Employee and Director Long-Term Incentive Plan Awards

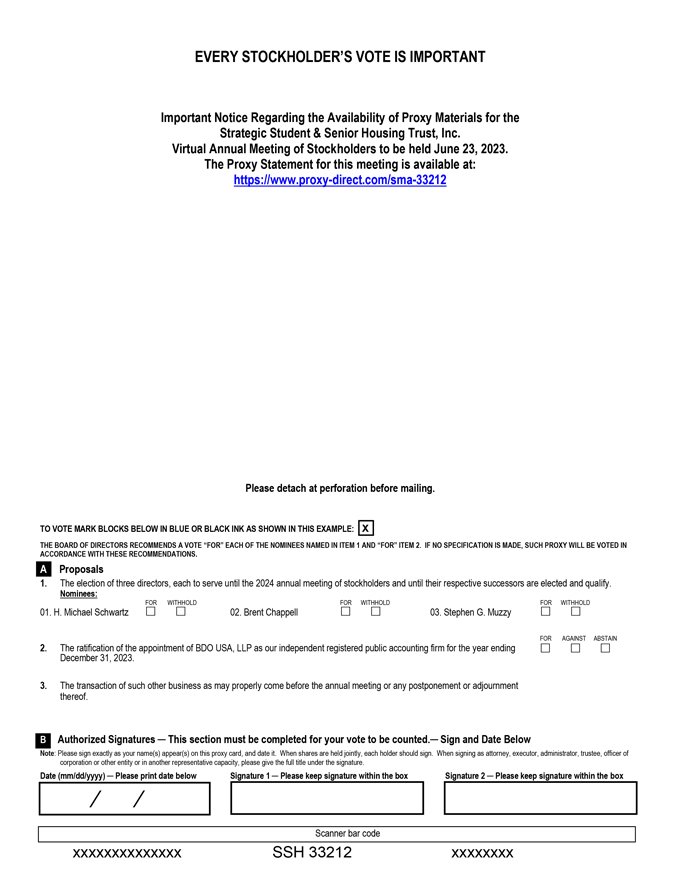

Pursuant to the Plan, we issued 2,500 shares of restricted stock to each independent director, which vest ratably over a period of four years from the date such initial award was awarded to the independent directors (the “Initial Restricted Stock Awards”). We also issued additional awards of 1,250 shares of restricted stock to each independent director upon each of their re-elections to our board of directors, which vest ratably over a period of four years from the date of re-election (the “Annual Restricted Stock Awards”). Mr. Muzzy and Mr. Chappell have each received a total of 8,750 shares of restricted stock of which 5,625 shares had vested as of December 31, 2022. Both the Initial Restricted Stock Awards and the Annual Restricted Stock Awards are subject to a number of other conditions set forth in such awards.

The Plan was approved and adopted in order to (1) provide incentives to individuals who are granted awards because of their ability to improve our operations and increase profits; (2) encourage selected persons to accept or continue employment with us or with our Advisor or its affiliates that we deem important to our long-term success; and (3) increase the interest of our independent directors in our success through their participation in the growth in value of our stock. Pursuant to the Plan, we may issue options, stock appreciation rights, distribution equivalent rights and other equity-based awards, including, but not limited to, restricted stock.

The total number of shares of our Class A common stock reserved for issuance under the Plan is equal to 10% of our outstanding shares of common stock at any time, but not to exceed 10,000,000 shares in the aggregate. As of December 31, 2022, there were approximately 1,290,842 shares available for issuance under the Plan. The term of the Plan is ten years. Upon our earlier dissolution or liquidation, reorganization, merger or consolidation with one or more corporations as a result of which we are not the surviving corporation, or sale of all or substantially all of our properties, the Plan will terminate, and provisions will be made for the assumption by the successor corporation of the awards granted under the Plan or the replacement of such awards with similar awards with respect to the stock of the successor corporation, with appropriate adjustments as to the number and kind of shares and exercise prices. Alternatively, rather than providing for the assumption of such awards, the board of directors may either (1) shorten the period during which awards are exercisable, or (2) cancel an award upon payment to the participant of an amount in cash that the Compensation Committee determines is equivalent to the fair market value of the consideration that the participant would have received if the participant exercised the award immediately prior to the effective time of the transaction.

In the event our board of directors or Compensation Committee determines that any distribution, recapitalization, stock split, reorganization, merger, liquidation, dissolution or sale, transfer, exchange or other disposition of all or substantially all of our assets, or other similar corporate transaction or event, affects our stock such that an adjustment is appropriate in order to prevent dilution or enlargement of the benefits or potential benefits intended to be made available under the Plan or with respect to an award, then the board of directors or Compensation Committee shall, in such manner as it may deem equitable, adjust the number and kind of shares or the exercise price with respect to any award.

Director Life Insurance Policies

Our Sponsor has purchased life insurance policies covering each of the members of our board of directors for the benefit of such director’s beneficiaries. For the year ended December 31, 2022, we reimbursed our Sponsor for the total premiums paid on such life insurance policies, which was $1,227. Of this amount, $245 was attributed to the policy covering H. Michael Schwartz, $491 was attributed to the policy covering Stephen G. Muzzy and $491 was attributed to the policy covering Brent Chappell. At the present time, we intend to continue maintaining these life insurance policies for our directors.

15