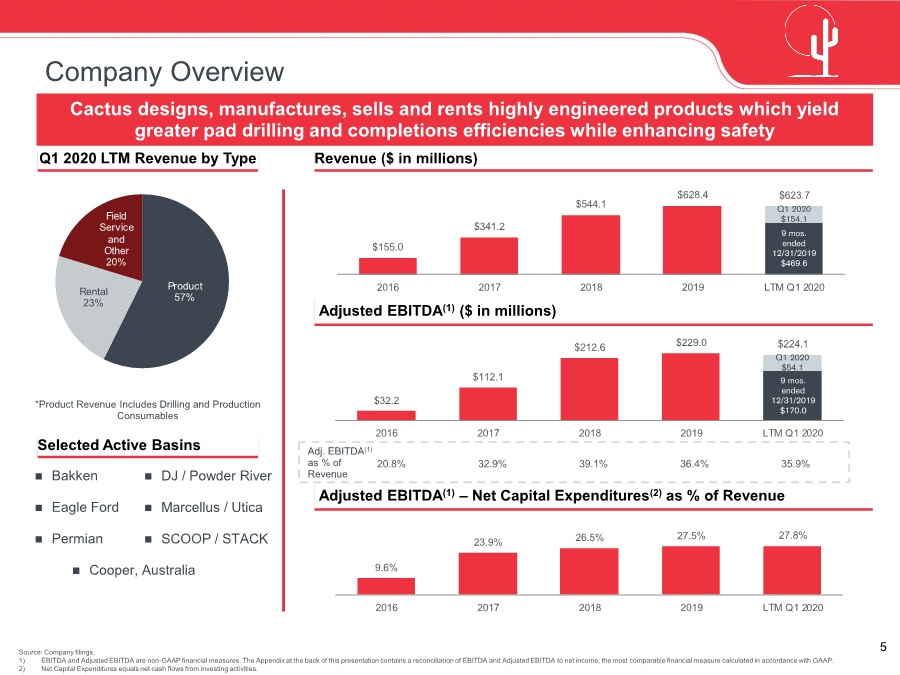

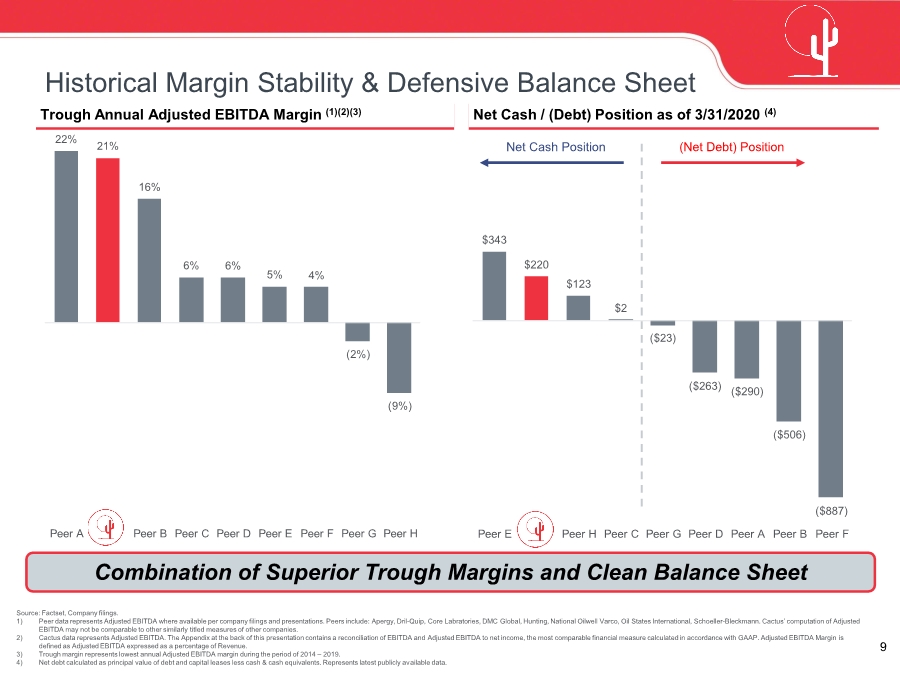

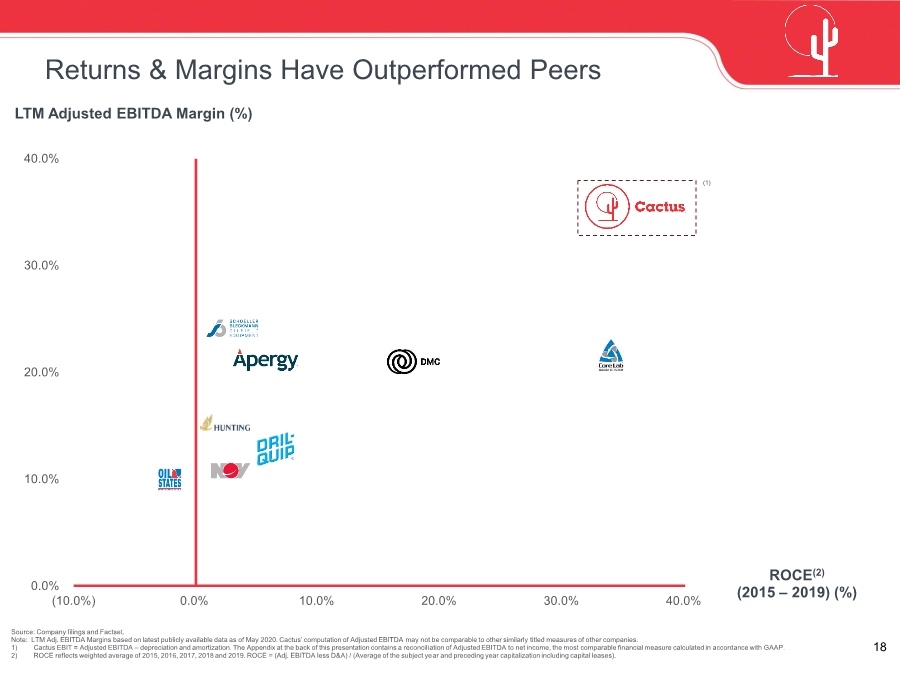

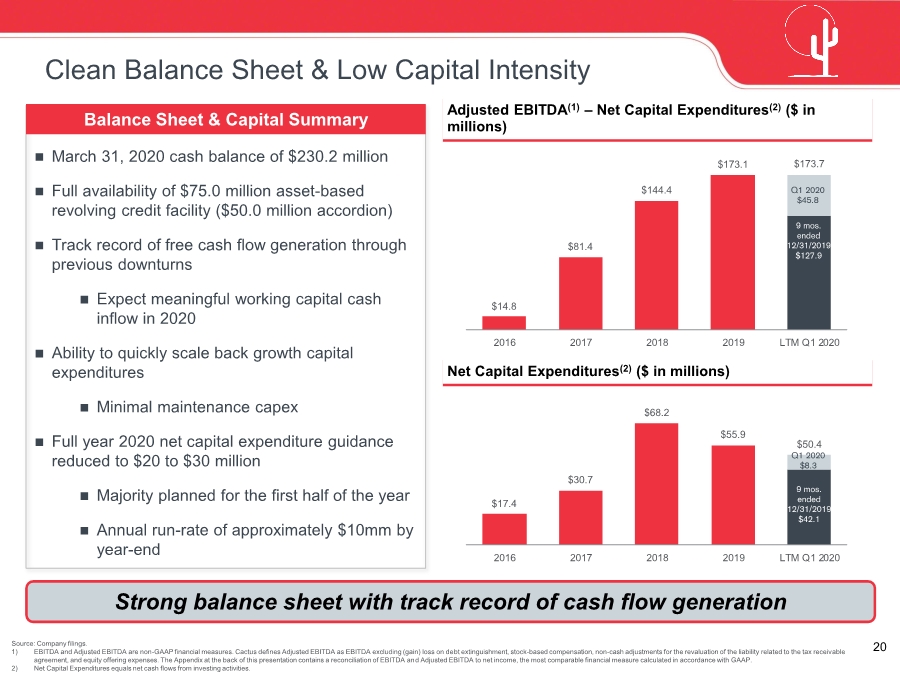

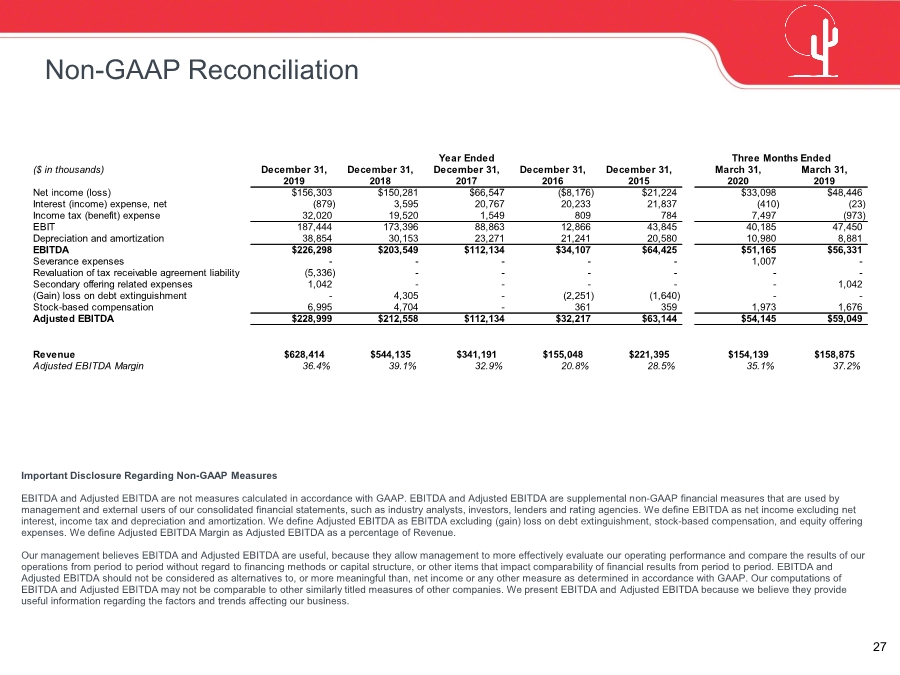

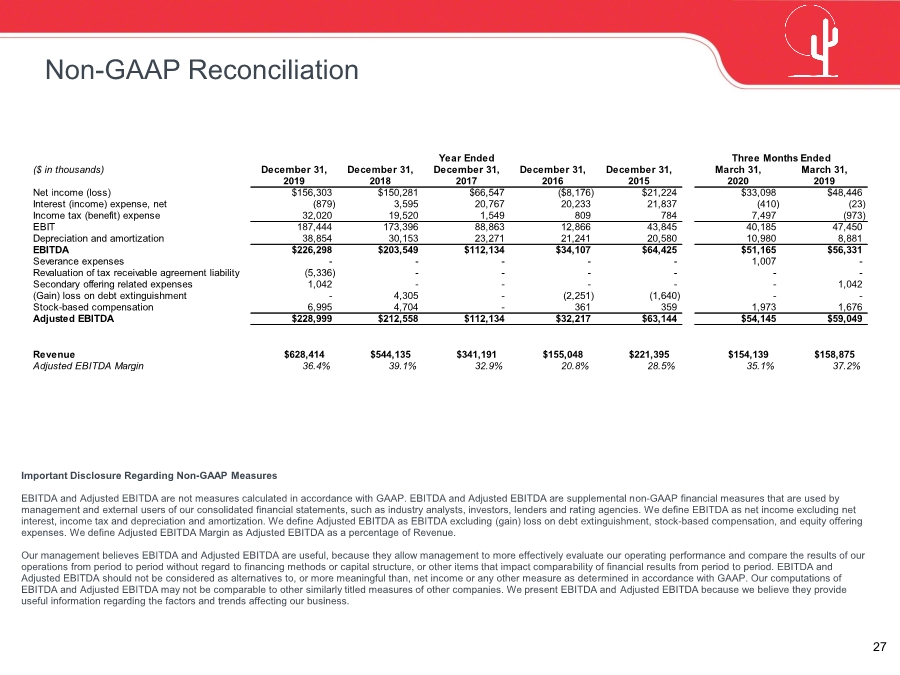

| 27 Important Disclosure Regarding Non-GAAP Measures EBITDA and Adjusted EBITDA are not measures calculated in accordance with GAAP. EBITDA and Adjusted EBITDA are supplemental non-GAAP financial measures that are used by management and external users of our consolidated financial statements, such as industry analysts, investors, lenders and rating agencies. We define EBITDA as net income excluding net interest, income tax and depreciation and amortization. We define Adjusted EBITDA as EBITDA excluding (gain) loss on debt extinguishment, stock-based compensation, and equity offering expenses. We define Adjusted EBITDA Margin as Adjusted EBITDA as a percentage of Revenue. Our management believes EBITDA and Adjusted EBITDA are useful, because they allow management to more effectively evaluate our operating performance and compare the results of our operations from period to period without regard to financing methods or capital structure, or other items that impact comparability of financial results from period to period. EBITDA and Adjusted EBITDA should not be considered as alternatives to, or more meaningful than, net income or any other measure as determined in accordance with GAAP. Our computations of EBITDA and Adjusted EBITDA may not be comparable to other similarly titled measures of other companies. We present EBITDA and Adjusted EBITDA because we believe they provide useful information regarding the factors and trends affecting our business. Year Ended Three Months Ended ($ in thousands) December 31, December 31, December 31, December 31, December 31, March 31, March 31, 2019 2018 2017 2016 2015 2020 2019 Net income (loss) $156,303 $150,281 $66,547 ($8,176) $21,224 $33,098 $48,446 Interest (income) expense, net (879) 3,595 20,767 20,233 21,837 (410) (23) Income tax (benefit) expense 32,020 19,520 1,549 809 784 7,497 (973) EBIT 187,444 173,396 88,863 12,866 43,845 40,185 47,450 Depreciation and amortization 38,854 30,153 23,271 21,241 20,580 10,980 8,881 EBITDA $226,298 $203,549 $112,134 $34,107 $64,425 $51,165 $56,331 Severance expenses - - - - - 1,007 - Revaluation of tax receivable agreement liability (5,336) - - - - - - Secondary offering related expenses 1,042 - - - - - 1,042 (Gain) loss on debt extinguishment - 4,305 - (2,251) (1,640) - - Stock-based compensation 6,995 4,704 - 361 359 1,973 1,676 Adjusted EBITDA $228,999 $212,558 $112,134 $32,217 $63,144 $54,145 $59,049 Revenue $628,414 $544,135 $341,191 $155,048 $221,395 $154,139 $158,875 Adjusted EBITDA Margin 36.4% 39.1% 32.9% 20.8% 28.5% 35.1% 37.2% Non-GAAP Reconciliation |