STRATEGIC STUDENT & SENIOR HOUSING TRUST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

September 30, 2018

(Unaudited)

Note 1. Organization

Strategic Student & Senior Housing Trust, Inc., a Maryland corporation (the “Company”), was formed on October 4, 2016 under the Maryland General Corporation Law for the purpose of engaging in the business of investing in student housing and senior housing real estate investments. The Company’syear-end is December 31. As used in these consolidated financial statements, “we,” “us,” and “our” refer to Strategic Student & Senior Housing Trust, Inc. and each of our subsidiaries.

On October 4, 2016, our Advisor, as defined below, acquired 111.11 shares of our common stock for $1,000 and became our initial stockholder. On January 27, 2017, pursuant to a confidential private placement memorandum (the “private placement memorandum”), we commenced a private offering of up to $100,000,000 in shares of our common stock (the “Primary Private Offering”) and 1,000,000 shares of common stock pursuant to our distribution reinvestment plan (collectively, the “Private Offering” and together with the Public Offering, the “Offerings”). The Private Offering required a minimum offering amount of $1,000,000. On August 4, 2017, we met such minimum offering requirement. Our Private Offering terminated on March 15, 2018. We raised offering proceeds of approximately $93 million from the issuance of approximately 10.8 million shares pursuant to the Private Offering.

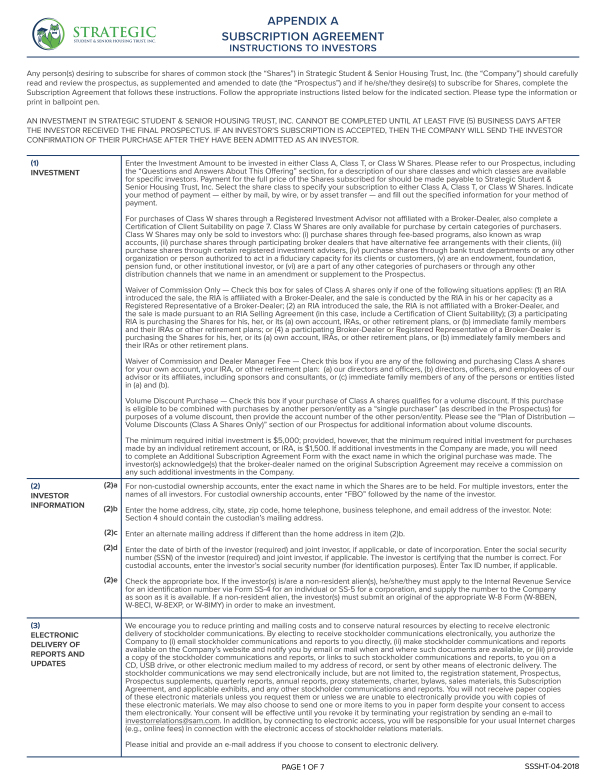

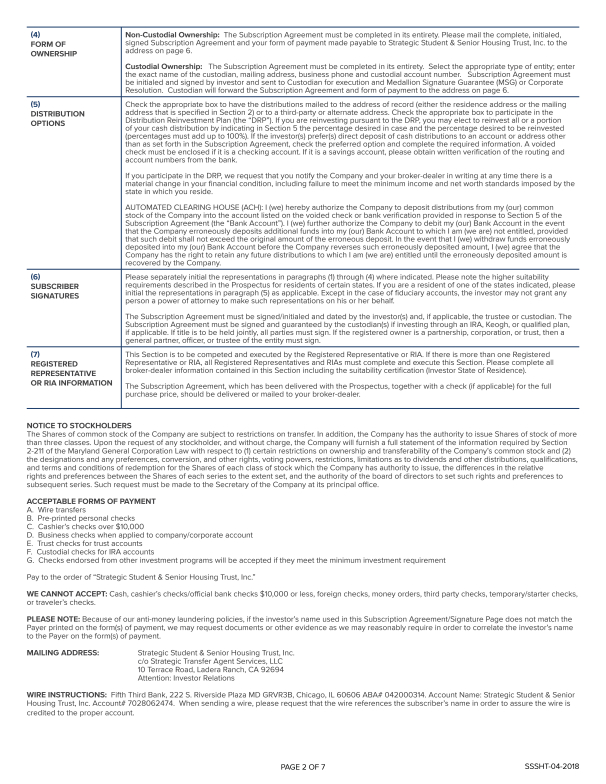

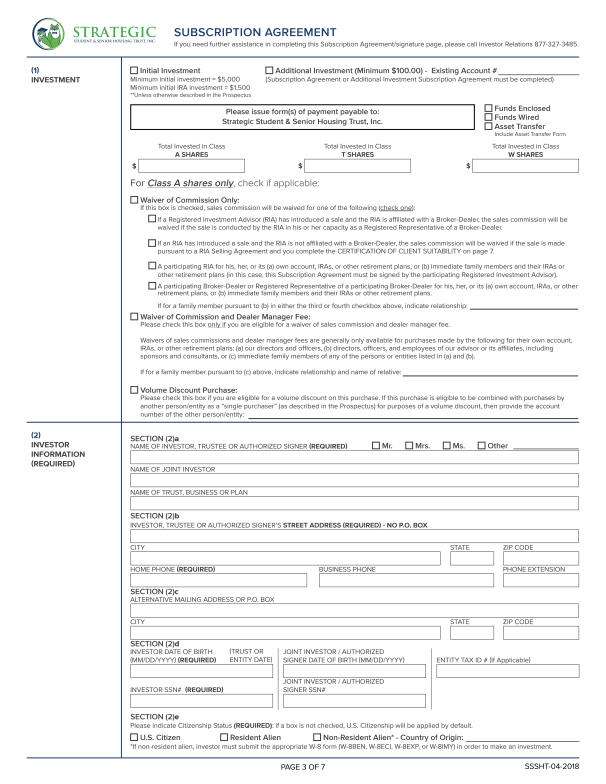

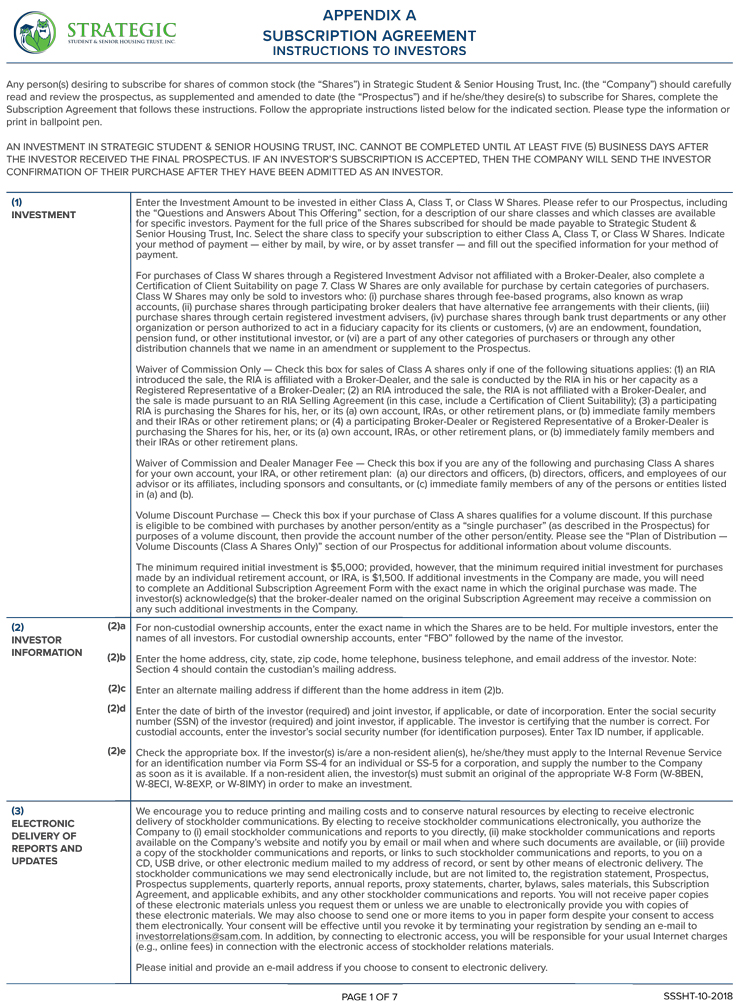

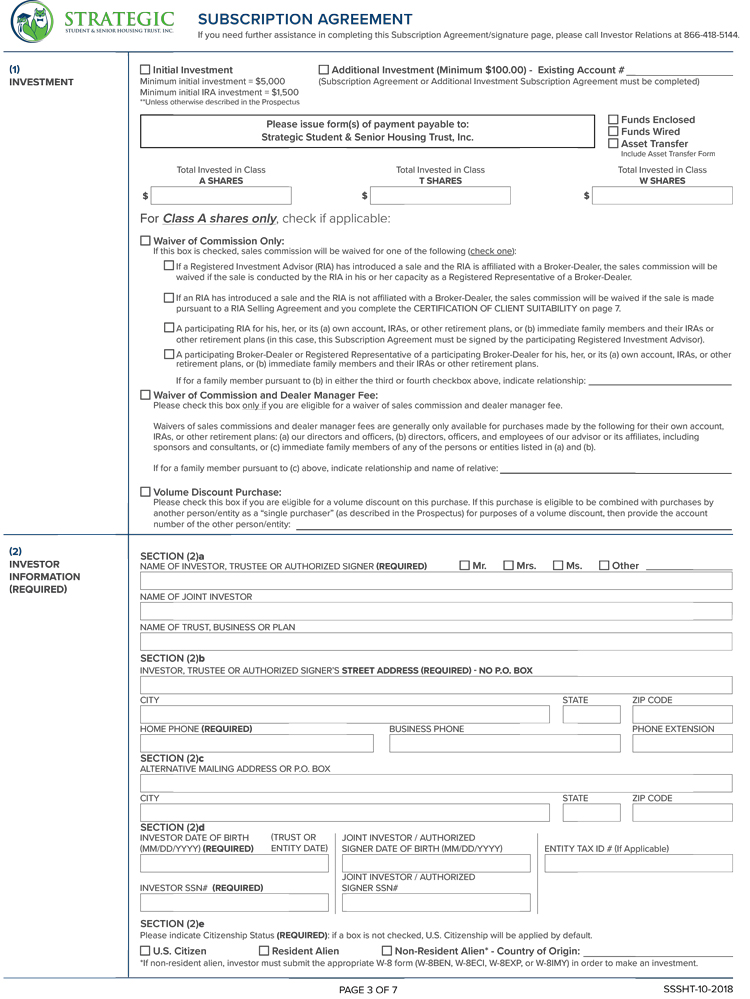

On May 1, 2018, our registration statement on FormS-11 (FileNo. 333-220646) (the “Registration Statement”) was declared effective by the Securities and Exchange Commission (“SEC”). The Registration Statement registered up to $1.0 billion in shares of common stock for sale to the public (the “Primary Offering”) consisting of three classes of shares — Class A shares for $10.33 per share (up to $450 million in shares), Class T shares for $10.00 per share (up to $450 million in shares), and Class W shares for $9.40 per share (up to $100 million in shares) — and up to $95,000,000 in shares of common stock for sale pursuant to our distribution reinvestment plan (together with the Primary Offering, the “Public Offering”) at $9.81 per share for Class A shares, $9.50 per share for Class T shares and $9.40 per share for Class W shares.

Concurrently with our Registration Statement being declared effective, we filed articles of amendment to our Charter (the “Articles of Amendment”) and articles supplementary to our Charter (the “Articles Supplementary”). As a result of filing the Articles of Amendment and the Articles Supplementary, all shares issued in our Private Offering were redesignated as Class A shares and the remaining shares were reclassified such that we now have 315,000,000 shares classified as Class A shares, 315,000,000 shares classified as Class T shares and 70,000,000 shares classified as Class W shares. As of September 30, 2018, we had sold approximately 51,000 Class A shares, no Class T shares, and approximately 27,000 Class W shares for gross offering proceeds of approximately $750,000 in our Public Offering.

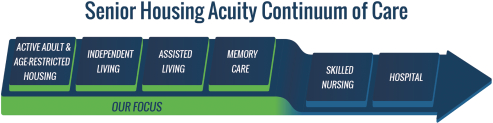

While the Company was formed on October 4, 2016, no formal operations commenced until our acquisition of a property in Fayetteville, Arkansas (the “Fayetteville Property”) on June 28, 2017 and, therefore, there were no revenues or expenses prior thereto. We intend to invest the net proceeds from our Primary Offering primarily in income-producing student housing and senior housing properties and related real estate investments located in the United States. We may also purchase growth-oriented student housing and senior housing real estate assets. As of September 30, 2018, we owned (i) two student housing properties, (ii) four senior housing properties and (iii) an approximately 2.6% beneficial interest in a Delaware Statutory Trust (DST) that owns another student housing property.

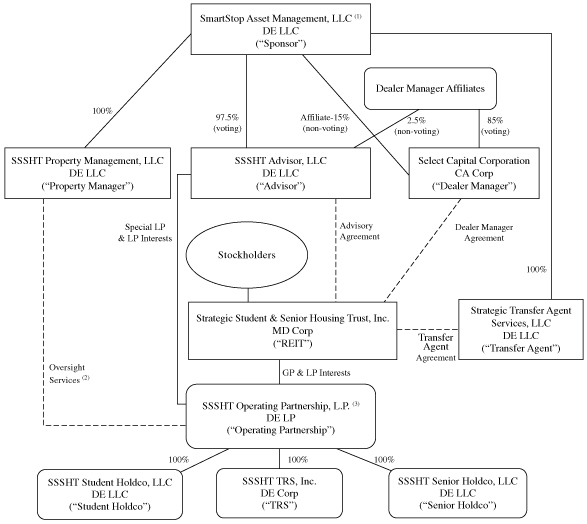

Our operating partnership, SSSHT Operating Partnership, L.P., a Delaware limited partnership (our “Operating Partnership”), was formed on October 5, 2016. On October 5, 2016, our Advisor agreed to acquire a limited partnership interest in our Operating Partnership for $1,000 (111.11 partnership units) and we agreed to contribute the initial $1,000 capital contribution to our Operating Partnership in exchange for the general partner interest. In addition, on September 28, 2017, our Advisor acquired additional limited partnership interests (25,447.57 partnership units) in our Operating Partnership for $199,000, resulting in total capital contributions of $200,000 by our Advisor in our Operating Partnership. Our Operating Partnership owns, directly or indirectly through one or more special purpose entities, all of the student housing and senior housing properties that we acquire. As of September 30, 2018, we owned approximately 99.8% of the common units of limited partnership interest of our Operating Partnership. The remaining approximately 0.2% of the common units are owed by our Advisor. We will conduct certain activities directly or indirectly through our taxable REIT subsidiary, SSSHT TRS, Inc., a Delaware corporation (the “TRS”) which was formed on October 6, 2016, and is a wholly owned subsidiary of our Operating Partnership. See also Note 6 – Preferred Equity in our Operating Partnership.

SmartStop Asset Management, LLC, a Delaware limited liability company organized in 2013 (our “Sponsor”), is the sponsor of our Public Offering of shares of our common stock. Our Sponsor is a company focused on providing real estate advisory, asset management, and property management services. As of September 30, 2018, our Sponsor owns 97.5% of the economic interests (and 100% of the voting membership interests) of our Advisor and owns 100% of our Property Manager, each as defined below.

F-5