless the conditions described in this prospectus are satisfied, in which case the Issuer will be entitled to pay, to the extent described herein, interest for any interest period by increasing the principal amount of the Notes or by issuing Notes in a principal amount equal to such interest (in each case, "PIK Interest"). Interest on the New Notes will be payable on March 15 and September 15 of each year, beginning on September 15, 2017. |

|

|

Interest on the New Dollar Notes will accrue at the rate of 7.125% per annum with respect to Cash Interest and, if PIK Interest is payable, 7.875% per annum with respect to PIK Interest. Interest on the New Euro Notes will accrue at a rate of 6.625% per annum with respect to Cash Interest and, if PIK interest is payable, 7.375% per annum with respect to PIK Interest. |

|

|

If the Issuer pays any PIK Interest, it will increase the principal amount of the New Notes or issue additional New Notes in an amount equal to the interest payment for the applicable interest period (rounded up to the nearest $1 or €1, as applicable) to holders of New Notes on the relevant record date. |

16

Table of Contents

| | |

| Ranking | | The New Notes will: |

| | • be the Issuer's general obligations; |

| | • rank effectively senior in right of payment to any and all of the Issuer's future indebtedness that is subordinated in right of payment to the New Notes; |

| | • rank equally in right of payment with any and all of the Issuer's future indebtedness that is not subordinated in right of payment to the New Notes; and |

| | • be effectively subordinated to all of the Issuer's future indebtedness that is secured by property or assets that do not secure the New Notes to the extent of the value of the collateral securing such indebtedness. |

Security |

|

The New Notes will initially be secured by liens in the form of share pledges on all issued Class B common shares of Ardagh Group. See "Description of the New Notes—Security." |

Redemption |

|

The Issuer may redeem the Dollar Notes and/or the Euro Notes in whole or in part at any time on or after September 15, 2019 at the redemption prices set forth in "Description of the New Notes—Redemption—Optional Redemption on or after September 15, 2019." |

|

|

Prior to September 15, 2019, the Issuer may redeem all or part of the Dollar Notes and/or the Euro Notes by paying a "make whole" premium, as described in "Description of the New Notes—Redemption—Optional Redemption prior to September 15, 2019." |

|

|

Prior to September 15, 2019, the Issuer shall redeem Dollar Notes and Euro Notes with the net cash proceeds of certain equity offerings at the redemption prices listed under "Description of the New Notes—Redemption—Mandatory Redemption prior to September 15, 2019." |

|

|

On or after September 15, 2019, the Issuer shall redeem Dollar Notes and Euro Notes with the net proceeds of certain equity offerings at the redemption prices listed under "Description of the New Notes—Redemption—Mandatory Redemption on or after September 15, 2019." |

|

|

For a more detailed description, see "Description of the New Notes—Redemption." |

Restrictive Covenants |

|

The Indenture contains covenants that restrict our ability to: |

| | • incur more debt; |

| | • pay dividends, repurchase stock and make distributions or certain other payments; |

| | • create liens; |

| | • enter into transactions with affiliates; and |

17

Table of Contents

| | |

| | • transfer or sell assets. |

|

|

For a more detailed description of these covenants, see "Description of the New Notes—Certain Covenants." These covenants are subject to a number of important qualifications and exceptions. |

Change of Control |

|

In the event of a Change of Control, the Issuer will be obligated to make an offer to purchase all outstanding Notes at a redemption price of 101% of the principal amount thereof, plus accrued and unpaid interest, if any, to the date of purchase. See "Description of the New Notes—Purchase of Notes upon a Change of Control." |

Additional Amounts |

|

Any payments made by the Issuer under or with respect to the New Notes will be made without withholding or deduction for any taxes imposed by any relevant taxing jurisdiction, unless required by law. If any such withholding or deduction is required by law, subject to certain exceptions, we will pay the additional amounts necessary so that the net amount received by the holders after the withholding or deduction (including any withholding or deduction in respect of any additional amounts) is not less than the amount that they would have received in the absence of such withholding or deductions. See "Description of the New Notes—Additional Amounts." |

United States Federal Income Taxation |

|