First Quarter 2019 Earnings Presentation May 6, 2019 Stephen I. Chazen – Chairman, President & CEO Christopher Stavros – Executive Vice President & CFO Brian Corales – Vice President, Investor Relations Exhibit 99.2

Disclaimer FORWARD LOOKING STATEMENTS The information in this presentation and the oral statements made in connection therewith include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of present or historical fact included in this presentation, regarding Magnolia Oil & Gas Corporation’s (“Magnolia,” “we,” “us,” “our” or the “Company”) financial and production guidance, strategy, future operations, financial position, estimated revenues, and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. When used in this presentation, including any oral statements made in connection therewith, the words “could,” “should,” “will,” “may,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” the negative of such terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on management’s current expectations and assumptions about future events. Except as otherwise required by applicable law, Magnolia disclaims any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this presentation. Magnolia cautions you that these forward-looking statements are subject to all of the risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of Magnolia, incident to the development, production, gathering and sale of oil, natural gas and natural gas liquids. These risks include, but are not limited to, commodity price volatility, low prices for oil and/or natural gas, global economic conditions, inflation, increased operating costs, lack of availability of drilling and production equipment, supplies, services and qualified personnel, processing volumes and pipeline throughput, and certificates related to new technologies, geographical concentration of operations, environmental risks, weather risks, security risks, drilling and other operating risks, regulatory changes, the uncertainty inherent in estimating oil and natural gas reserves and in projecting future rates of production, reductions in cash flow, lack of access to capital, Magnolia’s ability to satisfy future cash obligations, restrictions in existing or future debt agreements, the timing of development expenditures, managing growth and integration of acquisitions, failure to realize expected value creation from property acquisitions, and the defects and limited control over non-operated properties. Should one or more of the risks or uncertainties described in this presentation and the oral statements made in connection therewith occur, or should underlying assumptions prove incorrect, actual results and plans could different materially from those expressed in any forward-looking statements. Additional information concerning these and other factors that may impact Magnolia's operations and projections can be found in its filings with the Securities and Exchange Commission (the "SEC"), its Annual Report on Form 10-K for the fiscal year ended December 31, 2018 filed with the SEC on February 27, 2019. Magnolia’s SEC filings are available publicly on the SEC’s website at www.sec.gov. NON-GAAP FINANCIAL MEASURES This presentation includes non-GAAP financial measures, including EBITDAX, adjusted EBITDAX, adjusted operating margin, adjusted net income and adjusted earnings. Magnolia believes these metrics are useful because they allow Magnolia to more effectively evaluate its operating performance and compare the results of its operations from period to period and against its peers without regard to financing methods or capital structure. Magnolia does not consider these non-GAAP measures in isolation or as an alternative to similar financial measures determined in accordance with GAAP. The computations of these non-GAAP measures may not be comparable to other similarly titled measures of other companies. Magnolia excludes certain items from net income in arriving at adjusted operating margin, adjusted net income and adjusted earnings because these amounts can vary substantially from company to company within its industry depending upon accounting methods, book values of assets and the method by which the assets were acquired. Adjusted EBITDAX, adjusted operating margin, adjusted net income and adjusted earnings should not be considered as alternatives to, or more meaningful than, net income as determined in accordance with GAAP. Certain items excluded from Adjusted EBITDAX, adjusted operating margin, adjusted net income and adjusted earnings are significant components in understanding and assessing a company’s financial performance, and should not be construed as an inference that its results will be unaffected by unusual or non-recurring terms. As performance measures, adjusted operating margin, Adjusted EBITDAX and adjusted net income may be useful to investors in facilitating comparisons to others in the Company’s industry because certain items can vary substantially in the oil and gas industry from company to company depending upon accounting methods, book value of assets, and capital structure, among other factors. Management believes excluding these items facilitates investors and analysts in evaluating and comparing the underlying operating and financial performance of our business from period to period by eliminating differences caused by the existence and timing of certain expense and income items that would not otherwise be apparent on a GAAP basis. However, our presentation of adjusted operating margin, adjusted operating margin per Boe, adjusted net income, and Adjusted EBITDAX may not be comparable to similar measures of other companies in our industry. An adjusted operating margin per Boe reconciliation is shown on page 6 of the presentation, an Adjusted EBITDAX reconciliation is shown on page 7 of the presentation and Adjusted Net Income reconciliation is shown on page 12. INDUSTRY AND MARKET DATA This presentation has been prepared by Magnolia and includes market data and other statistical information from sources believed by Magnolia to be reliable, including independent industry publications, governmental publications or other published independent sources. Some data is also based on the good faith estimates of Magnolia, which are derived from its review of internal sources as well as the independent sources described above. Although Magnolia believes these sources are reliable, it has not independently verified the information and cannot guarantee its accuracy and completeness.

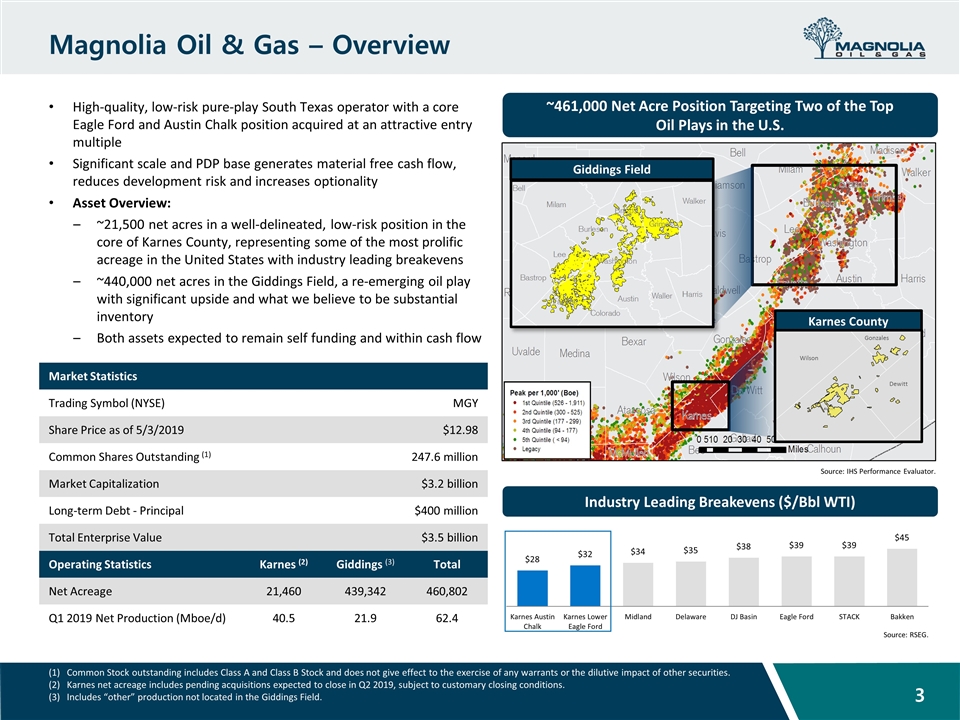

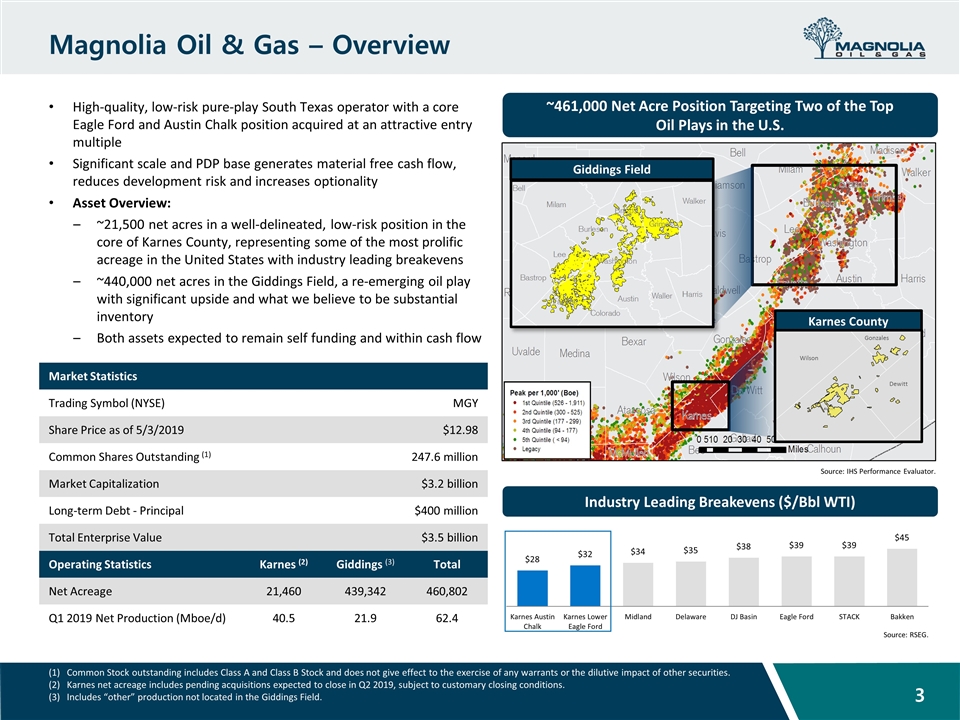

Magnolia Oil & Gas – Overview High-quality, low-risk pure-play South Texas operator with a core Eagle Ford and Austin Chalk position acquired at an attractive entry multiple Significant scale and PDP base generates material free cash flow, reduces development risk and increases optionality Asset Overview: ~21,500 net acres in a well-delineated, low-risk position in the core of Karnes County, representing some of the most prolific acreage in the United States with industry leading breakevens ~440,000 net acres in the Giddings Field, a re-emerging oil play with significant upside and what we believe to be substantial inventory Both assets expected to remain self funding and within cash flow Karnes County Giddings Field ~461,000 Net Acre Position Targeting Two of the Top Oil Plays in the U.S. Market Statistics Trading Symbol (NYSE) MGY Share Price as of 5/3/2019 $12.98 Common Shares Outstanding (1) 247.6 million Market Capitalization $3.2 billion Long-term Debt - Principal $400 million Total Enterprise Value $3.5 billion Operating Statistics Karnes (2) Giddings (3) Total Net Acreage 21,460 439,342 460,802 Q1 2019 Net Production (Mboe/d) 40.5 21.9 62.4 Industry Leading Breakevens ($/Bbl WTI) Source: IHS Performance Evaluator. Source: RSEG. Wilson Dewitt Gonzales Common Stock outstanding includes Class A and Class B Stock and does not give effect to the exercise of any warrants or the dilutive impact of other securities. Karnes net acreage includes pending acquisitions expected to close in Q2 2019, subject to customary closing conditions. Includes “other” production not located in the Giddings Field.

Magnolia Oil & Gas – Q1 2019 Key Metrics Earnings and EPS (GAAP) (1) Total Production 62.4 Mboe/d Adjusted Net Income & Total Shares (3)(4) $23.0 Million 251.5 Million shares Adjusted EBITDAX (3) $160.1 Million D&C Capex $139.8 Million $13.0 Million $0.08/sh Oil Realizations (2) $59.07/bbl (108% of WTI) Earnings is attributed to Class A Common Stock only. Based on Average WTI prices for Q1 2019. Adjusted net income and Adjusted EBITDAX are non-GAAP measures. For a reconciliation to the most directly comparable GAAP measure see pages 7 and 12. Weighted average total shares outstanding include diluted weighted average shares of Class A Common Stock outstanding during the period and Class B common stock, which are anti-dilutive in the calculation of weighted average number of common shares outstanding.

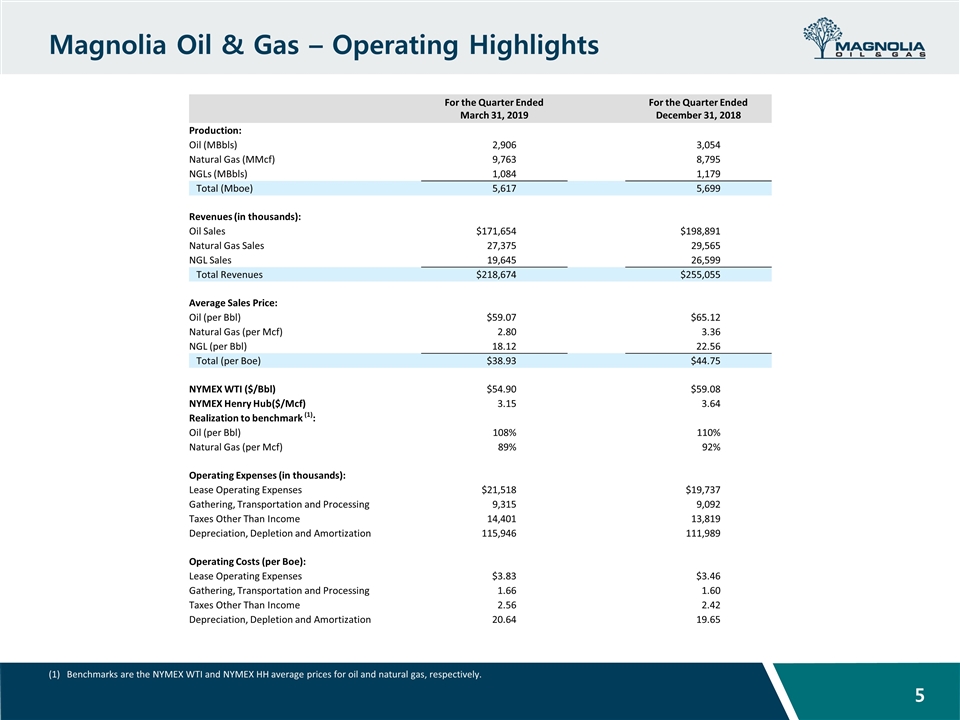

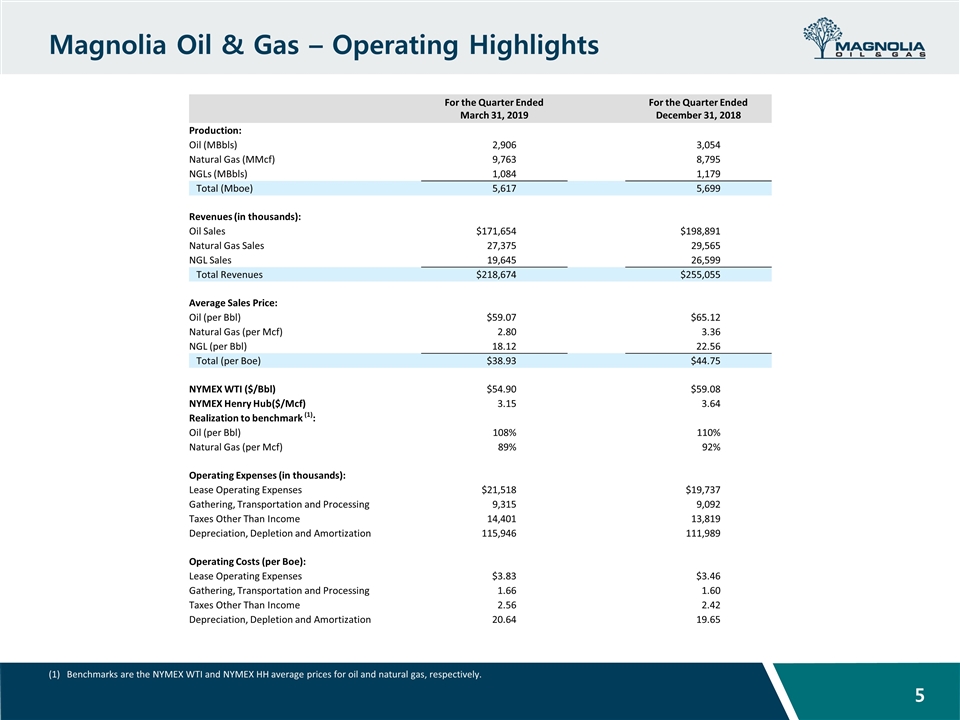

Magnolia Oil & Gas – Operating Highlights Benchmarks are the NYMEX WTI and NYMEX HH average prices for oil and natural gas, respectively. For the Quarter Ended March 31, 2019 For the Quarter Ended December 31, 2018 Production: Oil (MBbls) 2,906 3,054 Natural Gas (MMcf) 9,763 8,795 NGLs (MBbls) 1,084 1,179 Total (Mboe) 5,617 5,699 Revenues (in thousands): Oil Sales $171,654 $198,891 Natural Gas Sales 27,375 29,565 NGL Sales 19,645 26,599 Total Revenues $218,674 $255,055 Average Sales Price: Oil (per Bbl) $59.07 $65.12 Natural Gas (per Mcf) 2.80 3.36 NGL (per Bbl) 18.12 22.56 Total (per Boe) $38.93 $44.75 NYMEX WTI ($/Bbl) $54.90 $59.08 NYMEX Henry Hub($/Mcf) 3.15 3.64 Realization to benchmark (1): Oil (per Bbl) 108% 110% Natural Gas (per Mcf) 89% 92% Operating Expenses (in thousands): Lease Operating Expenses $21,518 $19,737 Gathering, Transportation and Processing 9,315 9,092 Taxes Other Than Income 14,401 13,819 Depreciation, Depletion and Amortization 115,946 111,989 Operating Costs (per Boe): Lease Operating Expenses $3.83 $3.46 Gathering, Transportation and Processing 1.66 1.60 Taxes Other Than Income 2.56 2.42 Depreciation, Depletion and Amortization 20.64 19.65

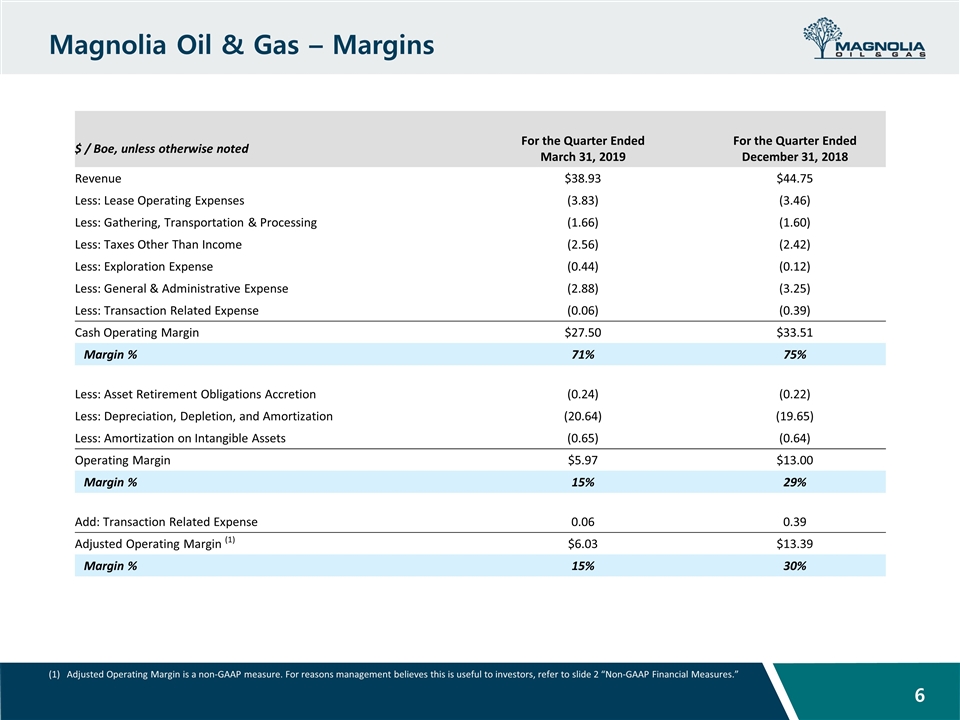

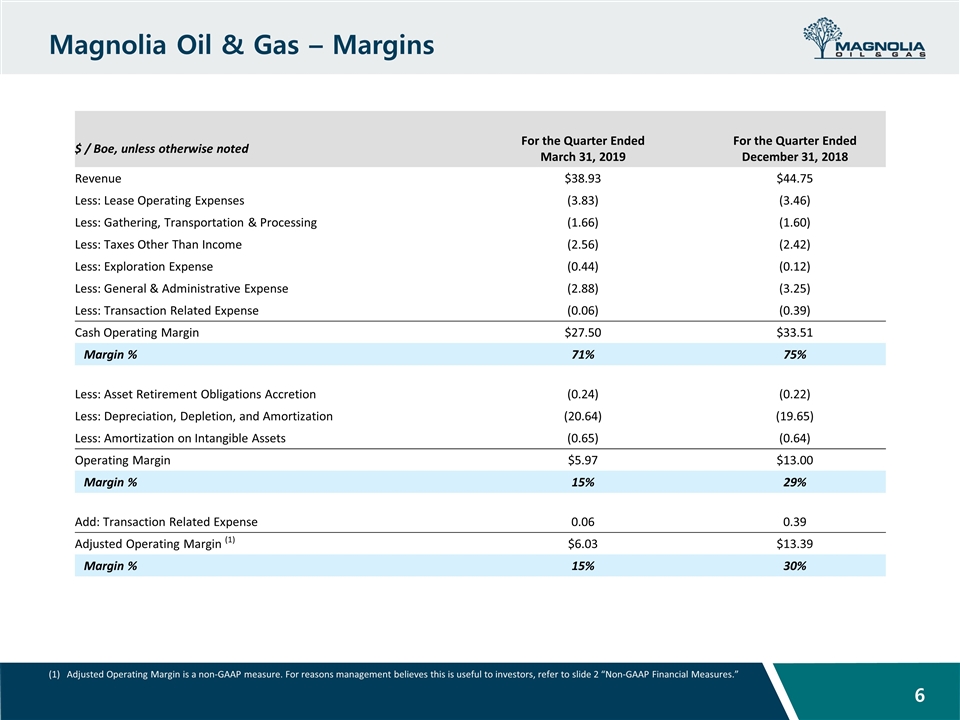

Magnolia Oil & Gas – Margins Adjusted Operating Margin is a non-GAAP measure. For reasons management believes this is useful to investors, refer to slide 2 “Non-GAAP Financial Measures.” $ / Boe, unless otherwise noted For the Quarter Ended March 31, 2019 For the Quarter Ended December 31, 2018 Revenue $38.93 $44.75 Less: Lease Operating Expenses (3.83) (3.46) Less: Gathering, Transportation & Processing (1.66) (1.60) Less: Taxes Other Than Income (2.56) (2.42) Less: Exploration Expense (0.44) (0.12) Less: General & Administrative Expense (2.88) (3.25) Less: Transaction Related Expense (0.06) (0.39) Cash Operating Margin $27.50 $33.51 Margin % 71% 75% Less: Asset Retirement Obligations Accretion (0.24) (0.22) Less: Depreciation, Depletion, and Amortization (20.64) (19.65) Less: Amortization on Intangible Assets (0.65) (0.64) Operating Margin $5.97 $13.00 Margin % 15% 29% Add: Transaction Related Expense 0.06 0.39 Adjusted Operating Margin (1) $6.03 $13.39 Margin % 15% 30%

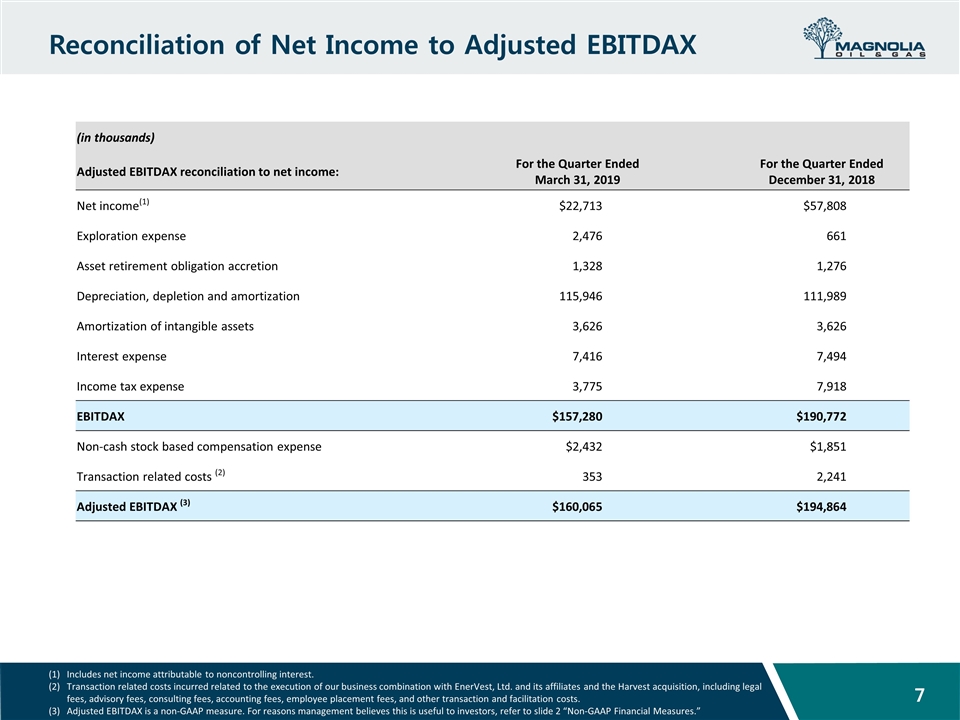

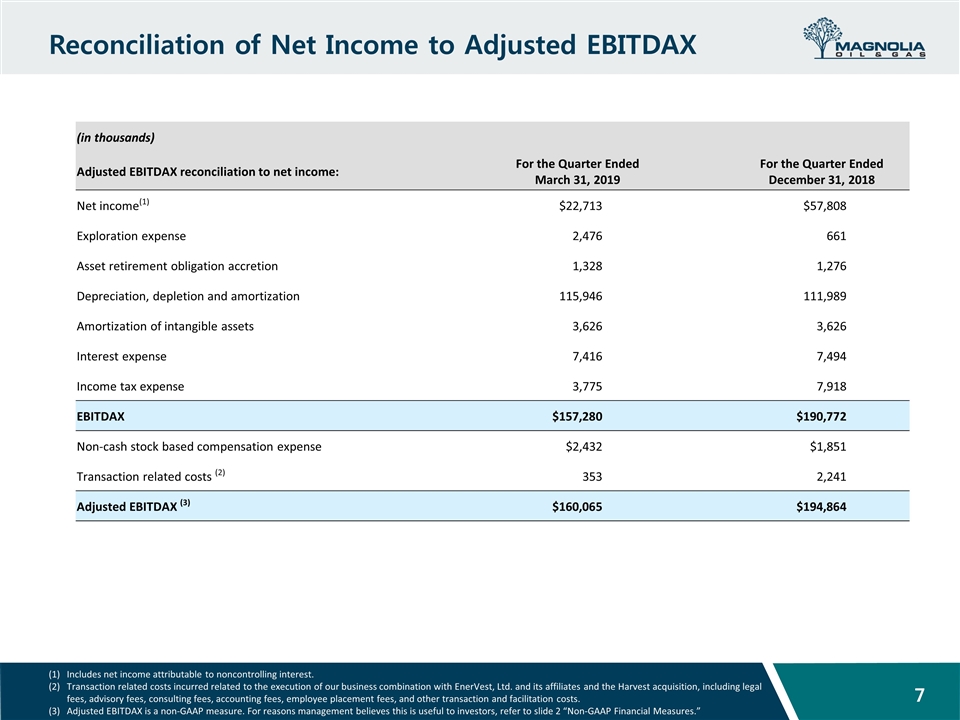

Reconciliation of Net Income to Adjusted EBITDAX Includes net income attributable to noncontrolling interest. Transaction related costs incurred related to the execution of our business combination with EnerVest, Ltd. and its affiliates and the Harvest acquisition, including legal fees, advisory fees, consulting fees, accounting fees, employee placement fees, and other transaction and facilitation costs. Adjusted EBITDAX is a non-GAAP measure. For reasons management believes this is useful to investors, refer to slide 2 “Non-GAAP Financial Measures.” (in thousands) Adjusted EBITDAX reconciliation to net income: For the Quarter Ended March 31, 2019 For the Quarter Ended December 31, 2018 Net income(1) $22,713 $57,808 Exploration expense 2,476 661 Asset retirement obligation accretion 1,328 1,276 Depreciation, depletion and amortization 115,946 111,989 Amortization of intangible assets 3,626 3,626 Interest expense 7,416 7,494 Income tax expense 3,775 7,918 EBITDAX $157,280 $190,772 Non-cash stock based compensation expense $2,432 $1,851 Transaction related costs (2) 353 2,241 Adjusted EBITDAX (3) $160,065 $194,864

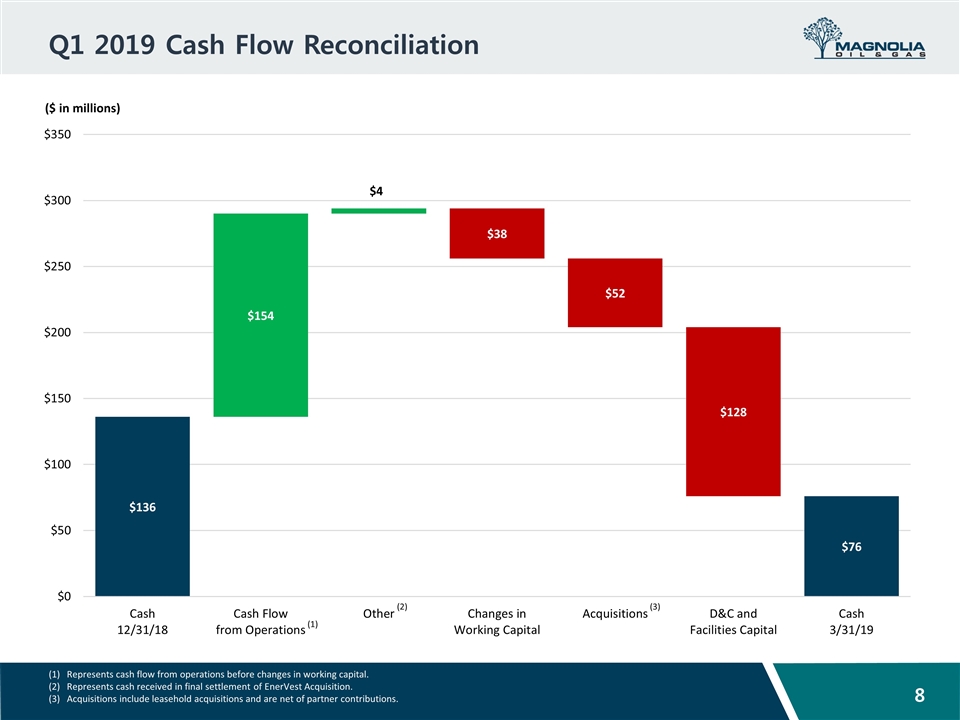

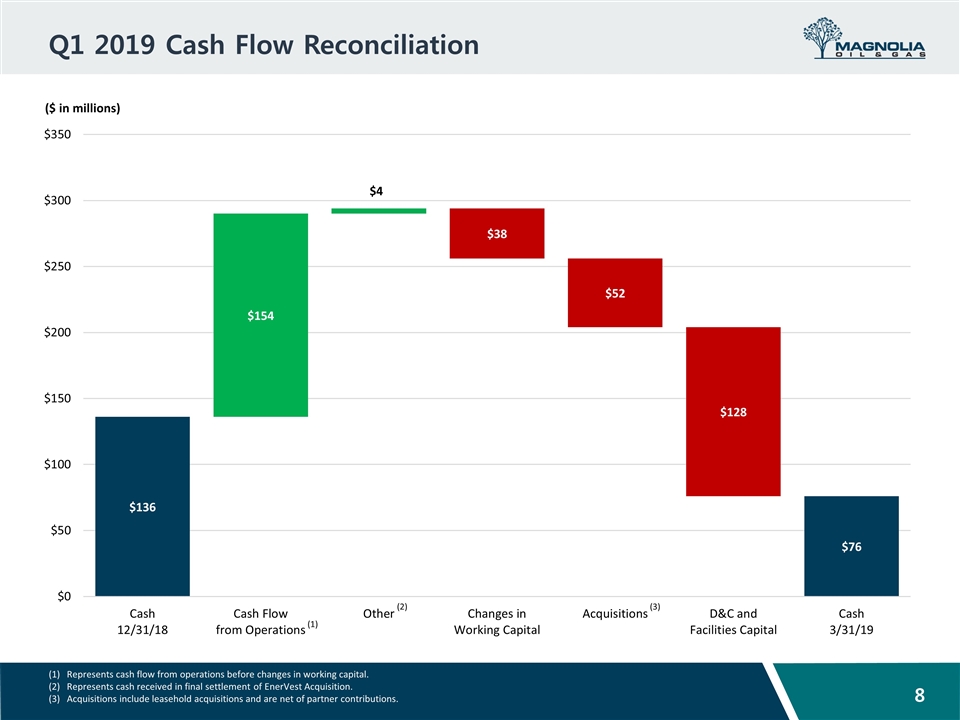

Q1 2019 Cash Flow Reconciliation ($ in millions) Represents cash flow from operations before changes in working capital. Represents cash received in final settlement of EnerVest Acquisition. Acquisitions include leasehold acquisitions and are net of partner contributions. (1) (2) (3)

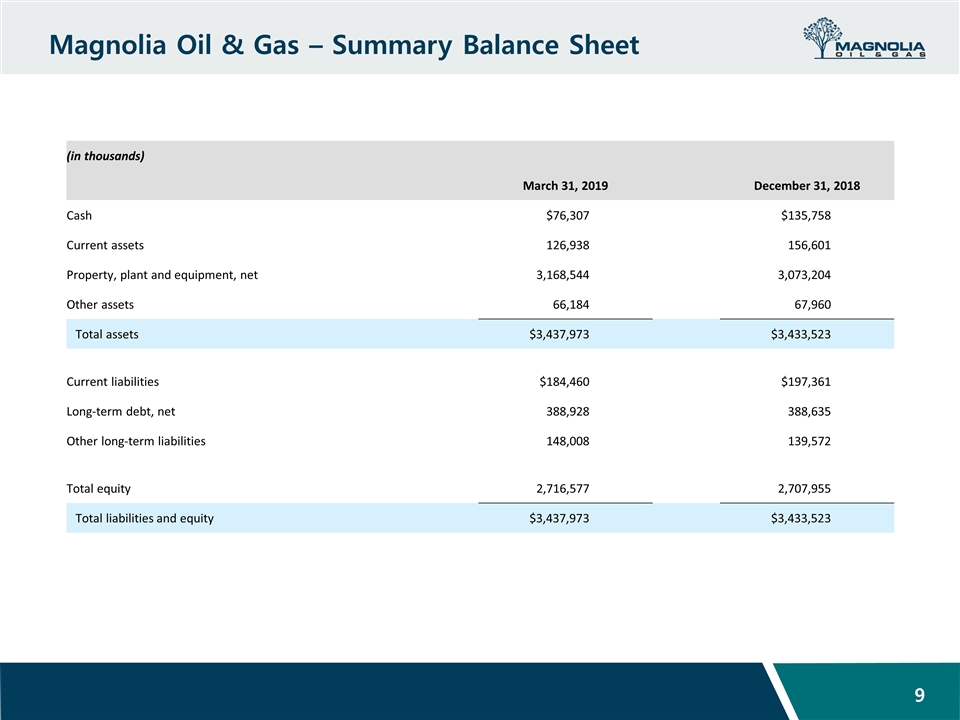

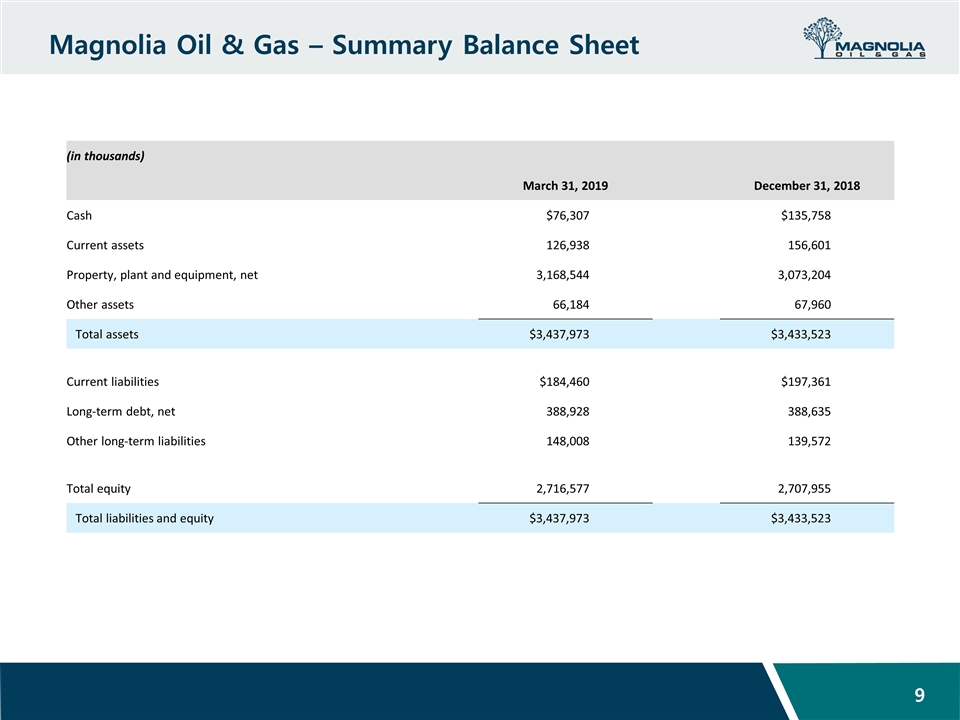

Magnolia Oil & Gas – Summary Balance Sheet (in thousands) March 31, 2019 December 31, 2018 Cash $76,307 $135,758 Current assets 126,938 156,601 Property, plant and equipment, net 3,168,544 3,073,204 Other assets 66,184 67,960 Total assets $3,437,973 $3,433,523 Current liabilities $184,460 $197,361 Long-term debt, net 388,928 388,635 Other long-term liabilities 148,008 139,572 Total equity 2,716,577 2,707,955 Total liabilities and equity $3,437,973 $3,433,523

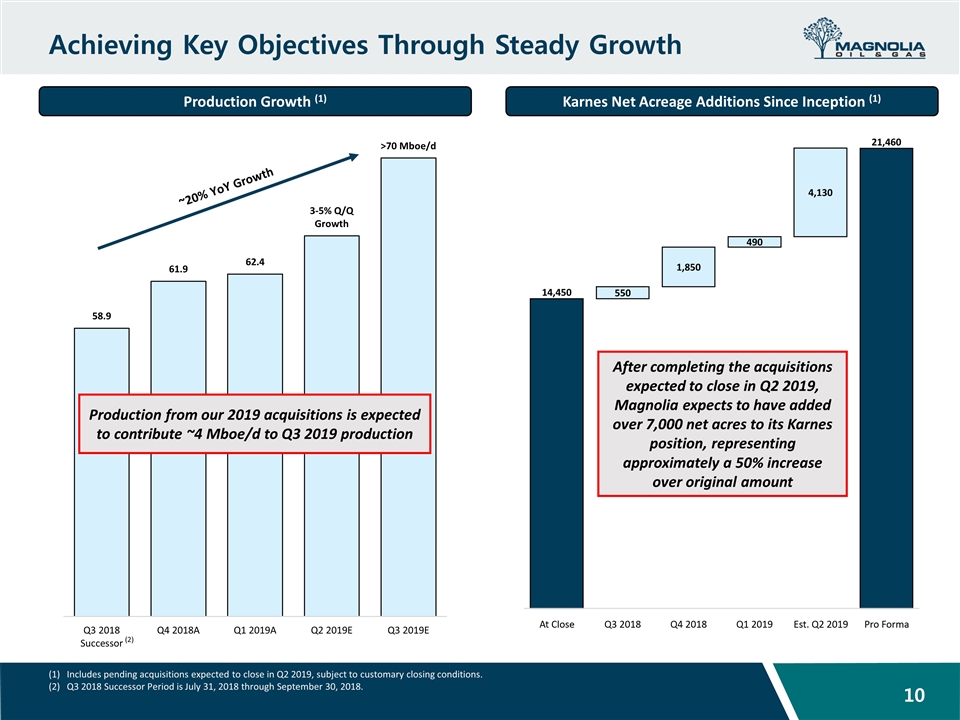

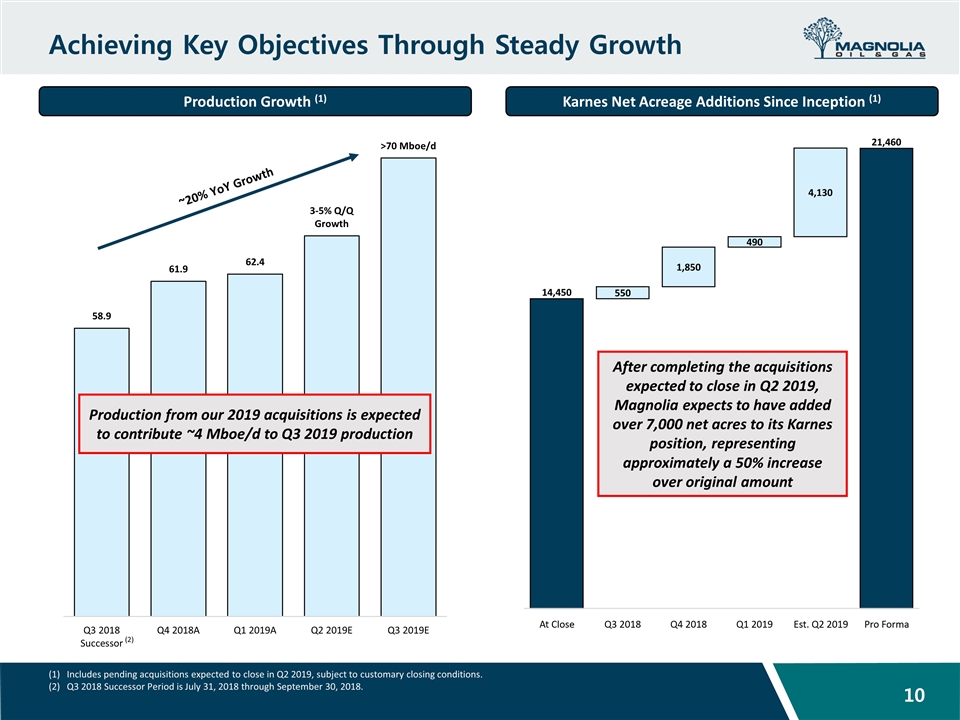

Achieving Key Objectives Through Steady Growth Includes pending acquisitions expected to close in Q2 2019, subject to customary closing conditions. Q3 2018 Successor Period is July 31, 2018 through September 30, 2018. Karnes Net Acreage Additions Since Inception (1) After completing the acquisitions expected to close in Q2 2019, Magnolia expects to have added over 7,000 net acres to its Karnes position, representing approximately a 50% increase over original amount Production Growth (1) (2) ~20% YoY Growth Production from our 2019 acquisitions is expected to contribute ~4 Mboe/d to Q3 2019 production

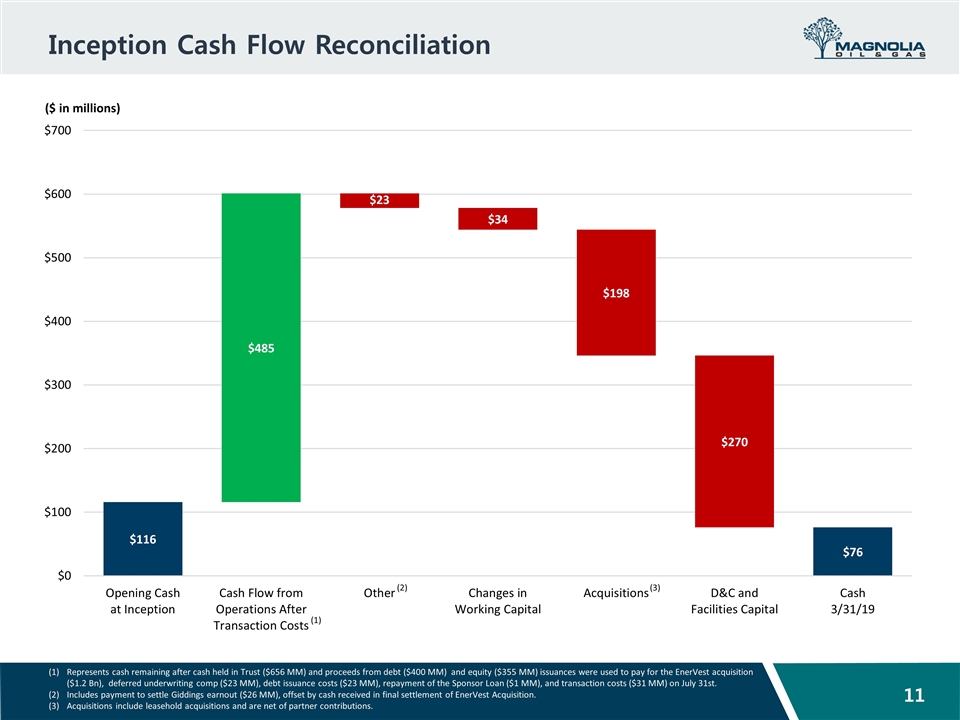

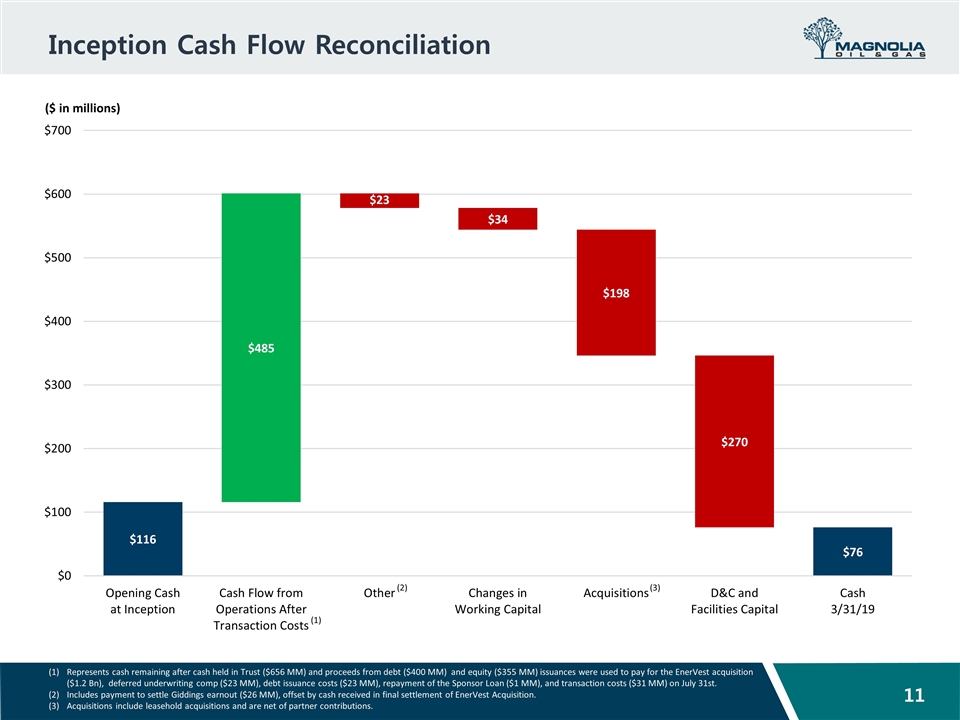

Inception Cash Flow Reconciliation Represents cash remaining after cash held in Trust ($656 MM) and proceeds from debt ($400 MM) and equity ($355 MM) issuances were used to pay for the EnerVest acquisition ($1.2 Bn), deferred underwriting comp ($23 MM), debt issuance costs ($23 MM), repayment of the Sponsor Loan ($1 MM), and transaction costs ($31 MM) on July 31st. Includes payment to settle Giddings earnout ($26 MM), offset by cash received in final settlement of EnerVest Acquisition. Acquisitions include leasehold acquisitions and are net of partner contributions. ($ in millions) (1) (2) (3)

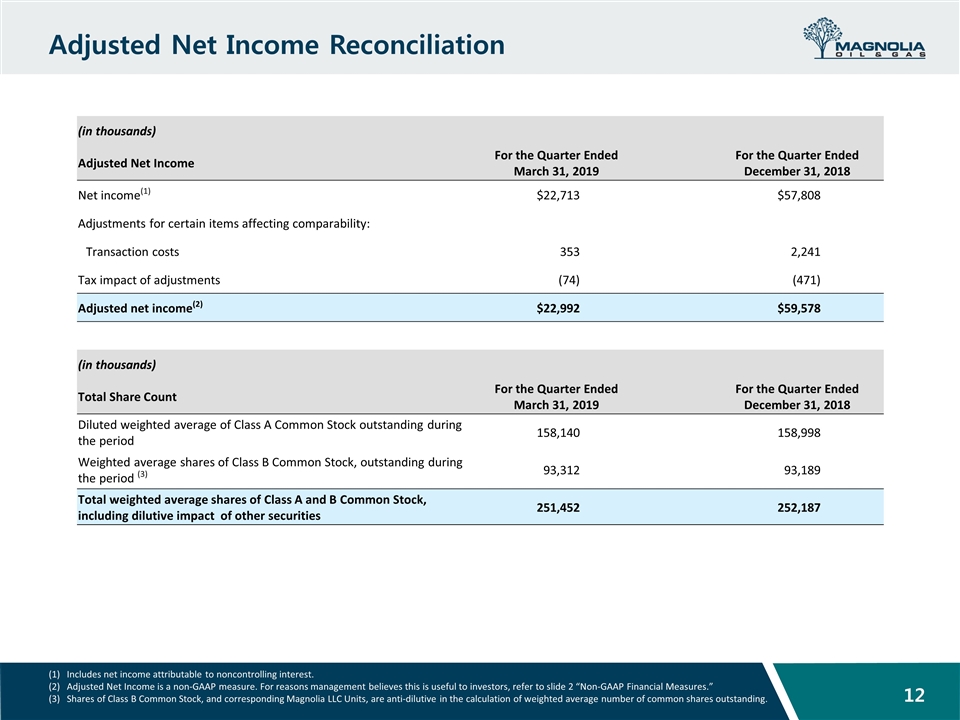

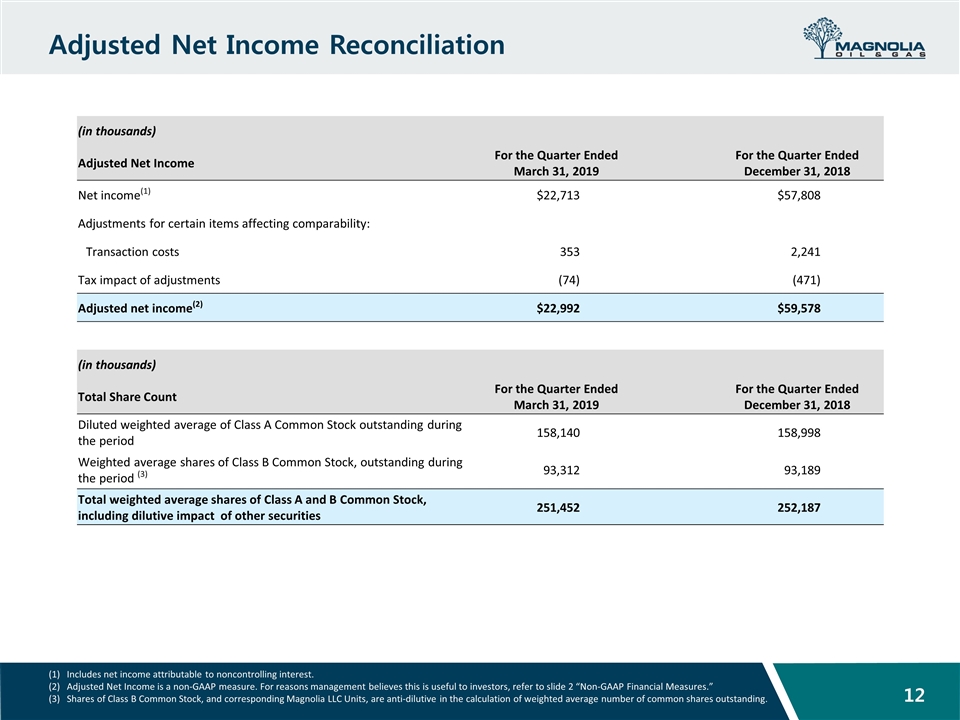

Adjusted Net Income Reconciliation Includes net income attributable to noncontrolling interest. Adjusted Net Income is a non-GAAP measure. For reasons management believes this is useful to investors, refer to slide 2 “Non-GAAP Financial Measures.” Shares of Class B Common Stock, and corresponding Magnolia LLC Units, are anti-dilutive in the calculation of weighted average number of common shares outstanding. (in thousands) Adjusted Net Income For the Quarter Ended March 31, 2019 For the Quarter Ended December 31, 2018 Net income(1) $22,713 $57,808 Adjustments for certain items affecting comparability: Transaction costs 353 2,241 Tax impact of adjustments (74) (471) Adjusted net income(2) $22,992 $59,578 (in thousands) Total Share Count For the Quarter Ended March 31, 2019 For the Quarter Ended December 31, 2018 Diluted weighted average of Class A Common Stock outstanding during the period 158,140 158,998 Weighted average shares of Class B Common Stock, outstanding during the period (3) 93,312 93,189 Total weighted average shares of Class A and B Common Stock, including dilutive impact of other securities 251,452 252,187

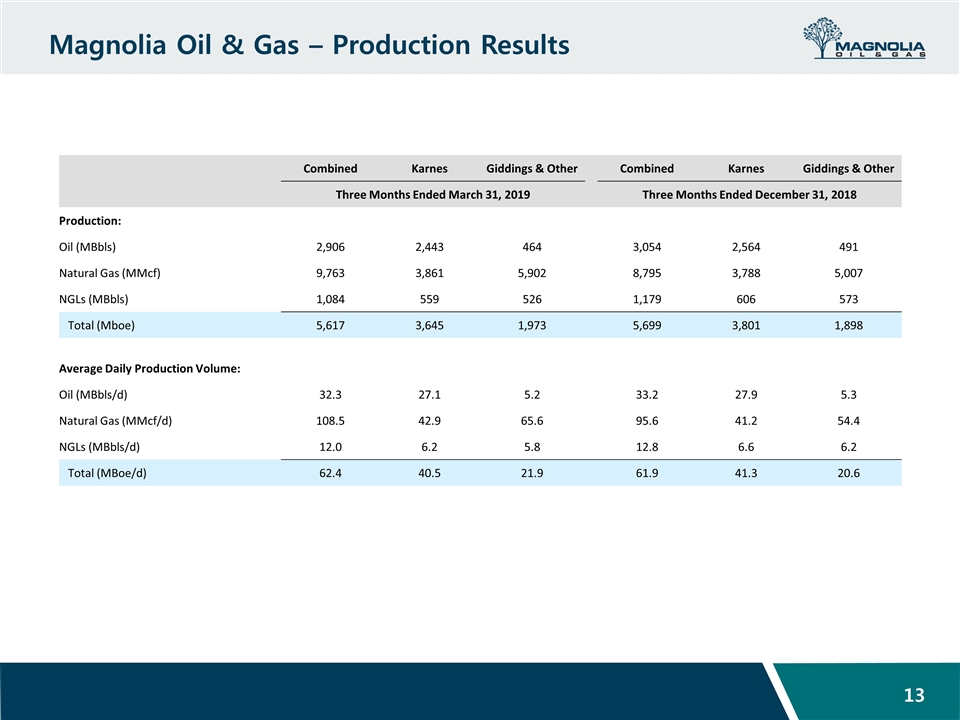

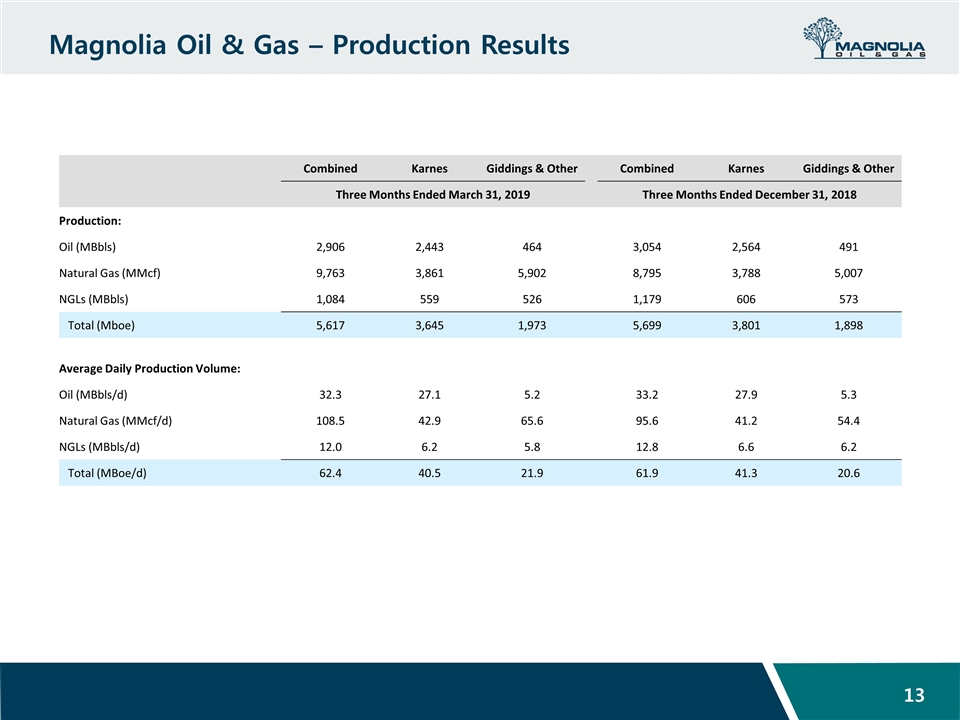

Magnolia Oil & Gas – Production Results Combined Karnes Giddings & Other Combined Karnes Giddings & Other Three Months Ended March 31, 2019 Three Months Ended December 31, 2018 Production: Oil (MBbls) 2,906 2,443 464 3,054 2,564 491 Natural Gas (MMcf) 9,763 3,861 5,902 8,795 3,788 5,007 NGLs (MBbls) 1,084 559 526 1,179 606 573 Total (Mboe) 5,617 3,645 1,973 5,699 3,801 1,898 Average Daily Production Volume: Oil (MBbls/d) 32.3 27.1 5.2 33.2 27.9 5.3 Natural Gas (MMcf/d) 108.5 42.9 65.6 95.6 41.2 54.4 NGLs (MBbls/d) 12.0 6.2 5.8 12.8 6.6 6.2 Total (MBoe/d) 62.4 40.5 21.9 61.9 41.3 20.6