Filed Pursuant to Rule 424(b)(3)

Registration No. 333-220646

STRATEGIC STUDENT & SENIOR HOUSING TRUST, INC.

SUPPLEMENT NO. 1 DATED JUNE 20, 2018

TO THE PROSPECTUS DATED MAY 1, 2018

This document supplements, and should be read in conjunction with, the prospectus of Strategic Student & Senior Housing Trust, Inc. dated May 1, 2018. Unless otherwise defined in this supplement, capitalized terms used in this supplement shall have the same meanings as set forth in the prospectus.

The purpose of this supplement is to disclose:

| | • | | an update on the status of our offerings; |

| | • | | an update regarding the potential acquisition of a property in Portland, Oregon; |

| | • | | an update regarding our Preferred Units; |

| | • | | an update regarding our borrowing strategy and policies; |

| | • | | updates to our risk factors; |

| | • | | an update to the “Management” section of our prospectus; |

| | • | | information regarding our share redemption program; |

| | • | | information regarding related party fees and expenses; |

| | • | | an update to the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section of the prospectus to include information for the three months ended March 31, 2018; |

| | • | | a revised subscription agreement; and |

| | • | | our unaudited consolidated financial statements as of and for the three months ended March 31, 2018. |

Status of Our Offerings

Pursuant to our private offering, which terminated on March 15, 2018, we sold approximately $92.8 million in Class A shares, or approximately 10.8 million Class A shares. On May 1, 2018, our public offering was declared effective. As of June 14, 2018, we had not sold any shares in connection with our public offering. As of June 14, 2018, approximately $1.1 billion in shares remained available for sale in our public offering, including shares available pursuant to our distribution reinvestment plan.

Potential Acquisition of a Property in Portland, Oregon

On June 5, 2018, a subsidiary of ours entered into a purchase and sale agreement with unaffiliated third parties for the acquisition of anexisting 284-unit senior housing community, known as Courtyard at Mt. Tabor,

1

located in Portland, Oregon. Accordingly, our prospectus is hereby updated as described below.

The following disclosure is added to the end of the “Our Properties—Potential Acquisitions” section on page 72 of our prospectus.

Potential Acquisition of the Courtyard Property

On June 5, 2018, a subsidiary of ours entered into a purchase and sale agreement with unaffiliated third parties (the “Courtyard Purchase Agreement”) for the acquisition of an existing284-unit senior housing community, known as Courtyard at Mt. Tabor, located in Portland, Oregon (the “Courtyard Property”).

The Courtyard Property is comprised of independent living(199-units), assisted living(73-units) and memory care(12-units). The Courtyard Property also contains developable land intended to be developed for an additional23-units of memory care. The Courtyard Property is currently operated by Integral Senior Living (“ISL”) and offers24-hour staffing, three daily meals and social activities. Amenities generally include a library, café, salon, activity room and fitness center. If the acquisition is completed, we plan to utilize a RIDEA structure for the Courtyard Property and continue to use ISL as the third party operator for the Courtyard Property. ISL’s portfolio of managed communities includes approximately 59 communities with approximately 5,000 residents and 3,000 employees.

The purchase price for the Courtyard Property is $92 million. We expect to fund approximately 70% of our acquisition of the Courtyard Property with a mortgage loan in the amount of $63.2 million from KeyBank as a Freddie Mac Multifamily Approved Seller/Servicer (the “Freddie Mac Portland Loan”) and to fund the remaining portion with any combination of net proceeds from our offering, a bridge loan, and/or other equity or debt financing from third parties or affiliates. The closing of the Courtyard Property is anticipated to occur on August 31, 2018 but is subject to two30-day extensions at our option. There can be no assurance that we will be able to obtain the Freddie Mac Portland Loan, a bridge loan, or other equity or debt financing at or prior to the time of closing. In addition, we anticipate that the construction of the additional23-units of memory care, which is expected to be completed post-closing, will cost approximately $9.0 million and will be funded using any combination of net proceeds from our offering, a bridge loan, and/or other equity or debt financing from third parties or affiliates.

Pursuant to the Courtyard Purchase Agreement, we will be obligated to purchase the Courtyard Property only after satisfactory completion of agreed upon closing conditions. We will decide whether to acquire the Courtyard Property generally based upon:

| | • | | our ability to raise sufficient net proceeds from our offering, obtain the Freddie Mac Portland Loan, or obtain funds from other equity or debt financing; |

| | • | | satisfactory completion of due diligence on the Courtyard Property and the sellers of the Courtyard Property; |

| | • | | approval by our board of directors to purchase the Courtyard Property; |

| | • | | satisfaction of the conditions to the acquisition in accordance with the Courtyard Purchase Agreement; and |

| | • | | no material adverse changes relating to the Courtyard Property, the sellers of the Courtyard Property or certain economic conditions. |

There can be no assurance that we will complete the acquisition of the Courtyard Property. We and our operating partnership are required to apply 100% of the net proceeds (net of customary transaction costs, offering costs, and certain corporate expenditures approved by KeyBank, including distributions to our common stockholders) of all capital events, including equity issuances, to repay an existing bridge loan with KeyBank related to our acquisition of the Salt Lake Properties, which will impact the amount of funds we would otherwise have available.

2

In connection with the potential acquisition of the Courtyard Property, our operating partnership has deposited earnest money of $500,000 and is obligated to deposit $500,000 of additional earnest money on or before July 19, 2018 if we elect to proceed. The initial $500,000 deposit was funded by an affiliate of our sponsor in exchange for preferred units in our operating partnership pursuant to the terms of our Series A Cumulative Redeemable Preferred Unit Purchase Agreement.

In connection with the Freddie Mac Portland Loan, we have signed a loan application agreement, which required an application deposit of approximately $0.1 million. The initial application deposit was funded by an affiliate of our sponsor in exchange for preferred units in our operating partnership pursuant to the terms of our Series A Cumulative Redeemable Preferred Unit Purchase Agreement. The initial application deposit will be used to pay for various fees and expenses during the loan process. We also expect to have the ability to post an index lock deposit equal to 2% of the loan amount, or approximately $1.3 million. If we elect to proceed with the purchase of the Courtyard Property and enter into an index lock, and then subsequently fail to complete the acquisition of the Courtyard Property, we may forfeit at least $2.4 million in earnest money, deposits and fees. However, the actual amount forfeited may be more if certain breakage fees are greater than the index lock deposit. In addition to the foregoing, we will incur other costs and expenses with respect to the loan and acquisition, such as those related to our due diligence process.

Other properties and investments may be identified in the future that we may acquire prior to or instead of the Courtyard Property. Due to the considerable conditions to the consummation of the acquisition of the Courtyard Property, we cannot make any assurances that the closing of the Courtyard Property is probable.

Our Preferred Units

In connection with our potential acquisition of the Courtyard Property, the Preferred Investor has made additional Investments in exchange for Preferred Units in our operating partnership. In particular, the Preferred Investor funded our initial deposit with respect to the Courtyard Property of $500,000 in exchange for 20,000 Preferred Units, as well as our initial application deposit with respect to the Freddie Mac Portland Loan of approximately $0.1 million in exchange for 4,400 Preferred Units. In addition, pursuant to the terms of the Unit Purchase Agreement, our operating partnership has issued to the Preferred Investor an additional 244 Preferred Units, or 1% of the aggregate amount of the foregoing Investments. Accordingly, our prospectus is hereby updated as described below.

The disclosure regarding the Preferred Units in the sections of our prospectus titled “Our Properties,” “Conflicts of Interest” and “Our Operating Partnership Agreement,” as well as the risk factor on page 26 of our prospectus titled “The preferred units of limited partnership interests in our operating partnership rank senior to all classes or series of partnership interests in our operating partnership and therefore, at any time in which such preferred units are issued and outstanding, any cash we have to pay distributions may be used to pay distributions to the holder of such preferred units first, which could have a negative impact on our ability to pay distributions to you,” are hereby updated accordingly.

In addition, footnote 3 to the chart showing our ownership structure on pages 15 and 127 of our prospectus is hereby deleted and replaced with the following:

(3) We own all of the common units in our operating partnership, other than 25,558.68 common units which are owned by SSSHT Advisor, LLC. A wholly-owned subsidiary of our sponsor owns 100% of the Preferred Units in our operating partnership as a result of the preferred equity investment described elsewhere in this prospectus.

Our Borrowing Strategy and Policies

The second paragraph of the “Our Borrowing Strategy and Policies” subsection of the “Prospectus Summary” section on page 23 of our prospectus is hereby deleted and replaced with the following.

We may incur our indebtedness in the form of bank borrowings, purchase money obligations to the sellers of properties and publicly- or privately-placed debt instruments or financing from institutional investors or other lenders, including bridge financing. We may obtain a credit facility or a separate loan for each acquisition. Our indebtedness may be unsecured or may be secured by mortgages or other interests in our properties. We may use borrowing proceeds to finance acquisitions of new properties, to pay for capital improvements, repairs, or buildouts, to refinance existing indebtedness, to pay distributions, to fund redemptions of our shares, or to provide working capital (which may include fees and expenses owed to our affiliates).

The second paragraph of the “Our Borrowing Strategy and Policies” subsection of the “Investment Objectives, Strategy and Related Policies” section on pages 79-80 of our prospectus is hereby deleted and replaced with the following.

We may incur our indebtedness in the form of bank borrowings, purchase money obligations to the sellers of properties and publicly- or privately-placed debt instruments or financing from institutional investors or other lenders, including bridge financing. We may obtain a credit facility or a separate loan for each acquisition. Our indebtedness may be unsecured or may be secured by mortgages or other interests in our properties. We may use borrowing proceeds to finance acquisitions of new properties, to pay for capital improvements, repairs or buildouts, to refinance existing indebtedness, to pay distributions, to fund redemptions of our shares or to provide working capital. Such working capital may include fees and expenses owed to our affiliates. See “Conflicts of Interest” for more information regarding such fees and expenses.

Updates to our Risk Factors

The following is added as a new risk factor under “Risks Related to this Offering and an Investment in Strategic Student & Senior Housing Trust, Inc.”

We have incurred a net loss to date, have an accumulated deficit and our operations may not be profitable in 2018.

We incurred a net loss of approximately $2.7 million for the three months ended March 31, 2018. Our accumulated deficit was approximately $9.0 million as of March 31, 2018. Given that we are still early in our fundraising and acquisition stage, we do not expect our operations will be profitable in 2018.

3

Update to “Management”

The eighth paragraph in the “Management — Limited Liability and Indemnification of Directors, Officers, Employees, and Other Agents” section of our prospectus is hereby replaced in its entirety with the following.

The SEC and the Commonwealth of Pennsylvania take the position that indemnification against liabilities arising under the Securities Act is against public policy and unenforceable. Indemnification of our directors, officers, employees, agents, advisor, or affiliates and any persons acting as a broker-dealer will not be allowed for liabilities arising from or out of a violation of state or federal securities laws, unless one or more of the following conditions are met:

| | • | | there has been a successful adjudication on the merits of each count involving alleged securities law violations; |

| | • | | such claims have been dismissed with prejudice on the merits by a court of competent jurisdiction; or |

| | • | | a court of competent jurisdiction approves a settlement of the claims against the indemnitee and finds that indemnification of the settlement and the related costs should be made, and the court considering the request for indemnification has been advised of the position of the SEC and of the published position of any state securities regulatory authority in which our securities were offered as to indemnification for violations of securities laws. |

Share Redemption Program Information

For the three months ended March 31, 2018, we did not receive any redemption requests nor did we redeem any shares of common stock.

Related Party Fees and Expenses

The following table summarizes related party costs incurred and paid by us for the year ended December 31, 2017 and the three months ended March 31, 2018, as well as any related amounts payable as of December 31, 2017 and March 31, 2018:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, 2017 | | | Three Months Ended March 31, 2018 | |

| | | Incurred | | | Paid | | | Payable | | | Incurred | | | Paid | | | Payable | |

Expensed | | | | | | | | | | | | | | | | | | | | | | | | |

Operating expenses (including organizational costs) | | $ | 394,654 | | | $ | 271,229 | | | $ | 123,425 | | | $ | 179,206 | | | $ | 302,631 | | | $ | — | |

Asset management fees(1) | | | 135,163 | | | | 93,492 | | | | 41,671 | | | | 111,682 | | | | 153,353 | | | | — | |

Acquisition expenses | | | 2,310,020 | | | | 2,310,020 | | | | — | | | | 55,974 | | | | 55,974 | | | | — | |

Capitalized | | | | | | | | | | | | | | | | | | | | | | | | |

Debt issuance costs | | | 499,382 | | | | 465,500 | | | | 33,882 | | | | 357,025 | | | | 67,290 | | | | 323,617 | |

Acquisition expenses | | | — | | | | — | | | | — | | | | 1,570,000 | | | | 1,200,000 | | | | 370,000 | |

Additional Paid-in Capital | | | | | | | | | | | | | | | | | | | | | | | | |

Selling commissions | | | 3,947,269 | | | | 3,915,109 | | | | 32,160 | | | | 806,713 | | | | 823,333 | | | | 15,540 | |

Dealer Manager fees | | | 1,490,524 | | | | 1,474,704 | | | | 15,820 | | | | 443,820 | | | | 450,464 | | | | 9,176 | |

Offering costs | | | 508,350 | | | | 508,350 | | | | — | | | | 114,342 | | | | 114,342 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total | | $ | 9,285,362 | | | $ | 9,038,404 | | | $ | 246,958 | | | $ | 3,638,762 | | | $ | 3,167,387 | | | $ | 718,333 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

4

| (1) | For the year ended December 31, 2017 and three months ended March 31, 2018, the Advisor permanently waived one half of the asset management fee totaling approximately $135,000 and $112,000, respectively. Such amount was waived permanently and accordingly, will not be paid to the Advisor. |

Distributions

Third Quarter of 2018 Distribution Declaration

On June 11, 2018, our board of directors declared a daily distribution in the amount of $0.0016980822 per day per share on our outstanding common stock for the period from July 1, 2018 to September 30, 2018. Such distributions payable to each stockholder of record during a month will be paid the following month.

The following table shows the distributions we have paid through March 31, 2018:

| | | | | | | | | | | | | | | |

Quarter | | Preferred

Unit

Holders | | Common

Stockholders | | Distributions

Declared per

Common Share |

3rd Quarter 2017 | | | $ | 136,282 | | | | $ | 69,415 | | | | $ | 0.096 | |

4th Quarter 2017 | | | $ | 103,603 | | | | $ | 850,816 | | | | $ | 0.155 | |

1st Quarter 2018 | | | | — | | | | $ | 1,399,074 | | | | $ | 0.153 | |

The following shows our distributions and the sources of such distributions for the three months ended March 31, 2018.

| | | | | | | | |

| | | Three Months

Ended

March 31, 2018 | | | | |

Distributions paid in cash — common stockholders | | $ | 867,806 | | | | | |

Distributions reinvested | | | 531,268 | | | | | |

| | | | | | | | |

Total distributions | | $ | 1,399,074 | | | | | |

| | | | | | | | |

Source of distributions | | | | | | | | |

Cash flows provided by operations | | $ | 483,997 | | | | 34.6 | % |

Proceeds from our Private Offering | | | 383,809 | | | | 27.4 | % |

Offering proceeds from distribution reinvestment plan | | | 531,268 | | | | 38.0 | % |

| | | | | | | | |

Total sources | | $ | 1,399,074 | | | | 100.0 | % |

| | | | | | | | |

We did not commence paying distributions until September 2017. From our inception through March 31, 2018, we paid cumulative distributions of approximately $2.9 million including approximately $0.2 million related to our preferred unitholders, as compared to cumulative net loss attributable to our common stockholders of approximately $9.0 million which includes acquisition related expenses of approximately $3.1 millionand non-cash depreciation and amortization of approximately $6.8 million.

For the three months ended March 31, 2018, we paid total distributions of approximately $1.4 million, as compared to net loss attributable to our common stockholders of approximately $2.7 million. Net loss attributable to our common stockholders for the three months ended March 31, 2018includes non-cash depreciation and amortization of approximately $3.0 million, and acquisition related expenses of approximately $0.2 million.

We must distribute to our stockholders at least 90% of our taxable income each year in order to meet the requirements for being treated as a REIT under the Code. Our directors may authorize distributions in excess of this percentage as they deem appropriate. Because we may receive income from interest or rents at various times during our fiscal year, distributions may not reflect our income earned in that particular distribution period,

5

but may be made in anticipation of cash flow that we expect to receive during a later period and may be made in advance of actual receipt of funds in an attempt to make distributions relatively uniform. To allow for such differences in timing between the receipt of income and the payment of expenses, and the effect of required debt payments, among other things, we could be required to borrow funds from third parties on a short-term basis, issue new securities, or sell assets to meet the distribution requirements that are necessary to achieve the tax benefits associated with qualifying as a REIT. We are not prohibited from undertaking such activities by our charter, bylaws or investment policies, and we may use an unlimited amount from any source to pay our distributions. These methods of obtaining funding could affect future distributions by increasing operating costs and decreasing available cash, which could reduce the value of our stockholders’ investment in our shares. In addition, such distributions may constitute a return of investors’ capital.

We have not been able to and may not be able to pay distributions solely from our cash flows from operations, in which case distributions may be paid in part from debt financing or from proceeds from the issuance of common stock in the Offerings. The payment of distributions from sources other than cash flows from operations may reduce the amount of proceeds available for investment and operations or cause us to incur additional interest expense as a result of borrowed funds.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations should be read in conjunction with our financial statements and notes thereto contained elsewhere in this supplement. The following Management’s Discussion and Analysis of Financial Condition and Results of Operations should also be read in conjunction with our financial statements and notes thereto and Management’s Discussion and Analysis of Financial Condition and Results of Operations included in our Registration Statement on FormS-11 (SEC RegistrationNo. 333-220646), which are incorporated by reference into our prospectus.

Overview

Strategic Student & Senior Housing Trust, Inc. was formed on October 4, 2016 and commenced formal operations on June 28, 2017, as discussed below. We were formed under the MGCL for the purpose of engaging in the business of investing in student housing and senior housing properties and related real estate investments. We intend to elect to be treated as a REIT under the Internal Revenue Code for federal income tax purposes beginning with our taxable year ended December 31, 2017.

On January 27, 2017, pursuant to a confidential private placement memorandum, we commenced a private offering of up to $100,000,000 in shares of our common stock (the “Primary Private Offering”) and 1,000,000 shares of common stock pursuant to our distribution reinvestment plan (together with the Primary Private Offering, the “Private Offering”). The Private Offering required a minimum offering amount of $1,000,000, which we met on August 4, 2017. Please see the Notes to the Consolidated Financial Statements contained elsewhere in this supplement for additional information. As of March 31, 2018, we had received approximately $91.9 million in offering proceeds from the sale of our common stock pursuant to the Primary Private Offering. Upon the commencement of our Public Offering, discussed below, and the filing of the articles of amendment to our charter, all outstanding common stock was redesignated as Class A common stock.

On May 1, 2018, we commenced a public offering of a maximum of $1.0 billion in common shares for sale to the public (the “Primary Offering”) and $95.0 million in common shares for sale pursuant to our distribution reinvestment plan (together with the Primary Offering, the “Public Offering,” and collectively with the Private Offering, the “Offerings”), consisting of three classes of shares: Class A shares for $10.33 per share (up to $450 million in shares), Class T shares for $10.00 per share (up to $450 million in shares), and Class W shares for $9.40 per share (up to $100 million in shares). As of March 31, 2018, we had not sold any shares in the Public Offering.

As of March 31, 2018, we owned two student housing properties, an approximately 2.6% beneficial interest in a DST that owns another student housing property and three senior housing properties.

6

Student Housing

As of March 31, 2018, our student housing property portfolio was comprised as follows:

| | | | | | | | | | | | | | | | | | | | | | |

Property | | Date Acquired | | Date Completed | | Primary University Served | | Average

Monthly

Revenue

/ Bed(1) | | | # of

Units | | | # of

Beds | | | Occupancy%(2) | |

Fayetteville | | June 28, 2017 | | August 2016 | | University of Arkansas | | $ | 684 | | | | 198 | | | | 592 | | | | 95.6 | % |

Tallahassee | | September 28, 2017 | | August 2017 | | Florida State University | | | 783 | | | | 125 | | | | 434 | | | | 99.3 | % |

| | | | | | | | | | | | | | | | | | | | | | |

Total | | | | | | | | $ | 727 | | | | 323 | | | | 1,026 | | | | 97.2 | % |

| | | | | | | | | | | | | | | | | | | | | | |

| (1) | Calculated based on our base rental revenue earned during the three months ended March 31, 2018 divided by average occupied beds over the same period. Each property is included in the respective calculations starting with its first full month of operations after we acquire the property, as appropriate. |

| (2) | Represents occupied beds divided by total rentable beds as of March 31, 2018. |

Senior Housing

On February 23, 2018, we purchased our first three senior housing properties, which are located near Salt Lake City, Utah and are known as The Wellington, Cottonwood Creek and The Charleston (collectively, the “Salt Lake Properties”). As of March 31, 2018, our senior housing property portfolio was comprised as follows:

| | | | | | | | | | | | | | | | | | | | | | |

Property | | Date Acquired | | | Year

Built | | | Address | | Average

Monthly

Revenue

/ Unit(1) | | | # of

Units | | | Occupancy%(2) | |

The Wellington | | | February 23, 2018 | | | | 1999 | | | 4522 South 1300 East, Mill Creek, Utah | | $ | 4,720 | | | | 119 | | | | 92.4 | % |

Cottonwood Creek | | | February 23, 2018 | | | | 1982 | | | 1245 East Murray Holladay Road, Mill Creek, Utah | | | 3,632 | | | | 112 | | | | 77.7 | % |

The Charleston at Cedar Hills | | | February 23, 2018 | | | | 2005 | | | 10020 North 4600 West, Cedar Hills, Utah | | | 3,880 | | | | 64 | | | | 92.2 | % |

| | | | | | | | | | | | | | | | | | | | | | |

Total | | $ | 4,157 | | | | 295 | | | | 86.8 | % |

| | | | | | | | | | | | |

| (1) | Calculated based on our revenue earned during the three months ended March 31, 2018 divided by average occupied units over the same period. Each property is included in the respective calculations starting with its first full month of operations after we acquire the property, as appropriate. |

| (2) | Represents occupied units divided by total rentable units as of March 31, 2018. |

Critical Accounting Policies

We have established accounting policies which conform to generally accepted accounting principles (“GAAP”). Preparing financial statements in conformity with GAAP requires management to use judgment in the application of accounting policies, including making estimates and assumptions. Following is a discussion of the estimates and assumptions used in setting accounting policies that we consider critical in the presentation of our financial statements. Many estimates and assumptions involved in the application of GAAP may have a material impact on our financial condition or operating performance, or on the comparability of such information to amounts reported for other periods, because of the subjectivity and judgment required to account for highly uncertain items or the susceptibility of such items to change. These estimates and assumptions affect our reported amounts of assets and liabilities, our disclosure of contingent assets and liabilities at the dates of the financial statements and our reported amounts of revenues and expenses during the periods covered by the financial statements contained elsewhere in this supplement. If management’s judgment or interpretation of the facts and circumstances relating to various transactions had been different, it is possible that different accounting policies

7

would have been applied or different amounts of assets, liabilities, revenues and expenses would have been recorded, thus resulting in a materially different presentation of the financial statements or materially different amounts being reported in the financial statements. Additionally, other companies may use different estimates and assumptions that may impact the comparability of our financial condition and results of operations to those companies.

We believe that our critical accounting policies include the following: real estate purchase price allocations; the evaluation of whether any of our long-lived assets have been impaired; the determination of the useful lives of our long-lived assets; and the evaluation of the consolidation of our interests in joint ventures. The following discussion of these policies supplements, but does not supplant the description of our significant accounting policies, as contained in Note 2 of the Notes to the Consolidated Financial Statements contained elsewhere in this supplement, and is intended to present our analysis of the uncertainties involved in arriving upon and applying each policy.

Real Estate Purchase Price Allocation

We account for acquisitions in accordance with GAAP which requires that we allocate the purchase price of a property to the tangible and intangible assets acquired and the liabilities assumed based on their relative fair values. This guidance requires us to make significant estimates and assumptions, including fair value estimates, which requires the use of significant unobservable inputs as of the acquisition date.

The value of the tangible assets, consisting of land and buildings, is determined as if vacant. Because we believe that substantially all of the leases in place at properties we will acquire will be at market rates, as the majority of the leases are one year or less, we do not expect to allocate any portion of the purchase prices to above or below market leases. Acquisitions of portfolios of properties are allocated to the individual properties based upon an income approach or a cash flow analysis using appropriate risk adjusted capitalization rates which take into account the relative size, age, and location of the individual property along with current and projected occupancy and rental rate levels or appraised values, if available.

Our allocations of purchase prices could result in a materially different presentation of the financial statements or materially different amounts being reported in the financial statements, as such allocations may vary dramatically based on the estimates and assumptions we use.

Impairment of Long-Lived Assets

The majority of our assets, other than cash and cash equivalents, and restricted cash, consist of long-lived real estate assets as well as intangible assets related to our acquisitions. We will evaluate such assets for impairment based on events and changes in circumstances that may arise in the future and that may impact the carrying amounts of our long-lived assets. When indicators of potential impairment are present, we will assess the recoverability of the particular asset by determining whether the carrying value of the asset will be recovered, through an evaluation of the undiscounted future operating cash flows expected from the use of the asset and its eventual disposition. This evaluation is based on a number of estimates and assumptions. Based on this evaluation, if the expected undiscounted future cash flows do not exceed the carrying value, we will adjust the value of the long-lived asset and recognize an impairment loss. Our evaluation of the impairment of long-lived assets could result in a materially different presentation of the financial statements or materially different amounts being reported in the financial statements, as the amount of impairment loss recognized, if any, may vary based on the estimates and assumptions we use.

Estimated Useful Lives of Long-Lived Assets

We assess the useful lives of the assets underlying our properties based upon a subjective determination of the period of future benefit for each asset. We record depreciation expense with respect to these assets based upon the estimated useful lives we determine. Our determinations of the useful lives of the assets could result in a materially different presentation of the financial statements or materially different amounts being

8

reported in the financial statements, as such determinations, and the corresponding amount of depreciation expense, may vary dramatically based on the estimates and assumptions we use.

Consolidation of Investments in Joint Ventures

We will evaluate the consolidation of our investments in joint ventures in accordance with relevant accounting guidance. This evaluation requires us to determine whether we have a controlling interest in a joint venture through a means other than voting rights, and, if so, such joint venture may be required to be consolidated in our financial statements. Our evaluation of our joint ventures under such accounting guidance could result in a materially different presentation of the financial statements or materially different amounts being reported in the financial statements, as the joint venture entities included in our financial statements may vary based on the estimates and assumptions we use.

REIT Qualification

We intend to make an election to be taxed as a REIT, under Sections 856 through 860 of the Code, commencing with our taxable year ended December 31, 2017. To qualify as a REIT, we must meet certain organizational and operational requirements, including a requirement to currently distribute at least 90% of the REIT’s ordinary taxable income to stockholders. As a REIT, we generally will not be subject to federal income tax on taxable income that we distribute to our stockholders. If we fail to qualify as a REIT in any taxable year, we will then be subject to federal income taxes on our taxable income at regular corporate rates and will not be permitted to qualify for treatment as a REIT for federal income tax purposes for four years following the year during which qualification is lost unless the IRS grants us relief under certain statutory provisions. Such an event could materially adversely affect our net income and net cash available for distribution to stockholders. However, we believe that we are organized and operate in such a manner as to qualify for treatment as a REIT and intend to operate in the foreseeable future in such a manner that we will remain qualified as a REIT for federal income tax purposes.

Results of Operations

Overview

As of March 31, 2018, we have derived revenues principally from rents and related fees received from residents of our student housing and senior housing properties and to a lesser extent from other services provided at our senior housing properties. Our operating results depend significantly on our ability to successfully acquire additional student housing and senior housing properties, retain our existing residents and lease our available units to new residents, while maintaining and, where possible, increasing rates. Additionally, our operating results depend on our residents making their required payments to us.

Competition in the markets in which we operate is significant and affects the occupancy levels, rental rates, rental revenues, fees and operating expenses of our student housing and senior housing properties. Development of any new student housing or senior housing properties would intensify competition in the markets in which we operate and could negatively impact our results.

On June 28, 2017, we purchased the Fayetteville Property and commenced formal operations. On September 28, 2017, we purchased our second property, the Tallahassee Property. On February 23, 2018, we purchased our first three senior housing properties, the Salt Lake Properties. Operating results in future periods will depend on the results of operations of these properties and additional student housing and senior housing properties that we acquire.

As we did not acquire our first property and commence formal operations until June 2017, a comparison between the three months ended March 31, 2018 and the three months ended March 31, 2017 would not be meaningful. As a result, these results of operations are described solely with respect to the three months ended March 31, 2018. We expect revenues and expenses to increase in future periods as we acquire additional

9

properties, as well as from recognizing full period operating results for the three senior housing properties acquired on February 23, 2018.

Our results of operations for the three months ended March 31, 2018 are not indicative of those expected in future periods as we expect that revenue, operating expenses, depreciation expense, amortization expense, acquisition expense and interest expense will each increase in future periods as a result of recognizing a full period of operating results for acquisitions completed during the three months ended March 31, 2018 and anticipated future acquisitions.

Leasing and Related Revenues – Student

Leasing and related revenues – student for the three months ended March 31, 2018 were approximately $2.3 million. We expect such revenues primarily to increase in future periods commensurate with our future student housing acquisition activity.

Leasing and Related Revenues – Senior

Leasing and related revenues – senior for the three months ended March 31, 2018 were approximately $1.3 million. We expect such revenues primarily to increase in future periods commensurate with our future senior housing acquisition activity, as well as from recognizing full period operating results for senior housing acquisitions completed during the three months ended March 31, 2018.

Property Operating Expenses – Student

Property operating expenses – student for the three months ended March 31, 2018 were approximately $0.9 million. Such property operating expenses includes the cost to operate our student housing properties including payroll, utilities, insurance, real estate taxes, repairs and maintenance, and marketing. These property operating expenses are attributable to our two student housing properties that we own. We expect such property operating expenses to increase in future periods commensurate with our future acquisition activity.

Property Operating Expenses—Senior

Property operating expenses – senior for the three months ended March 31, 2018 were approximately $0.7 million. Such property operating expenses include the cost to operate our senior housing properties including payroll, food service costs, utilities, insurance, real estate taxes, repairs and maintenance and marketing. These property operating expenses are attributable to our three senior housing properties that we own. We expect such property operating expenses to increase in future periods commensurate with our future acquisition activity, as well as from recognizing full period operating results for acquisitions completed during the three months ended March 31, 2018.

Property Operating Expenses – Affiliates

Property operating expenses – affiliates for the three months ended March 31, 2018 were approximately $112,000. Property operating expenses – affiliates consists solely of asset management fees paid to our advisor and does not include approximately $112,000 of asset management fees that were permanently waived. The property operating expenses – affiliates are attributable to our two student housing properties and three senior housing properties that we own. We expect property operating expenses – affiliates to increase in future periods commensurate with our future acquisition activity.

General and Administrative Expenses

General and administrative expenses for the three months ended March 31, 2018 were approximately $0.3 million. General and administrative expenses consist primarily of legal expenses, directors’ and officers’ insurance expense, an allocation of a portion of payroll related costs attributable to our advisor and its affiliates

10

and accounting expenses. We expect general and administrative expenses to increase in the future as our operational activity increases.

Depreciation and Intangible Amortization Expenses

Depreciation and intangible amortization expenses for the three months ended March 31, 2018 were approximately $3.0 million. Depreciation expense consists primarily of depreciation on the buildings, site improvements, and furniture, fixtures and equipment at our properties. Intangible amortization expense consists of the amortization of intangible assets resulting from our two student housing properties and three senior housing properties that we own.

Acquisition Expenses – Affiliates

Acquisition expenses – affiliates for the three months ended March 31, 2018 were approximately $56,000. These acquisition expenses primarily relate to costs related to student housing and senior housing properties which were acquired in the current period or may be acquired in future periods and such costs did not meet our capitalization criteria.

Other Acquisition Expenses

Other acquisition expenses for the three months ended March 31, 2018 were approximately $0.2 million. These other acquisition expenses include pursuit costs incurred by third parties. These other acquisition expenses primarily relate to pursuit costs for student housing and senior housing properties which were acquired in the current period or may be acquired in future periods and such costs did not meet our capitalization criteria.

Interest Expense

Interest expense for the three months ended March 31, 2018 was approximately $0.9 million. Interest expense consists of interest incurred on debt related to the acquisition of our properties. We expect interest expense to increase in future periods commensurate with our future debt level.

Interest Expense – Debt Issuance Costs

Interest expense – debt issuance costs for the three months ended March 31, 2018 was approximately $79,000. Interest expense – debt issuance costs reflects the amortization of fees incurred in connection with obtaining debt related to the acquisition of our properties. We expect interest expense – debt issuance costs to increase commensurate with our future financing activity.

Liquidity and Capital Resources

Cash Flows

Below is information regarding our cash flows for operating, investing and financing activities for the three months ended March 31, 2018:

| | | | |

| | | Three Months

Ended

March 31, 2018 | |

Net cash flow provided by (used in): | | | | |

Operating activities | | $ | 483,997 | |

Investing activities | | | (78,923,127 | ) |

Financing activities | | | 77,732,392 | |

11

Cash flows provided by operating activities for the three months ended March 31, 2018 were approximately $0.5 million, which is primarily the result of our net loss during the period, excluding depreciation and amortization.

Cash flows used in investing activities for the three months ended March 31, 2018 were approximately $78.9 million, which is primarily the result of the cash paid for the acquisitions of our three senior housing properties.

Cash flows provided by financing activities for the three months ended March 31, 2018 were approximately $77.7 million, which is primarily the result of net debt inflows of approximately $64.5 million and approximately $14.1 million from the net proceeds from the issuance of common stock.

Short-Term Liquidity and Capital Resources

Our Advisor funded and was responsible for our organization and offering costs on our behalf, prior to the commencement of our formal operations on June 28, 2017 when we acquired the Fayetteville Property. Currently, we generally expect that we will meet our short-term operating liquidity requirements from the combination of proceeds from our Offerings, proceeds from secured or unsecured financing from banks or other lenders, net cash provided by property operations and advances from our Advisor, which will be repaid, without interest, as funds are available after meeting our current liquidity requirements, subject to the limitations on reimbursement set forth in our Advisory Agreement.

Distribution Policy

On March 6, 2018, our board of directors authorized a daily distribution rate for the second quarter of 2018 of $0.0016980822 per day per share on the outstanding shares of common stock payable to stockholders of record of such shares as shown on our books as of the close of business on each day during the period, commencing on April 1, 2018 and continuing on each day thereafter through and including June 30, 2018. As a result of the redesignation of our outstanding shares of common stock to Class A shares on May 1, 2018, the previously declared daily distribution rate of $0.0016980822 per day per share now applies to all stockholders of Class A shares. In addition, on May 1, 2018, our board of directors declared a daily distribution rate for the second quarter of 2018 of $0.0016980822 per day per share on the outstanding shares of Class T and Class W common stock payable to stockholders of record of such shares as shown on our books at the close of business on each day during the period, commencing on May 1, 2018 and continuing on each day thereafter through and including June 30, 2018. In connection with this distribution, for the stockholders of Class T shares, after the stockholder servicing fee is paid, approximately $0.00142 per day will be paid per Class T share and for the stockholders of Class W shares, after the dealer manager servicing fee is paid, approximately $0.00144 per day will be paid per Class W share. Such distributions payable to each stockholder of record will be paid the following month.

Currently, we are making distributions to our stockholders using a combination of cash flows from operations and the proceeds from the Private Offering in anticipation of additional future cash flow. As such, this reduces the amount of capital we will ultimately invest in properties. Because substantially all of our operations are performed indirectly through our Operating Partnership, our ability to pay distributions depends in large part on our Operating Partnership’s ability to pay distributions to its partners, including to us. In the event we do not have enough cash from operations to fund cash distributions, we may borrow, issue additional securities or sell assets in order to fund the distributions or make the distributions out of net proceeds from the Offerings. Though we presently intend to pay only cash distributions, and potentially stock distributions, we are authorized by our charter to payin-kind distributions of readily marketable securities, distributions of beneficial interests in a liquidating trust established for our dissolution and the liquidation of our assets in accordance with the terms of the charter or distributions that meet all of the following conditions: (a) our board of directors advises each stockholder of the risks associated with direct ownership of the property; (b) our board of directors offers each stockholder the election of receiving suchin-kind distributions; and(c) in-kind distributions are only made to those stockholders who accept such offer.

12

During our Public Offering, we may raise capital more quickly than we acquire income-producing assets, we may not be able to pay distributions from our cash flows from operations, in which case distributions may be paid in part from debt financing or from proceeds from the Offerings. The payment of distributions from sources other than cash flows from operations may reduce the amount of proceeds available for investment and operations or cause us to incur additional interest expense as a result of borrowed funds.

Over the long-term, we expect that a greater percentage of our distributions will be paid from cash flows from operations. However, our operating performance cannot be accurately predicted and may deteriorate in the future due to numerous factors, including our ability to raise and invest capital at favorable yields, the financial performance of our investments in the current real estate and financial environment and the types and mix of investment in our portfolio. As a result, future distributions declared and paid may exceed cash flow from operations.

Distributions are paid to our stockholders based on the record date selected by our board of directors. We currently pay distributions monthly based on daily declaration and record dates so that investors may be entitled to distributions immediately upon purchasing our shares. We expect to continue to regularly pay distributions unless our results of operations, our general financial condition, general economic conditions, or other factors inhibit us from doing so. Distributions are authorized at the discretion of our board of directors, which are directed, in substantial part, by its obligation to cause us to comply with the REIT requirements of the Code. Our board of directors may increase, decrease or eliminate the distribution rate that is being paid at any time. Distributions are made on all classes of our common stock at the same time. The per share amount of distributions on Class A shares, Class T shares and Class W shares will likely differ because of different allocations of class-specific expenses. Specifically, distributions on Class T shares and Class W shares will likely be lower than distributions on Class A shares because Class T Shares are subject to ongoing stockholder servicing fees and Class W shares are subject to ongoing dealer manager servicing fees. The funds we receive from operations that are available for distribution may be affected by a number of factors, including the following:

| | • | | the amount of time required for us to invest the funds received in the Public Offering; |

| | • | | our operating and interest expenses; |

| | • | | the amount of distributions or dividends received by us from our indirect real estate investments; |

| | • | | our ability to keep our properties occupied; |

| | • | | our ability to maintain or increase rental rates; |

| | • | | capital expenditures and reserves for such expenditures; |

| | • | | the issuance of additional shares; and |

| | • | | financings and refinancings. |

The following shows our distributions and the sources of such distributions for the three months ended March 31, 2018.

| | | | | | | | |

| | | Three Months

Ended

March 31,

2018 | | | | |

Distributions paid in cash — common stockholders | | $ | 867,806 | | | | | |

Distributions reinvested | | | 531,268 | | | | | |

| | | | | | | | |

Total distributions | | $ | 1,399,074 | | | | | |

| | | | | | | | |

Source of distributions | | | | | | | | |

Cash flows provided by operations | | $ | 483,997 | | | | 34.6 | % |

Proceeds from our Private Offering | | | 383,809 | | | | 27.4 | % |

Offering proceeds from distribution reinvestment plan | | | 531,268 | | | | 38.0 | % |

| | | | | | | | |

Total sources | | $ | 1,399,074 | | | | 100.0 | % |

| | | | | | | | |

13

We did not commence paying distributions until September 2017. From our inception through March 31, 2018, we paid cumulative distributions of approximately $2.9 million including approximately $0.2 million related to our preferred unitholders, as compared to cumulative net loss attributable to our common stockholders of approximately $9.0 million which includes acquisition related expenses of approximately $3.1 million andnon-cash depreciation and amortization of approximately $6.8 million.

For the three months ended March 31, 2018, we paid total distributions of approximately $1.4 million, as compared to net loss attributable to our common stockholders of approximately $2.7 million. Net loss attributable to our common stockholders for the three months ended March 31, 2018 includesnon-cash depreciation and amortization of approximately $3.0 million, and acquisition related expenses of approximately $0.2 million.

We must distribute to our stockholders at least 90% of our taxable income each year in order to meet the requirements for being treated as a REIT under the Code. Our directors may authorize distributions in excess of this percentage as they deem appropriate. Because we may receive income from interest or rents at various times during our fiscal year, distributions may not reflect our income earned in that particular distribution period, but may be made in anticipation of cash flow that we expect to receive during a later period and may be made in advance of actual receipt of funds in an attempt to make distributions relatively uniform. To allow for such differences in timing between the receipt of income and the payment of expenses, and the effect of required debt payments, among other things, we could be required to borrow funds from third parties on a short-term basis, issue new securities, or sell assets to meet the distribution requirements that are necessary to achieve the tax benefits associated with qualifying as a REIT. We are not prohibited from undertaking such activities by our charter, bylaws or investment policies, and we may use an unlimited amount from any source to pay our distributions. These methods of obtaining funding could affect future distributions by increasing operating costs and decreasing available cash, which could reduce the value of our stockholders’ investment in our shares. In addition, such distributions may constitute a return of investors’ capital.

We have not been able to and may not be able to pay distributions solely from our cash flows from operations, in which case distributions may be paid in part from debt financing or from proceeds from the issuance of common stock in the Offerings. The payment of distributions from sources other than cash flows from operations may reduce the amount of proceeds available for investment and operations or cause us to incur additional interest expense as a result of borrowed funds.

Indebtedness

As of March 31, 2018, our total indebtedness was approximately $118.4 million, which included approximately $99.9 million in fixed rate debt and $18.5 million in variable rate debt. See Note 5 of the Notes to the Consolidated Financial Statements for more information about our indebtedness.

Long-Term Liquidity and Capital Resources

On a long-term basis, our principal demands for funds will be for property acquisitions, either directly or through entity interests, for the payment of operating expenses and distributions, and for the payment of interest on our outstanding indebtedness, if any.

Long-term potential future sources of capital include proceeds from our Public Offering, secured or unsecured financings from banks or other lenders, issuance of equity instruments and undistributed funds from operations. To the extent we are not able to secure requisite financing in the form of a credit facility or other debt, we will be dependent upon proceeds from the issuance of equity securities and cash flows from operating activities in order to meet our long-term liquidity requirements and to fund our distributions.

14

Contractual Obligations

The following table summarizes our contractual obligations as of March 31, 2018:

| | | | | | | | | | | | | | | | | | | | |

| | | Payments due by period: | |

| | | Total | | | Less than

1

year | | | 1-3 years | | | 3-5 years | | | More than 5

years | |

Debt interest(1) | | $ | 37,158,126 | | | $ | 3,419,059 | | | $ | 9,091,968 | | | $ | 9,646,544 | | | $ | 15,000,555 | |

Debt principal(1) | | | 99,905,000 | | | | — | | | | 527,944 | | | | 1,393,911 | | | | 97,983,145 | |

| | | | | | | | | | | | | | | | | | | | |

Total contractual obligations | | $ | 137,063,126 | | | $ | 3,419,059 | | | $ | 9,619,912 | | | $ | 11,040,455 | | | $ | 112,983,700 | |

| | | | | | | | | | | | | | | | | | | | |

| (1) | Amounts do not include the Second Amended KeyBank Bridge Loan, as this is neither a long-term debt obligation nor a long-term liability. See Note 5 of the Notes to the Consolidated Financial Statements for more information about our indebtedness. |

Off-Balance Sheet Arrangements

Our investment in a private placement offering by Reno Student Housing, DST is accounted for under the equity method of accounting. For more information please see Note 8 of the Notes to the Consolidated Financial Statements contained in this supplement. Other than that, we do not have any relationships with unconsolidated entities or financial partnerships. Such entities are often referred to as structured finance or special purposes entities, which typically are established for the purpose of facilitatingoff-balance sheet arrangements or other contractually narrow or limited purposes. Further, we have not guaranteed any obligations of unconsolidated entities nor do we have any commitments or intent to provide funding to any such entities.

Subsequent Events

Please see Note 11 of the Notes to the Consolidated Financial Statements contained elsewhere in this supplement.

Financial Statements

The financial statements listed below are contained in this supplement:

| | | | |

Consolidated Financial Statements | | | |

Consolidated Balance Sheets as of March 31, 2018 (unaudited) and December 31, 2017 | | | F-1 | |

Consolidated Statements of Operations for the Three Months Ended March 31, 2018 and 2017 (unaudited) | | | F-2 | |

Consolidated Statement of Equity for the Three Months Ended March 31, 2018 (unaudited) | | | F-3 | |

Consolidated Statements of Cash Flows for the Three Months Ended March 31, 2018 and 2017 (unaudited) | | | F-4 | |

Notes to Consolidated Financial Statements (unaudited) | | | F-5 | |

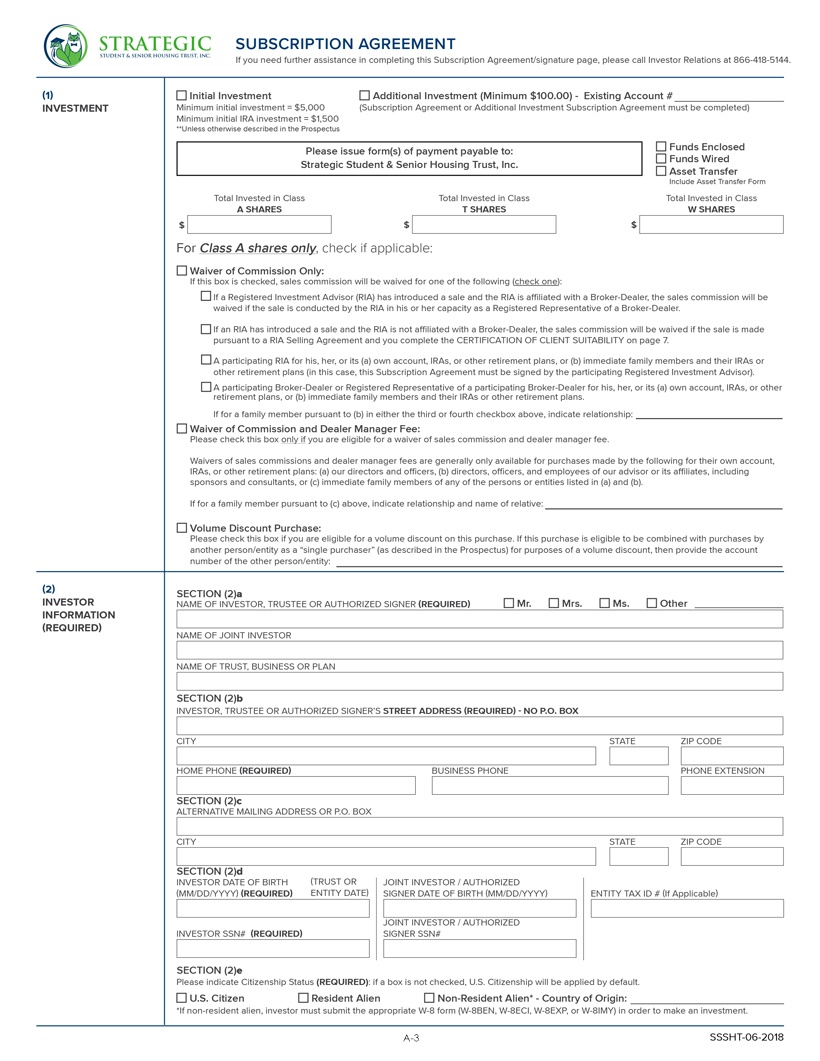

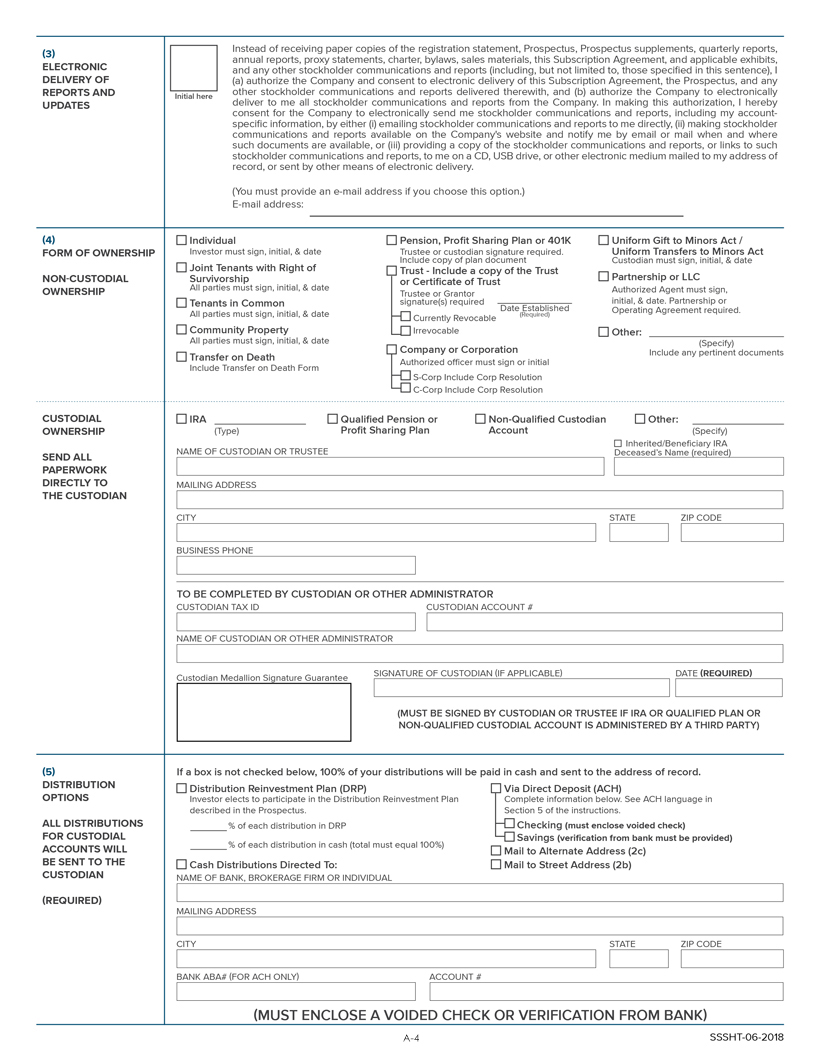

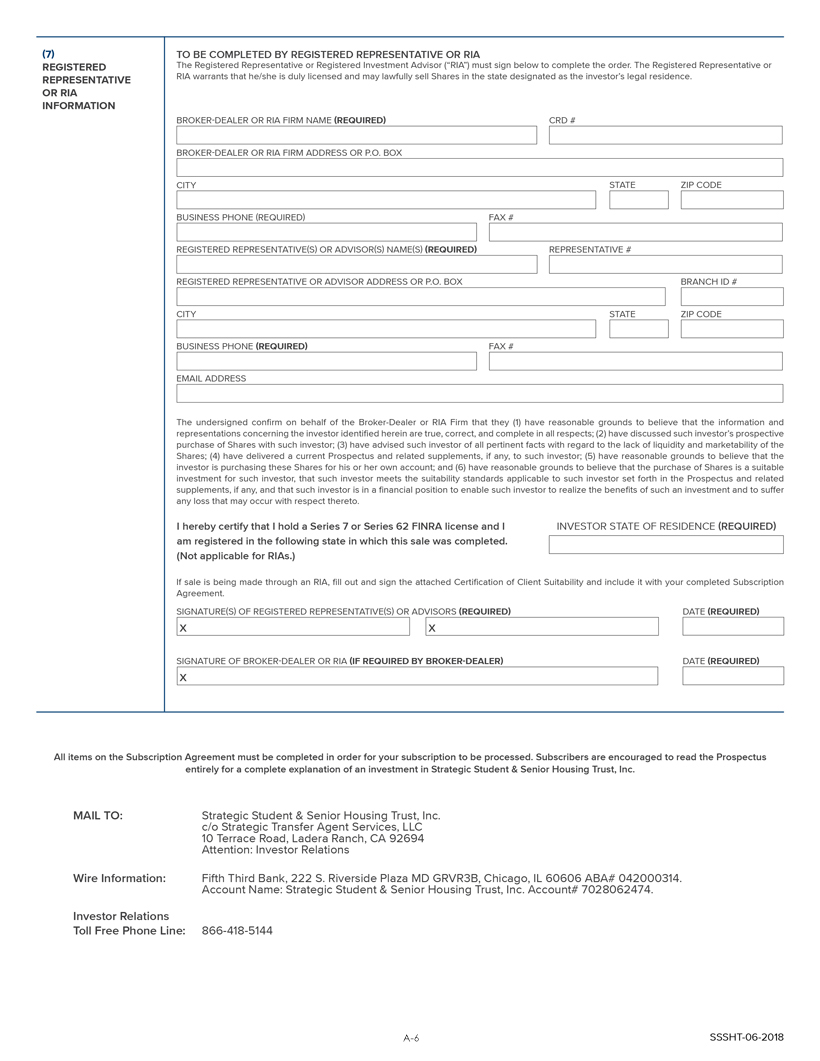

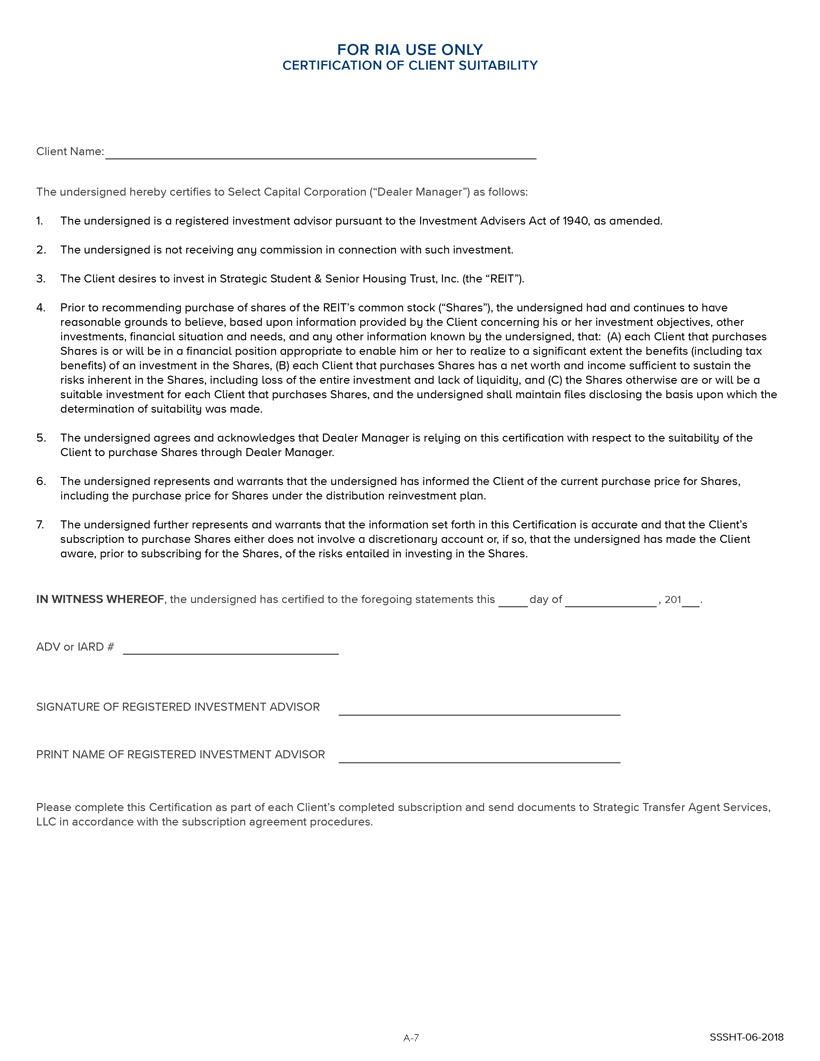

Subscription Agreement

The subscription agreement contained as Appendix A to the prospectus is hereby deleted and replaced with the Appendix A to this supplement.

15

STRATEGIC STUDENT & SENIOR HOUSING TRUST, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

| | | | | | | | |

| | | March 31, 2018

(Unaudited) | | | December 31,

2017 | |

ASSETS | | | | | | | | |

Real estate facilities: | | | | | | | | |

Land | | $ | 14,992,000 | | | $ | 8,683,000 | |

Buildings | | | 147,241,878 | | | | 83,026,000 | |

Site improvements | | | 2,576,000 | | | | 1,511,000 | |

Furniture, fixtures and equipment | | | 7,277,765 | | | | 5,038,516 | |

| | | | | | | | |

| | | 172,087,643 | | | | 98,258,516 | |

Accumulated depreciation | | | (2,274,719 | ) | | | (1,254,849 | ) |

| | | | | | | | |

Real estate facilities, net | | | 169,812,924 | | | | 97,003,667 | |

Cash and cash equivalents | | | 9,417,351 | | | | 10,371,998 | |

Restricted cash | | | 247,909 | | | | — | |

Other assets | | | 3,798,895 | | | | 4,006,881 | |

Intangible assets, net | | | 8,234,032 | | | | 3,743,640 | |

| | | | | | | | |

Total assets | | $ | 191,511,111 | | | $ | 115,126,186 | |

| | | | | | | | |

LIABILITIES AND EQUITY | | | | | | | | |

Debt, net | | $ | 116,590,397 | | | $ | 52,299,638 | |

Accounts payable and accrued liabilities | | | 2,435,870 | | | | 1,556,415 | |

Due to affiliates | | | 718,333 | | | | 246,958 | |

Distributions payable | | | 551,062 | | | | 463,848 | |

| | | | | | | | |

Total liabilities | | | 120,295,662 | | | | 54,566,859 | |

| | | | | | | | |

Commitments and contingencies (Note 9) | | | | | | | | |

Redeemable common stock | | | 835,112 | | | | 303,844 | |

| | | | | | | | |

Equity: | | | | | | | | |

Strategic Student & Senior Housing Trust, Inc. equity: | | | | | | | | |

Preferred stock, $0.001 par value; 200,000,000 shares authorized; none issued and outstanding at March 31, 2018 and December 31, 2017 | | | — | | | | — | |

Common stock, $0.001 par value; 700,000,000 shares authorized; 10,742,658 and 8,948,551 shares issued and outstanding at March 31, 2018 and December 31, 2017, respectively | | | 10,743 | | | | 8,948 | |

Additionalpaid-in capital | | | 83,142,230 | | | | 68,799,264 | |

Distributions | | | (2,862,330 | ) | | | (1,379,950 | ) |

Accumulated deficit | | | (8,960,290 | ) | | | (6,233,945 | ) |

| | | | | | | | |

Total Strategic Student & Senior Housing Trust, Inc. equity | | | 71,330,353 | | | | 61,194,317 | |

| | | | | | | | |

Noncontrolling interests in our Operating Partnership | | | (950,016 | ) | | | (938,834 | ) |

| | | | | | | | |

Total equity | | | 70,380,337 | | | | 60,255,483 | |

| | | | | | | | |

Total liabilities and equity | | $ | 191,511,111 | | | $ | 115,126,186 | |

| | | | | | | | |

See notes to consolidated financial statements.

F-1

STRATEGIC STUDENT & SENIOR HOUSING TRUST, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | | | | | | | |

| | | Three Months Ended

March 31, | |

| | | 2018 | | | 2017 | |

Revenues: | | | | | | | | |

Leasing and related revenues – student | | $ | 2,293,714 | | | $ | — | |

Leasing and related revenues – senior | | | 1,267,722 | | | | | |

| | | | | | | | |

Total revenues | | | 3,561,436 | | | | — | |

| | | | | | | | |

Operating expenses: | | | | | | | | |

Property operating expenses – student | | | 923,181 | | | | — | |

Property operating expenses – senior | | | 734,711 | | | | | |

Property operating expenses – affiliates | | | 111,682 | | | | — | |

General and administrative | | | 337,082 | | | | — | |

Depreciation | | | 1,019,870 | | | | — | |

Intangible amortization expense | | | 1,973,608 | | | | — | |

Acquisition expenses – affiliates | | | 55,974 | | | | — | |

Other property acquisition expenses | | | 164,927 | | | | — | |

| | | | | | | | |

Total operating expenses | | | 5,321,035 | | | | — | |

| | | | | | | | |

Operating loss | | | (1,759,599 | ) | | | — | |

Other income (expense): | | | | | | | | |

Interest expense | | | (903,182 | ) | | | — | |

Interest expense – debt issuance costs | | | (78,537 | ) | | | — | |

Other | | | 7,698 | | | | — | |

| | | | | | | | |

Net loss | | | (2,733,620 | ) | | | — | |

Net loss attributable to the noncontrolling interests in our Operating Partnership | | | 7,275 | | | | — | |

| | | | | | | | |

Net loss attributable to Strategic Student & Senior Housing Trust, Inc. common stockholders | | $ | (2,726,345 | ) | | $ | — | |

| | | | | | | | |

Net loss per common stock share – basic and diluted | | $ | (0.28 | ) | | $ | — | |

| | | | | | | | |

Weighted average common stock shares outstanding – basic and diluted | | | 9,705,067 | | | | 111 | |

| | | | | | | | |

See notes to consolidated financial statements.

F-2

STRATEGIC STUDENT & SENIOR HOUSING TRUST, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF EQUITY

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Common Stock | | | | | | | | | | | | Total Strategic | | | | | | | | | | |

| | | Number of

Shares | | | Common

Stock

Par Value | | | Additional

Paid-in

Capital | | | Distributions | | | Accumulated

Deficit | | | Student &

Senior Housing

Trust,

Inc. Equity | | | Noncontrolling

Interests in

our Operating

Partnership | | | Total

Equity | | | Redeemable

Common

Stock | |

Balance as of December 31, 2017 | | | 8,948,551 | | | $ | 8,948 | | | $ | 68,799,264 | | | $ | (1,379,950 | ) | | $ | (6,233,945 | ) | | $ | 61,194,317 | | | $ | (938,834 | ) | | $ | 60,255,483 | | | $ | 303,844 | |

Gross proceeds from issuance of common stock | | | 1,733,591 | | | | 1,734 | | | | 15,738,296 | | | | — | | | | — | | | | 15,740,030 | | | | — | | | | 15,740,030 | | | | — | |

Offering costs | | | — | | | | — | | | | (1,395,269 | ) | | | — | | | | — | | | | (1,395,269 | ) | | | — | | | | (1,395,269 | ) | | | — | |

Changes to redeemable common stock | | | — | | | | — | | | | (531,268 | ) | | | — | | | | — | | | | (531,268 | ) | | | — | | | | (531,268 | ) | | | 531,268 | |

Distributions | | | — | | | | — | | | | — | | | | (1,482,380 | ) | | | — | | | | (1,482,380 | ) | | | — | | | | (1,482,380 | ) | | | — | |

Distributions to noncontrolling interests | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (3,907 | ) | | | (3,907 | ) | | | — | |

Issuance of shares for distribution reinvestment plan | | | 60,516 | | | | 61 | | | | 531,207 | | | | — | | | | — | | | | 531,268 | | | | — | | | | 531,268 | | | | — | |

Net loss attributable to Strategic Student & Senior Housing Trust, Inc. | | | — | | | | — | | | | — | | | | — | | | | (2,726,345 | ) | | | (2,726,345 | ) | | | — | | | | (2,726,345 | ) | | | — | |

Net loss attributable to the noncontrolling interests | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (7,275 | ) | | | (7,275 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

Balance as of March 31, 2018 | | | 10,742,658 | | | $ | 10,743 | | | $ | 83,142,230 | | | $ | (2,862,330 | ) | | $ | (8,960,290 | ) | | $ | 71,330,353 | | | $ | (950,016 | ) | | $ | 70,380,337 | | | $ | 835,112 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

See notes to consolidated financial statements.

F-3

STRATEGIC STUDENT & SENIOR HOUSING TRUST, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | | | | | | | |

| | | Three Months Ended

March 31, | |

| | | 2018 | | | 2017 | |

Cash flows from operating activities: | | | | | | | | |

Net loss | | $ | (2,733,620 | ) | | $ | — | |

Adjustments to reconcile net loss to net cash provided by operating activities: | | | | | | | | |

Depreciation and amortization | | | 3,072,015 | | | | — | |

Increase (decrease) in cash and cash equivalents from changes in assets and liabilities: | | | | | | | | |

Other assets | | | (322,035 | ) | | | — | |

Accounts payable and accrued liabilities | | | 632,733 | | | | — | |

Due to affiliates | | | (165,096 | ) | | | — | |

| | | | | | | | |

Net cash provided by operating activities | | | 483,997 | | | | — | |

| | | | | | | | |

Cash flows from investing activities: | | | | | | | | |

Purchase of real estate | | | (78,830,878 | ) | | | — | |

Additions to real estate | | | (92,249 | ) | | | — | |

| | | | | | | | |

Net cash used in investing activities | | | (78,923,127 | ) | | | — | |

| | | | | | | | |

Cash flows from financing activities: | | | | | | | | |

Proceeds from issuance ofnon-revolving mortgage debt | | | 46,905,000 | | | | — | |

Proceeds from issuance of KeyBank loan | | | 24,500,000 | | | | | |

Principal payments of KeyBank loan | | | (6,026,593 | ) | | | — | |

Debt issuance costs | | | (876,450 | ) | | | — | |

Gross proceeds from issuance of common stock | | | 15,512,031 | | | | — | |

Private offering costs | | | (1,397,730 | ) | | | — | |

Public offering costs | | | (16,060 | ) | | | — | |

Distributions paid to common stockholders | | | (867,806 | ) | | | — | |

| | | | | | | | |

Net cash provided by financing activities | | | 77,732,392 | | | | — | |

| | | | | | | | |

Net change in cash, cash equivalents, and restricted cash | | | (706,738 | ) | | | — | |

Cash, cash equivalents, and restricted cash beginning of period | | | 10,371,998 | | | | — | |

| | | | | | | | |

Cash, cash equivalents, and restricted cash end of period | | $ | 9,665,260 | | | $ | — | |

| | | | | | | | |

Supplemental disclosures andnon-cash transactions: | | | | | | | | |

Cash paid for interest | | $ | 445,144 | | | $ | — | |

Debt issuance costs included in due to affiliates | | $ | 289,735 | | | $ | — | |

Deposits applied to purchase of real estate | | $ | 1,000,000 | | | $ | — | |

Acquisition costs included in due to affiliates | | $ | 370,000 | | | $ | — | |

Public offering costs included in accounts payable and accrued liabilities | | $ | 453,920 | | | $ | — | |

Private offering costs included in due to affiliates | | $ | 23,264 | | | $ | — | |

Private offering costs included in accounts payable and accrued liabilities | | $ | 20,804 | | | $ | — | |

Distributions payable | | $ | 551,062 | | | $ | — | |

Issuance of shares pursuant to distribution reinvestment plan | | $ | 531,268 | | | $ | — | |

See notes to consolidated financial statements.

F-4

STRATEGIC STUDENT & SENIOR HOUSING TRUST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2018

(Unaudited)

Note 1. Organization

Strategic Student & Senior Housing Trust, Inc., a Maryland corporation (the “Company”), was formed on October 4, 2016 under the Maryland General Corporation Law for the purpose of engaging in the business of investing in student housing and senior housing real estate investments. The Company’syear-end is December 31. As used in these consolidated financial statements, “we,” “us,” and “our” refer to Strategic Student & Senior Housing Trust, Inc.

On October 4, 2016, our Advisor, as defined below, acquired 111.11 shares of our common stock for $1,000 and became our initial stockholder. Pursuant to our First Articles of Amendment and Restatement, filed on January 30, 2017, we authorized 700,000,000 shares of common stock with a par value of $0.001 and 200,000,000 shares of preferred stock with a par value of $0.001. On May 1, 2018, in connection with our Public Offering, defined below, we filed articles of amendment to our Charter (the “Articles of Amendment”) and articles supplementary to our Charter (the “Articles Supplementary”). Following the filing of the Articles of Amendment and the Articles Supplementary, our authorized common stock is now 315,000,000 shares designated as Class A shares, 315,000,000 shares designated as Class T shares, and 70,000,000 shares designated as Class W shares. Additionally, on May 1, 2018 all of our then existing shares of common stock became Class A shares. On May 1, 2018 (the “Effective Date”), the Securities and Exchange Commission (“SEC”) declared our registration statement effective to offer a maximum of $1,000,000,000 in shares of common stock for sale to the public (the “Primary Offering”) and $95,000,000 in shares of common stock for sale pursuant to our distribution reinvestment plan (collectively, the “Public Offering”).

On January 27, 2017, pursuant to a confidential private placement memorandum (the “private placement memorandum”), we commenced a private offering of up to $100,000,000 in shares of our common stock (the “Primary Private Offering”) and 1,000,000 shares of common stock pursuant to our distribution reinvestment plan (collectively, the “Private Offering” and together with the Public Offering, the “Offerings”). The Private Offering required a minimum offering amount of $1,000,000. On August 4, 2017, we met such minimum offering requirement. As of March 31, 2018, we had sold approximately 10.7 million shares of our common stock for gross offering proceeds of approximately $91.9 million in the Private Offering. Our Private Offering terminated on March 15, 2018.

While the Company was formed on October 4, 2016, no formal operations commenced until the acquisition of our property in Fayetteville, Arkansas (the “Fayetteville Property”) on June 28, 2017 and, therefore, there were no revenues or expenses prior thereto. We intend to invest the net proceeds from the Offerings primarily in income-producing student housing and senior housing properties and related real estate investments located in the United States. We may also purchase growth-oriented student housing and senior housing real estate assets. As of March 31, 2018, we owned two student housing properties an approximately 2.6% beneficial interest in a DST that owns another student housing property and three senior housing properties.

Our operating partnership, SSSHT Operating Partnership, L.P., a Delaware limited partnership (our “Operating Partnership”), was formed on October 5, 2016. On October 5, 2016, our Advisor agreed to acquire a limited partnership interest in our Operating Partnership for $1,000 (111.11 partnership units) and we agreed to contribute the initial $1,000 capital contribution to our Operating Partnership in exchange for the general partner interest. In addition, on September 28, 2017, our Advisor acquired additional limited partnership interests (25,447.57 partnership units) in our Operating Partnership for $199,000, resulting in total capital contributions of $200,000 by our Advisor in our Operating Partnership. Our Operating Partnership owns, directly or indirectly through one or more special purpose entities, all of the student housing and senior housing properties that we acquire. We will conduct certain activities directly or indirectly through our taxable REIT subsidiary, SSSHT TRS, Inc., a Delaware corporation (the “TRS”) which was formed on October 6, 2016, and is a wholly owned subsidiary of our Operating Partnership.

SmartStop Asset Management, LLC, a Delaware limited liability company organized in 2013 (our “Sponsor”), is the sponsor of our Public Offering of shares of our common stock. Our Sponsor is a company focused on providing real estate advisory, asset management, and property management services. As of March 31, 2018 our Sponsor owns 97.5% of the economic interests (and 100% of the voting membership interests) of our Advisor and owns 100% of our Property Manager, each as defined below.

F-5

STRATEGIC STUDENT & SENIOR HOUSING TRUST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2018

(Unaudited)

We have no employees. Our advisor is SSSHT Advisor, LLC, a Delaware limited liability company (our “Advisor”) which was formed on October 3, 2016. Our Advisor is responsible for managing our affairs on aday-to-day basis and identifying and making acquisitions and investments on our behalf under the terms of an advisory agreement we entered into with our Advisor on January 27, 2017 (our “Private Offering Advisory Agreement”) which, in connection with our Public Offering, we amended and restated on May 1, 2018 (our “Advisory Agreement”). The majority of the officers of our Advisor are also officers of us and our Sponsor, as well as Strategic Storage Trust II, Inc., Strategic Storage Growth Trust, Inc., and Strategic Storage Trust IV, Inc., each of which are publicnon-traded REITs also sponsored by our Sponsor that are focused on investing in self storage properties.

SSSHT Property Management, LLC, a Delaware limited liability company (our “Property Manager”), was formed on October 3, 2016. Our Property Manager derives substantially all of its income from the property management oversight services it performs for us. We expect that we will enter into property management agreements directly with third party property managers and that our Property Manager will provide oversight services with respect to such third party property managers. Please see Note 8 – Related Party Transactions for additional detail.

The Fayetteville Property and our property in Tallahassee, Florida (the “Tallahassee Property”) are managed by Asset Campus Housing (“ACH”), a third-party student housing property manager. The three senior housing properties are managed by MSL Community Management LLC, an affiliate of MBK Senior Living LLC (“MBK”). Please see Note 9 – Commitments and Contingencies for additional detail.

Our dealer manager is Select Capital Corporation, a California corporation (our “Dealer Manager”). On January 27, 2017, we executed a dealer manager agreement (as amended, the “Private Offering Dealer Manager Agreement”) with our Dealer Manager with respect to the Private Offering. The Private Offering Dealer Manager Agreement terminated at the closing of our Private Offering. We executed a similar dealer manager agreement (the “Dealer Manager Agreement”) with our Dealer Manager with respect to the Public Offering on May 1, 2018. Our Dealer Manager was responsible for marketing our shares offered pursuant to our Primary Private Offering and is now similarly responsible for our Primary Offering. Our Sponsor owns, through a wholly-owned limited liability company, a 15%non-voting equity interest in our Dealer Manager. Affiliates of our Dealer Manager own a 2.5%non-voting membership interest in our Advisor, which they acquired on January 1, 2018.

Our Sponsor owns 100% of the membership interests of Strategic Transfer Agent Services, LLC, our transfer agent (our “Transfer Agent”). Our Transfer Agent provides transfer agent and registrar services to us that are substantially similar to what a third party transfer agent would provide in the ordinary course of performing its functions as a transfer agent. Our Transfer Agent may retain and supervise third party vendors in its efforts to administer certain services.