UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-U

CURRENT REPORT

Pursuant to Regulation A of the Securities Act of 1933

March 7, 2022

(Date of Report (Date of earliest event reported))

RealtyMogul Apartment Growth REIT, Inc.

(Exact name of issue as specified in its charter)

| Maryland | | 81-5263630 |

| (State or other jurisdiction | | (I.R.S. Employer |

| of incorporation or organization) | | Identification No.) |

10573 W Pico Blvd,

PMB #603

Los Angeles, CA, 90064

(Full mailing address of

principal executive offices)

(877) 781-7153

(Issuer’s telephone number, including area code)

Common Stock

(Title of each class of securities issued pursuant to Regulation A)

Item 9. Other Events.

On March 7, 2022, RealtyMogul Apartment Growth REIT, Inc. issued an investor communication relating to the quarter ended December 31, 2021. The text of the investor communication is set forth below.

Q4 2021*

To discuss your REIT holdings, schedule a Call with Investor Relations at:

https://calendly.com/realtymogul-investor-relations or call 877-781-7062

REALTYMOGUL APARTMENT GROWTH REIT

| OFFERING OVERVIEW | | TOTAL ASSET VALUE1 | | $ | 236,000,000 | |

| | | NUMBER OF INVESTMENTS2 | | | 8 | |

| RealtyMogul Apartment Growth REIT is a public, non-traded REIT, investing in value-add multifamily apartment buildings with both preferred and joint venture equity, with a focus on providing capital appreciation to investors. | | TOTAL NUMBER OF MULTIFAMILY UNITS2 | | | 1,576 | |

| | | 2021 TOTAL RETURN3 | | | 15.2 | % |

| | | 2021 ANNUAL DISTRIBUTION RATE4 | | | 12.5 | % |

| | | WEIGHTED AVERAGE PROJECTED HOLD PERIOD | | | 66 Months | |

| KEY OBJECTIVES | | DISTRIBUTION FREQUENCY | | | Quarterly | |

| | | TAX REPORTING FORM | | | 1099-DIV | |

| ● | To realize capital appreciation in the value of our investments over the long term | |

| ● | To pay attractive and stable cash distributions. | |

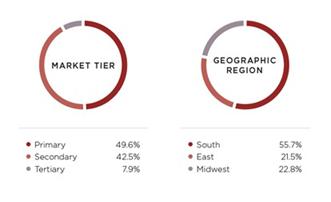

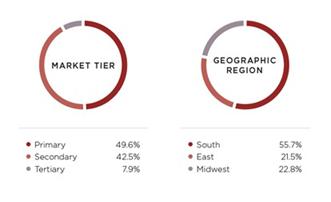

PORTFOLIO STATISTICS5

*All data as of December 31, 2021 unless otherwise specified.

1 Aggregate value of all underlying properties in RealtyMogul Apartment Growth REIT, Inc. as of February 28, 2022 based on the most recent internal valuations as of December 31, 2021 pursuant to our valuation policies; provided, however, the value of properties underlying investments acquired since the effective date of the most recently announced NAV per share is based on the most recent purchase price of such properties. As with any methodology used to estimate value, the methodology employed by our affiliates’ internal accountants or asset managers is based upon a number of estimates and assumptions about future events that may not be accurate or complete. For more information, see the “Description of Our Common Stock – Valuation Policies” section of our offering circular.

2 Based on the current outstanding investments as of February 28, 2022.

3 2021 total return represents the average total return based on the average aggregate distributions issued by RealtyMogul Apartment Growth REIT, Inc. and increase in NAV per share for most recent consecutive twelve-month period immediately preceding December 31, 2021. An individual stockholder’s total return may vary from this average total return, and there is no assurance that stockholders will be able to realize the estimated NAV per share upon attempting to sell their shares. For purposes of this calculation, “Total Return” equals distributions issued to a stockholder plus the change in NAV per share (either positive or negative), less any applicable share repurchase fees, over the course of such stockholder’s investment. Past performance is not indicative of current and future results.

4 There is no guarantee that stockholders will receive a distribution, and distributions have been paid from net proceeds from our offering, cash advances by our Manager, cash resulting from a waiver of fees or reimbursements due to our Manager, borrowings in anticipation of future operating cash flow and the issuance of additional securities.

5 Based on the current outstanding real estate investment amounts as of February 28, 2022.

VIEWS FROM MANAGEMENT

Dear Investor,

Thank you for your continued support of RealtyMogul Apartment Growth REIT. We have now provided 16 consecutive quarters of distributions, totaling over $4,100,000. To date, over 2,700 investors have invested, and RealtyMogul Apartment Growth REIT holds investments in over $236 million6 of real estate. We are also happy to share that 68% of investors have enrolled in the distribution reinvestment plan (DRIP), allowing for their distributions to compound over time. If you would like to participate in the DRIP, simply log into your account and then select “Reinvest Distributions.”

We are proud to share that the RealtyMogul Apartment Growth REIT achieved a total return of 15.2% in 2021, with average daily distributions equating to a 12.5% annualized return.7 Total return consists of two components: change in net asset value (“NAV”) and distributions. For 2021, NAV per share increased from $10.16 to $10.43, reflecting a 2.7% increase. Quarterly distributions, including the quarterly distribution declared in December 2021 and paid in January 2022, totaled $0.473 per share, reflecting a 4.6% annual distribution rate based on the NAV per share of $10.16 as of January 1, 2021. In addition to quarterly distributions, the Apartment Growth REIT also declared a special distribution in December 2021 that was paid to stockholders on February 1, 2022. The special distribution of $0.802 per share was paid to stockholders of record as of December 31, 2021 and reflected a 7.9% annual distribution rate based on the NAV per share of $10.16 as of January 1, 2021.

Two properties in our portfolio sold in 2021, Terrace Hill Apartments & Villas de Toscana. In addition, a third property, Clover at Park Lane, sold in January 2022. A portion of the gains from the 2021 dispositions was issued to stockholders of record as of December 31, 2021 in the form of a special distribution authorized by the board of directors. All distributions are classified as capital gains in the 2021 1099-DIV as a result of the property dispositions. As the special distribution was paid in February 2022, it will be included in the 2022 1099-DIV.8

Distributions paid to stockholders directly impact NAV per share by reducing the amount of cash, an asset, on the balance sheet as the cash has been paid to stockholders. As such, when RealtyMogul Apartment Growth REIT pays distributions to stockholders, and assuming no other changes to its balance sheet, the NAV per share decreases while stockholder distributions increases. The NAV per share decrease from $11.05 as of September 30, 2021 to $10.43 as of December 31, 2021 is a direct result of the special distribution. Quarter over quarter, NAV per share decreased by 5.9%; however, the special distribution was made at an annualized rate of 7.9%.

We continue to seek a diversified portfolio of multifamily real estate investments to provide stockholders exposure to the multifamily real estate market through their investment in RealtyMogul Apartment Growth REIT.9 As of February 28, 2022, RealtyMogul Apartment Growth REIT has eight investments spread across six markets.

6 Aggregate value of all underlying properties in RealtyMogul Apartment Growth REIT, Inc. as of February 28, 2022 based on the most recent internal valuations as of December 31, 2021 pursuant to our valuation policies; provided, however, the value of properties underlying investments acquired since the effective date of the most recently announced NAV per share is based on the most recent purchase price of such properties.. As with any methodology used to estimate value, the methodology employed by our affiliates’ internal accountants or asset managers is based upon a number of estimates and assumptions about future events that may not be accurate or complete. For more information, see the “Description of Our Common Stock – Valuation Policies” section of our offering circular.

7 Represents the average total return based on the average aggregate distributions issued by RealtyMogul Apartment Growth REIT, Inc. and increase in NAV per share for the last twelve months ended December 31, 2021. An individual stockholder’s total return may vary from this average total return, and there is no assurance that stockholders will be able to realize the estimated NAV per share upon attempting to sell their shares. For purposes of this calculation, “Total Return” equals distributions issued to a stockholder plus the change in NAV per share (either positive or negative), less any applicable share repurchase fees, over the course of such stockholder’s investment.

8 There is no guarantee that stockholders will receive a distribution, and distributions have been paid from net proceeds from our offering, cash advances by our Manager, cash resulting from a waiver of fees or reimbursements due to our Manager, borrowings in anticipation of future operating cash flow and the issuance of additional securities.

9 An investment in RealtyMogul Apartment Growth REIT, Inc. is not a direct investment in commercial real estate.

During Q4 2021, rent collections for the properties in RealtyMogul Apartment Growth REIT’s portfolio averaged 89%, a 3% decrease quarter over quarter. Our portfolio consists entirely of multifamily properties, which we believe is an economically resilient asset type that offers optimal risk-adjusted returns.

During Q4 2021, the U.S. Bureau of Economic Analysis estimated that U.S. seasonally adjusted real GDP grew 6.9% quarter over quarter. The Federal Reserve cut its forecast for 2022 growth in the nation’s gross domestic product from the 5.9% it projected in September 2021 to 5.5% as well as projected a 4.3% unemployment rate by year-end, down from 4.8% in September 2021. The unemployment rate ended 2021 at 3.9%. Average hourly earnings for employees increased 4.7% year over year and achieved greater than 3% year over year increases since June 2021 according to the U.S. Bureau of Labor Statistics. In addition, the Consumer Price Index rose year over year 6.2% in October, 6.8% in November, and 7.0% in December according to the U.S. Bureau of Labor Statistics. Shelter costs, which comprise approximately one-third of CPI, increased 4.2% year over year. Given the economic inflation, the Federal Reserve has indicated that they will begin reducing their balance sheet and increasing the federal funds rate. As it relates to real estate purchases, the cost to finance a real estate investment with a mortgage has increased in Q4 2021 and will likely continue to increase in 2022 if the Federal Reserve raises interest rates; however, we believe that real estate is positively correlated with inflation as property prices and rental income tend to rise as inflation rises. We like multifamily investments in an inflationary environment as the typical one-year lease term allows an owner to mark rents to market on an annual basis. We believe that RealtyMogul Apartment Growth REIT is well positioned as it continues to seek a diversified portfolio of commercial real estate, which has a low or negative correlation to other major asset classes and over time has exhibited less volatility than other asset classes.10

10 Commercial real estate performs differently than other asset classes, such as stocks or bonds, and lacks liquidity. An investment in RealtyMogul Apartment Growth REIT, Inc. is not a direct investment in commercial real estate.

INVESTMENT UPDATES

| BROOKLYN PORTFOLIO | | VILLAS DEL SOL I & II (FKA PLANO MULTIFAMILY PORTFOLIO) |

| |  |

Location: Brooklyn, NY Equity Investment: $3,000,000 Business Plan: Acquire nine rent-stabilized properties, maximize occupancy and increase rents as allowed. Investment Type: Joint Venture Equity Date Added to REIT: 11/30/2017 Asset Management Update: Portfolio occupancy increased 1% quarter over quarter, ending Q4 at 98%, with two vacant units in the 112-unit portfolio. The real estate company has been leasing, and will continue to lease, units according to the legal rents set by the New York Rent Guidelines Board. In Q4 2021, property collections averaged 91%. | | Location: Plano, TX Equity Investment: $1,000,000 Business Plan: Acquire and renovate a portfolio of garden-style apartment buildings. Investment Type: Joint Venture Equity Date Added to REIT: 01/09/2018 Asset Management Update: Portfolio occupancy decreased 2% quarter over quarter, ending Q4 at 97% occupied. 62 of the 156 units have been upgraded with new flooring, appliances, backsplash, and lighting packages. Exterior and common area improvements are complete, and the property is amenitized with an improved leasing office, gazebos, BBQ grills, an upgraded laundry room and soccer court. The property averaged 99% collections for Q4 2021. |

VILLAS DE SONOMA (FKA VILLAS DE MAR)

Location: Fort Worth, TX Equity Investment: $1,566,558 Business Plan: Acquire and renovate a garden-style apartment community. Investment Type: Joint Venture Equity Date Added to REIT: 02/28/2018 Asset Management Update: Property occupancy decreased 6% quarter over quarter, ending Q4 at 77% occupied. 49 of the 263 units have been upgraded with new flooring, appliances, backsplash, and lighting packages. The real estate company has also completed light to moderate upgrades on 58 units. The real estate company has completed all exterior capex work, which included clubhouse renovations, BBQ grills, paint, signage and water retrofit. The retaining wall repair has been successfully completed as well. The property averaged 53% collections for Q4 2021 as a result of failed inspections by the housing authority for certain Section 8 units. Capital improvements were completed, and these units were subsequently brought back online and approved by the housing authority in February 2022. During Q4 2021, the Company funded capital calls totaling $500,000 to augment operations in connection with positioning the property for sale. | | AVON PLACE APARTMENTS

Location: Avon, CT Equity Investment: $3,000,000 Business Plan: Acquire and renovate a garden-style apartment community. Investment Type: Joint Venture Equity Date Added to REIT: 11/01/2018 Asset Management Update: Property occupancy decreased 2% quarter over quarter, ending Q4 at 94% occupied. The real estate company resumed unit renovations in Q3 2021. As of December 2021, 39 of the 164 units have been renovated since acquisition. Of those 39 units, 38 have been leased and have achieved an average premium of $333/month above prior rents and 7% above projected rents. The real estate company had previously completed property improvements, including painting all common areas and hallways, furnishing the pool area and renovating the clubhouse/game room and kitchen. The property averaged 98% collections for Q4 2021. |

NINETY-NINE44 APARTMENTS

Location: Dallas, TX Equity Investment: $4,000,000 Business Plan: Acquire and renovate a garden-style apartment community. Investment Type: Joint Venture Equity Date Added to REIT: 9/9/2020 Asset Management Update: Property occupancy increased 5% quarter over quarter, ending Q4 at 97% occupied. As of December 2021, the real estate company renovated 49 units. Of those 49 units, 47 have been leased and have achieved an average premium of $144/month over prior rents and 3% above projected rents. The real estate company has completed exterior capex work, including landscaping, parking lot repairs, parking lot restriping, trip hazard repairs, laundry room improvements and fitness center improvements. The real estate company plans to improve the fans, lighting, and air conditioning for the fitness center in the coming quarters. The property averaged 91% collections for Q4 2021. | | THE ORION

Location: Orion Township, MI Equity Investment: $5,000,000 Business Plan: Acquire and renovate a garden-style apartment community. Investment Type: Joint Venture Equity Date Added to REIT: 3/23/2021 Asset Management Update: The property ended Q4 at 96% occupancy. As of December 2021, 34 of the 200 units have been renovated since acquisition. Of those 34 units, 33 have been leased and have achieved an average premium of $309/month over prior rents and 13% over projected rents. Exterior improvements continue to progress as the clubhouse remodel, new exterior paint, new signage, and new dog park projects have been completed. Improvements to tenant amenity areas and the parking lot are underway. Based on current bids, exterior improvements are expected to be completed below budget. The property averaged 93% collections for Q4 2021. |

LOTUS VILLAGE

Location: Austin, TX Equity Investment: $2,500,000 Business Plan: Acquire and renovate a low-rise apartment community. Investment Type: Joint Venture Equity Date Added to REIT: 6/25/2021 Asset Management Update: The property ended Q4 at 94% occupancy. During Q4, five units were renovated and are anticipated to be completed in January 2022. Improvements to the fitness center and pool area as well as exterior repairs are currently in process. The property averaged 86% collections for Q4 2021. | | SHERWOOD OAKS

Location: Riverview, FL Equity Investment: $4,200,000 Business Plan: Acquire and renovate a garden-style apartment community. Investment Type: Joint Venture Equity Date Added to REIT: 11/30/2021 Asset Management Update: The recently acquired property ended Q4 at 95% occupancy. The capital improvements budget includes exterior work as the prior owner previously renovated all unit interiors. Exterior renovations have commenced, including improvements to the landscaping, lighting, pool, parking lot, wastewater facility, fitness center and dog park. Outdoor amenities are also underway. The property achieved 99% rent collection for December 2021. |

INVESTMENT PAYOFFS

VILLAS DE TOSCANA (FKA TUSCANY AT WESTOVER HILLS) | | THE CLOVER ON PARK LANE (FKA SERENDIPITY APARTMENTS) |

| |  |

Location: San Antonio, TX Equity Investment: $1,000,000 Business Plan: Acquire and renovate a garden-style apartment community. Investment Type: Joint Venture Equity Date Added to REIT: 01/31/2018 Date Sold: 12/20/2021 Asset Management Update: On December 20, 2021, the property was sold. The property was originally acquired for $14,350,000, or $75,526 per unit, and was sold for $17,650,000, or $92,895 per unit. Based on the sale price, the property achieved approximately a 4.5% property-level internal rate of return (“IRR”), a 1.2x equity multiple and 3.2% average cash-on-cash return over the 4-year hold period. | | Location: Dallas, TX Equity Investment: $4,000,000 Business Plan: Acquire and renovate a garden-style apartment community. Investment Type: Joint Venture Equity Date Added to REIT: 09/01/2017 Date Sold: 1/7/2022 Asset Management Update: On January 7, 2022, the property was sold. As a result of the business plan for the renovation of the property, since the property’s acquisition, 279 of the 343 units had been renovated, and renovation costs remained under budget. The Exterior and common area improvements were completed, including landscaping, installation of new signage, lighting, fencing, gates/security systems, a playground and dog park as well as a complete renovation of the leasing office/clubhouse. Other improvements included resurfacing of the pool, foundation repairs, exterior sliding repairs and painting. Since the property’s acquisition, the property’s average rent rate increased from $578/month as of October 2017 to $830/month upon the sale of the property, representing a 44% increase in rent rate. The property was originally acquired for $19,500,000, or $56,851 per unit, and was sold for $38,500,000, or $112,245 per unit. The initial underwriting projected a property-level IRR of 20.9%, a 2.3x equity multiple and 9.2% average cash-on-cash return throughout a 5-year period hold. Based on the property’s sale price, the property achieved approximately a 36.2% property-level IRR, a 3.2x equity multiple and 8.7% average cash-on-cash return over the 4.3-year hold period. |

INVESTMENT ACTIVITY

DISTRIBUTIONS

RealtyMogul Apartment Growth REIT has declared distributions for 16 consecutive quarters. The board of directors authorized a distribution for each month of the fourth quarter of 2021 on September 30, 2021. In addition to monthly distributions, the board of directors also authorized a special distribution in December 2021. The special distribution of $0.802 per share was paid to stockholders of record as of December 31, 2021 and reflected a 7.9% annual distribution rate based on the NAV per share of $10.16 as of January 1, 2021. Exclusive of special distributions, distributions have been paid on a quarterly basis since January 1, 2018 and equate to approximately 4.5% on an annualized basis based upon the then current per share purchase price.

NET ASSET VALUE (NAV)

| PRICE PER SHARE (AS OF 1/28/22)* | | NAV PER SHARE (AS OF 12/31/21) |

| $10.43 | | $10.43 |

*Our offering price per share equals our most recently announced NAV per share and will be adjusted at the beginning of every fiscal quarter (or as soon as commercially reasonable thereafter). On January 28, 2022, we announced that our NAV per share is $10.43, as of December 31, 2021. Accordingly, effective January 28, 2022, the offering price per share is $10.43. The price per share pursuant to our distribution reinvestment plan will equal our most recently announced NAV per share and any repurchases of shares made pursuant to our share repurchase program will be made at the most recent NAV per share (less any applicable discounts, as set forth in our offering circular).

The NAV per share calculation reflects the total value of our assets minus the total value of our liabilities, divided by the number of shares outstanding.

As with any methodology used to estimate value, the methodology employed calculating our NAV per share is based upon a number of estimates and assumptions about future events that may not be accurate or complete. Further, different parties using different assumptions and estimates could derive a different NAV per share, which could be significantly different from our calculated NAV per share. Our NAV will fluctuate over time and does not represent: (i) the price at which our shares would trade on a national securities exchange, (ii) the amount per share a stockholder would obtain if he, she or it tried to sell his, her or its shares or (iii) the amount per share stockholders would receive if we liquidated our assets and distributed the proceeds after paying all our expenses and liabilities.

Copyright © 2022 RM Adviser, LLC, All rights reserved.

Previous Updates

Please follow the below links to access updates from the prior four quarters. Historical quarterly updates can also be found on the SEC EDGAR website.

Q3 2021 Shareholder Letter

Q2 2021 Shareholder Letter

Q1 2021 Shareholder Letter

Q4 2020 Shareholder Letter

As always, please feel free to contact us at info@realtymogul.com or call directly with any questions you may have.

Sincerely,

| /s/ Jilliene Helman | | /s/ Eric Levy |

| Jilliene Helman | | Eric Levy |

| CEO, RM Adviser, LLC | | Vice President, Portfolio Manager, RM Adviser, LLC |

Forward-Looking Statements

This Current Report on Form 1-U contains forward-looking statements within the meaning of the federal securities laws. The words “believe,” “estimate,” “expect,” “anticipate,” “intend,” “plan,” “seek,” “may,” “continue,” “could,” “might,” “potential,” “predict,” “should,” “will,” “would,” and similar expressions or statements regarding future periods or the negative of these terms are intended to identify forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties and other important factors that could cause our actual results, performance or achievements, or industry results, to differ materially from any predictions of future results, performance or achievements that we express or imply in this Current Report on Form 1-U.

SIGNATURES

Pursuant to the requirements of Regulation A, the issuer has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | REALTYMOGUL APARTMENT GROWTH REIT, INC. |

| | | |

| | By: | /s/ Jilliene Helman |

| | Name: | Jilliene Helman |

| | Title: | Chief Executive Officer and President |

| | | |

| | By: | /s/ Eric Levy |

| | Name: | Eric Levy |

| | Title: | Vice President, Portfolio Manager, RM Adviser, LLC |

| | | |

| | Date: | March 7, 2022 |