- NESR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

CORRESP Filing

National Energy Services Reunited (NESR) CORRESPCorrespondence with SEC

Filed: 2 Apr 18, 12:00am

National Energy Services Reunited Corp.

777 Post Oak Blvd., Suite 730

Houston, Texas, 77056

April 2, 2018

VIA EDGAR

U.S. Securities and Exchange Commission

Office of Natural Resources

100 F Street, N.E.

Mail Stop 4628

Washington, DC 20549

Attn: H. Roger Schwall, Assistant Director

| Re: | National Energy Services Reunited Corp. | |

| Preliminary Proxy Statement on Schedule 14A | ||

| Filed February 14, 2018 | ||

| File No. 001-38091 |

Dear Mr. Schwall:

National Energy Services Reunited Corp. (“NESR”, “we”, “us” or “our”) hereby transmits its response to the comment letter received by us from the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”), dated March 14, 2018, regarding our Preliminary Proxy Statement on Schedule 14A (the “Proxy Statement”) previously filed on February 14, 2018. NESR has filed today Amendment No. 1 to the Proxy Statement (“Amendment No. 1”).

Our responses below correspond to the captions and numbers of the Staff’s comments. For the convenience of the Staff, we have reproduced those comments below in bold and our response to each comment immediately follows the applicable comment. Capitalized terms used in this letter but not otherwise defined have the meanings assigned to them in Amendment No. 1.

In addition to submitting this letter by EDGAR, we will also deliver to the Staff a copy of this letter together with Amendment No. 1 marked to show revisions we have made to the Proxy Statement, including revisions made in response to the Staff’s comments.

General

| 1. | With your revised proxy statement, provide updated disclosures regarding significant developments. For example, please disclose the status of the exemption application to which you refer at page 46. Similarly, your answer at page 21 under “What happens if I vote against...?” emphasizes that you would need to dissolve and liquidate, but this appears to discount the possibility that the company would be able to actively solicit and pursue other possible transactions prior to the May 2019 deadline. |

Response:In response to the Staff’s comment, NESR has updated all disclosures in Amendment No. 1 where there have been significant developments since the filing of the Proxy Statement on February 14, 2018, including but not limited to the status of the exemption application referenced on page 46 (which status has been updated on page 26).

H. Roger Schwall, Assistant Director

U.S. Securities and Exchange Commission

April 2, 2018

Page 2 of 19

In addition, in response to the Staff’s comment, NESR has revised the disclosure to the answer on page 21 under “What happens if I vote against...?” to include the following language in Amendment No. 1:

“If the Business Combination Proposal is not approved, we may proceed to identify another transaction which may be submitted for shareholder approval. If we are ultimately unable to consummate a Business Combination and close such transaction by May 17, 2019, then we will be required to dissolve and liquidate our trust account by returning the then remaining funds in such account to the public shareholders.”

Questions and Answers about the Proposals for Shareholders

Q: What equity stake will (i) current NESR shareholders . . . page 18

| 2. | Please revise to include a separate question and answer in which you identify the Backstop Investor and address its maximum potential holdings upon consummation of the transaction. |

Response:In response to the Staff’s comment, NESR has included the following question and answer in Amendment No. 1 on page 18:

“Q: Who is the Backstop Investor and what will be their minimum and maximum potential holdings upon the consummation of the transaction?

A:The Backstop Investor is party(ies) arranged by MEA Energy Advisory UK, LLP or its affiliates who are providing the Backstop Commitment.

Assuming no redemptions occur and NESR does not exercise its option to draw an additional $80 million under the Backstop Commitment, the Backstop Investor, following completion of the Business Combination, will own a minimum of 7,000,000 ordinary shares at $10.00 per share, which will represent an ownership interest of 7.9% in NESR, and NESR’s public shareholders will retain an ownership interest of 25.7% in NESR.

In the event NESR exercises its option to draw the full additional amount under the Backstop Commitment of $80 million in exchange for 7,114,906 ordinary shares at $11.244 per share and assuming no redemptions occur, then following completion of the Business Combination the Backstop Investor will have an ownership interest of 14.7% in NESR, and NESR’s public shareholders will retain an ownership interest of 23.8% in NESR.”

H. Roger Schwall, Assistant Director

U.S. Securities and Exchange Commission

April 2, 2018

Page 3 of 19

Summary of the Proxy Statement, page 26

General

| 3. | We note your reference in this section to NPS Holdings Limited as the “largest regionally-owned oil, gas and petrochemical services provider in the Middle East.” At page 31, you assert that the Target Companies “have ... outperformed their peers in key financial metrics.” Please identify the “key metrics” to which you refer, and supplementally provide us with highlighted copies of the materials, both publically available and customer-prepared, that served as the basis for these assertions. |

Response:In response to the Staff’s comment, NESR has revised the disclosures on pages 27 and 171 of Amendment No. 1 from “the largest regionally-owned oil, gas and petrochemical services provider in the Middle East” to “one of the largest regionally-owned oilfield services providers of the businesses in which it operates in the Middle East”. Since most of the regional oilfield services companies in the MENA region are privately held companies and hence public information is not available for them, we based our assertions on NPS management’s knowledge of the size of each competitor’s operations and information procured by a third-party evaluation firm.

In response to the Staff’s request, NESR has provided to the Staff, under separate cover (all information included in that submission, the “Supplemental Information”) on a confidential and supplemental basis pursuant to Rule 12b-4 of the Exchange Act (“Rule 12b-4”), hard copies of extracts of information procured by a third-party evaluation firm. In accordance with such rule, the Supplemental Information was provided together with a request that such information either be returned or shredded (and provide us with acknowledgement of same) promptly following completion of the Staff’s review thereof. Such materials are not, and will not be, filed with or deemed to be part of the Proxy Statement or any amendments thereto. A request for confidential treatment of such materials pursuant to the provisions of 17 C.F.R. § 200.83 has also been made under separate cover.

With respect to the language on page 31 referenced in the Staff’s comment, NESR has also provided to the Staff in the Supplemental Information hard copies of the “Key Metrics” referred to on page 31 and referenced in the Staff’s comment. In accordance with Rule 12b-4, the Supplemental Information was provided on a confidential and supplemental basis together with a request that such information either be returned or shredded (and provide us with acknowledgement of same) promptly following completion of the Staff’s review thereof. Such materials are not, and will not be, filed with or deemed to be part of the Proxy Statement or any amendments thereto. A request for confidential treatment of such materials pursuant to the provisions of 17 C.F.R. § 200.83 has also been made under separate cover.

Organizational Structure, page 28

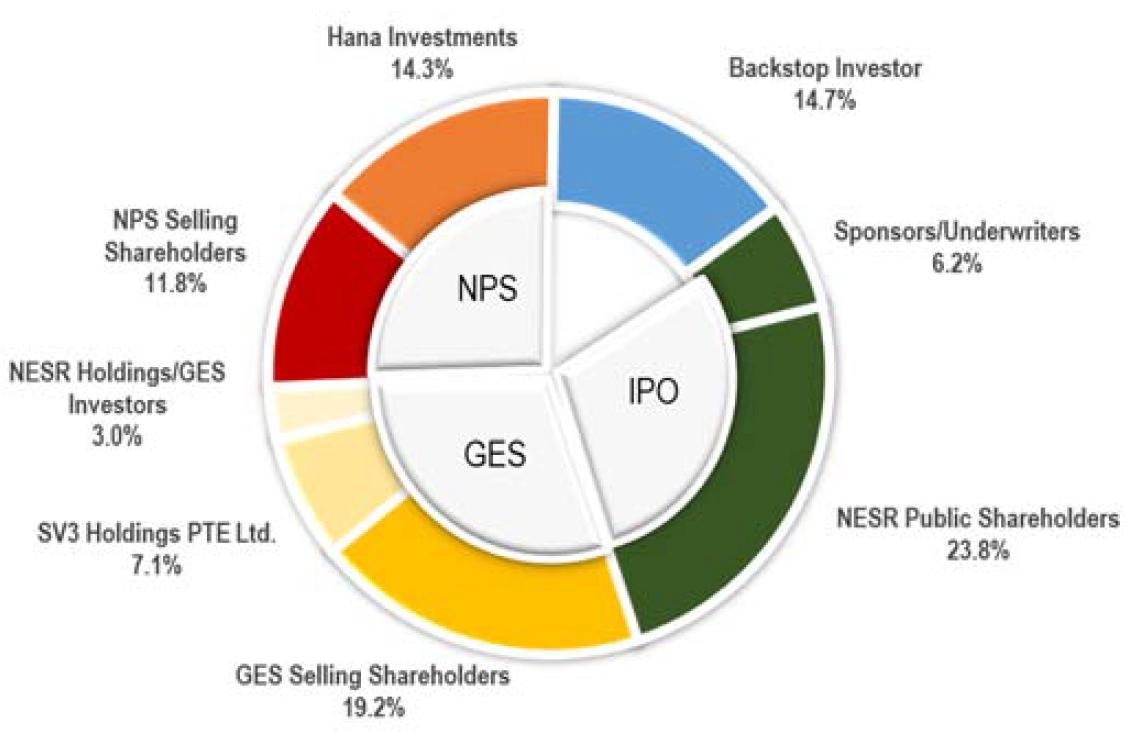

| 4. | Please expand the diagram or provide an additional chart to illustrate the anticipated holdings of the Backstop Investor, GES Selling Stockholders, NPS Selling Stockholders, and your sponsor upon consummation of the contemplated transactions. |

Response:In response to the Staff’s comment, please see below an additional chart to illustrate the anticipated holdings of the Backstop Investor, GES Selling Stockholders, NPS Selling Stockholders, and the Sponsor, as well as the remaining shareholders, upon consummation of the contemplated transactions, assuming no redemptions and utilization of the full $150 million Backstop Commitment. This chart has been added to page 29 of Amendment No. 1.

H. Roger Schwall, Assistant Director

U.S. Securities and Exchange Commission

April 2, 2018

Page 4 of 19

Consideration for the Acquisition of GES in the Business Combination, page 28

| 5. | Revise to clarify where footnotes 1 and 3 should be shown in the table summarizing the consideration for the acquisition of NPS and GES. |

Response:In response to the Staff’s comment, the referenced table has been revised on page 28 of Amendment No. 1 as follows to clarify the footnote references:

| NESR Ordinary Shares | Cash (in millions) | |||||||

| NPS Selling Stockholders(2) | 11,318,827 | $ | 292.8 | |||||

| Hana Investments(3) | 13,758,449 | - | ||||||

| Total for NPS | 25,077,276 | $ | 292.8 | |||||

| GES Selling Stockholders | 18,484,848 | - | ||||||

| SV3 Holdings Pte Ltd | 6,825,000 | - | ||||||

| NESR Holdings Ltd/ GES Investors(4) | 2,925,000 | - | ||||||

| Total for GES | 28,234,848 | - | ||||||

| Total for NPS and GES transactions | 53,312,125 | $ | 292.8 | (1) | ||||

1Part of the proceeds from the Forward Purchase Agreement will be used to help finance the cash consideration payable to the NPS Selling Stockholders.

2Excludes possible Cash Earnout, Equity Earnout and Ticker Fee as described in the Consideration for the Acquisition of NPS.

3Includes 418,001 NESR ordinary shares to be issued as payment for $4.7 million interest accrued for Hana Investments.

4Excludes interest on the loans of approximately $1.25 million payable in cash to the GES Investors.

H. Roger Schwall, Assistant Director

U.S. Securities and Exchange Commission

April 2, 2018

Page 5 of 19

Reasons for the Business Combination, page 31

| 6. | Provide updated disclosure regarding current market conditions. You state that “overall MENA drilling activity has not declined over the last three years while, in comparison, the United States drilling rig counts dropped considerably.” |

Response:In response to the Staff’s comment, NESR revised the disclosure on pages 31 and 109 of Amendment No. 1 by deleting the referenced sentence and replacing it with the following two sentences:

“Overall Middle East drilling activity has not declined materially over the last three years while, in comparison, the United States drilling rig count has dropped considerably, as evidenced by the February 2018 Baker Hughes World Wide Rig Count Report stating that since 2014, the monthly average Middle East rig count has dropped less than 1% from January 2015 to December 2017 while the monthly average rig count in the United States dropped 50% over the same three-year period.”

The information is located on the Baker Hughes GE website at the following link:http://phx.corporate-ir.net/phoenix.zhtml?c=79687&p=irol-rigcountsoverview

Selected Historical Financial Information of GES, page 34

| 7. | Provide disclosure stating the selected financial data of GES presented here is prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board. |

Response:In response to the Staff’s comment, NESR has revised the disclosure on page 34 of Amendment No. 1 to state that the selected financial data of GES has been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board.

Unaudited Pro Forma Condensed Combined Financial Information, page 67

| 8. | As it relates to the acquisition of NPS and GES, we note the factors you cite on page 69 in support of your conclusion that NESR is the accounting acquirer pursuant to ASC 805. Please provide us with your complete analysis in support of the conclusion that NESR is the accounting acquirer. Your response should provide further information regarding the relative voting rights in the combined entity, with consideration given to minimum and maximum redemption scenarios. |

Response:In response to the Staff’s comment, NESR respectfully submits additional detail of its previous accounting acquirer evaluation in accordance with ASC 805.

To determine the accounting acquirer, NESR considered the different elements stipulated in ASC 805. NESR evaluated the consideration exchanged, the size of the entities involved, as well as the factors present in ASC 805-10-55-11 and ASC 805-10-55-12. Additionally, NESR also reviewed ASC 805-40 to determine if the Business Combination would be considered a forward or reverse acquisition.

The form of the Business Combination includes a mix of cash and equity-based consideration issued by NESR to the shareholders of two operating companies. In this form of transaction, the accounting acquirer may not be the legal acquirer. Based on NESR’s analysis of the facts and circumstances of the Business Combination, NESR concluded that it was the accounting acquirer.

H. Roger Schwall, Assistant Director

U.S. Securities and Exchange Commission

April 2, 2018

Page 6 of 19

NESR’s conclusion was based on five primary factors, summarized below and also discussed in further detail, which hold true for both the minimum and maximum redemption scenarios:

| ● | NESR is transferring cash via the use of funds in NESR’s trust account, issuing NESR ordinary shares, and will be incurring liabilities to execute the Business Combination; | |

| ● | NESR has the right to nominate 4 out of the 9 initial members who will serve on the Board of Directors of the post-closing combined company. Furthermore, NESR’s Chief Executive Officer will be the Chairman of the Board of the combined company. This provides a plurality for NESR with no other company representing more than 3 seats on the Board of the combined company. There are also no special voting rights conveyed in the Business Combination; | |

| ● | NESR’s executive management team will comprise the executive management of the combined company; | |

| ● | NESR was the entity that initiated the Business Combination; and | |

| ● | The headquarters of the combined company will be NESR’s headquarters. |

An analysis of ASC 805 in view of these five factors is provided below:

Transfers cash / incurs indebtedness / Issuer of equity

Per ASC 805-10-55-11:

In a business combination effected primarily by transferring cash or other assets or by incurring liabilities, the acquirer usually is the entity that transfers the cash or other assets or incurs the liabilities.

Per ASC 805-10-55-12:

In a business combination effected primarily by exchanging equity interests, the acquirer usually is the entity that issues its equity interests.

To consummate the Business Combination, NESR will issue its equity to shareholders of the Targets, in addition to outside investors who have put in capital to fund the Business Combination. NESR will also use its funds sitting in trust as a source of the cash portion of the consideration in the Business Combination. No other party or entity is issuing new equity interests in the Business Combination. This favors NESR as the accounting acquirer in the Business Combination.

Furthermore, NESR is incurring liabilities as it will assume the obligation to satisfy the Loan Contracts with the GES Investors. Additionally, outside investors will contribute cash. The outside investors are not affiliated with Targets, and the capital contributed by them is convertible into shares of NESR at a pre-defined per share price. No bank debt will be utilized as a source of purchase consideration of Targets. This favors NESR as the accounting acquirer in the Business Combination.

H. Roger Schwall, Assistant Director

U.S. Securities and Exchange Commission

April 2, 2018

Page 7 of 19

Relative voting rights

Per ASC 805-10-55-12(a):

The relative voting rights in the combined entity after the business combination. The acquirer usually is the combining entity whose owners as a group retain or receive the largest portion of the voting rights in the combined entity.

The acquirer is usually the entity whose owners as a group retain or receive the largest portion of the voting rights in the combined entity (i.e., NESR). For purposes of applying this criteria, the existence of any unusual or special voting arrangements and options, warrants, or convertible securities should be considered.

The relative voting interest of the individuals holding NESR shares at-close will be equal to their ownership interest. The Proxy Statement outlines the anticipated ownership percentages of each group of shareholders on pages 30 and 83, assuming no NESR shareholders redeem their shares and also assuming the maximum amount of share redemptions takes place. In a minimum redemption scenario, NESR is the largest shareholder group, whereas GES is the largest shareholder group in a maximum redemption scenario. However, under both a minimum and maximum redemption scenario, no individual shareholder (as a group) will own in excess of 50% of the shares, and thus no single shareholder will have sufficient voting rights to exert absolute influence over the combined company.

Composition of governing body

Per ASC 805-10-55-12(c):

The acquirer usually is the combining entity whose owners have the ability to elect or appoint or to remove a majority of the members of the governing body of the combined entity.

Subsequent to the Business Combination, the Board of Directors will be comprised of 4 individual incumbent directors of NESR, 2 individuals from NPS, 2 from GES, and 1 from SV3 for a total of 9 members. The fact that, as noted above, there is no single shareholder with the ability to exert influence over the combined company and restructure the composition of its Board, combined with the fact that NESR will have the right to nominate the most seats on the Board, including Sherif Foda, Chief Executive Officer of NESR, who currently serves as Chairman of the Board of NESR and is expected to continue as Chairman of the Board of the combined company, favors NESR as the accounting acquirer in the Business Combination.

Composition of management

Per ASC 805-10-55-12(d):

The acquirer usually is the combining entity whose former management dominates the management of the combined entity.

NESR’s Chief Executive Officer, Sherif Foda, and its Chief Financial Officer, Thomas Wood, will initially form the executive management team of the combined entity. Furthermore, other management positions will be determined and designated solely by current NESR management.

H. Roger Schwall, Assistant Director

U.S. Securities and Exchange Commission

April 2, 2018

Page 8 of 19

Initiation of combination

Per ASC 805-10-55-14:

In a business combination involving more than two entities, determining the acquirer shall include a consideration of, among other things, which of the combining entities initiated the combination, as well as the relative size of the combining entities, as discussed in the preceding paragraph.

NESR was formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar Business Combination with one or more businesses. NESR’s sole operations to date have been to conduct an extensive search for and negotiate a potential transaction utilizing the global network and investing and operating experience of its management team, Board of Directors, and external advisors. NESR was seeking opportunities in the Middle East due to its fragmented market, strong demand, and customers seeking alternative options. Ultimately, NESR identified the Targets with robust operations in the Middle East and pursued the Business Combination with the goal of creating the first and only NASDAQ-listed oilfield service company in the Middle East and North Africa region. This favors NESR as the accounting acquirer in the Business Combination.

Other factors considered

The headquarters of NESR, specifically the work location of executives, are expected to be NESR’s offices in Houston, Texas. This favors NESR as the accounting acquirer in the Business Combination.

Weighing all the factors discussed above (NESR is the entity transferring cash, incurring liabilities, issuing shares; NESR has the right to nominate a plurality of the Board of Directors; NESR’s executive management will comprise the executive management of the combined company; NESR is the entity initiating the Business Combination; and the headquarters of the combined company will be NESR’s headquarters), the preponderance of the evidence indicates that NESR is the accounting acquirer in the Business Combination.

Unaudited Pro Forma Condensed Combined Balance Sheet, page 70

| 9. | It appears to us that pro forma adjustment (h) shown on the Trust Account line item should instead be pro forma adjustment (g). Please revise as necessary. |

Response:In response to the Staff’s comment, NESR has revised the disclosure on page 70 of Amendment No. 1.

| 10. | It appears the pro forma adjustment of $68,275 labeled as (j) shown on the Common stock line item under the scenario assuming maximum redemptions should instead be labeled as pro forma adjustment (k). Please revise as necessary. |

Response:In response to the Staff’s comment, NESR has revised the disclosure on page 70 of Amendment No. 1.

H. Roger Schwall, Assistant Director

U.S. Securities and Exchange Commission

April 2, 2018

Page 9 of 19

Notes to Unaudited Pro Forma Condensed Combined Financial Information, page 73

| 11. | It appears from the table on page 80 summarizing the components of the estimated Merger Consideration that NESR ordinary shares are valued at $10.00. Please clarify your intentions with regard to updating the purchase price computation based on the most recent stock price of NESR ordinary shares prior to the mailing date of the proxy statement. Also, include disclosure of the date at which the stock price was determined and a sensitivity analysis for the range of possible outcomes based upon percentage increases and decreases in the recent stock price. The appropriate percentages should be reasonable in light of NESR’s volatility. |

Response:In response to the Staff’s comment, NESR has revised its disclosures on page 79 of Amendment No. 1 to include a sensitivity analysis and to explicitly indicate the price per share of NESR ordinary shares. For the purposes of this unaudited pro forma condensed combined financial information a price per share of $10.00 was used as a proxy of fair value. Final merger consideration will be based on NESR’s share price at the date of the consummation of the Business Combination. Upon filing the Form 8-K, the unaudited pro forma condensed combined financial information will be updated to reflect NESR’s share price at the date of the consummation of the Business Combination. To demonstrate the potential changes to merger consideration based on NESR share price at the date of the consummation of the Business Combination, the Company has provided a hypothetical 5% sensitivity on merger consideration and goodwill. NESR believes that a 5% fluctuation in the market price of its ordinary shares is reasonable and in-line with its historical stock volatility.

Description of the GES Transaction, page 74

| 12. | We note you have “assumed that the repayment of the Loan Contracts will be made in NESR ordinary shares, and that the interest on the Loan Contracts will be made in cash, at the time of their assumption.” Tell us why you believe the assumption that the GES Investors will accept repayment in NESR ordinary shares is factually supportable under Rule 11-02(b)(6) of Regulation S-X since each GES Investor has agreed to accept repayment in a form subject to their consent. In addition, expand your disclosure to state the repayment amount, if the Loan Contracts were assumed to be repaid in cash. |

Response:Rule 11-02(b)(6) of Regulation S-X states (in part) that pro forma adjustments related to the pro forma condensed income statement shall include adjustments which give effect to events that are (i) directly attributable to the transaction, (ii) expected to have a continuing impact on the registrant, and (iii) factually supportable. Management of NESR has concluded that the repayment of principal of the Loan Contracts will be made in NESR ordinary shares based on discussions they have had with each of the GES Investors and further believes that the GES Investors desire to receive the NESR ordinary shares at the agreed price of $10.00 per share. The Loan Contracts allow for the GES Investors to receive either NESR ordinary shares, GES shares, or cash in repayment of the loans, and in most of these contracts such selection is at NESR’s discretion, subject to GES Investors having the right for twenty-one (21) days after filing of the Definitive Proxy Statement to reject in writing acceptance of NESR ordinary shares. NESR does not believe that any GES Investor would reject NESR ordinary shares and risk receipt of a small minority stock position in GES, which, given GES’s status as a private company, would be illiquid. We believe these facts meet all of the requirements of Rule 11-02(b)(6).

With respect to the possibility that the Loan Contracts may be repaid in cash, in response to the Staff’s comment, the following sentence has been added to our disclosure on page 73 of Amendment No. 1:

“Repayment of the Loan Contracts in cash instead of NESR ordinary shares results in an increase to cash consideration paid of $29.3 million and a reduction to NESR ordinary shares issued of 2,925,000.”

H. Roger Schwall, Assistant Director

U.S. Securities and Exchange Commission

April 2, 2018

Page 10 of 19

On a similar point, we note you have assumed up to $4.7 million in interest owed to Hana Investments will be funded through the issuance of 418,001 shares of NESR as opposed to payment in cash of up to $4.7 million, as disclosed on page 2. Please tell us why you believe the repayment in NESR ordinary shares is factually supportable under Rule 11-02(b)(6) of Regulation S-X, and expand your disclosure to clarify that the interest may be paid in cash of up to $4.7 million.

Response:In response to the Staff’s comment, NESR discussions with Hana Investments are ongoing regarding the details of certain rights, such as registration rights. During these discussions, there has been no disagreement among the parties that NESR has the right to pay the $4.7 million in NESR ordinary shares. Rule 11-02(b)(6) of Regulation S-X states (in part) that pro forma adjustments related to the pro forma condensed income statement shall include adjustments which give effect to events that are (i) directly attributable to the transaction, (ii) expected to have a continuing impact on the registrant, and (iii) factually supportable. NESR has revised its disclosure on page 74 of Amendment No. 1 to explain that NESR has the right and expects to pay the $4.7 million of interest in shares, based on negotiations between the parties, but the payment can be made in cash at NESR’s option. We will include the final written agreement between the parties as an Annex to an amended proxy statement filing when the agreement is finalized and we will make any necessary changes to the disclosures in such amended filing. We believe this signed agreement will meet the requirements of Rule 11-02(b)(6).

Note 3. GES Historical Financial Statements, page 77

| 13. | Please add an explanation of the conversion rate used for purposes of the column titled “Conversion from Rial Omani to U.S. Dollar.” |

Response:In response to the Staff’s comment, NESR has revised its disclosures on page 76 of Amendment No. 1 to add that the conversation rate used in the column titled “Conversion from Rial Omani to U.S. Dollar” was 1 USD: 0.385 RO (rate quoted from the Central Bank of Oman), as the movement of Rial Omani is fixed to the U.S. Dollar.

| 14. | In the table of GES Historical Statement of Operations for the Year Ended December 31, 2016, the non-controlling interest amount of $6,003 reflected in the GES Historical column appears incorrect and does not agree with the amount reflected in your pro forma financial statements of $5,002. Please correct the disclosed amounts, as appropriate. |

Response:In response to the Staff’s comment, NESR has updated the disclosures on page 77 of Amendment No. 1 accordingly.

Adjustments to Unaudited Pro Forma Condensed Combined Balance Sheet, page 79

| 15. | With reference to pro forma adjustment (c), please add disclosure that describes how the Estimated Earn-Out Mechanisms totaling $31,699 was determined. |

Response:In response to the Staff’s comment, NESR has revised its disclosures on page 79 of Amendment No. 1 to add the following:

H. Roger Schwall, Assistant Director

U.S. Securities and Exchange Commission

April 2, 2018

Page 11 of 19

“The terms of the NPS transaction include specific earn-out provisions which, if achieved, will be settled in cash or NESR ordinary shares, depending on the earn-out. The cash earn-out calls for payment of $7.6 million on renewal of a major customer contract. The first and second equity earn-outs are tied to 2018 EBITDA performance measures, with payments to be made in NESR ordinary shares, and are quantified based on expected 2018 EBITDA targets being met. Based on the range of scenarios and probabilities considered, NESR estimated equity earn-outs of 1.67 million shares at $10 per share (equal to $16.7 million) and 740,000 shares at $10 per share (equal to $7.4 million) for the first and second equity earn-outs, respectively. Combining the $7.6 million cash earn-out with the equity earn-outs of $16.7 million and $7.4 million, equals an estimated earn-out of $31.7 million.”

| 16. | The adjustment to Other Assets in pro forma adjustment (d) appears to incorrectly reflect the fair value of GES Other Assets as $0, instead of $529 as disclosed in the table presented in Note 5 on page 80. Please revise the adjustment to Other Assets, as appropriate. |

Response:In response to the Staff’s comment, NESR has updated the disclosures on page 80 of Amendment No. 1 accordingly.

Adjustments to Unaudited Pro Forma Condensed Combined Statements of Operations, page 82

| 17. | With regard to pro forma adjustment (dd), please clarify the nature of this adjustment and why you believe it is factually supportable under Rule 11-02(b)(6) of Regulation S-X. |

Response:In response to the Staff’s comment, NESR has considered in more detail the applicable provisions of Article 11 of Regulation S-X and the related interpretive guidance provided by the Staff, including the discussion of pro forma adjustments contained in the Division of Corporate Finance Financial Reporting Manual.

In conjunction with the Business Combination, the GES Founders have executed a Non-Compete and Non-Disclosure Agreement and have agreed to provide advisory services to NESR for five (5) years. Pursuant to the agreement, the GES Founders will each receive annual payments of $1 million over the course of 5 years. Furthermore, pursuant to separate Waiver of Termination Fees Agreements, each GES Founder agreed to waive their right to substantial severance payments triggered either by the event of the termination of their employment or change of control.

Rule 11-02(b)(6) of Regulation S-X states (in part) that pro forma adjustments related to the pro forma condensed income statement shall include adjustments which give effect to events that are (i) directly attributable to the transaction, (ii) expected to have a continuing impact on the registrant, and (iii) factually supportable. NESR believes that the pro forma adjustments relating to the Non-Compete and Non-Disclosure Agreement are appropriate because they meet each of these requirements.

In particular, NESR believes that the pro forma adjustments referred to above meet the factually supportable criterion contained in Rule 11-02(b)(6) of Regulation S-X since there is an executed contract, the Non-Compete and Non-Disclosure Agreement, in place between GES and NESR for the GES Founders. Furthermore, the Non-Compete and Non-Disclosure Agreement was entered into in contemplation of the Business Combination. As such, this agreement is for the benefit of the combined company and thus needs to be recognized in the pro forma statement of operations as it is expected to have a continuing impact on NESR given its term of 5 years.

H. Roger Schwall, Assistant Director

U.S. Securities and Exchange Commission

April 2, 2018

Page 12 of 19

The Business Combination Proposal, page 93

General

| 18. | We note your brief reference to the Stock Purchase Agreements, the Contribution Agreement, the Shares Exchange Agreement and the Relationship Agreement. Please revise to provide further details regarding the principal terms and conditions of each such material agreement. |

Response:In response to the Staff’s comment, we respectfully point to the detailed descriptions of the Stock Purchase Agreements, the Contribution Agreement, the Shares Exchange Agreement and the Relationship Agreement, set forth on the immediately following pages 94 through 100 of Amendment No. 1. Specifically, a description of the Stock Purchase Agreements for both NPS and GES can be found on pages 94 through 100, descriptions of the Contribution and Share Exchange Agreements are on page 97, and the ANI Relationship Agreement and WAHA Relationship Agreements are set forth on page 96. NESR has revised its disclosure on page 12 of Amendment No. 1 to add cross references by the initial listing of agreements to reflect where in the document more detailed information can be found for each agreement.

The NPS Transaction, page 94

| 19. | We note that a dividend has been declared by NPS Selling Stockholders wherein they will receive a distribution from NPS of $48M. Please note that if a planned distribution to owners, regardless of whether it has been declared, is not reflected in the latest balance sheet but would be significant relative to reported equity, a pro forma balance sheet reflecting the distribution accrual should be presented alongside the historical balance sheet in the filing. Tell us your consideration of this presentation on the face of the historical balance sheet of NPS Holdings Limited. |

Response:In response to the Staff’s comment, NESR has revised the pro forma balance sheet on page 70 of Amendment No. 1 to reflect the $48 million distribution, which was paid in February 2018, after the execution of the NPS Stock Purchase Agreement. The Company determined that the distribution is a type 2 subsequent event and no accrual is necessary on the historical balance sheet of NPS as of December 31, 2017.

Backstop and Forward Purchase Agreement, page 99

| 20. | As developments warrant, please provide updated disclosure regarding the status of the negotiations and the related references, including to the “subsequent $80 million investment” at page 123. |

Response:In response to the Staff’s comment, NESR will provide updated disclosures in future filings as soon as developments warrant.

| 21. | Please revise to clarify the extent to which the financial advisor assumed the implementation of that agreement in preparing its fairness opinion, the related letter of which you include as Annex E. |

Response:In response to the Staff’s comment, NESR has revised the disclosure in Amendment No. 1 to clarify that J.P. Morgan did not consider the effects of any Forward Purchase Agreement, which is in the process of being negotiated and will be entered into after the delivery of J.P. Morgan’s written opinion. The additional disclosure included on page 114 of Amendment No. 1 is as follows:

H. Roger Schwall, Assistant Director

U.S. Securities and Exchange Commission

April 2, 2018

Page 13 of 19

“Without limiting the generality of the foregoing, J.P. Morgan did not consider any potential Forward Purchase Agreement into which NESR may enter into following the date of J.P. Morgan’s opinion.”

Background of the Business Combination, page 100

| 22. | Please provide us supplementally with copies of any material non-public information — board books, documents, financial forecasts, projections and presentations — exchanged by the companies in the negotiations. |

Response:In response to the Staff’s request, NESR has provided to the Staff, under separate cover, as Supplemental Information on a confidential and supplemental basis pursuant to Rule 12b-4, hard copies of the financial forecasts, projections, presentations and other material documents exchanged by the companies in the negotiations. In accordance with such rule, the Supplemental Information was provided together with a request that such information either be returned or shredded (and provide us with acknowledgement of same) promptly following completion of the Staff’s review thereof. Such materials are not, and will not be, filed with or deemed to be part of the Proxy Statement or any amendments thereto. A request for confidential treatment of such materials pursuant to the provisions of 17 C.F.R. § 200.83 has also been made under separate cover.

Also revise to clarify the process whereby the company was able to prepare projections of the Target Companies (which J.P. Morgan relied upon) in the absence of publicly available information. We may have additional comments.

Response:In response to the Staff’s comments, NESR has revised the disclosure on page 101 of Amendment No. 1 to add a subsection to the section entitled “Background of the Business Combination” as follows:

“Preparation of the Projections of the Target Companies

During the due diligence process from September to November of 2017 as well as subsequent to entering into the Share Purchase Agreement, NESR management had been in active and continuous discussions with NPS and GES management teams to review the projections of financial performance as well as the respective growth plans for the Targets. NESR management has significant experience in oilfield services in the region and leveraged that knowledge base to vet, qualify and supplement these projections. NESR identified several areas of synergies with respect to revenue and costs and also built in the effect of additional investments in new technology and tools to generate incremental revenue for the Targets. The combined projections were then discussed and agreed with NPS and GES Selling Stockholders. The NPS Selling Stockholders negotiated and agreed to earnouts keyed to the projected performance of the combined business and SCF Partners had also performed an independent evaluation of the growth projections for GES and conducted an in-depth market analysis for purposes of evaluating and negotiating its initial investment in GES in 2017.”

H. Roger Schwall, Assistant Director

U.S. Securities and Exchange Commission

April 2, 2018

Page 14 of 19

Opinion of J.P. Morgan, page 112

| 23. | We note that the opinion delivered by J.P. Morgan was premised upon certain internal financial analyses and forecasts and expected cost savings and related synergies prepared by the Target Companies. Please describe these projections and the material assumptions underlying such figures. |

Response:In response to the Staff’s comment, we note that J.P. Morgan relied on the financial analyses and forecasts prepared by the management of NESR related to the Target Companies. These financial analyses and forecasts are summarized in the section “Certain Unaudited Internal Financial Projections” on pages 119 through 120 of Amendment No. 1, and cross references to this section are included in the section “Opinion of J.P. Morgan” on page 113 of Amendment No. 1. Further, NESR has expanded the description of the material assumptions underlying the projections and added the following description of NESR’s internal projections regarding synergies in the section “Certain Unaudited Internal Financial Projections” on page 119 and 120 of Amendment No. 1:

“The unaudited financial projections set forth below were prepared by NESR’s management based on information available to them, in particular with respect to each of the Target Companies. The unaudited financial projections were prepared based on reviews of financial information about GES and NPS prepared by each of GES and NPS, respectively, available to NESR, extensive discussions between NESR’s management with each of GES’s management and stockholders and NPS’s management and stockholders, and NESR’s management’s knowledge of the industries in which the companies operate. In connection with the negotiation of the definitive agreements providing for the transaction and prior to the preparation of the unaudited financial projections, NESR negotiated with the NPS Selling Stockholders certain EBITDA-based earnouts, which were based in part on preliminary projections for the performance of NPS.”

“Projected Synergies

The expected cost savings and synergies include NESR’s estimates of spare equipment available for deployment and incremental activity that NESR believes they can bring to the Target Companies by utilizing existing equipment as well as additional investments in new technology and tools to generate incremental revenue, EBITDA and net income. The expected synergies also include the cross-utilization of services and equipment from one Target Company to the other Target Company rather than utilizing services of a third party. The cost savings also include savings from integrating the two organizations under one company resulting from efficiencies in information systems, support functions, supply chain and other infrastructure restructuring. These synergies and cost savings were net of additional costs incurred by NESR to meet its more complex reporting and internal control requirements as a public company. Synergies estimates for the first and second full year after closing are projected to be $25 million and $33 million, respectively. These EBITDA synergies are not reflected in the projections provided above.”

H. Roger Schwall, Assistant Director

U.S. Securities and Exchange Commission

April 2, 2018

Page 15 of 19

| 24. | Similarly, please revise the disclosure at pages 120 to 121 to eliminate any potential ambiguity about the source for the projected information, which appears to have originated with the company. Consider the guidance regarding projections set forth at Item 10(b) of Regulation S-K. |

Response:In response to the Staff’s comment, please note that the projections were based on extensive discussions between the management teams of NESR, GES and NPS. Pursuant to Item 10(b)(1) of Regulation S-K, NESR believes it has a reasonable basis for the projections, as the projections of GES and NPS management represent a good faith assessment of the future performance of GES and NPS. NESR will add the following additional language on page 120 of Amendment No. 1 as discussed in response 23 above:

“The unaudited financial projections set forth below were prepared by NESR’s management based on information available to them, in particular with respect to the industry and each of the Target Companies. The unaudited financial projections were prepared based on reviews of financial information about GES and NPS prepared by management of each of GES and NPS, respectively, available to NESR, extensive discussions between NESR’s management with each of GES’s management and stockholders and NPS’s management and stockholders, and NESR’s management’s knowledge of the industries in which the companies operate. In connection with the negotiation of the definitive agreements providing for the transaction, NESR negotiated with the NPS Selling Stockholders certain EBITDA-based earnouts, which were based in part on preliminary projections for the performance of NPS.”

GES Management’s Discussion and Analysis of Financial Condition and Results of Operations, page 229

Note Regarding Non-GAAP Financial Measures, page 231

| 25. | You state here that “GES’s financial statements in this proxy statement are presented in accordance with U.S. GAAP.” However, the financial information discussed in this section is based on the financial statements of GES presented in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board. Please revise your disclosure. |

Response:In response to the Staff’s comment, NESR has revised the disclosure on page 225 of Amendment No. 1 to state that the GES financial statements are presented in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board, as opposed to U.S. GAAP.

Price Range of Securities and Dividends, page 261

Dividend Policy of GES, page 263

| 26. | We note that GES declared approximately $90.2 million in dividends to its shareholders in 2017. Tell us where the dividend payable is reflected in the financial statements for the fiscal quarter ended September 30, 2017. |

Response:NESR respectfully advises the Staff that GES declared and paid the $90.2 million in dividends to its shareholders in the fourth quarter of 2017 and therefore it would not be reflected in the financial statements for the fiscal quarter ended September 30, 2017. The dividend is reflected in the historical financial statements of GES for the year ended December 31, 2017 that have been included in Amendment No. 1.

H. Roger Schwall, Assistant Director

U.S. Securities and Exchange Commission

April 2, 2018

Page 16 of 19

NPS Holdings Limited Financial Statements

Consolidated Statements of Cash Flows, page F-33

| 27. | We note the line item for the reversal of excess and obsolete inventory. However, the write-down of inventory creates a new cost basis under US GAAP that cannot subsequently be reversed. Please explain the basis for your accounting. Refer to SAB Topic 5.BB for further guidance. |

Response: In response to the Staff’s comment, the Company advises that in accordance with guidance in SAB Topic 5.BB, the Company has not subsequently marked up inventory based on changes in the underlying facts and circumstances. The reference “reversal of excess and obsolete inventory” identified by the Staff within the Statement of Cash Flows, refers to the Company’s removal of the portion of the inventory provision related to marked-down inventory that has been consumed and included as part of cost of services in the consolidated statements of income.

The Company inadvertently classified the consumption of the marked down inventory in the Statement of Cash Flows as “reversal of excess and obsolete inventory”. The Company has revised the disclosure on page F-24 of Amendment No. 1 to include the item within the “(Increase) decrease in service inventories” under the sub-heading “Changes in operating assets and liabilities” which forms part of “Cash flows from operating activities.”

Note 9. Debt, page F-43

| 28. | We note that NPS has entered into a “syndicated Murabaha facility” for $150,000 thousand that was fully drawn in November 2014 (“the Facility”). Based on the description of the terms of the Facility as a “rent-to-own arrangement”, support your accounting for this facility under U.S. GAAP with reference to the applicable accounting guidance you relied upon. In your response, describe for us what item(s) owned by NPS the lending bank has retained ownership interest in until the loan is paid in full and how this item is accounted for in the financial statements of NPS. |

Response:Under Islamic law, the charging or receiving of interest is prohibited. Money is considered to be a tool for measuring value and a medium of exchange, and has no intrinsic utility. Accordingly, under the principles of Islamic law, an investor should realize no interest or gain merely for the employment of money. The return to an investor must be linked to the profits of an enterprise and derived from the commercial risk assumed by that investor.

With the above principle in mind, NESR respectfully advises the Staff that there are a few Islamic financing structures employed when companies need to raise debt. One of the financing structures used is a ‘Murabaha Facility’. The following is an example of key features of the Murabaha Facility which is typically employed and is currently used by NPS:

| ● | A company enters into debt negotiations with the bank and agrees on the critical terms of the arrangement, such as, the amount of the loan facility, the tenure, the stated interest rate, the amortization schedule, etc.; |

H. Roger Schwall, Assistant Director

U.S. Securities and Exchange Commission

April 2, 2018

Page 17 of 19

| ● | Once the terms of the loan facility are agreed upon, the lending bank prepares a financing structure to ensure the facility is in compliance with Islamic law, wherein the bank does not realize interest or gain by the mere activity of lending money; | |

| ● | On the date of the agreement, the company submits a draw down request for the facility amount and the lending bank transfers the funds (equivalent to the agreed financing amount) to the company; and | |

| ● | On the amortization dates of the facility, the company enters into following Murabaha Facility transactions: |

| ● | Step 1: the company purchases a commodity from an agent of the bank at a price equal to the principal amount due on the facility on the amortization date, plus an amount equal to the interest portion due on the facility and to be paid to the bank; | |

| ● | Step 2: the company sells the above commodity immediately at the same amount as the purchase in Step 1, which is equivalent to the principal amount due on the facility on the amortization date, to a commodity trader identified by the bank; | |

| ● | Step 3: On the amortization date, the company repays the bank the principal amount due as mentioned in Step 1; and | |

| ● | Step 4: Based on the amounts listed in the amortization schedule, the company repeats the steps 1, 2 & 3 until the entire principal outstanding is fully settled. |

As the above illustrates, neither the company or the bank takes ownership of the commodity. NESR considers the economic substance of the Murabaha facility to be similar and comparable to a conventional debt instrument. The Murabaha facility represents a contractual obligation for NPS to pay principal and interest on determinable dates to the bank as scheduled in the loan documents and contains terms, conditions restrictive covenants that are standard to these types of financing arrangements. The purchase and sale of the underlying commodity are used to facilitate the structure of the transaction to comply with Islamic laws.

In response to the Staff’s comment, the NESR respectfully advises the Staff that NPS continues to have full title to and risks and reward of ownership of its assets. NESR recognizes that the current disclosure inadvertently compares the Murabaha Facility to a “rent to own arrangement”. Accordingly, NESR has revised the paragraphs following the table in note 9 to the consolidated financial statements of NPS on page F-36 of Amendment No. 1 to read as follows:

“The Company entered into a syndicated Murabaha facility (“the Facility”) for $150 million which was fully drawn by the Company on November 26, 2014. Murabaha is an Islamic financing structure where a set fee is charged rather than interest. This type of loan is legal in Islamic countries as banks are not authorized to charge interest on loans, so banks charge a flat fee for continuing daily operations of the bank in lieu of interest.

The Facility of $150 million is from a syndicate of three commercial banks. The Facility is repayable in semi-annual instalments ranging from $7.5 million to $30 million commencing from May 26, 2017 with the last instalment due on November 26, 2020. The Facility carries as set fee which equals to the stated interest rate of six months LIBOR plus a fixed profit margin of 2.9% per annum. The Facility is secured by pro-rated personal guarantees of two individual shareholders and letters of awareness executed by the corporate shareholders as credit support for the Facility.

H. Roger Schwall, Assistant Director

U.S. Securities and Exchange Commission

April 2, 2018

Page 18 of 19

Costs incurred to obtain financing are capitalized and amortized using the effective interest method and netted against the carrying amount of the related borrowing. The amortization is recorded in interest expense on the consolidated statements of income / (loss) and was $154 thousand, $279 thousand, and $278 thousand for the years ended December 31, 2017, 2016 and 2015 respectively.

The Facility contains covenants which, among others, require that certain financial ratios be maintained, which include maintaining a gearing ratio of 1.5:1. The gearing ratio is calculated as all the Company’s debt divided by the Company’s total equity and debt. As of December 31, 2017 and 2016 the Company was in compliance with all its covenants.

On May 28, 2017, the maturity of the Facility (“Amended Facility”) was refinanced to extend the maturity of the agreement. The Amended Facility is repayable in quarterly instalments ranging from $1.076 million to $57.852 million commencing from August 1, 2019 with the last instalment due on May 28, 2025. The Amended Facility carries a stated interest rate of three months LIBOR plus a fixed profit margin of 3.25% per annum. The Amended Facility is secured by pro-rated personal guarantees of one individual shareholder and letters of awareness executed by the corporate shareholders as credit support for the new Amended Facility.”

* * * * * *

H. Roger Schwall, Assistant Director

U.S. Securities and Exchange Commission

April 2, 2018

Page 19 of 19

We thank the Staff for its review of the foregoing and hope that it has been responsive to the Staff’s comments. If you have any questions relating to the foregoing or further comments, please contact our counsel, Benjamin Reichel, at breichel@egsllp.com or by telephone at (212) 370-1300.

| Very truly yours, | |

| /s/ Sherif Foda | |

| Sherif Foda, Chief Executive Officer |

| cc: | Ellenoff Grossman & Schole LLP |