Strategic Student & Senior Housing Trust, Inc.Exhibit 99.1 H. Michael Schwartz – Founder, Chairman & CEO Second Quarter Update This is neither an offer to sell nor a solicitation of an offer to buy the securities described herein. Only the prospectus makes such an offer. The literature must be read in conjunction with the prospectus in order to fully understand all of the implications and risk of the offering of securities to which it relates. Please read the prospectus in its entirety before investing for complete information and to learn more about the risks associated with this offering. Shares Offered through Select Capital Corporation ( Member of FINRA and SIPC )

Risk Factors & Other Information This investor presentation may contain certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” or other similar words. Because such statements include risks, uncertainties and contingencies, actual results may differ materially from the expectations, intentions, beliefs, plans or predictions of the future expressed or implied by such forward-looking statements. These risks, uncertainties and contingencies include, but are not limited to: uncertainties relating to changes in general economic and real estate conditions; uncertainties relating to the implementation of our real estate investment strategy; uncertainties relating to financing availability and capital proceeds; uncertainties relating to the closing of property acquisitions; uncertainties related to the timing and availability of distributions; and other risk factors as outlined in the Company’s public filings with the Securities and Exchange Commission. This is neither an offer nor a solicitation to purchase securities. See our Form S-11 and recent Form 10-Qs for specific risks associated with an investment in Strategic Student & Senior Housing Trust, Inc. We incurred a net loss of approximately $9.4 million for the six months ended June 30, 2019. Our accumulated deficit was approximately $31.6 million as of June 30, 2019. Given that we are still early in our fundraising and acquisition stage, our operations may not be profitable in 2019. We have paid distributions from sources other than our cash flows from operations, including from the net proceeds of our public offering, including our distribution reinvestment plan. We are not prohibited from undertaking such activities by our charter, bylaws, or investment policies, and we may use an unlimited amount from any source to pay our distributions, and it is likely that we will continue to use public offering proceeds to fund a majority of our early distributions. For the year ended December 31, 2017, we funded 73.8% of our distributions using proceeds from our private offering and 26.2% using proceeds from our distribution reinvestment plan. For the year ended December 31, 2018, we funded 12.9% of our distributions using cash flows from operations, 50.6% using proceeds from our public and private offerings and 36.5% using proceeds from our distribution reinvestment plan. For the six months ended June 30, 2019, we funded 51.0% of our distributions using cash flows from operations, 16.1% using proceeds from our public and private offerings and 32.9% using proceeds from our distribution reinvestment plan. Payment of distributions in excess of earnings may have a dilutive effect on the value of our shares. If we pay distributions from sources other than cash flow from operations, we will have fewer funds available for acquiring properties, which may reduce our stockholders’ overall returns. Additionally, to the extent distributions exceed cash flow from operations, a stockholder’s basis in our stock may be reduced and, to the extent distributions exceed a stockholder’s basis, the stockholder may recognize a capital gain. No public market currently exists for shares of our common stock and we may not list our shares on a national securities exchange before three to five years after completion of our public offering, if at all; therefore, it may be difficult for our stockholders to sell their shares. If our stockholders sell their shares, it will likely be at a substantial discount. Our charter does not require us to pursue a liquidity transaction at any time. Until we generate operating cash flows sufficient to pay distributions to our stockholders, we may pay distributions from financing activities, which may include borrowings in anticipation of future cash flows or the net proceeds of our offerings (which may constitute a return of capital). Therefore, it is likely that some or all of the distributions that we make will represent a return of capital to our stockholders, at least in the first few years of operation. We are not prohibited from undertaking such activities by our charter, bylaws or investment policies, and we may use an unlimited amount from any source to pay our distributions, and it is likely that we will use offering proceeds to fund a majority of our initial distributions. This is an initial public offering and we have limited operating history. The prior performance of real estate programs sponsored by our sponsor or its affiliates may not be indicative of our future results. This is a “best efforts” offering. If we are unable to raise substantial funds in our public offering, we may not be able to invest in a diverse portfolio of real estate and real estate-related investments, and the value of our stockholders’ investment may fluctuate more widely with the performance of specific investments. We are a “blind pool” because we have not identified any properties to acquire with the net proceeds from our public offering. As a result, our stockholders will not be able to evaluate the economic merits of our future investments prior to their purchase. We may be unable to invest the net proceeds from our public offering on acceptable terms to investors, or at all. Investors in our public offering will experience immediate dilution in their investment primarily because pursuant to our private offering, we sold approximately 10.7 million shares of our common stock at a weighted average purchase price of approximately $8.55 per share and received weighted average net proceeds of approximately $7.93 per share in our private offering. A portion of the proceeds received in our public offering may be used to honor share redemption requests from our stockholders which will reduce the net proceeds available to acquire additional properties. There are substantial conflicts of interest among us and our sponsor, advisor, affiliated property manager, transfer agent and dealer manager. Our advisor may face conflicts of interest relating to the purchase of properties and such conflicts may not be resolved in our favor, which could adversely affect our investment opportunities. We have no employees and must depend on our advisor to select investments and conduct our operations, and there is no guarantee that our advisor will devote adequate time or resources to us. We will pay substantial fees and expenses to our advisor, its affiliates and participating broker-dealers, which will reduce cash available for investment and distribution. We may incur substantial debt, which could hinder our ability to pay distributions to our stockholders or could decrease the value of our stockholders’ investment. We may fail to qualify as a REIT, which could adversely affect our operations and our ability to make distributions. Our board of directors may change any of our investment objectives without our stockholders’ consent.

SmartStop Asset Management, LLC

SmartStop Asset Management, LLC SmartStop Asset Management, LLC (“SAM”) and its affiliates* have a managed real estate portfolio of approximately $1.9 billion. An affiliate* of SAM sponsors, advises and manages one public, non-traded REIT and one private REIT focusing on self storage properties Growing self storage portfolio of properties in the greater Toronto area, comprising over 1 million net rentable square feet Company and affiliates have acquired over $6 billion in real estate assets over the past 15 years National sponsor of 1031 DST programs Current managed portfolio comprises approx. 11.6 million rentable square feet across 21 states & Toronto, Canada SAM and its affiliates have an aggregate of over 370 employees, including 32 self storage employees in Toronto, Canada Experienced developer of self storage and mixed-use properties in the U.S. and Toronto, including ground up & redevelopment projects Sponsor of public, non-traded REIT investing in student & senior housing *Self Storage REITs are sponsored by SmartStop REIT Advisors, LLC., an affiliate of SAM

Strategic Student & Senior Housing Trust, Inc. Executive Team H. Michael Schwartz Chairman of the Board & Chief Executive Officer Paula Mathews Executive Vice President James Berg Secretary John Strockis President & Chief Investment Officer Mike Terjung Chief Financial Officer & Treasurer Mike Crear Vice President & Controller

Student & Senior Housing Overview

Why Student & Senior Housing v Alternative Asset Class ✓ ✓ Fragmented Ownership ✓ ✓ Operating Business/Economies of Scale ✓ ✓ Brand-based Real Estate Recession-resistant Traits1 ✓ ✓ Inflation/Interest Rate Hedge2 ✓ ✓ “Much of the student housing industry’s current luster comes from its performance during the Great Recession. The primary driver of student housing is college enrollment, and when the economy loses jobs it tends to gain students.” Source: “Is Student Housing Recession-Proof - Sector Strength Draws Investors” - Axiometrics, Sarah Simmons, Senior Content Writer and Editor, May 11, 2017. “Seniors housing returns are also often less volatile than that of other property types. Indeed, during the Great Recession, returns for seniors housing, as measured by NCREIF, were less volatile and suffered an outright decline of 6.7 percent over the course of only two quarters versus returns on apartments, which declined 24 percent over the course of seven quarters”. Commercial Investment Real Estate Magazine Jan/Feb 2015 - Seniors Housing Stacks Up by Beth Burnham Mace, Chief Economist for the National Investment Center for Seniors Housing and Care. Past performance is no indication of future results. It is possible to lose money on this investment. While the student housing and senior housing industries may be resistant to recessions, there is no guarantee that a related investment will realize a profit or prevent against loss. Interest rates: Equity REIT returns have typically been stronger when market interest rates are going up than when they are going down. Inflation: Data going back to the beginning of 1972 suggest that when inflation rates have been relatively high for extended periods, equity REIT total returns have exceeded them 69% of the time. When inflation has been high the total returns on REITs has been strong (averaging 13.7% per year) and when inflation has been low the total returns on REITs have remained strong averaging 11.95% per year. NAREIT - REITs and Real Estate: Outlook for 2017, Macroeconomic Outlook and Commercial Real Estate Fundamentals, Calvin Schnure, SVP, Research & Economic Analysis The “YOUnion” brand and its associated trademarks are owned by our sponsor. Senior Housing Student Housing The Charleston, Cedar Hills, Utah Younion @ Tallahassee, Florida State University Student Housing 3

Characteristics That Drive Returns Anchored by the stability of major universities Majority of leases backed by parent guaranties Supply constrained markets (on- & off-campus) Limited government funding for new dorms & enhancements By 2030, 1 in every 5 U.S. residents will be retirement age (65 or older)** By 2035, older people are projected to outnumber children for the first time in US history** Leases are backed primarily by private pay and/or long-term care insurance/benefits Recession-Resistant Characteristics* Student Housing Senior Housing Diversification By: Geography, Asset Type, & Demographics Highly Fragmented Sector With Consolidation Opportunities Younion @ Tallahassee, Florida State University The Charleston, Cedar Hills, Utah *“Much of the student housing industry’s current luster comes from its performance during the Great Recession. The primary driver of student housing is college enrollment, and when the economy loses jobs it tends to gain students.” Source: “Is Student Housing Recession-Proof - Sector Strength Draws Investors” - Axiometrics, Sarah Simmons, Senior Content Writer and Editor, May 11, 2017. “Seniors housing returns are also often less volatile than that of other property types. Indeed, during the Great Recession, returns for seniors housing, as measured by NCREIF, were less volatile and suffered an outright decline of 6.7 percent over the course of only two quarters versus returns on apartments, which declined 24 percent over the course of seven quarters.” Commercial Investment Real Estate Magazine Jan/Feb 2015 - Seniors Housing Stacks Up by Beth Burnham Mace, Chief Economist for the National Investment Center for Seniors Housing and Care. Past performance is no indication of future results. It is possible to lose money on this investment. While the student housing and senior housing industries may be resistant to recessions, there is no guarantee that a related investment will realize a profit or prevent against loss. ** US Census Bureau study “Older people to outnumber children for the first time in US history” March 13, 2018

Factors Driving Demand Steady enrollment increase at major universities Increase in advanced degrees Outdated on-campus dormitories Increased desire for more than just a living space 78 Million aging Baby Boomers projected by 2035* Need for community living & social engagement Fewer family caregivers Need to downsize living space Student Housing Senior Housing Undergraduate enrollment is expected to increase by 14% between 2015 and 2026.* Number of Americans aged 65+ is expected to increase over 4x faster than overall population (approximately 65% from 2015 to 2035).* *National Center of Educational Statistics *U.S. Census Bureau Younion @ Fayetteville, University of Arkansas The Wellington at Salt Lake City, Utah

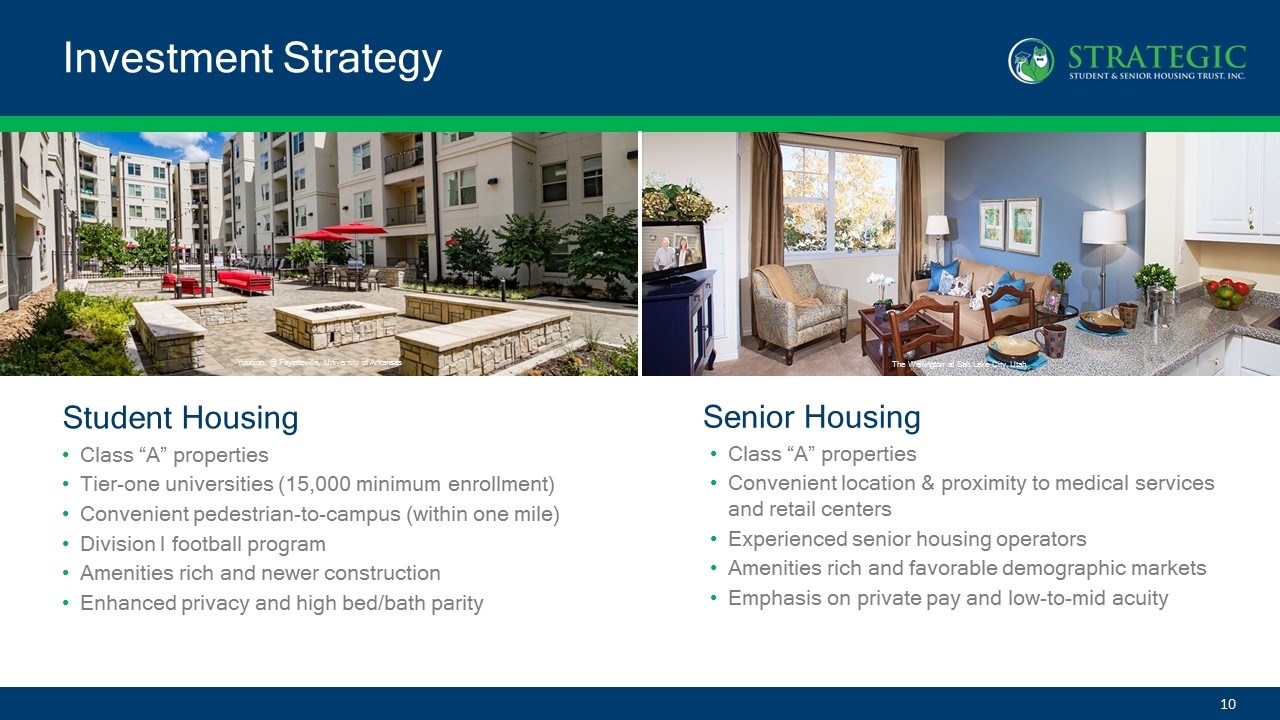

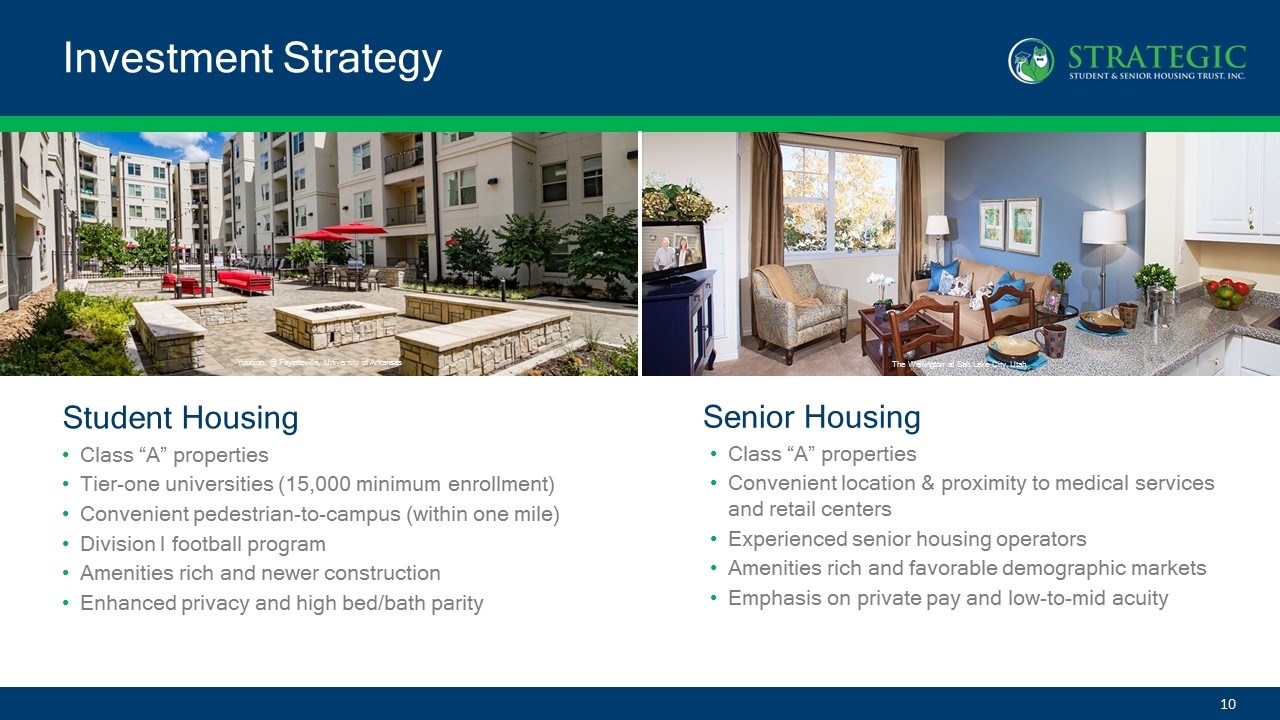

Investment Strategy Class “A” properties Tier-one universities (15,000 minimum enrollment) Convenient pedestrian-to-campus (within one mile) Division I football program Amenities rich and newer construction Enhanced privacy and high bed/bath parity Student Housing Senior Housing Class “A” properties Convenient location & proximity to medical services and retail centers Experienced senior housing operators Amenities rich and favorable demographic markets Emphasis on private pay and low-to-mid acuity This property is owned by Strategic Student & Senior Housing Trust, Inc. This property is owned by Strategic Student & Senior Housing Trust, Inc. Younion @ Fayetteville, University of Arkansas The Wellington at Salt Lake City, Utah

Strategic Student & Senior Housing Trust, Inc.

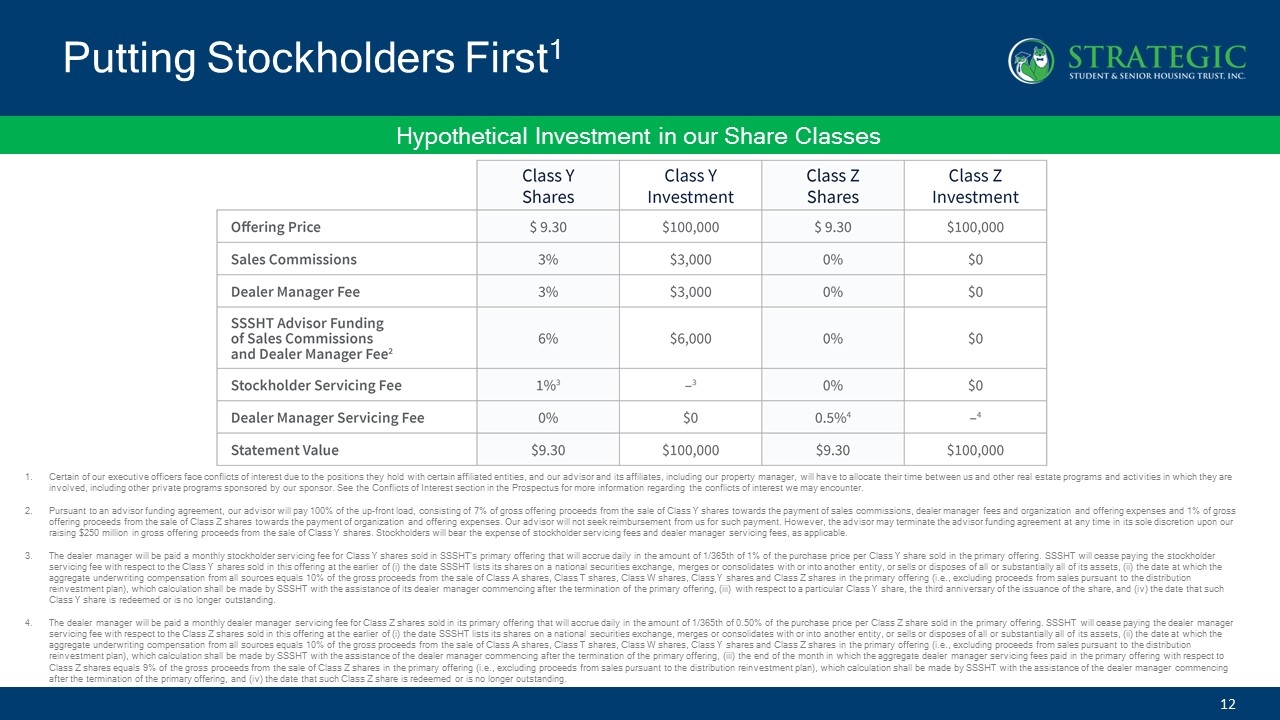

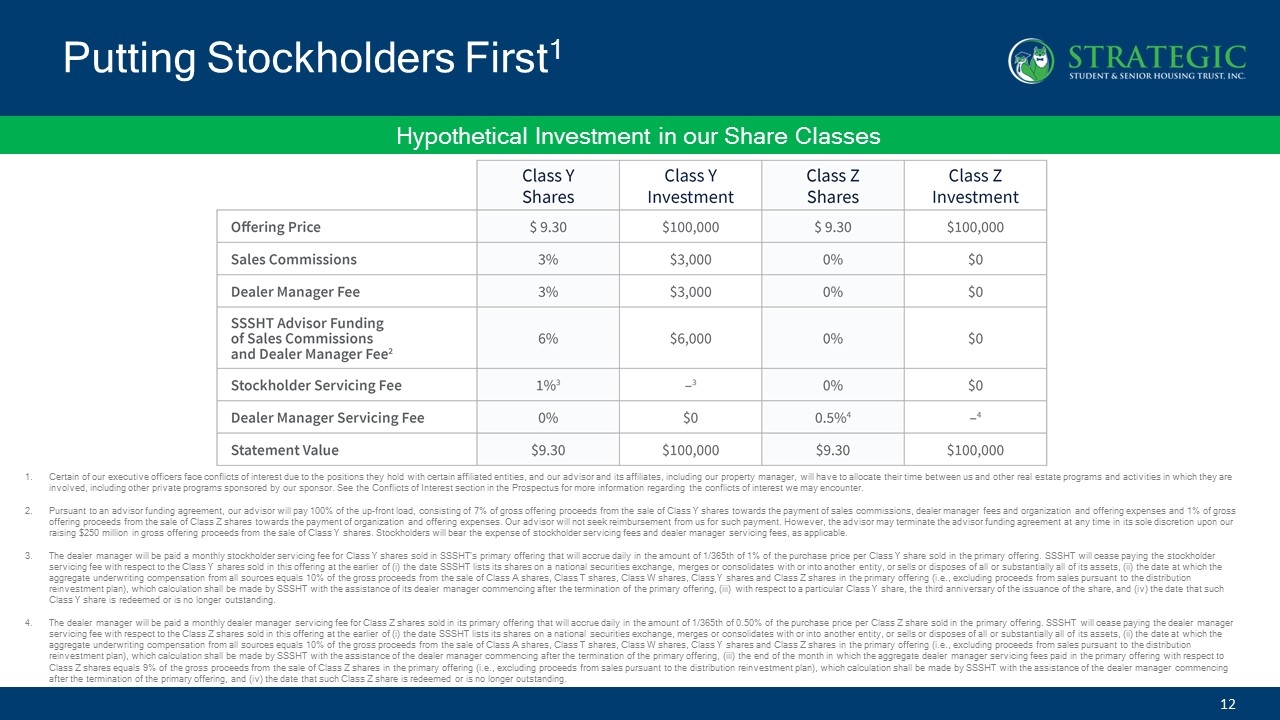

Putting Stockholders First1 Hypothetical Investment in our Share Classes Certain of our executive officers face conflicts of interest due to the positions they hold with certain affiliated entities, and our advisor and its affiliates, including our property manager, will have to allocate their time between us and other real estate programs and activities in which they are involved, including other private programs sponsored by our sponsor. See the Conflicts of Interest section in the Prospectus for more information regarding the conflicts of interest we may encounter. Pursuant to an advisor funding agreement, our advisor will pay 100% of the up-front load, consisting of 7% of gross offering proceeds from the sale of Class Y shares towards the payment of sales commissions, dealer manager fees and organization and offering expenses and 1% of gross offering proceeds from the sale of Class Z shares towards the payment of organization and offering expenses. Our advisor will not seek reimbursement from us for such payment. However, the advisor may terminate the advisor funding agreement at any time in its sole discretion upon our raising $250 million in gross offering proceeds from the sale of Class Y shares. Stockholders will bear the expense of stockholder servicing fees and dealer manager servicing fees, as applicable. The dealer manager will be paid a monthly stockholder servicing fee for Class Y shares sold in SSSHT’s primary offering that will accrue daily in the amount of 1/365th of 1% of the purchase price per Class Y share sold in the primary offering. SSSHT will cease paying the stockholder servicing fee with respect to the Class Y shares sold in this offering at the earlier of (i) the date SSSHT lists its shares on a national securities exchange, merges or consolidates with or into another entity, or sells or disposes of all or substantially all of its assets, (ii) the date at which the aggregate underwriting compensation from all sources equals 10% of the gross proceeds from the sale of Class A shares, Class T shares, Class W shares, Class Y shares and Class Z shares in the primary offering (i.e., excluding proceeds from sales pursuant to the distribution reinvestment plan), which calculation shall be made by SSSHT with the assistance of its dealer manager commencing after the termination of the primary offering, (iii) with respect to a particular Class Y share, the third anniversary of the issuance of the share, and (iv) the date that such Class Y share is redeemed or is no longer outstanding. The dealer manager will be paid a monthly dealer manager servicing fee for Class Z shares sold in its primary offering that will accrue daily in the amount of 1/365th of 0.50% of the purchase price per Class Z share sold in the primary offering. SSSHT will cease paying the dealer manager servicing fee with respect to the Class Z shares sold in this offering at the earlier of (i) the date SSSHT lists its shares on a national securities exchange, merges or consolidates with or into another entity, or sells or disposes of all or substantially all of its assets, (ii) the date at which the aggregate underwriting compensation from all sources equals 10% of the gross proceeds from the sale of Class A shares, Class T shares, Class W shares, Class Y shares and Class Z shares in the primary offering (i.e., excluding proceeds from sales pursuant to the distribution reinvestment plan), which calculation shall be made by SSSHT with the assistance of the dealer manager commencing after the termination of the primary offering, (iii) the end of the month in which the aggregate dealer manager servicing fees paid in the primary offering with respect to Class Z shares equals 9% of the gross proceeds from the sale of Class Z shares in the primary offering (i.e., excluding proceeds from sales pursuant to the distribution reinvestment plan), which calculation shall be made by SSSHT with the assistance of the dealer manager commencing after the termination of the primary offering, and (iv) the date that such Class Z share is redeemed or is no longer outstanding. *

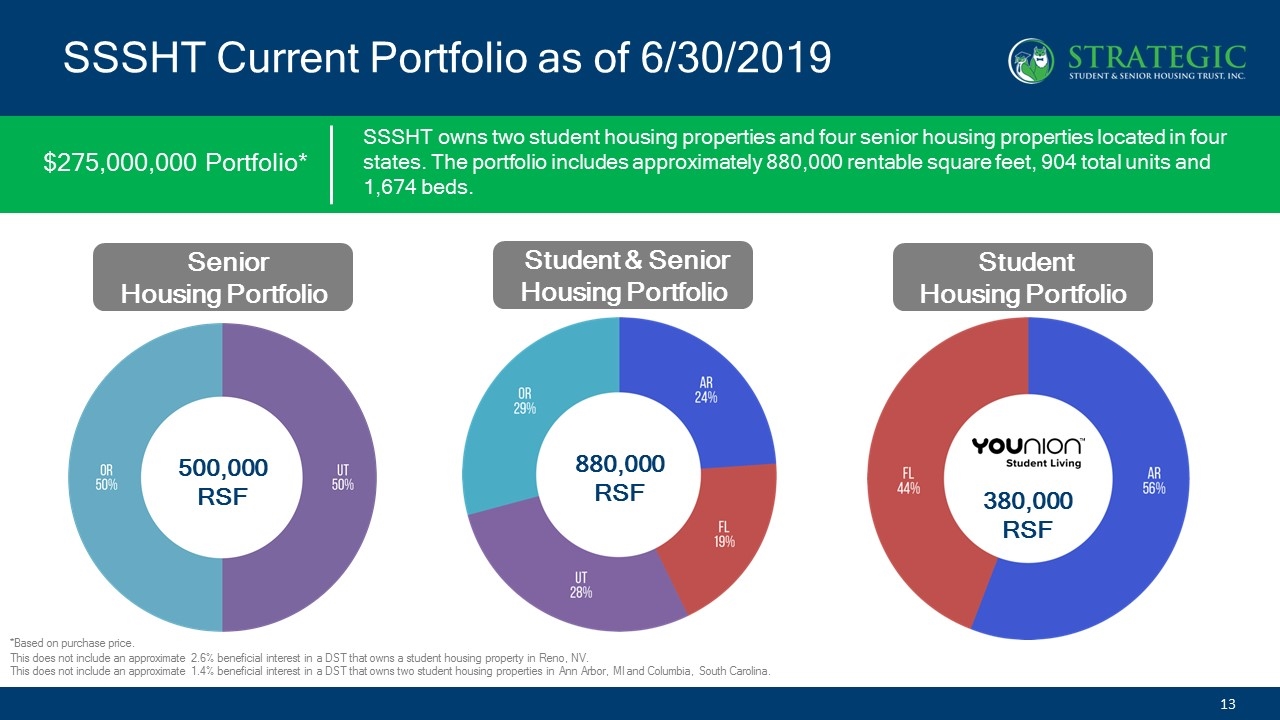

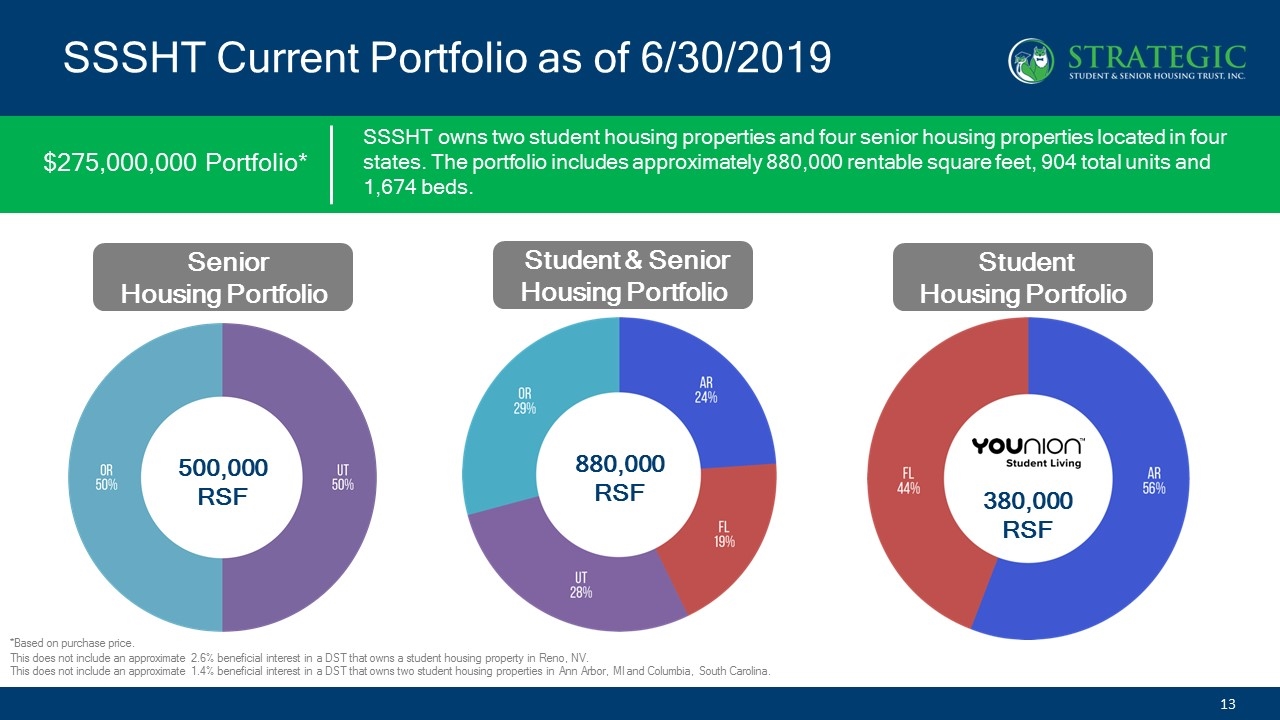

SSSHT Current Portfolio as of 6/30/2019 $275,000,000 Portfolio* SSSHT owns two student housing properties and four senior housing properties located in four states. The portfolio includes approximately 880,000 rentable square feet, 904 total units and 1,674 beds. *Based on purchase price. 380,000 RSF Student Housing Portfolio 500,000 RSF Senior Housing Portfolio This does not include an approximate 2.6% beneficial interest in a DST that owns a student housing property in Reno, NV. This does not include an approximate 1.4% beneficial interest in a DST that owns two student housing properties in Ann Arbor, MI and Columbia, South Carolina. Student & Senior Housing Portfolio 880,000 RSF

Portfolio Summary

Equity Update Puyallup, Washington Property Equity Update Approx. $100 Million as of 6/30/19 (includes private offering) Distributions(1) SSSHT pays a distribution rate of approximately $0.00169808 per day per share (equivalent to $0.62 per share annually) to Class A, Class T, Class W, Class Y and Class Z stockholders of record. The T and Y share distributions are reduced by an ongoing stockholder servicing fee equal to an annual rate of 1% of the T and Y share purchase price. The W and Z share distributions are reduced by an ongoing dealer manager servicing fee equal to an annual rate of 0.50% of the W and Z share purchase price. (1) We have paid and may continue to pay, distributions from sources other than cash flow from operations, therefore, we will have fewer funds available for acquisitions of properties and our stockholders overall return may be reduced. Future distributions are at the sole discretion of our board of directors and are not guaranteed.

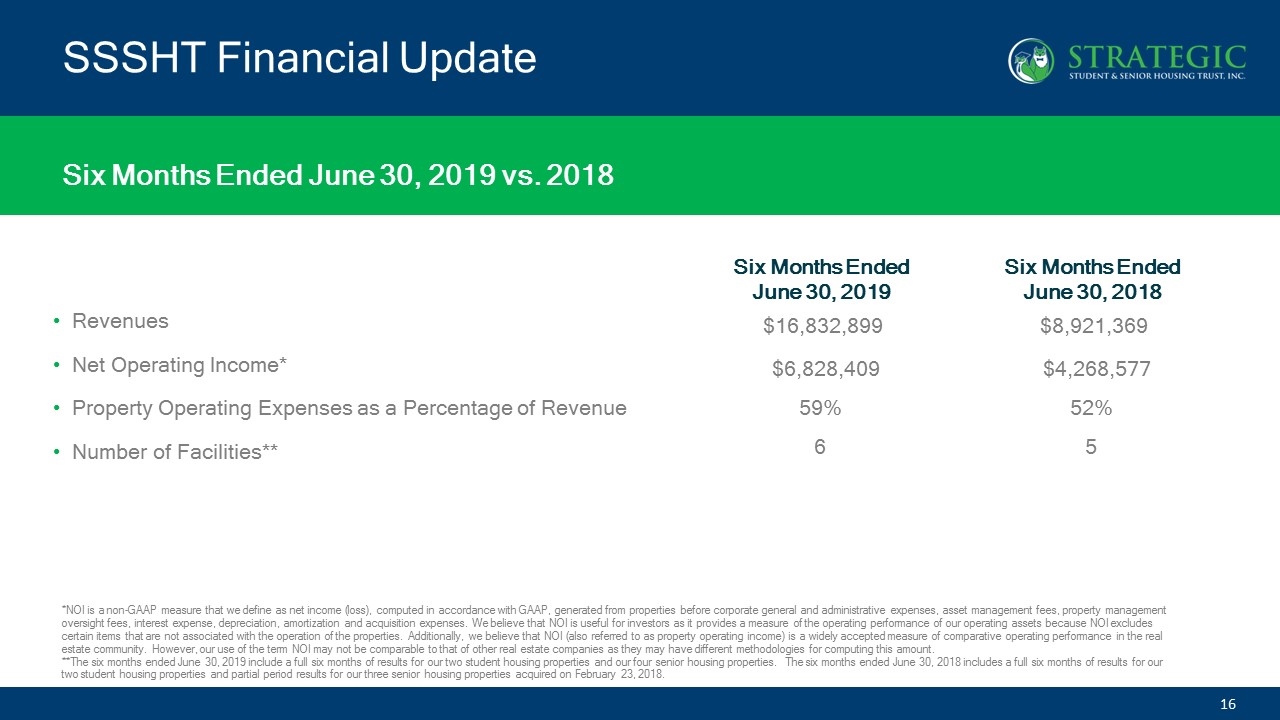

SSSHT Financial Update Revenues Net Operating Income* Property Operating Expenses as a Percentage of Revenue Number of Facilities** Six Months Ended June 30, 2019 $16,832,899 $6,828,409 59% 6 Six Months Ended June 30, 2018 $8,921,369 $4,268,577 52% 5 Six Months Ended June 30, 2019 vs. 2018 *NOI is a non-GAAP measure that we define as net income (loss), computed in accordance with GAAP, generated from properties before corporate general and administrative expenses, asset management fees, property management oversight fees, interest expense, depreciation, amortization and acquisition expenses. We believe that NOI is useful for investors as it provides a measure of the operating performance of our operating assets because NOI excludes certain items that are not associated with the operation of the properties. Additionally, we believe that NOI (also referred to as property operating income) is a widely accepted measure of comparative operating performance in the real estate community. However, our use of the term NOI may not be comparable to that of other real estate companies as they may have different methodologies for computing this amount. **The six months ended June 30, 2019 include a full six months of results for our two student housing properties and our four senior housing properties. The six months ended June 30, 2018 includes a full six months of results for our two student housing properties and partial period results for our three senior housing properties acquired on February 23, 2018.

YOUNION – Student Housing Brand* * The “YOUnion” Brand and its associated trademarks are owned by our sponsor.

YOUnion Arkansas 3 blocks from University of Arkansas Tier-1 rated top college Division I football team in SEC conference Newly constructed Fully furnished units (beds, desks, appliances, washer/dryer) 1 bed/1 bath parity 1 block from eatery & entertainment corridor Fiber optic cable with 1 gigabit of bandwidth LEED Gold certified Student Housing Acquired June 2017

YOUnion Florida State University 1 block from Florida State University Tier-1 rated top college Division I football team Newly constructed Fully furnished units (beds, desks, appliances, washer/dryer) 1 bed/1 bath parity Fiber optic cable with one Gigabit of bandwidth Extraordinary amenities package fitness center, study rooms, computer center, powered furniture Student Housing Acquired September 2017

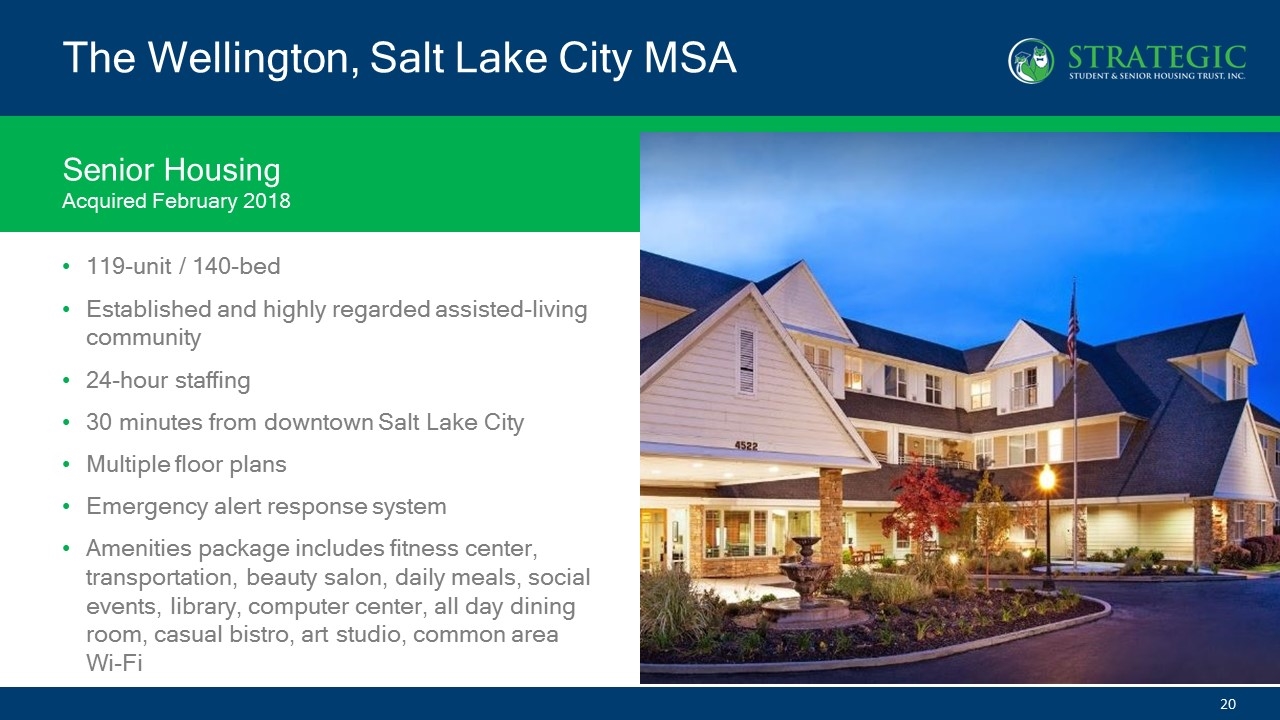

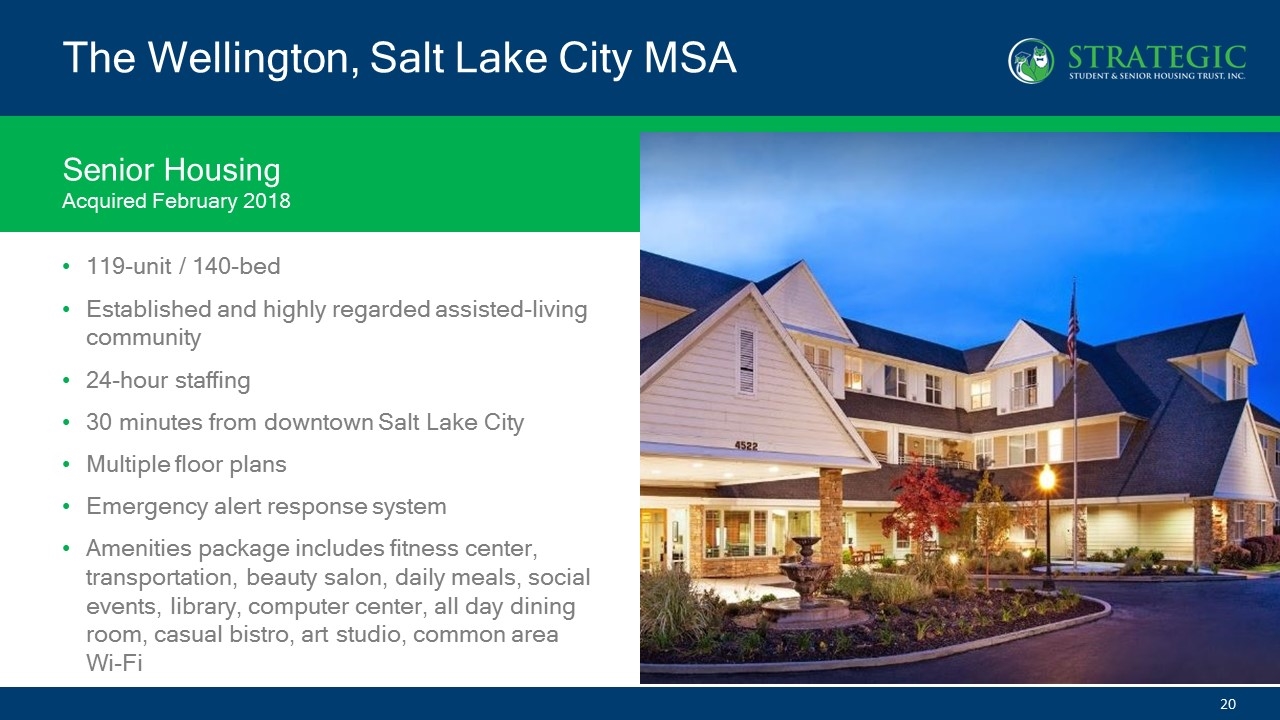

The Wellington, Salt Lake City MSA 119-unit / 140-bed Established and highly regarded assisted-living community 24-hour staffing 30 minutes from downtown Salt Lake City Multiple floor plans Emergency alert response system Amenities package includes fitness center, transportation, beauty salon, daily meals, social events, library, computer center, all day dining room, casual bistro, art studio, common area Wi-Fi Senior Housing Acquired February 2018

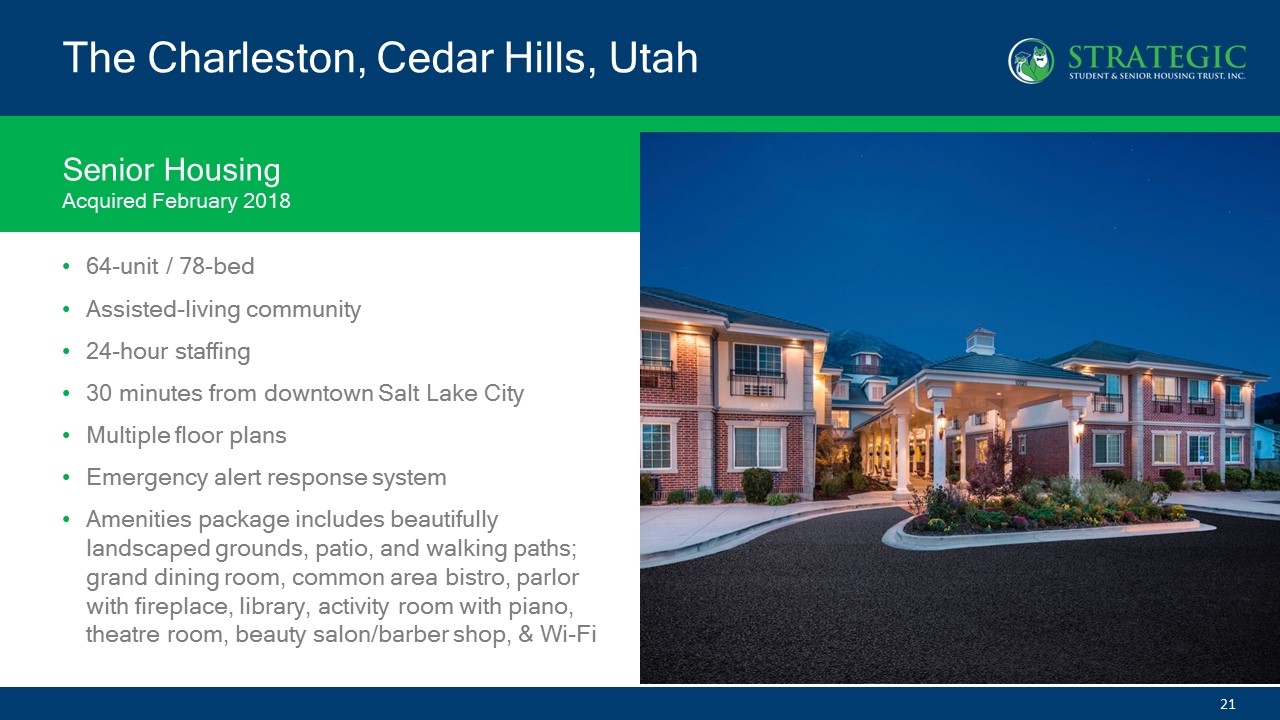

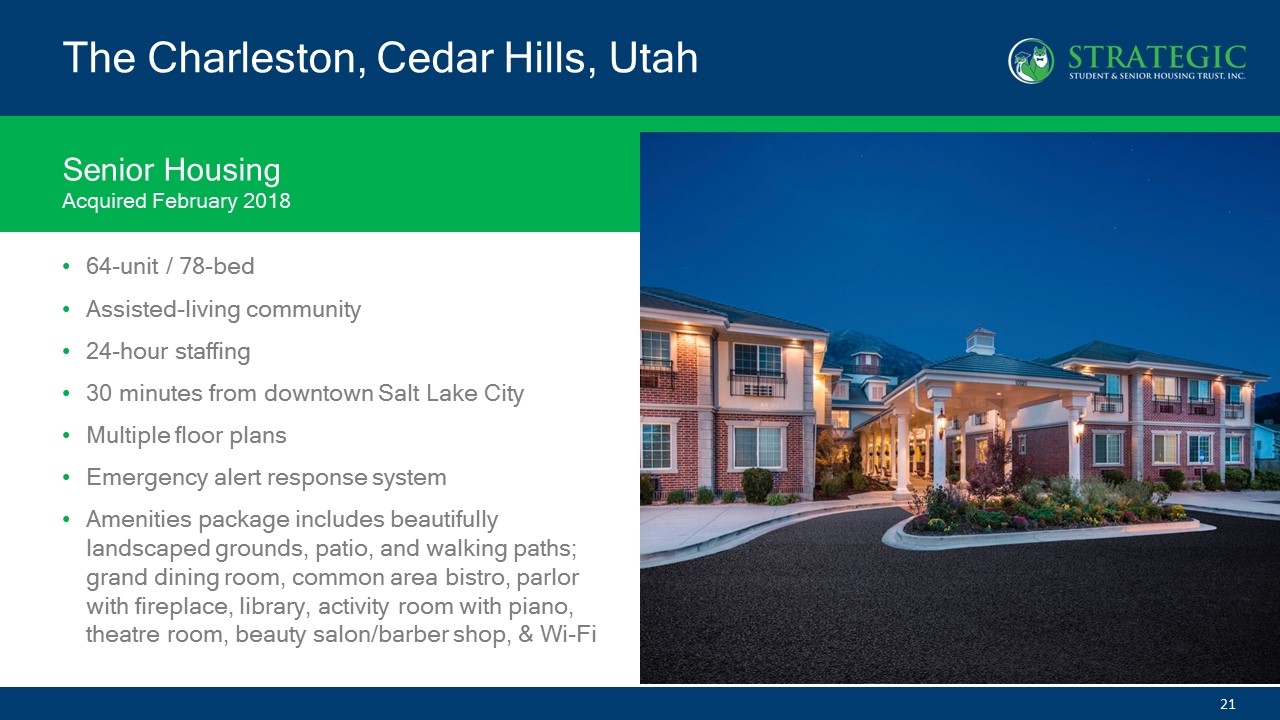

The Charleston, Cedar Hills, Utah 64-unit / 78-bed Assisted-living community 24-hour staffing 30 minutes from downtown Salt Lake City Multiple floor plans Emergency alert response system Amenities package includes beautifully landscaped grounds, patio, and walking paths; grand dining room, common area bistro, parlor with fireplace, library, activity room with piano, theatre room, beauty salon/barber shop, & Wi-Fi Senior Housing Acquired February 2018

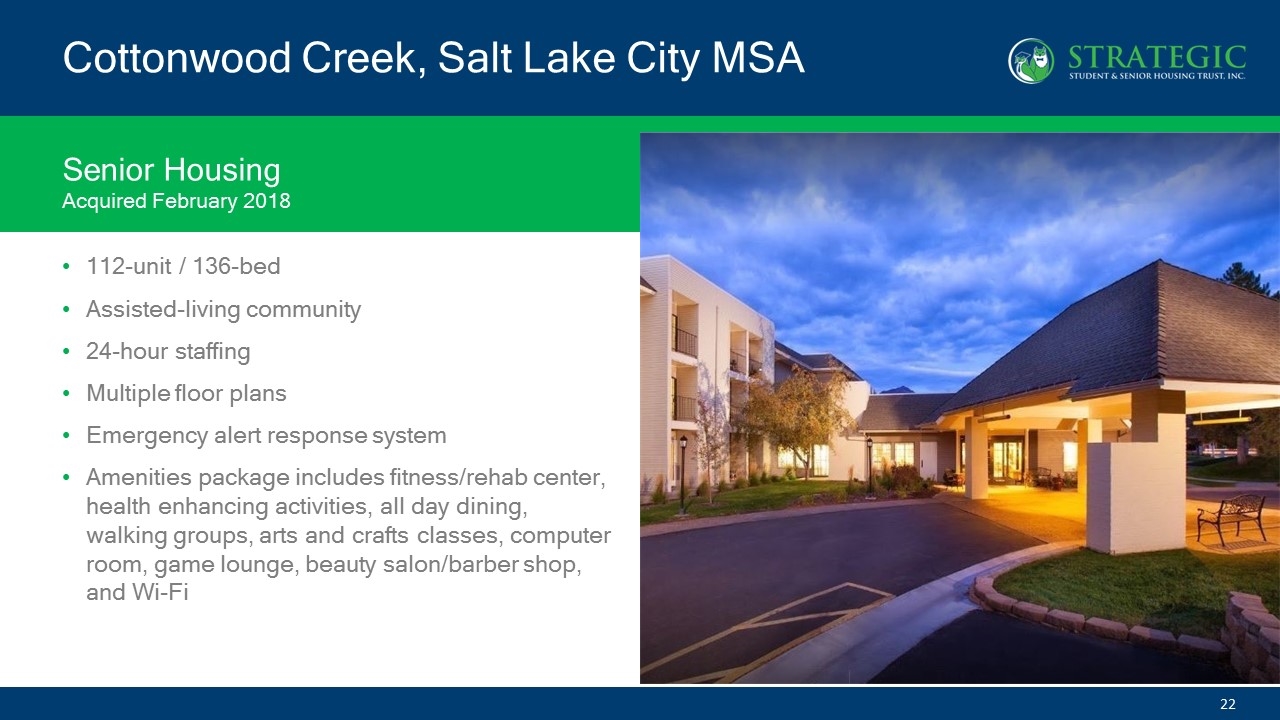

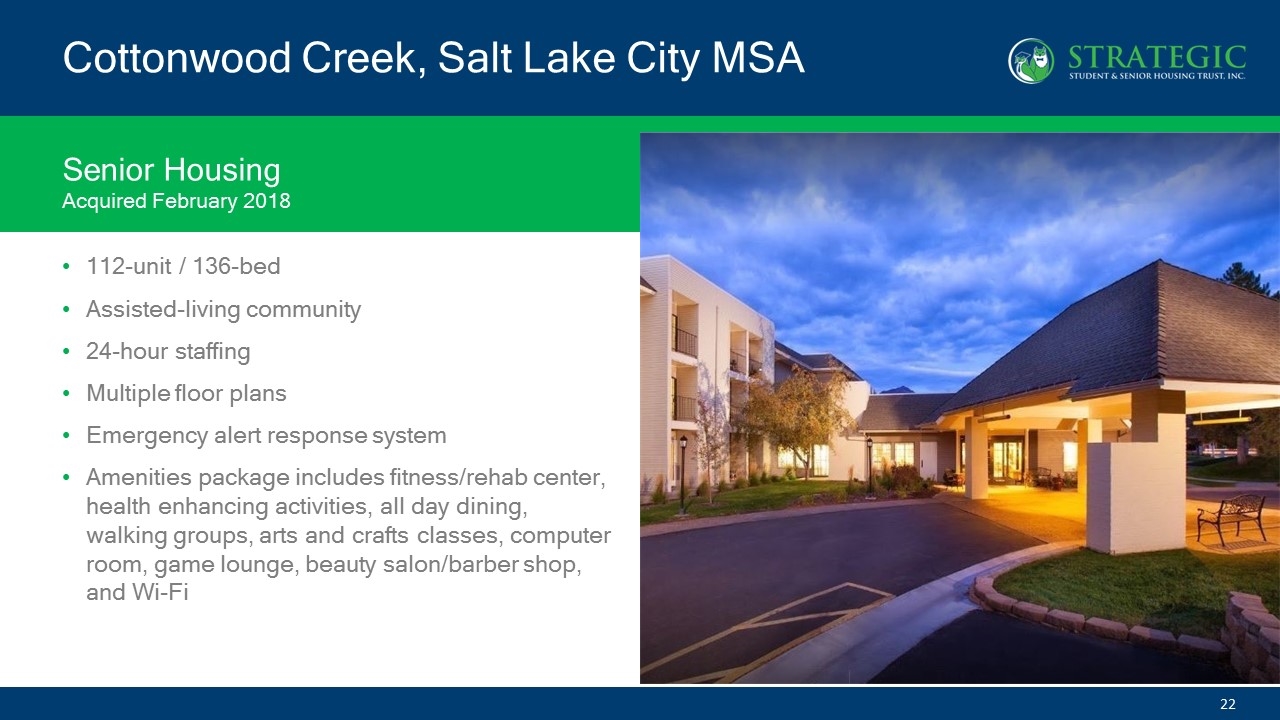

Cottonwood Creek, Salt Lake City MSA 112-unit / 136-bed Assisted-living community 24-hour staffing Multiple floor plans Emergency alert response system Amenities package includes fitness/rehab center, health enhancing activities, all day dining, walking groups, arts and crafts classes, computer room, game lounge, beauty salon/barber shop, and Wi-Fi Senior Housing Acquired February 2018

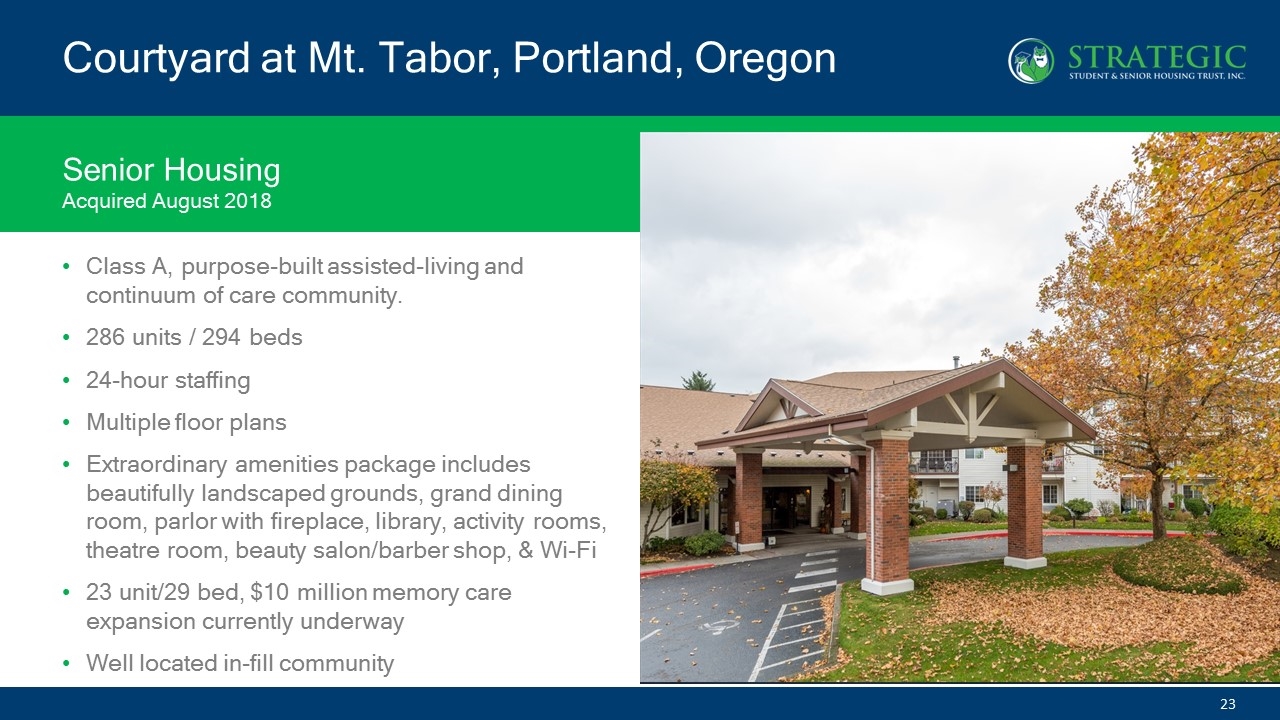

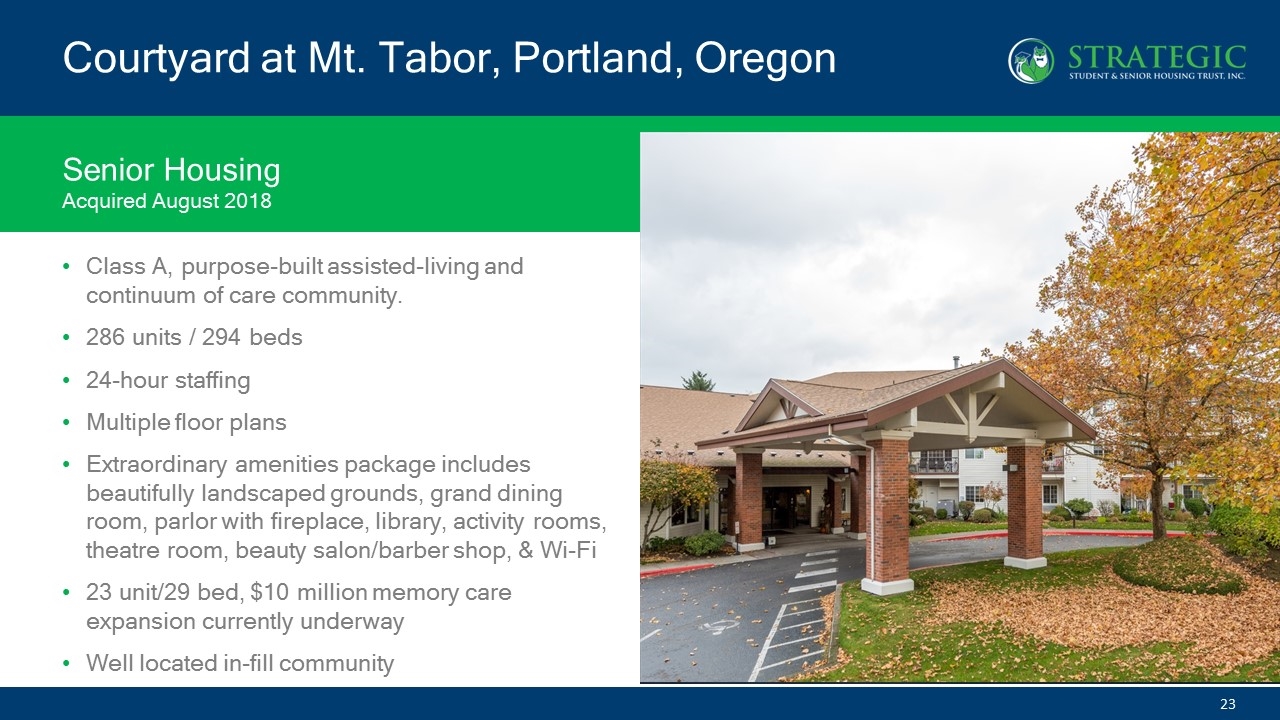

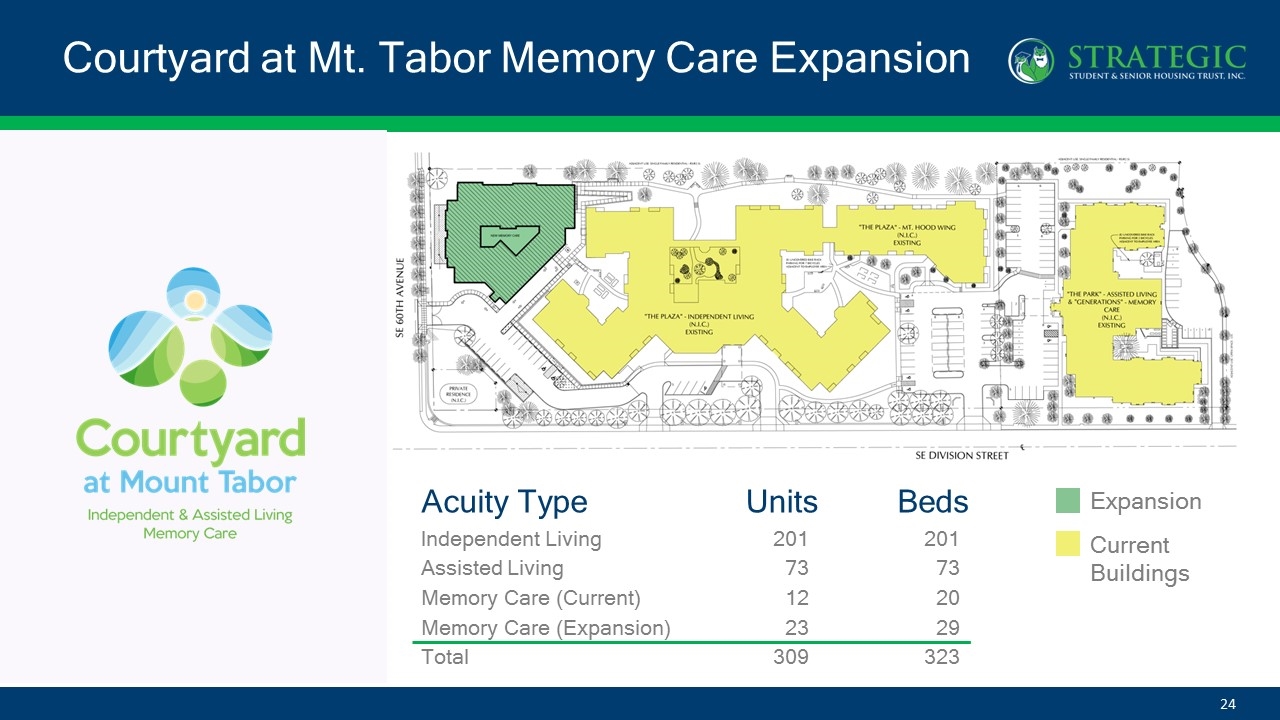

Courtyard at Mt. Tabor, Portland, Oregon Class A, purpose-built assisted-living and continuum of care community. 286 units / 294 beds 24-hour staffing Multiple floor plans Extraordinary amenities package includes beautifully landscaped grounds, grand dining room, parlor with fireplace, library, activity rooms, theatre room, beauty salon/barber shop, & Wi-Fi 23 unit/29 bed, $10 million memory care expansion currently underway Well located in-fill community Senior Housing Acquired August 2018

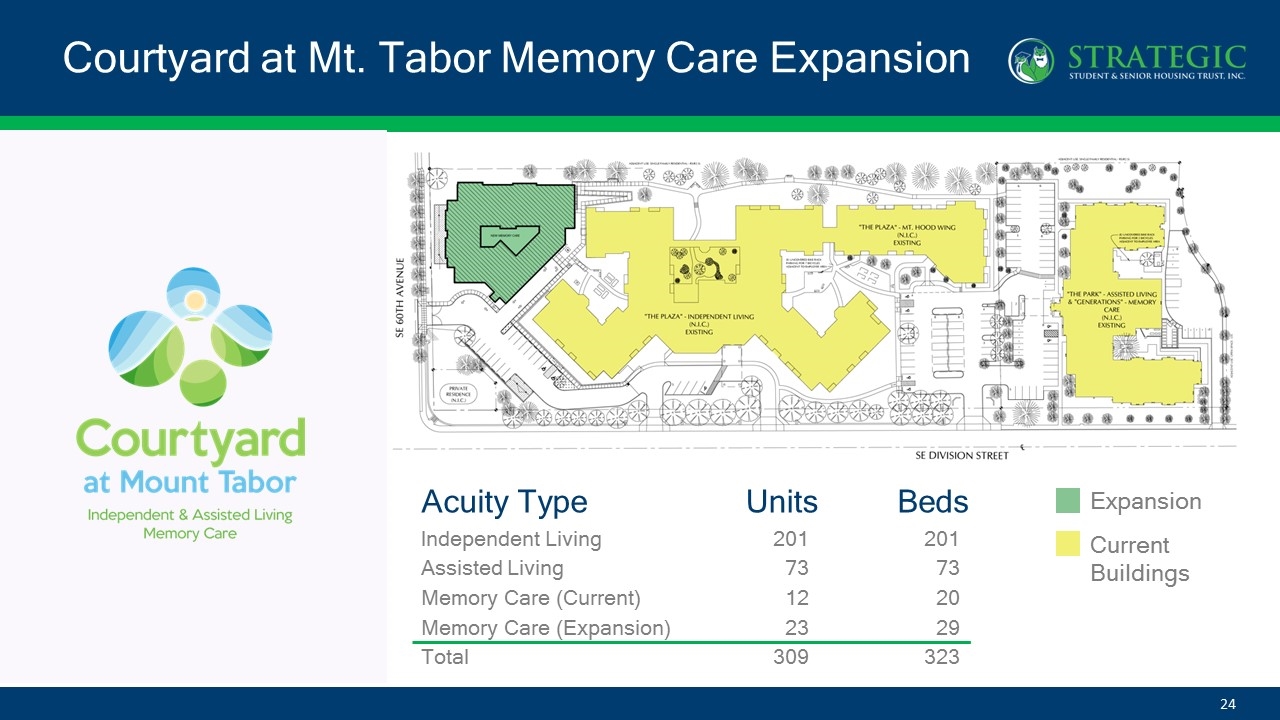

Independent Living Assisted Living Memory Care (Current) Memory Care (Expansion) Total Acuity Type 201 73 12 23 309 Units 201 73 20 29 323 Beds Expansion Current Buildings Courtyard at Mt. Tabor Memory Care Expansion

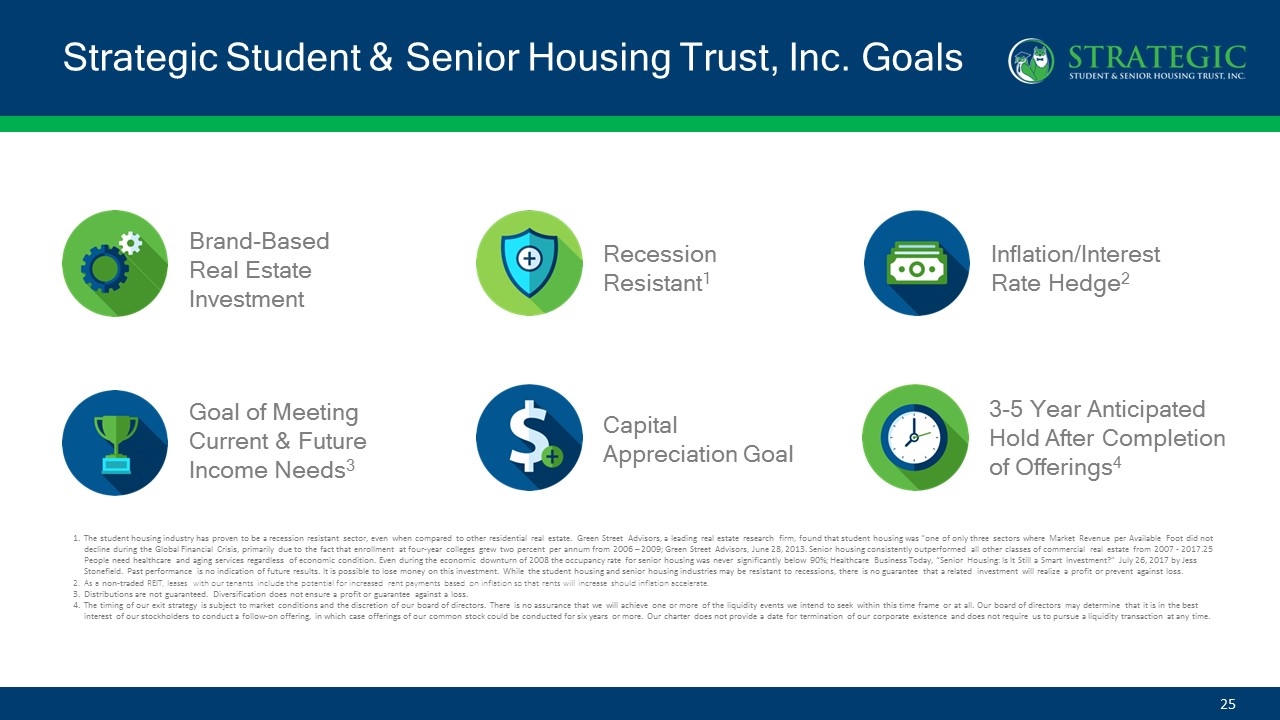

Strategic Student & Senior Housing Trust, Inc. Goals Capital Appreciation Goal Recession Resistant1 Goal of Meeting Current & Future Income Needs3 3-5 Year Anticipated Hold After Completion of Offerings4 The student housing industry has proven to be a recession resistant sector, even when compared to other residential real estate. Green Street Advisors, a leading real estate research firm, found that student housing was “one of only three sectors where Market Revenue per Available Foot did not decline during the Global Financial Crisis, primarily due to the fact that enrollment at four-year colleges grew two percent per annum from 2006 – 2009; Green Street Advisors, June 28, 2013. Senior housing consistently outperformed all other classes of commercial real estate from 2007 - 2017.25 People need healthcare and aging services regardless of economic condition. Even during the economic downturn of 2008 the occupancy rate for senior housing was never significantly below 90%; Healthcare Business Today, “Senior Housing: Is It Still a Smart Investment?” July 26, 2017 by Jess Stonefield. Past performance is no indication of future results. It is possible to lose money on this investment. While the student housing and senior housing industries may be resistant to recessions, there is no guarantee that a related investment will realize a profit or prevent against loss. As a non-traded REIT, leases with our tenants include the potential for increased rent payments based on inflation so that rents will increase should inflation accelerate. Distributions are not guaranteed. Diversification does not ensure a profit or guarantee against a loss. The timing of our exit strategy is subject to market conditions and the discretion of our board of directors. There is no assurance that we will achieve one or more of the liquidity events we intend to seek within this time frame or at all. Our board of directors may determine that it is in the best interest of our stockholders to conduct a follow-on offering, in which case offerings of our common stock could be conducted for six years or more. Our charter does not provide a date for termination of our corporate existence and does not require us to pursue a liquidity transaction at any time. Brand-Based Real Estate Investment Inflation/Interest Rate Hedge2

Student & Senior Housing REITs Publicly Traded Competitors NYSE: VTR NYSE: ACC NYSE:WELL NYSE:BKD NYSE:CSU Public Non-Traded Student & Senior Housing REIT Student Housing Senior Housing NYSE:NHI

Next Steps Main Office 10 Terrace Road Ladera Ranch, CA 92694 Sales Desk 877.32.REIT5 (877.327.3485) info@strategicREIT.com Company Info: StrategicREIT.com Student Rentals: YOUnion.com Investor Services 866.418.5144 Shares Offered Through Select Capital Corporation, Dealer Manager for Strategic Student & Senior Housing Trust, Inc. Member FINRA | SIPC 866.699.5338

Questions? Main Office: 10 Terrace Road, Ladera Ranch, CA 92694 949.429.6600 | SAM.com | StrategicREIT.com This property is owned by SmartStop Asset Management