Exhibit (c)(10)

Highly Confidential

DISCUSSION MATERIALS

Project Amsterdam

March 31, 2017

J.P.Morgan

PROJ ECT AMS TERDAM Highly Confidential This presentation was prepared exclusively for the benefit and internal use of the J.P. Morgan client to whom it is directly addressed and delivered (including such client’s subsidiaries, the “Company”) in order to assist the Company in evaluating, on a preliminary basis, the feasibility of a possible transaction or transactions and does not carry any right of publication or disclosure, in whole or in part, to any other party. This presentation is for discussion purposes only and is incomplete without reference to, and should be viewed solely in conjunction with, the oral briefing provided by J.P. Morgan. Neither this presentation nor any of its contents may be disclosed or used for any other purpose without the prior written consent of J.P. Morgan. The information in this presentation is based upon any forecasts supplied to us and reflects prevailing conditions and our views as of this date, all of which are accordingly subject to change. J.P. Morgan’s opinions and estimates constitute J.P. Morgan’s judgment and should be regarded as indicative, preliminary and for illustrative purposes only. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Company or which was otherwise reviewed by us. In addition, our analyses are not and do not purport to be appraisals of the assets, stock, or business of the Company or any other entity. J.P. Morgan makes no representations as to the actual value which may be received in connection with a transaction nor the legal, tax or accounting effects of consummating a transaction. Unless expressly contemplated hereby, the information in this presentation does not take into account the effects of a possible transaction or transactions involving an actual or potential change of control, which may have significant valuation and other effects. Notwithstanding anything herein to the contrary, the Company and each of its employees, representatives or other agents may disclose to any and all persons, without limitation of any kind, the U.S. federal and state income tax treatment and the U.S. federal and state income tax structure of the transactions contemplated hereby and all materials of any kind (including opinions or other tax analyses) that are provided to the Company relating to such tax treatment and tax structure insofar as such treatment and/or structure relates to a U.S. federal or state income tax strategy provided to the Company by J.P. Morgan. J.P. Morgan’s policies prohibit employees from offering, directly or indirectly, a favorable research rating or specific price target, or offering to change a rating or price target, to a subject company as consideration or inducement for the receipt of business or for compensation. J.P. Morgan also prohibits its research analysts from being compensated for involvement in investment banking transactions except to the extent that such participation is intended to benefit investors. IRS Circular 230 Disclosure: JPMorgan Chase & Co. and its affiliates do not provide tax advice. Accordingly, any discussion of U.S. tax matters included herein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone not affiliated with JPMorgan Chase & Co. of any of the matters addressed herein or for the purpose of avoiding U.S. tax-related penalties. J.P. Morgan is the marketing name for the Corporate and Investment Banking activities of JPMorgan Chase Bank, N.A., JPMS (member, NYSE), J.P. Morgan PLC authorized by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority) and their investment banking affiliates. DISCUSSION MATERIALS

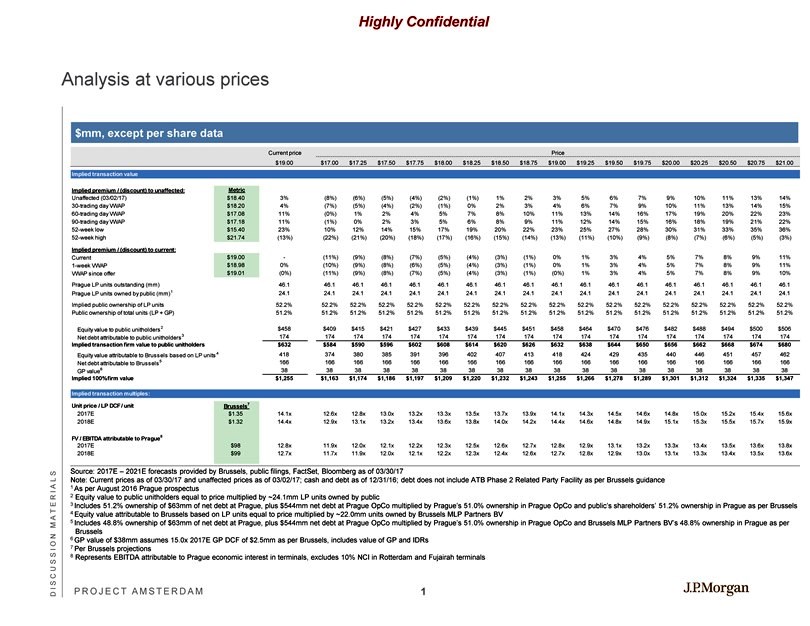

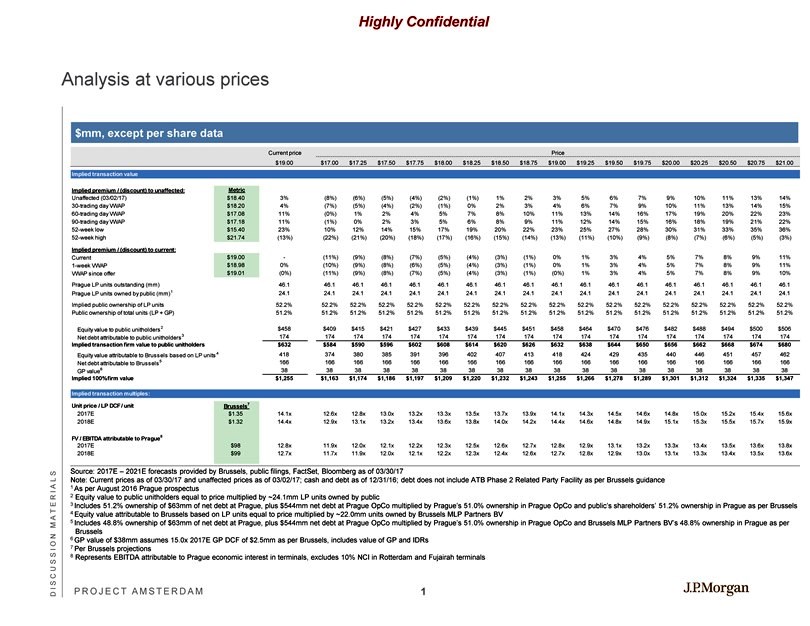

PROJ ECT AMS TERDAM Highly Confidential Analysis at various prices DISCUSSION MATERIALS $mm, except per share data Source: 2017E 2021E forecasts provided by Brussels, public filings, FactSet, Bloomberg as of 03/30/17 Note: Current prices as of 03/30/17 and unaffected prices as of 03/02/17; cash and debt as of 12/31/16; debt does not include ATB Phase 2 Related Party Facility as per Brussels guidance 1 As per August 2016 Prague prospectus 2 Equity value to public unitholders equal to price multiplied by ~24.1mm LP units owned by public 3 Includes 51.2% ownership of $63mm of net debt at Prague, plus $544mm net debt at Prague OpCo multiplied by Pragues 51.0% ownership in Prague OpCo and publics shareholders 51.2% ownership in Prague as per Brussels 4 Equity value attributable to Brussels based on LP units equal to price multiplied by ~22.0mm units owned by Brussels MLP Partners BV 5 Includes 48.8% ownership of $63mm of net debt at Prague, plus $544mm net debt at Prague OpCo multiplied by Pragues 51.0% ownership in Prague OpCo and Brussels MLP Partners BVs 48.8% ownership in Prague as per Brussels 6 GP value of $38mm assumes 15.0x 2017E GP DCF of $2.5mm as per Brussels, includes value of GP and IDRs 7 Per Brussels projections 8 Represents EBITDA attributable to Prague economic interest in terminals, excludes 10% NCI in Rotterdam and Fujairah terminals Current price Price $19.00 $17.00 $17.25 $17.50 $17.75 $18.00 $18.25 $18.50 $18.75 $19.00 $19.25 $19.50 $19.75 $20.00 $20.25 $20.50 $20.75 $21.00 Implied transaction value Implied premium / (discount) to unaffected: Metric Unaffected (03/02/17) $18.40 3% (8%) (6%) (5%) (4%) (2%) (1%) 1% 2% 3% 5% 6% 7% 9% 10% 11% 13% 14% 30-trading day VWAP $18.20 4% (7%) (5%) (4%) (2%) (1%) 0% 2% 3% 4% 6% 7% 9% 10% 11% 13% 14% 15% 60-trading day VWAP $17.08 11% (0%) 1% 2% 4% 5% 7% 8% 10% 11% 13% 14% 16% 17% 19% 20% 22% 23% 90-trading day VWAP $17.18 11% (1%) 0% 2% 3% 5% 6% 8% 9% 11% 12% 14% 15% 16% 18% 19% 21% 22% 52-week low $15.40 23% 10% 12% 14% 15% 17% 19% 20% 22% 23% 25% 27% 28% 30% 31% 33% 35% 36% 52-week high $21.74 (13%) (22%) (21%) (20%) (18%) (17%) (16%) (15%) (14%) (13%) (11%) (10%) (9%) (8%) (7%) (6%) (5%) (3%) Implied premium / (discount) to current: Current $19.00—(11%) (9%) (8%) (7%) (5%) (4%) (3%) (1%) 0% 1% 3% 4% 5% 7% 8% 9% 11% 1-week VWAP $18.98 0% (10%) (9%) (8%) (6%) (5%) (4%) (3%) (1%) 0% 1% 3% 4% 5% 7% 8% 9% 11% VWAP since offer $19.01 (0%) (11%) (9%) (8%) (7%) (5%) (4%) (3%) (1%) (0%) 1% 3% 4% 5% 7% 8% 9% 10% Prague LP units outstanding (mm) 46.1 46.1 46.1 46.1 46.1 46.1 46.1 46.1 46.1 46.1 46.1 46.1 46.1 46.1 46.1 46.1 46.1 46.1 Prague LP units owned by public (mm)1 24.1 24.1 24.1 24.1 24.1 24.1 24.1 24.1 24.1 24.1 24.1 24.1 24.1 24.1 24.1 24.1 24.1 24.1 Implied public ownership of LP units 52.2% 52.2% 52.2% 52.2% 52.2% 52.2% 52.2% 52.2% 52.2% 52.2% 52.2% 52.2% 52.2% 52.2% 52.2% 52.2% 52.2% 52.2% Public ownership of total units (LP + GP) 51.2% 51.2% 51.2% 51.2% 51.2% 51.2% 51.2% 51.2% 51.2% 51.2% 51.2% 51.2% 51.2% 51.2% 51.2% 51.2% 51.2% 51.2% Equity value to public unitholders 2 $458 $409 $415 $421 $427 $433 $439 $445 $451 $458 $464 $470 $476 $482 $488 $494 $500 $506 Net debt attributable to public unitholders 3 174 174 174 174 174 174 174 174 174 174 174 174 174 174 174 174 174 174 Implied transaction firm value to public unitholders $632 $584 $590 $596 $602 $608 $614 $620 $626 $632 $638 $644 $650 $656 $662 $668 $674 $680 Equity value attributable to Brussels based on LP units 4 418 374 380 385 391 396 402 407 413 418 424 429 435 440 446 451 457 462 Net debt attributable to Brussels5 166 166 166 166 166 166 166 166 166 166 166 166 166 166 166 166 166 166 GP value6 38 38 38 38 38 38 38 38 38 38 38 38 38 38 38 38 38 38 Implied 100% firm value $1,255 $1,163 $1,174 $1,186 $1,197 $1,209 $1,220 $1,232 $1,243 $1,255 $1,266 $1,278 $1,289 $1,301 $1,312 $1,324 $1,335 $1,347 Implied transaction multiples: Unit price / LP DCF / unit Brussels7 2017E $1.35 14.1x 12.6x 12.8x 13.0x 13.2x 13.3x 13.5x 13.7x 13.9x 14.1x 14.3x 14.5x 14.6x 14.8x 15.0x 15.2x 15.4x 15.6x 2018E $1.32 14.4x 12.9x 13.1x 13.2x 13.4x 13.6x 13.8x 14.0x 14.2x 14.4x 14.6x 14.8x 14.9x 15.1x 15.3x 15.5x 15.7x 15.9x FV / EBITDA attributable to Prague8 2017E $98 12.8x 11.9x 12.0x 12.1x 12.2x 12.3x 12.5x 12.6x 12.7x 12.8x 12.9x 13.1x 13.2x 13.3x 13.4x 13.5x 13.6x 13.8x 2018E $99 12.7x 11.7x 11.9x 12.0x 12.1x 12.2x 12.3x 12.4x 12.6x 12.7x 12.8x 12.9x 13.0x 13.1x 13.3x 13.4x 13.5x 13.6x 1

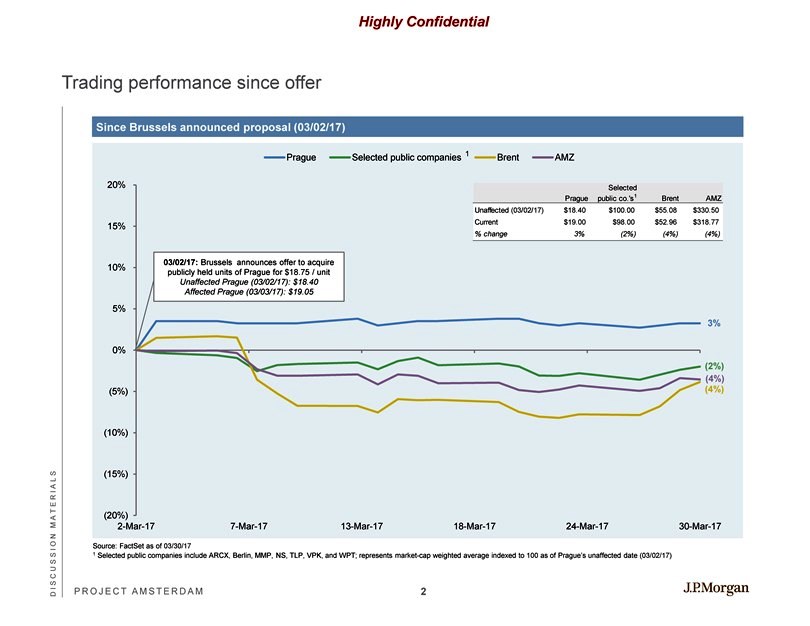

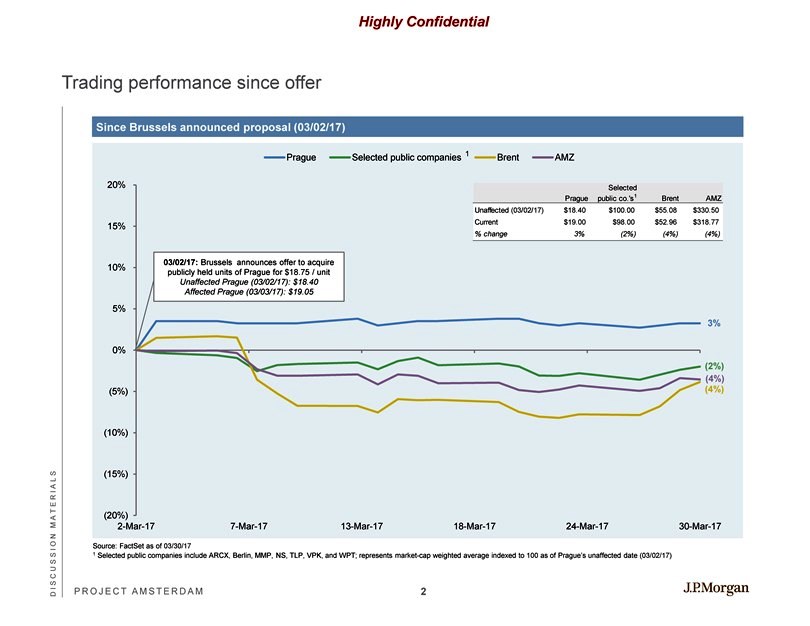

PROJ ECT AMS TERDAM Highly Confidential Trading performance since offer DISCUSSION MATERIALS Since Brussels announced proposal (03/02/17) Source: FactSet as of 03/30/17 1 Selected public companies include ARCX, Berlin, MMP, NS, TLP, VPK, and WPT; represents market-cap weighted average indexed to 100 as of Prague’s unaffected date (03/02/17) (20%) (15%) (10%) (5%) 0% 5% 10% 15% 20% 2-Mar-17 7-Mar-17 13-Mar-17 18-Mar-17 24-Mar-17 30-Mar-17 Prague Selected public companies Brent AMZ 3% (4%) (2%) (4%) 1 03/02/17: Brussels announces offer to acquire publicly held units of Prague for $18.75 / unit Unaffected Prague (03/02/17): $18.40 Affected Prague (03/03/17): $19.05 Selected Prague public co.‘s1 Brent AMZ Unaffected (03/02/17) $18.40 $100.00 $55.08 $330.50 Current $19.00 $98.00 $52.96 $318.77 % change 3% (2%) (4%) (4%) 2