Gardner Denver

Fourth Quarter 2019 Earnings Conference Call

February 18, 2020 at 8:00 AM Eastern

CORPORATE PARTICIPANTS

Vikram Kini - Investor Relations

Vicente Reynal - Chief Executive Officer

Emily A. Weaver - Chief Financial Officer

PRESENTATION

Operator

Good morning and welcome to the Gardner Denver Fourth Quarter 2019 Earnings Conference Call.

All participants will be in listen-only mode. Should you need assistance, please signal a conference specialist by pressing the star key, followed by zero. After today’s presentation there will be an opportunity to ask questions. Please note this event is being recorded.

I would now like to turn the conference over to Vik Kini, Investor Relations Leader. Please go ahead.

Vikram Kini

Thank you and welcome to the Gardner Denver 2019 Fourth Quarter Earnings Call.

I’m Vik Kini, Gardner Denver’s Investor Relations Leader, and with me today are Vicente Reynal, Chief Executive Officer, and Emily Weaver, Chief Financial Officer.

Our earnings release, which was issued yesterday, and a supplemental presentation, which will be referenced during the call, are both available on the Investor Relations section of our website, gardnerdenver.com. In addition, a replay of this morning’s conference call will be available later today. The replay number, as well as access code can be found on Slide 2 of the presentation.

Before we get started, I would like to remind everyone that certain statements on this call are forward-looking in nature and are subject to the risks and uncertainties discussed in our previous SEC filings which you should read in conjunction with the information provided on this call. For more details on these risks, please refer to Gardner Denver’s Annual Report on Form 10-K filed with the Securities and Exchange Commission, which are available on our website at GardnerDenver.com.

Additional disclosure regarding forward-looking statements is included on Slide 3 of the presentation.

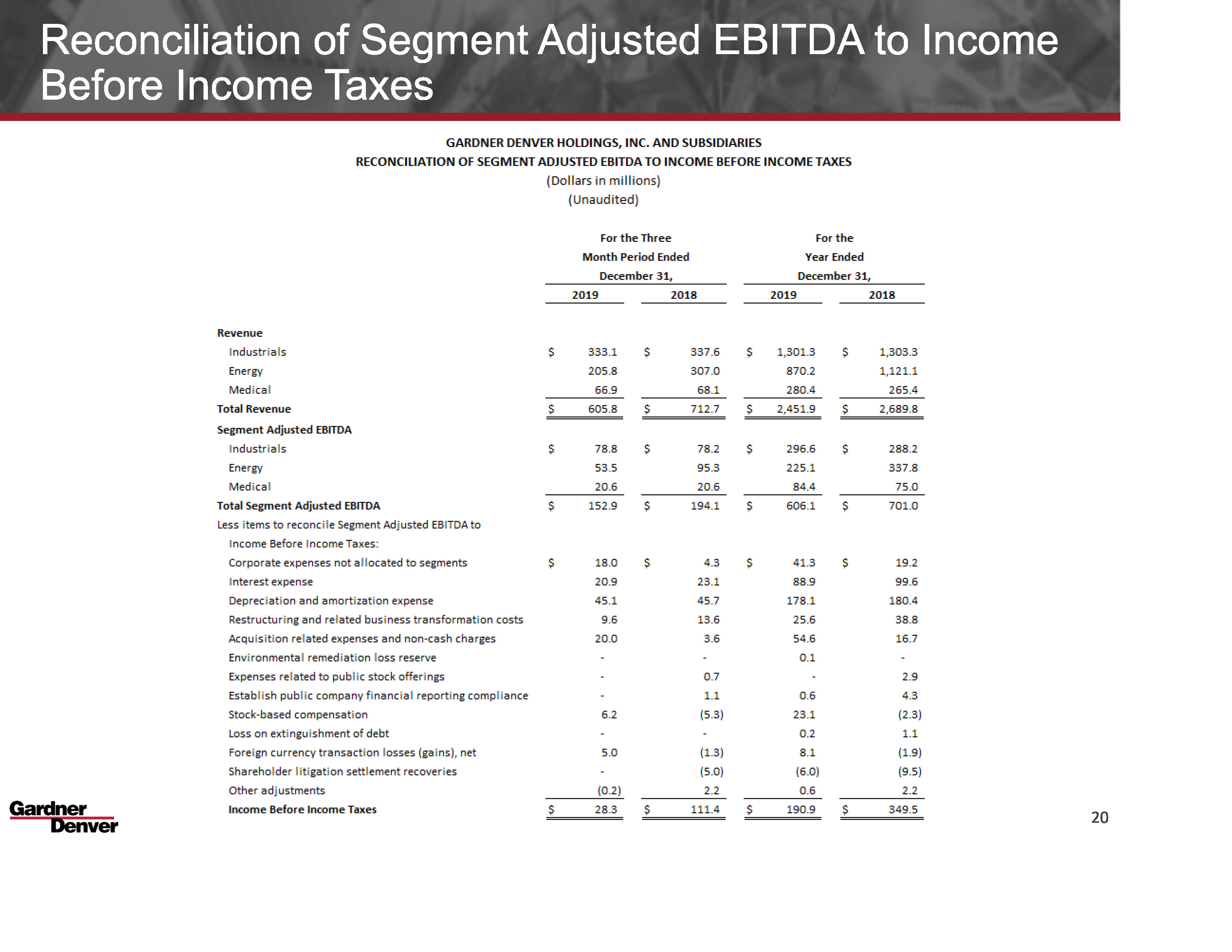

In addition, in today’s remarks we’ll refer to certain non-GAAP financial measures. You can find a reconciliation of these measures to the most comparable measure calculated and presented in accordance with GAAP in our slide presentation and in our earnings release which are both available on the Investor Relations section of our website.

Turning to Slide 4, on today’s call we will review our fourth quarter and total year highlights, as well as an update on the pending transaction with Ingersoll Rand, and introduce 2020 guidance. We will conclude today’s call with a Q&A session. As a reminder, we would ask that each caller keep to one question and one follow-up to allow for enough time for other participants.

At this time, I will now turn it over to Vicente Reynal, Chief Executive Officer.

Vicente Reynal

Thanks, Vik, and good morning to everyone.

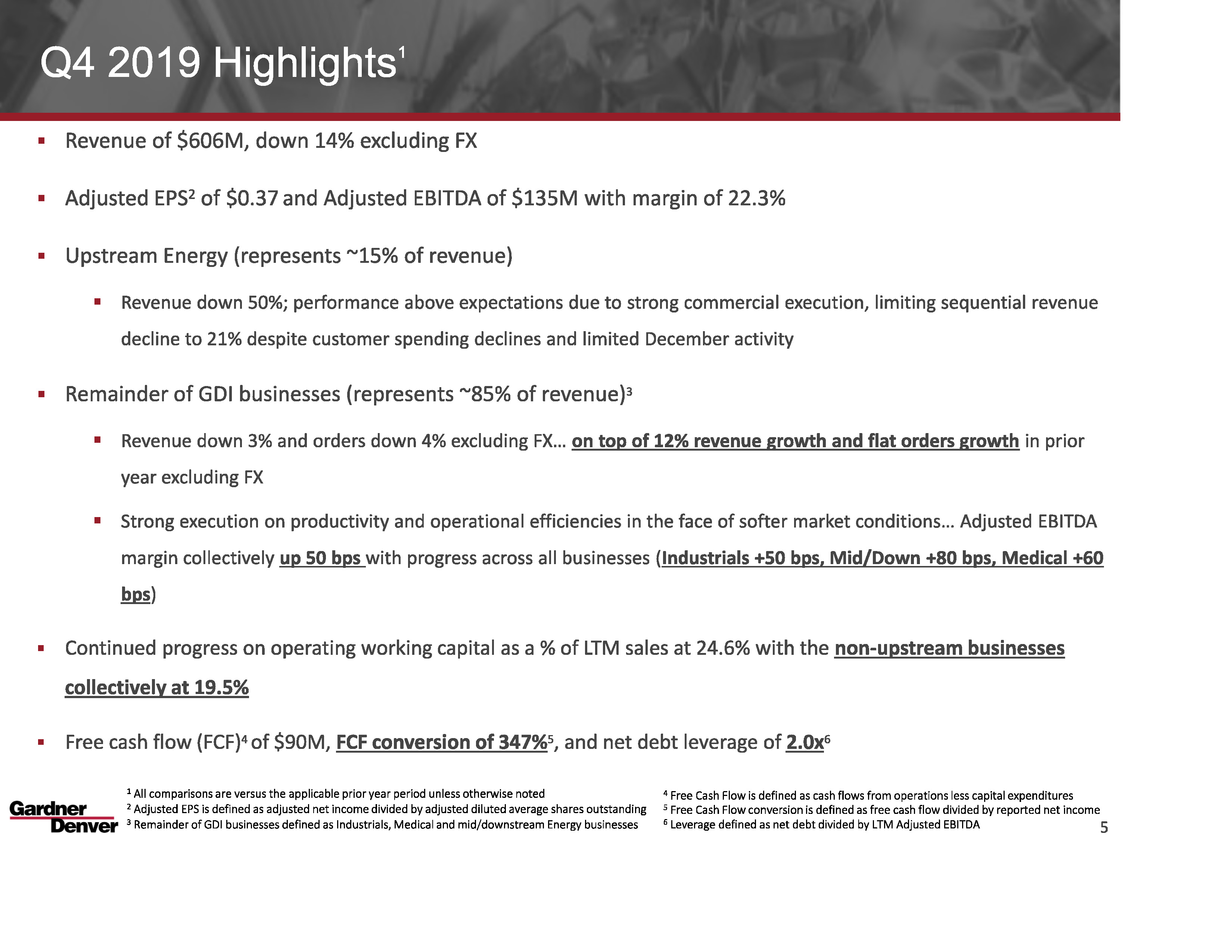

Turning to Slide 5, let me start with a brief overview of the fourth quarter. Overall, the fourth quarter was a good example of the team’s ability to use the Gardner Denver execution excellence process, or GDX, to remain nimble in the face of a soft economic environment. As expected, entering the quarter, core industrial markets continued to show signs of slowdown and the upstream energy market continued to face similar headwinds as we have seen in prior quarters. However, the team utilized the GDX process to drive quick actions that resulted in solid commercial and operational execution with strong margin expansion in our non-Upstream Energy businesses and healthy free cash flow generation.

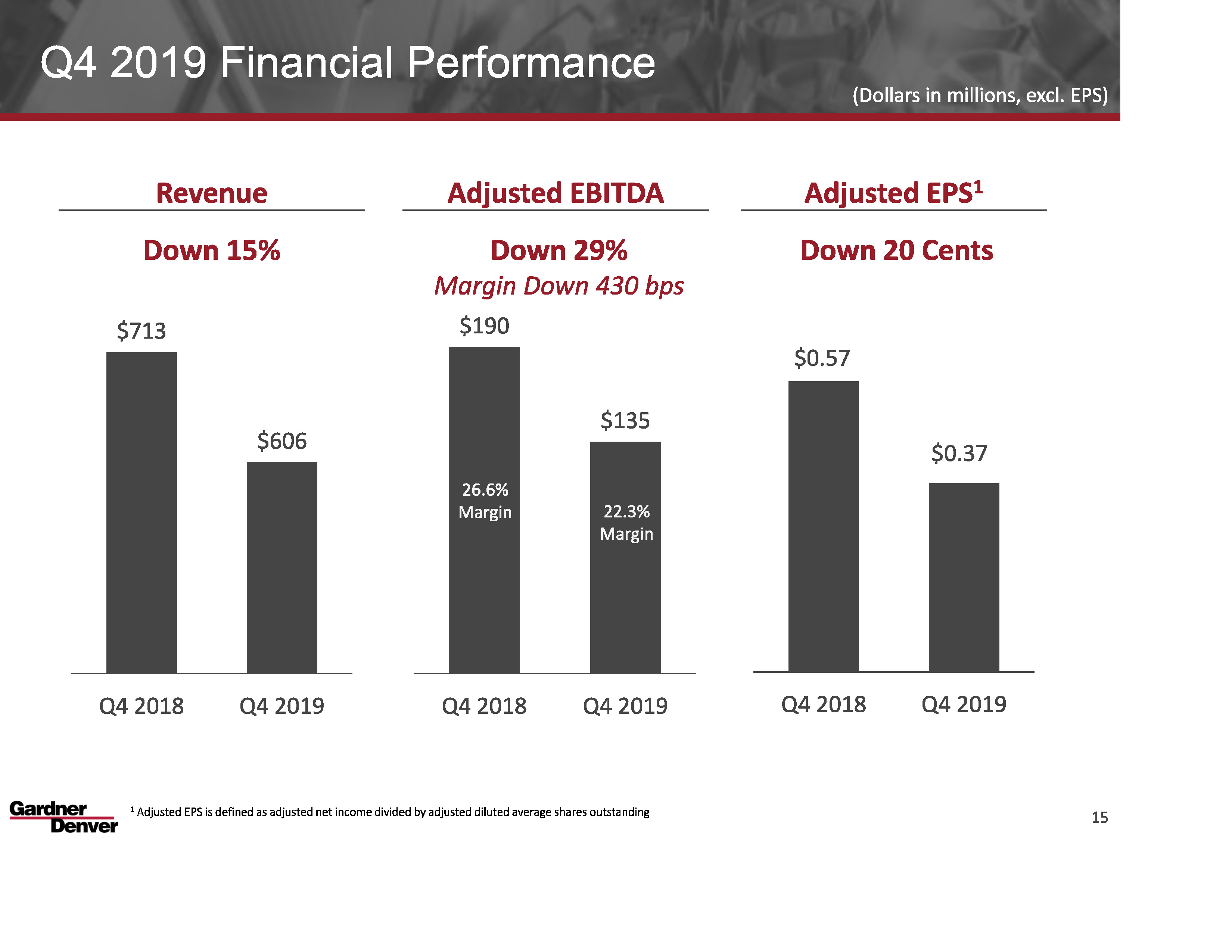

Let me provide a bit more color on the financial highlights in the fourth quarter. From a total Company perspective, FX adjusted revenue and orders declines of 14% and 16% (phon) respectively were heavily impacted by the known softness in the Upstream Energy business, where both revenue and orders were down approximately 50% due to the known oversupply in the market and limited activity in the later end of the year. Despite these headwinds, the Upstream Team executed on several targeted customer wins due to new product introductions, limiting the sequential revenue decline to only 21%, which was better than our expectations coming into the quarter.

The remainder of our businesses, including Industrials, Mid- and Downstream Energy, and Medical, saw a collective FX adjusted revenue decline of 3% and orders decline of 4% given the softer macroeconomic environment as well as meaningful prior-year comps.

The Company delivered adjusted diluted earnings per share of $0.37 and Adjusted EBITDA of $135 million with an overall margin of 22.3%. Overall margins were impacted by the expected declines in Upstream revenue, as well as increased corporate costs in the quarter driven by growth investments and incentive compensation payout related to better-than-anticipated business performance.

We were also very pleased with the performance of the Industrials, Medical, and Mid- and Downstream businesses which collectively expanded Adjusted EBITDA margin by 50 basis points despite the top line headwinds. The margin improvement was driven by initiatives such as i2V and proactive cost measures that the team has implemented, including the restructuring actions that we announced in Q3.

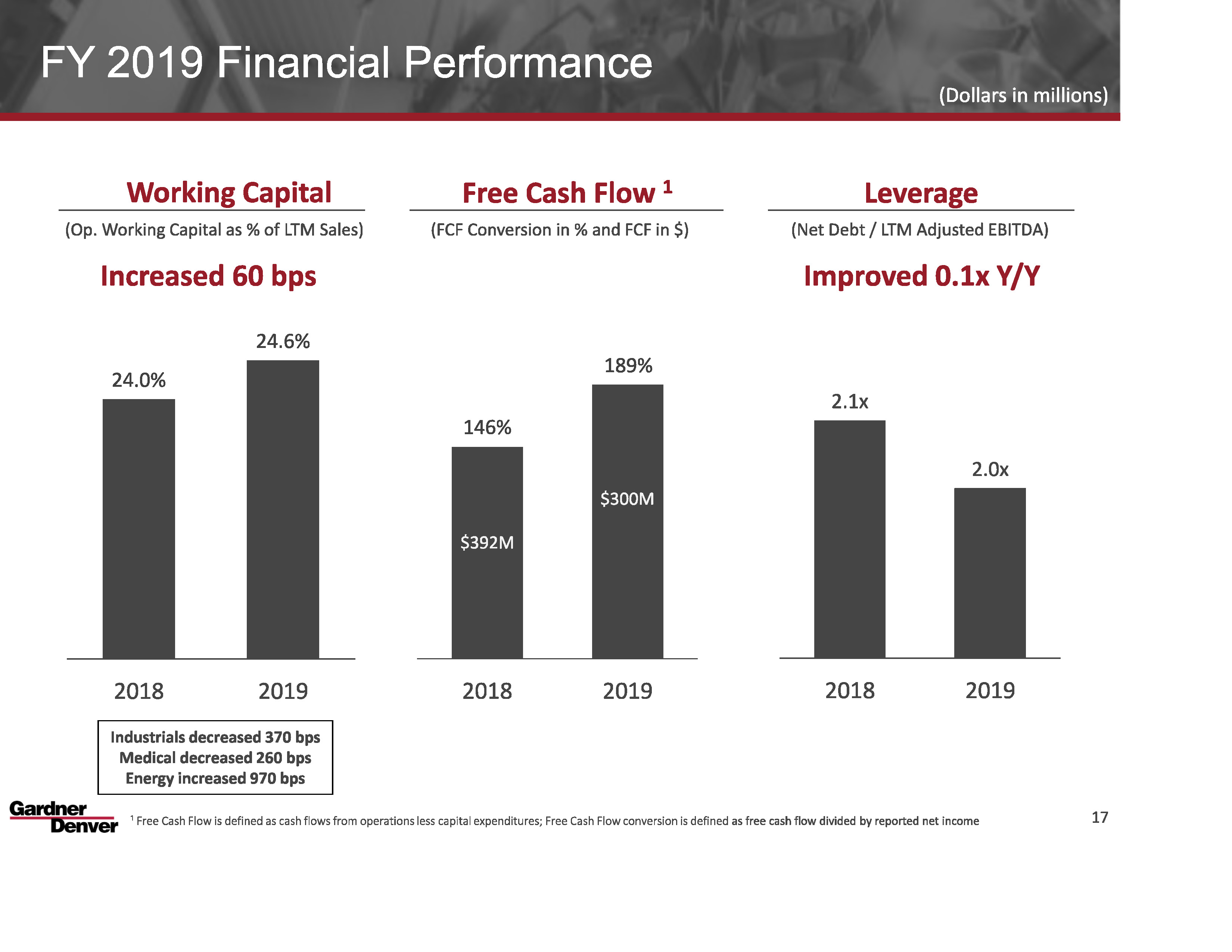

From a balance sheet perspective, free cash flow in the quarter was $90 million. Free cash flow conversion to reported net income was 347% as the teams continued the make strong progress on working capital, including reducing inventory by $37 million within the quarter. While total Company operating working capital as a percentage of revenue finished slightly higher than prior year at 24.6%, this increase was due entirely to the Upstream Energy business which has a meaningful opportunity as we look ahead. The remainder of the businesses finished the year collectively at 19.5%, 170 basis point improvement versus prior year. This marks the first time we’ve seen this metric below 20%.

The strong cash performance led to net debt leverage of 2 times at the end of the year, an improvement of 0.1 times as compared to prior year.

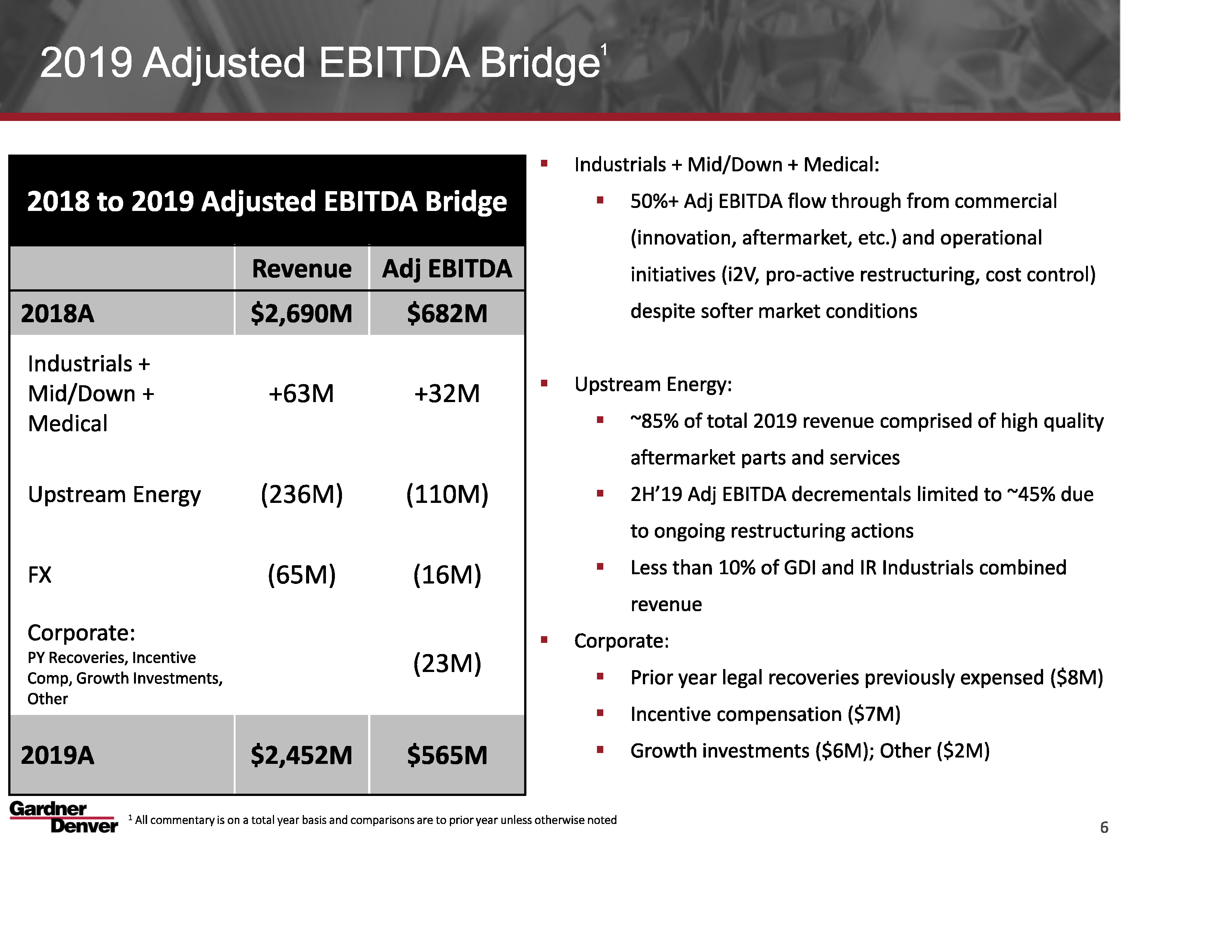

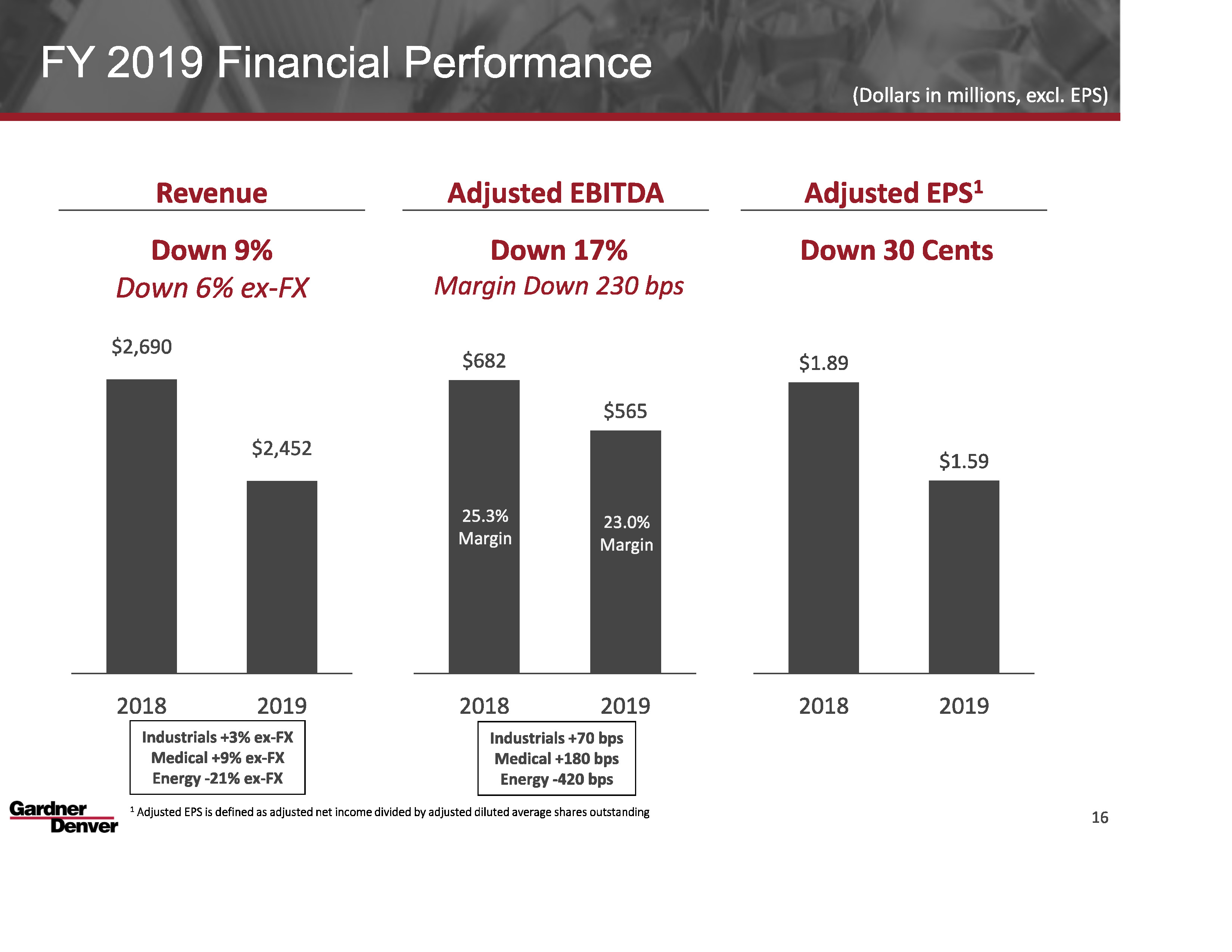

Moving to Slide 6, as I reflect on the total year, 2019 was a solid year that showed the resilience of the business model and the team’s ability to drive results in the face of changing market conditions. The bridge in the page starts with Industrials, Mid- and Downstream Energy, and Medical businesses, which collectively deliver 3% FX adjusted growth and Adjusted EBITDA margins of 24.2%, which was 80 basis points up versus prior year. This is a very strong performance in the face of challenging macroeconomic conditions with flow through to EBITDA in excess of 50%, due in large part to the continued execution of GDX that the team is driving. Upstream Energy did face a challenging year, but I’m pleased with the steps the team has taken to proactively right-size the cost structure and limit the decremental (phon) margins in the second half of the year. While FX and other investments did prove to be headwinds on a year-over-year basis, they were largely in line with anticipated levels from the beginning of the year.

Turning to Slide 7, I would like to spend a few moments discussing the progress we’re making on the pending R&D with the Ingersoll Rand Industrial segment. As you probably saw a few weeks ago, we received unconditional clearance from the European Commission for the transaction. This was a major milestone as it marked the final regulatory clearance needed for approval of the deal. Since that time, we have continued to make strong progress as we launch the financing for the deal in late January and completed that on February 7 with fully committed Term Loan B structure.

In addition, Ingersoll Rand completed their shareholder vote on February 4 with all proposals being approved and Gardner Denver shareholder vote is now scheduled for February 21. We do not anticipate any issues with the final legal requirements required to close the deal, and I’m very excited to announce that the merger should be completed on February 29. This marks an exciting time for the new Company and I’m very much looking forward to the bright future ahead for the new Ingersoll Rand.

Moving to Slide 8, I want to spend a moment reflecting on our four-point strategy, as this will serve as the basis for how we operate the new Company. I’ve said it many times that talent is at the center of everything we do, and having announced a new team is core to our strategy. As you may have seen, we announced the Leadership Team for the new Ingersoll Rand back at December. I’m very excited by the talent from both Ingersoll Rand and Gardner Denver coming together as we have strong representation from both organizations that will help as we create a combined culture for the new Company. Everything starts with the people and I see this as a great way to infuse best practices from both organizations into our daily routines.

As part of our integration plan and efforts over the past few months, we are in the final stages of our detailed organizational design across the new Company and I’m looking forward to sharing this with the teams shortly after closing.

Another key facet of our strategy has been margin expansion. As we look ahead, a major component of the transaction is delivering our previously announced $250 million of cost synergy targets. We continue to have strong confidence in delivering this target. That confidence is driven by the integration planning efforts we’ve done over the past nine months, as well as the continued momentum we see at Gardner Denver, as shown by the 80 basis points of Adjusted EBITDA margin expansion we delivered in our non-Upstream businesses in 2019.

A key catalyst to that margin expansion, and one that we are excited to expand in the new Company, is the Innovative to Value process, or i2V. i2V continues to yield very strong results across the Gardner Denver businesses, including recent wins in redesigning products within our European Blower and Vacuum platform. As we think ahead, we will take these very same principles to the $3 billion-plus revenue segment at Ingersoll Rand Industrials where we expect to see similar momentum and opportunity in improving the products, while at the same time delivering margin benefits for the businesses.

Moving to Slide 9, I will provide more color on the operating performance of our segments. I will start with the Industrial segment, where, as expected, we saw growth slowed down from what we have seen in prior quarters, driven by the softening macroeconomic backdrop. The Industrial segment’s fourth quarter order intake was $308 million, down 3% versus prior year, excluding FX. Revenues in the quarter were $333 million, flat excluding FX. From a geographic perspective, revenue in the Americas declined 2% on an FX adjusted basis. We view this as an excellent performance when you take into account that the U.S. manufacturing activity in December was the lowest result in a decade according to ISM Index. In addition to this, we’re overcoming very strong comps from prior year where FX adjusted growth was 12%.

From an overall market perspective, we feel good about our relative position in the U.S. as third-party industry reports continue to show that we are outpacing the market in terms of units and dollars in both of the main compressor offerings of oil-lubricated, rotary (phon) screws, and reciprocating technologies.

In Europe, performance was very comparable to what we saw in the Americas with revenue down 2%, FX adjusted. Despite the continued tough macroeconomic environment, the majority of the European regions, including mainland Western Europe and India, saw relatively stable performance, including low single-digit growth in oil-lubricated compressors and continued momentum in niche products like blowers. Middle East and Africa collectively saw double-digit revenue decline, due in large part to the non-repeat of a large high-pressure compressor system that shipped in 2018. Asia-Pacific reported a double-digit revenue increase due to growth in niche products like oil-free compressors and transport equipment, as well as strong execution on few large custom projects.

As the market continues to see general softness in most major regions, we continue to advance our strategy of differentiated innovation complemented by the efforts of demand generation in order to drive outsized growth in niche verticals. One such case study is highlighted at the bottom of the slide where we have introduced the innovative Robox Screw Compressor to the marine industry for the application of air lubrication. Air lubrication is the process of infusing air bubbles beneath a ship’s hull to reduce friction between the hull and the water. This helps reduce resistance and the amount of energy needed to propel the ship, leading to 5% to 10% fuel savings and reduced CO2 emissions. Products like the Robox Compressor have led to outsized growth in the marine industry where we saw strong double-digit growth in 2019.

Moving to Adjusted EBITDA, Industrial delivered $79 million in the quarter, up 2% excluding FX. Fourth quarter Adjusted EBITDA margin was 23.7%, up 50 basis points versus prior year and up 150 basis point sequentially from Q3. The year-over-year margin increase was largely attributable to ongoing productivity initiatives, like i2V, as well as benefits from the restructuring actions that we completed in Q3.

The margin profile in Q4 marked the highest level we have ever seen in our Industrial segment and continues the momentum towards our mid-‘20s EBITDA margin target that we have previously stated.

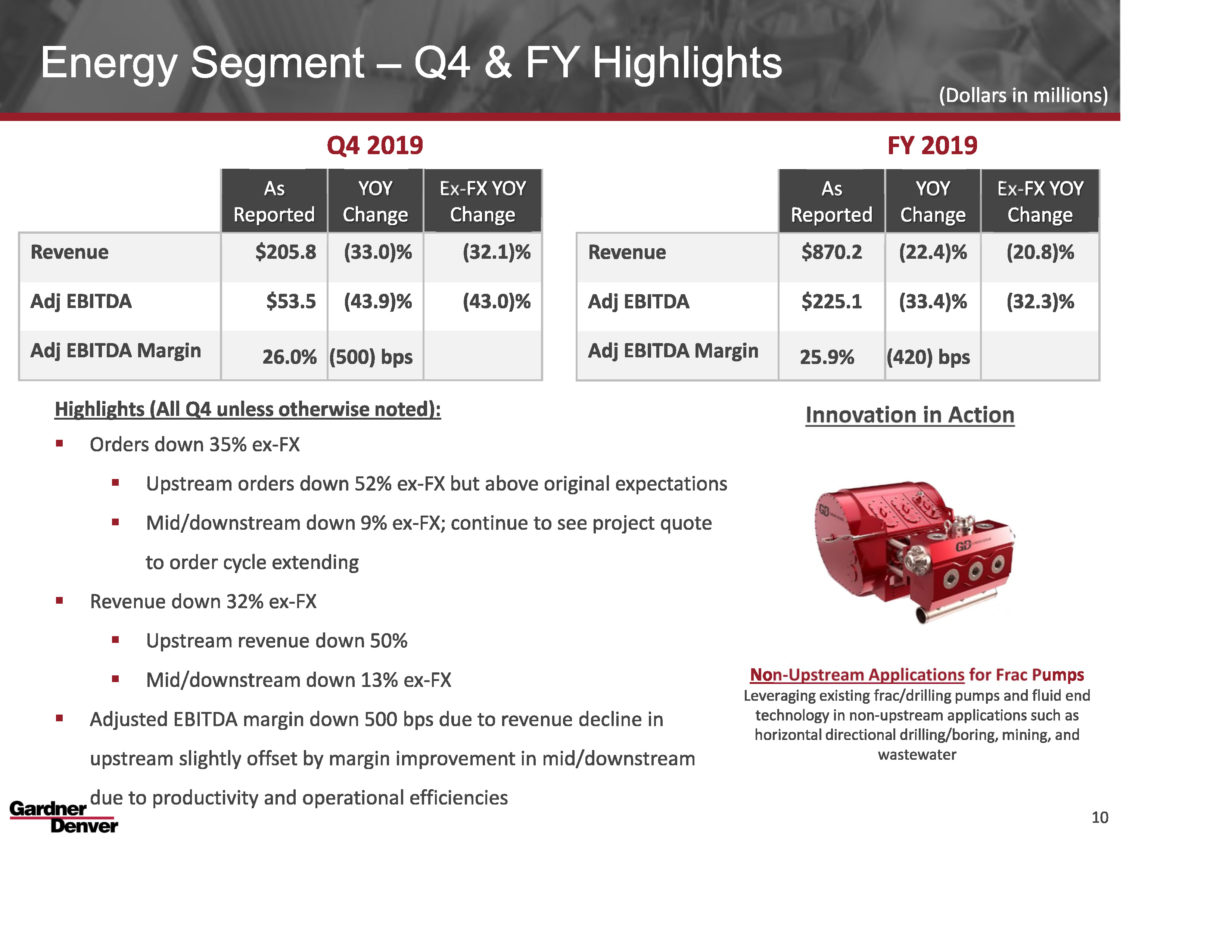

Moving next to the Energy segment on Slide 10, the Energy segment’s fourth quarter order intake was $172 million, down 35%, excluding FX, driven largely by the expected declines in Upstream energy and, to a lesser degree, by high single-digit FX adjusted decline in the Mid- and Downstream businesses, as we continue to see an elongation in the project quote to order cycle.

Revenues in the quarter were $206 million, down 32% excluding FX. Book to bill in the fourth quarter was 0.83, which was relatively similar to what we saw in Q4 of 2018.

Addressing the components of Energy, let me start with Upstream. Orders and revenue both finished at $79 million, down 52% and 50% respectively, excluding FX. Both of these levels were above our initial expectations entering the quarter, as the team did a very nice job on executing commercially on newly introduced products and solutions that we’ve been speaking about over the past few quarters.

Digging a little deeper on orders and revenue, the results were in line with what we saw in Q3, as the composition was largely aftermarket centric with minimal orders from original (phon) equipment frac pumps. Given market capacity utilization and customers stacking and impairing horsepower, as well as spending less cap ex, it is not surprising for us to see relatively low levels of original equipment orders and shipments. We continue to be pleased with the momentum we’re seeing in consumables as customers continue to value the differentiation that our products provide, leading to consumables being down only mid-teens on a year-over-year perspective. In addition, pricing levels continue to remain relatively flat on a quarter-over-quarter basis.

From a margin perspective, despite the 50% revenue decline on a year-over-year basis, the upstream business was able to deliver 20% EBITDA margins, a healthy concentration of higher-margin aftermarket revenue, coupled with proactive restructuring efforts that the team took throughout the year limited decremental (phon) margins in the second half of the year to 45% as opposed to levels in excess of 50% when the business was ramping up.

As we look ahead, one of the exciting initiatives that the upstream team has been working on is diversifying the end-market base of its products away from upstream-oriented applications. You may have seen in the 8-K that we published back in December that we intend to call this business High-Pressure Solutions as part of the new Company. The name speaks to the highly differentiated product that we have developed and the ability to apply some of our legacy frac and drilling technology to industrial applications. Specifically, we’re entering horizontal directional drilling applications in the field like mining, wastewater, and utilities where Gardner Denver high-pressure pump technology provides a more efficient and reliable solution than legacy technologies. This is just one example where the team is entering new spaces that expand the total addressable market for the business.

On the mid- and downstream side, orders were collectively down 9% and revenue was down 13%, both excluding FX. Book to bill came in at 0.73 which was actually a bit higher than what we saw last year in the fourth quarter. As noted earlier, we continue to see a relatively healthy quotation funnel for larger projects, but customers are taking longer to convert those quotes to order. The good news is that the discussions with the customers continue to be very active, so we’re optimistic about seeing many of these orders convert and fill the funnel for 2020.

The Energy segment delivered Adjusted EBITDA of $53 million in the fourth quarter, which was down 43% to prior year, excluding FX. As a percentage of revenues, fourth quarter Adjusted EBITDA was 26%, down 500 basis points from prior year due to the decline in upstream energy with a slight offset from margin improvement in the mid- and downstream business.

Moving next to the Medical segment on Slide 11, order intake was $64 million, down 2%, excluding FX. The orders decline was due to the same dynamic referenced in Q3 where a customer is now ordering in smaller quarterly installments as opposed to the historical pattern of larger frame orders. Revenues in the quarter were $67 million, flat excluding FX, on top of very strong prior-year comps of 19% growth. Overall, book to bill was 0.95 which is comparable to prior-year fourth quarter. The business continued to see good momentum across both gas and liquid pump markets, with ongoing progress on new innovation. One such product is highlighted at the bottom of the slide.

Our compact and lightweight gas pumps are integral to the application of Negative Pressure Wound Therapy whereby a vacuum is drawn on a wound to help it heal faster. The solution delivers increased efficiency by minimizing size, sound, vibration, and energy consumption, and is an exciting win for the team as it is a growing end market in the medical space. Third-party reports indicate that Negative Pressure Wound Therapy is expected to grow at an 8% CAGR over the next four years. This is just another example on how our team continues to pivot to faster growing markets.

Medical Adjusted EBITDA performance for the quarter was $21 million, up 1% excluding FX. Margins were 30.8%, up 60 basis points versus prior year, and marked the sixth consecutive quarter of positive margin expansion as the teams continue to drive operational efficiency.

I will now turn over the call to Emily to walk us through the guidance for 2020.

Emily A. Weaver

Thanks, Vicente, and good morning to everyone on the call.

I’d like to start by saying that it’s been a pleasure to be part of the Gardner Denver team and I look forward to the bright future we have ahead for the new Ingersoll Rand team.

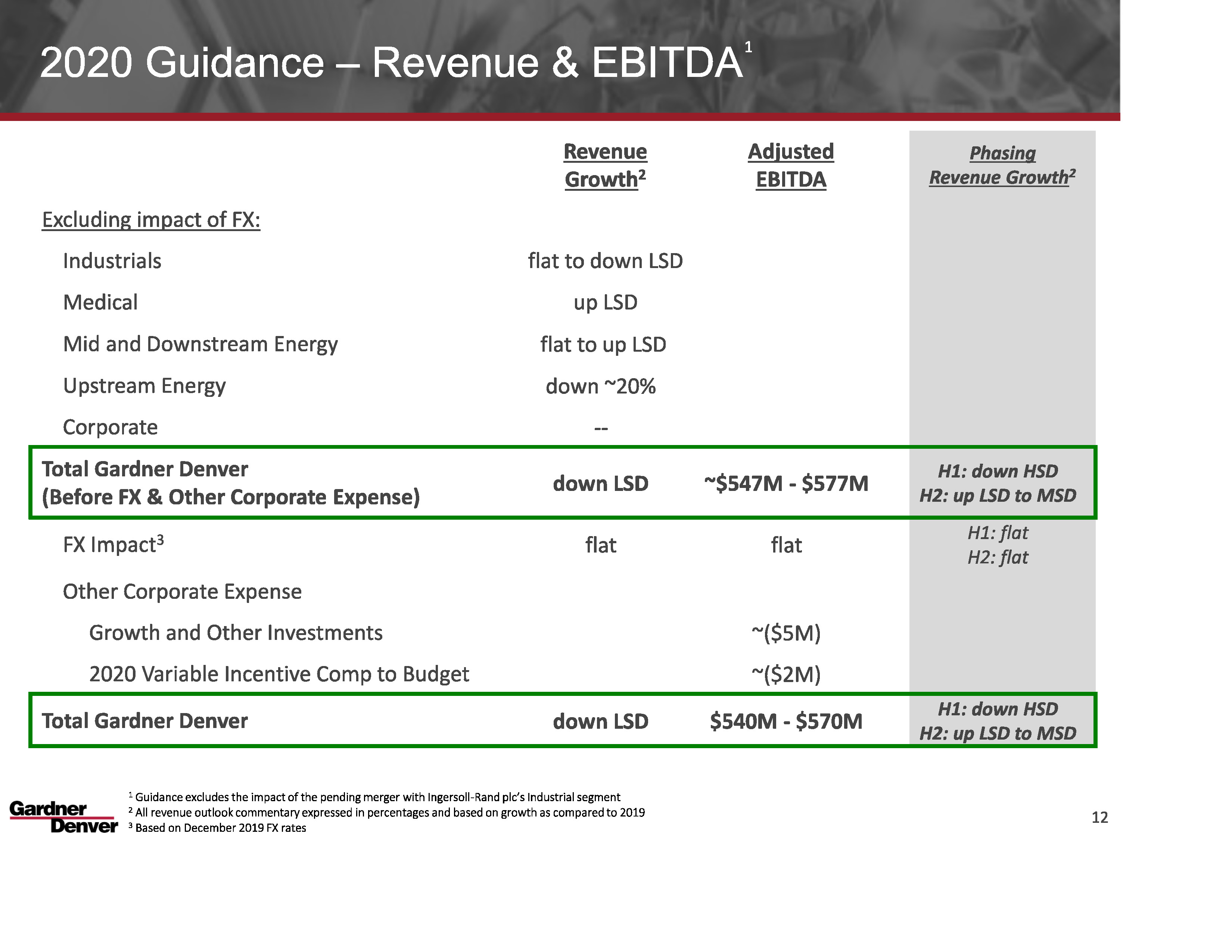

Let’s move to Slide 12 and review the guidance for 2020. We will start with our revenue growth expectations for the year. We expect total Gardner Denver revenue to be down low single digits on both an as reported and FX adjusted basis, as FX is expected to be relatively flat year-over-year. From a phasing perspective, we anticipate the first half of the year to be down high single digits, driven notably by the tough comps in both Upstream Energy as well as Industrials, where we delivered mid-single-digit growth in the first half of 2019. The second half of the year is expected to be comparatively better with growth of low- to mid-single digits.

As is typical for us, we are expecting Q1 to be comparatively lighter than the remaining quarters of 2020. This year will be a bit more exacerbated by the coronavirus. As such, we expect Q1 to deliver slightly less than 20% of full-year profitability. While China is a relatively small percentage of our overall revenue base, we’re expecting some shipment deferrals from the first quarter into Q2 and the balance of the year. As of right now it is important to note that our guidance does not include any total year impact.

Most importantly, we are very pleased to report that all of our employees are currently safe and their well-being remains our utmost concern. We will continue to monitor the situation daily as our employees, customers, and suppliers are allowed to get back to work.

Now moving to our segments, we expect Industrials revenue growth for the year to be flat to down low single digits. Given the slowdown we’ve seen in the general industrial market in the second half of 2019, we don’t expect that to change significantly as we enter 2020. The teams will continue to focus on operational efficiencies, such as i2V and cost control where we’re expecting to deliver positive margin expansion in 2020 despite the moderating top line.

In Medical, we expect low single digit growth for the total segment, as well as for both gas and liquid product within the portfolio.

Moving to the Energy segment, I’ll start with mid- and downstream Energy. As you know, these businesses play in similar end markets to our Industrials segment and the general macroeconomic softness we’re seeing there has a similar impact on these businesses. We continue to see a good funnel for projects. As previously mentioned, we expect to see several of those orders convert within the year, resulting in flat to low single digit growth for these businesses.

Moving to upstream, we don’t expect much change in the market as we move into 2020. Given the dynamics we’ve been discussing around oversupply and cannibalization of equipment, along with what customers have been communicating on capital spend expectations, we expect revenue to be down approximately 20% on a year-over-year basis. We expect declines to be higher in the first half of the year, driven mainly by the tough comps, and to moderate in the back half of the year. The teams will continue to manage the business as we did in the second half of 2019, with a focus on controlling costs, protecting margins, and rightsizing working capital, particularly inventory.

That said, we are currently taking a prudent view of 2020 demand levels in upstream energy, although we do see some signs of optimism as we look into the future. First, customers have impaired approximately $4 million of horsepower in Q4 with expectations of another $1 million to come in Q1. This helps normalize supply and demand which is needed in this market. Second, we continue to see cannibalization in the field of both pumps and fluid ends (phon). This is a trend that can’t go on indefinitely. Eventually this equipment will come back for service and repair or for replacement, and we are prepared to handle that demand. Third, our launch of new consumable offerings continues to see strong traction in the market and we’re strengthening our partnerships with key accounts. Finally, we’re excited about the prospects for new revenue streams by selling legacy frac and drilling technologies into industrial end markets that Vicente highlighted earlier.

Based on these revenue assumptions, we’re introducing 2020 Adjusted EBITDA guidance of $540 million to $570 million. This range includes slight increases in corporate costs of approximately $7 million on a year-over-year basis, driven by two main items. First, growth investments in key areas such as demand generation and IoT, which we continue to see as core strategies to deliver above-market growth; and, second, a slight increase in variable incentive compensation expense for 2020 as we reset to target levels this time each year. Including these items, we expect corporate costs to be approximately $12 million per quarter.

Turning to Slide 13, our expectation for capital expenditures is $45 million to $55 million, and we expect to generate $280 million to $300 million in free cash flow which is generally consistent with what we delivered in 2019. In addition, we expect free cash flow to reported net income to be in excess of 100%. Finally, we expect the tax rate to be between 22% and 23% and share count to be approximately 209 million shares. It’s worth noting that all of these estimates are for standalone Gardner Denver. Upon closure of the transaction, we will take the requisite time to combine the financials for the two organizations and, in due course, provide both pro forma historical financials for the new Company, as well as guidance.

I’ll now turn it back to Vicente for some closing remarks.

Vicente Reynal

Thank you, Emily.

As we look ahead, 2020 will continue to be challenging from a macroeconomic perspective, but I’m confident that the teams have the right toolkit with GDX to both navigate the environment can continue to deliver progress on our commercial and operational initiatives. We also are at the landmark moment for the Company as we prepare to merge with Ingersoll Rand Industrial segment and become the new Ingersoll Rand. The long-term prospects of the combined Company and the value creation opportunity both remain very positive and I’m very excited to lead the combined organization going forward.

With that, I’ll turn the call over to the Operator and open it up for Q&A.

QUESTIONS AND ANSWERS

Operator

We will now begin the question-and-answer session. To ask a question, you may press star, then one on your touchtone phone. If you’re using a speakerphone, please pick up your handset before pressing the keys. To withdraw your question, please press star, then two. At this time we will pause momentarily to assemble our roster.

Our first question comes from Mike Halloran of Baird. Please go ahead.

Michael Halloran

Hey. Good morning, everyone.

Vincent:

Good morning, Mike.

Emily A. Weaver

Hey, Mike.

Michael Halloran

Can we just start with the guidance assumptions here, maybe some thoughts on what’s embedded from an underlying perspective by segment? In other words, is there fundamental improvement embedded in the outlook through the year? Obviously, Emily highlighted the 1Q impacts from the coronavirus, but, stripping that out, how do you think about what underlying demand looks like sequentially as you work through the year; any assumptions for improvement? Then anything else that could help us get comfortable with how that 1H/2H ramp looks?

Vicente Reynal

Yes. Mike, I’ll say that it is gradually improving in the second half, primarily as comps get easier. As we said on the remarks, the first half is expected to be down high single digits while the second half, positive low single to mid-single. The majority of this is really due to more difficult comps that we have here in the first half.

Michael Halloran

So, pretty normal sequentials, Vicente?

Vicente Reynal

Exactly. Yes. That’s right. Yes.

Michael Halloran

Then when you think—a separate question—then when you think about the underlying internal improvement, continue to do a lot of work there, positive work; maybe help provide some thoughts on what the major priorities on the legacy business are going into 2020 and what kind of impact do you think that can have on the EBITDA line?

Vicente Reynal

Yes. Mike, I think I’ll say, number one, as you saw, we—if I talk about Industrials as a great example, even on flat to low single digit growth, we still expect the business to generate positive basis point margin expansion. That’s just one example on how we’re having our teams put together a plan that puts a picture of no growth, but we still need to execute very thoughtfully the initiatives that we have been doing. For example, control the areas that are within our control. An example of that is i2V. Innovate to Value continues to be a great tool for us to deliver that gross margin expansion. We will continue to do a lot of activity that we have been doing on pricing, as that continues to be a great lever for us to strategically be more focused on price. Then more areas, such as working capital; I mean, inventory continues to be a big area for us for improvement to generate and unlock a lot of cash that we have in the business.

Michael Halloran

Thank you for the time. Appreciate it.

Vicente Reynal

Thank you, Mike.

Operator

Our next question comes from Jeff Sprague of Vertical Research Partners. Please go ahead.

Jeff Sprague

Thank you. Good morning, everyone.

Vicente Reynal

Good morning, Jeff.

Jeff Sprague

Morning. First, Emily, you said in due course, but can you give us a little bit of color on what your timing is like in terms of pro forma financials or kind of your initial NewCo guide?

Emily A. Weaver

Yes. Jeff, thanks for the question. No one is more excited to get this out than I am, but it will take us a little bit of time to get through the data that we’re going to get on day one coming up here in a few weeks or less. Once we get through that initial work, we’ll come back to you with some dates on when the pro formas and the guidance will come out so that you guys can plan the calendar.

Jeff Sprague

Great. Then, Vicente, I’m wondering just on the cost reductions which you affirmed today, if you could give us a little bit of color on how your visibility on that has evolved from the beginning of the process to here near the conclusion, and if there’s anything qualitative you might say about your confidence level or potential upside to that number.

Vicente Reynal

Yes. Jeff, I mean, obviously $250 million of synergies doesn’t include any revenue potential synergies that we may have, but the confidence has been growing because of all of the work that we have been doing here over the past nine months. As we talked about on the last call, we put an example on how we have now kind of analyzed the direct material spend from both companies through what we call a clean room environment. We’re even at this point right now reassessing one more time that data point so that we’re ready with these RFPs and RFQs for day one.

I’ll say the funnel has continued to grow internally. Clearly for us, in order to hit the $250 million of synergy we have a funnel that is larger than that in order to be able to execute that level of synergies. But the confidence level continues to grow, not only from what we talked about within the operational side but also the organizational structure.

Jeff Sprague

Great. Thank you.

Vicente Reynal

Thank you, Jeff.

Operator

Our next question comes from Julian Mitchell of Barclays. Please go ahead.

Alan

Hey, good morning everyone. This is Alan (phon) for Julian.

Vicente Reynal

Hi. Good morning.

Emily A. Weaver

Good morning.

Alan

Good morning. Digging deeper into kind of the upstream/midstream within Energy, can you talk a bit more about this project timing push out you guys are seeing. Is this a bit more transitory or do you think it has to do it maybe a softer end market as a whole?

Vicente Reynal

Yes. The project push out, it is mainly related to the mid- and downstream, and particularly more on the downstream side of the business. It is really transitory. I think there are some quote processes elongation that’s going on in this market, but nothing that gets us worried or concerned at this stage.

Alan

Got it. Then maybe within Industrial, looking at—it seems like you guys are basically guiding for a sequential softening into the first half. I know part of it is a tough comp, but is there any color you can provide on maybe which end markets you see as potentially firming up and which ones you see as only being a second half story?

Vicente Reynal

No. I think it’s consistent. I think we continue to be pretty excited with the work the teams are doing around niche markets. Again, there’s also a lot of good self-help initiatives on the commercial side with our demand-generation activities, but also new niche markets that we’re finding and penetrating. I’ll say we view the general industrial market is kind of tough while the niche end markets that we’re highly selective on are going to continue to do better.

Alan

Perfect. Thank you.

Vicente Reynal

Thank you.

Operator

Our next question comes from Andrew Kaplowitz of Citi. Please go ahead.

Binder

Hi. This is (Inaudible) Binder on for Andy. Good morning.

Vicente Reynal

Hey, good morning.

Emily A. Weaver

Hey.

Binder

Your upstream Energy guide for 2020 of down 20% is coming off a comp where there was already muted original equipment sales in 2019. With 85% of upstream Energy coming from aftermarket, can you parse out how much of the continued decline is coming from upstream aftermarket; and what sort of visibility do you have to the cannibalization of equipment going on in the fields reaching a potential inflection?

Vicente Reynal

Yes. I think one of the things that you’ll see here, kind of year-over-year we saw in the first half of 2019 some OE, Original Equipment, pumps. So we’re still kind of in the first half of 2020 comping some tough numbers based on that. If you were to think about it, we kind of take it for a more—the performance that we did in the fourth quarter that, basically, when you think about that sequentially, in the fourth quarter we saw roughly, call it, $10 million of OE pumps. What we’re saying is that coming into the first half, and most likely here in the first quarter, we’re not going to see any of that. It’s going to be a highly book in turn aftermarket business where, as you saw in the remarks, we continue to do well by penetrating new accounts and increasing the share of wallet in accounts that we know we can take some share.

Then the rest of the year, obviously very opaque; I mean, we don’t have a lot of visibility forward, and that’s why we kind of put here a forecast that in our view continues to be highly aftermarket centric because we expect that there will continue to be a lot of activity in the field. Like you said, there’s a lot of fleets that are getting impaired and parked, so we think long term the supply and demand of horsepower is going to get very well-balanced, so the prospects here continue to look positive for us.

Binder

Thank you. As a follow-up, the Medical segment was flat organically versus tough comp, about 19%. Looking back at 3Q, there was also a tough comp, about 19%. I’m just thinking about the sustainable growth rate for the segment going forward; is it more low single digits, similar to the guidance for 2020 or can it return to high single digits like in 2019?

Vicente Reynal

Yes. Our expectation is really more kind of mid to high single digits. The reason for why we’re saying low single digits is because if you think about the total general industrial market being down, I mean, there’s going to be potentially some effects that kind of take the medical market to be slightly down from mid-single to low single. But, again, as you pointed out, if you look at the historical numbers for this business, in ‘18 they did low double digit, in ‘19 high single digits. So, we think long term continues to be our expectation that this business, over the course, will be mid-single digits and here in 2020, similar to what we’ve done in other businesses, we told the team expect a slow growth environment and let’s focus on our margin expansion.

Binder

Thank you.

Operator

Our next question comes from Josh Pokrzyqinski of Morgan Stanley. Please go ahead.

Josh Pokrzyqinski

Hey. Good morning, everyone.

Vicente Reynal

Good morning, Josh.

Emily A. Weaver

Hey, Josh.

Josh Pokrzyqinski

Vicente, just starting off with obviously a weaker near-term environment from a market perspective than maybe what we would’ve anticipated six or 12 month ago at different points in the planning process for the integration, is there more of a mind of, I guess for lack of a better term, demand triage as the transaction closes that, as much as you want to get to the meat of some of the integration pieces, you want to get your arms around the demand curves as well; or is it really just focusing on the real core integration activities?

Vicente Reynal

Yes. Josh, I’ll say that even as we were—I think on our last earnings call we also talked about, which is around the budget timing for us—we said that we are planning to have a very slow growth to no growth environment and that we were going to be very focused on the activity that we could do into our control, and, as we look into our integration, that if we see the environment to be even worse than the slow to no growth, that we could find ways on accelerating synergy creation.

At the same time, I mean, we have the team very focused on the market. You can see that we continue to invest in demand generation and new technology platforms like IoT. We continue to view those as great ways for us to penetrate the market and take share, but we’ll continue to be very focused in areas of our control while we continue to find ways to invest in those very unique domain expertise that we have that we think are differentiated.

Josh Pokrzyqinski

Got it. That’s helpful. Then just thinking more broadly on the nature of the slowdown, maybe leaving upstream off to the side because it’s just a different animal these days, but is there evidence in the business of a coiled spring impact of effect with customers where they’re sitting on capital waiting to deploy, or does this just come across more as a soft landing, and then once we get through some of these exogenous shocks, whether it’s trade of coronavirus, we return back to more normalized growth? Just any sense as you talk to customers out there, thanks.

Vicente Reynal

Yes. I don’t think that there’s, as you describe it, that coil spring that we—we were not expecting that and I don’t think that is what we see out there in the market. I think the current situation in coronavirus is obviously creating some potentially delays in shipments and demand. However, we see also other customers investing, as some companies are re-looking at diversifying their supply chain again.

We’re not planning for acceleration of growth. We continue to view the market as being kind of slow to low growth, but we continue to see a pretty healthy funnel in the Downstream side for small and medium projects. I guess, all up, Josh, I’ll say no dramatic change, and here in the first quarter what we see is just a little bit more pronounced downturn just based on the coronavirus, but we expect that to be transitory and be able to recover here in the later part of the year.

Josh Pokrzyqinski

Okay. Thanks for the color and good luck on the approaching close.

Vicente Reynal

Okay. Thank you, Josh.

Emily A. Weaver

Thanks.

Operator

Again, if you would like to ask a question, please press star, then one. Our next question will come from Nicole Deblase of Deutsche Bank. Please go ahead.

Nicole Deblase

Yes. Thanks. Good morning.

Vicente Reynal

Hi, Nicole.

Emily A. Weaver

Hey, Nicole.

Nicole Deblase

Hi there. Just a quick clarification; when you guys talked about slightly less than 20% contribution in the first quarter, that was on Adjusted EBITDA, correct? Second question, if that’s the case, is just what level of revenue is that based on?

Vicente Reynal

Yes. On the first question, yes, you’re correct. On the second question, it’s on the base of roughly kind of low double digit growth on a year-over-year basis.

Nicole Deblase

Okay. Got it. Thanks, Vicente. That’s helpful. Then totally understand that your guidance isn’t baking in the impact of coronavirus, but maybe can you talk a little bit about that what you’re seeing on the ground in China. I think factories just kind of got back to work last week, so obviously a lot is in flux, but it would be helpful the hear what you’re hearing from your customers as well as the potential supply chain impact.

Vicente Reynal

Sure. Nicole, yes, so we obviously have launched a very rigorous progress where we stay in touch with all of our employees in China and lend a hand as much as we can. We also continue to do a lot of kind of donations to local communities based on our ability of what we can do.

Our kind of main factory, the one that we have in North China, it’s open. I’ll say maybe kind 80%-ish capacity as not all employees have been able to come back from the holidays. Our Medical facility, kind of about the same; I’ll say, running 80%, 90% capacity utilization at this point in time. The Medical is making pumps that get used and consumed for respiratory systems as well, so that’s obviously very critically needed in the current environment.

But from a supply chain perspective, we clearly see some disruption in the supply chain. Our team is then working extensively on how to diversify and find obviously other suppliers that could ramp up to the needs that we need to. I think the good news here is that when the tariffs were established, our team was already re-sourcing and refining new supply chain, so I think that’s actually quite helpful, that we have now second and third sources of supply base.

All up, I think the team is reacting very quickly, very agile, and trying to protect the customers that still need the product, and for us to be able to recover quickly.

Nicole Deblase

Thanks. That’s helpful.

Emily A. Weaver

Nicole, as I mentioned in the prepared remarks, we’re really pleased that our teams are safe and healthy right now. We’re paying close attention to that, of course, as well as the numbers.

Operator

This concludes our question-and-answer session. I would like to turn the conference back over to the Company for any closing remarks.

CONCLUSION

Vicente Reynal

Yes. First, I would like to thank our employees for the efforts and the great work that everyone continues to do, especially as we pivot to this great moment in our history of being able to combine two fantastic premier companies and then create the new Ingersoll Rand moving forward. We look forward to speaking to many of you here shortly and we’ll talk again soon. Thank you.

Operator

The conference has now concluded. Thank you for attending today’s presentation. You may now disconnect.