UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-K

ANNUAL REPORT PURSUANT TO REGULATION A

For the fiscal year ended:

December 31, 2018

Emerald Health Pharmaceuticals Inc.

(Exact name of issuer as specified in its charter)

Delaware

(State or other jurisdiction of incorporation or organization)

82-0669961

(I.R.S. Employer Identification Number)

5910 Pacific Center Blvd, Suite 300, San Diego, CA 92121

(Full mailing address of principal executive offices)

(858) 352-0622

(Issuer’s telephone number, including area code)

Common stock, par value $0.0001

(Title of each class of securities issued pursuant to Regulation A)

Part II.

STATEMENTS REGARDING FORWARD-LOOKING INFORMATION

We make statements in this Annual Report on Form 1-K that are forward-looking statements within the meaning of the federal securities laws. The words “believe,” “estimate,” “expect,” “anticipate,” “intend,” “plan,” “seek,” “may,” and similar expressions or statements regarding future periods are intended to identify forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties and other important factors that could cause our actual results, performance or achievements, or industry results, to differ materially from any predictions of future results, performance or achievements that we express or imply in this Annual Report or in the information incorporated by reference into this Annual Report.

The forward-looking statements included in this Annual Report on Form 1-K are based upon our current expectations, plans, estimates, assumptions and beliefs that involve numerous risks and uncertainties. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. Although we believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, our actual results and performance could differ materially from those set forth in the forward-looking statements. Factors which could have a material adverse effect on our operations and future prospects include, but are not limited to:

| ● | The success of our product candidates will require significant capital resources and years of clinical development efforts; |

| ● | The results of clinical testing and trial activities of our products; |

| ● | Our ability to obtain regulatory approval and market acceptance of, and reimbursement for our products; |

| ● | Our ability to protect our intellectual property and to develop, maintain and enhance a strong brand; |

| ● | Our ability to compete and succeed in a highly competitive and evolving industry; |

| ● | Our lack of operating history on which to judge our business prospects and management; |

| ● | Our ability to raise capital and the availability of future financing; |

| ● | Our ability to manage our research, development, expansion, growth and operating expenses; and |

| ● | Our reliance on third parties to conduct our research, preclinical studies, manufacturing and clinical trials. |

Any of the assumptions underlying forward-looking statements could be inaccurate. You are cautioned not to place undue reliance on any forward-looking statements included in this Annual Report. All forward-looking statements are made as of the date of this Annual Report on Form 1-K and the risk that actual results will differ materially from the expectations expressed in this Annual Report will increase with the passage of time. Except as otherwise required by the federal securities laws, we undertake no obligation to publicly update or revise any forward-looking statements after the date of this Annual Report, whether as a result of new information, future events, changed circumstances or any other reason. In light of the significant uncertainties inherent in the forward-looking statements included in this Annual Report, the inclusion of such forward-looking statements should not be regarded as a representation by us or any other person that the objectives and plans set forth in this Annual Report will be achieved.

Overview

We are a biotechnology/pharmaceutical company headquartered in San Diego, California, focused on developing product candidates derived from synthetic cannabinoids (molecules found in cannabis) to treat diseases with unmet medical needs primarily in inflammatory, autoimmune, metabolic, neurodegenerative and fibrotic diseases. We are currently developing two initial therapeutic product candidates that together target four initial indications, multiple sclerosis (MS), scleroderma, or systemic sclerosis (SSc), Parkinson’s disease (PD) and Huntington’s disease (HD).

Our platform technology consists of a library of twenty-five novel derivatives of cannabidiol (CBD) and cannabigerol (CBG), two of the main natural molecules found in the cannabis plant. These molecules are new chemical entities (NCEs) covered by three United States patents, two European patents, two Japanese patents, two Mexican patents, one patent in China and one patent in the Russian Federation. In addition, we have twenty-one pending patent applications.

Our current product pipeline includes two initial product candidates from our library of NCEs, EHP-101 and EHP-102.EHP-101is an oral formulation of a novel synthetic CBD derivative and is our lead candidate, currently in Phase I clinical development; EHP-102 is a formulation of a novel synthetic CBG derivative, currently in preclinical development. Based on our preclinical studies to date, we believe that these initial product candidates represent potential disease-modifying therapeutics for several indications with unmet medical need. We are currently targeting four distinct diseases, two for each of these initial product candidates. With EHP-101, we are initially targeting MS and SSc, and with EHP-102, we are initially targeting PD and HD. Other applications are also being investigated, with our two current product candidates, different formulations and other molecules within our NCE portfolio.

Our current plans for our two initial product candidates are to advance EHP-101 into Phase II safety and efficacy studies in MS and SSc patients following completion of the ongoing Phase I study as well as advance EHP-102 into human clinical studies (Phase I) as quickly as possible. If such studies are successful, the product candidates will then advance into efficacy (Phase II and Phase III) studies thereafter.

As support for this plan, we have completed preclinical proof of concept (POC) work for both EHP-101 and EHP-102 and have completed our clinical-enabling preclinical studies for EHP-101, our lead candidate. In September 2018, we advanced EHP-101 to a Phase I study in Australia to establish safety and pharmacokinetics (PK) in human healthy volunteers that we believe could support worldwide Phase II clinical studies in both MS and SSc. For EHP-102, we are in the manufacturing and formulation development stage and, if successfully completed, expect to begin clinical-enabling studies for HD and PD in 2019.

We believe treatments for these indications represent markets with underserved patient populations. With the SSc indication, we have been granted Orphan Drug Designation (ODD) for EHP-101 from the United States Food and Drug Administration (FDA) and the European Medicines Agency (EMA) in Europe. We have also been granted ODD from the FDA for EHP-102 in the HD indication.

We believe our cannabinoid-based technology platform represents an advancement to existing therapies because our NCEs are chemically modified from CBD and CBG to act on additional targets to specifically treat these diseases, which CBD and CBG alone do not affect.

While the starting material for the active pharmaceutical ingredient (API) in our product candidates are CBD and CBG, which may be classified by the United States Drug Enforcement Administration (DEA) as controlled substances in the United States depending on their origin and purity, in March 2019 we received a decision from the DEA that the API (VCE-004.8) in our lead product candidate (EHP-101) is not a controlled substance, based partly on the fact that our molecule is chemically derived from synthetic CBD as an NCE containing no remaining CBD or other controlled substances. We have also received the same decision from the UK Home Office. VCE-004.8 not being a controlled substance eliminates costs and complexities associated with developing controlled substances, by facilitating the manufacturing and import of the product to the U.S. and simplifying the conduct of nonclinical studies and the selection of U.S. clinical sites to conduct the clinical studies being planned in MS and SSc patients. Once we advance our second product candidate (EHP-102) further in development, we will request a similar decision from the DEA for this product candidate.

Background and Pathology

The Endocannabinoid System

We believe that the body’s endocannabinoid system (ECS) promotes biological balance in our cells, tissues and organs supporting brain, immune, and nervous system function and overall health and wellness.

The ECS is presently thought to include:

| ● | main receptor sites on cells called cannabinoid type-1 (CB1) and cannabinoid type-2 (CB2) receptors |

| ● | compounds known as endocannabinoids, such as anandamide and 2-arachydonoil glycerol, which are produced in the body from dietary fats, that bind to CB1 and CB2 receptors; and |

| ● | enzymes that impact the production and metabolism of these endocannabinoids. |

In general, receptors within the body send vital information to cells, organs, and the nervous system, and are critical to maintaining optimal health and a stable internal environment, or homeostasis, despite fluctuations in the external environment. In the human body, the ECS is believed to have more cellular receptor sites than any other receptor system. The ECS is comprised of lock-and-key receptor sites, mainly CB1 and CB2 receptors, which are activated by specific molecules produced in the body (endocannabinoids), or from plants (phytocannabinoids) and cannabinoid-like compounds, both natural or synthetic.

Endocannabinoids and their receptors are found throughout the body: in the brain, organs, connective tissues, glands, and immune cells. In each tissue, the ECS performs different tasks, but the goal is always the same: homeostasis.

We believe the role of the ECS in maintaining homeostasis could make it a promising target in medicine. The widespread distribution of cannabinoid receptors suggests that the ECS is important in maintaining overall bodily function and health, including the brain and peripheral organs. This, along with the ability of our novel CBD and CBG derivative molecules to affect additional receptors and pathways within the body, provides us with the potential for unique therapeutic advantages over current therapies for the diseases we are targeting.

Only CB1 receptors in the brain are responsible for the psychoactive effects of cannabis. As with the natural molecules, CBD and CBG, our synthetic derivative molecules do not interact with CB1 receptors and, therefore, have no potential for psychoactive effects. In our studies conducted to date, this lack of psychoactive effects has been verified.

Our Unique Technological Advantage

Our patented molecules are derivatives of CBD and CBG. We believe that CBD and CBG may provide positive health and therapeutic effects, primarily through interactions with the ECS. Our strategy in the creation of our cannabinoid derivatives is to improve upon these health and therapeutic benefits by modifying the CBD and CBG molecules so they interact with selected ECS receptors such as CB2more directly as well as additional well-known receptors and physiologic pathways involved in specific, life-threatening diseases. Using this strategy, we currently have rationally designed 25 molecules with possible disease-modifying capabilities based on their the mechanism of action (MOA). We know of no other products on the market or product candidates in development that effect the same combined targets related to these diseases.

Biologic Receptors and Physiologic Pathways Involved in Our Initial Product Candidates

We believe that one of the competitive advantages of our technology is the effect our product candidates could have on various additional biologic receptors and physiologic/biochemical pathways not displayed by other molecules (including other cannabinoids). Our synthetic cannabinoid derivatives are designed to improve the bioactivities of their natural precursors and provide opportunities to advance their development into pharmaceutical products. Some examples of these receptors and pathways are:

Cannabinoid Receptor Type-2 (CB2)

Cannabinoids are a complex group of molecules that comprise phytocannabinoids (from plants), endocannabinoids (naturally occurring within the body) and synthetic cannabinoids (made synthetically). Cannabinoids were initially identified by their ability to bind and activate the classical endocannabinoid receptors CB1 and CB2, but these compounds also activate other types of receptors, including PPARγ. Tetrahydrocannabinol (THC), the primary psychoactive component of cannabis, produces many of its psychoactive effects by engaging CB1 cannabinoid receptors. CB2 receptors have been the subject of considerable attention, primarily due to their promising therapeutic potential for treating various pathologies while avoiding the adverse psychotropic effects that can accompany CB1 receptor-based therapies. We believe the multi-target activity of cannabinoids (specifically CBD and CBG) accounts for their ability to modulate several key processes including neuroprotection, inflammation, immunomodulation and vascular responses. Our technology, based on derivatives of CBD, can enhance the CB2 receptor and PPARγ modulation activity of CBD and provide additional physiologic pathway stabilization and activation which can potentially increase therapeutic benefits.

Peroxisome Proliferator-Activated Receptors

Peroxisome Proliferator-Activated Receptors (PPARs) play essential roles in the regulation of cellular differentiation, development, and metabolism (carbohydrate, lipid, protein). Three types of PPARs have been identified, alpha (α), gamma (γ), and beta/delta (β/δ). PPARγ is a nuclear receptor originally implicated in the regulation of cell growth, lipid metabolism and blood sugar regulation. However, PPARγ is broadly expressed and has been recognized to play a key role in inflammatory and connective tissue balance. PPARγ activators have been shown to prevent inflammation, dermal fibrosis and loss of fatty tissue. PPARγ is activated by some endocannabinoids and related signaling lipids, as well as by certain natural and synthetic cannabinoids.

Hypoxia-Inducible Factor Pathway

Hypoxia-Inducible Factor (HIF)-1 is a protein complex that plays an integral role in the body’s response to low oxygen concentrations, or hypoxia. HIF-1 is among the primary genes involved in the homeostatic process and has two subunits, HIF-1α and HIF-1β. HIF operates in all mammalian cell types and responds to changes in oxygen, providing cells with a master regulator that coordinates changes in gene transcription. Hypoxia preconditioning induced by mild hypoxia can be beneficial in a wide number of disorders including neurologic and inflammatory diseases. Cellular adaptation to severe or mild hypoxia begins immediately with the activation of the HIF pathway, and regulates a plethora of genes involved in many biological processes, including red blood cell production, angiogenesis, neuroprotection, remyelination, vascular tone and immunity. HIF-1α activation may play a role in the inflammatory and the remitting phases of MS. For instance, HIF-1α may exert anti-inflammatory activity by inducing the release of transforming growth factor beta (TGFβ), a potent anti-inflammatory cytokine. In addition, there is evidence suggesting that activation of the HIF pathway may be also linked to neuroprotection and myelination. Thus, the erythropoietin (EPO) gene is HIF-dependent and EPO is neuroprotective in different animal models of MS. In addition, HIF-1α activates several blood vessels forming genes, including vascular endothelial growth factor (VEGF-A) and fibroblast growth factor-2 (FGF-2), which are mainly produced by vascular endothelial cells. The vascular endothelial cells produce factors that help maintain brain homeostasis within the context of the neurovascular unit. In general, HIF-1α activates many genes whose products exert neuroprotective activities and also HIF-1α activation is implicated in the modulation of the immune system.

Our Initial Product Candidates

We call our initial product candidates EHP-101 and EHP-102. EHP-101 is a formulation of one of our CBD derivatives (VCE-004.8) for oral administration and EHP-102 is a formulation of one of our CBG derivatives (VCE-003.2) currently being developed for oral administration.Based on the various additional biologic receptors and physiologic/chemical pathways affected by our product candidates, we believe our cannabinoid-based technology could be suitable medications for neurodegenerative, neurological, autoimmune, inflammatory, metabolic and fibrotic disorders. We believe that unlike most compounds in development for these diseases, EHP-101 and EHP-102 have the potential to be disease modifying, while most other compounds for these diseases are limited to targeting the symptoms and side effects.

Here is a summary of our two initial product candidates:

EHP-101 (VCE-004.8)

Overview

Our lead product candidate, EHP-101, is an oral formulation of an NCE derived from CBD (reported as VCE-004.8 in some of the scientific literature) that affects some of the accepted biologic receptors and physiologic pathways involved in MS and SSc. Thus, our first two chosen indications for EHP-101 are (1) MS and (2) SSc.

We believe that the PPARγ and CB2activators have strong potential as disease-modifying agents in MS and SSc. EHP-101 is a formulated product containing VCE-004.8 that is a ligand agonist of PPARγ and CB2 as demonstrated byin vitro binding and transcriptional assays. EHP-101 therefore has a potential ability to directly bind and activate PPARγ and CB2. We believe the combination of activities toward both PPARγ and CB2-dependent signaling pathways could represent an important advancement in the development of anti-inflammatory and antifibrotic therapies for MS and SSc.

In addition to PPARγ and CB2, the HIF pathway also has potential benefits in MS and SSc. Studies have indicated that HIF-1α activation may play a role in inflammatory and remitting phases of MS. For instance, HIF-1α activates many genes whose products exert neuroprotective activities. HIF-1α activation is also implicated in the modulation of the immune system. In addition, there is strong evidence suggesting that activation of the HIF pathway may be linked to neuroprotection and myelination. HIF-1α also activates several genes involved in vascular physiology, including VEGF-A and FGF-2, which are mainly produced by vascular endothelial cells. The vascular endothelial cells produce factors that maintain brain homeostasis.

Formulation and Pharmacokinetics

EHP-101 is formulated as a combination of long-chain mono-, di, and triglycerides with the API also known as VCE-004.8.

To date, the pharmacokinetic profile of EHP-101 has been studied in a number of mice, rat and dog studies. PK studies evaluate the drug absorption, distribution, metabolism, and excretion (ADME) from the body and measures, among other things, the concentration of the drug in plasma.

Toxicology

To date, we have completed extensive preclinical animal toxicology studies on EHP-101 that have supported the initiation of a human clinical Phase I study. Additional studies have been completed or are ongoing to support the initiation of Phase II studies worldwide. In addition, using a CB1 ligand agonist assay, we have found that EHP-101 has no CB1 activity resulting in no psychotropic effects.

Manufacturing and Supply for EHP-101

A cGMP process has been developed to manufacture EHP-101 API and drug product through our contract manufacturers. The current contract manufacturer of the API has produced several multi-kilogram scale bulk batches for use in our preclinical studies and ongoing Phase I clinical study of EHP-101. We do not own or operate manufacturing facilities for the production of EHP-101. We expect to depend on third-party suppliers and manufacturing organizations for all of our clinical trial quantities of raw materials, drug substance, and finished product. EHP-101 API is a synthetic molecule, produced from synthetic CBD, and we believe there are readily available supplies of all raw materials needed for the manufacture of EHP-101. We are currently transferring the manufacturing of the API (VCE-004.8) and the formulation EHP-101 to an end-to-end contract manufacturer (CMO) with large scale and commercial capabilities.

Our Planned Clinical Trials

We plan to initiate Phase II clinical studies of EHP-101 in MS and SSc patients in Australia, the United States, Canada and/or Europe and possibly other countries. The GLP preclinical studies required to advance into Phase II human studies for MS and SSc are in progress, with completion currently expected in 2020. We designed the Phase I study so that this single study allows us to proceed into Phase II for both MS and SSc. Prior to initiating Phase I, we sought advice from the FDA on (1) our strategy of pursuing one Phase I study in support of subsequent Phase II studies for both the MS and SSc indications, (2) the design of the planned Phase I study, with the aim of designing the study so that the subsequent Phase II studies could be completed wholly or partially in the United States, and (3) the preliminary planned design of our Phase II clinical studies.

EHP-101 Indication 1: Multiple Sclerosis

MS is a chronic autoimmune disease of the CNS that affects over 900,000 patients worldwide. Myelin provides insulation for nerve fibers and is essential to maintain nerve conduction velocity. The hallmarks of MS include neuroinflammation, the loss of myelin and nerve cell damage. Disease progression is thought to be composed of two underlying processes: myelin destruction, or demyelination, with failure to remyelinate and progressive nerve cell damage with little capacity for recovery. Exacerbated innate and adaptive immune responses contribute to the pathophysiology of the disease and the majority of current therapies for MS are directed towards modulation of the immune response. However, therapies aimed to remyelinate nerve cells are needed.

Cannabinoids such as CBD that do not bind and activate CB1 and therefore do not produce psychotropic effects are considered of special interest as therapeutic agents in CNS diseases. In the CNS, there is evidence that CB2 receptors regulate neurotoxicity in certain cells of the CNS, called microglia. Cannabinoids also bind and activate the nuclear receptor superfamily of PPARs. Three forms of PPAR have been identified (PPARγ, PPARα and PPARβ/δ) and within these receptors, PPARγ can be activated weakly by cannabinoids such as CBD. Due, in part, to their PPARγ-activating properties, we believe these cannabinoids may exert anti-inflammatory activities, thus showing a therapeutic potential for the treatment of inflammatory diseases. PPARγ has been detected in certain nerve cells and participates in mechanisms that control activation of inflammatory response including modulation of cytokines and chemokine expression, neuronal dysfunction, and neurodegeneration. Neuroinflammation is an integral component to disorders such as Alzheimer’s disease, PD, stroke and MS.

Despite being the most common human primary demyelinating disease of the CNS, there is presently no cure for MS. PPARγ activators have been shown to reduce the incidence and severity of disease in experimental models of MS, such as experimental autoimmune encephalomyelitis (EAE), and a small clinical trial suggested that PPARγ could be a pharmacological target for the management of MS.

Our preliminary studies indicate that EHP-101 stabilizes HIF-1α and activates the HIF pathway in different CNS cells as demonstrated byin vivo protein expression and functional assays. The results of these assays show that EHP-101 up-regulates the expression of neuroprotective genes such as erythropoietin and VEGF-A. In addition, based on these assays, we believe that EHP-101 induces the expression of Arginase 1 in macrophages and microglia cells, which provides anti-inflammatory and anti-fibrotic activities.

In vivo experiments in two mouse models of MS, EAE and Theiler virus-induced encephalopathy (TMEV) using VCE-004.8, have resulted in the prevention of demyelination, nerve cell damage and immune cell infiltration. VCE-004.8 also down-regulated the expression of several genes including chemokines, cytokines and adhesion molecules, which are closely associated with MS pathophysiology. In addition, EHP-101, the oral formulation of VCE-004.8, resulted in elimination of MS symptoms in the EAE model of MS in mice with doses as low as 5 mg/kg.

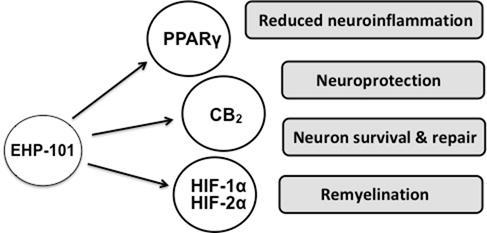

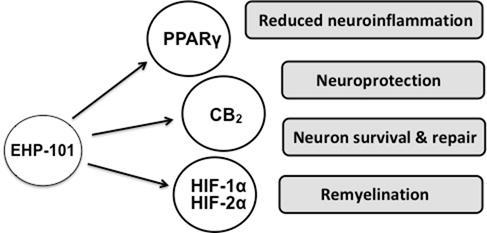

Summary of Mechanisms of EHP-101 in MS

| | EHP-101 is a multifunctional drug acting at different molecular targets involved in the pathophysiology of MS. EHP-101 has potent anti-inflammatory and neuroprotective activity through effects on PPARɣand CB2. In addition, EHP-101 activates the HIF pathway and mediates the expression of growth factors that play a role in CNS activity, homeostasis, and remyelination. |

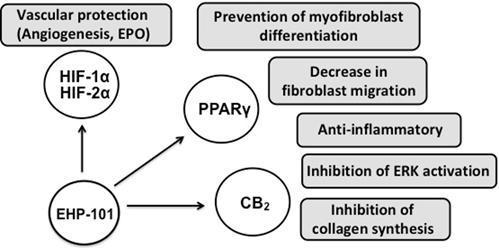

In summary, we believe that EHP-101 is a promising product candidate for MS treatment, by ameliorating neuroinflammation through PPARγ/CB2receptors and by inducting neuroprotection and possibly remyelination through activation of the HIF pathway. These activities are summarized in the diagram above. We are not aware of any drugs currently on the market or in development with the same combined MOA as EHP-101.

EHP-101 Indication 2: Scleroderma

Our second indication for EHP-101 is SSc, a rare and heterogeneous disease that involves three main hallmarks: fibroblast dysfunction leading to increased deposition of extracellular matrix proteins, small vessel damage resulting in tissue hypoxia and an immune response with autoantibody production. Scleroderma is characterized by progressive thickening and fibrosis of the skin secondary to excessive collagen accumulation, that can be limited to skin areas below, but not above, the elbows and knees, with or without involvement of the face (limited cutaneous SSc) or wider skin areas (skin on the arms, above and below the elbows, frequently on the legs, above and below the knees, with or without involvement of the face as well as on the torso) (diffuse cutaneous SSc, or dcSSc), both with internal organs involvement (e.g., lung, kidney, heart, stomach, bowels).

SSc is initiated by microvascular injury and inflammation followed by fibroblast activation, a key event in fibrosis development. Activated fibroblasts are responsible for the excessive collagen synthesis and TGFβ production. TGFβ signaling plays a critical role in the regulation of cell growth, differentiation, and development in a wide range of biological systems. Excessive TGFβ signaling is the hallmark of SSc and different strategies aimed to disrupt this signaling pathway have been proposed for the treatment of SSc and related fibrotic diseases. Different studies prove that PPARγ and CB2 receptors are potential therapeutic targets for the disease because of their involvement in the inhibition of inflammation and fibrosis progression.

Recent evidence indicates that genetic and pharmacological manipulation of the endocannabinoid system modulates the fibrotic response. Thus, CB1 and CB2 receptors have shown different patterns in experimental models of dermal fibrosis. While CB1 activation is detrimental for the disease, CB2 activation has shown protection in mice from experimental dermal fibrosis.

SSc is a rare disease with no cure, with approximately 150,000 patients annually in the seven major markets . We have been granted ODD by the FDA in the United States and the EMA in Europe. SSc is a condition that is both chronically debilitating and life-threatening. The debilitating nature of the disease manifests itself through the development of painful lesions, disfigurement and the loss of ability to function normally. Currently there are no treatments for SSc that could stop the pathological fibrotic transformation in tissues of patients with SSc. Despite recent progress in the understanding of SSc pathophysiology, the current therapeutic recommendations focus on the management of organ specific morbidity and no single therapeutic agent has been proven to be efficacious as a universal disease-modifying agent that provides benefit to SSc patients regardless of which organs are affected by the disease.

SSc is life-threatening because of its effects on the vital organs: heart, lungs and kidneys. The life-threatening acute onset of severe hypertension and renal failure occurs in approximately 66% of patients with SSc within the first 12 months of diagnosis. Up to 80% of SSc patients develop interstitial lung disease. Despite advances in early recognition of the disease and availability of efficient treatments for some of its organ complications, the mortality of SSc continues to be high. Although the median survival rate is 21.9 years, it varies significantly among different population groups. Additionally, the side effects of immunosuppressive treatments, which SSc patients typically receive as a standard of care, often result in life-threatening complications requiring intensive care unit admissions. Furthermore, the sites of SSc activity, such as skin, lung and liver, are susceptible to malignant transformation. The incidences of skin, lung and liver cancers are 3 to 4-fold higher in SSc patients compared to general population.

As described previously, EHP-101 behaves as a dual activator of PPARγ and CB2 receptors and, therefore, inhibits collagen synthesis. Moreover, EHP-101 has been shown to inhibit the TGFβ-associated differentiation of cells (called myofibroblasts) that are responsible for fibrosis. Finally, EHP-101 also promotes ERK 1 and 2 activation, which plays a central role in cellular proliferation control.

The anti-fibrotic efficacyin vivo was investigated in a mouse model of scleroderma induced by bleomycin (BLM) in 64 mice (8 total groups with 8 mice in each group, using doses of 10 mg/kg and 20 mg/kg). EHP-101 reduced dermal thickness, blood vessel collagen accumulation and prevented other negative cell activities in the skin. In addition, it prevented the expression of several key genes associated with fibrosis, qualifying this synthetic cannabinoid as a promising compound for the management of scleroderma and, potentially, other fibrotic diseases.

As expected, histological examination of the skin after BLM administration resulted in dermal thickness and loss of the subcutaneous fat layer. Oral treatment with EHP-101 demonstrated a positive effect on the progression of dermal thickness, skin fibrosis, and perivascular collagen deposition. The fact that pre-treatment with the CB2antagonist AM630 or the PPARγ antagonist T007907 partially negated the effect of EHP-101 indicates that the anti-fibrotic response was dependent on the dual PPARγ and CB2activation.

HIF activators have not been investigated extensively in fibrotic diseases such as SSc, however, based on our preclinical studies, we believe that the potential of this class of compounds to induced vascular protection is expected from other experimental models. Moreover, we believe that EHP-101 strongly upregulates the expression of Arginase 1, probably through PPARγ/HIF-1α interaction, in macrophages, a class of immune cells that play a major role on the pathophysiology of SSc. Again, we believe that Arginase 1 has anti-inflammatory and anti-fibrotic activities.

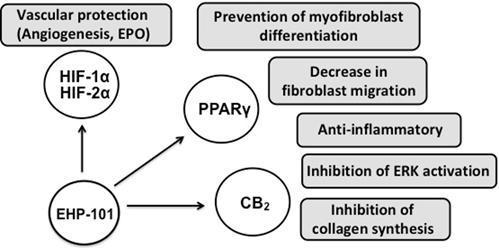

Summary of Mechanisms of EHP-101 in SSc

| | EHP-101 is a multifunctional drug acting at different molecular targets that are the hallmark of SSc. EHP-101 has potent anti-inflammatory and anti-fibrotic activities by targeting PPARɣand CB2. EHP-101 also inhibits ERK activation, fibroblast to myofibroblast differentiation and collagen synthesis. In addition, EHP-101 activates the HIF pathway and mediates the expression of growth factors that can help vascular remodeling that is impaired in the disease (currently being studied in relation to benefits in SSc). |

EHP-102 (VCE-003.2)

Overview

Our second product candidate, EHP-102, is an oral formulation of VCE-003.2, an NCE derived from CBG that affects some of the accepted biologic receptors and pathways involved in various neurodegenerative diseases. Based on preclinical studies to date, we are developing EHP-102 initially for two indications, HD and PD.

VCE-003.2 is a CBG aminoquinone derivative acting primarily as a ligand activator of PPARγ measured by binding and transcriptional assays. Preclinical studies have shown that VCE-003.2 is neuroprotective and anti-inflammatory in animal models of PD and HD, as measured by proinflammatory cytokines and behavioral score, respectively. In addition, VCE-003.2 also reduced mutant huntingtin protein aggregates (altered huntingtin protein is associated with HD) detected by confocal microscopy techniques.

In addition to PPARγ and other potential receptor activation, EHP-102 is also an activator of the extracellular signal-regulated kinases (ERK) pathway (more recently referred to as the mitogen-activated protein kinases [MAPK] pathway). This pathway influences neural survival and can, therefore, provide benefits in neurodegenerative diseases such as HD and PD.

Formulation and Pharmacokinetics

We are currently in the manufacturing and formulation development stage for EHP-102. We expect to be able to finalize manufacturing process development and formulation prototype selection, then initiate PK and nonclinical studies in 2019.

Safety, Toxicology and Clinical Trials

Once the manufacturing and formulation development activities are completed for EHP-102, we plan to initiate an animal safety and toxicology program in support of initiating human clinical development.

Manufacturing and Supply for EHP-102

An industrial scalable process is being developed to manufacture the EHP-102 API (VCE-003.2) and drug product through our contract manufacturers. We do not own or operate manufacturing facilities for the production of EHP-102. We expect to depend on third-party suppliers and manufacturing organizations for all of our preclinical and clinical trial quantities of raw materials and drug substance.

Our Planned Clinical Trials

Since Phase I human studies are not expected to begin within the next year, we have not yet begun to develop the full clinical development plan for EHP-102.

EHP-102 Indication 1: Huntington’s Disease

HD is an autosomal dominant genetic disorder that causes progressive degeneration of nerve cells in the brain, specifically, cells of the basal ganglia. This devastating and disabling disease affects middle-aged people with typical onset between the ages of 30 and 50. The genetic defect that causes HD is an abnormal repeat of certain DNA sequences on chromosome number 4. With each successive generation, the number of repeats increases. There is a 50% chance that the disease will be passed to offspring.

HD is a rare disease with approximately 30,000 patients annually in the United States. We have been granted ODD by the FDA in the United States and intend to apply for ODD to the EMA in Europe in 2019.

One of the hallmark signs and symptoms of this disease is involuntary movements and tics. These involuntary movements and tics begin distally and move proximally as the disease progresses. The involuntary movements and tics are not specific and may involve the hands, feet, and face, with the most prominent movements taking place in the muscles of the back. The involuntary movements lead to the appearance that a patient is inebriated. Swallowing becomes difficult, and patients are at risk for choking. Reduced movement and rigidity are common. Patients may also suffer from flexion contractures and become bed bound. Finally, the patient is completely dependent on others for care. The risk of choking increases and the involuntary movements may become more severe or completely disappear. At this point the patients can no longer walk. Cognitive symptoms may include feelings of low self-esteem, guilt, anxiety, apathy, irritability, aggression, dementia and psychosis with paranoia and auditory hallucinations. The cause of death is usually from secondary causes of the disease such as choking and infection

There is no known curative treatment for HD. Treatment is mostly directed at symptomatic relief with suppression of the involuntary movements and tics. Dopamine-depleting agents, dopamine activators, benzodiazepines, glutamate antagonists, acetylcholinesterase inhibitors, dopamine antagonists, anti-seizure medications, cannabinoids, lithium, along with deep brain stimulation and fetal cell transplantation are being used to treat HD.

The molecular mechanisms of HD pathophysiology are unclear. The current model of disease progression includes development of mitochondrial dysfunction in the huntingtin protein. PPARγ is believed to play a key role in neurodegenerative diseases as it regulates neural progenitor cell proliferation and differentiation. Studies have demonstrated that there are significant defects in the PPARγ signaling pathway in mutant huntingtin expressing cells as compared to wild-type huntingtin protein cells. PPARγ activators improve mitochondrial function in cells expressing mutant huntingtin. The activation of the PPARγ signaling pathway can help mitochondrial function, a pivotal process in the pathogenesis of HD. Therefore, the PPARγ pathway could be a rational therapeutic target in the treatment of HD.

Preclinicalin vitro studies have shown that VCE-003.2 preserves the ability to activate PPARγ and exerts a prosurvival action in progenitor cells during neuronal differentiation. In addition to EHP-102’s effect on PPARγ, our studies indicate effects on other receptor targets involved in neurodegeneration. For example, EHP-102 reduced mutant huntingtin aggregates in striatal cells as noted above. The neuroprotective profile of EHP-102 was also analyzed using twoin vivo models of striatal neurodegeneration, which mimic HD in humans. EHP-102 inhibited the up-regulation of proinflammatory markers and improved antioxidant defenses in the brain of the test animals.

To assess the pathophysiological relevance of the neuroprotective action of EHP-102in vivo, we employed two mouse models of the disease.

In summary, these studies suggest that EHP-102 displays neuroprotective and anti-inflammatory activities in different mouse models of HD. For example, in these models EHP-102 has:

| ● | prevented neural damage and neuroinflammation; |

| ● | alleviated motor symptomatology; |

| ● | improved motor symptomatology in mice expressing a mutated form of huntingtin protein in the brain; |

| ● | inhibited the up-regulation of proinflammatory markers such as COX-2, TNF-α, and IL-6; and |

| ● | improved oxidative stress markers. |

These data suggest that EHP-102 could have potential for the treatment of HD and other neurodegenerative diseases with neuroinflammatory traits.

EHP-102 Indication 2: Parkinson’s Disease

PD is a long-term degenerative disorder of the central nervous system that mainly affects the motor system. It is a disease where damaged neurons do not produce sufficient dopamine (dopamine helps transmit impulses from the brain to the muscles). Over 10 million people suffer from PD worldwide. The symptoms generally present slowly over time. Early in the disease, the most obvious symptoms are shaking, rigidity, slowness of movement, and difficulty with walking. Thinking and behavioral problems may also occur. Dementia becomes common in the advanced stages of the disease. Depression and anxiety are also common, occurring in more than a third of people with PD. Other symptoms may include sensory, sleep, and emotional problems. The main motor symptoms are collectively called “Parkinsonism,” or a “Parkinsonian syndrome.”

Inflammation is a key pathogenic event in PD, so anti-inflammatory strategies are being investigated to limit neuronal deterioration in this disease. Certain cannabinoids have been shown to have anti-inflammatory and neuroprotective properties. In addition, epidemiological data support that the regular use of non-steroidal anti-inflammatory drugs (e.g., ibuprofen) reduces the risk of developing PD. In light of this, different anti-inflammatory agents have been investigated, at preclinical and clinical levels, with variable success in affecting the symptoms of PD.

Cannabinoids have been investigated for the reduction of inflammatory events in PD due mainly to selective CB2 receptor activation. Activating these receptors elicited frequent positive responses, predominantly by recruiting microglial cells and infiltrated macrophages to the CNS areas lesioned in PD, as well as on the anti-inflammatory and neuroprotective effects derived from the selective activation of these receptors. In addition, another possible rationale for the therapeutic potential in PD may be the possibility of targeting PPARγ receptors with certain cannabinoids. Such conclusion is based on: (i) the relevant role played by these nuclear receptors in the control of inflammation in numerous pathological conditions (ii) the well-described PPARγ-mediated anti-inflammatory activity of certain cannabinoids in different models of central and peripheral inflammation, and (iii) the effects of non-cannabinoid PPARγ activators (e.g., thiazolidinediones) in PD. The three different PPAR isotypes (α, β/δ and γ) are expressed in all cell types in the brain and all of them, by functioning in an integrated manner as a complex system – the so-called the PPAR triad, have been reported to have neuroprotective properties.

Given the activity of EHP-102 on the PPARγ receptor, which is an important factor involved in the control of inflammation, we evaluated its anti-inflammatory/neuroprotective properties in a typicalin vivo inflammatory model of PD, LPS-lesioned mice. Positive results were obtained in all measurements assessed, both qualitative and quantitative. Unlike EHP-101, EHP-102 has no activity on CB2, however, in this study proinflammatory mediators such as tumor necrosis factor-α (TNF-α), interleukin-1β (IL-1β), and inducible nitric oxide synthase (iNOS) were strongly reduced by the treatment with EHP-102. Thus, in this model and others, therefore, EHP-102 reduced inflammatory marker expression and prevented dopaminergic neuronal loss. It also improved clinical symptoms and recovered movement parameters (motor coordination and activity) in mice injected with 3-NP and treated with our drug candidate. These data lead us to believe EHP-102 could be a potential treatment for PD.

Intellectual Property

We believe it is important to our success that we:

| ● | obtain and maintain patent and other legal protections for the proprietary molecules, technology, inventions and improvements we consider important to our business; |

| ● | prosecute our patent applications and defend our issued patents; |

| ● | preserve the confidentiality of our trade secrets; and |

| ● | operate without infringing the patents and proprietary rights of third parties. |

We have sought and intend to continue to seek appropriate patent protection for our product candidates, as well as other proprietary technologies and their uses by filing additional patent applications in the United States and selected other countries.

As of April 23, 2019, we owned a total of three United States patents, two Japanese patents, two European patents, two Mexican patents, one patent in China and one patent in the Russian Federation. In addition, we have twenty-one pending patent applications. These patents and patent applications will expire between 2030 through 2037 and could be eligible for patent term extension for delay caused by regulatory review, thereby further extending their patent terms. Our patent portfolio is not specific to any single indication, which we believe could allow us to develop products for additional patient populations in markets with unmet medical need.

Our patent plan is focused on two major areas, as follows:

| ● | First, to develop NCEs derived from cannabinoids; and |

| ● | Second, to explore the possibility that our patented molecules synergize with other drugs for a well-defined application for MS, SSc, HD and PD. This type of combination therapy could lead to new intellectual property developments, which could also be protected by patents. While our existing patents cover all molecules in the two series of NCEs, we believe there are more molecules that can be discovered within this space. |

The following is a summary of our six patent families:

Family

Number | | Patent

Publication/Application

Number | | Status | | Expiry | | Title | | Description |

1 4.2 | | PCT/EP2017/057389 | | Pending | | | | Cannabidiol derivatives as inhibitors of the HIF prolyl hydroxylases activity | | CBD quinone derivatives to be used as medicaments in therapy, particularly for treating diseases and conditions responsive to HIF-1 activation. |

2 3.1 | | US8772349 EP2551255B1 JP05575324B2 WO 2011/117429 | | Granted Granted Granted Expired | | 2030 | | Cannabinoid Quinone Derivatives | | Cannabinoid quinone derivatives to be used as medicaments, particularly as PPARγ activators for treating diseases which etiology is based on an impaired PPARγ function and can benefit from PPARγ activation. |

3 3.3 | | US9802880 AU2015222384A1 CA2937275A1 CN106061937A EP2913321A1 JP2017513810A KR2016126006 MX2016010952 WO2015128200A1 BRPI1619891A2 IN201647028497A RU2016132415 IS247149 HK17103324.2 | | Granted Pending Pending Pending Pending Pending Pending Granted Expired Pending Pending Pending Pending Pending | | 2035 | | Cannabigerol Derivatives | | CBG derivatives to be used as medicaments in therapy particularly for treating PPARγ-related diseases due to their high PPARγ activatory effect. |

3 3.3 | | EP 18382908.4 | | Pending | | 2038 | | Cannabigerol Quinone Acid and Salts | | CBG quinone acid and its salts, and new methods of synthesis |

4 4.1 | | US9701618 AU2014390738A1 CA2945867A1 CN106232570A EP3131874A1 JP06167248B2 KR2016146765A IN201617038938A BRPI1623902A2 MX2016013151A WO2015158381A1 RU2667504 IS248030 HK17104665.7 | | Granted Pending Pending Granted Granted Granted Pending Pending Pending Granted Expired Granted Pending Pending | | 2034 | | Cannabidiol Quinone Derivatives | | CBD quinone derivatives to be used as medicaments in therapy, particularly or treating diseases and conditions responsive to PPARγ modulation due to their high PPARγ activatory effect |

4 4.3 | | US62/801756 | | Pending | | | | Cannabidiol Quinone Derivatives | | CBD quinone derivatives to be used as Modulators of Cannabinoid Receptor Type 2 (CB2) |

Controlled Substances Laws

The CSA and its implementing regulations establish a “closed system” of distribution for controlled substances. The CSA imposes registration, security, recordkeeping and reporting, storage, manufacturing, distribution, labeling, importation, exportation, disposal and other requirements under the oversight of the DEA. The DEA is the federal agency responsible for regulating controlled substances, and requires those individuals or entities that manufacture, import, export, distribute, research, or dispense controlled substances to comply with the regulatory requirements to prevent the diversion of controlled substances to illicit channels of commerce.

Facilities that research, manufacture, distribute, import or export any controlled substance must register annually with the DEA. The DEA registration is specific to the particular location, activity(ies) and controlled substances utilized. For example, separate registrations are required for importation and manufacturing activities, and each registration authorizes which schedules of controlled substances the registrant may handle. However, certain coincident activities are permitted without obtaining a separate DEA registration, such as distribution of controlled substances by the manufacturer that produces them.

The DEA categorizes controlled substances into one of five schedules — Schedule I, II, III, IV, or V — with varying qualifications for listing in each schedule. Schedule I substances by definition have a high potential for abuse, have no currently “accepted medical use” in treatment in the United States and lack accepted safety for use under medical supervision. They may be used only in federally-approved research programs and may not be marketed or sold for dispensing to patients in the United States. Pharmaceutical products having a currently accepted medical use may be listed as Schedule II, III, IV or V substances, with Schedule II substances presenting the highest potential for abuse and physical or psychological dependence, and Schedule V substances presenting the lowest relative potential for abuse and dependence. The regulatory requirements are more restrictive for Schedule II substances than Schedule III-V substances. For example, all Schedule II drug prescriptions must be signed by a physician, physically presented to a pharmacist in most situations, and cannot be refilled. While cannabis and THC are Schedule I controlled substances, products approved for medical use in the United States that contain cannabis, THC or cannabis/THC extracts must be placed in Schedules II-V, since approval by the FDA satisfies the “acceptable medical use” requirement.

The DEA inspects all manufacturing facilities to review security, record keeping, reporting and compliance with other DEA regulatory requirements prior to issuing a controlled substance registration. The specific security requirements vary by the type of business activity and the schedule and quantity of controlled substances handled. The most stringent requirements apply to manufacturers of Schedule I and Schedule II substances. Required security measures commonly include background checks on employees and physical control of controlled substances through storage in approved vaults, safes and cages, and through use of alarm systems and surveillance cameras. An application for a manufacturing registration as a bulk manufacturer (not a dosage form manufacturer or a repacker/relabeler) for a Schedule I or II substance must be published in the Federal Register, and is open for 30 days to permit interested persons to submit comments, objections, or requests for a hearing. A copy of the notice of the Federal Register publication is forwarded by the DEA to all those registered, or applicants for registration, as bulk manufacturers of that substance. Once registered, manufacturing facilities must maintain records documenting the manufacture, receipt and distribution of all controlled substances. Manufacturers must submit periodic reports to the DEA of the distribution of Schedule I and II controlled substances, Schedule III narcotic substances, and other designated substances. Registrants must also report any controlled substance thefts or significant losses, and must adhere to certain requirements to dispose of controlled substances. As with applications for registration as a bulk manufacturer, an application for an importer registration for a Schedule I or II substance must also be published in the Federal Register, which remains open for 30 days for comments. Imports of Schedule I and II controlled substances for commercial purposes are generally restricted to substances not already available from a domestic supplier or where there is not adequate competition among domestic suppliers. In addition to an importer or exporter registration, importers and exporters must obtain a permit for every import or export of a Schedule I and II substance, Schedule III, IV and V narcotic, specially designated Schedule III non-narcotics, or Schedule IV or V narcotics controlled in Schedule I or II by the Convention on Psychotropic Substances and submit import or export declarations for Schedule III, IV and V non-narcotics.

The federal government recently issued guidance to federal prosecutors concerning marijuana enforcement under the CSA. On January 4, 2018, Attorney General Jeff Sessions issued a memorandum for all United States Attorneys concerning marijuana enforcement. Mr. Sessions rescinded all previous prosecutorial guidance issued by the Department of Justice regarding marijuana, including the Cole Memorandum.

The Cole Memorandum previously set out the Department of Justice’s prosecutorial priorities in light of various states legalizing marijuana for medicinal and/or recreational use. The Cole Memorandum provided that when states have implemented strong and effective regulatory and enforcement systems to control the cultivation, distribution, sale, and possession of marijuana, conduct in compliance with those laws and regulations is less likely to threaten the federal priorities. Indeed, a robust system may affirmatively address those priorities by, for example, implementing effective measures to prevent diversion of marijuana outside of the regulated system and to other states, prohibiting access to marijuana by minors, and replacing an illicit marijuana trade that funds criminal enterprises with a tightly regulated market in which revenues are tracked and accounted for. In those circumstances, consistent with the traditional allocation of federal-state efforts in this area, the Cole Memorandum provided that enforcement of state law by state and local law enforcement and regulatory bodies should remain the primary means of addressing marijuana-related activity. If state enforcement efforts are not sufficiently robust to protect against the harms set forth above, the federal government may seek to challenge the regulatory structure itself in addition to continuing to bring individual enforcement actions, including criminal prosecutions, focused on those harms.

By rescinding the Cole Memorandum, Mr. Sessions injected material uncertainty as it relates to how the Department of Justice will evaluate marijuana cases for prosecution.

For drugs manufactured in the United States, the DEA establishes annually an aggregate quota for the amount of substances within Schedules I and II that may be manufactured or produced in the United States based on the DEA’s estimate of the quantity needed to meet legitimate medical, scientific, research and industrial needs. This limited aggregate amount of cannabis that the DEA allows to be produced in the United States each year is allocated among individual companies, which, in turn, must annually apply to the DEA for individual manufacturing and procurement quotas. The quotas apply equally to the manufacturing of the API and production of dosage forms. The DEA may adjust aggregate production quotas a few times per year, and individual manufacturing or procurement quotas from time to time during the year, although the DEA has substantial discretion in whether or not to make such adjustments for individual companies.

The states also maintain separate controlled substance laws and regulations, including licensing, recordkeeping, security, distribution, and dispensing requirements. State authorities, including Boards of Pharmacy, regulate use of controlled substances in each state. Failure to maintain compliance with applicable requirements, particularly as manifested in the loss or diversion of controlled substances, can result in enforcement action that could have a material adverse effect on our business, operations and financial condition. The DEA may seek civil penalties, refuse to renew necessary registrations, or initiate proceedings to revoke those registrations. In certain circumstances, violations could lead to criminal prosecution.

We currently manufacture the API and formulations, as well as perform most of the preclinical testing for EHP-101 and EHP-102 in Europe. We are conducting a Phase I trial for EHP-101 in Australia. We may decide to develop, manufacture or commercialize our product candidates in the United States or additional countries. As a result, we may be subject to controlled substance laws and regulations from regulatory agencies in countries where we develop, manufacture or commercialize EHP-101 and EHP-102 in the future.

While the starting material for the active pharmaceutical ingredient (API) in our product candidates are CBD and CBG, which may be classified by the United States Drug Enforcement Administration (DEA) as controlled substances in the United States depending on their origin and purity, in March 2019 we received a decision from the DEA that the API (VCE-004.8) in our lead product candidate (EHP-101) is not a controlled substance, based partly on the fact that our molecule is chemically derived from synthetic CBD as an NCE containing no remaining CBD or other controlled substances. We have also received the same decision from the UK Home Office. VCE-004.8 not being a controlled substance eliminates costs and complexities associated with developing controlled substances, by facilitating the manufacturing and import of the product to the U.S. and simplifying the conduct of nonclinical studies and the selection of U.S. clinical sites to conduct the clinical studies being planned in MS and SSc patients. Once we advance our second product candidate (EHP-102) further in development, we will request a similar decision from the DEA for this product candidate.

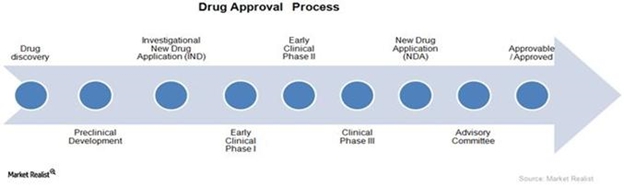

Drug Approval Process in the Biotechnology Industry

Pipeline assets

Compared to the pharmaceutical industry, the biotechnology industry is more research and development (R&D) intensive. The fair value of a biotechnology company thus depends not only on its existing assets but also on its future growth assets.

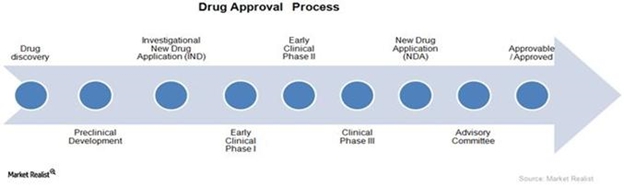

The above graph shows the FDA’s typical drug approval process. The process is required in order for a new drug to enter the market. We are currently in the clinical development stage (Phase I) for EHP-101 and in the preclinical development stage for EHP-102. Since we are conducting our first clinical study in Australia, the approval from the Ethics Committee (HREC) and TGA was required in Australia, and the IND application indicated in the above graphic will not be needed until we intend to initiate the planned Phase II studies in the U.S.

Employees

As of April 23, 2019, we employed 15 full-time employees and two independent contractors.

Legal Proceedings

We are not currently a party to any legal proceedings, the adverse outcome of which, individually or in the aggregate, we believe will have a material adverse effect on our business, financial condition or operating results.

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

You should read the following discussion and analysis of our financial condition and results of our operations together with our financial statements and related notes appearing at the end of this Annual Report. This discussion contains forward-looking statements reflecting our current expectations that involve risks and uncertainties. Actual results and the timing of events may differ materially from those contained in these forward-looking statements due to a number of factors, including those discussed elsewhere in this Annual Report.

Results of Operations for the Year Ended December 31, 2018 and the Period from March 2, 2017 (inception) to December 31, 2017

Revenues

Emerald Health Pharmaceuticals Inc. (the Company, EHP, we, or our) is a pre-revenue development stage biotechnology company focused on the development of product candidates based on patented new chemical entities (NCEs) derived from two of the molecules found in the cannabis plant. We have no products approved for commercial sale and have not generated any revenues from product sales since our inception in March 2017.

Research and Development Expenses

Research and development expenses consist primarily of expenses associated with preclinical development and clinical trials, payments to third-party contract research organizations, or CROs, contract manufacturing organizations, or CMO’s, contractor laboratories and independent contractors, and personnel-related expenses, such as salaries, benefits, travel and other related expenses, including stock-based compensation.

Our research and development expenses were $5.7 million for the year ended December 31, 2018, compared to $2.5 million for the period from March 2, 2017 (inception) to December 31, 2017. This increase was primarily related to additional preclinical development and manufacturing during the current period resulting in additional expense of approximately $1.2 million compared to the prior period. Also, the commencement of Phase I clinical studies in September 2018 resulted in an increase in clinical expense of approximately $0.6 million, net of accrued incentive rebate of $0.4 million. In addition, personnel-related expenses for the year ended December 31, 2018 increased by approximately $0.8 million as we our headcount increased throughout the year.

We expect research and development expenses to continue to increase in 2019 as compared to 2018 as we continue our clinical trials. These expenditures are subject to numerous uncertainties regarding timing and cost to completion. Completion of our preclinical development and clinical trials may take several years or more and the length of time generally varies according to the type, complexity, novelty and intended use of a product candidate.

General and Administrative Expenses

General and administrative expenses consist primarily of compensation and related benefits, legal and patent fees, professional service fees, travel, facility and office expenses, and non-cash stock-based compensation. Our general and administrative expenses were $2.0 million for the year ended December 31, 2018, compared to $0.4 million for the period from March 2, 2017 (inception) to December 31, 2017. This increase was primarily related to an increase in expenses associated with personnel costs, including stock-based compensation expense, of approximately $0.4 million and an increase in legal, patent and professional fees of approximately $0.4 million. In addition, the Company entered into an operating lease for office space in May 2018, resulting in additional facility and office expenses of approximately $0.2 million compared to the prior year.

Other Income (Expense)

During the year ended December 31, 2018, we recognized $667,155 in interest expense on our related party loan, compared to interest expense of $34,157 for the period from March 2, 2017 (inception) to December 31, 2017. The increase is due to the additional borrowings under the loan during the current year. During the year ended December 31, 2018 we recognized a foreign currency loss of $54,473 compared a foreign currency loss of $18,011 for the period from March 2, 2017 (inception) to December 31, 2017. Foreign currency losses are due primarily to the timing of fluctuations in the exchange rates between the U.S. Dollar and other foreign currencies, related to contracts and other transactions which are denominated in currencies other than the U.S. Dollar.

Net Loss

Our net loss was $8.4 million for the year ended December 31, 2018, compared to $2.9 million for the period from March 2, 2017 (inception) to December 31, 2017.

Liquidity and Capital Resources

To date, we have generated no cash from operations and negative cash flows from operating activities. All costs in connection with our formation, development, legal services and support have been funded by EHS, our majority stockholder. EHS has financed our operations through a revolving loan agreement. We have the ability to continue borrowing under the loan but there is no guarantee of continued funding under the loan agreement. The loan may be repaid by us or, at the option of our majority stockholder, converted by our majority stockholder into shares of the Company at $2.00 per share.

The Company filed a Tier 2 offering (the Offering) pursuant to Regulation A under the Securities Act of 1933, as amended (Securities Act), which was qualified by the U.S. Securities and Exchange Commission in March 2018. We offered a maximum of 10,000,000 shares of common stock on a “best efforts” basis, at a price of $5.00 per share. As of April 23, 2019, the Company has sold 2,539,836 shares of common stock pursuant to the Offering for gross proceeds of $12.7 million. In addition, the Company has also sold 58,600 shares of common stock for gross proceeds of $293,000 in an exempt offshore offering under Regulation S.

In April 2019, we received written notice of demand (Notice) from EHS for payment of all accrued interest on our related party loan as of March 31, 2019 ($1,044,901), to be paid in cash to EHS by April 30, 2019. Also in April 2019, we received a second Notice from EHS that calls for the following, upon qualification by the SEC of the Company’s Form 1-A Post-Qualification Offering Circular Amendment: (1) repayment of $2,000,000 of the unpaid principal balance under the loan, and (2) the conversion of an additional $2.5 million of the unpaid principal balance under the loan at a conversion price of $2.00 per share, which will result in the issuance to EHS of 1,250,000 shares of EHP common stock.

Our future expenditures and capital requirements will depend on numerous factors, including the success of our Offering and the progress of our research and development efforts.

Our business does not presently generate any cash. We believe that if we raise $50,000,000.00 (the Maximum Amount) in our Offering, we will have sufficient capital to finance our operations for at least the next 24 months, however, if we do not sell the Maximum Amount or if our operating and development costs are higher than expected, we will need to obtain additional financing prior to that time. We do not have any track record for self-underwritten Regulation A+ offerings, and there can be no assurance we will raise the Maximum Amount. Further, we expect that after such 24-month period, we will be required to raise additional funds to finance our operations until such time that we can conduct profitable revenue-generating activities. However, no assurances can be made that we will be successful obtaining additional equity or debt financing, or that ultimately, we will achieve profitable operations and positive cash flow.

Going Concern

Our financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. The Company’s ability to continue as a going concern is contingent upon its ability to raise additional capital as required. During the period from March 2, 2017 (inception) through December 31, 2018, the Company incurred net losses of $11.3 million. Initially, we intend to finance our operations through equity and debt financings.

The Company does not generate any cash on its own. We have funded operations in part in the form of expenditures paid for on behalf of the Company by our majority stockholder, EHS, in addition to advances received directly from EHS. The Company and EHS currently have a revolving loan agreement, however there is no guarantee of continued funding under the loan agreement.

We continually evaluate our plan of operations to determine the manner in which we can most effectively utilize our limited cash resources. The timing of completion of any aspect of our plan of operations is highly dependent upon the availability of cash to implement that aspect of the plan and other factors beyond our control. There is no assurance that we will successfully obtain the required capital or revenues, or, if obtained, that the amounts will be sufficient to fund our ongoing operations.

These circumstances raise substantial doubt on our ability to continue as a going concern. Our financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts or amounts and classification of liabilities that might result from this uncertainty.

Credit Facilities

In September 2017, the Company and EHS entered a revolving loan agreement, which was amended in January 2018. Under the loan, past advances and future advances, which EHP may draw down from time to time in one or more advances, will be evidenced by a demand grid promissory note (the Note). The Note will be revised to reflect the aggregate principal amount of the loan outstanding as of the date of each advance or repayment. The loan may be repaid by the Company or, at the option of EHS, converted by EHS into shares of EHP at $2.00 per share. The loan bears interest at 12% per annum, calculated semi-annually in advance. The Note is payable upon demand and includes no expiration date. As of December 31, 2018, we have an outstanding balance of $9.6 million under the loan plus accrued interest of approximately $0.7 million. We have the ability to continue borrowing under this loan agreement, however there is no guarantee of continued funding. In the event of conversion of the Note, investors in the Offering will suffer significant dilution.

Capital Expenditures

We do not have any contractual obligations for ongoing capital expenditures at this time.

Contractual Obligations, Commitments and Contingencies

We may be required to make future payments to Emerald Health Biotechnology España S.L.U. (EHBE), formerly VivaCell Biotechnology España S.L. (VivaCell) based on the achievement of milestones set forth in the intellectual property transfer agreement. These milestone payments are based on the achievement of development or regulatory milestones, including commencement of various phases of clinical trials, filing of product license applications and approval of product licenses from the United States Food and Drug Administration (FDA) or a foreign regulatory agency. The aggregate amount of additional milestone payments that we could be required to pay under our agreement with EHBE is 2.7 million Euros, or approximately $3.1 million per product, based upon the exchange rate at December 31, 2018. These amounts assume that all remaining milestones associated with the milestone payments are met. In the event that product license approval for any of the related products is obtained, we are required to make royalty payments of 2.5% of net revenues from commercial sales of the related products. Because the milestones are contingent, we are not in a position to reasonably estimate how much, if any, of the potential milestone payments will ultimately be paid, or when. Additionally, many of the milestone events are related to progress in clinical trials which will take several years to achieve.

Effective May 1, 2018, we entered into a two-year non-cancelable building lease for our corporate headquarters in San Diego, California. Under the lease, we will pay a base rent of $7,590 per month through April 30, 2019 after which time the base rent will increase to $8,349 per month. Our obligations under this operating lease are $97,152 in 2019 and $33,396 in 2020.

Off-Balance Sheet Arrangements

We did not have during the periods presented, and we do not currently have, any off-balance sheet arrangements.

Trend Information

Because we are still in the startup phase and have only recently commenced our research and product development, we are unable to identify any recent trends in revenue or expenses. Thus, we are unable to identify any known trends, uncertainties, demands, commitments or events involving our business that are reasonably likely to have a material effect on our revenues, income from operations, profitability, liquidity or capital resources, or that would cause the reported financial information in this Offering to not be indicative of future operating results or financial condition.

| Item 3. | Directors, Officers and Significant Employees |

The table below sets forth our directors and executive officers of as of the date of this Annual Report.

| Name | | Position | | Age | | | Term of Office | | | Approximate hours per week

for part-time employees |

| Officers and Significant Employees: | | | | | | | | | | |

| Avtar Dhillon | | President | | | 58 | | | | Since March 2017 | | | |

| James DeMesa | | Chief Executive Officer | | | 61 | | | | Since March 2017 | | | |

| Lisa Sanford | | Chief Financial Officer | | | 52 | | | | (1) | | | |

| Alain Rolland | | Chief Development Officer | | | 59 | | | | (2) | | | |

| Joachim Schupp | | Chief Medical Officer | | | 66 | | | | (3) | | | Dr. Schupp worked 30 hours per week in his role of Senior Vice President of Medical Affairs. |

| Eduardo Muñoz | | Chief Scientific Officer | | | 60 | | | | Since June 2017 | | | Dr. Muñoz is a consultant who may be deemed a significant employee and acts as our Chief Scientific Officer pursuant to a consulting agreement with the University of Córdoba where Dr. Muñoz is employed in the Department of Cellular Biology, Physiology and Immunology. Dr. Muñoz works for us approximately 25 hours per week. |

| | | | | | | | | | | | | |

| Directors: | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Avtar S. Dhillon | | Director & Executive Chairman | | | 58 | | | | Since March 2017 | | | |

| James L. Heppell | | Director | | | 63 | | | | Since March 2017 | | | |

| Gaetano A. Morello | | Director | | | 57 | | | | Since March 2017 | | | |

| Punit S. Dhillon | | Director | | | 38 | | | | Since March 2017 | | | |

| (1) | Lisa Sanford was appointed Interim Chief Financial Officer as of October 1, 2018 and was appointed Chief Financial Officer as of April 1, 2019. From July 20, 2018 through September 30, 2018 she served as Vice President of Finance. |

| (2) | Alain Rolland was appointed Chief Development Officer as of May 1, 2018. From February 1, 2018 through April 20, 2018 he served as Vice President of Product Development. |

| (3) | Joachim Schupp was appointed Chief Medical Officer as of January 1, 2019. From August 1, 2018 through December 31, 2018 he served as Senior Vice President of Medical Affairs. |

There is no arrangement or understanding between the persons described above and any other person pursuant to which the person was selected to his or her office or position.

Avtar S. Dhillon, M.D., President and Executive Chairman.Dr. Dhillon is a life sciences entrepreneur with more than 20 years’ experience building public companies through mergers and acquisitions, leading innovation in scientific, engineering and farming enterprises, securing government grants and non-governmental organization (NGO) funding, and building IP portfolios through partnering. During his tenure from 2001 to 2009 as President and CEO at Inovio Pharmaceuticals, Inc., Dr. Dhillon led the company through a restructuring and a number of acquisitions. Since 2009, he has served as Inovio’s Chairman of the Board. Prior to joining Inovio, he was Vice President of MDS Capital Corp. (now Lumira Capital Corp.), one of North American’s leading healthcare venture capital organizations. Dr. Dhillon was a member of the Board of Directors of BC Advantage Funds, a venture capital corporation in British Columbia, from 2003 to January 2015. Dr. Dhillon currently serves as a director and Chairman of OncoSec Medical Incorporated, a biotechnology company engaged in the development of new technologies to target and attack cancer; Executive Chairman and President of Emerald Health Therapeutics Inc. (TSXV: EMH); and Emerald Health Sciences Inc. and its various subsidiaries. Dr. Dhillon practiced family medicine for over 12 years and currently sits on the board of the Cannabis Association of Canada. He has a BSc (Honours) in Human Physiology and an MD from the University of British Columbia.

James M. DeMesa, M.D., Chief Executive Officer.Dr. DeMesa has 30 years of experience in biotech product development, clinical and regulatory management, and partnerships with pharmaceutical, biotech, and medical device companies. He is the former CEO of two public biotech companies: Migenix, from 2001 to 2008 and GenSci Regeneration Sciences, from 1996 to 2001 (now part of Integra LifeSciences). Dr. DeMesa also currently serves on the Board of Directors for two biotech companies: OncoSec Medical Incorporated and Induce Biologics. He also served as director for Trillium Therapeutics from 2005 to 2014. Previously, he was Vice President, Medical and Regulatory Affairs at Biodynamics International (now part of RTI Surgical) and Bentley Pharmaceuticals (now part of Teva Pharmaceuticals). Dr. DeMesa received his BA in Chemistry, MD, and MBA from the University of South Florida.

Eduardo Muñoz, PhD, M.D., Chief Scientific Officer.Dr. Muñoz has been a Professor of Immunology in the Department of Cell Biology, Physiology and Immunology of the University of Córdoba (Spain) since 1992 and Director of the Inflammation and Cancer Research Group at the Institute Maimonides for Biomedical Research of Córdoba since 2012. Dr. Muñoz has more than 30 years of experience in biomedical research, and is the author of nearly 200 articles, patents, and book chapters with almost 5,500 citations. He is experienced in the mechanism of actions of cannabinoids and endocannabinoids as well as the development of cannabinoid-based new chemical entities. Dr. Muñoz belongs to the editorial board of several scientific journals and is a co-founder of two biotech companies, Emerald Health Biotechnology España, S.L.U.(Spain) and Innohealth Group (Spain). He received a PhD in Medicine and Surgery at the University of Córdoba and was an associate researcher at Tufts University in Boston, and at the Institute Pasteur in Paris.