Ameren Corporation

Vote FOR: Proxy Ballot Item #5

“Shareholder Proposal Regarding Scopes 1 & 2 Emissions Targets”

Annual Meeting: May 11, 2023

CONTACT: Mary Minette, Mercy Investment Services | mminette@Mercyinvestments.org

SUMMARY

As long-term investors in Ameren Corporation (“Ameren” or “the Company”), we are concerned that the Company’s existing targets to reduce its greenhouse gas emissions are not 1.5C aligned consistent with sector-modelled pathways. The electric utility industry must decarbonize quickly if we are to stay within 1.5C of warming; however, Ameren’s targets are not on a sufficiently accelerated pace to be considered in alignment with that goal, lagging both peers and diverging from widely recognized science-based pathways. As a regulated utility which has earnings linked to capital expenditures on its asset base, we believe there is an exceptionally strong business case for Ameren to simultaneously reduce its operational emissions and grow earnings by shifting generation from largely depreciated coal assets to new investments in renewables and the enabling grid infrastructure. Accordingly, investors are encouraged to vote “FOR” this proposal.

RESOLVED CLAUSE

Shareholders request Ameren issue a report within a year, and annually thereafter, at reasonable expense and excluding confidential information, that discloses Scopes 1 and 2 operational greenhouse gas targets in the short, medium and long-term aligned with the Paris Agreement’s goal of maintaining global temperature rise at 1.5 degrees Celsius, consistent with sector-modelled pathways, and plans to achieve them.

SUPPORTING STATEMENT

In assessing targets, we recommend, at the board’s discretion:

| · | Pursuing alignment with sector-modelled 1.5C aligned pathways such as those outlined by the IPCC or IEA; |

| · | Taking into consideration approaches used by groups like the Science Based Targets initiative and Transition Pathway Initiative; and |

| · | Developing a decarbonization strategy which identifies and quantifies the set of actions Ameren intends to take to achieve its GHG reduction targets over the targeted timeframe. |

RATIONALE FOR A YES VOTE

| 1) | Ameren’s Scope 1 and 2 emissions targets do not align with 1.5C sector pathways for electric utilities. |

| 2) | Ameren’s Scope 1 and 2 targets lag those of its peers in pace and ambition. |

| 3) | Reducing operational emissions is a significant earnings growth and capital deployment opportunity for Ameren and its shareholders. |

DISCUSSION

| 1) | Ameren’s Scope 1 and 2 emissions targets do not align with 1.5C sector pathways for electric utilities. |

Electric power is arguably the most important sector to decarbonize over the next decade. Rapid decarbonization is needed to address the sector’s substantial greenhouse gas emissions and to support the transition of other sectors, such as transportation and buildings, to net zero through electrification.The International Energy Agency (IEA) Net Zero By 2050 report found that emissions from the power sector must reach net zero by 2035 in advanced economies and by 2040 globally.1 Under this scenario, electricity generation using natural gas without carbon capture must begin falling by 2030 and is 90% lower by 2040.

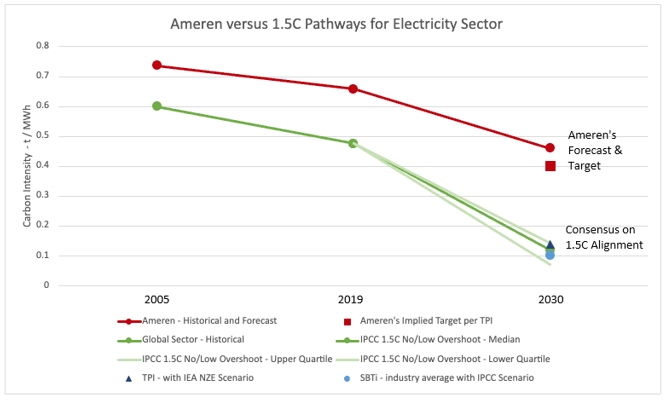

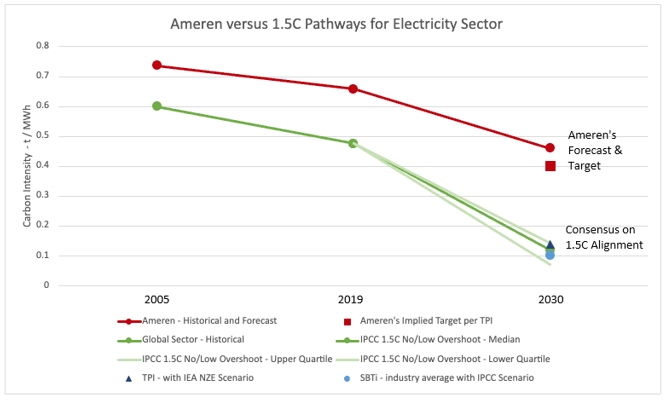

Ameren’s opposition statement notes that its Scope 1 and 2 targets are aimed at reaching net zero emissions by 2045 and argues that this target, and the Company’s interim goals of 60% reduction in carbon emissions by 2030 and a medium-term 85% carbon emissions reduction by 2040 from a 2005 baseline, render this proposal moot. However, our proposal requests targets aligned with a utility sector pathway to limit temperature rise to 1.5C as outlined by the Intergovernmental Panel on Climate Change.2 Ameren’s targets are inconsistent with sector-modelled pathways for electric utilities because they are not on a sufficiently accelerated pace.

The proposal highlights some of the key available frameworks for assessing alignment with sector-modelled 1.5C pathways, referencing approaches used by groups like the Science Based Targets initiative and Transition Pathway Initiative (TPI). These widely recognized pathways clearly demonstrate that a sector-aligned approach for electric utilities requires more intensive near- and medium-term targets than those currently established by the Company.

_____________________________

1 https://www.iea.org/reports/net-zero-by-2050

2 https://www.ipcc.ch/report/ar6/wg3/downloads/report/IPCC_AR6_WGIII_TechnicalSummary.pdf

For example, TPI, a global initiative led by asset owners and supported by asset managers, derives its pathways from a widely recognized IEA scenario.3 As demonstrated in the chart below, TPI has found that Ameren’s absolute 2030 target is equivalent to an intensity target of 0.4 t CO2e / MW, almost three times higher than the level aligned with 1.5C sector pathways. 4

In its opposition statement, Ameren asserts that “[i]t is generally acknowledged that the standard for achieving the Paris Agreement’s 1.5C goal is to achieve net zero carbon emissions by 2050. The Company’s carbon emissions reduction targets as described above are designed to achieve net zero Scope 1 and 2 emissions by 2045, and thus provide a clear pathway to the Paris Agreement’s 2050 net zero goal.” This statement ignores the conclusion of the IEA’s Net Zero by 2050 Roadmap that the electricity sector in advanced economies must reach net zero emissions by 2035 for the global economy to reach net zero by 2050.5 Ameren’s conclusion that its goal is sufficient to meet a net zero target that is aligned with a 1.5C pathway is therefore flawed.

_____________________________

3 https://www.iea.org/reports/world-energy-outlook-2022

4 https://www.transitionpathwayinitiative.org/companies/ameren?cp_assessment_id=4494#carbon-performance

5 https://iea.blob.core.windows.net/assets/7ebafc81-74ed-412b-9c60-5cc32c8396e4/NetZeroby2050-ARoadmapfortheGlobalEnergySector-SummaryforPolicyMakers_CORR.pdf

| 2) | Ameren’s Scope 1 and 2 targets lag those of its peers in pace and ambition. |

Ameren’s peers are outpacing the Company in decarbonizing their generation and electricity supply, further highlighting its misalignment with widely recognized sector-modelled pathways. For example, peer companies are accelerating plans to phase out their use of coal in recognition of the growing global consensus that earlier retirement is needed. WEC6 and DTE7 plan to retire their coal generation by 2035; Xcel is accelerating its coal retirement schedule to 20308; and CMS Energy plans to retire its coal plants by 2025.9 In contrast, Ameren currently plans to continue to run two coal units at the Labadie Energy Center beyond 2040.10 In January 2021 the UN Secretary-General called for the phase out of coal generation in OECD countries by 2030 at the latest, and in developing economies by 2040.11

Ameren's target of 60% absolute reduction by 2030 clearly lags the targets of Xcel and other peers. For example, Xcel's target of 80% absolute reduction in emissions by 2030 from a 2005 base was confirmed by the University of Denver's analysis as being consistent with 1.5C pathways for the sector.12 Clearly, Ameren's contrasting target would not pass the University of Denver's assessment framework.

Many of Ameren’s peers are generating more of their electricity from renewable sources.13 In addition, regulated utility peers such as AEP,14 Xcel Energy15 and Dominion Energy16 have announced medium-term plans to deploy substantial capital into renewables and grid upgrades that will decarbonize operations while simultaneously growing assets that will support future earnings growth. Following the passage of the Inflation Reduction Act in 2022, more investment in clean energy sources is likely. However, Ameren currently plans a generation mix dominated by fossil fuels well into the future.

_____________________________

6 https://www.wecenergygroup.com/home/generation-reshaping-plan.htm

7 https://www.detroitnews.com/story/business/2022/11/03/dte-speeds-coal-exit-adds-natural-gas-renewable-energy-in-2042-plan/69613541007/

8 https://www.businesswire.com/news/home/20221031005623/en/Xcel-Energy-proposes-to-exit-coal-by-2030

9 https://www.consumersenergy.com/-/media/CE/Documents/company/IRP-2021.ashx

10 https://www.ameren.com/missouri/company/environment-and-sustainability/integrated-resource-plan

11 https://unfccc.int/news/un-chief-phase-out-of-coal-is-key-climate-priority#:~:text=In%20a%20message%20on%2015,the%20rest%20of%20the%20world.

12 https://www.xcelenergy.com/staticfiles/xe/PDF/University%20of%20Denver%20analysis%20of%20Xcel%20Energy%20carbon%20goals.pdf

13 https://www.ceres.org/resources/reports/benchmarking-air-emissions-100-largest-electric-power-producers-united-states-2022

14 https://www.aep.com/Assets/docs/investors/eventspresentationsandwebcasts/AnalystDayPresentation2022.pdf

15 https://s25.q4cdn.com/680186029/files/doc_presentations/2022/11/EEI-Financial-Conference-Presentation-11-13-2022.pdf

16 https://s2.q4cdn.com/510812146/files/doc_financials/2022/q3/2022-11-04-DE-IR-3Q-2022-earnings-call-slides-vTC.pdf

| 3) | Reducing operational emissions is a significant earnings growth and capital deployment opportunity for Ameren and its shareholders. |

Ameren’s operational emissions (28.3 million metric tonnes of carbon dioxide equivalent (CO2eq) in 2021) are dominated by the electricity generation fleet in its Missouri utility. 17 In particular, the coal fleet emitted 27.7 million metric tonnes of CO2eq in 2021.18

Decarbonization of operational emissions represents a significant opportunity for rate-regulated electric utilities like Ameren because deploying capital to build the new low-carbon energy system adds to its rate base and earnings. To a limited extent, Ameren is pursuing this investment opportunity through its updated 2022 Missouri resource plan. Ameren’s 2022 10-K outlines $7.5 billion and $650 million of planned renewables and supporting energy storage investments, respectively, through 2040,19 not including investments in enabling system-wide transmission infrastructure upgrades. These amounts are reasonably significant, but this is a very extended timeframe.

Ameren expects that the updated 2022 plan, including the investment opportunities mentioned above, will see its carbon intensity decline to 0.18 t / MWh by 2040. This still exceeds a 1.5C pathway. Aligning with a 1.5C pathway in the medium term would mainly involve compressing the existing investment plan - which Ameren has already proven meets its reliability and affordability needs - into the 2030 timeframe, thereby realizing benefits for itself, consumers, and investors much sooner. In addition, Ameren has several options for fully aligning with a 1.5C pathway by 2030, including: a) scaling up these renewables-centric investment plans, so that more generation is shifted from coal to renewables; b) more emission-optimal dispatch of the existing fossil fuel fleet; and c) improvements in efficiency of its fossil fuel fleet (which would involve deploying capital too). Since 1.5C alignment is typically measured at the portfolio level, Ameren has flexibility on the combination of these options and can therefore pursue decarbonization without compromising its reliability and affordability objectives.

The financial implications of rapidly reducing reliance on coal generation are not especially significant, because the coal generation phaseout, in volumes of megawatt-hours, can occur through outright retirements and/or reduced utilization of plants ahead of those retirements. Even complete retirements of the coal fleet on an accelerated timeline would likely have a minor impact on Ameren. Its three remaining plants contribute only $2 billion to its rate base of $23.6 billion because of accumulated depreciation across all plants as they approach the ends of their economic lives. With the retirement of the two Meramec units in 2022, almost half of the remaining net summer capacity is already scheduled to retire in 2025 and 2030. Importantly, Ameren would likely need to replace this retiring coal capacity with other forms of dispatchable capacity. New sources of capacity would likely have a greater value in the rate base because their value is not yet depreciated, with a greater contribution to earnings.

_____________________________

17 https://www.ameren.com/-/media/corporate-site/files/environment/reports/eei-aga-esg-sustainability-template.ashx

18 https://www.ameren.com/-/media/corporate-site/files/environment/reports/eei-aga-esg-sustainability-template.ashx

19 https://d18rn0p25nwr6d.cloudfront.net/CIK-0001002910/65fe34c4-aeb2-4942-90af-17207c3d8f2e.pdf

If accelerated coal plant retirements are not feasible, an alternative low-cost option is to switch unretired plants from baseload to seasonal roles. This would be particularly relevant to the Labadie plant that is dominant in coal generation volumes in 2022, has scheduled retirements well beyond 2030 and was operated at a very high capacity factor of 79% in 2020.20 Such a switch in roles does not impact the rate-based value of the coal plant itself, and this has the added benefit of increasing opportunities for more capital deployment to new renewables.

Analysis from Lazard (2021) shows that the costs of new solar and wind, at the times that output is available, can already be competitive with the costs of existing coal-fired generation on an unsubsidized basis.21 Further, RMI analysis of the incentives of the Inflation Reduction Act shows that the cost of renewables are expected to drop dramatically, with costs below $20 per MWh expected for both wind and solar later this decade.22

According to Lazard, total costs of solar and wind are dominated by upfront capital costs, which would be additive to Ameren’s rate base, and have very low operating costs. In contrast, coal is dominated by higher operating costs, which are recovered-only and do not flow through to allowable profits for Ameren. Therefore, switching away from coal to renewables is not about adding costs that would be incurred by consumers. Rather, it is about changing the cost structure, and the share of total system costs that flow through to its shareholders as allowable profits under the rate-based regulatory model. This growth strategy, which has been adopted by Xcel Energy and others, has been described as ’steel for fuel’.23

For its investors, Ameren’s energy transition involves building the new energy system to meet the ongoing needs of its customers, and not simply phasing out the Company’s coal assets in isolation. While Ameren is already partly pursuing this opportunity through its plans to retire part of its coal fleet this decade and its modest investment plans to build and own renewables, alignment with a 1.5C pathway for the sector requires Ameren to fully pursue these growth opportunities.

_____________________________

20 https://www.sustainability.com/thinking/benchmarking-air-emissions-100-largest-us-power-producers/

21 https://www.lazard.com/media/451905/lazards-levelized-cost-of-energy-version-150-vf.pdf

22 https://rmi.org/business-case-for-new-gas-is-shrinking/

23 https://energyinnovation.org/wp-content/uploads/2018/11/Steel-for-Fuel-Brief_December-2018.pdf

CONCLUSION

Vote “FOR” on this Shareholder Proposal

Investors increasingly expect companies to set targets to indicate that they are anticipating and managing the risks of climate change to their business and to ensure that the world is on track to limit temperature rise to 1.5C. Electric utilities must decarbonize more rapidly than other sectors to ensure that a 1.5C trajectory is even possible. Ameren’s current goals are not in alignment with sector-specific 1.5C pathways for the industry, and the Company lags its peers in its pace of decarbonization and investments in renewable sources of generation. In addition, decarbonization of operational emissions is a significant earnings growth opportunity for Ameren through deployment of capital into renewables and grid infrastructure. Under the rate-regulated utility model, it is in investors direct financial interests that Ameren pursue these opportunities on an accelerated timeframe such as outlined by 1.5C pathways for the sector. Accordingly, investors are encouraged to vote “FOR” this proposal.

--

THE FOREGOING INFORMATION MAY BE DISSEMINATED TO SHAREHOLDERS VIA TELEPHONE, U.S. MAIL, E-MAIL, CERTAIN WEBSITES AND CERTAIN SOCIAL MEDIA VENUES, AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE OR AS A SOLICITATION OF AUTHORITY TO VOTE YOUR PROXY. THE COST OF DISSEMINATING THE FOREGOING INFORMATION TO SHAREHOLDERS IS BEING BORNE ENTIRELY BY ONE OR MORE OF THE CO-FILERS. PROXY CARDS WILL NOT BE ACCEPTED BY ANY CO-FILER. PLEASE DO NOT SEND YOUR PROXY TO ANY CO-FILER. TO VOTE YOUR PROXY, PLEASE FOLLOW THE INSTRUCTIONS ON YOUR PROXY CARD.

7