Corporate Presentation September 16, 2020 Cantor Healthcare Conference Exhibit 99.1

Forward-looking Statements This presentation contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995 regarding, among other things, the initiation, timing and submission to the U.S. Food and Drug Administration (FDA) of a New Drug Application (NDA) for tebipenem HBr and the potential approval of tebipenem HBr by the FDA; future commercialization, the potential number of patients who could be treated by tebipenem HBr and market demand for tebipenem HBr generally; expected broad access across payer channels for tebipenem HBr; the expected pricing of tebipenem HBr and the anticipated shift from intravenous to oral administration; the initiation, timing, progress and results of the Company’s preclinical studies and clinical trials and its research and development programs, including management’s assessment of such results; the timing of the availability of data from the Company’s clinical trials; the timing of the Company’s filings with regulatory agencies; product candidate benefits; competitive position; business strategies; objectives of management; potential growth opportunities; potential market size; reimbursement matters; possible or assumed future results of operations; projected costs; and the Company’s cash forecast and the availability of additional non-dilutive funding from governmental agencies beyond any initially funded awards. In some cases, forward-looking statements can be identified by terms such as “may,” “will,” “should,” “expect,” “plan,” “aim,” “anticipate,” “could,” “intent,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these terms or other similar expressions. All statements other than statements of historical facts contained in this presentation are forward-looking statements. The Company may not actually achieve the plans, intentions or expectations disclosed in these forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in these forward-looking statements as a result of various factors, including: the Company’s ability to timely complete related Phase 1 trials for NDA submission, taking into account the possible effects of the COVID-19 pandemic; the Company’s need for additional funding; the lengthy, expensive, and uncertain process of clinical drug development; the Company’s reliance on third parties to manufacture, develop, and commercialize its product candidates, if approved; the ability to develop and commercialize the Company’s product candidates, if approved; the potential impact of the COVID-19 pandemic; the Company’s ability to retain key personnel and to manage its growth; whether results obtained in preclinical studies and clinical trials will be indicative of results obtained in future clinical trials and whether preliminary data from the Company’s clinical trials will be predictive of final results from such trials; whether the Company’s product candidates will advance through the preclinical development and clinical trial process on a timely basis, or at all, taking into account such factors as the effects of possible regulatory delays, slower than anticipated patient enrollment, manufacturing challenges, clinical trial design, clinical data requirements and clinical outcomes; whether the results of such clinical trials will warrant submission for approval from the FDA or equivalent foreign regulatory agencies; decisions made by the FDA and equivalent foreign regulatory agencies with respect to the development and commercialization of the Company’s product candidates; the commercial potential of the Company’s product candidates; the Company’s ability to obtain adequate third-party reimbursement for its product candidates; whether the FDA will accept a rolling NDA submission with respect to tebipenem HBr; whether the Company will satisfy all of the pre-conditions to receipt of the development milestone payment under its agreement with Everest Medicines; whether BARDA elects to exercise its second option under the Company’s agreement with BARDA; the Company’s ability to implement its strategic plans; the Company’s ability to obtain, maintain and enforce intellectual property and other proprietary rights for its product candidates; the risks and uncertainties related to market conditions; whether the Company’s cash resources will be sufficient to fund its continuing operations for the periods and/or trials anticipated; and other factors discussed in the “Risk Factors” section of the Company’s periodic reports filed with the U.S. Securities and Exchange Commission (SEC), and risks described in other filings the Company may make with the SEC in the future. The forward-looking statements included in this presentation represent the Company’s views as of the date of this presentation. The Company anticipates that subsequent events and developments will cause its views to change. However, while the Company may elect to update these forward-looking statements at some point in the future, it specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing the Company’s views as of any date subsequent to the date of this presentation. 102931629v.1 102931629v.1

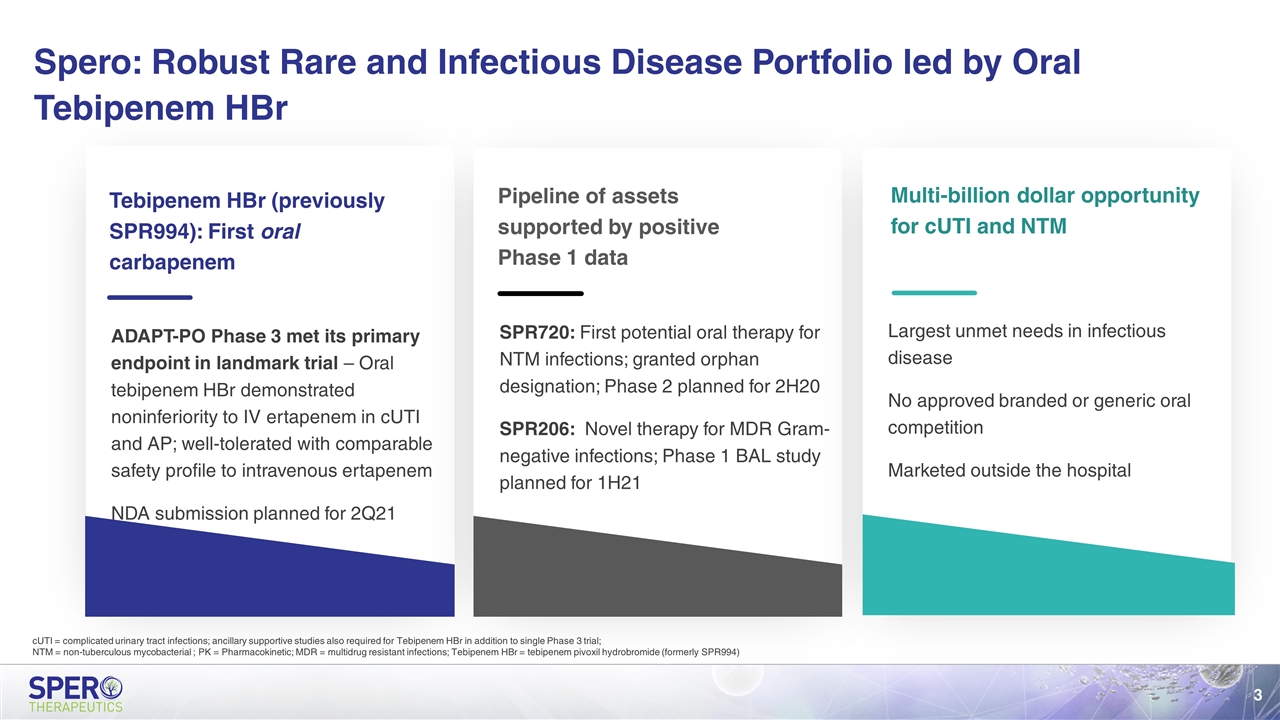

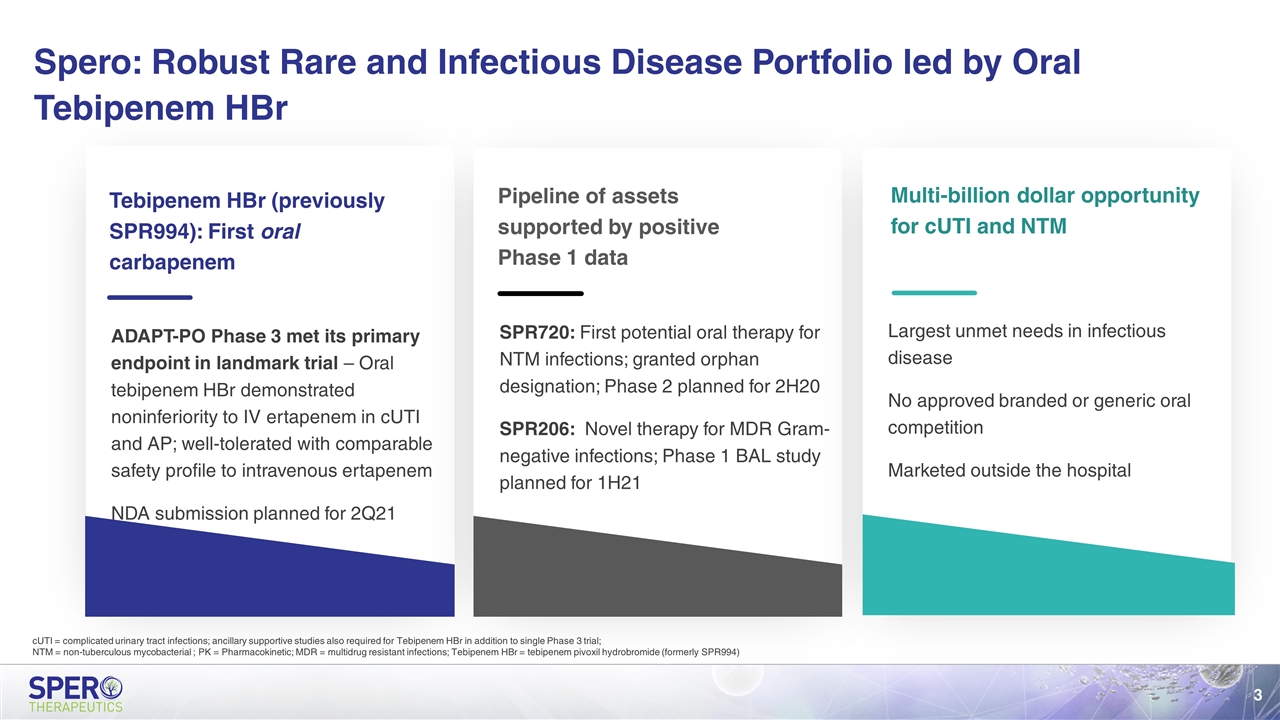

Tebipenem HBr (previously SPR994): First oral carbapenem ADAPT-PO Phase 3 met its primary endpoint in landmark trial – Oral tebipenem HBr demonstrated noninferiority to IV ertapenem in cUTI and AP; well-tolerated with comparable safety profile to intravenous ertapenem NDA submission planned for 2Q21 Pipeline of assets supported by positive Phase 1 data SPR720: First potential oral therapy for NTM infections; granted orphan designation; Phase 2 planned for 2H20 SPR206: Novel therapy for MDR Gram-negative infections; Phase 1 BAL study planned for 1H21 Multi-billion dollar opportunity for cUTI and NTM Largest unmet needs in infectious disease No approved branded or generic oral competition Marketed outside the hospital Spero: Robust Rare and Infectious Disease Portfolio led by Oral Tebipenem HBr cUTI = complicated urinary tract infections; ancillary supportive studies also required for Tebipenem HBr in addition to single Phase 3 trial; NTM = non-tuberculous mycobacterial ; PK = Pharmacokinetic; MDR = multidrug resistant infections; Tebipenem HBr = tebipenem pivoxil hydrobromide (formerly SPR994)

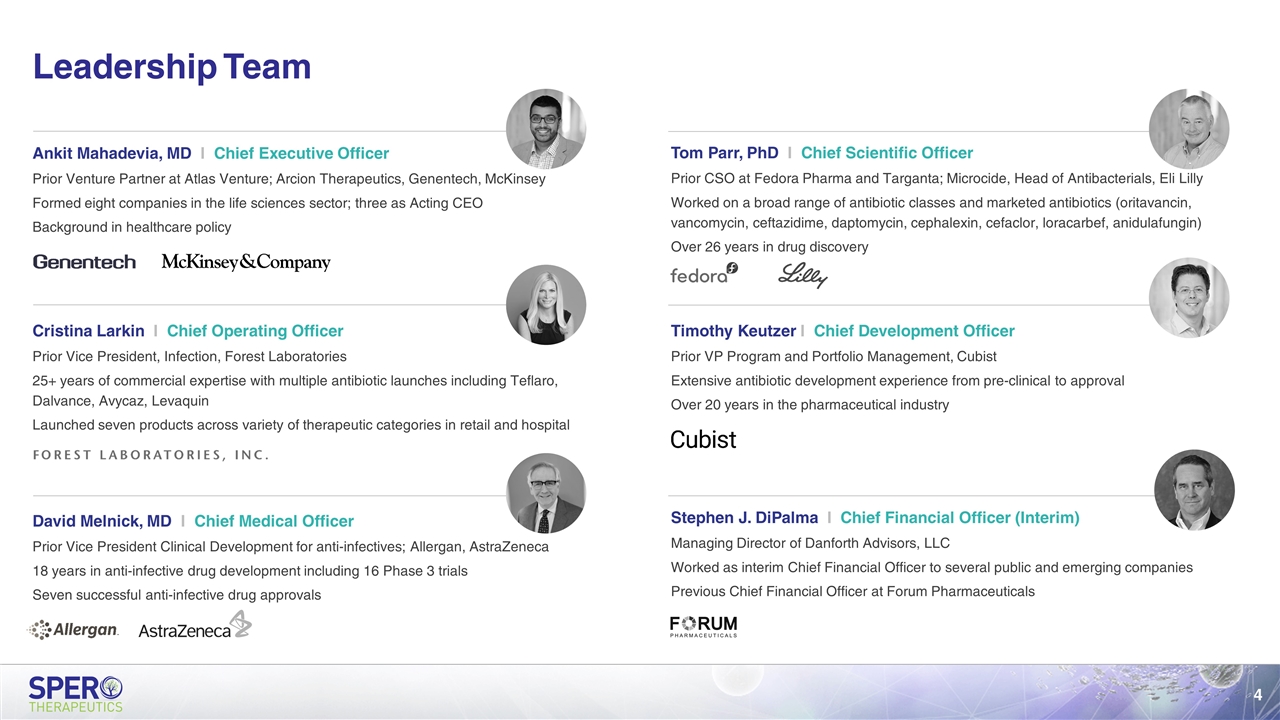

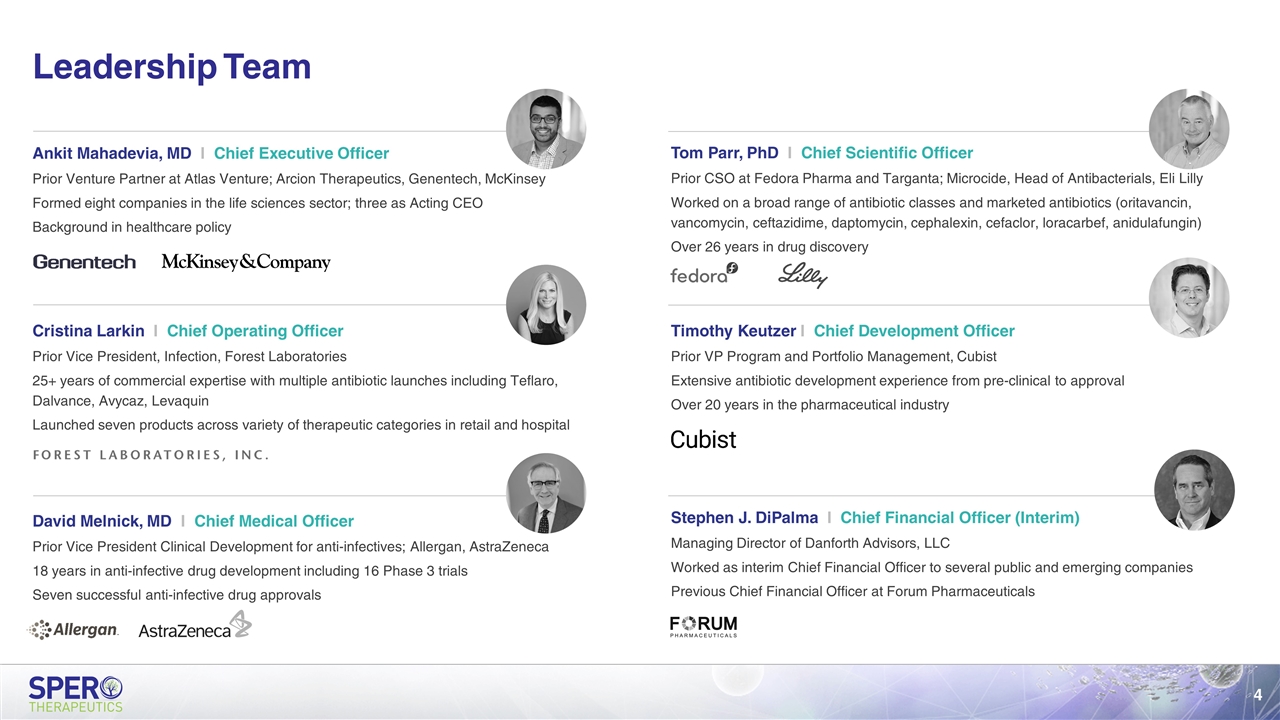

Cristina Larkin I Chief Operating Officer Prior Vice President, Infection, Forest Laboratories 25+ years of commercial expertise with multiple antibiotic launches including Teflaro, Dalvance, Avycaz, Levaquin Launched seven products across variety of therapeutic categories in retail and hospital Leadership Team Ankit Mahadevia, MD I Chief Executive Officer Prior Venture Partner at Atlas Venture; Arcion Therapeutics, Genentech, McKinsey Formed eight companies in the life sciences sector; three as Acting CEO Background in healthcare policy David Melnick, MD I Chief Medical Officer Prior Vice President Clinical Development for anti-infectives; Allergan, AstraZeneca 18 years in anti-infective drug development including 16 Phase 3 trials Seven successful anti-infective drug approvals Timothy Keutzer I Chief Development Officer Prior VP Program and Portfolio Management, Cubist Extensive antibiotic development experience from pre-clinical to approval Over 20 years in the pharmaceutical industry Tom Parr, PhD I Chief Scientific Officer Prior CSO at Fedora Pharma and Targanta; Microcide, Head of Antibacterials, Eli Lilly Worked on a broad range of antibiotic classes and marketed antibiotics (oritavancin, vancomycin, ceftazidime, daptomycin, cephalexin, cefaclor, loracarbef, anidulafungin) Over 26 years in drug discovery Stephen J. DiPalma I Chief Financial Officer (Interim) Managing Director of Danforth Advisors, LLC Worked as interim Chief Financial Officer to several public and emerging companies Previous Chief Financial Officer at Forum Pharmaceuticals

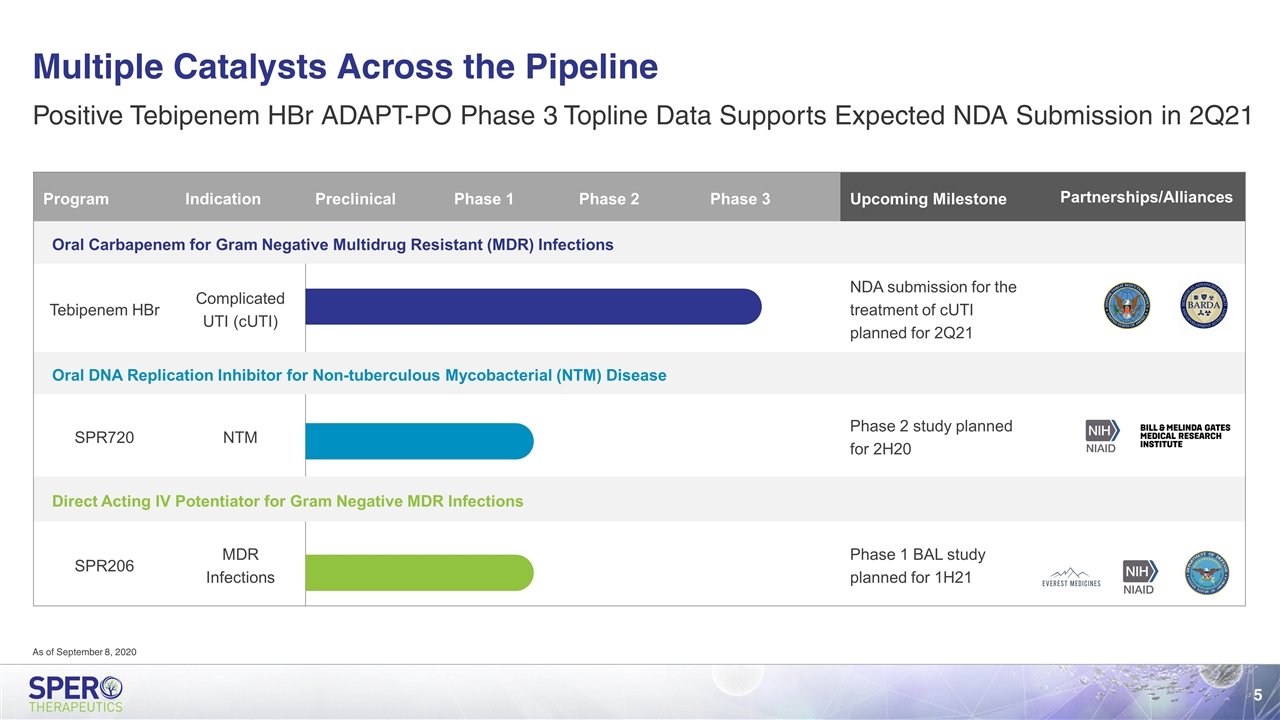

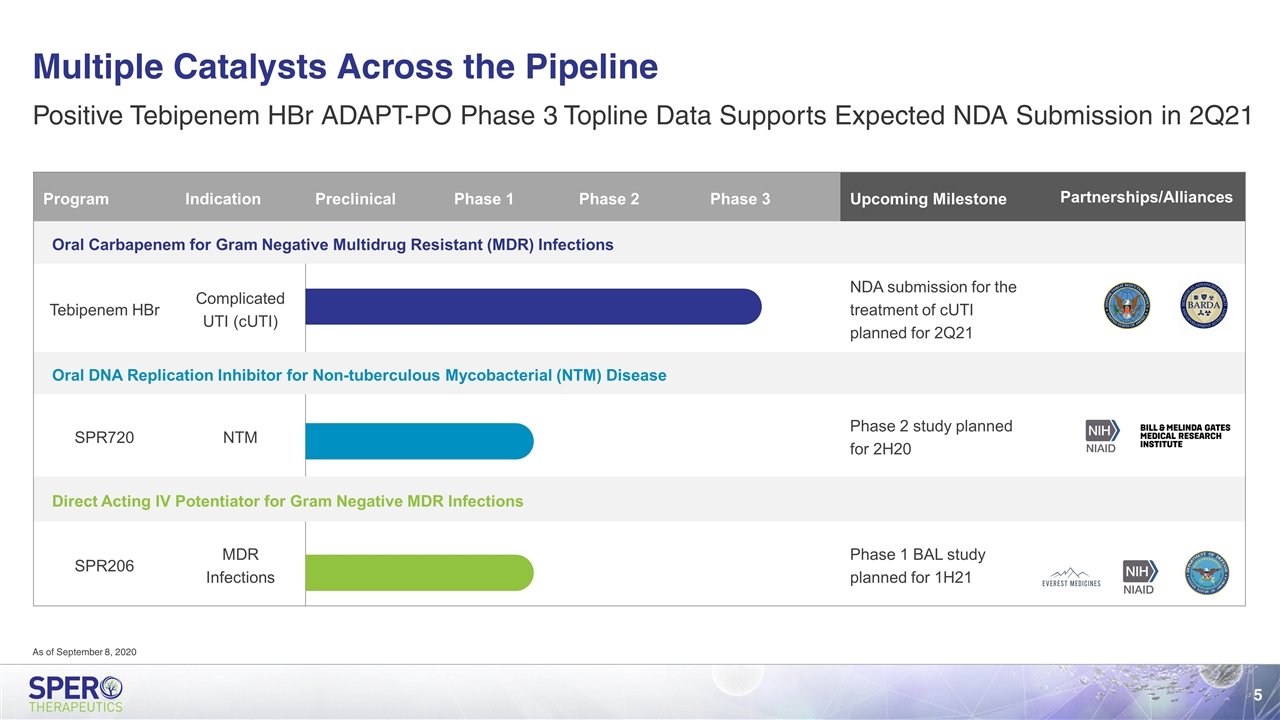

Multiple Catalysts Across the Pipeline Program Indication Preclinical Phase 1 Phase 2 Phase 3 Upcoming Milestone Partnerships/Alliances Partnerships/Alliances Oral Carbapenem for Gram Negative Multidrug Resistant (MDR) Infections Tebipenem HBr Complicated UTI (cUTI) NDA submission for the treatment of cUTI planned for 2Q21 Oral DNA Replication Inhibitor for Non-tuberculous Mycobacterial (NTM) Disease SPR720 NTM Phase 2 study planned for 2H20 Direct Acting IV Potentiator for Gram Negative MDR Infections SPR206 MDR Infections Phase 1 BAL study planned for 1H21 Positive Tebipenem HBr ADAPT-PO Phase 3 Topline Data Supports Expected NDA Submission in 2Q21 As of September 8, 2020

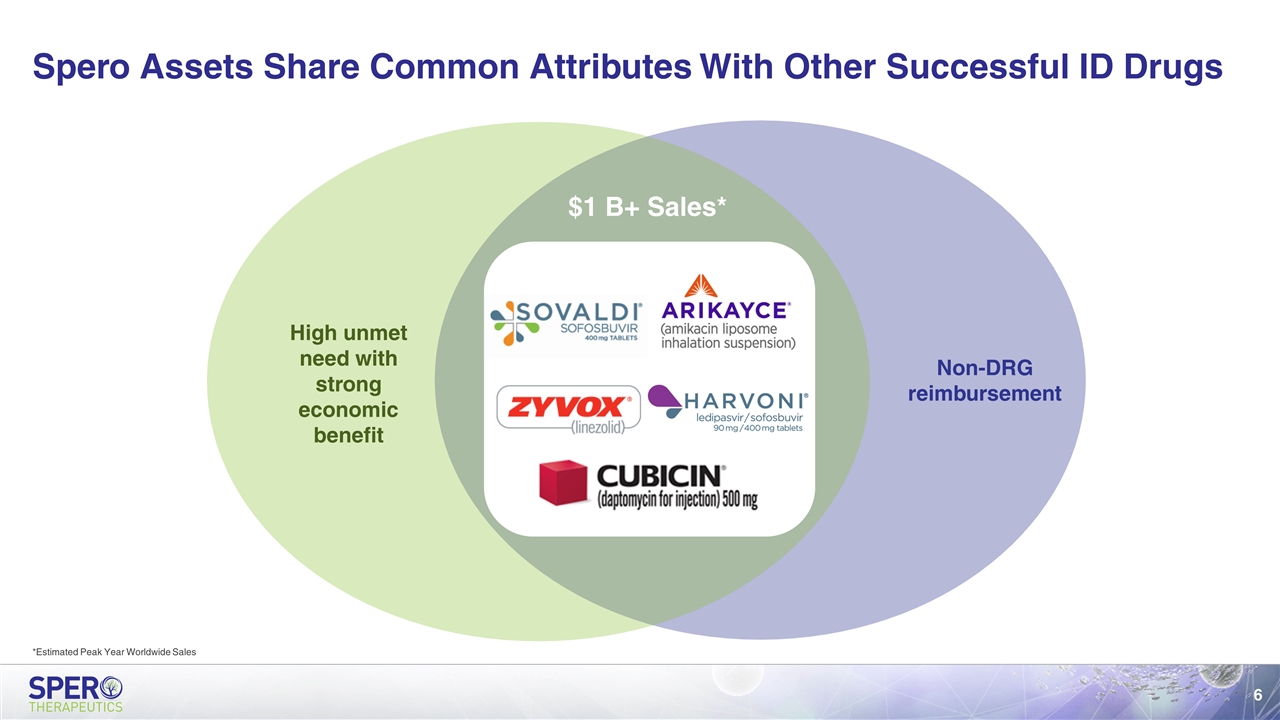

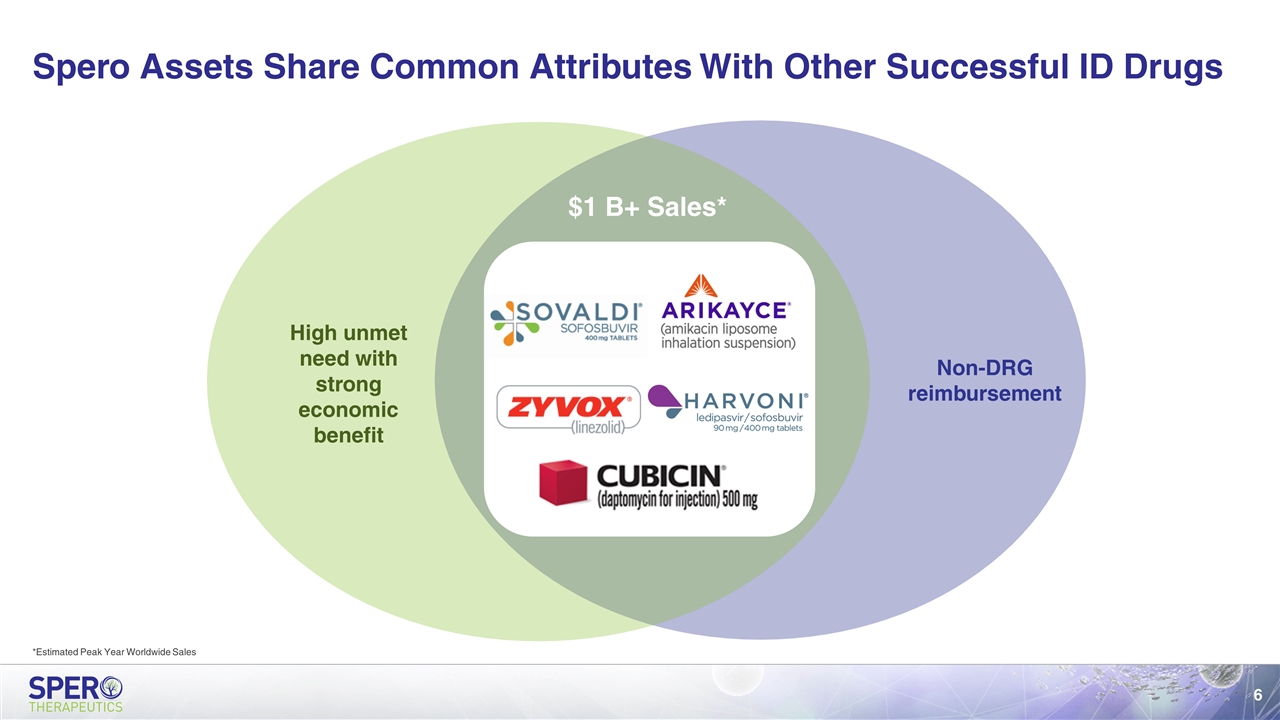

Spero Assets Share Common Attributes With Other Successful ID Drugs Non-DRG reimbursement High unmet need with strong economic benefit $1 B+ Sales* *Estimated Peak Year Worldwide Sales

First Oral Carbapenem Tebipenem HBr

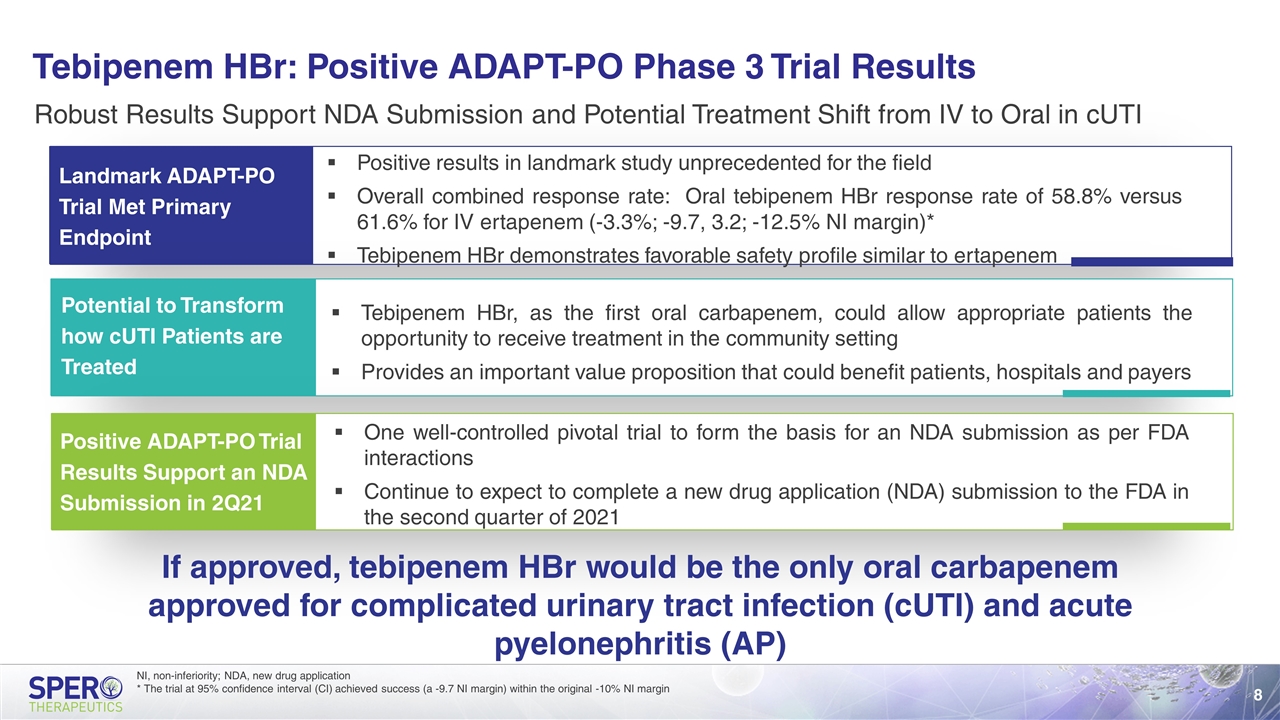

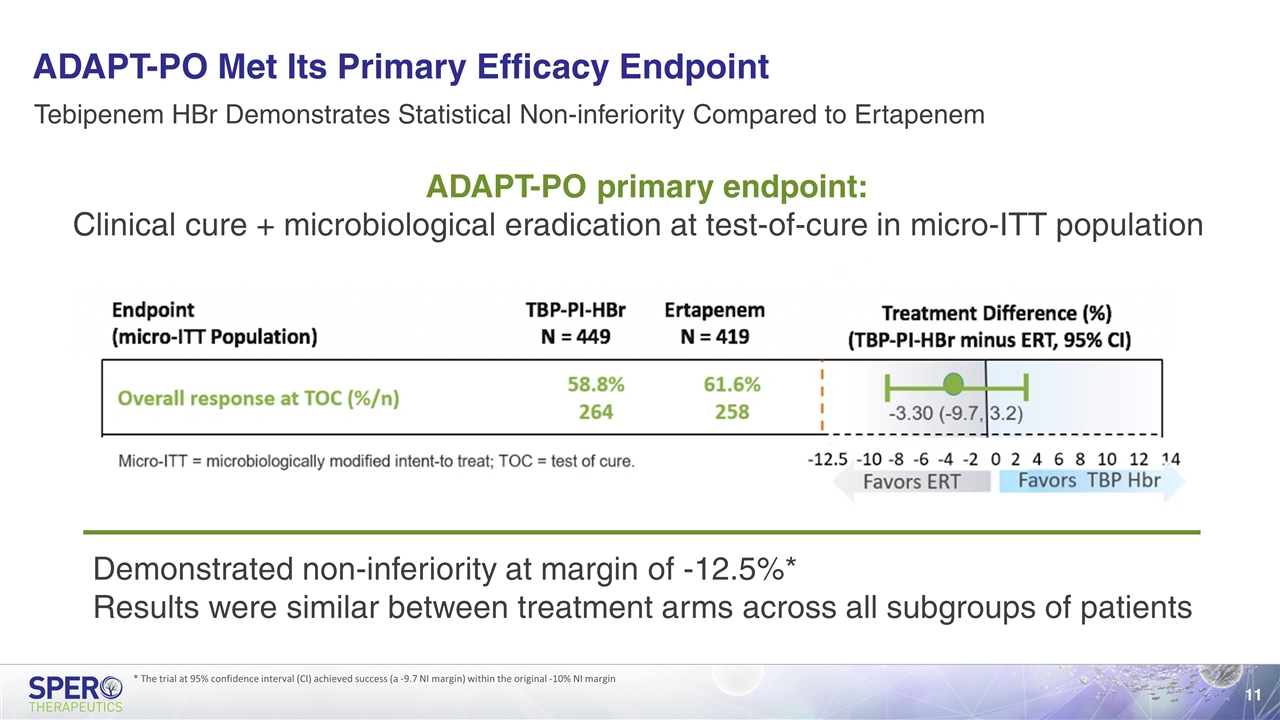

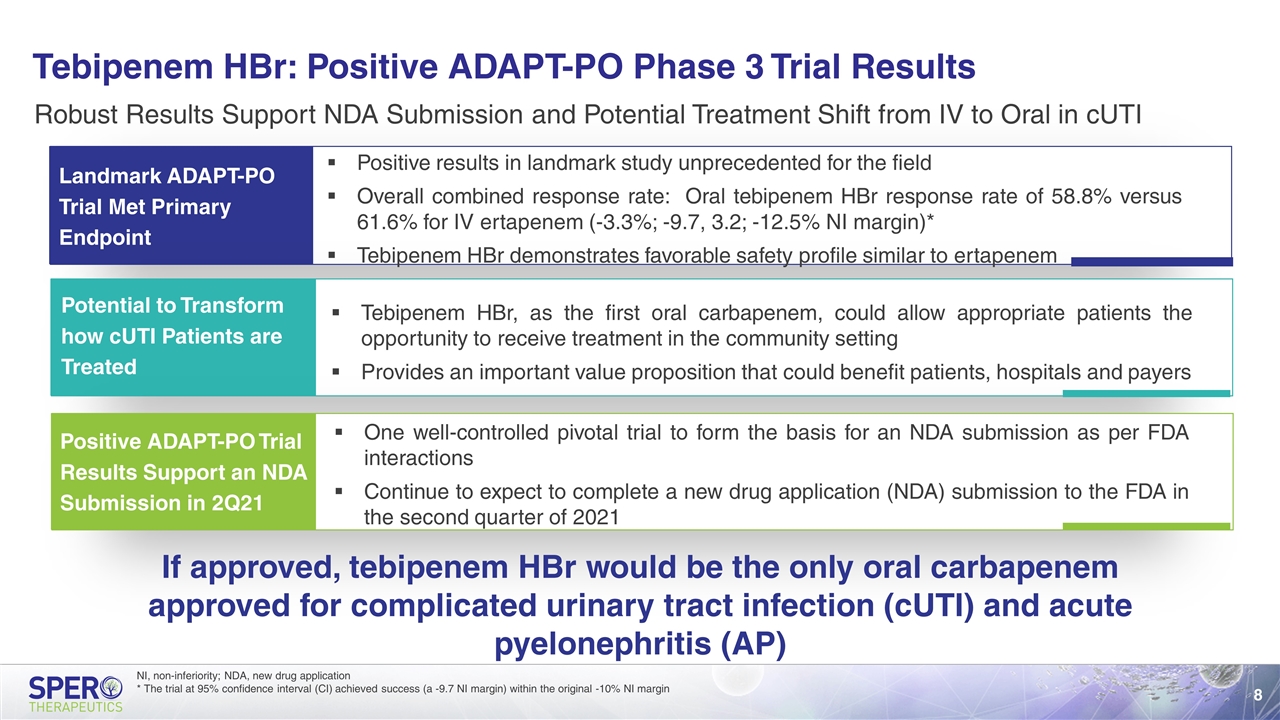

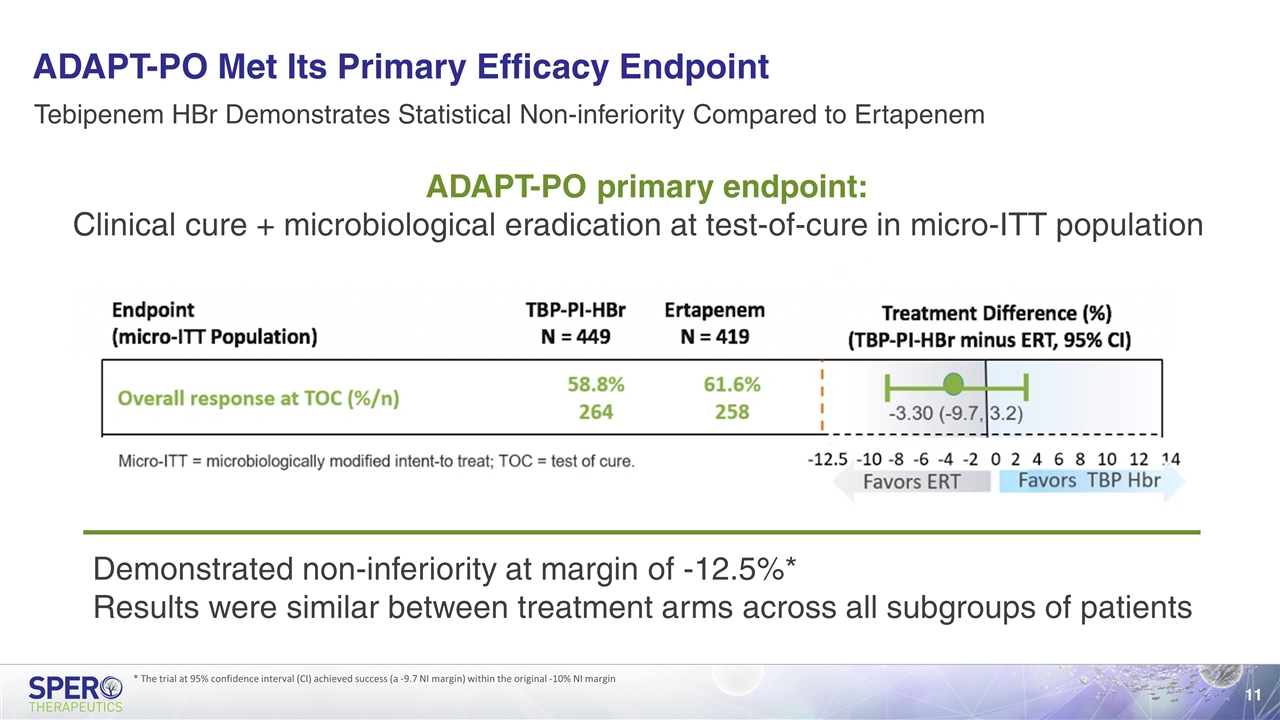

Tebipenem HBr: Positive ADAPT-PO Phase 3 Trial Results Robust Results Support NDA Submission and Potential Treatment Shift from IV to Oral in cUTI Landmark ADAPT-PO Trial Met Primary Endpoint Positive ADAPT-PO Trial Results Support an NDA Submission in 2Q21 One well-controlled pivotal trial to form the basis for an NDA submission as per FDA interactions Continue to expect to complete a new drug application (NDA) submission to the FDA in the second quarter of 2021 If approved, tebipenem HBr would be the only oral carbapenem approved for complicated urinary tract infection (cUTI) and acute pyelonephritis (AP) Potential to Transform how cUTI Patients are Treated Positive results in landmark study unprecedented for the field Overall combined response rate: Oral tebipenem HBr response rate of 58.8% versus 61.6% for IV ertapenem (-3.3%; -9.7, 3.2; -12.5% NI margin)* Tebipenem HBr demonstrates favorable safety profile similar to ertapenem Tebipenem HBr, as the first oral carbapenem, could allow appropriate patients the opportunity to receive treatment in the community setting Provides an important value proposition that could benefit patients, hospitals and payers NI, non-inferiority; NDA, new drug application * The trial at 95% confidence interval (CI) achieved success (a -9.7 NI margin) within the original -10% NI margin

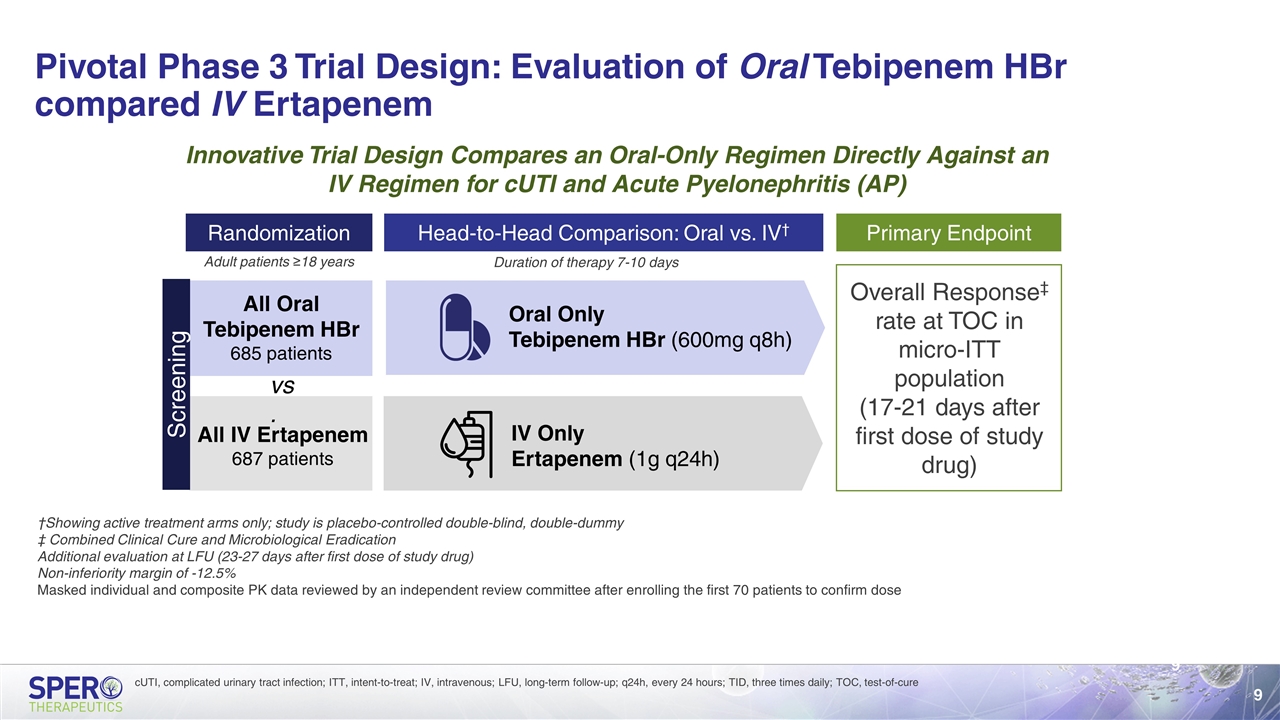

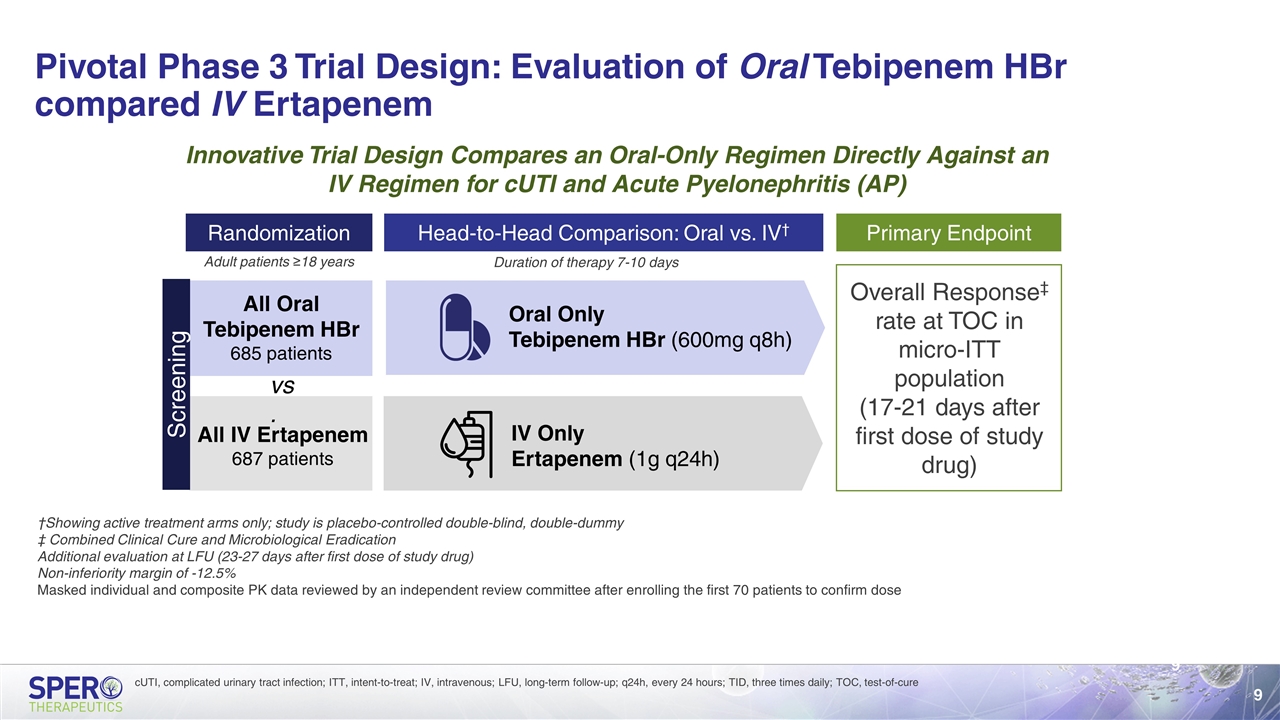

Pivotal Phase 3 Trial Design: Evaluation of Oral Tebipenem HBr compared IV Ertapenem Randomization All Oral Tebipenem HBr 685 patients All IV Ertapenem 687 patients Primary Endpoint Head-to-Head Comparison: Oral vs. IV† Oral Only Tebipenem HBr (600mg q8h) IV Only Ertapenem (1g q24h) Duration of therapy 7-10 days Adult patients ≥18 years Innovative Trial Design Compares an Oral-Only Regimen Directly Against an IV Regimen for cUTI and Acute Pyelonephritis (AP) †Showing active treatment arms only; study is placebo-controlled double-blind, double-dummy ‡ Combined Clinical Cure and Microbiological Eradication Additional evaluation at LFU (23-27 days after first dose of study drug) Non-inferiority margin of -12.5% Masked individual and composite PK data reviewed by an independent review committee after enrolling the first 70 patients to confirm dose Screening Overall Response‡ rate at TOC in micro-ITT population (17-21 days after first dose of study drug) vs. cUTI, complicated urinary tract infection; ITT, intent-to-treat; IV, intravenous; LFU, long-term follow-up; q24h, every 24 hours; TID, three times daily; TOC, test-of-cure

ADAPT-PO Safety Population Demographics: Representative of Anticipated cUTI Population Parameters balanced across treatment arms Mean age: 57 years; 43.6% age 65 years of age or older 55% female, 45% male population Baseline diagnosis of cUTI (52%) vs. AP (48%) within range anticipated based on historical trials ~8% bacteremia at baseline; 19% met modified SIRS criteria; 39% infected with FQ non-susceptible pathogens SIRS, systemic inflammatory response syndrome FQ-non-susceptible = Levofloxacin MIC ≥ 1 mcg /mL

ADAPT-PO Met Its Primary Efficacy Endpoint ADAPT-PO primary endpoint: Clinical cure + microbiological eradication at test-of-cure in micro-ITT population Tebipenem HBr Demonstrates Statistical Non-inferiority Compared to Ertapenem Demonstrated non-inferiority at margin of -12.5%* Results were similar between treatment arms across all subgroups of patients * The trial at 95% confidence interval (CI) achieved success (a -9.7 NI margin) within the original -10% NI margin

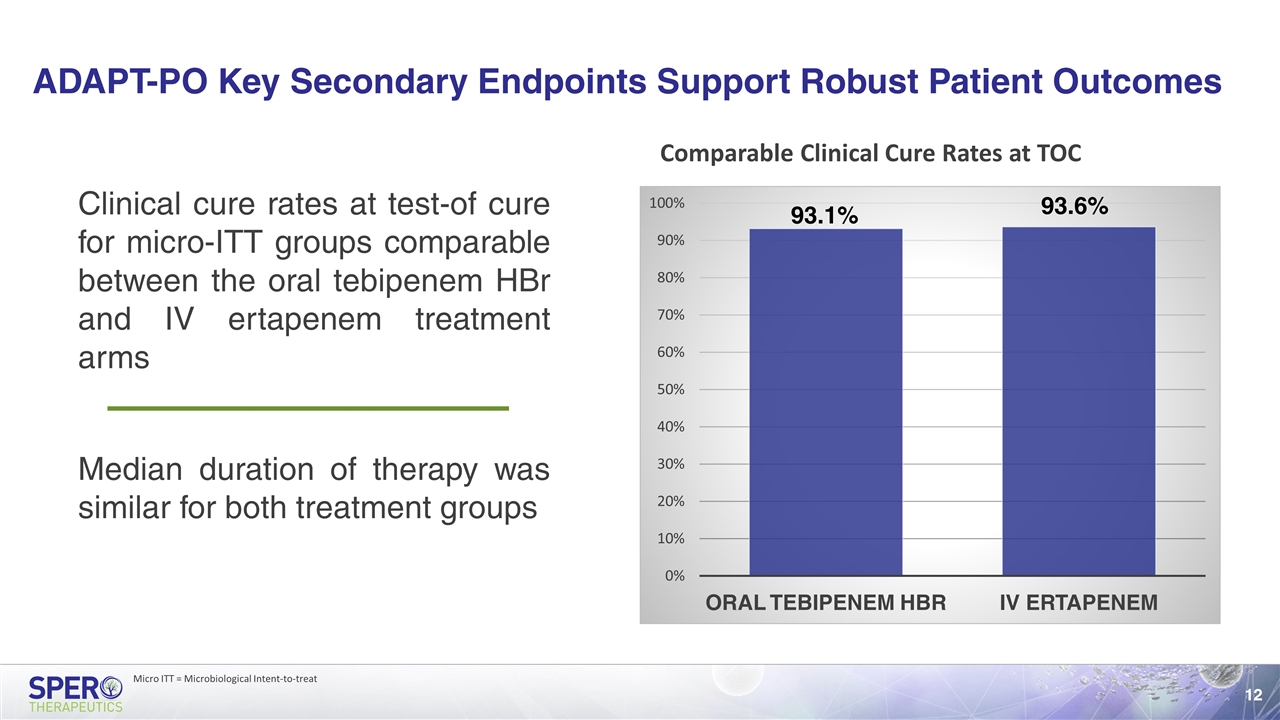

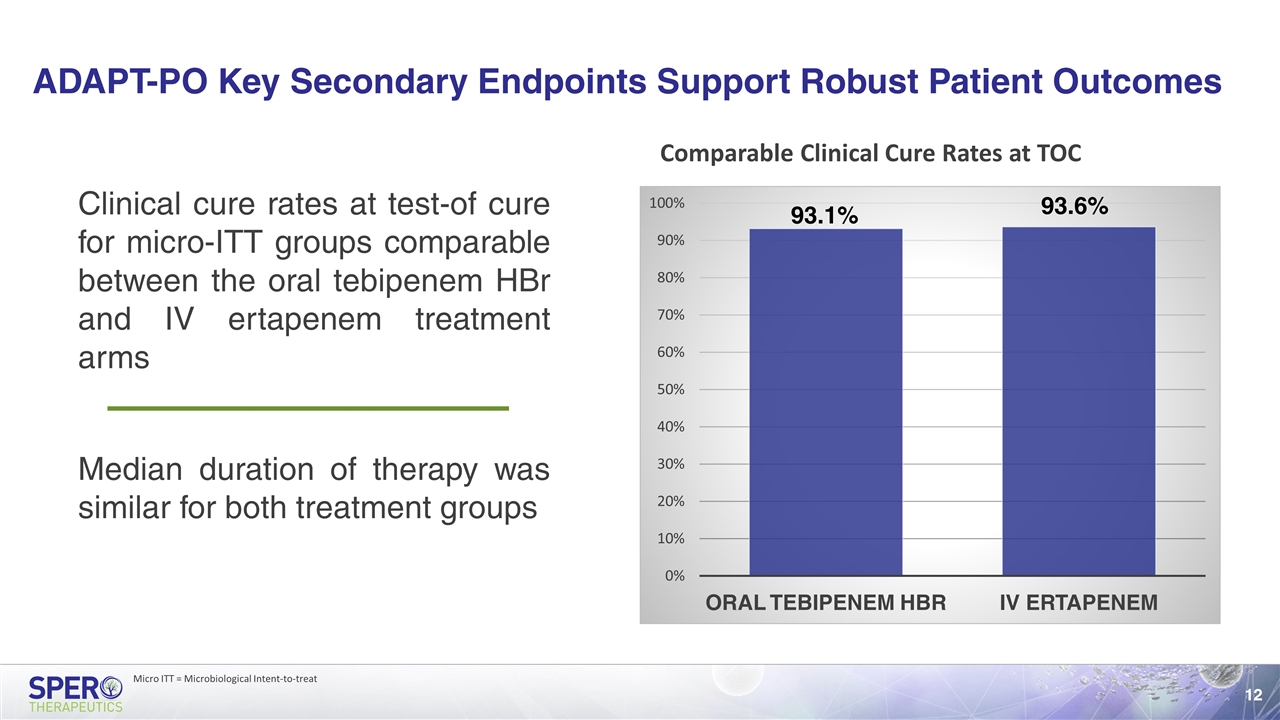

ADAPT-PO Key Secondary Endpoints Support Robust Patient Outcomes Clinical cure rates at test-of cure for micro-ITT groups comparable between the oral tebipenem HBr and IV ertapenem treatment arms Comparable Clinical Cure Rates at TOC Median duration of therapy was similar for both treatment groups Micro ITT = Microbiological Intent-to-treat

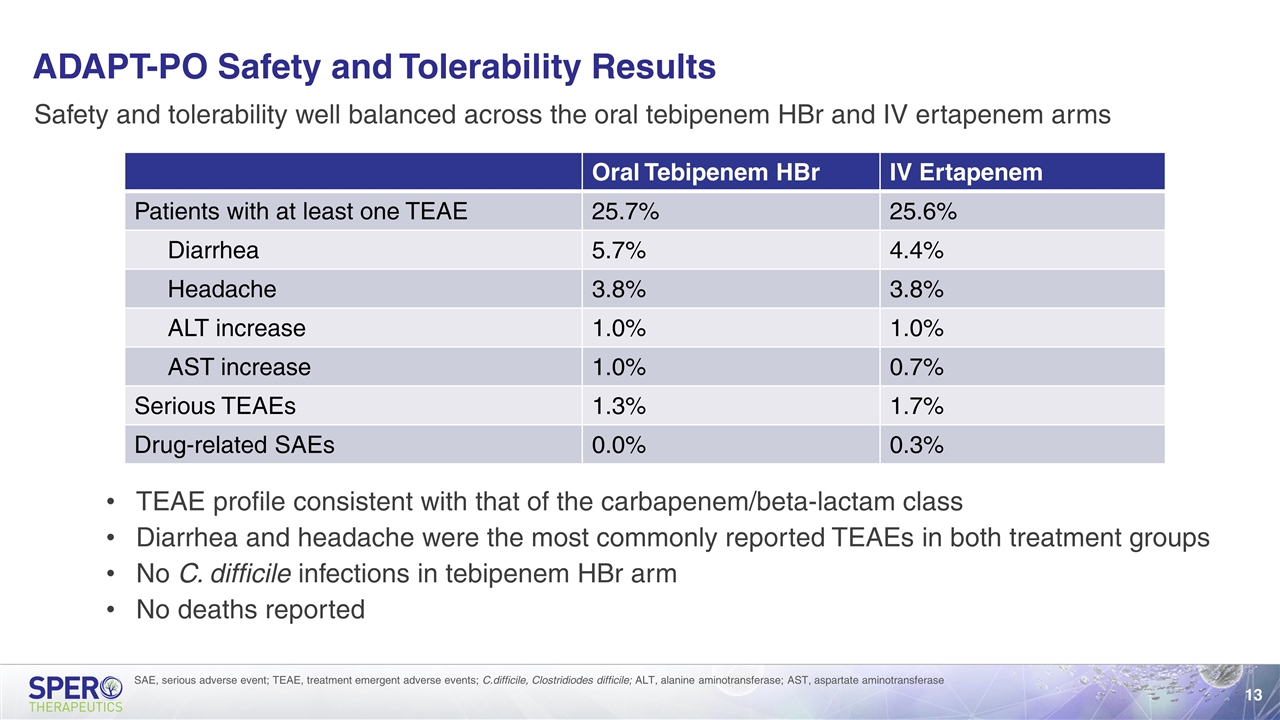

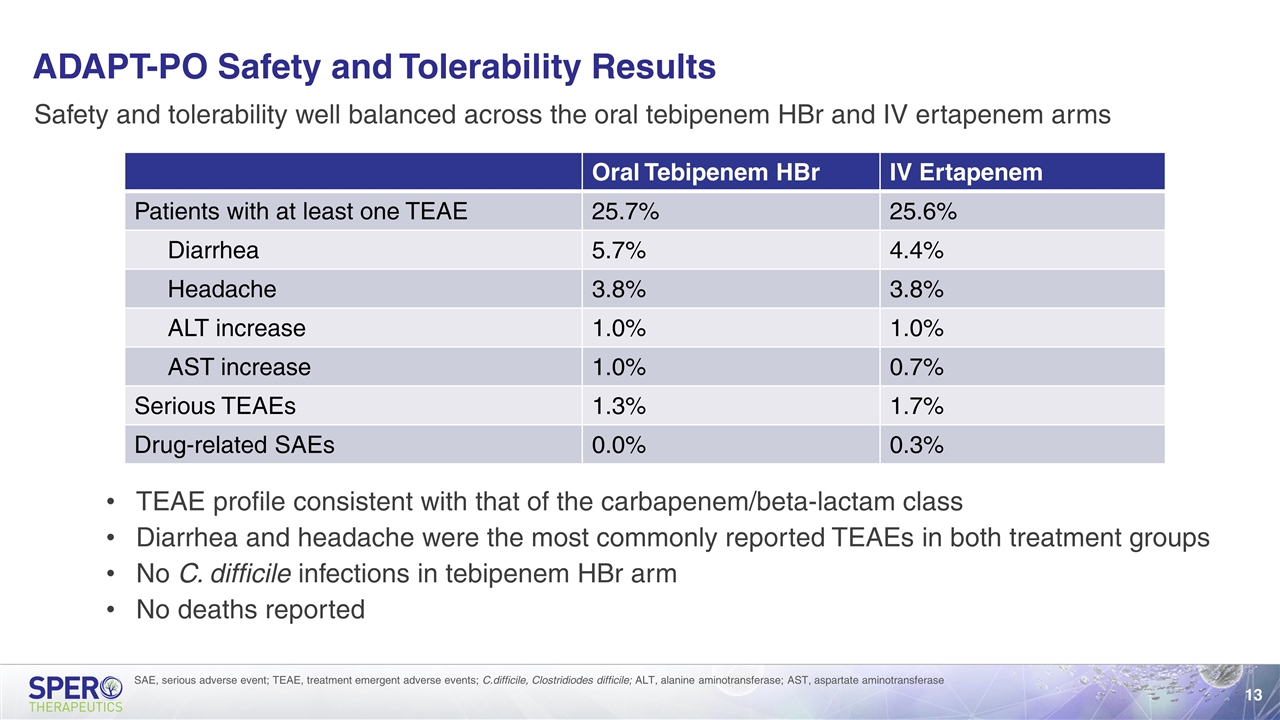

ADAPT-PO Safety and Tolerability Results Safety and tolerability well balanced across the oral tebipenem HBr and IV ertapenem arms TEAE profile consistent with that of the carbapenem/beta-lactam class Diarrhea and headache were the most commonly reported TEAEs in both treatment groups No C. difficile infections in tebipenem HBr arm No deaths reported SAE, serious adverse event; TEAE, treatment emergent adverse events; C.difficile, Clostridiodes difficile; ALT, alanine aminotransferase; AST, aspartate aminotransferase Oral Tebipenem HBr IV Ertapenem Patients with at least one TEAE 25.7% 25.6% Diarrhea 5.7% 4.4% Headache 3.8% 3.8% ALT increase 1.0% 1.0% AST increase 1.0% 0.7% Serious TEAEs 1.3% 1.7% Drug-related SAEs 0.0% 0.3%

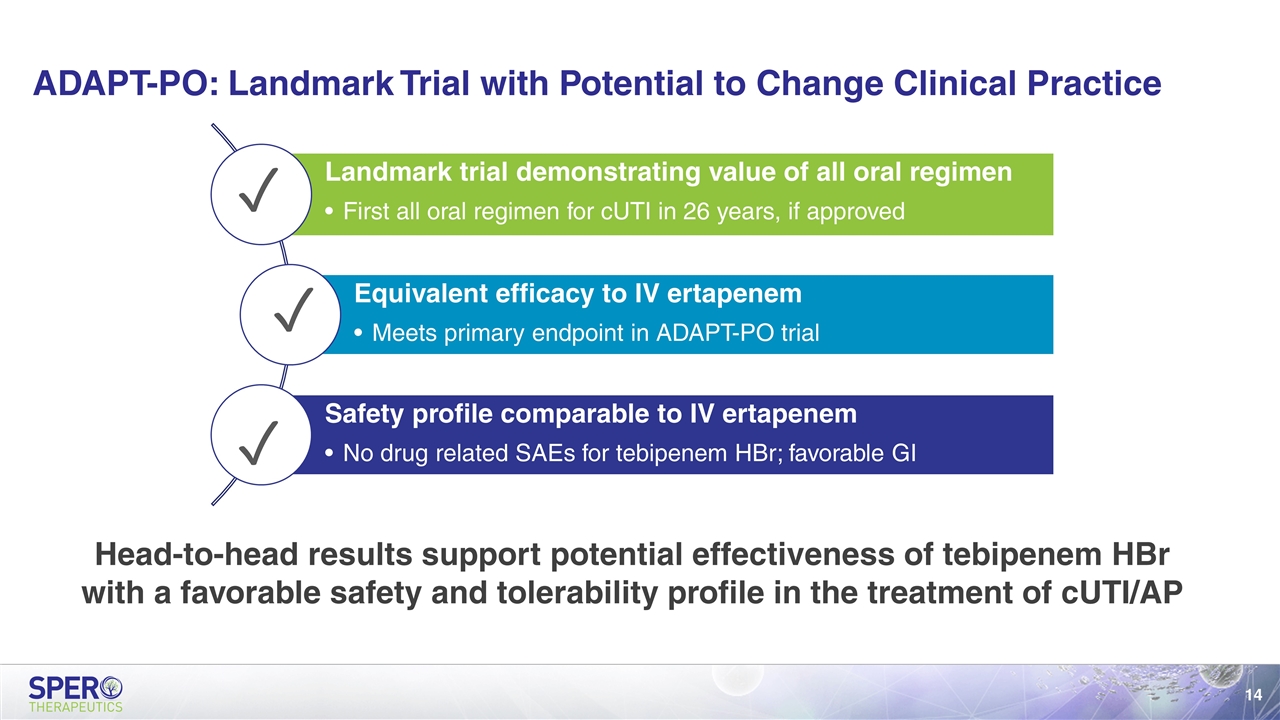

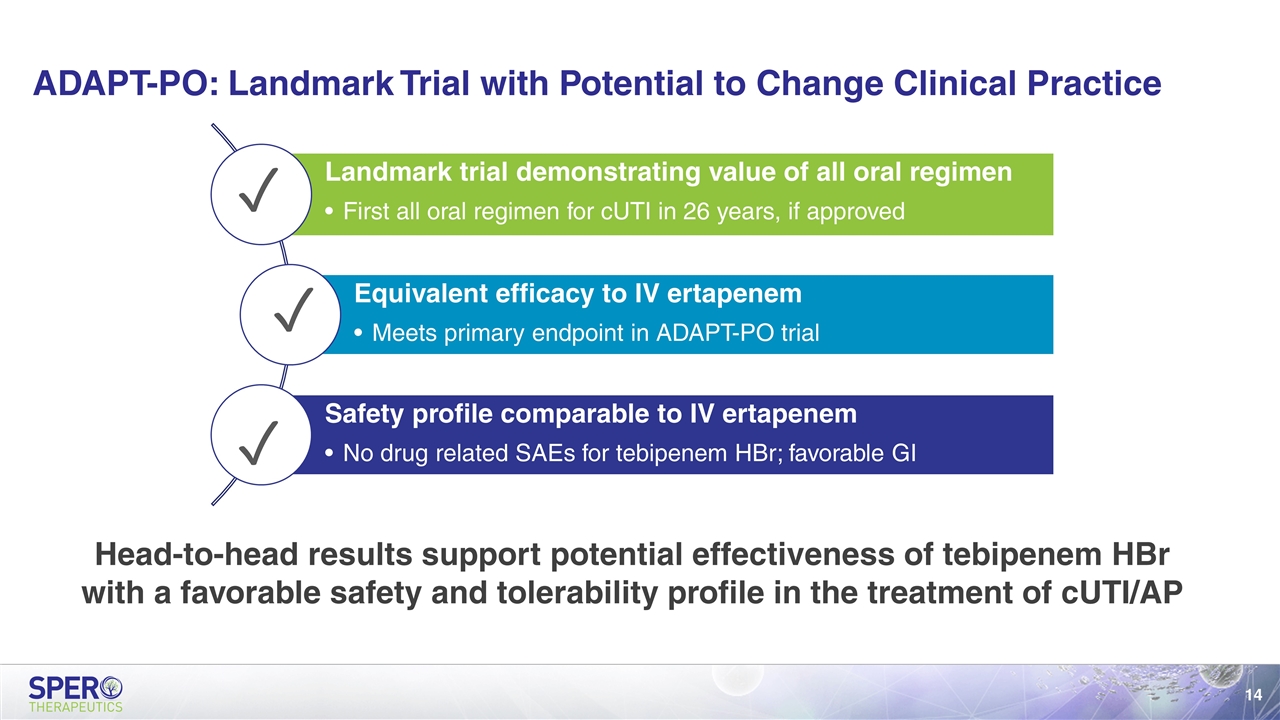

ADAPT-PO: Landmark Trial with Potential to Change Clinical Practice Head-to-head results support potential effectiveness of tebipenem HBr with a favorable safety and tolerability profile in the treatment of cUTI/AP ✓ ✓ ✓ Landmark trial demonstrating value of all oral regimen First all oral regimen for cUTI in 26 years, if approved Equivalent efficacy to IV ertapenem Meets primary endpoint in ADAPT-PO trial Safety profile comparable to IV ertapenem No drug related SAEs for tebipenem HBr; favorable GI

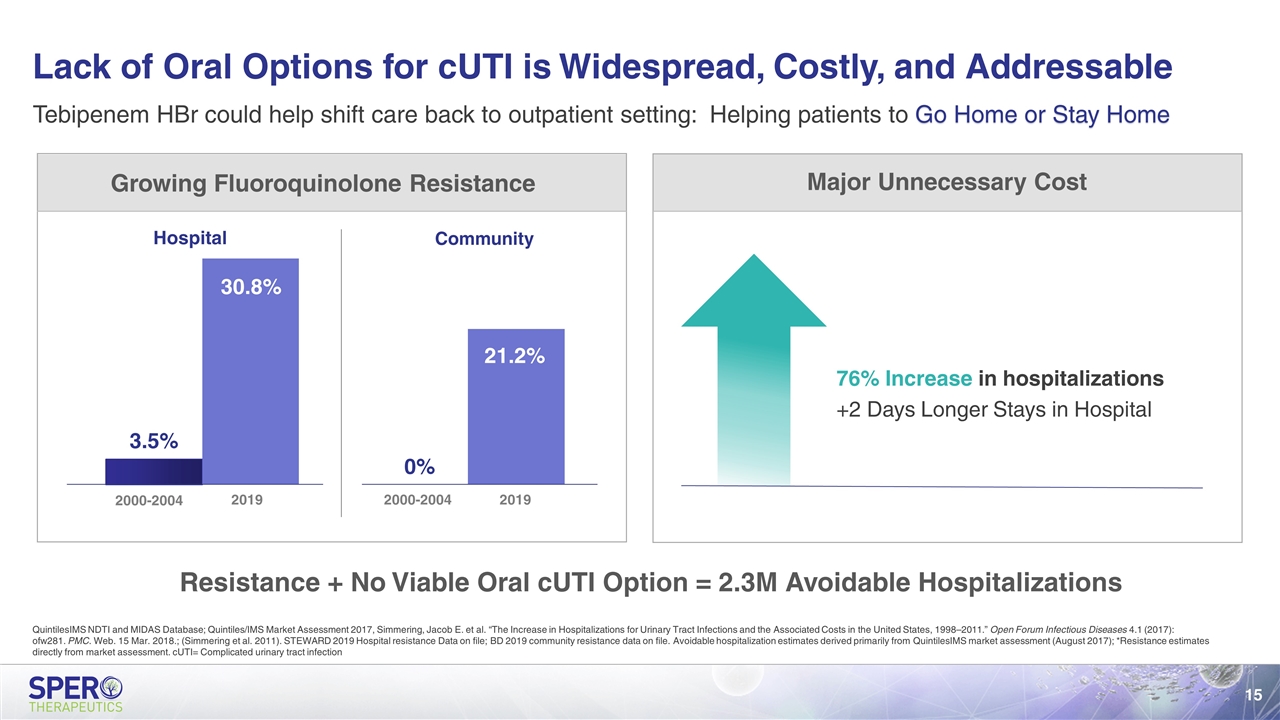

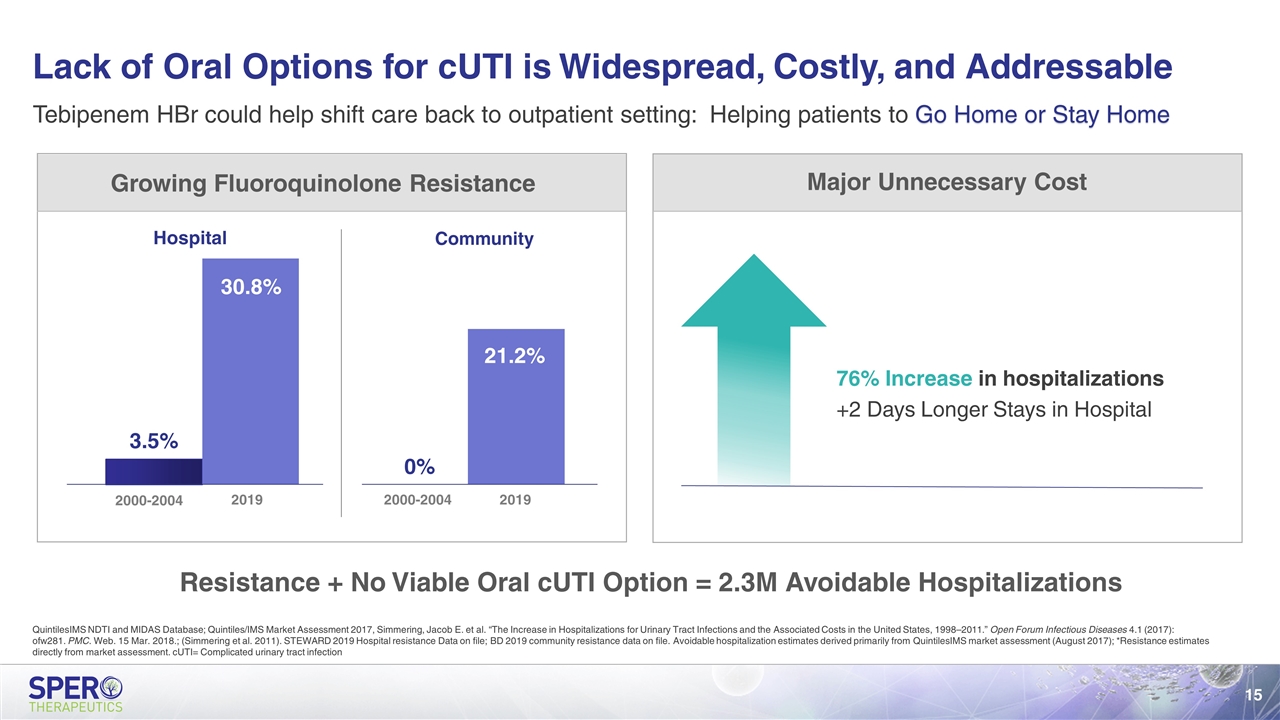

Lack of Oral Options for cUTI is Widespread, Costly, and Addressable 2000-2004 Hospital Community $10,741 $7,083 76% Increase in hospitalizations +2 Days Longer Stays in Hospital Resistance + No Viable Oral cUTI Option = 2.3M Avoidable Hospitalizations Major Unnecessary Cost Growing Fluoroquinolone Resistance 2000-2004 Tebipenem HBr could help shift care back to outpatient setting: Helping patients to Go Home or Stay Home QuintilesIMS NDTI and MIDAS Database; Quintiles/IMS Market Assessment 2017, Simmering, Jacob E. et al. “The Increase in Hospitalizations for Urinary Tract Infections and the Associated Costs in the United States, 1998–2011.” Open Forum Infectious Diseases 4.1 (2017): ofw281. PMC. Web. 15 Mar. 2018.; (Simmering et al. 2011). STEWARD 2019 Hospital resistance Data on file; BD 2019 community resistance data on file. Avoidable hospitalization estimates derived primarily from QuintilesIMS market assessment (August 2017); *Resistance estimates directly from market assessment. cUTI= Complicated urinary tract infection 2019 2019

Tebipenem HBr has the Potential to be a Highly Differentiated Therapy No branded or generic oral substitutes Existing, large, and growing unmet need Primary reimbursement outside of the hospital Current practice and financial incentives support usage Prescriber base beyond infectious disease

Tebipenem HBr Intended to Treat a Large and Existing UTI Population Katrina, college student at the University of Kansas, experienced “a U.T.I. that did not respond to three different rounds of antibiotics.” “It got so bad that I was out of school for months and had to get a medical withdrawal,” she said. Hospital Avoidance Stay Home Timothy, a medical student, was hospitalized with E. coli that was highly resistant to a wide variety of antibiotics. His discharge was delayed because the resistant nature of the bacteria would require insurance approval of home IV antibiotics.” Get Home Sooner From Hospital Go Home Sources: NYT Aug 20, 2019; IDSA Faces of Antimicrobial Resistance

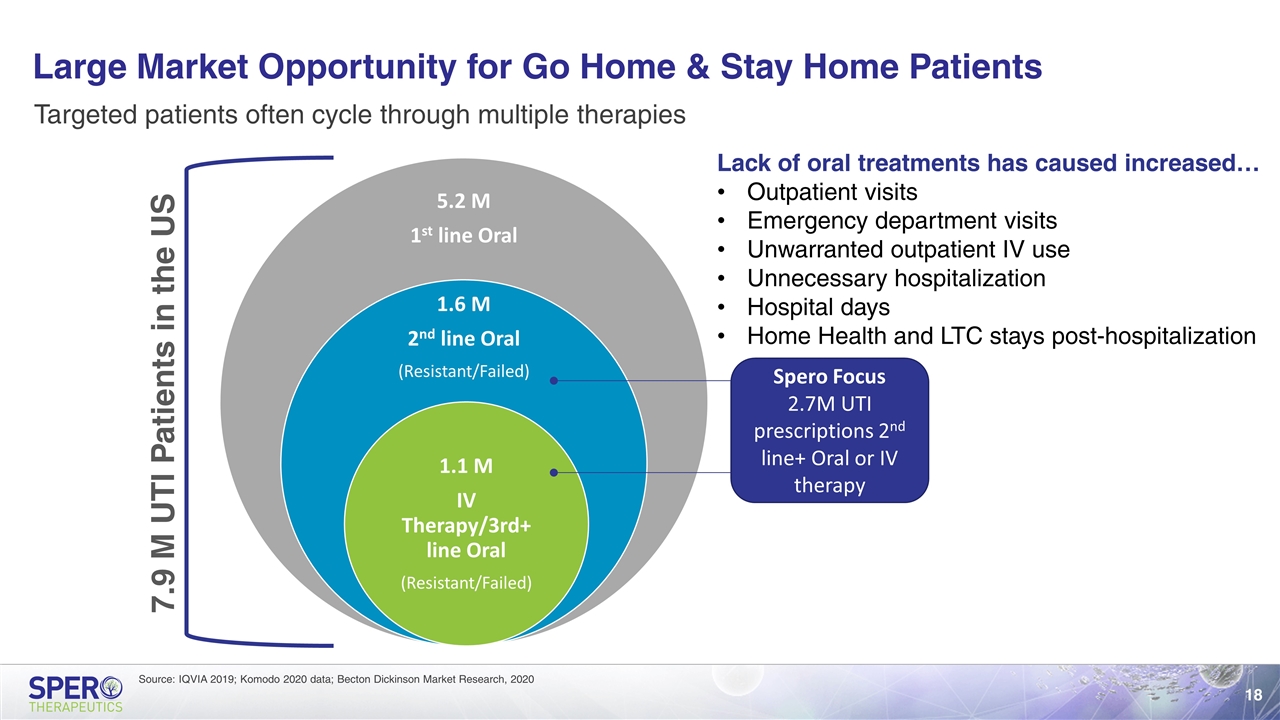

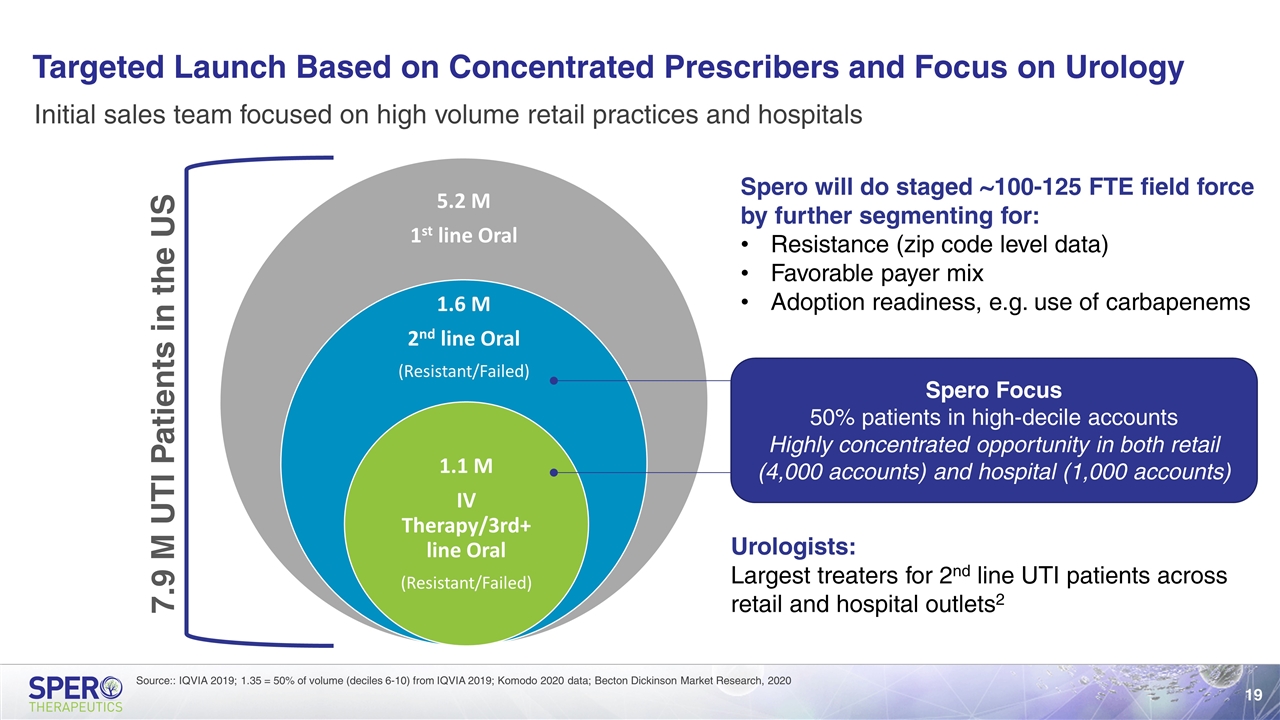

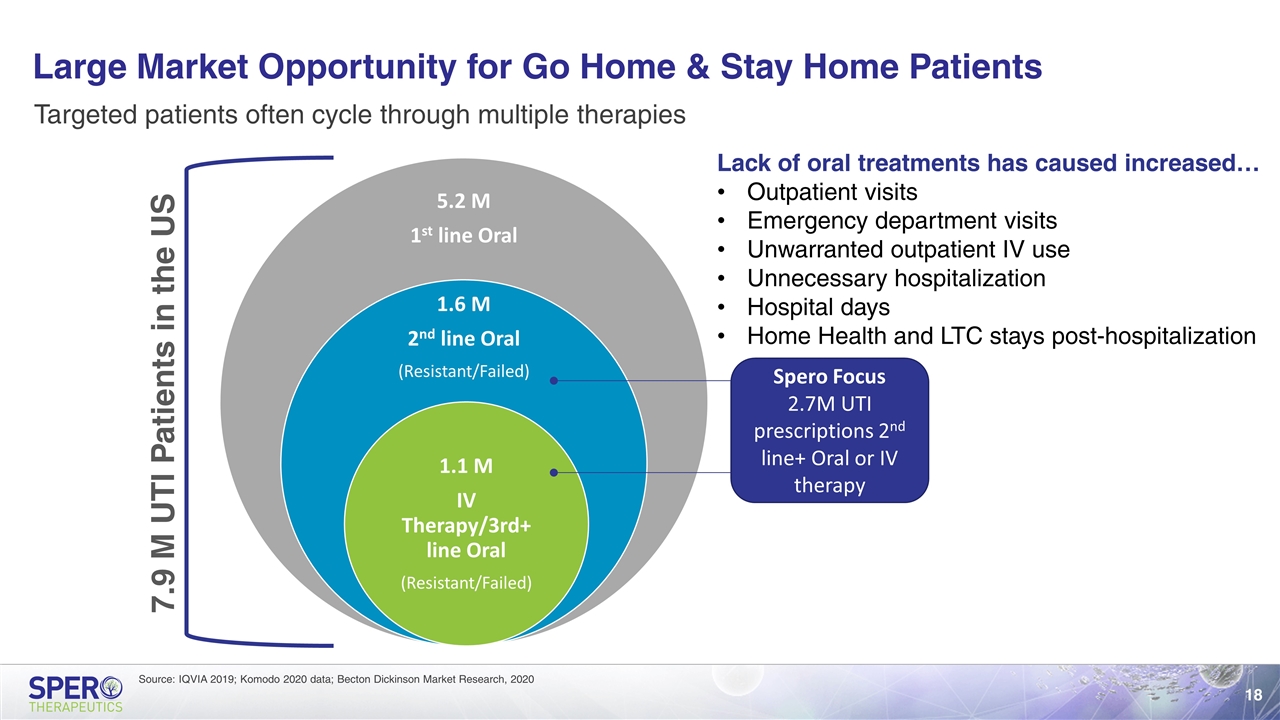

Large Market Opportunity for Go Home & Stay Home Patients Source: IQVIA 2019; Komodo 2020 data; Becton Dickinson Market Research, 2020 Targeted patients often cycle through multiple therapies 7.9 M UTI Patients in the US Spero Focus 2.7M UTI prescriptions 2nd line+ Oral or IV therapy Lack of oral treatments has caused increased… Outpatient visits Emergency department visits Unwarranted outpatient IV use Unnecessary hospitalization Hospital days Home Health and LTC stays post-hospitalization 5.2 M 1 st line Oral 1.6 M 2 nd line Oral (Resistant/Failed) 1.1 M IV Therapy/3rd+ line Oral (Resistant/Failed)

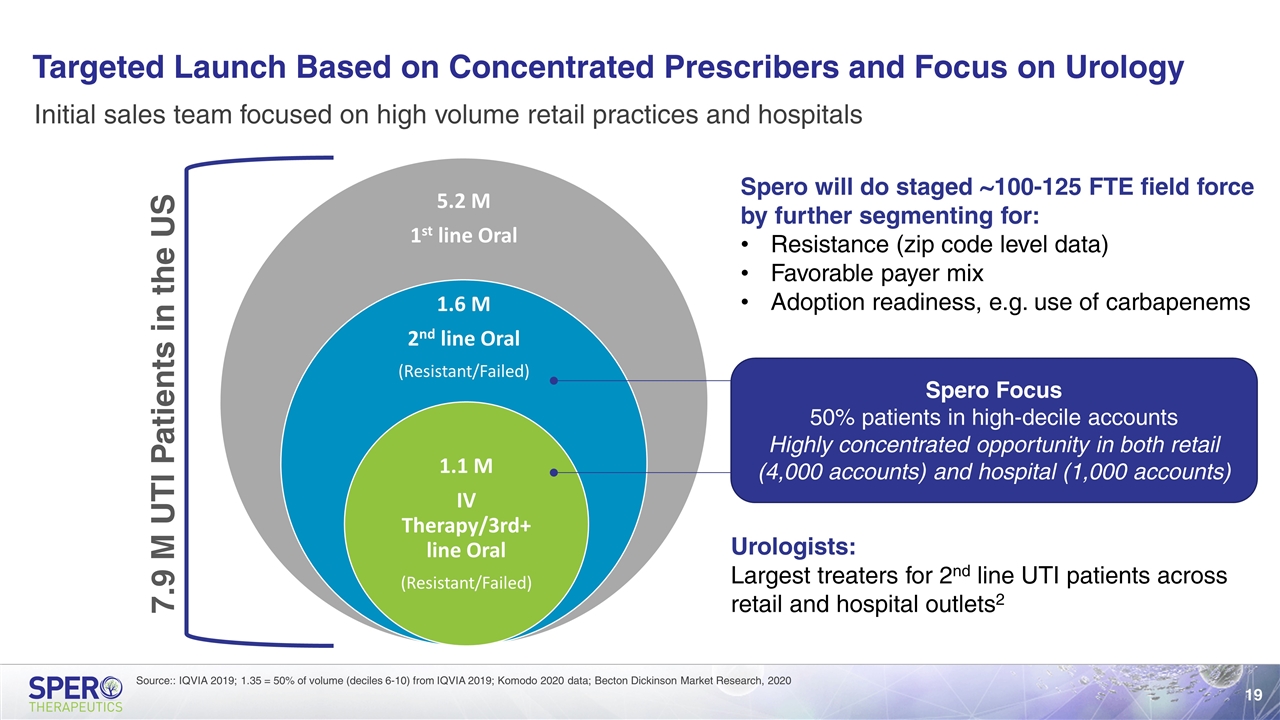

Targeted Launch Based on Concentrated Prescribers and Focus on Urology Source:: IQVIA 2019; 1.35 = 50% of volume (deciles 6-10) from IQVIA 2019; Komodo 2020 data; Becton Dickinson Market Research, 2020 Initial sales team focused on high volume retail practices and hospitals 7.9 M UTI Patients in the US Spero Focus 50% patients in high-decile accounts Highly concentrated opportunity in both retail (4,000 accounts) and hospital (1,000 accounts) Spero will do staged ~100-125 FTE field force by further segmenting for: Resistance (zip code level data) Favorable payer mix Adoption readiness, e.g. use of carbapenems Urologists: Largest treaters for 2nd line UTI patients across retail and hospital outlets2 5.2 M 1 st line Oral 1.6 M 2 nd line Oral (Resistant/Failed) 1.1 M IV Therapy/3rd+ line Oral (Resistant/Failed)

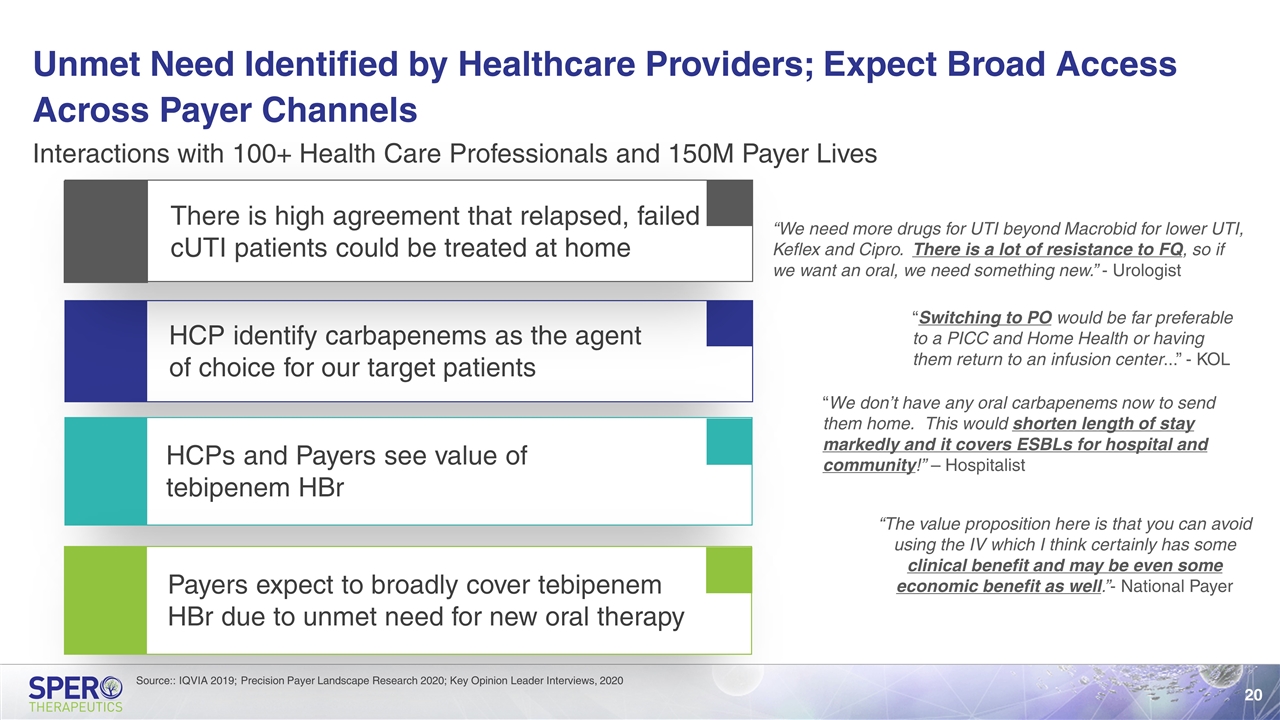

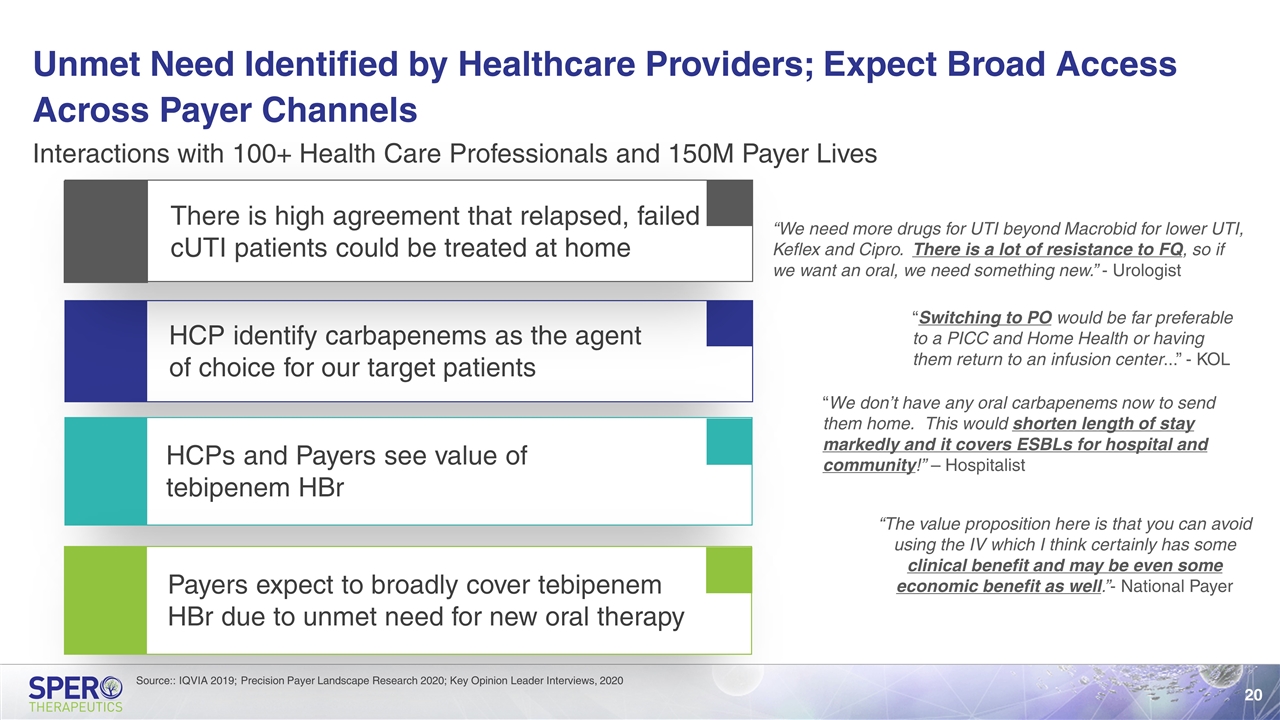

Unmet Need Identified by Healthcare Providers; Expect Broad Access Across Payer Channels HCP identify carbapenems as the agent of choice for our target patients HCPs and Payers see value of tebipenem HBr Interactions with 100+ Health Care Professionals and 150M Payer Lives There is high agreement that relapsed, failed cUTI patients could be treated at home Payers expect to broadly cover tebipenem HBr due to unmet need for new oral therapy “We need more drugs for UTI beyond Macrobid for lower UTI, Keflex and Cipro. There is a lot of resistance to FQ, so if we want an oral, we need something new.” - Urologist “Switching to PO would be far preferable to a PICC and Home Health or having them return to an infusion center...” - KOL “We don’t have any oral carbapenems now to send them home. This would shorten length of stay markedly and it covers ESBLs for hospital and community!” – Hospitalist “The value proposition here is that you can avoid using the IV which I think certainly has some clinical benefit and may be even some economic benefit as well.”- National Payer Source:: IQVIA 2019; Precision Payer Landscape Research 2020; Key Opinion Leader Interviews, 2020

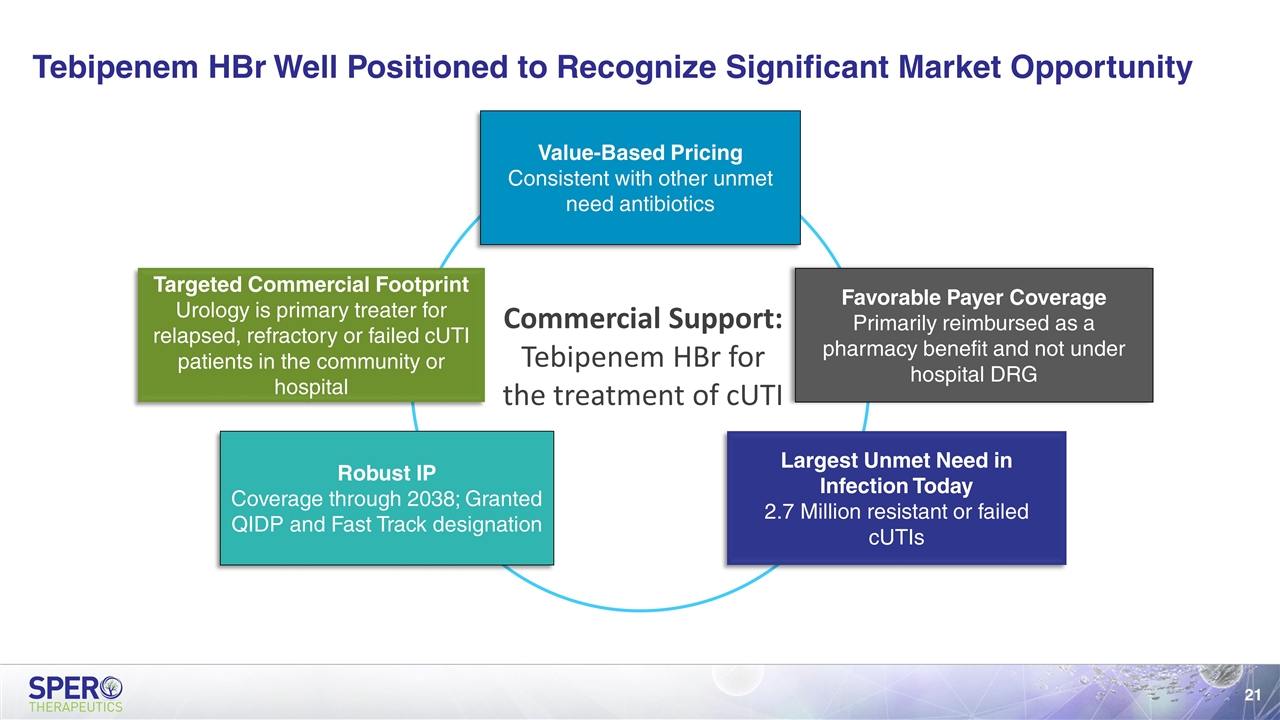

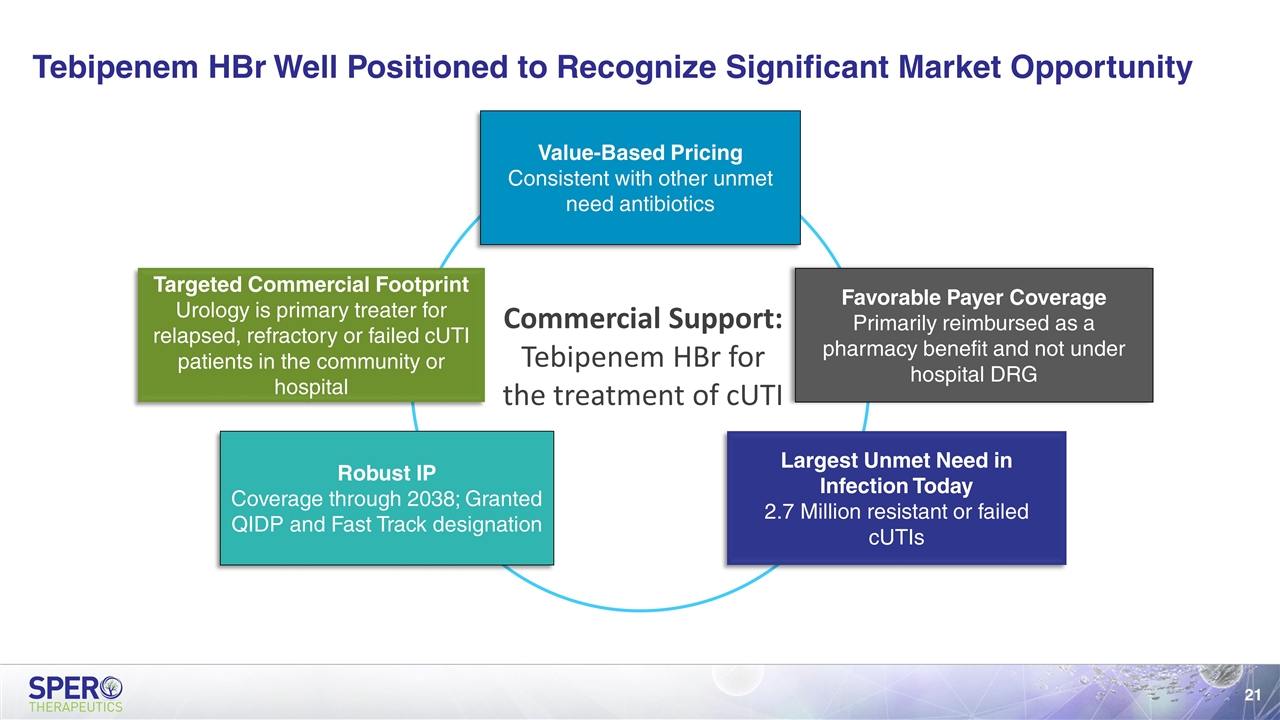

Tebipenem HBr Well Positioned to Recognize Significant Market Opportunity Value-Based Pricing Consistent with other unmet need antibiotics Favorable Payer Coverage Primarily reimbursed as a pharmacy benefit and not under hospital DRG Largest Unmet Need in Infection Today 2.7 Million resistant or failed cUTIs Robust IP Coverage through 2038; Granted QIDP and Fast Track designation Targeted Commercial Footprint Urology is primary treater for relapsed, refractory or failed cUTI patients in the community or hospital Commercial Support: Tebipenem HBr for the treatment of cUTI

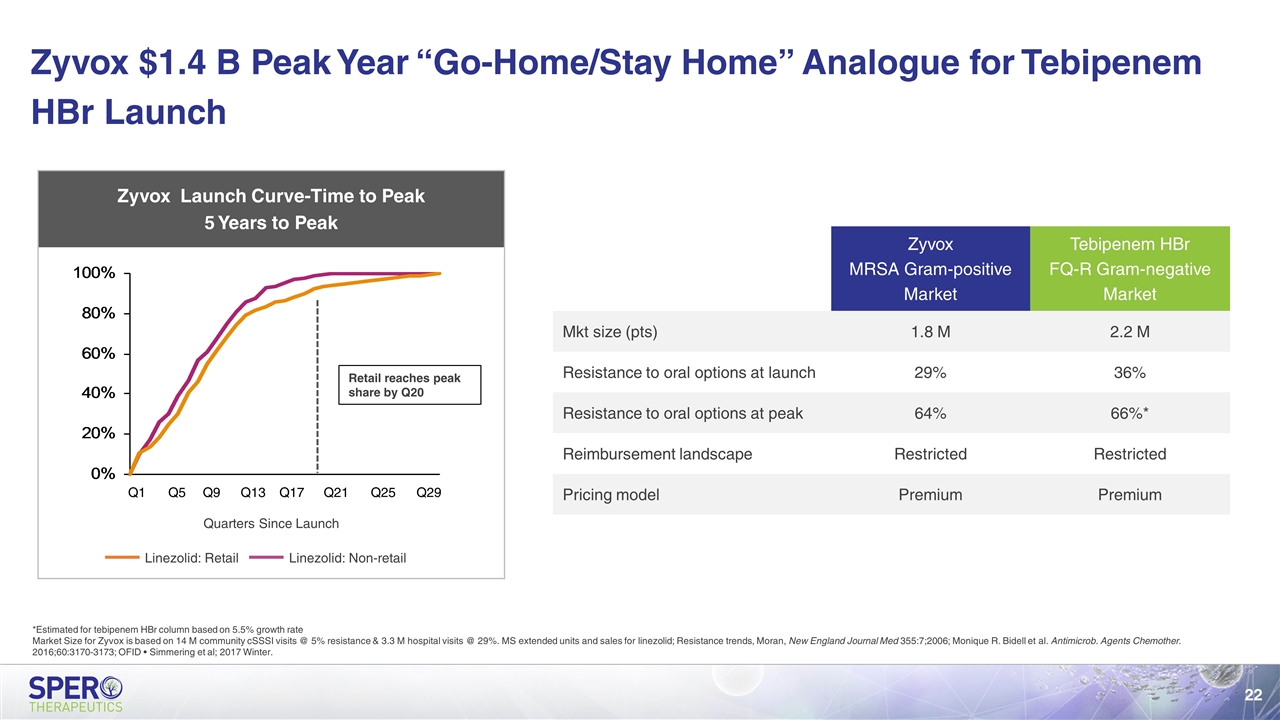

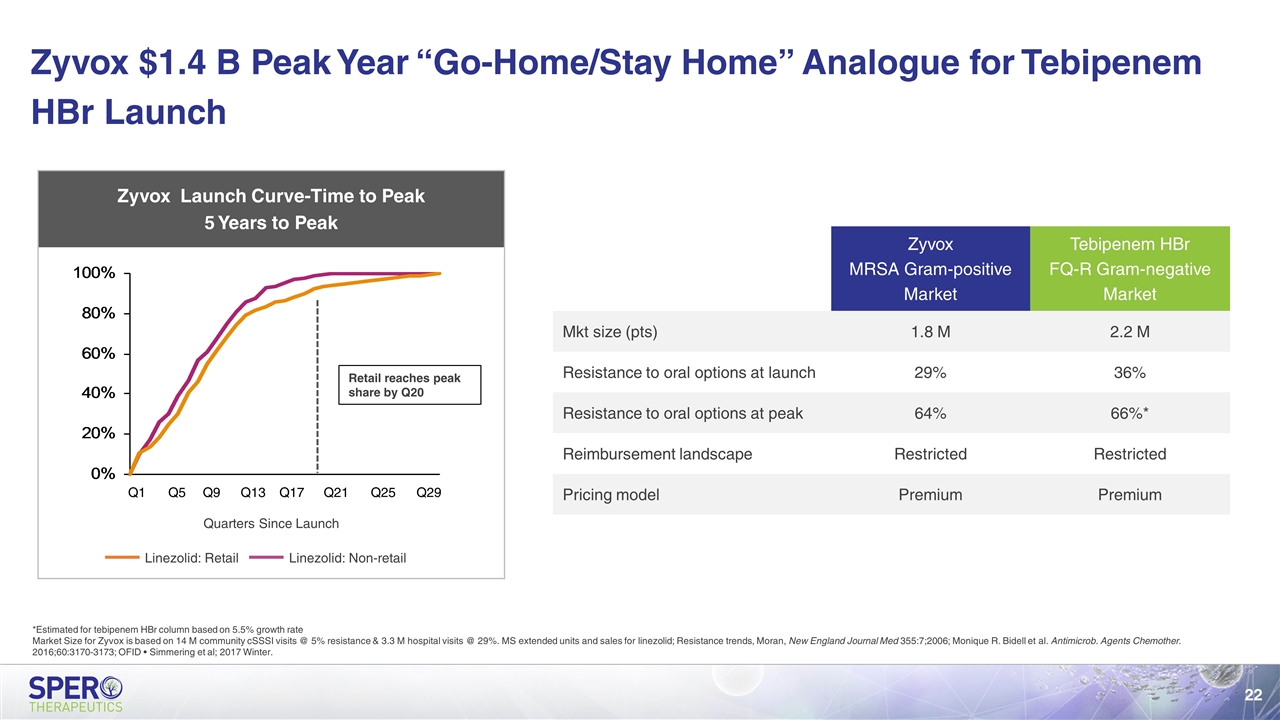

Zyvox MRSA Gram-positive Market Tebipenem HBr FQ-R Gram-negative Market Mkt size (pts) 1.8 M 2.2 M Resistance to oral options at launch 29% 36% Resistance to oral options at peak 64% 66%* Reimbursement landscape Restricted Restricted Pricing model Premium Premium Zyvox Launch Curve-Time to Peak 5 Years to Peak Retail reaches peak share by Q20 Quarters Since Launch Zyvox $1.4 B Peak Year “Go-Home/Stay Home” Analogue for Tebipenem HBr Launch *Estimated for tebipenem HBr column based on 5.5% growth rate Market Size for Zyvox is based on 14 M community cSSSI visits @ 5% resistance & 3.3 M hospital visits @ 29%. MS extended units and sales for linezolid; Resistance trends, Moran, New England Journal Med 355:7;2006; Monique R. Bidell et al. Antimicrob. Agents Chemother. 2016;60:3170-3173; OFID • Simmering et al; 2017 Winter.

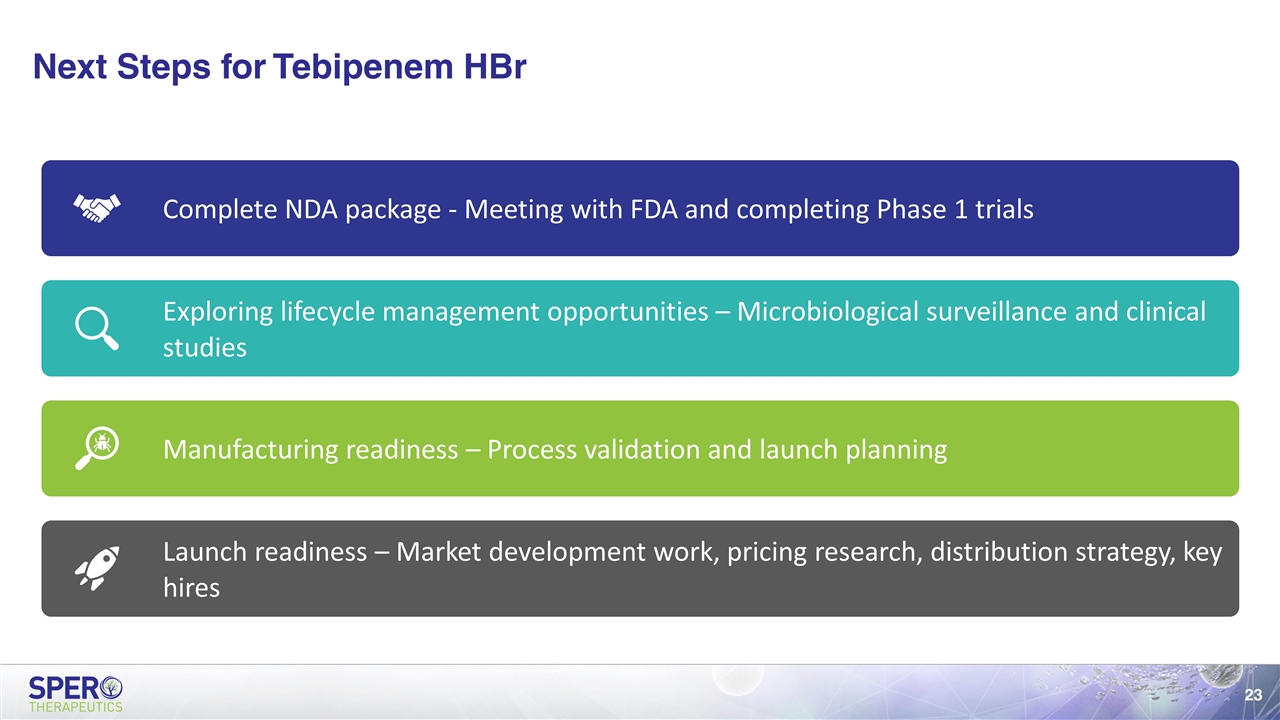

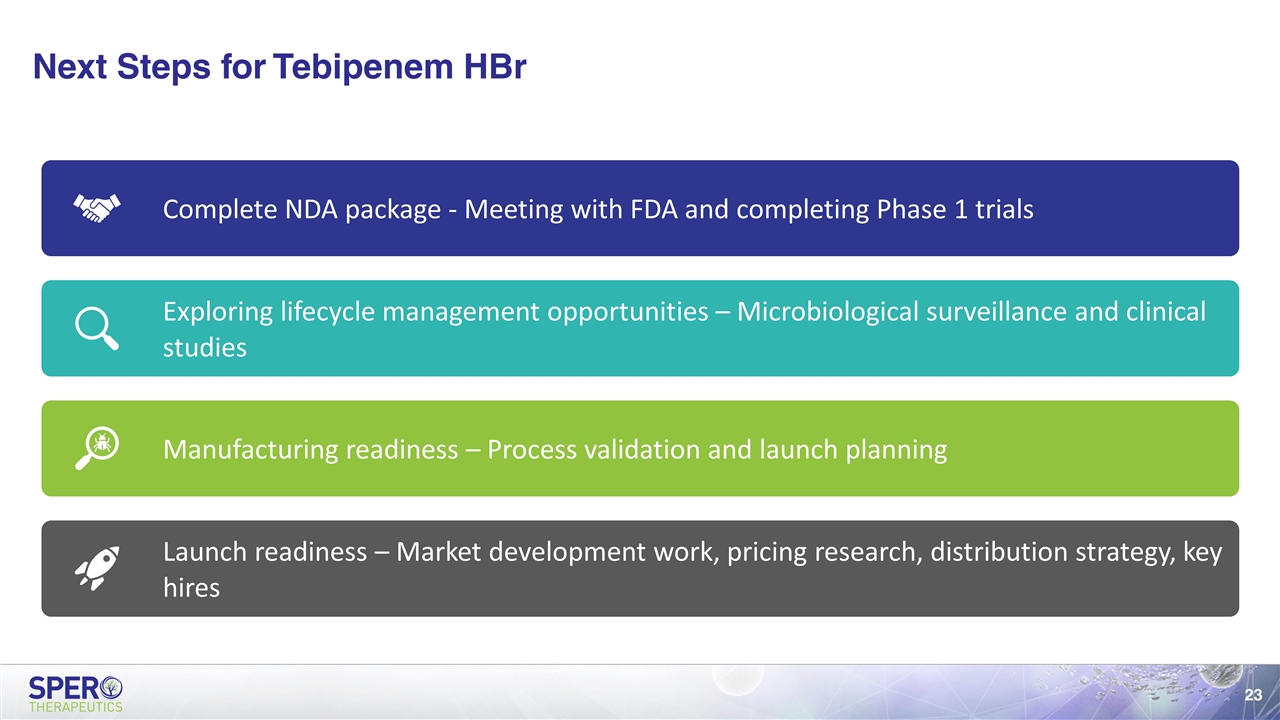

Next Steps for Tebipenem HBr Complete NDA package - Meeting with FDA and completing Phase 1 trials Exploring lifecycle management opportunities – Microbiological surveillance and clinical studies Manufacturing readiness – Process validation and launch planning Launch readiness – Market development work, pricing research, distribution strategy, key hires

Rare Disease Pipeline SPR720

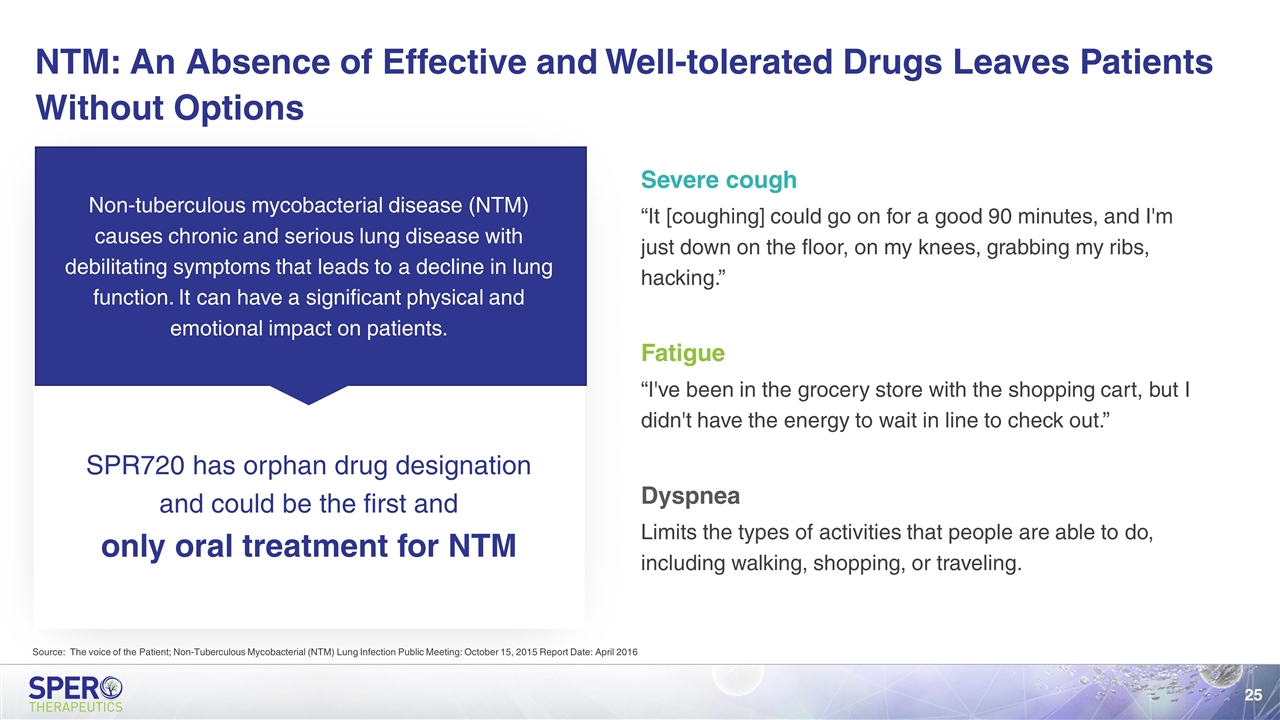

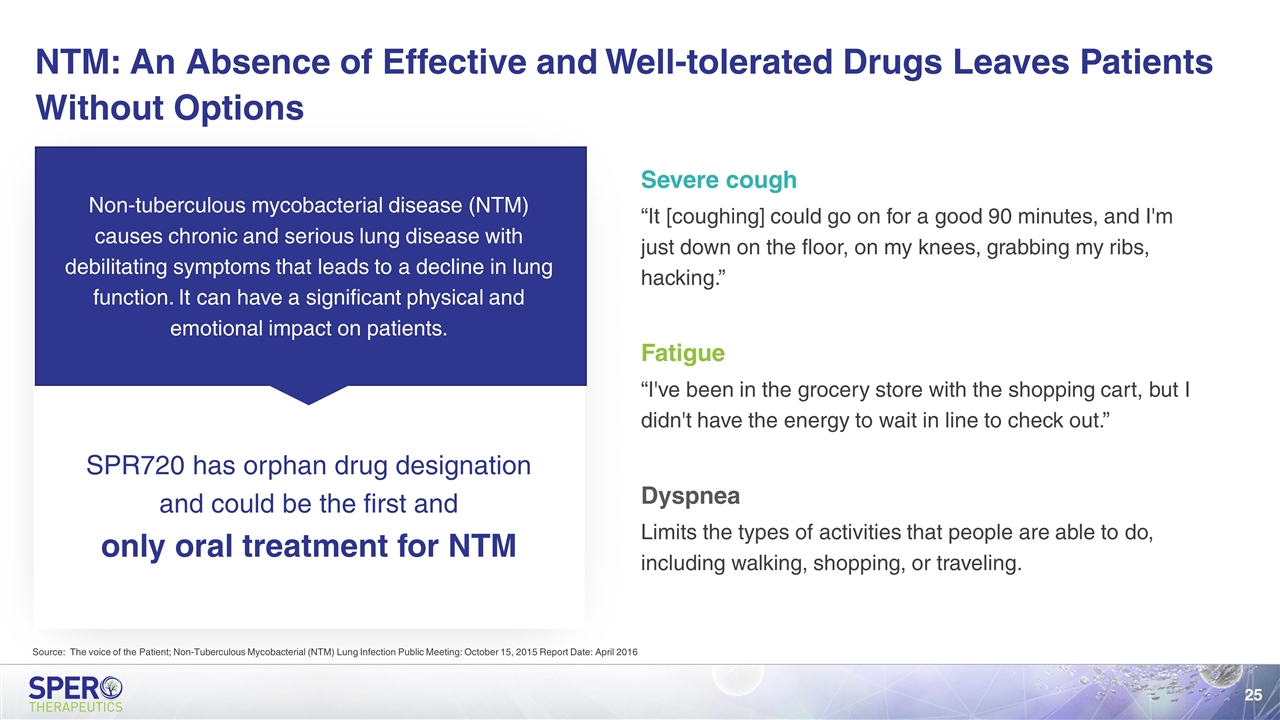

Severe cough “It [coughing] could go on for a good 90 minutes, and I'm just down on the floor, on my knees, grabbing my ribs, hacking.” Fatigue “I've been in the grocery store with the shopping cart, but I didn't have the energy to wait in line to check out.” Dyspnea Limits the types of activities that people are able to do, including walking, shopping, or traveling. Non-tuberculous mycobacterial disease (NTM) causes chronic and serious lung disease with debilitating symptoms that leads to a decline in lung function. It can have a significant physical and emotional impact on patients. SPR720 has orphan drug designation and could be the first and only oral treatment for NTM NTM: An Absence of Effective and Well-tolerated Drugs Leaves Patients Without Options Source: The voice of the Patient; Non-Tuberculous Mycobacterial (NTM) Lung Infection Public Meeting: October 15, 2015 Report Date: April 2016

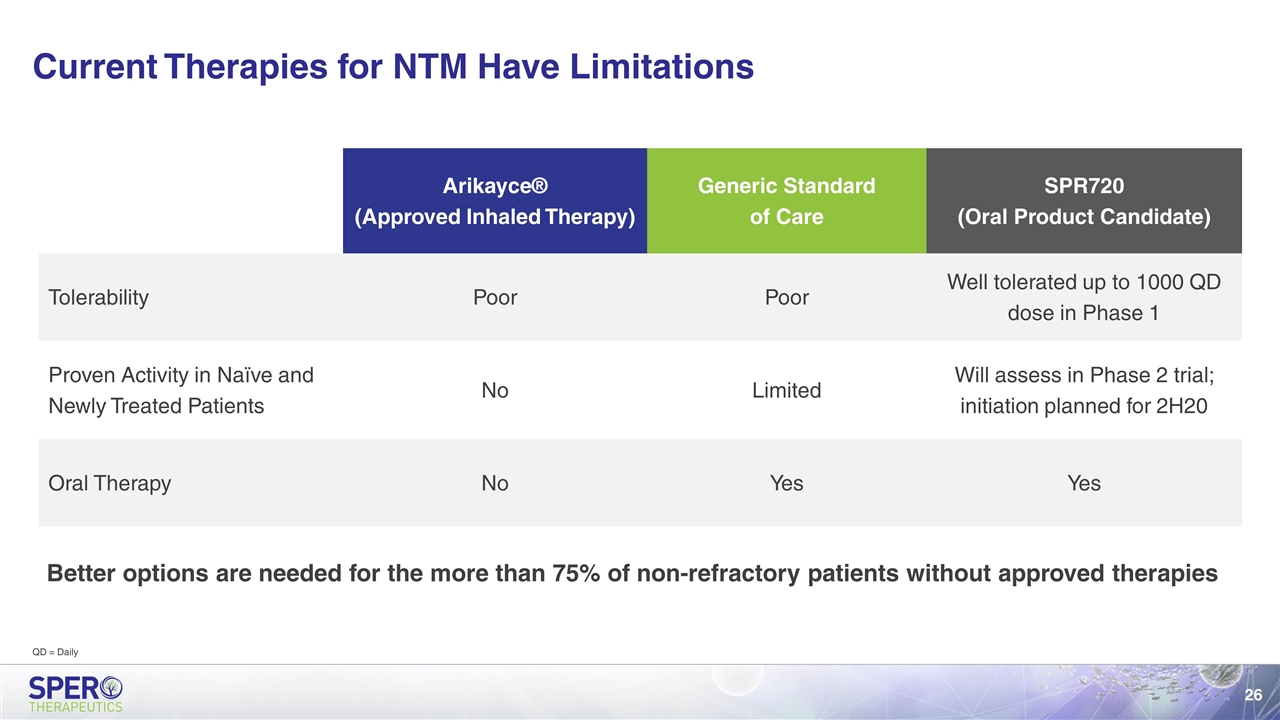

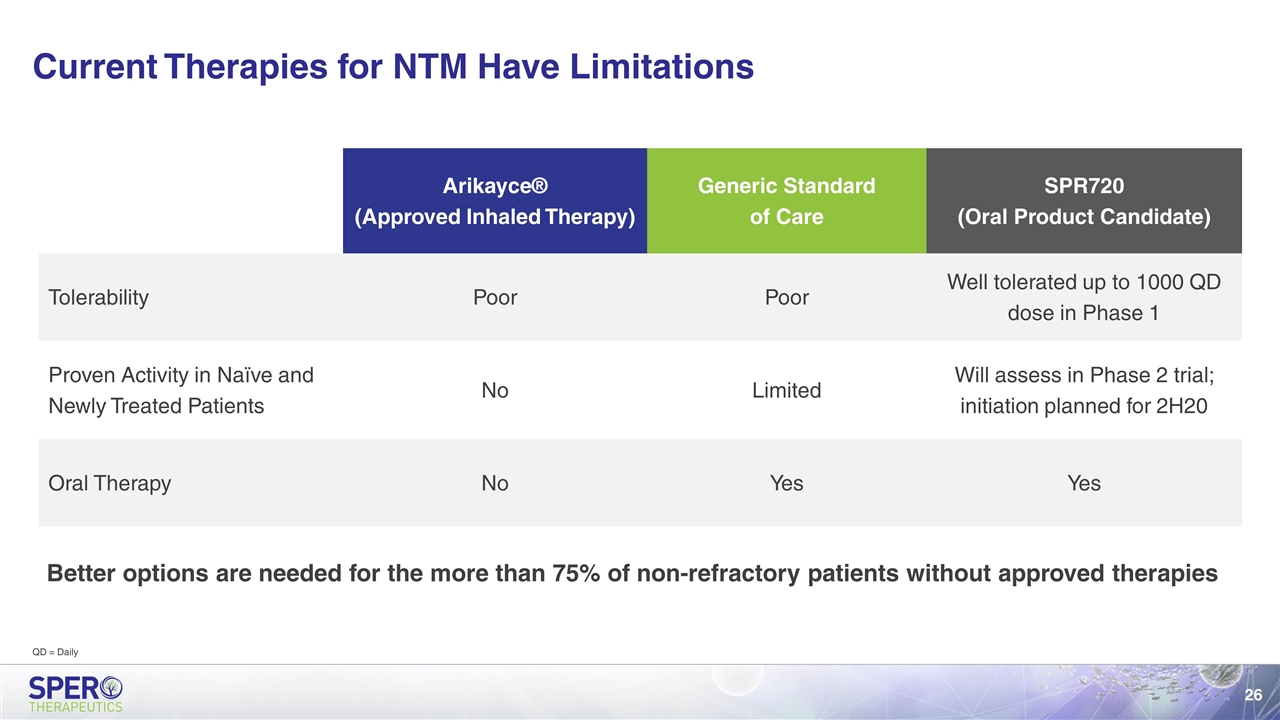

Current Therapies for NTM Have Limitations Better options are needed for the more than 75% of non-refractory patients without approved therapies Arikayce® (Approved Inhaled Therapy) Generic Standard of Care SPR720 (Oral Product Candidate) Tolerability Poor Poor Well tolerated up to 1000 QD dose in Phase 1 Proven Activity in Naïve and Newly Treated Patients No Limited Will assess in Phase 2 trial; initiation planned for 2H20 Oral Therapy No Yes Yes QD = Daily

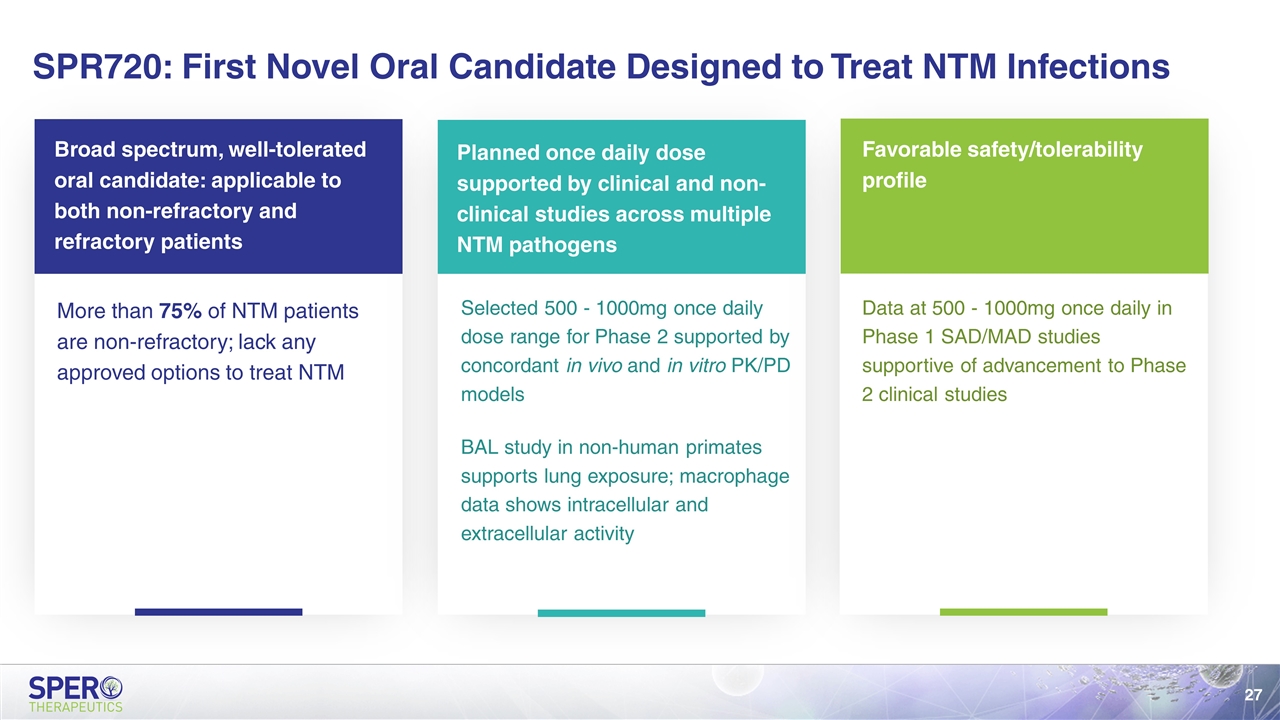

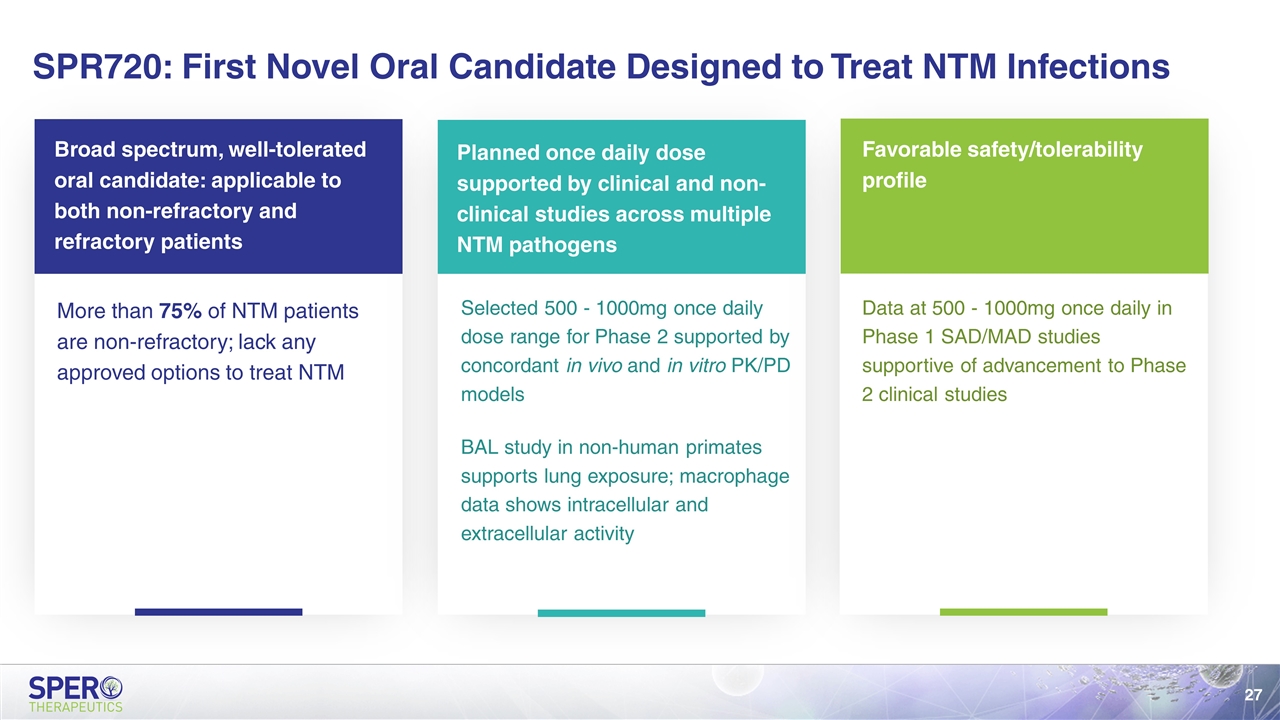

SPR720: First Novel Oral Candidate Designed to Treat NTM Infections Broad spectrum, well-tolerated oral candidate: applicable to both non-refractory and refractory patients More than 75% of NTM patients are non-refractory; lack any approved options to treat NTM Planned once daily dose supported by clinical and non-clinical studies across multiple NTM pathogens Selected 500 - 1000mg once daily dose range for Phase 2 supported by concordant in vivo and in vitro PK/PD models BAL study in non-human primates supports lung exposure; macrophage data shows intracellular and extracellular activity Favorable safety/tolerability profile Data at 500 - 1000mg once daily in Phase 1 SAD/MAD studies supportive of advancement to Phase 2 clinical studies

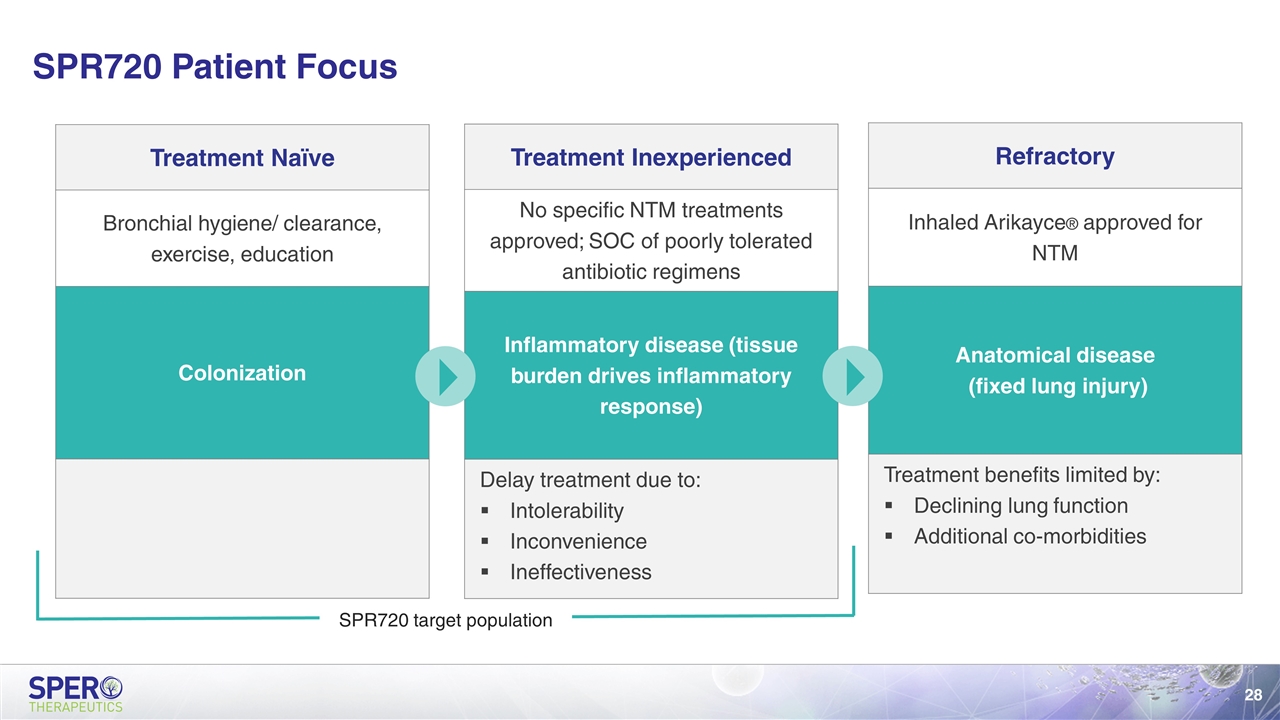

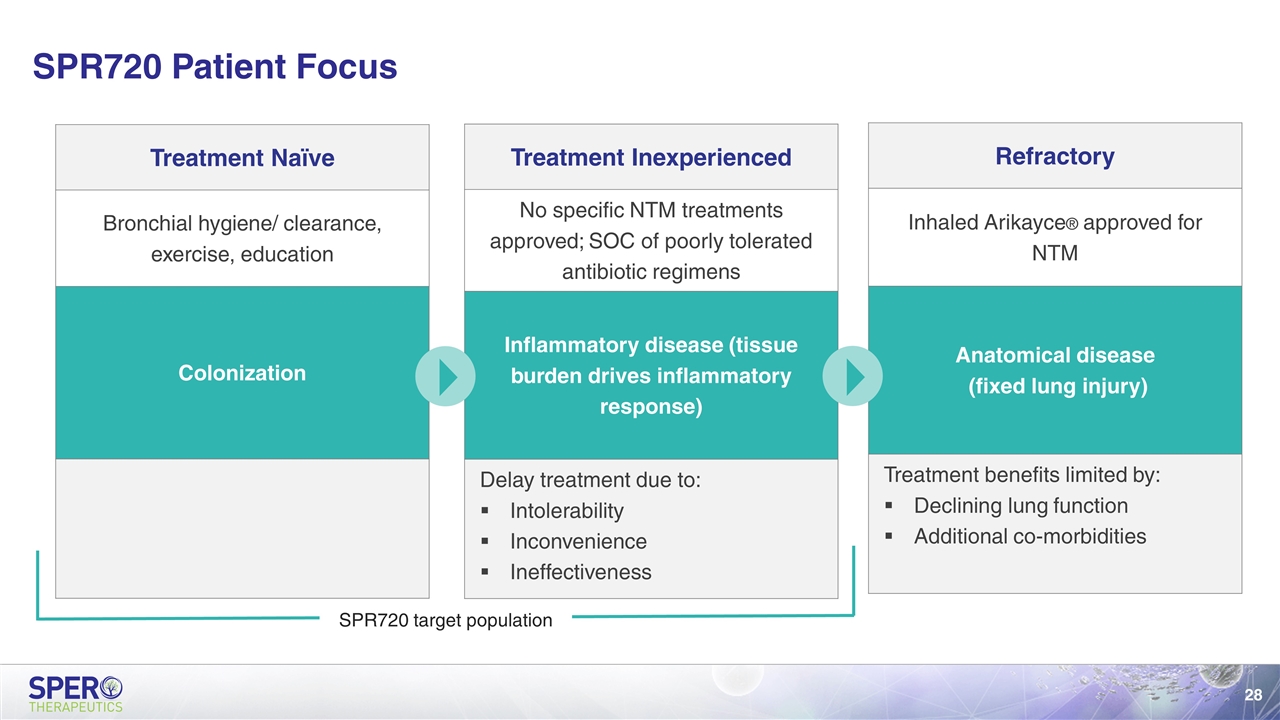

Refractory Inhaled Arikayce® approved for NTM Anatomical disease (fixed lung injury) Treatment benefits limited by: Declining lung function Additional co-morbidities SPR720 Patient Focus Inflammatory disease (tissue burden drives inflammatory response) Treatment Naïve Bronchial hygiene/ clearance, exercise, education Colonization Treatment Inexperienced No specific NTM treatments approved; SOC of poorly tolerated antibiotic regimens Inflammatory disease (tissue burden drives inflammatory response) Delay treatment due to: Intolerability Inconvenience Ineffectiveness SPR720 target population

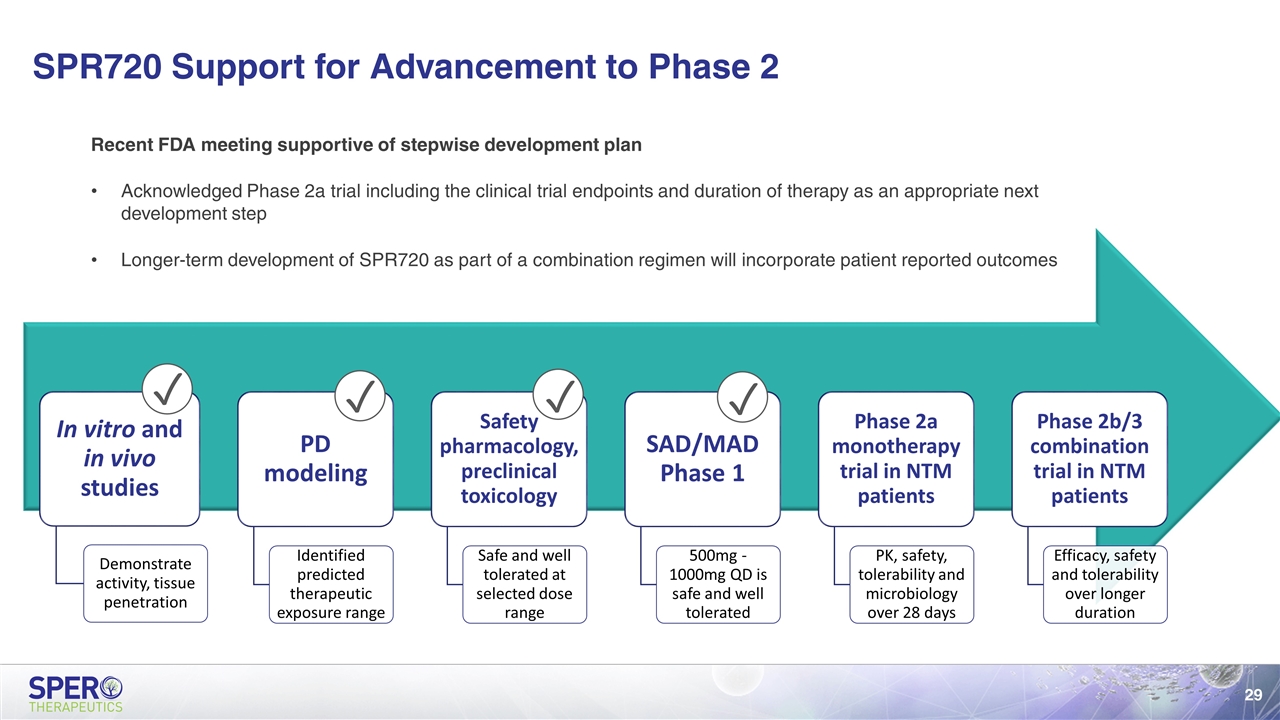

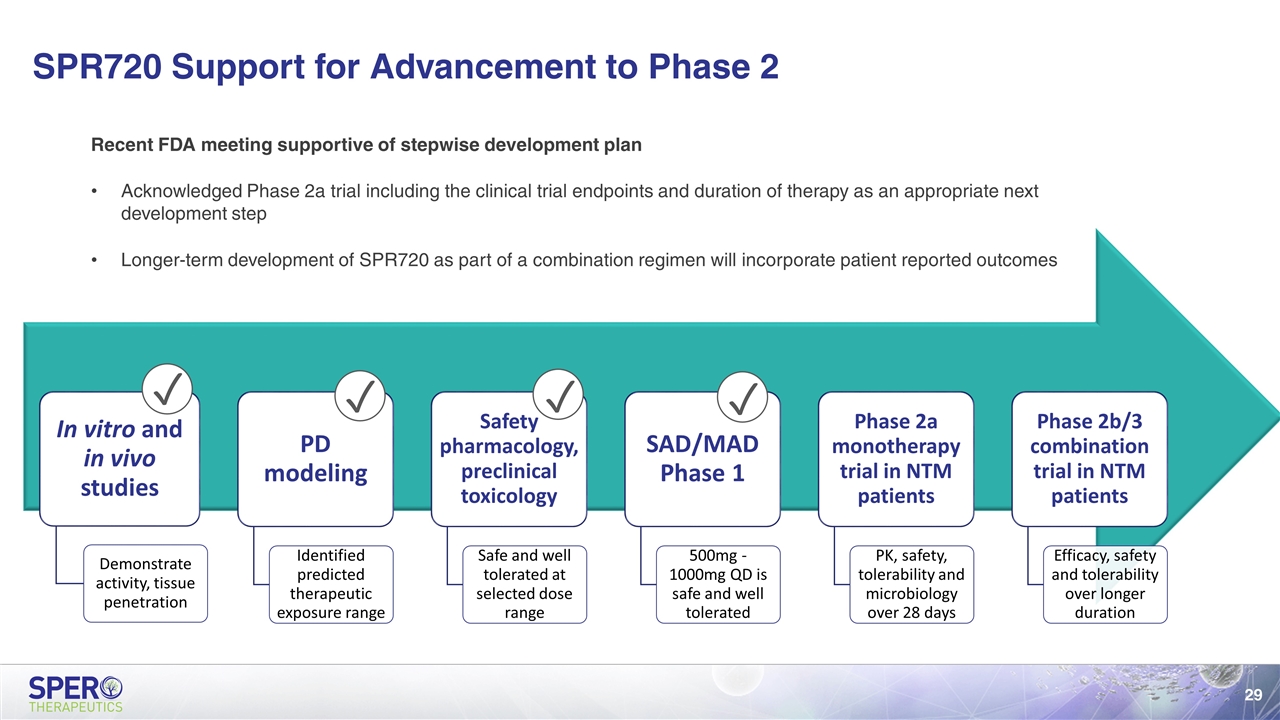

SPR720 Support for Advancement to Phase 2 ✓ ✓ ✓ ✓ Recent FDA meeting supportive of stepwise development plan Acknowledged Phase 2a trial including the clinical trial endpoints and duration of therapy as an appropriate next development step Longer-term development of SPR720 as part of a combination regimen will incorporate patient reported outcomes In vitro and in vivo studies Demonstrate activity, tissue penetration PD modeling Identified predicted therapeutic exposure range Safety pharmacology, preclinical toxicology Safe and well tolerated at selected dose range SAD/MAD Phase 1 500mg - 1000mg QD is safe and well tolerated Phase 2a monotherapy trial in NTM patients PK, safety, tolerability and microbiology over 28 days Phase 2b/3 combination trial in NTM patients Efficacy, safety and tolerability over longer duration

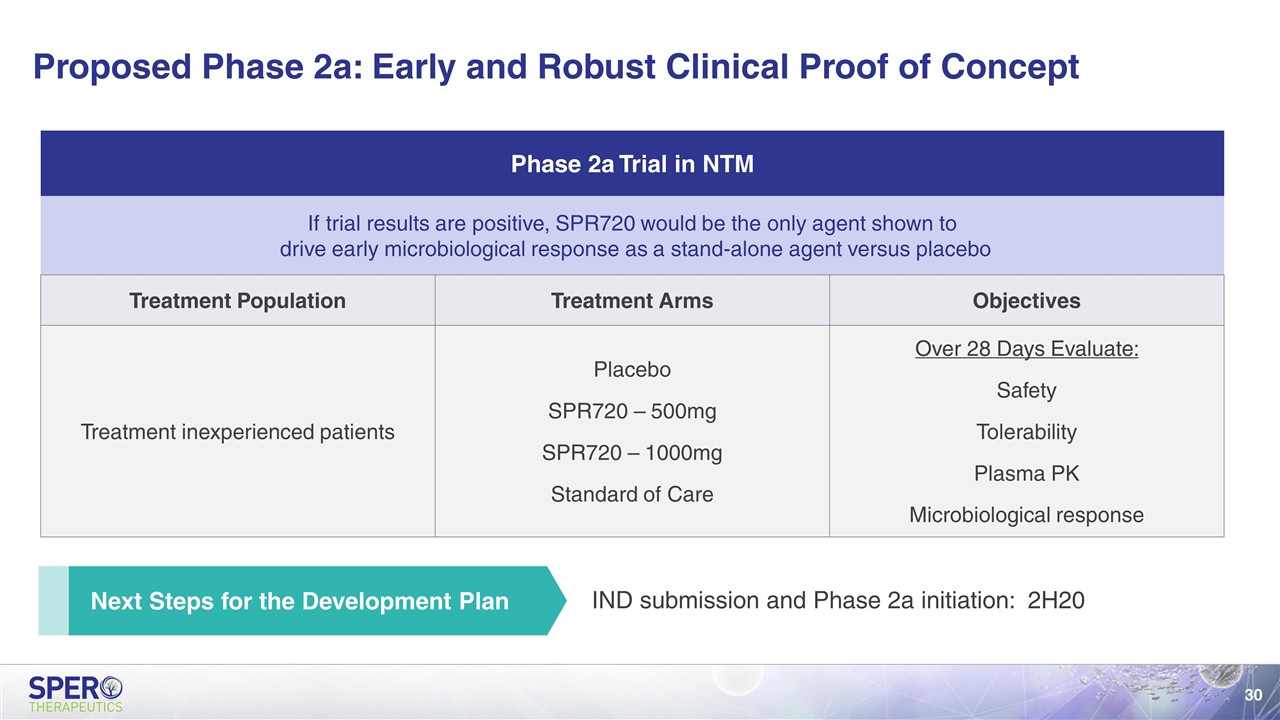

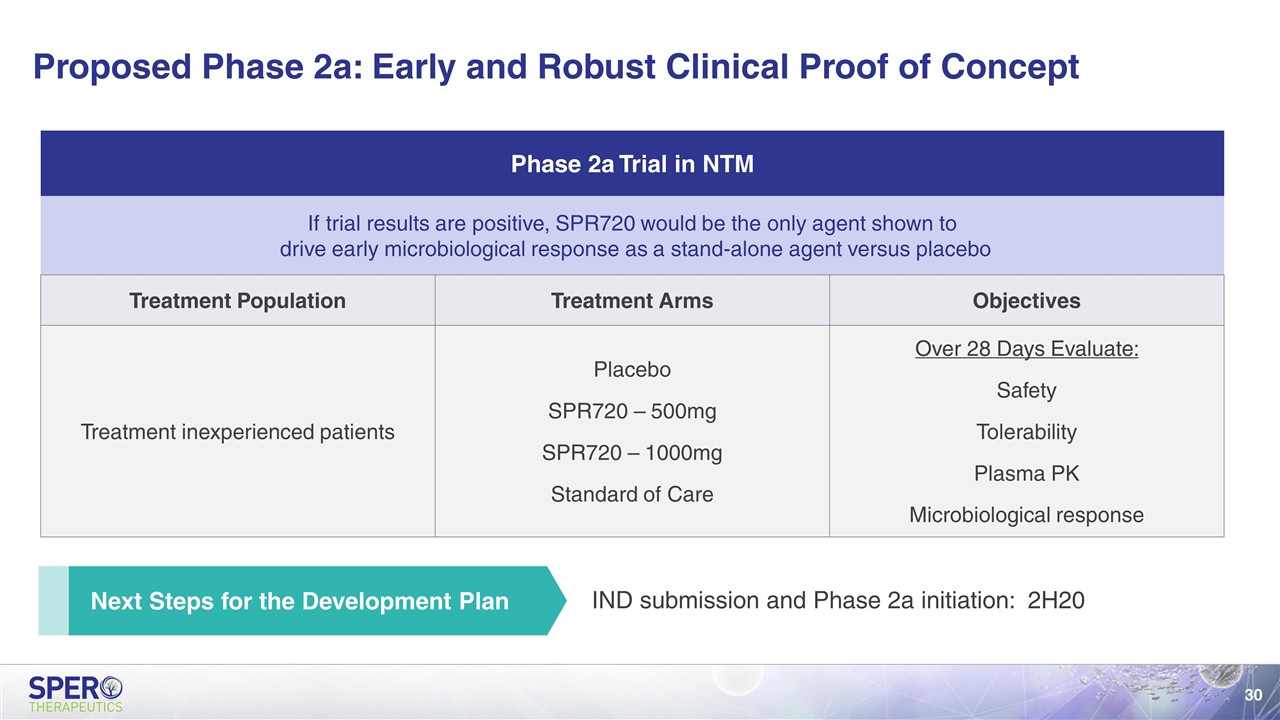

Proposed Phase 2a: Early and Robust Clinical Proof of Concept Next Steps for the Development Plan Phase 2a Trial in NTM If trial results are positive, SPR720 would be the only agent shown to drive early microbiological response as a stand-alone agent versus placebo Treatment Population Treatment Arms Objectives Treatment inexperienced patients Placebo SPR720 – 500mg SPR720 – 1000mg Standard of Care Over 28 Days Evaluate: Safety Tolerability Plasma PK Microbiological response IND submission and Phase 2a initiation: 2H20

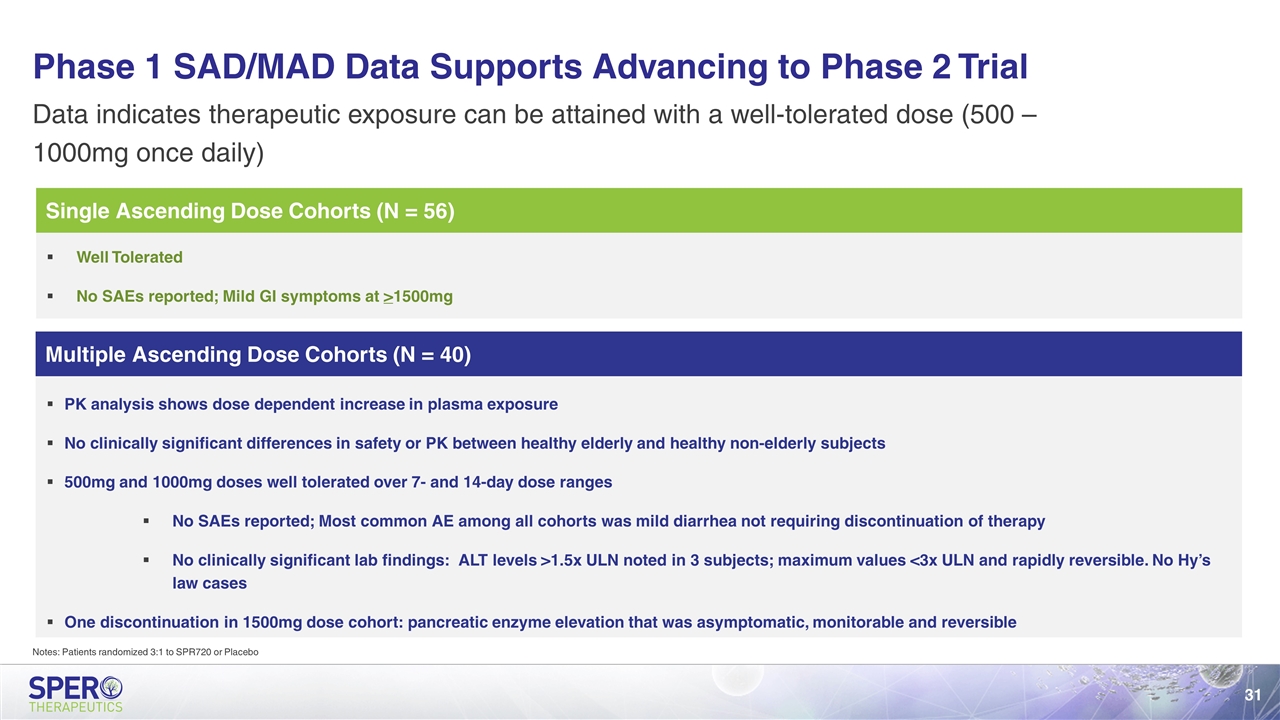

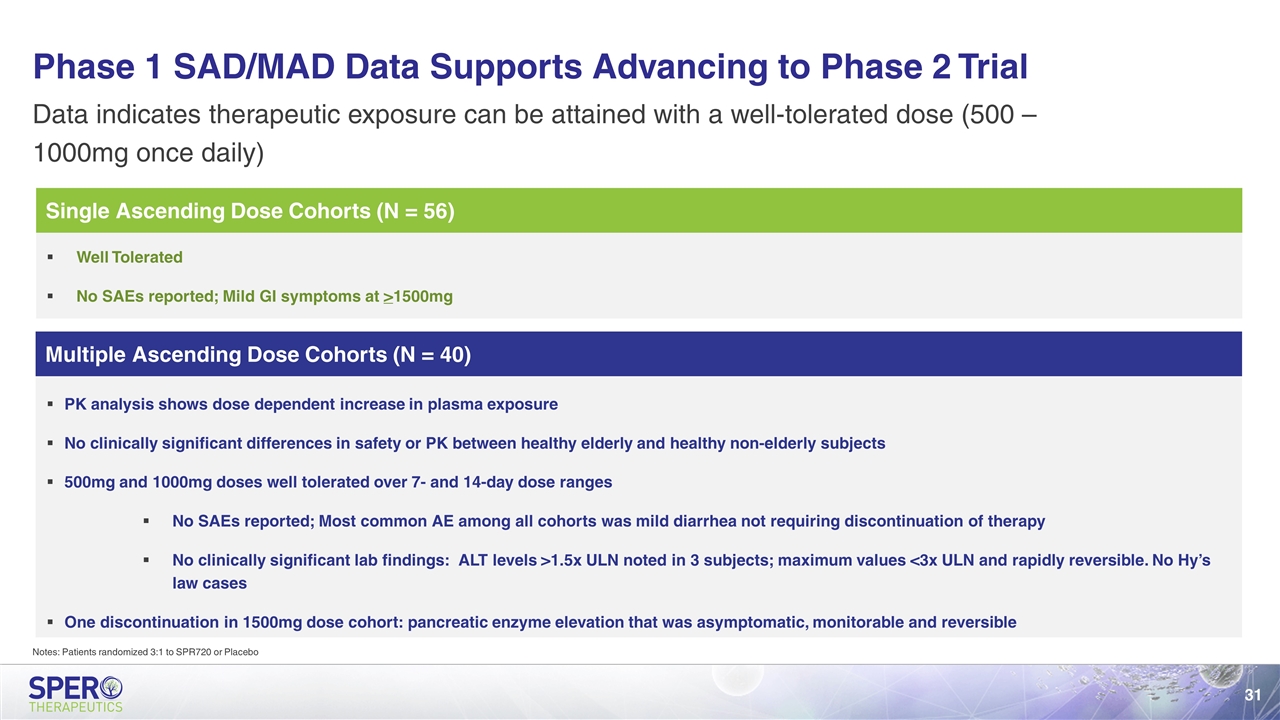

Multiple Ascending Dose Cohorts (N = 40) Single Ascending Dose Cohorts (N = 56) Phase 1 SAD/MAD Data Supports Advancing to Phase 2 Trial Data indicates therapeutic exposure can be attained with a well-tolerated dose (500 – 1000mg once daily) Well Tolerated No SAEs reported; Mild GI symptoms at >1500mg PK analysis shows dose dependent increase in plasma exposure No clinically significant differences in safety or PK between healthy elderly and healthy non-elderly subjects 500mg and 1000mg doses well tolerated over 7- and 14-day dose ranges No SAEs reported; Most common AE among all cohorts was mild diarrhea not requiring discontinuation of therapy No clinically significant lab findings: ALT levels >1.5x ULN noted in 3 subjects; maximum values <3x ULN and rapidly reversible. No Hy’s law cases One discontinuation in 1500mg dose cohort: pancreatic enzyme elevation that was asymptomatic, monitorable and reversible Notes: Patients randomized 3:1 to SPR720 or Placebo

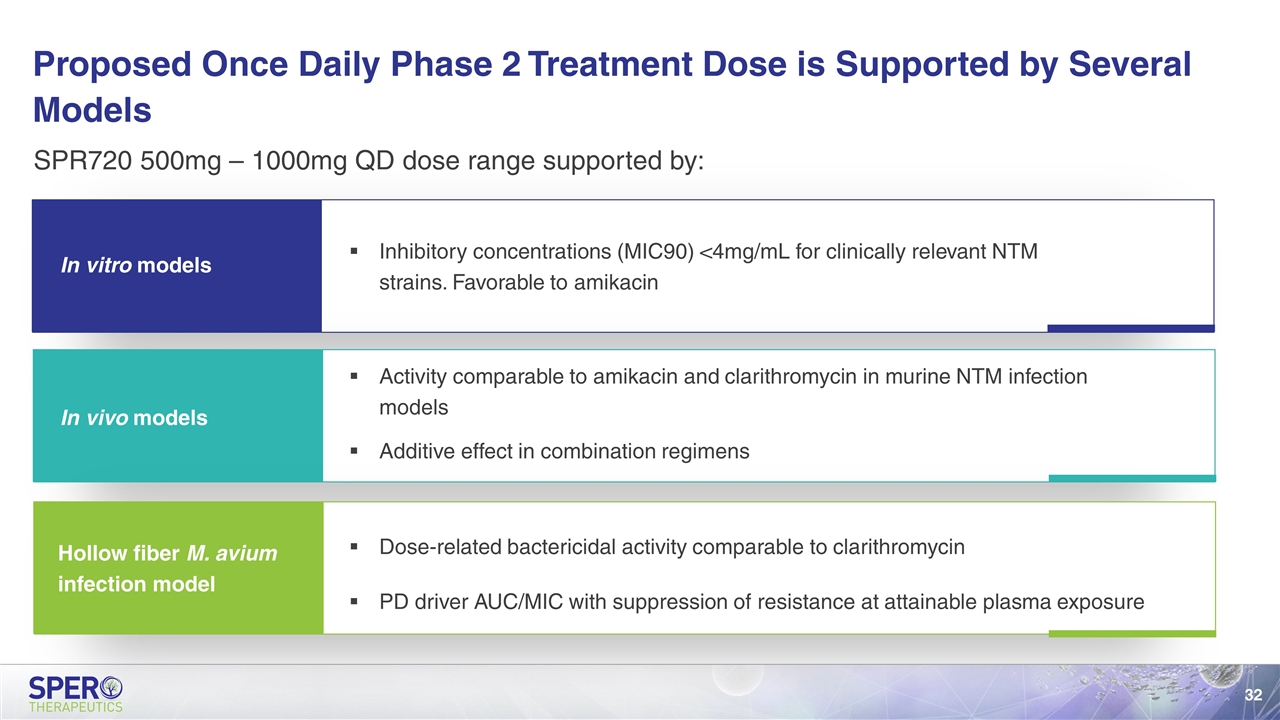

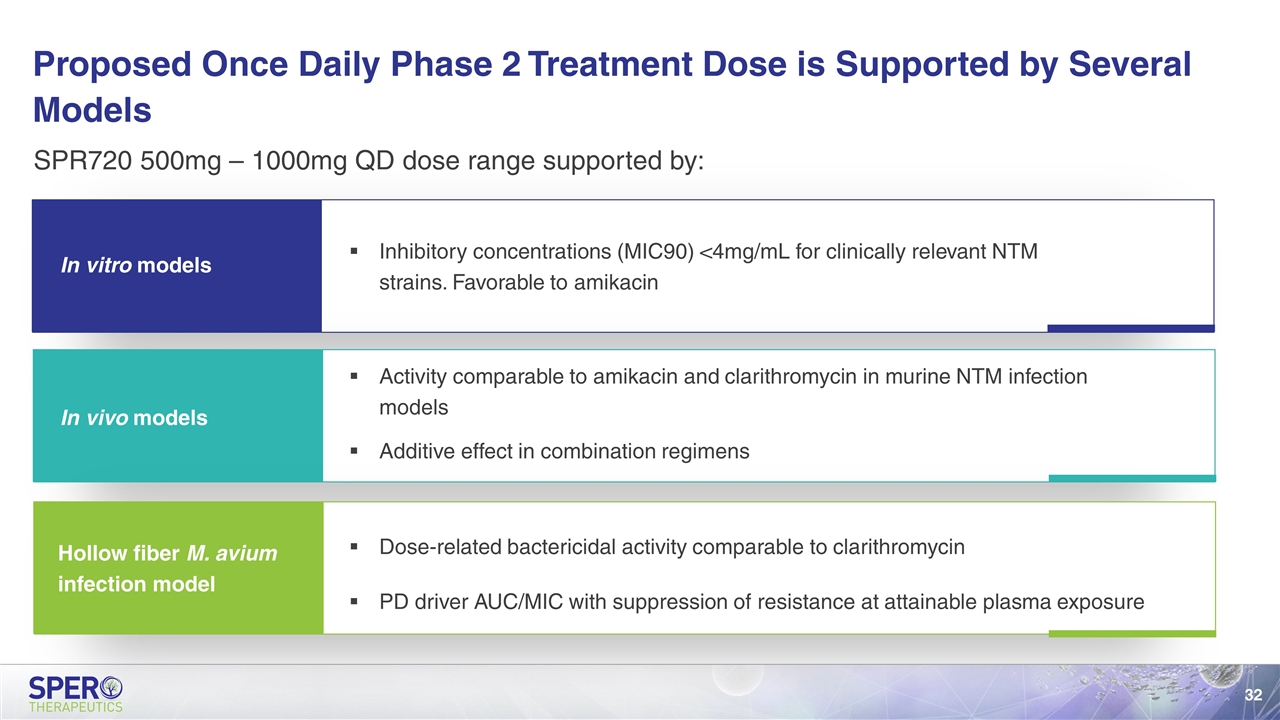

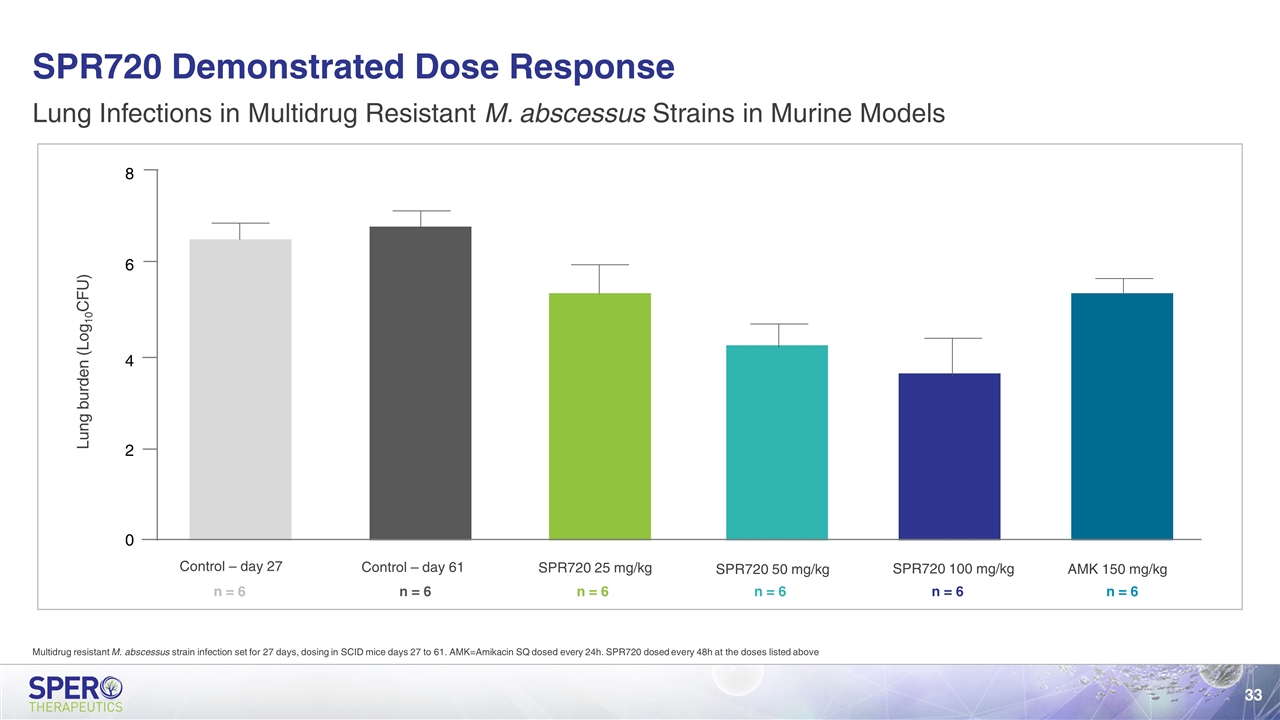

SPR720 500mg – 1000mg QD dose range supported by: Proposed Once Daily Phase 2 Treatment Dose is Supported by Several Models In vitro models In vivo models Hollow fiber M. avium infection model Inhibitory concentrations (MIC90) <4mg/mL for clinically relevant NTM strains. Favorable to amikacin Activity comparable to amikacin and clarithromycin in murine NTM infection models Additive effect in combination regimens Dose-related bactericidal activity comparable to clarithromycin PD driver AUC/MIC with suppression of resistance at attainable plasma exposure

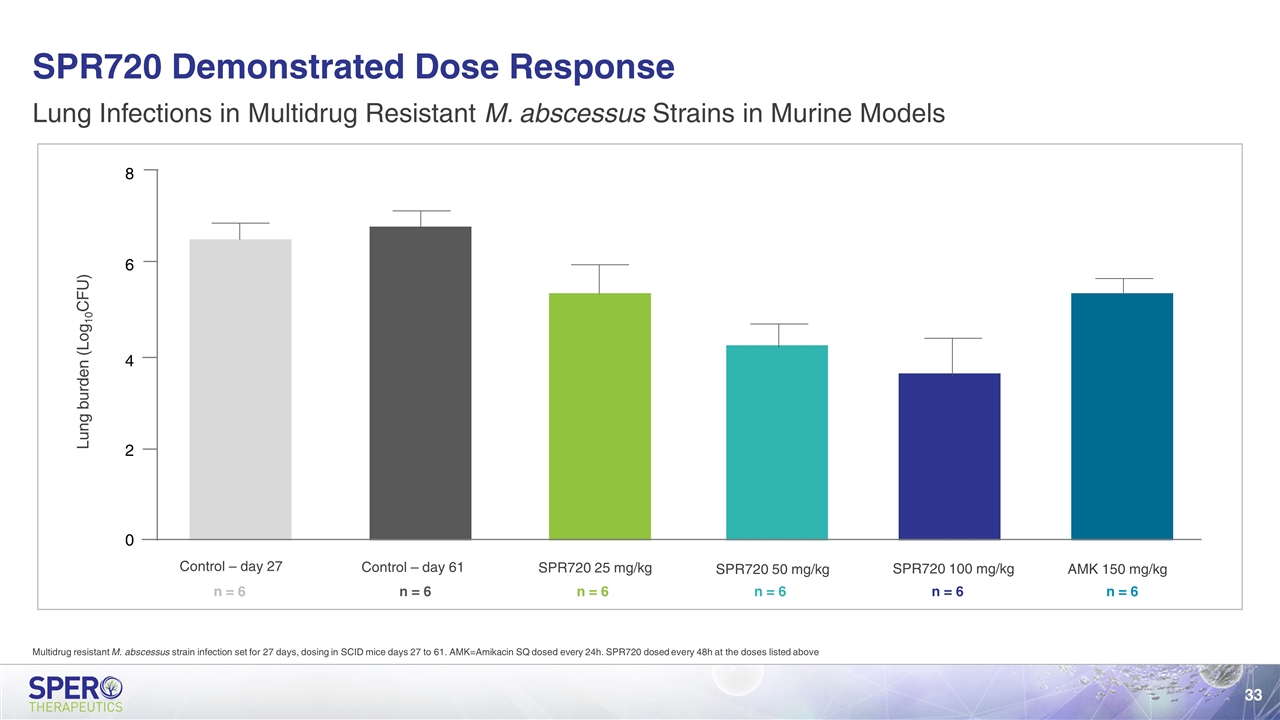

SPR720 Demonstrated Dose Response Lung Infections in Multidrug Resistant M. abscessus Strains in Murine Models 8 6 4 2 0 Lung burden (Log10CFU) Control – day 27 Control – day 61 SPR720 25 mg/kg SPR720 50 mg/kg SPR720 100 mg/kg AMK 150 mg/kg n = 6 n = 6 n = 6 n = 6 n = 6 n = 6 Multidrug resistant M. abscessus strain infection set for 27 days, dosing in SCID mice days 27 to 61. AMK=Amikacin SQ dosed every 24h. SPR720 dosed every 48h at the doses listed above

Direct Acting IV Potentiator: SPR206

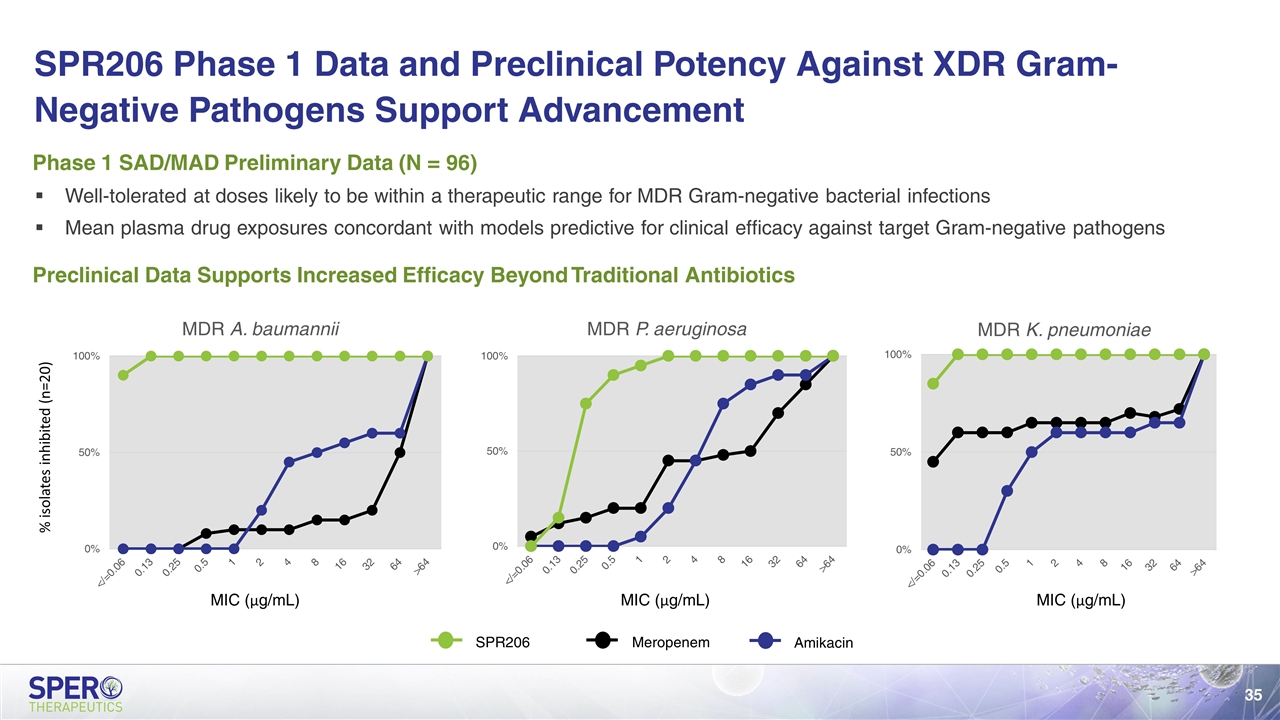

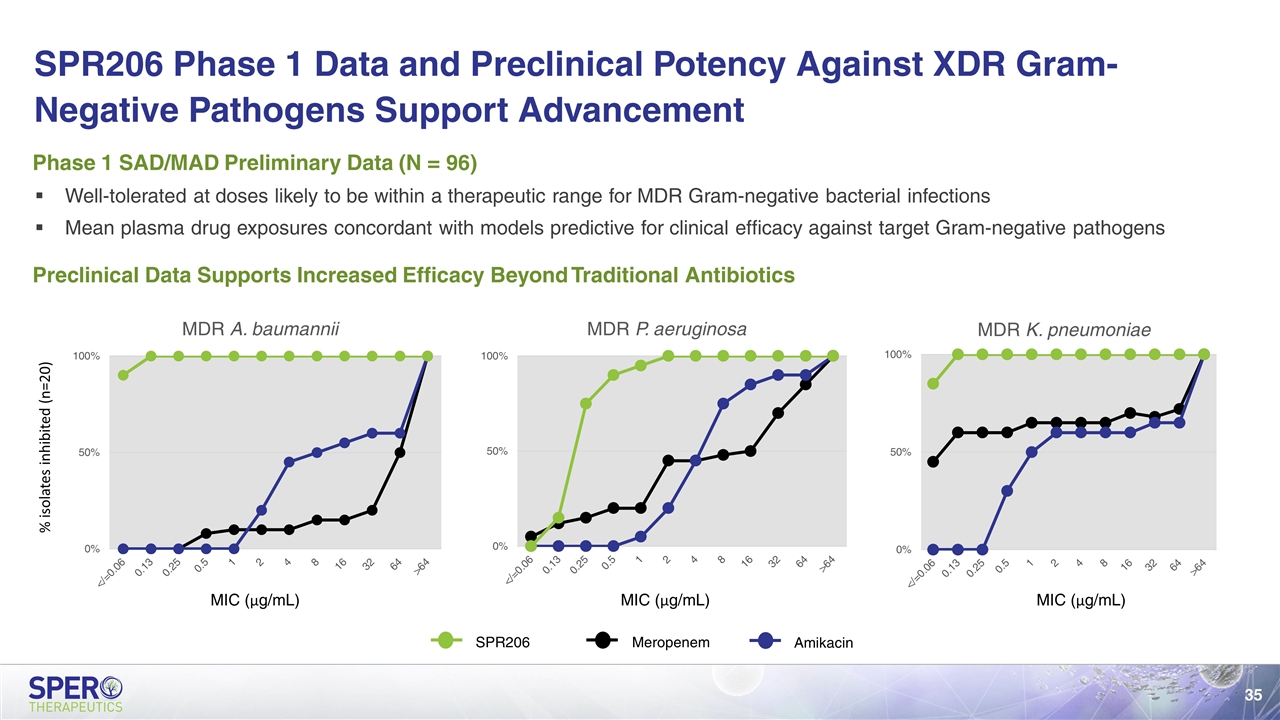

Well-tolerated at doses likely to be within a therapeutic range for MDR Gram-negative bacterial infections Mean plasma drug exposures concordant with models predictive for clinical efficacy against target Gram-negative pathogens Phase 1 SAD/MAD Preliminary Data (N = 96) Preclinical Data Supports Increased Efficacy Beyond Traditional Antibiotics SPR206 Meropenem Amikacin % isolates inhibited (n=20) MIC (μg/mL) MIC (μg/mL) MIC (μg/mL) SPR206 Phase 1 Data and Preclinical Potency Against XDR Gram-Negative Pathogens Support Advancement

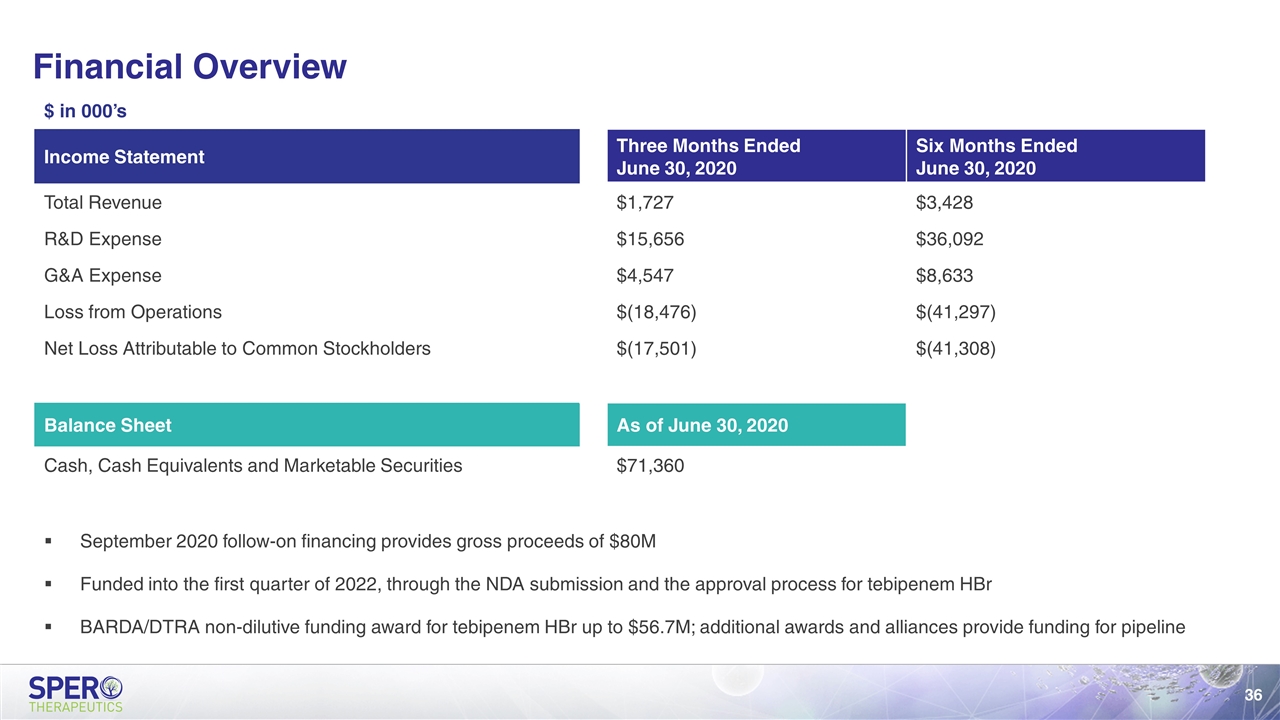

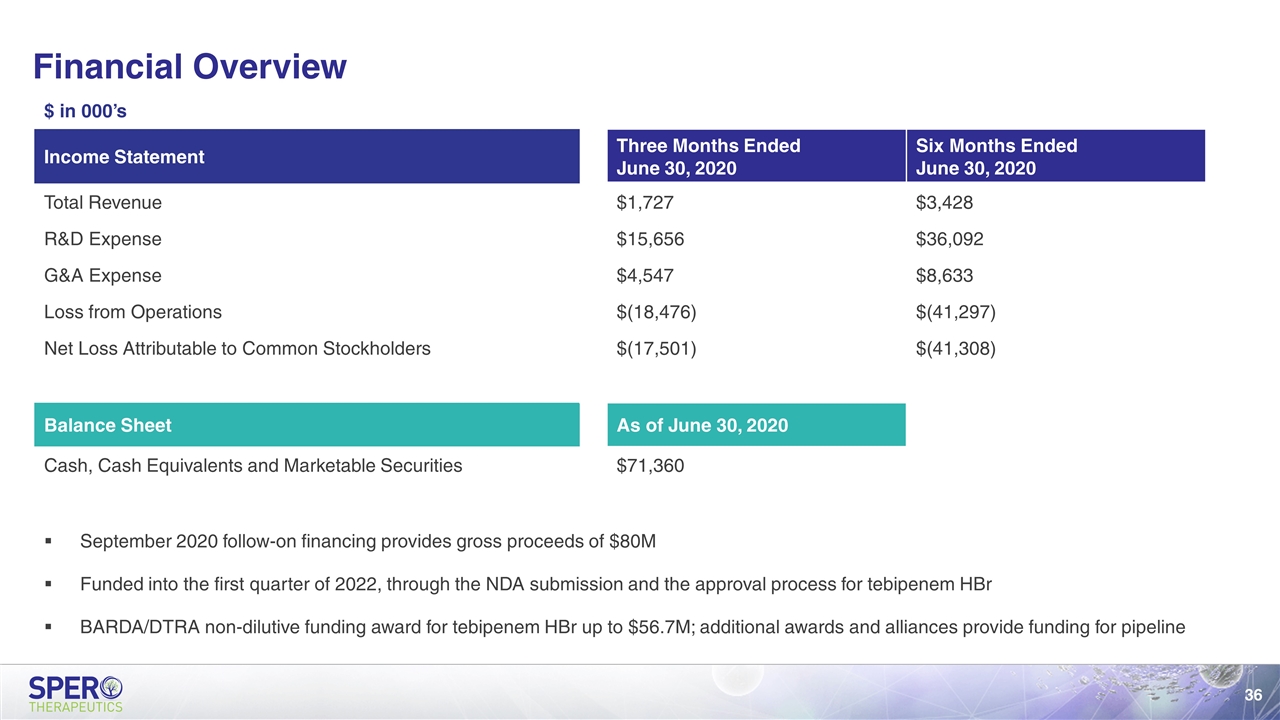

Financial Overview September 2020 follow-on financing provides gross proceeds of $80M Funded into the first quarter of 2022, through the NDA submission and the approval process for tebipenem HBr BARDA/DTRA non-dilutive funding award for tebipenem HBr up to $56.7M; additional awards and alliances provide funding for pipeline $ in 000’s Income Statement Three Months Ended June 30, 2020 Six Months Ended June 30, 2020 Total Revenue $1,727 $3,428 R&D Expense $15,656 $36,092 G&A Expense $4,547 $8,633 Loss from Operations $(18,476) $(41,297) Net Loss Attributable to Common Stockholders $(17,501) $(41,308) Balance Sheet As of June 30, 2020 Cash, Cash Equivalents and Marketable Securities $71,360

Experienced management team Key Investment Highlights Accelerated path to market Significant near-term catalysts Pipeline products with a solid value proposition Multiple drugs in clinical development Large and existing market opportunities