Fourth Quarter 2024 Earnings Presentation February 2025

Important Information Forward-Looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical fact, contained in this presentation are forward-looking statements, including, but not limited to, any statements regarding our estimates of number of gaming terminals, locations, revenues, Adjusted EBITDA, capital expenditures, our expansion into casino operations and horse racing, and our ability to consummate share repurchases in the amounts authorized pursuant to our share repurchase program or at all. The words “predict,” “estimated,” “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “would,” “continue,” and similar expressions or the negatives thereof are intended to identify forward-looking statements. These forward-looking statements represent our current reasonable expectations and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance and achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. We cannot guarantee the accuracy of the forward-looking statements, and you should be aware that results and events could differ materially and adversely from those contained in the forward-looking statements due to a number of factors including, but not limited to: Accel’s ability to operate in existing markets or expand into new jurisdictions; Accel’s ability to offer new and innovative products and services that fulfill the needs of location partners and create strong and sustained player appeal; Accel’s dependence on relationships with key manufacturers, developers and third parties to obtain gaming terminals, amusement machines, and related supplies, programs, and technologies for its business on acceptable terms; the negative impact on Accel’s future results of operations by the slow growth in demand for gaming terminals and by the slow growth of new gaming jurisdictions; Accel’s heavy dependency on its ability to win, maintain and renew contracts with location partners; Accel's expansion into casino operations and horse racing; unfavorable macroeconomic condit ions or decreased discretionary spending due to other factors such as interest rate volatility, persistent inflation, increased or retaliatory tariffs, actual or perceived instability in the U.S. and global banking systems, high fuel rates, recessions, epidemics or other public health issues, terrorist activity or threat thereof, civil unrest or other macroeconomic or political uncertainties, that could adversely affect Accel’s business, results of operations, cash flows and financial conditions and other risks and uncertainties indicated from time to time in documents filed or to be filed with the Securities and Exchange Commission (“SEC”). Accordingly, forward-looking statements, including any projections or analysis, should not be viewed as factual and should not be relied upon as an accurate prediction of future results. The forward-looking statements contained in this presentation are based on our current expectations and beliefs concerning future developments and their potential effects on Accel. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control), or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in the section entitled “Risk Factors” in the Annual Report on Form 10-K for the fiscal year ended December 31, 2024. Except as required by law, we do not undertake publicly to update or revise these statements, even if experience or future changes make it clear that any projected results expressed in this or other presentations or future quarterly reports, or company statements will not be realized. In addition, the inclusion of any statement in this presentation does not constitute an admission by us that the events or circumstances described in such statement are material. We qualify all of our forward-looking statements by these cautionary statements. In addition, the industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors including those described in the section entitled “Risk Factors” in the Form 10-K, as well as Accel’s other filings with the SEC. These and other factors could cause our results to differ materially from those expressed in this presentation. Industry and Market Data Unless otherwise indicated, information contained in this presentation concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity, and market size, is based on information from various sources, on assumptions that we have made that are based on those data and other similar sources, and on our knowledge of the markets for our services. This information includes a number of assumptions and limitations, and you are cautioned not to give undue weight to such information. In addition, projections, assumptions, and estimates of our future performance and the future performance of the industry in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the Form 10-K, as well as Accel’s other filings with the SEC. These and other factors could cause results to differ materially from those expressed in the estimates made by third parties and by us. Use of Non-GAAP Financial Measures This presentation includes non-GAAP financial measures, including Adjusted net income, Adjusted EBITDA, EBIT, Capex, and Net Debt. Management believes that these non-GAAP measures of financial results enhance the understanding of Accel’s underlying drivers of profitability and trends in Accel’s business and facilitate company-to-company and period-to period comparisons, because these non-GAAP financial measures exclude the effects of certain non-cash items or represent certain nonrecurring items that are unrelated to core performance. Management of Accel also believes that these non-GAAP financial measures are used by investors, analysts and other interested parties as measures of financial performance and to evaluate Accel’s ability to fund capital expenditures, service debt obligations and meet working capital requirements. For definitions of non-GAAP financial measures and reconciliations of non-GAAP financial measures to the most directly comparable GAAP measure, please see the Appendix to this presentation. 2

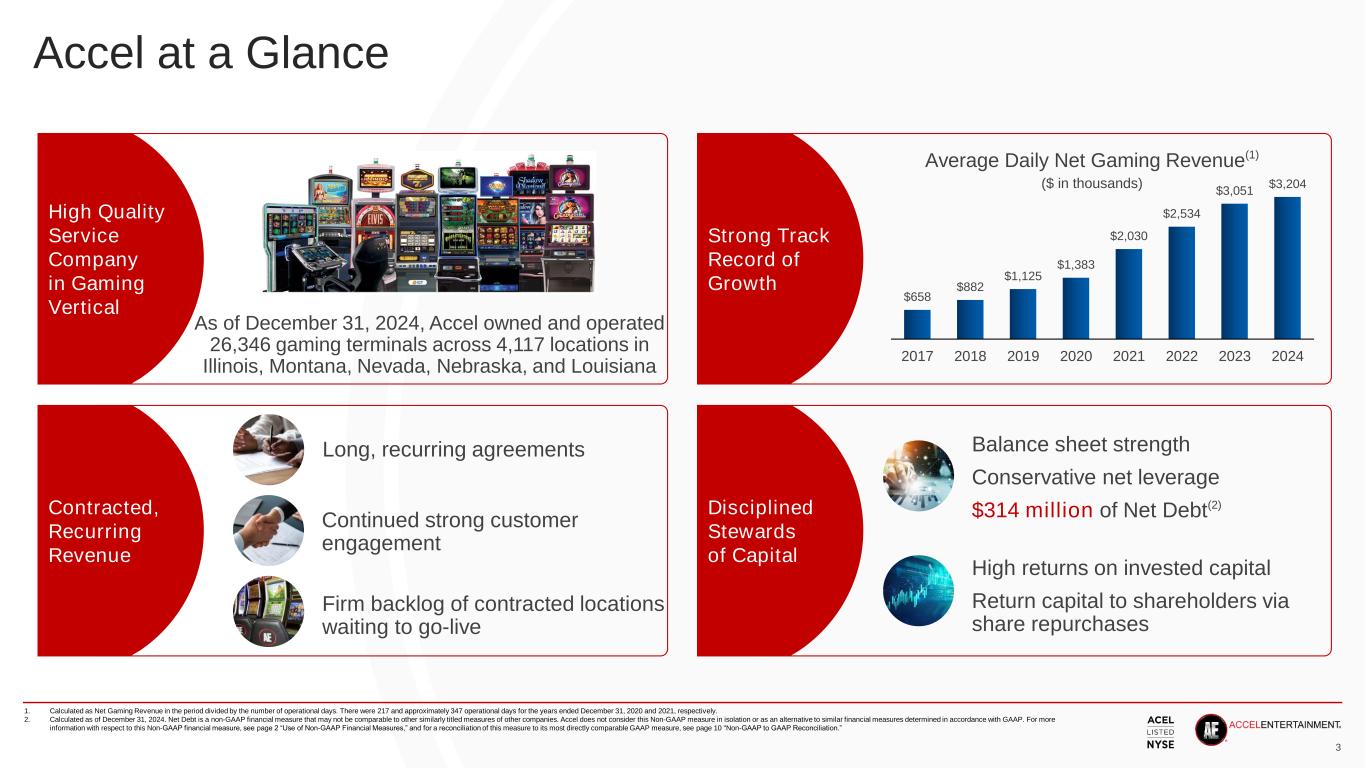

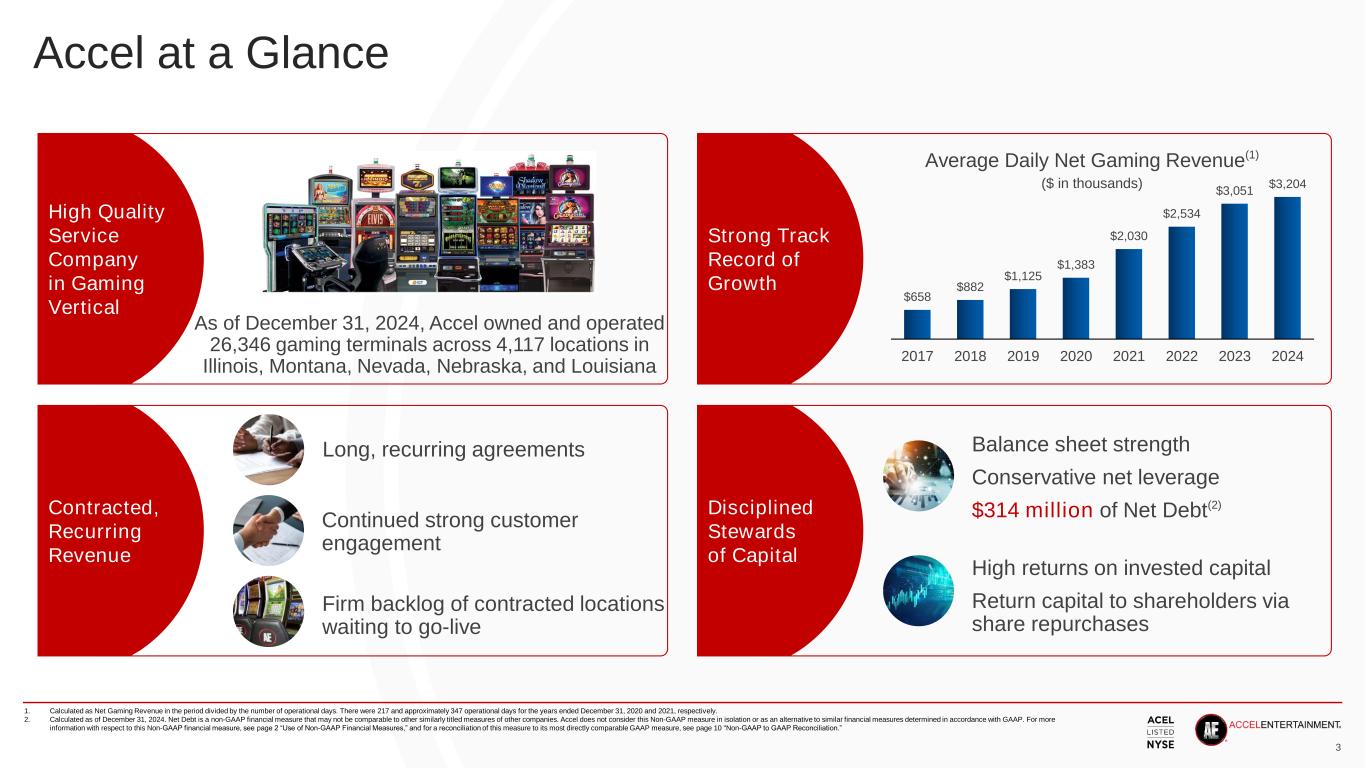

Accel at a Glance 1. Calculated as Net Gaming Revenue in the period divided by the number of operational days. There were 217 and approximately 347 operational days for the years ended December 31, 2020 and 2021, respectively. 2. Calculated as of December 31, 2024. Net Debt is a non-GAAP financial measure that may not be comparable to other similarly titled measures of other companies. Accel does not consider this Non-GAAP measure in isolation or as an alternative to similar financial measures determined in accordance with GAAP. For more information with respect to this Non-GAAP financial measure, see page 2 “Use of Non-GAAP Financial Measures,” and for a reconciliation of this measure to its most directly comparable GAAP measure, see page 10 "Non-GAAP to GAAP Reconciliation.” Strong Track Record of Growth Disciplined Stewards of Capital As of December 31, 2024, Accel owned and operated 26,346 gaming terminals across 4,117 locations in Illinois, Montana, Nevada, Nebraska, and Louisiana Average Daily Net Gaming Revenue(1) ($ in thousands) Long, recurring agreements Continued strong customer engagement Firm backlog of contracted locations waiting to go-live High Quality Service Company in Gaming Vertical Contracted, Recurring Revenue 3 Balance sheet strength Conservative net leverage $314 million of Net Debt(2) High returns on invested capital Return capital to shareholders via share repurchases $658 $882 $1,125 $1,383 $2,030 $2,534 $3,051 $3,204 2017 2018 2019 2020 2021 2022 2023 2024

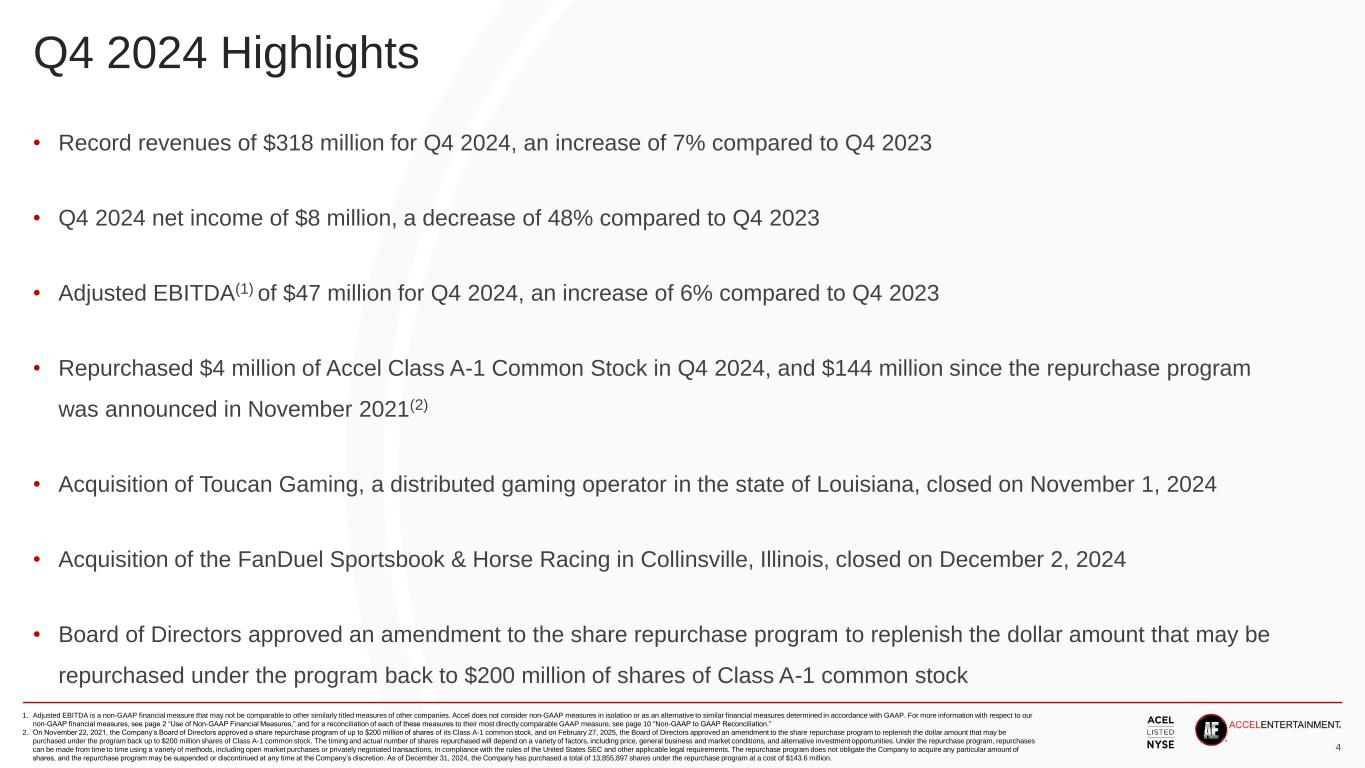

Q4 2024 Highlights • Record revenues of $318 million for Q4 2024, an increase of 7% compared to Q4 2023 • Q4 2024 net income of $8 million, a decrease of 48% compared to Q4 2023 • Adjusted EBITDA(1) of $47 million for Q4 2024, an increase of 6% compared to Q4 2023 • Repurchased $4 million of Accel Class A-1 Common Stock in Q4 2024, and $144 million since the repurchase program was announced in November 2021(2) • Acquisition of Toucan Gaming, a distributed gaming operator in the state of Louisiana, closed on November 1, 2024 • Acquisition of the FanDuel Sportsbook & Horse Racing in Collinsville, Illinois, closed on December 2, 2024 • Board of Directors approved an amendment to the share repurchase program to replenish the dollar amount that may be repurchased under the program back to $200 million of shares of Class A-1 common stock 4 1. Adjusted EBITDA is a non-GAAP financial measure that may not be comparable to other similarly titled measures of other companies. Accel does not consider non-GAAP measures in isolation or as an alternative to similar financial measures determined in accordance with GAAP. For more information with respect to our non-GAAP financial measures, see page 2 “Use of Non-GAAP Financial Measures,” and for a reconciliation of each of these measures to their most directly comparable GAAP measure, see page 10 "Non-GAAP to GAAP Reconciliation.” 2. On November 22, 2021, the Company’s Board of Directors approved a share repurchase program of up to $200 million of shares of its Class A-1 common stock, and on February 27, 2025, the Board of Directors approved an amendment to the share repurchase program to replenish the dollar amount that may be purchased under the program back up to $200 million shares of Class A-1 common stock. The timing and actual number of shares repurchased will depend on a variety of factors, including price, general business and market conditions, and alternative investment opportunities. Under the repurchase program, repurchases can be made from time to time using a variety of methods, including open market purchases or privately negotiated transactions, in compliance with the rules of the United States SEC and other applicable legal requirements. The repurchase program does not obligate the Company to acquire any particular amount of shares, and the repurchase program may be suspended or discontinued at any time at the Company’s discretion. As of December 31, 2024, the Company has purchased a total of 13,855,897 shares under the repurchase program at a cost of $143.6 million.

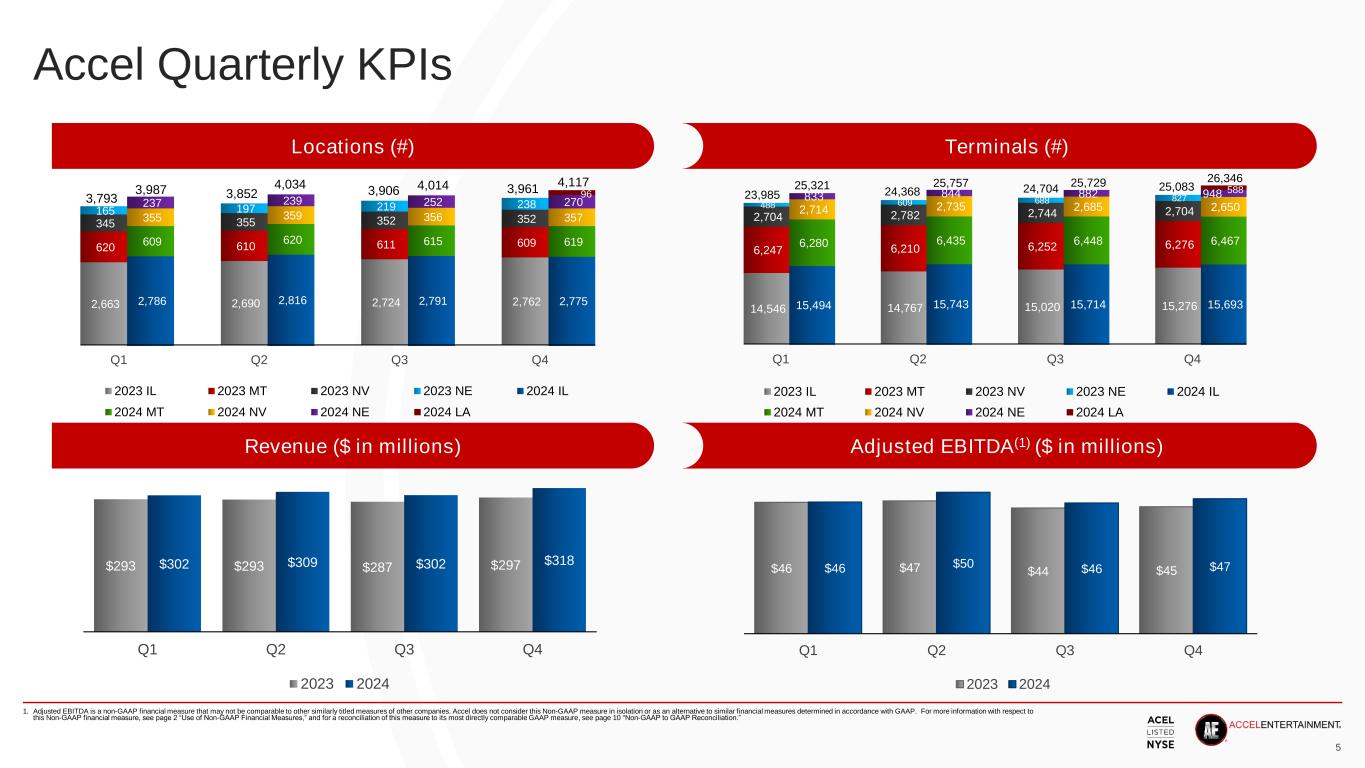

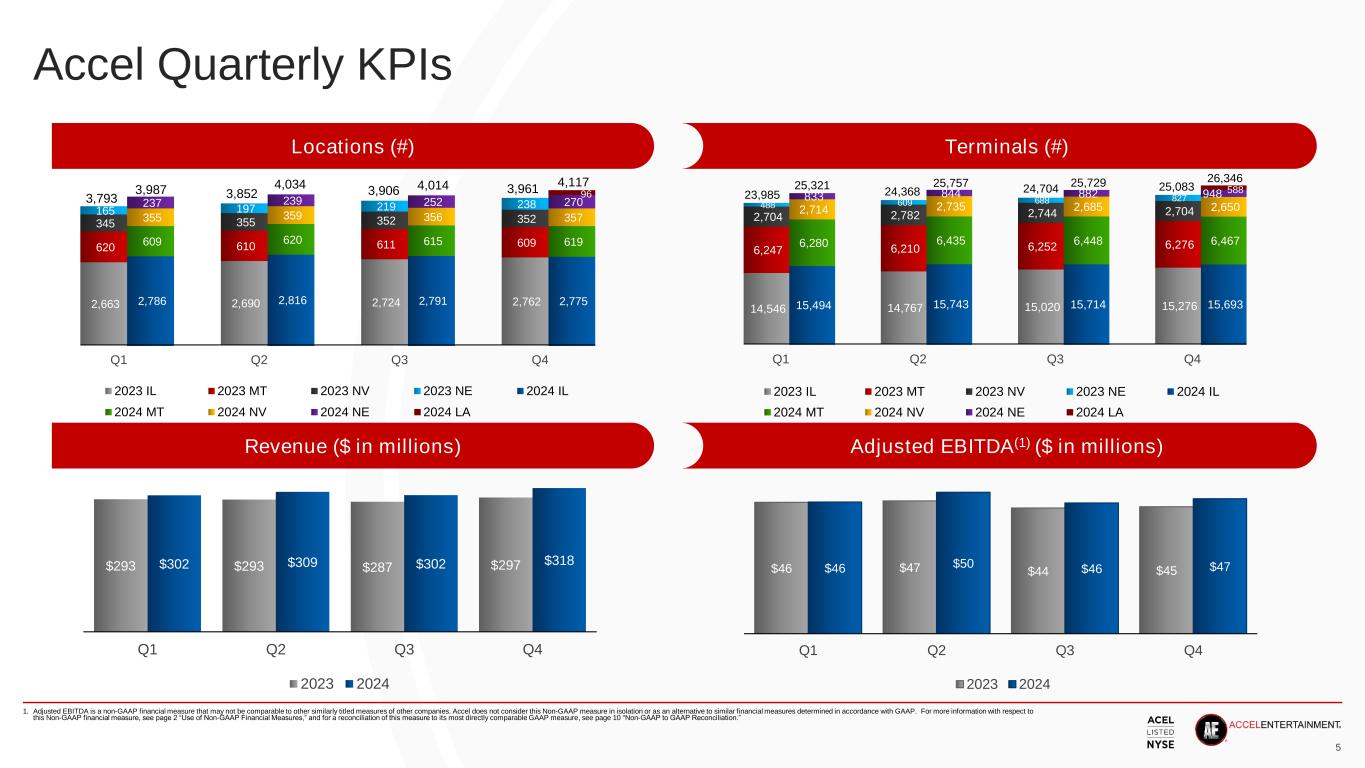

$46 $47 $44 $45$46 $50 $46 $47 Q1 Q2 Q3 Q4 2023 2024 $293 $293 $287 $297$302 $309 $302 $318 Q1 Q2 Q3 Q4 2023 2024 Accel Quarterly KPIs 1. Adjusted EBITDA is a non-GAAP financial measure that may not be comparable to other similarly titled measures of other companies. Accel does not consider this Non-GAAP measure in isolation or as an alternative to similar financial measures determined in accordance with GAAP. For more information with respect to this Non-GAAP financial measure, see page 2 “Use of Non-GAAP Financial Measures,” and for a reconciliation of this measure to its most directly comparable GAAP measure, see page 10 "Non-GAAP to GAAP Reconciliation.” Locations (#) Terminals (#) Revenue ($ in millions) Adjusted EBITDA(1) ($ in millions) 5 2,663 2,690 2,724 2,762 620 610 611 609 345 355 352 352 165 197 219 238 2,786 2,816 2,791 2,775 609 620 615 619 355 359 356 357 237 239 252 270 96 3,793 3,987 3,852 4,034 3,906 4,014 3,961 4,117 Q1 Q2 Q3 Q4 2023 IL 2023 MT 2023 NV 2023 NE 2024 IL 2024 MT 2024 NV 2024 NE 2024 LA 14,546 14,767 15,020 15,276 6,247 6,210 6,252 6,276 2,704 2,782 2,744 2,704 488 609 688 827 15,494 15,743 15,714 15,693 6,280 6,435 6,448 6,467 2,714 2,735 2,685 2,650 833 844 882 948 588 23,985 25,321 24,368 25,757 24,704 25,729 25,083 26,346 Q1 Q2 Q3 Q4 2023 IL 2023 MT 2023 NV 2023 NE 2024 IL 2024 MT 2024 NV 2024 NE 2024 LA

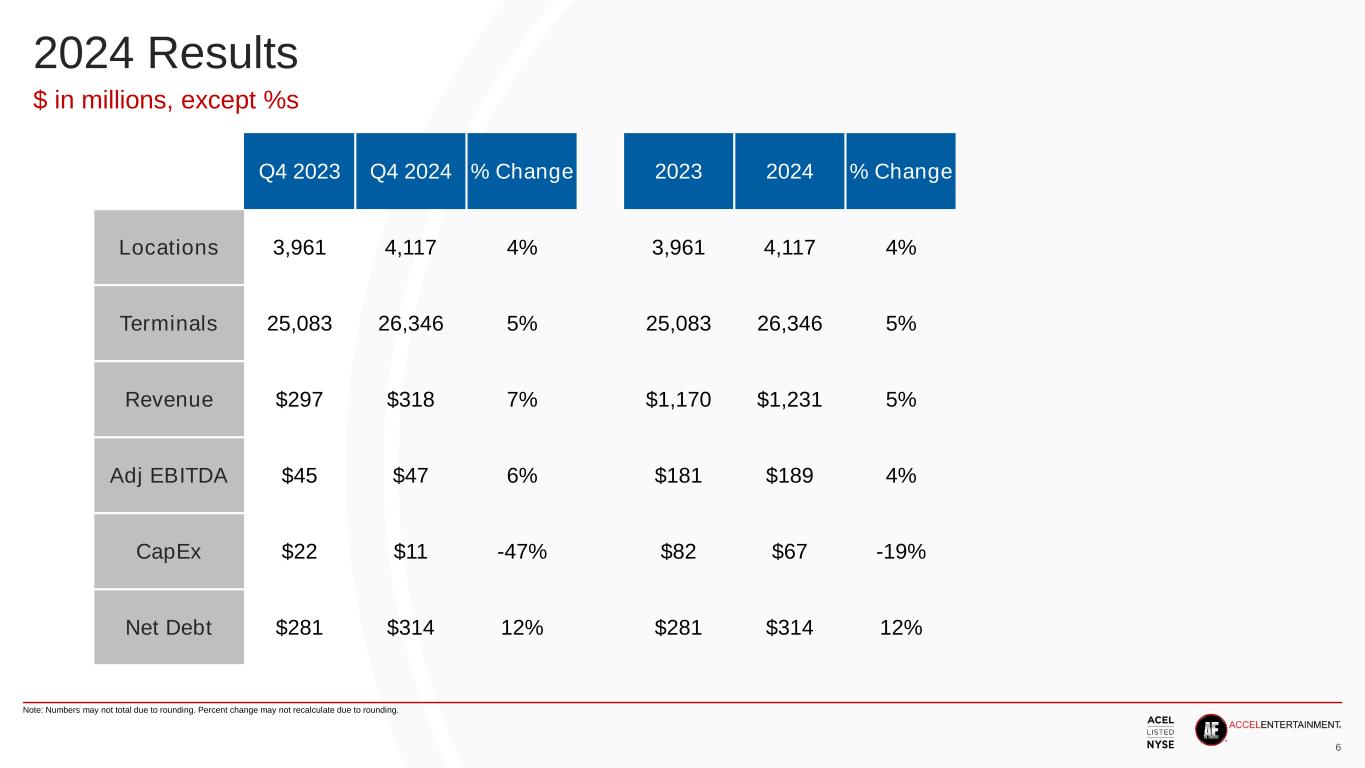

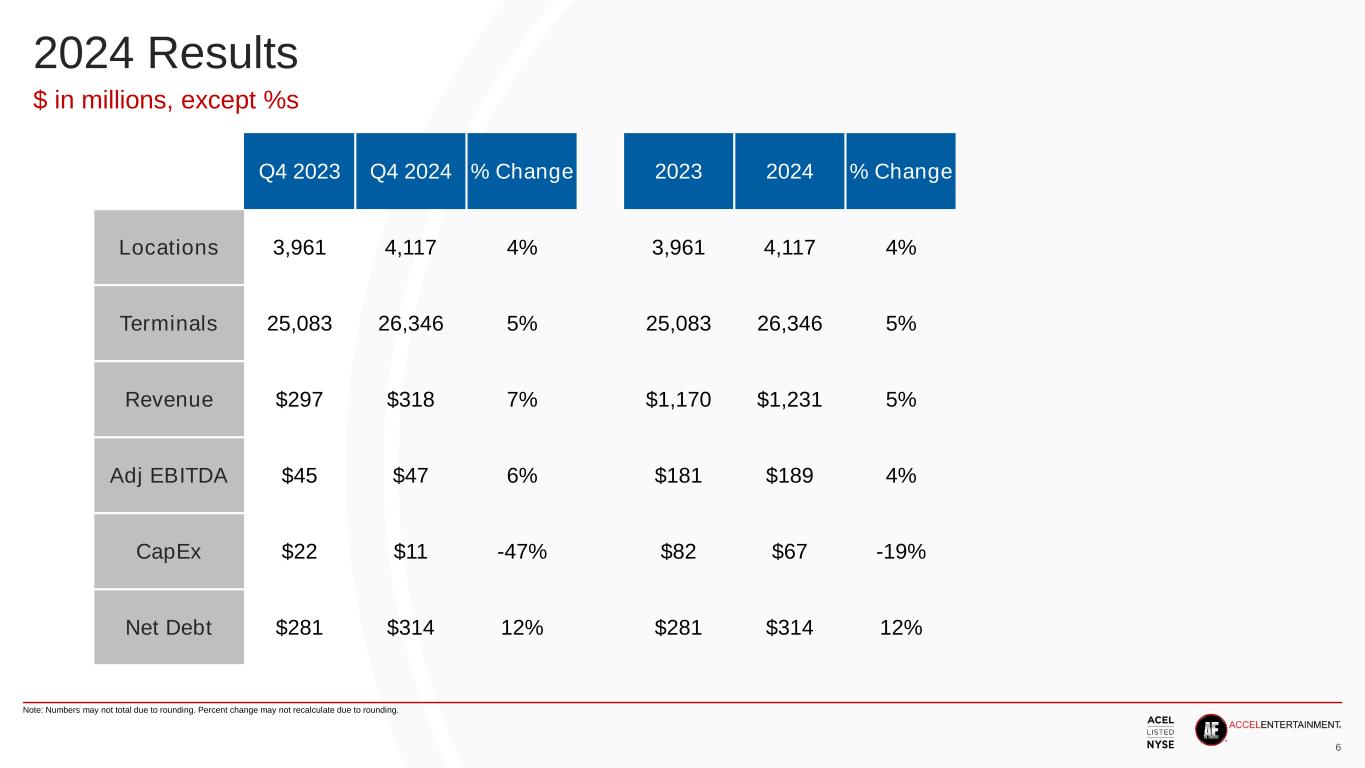

2024 Results 6 Note: Numbers may not total due to rounding. Percent change may not recalculate due to rounding. $ in millions, except %s Q4 2023 Q4 2024 % Change 2023 2024 % Change Locations 3,961 4,117 4% 3,961 4,117 4% Terminals 25,083 26,346 5% 25,083 26,346 5% Revenue $297 $318 7% $1,170 $1,231 5% Adj EBITDA $45 $47 6% $181 $189 4% CapEx $22 $11 -47% $82 $67 -19% Net Debt $281 $314 12% $281 $314 12%

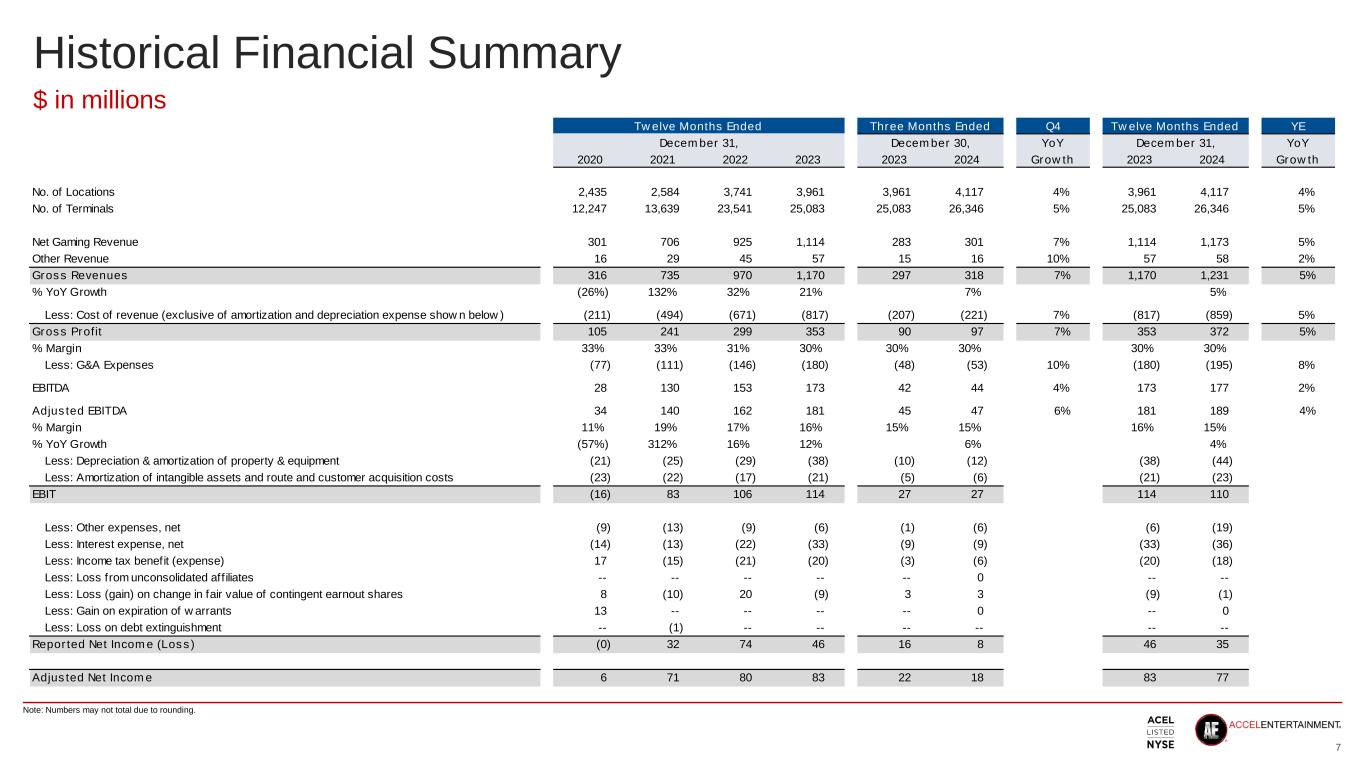

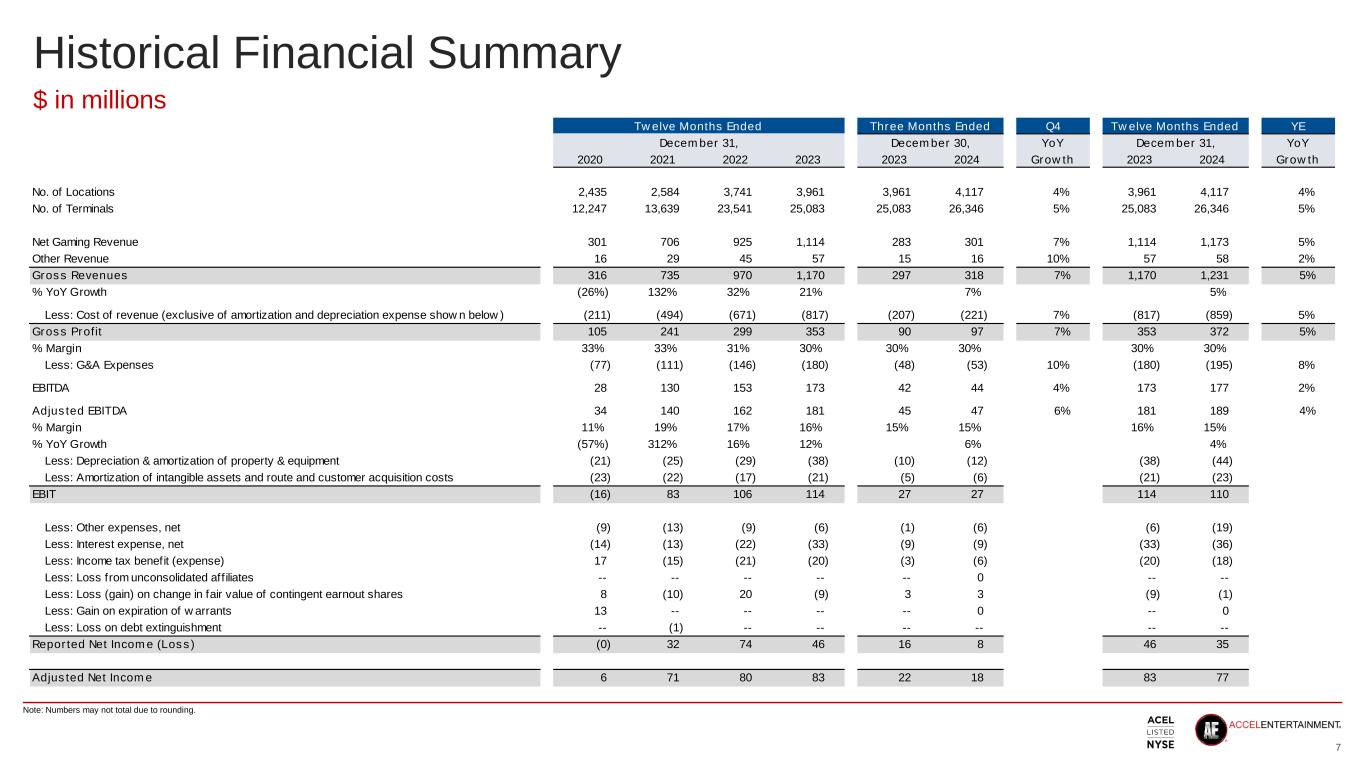

Historical Financial Summary 7 $ in millions Note: Numbers may not total due to rounding. Q4 YE YoY YoY 2020 2021 2022 2023 2023 2024 Growth 2023 2024 Growth No. of Locations 2,435 2,584 3,741 3,961 3,961 4,117 4% 3,961 4,117 4% No. of Terminals 12,247 13,639 23,541 25,083 25,083 26,346 5% 25,083 26,346 5% Net Gaming Revenue 301 706 925 1,114 283 301 7% 1,114 1,173 5% Other Revenue 16 29 45 57 15 16 10% 57 58 2% Gross Revenues 316 735 970 1,170 297 318 7% 1,170 1,231 5% % YoY Growth (26%) 132% 32% 21% 7% 5% Less: Cost of revenue (exclusive of amortization and depreciation expense show n below ) (211) (494) (671) (817) (207) (221) 7% (817) (859) 5% Gross Profit 105 241 299 353 90 97 7% 353 372 5% % Margin 33% 33% 31% 30% 30% 30% 30% 30% Less: G&A Expenses (77) (111) (146) (180) (48) (53) 10% (180) (195) 8% EBITDA 28 130 153 173 42 44 4% 173 177 2% Adjusted EBITDA 34 140 162 181 45 47 6% 181 189 4% % Margin 11% 19% 17% 16% 15% 15% 16% 15% % YoY Growth (57%) 312% 16% 12% 6% 4% Less: Depreciation & amortization of property & equipment (21) (25) (29) (38) (10) (12) (38) (44) Less: Amortization of intangible assets and route and customer acquisition costs (23) (22) (17) (21) (5) (6) (21) (23) EBIT (16) 83 106 114 27 27 114 110 Less: Other expenses, net (9) (13) (9) (6) (1) (6) (6) (19) Less: Interest expense, net (14) (13) (22) (33) (9) (9) (33) (36) Less: Income tax benefit (expense) 17 (15) (21) (20) (3) (6) (20) (18) Less: Loss from unconsolidated aff iliates -- -- -- -- -- 0 -- -- Less: Loss (gain) on change in fair value of contingent earnout shares 8 (10) 20 (9) 3 3 (9) (1) Less: Gain on expiration of w arrants 13 -- -- -- -- 0 -- 0 Less: Loss on debt extinguishment -- (1) -- -- -- -- -- -- Reported Net Income (Loss) (0) 32 74 46 16 8 46 35 Adjusted Net Income 6 71 80 83 22 18 83 77 Twelve Months Ended Three Months Ended Twelve Months Ended December 31, December 30, December 31,

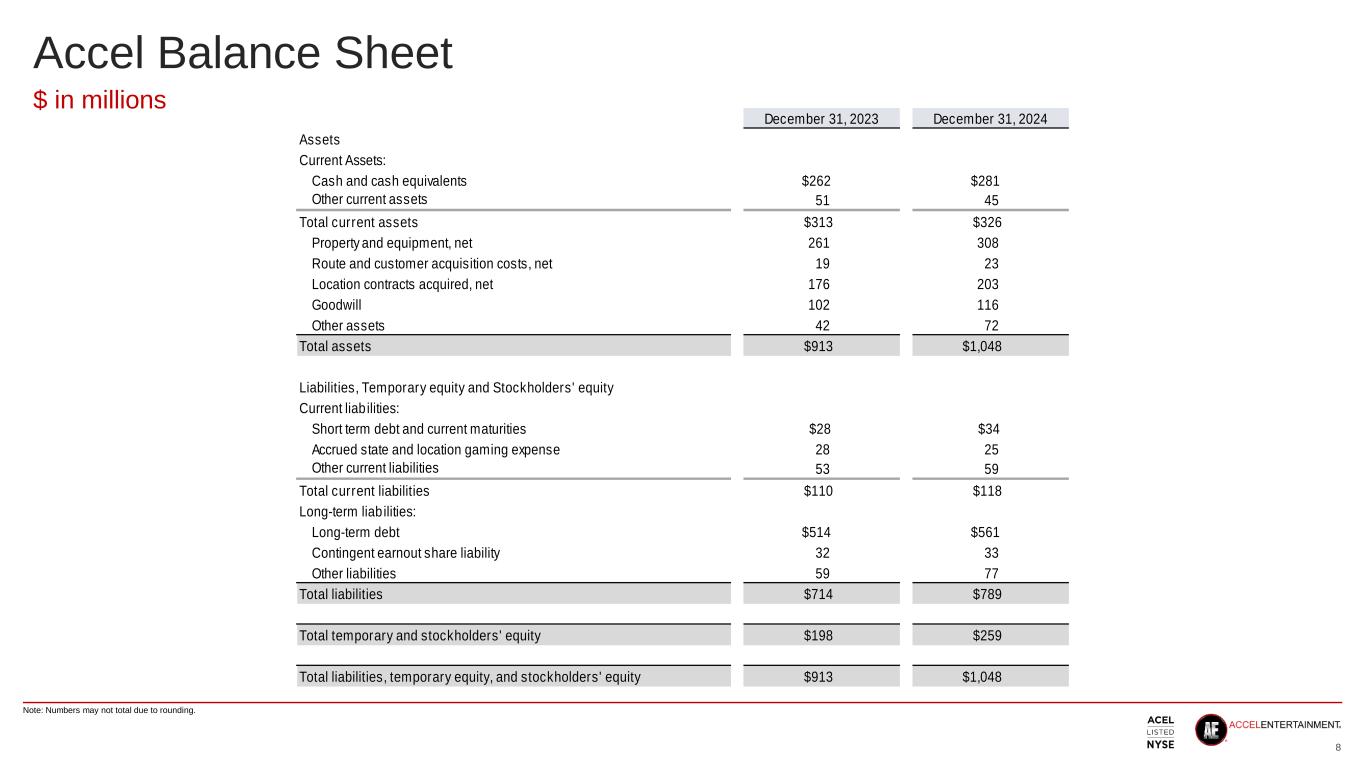

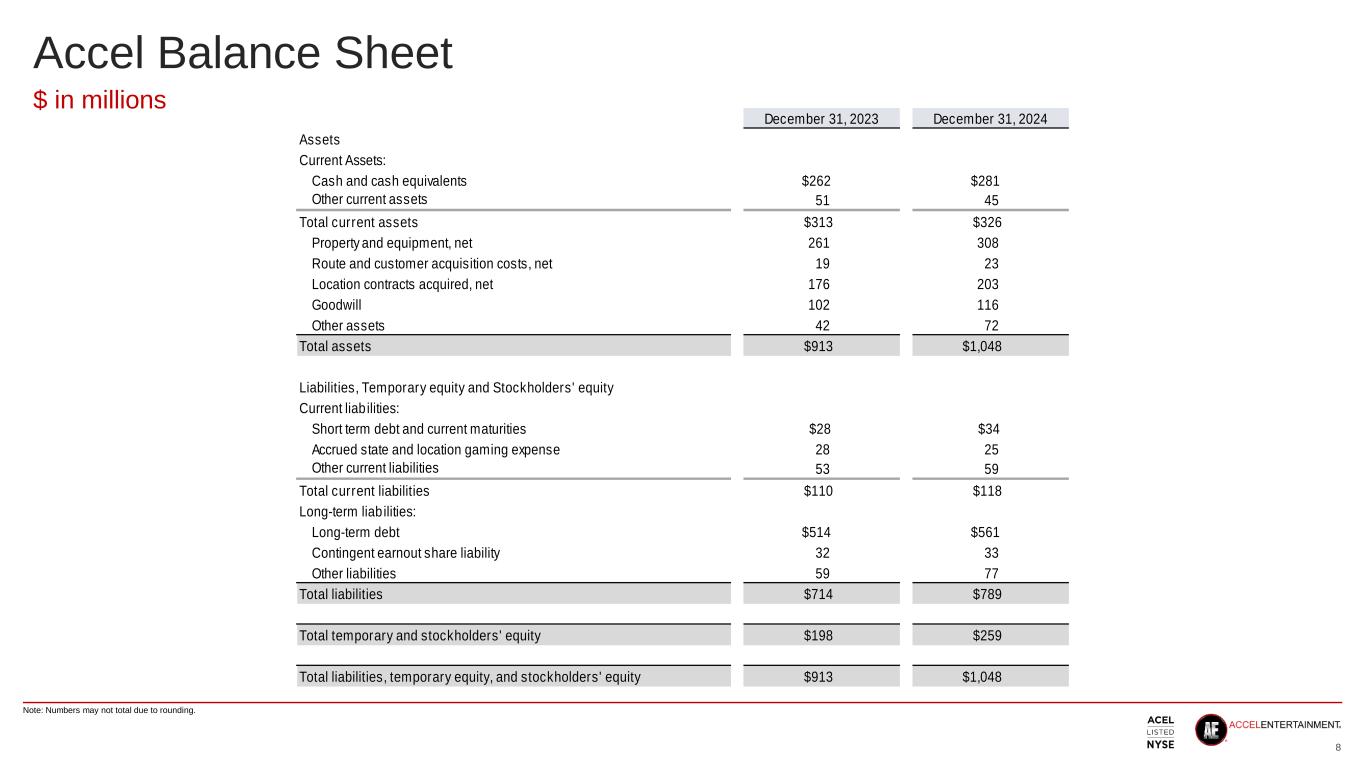

Accel Balance Sheet 8 Note: Numbers may not total due to rounding. $ in millions December 31, 2023 December 31, 2024 Assets Current Assets: Cash and cash equivalents $262 $281 Other current assets 51 45 Total current assets $313 $326 Property and equipment, net 261 308 Route and customer acquisition costs, net 19 23 Location contracts acquired, net 176 203 Goodwill 102 116 Other assets 42 72 Total assets $913 $1,048 Liabilities, Temporary equity and Stockholders' equity Current liab ilities: Short term debt and current maturities $28 $34 Accrued state and location gaming expense 28 25 Other current liabilities 53 59 Total current liabilities $110 $118 Long-term liab ilities: Long-term debt $514 $561 Contingent earnout share liability 32 33 Other liabilities 59 77 Total liabilities $714 $789 Total temporary and stockholders' equity $198 $259 Total liabilities, temporary equity, and stockholders' equity $913 $1,048

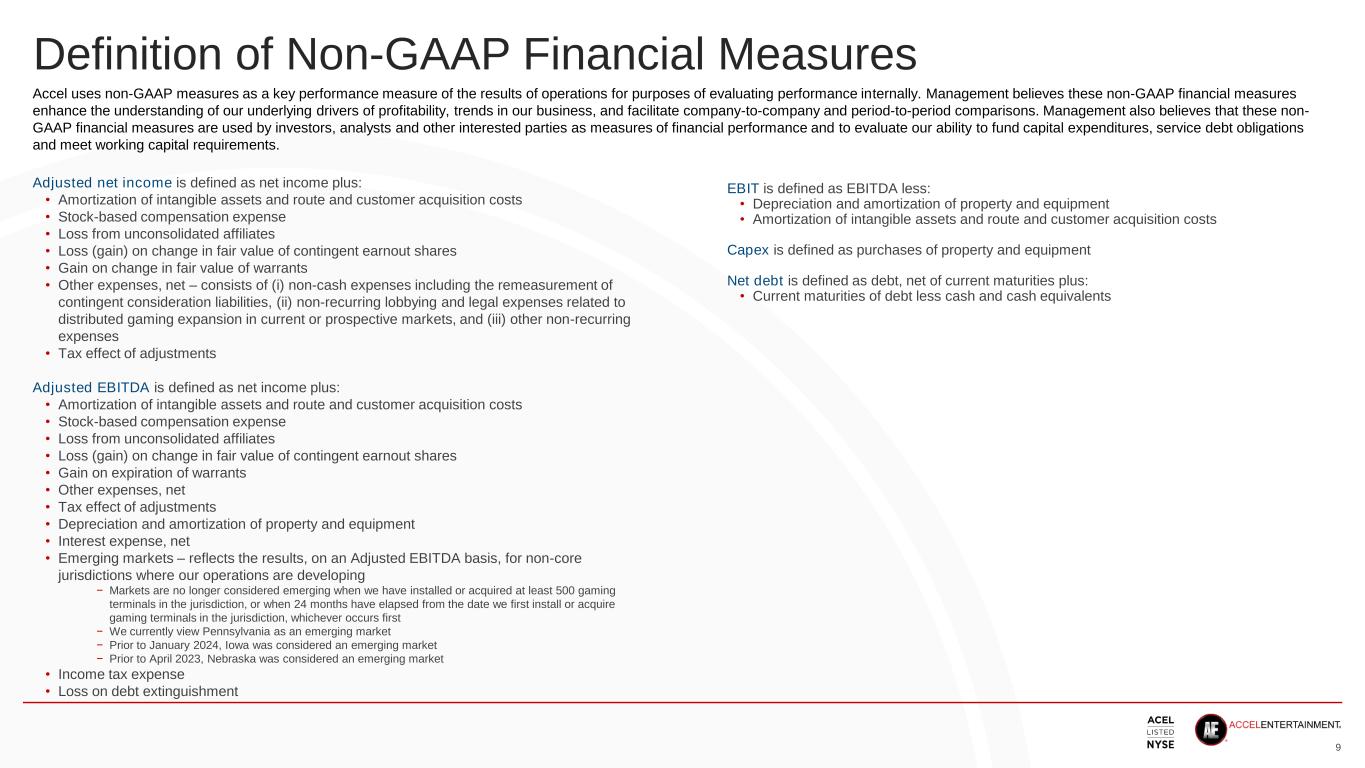

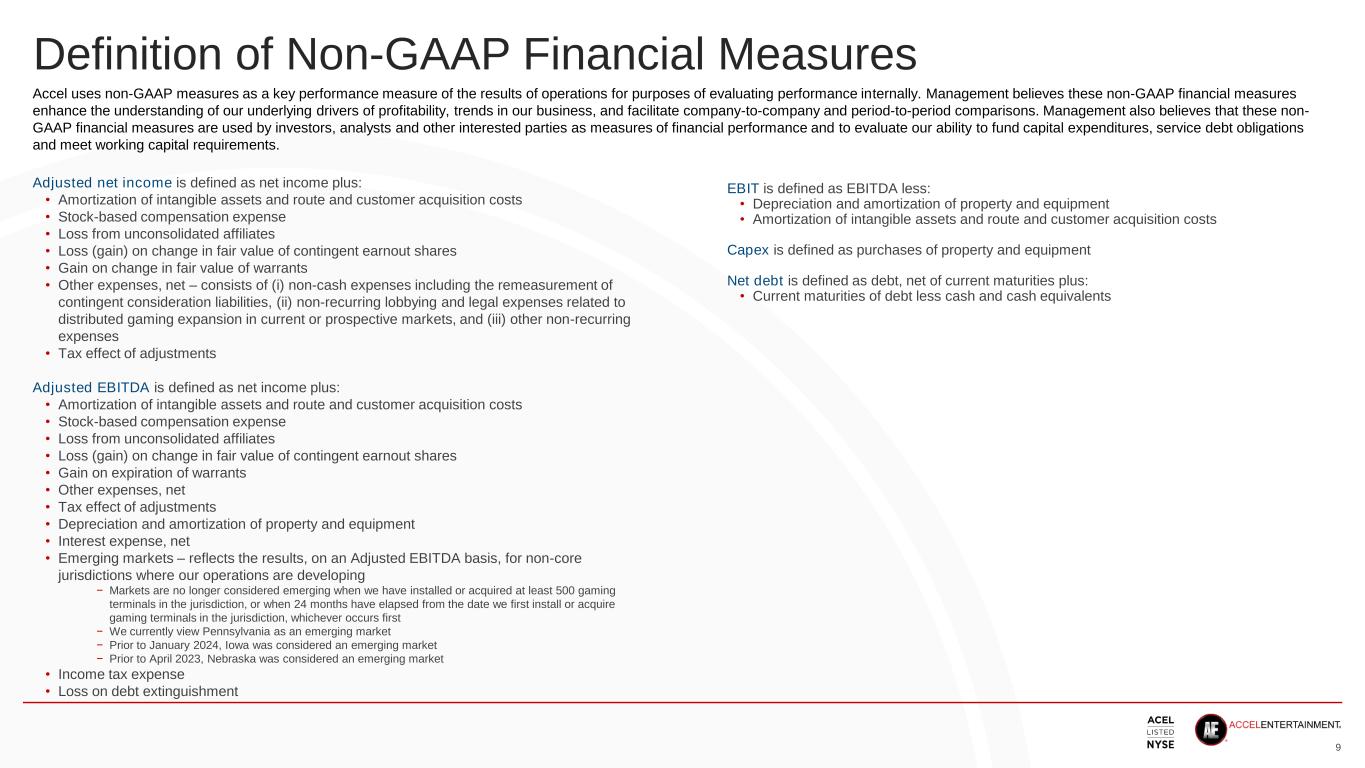

Definition of Non-GAAP Financial Measures Adjusted net income is defined as net income plus: • Amortization of intangible assets and route and customer acquisition costs • Stock-based compensation expense • Loss from unconsolidated affiliates • Loss (gain) on change in fair value of contingent earnout shares • Gain on change in fair value of warrants • Other expenses, net – consists of (i) non-cash expenses including the remeasurement of contingent consideration liabilities, (ii) non-recurring lobbying and legal expenses related to distributed gaming expansion in current or prospective markets, and (iii) other non-recurring expenses • Tax effect of adjustments Adjusted EBITDA is defined as net income plus: • Amortization of intangible assets and route and customer acquisition costs • Stock-based compensation expense • Loss from unconsolidated affiliates • Loss (gain) on change in fair value of contingent earnout shares • Gain on expiration of warrants • Other expenses, net • Tax effect of adjustments • Depreciation and amortization of property and equipment • Interest expense, net • Emerging markets – reflects the results, on an Adjusted EBITDA basis, for non-core jurisdictions where our operations are developing − Markets are no longer considered emerging when we have installed or acquired at least 500 gaming terminals in the jurisdiction, or when 24 months have elapsed from the date we first install or acquire gaming terminals in the jurisdiction, whichever occurs first − We currently view Pennsylvania as an emerging market − Prior to January 2024, Iowa was considered an emerging market − Prior to April 2023, Nebraska was considered an emerging market • Income tax expense • Loss on debt extinguishment 9 Accel uses non-GAAP measures as a key performance measure of the results of operations for purposes of evaluating performance internally. Management believes these non-GAAP financial measures enhance the understanding of our underlying drivers of profitability, trends in our business, and facilitate company-to-company and period-to-period comparisons. Management also believes that these non- GAAP financial measures are used by investors, analysts and other interested parties as measures of financial performance and to evaluate our ability to fund capital expenditures, service debt obligations and meet working capital requirements. EBIT is defined as EBITDA less: • Depreciation and amortization of property and equipment • Amortization of intangible assets and route and customer acquisition costs Capex is defined as purchases of property and equipment Net debt is defined as debt, net of current maturities plus: • Current maturities of debt less cash and cash equivalents

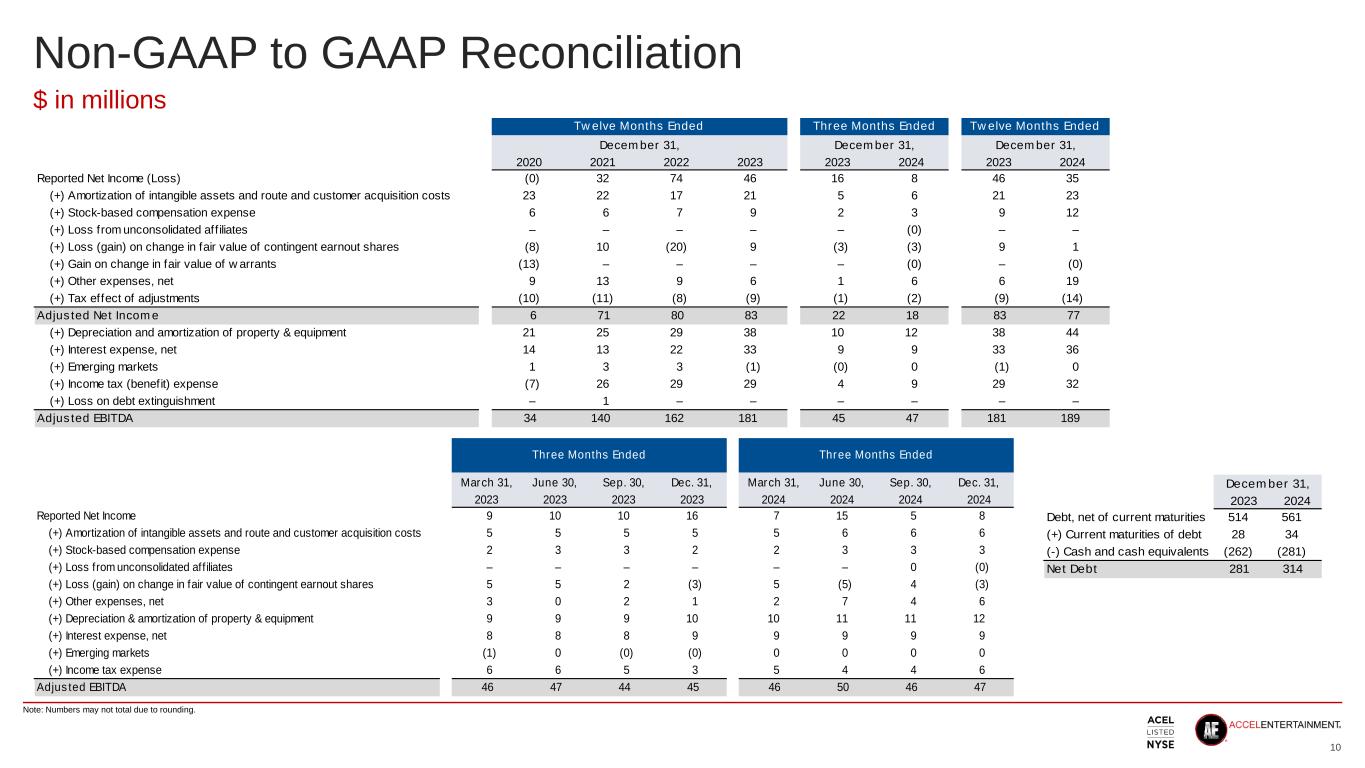

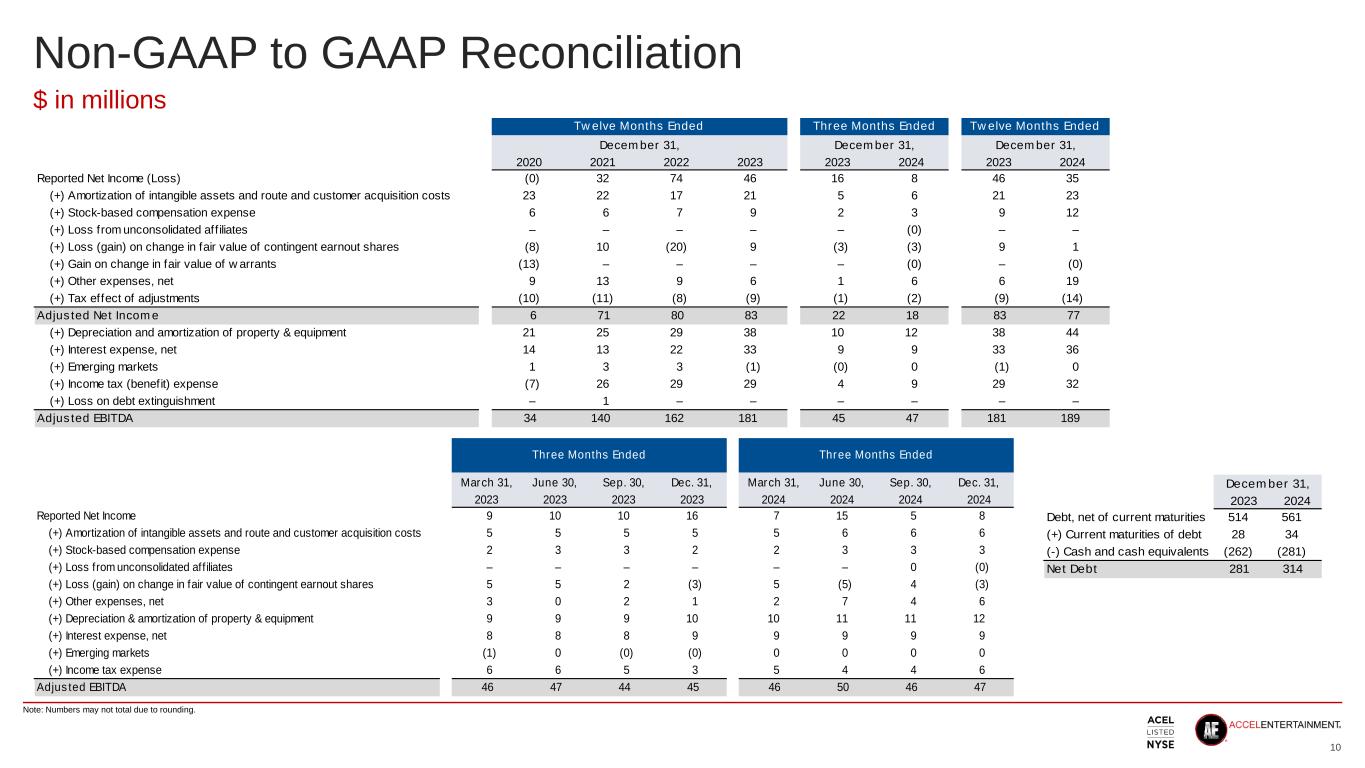

Non-GAAP to GAAP Reconciliation 10 Note: Numbers may not total due to rounding. $ in millions 2020 2021 2022 2023 2023 2024 2023 2024 Reported Net Income (Loss) (0) 32 74 46 16 8 46 35 (+) Amortization of intangible assets and route and customer acquisition costs 23 22 17 21 5 6 21 23 (+) Stock-based compensation expense 6 6 7 9 2 3 9 12 (+) Loss from unconsolidated aff iliates – – – – – (0) – – (+) Loss (gain) on change in fair value of contingent earnout shares (8) 10 (20) 9 (3) (3) 9 1 (+) Gain on change in fair value of w arrants (13) – – – – (0) – (0) (+) Other expenses, net 9 13 9 6 1 6 6 19 (+) Tax effect of adjustments (10) (11) (8) (9) (1) (2) (9) (14) Adjusted Net Income 6 71 80 83 22 18 83 77 (+) Depreciation and amortization of property & equipment 21 25 29 38 10 12 38 44 (+) Interest expense, net 14 13 22 33 9 9 33 36 (+) Emerging markets 1 3 3 (1) (0) 0 (1) 0 (+) Income tax (benefit) expense (7) 26 29 29 4 9 29 32 (+) Loss on debt extinguishment – 1 – – – – – – Adjusted EBITDA 34 140 162 181 45 47 181 189 Twelve Months Ended Three Months Ended Twelve Months Ended December 31, December 31, December 31, March 31, June 30, Sep. 30, Dec. 31, March 31, June 30, Sep. 30, Dec. 31, 2023 2023 2023 2023 2024 2024 2024 2024 Reported Net Income 9 10 10 16 7 15 5 8 (+) Amortization of intangible assets and route and customer acquisition costs 5 5 5 5 5 6 6 6 (+) Stock-based compensation expense 2 3 3 2 2 3 3 3 (+) Loss from unconsolidated aff iliates – – – – – – 0 (0) (+) Loss (gain) on change in fair value of contingent earnout shares 5 5 2 (3) 5 (5) 4 (3) (+) Other expenses, net 3 0 2 1 2 7 4 6 (+) Depreciation & amortization of property & equipment 9 9 9 10 10 11 11 12 (+) Interest expense, net 8 8 8 9 9 9 9 9 (+) Emerging markets (1) 0 (0) (0) 0 0 0 0 (+) Income tax expense 6 6 5 3 5 4 4 6 Adjusted EBITDA 46 47 44 45 46 50 46 47 Three Months Ended Three Months Ended December 31, 2023 2024 Debt, net of current maturities 514 561 (+) Current maturities of debt 28 34 (-) Cash and cash equivalents (262) (281) Net Debt 281 314