Third Quarter 2018 Earnings Presentation November 13, 2018 Stephen I. Chazen – Chairman, President & CEO Christopher Stavros – Executive Vice President & CFO Brian Corales – Vice President, Investor Relations Exhibit 99.2

Disclaimer FORWARD LOOKING STATEMENTS The information in this presentation and the oral statements made in connection therewith include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of present or historical fact included in this presentation, regarding Magnolia Oil & Gas Corporation’s (“Magnolia,” “we,” “us,” “our” or the “Company”) financial and production guidance, strategy, future operations, financial position, estimated revenues, and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. When used in this presentation, including any oral statements made in connection therewith, the words “could,” “should,” “will,” “may,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” the negative of such terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on management’s current expectations and assumptions about future events. Except as otherwise required by applicable law, Magnolia disclaims any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this presentation. Magnolia cautions you that these forward-looking statements are subject to all of the risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of Magnolia, incident to the development, production, gathering and sale of oil, natural gas and natural gas liquids. These risks include, but are not limited to, commodity price volatility, low prices for oil and/or natural gas, global economic conditions, inflation, increased operating costs, lack of availability of drilling and production equipment, supplies, services and qualified personnel, processing volumes and pipeline throughput, and certificates related to new technologies, geographical concentration of operations, environmental risks, weather risks, security risks, drilling and other operating risks, regulatory changes, the uncertainty inherent in estimating oil and natural gas reserves and in projecting future rates of production, reductions in cash flow, lack of access to capital, Magnolia’s ability to satisfy future cash obligations, restrictions in existing or future debt agreements, the timing of development expenditures, managing growth and integration of acquisitions, failure to realize expected value creation from property acquisitions, and the defects and limited control over non-operated properties. Should one or more of the risks or uncertainties described in this presentation and the oral statements made in connection therewith occur, or should underlying assumptions prove incorrect, actual results and plans could different materially from those expressed in any forward-looking statements. Additional information concerning these and other factors that may impact Magnolia's operations and projections can be found in its filings with the Securities and Exchange Commission (the "SEC"), including its Annual Report on Form 10-K for the fiscal year ended December 31, 2017 and its definitive proxy statement regarding filed with the SEC on July 2, 2018. Magnolia’s SEC filings are available publicly on the SEC’s website at www.sec.gov. PRO FORMA FINANCIAL INFORMATION The pro forma financial information set forth in this presentation gives pro forma effect to the EnerVest Business Combination as if it occurred on January 1, 2017. The Predecessor’s acquisition of the GulfTex assets on March 1, 2018 are included in the Company’s pro forma results. Pro forma financial and operating data in this presentation is calculated in accordance with Accounting Standards Codification (ASC) 805. NON-GAAP FINANCIAL MEASURES This presentation includes non-GAAP financial measures, including pro forma EBITDAX, adjusted operating margin and adjusted earnings. Magnolia believes these metrics are useful because they allow Magnolia to more effectively evaluate its operating performance and compare the results of its operations from period to period and against its peers without regard to financing methods or capital structure. Magnolia does not consider these non-GAAP measures in isolation or as an alternative to similar financial measures determined in accordance with GAAP. The computations of these non-GAAP measures may not be comparable to other similarly titled measures of other companies. Magnolia excludes certain items from net income in arriving at adjusted operating margin and adjusted earnings because these amounts can vary substantially from company to company within its industry depending upon accounting methods, book values of assets and the method by which the assets were acquired. Pro forma EBITDAX, adjusted operating margin, and adjusted earnings should not be considered as alternatives to, or more meaningful than, net income as determined in accordance with GAAP. Certain items excluded from pro forma EBITDAX, adjusted operating margin, and adjusted earnings are significant components in understanding and assessing a company’s financial performance, and should not be construed as an inference that its results will be unaffected by unusual or non-recurring terms. In this presentation, we refer to adjusted operating margin per Boe and pro forma EBITDAX, both are supplemental non-GAAP financial measures that are used by management. We define adjusted operating margin per Boe as total revenues per Boe less operating expenses per Boe adjusted for certain unusual or non-recurring items per Boe that management does not consider to be representative of the Company's on-going business operations. We define pro forma EBITDAX as pro forma net income before interest expense, income taxes, depreciation, depletion and amortization and accretion of asset retirement obligations, and exploration costs. Management believes these metrics provide relevant and useful information, which is used by management in assessing the Company’s profitability and comparability of results to our peers. We believe pro forma EBIDTAX is an important supplemental measure of operating performance for this period because it combines the operations of both the Karnes County and Giddings Field Assets and eliminates items that have less bearing on combined operating performance and so highlights trends in our core business that may not otherwise be apparent when relying solely on GAAP financial measures. We also believe that securities analysts, investors and other interested parties may use pro forma EBITDAX in the evaluation of our Company. As performance measures, adjusted operating margin and pro forma EBITDAX may be useful to investors in facilitating comparisons to others in the Company’s industry because certain items can vary substantially in the oil and gas industry from company to company depending upon accounting methods, book value of assets, and capital structure, among other factors. Management believes excluding these items facilitates investors and analysts in evaluating and comparing the underlying operating and financial performance of our business from period to period by eliminating differences caused by the existence and timing of certain expense and income items that would not otherwise be apparent on a GAAP basis. However, our presentation of adjusted operating margin, adjusted operating margin per Boe, and pro forma EBITDAX may not be comparable to similar measures of other companies in our industry. An adjusted operating margin per Boe reconciliation is shown on page 8 of the presentation and an EBITDAX reconciliation is shown on page 9 of the presentation INDUSTRY AND MARKET DATA This presentation has been prepared by Magnolia and includes market data and other statistical information from sources believed by Magnolia to be reliable, including independent industry publications, governmental publications or other published independent sources. Some data is also based on the good faith estimates of Magnolia, which are derived from its review of internal sources as well as the independent sources described above. Although Magnolia believes these sources are reliable, it has not independently verified the information and cannot guarantee its accuracy and completeness.

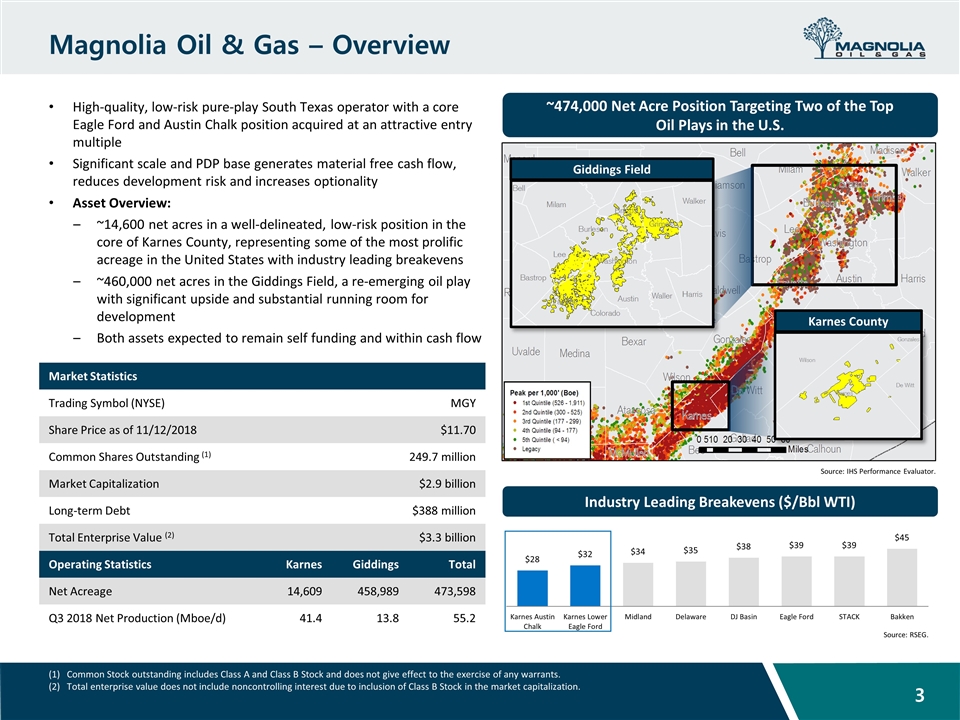

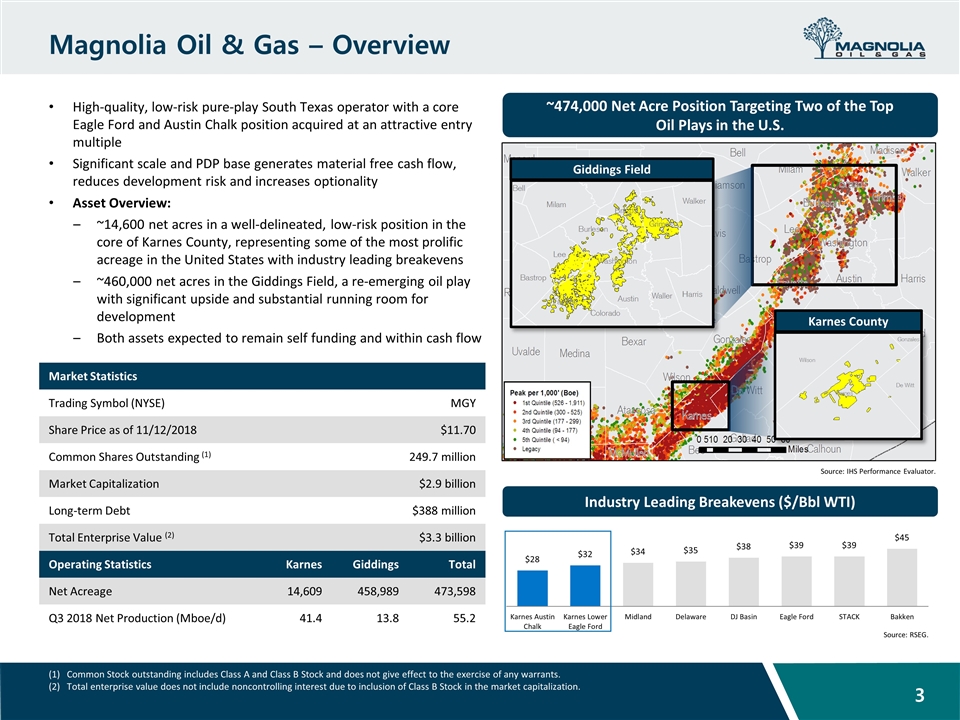

Magnolia Oil & Gas – Overview High-quality, low-risk pure-play South Texas operator with a core Eagle Ford and Austin Chalk position acquired at an attractive entry multiple Significant scale and PDP base generates material free cash flow, reduces development risk and increases optionality Asset Overview: ~14,600 net acres in a well-delineated, low-risk position in the core of Karnes County, representing some of the most prolific acreage in the United States with industry leading breakevens ~460,000 net acres in the Giddings Field, a re-emerging oil play with significant upside and substantial running room for development Both assets expected to remain self funding and within cash flow Karnes County Giddings Field ~474,000 Net Acre Position Targeting Two of the Top Oil Plays in the U.S. Market Statistics Trading Symbol (NYSE) MGY Share Price as of 11/12/2018 $11.70 Common Shares Outstanding (1) 249.7 million Market Capitalization $2.9 billion Long-term Debt $388 million Total Enterprise Value (2) $3.3 billion Operating Statistics Karnes Giddings Total Net Acreage 14,609 458,989 473,598 Q3 2018 Net Production (Mboe/d) 41.4 13.8 55.2 Industry Leading Breakevens ($/Bbl WTI) Source: IHS Performance Evaluator. Source: RSEG. Common Stock outstanding includes Class A and Class B Stock and does not give effect to the exercise of any warrants. Total enterprise value does not include noncontrolling interest due to inclusion of Class B Stock in the market capitalization.

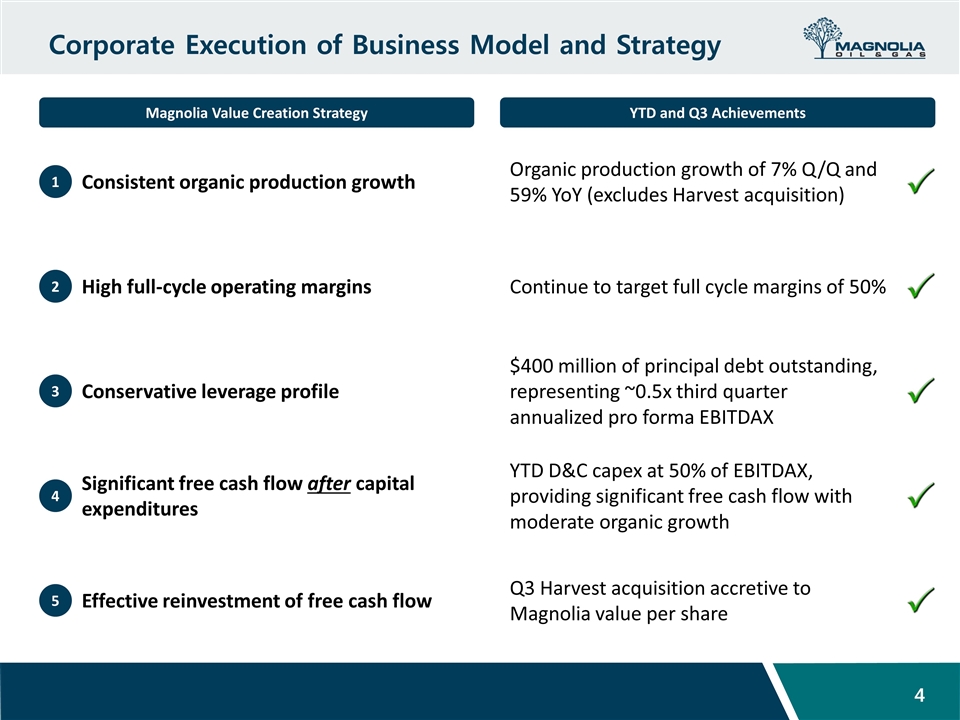

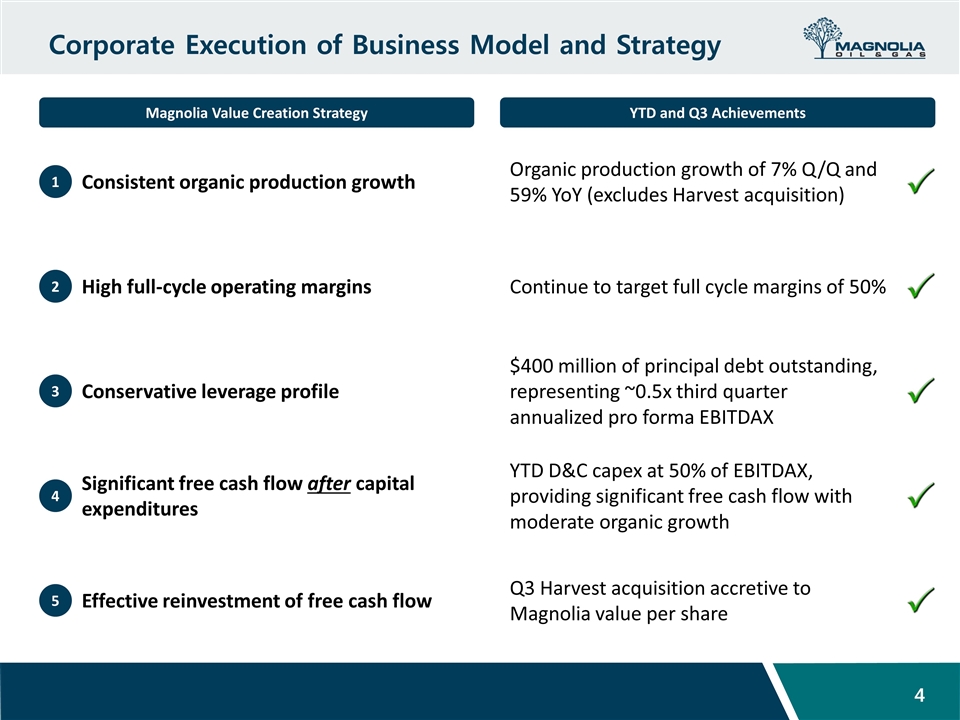

Corporate Execution of Business Model and Strategy Magnolia Value Creation Strategy YTD and Q3 Achievements 1 Consistent organic production growth Organic production growth of 7% Q/Q and 59% YoY (excludes Harvest acquisition) 3 Conservative leverage profile $400 million of principal debt outstanding, representing ~0.5x third quarter annualized pro forma EBITDAX 4 Significant free cash flow after capital expenditures YTD D&C capex at 50% of EBITDAX, providing significant free cash flow with moderate organic growth 5 Effective reinvestment of free cash flow Q3 Harvest acquisition accretive to Magnolia value per share 2 High full-cycle operating margins Continue to target full cycle margins of 50%

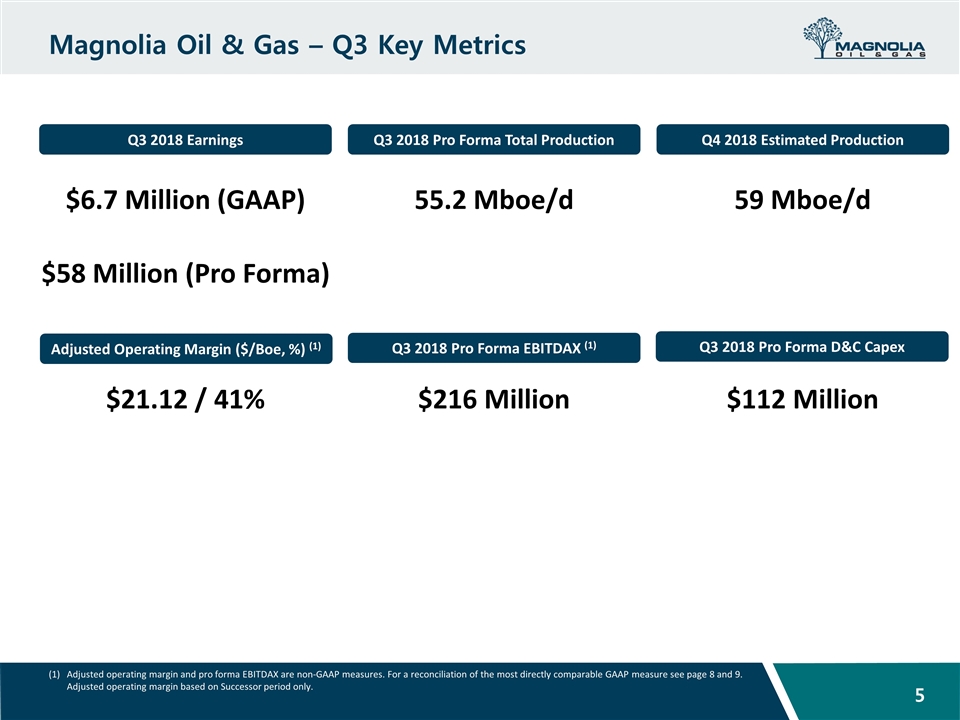

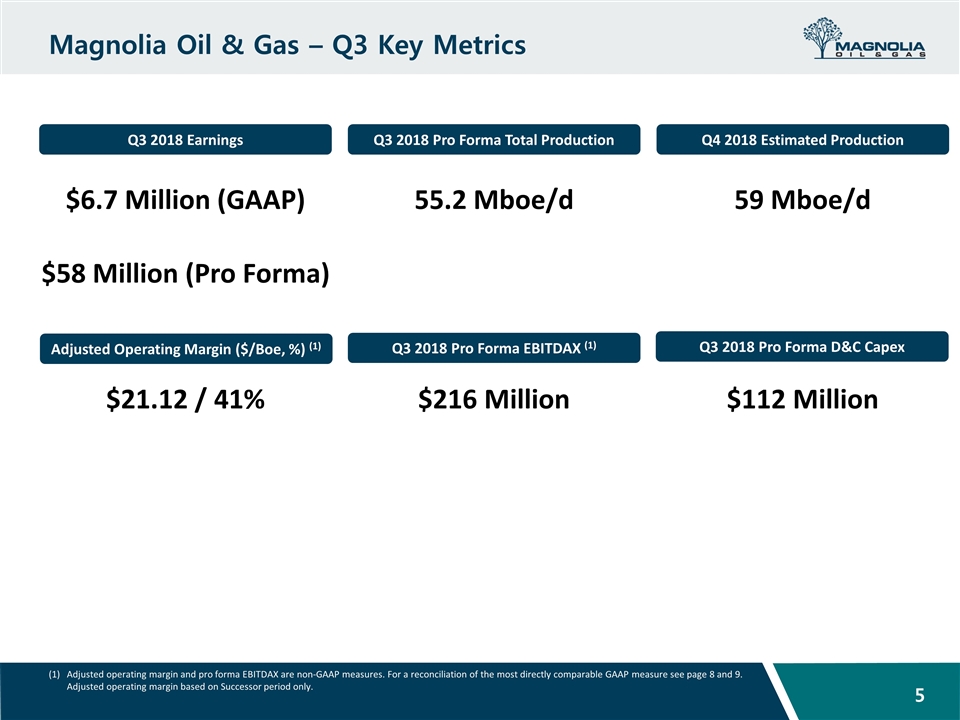

Magnolia Oil & Gas – Q3 Key Metrics Q3 2018 Earnings $58 Million (Pro Forma) Adjusted operating margin and pro forma EBITDAX are non-GAAP measures. For a reconciliation of the most directly comparable GAAP measure see page 8 and 9. Adjusted operating margin based on Successor period only. Q3 2018 Pro Forma Total Production 55.2 Mboe/d Q4 2018 Estimated Production 59 Mboe/d Adjusted Operating Margin ($/Boe, %) (1) $21.12 / 41% Q3 2018 Pro Forma EBITDAX (1) $216 Million Q3 2018 Pro Forma D&C Capex $112 Million $6.7 Million (GAAP)

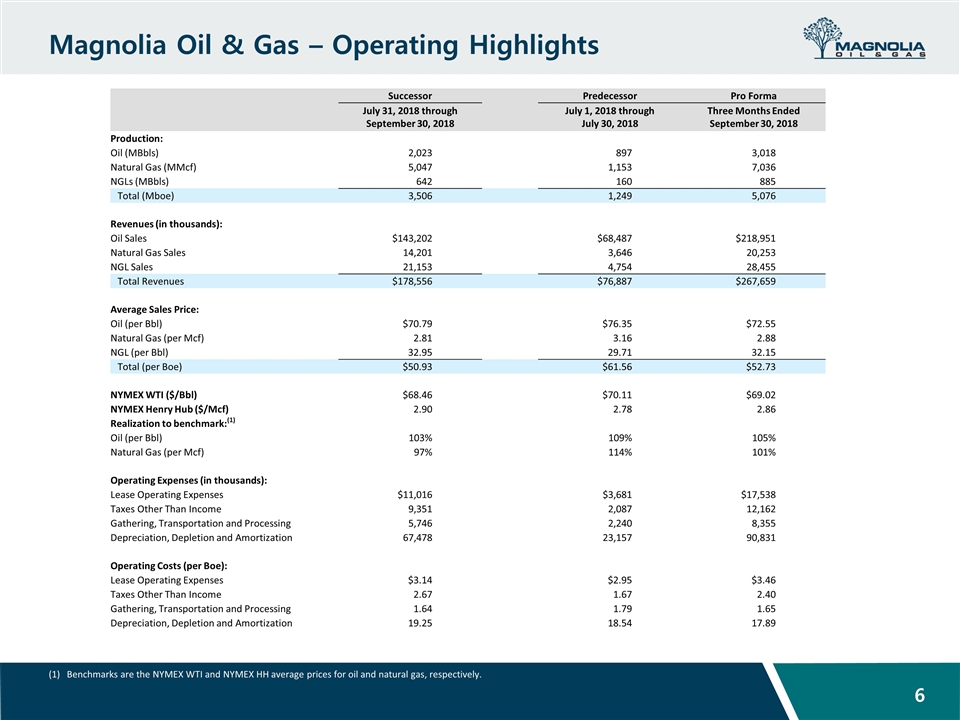

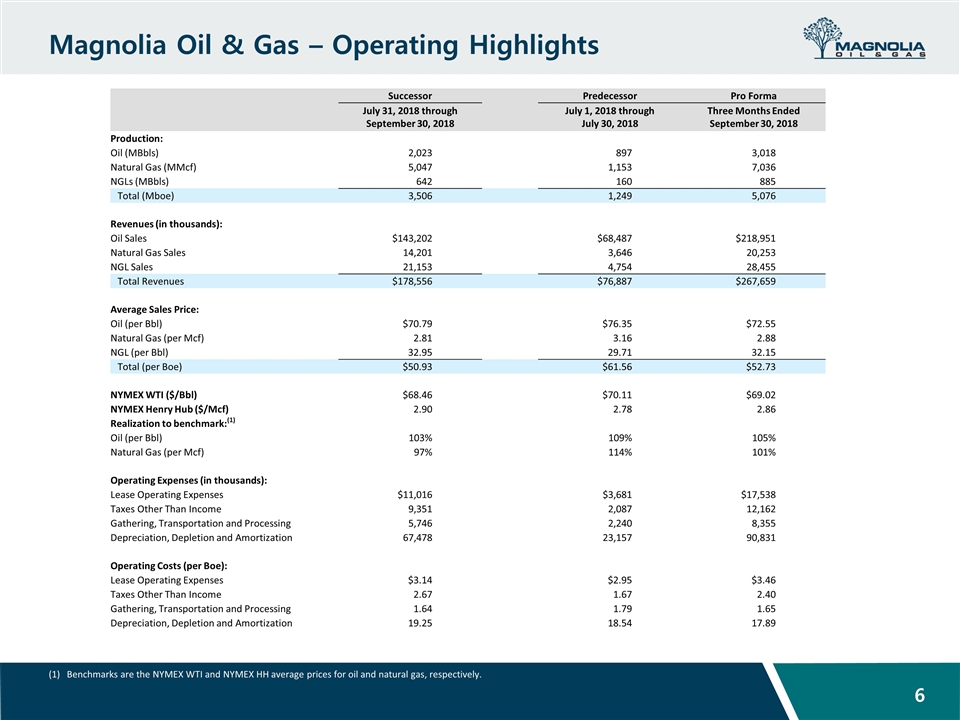

Magnolia Oil & Gas – Operating Highlights Successor Predecessor Pro Forma July 31, 2018 through September 30, 2018 July 1, 2018 through July 30, 2018 Three Months Ended September 30, 2018 Production: Oil (MBbls) 2,023 897 3,018 Natural Gas (MMcf) 5,047 1,153 7,036 NGLs (MBbls) 642 160 885 Total (Mboe) 3,506 1,249 5,076 Revenues (in thousands): Oil Sales $143,202 $68,487 $218,951 Natural Gas Sales 14,201 3,646 20,253 NGL Sales 21,153 4,754 28,455 Total Revenues $178,556 $76,887 $267,659 Average Sales Price: Oil (per Bbl) $70.79 $76.35 $72.55 Natural Gas (per Mcf) 2.81 3.16 2.88 NGL (per Bbl) 32.95 29.71 32.15 Total (per Boe) $50.93 $61.56 $52.73 NYMEX WTI ($/Bbl) $68.46 $70.11 $69.02 NYMEX Henry Hub ($/Mcf) 2.90 2.78 2.86 Realization to benchmark:(1) Oil (per Bbl) 103% 109% 105% Natural Gas (per Mcf) 97% 114% 101% Operating Expenses (in thousands): Lease Operating Expenses $11,016 $3,681 $17,538 Taxes Other Than Income 9,351 2,087 12,162 Gathering, Transportation and Processing 5,746 2,240 8,355 Depreciation, Depletion and Amortization 67,478 23,157 90,831 Operating Costs (per Boe): Lease Operating Expenses $3.14 $2.95 $3.46 Taxes Other Than Income 2.67 1.67 2.40 Gathering, Transportation and Processing 1.64 1.79 1.65 Depreciation, Depletion and Amortization 19.25 18.54 17.89 Benchmarks are the NYMEX WTI and NYMEX HH average prices for oil and natural gas, respectively.

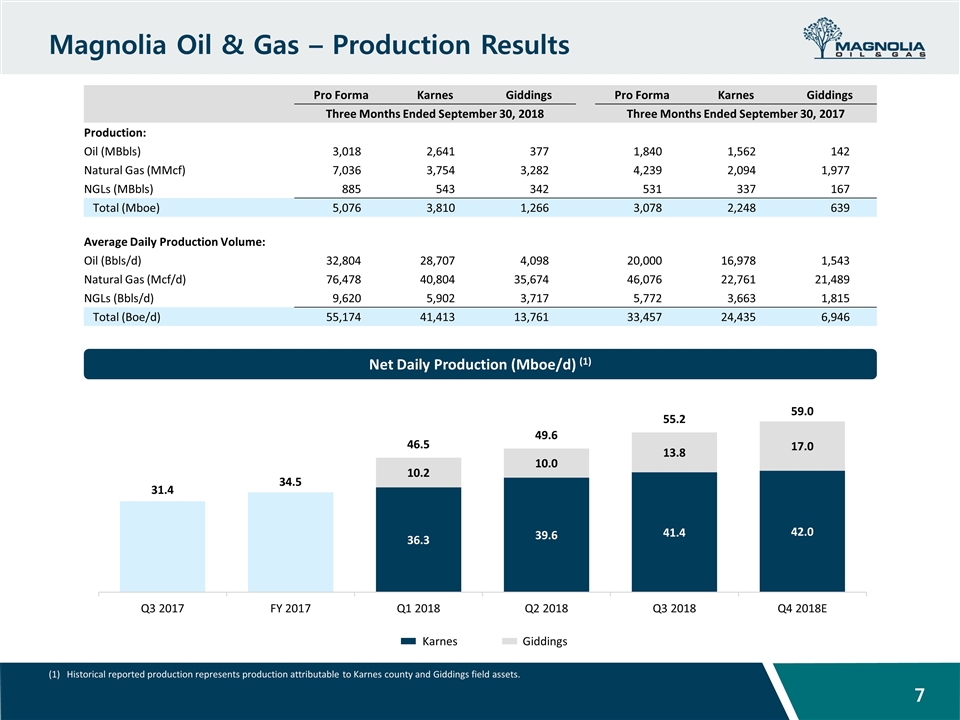

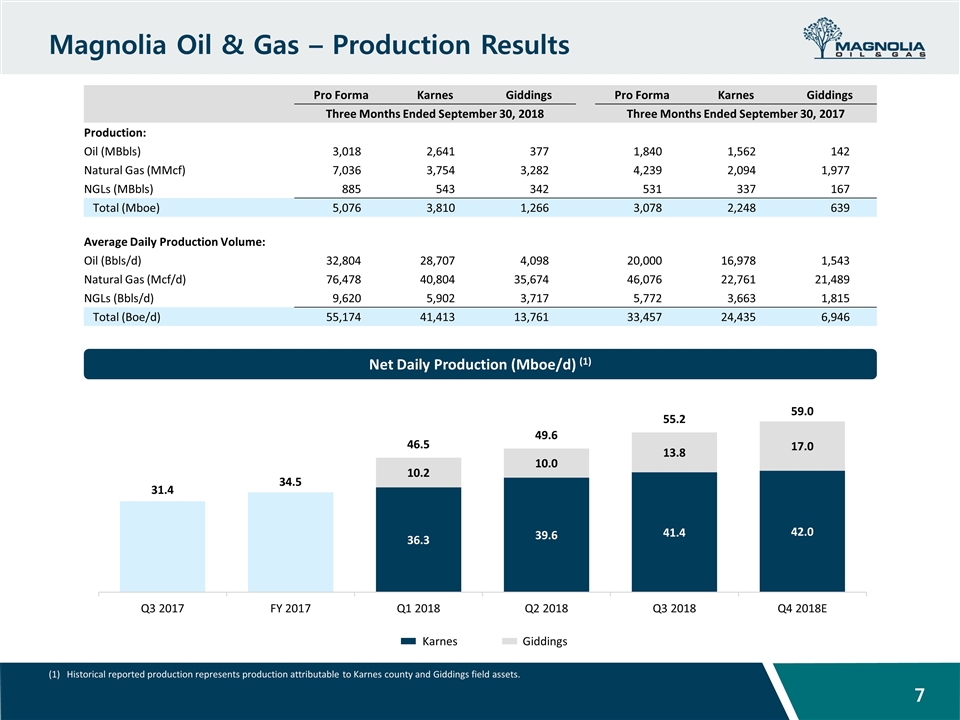

Magnolia Oil & Gas – Production Results Net Daily Production (Mboe/d) (1) Historical reported production represents production attributable to Karnes county and Giddings field assets. Karnes Giddings Pro Forma Karnes Giddings Pro Forma Karnes Giddings Three Months Ended September 30, 2018 Three Months Ended September 30, 2017 Production: Oil (MBbls) 3,018 2,641 377 1,840 1,562 142 Natural Gas (MMcf) 7,036 3,754 3,282 4,239 2,094 1,977 NGLs (MBbls) 885 543 342 531 337 167 Total (Mboe) 5,076 3,810 1,266 3,078 2,248 639 Average Daily Production Volume: Oil (Bbls/d) 32,804 28,707 4,098 20,000 16,978 1,543 Natural Gas (Mcf/d) 76,478 40,804 35,674 46,076 22,761 21,489 NGLs (Bbls/d) 9,620 5,902 3,717 5,772 3,663 1,815 Total (Boe/d) 55,174 41,413 13,761 33,457 24,435 6,946

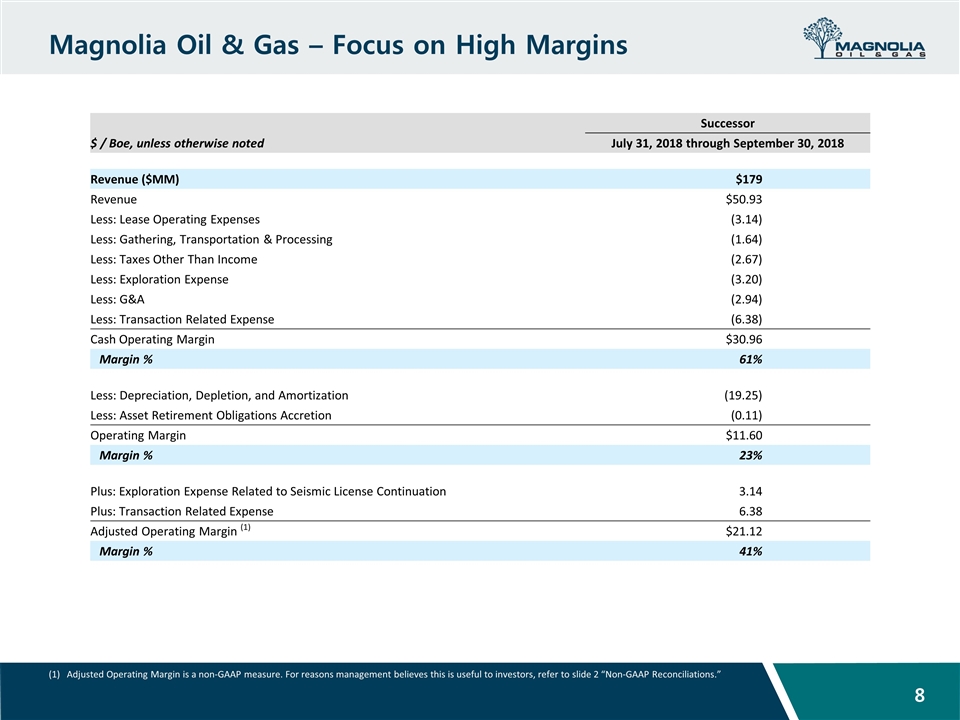

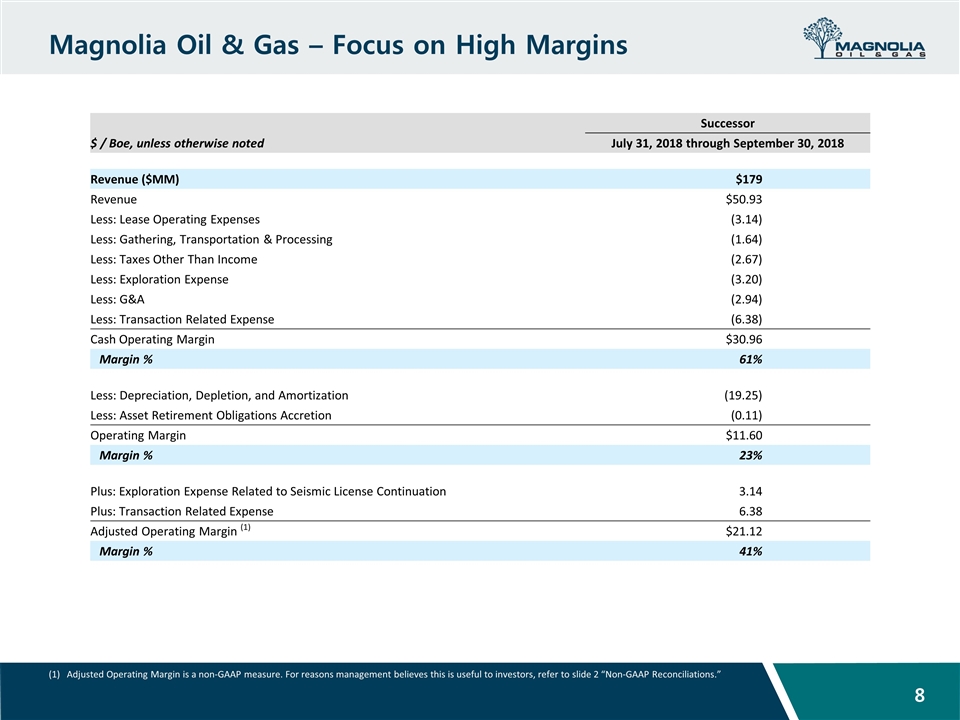

Magnolia Oil & Gas – Focus on High Margins Adjusted Operating Margin is a non-GAAP measure. For reasons management believes this is useful to investors, refer to slide 2 “Non-GAAP Reconciliations.” Successor $ / Boe, unless otherwise noted July 31, 2018 through September 30, 2018 Revenue ($MM) $179 Revenue $50.93 Less: Lease Operating Expenses (3.14) Less: Gathering, Transportation & Processing (1.64) Less: Taxes Other Than Income (2.67) Less: Exploration Expense (3.20) Less: G&A (2.94) Less: Transaction Related Expense (6.38) Cash Operating Margin $30.96 Margin % 61% Less: Depreciation, Depletion, and Amortization (19.25) Less: Asset Retirement Obligations Accretion (0.11) Operating Margin $11.60 Margin % 23% Plus: Exploration Expense Related to Seismic License Continuation 3.14 Plus: Transaction Related Expense 6.38 Adjusted Operating Margin (1) $21.12 Margin % 41%

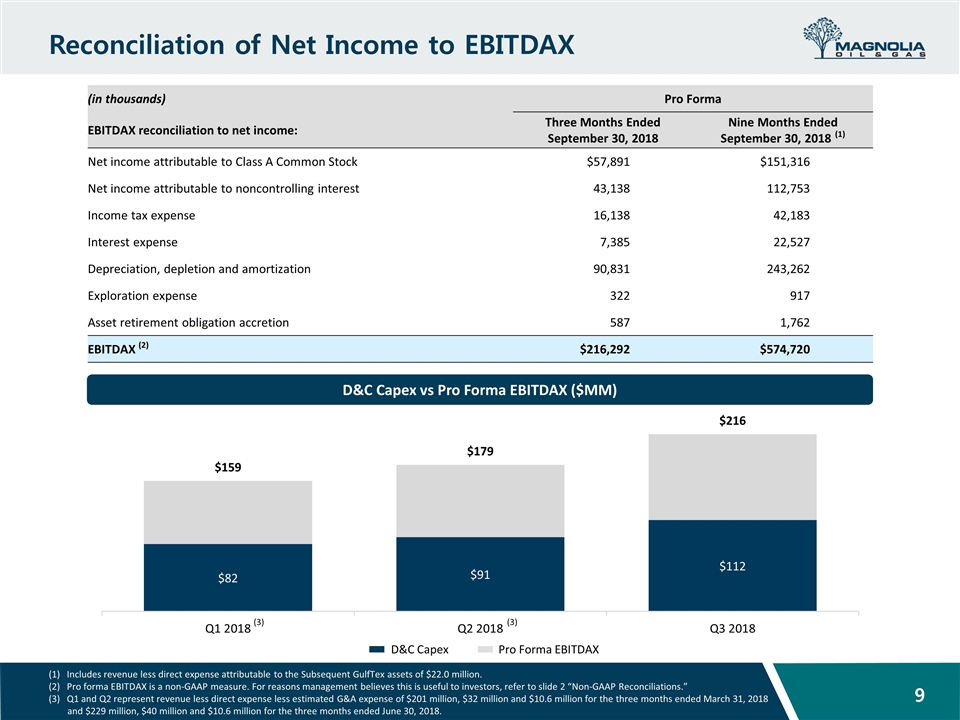

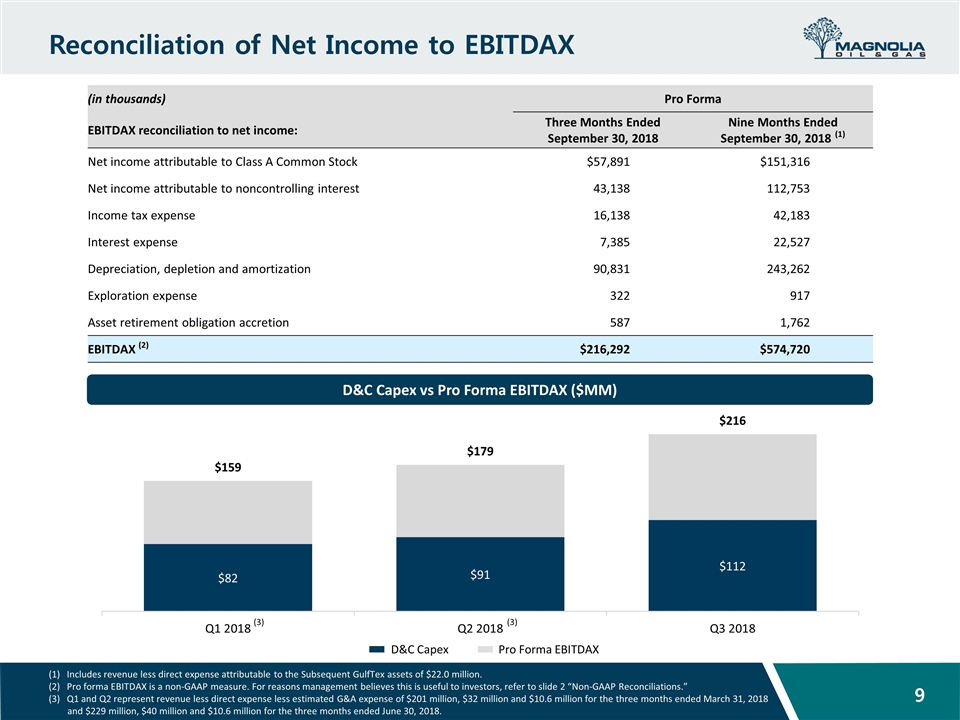

Reconciliation of Net Income to EBITDAX Includes revenue less direct expense attributable to the Subsequent GulfTex assets of $22.0 million. Pro forma EBITDAX is a non-GAAP measure. For reasons management believes this is useful to investors, refer to slide 2 “Non-GAAP Reconciliations.” Q1 and Q2 represent revenue less direct expense less estimated G&A expense of $201 million, $32 million and $10.6 million for the three months ended March 31, 2018 and $229 million, $40 million and $10.6 million for the three months ended June 30, 2018. D&C Capex vs Pro Forma EBITDAX ($MM) (in thousands) Pro Forma EBITDAX reconciliation to net income: Three Months Ended September 30, 2018 Nine Months Ended September 30, 2018 (1) Net income attributable to Class A Common Stock $57,891 $151,316 Net income attributable to noncontrolling interest 43,138 112,753 Income tax expense 16,138 42,183 Interest expense 7,385 22,527 Depreciation, depletion and amortization 90,831 243,262 Exploration expense 322 917 Asset retirement obligation accretion 587 1,762 EBITDAX (2) $216,292 $574,720 D&C Capex Pro Forma EBITDAX

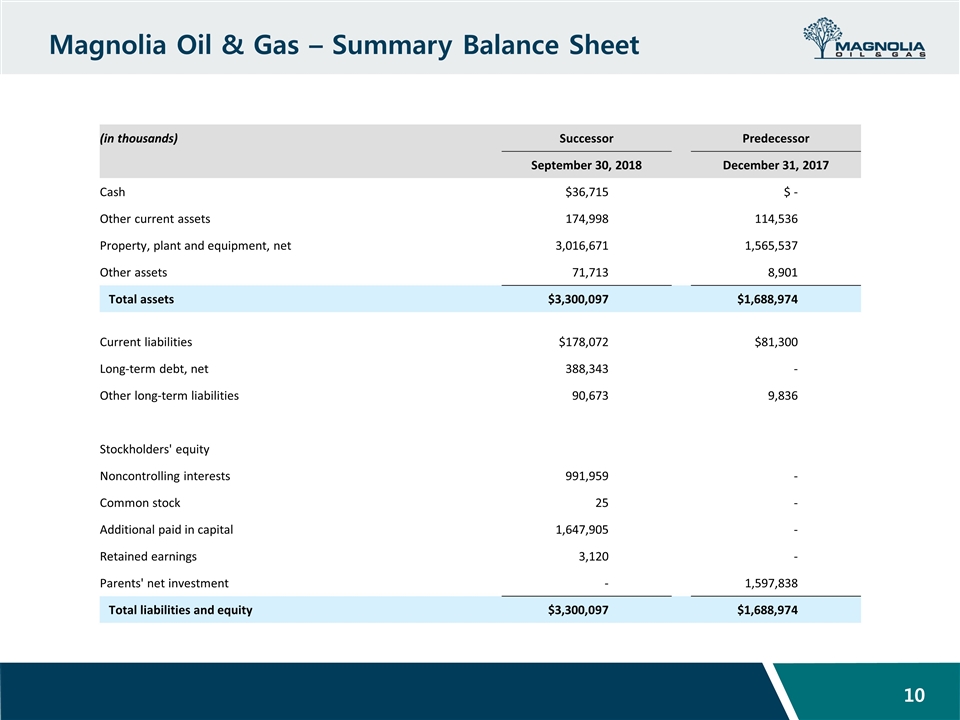

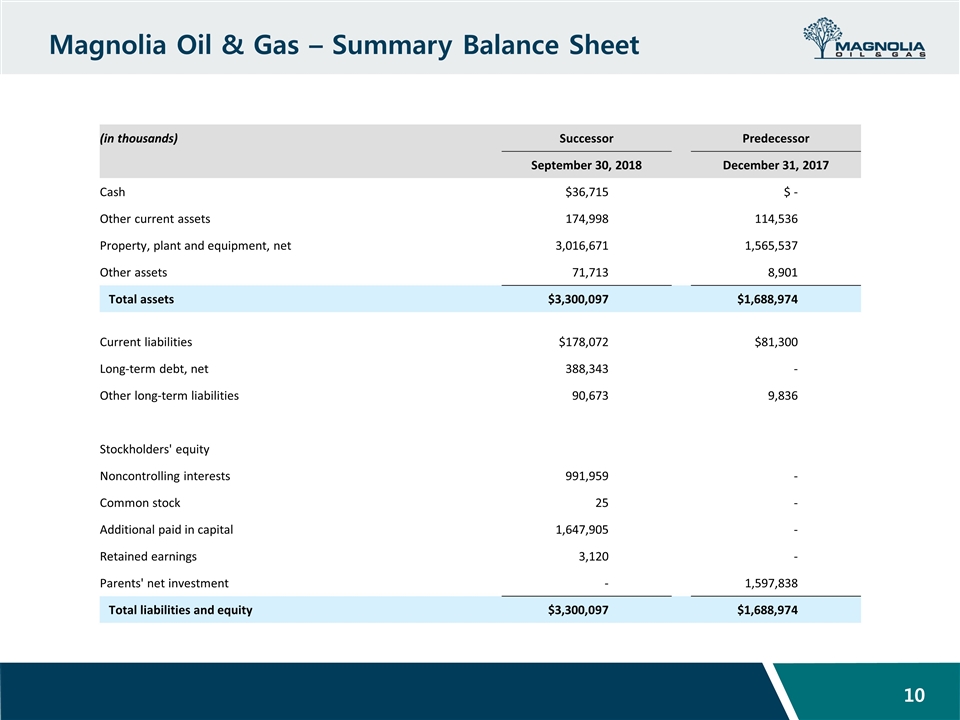

Magnolia Oil & Gas – Summary Balance Sheet (in thousands) Successor Predecessor September 30, 2018 December 31, 2017 Cash $36,715 $ - Other current assets 174,998 114,536 Property, plant and equipment, net 3,016,671 1,565,537 Other assets 71,713 8,901 Total assets $3,300,097 $1,688,974 Current liabilities $178,072 $81,300 Long-term debt, net 388,343 - Other long-term liabilities 90,673 9,836 Stockholders' equity Noncontrolling interests 991,959 - Common stock 25 - Additional paid in capital 1,647,905 - Retained earnings 3,120 - Parents' net investment - 1,597,838 Total liabilities and equity $3,300,097 $1,688,974

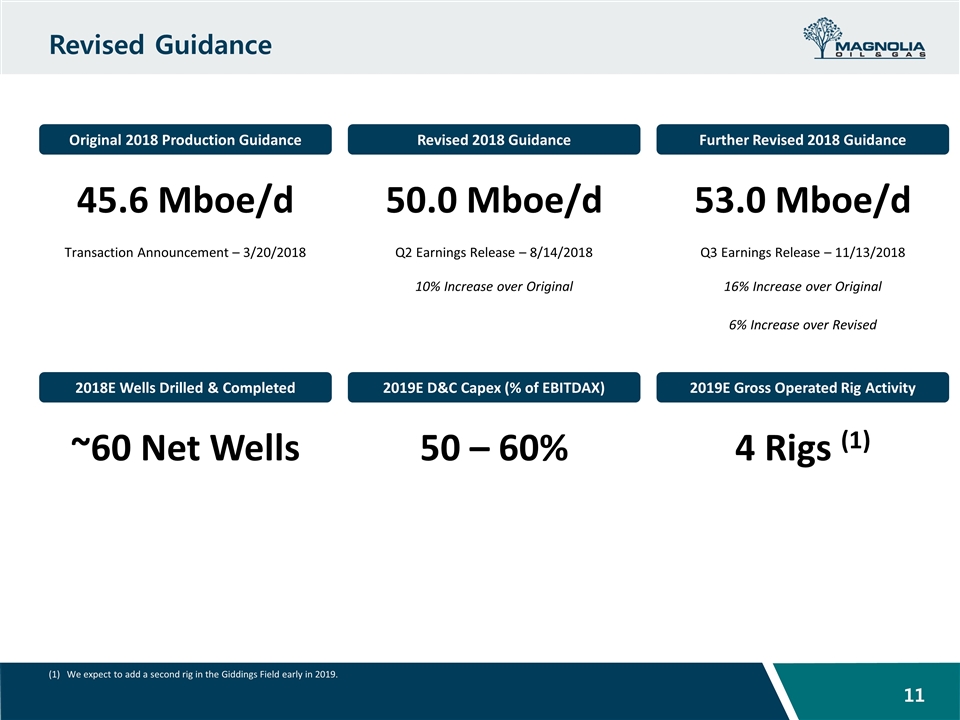

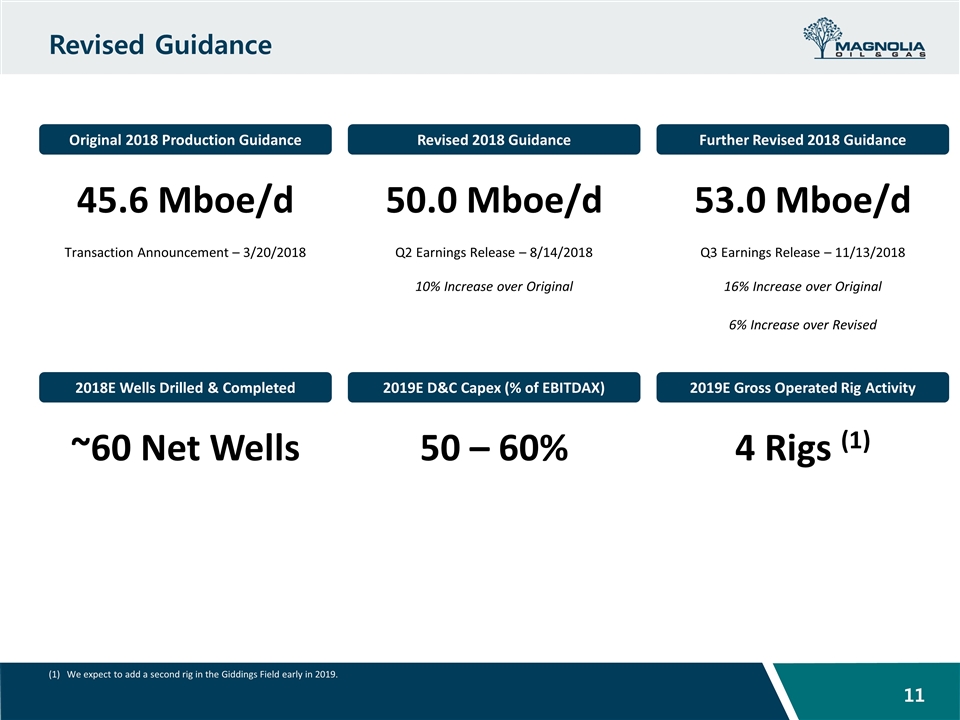

Revised Guidance Original 2018 Production Guidance 45.6 Mboe/d Revised 2018 Guidance 50.0 Mboe/d Further Revised 2018 Guidance 53.0 Mboe/d Transaction Announcement – 3/20/2018 Q2 Earnings Release – 8/14/2018 10% Increase over Original Q3 Earnings Release – 11/13/2018 16% Increase over Original 6% Increase over Revised 2018E Wells Drilled & Completed ~60 Net Wells 2019E D&C Capex (% of EBITDAX) 50 – 60% 2019E Gross Operated Rig Activity 4 Rigs (1) We expect to add a second rig in the Giddings Field early in 2019.

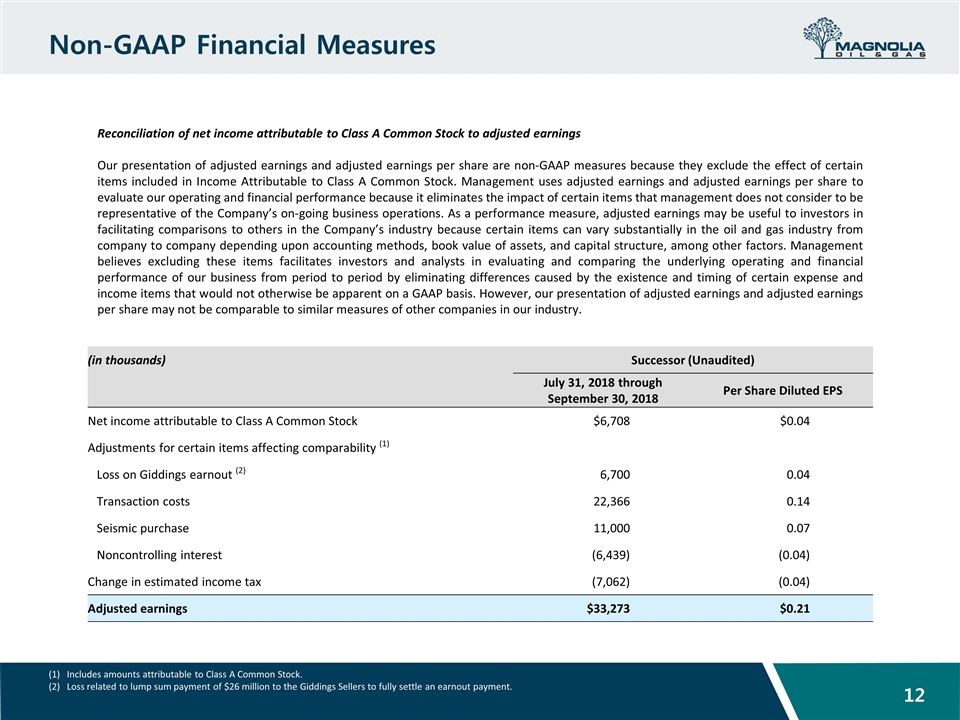

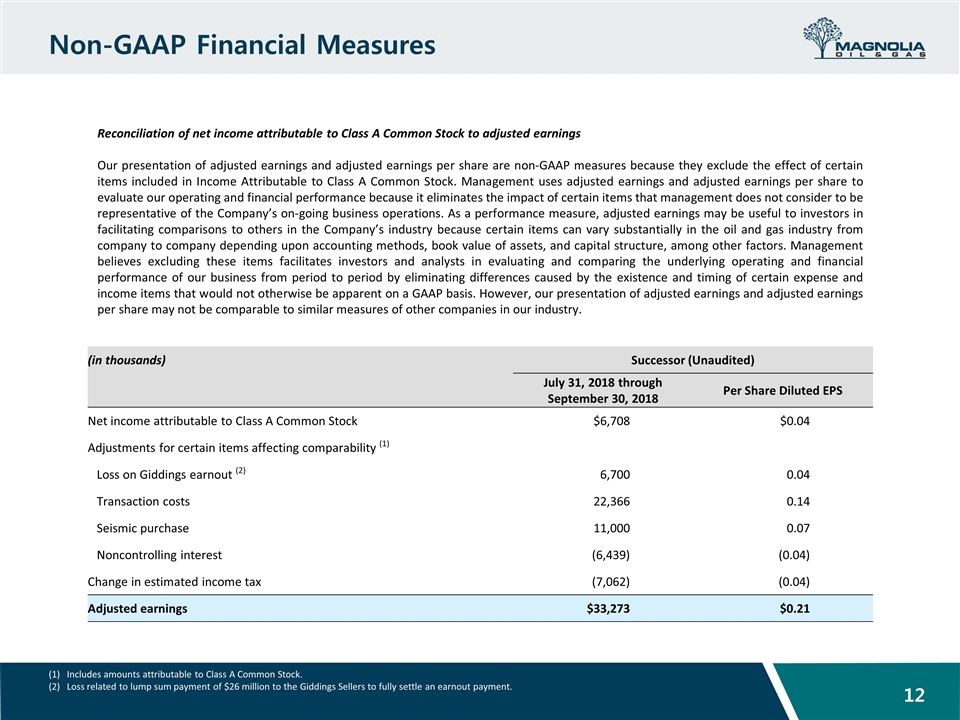

Non-GAAP Financial Measures (in thousands) Successor (Unaudited) July 31, 2018 through September 30, 2018 Per Share Diluted EPS Net income attributable to Class A Common Stock $6,708 $0.04 Adjustments for certain items affecting comparability (1) Loss on Giddings earnout (2) 6,700 0.04 Transaction costs 22,366 0.14 Seismic purchase 11,000 0.07 Noncontrolling interest (6,439) (0.04) Change in estimated income tax (7,062) (0.04) Adjusted earnings $33,273 $0.21 Includes amounts attributable to Class A Common Stock. Loss related to lump sum payment of $26 million to the Giddings Sellers to fully settle an earnout payment. Reconciliation of net income attributable to Class A Common Stock to adjusted earnings Our presentation of adjusted earnings and adjusted earnings per share are non-GAAP measures because they exclude the effect of certain items included in Income Attributable to Class A Common Stock. Management uses adjusted earnings and adjusted earnings per share to evaluate our operating and financial performance because it eliminates the impact of certain items that management does not consider to be representative of the Company’s on-going business operations. As a performance measure, adjusted earnings may be useful to investors in facilitating comparisons to others in the Company’s industry because certain items can vary substantially in the oil and gas industry from company to company depending upon accounting methods, book value of assets, and capital structure, among other factors. Management believes excluding these items facilitates investors and analysts in evaluating and comparing the underlying operating and financial performance of our business from period to period by eliminating differences caused by the existence and timing of certain expense and income items that would not otherwise be apparent on a GAAP basis. However, our presentation of adjusted earnings and adjusted earnings per share may not be comparable to similar measures of other companies in our industry.