- WHD Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

424B7 Filing

Cactus (WHD) 424B7Prospectus with selling stockholder info

Filed: 18 Mar 19, 9:54pm

Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS

Filed Pursuant to Rule 424(b)(7)

Registration No. 333-230328

The information in this preliminary prospectus supplement and the accompanying prospectus is not complete and may be changed. This preliminary prospectus supplement and the accompanying prospectus are not an offer to sell the securities nor do they seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MARCH 19, 2019

PRELIMINARY PROSPECTUS SUPPLEMENT

(To prospectus dated March 15, 2019)

8,500,000 Shares

Cactus, Inc.

Class A Common Stock

The selling stockholders identified in this prospectus supplement are selling an aggregate of 8,500,000 shares of Class A common stock of Cactus, Inc. The underwriters have agreed to purchase our Class A common stock from the selling stockholders at a price of $ per share. The underwriters may offer our Class A common stock from time to time in one or more transactions on the New York Stock Exchange, in the over-the-counter market or through negotiated transactions or otherwise at market prices prevailing at the time of sale, at prices related to prevailing market prices or at negotiated prices. See "Underwriting." We will not receive any proceeds from the sale of shares of our Class A common stock in this offering.

Our Class A common stock is listed on the New York Stock Exchange under the symbol "WHD." The last reported sales price of our Class A common stock on the New York Stock Exchange on March 18, 2019 was $37.72 per share.

We are an "emerging growth company," as that term is defined under the federal securities laws and, as such, may elect to comply with certain reduced public company reporting requirements.

Investing in our Class A common stock involves a high degree of risk. See "Risk Factors" on page S-11 of this prospectus supplement, on page 7 of the accompanying base prospectus and in the documents incorporated by reference herein and therein.

Neither the Securities and Exchange Commission (the "SEC") nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of our Class A common stock to investors against payment on or about , 2019.

| Citigroup | Credit Suisse |

The date of this prospectus supplement is March , 2019

TABLE OF CONTENTS

Prospectus Supplement | ||||

| | Page | |||

|---|---|---|---|---|

ABOUT THIS PROSPECTUS | S-ii | |||

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS | S-iv | |||

SUMMARY | S-1 | |||

RISK FACTORS | S-11 | |||

USE OF PROCEEDS | S-12 | |||

MARKET FOR REGISTRANT'S COMMON EQUITY | S-13 | |||

SELLING STOCKHOLDERS | S-14 | |||

MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES FOR NON-U.S. HOLDERS | S-16 | |||

UNDERWRITING | S-20 | |||

LEGAL MATTERS | S-26 | |||

AVAILABLE INFORMATION | S-26 | |||

EXPERTS | S-26 | |||

INFORMATION INCORPORATED BY REFERENCE | S-26 | |||

| ||||

Page | ||||

ABOUT THIS PROSPECTUS | 1 | |||

ABOUT CACTUS, INC. | 2 | |||

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE | 3 | |||

AVAILABLE INFORMATION | 3 | |||

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS | 5 | |||

RISK FACTORS | 7 | |||

USE OF PROCEEDS | 8 | |||

DESCRIPTION OF CAPITAL STOCK | 9 | |||

DESCRIPTION OF DEPOSITARY SHARES | 14 | |||

DESCRIPTION OF WARRANTS | 15 | |||

DESCRIPTION OF DEBT SECURITIES | 16 | |||

REDEMPTION OF CW UNITS AND CLASS B COMMON STOCK | 19 | |||

SELLING STOCKHOLDERS | 20 | |||

PLAN OF DISTRIBUTION | 22 | |||

LEGAL MATTERS | 24 | |||

EXPERTS | 24 | |||

S-i

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering of our Class A common stock. The second part is the accompanying base prospectus, which contains descriptions of our securities and gives more general information, some of which may not apply to this offering of our Class A common stock. Generally, when we refer only to the "prospectus," we are referring to both this prospectus supplement and the accompanying base prospectus combined. If the information relating to the offering varies between this prospectus supplement and the accompanying base prospectus, you should rely on the information in this prospectus supplement.

You should rely only on the information contained in or incorporated by reference into this prospectus supplement, the accompanying base prospectus and any free writing prospectus prepared by us or on our behalf relating to this offering of our Class A common stock, or to the information which we have referred you. Neither we, the selling stockholders nor the underwriters have authorized anyone to provide you with additional or different information. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus supplement and the accompanying base prospectus constitute an offer to sell only the shares of our Class A common stock offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. You should assume that the information we have included in this prospectus supplement or the accompanying base prospectus is accurate only as of the date of this prospectus supplement or the accompanying base prospectus and that any information we have incorporated by reference is accurate only as of the date of the document incorporated by reference. Our business, results of operations, financial condition and prospects may have changed since that date.

Any statement made in this prospectus supplement or in a document incorporated or deemed to be incorporated by reference into this prospectus supplement will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus supplement or in any other subsequently filed document that is also incorporated by reference into this prospectus modifies or supersedes that statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus. Please read "Information Incorporated by Reference" on page S-26 of this prospectus supplement.

None of Cactus, Inc., the selling stockholders, the underwriters or any of their respective representatives is making any representation to you regarding the legality of an investment in our Class A common stock by you under applicable laws. You should consult with your own advisors as to legal, tax, business, financial and related aspects of an investment in our Class A common stock.

Industry and Market Data

The market data and certain other statistical information used or incorporated by reference in this prospectus are based on independent industry publications, government publications and other published independent sources. Some data is also based on our good faith estimates. Although we believe these third-party sources are reliable as of their respective dates, neither we nor the underwriters have independently verified the accuracy or completeness of this information. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section entitled "Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2018 and the other documents we incorporate by reference. These and other factors could cause results to differ materially from those expressed in these publications.

S-ii

Trademarks and Trade Names

We own or have rights to various trademarks, service marks and trade names that we use in connection with the operation of our business. This prospectus and the documents incorporated by reference herein may also contain trademarks, service marks and trade names of third parties, which are the property of their respective owners. Our use or display of third parties' trademarks, service marks, trade names or products in this prospectus or in the documents that are incorporated by reference herein is not intended to, and does not imply a relationship with, or endorsement or sponsorship by us. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks, service marks and trade names.

S-iii

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The information in this prospectus and the documents incorporated by reference herein includes "forward-looking statements" within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. All statements, other than statements of historical fact included or incorporated by reference in this prospectus, regarding our strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. When used in this prospectus and the documents incorporated by reference herein, the words "could," "believe," "anticipate," "intend," "estimate," "expect," "project" and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on our current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. When considering forward-looking statements, you should keep in mind the risk factors and other cautionary statements described under, but not limited to, the heading "Risk Factors" and elsewhere in this prospectus and our most recent Annual Report on Form 10-K, which are incorporated by reference herein, and the cautionary statements included in this prospectus, any applicable prospectus supplement and the other documents incorporated by reference herein. These forward-looking statements are based on management's current belief, based on currently available information, as to the outcome and timing of future events. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to, those summarized below:

S-iv

We caution you that these forward-looking statements are subject to all of the risks and uncertainties, most of which are difficult to predict and many of which are beyond our control, incident to the operation of our business. These risks include, but are not limited to, the risks described under "Risk Factors" in this prospectus.

Should one or more of the risks or uncertainties described in this prospectus occur, or should underlying assumptions prove incorrect, our actual results and plans could differ materially from those expressed in any forward-looking statements.

All forward-looking statements, expressed or implied, included in this prospectus are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that we or persons acting on our behalf may issue.

Except as otherwise required by applicable law, we disclaim any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this prospectus.

S-v

This summary highlights information contained elsewhere in or incorporated by reference into this prospectus supplement and the accompanying base prospectus. Because this is a summary, it may not contain all of the information that may be important to you and to your investment decision. The following summary is qualified in its entirety by the more detailed information and financial statements and notes thereto included elsewhere in this prospectus supplement, the accompanying base prospectus and the documents incorporated herein by reference and other documents to which we refer. You should read "Risk Factors" beginning on page S-11 of this prospectus supplement, on page 7 of the accompanying base prospectus and in our Annual Report on Form 10-K for the year ended December 31, 2018 for more information about important risks that you should consider carefully before buying our Class A common stock.

Cactus, Inc. ("Cactus Inc."), the issuer in this offering, is a holding company whose only material asset is an equity interest consisting of units representing limited liability company interests in Cactus Wellhead, LLC ("Cactus LLC"). Cactus Inc. became the managing member of Cactus LLC upon completion of Cactus Inc.'s IPO (as defined below) and is responsible for all operational, management and administrative decisions relating to Cactus LLC's business and consolidates the financial results of Cactus LLC and its subsidiaries. Cactus LLC is our predecessor for financial reporting purposes. Unless otherwise indicated in this prospectus supplement or the context requires otherwise, references to "Cactus," the "Company," "us," "we," "our," "ours" or like terms refer to (i) Cactus LLC and its consolidated subsidiaries prior to the completion of our initial public offering on February 12, 2018 (our "IPO") and (ii) Cactus Inc. and its consolidated subsidiaries (including Cactus LLC) following the completion of our IPO, unless we state otherwise or the context otherwise requires.

We design, manufacture, sell and rent a range of wellhead and pressure control equipment. Our products are sold and rented principally for onshore uncoventional oil and gas wells and are utilized during the drilling, completion and production phases of our customers' wells. In addition, we provide field services for all of our products and rental items to assist with the installation, maintenance and handling of the wellhead and pressure control equipment.

Our principal products include our Cactus SafeDrill® wellhead systems as well as frac stacks, zipper manifolds and production trees that we design and manufacture. Every oil and gas well requires a wellhead, which is installed at the onset of the drilling process that remains with the well through its entire productive life. The Cactus SafeDrill® wellhead systems employ technology which allows technicians to land and secure casing strings more safely from the rig floor, reducing the need to descend into the cellar. We believe we are a market leader in the application of such technology, with thousands of our products sold and installed across the United States since 2011. During the completion phase of a well, we rent frac stacks, zipper manifolds and other high-pressure equipment that are used for well control and for managing the transmission of frac fluids and proppants during the hydraulic fracturing process. These severe service applications require robust and reliable equipment. For the subsequent production phase of a well, we sell production trees that regulate hydrocarbon production, which are installed on the wellhead after the frac stack has been removed. In addition, we provide mission-critical field services for all of our products and rental items, including 24-hour service crews to assist with the installation, maintenance, repair and safe handling of the wellhead and pressure control equipment.

Our innovative wellhead products and pressure control equipment are developed internally. We believe our close relationship with our customers provides us with insight into the specific issues encountered in the drilling and completion processes, allowing us to provide them appropriate product and service solutions. We have achieved significant market share, as measured by the percentage of

S-1

total active U.S. onshore rigs that we follow (which we define as the number of active U.S. onshore drilling rigs to which we are the primary provider of wellhead products and corresponding services during drilling), and brand name recognition with respect to our engineered products, which we believe is due to our focus on safety, reliability, cost effectiveness and time saving features. We optimize our products for pad drilling (i.e., the process of drilling multiple wellbores from a single surface location) to reduce rig time and provide operators with significant efficiencies that translate to cost savings at the wellsite.

Our manufacturing and production facilities are located in Bossier City, Louisiana and Suzhou, China. Although both facilities can produce our full range of products, our Bossier City facility has advanced capabilities and is designed to support time-sensitive and rapid turnaround orders, while our facility in China is optimized for longer lead time orders and outsources its machining requirements. Both our Bossier City and China facilities are licensed to the latest American Petroleum Institute ("API") 6A specification for both wellheads and valves and API Q1 and ISO9001:2015 quality management systems.

We operate 15 service centers in the United States, which are strategically located in the key oil and gas producing regions, including the Permian, SCOOP/STACK, Marcellus, Utica, Eagle Ford, Bakken and other active oil and gas regions in the United States. We also have one service center in Eastern Australia. These service centers support our field services and provide equipment assembly and repair services.

Our engineered wellhead and pressure control equipment is designed for horizontal wells and supports greater pad drilling efficiency while enhancing safety. We believe that demand for our products and services will continue to increase over the medium and long-term as a result of numerous favorable industry trends, including an expected increase in horizontal wells as a percentage of all wells drilled and an industry shift towards pad drilling and simultaneous fracturing operations, for which we believe exploration and production companies will seek to work with vendors that can provide a variety of products and services to reduce pad congestion and who are focused on reliability and quality.

In February 2019, Rystad Energy reported that in the Delaware Basin, the number of wells drilled on a pad as a percentage of all wells drilled increased by 22% in 2014, 35% in 2015, 39% in 2016, 56% in 2017 and 66% in 2018. In the Marcellus region in 2018, the number of wells drilled on a pad was 95% of all wells drilled, compared to a national onshore average of 76%. In addition, Rystad Energy reported that the average number of wells per pad in the Delaware Basin was 2.5 in 2018, compared to 2.2 in 2014, 2.2 in 2015, 2.4 in 2016 and 2.5 in 2017. In 2018, in the Marcellus region, the average number of wells per pad was 4.9 wells, compared to a national average of 3.3 wells.

S-2

The table below sets forth the number of active U.S. onshore rigs that we followed, the total number of active U.S. onshore rigs as reported by Baker Hughes and the percentage of the total number of active U.S. onshore rigs that we followed, as of the dates presented. We believe that comparing the total number of active U.S. onshore rigs to which we are providing our products and services at a given time to the total number of active U.S. onshore rigs on or about such time provides us with a reasonable approximation of our market share with respect to our wellhead products sold and the corresponding services we provide.

As of Mid-Month | Number of Active U.S. Onshore Rigs We Followed(1) | Total Number of Active U.S. Onshore Rigs(2) | Our Percentage of the Total Number of Active U.S. Onshore Rigs(3) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

December 2011 | 15 | 1,931 | 0.8 | % | ||||||

June 2012 | 47 | 1,899 | 2.5 | % | ||||||

December 2012 | 75 | 1,729 | 4.3 | % | ||||||

June 2013 | 100 | 1,694 | 5.9 | % | ||||||

December 2013 | 119 | 1,703 | 7.0 | % | ||||||

June 2014 | 158 | 1,780 | 8.9 | % | ||||||

December 2014 | 179 | 1,820 | 9.8 | % | ||||||

June 2015 | 119 | 825 | 14.4 | % | ||||||

December 2015 | 99 | 684 | 14.5 | % | ||||||

June 2016 | 68 | 388 | 17.5 | % | ||||||

December 2016 | 129 | 601 | 21.5 | % | ||||||

June 2017 | 220 | 902 | 24.4 | % | ||||||

December 2017 | 245 | 909 | 27.0 | % | ||||||

June 2018 | 275 | 1,035 | 26.6 | % | ||||||

December 2018 | 295 | 1,045 | 28.2 | % | ||||||

Our Principal Executive Offices

Our principal executive offices are located at 920 Memorial City Way, Suite 300, Houston, Texas 77024, and our telephone number at that address is (713) 626-8800. Our website address is www.CactusWHD.com. Information contained on our website does not constitute part of this prospectus.

S-3

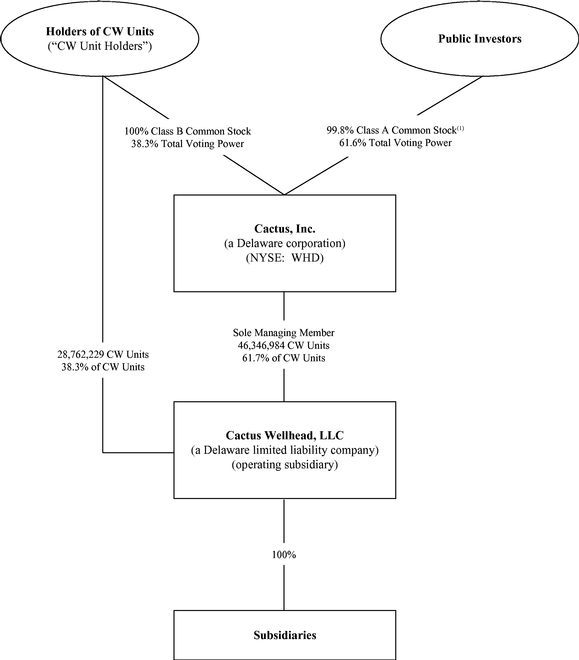

Cactus Inc. was incorporated as a Delaware corporation on February 17, 2017 for the purpose of completing an initial public offering and related transactions. On February 12, 2018, following the completion of our IPO, Cactus Inc. became a holding company whose only material asset is an equity interest consisting of units representing limited liability company interests ("CW Units") in Cactus LLC, the operating subsidiary through which we operate our business. Cactus Inc. is the sole managing member of Cactus LLC. The following diagram indicates our simplified ownership structure immediately following this offering and the transactions related thereto.

S-4

Class A common stock offered by the selling stockholders | 8,500,000 shares. | |

Class A common stock outstanding before this offering | 37,873,071 shares. | |

Class A common stock to be outstanding immediately after completion of this offering | 46,346,984 shares. | |

Class B common stock to be outstanding immediately after completion of this offering | 28,762,229 shares, or one share for each CW Unit held by the CW Unit Holders immediately following the completion of this offering. Each share of our Class B common stock has no economic rights but entitles its holder to one vote. When a CW Unit is redeemed for a share of our Class A common stock pursuant to the exercise of the Redemption Right (as defined below) or our Call Right (as defined below), a corresponding share of our Class B common stock will be canceled. | |

Voting power of Class A common stock outstanding after giving effect to this offering | 61.7% (or 100% if all outstanding CW Units held by the CW Unit Holders are redeemed, along with a corresponding number of shares of our Class B common stock, for newly-issued shares of our Class A common stock on a one-for-one basis). | |

Voting power of Class B common stock outstanding after giving effect to this offering | 38.3% (or 0% if all outstanding CW Units held by the CW Unit Holders are redeemed, along with a corresponding number of shares of our Class B common stock, for newly-issued shares of our Class A common stock on a one-for-one basis). | |

Use of proceeds | We will not receive any proceeds from the sale of shares of our Class A common stock by the selling stockholders in this offering. |

S-5

Voting rights | Each share of our Class A common stock entitles its holder to one vote on all matters to be voted on by stockholders generally. Each share of our Class B common stock entitles its holder to one vote on all matters to be voted on by stockholders generally. Holders of our Class A common stock and Class B common stock vote together as a single class on all matters presented to our stockholders for their vote or approval, except as otherwise required by applicable law or by our amended and restated certificate of incorporation. See "Description of Capital Stock" on page 9 of the accompanying base prospectus. | |

Dividend policy | We have not paid any dividends to holders of our common stock. Our future dividend policy is within the discretion of our board of directors. In addition, our credit agreement includes conditions on our ability to pay cash dividends. See "Description of Capital Stock" on page 9 of the accompanying base prospectus. | |

Redemption rights of holders of CW Units | Under the Cactus Wellhead LLC Agreement, each CW Unit Holder, subject to certain limitations, has the right (the "Redemption Right") to cause Cactus LLC to acquire all or at least a minimum portion of its CW Units for, at Cactus LLC's election, (x) shares of our Class A common stock at a redemption ratio of one share of our Class A common stock for each CW Unit redeemed, subject to conversion rate adjustments for stock splits, stock dividends and reclassifications and other similar transactions, or (y) an equivalent amount of cash. Alternatively, upon the exercise of the Redemption Right, Cactus Inc. (instead of Cactus LLC) will have the right (the "Call Right") to acquire each tendered CW Unit directly from the exchanging CW Unit Holder for, at its election, (x) one share of our Class A common stock, subject to conversion rate adjustments for stock splits, stock dividends and reclassifications and other similar transactions, or (y) an equivalent amount of cash. In connection with any redemption of CW Units pursuant to the Redemption Right or our Call Right, a corresponding number of shares of our Class B common stock will be canceled. See "Redemption of CW Units and Class B Common Stock" on page 19 of the accompanying base prospectus. In connection with this offering, selling stockholders who own CW Units will exercise their Redemption Rights with respect to an aggregate of 8,473,913 CW Units, and upon such exercise, Cactus Inc. will acquire each CW Unit directly from such selling stockholders for one share of our Class A common stock pursuant to its Call Right. |

S-6

Risk factors | You should consider carefully all of the information included or incorporated by reference in this prospectus supplement and the accompanying base prospectus. In particular, before making an investment decision, you should evaluate the risks set forth under "Risk Factors" beginning on page S-11 of this prospectus supplement, page 7 of the accompanying base prospectus and in our Annual Report on Form 10-K for the year ended December 31, 2018. | |

New York Stock Exchange symbol | WHD. |

S-7

SUMMARY HISTORICAL FINANCIAL DATA

The following tables show selected historical consolidated financial data, for the periods and as of the dates indicated, of Cactus Inc. and subsidiaries. Our historical results are not necessarily indicative of future results. The following selected financial and operating data should be read in conjunction with "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations" and the consolidated financial statements and related notes in our Annual Report on Form 10-K for the year ended December 31, 2018, which is incorporated by reference in this prospectus.

| | Year Ended December 31, | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2018 | 2017 | 2016 | 2015 | |||||||||

| | (in thousands, except per unit data) | ||||||||||||

Consolidated Statements of Income Data: | |||||||||||||

Total revenues | $ | 544,135 | $ | 341,191 | $ | 155,048 | $ | 221,395 | |||||

Total costs and expenses | 366,434 | 252,328 | 144,433 | 179,190 | |||||||||

| | | | | | | | | | | | | | |

Income from operations | 177,701 | 88,863 | 10,615 | 42,205 | |||||||||

| | | | | | | | | | | | | | |

Interest expense, net | (3,595 | ) | (20,767 | ) | (20,233 | ) | (21,837 | ) | |||||

Other income (expense), net | (4,305 | ) | — | 2,251 | 1,640 | ||||||||

| | | | | | | | | | | | | | |

Income (loss) before income taxes | 169,801 | 68,096 | (7,367 | ) | 22,008 | ||||||||

Income tax expense(1) | 19,520 | 1,549 | 809 | 784 | |||||||||

| | | | | | | | | | | | | | |

Net income (loss) | $ | 150,281 | $ | 66,547 | $ | (8,176 | ) | $ | 21,224 | ||||

Less: pre-IPO net income attributable to Cactus LLC | 13,648 | 66,547 | (8,176 | ) | 21,224 | ||||||||

Less: net income attributable to non-controlling interest | 84,950 | — | — | — | |||||||||

| | | | | | | | | | | | | | |

Net income attributable to Cactus Inc. | $ | 51,683 | $ | — | $ | — | $ | — | |||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Earnings per Class A share—basic(2) | $ | 1.60 | $ | — | $ | — | $ | — | |||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Earnings per Class A share—diluted(2) | $ | 1.58 | $ | — | $ | — | $ | — | |||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Weighted average Class A shares outstanding—basic(2) | 32,329 | — | — | — | |||||||||

Weighted average Class A shares outstanding—diluted(2) | 32,695 | — | — | — | |||||||||

Consolidated Balance Sheets Data (at period end): | |||||||||||||

Cash and cash equivalents | $ | 70,841 | $ | 7,574 | $ | 8,688 | $ | 12,526 | |||||

Total assets | 584,744 | 266,456 | 165,328 | 177,559 | |||||||||

Long-term debt, net(3) | — | 241,437 | 242,254 | 250,555 | |||||||||

Capital leases | 16,094 | 12,613 | 3,199 | — | |||||||||

Stockholders'/Members' equity (deficit)(2)(4) | 362,328 | (36,217 | ) | (103,321 | ) | (93,167 | ) | ||||||

Consolidated Statements of Cash Flows Data: | |||||||||||||

Net cash provided by (used in): | |||||||||||||

Operating activities | $ | 167,180 | $ | 34,707 | $ | 23,975 | $ | 45,927 | |||||

Investing activities | (68,154 | ) | (30,678 | ) | (17,358 | ) | (23,422 | ) | |||||

Financing activities | (35,004 | ) | (5,313 | ) | (10,171 | ) | (22,776 | ) | |||||

Other Financial Data (unaudited): | |||||||||||||

EBITDA(5) | $ | 203,549 | $ | 112,134 | $ | 34,107 | $ | 64,425 | |||||

Adjusted EBITDA(5) | $ | 212,558 | $ | 112,134 | $ | 32,217 | $ | 63,144 | |||||

S-8

entity-level taxes for certain states within the United States. Additionally, our operations in both Australia and China are subject to local country income taxes.

Non-GAAP Financial Measures

EBITDA and Adjusted EBITDA

EBITDA and Adjusted EBITDA are not measures of net income as determined by GAAP. EBITDA and Adjusted EBITDA are supplemental non-GAAP financial measures that are used by management and external users of our consolidated financial statements, such as industry analysts, investors, lenders and rating agencies. We define EBITDA as net income excluding net interest expense, income tax and depreciation and amortization. We define Adjusted EBITDA as EBITDA excluding (gain) loss on debt extinguishment and stock-based compensation expense.

Management believes EBITDA and Adjusted EBITDA are useful because they allow management to more effectively evaluate our operating performance and compare the results of our operations from period to period without regard to our financing methods or capital structure, or other items that impact comparability of financial results from period to period. EBITDA and Adjusted EBITDA should not be considered as alternatives to, or more meaningful than, net income or any other measure as determined in accordance with GAAP. Our computations of EBITDA and Adjusted EBITDA may not be comparable to other similarly titled measures of other companies. We present EBITDA and Adjusted EBITDA because we believe they provide useful information regarding the factors and trends affecting our business.

S-9

The following table presents a reconciliation of EBITDA and Adjusted EBITDA to the GAAP financial measure of net income (loss) for each of the periods indicated (unaudited and in thousands).

| | Year Ended December 31, | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2018 | 2017 | 2016 | 2015 | |||||||||

| | (in thousands, except per unit data) | ||||||||||||

Net income (loss) | $ | 150,281 | $ | 66,547 | $ | (8,176 | ) | $ | 21,224 | ||||

| | | | | | | | | | | | | | |

Interest expense, net | 3,595 | 20,767 | 20,233 | 21,837 | |||||||||

Income tax expense | 19,520 | 1,549 | 809 | 784 | |||||||||

Depreciation and amortization | 30,153 | 23,271 | 21,241 | 20,580 | |||||||||

| | | | | | | | | | | | | | |

EBITDA | 203,549 | 112,134 | 34,107 | 64,425 | |||||||||

| | | | | | | | | | | | | | |

(Gain) loss on debt extinguishment | 4,305 | — | (2,251 | ) | (1,640 | ) | |||||||

Stock-based compensation | 4,704 | — | 361 | 359 | |||||||||

| | | | | | | | | | | | | | |

Adjusted EBITDA | $ | 212,558 | $ | 112,134 | $ | 32,217 | $ | 63,144 | |||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

For the year ended December 31, 2014, we had total revenues of $259.5 million and EBITDA of $88.8 million, representing net income of $59.1 million, excluding net interest expense of $11.2 million, income tax expense of $0.3 million and depreciation and amortization of $18.2 million. There was no early extinguishment of debt and $1.3 million of stock-based compensation in 2014. Adjusted EBITDA was $90.1 million for 2014.

S-10

An investment in our Class A common stock involves a significant degree of risk. Before you invest in our Class A common stock you should carefully consider those risk factors described herein and under, but not limited to, the heading "Risk Factors" and elsewhere in our Annual Report on Form 10-K for the year ended December 31, 2018, as they may be amended, supplemented or superseded from time to time by other reports that we subsequently file with the SEC and in our other filings with the SEC, which are incorporated by reference in this prospectus supplement and the accompanying base prospectus. The risks described are not the only ones we face. Additional risks not presently known to us or that we currently deem immaterial individually or in the aggregate as well as the additional risks and uncertainties described elsewhere in this prospectus supplement or in the documents incorporated by reference in this prospectus supplement may also adversely affect our business, operating results, financial condition and prospects, as well as the value of an investment in our Class A common stock. If any of these risks were actually to occur, our business, financial condition or results of operations could be materially adversely affected. Additional risks not presently known to us or that we currently believe are immaterial may also significantly impair our business operations and financial condition. Please also read "Cautionary Statement Regarding Forward-Looking Statements" beginning on page S-iv of this prospectus supplement and page 5 of the accompanying base prospectus.

The underwriters of this offering may waive or release parties to the lock-up agreements entered into in connection with this offering, which could adversely affect the price of our Class A common stock.

We, our executive officers and directors, Cadent and the other selling stockholders have entered or will enter into lock-up agreements pursuant to which we and they will be subject to certain restrictions with respect to the sale or other disposition of our Class A common stock for a period of 60 days following the date of this prospectus supplement. The representative of the underwriters, at any time and without notice, may release all or any portion of the Class A common stock subject to the foregoing lock-up agreements. See "Underwriting" for more information on these agreements. If the restrictions under the lock-up agreements are waived, then the Class A common stock, subject to compliance with the Securities Act or exceptions therefrom, will be available for sale into the public markets, which could cause the market price of our Class A common stock to decline and impair our ability to raise capital. Sales of a substantial number of shares upon expiration of the lock-up and market stand-off agreements, the perception that such sales may occur, or early release of these agreements, could cause our market price to fall or make it more difficult for you to sell your Class A common stock at a time and price that you deem appropriate.

S-11

The selling stockholders are selling all of the shares of our Class A common stock being sold in this offering. Accordingly, we will not receive any proceeds from the sale of shares of our Class A common stock in this offering. See "Selling Stockholders" beginning on page S-14 of this prospectus supplement.

We will pay all expenses in connection with the offering of the shares of our Class A common stock to be offered by the selling stockholders under this prospectus supplement including, without limitation, SEC filing fees and expenses and compliance with state securities laws, except that the selling stockholders will pay any underwriting discounts and selling commissions incurred by them in connection with such sales.

S-12

MARKET FOR REGISTRANT'S COMMON EQUITY

Our Class A common stock is listed on the NYSE under the symbol "WHD." On March 18, 2019, the last sales price of our Class A common stock as reported on the New York Stock Exchange was $37.72 per share. As of March 13, 2019, there was one record holder of our Class A common stock and five record holders of our Class B common stock.

S-13

The following table sets forth information regarding the beneficial ownership of our Class A common stock and Class B common stock as of the date of this prospectus supplement by each selling stockholder. In addition, the nature of any position, office or other material relationship which the selling stockholders have had, within the past three years, with us or with any of our predecessors or affiliates, is indicated in a footnote to the table. See "Directors, Executive Officers and Corporate Governance" in our Annual Report on Form 10-K for the year ended December 31, 2018 for more information on certain of our selling stockholders. We have paid all expenses relating to the registration of the shares of our Class A common stock by the selling stockholders under the Securities Act and will pay any other offering expenses, except that the selling stockholders will pay all underwriting discounts and commissions. We will not receive any proceeds from the sale of our Class A common stock by the selling stockholders.

In connection with this offering, selling stockholders who own CW Units will exercise their Redemption Rights with respect to an aggregate of 8,473,913 CW Units, and upon such exercise, Cactus Inc. will acquire each CW Unit directly from such selling stockholders for one share of our Class A common stock pursuant to its Call Right.

We prepared the table based on information provided to us by the selling stockholders. We have not sought to verify such information. The selling stockholders are likely to sell additional shares of our Class A common stock pursuant to registered public offerings and/or exemptions from the registration requirements. The selling stockholders have agreed, subject to certain exceptions and extensions, not to sell any Class A common stock for a period of 60 days from the date of this prospectus. See "Underwriting" for a description of these lock-up provisions.

Beneficial ownership is determined in accordance with the rules and regulations of the SEC. The percentage ownership interests shown in the following table are based on 37,873,071 shares of our Class A common stock and 37,236,142 shares of our Class B common stock issued and outstanding on March 13, 2019.

| | | | | | | | Number of Shares of Class A Common Stock Offered(3) | | | | | | | ||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Shares Beneficially Owned Before this Offering | Shares Beneficially Owned After this Offering | |||||||||||||||||||||||||||||||||||||

| | Class A Common Stock | Class B Common Stock(1) | Combined Voting Power(2) | Class A Common Stock | Class B Common Stock | Combined Voting Power(2) | |||||||||||||||||||||||||||||||||

| | Number | % | Number | % | Number | % | Number | Number | % | Number | % | Number | % | ||||||||||||||||||||||||||

| Selling Stockholder: | |||||||||||||||||||||||||||||||||||||||

Cadent Energy Partners II, L.P.(4) | 5,264 | * | 14,297,466 | 38.4 | 14,302,730 | 19.0 | 5,950,000 | 5,264 | * | 8,347,466 | 29.0 | 8,352,730 | 11.1 | ||||||||||||||||||||||||||

Bender Investment Company(5) | — | — | 21,037,017 | 56.5 | 21,037,017 | 28.0 | 1,802,027 | — | — | 18,738,886 | 65.2 | 18,738,886 | 24.9 | ||||||||||||||||||||||||||

SJB BIC LP(6) | — | — | 133,612 | * | 133,612 | * | 133,612 | — | — | — | — | — | — | ||||||||||||||||||||||||||

JAB BIC LP(7) | — | — | 133,612 | * | 133,612 | * | 133,612 | — | — | — | — | — | — | ||||||||||||||||||||||||||

Steven Bender(8) | 7,820 | * | 228,880 | * | 236,700 | * | 228,880 | 7,820 | * | — | — | 7,820 | * | ||||||||||||||||||||||||||

Lee Boquet(9) | 697 | * | 1,759,655 | 4.7 | 1,760,352 | 2.3 | 192,304 | 697 | * | 1,567,351 | 5.4 | 1,568,048 | 2.1 | ||||||||||||||||||||||||||

Michael McGovern(10) | 5,264 | * | 73,409 | * | 78,673 | * | 17,391 | 5,264 | * | 56,018 | * | 61,282 | * | ||||||||||||||||||||||||||

John (Andy) O'Donnell(11) | 5,264 | * | 68,595 | * | 73,859 | * | 16,087 | 5,264 | * | 52,508 | * | 57,772 | * | ||||||||||||||||||||||||||

Alan Semple(12) | 27,194 | * | — | — | 27,194 | * | 9,130 | 18,064 | * | — | — | 18,064 | * | ||||||||||||||||||||||||||

Gary Rosenthal(13) | 27,194 | * | — | — | 27,194 | * | 16,957 | 10,237 | * | — | — | 10,237 | * | ||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total | 8,500,000 | ||||||||||||||||||||||||||||||||||||||

S-14

S-15

MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES

FOR NON-U.S. HOLDERS

The following discussion is a summary of the material U.S. federal income tax considerations related to the purchase, ownership and disposition of our Class A common stock by a non-U.S. holder (as defined below), that holds our Class A common stock as a "capital asset" (generally property held for investment). This summary is based on the provisions of the Internal Revenue Code of 1986, as amended (the "Code"), U.S. Treasury regulations, administrative rulings and judicial decisions, all as in effect on the date hereof, and all of which are subject to change, possibly with retroactive effect. We have not sought any ruling from the Internal Revenue Service ("IRS") with respect to the statements made and the conclusions reached in the following summary, and there can be no assurance that the IRS or a court will agree with such statements and conclusions.

This summary does not address all aspects of U.S. federal income taxation that may be relevant to non-U.S. holders in light of their personal circumstances. In addition, this summary does not address the Medicare tax on certain investment income, U.S. federal estate or gift tax laws, any state, local or non-U.S. tax laws or any tax treaties. This summary also does not address tax considerations applicable to investors that may be subject to special treatment under the U.S. federal income tax laws, such as:

PROSPECTIVE INVESTORS ARE ENCOURAGED TO CONSULT THEIR TAX ADVISORS WITH RESPECT TO THE APPLICATION OF THE U.S. FEDERAL INCOME TAX LAWS TO THEIR PARTICULAR SITUATIONS, AS WELL AS ANY TAX CONSEQUENCES OF THE PURCHASE, OWNERSHIP AND DISPOSITION OF OUR CLASS A COMMON STOCK ARISING UNDER THE U.S. FEDERAL ESTATE OR GIFT TAX LAWS OR UNDER THE LAWS OF ANY STATE, LOCAL, NON-U.S. OR OTHER TAXING JURISDICTION OR UNDER ANY APPLICABLE INCOME TAX TREATY.

S-16

Non-U.S. Holder Defined

For purposes of this discussion, a "non-U.S. holder" is a beneficial owner of our Class A common stock that is not for U.S. federal income tax purposes a partnership or any of the following:

If a partnership (including an entity or arrangement treated as a partnership for U.S. federal income tax purposes) holds our Class A common stock, the tax treatment of a partner in the partnership generally will depend upon the status of the partner, upon the activities of the partnership and upon certain determinations made at the partner level. Accordingly, we urge partners in partnerships (including entities or arrangements treated as partnerships for U.S. federal income tax purposes) considering the purchase of our Class A common stock to consult their tax advisors regarding the U.S. federal income tax considerations of the purchase, ownership and disposition of our Class A common stock by such partnership.

Distributions

We have not made any distributions on our Class A common stock, and we do not plan to make any distribution for the foreseeable future. However, in the event we do make distributions of cash or other property on our Class A common stock, such distributions will constitute dividends for U.S. federal income tax purposes to the extent paid from our current or accumulated earnings and profits, as determined under U.S. federal income tax principles. To the extent those distributions exceed our current and accumulated earnings and profits, the distributions will be treated as a non-taxable return of capital to the extent of the non-U.S. holder's tax basis in our Class A common stock and thereafter as capital gain from the sale or exchange of such Class A common stock. See "—Gain on Disposition of Class A Common Stock." Subject to the withholding requirements under FATCA (as defined below) and with respect to effectively connected dividends, each of which is discussed below, any distribution made to a non-U.S. holder on our Class A common stock generally will be subject to U.S. withholding tax at a rate of 30% of the gross amount of the distribution unless an applicable income tax treaty provides for a lower rate. To receive the benefit of a reduced treaty rate, a non-U.S. holder must provide the applicable withholding agent with an IRS Form W-8BEN or IRS Form W-8BEN-E (or other applicable or successor form) certifying qualification for the reduced rate.

Dividends paid to a non-U.S. holder that are effectively connected with a trade or business conducted by the non-U.S. holder in the United States (and, if required by an applicable income tax treaty, are treated as attributable to a permanent establishment maintained by the non-U.S. holder in the United States) generally will be taxed on a net income basis at the rates and in the manner generally applicable to United States persons (as defined under the Code). Such effectively connected dividends will not be subject to U.S. withholding tax if the non-U.S. holder satisfies certain certification requirements by providing the applicable withholding agent with a properly executed IRS Form W-8ECI certifying eligibility for exemption. If the non-U.S. holder is a corporation for U.S. federal income tax purposes, it may also be subject to a branch profits tax (at a 30% rate or such lower

S-17

rate as specified by an applicable income tax treaty) on its effectively connected earnings and profits (as adjusted for certain items), which will include effectively connected dividends.

Gain on Disposition of Class A Common Stock

Subject to the discussions below under "—Backup Withholding and Information Reporting," a non-U.S. holder generally will not be subject to U.S. federal income or withholding tax on any gain realized upon the sale or other disposition of our Class A common stock unless:

A non-U.S. holder described in the first bullet point above will be subject to U.S. federal income tax at a rate of 30% (or such lower rate as specified by an applicable income tax treaty) on the amount of such gain, which generally may be offset by U.S. source capital losses.

A non-U.S. holder whose gain is described in the second bullet point above or, subject to the exceptions described in the next paragraph, the third bullet point above generally will be taxed on a net income basis at the rates and in the manner generally applicable to United States persons (as defined under the Code) unless an applicable income tax treaty provides otherwise. If the non-U.S. holder is a corporation for U.S. federal income tax purposes whose gain is described in the second bullet point above, then such gain would also be included in its effectively connected earnings and profits (as adjusted for certain items), which may be subject to a branch profits tax (at a 30% rate or such lower rate as specified by an applicable income tax treaty).

Generally, a corporation is a USRPHC if the fair market value of its United States real property interests equals or exceeds 50% of the sum of the fair market value of its worldwide real property interests and its other assets used or held for use in a trade or business. We believe that we currently are not a USRPHC for U.S. federal income tax purposes, and we do not expect to become a USRPHC for the foreseeable future. However, in the event that we become a USRPHC, as long as our Class A common stock continues to be "regularly traded on an established securities market" (within the meaning of the U.S. Treasury Regulations), only a non-U.S. holder that actually or constructively owns, or owned at any time during the shorter of the five-year period ending on the date of the disposition or the non-U.S. holder's holding period for the Class A common stock, more than 5% of our Class A common stock will be treated as disposing of a U.S. real property interest and will be taxable on gain realized on the disposition of our Class A common stock as a result of our status as a USRPHC. If we were to become a USRPHC and our Class A common stock were not considered to be regularly traded on an established securities market, such holder (regardless of the percentage of stock owned) would be treated as disposing of a U.S. real property interest and would be subject to U.S. federal income tax on a taxable disposition of our Class A common stock (as described in the preceding paragraph), and a 15% withholding tax would apply to the gross proceeds from such disposition.

Non-U.S. holders should consult their tax advisors with respect to the application of the foregoing rules to their ownership and disposition of our Class A common stock.

S-18

Backup Withholding and Information Reporting

Any dividends paid to a non-U.S. holder must be reported annually to the IRS and to the non-U.S. holder. Copies of these information returns may be made available to the tax authorities in the country in which the non-U.S. holder resides or is established. Payments of dividends to a non-U.S. holder generally will not be subject to backup withholding if the non-U.S. holder establishes an exemption by properly certifying its non-U.S. status on an IRS Form W-8BEN or IRS Form W-8BEN-E (or other applicable or successor form).

Payments of the proceeds from a sale or other disposition by a non-U.S. holder of our Class A common stock effected by or through a U.S. office of a broker generally will be subject to information reporting and backup withholding (at the applicable rate) unless the non-U.S. holder establishes an exemption by properly certifying its non-U.S. status on an IRS Form W-8BEN or IRS Form W-8BEN-E (or other applicable or successor form) and certain other conditions are met. Information reporting and backup withholding generally will not apply to any payment of the proceeds from a sale or other disposition of our Class A common stock effected outside the United States by a non-U.S. office of a broker. However, unless such broker has documentary evidence in its records that the non-U.S. holder is not a United States person and certain other conditions are met, or the non-U.S. holder otherwise establishes an exemption, information reporting will apply to a payment of the proceeds of the disposition of our Class A common stock effected outside the United States by such a broker if it has certain relationships within the United States.

Backup withholding is not an additional tax. Rather, the U.S. federal income tax liability (if any) of persons subject to backup withholding will be reduced by the amount of tax withheld. If backup withholding results in an overpayment of taxes, a refund may be obtained, provided that the required information is timely furnished to the IRS.

Additional Withholding Requirements under FATCA

Sections 1471 through 1474 of the Code, and the U.S. Treasury regulations and administrative guidance issued thereunder ("FATCA"), impose a 30% withholding tax on any dividends paid on our Class A common stock if paid to a "foreign financial institution" or a "non-financial foreign entity" (each as defined in the Code) (including, in some cases, when such foreign financial institution or non-financial foreign entity is acting as an intermediary), unless (i) in the case of a foreign financial institution, such institution enters into an agreement with the U.S. government to withhold on certain payments, and to collect and provide to the U.S. tax authorities substantial information regarding U.S. account holders of such institution (which includes certain equity and debt holders of such institution, as well as certain account holders that are non-U.S. entities with U.S. owners); (ii) in the case of a non-financial foreign entity, such entity certifies that it does not have any "substantial United States owners" (as defined in the Code) or provides the applicable withholding agent with a certification identifying the direct and indirect substantial United States owners of the entity (in either case, generally on an IRS Form W-8BEN-E); or (iii) the foreign financial institution or non-financial foreign entity otherwise qualifies for an exemption from these rules and provides appropriate documentation (such as an IRS Form W-8BEN-E). Foreign financial institutions located in jurisdictions that have an intergovernmental agreement with the United States governing these rules may be subject to different rules. Under certain circumstances, a holder might be eligible for refunds or credits of such taxes. Non-U.S. holders are encouraged to consult their own tax advisors regarding the effects of FATCA on their investment in our Class A common stock.

INVESTORS CONSIDERING THE PURCHASE OF OUR CLASS A COMMON STOCK ARE URGED TO CONSULT THEIR OWN TAX ADVISORS REGARDING THE APPLICATION OF THE U.S. FEDERAL INCOME TAX LAWS TO THEIR PARTICULAR SITUATIONS AND THE APPLICABILITY AND EFFECT OF U.S. FEDERAL ESTATE AND GIFT TAX LAWS AND ANY STATE, LOCAL OR NON-U.S. TAX LAWS AND TAX TREATIES.

S-19

Citigroup Global Markets Inc. and Credit Suisse Securities (USA) LLC are acting as joint book-running managers of the offering and as representatives of the underwriters named below. Subject to the terms and conditions stated in the underwriting agreement dated the date of this prospectus supplement, each underwriter named below has severally agreed to purchase, and the selling stockholders have agreed to sell to that underwriter, the number of shares of Class A common stock set forth opposite the underwriter's name.

Underwriter | Number of Shares | |

|---|---|---|

Citigroup Global Markets Inc. | ||

Credit Suisse Securities (USA) LLC | ||

| | | |

Total | ||

| | | |

| | | |

| | | |

The underwriting agreement provides that the obligations of the underwriters to purchase the shares of Class A common stock included in this offering are subject to approval of legal matters by counsel and to other conditions. The underwriters are obligated to purchase all the shares if they purchase any of the shares.

The underwriters may offer the shares of Class A common stock offered hereby from time to time for sale in one or more transactions on the NYSE, in the over-the-counter market, through negotiated transactions or otherwise at market prices prevailing at the time of sale, at prices related to prevailing market prices or at negotiated prices, subject to receipt and acceptance by them and subject to their right to reject any order in whole or in part. The underwriters may effect such transactions by selling shares to or through dealers, and such dealers may receive compensation in the form of discounts, concessions or commissions from the underwriters and/or purchasers of shares for whom they may act as agents or to whom they may sell as principal. The difference between the price at which the underwriters purchase the shares of Class A common stock and the price at which the underwriters resell such shares may be deemed underwriting compensation.

We, our executive officers and directors, Cadent and the other selling stockholders have agreed that, subject to certain exceptions, for a period of 60 days from the date of this prospectus supplement, we and they will not, without the prior written consent of Citigroup and Credit Suisse, dispose of or hedge any shares or any securities convertible into or exchangeable for our Class A common stock. Citigroup and Credit Suisse in their sole discretion may release any of the securities subject to these lock-up agreements at any time, which, in the case of officers and directors, shall be with notice.

Our Class A common stock is listed on the NYSE under the symbol "WHD."

We estimate that the expenses of this offering (excluding underwriting discounts and commissions) will be approximately $1.0 million, all of which will be paid by us. We have agreed to reimburse the underwriters for their expenses relating to the clearance of this offering with the Financial Industry Regulatory Authority, Inc. (including filing fees and the reasonable fees and expenses of counsel for the underwriters relating to such filings) up to $25,000.

In connection with the offering, the underwriters may purchase and sell shares of Class A common stock in the open market. Purchases and sales in the open market may include short sales, purchases to cover short positions and stabilizing purchases.

S-20

Purchases to cover short positions and stabilizing purchases, as well as other purchases by the underwriters for their own accounts, may have the effect of preventing or retarding a decline in the market price of the shares of Class A common stock. They may also cause the price of the shares of Class A common stock to be higher than the price that would otherwise exist in the open market in the absence of these transactions. The underwriters may conduct these transactions on the NYSE, in the over-the-counter market or otherwise. If the underwriters commence any of these transactions, they may discontinue them at any time.

We and the selling stockholders have agreed to indemnify the underwriters against certain liabilities, including liabilities under the Securities Act, or to contribute to payments the underwriters may be required to make in respect of those liabilities.

The underwriters are full service financial institutions engaged in various activities, which may include securities trading, commercial and investment banking, financial advisory, investment management, principal investment, hedging, financing and brokerage activities. Certain of the underwriters and their respective affiliates have in the past performed commercial banking, investment banking and advisory services for us from time to time for which they have received customary fees and reimbursement of expenses and may, from time to time, engage in transactions with and perform services for us in the ordinary course of their business for which they may receive customary fees and reimbursement of expenses.

In the ordinary course of their various business activities, the underwriters and their respective affiliates may make or hold a broad array of investments and actively trade debt and equity securities (or related derivative securities) and financial instruments (which may include bank loans and/or credit default swaps) for their own account and for the accounts of their customers and may at any time hold long and short positions in such securities and instruments. Such investments and securities activities may involve securities and/or instruments of ours or our affiliates. The underwriters and their affiliates may also make investment recommendations and/or publish or express independent research views in respect of such securities or financial instruments and may hold, or recommend to clients that they acquire, long and/or short positions in such securities and instruments.

Electronic Distribution

In connection with the offering, certain of the underwriters or securities dealers may distribute prospectuses by electronic means, such as email.

Notice to Prospective Investors in Australia

No prospectus or other disclosure document (as defined in the Corporations Act 2001 (Cth) of Australia ("Corporations Act")) in relation to the common stock has been or will be lodged with the Australian Securities & Investments Commission ("ASIC"). This document has not been lodged with ASIC and is only directed to certain categories of exempt persons. Accordingly, if you receive this document in Australia:

(a) you confirm and warrant that you are either:

(i) a "sophisticated investor" under section 708(8)(a) or (b) of the Corporations Act;

(ii) a "sophisticated investor" under section 708(8)(c) or (d) of the Corporations Act and that you have provided an accountant's certificate to us which complies with the requirements of section 708(8)(c)(i) or (ii) of the Corporations Act and related regulations before the offer has been made;

S-21

(iii) a person associated with the company under section 708(12) of the Corporations Act; or

(iv) a "professional investor" within the meaning of section 708(11)(a) or (b) of the Corporations Act, and to the extent that you are unable to confirm or warrant that you are an exempt sophisticated investor, associated person or professional investor under the Corporations Act any offer made to you under this document is void and incapable of acceptance; and

(b) you warrant and agree that you will not offer any of the common stock for resale in Australia within 12 months of that common stock being issued unless any such resale offer is exempt from the requirement to issue a disclosure document under section 708 of the Corporations Act.

Notice to Prospective Investors in Canada

The shares may be sold in Canada only to purchasers purchasing, or deemed to be purchasing, as principal that are accredited investors, as defined in National Instrument 45-106 Prospectus Exemptions or subsection 73.3(1) of theSecurities Act (Ontario), and are permitted clients, as defined in National Instrument 31-103Registration Requirements, Exemptions and Ongoing Registrant Obligations. Any resale of the shares must be made in accordance with an exemption from, or in a transaction not subject to, the prospectus requirements of applicable securities laws.

Securities legislation in certain provinces or territories of Canada may provide a purchaser with remedies for rescission or damages if this prospectus (including any amendment thereto) contains a misrepresentation, provided that the remedies for rescission or damages are exercised by the purchaser within the time limit prescribed by the securities legislation of the purchaser's province or territory. The purchaser should refer to any applicable provisions of the securities legislation of the purchaser's province or territory for particulars of these rights or consult with a legal advisor.

Pursuant to section 3A.3 of National Instrument 33-105Underwriting Conflicts ("NI 33-105"), the underwriters are not required to comply with the disclosure requirements of NI 33-105 regarding underwriter conflicts of interest in connection with this offering.

Notice to Prospective Investors in the European Economic Area

In relation to each member state of the European Economic Area that has implemented the Prospectus Directive (each, a relevant member state), with effect from and including the date on which the Prospectus Directive is implemented in that relevant member state (the relevant implementation date), an offer of shares described in this prospectus supplement may not be made to the public in that relevant member state other than:

provided that no such offer of shares shall require us or any underwriter to publish a prospectus pursuant to Article 3 of the Prospectus Directive.

For purposes of this provision, the expression an "offer of securities to the public" in any relevant member state means the communication in any form and by any means of sufficient information on the terms of the offer and the shares to be offered so as to enable an investor to decide to purchase or subscribe for the shares, as the expression may be varied in that member state by any measure

S-22

implementing the Prospectus Directive in that member state, and the expression "Prospectus Directive" means Directive 2003/71/EC (and amendments thereto, including the 2010 PD Amending Directive, to the extent implemented in the relevant member state) and includes any relevant implementing measure in the relevant member state. The expression 2010 PD Amending Directive means Directive 2010/73/EU.

The sellers of the shares have not authorized and do not authorize the making of any offer of shares through any financial intermediary on their behalf, other than offers made by the underwriters with a view to the final placement of the shares as contemplated in this prospectus supplement. Accordingly, no purchaser of the shares, other than the underwriters, is authorized to make any further offer of the shares on behalf of the sellers or the underwriters.

Notice to Prospective Investors in the United Kingdom

This prospectus supplement and the accompanying prospectus are only being distributed to, and are only directed at, persons in the United Kingdom that are qualified investors within the meaning of Article 2(1)(e) of the Prospectus Directive that are also (i) investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the "Order") or (ii) high net worth entities, and other persons to whom it may lawfully be communicated, falling within Article 49(2)(a) to (d) of the Order (each such person being referred to as a "relevant person"). This prospectus supplement and its contents are confidential and should not be distributed, published or reproduced (in whole or in part) or disclosed by recipients to any other persons in the United Kingdom. Any person in the United Kingdom that is not a relevant person should not act or rely on this document or any of its contents.

Notice to Prospective Investors in France

Neither this prospectus supplement nor any other offering material relating to the shares described in this prospectus supplement has been submitted to the clearance procedures of theAutorité des Marchés Financiers or of the competent authority of another member state of the European Economic Area and notified to theAutorité des Marchés Financiers. The shares have not been offered or sold and will not be offered or sold, directly or indirectly, to the public in France. Neither this prospectus supplement nor any other offering material relating to the shares has been or will be:

Such offers, sales and distributions will be made in France only:

The shares may be resold directly or indirectly, only in compliance with articles L.411-1, L.411-2, L.412-1 and L.621-8 through L.621-8-3 of the FrenchCode monétaire et financier.

S-23

Notice to Prospective Investors in Hong Kong

The shares may not be offered or sold in Hong Kong by means of any document other than (i) in circumstances which do not constitute an offer to the public within the meaning of the Companies Ordinance (Cap. 32, Laws of Hong Kong), or (ii) to "professional investors" within the meaning of the Securities and Futures Ordinance (Cap. 571, Laws of Hong Kong) and any rules made thereunder, or (iii) in other circumstances which do not result in the document being a "prospectus" within the meaning of the Companies Ordinance (Cap. 32, Laws of Hong Kong) and no advertisement, invitation or document relating to the shares may be issued or may be in the possession of any person for the purpose of issue (in each case whether in Hong Kong or elsewhere), which is directed at, or the contents of which are likely to be accessed or read by, the public in Hong Kong (except if permitted to do so under the laws of Hong Kong) other than with respect to shares which are or are intended to be disposed of only to persons outside Hong Kong or only to "professional investors" within the meaning of the Securities and Futures Ordinance (Cap. 571, Laws of Hong Kong) and any rules made thereunder.

Notice to Prospective Investors in Switzerland

The shares may not be publicly offered in Switzerland and will not be listed on the SIX Swiss Exchange ("SIX") or on any other stock exchange or regulated trading facility in Switzerland. This document has been prepared without regard to the disclosure standards for issuance prospectuses under art. 652a or art. 1156 of the Swiss Code of Obligations or the disclosure standards for listing prospectuses under art. 27 ff. of the SIX Listing Rules or the listing rules of any other stock exchange or regulated trading facility in Switzerland. Neither this document nor any other offering or marketing material relating to the shares or the offering may be publicly distributed or otherwise made publicly available in Switzerland.

Neither this document nor any other offering or marketing material relating to the offering, the company, the shares have been or will be filed with or approved by any Swiss regulatory authority. In particular, this document will not be filed with, and the offer of shares will not be supervised by, the Swiss Financial Market Supervisory Authority FINMA, and the offer of shares has not been and will not be authorized under the Swiss Federal Act on Collective Investment Schemes ("CISA"). The investor protection afforded to acquirers of interests in collective investment schemes under the CISA does not extend to acquirers of shares.

Notice to Prospective Investors in Japan

The shares offered in this prospectus supplement have not been and will not be registered under the Financial Instruments and Exchange Law of Japan. The shares have not been offered or sold and will not be offered or sold, directly or indirectly, in Japan or to or for the account of any resident of Japan (including any corporation or other entity organized under the laws of Japan), except (i) pursuant to an exemption from the registration requirements of the Financial Instruments and Exchange Law and (ii) in compliance with any other applicable requirements of Japanese law.

Notice to Prospective Investors in Singapore

This prospectus supplement has not been registered as a prospectus with the Monetary Authority of Singapore. Accordingly, this prospectus supplement and any other document or material in connection with the offer or sale, or invitation for subscription or purchase, of the shares may not be circulated or distributed, nor may the shares be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to persons in Singapore other than (i) to an institutional investor under Section 274 of the Securities and Futures Act, Chapter 289 of Singapore (the "SFA"), (ii) to a relevant person pursuant to Section 275(1), or any person pursuant to

S-24

Section 275(1A), and in accordance with the conditions specified in Section 275 of the SFA or (iii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA, in each case subject to compliance with conditions set forth in the SFA.

Where the shares are subscribed or purchased under Section 275 of the SFA by a relevant person which is:

shares, debentures and units of shares and debentures of that corporation or the beneficiaries' rights and interest (howsoever described) in that trust shall not be transferred within six months after that corporation or that trust has acquired the shares pursuant to an offer made under Section 275 of the SFA except:

Singapore Securities and Futures Act Product Classification—Solely for the purposes of its obligations pursuant to sections 309B(1)(a) and 309B(1)(c) of the SFA, the company has determined, and hereby notifies all relevant persons (as defined in Section 309A of the SFA) that the shares are "prescribed capital markets products" (as defined in the Securities and Futures (Capital Markets Products) Regulations 2018) and Excluded Investment Products (as defined in MAS Notice SFA 04-N12: Notice on the Sale of Investment Products and MAS Notice FAA-N16: Notice on Recommendations on Investment Products).

S-25

The validity of our Class A common stock offered by this prospectus will be passed upon for us by Baker Botts L.L.P., New York, New York. Certain legal matters in connection with this offering will be passed upon for the underwriters by Vinson & Elkins L.L.P., New York, New York.

We file annual, quarterly and other reports and other information with the SEC under the Securities Exchange Act of 1934, as amended (the "Exchange Act"). The SEC maintains a website that contains information we file electronically with the SEC, which you can access over the Internet athttp://www.sec.gov. You can also obtain information about us at the offices of the New York Stock Exchange, 20 Broad Street, New York, New York 10005. We also make available free of charge on our website atwww.CactusWHD.com all of the documents that we file with the SEC as soon as reasonably practicable after we electronically file such material with the SEC. Information on our website or any other website is not incorporated by reference into this prospectus and does not constitute a part of this prospectus, and investors should not rely on such information in making a decision to purchase our Class A common stock.

The consolidated financial statements incorporated in this Prospectus by reference to the Annual Report on Form 10-K for the year ended December 31, 2018 have been so incorporated in reliance on the report of PricewaterhouseCoopers LLP, an independent registered public accounting firm, given on the authority of said firm as experts in auditing and accounting.

INFORMATION INCORPORATED BY REFERENCE

The SEC allows us to "incorporate by reference" the information we have filed with the SEC. This means that we can disclose important information to you without actually including the specific information in this prospectus by referring you to other documents filed separately with the SEC. These other documents contain important information about us, our financial condition and results of operations. The information incorporated by reference is an important part of this prospectus. Information that we file later with the SEC will automatically update and may replace information in this prospectus and information previously filed with the SEC.

We incorporate by reference in this prospectus supplement the documents listed below and any subsequent filings we make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (excluding information deemed to be furnished and not filed with the SEC) until all offerings under this registration statement are completed:

You may request a copy of any document incorporated by reference in this prospectus, including the exhibits thereto, at no cost, by writing or telephoning us at the following address or telephone number:

Cactus, Inc.

920 Memorial City Way, Suite 300

Houston, Texas 77024

Phone: (713) 626-8800

Attention: Investor Relations

S-26

PROSPECTUS

Cactus, Inc.

Class A Common Stock

Preferred Stock

Depositary Shares

Warrants

Debt Securities

We may offer and sell the following securities:

In addition, the selling stockholders named in this prospectus or in any supplement to this prospectus may offer and sell shares of our Class A common stock. We or the selling stockholders may offer and sell these securities from time to time in amounts, at prices and on terms to be determined by market conditions and other factors at the time of the offerings. We or the selling stockholders may offer and sell these securities through agents, through underwriters or dealers or directly to one or more purchasers, including existing stockholders.

This prospectus provides you with a general description of these securities and the general manner in which we or the selling stockholders will offer the securities. Each time securities are offered, we will provide a prospectus supplement that will contain specific information about the terms of that offering. The prospectus supplement may also add, update or change information contained in this prospectus.

We will not receive any proceeds from the sales of our common stock by the selling stockholders. See "Selling Stockholders" for a more detailed discussion about the selling stockholders.

Our Class A common stock is traded on the New York Stock Exchange under the symbol "WHD."

We are an "emerging growth company," as that term is defined under the federal securities laws and, as such, may elect to comply with certain reduced public company reporting requirements.

You should read carefully this prospectus, the documents incorporated by reference in this prospectus and any prospectus supplement before you invest. See "Risk Factors" beginning on page 7 of this prospectus for information on certain risks related to the purchase of our securities.