UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-K

ANNUAL REPORT PURSUANT TO REGULATION A |

|

|

For the fiscal year ended: March 31, 2018 | |

|

True Leaf Medicine International Ltd. |

(Exact name of issuer as specified in its charter) |

|

|

British Columbia | 00-0000000 |

State or other jurisdiction of incorporation or organization | (I.R.S. Employer Identification No.) |

|

|

100 Kalamalka Lake Road, Unit 32, Vernon, British Columbia V1T 9G1 |

(Full mailing address of principal executive of?ces) |

|

778-475-5323 |

(Issuer’s telephone number, including area code) |

| | |

1

Contents

2

Annual Report

In this Form 1-A - Annual Report Pursuant To Regulation A (“Annual Report” or “Form 1-A”), unless otherwise noted or the context indicates otherwise, the “we”, “us”, “our”, “True Leaf”, and “Company” refers to True Leaf Medicine International Ltd. and its subsidiaries, True Leaf Investments Corp. (“TL Investments”), True Leaf Medicine Inc. (“TL Medicine”), True Leaf Pet Inc. (“TL Pet”), True Leaf Pet Europe LLC Sàrl (“TL Europe”), and True Leaf USA Inc. (“TL USA”).

This Annual Report contains company names, product names, trade names, trademarks and service marks of the Company and other organizations, all of which are property of their respective owners.

All financial information in this Annual Information Form is reported in Canadian dollars and using International Financial Reporting Standards as issued by the International Accounting Standards Board.

The information contained herein is dated as of March 31, 2018 unless otherwise stated.

Forward Looking Statements

This Annual Report contains certain statements related to industry scope and state, production, revenue, expenses, plans, development schedules and similar items that represent forward-looking statements. Such statements are based on assumptions and estimates related to future economic and market conditions. Such statements include declarations regarding management’s intent, belief or current expectations. Certain statements contained herein may contain words such as “could”, “should”, “expect”, “believe”, “will” and similar expressions and statements relating to matters that are not historical facts but are forward-looking statements. Investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve a number of risks and uncertainties; actual results may differ materially from those indicated by such forward-looking statements. Some of the important factors, but certainly not all, that could cause actual results to differ materially from those indicated by such forward-looking statements are: (i) that the information is of a preliminary nature and may be subject to further adjustment, (ii) the possible unavailability of financing, (iii) start-up risks, (iv) general operating risks, (v) dependence on third parties, (vi) changes in government regulation, (vii) the effects of competition, (viii) dependence on senior management, (ix) impact of Canadian economic conditions, and (x) fluctuations in currency exchange rates and interest rates.

Item 1. Business

Corporate Structure

True Leaf Medicine International Ltd. was incorporated under the laws of British Columbia on June 9, 2014.

The Company’s head office is located at 100 Kalamalka Lake Road, Unit 32, Vernon, British Columbia V1T 9G1.

The Company’s registered and records office is located at 1055 West Hastings Street, Suite 1700, Vancouver, BC V6E 2E9.

3

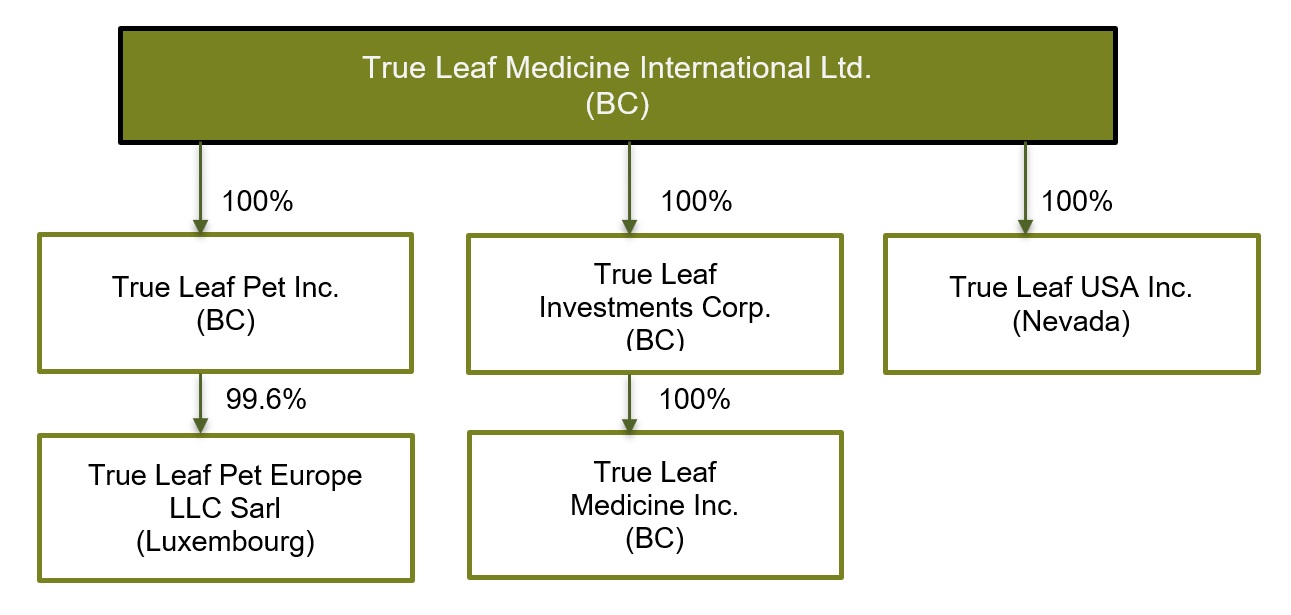

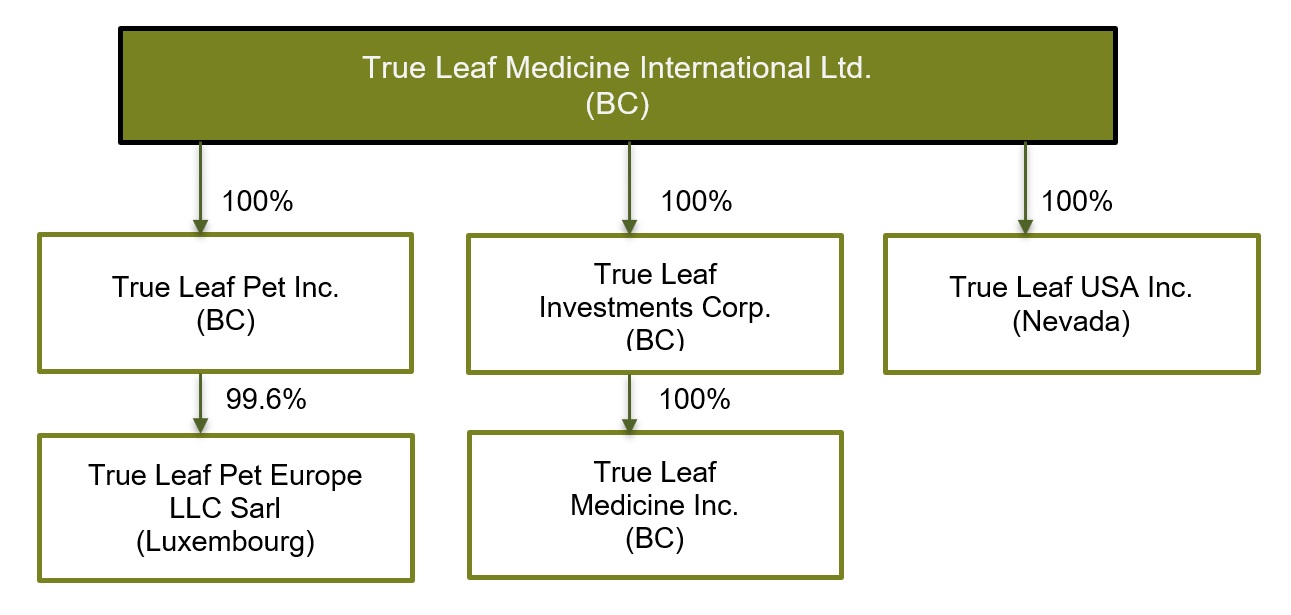

Intercorporate Relationships

We have five subsidiaries: True Leaf Investments Corp. (“TL Investments”), True Leaf Medicine Inc. (“TL Medicine”). True Leaf Pet Inc. (“TL Pet”), True Leaf Pet Europe LLC Sàrl (“TL Europe”), and True Leaf USA Inc. (“TL USA”).

TL Investments, TL Medicine, and TL Pet were formed in British Columbia on March 26, 2014, July 4, 2013, and November 18, 2015 respectively. TL Europe was formed in Luxemburg on July 18, 2016, and TL USA was formed in Nevada on September 11, 2017.

The following chart illustrates the Company’s corporate structure, the percentage of voting securities of each subsidiary owned by the Company, and the governing jurisdiction of each entity.

General Development of the Business

Overview

True Leaf is a plant-forward wellness brand for people and their pets.

We are a federally incorporated Canadian company with its common shares publicly traded on the Canadian Securities Exchange under the trading symbol: “MJ”, on the Frankfurt stock exchange under the trading symbol: “TLA”, and on the OTC Market Group's OTCQB Venture Market under the trading symbol "TRLFF". The Company is a reporting issuer in British Columbia, Alberta, and Ontario.

Founded in 2013, we have two main divisions: True Leaf Pet (“TL Pet”) and True Leaf Medicine (“TL Medicine”). TL Pet is focused on developing and selling supplements and treats for pets and TL Medicine is focused on becoming a licensed producer of cannabis developing cannabinoid related products for medicinal purposes. Our goal is to be a global cannabis-for-pets brand leader by embracing natural alternatives to help pets live healthier and longer lives. We believe that both the cannabis and pet industries represent high-growth industries. We plan to develop legally compliant medicinal cannabis products that can be sold across Canada, United States and other countries around the world.

4

True Leaf Pet

TL Pet launched its hemp-seed based pet supplement and treat product line in the fall of 2015. We share the commitment of our customers to improve the overall health of their pets with natural ingredients. We believe that consumers are looking for higher quality products that address the nutritional needs of their pets, without worrying about food safety or harmful side effects. Products containing hemp, including hemp seed oil, hemp protein and hemp extracts are gaining significant acceptance as evidence of their nutritional effectiveness becomes recognized. Our products are developed and marketed for the purpose of improving the health, comfort, enjoyment and safety of our customers' pets. We love animals and believe they deserve quality food and care.

Our current products are primarily sold through a combination of direct sales, distributors and brokers to veterinarians, food retailers, food wholesalers, drug stores, club stores, mass merchandisers, discount stores, natural foods stores and pet specialty stores. We currently sell our pet products in Canada, the United States and Europe.

Our Pet Products

In 2015, we began manufacturing, marketing and selling three dog chew products containing hemp which were created with veterinarian support and include other natural holistic ingredients. The hemp-based pet products we sell include additional quality ingredients such as green lipped mussel, curcuminoids from turmeric, L-theanine, lemon balm, chamomile, polyphenols from pomegranate, and DHA (an omega fatty acid) to create a high-value product that aligns with current consumer demands which focus on calming their pets, hip & joint pain relief and a daily omega supplement. The following are our hemp-based dog chew products:

5

True Hemp Chews - Calming

Support for Dogs | True Hemp Chews - Hip + Joint

Support for Dogs | True Hemp Chews- Immune + Heart Support for Dogs (Omega) |

Active Ingredients | Active Ingredients | Active Ingredients |

•Ground Hemp Seed - 500 mg •Hemp Seed Oil - 100 mg •L-Theanine - 25 mg •Chamomile - 12.5 mg •Lemon Balm - 12.5 mg | •Ground Hemp Seed - 500 mg •Hemp Seed Oil - 100 mg •Green Lipped Mussel - 150 mg •Turmeric Root Extract (95% Curcuminoids) - 35 mg | • Ground Hemp Seed - 500 mg • Hemp Seed Oil - 100mg • DHA - 75 mg • Polyphenols from Pomegranate - 25 mg |

| | |

Each of these products is natural, grain-free, and non-GMO certified hemp with no artificial colors or flavors. The inactive ingredients in all our chews include: peas, chickpeas, sweet potato, honey, cane molasses, gelatin, coconut oil, sea salt, calcium lactate, distilled vinegar, natural flavor, lactic acid, citric acid and natural preservatives.

Hemp seed oil, a major component of hemp seed itself and of TL Pet’s product line- has a variety of beneficial properties and may be used as a supplement. Because hemp oil is extracted from the industrial hemp plant, it contains no psychoactive reactors. Hemp contains known antioxidants from tocopherols and hosts a variety of other beneficial properties including anti-inflammatory compounds from terpenes, plant sterols and methyl salicylate - a relative of acetylsalicylic acid or ‘aspirin’. Furthermore, hemp seed oil supports enhanced blood circulation and stimulates cognitive thinking. TL Pet has created a hemp seed oil line of pet products which it sells that also support calming, hip & joint pain relief and the provision of a daily omega supplement, similar to the pet chew line of products.

Hemp and marijuana are different varieties of the same plant species of ‘Cannabis Sativa’. Marijuana plants contain high levels of tetrahydrocannabinol (“THC”). Hemp, on the other hand, is non-psychoactive and contains very little THC (less than 0.3% by law), but certain cultivars contain cannabidiol (“CBD”) located primarily in the hemp leaf and the hemp flower. TL Pet uses whole hemp seed and cold-pressed hemp seed oil in the True Hemp™ product line, which does not contain detectable levels of THC or CBD.

Hemp is rich in essential fatty acids and other polyunsaturated fatty acids. It has almost as much protein as soybean and is also rich in Vitamin E and minerals such as phosphorus, potassium, sodium, magnesium, sulphur, calcium, iron and zinc.[1] Dietary hempseed is also particularly rich in the omega-6 fatty acid, linoleic acid and also contains high concentrations of the omega-3 fatty acid, alpha-linolenic acid. The linoleic acid: alpha-linolenic acid ratio normally exists in hempseed at between 2:1 and 3:1 levels; therefore, we include hemp in all of our pet chews.

_____________________

[1] Callaway, J.C. “Hempseed as a nutritional resource: An overview” Euphytica (2004) 140: 65. doi:10.1007/s10681-004-4811-6

6

Hemp is also legally refined in industrial factories for textile and nutritional use. It is often consumed and mixed into other products including cereal and granola bars. Hemp for dogs is increasing in popularity because of its significant potential health benefits that may include joint support and antioxidant support.

We are currently developing other hemp-based pet products which we intend to test and - if suitable - add to our product line. In particular, we have expanded the functional line with chew stick supplements for dogs and we are planning to add functional cat chews and supplements. The launch of these and other products is dependent upon favorable market conditions, successful research and development and raising additional capital.

On December 30, 2016, we acquired the assets and intellectual property of OregaPet®, a Canadian brand of plant-forward natural supplement products for pets. The OregaPet®, product line includes: oregano first aid drops, oregano first aid gel, dental health mini treats, dental health treats, dental spray, pet toothpaste, ear drops, bed and body spray, shampoo therapy and oil of oregano for pets.

True Leaf Medicine

TL Medicine was launched in July 2013 to become a licensed producer of medical cannabis for the Canadian market under Canada’s Access to Cannabis for Medical Purposes Regulations (“ACMPR”) program administered by Health Canada. TL Medicine will be subject to a Health Canada inspection upon completion of the construction of its facility to allow for the cultivation, manufacturing and distribution of cannabis products. We anticipate completing our facility in the fall of 2018 and anticipate receiving our license to grow cannabis in 2019.

Cannabis for Medical Purposes. TL Medicine began as a “licensed producer” applicant in Canada’s Marijuana for Medical Purposes Regulations (“MMPR”) program. Our original submission was submitted in July of 2013. A “ready to build” approval was granted for the first application in January 2014, but issues arose regarding the facility location and local zoning. In March 2014, we secured a new location and submitted another application on April 8, 2014.

In July 2015, we received a notice from Health Canada stating that our application had passed through the preliminary screening process and was undergoing enhanced screening. Enhanced screening is one of the necessary steps in the process of becoming a licensed producer of cannabis for medical purposes under the MMPR. Shortly thereafter the federal government set the election date for October 19, 2015, the application process for all applicants under the MMPR stalled.

On August 24, 2016, the federal government adopted the ACMPR program to replace the MMPR program.

On November 27, 2017, the House of Commons passed Bill C-45, an Act respecting cannabis and to amend the Controlled Drugs and Substances Act, the Criminal Code and other Acts (the “Cannabis Act”), and on June 21, 2018, the Government of Canada announced that the Cannabis Act received royal assent. On July 11, 2018, the regulations issued pursuant to the Cannabis Act (the “Cannabis Regulations”) were released by the Government of Canada and broadened the scope of individuals required to hold security clearances. The Cannabis Act came into force on October 17, 2018.

7

As of the date of this Annual Report we do not have a license under the Cannabis Act, and no cannabis products are in commercial production or use. We will be required to satisfy additional obligations under the Cannabis Act in order to qualify for a license including the completion of a compliant facility on a parcel of purchased land in Lumby, British Columbia (the "Lumby Property"). We continue to work diligently to comply with all of the requirements of Health Canada.

Product development

Our focus for TL Medicine is to support the creation, research and development of cannabis products for medicinal purposes. Led by its strategic partners, TL Medicine aims to build market recognition with the goal of becoming a premium niche brand of medicinal cannabis in Canada.

Significant Acquisitions

During the most recently completed financial year, the Company has not completed any significant acquisitions.

The Business

General

Revenue for the year ended March 31, 2018 increased 280% to $1,400,511 from $368,536 for the same period in the previous fiscal year. All of the Company’s revenues from inception to date are from the sale of its hemp-based nutrition for pets, the majority of which have occurred in North America and Europe. Revenue growth was primarily fuelled by us expanding the commercial reach of our TL Pet division into new geographies both in-store and online.

| Year ended March 31 |

Description | 2018 | 2017 | 2016 |

Revenues | $ 1,400,511 | $ 368,536 | $ 37,330 |

Cost of sales | (779,182) | (248,909) | (26,117) |

Gross profit ($) | $ 621,329 | $ 119,627 | $ 11,213 |

Gross profit (%) | 44% | 32% | 30% |

Total operating expenditures | (4,809,855) | (1,857,834) | (1,034,170) |

| | | |

8

Strategic Outlook

Our objectives for the next 12 months are:

- Continue to build worldwide market share, distribution networks, secure new customers, and launch new items in the natural pet product space, growing our line of innovative supplements and natural remedy products for pets. Sales will be through traditional distribution channels, direct-to-store and direct-to-consumer online sales channels;

- Successfully complete additional capital financings in order to fund the objectives of our business plan;

- Complete build-out of a portion of the first phase of our 25,000 square foot medicinal cannabis production facility located in Lumby, British Columbia, in order to comply with Health Canada’s requirements to become a licensed producer under the Cannabis Act;

- Receive approval to sell medicinal cannabis under the Cannabis Act by mid-2019 in order to commence the research & development and sale of cannabis based products; and

- Review potential joint ventures or strategic acquisition targets in the pet, wellness and medicinal cannabis space.

Pet Support Supplements and Treats - TL Pet

Established in 2015, TL Pet markets hemp-seed based products for the pet industry. We launched the True Hemp™ pet supplement line in Canada, the United States, and Europe, becoming one of the first hemp-seed based pet product lines to be marketed worldwide. The hemp-seed based formula meets US and Canadian guidelines allowing TL Pet to establish a distribution network that includes more than 2,000 stores globally, with retail partners including PetSmart Canada, Pets Supplies Plus USA, PetsCorner UK and Amazon.

TL Pet’s formulations were created with veterinarian support and include other natural plant-based holistic ingredients. The hemp-seed based products are legally compliant in both the US and Canada and are part of a broader strategy to position us as a global, cannabis-for-pets brand market leader. We are currently working with a Vancouver branding firm to solidify this strategy across both TL Pet and TL Medicine and plan to bring more products to market in the future.

Our long-term business objectives for TL Pet are:

- Create a global cannabis-for-pets brand, with the mission to improve the quality of life for companion animals;

- Increase sales, distribution and store count within the pet specialty, mass-pet, veterinary and food/mass/drug market segments and assess and implement other non-traditional distribution channels to market and sell our pet products;

- Launch additional product lines and secure additional distribution partners in the European markets;

- Seek out key distribution partners for alternative market regions including Asia and South America;

- Continue to perform R&D work and, if and when permitted by the applicable legislation in the jurisdiction, launch new ‘CBD’ pet formulations for the North American and European markets; and

- Seek out potential long-term strategic partners to support the business.

9

Production and Services

We outsource the manufacturing of our products to third parties whose facilities are GMP compliant (good manufacturing practice). GMP is a system for ensuring that products are consistently produced and controlled according to quality standards. Our products are certified by the National Animal Supplement Council (“NASC”). The Company received the NASC Seal after successfully passing a thorough quality audit and documentation review. As part of the certification, NASC ensures stringent ingredient qualification, quality production processes, adverse event reporting procedures, continuous product and data monitoring, and allowable product claims. NASC is one of the highest-level certifications in the pet industry. We have an oral contractual relationship with Okanagan Naturals in British Columbia to manufacture our products and three additional manufacturers located in the United States.

Specialized Skill and Knowledge

The global pet business is complex and requires a specialized knowledge of industry distribution channels, formula and product creation, and specific pet food manufacturing expertise. Darcy Bomford, our founder and President has more than 25 years of pet industry experience.

Prior to founding us, Mr. Bomford was the founder, President, Chief Executive Officer and director of Darford International Inc., a manufacturer and marketer of branded and private pet food products with three federally inspected production plants in the United States and Canada, whose common shares formerly traded on the TSX Venture Exchange under the symbol “WUF”.

Mr. Bomford has extensive expertise with professional manufacturing systems, including comprehensive third party audited food safety systems, product development, marketing and sales within a highly regulated and competitive industry. Darcy is able to leverage his extensive contacts and experience in the North American and European pet products industry to expand sales and markets and to create unique formulations for the Company’s pet product division.

Our team also includes talent and experience from the pet industry who have worked at leading pet companies including Mars Petcare, IAMS and Petcurean.

Competitive Conditions

The cannabis-for-pets industry is a new industry that is growing very rapidly. While this industry is subject to strict regulation, many of our competitors are manufacturing and selling pet products that are not fully legally compliant in their jurisdictions. As of the date of this AIF, CBD for pets is not legal in either Canada or US.

We believe that we will face competition from the following sources:

(i) Illegal / “Grey” businesses:

There are illegal cannabis-for-pet companies operating in the grey and black markets. Even though they are operating in the grey/black market, they still act as competitors to us by either diverting customers away due to product choice including CBD for pets products. We believe that we can reduce the impact of competition from illegal businesses by focusing on education of the importance of our safe, legal and effective hemp-seed based solutions for pets.

10

(ii) Licensed producers:

A few licensed producers in Canada have publicly declared their interest or launched early initiatives in the cannabis-for-pets space. These companies have larger operations and more financial resources than we do. We believe that we can reduce the impact of competition from Licensed Producers by virtue of our focus as a cannabis-for-pets pure play. We believe that our growing distribution network, brand and team, who are all authentically passionate about dogs and pets, will better connect with pet owners than the cannabis conglomerates can. We intend to distinguish ourselves from our competitors by being a global cannabis-for-pets pure play with legally compliant products and established worldwide distribution in more than 2,000 stores.

We believe that our leadership team, brand strategy, commitment to high quality, ability to formulate unique leading pet products, outstanding client service, adherence to the law and properly capitalized operations will enable us to establish and retain a leadership position in the cannabis-for-pets market.

We have applied for a “licensed producer status” under the ACMPR in Canada (now the Cannabis Act). As of September 28, 2018, Health Canada had granted licenses under the ACMPR to a total of 120 producers (“Licensed Producers”) of which 64 are fully authorized to produce and sell cannabis, 49 have a license restricted to the cultivation of medical cannabis, four have a license just to sell medical cannabis, two have a license just to label, test or package medical cannabis and one has a license only to produce cannabis oils. These licenses issued under the ACMPR are now deemed to be licenses under the Cannabis Act.

See below under the heading “Risk Factors - Competition” for further information.

New Products

TL Pet’s current formulations were created with veterinarian support and include other plant-based holistic ingredients. TL Pet introduced hemp-based treats specially formulated for cats at a trade show in May of 2018, in Nuremberg, Germany. The functional treats provide calming support for cats, promote skin and coat health, help prevent hairballs and support urinary tract function. We plan for these to be made available to our customers worldwide.

To support future product development, we created a Veterinary Advisory Board (“VAB”) led by Dr. Katherine Kramer, an internationally recognized opinion leader in the area of cannabis-based healing for pets. Dr. Kramer has been practicing veterinary medicine for 16 years and is an advocate for the research and therapeutic use of cannabis for animals. Dr. Kramer is currently the Medical Director at the VCA-Canada Vancouver Animal Wellness Hospital. As chair of our VAB, Dr. Kramer’s role includes recruiting veterinarians from around the world to join our VAB, to support our development of legal and safe medicinal cannabis products for pets. She and her colleagues will be instrumental in leading trials for our existing hemp-seed based products and the research and development of a future CBD pet product line for us (including the design and execution of supportive trials and the development of education programs for veterinarians and pet owners on the best use of cannabis products for pets). The VAB’s mandate is to provide strategic direction and oversight to our pipeline of new products (both hemp-seed based and, if and when legal, those containing CBD) and ensure that we remain on the leading edge of plant-based holistic solutions to pet ailments.

Components

We provide our contract manufacturers with our formula and manufacturing specifications for each of our products. We purchase all of our hemp seed powder, hemp seed oil and all of our active ingredients (chamomile, L-Theanine, green lipped mussel, etc.) from suppliers vetted by T.L. Pet. We use only the

11

highest quality ingredients in all of our pet products. Our manufacturers source and purchase all inactive raw ingredients and manufacture their products to our specifications.

We utilize hemp processors in Canada, the US and Europe who are able to meet our quality and quantity requirements at a competitive price. T.L. Pet’s North American operations source all of our hemp from Canadian processors. True Leaf Pet’s European operations source all of our hemp from processors in Europe.

Our products are made with natural and fresh ingredients sourced from North America and Europe. We have not entered into any long-term supply contracts. We believe all of our current suppliers have the ability to scale to support our growth in the future. We have identified multiple alternative sources for a majority of our product ingredients that meet our quality and safety standards in order to not be dependant on a single source or supply of our component inputs.

Economic Dependence

TL Pet earns revenue from a mix of online, retail and distributor customers. We are not economically dependent on a single customer. For the year ended March 31, 2018, 39% of revenue was earned from three customers (March 31, 2017 - two customers 27%). As at March 31, 2018, these three customers amounted to 29% (March 31, 2017 - two customers amounted to 16%) of total trade receivables.

Changes to Contracts

The Company has not entered into any contracts which, if terminated or re-negotiated in the current financial year, would have a material impact on the Company’s operations.

Environmental Protection

There are no specific environmental requirements to the Company’s TL Pet business. TL Pet outsources its manufacturing process to third parties.

Regulatory Framework

Pet Food-Related Regulation - Canada

In Canada, the labeling and advertising of pet food is regulated by the Consumer Packaging and Labelling Act and the Competition Act, administered by Industry Canada. The Consumer Packaging and Labelling Act sets out certain items that are required to be included on pet food labels.

The Pet Food Association of Canada (“PFAC”) with input from members from the Competition Bureau has also established pet food labeling guidelines. These guidelines are voluntary. The PFAC guidelines recommends pet food labels should include the following items: (1) a list of ingredients in descending order by percentage of weight; (2) feeding instructions; and (3) guaranteed analysis, being information on the minimum and maximum nutritional quantities. For example, the analysis will include the maximum or minimum percentage of protein, fat, fibre, and moisture as well as the nutritional adequacy or intended life stage for which the food is suitable. They also recommend that ingredients be listed and identified by their common name. When an ingredient or combination of ingredients makes up 90% or more of the total weight of all ingredients, these ingredients should also form a part of the product name. For example, if the product contains 90% or more beef, it may be called “my brand beef dog food”.

In Canada, products that pass the Canadian Veterinary Medical Association (“CVMA”) Pet Food Certification Program, which involves a feeding trial, carry a CVMA label on their packaging. Participation in the program is voluntary.

12

Pet Supplement Regulation - Canada

Products sold and marketed as ‘pet supplements’ in Canada are currently administered by the Canadian Low Risk Veterinary Health Products (“LVRHP”) Interim Notification Program. Health Canada considers the current INP (Interim Notification Program) structure to be a temporary measure pending the new veterinary drug framework to improve the regulation of LRVHPs.

The INP allows for LRVHPs to obtain a notification number if certain conditions have been met, the significant ones being:

- The product is for use only in dogs, cats, or horses that are not intended for food.

- All ingredients are listed in and meet the conditions of admissible substances in the ‘List of Substances’ established by Health Canada.

- There is objective and credible evidence demonstrating that the product is safe and can support a reasonable expectation of effectiveness when the product is used as intended.

- Product labeling information and any other information supplied to the users will match the information provided on the notification form (e.g. health claims) and comply with the conditions of admissible substances (e.g. contraindications, cautions and warnings).

Participation in the INP is voluntary and industry members may instead prefer to obtain a Notice of Compliance and Drug Identification Number through the normal regulatory process.

The company is participating in the program, has submitted all product information for registration and is currently waiting to be assigned its notification numbers for each product.

Pet Food-Related Regulation - United States

In the United States, the Food and Drug Administration’s (“FDA”) Center for Veterinary Medicine regulates animal feed, including pet food, under the Federal Food, Drug and Cosmetic Act (“FFDCA”) and its implementing regulations. Although pet foods are not required to obtain premarket approval from the FDA, any substance that is added to or is expected to become a component of a pet food must be used in accordance with a food additive regulation unless it is generally recognized as safe (“GRAS”) under the conditions of its intended use.

The labeling of pet foods is regulated by both the FDA and individual state regulatory authorities. FDA regulations require proper identification of the product, a net quantity statement, a statement of the name and place of business of the manufacturer or distributor and proper listing of all the ingredients in order of predominance by weight. The FDA also considers certain specific claims on pet food labels to be medical claims and therefore subject to prior review and approval by the FDA. In addition, the Food and Drug Administration Amendments Act of 2007 requires the FDA to establish ingredient standards and definitions for pet food, processing standards for pet food and updated labeling standards for pet food that include nutritional and ingredient information. The FDA is currently working to implement these requirements.

The FDA recently noted an increase in the number of dog and cat foods labeled as being intended for use in the diagnosis, cure, mitigation, treatment or prevention of disease and noted that animal health may suffer when such products are not subject to pre-market FDA approval and are provided in the absence of a valid veterinarian-client-patient relationship. The FDA recently issued guidance containing a list of specific factors it will consider in determining whether to initiate enforcement action against products that satisfy the definitions of both an animal food and an animal drug, but which do not comply with the regulatory requirements applicable to animal drugs. These include, among other things, whether the product is only made available through or under the direction of a veterinarian and does not present a known safety risk when used as labeled. We believe that we market our products in compliance with the policy articulated in FDAs guidance and in other claim-specific guidance, but

13

the FDA may disagree or may classify some of our products differently than we do and may impose more stringent regulations applicable to animal drugs, such as requirements for pre-market approval and compliance with GMPs for the manufacturing of pharmaceutical products.

Under Section 423 of the FFDCA, the FDA may require the recall of a pet food product if there is a reasonable probability that the product is adulterated or misbranded and the use of or exposure to the product will cause serious adverse health consequences or death. In addition, pet food manufacturers may voluntarily recall or withdraw their products from the market.

Most states also enforce their own labeling regulations, many of which are based on model definitions and guidelines developed by Association of American Feed Control Officials (“AAFCO”). AAFCO is a voluntary, non-governmental membership association of local, state and federal agencies that are charged with regulation of the sale and distribution of animal feed, including pet foods. The degree of oversight of the implementation of these regulations varies by state, but typically includes a state review and approval of each product label as a condition of sale in that state.

Most states require that pet foods distributed in the state be registered or licensed with the appropriate state regulatory agency.

Facilities that manufacture, process, pack, or hold foods, including pet foods, must register with the FDA and must renew their registration every two years. This includes most foreign facilities as well as domestic facilities. Registration must occur before the facility begins its pet food manufacturing, processing, packing, or holding operations.

We are also subject to the Food Safety Modernization Act (“FSMA”). Under the FSMA, the FDA implemented the Current Good Manufacturing Practice, Hazard Analysis and Risk-Based Preventive Controls for Food. Our manufacturing facilities must comply with the Foreign Supplier Verification Program on or before July 2017.

Pet Supplement Regulation - United States

Some of the company’s product line is marketed as dietary supplements for animals, not feed or treats. According to the FDA, dietary supplements for animals are not recognized as a class of products. Under the Federal Food, Drug, and Cosmetic Act, products marketed as dietary supplements for use in animals are classified as either foods or drugs, depending on their intended use.

In order to find a pathway to market for its supplement products, the company is a member and complies with the product guidelines of the National Animal Supplement Council (“NASC”). NASC was formed in 2001 when the animal health supplement industry was threatened to be shut down from a complicated and erratic regulatory environment under the AAFCO and FDA regulatory bodies.

The NASC put together a framework under which companies could market and distribute products, as long as they were ‘non-food’ and didn’t make nutritional claims or references anywhere on the label, website or promotional material. Product claims could only involve how the ingredients impacted the structure or function of the animal, ‘joint support’ or ‘cardiovascular health’ are common examples.

Since 2002, AAFCO, the FDA and the NASC have worked together and supported this product category, thus allowing the marketing and sale of animal supplements.

The company follows the NASC member requirements, including implementing standards for good manufacturing practices, participating in the NASC Adverse Event Reporting System and complying with all supplement labeling and claims guidelines.

14

Medical Marijuana - TL Medicine

TL Medicine was launched in July 2013 to become a licensed producer of medical cannabis for the Canadian market under Canada’s (now repealed) ACMPR program administered by Health Canada. Pursuant to the Cannabis Act and Cannabis Regulations, TL Medicine will be subject to a Health Canada inspection upon completion of the construction of its facility to allow for the cultivation, manufacturing and distribution of cannabis products. The Company anticipates completing its facility in the fall of 2018 and anticipates receiving its license to grow cannabis in 2019.

The Company’s long-term business objectives for TL Medicine are:

- Complete construction of the medicinal cannabis facility and be approved as a grower and seller of medicinal cannabis under the Cannabis Act in Canada;

- Build brand recognition with the goal of becoming the premium niche brand of over-the-counter hemp-based supplements and medicinal cannabis in Canada;

- Implement in-house lab and build out lab services business model;

- Implement extraction, fractionation and remediation equipment;

- Assess the creation and sale/lease of space within the Lumby facility, as well as offering value-added services, to support the micro-cultivator/craft cannabis community;

- Assess ongoing demand and implement plans for the build out and implementation of phase two, expanding production capacity to a total of 10,000 kilograms of dried flower per year;

- Assign capital towards research and development in order to build a base of intellectual property from proprietary formulations, cultivars, delivery mechanisms, with a focus on unique pet product formulations and supplements; and

- Assess and explore opportunities to develop a base of wholesale supply contracts for the recreational or medicinal markets.

Products and Services

We plan to be a cultivation-focused Licensed Producer with a specific focus on premium cannabis flower. Premium cannabis flower is produced through a combination of high quality genetics, facilities and standard operating procedures (“SOPs”).

If we receive a license to grow and sell cannabis from Health Canada, we plan to create a variety of premium CBD strains and offerings to support the research and development of a full line of unique and proprietary CBD pet supplements and products. Currently, CBD products for pets are not approved or legal, however, our expectation is these pet product formulations will become a legal, mainstream offering for the pet market in the future. We expect to have a competitive advantage to market and sell our CBD line for pets given our strong branding and global distribution network already in place.

We expect that any cannabis grown and not used for our CBD pet products and supplements line will be sold to the wholesale market in Canada.

We also intend to assess the merits of creating space to sell and/or lease, as well as offer value-added services, to support micro-cultivators. The Cannabis Regulations allow micro-cultivator licenses to small companies and individuals that would permit them to grow and sell cannabis to other licensed producers, licensed retailers and storefront dispensaries. These changes by Health Canada have created opportunity not only for the large commercial growers but also for independent growers.

15

Specialized Skill and Knowledge

The primary specialized skill and knowledge requirement for success as a Licensed Producer of cannabis for medical purposes is with respect to cultivating and producing cannabis. We believe our experienced growing team can produce premium, high quality cannabis to support the creation of industry leading cannabis products for pets.

Health Canada, pursuant to the Cannabis Regulations, sets the standard required for production and sale of medical cannabis. Our team of growers and quality assurance personnel will work to ensure a premium, consistent product is produced, meeting or exceeding Health Canada standards.

Competitive Conditions

We have applied for “licensed producer status” under the ACMPR in Canada (now transitioning to the Cannabis Act). As of September 28, 2018, Health Canada has granted licenses to a total of 120 Licensed Producers of which 64 are fully authorized to produce and sell cannabis, 49 have a license restricted to the cultivation of medical cannabis, four have a license just to sell medical cannabis, two have a license just to label, test or package medical cannabis and one has a license only to produce cannabis oils. A number of other entities have applications pending or will seek to obtain licensed producer status under the new Cannabis Act.

The differentiators of cannabis between competitors are expected to be price, quality (smell/taste/appearance), organic purity (zero additive, pesticide, mould treatment or anti-biological) and production process. The cost of growing an inexpensive strain (i.e. mass market) is identical to growing premium strains and the crop risks are identical (disease, pests and infrastructure failure). The majority of firms with listed product often overlap in strains and strengths (THC/CBD). We believe we will successfully compete with other Licensed Producers as our cannabis will be used to create unique, value added products to sell into the large, growing pet supplement market.

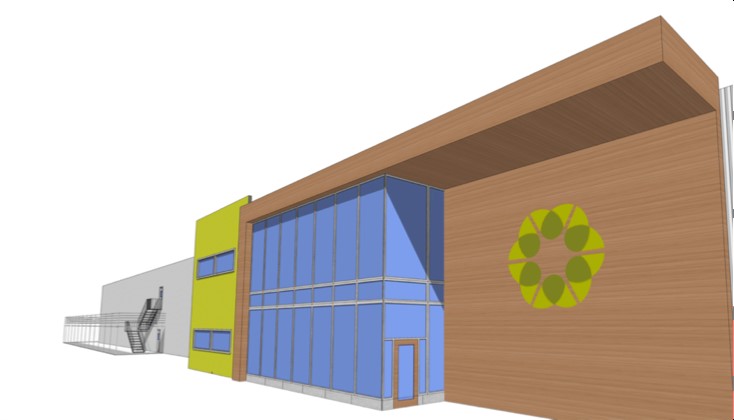

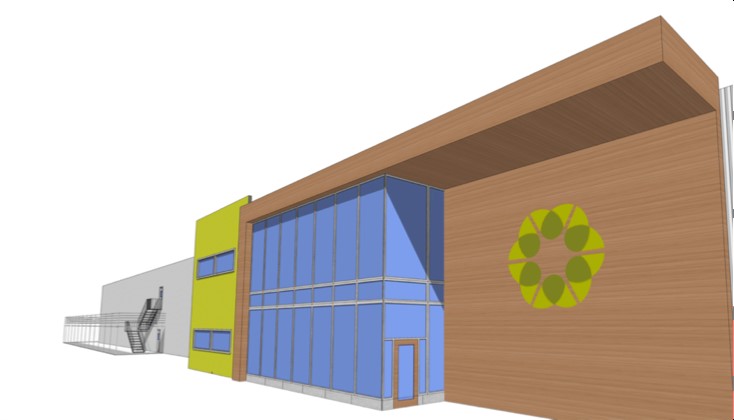

The Lumby Property

During the year ended March 31, 2018, we acquired 40 acres located in Lumby B.C. for total consideration of $3,380,387 to build our cannabis cultivation facility, the True Leaf Campus. As at March 31, 2018, construction costs incurred of $726,955 are capitalized and depreciation will commence when the facility is put into use. The total budget for the cannabis cultivation facility is estimated at $7.4 million. We have retained Colliers Project Leaders to provide professional project management services and assist us in keeping the project on time and on budget. As at September 30, 2018, we have spent $5.2 million on the facility, and anticipate spending an additional $2.2 million to complete the facility.

The True Leaf Campus and cultivation facility has provided a number of jobs to residents of the City of Lumby during the construction phase and is expected to support additional permanent jobs upon completion. The City of Lumby supports True Leaf’s presence and positive economic impact on its community.

The first phase of the project includes a two-storey 9,000 square foot central hub for the initial grow area, laboratory services, whole-plant extraction, and the research, development and production of cannabis products, plus a 16,000 square foot wing for cannabis cultivation. Ownership of the 40-acre site means we are well positioned to expand to meet future market demands. We are assessing best options and business models to fully realize optimal economic benefits of the Lumby property and believe we are well positioned for significant growth and expansion of our cannabis growing facilities if demand warrants.

16

True Leaf Campus (Final), Phase 1, Lumby, B.C

True Leaf Campus (as of Oct 19, 2018), Phase 1, Lumby, B.C

We expect to finish the construction of our Lumby facility in the fall of 2018. Our application to become a licensed producer or grower of cannabis under the ACMPR will be migrated to the CTLS under the Cannabis Act for review and approval. We also plan to apply for a license to sell cannabis products pursuant to standard processing techniques. We anticipate securing both licenses by the end of 2019.

Regulatory Framework

Legal Developments

On November 27, 2017, the House of Commons passed the Cannabis Act and on June 21, 2018, the Government of Canada announced that the Cannabis Act received Royal Assent. The Cannabis Act came into force on October 17, 2018. On July 11, 2018, the Cannabis Regulations were released by the government and these regulations also came into force on October 17, 2018. The Cannabis Regulations, among other things, set forth the following:

17

- Licenses, Permits and Authorizations;

- Security Clearances;

- Cannabis Tracking System;

- Cannabis Products;

- Packaging and Labelling;

- Cannabis for Medical Purposes; and

- Drugs Containing Cannabis.

Licenses, Permits and Authorizations

The Cannabis Regulations establish six classes of licenses: (1) cultivation licenses; (2) processing licenses; (3) analytical testing licenses; (4) sales for medical purposes licenses; (5) research licenses; and (6) cannabis drug licenses. The Cannabis Regulations also create subclasses for cultivation licenses (standard cultivation, micro-cultivation and nursery) and processing licenses (standard processing and micro-processing). Different licenses and each sub-class therein, carry differing rules and requirements that are intended to be proportional to the public health and safety risks posed by each license category and each sub-class.

The Cannabis Regulations provide that all licenses issued under the Cannabis Act are valid for a period of no more than five years and that no licensed activity may be conducted in a dwelling-house. The Cannabis Regulations also permit both outdoor and indoor cultivation of cannabis. The implications of the proposal to allow outdoor cultivation are not yet known, but such a development could be significant as it may reduce start-up capital required for new entrants in the cannabis industry. It may also ultimately lower prices as capital expenditure requirements related to growing outside are typically much lower than those associated with indoor growing.

Generally, the Cannabis Act provides that licenses issued under the ACMPR that were in force immediately before the Cannabis Act coming into force on October 17, 2018 are deemed to be licenses issued under the corresponding provisions of the Cannabis Act for the applicable activity and any such licenses will continue in force so long as they are renewed and are not revoked or expired. For example, under the ACMPR authorizing the production of fresh or dried cannabis, or cannabis plants or seeds is deemed to be a cultivation license under the Cannabis Act, a licence under the ACMPR authorizing the production of cannabis oil or cannabis resins deemed to be a processing license under the Cannabis Act, and a license under the ACMPR authorizing sale of cannabis plants, seeds, fresh or dried cannabis or cannabis oil to medical users is deemed to be a license for sale for medical purposes, provided that the license holder meets certain requirements.

Similarly, the Cannabis Act generally provides that licenses pertaining to cannabis or its derivatives issued under the Narcotic Control Regulations that are in force immediately before the Cannabis Act came into force are deemed to be licenses issued under the corresponding provisions of the Cannabis Act and any such license continues in force until revoked or it expires. For example, a license issued under the NCR authorizing cultivation of cannabis for scientific purposes shall be a research license under the Cannabis Act.

Security Clearances

Under the Cannabis Regulations, certain people associated with cannabis licensees, including individuals occupying a key position, directors, officers, large shareholders and individuals identified by the Minister of Health, must hold a valid security clearance issued by the Minister. This includes individuals that have direct control over a license holder, as well as the officers and directors of any corporation having direct control over a license holder (e.g., officers and directors of a parent corporation). The Cannabis Regulations

18

provide a three-month grace period for current license holders to identify those individuals that require security clearances and to apply for such security clearances (i.e., until January 17, 2019). Security clearances issued under the ACMPR are considered to be security clearances for the purposes of the Cannabis Act and Cannabis Regulations.

Under the Cannabis Regulations, the Minister of Health may refuse to grant security clearances to individuals with associations to organized crime or with past convictions for, or an association with drug trafficking, corruption or violent offences. Individuals who have histories of nonviolent, lower-risk criminal activity (for example, simple possession of cannabis, or small-scale cultivation of cannabis plants) are not precluded from participating in the legal cannabis industry, and the grant of security clearance to such individuals is at the discretion of the Minister and such applications will be reviewed on a case-by-case basis.

Cannabis Tracking System

Under the Cannabis Act, the Minister of Health is authorized to establish and maintain a national cannabis tracking system (the “Cannabis Tracking System”). The Cannabis Regulations provide the Minister of Health with the authority to make a ministerial order that would require certain persons named in such order to report specific information about their authorized activities with cannabis, in the form and manner specified by the Minister.

The Ministerial Order regarding the Cannabis Tracking System was published in the Canada Gazette, Part II, on September 5th, 2018 and came into effect on October 17, 2018. The purpose of this system is to track the flow of cannabis throughout the supply chain as a means of preventing the illegal inversion and diversion of cannabis into and out of the regulated system. Under the Cannabis Tracking System, a holder of a licence for cultivation, licence for processing, or a licence for sale for medical purposes is required to submit monthly reports to Health Canada. The first monthly reports from licence holders and provinces and territories under the Cannabis Tracking System are due no later than November 15, 2018.

Cannabis Products

The Cannabis Regulations permit the sale to the public of dried cannabis, cannabis oil, fresh cannabis, cannabis plants, and cannabis seeds, including in such forms as “pre-rolled” and in capsules. The THC content or and size of certain cannabis products is limited by the Cannabis Regulations. The sale of edible cannabis products and concentrates (such as hashish, wax and vaping products) are currently prohibited but are expected to be permitted within one year following the Cannabis Act coming into force.

Packaging and Labelling

The Cannabis Regulations set out requirements pertaining to the packaging and labelling of cannabis products. Such requirements are intended to promote informed consumer choice and allow for the safe handling and transportation of cannabis. All cannabis products are required to be packaged in a manner that is tamper-proof and child-resistant in accordance with the Cannabis Regulations.

Health Canada is proposing strict limits on the use of colours, graphics, and other special characteristics of packaging. Cannabis package labels must include specific information, such as: (i) product source information, including the class of cannabis and the name, phone number and email of the cultivator; (ii) a mandatory health warning, rotating between Health Canada’s list of standard health warnings; (iii) the Health Canada standardized cannabis symbol; and (iv) information specifying THC and CBD content.

A cannabis product brand name may only be displayed once on the principal display panel or, if there are separate principal display panels for English and French, only once on each principal display panel. It can be in any font style and any size, so long as it is equal to or smaller than the health-warning message.

19

The font must not be in metallic or fluorescent colour. In addition to the brand name, only one other brand element can be displayed.

The Cannabis Regulations provide a six-month transitional period to allow licensed holders under the ACMPRs to sell cannabis products labelled in accordance with the ACMPRs.

Advertising

The Cannabis Act provides for prohibitions regarding the promotion of cannabis products. Subject to a few exceptions, all promotion of cannabis products is prohibited unless authorized by the Cannabis Act. The prohibitions apply to anyone who may be involved in promotion cannabis, cannabis accessories and services related to cannabis, including: (1) persons who produce, sell or distribute cannabis; (2) persons who sell or distribute cannabis accessories; (3) persons who provide cannabis-related services; or (4) media organizations.

Limited promotion of cannabis, cannabis accessories and cannabis-related services is permitted under the Cannabis Act in specific circumstances including (1) informational promotion or brand-preference promotion; (2) point of sale; and (3) brand elements on things that are not cannabis or a cannabis accessory subject to restrictions.

Cannabis for Medical Purposes

On October 17, 2018, the medical cannabis regime under the ACMPRs was repealed and substantively reinstituted into the Cannabis Regulations under the Cannabis Act. As a result, the medical cannabis regulatory framework under the Cannabis Act and the Cannabis Regulations will remain substantively the same as previously existing under the Controlled Drugs and Substances Act and the ACMPR, with adjustments to create consistency with rules for non-medical use, improve patient access, and reduce the risk of abuse within the medical access system (see Part 14 of the Cannabis Regulations entitled “Access to Cannabis for Medical Purposes”). The sale of medical cannabis will remain federally regulated and in each case, sales can only be made by an entity that holds a licence to sell under the Cannabis Regulations to clients that have a medical document and that have registered with the licensed entity. Just as with the previous medical cannabis regime under the ACMPRs, under the Cannabis Regulations, clients (patients) will need to obtain a medical document (a document similar to a prescription) from their doctor and then register as a client with a cannabis company that has a licence to sell for medical purposes (the registration is only good for up to a year).

Provincial Regulatory Framework

While the Cannabis Act provides for the regulation of the commercial production of cannabis for recreational purposes and related matters by the federal government, the Cannabis Act proposes that affords the provinces and territories of Canada with the authority to regulate other aspects of cannabis for recreational purposes (similar to what is currently the case for liquor and tobacco products) such as sale and distribution, minimum age requirements that are greater than the minimum of 18 included in the Cannabis Act, places where cannabis can be consumed, and a range of other matters.

With respect to sale and distribution, there are essentially three general frameworks that the provinces and territories have implemented: (i) privately operated cannabis retailers licensed by the province; (ii) government run retail stores; or (iii) a combination of both frameworks (e.g. allowing for privately-operated and government-operated brick and mortar retail stores, while online retail stores, in most jurisdictions, are operated by the applicable provincial or territorial government). Regardless of the framework, the recreational cannabis market will ultimately be supplied by federally licensed cultivators and processors. Most jurisdictions have implemented a government-run wholesale model. Brick and mortar retail stores are required to obtain their cannabis products from the wholesalers, while the wholesalers, in turn, acquire the cannabis products from the federally licensed cultivators and processors.

20

General

Intangible Properties

The ownership and protection of our intellectual property is integral to our future success. Currently, we protect our intangible assets through trade secrets, technical know-how and proprietary information (the “Intellectual Property”). We protect our Intellectual Property by seeking and obtaining registered trademark protection where possible, developing and implementing standard operating procedures and entering into non-disclosure agreements with parties that have access to our Intellectual Property to protect our confidentiality and ownership of its Intellectual Property. We also seek to preserve the integrity and confidentiality of our Intellectual Property by maintaining physical security of our premises and physical and electronic security of our information technology systems.

Employees

We have thirteen (13) employees and engaged eight (8) consultants.

Foreign Operations

Our TL Pet division sells a similar range of pet treats in Europe.

Lending

The Company does not lend funds as part of its regular operations.

Bankruptcy and Similar Procedures

There have been no bankruptcy, receivership or similar proceedings against the Company or any of its subsidiaries, or any voluntary bankruptcy, receivership or similar proceedings by the Company or any of its subsidiaries, within the three most recently completed financial years or during or proposed for the current financial year.

Social or Environmental Policies

Construction of the Company’s cannabis production facility in Lumby, BC is in compliance with all applicable environmental requirements.

Risk Factors

General Business Risks

The existence of material uncertainties may cast significant doubt on our ability to continue as a going concern.

Our auditor has issued an opinion on our consolidated financial statements which states that the consolidated financial statements were prepared assuming we will continue as a going concern. Our auditor concurred with management’s assessment that our continued operations are dependent on our ability to generate future cash flows from operations and obtain additional funding through external financing to deliver on its business plan. There is a risk that financing will not be available on a timely basis or on terms acceptable to us.

21

Our success depends in part on our ability to attract and retain senior management and key skilled professionals which we may or may not be able to do. Our failure to do so could prevent us from achieving our goals or becoming profitable.

Our success is dependent on the ability of our directors and officers to develop our business and manage our operations. It is also dependent on our ability to attract and retain key quality assurance, scientific, sales, public relations, and marketing staff. The loss of any key person or the inability to find and retain new key persons could have a material adverse effect on our business. Competition for sales and marketing staff as well as officers and directors - can be intense. While competitive compensation packages are provided as a primary method of retaining the services of key individuals, no assurance can be provided that we will be able to attract or retain key personnel in the future. This may adversely impact our operations.

We will need a significant amount of capital to execute our business plan. Unless we are able to raise sufficient funds, we may be forced to discontinue our operations.

We are in the development stage and will likely operate at a loss until our business becomes established. We will require additional financing in order to fund future operations. Our ability to secure any required financing in order to commence and sustain our operations will depend, in part, upon prevailing capital market conditions, as well as our business success. There can be no assurance that we will be successful in our efforts to secure any additional financing or additional financing on terms satisfactory to our management. If additional financing is raised by issuing common shares, control may change and shareholders may suffer additional dilution. If adequate funds are not available or they are unavailable on acceptable terms, we may be required to scale back our business plan or cease operating.

We have a limited operating history, and accordingly, we are subject to many of the risks of early stage enterprises.

We have earned revenues from TL Pet and TL Europe since they began operations in 2015 and 2016 respectively; however, these two operations have not yet achieved profitability.

TL Medicine was launched in July 2013 to become a licensed producer of medicinal cannabis for the Canadian market under the ACMPR program administered by Health Canada. TL Medicine will be subject to a Health Canada inspection upon completion of the construction of its facility to allow for the cultivation, manufacturing, and distribution of cannabis products. As at March 31, 2018 we have completed the security clearance stage, but we do not have a license to produce cannabis and no products are in commercial production or use. We were not granted an ACMPR license prior to October 17, 2018 and will be required to satisfy additional obligations in order to qualify, including the completion of a compliant medical cannabis cultivation facility at the parcel of land owned by us in Lumby, British Columbia. Moving forward, TL Medicine will be complying with the licensing requirements pursuant to the Cannabis Act and Cannabis Regulations. We continue to work diligently to comply with all of the requirements of Health Canada in order to be successful at receiving a license to sell cannabis for medical purposes under the Cannabis Act. There is no guarantee that we will receive a license to produce cannabis under these new regulations. The Company is exploring alternative business models for TL Medicine in the event that it is unsuccessful in obtaining its license.

We are therefore subject to many of the risks common to early-stage enterprises, including under-capitalization, cash shortages, limitations with respect to personnel, financial, and other resources and lack of revenues. There is no assurance that our future operations will result in profitability. If we cannot generate sufficient revenues to operate profitably, we may suspend or cease our operations. There is no assurance that we will be successful in achieving a return on shareholders’ investment and the likelihood of success must be considered in light of the early stage of operations.

22

We have a history of operating losses.

We have a history of net losses, may incur significant net losses in the future and may not achieve or maintain profitability. We have incurred losses in recent periods. We may not be able to achieve or maintain profitability and may continue to incur significant losses in the future. In addition, we expect to continue to increase operating expenses as we implement initiatives to continue to grow our business and deliver on our business plan. If our revenues do not increase to offset these expected increases in costs and operating expenses, we will not be profitable. There is no assurance that future revenues will be sufficient to generate the funds required to continue operations without external funding.

Risks Related to Our Common Shares

If we issue additional common shares, shareholders may experience further dilution in their ownership of us.

We are authorized to issue an unlimited number of common shares without par value. We have the right to raise additional capital or incur borrowings from third parties to finance our business. Our board of directors has the authority, without the consent of any of our shareholders, to cause us to issue more common shares. Consequently, shareholders may experience more dilution in their ownership of us in the future. Our board of directors and majority shareholders have the power to amend our constating documents in order to affect forward and reverse stock splits, and recapitalizations of the company. The issuance of additional common shares by us would dilute all existing shareholders' ownership in us.

We cannot assure that we will ever pay dividends.

We do not currently anticipate declaring and paying dividends to our shareholders in the near future. It is our current intention to apply net earnings, if any, in the foreseeable future to increase our capital base and marketing. Prospective investors seeking or needing dividend income or liquidity should therefore not purchase our common shares. We cannot assure that we will ever have sufficient earnings to declare and pay dividends to the holders of our common shares, and in any event, a decision to declare and pay dividends is at the sole discretion of our board of directors.

We are controlled by our principal shareholder, Darcy Bomford, whose interests may differ from those of the other shareholders.

Mr. Darcy Bomford is our CEO, founder, principal shareholder and a director of the Company. As of the date of this AIF he owns directly and indirectly a total of 23,713,752 common shares or 24.89% of the total issued and outstanding common shares of our company.

Mr. Bomford, as our principal shareholder, is able to exercise significant control over all matters requiring shareholder approval including the election of directors and approval of significant corporate transactions. This concentration of ownership may have the effect of delaying or preventing a change in control and might adversely affect the market price of our common shares. This concentration of ownership may not be in the best interests of all of our shareholders.

Claims for indemnification by our directors and officers may reduce our available funds to satisfy successful third-party claims against us and may reduce the amount of money available to us.

23

Our articles provide that we will indemnify our directors and officers in each case to the fullest extent permitted by the Business Corporations Act (British Columbia) (the “BCA”). We must indemnify our officers and directors against all reasonable fees, expenses, charges and other costs of any type or nature whatsoever. This includes any and all expenses and obligations paid or incurred in connection with investigating, defending, being a witness in, participating in (including on appeal), or preparing to defend against any completed, actual, pending or threatened action, suit, claim or proceeding, whether civil, criminal, administrative or investigative, or establishing or enforcing a right to indemnification under the indemnification agreement.

Risks Related to the Trading of Our Common Shares

Future sales of our common shares, or the perception that such sales may occur could depress our common share price.

Our notice of articles authorizes us to issue up to an unlimited number of common shares. In the future, we may issue additional common shares or other securities if we need to raise additional capital. The number of new common shares issued in connection with raising additional capital could constitute a material portion of those current outstanding common shares. Any future sales of our common shares, or the perception that such sales may occur, could negatively impact the price of our common shares.

Our common shares are thinly traded and you may be unable to sell at or near asking price, or at all.

We do not have a liquid market for our common shares, and we cannot predict the extent to which an active public market for trading our common shares will be achieved or sustained. We can be thinly traded given we are a small company that is relatively unknown to stock analysts, stockbrokers, institutional investors and others in the investment community who generate or influence sales volume. Even if we came to the attention of such persons, those persons tend to be risk-averse and may be reluctant to follow, purchase, or recommend the purchase of shares of an unproven company such as ours until such time as we become more seasoned and viable. As a consequence, there may be periods of several days or more when trading activity in our shares is minimal or non-existent, as compared to a seasoned issuer which has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect on share price. We cannot give you any assurance that a broader or more active public trading market for our common shares will develop or be sustained, or that current trading levels will be sustained.

The market price for our common shares may be volatile, which may result in a decline in value of your investment.

The trading price of our common shares has been and may continue to be volatile. Securities markets worldwide experience significant price and volume fluctuations. This market volatility, as well as general economic, market or political conditions could reduce the market price of our common shares in spite of our operating performance. In addition, our results of operations could fail to meet the expectations of investors due to a number of potential factors, including variations in our quarterly results of operations, additions or departures of key management personnel, failure to meet our projected operational milestones, litigation and government investigations. Other factors which may affect the value of our common shares include: changes or proposed changes in laws, new regulations, or differing interpretations or enforcement of the law, adverse market reaction to any indebtedness we may incur or securities we may issue in the future, changes in market valuations of similar companies or speculation in the press or investment community, announcements by our competitors of significant contracts, acquisitions, dispositions, strategic partnerships, joint ventures or capital commitments, adverse publicity about our industry or individual scandals. All of these events could result in a decrease of the market price of our common shares and as a result, you may be unable to resell your common shares at or above the price you acquired our securities.

24

Risks Relating to Our Pet Business

We are subject to significant risks associated with introducing new products including the risk that our new product developments will not produce sufficient sales to recoup our investment.

Our pet support supplements and chews include ingredients not traditionally found in such products. Our success will depend on our ability to build a following for our products. We cannot assure you that we will be successful in achieving market acceptance of our products. Our failure to successfully market and build a customer base for our products could harm our ability to grow our business and could have a material adverse effect on our business, results of operations and financial condition.

We may not be able to successfully implement our growth strategy on a timely basis or at all.

Our future success depends, in large part, on our ability to implement our growth strategy, including expanding distribution in Canada, United States, and Europe, and generating sales in other key markets such as Asia, South Africa, Australia and New Zealand, attracting new consumers to our brand, introducing new products and product line extensions, and expanding into new markets. Our ability to implement this growth strategy depends, among other things, on our ability to:

- enter into distribution and other strategic arrangements with retailers and other potential distributors of our products;

- expand and maintain brand loyalty;

- effectively compete with specialty pet products;

- secure shelf space in stores;

- increase our brand recognition by effectively implementing our marketing strategy and advertising initiatives;

- develop new products and product line extensions that appeal to consumers;

- maintain sources for the required supply of quality raw ingredients to meet our growing demand; and

- identify and successfully enter and market our products in new geographic markets and market segments.

If we fail to implement our growth strategy or if we invest resources in a growth strategy that ultimately proves unsuccessful, our business, financial condition and results of operations may be materially adversely affected.

We rely on co-packers to provide our supply of pet supplement and treat products. Any failure by co-packers to fulfill their obligations or any termination or renegotiation of our co-packing agreements could adversely affect our results of operations.

We have supply agreements with co-packers that require them to provide us with specific finished products. We rely on co-packers as our sole-source for our products. The failure for any reason of a co-packer to fulfill its obligations under the applicable agreements with us or the termination or renegotiation of any such co-packing agreement could result in disruptions to our supply of finished goods and have an adverse effect on our results of operations. Additionally, from time to time, a co-packer may experience financial difficulties, bankruptcy, or other business disruptions which could disrupt our supply of finished goods. We may also be required to incur additional expenses from the need to provide financial accommodations to the co-packer or taking other steps to minimize or avoid supply disruption, such as establishing a new co-packing arrangement with another provider. During an economic downturn, our co-packers may be more susceptible to experiencing such financial difficulties, bankruptcies or other business disruptions. We mitigate this risk by working with co-packers who have an established track record. In the event we need to hire a new co-packer, the new co-packing arrangement may not be available on terms as favorable to us as the existing co-packing arrangement, if at all.

25

If we do not manage our supply chain effectively, including inventory levels, our business, financial condition and results of operations may be adversely affected.

The inability of any supplier, co-packer, third-party distributor or transportation provider to deliver or perform for us in a timely or cost-effective manner could cause our operating costs to increase and our profit margins to decrease. We must continuously monitor our inventory and product mix against forecasted demand or risk having inadequate supplies to meet consumer demand as well as having too much inventory on hand that may reach its expiration date and become unsalable. If we are unable to manage our supply chain effectively and ensure that our products are available to meet consumer demand, our operating costs could increase, and our profit margins could decrease.

Failure by our transportation providers to deliver our products on time or at all could result in lost sales.

We use third-party transportation providers for our product shipments. We rely on a number of different providers for our shipments based on cost efficiency and availability at the time of shipping. Transportation services include scheduling and coordinating transportation of finished products to our customers, shipment tracking and freight dispatch services. Risks include higher costs as a result of increases in fuel prices, potential employee strikes, inclement weather or other factors which could delay or cancel the transportation of our products. In the future we may not be able to obtain terms as favorable as those we receive from the third-party transportation providers that we currently use which, in turn, would increase our costs and thereby adversely affect our business, financial condition, and results of operations.

We may face difficulties as we expand into countries in which we have no prior operating experience.

We have recently launched sales of our products in the United States, Europe, Asia, South Africa, Australia and New Zealand. We intend to continue to expand in and into countries in which we have no prior operating experience. From time to time, we expect to encounter economic, political, regulatory, personnel, technological, and language barriers and other risks that may increase our expenses or delay our ability to become profitable in such countries. These risks include:

- the risk that we must spend significant amounts of time and money to build brand recognition without certainty that we will be successful;

- currency fluctuations;

- enforcing agreements and collecting receivables through some foreign legal systems;

- potentially longer payment cycles and greater difficulty in collecting accounts;

- changes in local tax laws, and tax rates that may exceed those of the United States or Canada;

- changes in economic conditions, consumer preferences, or demand for our products in these foreign markets;

- the credit risk of local customers and distributors;

- differences in culture and trends in foreign countries with respect to pets and pet care;

- government regulations that would have a direct or indirect adverse impact on our business and market opportunities, including nationalization of private enterprise; and

- our expansion into new countries may require significant resources and the efforts and attention of our management and other personnel, which could divert resources from our existing business operations.

26

As we expand globally, our success will depend on our ability to anticipate and effectively manage these and other risks associated with our foreign operations. We mitigate this risk through the use of local, on-ground employees and contractors.

Competition in the markets in which we operate, including internet-based competition, is strong. If we are unable to compete effectively, our ability to generate sales may suffer and our operating income and net income could decline.

We are one of many companies in the consumable pet products market competing for a significant market share. Our competition in the healthy feeding systems and healthy consumable products markets are both domestic and foreign companies, many of whom manufacture their products in low cost areas such as India, East Asia, Southeast Asia, and Mexico. Many of these companies also have more brand awareness. We are still building our market presence. Any reputation that we may successfully gain with retailers for quality products does not necessarily translate into name recognition or increased market share with the end consumer.