| Simpson Thacher & Bartlett llp |

425 Lexington Avenue New York, NY 10017-3954 |

| Facsimile (212) 455-2502 |

Direct Dial Number (212) 455-2812 | | E-Mail Address

RFenyes@STBLAW.COM |

April 25, 2017

VIA EDGAR

| Re: | Gardner Denver Holdings, Inc. Registration Statement on Form S-1 File No. 333-216320 |

Amanda Ravitz

Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, D.C. 20549

Ladies and Gentlemen:

On behalf of Gardner Denver Holdings, Inc. (the “Company”) we hereby submit to the Staff (the “Staff”) of the Division of Corporation Finance of the Securities and Exchange Commission (the “Commission”) the following supplemental information in order to facilitate the Staff’s review of the Amendment No. 2 to above-referenced registration statement on Form S-1 filed on the date hereof (as amended, the “Registration Statement”). This letter includes the analysis of the matters contemplated in comment 15 of the Staff’s comment letter, dated March 27, 2017 relating to the initial submission of the Registration Statement.

We advise the Staff that the Company expects to effect a 1.41322-for-1 reverse stock split prior to commencing the offering. Per share information presented below gives effect to the reverse stock split. The Company currently believes that the low end of the price range for shares of common stock will not be lower than $22.00 per share and that the high end of the range will not be higher than $27.00 per share, after giving effect to the reverse stock split. The Company expects to include a bona fide estimated price range, as required by Item 501(c) of Regulation S-K, in an amendment to the Registration Statement to be filed prior to the commencement of roadshow.

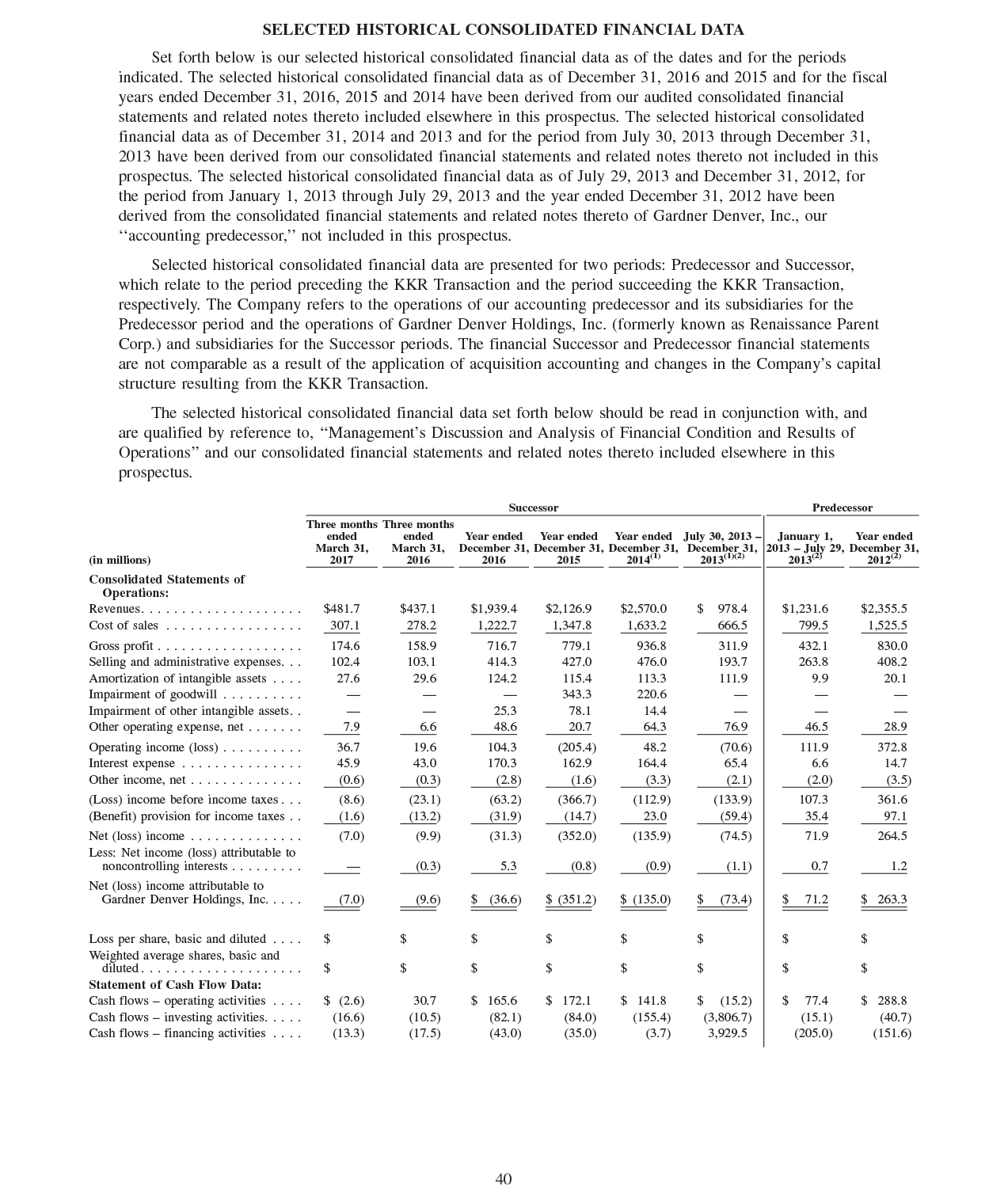

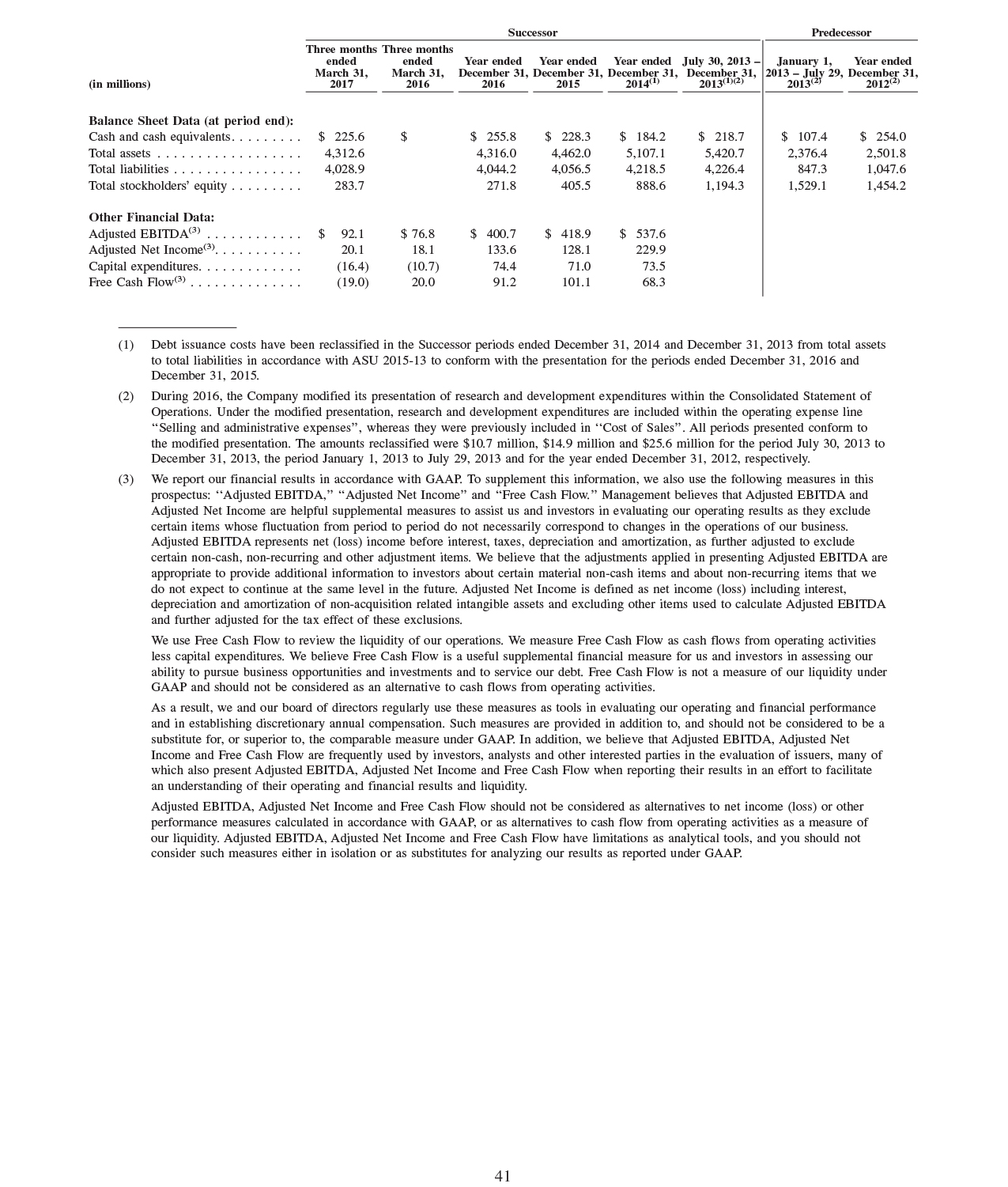

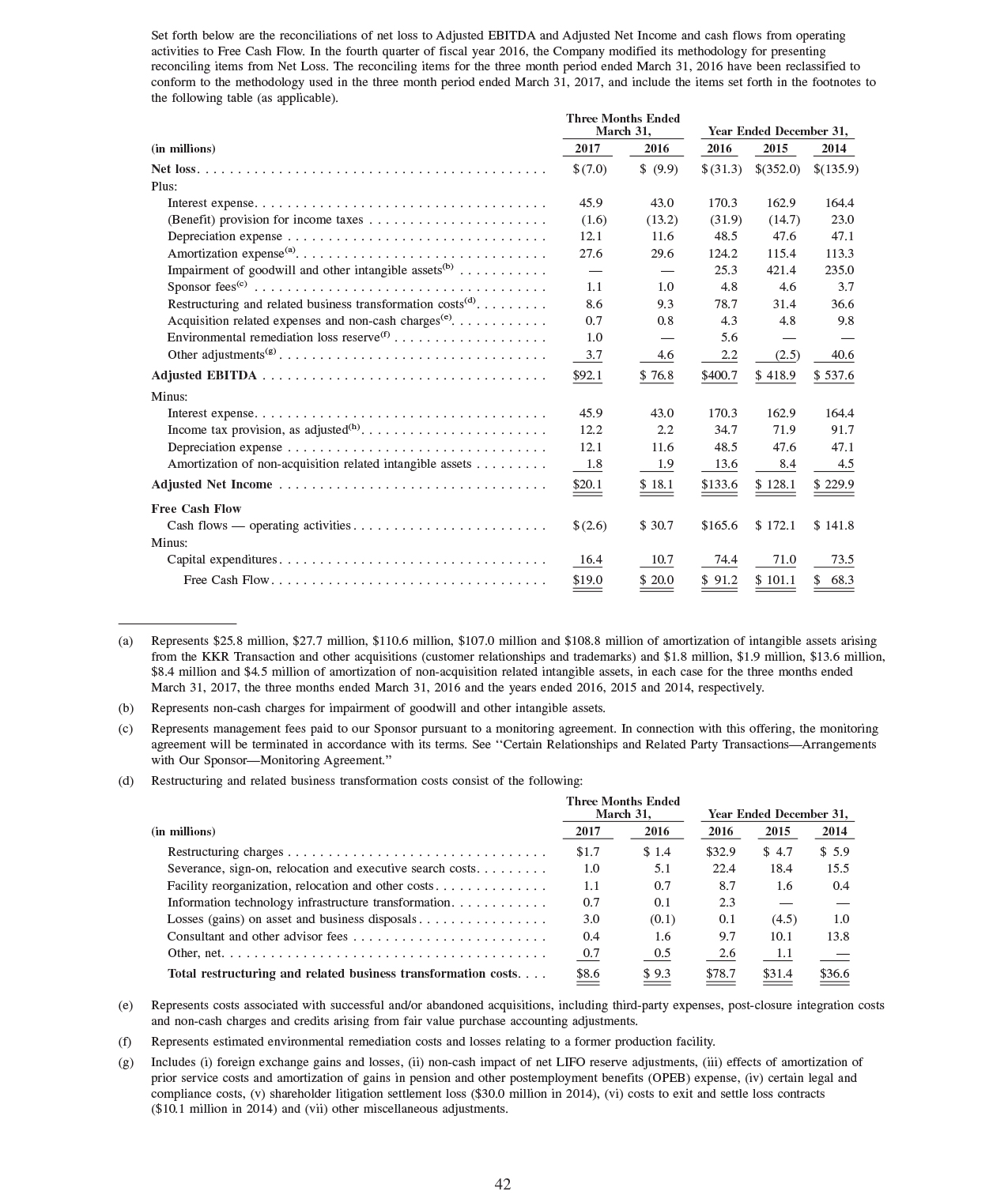

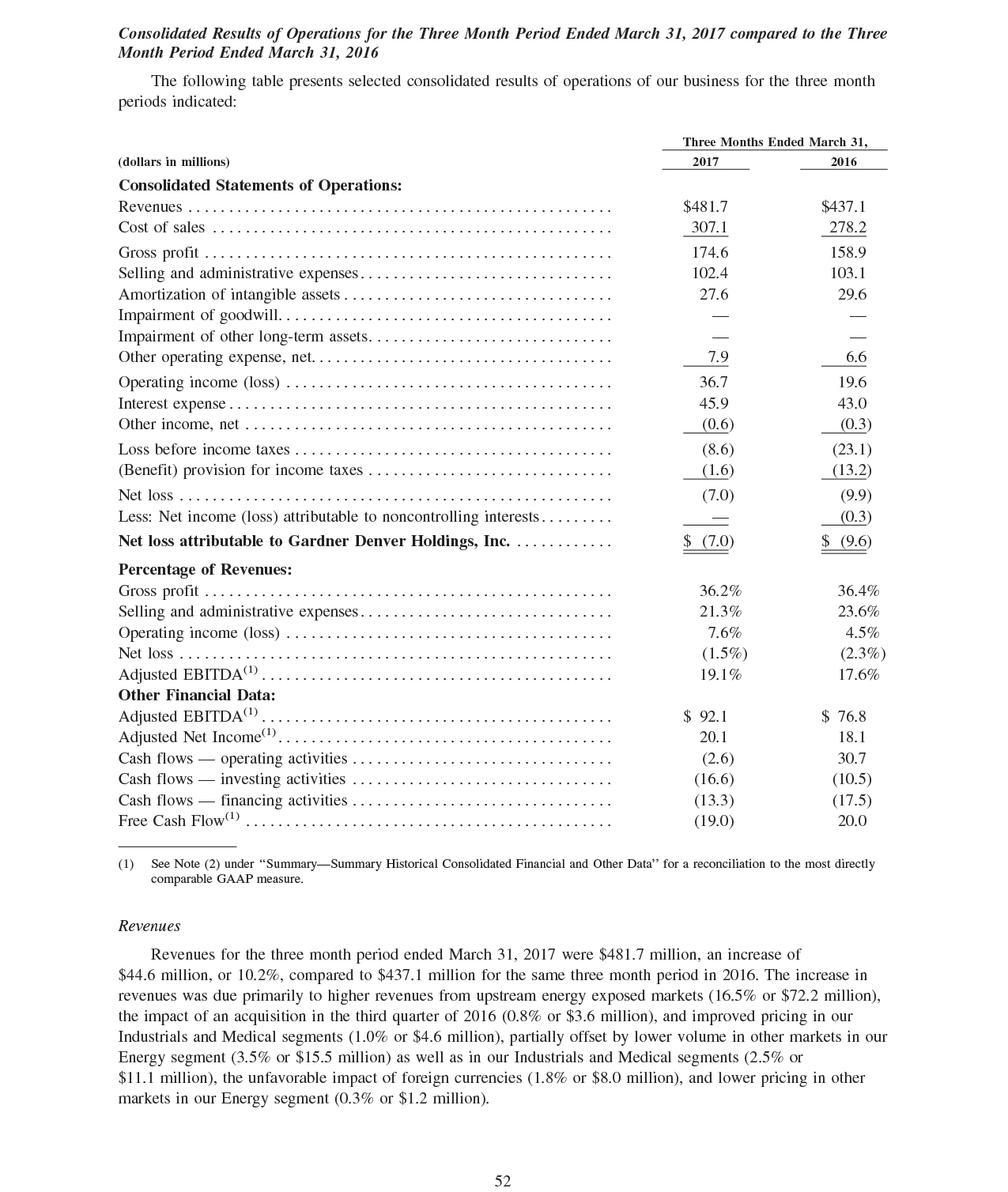

Additionally, the Company is in the process of finalizing its financial results for the three month period ended March 31, 2017 and expects to update the Registration Statement to reflect such information as soon as practicable. In order to facilitate the Commission’s review of such information, attached as Annex A are selected pages from the Registration Statement marked to show expected updates to reflect such results.

To assist your review, we have retyped the text of the Staff’s comment 15 in italics below. The responses and information described below are based upon information provided to us by the Company.

| 15. | Please tell us the estimated IPO price range. To the extent there is a significant difference between the estimated grant-date fair value of your common stock during the past twelve months and the estimated IPO price, please discuss for us each significant factor contributing to the difference. |

Summary

The mid-point of the estimated IPO price range described above is $24.50 per share. As more fully explained below, the increase from the grant-date fair value to the mid-point of the estimated IPO price range to the mid-point of the estimated IPO price range was driven primarily by improvement in the Company’s financial performance and improvements in the prospects of the Company’s industry. The combination of the Company’s improved performance and higher valuations among comparable companies has resulted in a Company valuation that is greater than the valuation upon which the Company’s most recent equity-based grants were made. The Company also believes that the elimination of the illiquidity discount positively impacts the value of the Company’s common stock.

Valuation Procedures

It is the Company’s policy for the Company’s Board of Directors (the “Board”) to determine a common stock value range and to approve a common stock fair value within that range for each fiscal quarter in which a stock-based award is made. The Company engages an independent third-party valuation expert to perform valuations to estimate the fair value of the Company’s common stock in connection with grants of stock-based awards. These estimates of fair value were used for financial reporting purposes in compliance with Accounting Standards Codification Topic 718 - Stock Compensation for options granted or modified during the year ended December 31, 2016. The valuation expert reviewed a number of objective and subjective factors that market participants would consider, including the history and nature of the business, the general economic outlook (such as economic growth, inflation, unemployment, the interest rate environment and global economic trends) and the industrial equipment industry outlook. The section captioned “Stock Compensation” on page 71 of the Registration Statement and Note 15: “Stock-based Compensation Plans” to the audited consolidated financial statements on pages F-37 and F-38 of the Registration Statement includes an explanation of the Company’s approach to accounting for stock-based compensation, the methodology used by the Company to determine the fair value of its stock when equity-based awards are granted, and factors and approach considered by the Company in determining fair value.

2016 Stock-based Awards

The Company granted stock-based awards on two separate dates in the year ended December 31, 2016: May 10, 2016 and December 9, 2016. The Company has not granted any stock-based awards in 2017. The 2016 stock-based award activity is described in the table below:

| Grant Date | | Award Type | | Shares Awarded | | | Common Stock Fair Value at Grant Date | |

| May 10, 2016 | | Time and Performance Options | | | 2,332,151 | | | $ | 9.19 | |

| December 9, 2016 | | Time and Performance Options | | | 473,581 | | | $ | 9.89 | |

Summary of the May 10, 2016 Option Award

The Company’s Board determined that the fair value of the underlying shares of common stock for the option award on May 10, 2016 was $9.19 per share. At the time of the May 10, 2016 award, the Company’s Board carefully considered all relevant information available to it including the most recent valuation report from its third-party independent valuation firm based on information as of March 31, 2016 (“March 2016 Valuation Report”). At the time of the grant, the Board determined there had not been any material changes in the Company’s business since March 31, 2016, or in the assumptions upon which the March 2016 Valuation Report was based, that affected the fair value of its shares of common stock.

In the March 2016 Valuation Report, the valuation expert applied the Income Approach (Discounted Free Cash Flows) and Market Approach (Guideline Company Method) to determine the Company’s enterprise value. An equal weighting was assigned to the valuations derived from the Income and Market approaches. The equal weighting reflected that neither approach was considered more reliable or relevant than the other approach.

The enterprise values derived under the Income and Market Approaches were then used to determine an aggregate total equity value, which was calculated by subtracting the interest-bearing debt and adding cash and subtracting a reasonable discount of 5% for lack of marketability from the calculated enterprise values.

For the Income Approach, projected free cash flows were discounted at a weighted average cost of capital (“WACC”) of 11.5%. The WACC is determined based on comparable companies’ debt to capital ratios, rates of return on equity and rates of return on debt. The valuation applied the WACC to estimate an enterprise value range of $4.00 billion to $4.41 billion with a midpoint of $4.19 billion.

For the Market Approach, the valuation expert identified a sample of comparable companies. The valuation utilized the financial results of the comparable companies to determine market multiples of business enterprise value over the next twelve months of projected revenue (“BEV/Revenue”) and the business enterprise value over the next twelve months of projected EBITDA (“BEV/EBITDA”). These multiples were used to determine an estimated enterprise value range of $4.33 billion to $4.78 billion with a midpoint of $4.56 billion.

The valuation weighted the estimated enterprise value range from the Income Approach and the Market Approach method equally to provide a final estimated enterprise value range of $4.21 billion to $4.67 billion, with a midpoint at $4.43 billion. This resulted in a fair value range of $8.04 to $10.25 per share. Based on this valuation, the Company’s Board approved a $9.19 per share fair value.

Summary of the December 9, 2016 Option Award

The Company’s Board determined that the fair value of the underlying shares of common stock for the option award on December 9, 2016 was $9.89 per share. At the time of the December 9, 2016 grant, the Company’s Board carefully considered all relevant information available to it including the most recent valuation report from its third-party independent valuation firm (“September 2016 Valuation Report”). At the time of the grant, the Board determined there had not been any material changes in the Company’s business since September 30, 2016, or in the assumptions upon which the September 2016 Valuation Report was based, that affected the fair value of its shares of common stock.

In the September 2016 Valuation Report, the valuation expert applied the Income Approach (Discounted Free Cash Flows) and Market Approach (Guideline Company Method) to determine the Company’s enterprise value. An equal weighting was assigned to the valuations derived from the Income and Market approaches. The equal weighting reflected that neither approach was considered more reliable or relevant than the other approach.

The enterprise values derived under the Income and Market Approaches were then used to determine an aggregate total equity value, which was calculated by subtracting the interest-bearing debt and adding cash and subtracting a reasonable discount of 5% for lack of marketability from the calculated enterprise values.

For the Income Approach, projected free cash flows were discounted at a WACC of 11.25%. The valuation applied the WACC to estimate an enterprise value range of $4.10 billion to $4.54 billion with a midpoint of $4.30 billion.

For the Market Approach, the valuation expert identified a sample of comparable companies. The valuation utilized the financial results of the comparable companies to determine market multiples of business enterprise value over the next twelve months of projected revenue and the business enterprise value over the next twelve months of projected EBITDA. These multiples were used to determine an estimated enterprise value range of $4.55 billion to $4.99 billion with a midpoint of $4.77 billion.

The valuation weighted the estimated enterprise value range from the Income Approach and the Market Approach method equally to provide a final estimated enterprise value range of $4.33 billion to $4.77 billion, with a midpoint at $4.54 billion, resulting in a fair value range of $8.95 to $11.19 per share. Based on this valuation, the Board approved a $9.89 per share fair value.

Contemplated midpoint of the price range upon offering

The Company believes the following factors are responsible for the differences between in the per share fair value of the Company’s common stock used for each of the 2016 options grants and the expected midpoint of the IPO price range:

| · | The Company’s has experienced strong financial performance since September 30, 2016. Revenue and Adjusted EBITDA increased 13% and 61%, respectively, in the fourth quarter of 2016 compared to the fourth quarter of 2015 and increased 10% and 20%, respectively, in the first quarter of 2017 compared to the first quarter of 2016. Last twelve months Adjusted EBITDA increased 21% to $416 million for the period ended March 31, 2017, as compared to $345 million for the period ended September 30, 2016. |

| · | Recent industry and broader equity market trends have resulted in higher valuations for comparable companies. For example, the current market valuations of comparable public companies that the Company has used in its historical valuations increased to approximately 15 times estimated 2017 Adjusted EBITDA, compared to approximately 11 times Adjusted EBITDA at the time of the Company’s March 2016 valuation. Applying current multiples to the Company’s Market Approach valuation methodology described above, which the Company believes is the most relevant approach for a public company, would have resulted in a value of approximately $23 per share. |

| · | The broader equity markets have also experienced a significant increase since the valuation dates used as the basis of the 2016 grants. For example, since March 31, 2016, the The Dow Jones Industrial Average increased 17.4% from 17,685 to 20,763 and the S&P 500 increased 15.3% from 2,059 to 2,374. |

| · | The price range also reflects the elimination of the 5% marketability or illiquidity discount for the Company’s common stock, given the public market created in connection with the initial public offering. |

In conclusion, the Company respectfully submits to the Staff that the third-party valuations and the Board’s determination of the fair values of the Company’s common stock used for stock-based grants during 2016 were based on methodologies, assumptions and inputs that were appropriate for the valuation of the common stock of a private company. The differences between those stock fair values and the preliminary IPO prices range are reasonable in light of the Company’s significantly improved performance and the increase in valuations of comparable public companies.

Stock-Based Compensation Expense

As described in Note 15 to the audited consolidated financial statements included in the Registration Statement on page F-37, the Company advises the Staff that it has not recorded compensation expense in respect of previously issued stock-based awards because the completion of either an initial public offering or a change of control, which are vesting conditions, were not probable at the applicable determination date. The Company expects that no compensation expense in respect of previously issued stock-based awards will be recorded during the three months ended March 30, 2017, based on the same analysis.

However, the Company expects to incur, during the fiscal quarter in which the IPO occurs, approximately $55 million in stock-based compensation expense associated with stock-based compensation awards outstanding prior to the completion of the IPO. This anticipated stock-based compensation expense will be reflected in a pre-effective amendment the Registration Statement on page 49 under the heading “—Stock Based Compensation Expense.”

* * * * * * * *

Please do not hesitate to call me at (212) 455-2812 with any questions or further comments regarding this submission or if you wish to discuss any of the above responses.

| | Very truly yours, |

| | |

| | /s/ Richard Fenyes |

| | Richard Fenyes |

| cc: | Securities and Exchange Commission | |

| | | Tom Jones | |

| | | Li Xiao | |

| | | Brian Cascio | |

| | | | |

| | Gardner Denver Holdings, Inc. | |

| | | Vicente Reynal | |

| | | Andrew Schiesl | |

| | | |

| | Latham & Watkins LLP | |

| | | Marc Jaffe | |

| | | Ian Schuman | |

Annex A

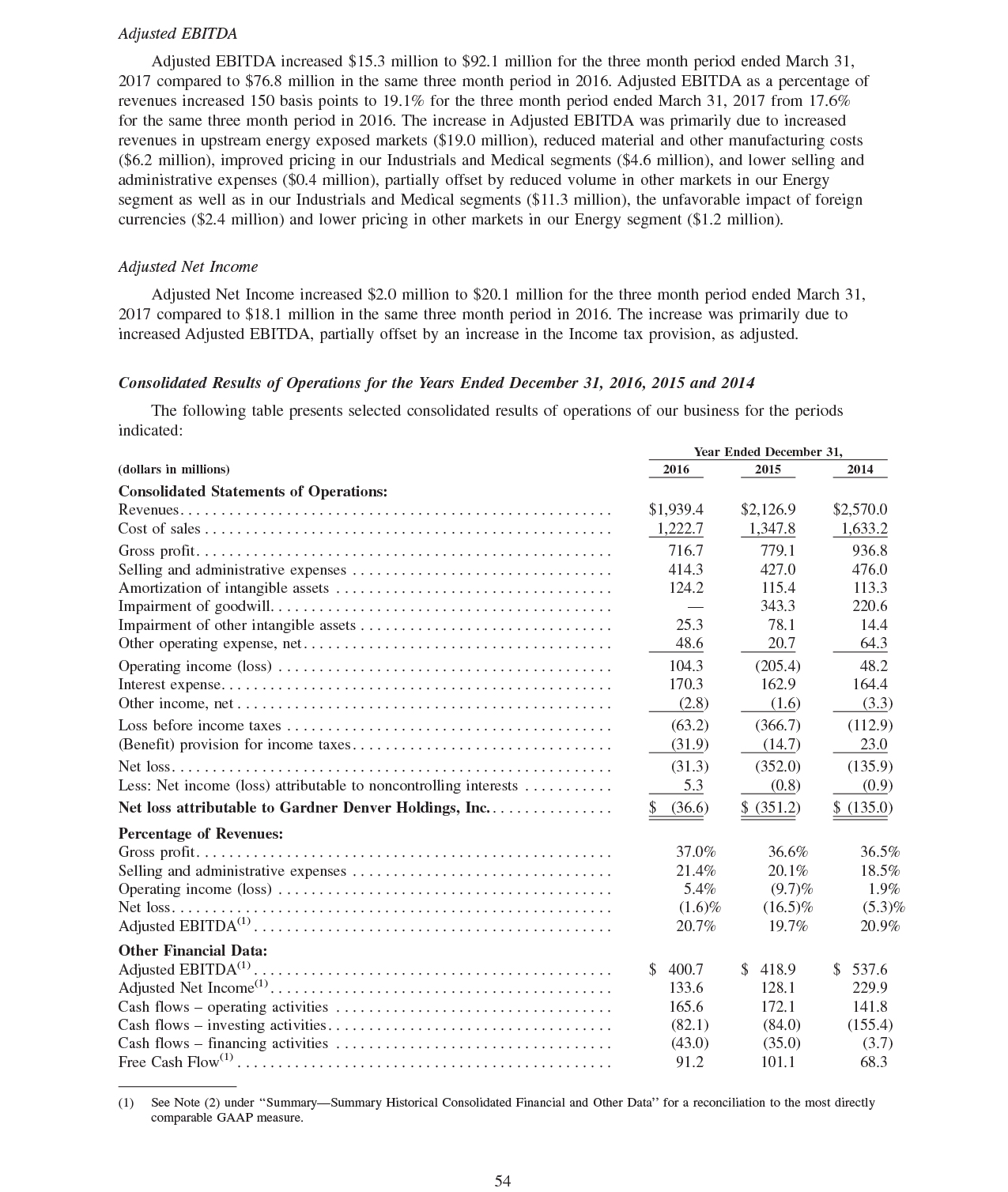

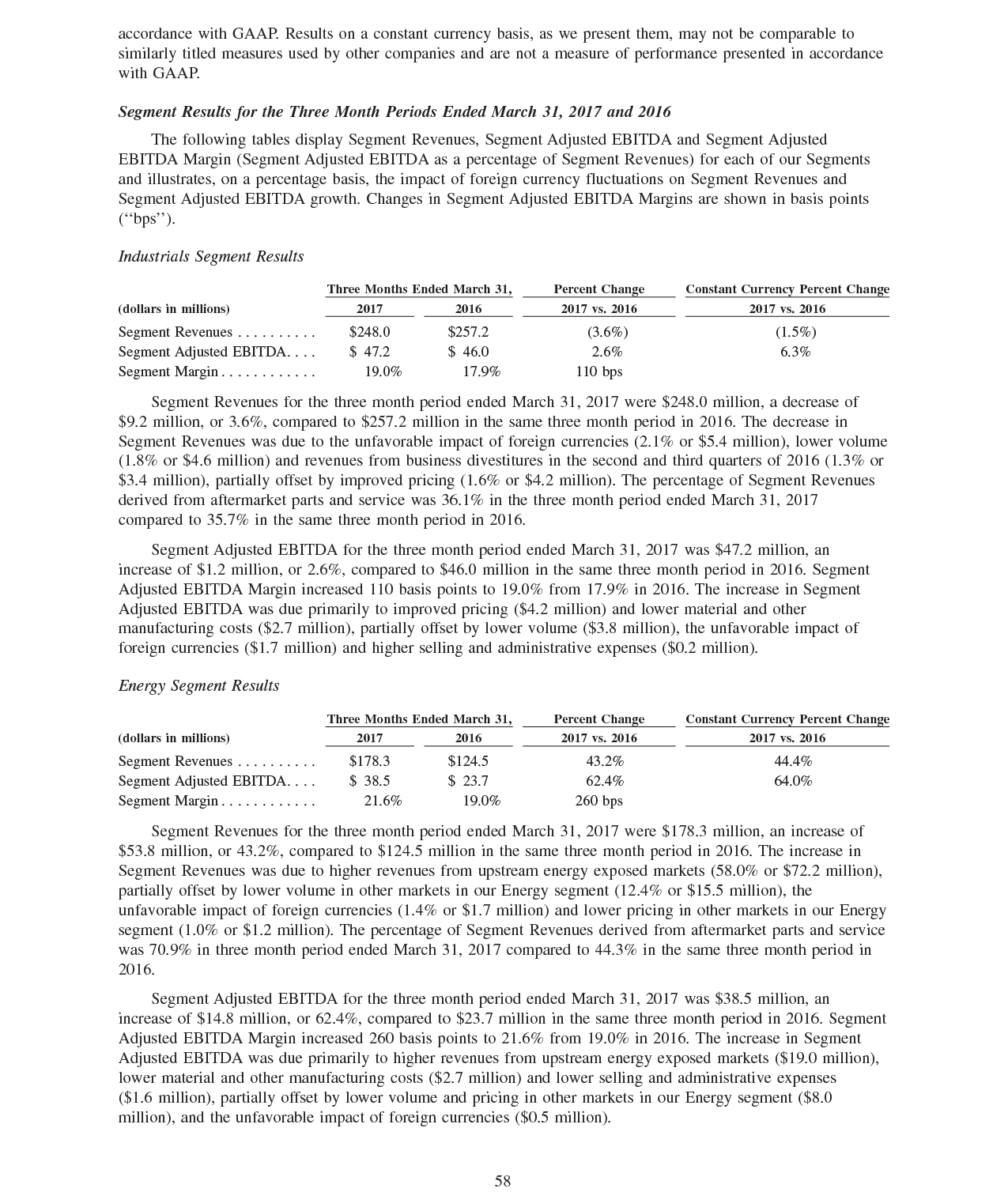

Selected Updates to the Registration Statement Reflecting March 31, 2017 Results