UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2022

___________________

Commission File Number: 000-55899

BANCO SANTANDER MÉXICO, S.A., INSTITUCIÓN DE BANCA MÚLTIPLE, GRUPO FINANCIERO SANTANDER MÉXICO

(Exact Name of Registrant as Specified in Its Charter)

Avenida Prolongación Paseo de la Reforma 500

Colonia Lomas de Santa Fe

Alcaldía Álvaro Obregón

01219, Ciudad de México

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

| Form 20-F | X | Form 40-F |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

| Yes | No | X |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

| Yes | No | X |

BANCO SANTANDER MÉXICO, S.A., INSTITUCIÓN DE BANCA MÚLTIPLE, GRUPO FINANCIERO SANTANDER MÉXICO

TABLE OF CONTENTS

| ITEM | |

| 1. | Fourth quarter 2022 earnings release of Banco Santander México, S.A., Institución de Banca Múltiple, Grupo Financiero Santander México |

| 2. | Fourth quarter 2022 earnings presentation of Banco Santander México, S.A., Institución de Banca Múltiple, Grupo Financiero Santander México |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

BANCO SANTANDER MÉXICO, S.A., INSTITUCIÓN DE BANCA MÚLTIPLE, GRUPO FINANCIERO SANTANDER MÉXICO | ||||

| By: | /s/ Hector Chávez Lopez | |||

| Name: | Hector Chávez Lopez | |||

| Title: | Executive Director of Investor Relations | |||

Date: February 4, 2022

Item 1

TABLE OF CONTENTS

| I.Key Highlights for the Quarter | 2 |

| II. CEO Message | 3 |

| III. Summary of 4Q21 Consolidated Results | 4 |

| IV. Analysis of 4Q21 Consolidated Results | 11 |

| V.Relevant Events, Transactions and Activities | 27 |

| VI.Awards and Recognitions | 29 |

| VII.Credit Ratings | 29 |

| VIII.4Q21 Earnings Call Dial-In Information | 31 |

| IX.Analyst Coverage | 31 |

| X.Definition of Ratios | 31 |

| XI.Consolidated Financial Statements | 34 |

| XII.Notes to Consolidated Financial Statements | 41 |

| XIII.Special Accounting Criteria — Subsidiaries | 167 |

Earnings Release | 4Q.2021 |  |

Banco Santander México | |

| 1 |

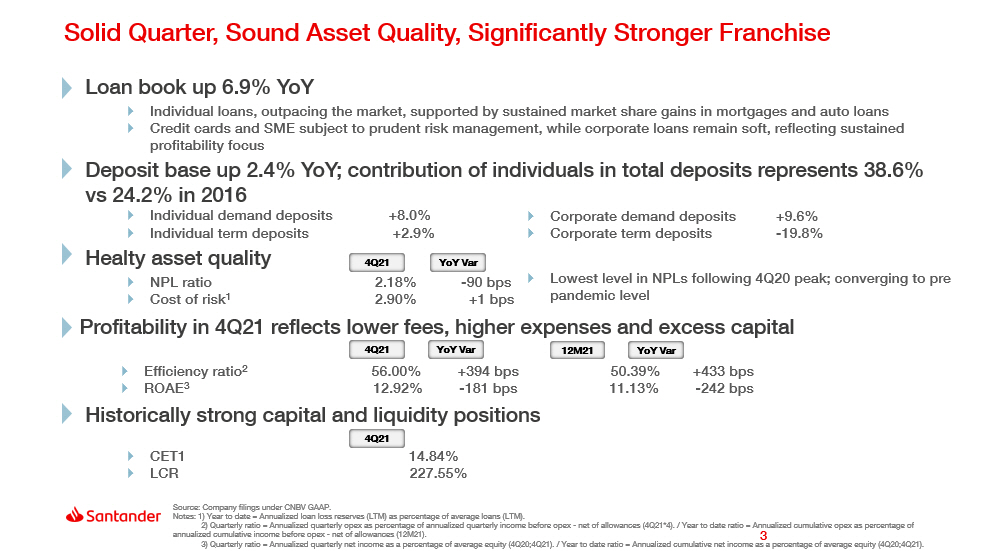

I.Key Highlights for the Quarter

Banco Santander México Reports Fourth Quarter 2021 Net Income of Ps.5,245 Million

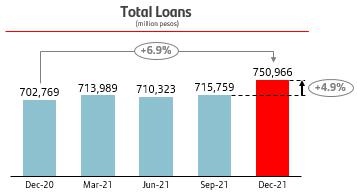

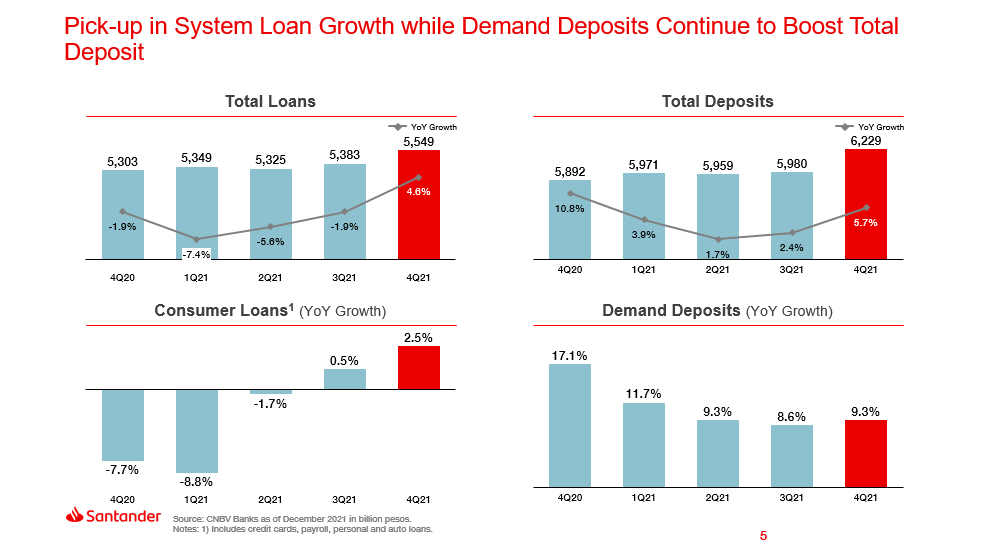

| - | Strong YoY total loan portfolio growth, outpacing the system, supported by sustained market share gains in mortgages and auto loans. While loan volumes in the commercial portfolio were driven by a pick-up in corporate and government lending. |

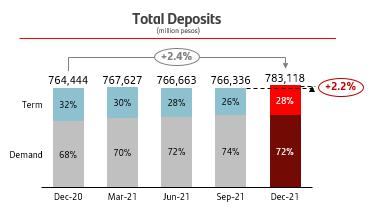

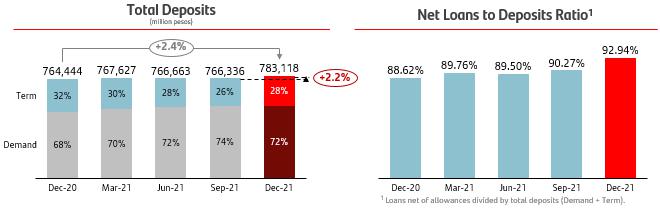

| - | Total deposits continued growing at a solid pace, improving the Bank’s funding mix by favoring demand deposits over term deposits. Meanwhile, contribution of inviduals has increased considerably during the last five years, in both demand and term deposits, currently the contribution of individuals in total deposits represent 38.6% vs 24.2% in 2016. |

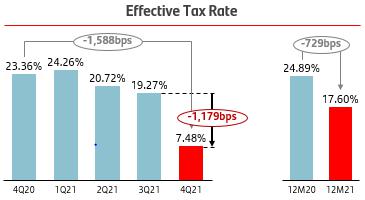

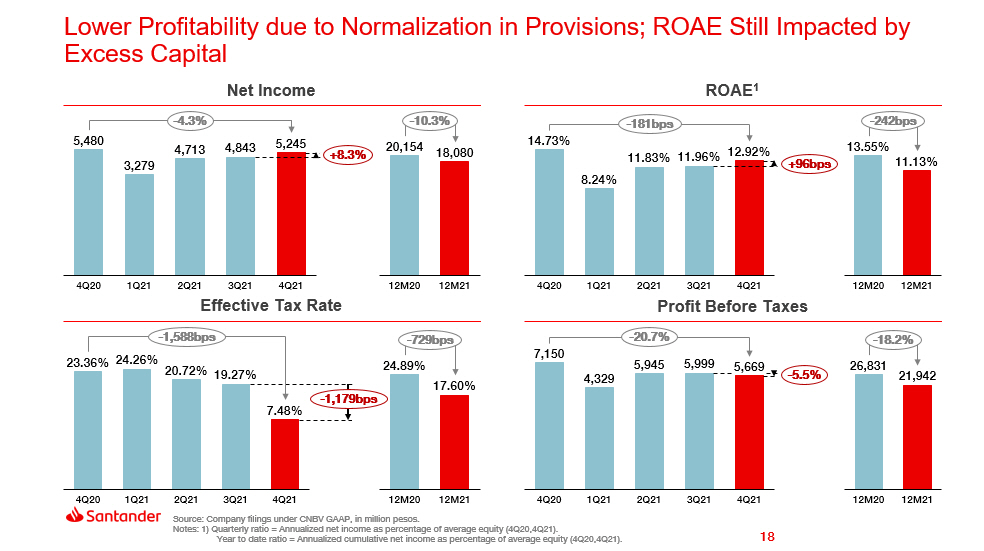

| - | Net income decreased 4.3% YoY in 4Q21, mainly due to higher expenses and provisions for loan losses, partially offset by a lower effective tax rate, solid growth in market related income and higher other operating income. |

Mexico City – February 3th, 2022, Banco Santander México, S.A., Institución de Banca Múltiple, Grupo Financiero Santander México (NYSE: BSMX; BMV: BSMX), (“Banco Santander México” or “the Bank”), today announced financial results for the three-month and twelve -month periods ending December 31st, 2021.

Banco Santander México reported net income of Ps.5,245 million in 4Q21, representing a YoY decrease of 4.3% and a QoQ increase of 8.3%. On a cumulative basis, net income for 12M21 reached Ps.18,080 million, representing a 10.3% YoY decrease.

| HIGHLIGHTS | ||||||||||||

| Results (Million pesos) | 4Q21 | 3Q21 | 4Q20 | %QoQ | %YoY | 12M21 | 12M20 | %YoY | ||||

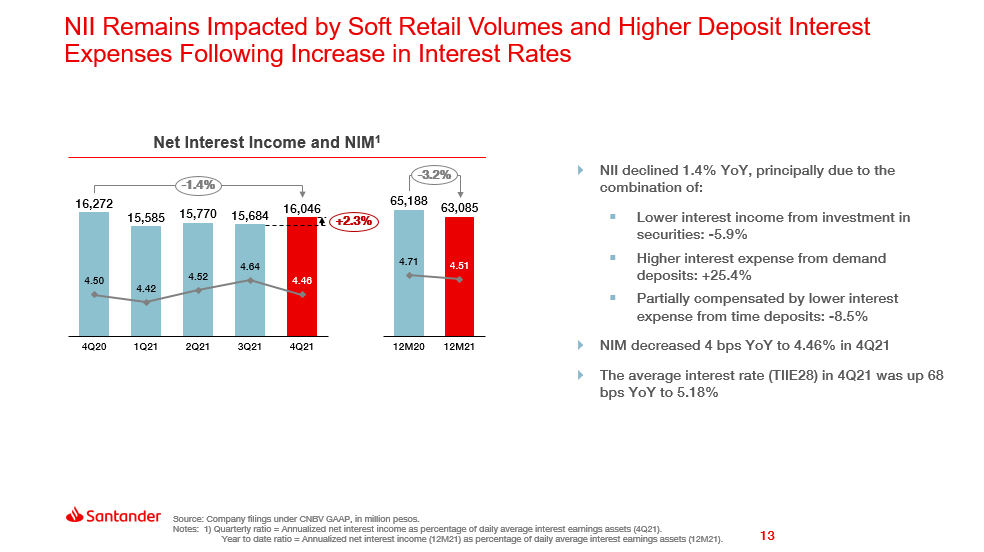

| Net interest income | 16,046 | 15,684 | 16,272 | 2.3 | (1.4) | 63,085 | 65,188 | (3.2) | ||||

| Fee and commission, net | 4,760 | 4,447 | 4,709 | 7.0 | 1.1 | 18,982 | 18,694 | 1.5 | ||||

| Core revenues | 20,806 | 20,131 | 20,981 | 3.4 | (0.8) | 82,067 | 83,882 | (2.2) | ||||

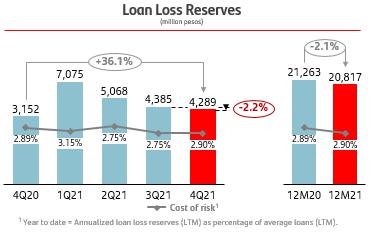

| Provisions for loan losses | 4,289 | 4,385 | 3,152 | (2.2) | 36.1 | 20,817 | 21,263 | (2.1) | ||||

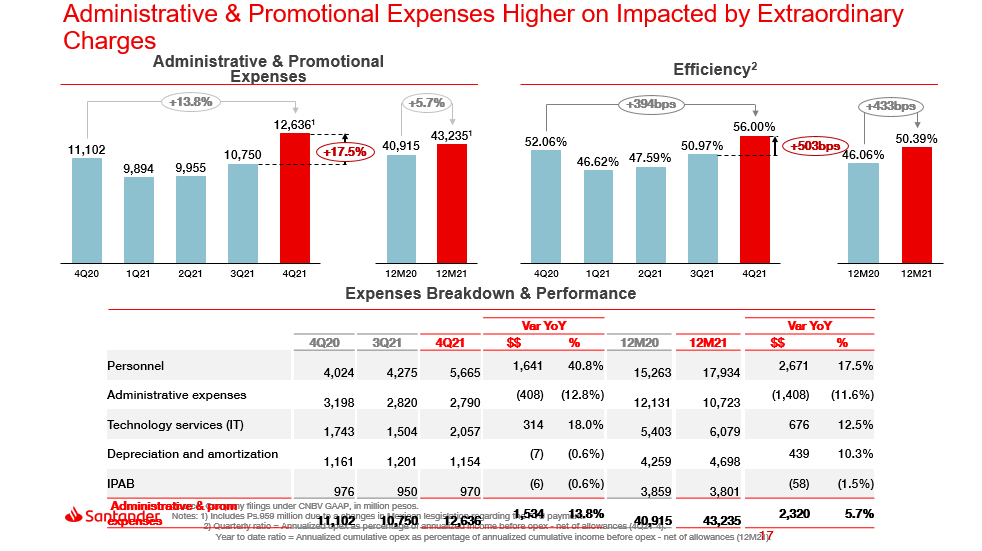

| Administrative and promotional expenses | 12,636 | 10,750 | 11,102 | 17.5 | 13.8 | 43,235 | 40,915 | 5.7 | ||||

| Net income | 5,245 | 4,843 | 5,480 | 8.3 | (4.3) | 18,080 | 20,154 | (10.3) | ||||

| Net income per share1 | 0.77 | 0.71 | 0.81 | 8.3 | (4.3) | 2.66 | 2.97 | (10.3) | ||||

| Balance Sheet Data (Million pesos) | Dec-21 | Sep-21 | Dec-20 | %QoQ | %YoY | Dec-21 | Dec-20 | %YoY | ||||

| Total assets | 1,639,652 | 1,669,138 | 1,856,213 | (1.8) | (11.7) | 1,639,652 | 1,856,213 | (11.7) | ||||

| Total loans | 750,966 | 715,759 | 702,769 | 4.9 | 6.9 | 750,966 | 702,769 | 6.9 | ||||

| Deposits | 783,118 | 766,336 | 764,444 | 2.2 | 2.4 | 783,118 | 764,444 | 2.4 | ||||

| Shareholders´ equity | 165,894 | 165,020 | 158,871 | 0.5 | 4.4 | 165,894 | 158,871 | 4.4 | ||||

| Key Ratios (%) | 4Q21 | 3Q21 | 4Q20 | bps QoQ | bps YoY | 12M21 | 12M20 | bps YoY | ||||

| Net interest margin | 4.46 | 4.64 | 4.50 | (18) | (4) | 4.51 | 4.71 | (20) | ||||

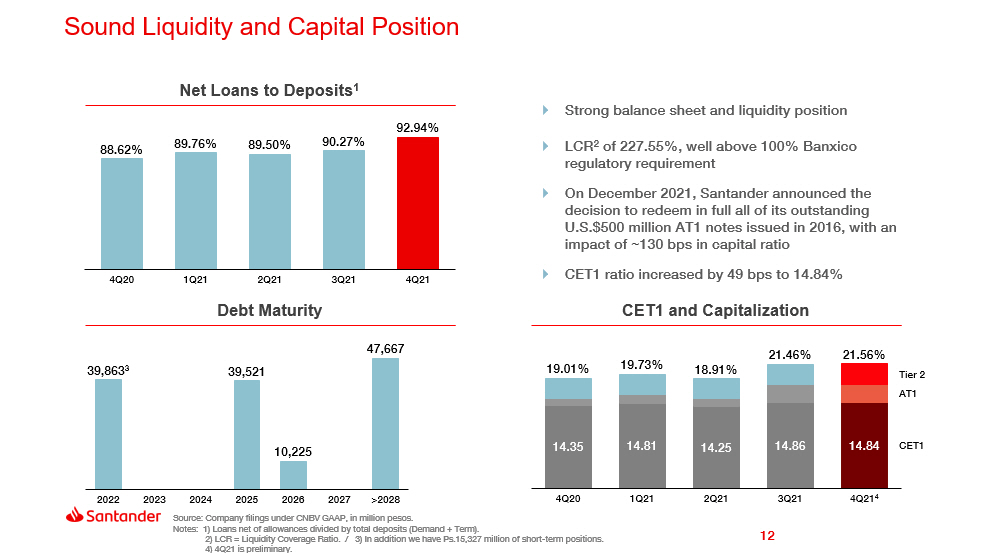

| Net loans to deposits ratio | 92.94 | 90.27 | 88.62 | 267 | 432 | 92.94 | 88.62 | 432 | ||||

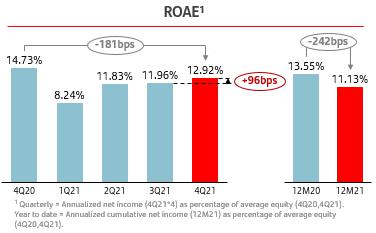

| ROAE | 12.92 | 11.96 | 14.73 | 96 | (181) | 11.13 | 13.55 | (242) | ||||

| ROAA | 1.20 | 1.10 | 1.34 | 10 | (14) | 1.03 | 1.23 | (20) | ||||

| Efficiency ratio | 56.00 | 50.97 | 52.06 | 503 | 394 | 50.39 | 46.06 | 433 | ||||

| Capital ratio | 21.56 | 21.46 | 19.01 | 10 | 255 | 21.56 | 19.01 | 255 | ||||

| NPLs ratio | 2.18 | 2.85 | 3.08 | (67) | (90) | 2.18 | 3.08 | (90) | ||||

| Cost of Risk | 2.90 | 2.75 | 2.89 | 15 | 1 | 2.90 | 2.89 | 1 | ||||

| Coverage ratio | 141.38 | 117.56 | 116.87 | — | — | 141.38 | 116.87 | — | ||||

| Operating Data | Dec-21 | Sep-21 | Dec-20 | %QoQ | %YoY | Dec-21 | Dec-20 | %YoY | ||||

| Branches | 1,036 | 1,039 | 1,013 | (0.3) | 2.3 | 1,036 | 1,013 | 2.3 | ||||

| Branches and offices2 | 1,346 | 1,350 | 1,350 | (0.3) | (0.3) | 1,346 | 1,350 | (0.3) | ||||

| ATMs | 9,498 | 9,564 | 9,448 | (0.7) | 0.5 | 9,498 | 9,448 | 0.5 | ||||

| Customers | 19,592,102 | 19,470,357 | 18,707,976 | 0.6 | 4.7 | 19,592,102 | 18,707,976 | 4.7 | ||||

| Employees | 25,276 | 24,901 | 21,183 | 1.5 | 19.3 | 25,276 | 21,183 | 19.3 |

| 1) | Accumulated EPS, net of treasury shares (compensation plan) and discontinued operations. Calculated by using weighted number of shares. |

| 2) | Includes cash desks (espacios select, box select and corner select) and SMEs business centers. Excluding brokerage house offices. |

Earnings Release | 4Q.2021 |  |

Banco Santander México | |

| 2 |

II. CEO Message

Héctor Grisi, Banco Santander México’s Executive President and CEO, commented: “During the fourth quarter, we maintained a strong balance sheet and liquidity position. We also started to see strengthening loan volumes, mostly boosted by commercial loans, with corporate loans increasing nearly 18% year-over-year while government loans grew 14%. Our individual loans continue outpacing the market, supported by sustained market share gains in mortgages and auto loans. In the consumer segment, we have been seeing signs of a solid sequential recovery, especially in credit cards, as economic activity starts to gather momentum. The segment was also helped by effective cross-selling within our commercial network and by promotional campaigns that we launched throughout the year.

Our deposits continue growing at a solid pace, while our funding mix improves as we favor demand over term deposits. In fact, our current deposit mix, with 72% demand and 28% term, is one of the best blends we have ever achieved. Also, it is worth highlighting that the contribution of individuals has increased considerably in both demand and term deposits. Currently, the contribution of individuals in total deposits represents close to 39%. Additionally, both our individual and corporate demand deposits are still expanding at high single-digit rates versus fourth quarter 2020, underscoring the success of our loyalty and customer acquisition strategies as well as our focus on lowering funding costs even further.

NPLs maintained their downward trend, reaching levels not seen since early 2020, reflecting our prudent risk management and resulting in a healthier loan portfolio. As Mexico’s economic activity picks up and our operating environment gains traction, we are pointing to more normalized levels of provisions and cost of risk, and therefore to further improvements in asset quality.

We ended another year during which we again faced the enormous, unpredictable and myriad challenges of the pandemic. Yet we remained resolute, quickly adapting and continuing to support many customers and businesses. As we enter the new year, we continue executing our strategy to strengthen client loyalty and further digitalize our products and operations, with the same ambition to become the bank that provides the best customer experience in Mexico. We also continue implementing many other growth initiatives, making new investments in our bank’s transformation, mainly in IT and digitalization, while seeking higher efficiency levels across business lines. Although we made additional progress this year, we are mindful that we must accelerate the pace of transformation.”

Earnings Release | 4Q.2021 |  |

Banco Santander México | |

| 3 |

III. Summary of 4Q21 Consolidated Results

Loan portfolio

Banco Santander México’s total loan portfolio, as of December 2021, increased 6.9% YoY, or Ps.48,197 million, to Ps.750,966 million, and 4.9%, or Ps.35,207 million, on a sequential basis.

During the quarter, total loan portfolio reflected strong YoY growth, supported by sustained market share gains in mortgages and auto loans. While loan volumes in the commercial portfolio were driven by a pick-up in corporate and government lending.

Deposits

Deposits, which represent 82.5% of Banco Santander México’s total funding1, increased 2.4% YoY in December 2021. In turn, demand deposits increased 9.0% YoY, while time deposits decreased 11.3% YoY, as lower interest rates made customers favor short term liquidity and supported by the Bank’s efforts to improve funding mix. On a sequential basis, demand deposits remained flat, while time deposits grew 8.0%, driven by recent hikes in the reference rate over the last couple of months of 2021. It is worth noting that demand deposits from individuals increased 8.0% YoY, supported by the Bank’s ongoing efforts to attract this type of deposits, in line with the strategy of focusing on prioritizing individual deposits and foregoing certain expensive corporate deposits.

In December 2021, demand deposits from individuals represented 36.8% of total demand deposits, compared with 37.1% in December 2020. Time deposits from individuals represented 43.4% of total time deposits, compared with 37.4% a year ago.

The loans-to-deposits ratio stood at 92.94% in December 2021, which compares to 88.62% in December 2020, and 90.27% in September 2021, maintaining a sound funding position.

_____________________

1 Total funding includes: deposits, credit instruments issued, bank and other loans and subordinated credit notes.

Earnings Release | 4Q.2021 |  |

Banco Santander México | |

| 4 |

Net income

Banco Santander México reported 4Q21 net income of Ps.5,245 million, representing a decrease of 4.3% YoY, and an increase of 8.3% sequentially. The YoY decrease was mainly due to higher expenses and provisions for loan losses, partially offset by a lower effective tax rate, solid growth in market related income and higher other operating income. On a cumulative basis, net income for 12M21 reached Ps.18,080 million, representing a 10.3% YoY decrease.

| Net income statement | |||||||||||

| Million pesos | % Variation | % Variation | |||||||||

| 4Q21 | 3Q21 | 4Q20 | QoQ | YoY | 12M21 | 12M20 | 21/20 | ||||

| Net interest income | 16,046 | 15,684 | 16,272 | 2.3 | (1.4) | 63,085 | 65,188 | (3.2) | |||

| Provisions for loan losses | (4,289) | (4,385) | (3,152) | (2.2) | 36.1 | (20,817) | (21,263) | (2.1) | |||

| Net interest income after provisions for loan losses | 11,757 | 11,299 | 13,120 | 4.1 | (10.4) | 42,268 | 43,925 | (3.8) | |||

| Commission and fee income, net | 4,760 | 4,447 | 4,709 | 7.0 | 1.1 | 18,982 | 18,694 | 1.5 | |||

| Net gain (loss) on financial assets and liabilities | 1,342 | 1,474 | 723 | (9.0) | 85.6 | 5,031 | 6,181 | (18.6) | |||

| Other operating income | 416 | (514) | (379) | — | — | (1,304) | (1,232) | 5.8 | |||

| Administrative and promotional expenses | (12,636) | (10,750) | (11,102) | 17.5 | 13.8 | (43,235) | (40,915) | 5.7 | |||

| Operating income | 5,639 | 5,956 | 7,071 | (5.3) | (20.3) | 21,742 | 26,653 | (18.4) | |||

| Equity in results of associated companies | 30 | 43 | 79 | (30.2) | (62.0) | 200 | 178 | 12.4 | |||

| Operating income before income taxes | 5,669 | 5,999 | 7,150 | (5.5) | (20.7) | 21,942 | 26,831 | (18.2) | |||

| Income taxes (net) | (424) | (1,156) | (1,670) | (63.3) | (74.6) | (3,862) | (6,677) | (42.2) | |||

| Net income | 5,245 | 4,843 | 5,480 | 8.3 | (4.3) | 18,080 | 20,154 | (10.3) | |||

| Effective tax rate (%) | 7.48 | 19.27 | 23.36 | 17.60 | 24.89 | ||||||

4Q21 vs 4Q20

The 4.3% year-on-year decrease in net income was principally driven by:

| i) | A 13.8%, or Ps.1,534 million, increase in administrative and promotional expenses, mainly due to increases in personnel expenses and higher technology services expenses, partly offset by a decrease in taxes and duties. The increase in personal expenses, was due to a change in Mexican legislation regarding the profit sharing benefit (PTU), that required an additional charge of Ps.959 million, hiring of employees that were previously outsourced and by a general salary increase; |

| ii) | A 36.1%, or Ps.1,137 million, increase in provisions for loan losses, reflecting a low base in 4Q20; |

| iii) | A 1.4%, or Ps.226 million, decrease in net interest income, reflecting a combination of lower interest income from credit cards and investments in securities and higher interest expenses for deposits, partially compensated by higher interest income from the loan portfolio – excluding credit cards; and |

Earnings Release | 4Q.2021 |  |

Banco Santander México | |

| 5 |

| iv) | A 62.0%, or Ps.49 million, decrease in the results of associated companies due to the recognition of GetNet México investment. |

The decrease in net income was partially offset by:

| i) | A 74.6%, or Ps.1,246 million, decrease in income taxes, which resulted in a 7.48% effective tax rate for the quarter, compared to 23.36% in 4Q20, due to a higher than expected inflation; |

| ii) | A Ps.795 million, increase in other operating income, mostly resulting by income from sale of acquiring business contracts, lower premiums paid on guarantees for the SMEs loan portfolio and higher other income, partially offset by lower cancellation of liabilities and reserves; |

| iii) | A 85.6%, or Ps.619 million, increase in net gains on financial assets and liabilities, as the Bank was able to capitalize on rising interest rates coupled with exchange rate volatility; and |

| iv) | A 1.1%, or Ps.51 million, increase in net commissions and fees, mainly due to increases in financial advisory services, insurance fees, collection services, foreign trade, investment funds, account management and lower banks correspondents commissions, partly offset by a decrease in debit and credit card fees, purchase-sale of securities and money market and an increase in other commissions and fees paid. |

12M21 vs 12M20

The 10.3% year-on-year decrease in net income was principally driven by:

| i) | A 5.7%, or Ps.2,320 million, increase in administrative and promotional expenses, mainly due to increases in personnel expenses, technology services expenses and depreciation and amortization, partly offset by decreases in other expenses, taxes and duties and professional fees. The increase in personal expenses, was due to a change in Mexican legislation regarding the PTU payment, that required an additional charge of Ps.959 million, hiring of employees that were previously outsourced and by a general salary increase; |

| ii) | A 3.2%, or Ps.2,103 million, decrease in net interest income, due to lower interest income from total loan portfolio – including credit cards and investment in securities, partially compensated by lower deposit costs; |

| iii) | A 18.6%, or Ps.1,150 million, decrease in net gains on financial assets and liabilities, mostly resulting of a higher base in 2020, due to extraordinary gains related to the sale of certain securities to strengthen the Bank’s liquidity position; and |

| iv) | A 5.8%, or Ps.72 million, increase in other operating expenses, mostly resulting from lower cancellation of liabilities and reserves, higher legal expenses and costs related to portfolio recoveries, lower profit from sale of foreclosed assets and lower interest on personnel loans, partly offset by income from sale of acquiring business contracts. |

The decrease in net income was partially offset by:

| i) | A 42.2%, or Ps.2,815 million, decrease in income taxes, which resulted in a 17.60% effective tax rate in 12M21, compared to 24.89% in 12M20, due to a higher inflation; |

| ii) | A 2.1%, or Ps.446 million, decrease in provisions for loan losses, as the Bank continues moving toward a more normalized operating environment; |

| iii) | A 1.5%, or Ps.288 million, increase in net commissions and fees, mainly due to increases in insurance fees, investment funds, collection services, financial advisory services and foreign trade, partly offset by a decrease in debit and credit card fees and an increase in other commissions and fees paid; and |

| iv) | A 12.4%, or Ps.22 million, increase in the results of associated companies due to the recognition of GetNet México investment. |

Earnings Release | 4Q.2021 |  |

Banco Santander México | |

| 6 |

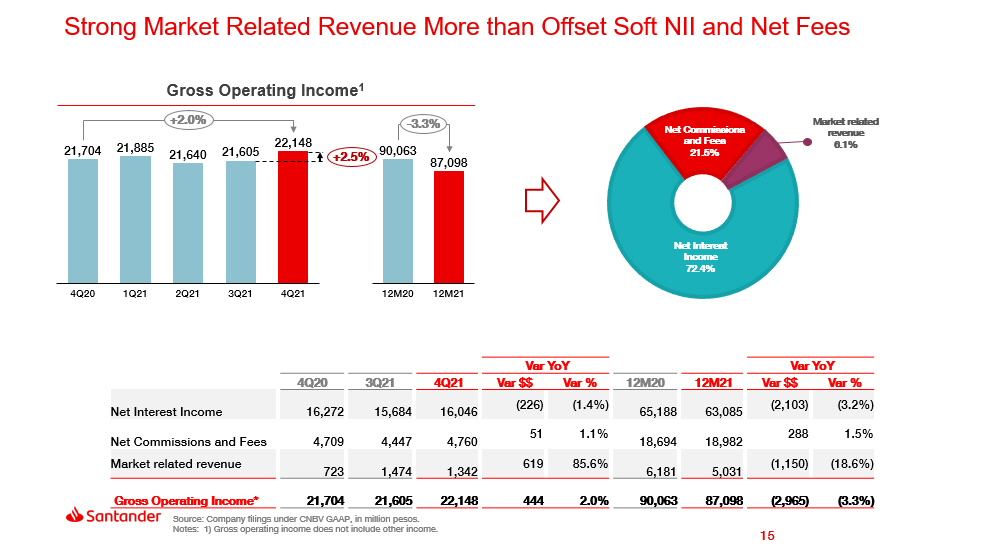

Gross operating income

Banco Santander México’s gross operating income for 4Q21 totaled Ps.22,148 million, representing an increase of 2.0% YoY, or Ps.444 million, and 2.5% QoQ, or Ps.543 million. The YoY increase was mainly due to solid performance in market related income and higher net commissions and fees income, partially offset by soft net interest income. Gross operating income for 12M21 amounted Ps.87,098 million, decreasing 3.3% YoY, or Ps.2,965 million.

Gross operating income is broken down as follows.

| Breakdown gross operating Income (%) | |||||||||||

| Variation (bps) | Variation (bps) | ||||||||||

| 4Q21 | 3Q21 | 4Q20 | QoQ | YoY | 12M21 | 12M20 | YoY | ||||

| Net Interest Income | 72.45 | 72.59 | 74.97 | (14) | (252) | 72.43 | 72.38 | 5 | |||

| Net Commissions and Fees | 21.49 | 20.59 | 21.70 | 90 | (21) | 21.79 | 20.76 | 103 | |||

| Market related revenue | 6.06 | 6.82 | 3.33 | (76) | 273 | 5.78 | 6.86 | (108) | |||

| Gross Operating Income* | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | ||||||

*Does not include other income

Return on average equity (ROAE)

ROAE for 4Q21 decreased 181 basis points to 12.92%, from 14.73% reported in 4Q20 and increased 96 basis points from 11.96% in 3Q21. For 12M21, ROAE stood at 11.13%, 242 basis points lower than the 13.55% reported in 12M20. The ROAE was impacted by an environment of limited growth in volumes, along with lower interest rates and higher provisions as a result of the additional reserves that the Bank had to build during 2021. The Bank continues accumulating capital per regulator’s recommendation to limit the pay out dividend of 2019 and 2020 earnings. In this regard, on November, 2021 the Bank paid a cash dividend of Ps.1,867 million, or Ps.0.28 per share.

Earnings Release | 4Q.2021 |  |

Banco Santander México | |

| 7 |

Strategic initiatives and commercial actions

Banco Santander Mexico is one of the leading financial groups in the country, focused on business transformation and innovation. In this uncertain and highly competitive environment, digital technology is transforming markets. Therefore, investing in technology puts Banco Santander Mexico at the forefront of the industry and strengthens its value proposition. The Bank's strategic priority is to simplify its processes faster, launch innovative products and services and the overall customer experience to attract potential customers while building a stronger franchise to effectively address the challenges and continue to be a major player in the market.

The most relevant aspects of the fourth quarter are highlighted below:

| Ø | The Bank’s strategic priorities are complemented by a new breadth of products and services, which will allow it to cater to its customers more comprehensively. |

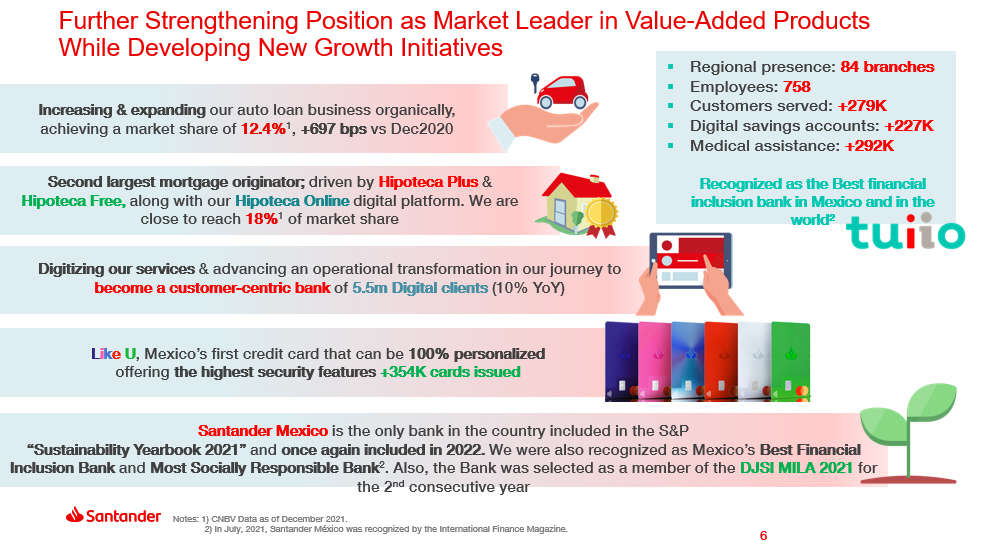

| § | The “LikeU” credit card, which is our latest credit card, the first in Mexico with “on-demand services” and with the highest security specifications, is having good market acceptance. Since its launch in early September, the Bank has issued +354 thousand Like U cards and 76% of active cards record at least one purchase. Through this new offer, Banco Santander Mexico strongly believes that will be almost doubling the acquisition of new accounts in 2022, helping to grow steadily and organically the portfolio in a more profitable way. |

| § | The Bank continued promoting referrals to digital channels through campaigns and incentives aimed at customers. During “El Buen Fin” in Mexico and the Christmas holiday season, several benefits were offered when using the Like U credit card, seeking greater adoption of the new card. |

| § | The bank is working on reinforcing its loans through ATMs by creating a secure and digital experience for customers; with only a debit card and the PIN access clients can acquire new loans. As of 4Q21, ATMs are placing 1 out of 10 new credits. |

| § | In line with the Bank's strategy, a new pre-approved payroll loan was launched so that customers can have an advanced payment for up to 5 - 8 thousand pesos, which will be deducted through their payroll without any interest. With this new offer, added to those already existing in the payroll plan, Banco Santander Mexico estimates that it will be increasing the acquisition of new payroll accounts by 500 thousand by year-end, contributing to the organic growth of the segment, without living aside prudent risk management. |

| § | The Bank announced the alliance with the National Chamber of the Restaurant and Spicy Food Industry (CANIRAC as per its acronym in Spanish) seeking to support the recovery of the restaurant sector through loan offers, POS terminals and other banking products that are expected to impact the 15 thousand members and more than 60 delegations distributed throughout the country. |

| § | The Bank established a new direct communication channel called Santander Whatsapp as part of the digital service strategy and because customers’ needs are evolving. |

| § | Santander Mexico will investment Ps.11 billion by 2022 in infrastructure and digital development as part of the Bank’s ongoing investment program. This is the largest amount for a single year in technology in the Bank's history. |

| § | This quarter, Santander increased its market share in auto loans by 204 bps QoQ to +12% (as of December) maintaining the 4th position in the market. All this thanks to the alliances that the bank has with Honda, Mazda, Tesla, Suzuki and Peugeot, together with Super Auto Santander, a platform that integrates the commercial and insurance offering in one place, allowing to offer an online pre-approval in less than 10 minutes. |

| § | The consolidation of the Hipoteca Online digital platform continued, being the only platform in Mexico that connects all processes end to end. In the quarter, the platform processed 95% of transactions digitally, which helped the Bank to consolidate as the second largest mortgage originator in the market. As of 4Q21, around 56% of originations came through Hipoteca Plus, which helps to drive cross-selling products, and 40% through Hipoteca Free. Santander continues to be the only bank in Mexico that offers a tailored interest rate based on the client's profile. |

Earnings Release | 4Q.2021 |  |

Banco Santander México | |

| 8 |

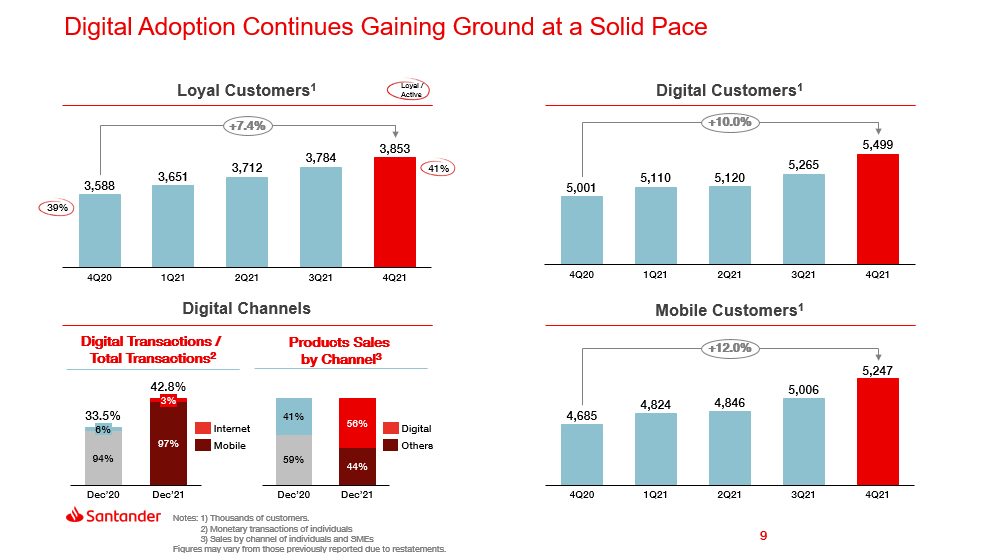

| § | The Bank continues to increase the number of its digital and mobile clients by 10% and 12% YoY, respectively. Besides, the ratio of loyal customers continues to grow, now loyal clients represent 41% of active clients (vs 39% in the fourth quarter of 2020). Moreover, digital transactions now account for almost 43% of total transactions, increasing 9.3 pp compared to December 2020. As of December 2021, 56% of product sales were made through digital channels, compared to 41% a year ago. |

| Customers | ||||||

| (Thousands) | % Variation | |||||

| Dec-21 | Sep-21 | Dec-20 | QoQ | YoY | ||

| Loyal Customers1 | 3,853 | 3,784 | 3,588 | 1.8 | 7.4 | |

| Digital Customers2 | 5,499 | 5,265 | 5,001 | 4.4 | 10.0 | |

| Mobile Customers3 | 5,247 | 5,006 | 4,685 | 4.8 | 12.0 | |

1 Loyal customers = Clients with non-zero balance and depending on the segment should have between two and four products and between three and ten transactions in the last 90 days.

2 Digital customers = Clients with at least one digital transaction per month in SuperNet or SuperMóvil.

3 Mobile customers = Clients using Supermóvil and/or Superwallet in the last 30 days.

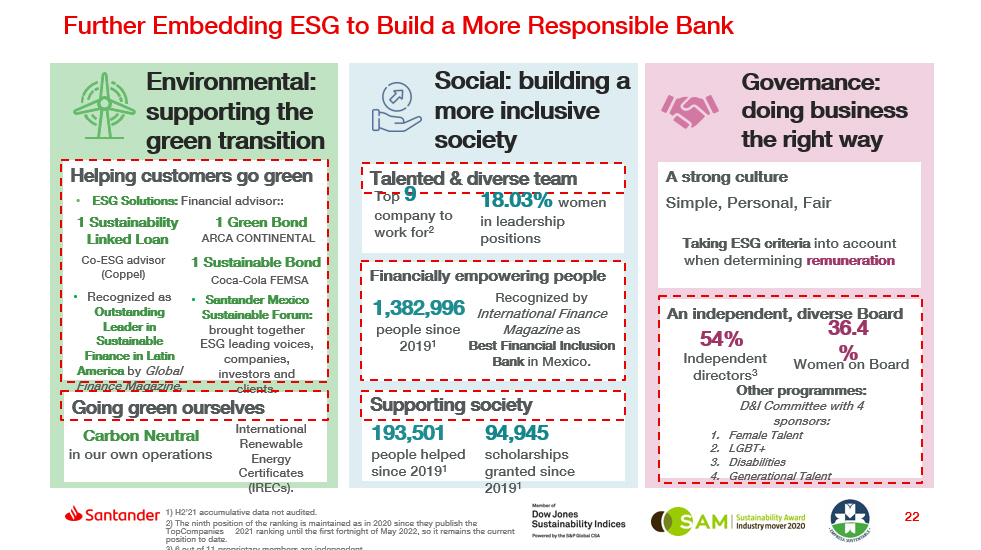

Responsible Banking

For Santander, being sustainable means taking into account the communities (individuals and companies) where we are present, in order to generate continuous and profitable social progress at an economic, environmental and ethical level.

We are committed to integrating into our operation the criteria, policies and internal processes that guarantee the care of the social and environmental aspects that demand of us, both sustainability and the 2030 Agenda for Sustainable Development.

The Bank seeks to become a leading participant in contributing to the progress of people and companies in Mexico and in the world. On this regard, it works on two main challenges: New Business Environment and Inclusive and Sustainable Growth.

The objective of the New Business Environment is for Santander employees to feel in a responsible, simple, diverse and inclusive work environment, where leadership and commitment follow the Simple, Personal and Fair culture, while designing products focused on the client.

The goal to achieve an Inclusive and Sustainable Growth aims to invest in the Bank’s community, financially empowering people, supporting higher education through scholarships and leaving a minimal environmental footprint while incentivizing ESG products across all business units.

At Grupo Santander, sustainability is made up of four pillars that mark the path of all our actions: Economic, Social, Environmental, Ethical and Corporate Governance.

For more details, please visit the Responsible Banking section in the investor relations website.y

As a result of these efforts, Banco Santander Mexico has achieved the following recognitions:

| · | In February 2022, Banco Santander Mexico was included for the second consecutive year in the S&P “Sustainability Yearbook 2022”. |

| · | In November 2021, Banco Santander Mexico was selected as a member of the Dow Jones Sustainability MILA Pacific Alliance Index (DJSI MILA 2021) for the second consecutive year. |

| · | In August 2021, the Bank was recognized as an Outstanding Leader in Sustainable Finance in Latin America by Global Finance Magazine. |

| · | In July 2021, International Finance Magazine recognized Santander Mexico as the Best Financial Inclusion Bank in the country and as the Most Socially Responsible Bank in Mexico. |

| · | In February 2021, Santander Mexico was the only bank in the country included in the S&P “Sustainability Yearbook 2021”. Additionally, the Bank obtained the “Industry Mover” emblem, for surpassing the score obtained in 2020 and presenting the strongest improvement in the financial sector. |

Earnings Release | 4Q.2021 |  |

Banco Santander México | |

| 9 |

| · | In 2021, Tuiio by Santander has been recognized as an outstanding practice to end poverty in Mexico within the study carried out by Mexico Global Compact, which pursues the 17 Sustainable Development Goals proposed by the 2030 Agenda of the United Nations. |

| · | In 2021, Laura Diez Barroso, Chairman of the Board of Directors of Santander Mexico, was named as one of "The 100 most powerful women in business" by Expansión within the framework of International Women's Day. In addition, Mrs. Diez Barroso participated in the signing of the commitment of banking to reduce the gender gap in the financial system in Mexico. |

| · | In 2020, it was included as constituted on the new S&P/BMV Total Mexico ESG Index, which replaced the IPC Sustainability Index, of which the Bank was part for seven consecutive years since 2013. |

| · | The Bank was part of the FTSE4Good Index from 2018 to 2021. |

| · | Santander Private Banking, Best Private Banking according to Euromoney since 2017. |

| · | Member of the United Nations Global Compact since 2012. |

| · | Santander Mexico holds an ISO 14001:2015 certification since 2004. |

| · | It has had a Responsible Banking recognition since 2004 by ESR (Empresa Socialmente Responsible by its acronym in Spanish). |

These indexes and recognitions evaluate the Bank’s performance across economic, environmental and social issues.

These are only some examples of the Bank’s effort to become a more responsible bank. For further information about Banco Santander México as a Responsible Bank go to:

https://servicios.santander.com.mx/comprometidos/eng/index.php

Earnings Release | 4Q.2021 |  |

Banco Santander México | |

| 10 |

IV. Analysis of 4Q21 Consolidated Results

(Amounts expressed in millions of pesos, except where otherwise stated)

Loan portfolio

The evolution of the total loan portfolio showed a strong YoY growth, outpacing the market, supported by sustained market share gains in mortgages and auto loans. While loan volumes in the commercial portfolio were driven by a pick-up in corporate and government lending. As a result, the total loan portfolio increased 6.9% YoY, or Ps.48,197 million, to Ps.750,966 million in December 2021. On a sequential basis, total loan portfolio increased 4.9%, or Ps.35,207 million.

| Portfolio Breakdown | ||||||

| Million pesos | % Variation | |||||

| Dec-21 | Sep-21 | Dec-20 | QoQ | YoY | ||

| Commercial | 435,364 | 411,419 | 414,186 | 5.8 | 5.1 | |

| Middle-market | 200,834 | 200,885 | 194,058 | (0.0) | 3.5 | |

| Corporates | 84,447 | 68,033 | 71,641 | 24.1 | 17.9 | |

| SMEs | 55,787 | 56,853 | 65,371 | (1.9) | (14.7) | |

| Government & Financial Entities | 94,296 | 85,648 | 83,116 | 10.1 | 13.5 | |

| Individuals | 315,602 | 304,340 | 288,583 | 3.7 | 9.4 | |

| Consumer | 121,762 | 116,066 | 115,712 | 4.9 | 5.2 | |

| Credit cards | 53,405 | 50,454 | 53,809 | 5.8 | (0.8) | |

| Other consumer | 68,357 | 65,612 | 61,903 | 4.2 | 10.4 | |

| Mortgages | 193,840 | 188,274 | 172,871 | 3.0 | 12.1 | |

| Total | 750,966 | 715,759 | 702,769 | 4.9 | 6.9 | |

The commercial loan portfolio is comprised of loans to business and commercial entities, as well as loans to government entities and financial institutions, and represented 58.0% of the total loan portfolio. Excluding loans to government entities and financial institutions, the commercial loan portfolio accounted for 45.4% of the total. Middle-market, Corporate and SME loans represented 26.8%, 11.2% and 7.4% of the total loan portfolio, respectively.

The individuals loan portfolio, comprised of mortgages, consumer and credit card loans, represented 42.0% of the total loan portfolio. Mortgage, consumer and credit card loans, represented 25.8%, 9.1% and 7.1% of the total loan portfolio, respectively.

Earnings Release | 4Q.2021 |  |

Banco Santander México | |

| 11 |

| Loan portfolio breakdown | ||||||||

| Million pesos | ||||||||

| Dec-21 | % | Sep-21 | % | Dec-20 | % | |||

| Performing loans | ||||||||

| Commercial | 430,969 | 57.4 | 404,239 | 56.5 | 407,941 | 58.0 | ||

| Individuals | 303,606 | 40.4 | 291,144 | 40.7 | 273,188 | 38.9 | ||

| Consumer | 117,995 | 15.7 | 111,992 | 15.6 | 108,173 | 15.4 | ||

| Credit cards | 51,502 | 6.9 | 48,346 | 6.8 | 49,793 | 7.1 | ||

| Other consumer | 66,493 | 8.9 | 63,646 | 8.9 | 58,380 | 8.3 | ||

| Mortgages | 185,611 | 24.7 | 179,152 | 25.0 | 165,015 | 23.5 | ||

| Total performing loans | 734,575 | 97.8 | 695,383 | 97.2 | 681,129 | 96.9 | ||

| Non-performing loans | ||||||||

| Commercial | 4,395 | 0.6 | 7,180 | 1.0 | 6,245 | 0.9 | ||

| Individuals | 11,996 | 1.6 | 13,196 | 1.8 | 15,395 | 2.2 | ||

| Consumer | 3,767 | 0.5 | 4,074 | 0.6 | 7,539 | 1.1 | ||

| Credit cards | 1,902 | 0.3 | 2,108 | 0.3 | 4,016 | 0.6 | ||

| Other consumer | 1,865 | 0.2 | 1,966 | 0.3 | 3,523 | 0.5 | ||

| Mortgages | 8,229 | 1.1 | 9,122 | 1.3 | 7,856 | 1.1 | ||

| Total non-performing loans | 16,391 | 2.2 | 20,376 | 2.8 | 21,640 | 3.1 | ||

| Total loan portfolio | ||||||||

| Commercial | 435,364 | 58.0 | 411,419 | 57.5 | 414,186 | 58.9 | ||

| Individuals | 315,602 | 42.0 | 304,340 | 42.5 | 288,583 | 41.1 | ||

| Consumer | 121,762 | 16.2 | 116,066 | 16.2 | 115,712 | 16.5 | ||

| Credit cards | 53,405 | 7.1 | 50,454 | 7.0 | 53,809 | 7.7 | ||

| Other consumer | 68,357 | 9.1 | 65,612 | 9.2 | 61,903 | 8.8 | ||

| Mortgages | 193,840 | 25.8 | 188,274 | 26.3 | 172,871 | 24.6 | ||

| Total loan portfolio | 750,966 | 100.0 | 715,759 | 100.0 | 702,769 | 100.0 |

As of December 2021, commercial loans increased 5.1% YoY, or Ps.21,178 million, due to increases of 17.9%, or Ps.12,806 million in corporate loans, 16.7%, or Ps.12,227 million in government entities loans and 3.5%, or Ps.6,775 million in middle-market loans. Meanwhile, SMEs and financial institutions loans, decreased, 14.7% YoY, or Ps.9,583 million and 10.4% YoY,or Ps.1,047 million, respectively. The YoY increase, reflected a pick-up in corporate and government loans, while middle-market and SMEs loans remained soft. Sequentially, commercial loans increased 5.8% or Ps.23,945 million.

Mortgage loans continued showing robust growth, increasing 12.1% YoY, or Ps.20,969 million and 3.0%, or Ps.5,566 million sequentially. The “Hipoteca Plus” product remains a main driver behind this strong performance, accounting for 56% of total mortgage origination in the quarter, which also helps the Bank to increase cross-selling of other products, as well as build customer loyalty. In addition, the digital onboarding platform for mortgages, “Hipoteca Online”, has allowed the Bank to be more efficient in terms of response times and eliminating the need for our customers to visit a branch, all resulting in a much better customer experience. During 4Q21, 95% of the mortgages were processed through this digital platform. However, the total mortgage loan portfolio is still affected by the run-off of acquired portfolios, excluding this effect, the mortgage portfolio would have increased 15.9% YoY.

It is worth noting that auto loans continued showing a strong performance, increasing 2.2x in December 2021 with respect to December 2020 and a 20.4%, or Ps.3,086 million, sequentially. This was a result of the Bank’s alliances with leading automakers, such as Honda, Mazda, Suzuki, Peugeot and Tesla, among others, togheter with “Super Auto Santander” platform. According to the last information published by CNBV, as of December 2021, market share in this business was 12.4% vs. 5.4% a year ago.

Credit card loans contracted 0.8% YoY, or Ps.404 million, and increased 5.8% QoQ, or Ps.2,951 million, reflecting an average usage increase of 16.6% YoY, and a 17.0% QoQ, the sequential growth was due to the Bank’s latest product “Like U” and higher billing, that resulted mainly from the campaign “El Buen Fin”. While, personal and payroll loans decreased 18.1% YoY, or Ps.3,044 million, and 2.0% YoY, or Ps.717 million, respectively, still affected by weak demand conditions and the Bank’s cautious approach.

Earnings Release | 4Q.2021 |  |

Banco Santander México | |

| 12 |

Total Deposits

Total deposits in December 2021 stood at Ps.783,118 million, an increase of 2.4% YoY, or Ps.18,674 million. On a sequential basis, total deposits grew 2.2%, or Ps.16,782 million. Demand deposits reached Ps.563,834 million, increasing 9.0% YoY, or Ps.46,593 million, while time deposits decreased 11.3% YoY, or Ps.27,919 million, as lower interest rates made customers favor short term liquidity and supported by the Bank’s efforts to improve funding mix. On a sequential basis, demand deposits remained flat, while time deposits increased 8.0% QoQ, or Ps.16,320 million. Deposits from individuals expanded 6.3% YoY, or Ps.18,002 million, and from corporates 0.1% YoY, or Ps.672 million. The Bank continues working on the strategy focused on prioritizing individual deposits and foregoing certain expensive corporate deposits.

Net interest income

| Net interest income | |||||||||||

| Million pesos | % Variation | % Variation | |||||||||

| 4Q21 | 3Q21 | 4Q20 | QoQ | YoY | 12M21 | 12M20 | 21/20 | ||||

| Interest on funds available | 416 | 398 | 464 | 4.5 | (10.3) | 1,554 | 2,303 | (32.5) | |||

| Interest on margin accounts | 88 | 76 | 66 | 15.8 | 33.3 | 289 | 412 | (29.9) | |||

| Interest and yield on securities | 6,020 | 5,164 | 6,398 | 16.6 | (5.9) | 23,162 | 25,347 | (8.6) | |||

| Interest and yield on loan portfolio – excluding credit cards | 15,870 | 15,150 | 15,347 | 4.8 | 3.4 | 60,695 | 67,347 | (9.9) | |||

| Interest and yield on loan portfolio related to credit cards | 3,170 | 3,037 | 3,463 | 4.4 | (8.5) | 12,175 | 14,373 | (15.3) | |||

| Commissions collected on loan originations | 143 | 143 | 137 | 0.0 | 4.4 | 573 | 554 | 3.4 | |||

| Interest and premium on sale and repurchase agreements and securities loans | 1,141 | 981 | 666 | 16.3 | 71.3 | 3,546 | 3,938 | (10.0) | |||

| Interest income | 26,848 | 24,949 | 26,541 | 7.6 | 1.2 | 101,994 | 114,274 | (10.7) | |||

| Daily average interest- earnings assets | 1,440,592 | 1,351,207 | 1,445,012 | 6.6 | (0.3) | 1,399,528 | 1,384,965 | 1.1 | |||

| Interest from customer deposits – demand deposits | (2,224) | (2,141) | (1,773) | 3.9 | 25.4 | (7,806) | (8,902) | (12.3) | |||

| Interest from customer deposits – time deposits | (2,403) | (2,119) | (2,626) | 13.4 | (8.5) | (8,939) | (14,956) | (40.2) | |||

| Interest from credit instruments issued | (1,231) | (1,114) | (1,268) | 10.5 | (2.9) | (4,755) | (4,647) | 2.3 | |||

| Interest on bank and other loans | (593) | (491) | (662) | 20.8 | (10.4) | (2,078) | (3,429) | (39.4) | |||

| Interest on subordinated capital notes | (427) | (411) | (422) | 3.9 | 1.2 | (1,668) | (1,767) | (5.6) | |||

| Interest and premium on sale and repurchase agreements and securities loans | (3,924) | (2,989) | (3,518) | 31.3 | 11.5 | (13,663) | (15,385) | (11.2) | |||

| Interest expense | (10,802) | (9,265) | (10,269) | 16.6 | 5.2 | (38,909) | (49,086) | (20.7) | |||

| Daily average interest-bearing liabilities | 1,264,541 | 1,189,088 | 1,299,562 | 6.3 | (2.7) | 1,242,346 | 1,240,686 | 0.1 | |||

| Net interest income | 16,046 | 15,684 | 16,272 | 2.3 | (1.4) | 63,085 | 65,188 | (3.2) | |||

Earnings Release | 4Q.2021 |  |

Banco Santander México | |

| 13 |

Net interest income in 4Q21 totaled Ps.16,046 million, decreasing 1.4% YoY, or Ps.226 million, and increasing 2.3% QoQ, or Ps.362 million.

The 1.4% YoY decrease in net interest income resulted from the combination of:

| i) | A 1.2%, or Ps.307 million, increase in interest income, to Ps.26,848 million, which resulted from the combined effect of a 10 basis points increase in the average interest rate received and a 0.3%, or Ps.4,421 million, decrease in average interest-earning assets; and |

| ii) | A 5.2%, or Ps.533 million, increase in interest expense, to Ps.10,802 million, stemming from a 25 basis points increase in the average interest rate paid and a 2.7%, or Ps.35,021 million, decrease in interest-bearing liabilities. |

The net interest margin ratio (NIM), calculated using daily average interest-earning assets for 4Q21, stood at 4.46%, compared to 4.50% in 4Q20 and 4.64% in 3Q21. The YoY decrease in NIM was principally driven by a combination of lower interest income from investments in securities and higher interest expenses for demand deposits, partially compensated by lower interest expense for time deposits. On a cumulative basis, NIM for 12M21 reached 4.51%, a decrease of 20 basis points from 12M20.

Interest Income

Total average interest earning assets in 4Q21 amounted to Ps.1,440,592 million, decreasing 0.3% YoY, or Ps.4,421 million, mainly driven by decreases of 39.9% YoY, or Ps.50,567 million, in the average amount of funds available and a 41.5%, or Ps.13,798 million, in margin accounts, partly offset by increases of 59.5%, or Ps.36,869 million, in repurchase agreement, 1.9%, or Ps.13,681 million, in the average loan portfolio and a 1.8%, or Ps.9,394 million, in the average amount of investment in securities. Banco Santander México’s interest earning assets are broken down as follows:

| Average Assets (Interest-Earnings Assets) | |||||

| Breakdown (%) | |||||

| 4Q20 | 1Q21 | 2Q21 | 3Q21 | 4Q21 | |

| Loan portfolio | 49.2 | 49.7 | 50.6 | 52.6 | 50.3 |

| Investment in securities | 35.4 | 36.3 | 33.1 | 29.1 | 36.2 |

| Funds available | 8.8 | 8.1 | 8.8 | 10.5 | 5.3 |

| Repurchase agreements | 4.3 | 3.9 | 6.1 | 6.5 | 6.9 |

| Margin accounts | 2.3 | 2.0 | 1.4 | 1.4 | 1.4 |

| Total | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

Earnings Release | 4Q.2021 |  |

Banco Santander México | |

| 14 |

Banco Santander México’s interest income consists mainly of interest from the loan portfolio and commissions on loan originations, which in 4Q21 generated Ps.19,183 million and accounted for 71.5% of total interest income. The remaining interest income of Ps.7,665 million is broken down as follows: 22.4% from investment in securities, 4.3% from repurchase agreements, 1.5% from funds available, and 0.3% from margin accounts.

Interest income for 4Q21 increased 1.2%, or Ps.307 million YoY, to Ps.26,848 million, reflecting higher interest income from repurchase agreements, total loan portfolio and margin accounts, which increased 71.3%, or Ps.475 million, 1.2%, or Ps.230 million and 33.3%, or Ps.22 million, respectively. Partialy, offset by lower interest income from investment in securities and funds available, which decreased 5.9%, or Ps.378 million and 10.3%, or Ps.48 million, respectively.

The average interest yield on interest-earning assets in 4Q21 stood at 7.29%, increasing 10 basis points from 7.19% in 4Q20. Sequentially, the average interest yield on interest-earning assets increased 6 basis points from 7.23% in 3Q21.

In 4Q21, the average interest rate on the total loan portfolio stood at 10.27%, a decrease of 7 basis points YoY. Relative to 4Q20, the average reference rate (TIIE28) increased 68 basis points. The average interest rate on the credit card loan portfolio stood at 23.44%, a decrease of 153 basis points YoY, while the yield of consumer loan portfolio stood at 22.59%, a decrease of 86 basis points YoY, the average interest rate on the mortgage loan portfolio stood at 9.23%, remained flat YoY and the yield of the commercial loan portfolio stood at 7.13%, an increase of 4 basis points YoY. While the average interest rate on the investment in securities portfolio stood at 4.52%, decreasing 38 basis points YoY.

| Interest income | |||||||||||

| Million Pesos | 4Q21 | 4Q20 | Var YoY | ||||||||

| Average Balance | Interest | Yield (%) | Average Balance | Interest | Yield (%) | Average Balance | Interest (%) | Yield (bps) | |||

| Funds available | 76,238 | 416 | 2.14 | 126,805 | 464 | 1.43 | (39.9) | (10.3) | 71 | ||

| Margin accounts | 19,483 | 88 | 1.77 | 33,281 | 66 | 0.78 | (41.5) | 33.3 | 99 | ||

| Investment in securities | 520,792 | 6,020 | 4.52 | 511,398 | 6,398 | 4.90 | 1.8 | (5.9) | (38) | ||

| Loan portfolio | 725,220 | 19,040 | 10.27 | 711,539 | 18,810 | 10.34 | 1.9 | 1.2 | (7) | ||

| Commissions collected on loan originations | — | 143 | — | — | 137 | — | — | 4.4 | — | ||

| Sale and repurchase agreements and securities loans | 98,859 | 1,141 | 4.52 | 61,990 | 666 | 4.20 | 59.5 | 71.3 | 32 | ||

| Interest income | 1,440,592 | 26,848 | 7.29 | 1,445,013 | 26,541 | 7.19 | (0.3) | 1.2 | 10 | ||

Interest income increase from the total loan portfolio was 1.2%, or Ps.230 million, which resulted from the combined effect of a 1.9%, or Ps.13,681 million, increase in average loan portfolio volume, and a 7 basis points decrease in the average interest rate. The increase in interest income from the loan portfolio resulted from the following YoY combined effects by product:

| § | Mortgages: 13.2%, or Ps.22,119 million increase, with a 9.23% interest yield, which increased 1 bps; |

Earnings Release | 4Q.2021 |  |

Banco Santander México | |

| 15 |

| § | Consumer: 9.2%, or Ps.5,570 million increase, with a 22.59% interest yield, which decreased 86 bps; |

| § | Credit Cards: 2.5%, or Ps.1,338 million decrease, with a 23.44% interest yield, which decreased 153 bps; and |

| § | Commercial: 2.9%, or Ps.12,669 million decrease, with a 7.13% interest yield, which increased 4 bps. |

Interest income from investment in securities decreased 5.9%, or Ps.378 million, which resulted from the combined effect of a 38 basis points decrease in the average interest rate, and an increase of 1.8%, or Ps.9,394 million, in average volume. Interest income from repurchase agreements increased 71.3%, or Ps.475 million, which resulted from the increase of 59.5%, or Ps.36,869 million, in average volume, and a 32 basis points increase in the average interest rate.

Interest expense

Total average interest-bearing liabilities amounted to Ps.1,264,541 million, decreasing 2.7% YoY, or Ps.35,021 million, and were driven by decreases of 14.3%, or Ps.40,688 million, in time deposits, 9.3%, or Ps.34,524 million, in repurchase agreements, 24.5%, or Ps.12,829 million, in bank and other loans, 2.2%, or Ps.1,813 million, in credit instruments issued. These decreases were partly offset by increases of 11.3%, or Ps.54,569 million, in demand deposits, and 1.0%, or Ps.264 million, in subordinated capital notes.

Banco Santander México’s interest-bearing liabilities are broken down as follows:

| Average liabilities (interest-bearing liabilities) | |||||

| Breakdown (%) | |||||

| 4Q20 | 1Q21 | 2Q21 | 3Q21 | 4Q21 | |

| Demand deposits | 37.1 | 37.9 | 40.7 | 44.7 | 42.4 |

| Sale and repurchase agreements and securities loans | 28.6 | 29.7 | 28.5 | 24.4 | 26.7 |

| Time deposits | 21.9 | 20.5 | 19.2 | 19.7 | 19.3 |

| Credit instruments issued | 6.3 | 6.4 | 6.2 | 6.2 | 6.4 |

| Bank and other loans | 4.0 | 3.4 | 3.3 | 2.8 | 3.1 |

| Subordinated capital notes | 2.1 | 2.1 | 2.1 | 2.2 | 2.1 |

| Total | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

Banco Santander México’s interest expense consists mainly of interest paid on customer deposits and repurchase agreements, which in 4Q21 amounted to Ps.4,627 million and Ps.3,924 million, respectively, accounting for 42.8% and 36.3% of interest expenses. The remaining Ps.2,251 million was paid as follows: 11.4% on credit instruments issued, 5.5% on bank and other loans, and 4.0% on subordinated capital notes.

Interest expense for 4Q21 increased 5.2% YoY, or Ps.533 million, to Ps.10,802 million, mainly driven by higher interest expenses on demand deposits, repurchase agreements and subordinated capital notes.

The average interest rate on interest-bearing liabilities increased 25 basis points to 3.34% in 4Q21. For 4Q21, the average interest rate on the main sources of funding increased YoY as follows:

| § | 24 basis points in time deposits, at an average interest rate paid of 3.86%; and |

| § | 18 basis points in demand deposits, at an average interest rate paid of 1.62%. |

Earnings Release | 4Q.2021 |  |

Banco Santander México | |

| 16 |

| Interest expense | |||||||||||

| Million pesos | 4Q21 | 4Q20 | Var YoY | ||||||||

| Average Balance | Interest | Yield (%) | Average Balance | Interest | Yield (%) | Average Balance | Interest (%) | Yield (bps) | |||

| Demand deposits | 536,639 | 2,224 | 1.62 | 482,070 | 1,773 | 1.44 | 11.3 | 25.4 | 18 | ||

| Time deposits | 243,389 | 2,403 | 3.86 | 284,077 | 2,626 | 3.62 | (14.3) | (8.5) | 24 | ||

| Credit instruments issued | 80,461 | 1,231 | 5.99 | 82,274 | 1,268 | 6.03 | (2.2) | (2.9) | (4) | ||

| Bank and other loans | 39,507 | 593 | 5.87 | 52,336 | 662 | 4.95 | (24.5) | (10.4) | 92 | ||

| Subordinated capital notes | 26,975 | 427 | 6.19 | 26,711 | 422 | 6.18 | 1.0 | 1.2 | 1 | ||

| Sale and repurchase agreements and securities loans | 337,570 | 3,924 | 4.55 | 372,094 | 3,518 | 3.70 | (9.3) | 11.5 | 85 | ||

| Interest expense | 1,264,541 | 10,802 | 3.34 | 1,299,562 | 10,269 | 3.09 | (2.7) | 5.2 | 25 | ||

Increases in retail deposits continue to reflect the Bank’s focus on driving profitability with a higher reliance on retail deposits. The average balance of demand deposits increased 11.3% YoY, or Ps.54,569 million, while the average balance of time deposits contracted 14.3% YoY, or Ps.40,688 million. Interest paid on demand deposits increased 25.4%, or Ps.451 million YoY, and interest paid on time deposits decreased 8.5% YoY, or Ps.223 million.

Earnings Release | 4Q.2021 |  |

Banco Santander México | |

| 17 |

Provisions for loan losses and asset quality

During 4Q21, provisions for loan losses amounted to Ps.4,289 million, which represented an increase of 36.1%, or Ps.1,137 million, YoY, reflecting a low base in 4Q20 and a decrease of 2.2%, or Ps.96 million, on a sequential basis, as two corporates prepaid the exposure they had with the Bank.

| Loan Loss Reserves | |||||||||||

| Million pesos | % Variation | % Variation | |||||||||

| 4Q21 | 3Q21 | 4Q20 | QoQ | YoY | 12M21 | 12M20 | YoY | ||||

| Commercial | 1,408 | 1,178 | 1,062 | 19.6 | 32.6 | 7,823 | 5,824 | 34.3 | |||

| Consumer | 2,538 | 2,767 | 2,742 | (8.3) | (7.5) | 11,251 | 13,277 | (15.3) | |||

| Mortgages | 343 | 440 | (652) | (22.0) | — | 1,743 | 2,162 | (19.4) | |||

| Total | 4,289 | 4,385 | 3,152 | (2.2) | 36.1 | 20,817 | 21,263 | (2.1) | |||

| Cost of Risk (%) | |||||||||||

| Variation (bps) | Variation (bps) | ||||||||||

| 4Q21 | 3Q21 | 4Q20 | QoQ | YoY | 12M21 | 12M20 | YoY | ||||

| Commercial | 1.87 | 1.76 | 1.27 | 11 | 60 | 1.87 | 1.27 | 60 | |||

| Consumer | 9.66 | 9.98 | 11.55 | (32) | (189) | 9.66 | 11.55 | (189) | |||

| Mortgages | 0.95 | 0.42 | 1.35 | 53 | (40) | 0.95 | 1.35 | (40) | |||

| Total | 2.90 | 2.75 | 2.89 | 15 | 1 | 2.90 | 2.89 | 1 | |||

Non-performing loans as of December 2021 decreased 24.3% YoY, or Ps.5,249 million, to Ps.16,391 million, and 19.6%, or Ps.3,985 miilion on a sequential basis. The YoY decrease in non-performing loans was due to decreases of 50.0%, or Ps.3,772 million, in consumer loans (including credit cards) and 29.6%, or Ps.1,850 million, in commercial loans, partly offset by an increase of 4.7%, or Ps.373 million, in mortgage loans. These decreases shown a relevant improvement across the Bank’s loan book.

Consumer loan portfolio (including credit cards) NPL ratio decreased 343 basis point YoY and 42 basis points sequentially. At the same time, SMEs loans NPL ratio decreased 241 basis points YoY and 125 basis points sequentially. While commercial loans NPL ratio decreased 50 basis points YoY and 74 basis points sequentially. Finally, mortgage loans NPL ratio decreased 29 basis points YoY and 60 basis points QoQ.

Earnings Release | 4Q.2021 |  |

Banco Santander México | |

| 18 |

The breakdown of the non-performing loan portfolio is as follows: mortgage loans 50.2%, commercial loans 26.8% and consumer loans (including credit cards) 23.0%.

| Non-Performing loan ratio (%) | ||||||

| Variation (bps) | ||||||

| Dec-21 | Sep-21 | Dec-20 | QoQ | YoY | ||

| Commercial | 1.01 | 1.75 | 1.51 | (74) | (50) | |

| SMEs | 2.80 | 4.05 | 5.21 | (125) | (241) | |

| Others | 0.75 | 1.39 | 0.81 | (64) | (6) | |

| Individuals | ||||||

| Consumer | 3.09 | 3.51 | 6.52 | (42) | (343) | |

| Credit Card | 3.56 | 4.18 | 7.46 | (62) | (390) | |

| Other consumer | 2.73 | 3.00 | 5.69 | (27) | (296) | |

| Mortgages | 4.25 | 4.85 | 4.54 | (60) | (29) | |

| Total | 2.18 | 2.85 | 3.08 | (67) | (90) | |

The aforementioned variations in non-performing loans led to an NPL ratio of 2.18% in December 2021, decreasing 90 basis points from 3.08% in December 2020, and 67 basis points compared to the 2.85% reported in September 2021.

Finally, the coverage ratio for December 2021 stood at 141.38%, increasing from 116.87% in December 2020 and from the 117.56% in September 2021.

Earnings Release | 4Q.2021 |  |

Banco Santander México | |

| 19 |

Commission and fee income, net

| Commission and fee income, net | |||||||||||

| Million pesos | % Variation | % Variation | |||||||||

| 4Q21 | 3Q21 | 4Q20 | QoQ | YoY | 12M21 | 12M20 | 21/20 | ||||

| Commission and fee income | |||||||||||

| Debit and credit card | 2,610 | 2,227 | 2,336 | 17.2 | 11.7 | 9,363 | 8,455 | 10.7 | |||

| Account management | 671 | 614 | 640 | 9.3 | 4.8 | 2,593 | 2,588 | 0.2 | |||

| Collection services | 532 | 531 | 480 | 0.2 | 10.8 | 2,206 | 2,074 | 6.4 | |||

| Investment funds | 458 | 446 | 414 | 2.7 | 10.6 | 1,747 | 1,611 | 8.4 | |||

| Insurance | 1,437 | 1,308 | 1,378 | 9.9 | 4.3 | 5,508 | 5,294 | 4.0 | |||

| Purchase-sale of securities and money market transactions | 211 | 271 | 233 | (22.1) | (9.4) | 959 | 962 | (0.3) | |||

| Checks trading | 46 | 43 | 48 | 7.0 | (4.2) | 174 | 184 | (5.4) | |||

| Foreign trade | 319 | 374 | 269 | (14.7) | 18.6 | 1,495 | 1,395 | 7.2 | |||

| Financial advisory services | 412 | 252 | 198 | 63.5 | 108.1 | 1,440 | 1,194 | 20.6 | |||

| Other | 247 | 232 | 205 | 6.5 | 20.5 | 953 | 799 | 19.3 | |||

| Total | 6,943 | 6,298 | 6,201 | 10.2 | 12.0 | 26,438 | 24,556 | 7.7 | |||

| Commission and fee expense | |||||||||||

| Debit and credit card | (1,180) | (1,013) | (747) | 16.5 | 58.0 | (3,937) | (2,741) | 43.6 | |||

| Investment funds | 0 | 0 | 0 | 0.0 | 0.0 | (1) | (1) | 0.0 | |||

| Insurance | 0 | (4) | (18) | 100.0 | 100.0 | (75) | (103) | (27.2) | |||

| Purchase-sale of securities and money market transactions | (62) | (37) | (38) | 67.6 | 63.2 | (182) | (163) | 11.7 | |||

| Checks trading | (12) | (13) | (12) | (7.7) | 0.0 | (48) | (43) | 11.6 | |||

| Financial advisory services | (134) | (1) | (8) | — | — | (142) | (19) | — | |||

| Bank Correspondents | (199) | (216) | (232) | (7.9) | (14.2) | (850) | (833) | 2.0 | |||

| Other | (596) | (567) | (437) | 5.1 | 36.4 | (2,221) | (1,959) | 13.4 | |||

| Total | (2,183) | (1,851) | (1,492) | 17.9 | 46.3 | (7,456) | (5,862) | 27.2 | |||

| Commission and fee income, net | |||||||||||

| Debit and credit card | 1,430 | 1,214 | 1,589 | 17.8 | (10.0) | 5,426 | 5,714 | (5.0) | |||

| Account management | 671 | 614 | 640 | 9.3 | 4.8 | 2,593 | 2,588 | 0.2 | |||

| Collection services | 532 | 531 | 480 | 0.2 | 10.8 | 2,206 | 2,074 | 6.4 | |||

| Investment funds | 458 | 446 | 414 | 2.7 | 10.6 | 1,746 | 1,610 | 8.4 | |||

| Insurance | 1,437 | 1,304 | 1,360 | 10.2 | 5.7 | 5,433 | 5,191 | 4.7 | |||

| Purchase-sale of securities and money market transactions | 149 | 234 | 195 | (36.3) | (23.6) | 777 | 799 | (2.8) | |||

| Checks trading | 34 | 30 | 36 | 13.3 | (5.6) | 126 | 141 | (10.6) | |||

| Foreign trade | 319 | 374 | 269 | (14.7) | 18.6 | 1,495 | 1,395 | 7.2 | |||

| Financial advisory services | 278 | 251 | 190 | 10.8 | 46.3 | 1,298 | 1,175 | 10.5 | |||

| Bank Correspondents | (199) | (216) | (232) | (7.9) | (14.2) | (850) | (833) | 2.0 | |||

| Other | (349) | (335) | (232) | 4.2 | 50.4 | (1,268) | (1,160) | 9.3 | |||

| Total | 4,760 | 4,447 | 4,709 | 7.0 | 1.1 | 18,982 | 18,694 | 1.5 | |||

In 4Q21, net commission and fee income totaled Ps.4,760 million, which represent increases of 1.1% YoY, or Ps.51 million, and 7.0% QoQ, or Ps.313 million. Commission and fee income increased 12.0% YoY, or Ps.742 million, to Ps.6,943 million in 4Q21, while commission and fee expense increased 46.3% YoY, or Ps.691 million, to Ps.2,183 million in 4Q21.

The main contributors to net commissions and fees were insurance fees, which accounted for 30.2% of the total, followed by credit and debit card fees, account management and collection services fees, which accounted for 30.0%, 14.1% and 11.2% of total commissions and fees, respectively.

Earnings Release | 4Q.2021 |  |

Banco Santander México | |

| 20 |

| Net commisions and fees | ||||||

| Breakdown (%) | ||||||

| 4Q21 | 3Q21 | 4Q20 | 12M21 | 12M20 | ||

| Insurance | 30.2 | 29.3 | 28.9 | 28.6 | 27.8 | |

| Debit and credit card | 30.0 | 27.3 | 33.7 | 28.6 | 30.6 | |

| Account management | 14.1 | 13.8 | 13.6 | 13.7 | 13.8 | |

| Collection services | 11.2 | 11.9 | 10.2 | 11.6 | 11.1 | |

| Investment funds | 9.6 | 10.0 | 8.8 | 9.2 | 8.6 | |

| Foreign trade | 6.7 | 8.4 | 5.7 | 7.9 | 7.5 | |

| Financial advisory services | 5.8 | 5.6 | 4.0 | 6.8 | 6.3 | |

| Purchase-sale of securities and money market transactions | 3.1 | 5.3 | 4.1 | 4.1 | 4.3 | |

| Checks trading | 0.7 | 0.7 | 0.8 | 0.7 | 0.8 | |

| Bank correspondents | (4.1) | (4.8) | (4.9) | (4.5) | (4.5) | |

| Other | (7.3) | (7.5) | (4.9) | (6.7) | (6.3) | |

| Total | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 |

Net commissions and fees went up 1.1% YoY, or Ps.51 million in 4Q21, mostly as a result of the following increases:

| i) | A 46.3%, or Ps.88 million, in financial advisory services, due to an improvement in market activity in investment banking transactions; |

| ii) | A 5.7%, or Ps.77 million, in insurance fees, driven by the performance of the Bank’s digital car insurance platform; |

| iii) | A 10.8%, or Ps.52 million, in collection services; and an increase of 4.8%, or Ps.31 million, in account management, mainly as a result of Banco Santander México’s continued focus on being an integral part of its clients’ liquidity management efforts, which led to increase transactional activity; |

| iv) | A 18.6%, or Ps.50 million, in foreign trade; and |

| v) | A 10.6%, or Ps.44 million, in investment funds. |

These increases was partly offset by the following effects:

| i) | A 10.0%, or Ps.159 million, decrease in debit and credit card fees, due to higher expenses, mainly to bonuses and rewards that were paid to customers as of consequence of the higher transactionality during the campaign “El Buen Fin”, partialy offset by a solid performance in transactionality; |

| ii) | A 50.4%, or Ps.117 million, increase in other commissions and fees paid; |

| iii) | A 23.6%, or Ps.46 million, decrease in purchase-sale of securities and money market; and |

| iv) | A 14.2%, or Ps.33 million, decrease in banks correspondents fees paid. |

On a cumulative basis, net commissions and fees amounted Ps.18,982 million in 12M21, reflecting a YoY increase of 1.5%, or Ps.288 million. Commission and fee income increased 7.7%, or Ps.1,882 million, while commission and fee expense increased 27.2%, or Ps.1,594 million.

Earnings Release | 4Q.2021 |  |

Banco Santander México | |

| 21 |

Net gain (loss) on financial assets and liabilities

| Net gain (loss) on financial assets and liabilities | |||||||||||

| Million pesos | % Variation | % Variation | |||||||||

| 4Q21 | 3Q21 | 4Q20 | QoQ | YoY | 12M21 | 12M20 | 21/20 | ||||

| Valuation | |||||||||||

| Foreign exchange | 81 | (624) | (3,642) | 113.0 | 102.2 | (1,093) | (2,124) | (48.5) | |||

| Derivatives | 1,557 | 289 | (1,457) | — | — | 5,900 | (4,528) | — | |||

| Equity securities | 1 | 252 | 163 | (99.6) | (99.4) | 131 | 248 | (47.2) | |||

| Debt instruments | (2,195) | (1,094) | 646 | 100.6 | — | (9,557) | 6,923 | — | |||

| Valuation result | (556) | (1,177) | (4,290) | (52.8) | (87.0) | (4,619) | 519 | — | |||

| Purchase / sale of securities | |||||||||||

| Foreign exchange | 830 | 969 | 4,811 | (14.3) | (82.7) | 4,430 | 3,244 | 36.6 | |||

| Derivatives | 758 | 1,661 | 89 | (54.4) | — | 3,582 | 1,298 | — | |||

| Equity securities | 53 | 5 | 101 | — | (47.5) | 264 | (323) | — | |||

| Debt instruments | 257 | 16 | 12 | — | — | 1,374 | 1,443 | (4.8) | |||

| Purchase -sale result | 1,898 | 2,651 | 5,013 | (28.4) | (62.1) | 9,650 | 5,662 | 70.4 | |||

| Total | 1,342 | 1,474 | 723 | (9.0) | 85.6 | 5,031 | 6,181 | (18.6) | |||

In 4Q21, Banco Santander México reported a Ps.1,342 million net gain from financial assets and liabilities, which compares with a gain of Ps.723 million in 4Q20 and a gain of Ps.1,474 million in 3Q21, as the Bank was able to capitalize on rising interest rates coupled with exchange rate volatility.

The Ps.1,342 million net gain from financial assets and liabilities in the quarter is mostly a result of:

| i) | A Ps.1,898 million purchase-sale gain, related to gains of Ps.830 million, Ps.758 million, Ps.257 million and Ps.53 million, in foreign exchange, derivatives, debt instruments and equity securities, respectively; and |

| ii) | A Ps.556 million valuation loss, which resulted from a loss of Ps.2,195 million in debt instruments. This loss was partly offset by gains of Ps.1,557 million, Ps.81 million and Ps.1 million, in derivatives, foreign exchange and equity securities. |

On a cumulative basis, net gain from financial assets and liabilities for 12M21, reached Ps.5,031 million, representing a decrease of 18.6% YoY, or Ps.1,150 million.

Earnings Release | 4Q.2021 |  |

Banco Santander México | |

| 22 |

Other operating expense

| Other operating expense | |||||||||||

| Million pesos | % Variation | % Variation | |||||||||

| 4Q21 | 3Q21 | 4Q20 | QoQ | YoY | 12M21 | 12M20 | 21/20 | ||||

| Cancellation of liabilities and reserves | 139 | 35 | 457 | — | (69.6) | 244 | 671 | (63.6) | |||

| Interest on personnel loans | 58 | 51 | 48 | 13.7 | 20.8 | 203 | 244 | (16.8) | |||

| Allowance for losses on foreclosed assets | (23) | (8) | (12) | — | 91.7 | (47) | (38) | 23.7 | |||

| Profit from sale of foreclosed assets | 30 | 23 | 17 | 30.4 | 76.5 | 174 | 341 | (49.0) | |||

| Technical advisory and technology services | 7 | 23 | (4) | (69.6) | — | 68 | 68 | 0.0 | |||

| Portfolio recovery legal expenses and costs | (238) | (166) | (238) | 43.4 | 0.0 | (995) | (762) | 30.6 | |||

| Premiums paid on guarantees for SMEs loans portfolio | (276) | (267) | (429) | 3.4 | (35.7) | (1,138) | (1,130) | 0.7 | |||

| Write-offs and bankruptcies | (78) | (166) | (111) | (53.0) | (29.7) | (670) | (672) | (0.3) | |||

| Provision for legal and tax contingencies | (114) | (71) | (75) | 60.6 | 52.0 | (292) | (286) | 2.1 | |||

| Income from sale of acquiring business contracts | 816 | 0 | 0 | 100.0 | 100.0 | 816 | 0 | 100.0 | |||

| Others | 95 | 32 | (32) | — | — | 333 | 332 | 0.3 | |||

| Total | 416 | (514) | (379) | — | — | (1,304) | (1,232) | 5.8 | |||

Other operating income in 4Q21 totaled Ps.416 million, which compares with an expense of Ps.379 million in 4Q20 and from an expense of Ps.514 million reported in 3Q21.

The Ps.795 million, YoY increase, in other operating income in 4Q21 was mainly driven by income from the sale of some acquiring business contracts for Ps.816 million, lower premiums paid on guarantees for the SMEs loan portfolio of 35.7%, or Ps.153 million, and higher other income of Ps.127 million, partially offset by lower cancellation of liabilities and reserves of 69.6%, or Ps.318 million.

On a cumulative basis, other operating expenses for 12M21, reached Ps.1,304 million, representing a 5.8%, or Ps.72 million, YoY increase.

Earnings Release | 4Q.2021 |  |

Banco Santander México | |

| 23 |

Administrative and promotional expenses

Administrative and promotional expenses consist of personnel costs, such as payroll and benefits, promotion and advertising expenses, and other general expenses. Personnel expenses consist mainly of salaries, social security contributions, bonuses and a long-term incentive plan for the Bank’s executives. Other general expenses are mainly related to technology and systems, administrative services - mainly outsourced in the areas of information technology - taxes and duties, professional fees, contributions to IPAB, rental of properties and hardware, advertising and communication, surveillance and cash courier services, and expenses related to maintenance, conservation and repair, among others.

| Administrative and promotional expenses | |||||||||||

| Million pesos | % Variation | % Variation | |||||||||

| 4Q21 | 3Q21 | 4Q20 | QoQ | YoY | 12M21 | 12M20 | 21/20 | ||||

| Salaries and employee benefits | 5,665 | 4,275 | 4,024 | 32.5 | 40.8 | 17,934 | 15,263 | 17.5 | |||

| Credit card operation | 3 | 44 | 41 | (93.2) | (92.7) | 146 | 202 | (27.7) | |||

| Professional fees | 359 | 291 | 421 | 23.4 | (14.7) | 1,053 | 1,155 | (8.8) | |||

| Leasehold | 703 | 648 | 646 | 8.5 | 8.8 | 2,587 | 2,588 | (0.0) | |||

| Promotional and advertising expenses | 247 | 198 | 159 | 24.7 | 55.3 | 757 | 833 | (9.1) | |||

| Taxes and duties | 308 | 531 | 705 | (42.0) | (56.3) | 1,969 | 2,362 | (16.6) | |||

| Technology services (IT) | 2,057 | 1,504 | 1,743 | 36.8 | 18.0 | 6,079 | 5,403 | 12.5 | |||

| Depreciation and amortization | 1,154 | 1,201 | 1,161 | (3.9) | (0.6) | 4,698 | 4,259 | 10.3 | |||

| Contributions to IPAB | 970 | 950 | 976 | 2.1 | (0.6) | 3,801 | 3,859 | (1.5) | |||

| Cash protection | 330 | 316 | 265 | 4.4 | 24.5 | 1,237 | 1,263 | (2.1) | |||

| Others | 840 | 792 | 961 | 6.1 | (12.6) | 2,974 | 3,728 | (20.2) | |||

| Total | 12,636 | 10,750 | 11,102 | 17.5 | 13.8 | 43,235 | 40,915 | 5.7 | |||

Banco Santander México’s administrative and promotional expenses are broken down as follows:

| Administrative and promotional expenses | ||||||

| Breakdown (%) | ||||||

| 4Q21 | 3Q21 | 4Q20 | 12M21 | 12M20 | ||

| Personnel | 44.8 | 39.8 | 36.2 | 41.5 | 37.3 | |

| Technology services (IT) | 16.3 | 14.0 | 15.7 | 14.1 | 13.2 | |

| Depreciation and amortization | 9.1 | 11.2 | 10.5 | 10.9 | 10.4 | |

| IPAB | 7.7 | 8.8 | 8.8 | 8.7 | 9.4 | |

| Others | 6.7 | 7.4 | 8.6 | 6.9 | 9.1 | |

| Leasehold | 5.6 | 6.0 | 5.8 | 5.9 | 6.3 | |

| Professional fees | 2.8 | 2.7 | 3.8 | 2.4 | 2.8 | |

| Cash protection | 2.6 | 3.0 | 2.4 | 2.9 | 3.1 | |

| Taxes and duties | 2.4 | 4.9 | 6.4 | 4.6 | 5.8 | |

| Promotional and advertising expenses | 2.0 | 1.8 | 1.4 | 1.8 | 2.1 | |

| Credit card operation | 0.0 | 0.4 | 0.4 | 0.3 | 0.5 | |

| Total | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | |

Earnings Release | 4Q.2021 |  |

Banco Santander México | |

| 24 |

Administrative and promotional expenses in 4Q21 totaled Ps.12,636 million, compared to Ps.11,102 million in 4Q20 and Ps.10,750 million in 3Q21, increasing 13.8% YoY, or Ps.1,534 million. Sequentially, the increase was 17.5%, or Ps.1,886 million, mainly to salaries and employee benefits and technology investments.

The 13.8% YoY, or Ps.1,534 million, increase in administrative and promotional expenses was mainly due to the following increases:

| i) | 40.8%, or Ps.1,641 million, in salaries and employee benefits, mainly due to a change in mexican legislation regarding the PTU payment, that required an additional charge of Ps.959 million, hiring of employees that were previously outsourced and by a general salary increase made in September 2021; and |

| ii) | 18.0%, or Ps.314 million, in technology services, mainly related to the Bank’s continous investment program, as Banco Santander México remain focused on digitizing more of services and reinforcing cybersecurity assets, among other ongoing technology investments. |

These increases were partly offset by the following decrease:

| i) | 56.3%, or Ps.397 million, in taxes and duties. |

The efficiency ratio for the quarter increased 394 basis points YoY and 503 basis points QoQ to 56.00%. The combination of a soft gross operating income and the significant increase in administrative and promotional expenses resulted in a deterioration of the efficiency ratio.

The recurrence ratio for 4Q21 was 37.67%, down from 42.42% in 4Q20 and 41.37% reported in 3Q21.

On a cumulative basis, administrative and promotional expenses in 12M21 amounted Ps.43,235 million, reflecting an increase of 5.7%, or Ps.2,320 million. The efficiency ratio for 12M21 increased 433 basis points YoY from 46.06% in 12M20 to 50.39% in 12M21.

Profit before taxes

Profit before taxes in 4Q21 was Ps.5,669 million, reflecting decreases of 20.7%, or Ps.1,481 million, YoY, and of 5.5%, or Ps.330 million, QoQ.

On a cumulative basis, profit before taxes for 12M21 amounted Ps.21,942 million, reflecting a YoY decrease of 18.2%, or Ps.4,889 million.

Earnings Release | 4Q.2021 |  |

Banco Santander México | |

| 25 |

Income taxes

In 4Q21, Banco Santander México reported a tax expense of Ps.424 million compared to Ps.1,670 million in 4Q20 and Ps.1,156 million in 3Q21. The effective tax rate for the quarter was 7.48%, compared to 23.36% reported in 4Q20 and 19.27% in 3Q21, these decreases were due to a higher inflation.

On a cumulative basis, the effective tax rate for 12M21 stood at 17.60%, 729 basis points lower than the 24.89% for 12M20.

Capitalization and liquidity

| Capitalization | ||||||

| Million pesos | Dec-21 | Sep-21 | Dec-20 | |||

| CET1 | 116,080 | 117,307 | 114,306 | |||

| Tier 1 | 140,688 | 141,980 | 124,255 | |||

| Tier 2 | 27,928 | 27,383 | 27,203 | |||

| Total capital | 168,616 | 169,365 | 151,458 | |||

| Risk-weighted assets | ||||||

| Credit risk | 517,698 | 519,194 | 540,191 | |||

| Credit, market and operational risk | 782,050 | 789,237 | 796,836 | |||

| Credit risk ratios: | ||||||

| CET1 (%) | 22.42 | 22.59 | 21.16 | |||

| Tier 1 (%) | 27.18 | 27.35 | 23.00 | |||

| Tier 2 (%) | 5.39 | 5.27 | 5.04 | |||

| Capitalization ratio (%) | 32.57 | 32.62 | 28.04 | |||

| Total capital ratios: | ||||||

| CET1 (%) | 14.84 | 14.86 | 14.35 | |||

| Tier 1 (%) | 17.99 | 17.99 | 15.59 | |||

| Tier 2 (%) | 3.57 | 3.47 | 3.42 | |||

| Capitalization ratio (%) | 21.56 | 21.46 | 19.01 |

Banco Santander México’s capital ratio at December 2021 was 21.56%, compared to 19.01% and 21.46% at December 2020 and September 2021, respectively. The 21.56% capital ratio was comprised of 14.84% of fundamental capital (CET1), 3.15% of additional capital (AT1), and 3.57% of complementary capital (Tier 2).

As of November 2021, Banco Santander México was classified in Category 1, in accordance with Article 134 Bis of the Mexican Banking Law, and the Bank remains in this category per the preliminary results dated December 31st, 2021, which is the most recent available analysis.

On November 30, 2021, Banco Santander Mexico issued two senior notes in the domestic market (Certificados Bursátiles Bancarios) for a total amount of Ps.10,000 million: (i) BSMX 21, corresponding to four-year, floating rate, Ps.3,500 million notes, and (ii) BSMX 21-2, corresponding to seven-year, fixed rate, Ps.6,500 million notes.

Earnings Release | 4Q.2021 |  |

Banco Santander México | |

| 26 |

On December 2021, the Bank announced its decision to redeem in full all of its outstanding U.S.$500 million perpetual subordinated non-preferred contingent convertible additional tier 1 capital notes issued in 2016. The impact of this strategy was 130 bps in the capital ratio.

Liquidity coverage ratio (LCR)

Pursuant to the regulatory requirements of Banxico and the Mexican National Banking and Securities Commission (Comisión Nacional Bancaria y de Valores, or “CNBV”), the average Liquidity Coverage Ratio (LCR or CCL by its Spanish acronym) for 4Q21 was 227.55%, which compares to 312.98% in 4Q20 and 329.68% in 3Q21. (Please refer to note 24 of this report).

Leverage ratio

In accordance with CNBV regulatory requirements, effective June 14, 2016, the leverage ratio was 8.92% for December 2021, 8.89% for September 2021, 7.95% for June 2021, 7.61% for March 2021 and 7.39% for December 2020.

This ratio is defined by regulators and is calculated by dividing core capital (according to Article 2 Bis 6 (CUB)) by adjusted assets (according to Article 1, II (CUB)).

V.Relevant Events, Transactions and Activities

Relevant Events

Full redemption of all the Bank’s outstanding perpetual subordinated non-preferred contingent convertible additional tier 1 capital notes issued in 2016 (AT-1)

On December 8, 2021, Banco Santander México announced its determination to fully redeem of all of its outstanding U.S.$500 million perpetual subordinated non-preferred contingent convertible additional tier 1 capital notes issued in 2016. The effective redemption date was January 20, 2022.

Banco Santander México informed that its Parent Company, issued a material fact announcement

On December 7, 2021, Banco Santander México announced that Banco Santander, S.A., its Parent Company, published the results of its tender offer for the securities representing the share capital of the Bank. As a result of the offer, Banco Santander’s shareholding in Banco Santander México increased to 96.16% of its share capital, with the remaining 3.84% held by minority shareholders.

Resolution of the Board of Directors in connection with the Tender Offer

On November 17, 2021, Banco Santander México informed that its Board of Directors after considering different opinions in connection with the Tender Offer, determined that the Share Offer Price and the American Depositary Shares (ADS) Offer Price set forth by Banco Santander, S.A. were fair from a financial point of view to Bank’s shareholders. In this regard, the Board considered, among others, the independent fairness opinion on the share price provided by Morgan Stanley & Co. LLC

Earnings Release | 4Q.2021 |  |

Banco Santander México | |

| 27 |

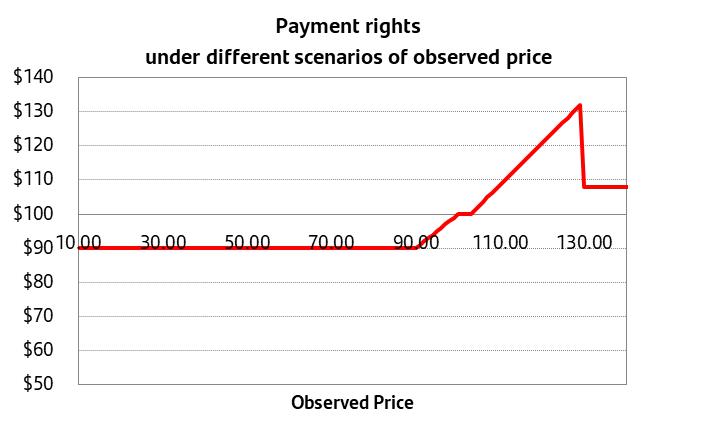

Banco Santander México informed that its Parent Company, issued a material fact announcement

On October 29, 2021 Banco Santander México announced that Banco Santander, S.A., its Parent Company, had issued a material fact to announce that it has determined to increase the price of the Tender Offer to Ps.26,50 pesos for each share and the and the U.S. Dollar equivalent of Ps.132.50 per American Depositary Shares (ADS) . This announcement complemented the ones issued on March 26, May 24 and June 8, 2021, related to the Tender Offer.

General Ordinary Shareholders’ Meetings

On October 25, 2021 Banco Santander México held its General Ordinary Shareholders’ Meeting, at which, among others, the following resolutions were adopted:

§ The payment of a cash dividend in the amount of Ps.1,867 million which was paid on November 5, 2021. The payment was made at a rate of Ps.0.2751349264 per share, in proportion to the number of shares each shareholder held on the record date.

Relevant Transactions

| § | Financing |

Banco Santander México participated in the following transactions:

| - | Grupo Simsa and Invex Grupo Infraestructura, senior mini-perm loan for an amount of US$170 million with a five-year term for the refinancing of the Tajín Project. Grupo Simsa is a petrochemicals products trading company. |

| - | ICA, bilateral mini-perm loan for a total amount of Ps.7,500 million with a two-year term for the refinancing of the Auneti Project (México-Tuxpan highway). ICA is a leading company in the construction and operation of infrastructure in the country. |

| - | Aleatica, subordinated loan for a total amount of Ps.2,359 million with a six-year term for the financing of the additional construction works of the Circuito Exterior Mexiquense Project. Aleatica is a transport infrastructure operator. |

| - | Fibra Soma, revolving credit facility, along with another bank, for a total amount of Ps.2,000 million with a three-year term. The Bank's participation was for a total amount of Ps.1,000 million. |

| - | Citrofrut, a bilateral loan in the amount of up to US$20 million with a 12-month. Citrofrut, a Mexican juice company, is an agro-industrial business company. |