- APRN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

PRE 14A Filing

Blue Apron (APRN) PRE 14APreliminary proxy

Filed: 17 Apr 19, 5:12pm

Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

ý | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

o | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material under §240.14a-12 | |

| BLUE APRON HOLDINGS, INC. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

PRELIMINARY PROXY STATEMENT—SUBJECT TO COMPLETION

April [29], 2019

Dear Blue Apron Stockholder:

I am pleased to invite you to attend the 2019 Annual Meeting of Stockholders (the "Annual Meeting") of Blue Apron Holdings, Inc. ("Blue Apron") to be held on Thursday, June 13, 2019 at 10:00 a.m., Eastern Time, at the offices of Wilmer Cutler Pickering Hale and Dorr LLP, 7 World Trade Center, 250 Greenwich Street, New York, NY 10007.

Details regarding the meeting and the business to be conducted are more fully described in the accompanying Notice of 2019 Annual Meeting of Stockholders and Proxy Statement.

Pursuant to the Securities and Exchange Commission rules that allow issuers to furnish proxy materials to stockholders over the Internet, we are posting the proxy materials on the Internet and delivering a notice of the Internet availability of the proxy materials. On or about April [29], 2019, we will begin mailing to our stockholders a Notice of Internet Availability (the "Notice") containing instructions on how to access or request a copy of our Proxy Statement for the Annual Meeting and our Annual Report on Form 10-K for the year ended December 31, 2018.

Your vote is important. Whether or not you plan to attend the Annual Meeting, I hope you will vote as soon as possible. You may vote over the Internet or in person at the Annual Meeting or, if you requested printed copies of proxy materials, you may also vote by mailing a proxy card or voting by telephone. Please review the instructions on the Notice or on the proxy card regarding your voting options.

Thank you for being a Blue Apron stockholder. We look forward to seeing you at our Annual Meeting.

Sincerely,

[Linda F. Kozlowski

President and Chief Executive Officer]

In order to ensure your representation at the Annual Meeting, whether or not you plan to attend the Annual Meeting, please vote your shares as promptly as possible over the Internet by following the instructions on your Notice or, if you requested printed copies of your proxy materials, by following the instructions on your proxy card. Your participation will help to ensure the presence of a quorum at the Annual Meeting and save Blue Apron the extra expense associated with additional solicitation. If you hold your shares through a broker, your broker is not permitted to vote on your behalf in the election of directors, unless you provide specific instructions to the broker by completing and returning any voting instruction form that the broker provides (or following any instructions that allow you to vote your broker-held shares via telephone or the Internet). For your vote to be counted, you will need to communicate your voting decision in accordance with the instructions set forth in the proxy materials. Voting your shares in advance will not prevent you from attending the Annual Meeting, revoking your earlier submitted proxy in accordance with the instructions set forth in the proxy materials or voting your shares in person.

PRELIMINARY PROXY STATEMENT—SUBJECT TO COMPLETION

BLUE APRON HOLDINGS, INC.

40 West 23rd Street

New York, NY 10010

NOTICE OF 2019 ANNUAL MEETING OF STOCKHOLDERS

Notice is hereby given that Blue Apron Holdings, Inc. will hold its 2019 Annual Meeting of Stockholders (the "Annual Meeting") on Thursday, June 13, 2019 at 10:00 a.m., Eastern Time, at the offices of Wilmer Cutler Pickering Hale and Dorr LLP, 7 World Trade Center, 250 Greenwich Street, New York, NY 10007, for the following purposes:

Only holders of record of our Class A common stock and Class B common stock at the close of business on April 22, 2019 (the "Record Date") are entitled to notice of and to vote at the Annual Meeting as set forth in the enclosed proxy statement (the "Proxy Statement"). If you plan to attend the Annual Meeting in person, you should be prepared to present photo identification such as a valid driver's license and verification of stock ownership for admittance. You are entitled to attend the Annual Meeting only if you were a stockholder as of the close of business on the Record Date or hold a valid proxy for the Annual Meeting. If you are a stockholder of record, your ownership as of the Record Date will be verified prior to admittance into the meeting. If you are not a stockholder of record but hold shares through a broker, trustee or nominee, you must provide proof of beneficial ownership as of the Record Date, such as an account statement or similar evidence of ownership. Please allow ample time for the admittance process. For instructions on how to vote your shares, please refer to the instructions on the Notice of Internet Availability of Proxy Materials you received in the mail, the section titled "Voting" beginning on page 1 of the attached Proxy Statement or, if you requested to receive printed proxy materials, your enclosed proxy card.

By Order of our Board of Directors,

Christina Halliday

General Counsel and Secretary

New York, New York

April [29], 2019

PRELIMINARY PROXY STATEMENT—SUBJECT TO COMPLETION

GENERAL INFORMATION | 1 | |||

EXPLANATORY NOTE | 1 | |||

Internet Availability of Proxy Materials | 2 | |||

Record Date | 2 | |||

Quorum | 2 | |||

Shares Outstanding | 2 | |||

Voting | 2 | |||

Revoking Your Proxy | 3 | |||

Voting Rights | 3 | |||

Votes Required to Adopt Proposals | 3 | |||

Effect of Abstentions and Broker Non-Votes | 4 | |||

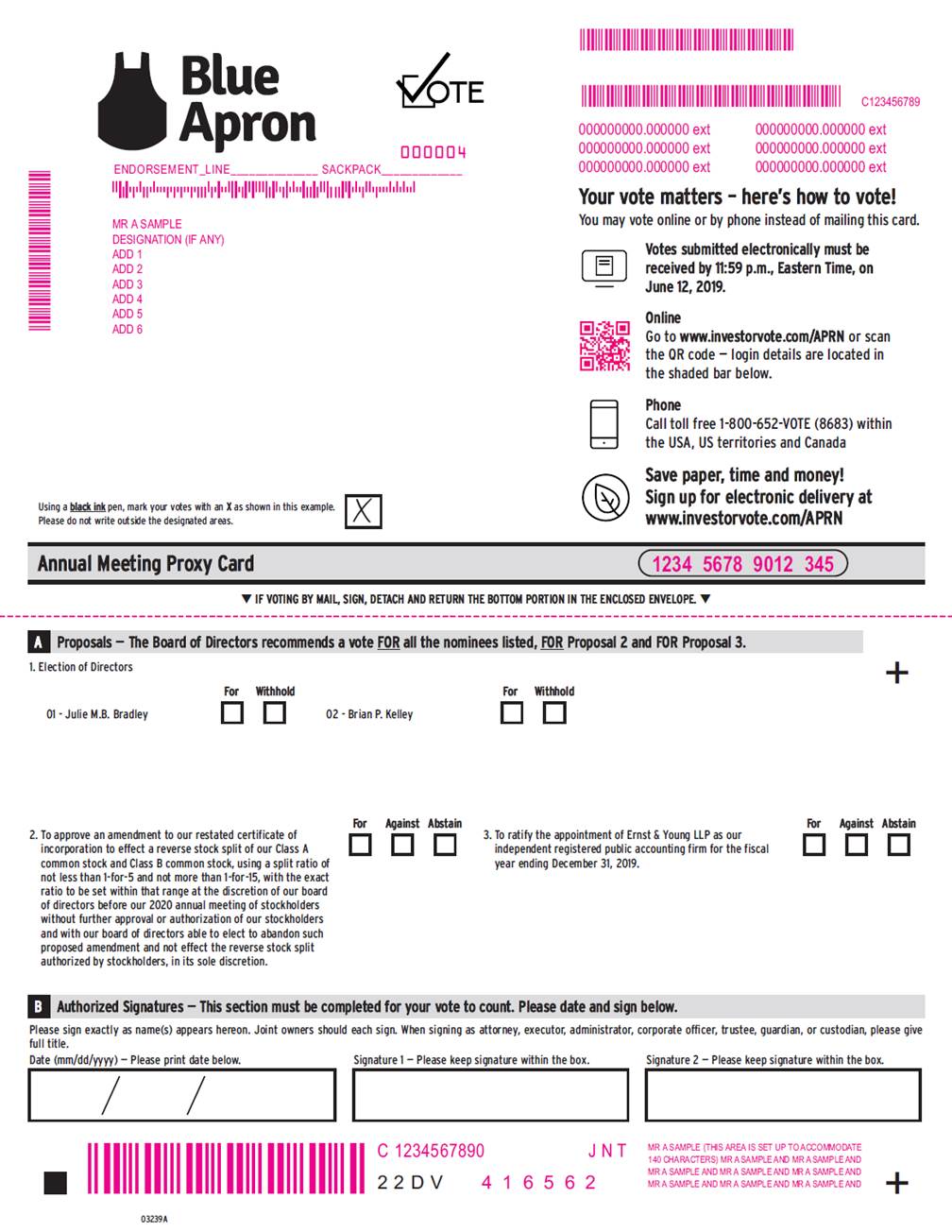

Voting Instructions | 5 | |||

Voting Results | 5 | |||

Additional Solicitation/Costs | 5 | |||

Householding | 6 | |||

PROPOSAL ONE—ELECTION OF DIRECTORS | 7 | |||

Number of Directors; Board Structure | 7 | |||

Nominees | 7 | |||

Recommendation of our Board of Directors | 7 | |||

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | 8 | |||

Board of Directors | 8 | |||

Nominees for Election for a Three-Year Term Ending at the 2022 Annual Meeting | 8 | |||

Directors Continuing in Office Until the 2020 Annual Meeting | 9 | |||

Directors Continuing in Office Until the 2021 Annual Meeting | 10 | |||

Executive Officers | 11 | |||

Director Independence | 11 | |||

Board Leadership Structure | 12 | |||

Code of Conduct and Ethics | 12 | |||

Corporate Governance Guidelines | 13 | |||

Board Meetings | 13 | |||

Annual Meeting Attendance | 13 | |||

Committees | 13 | |||

Compensation Consultants | 15 | |||

Compensation Committee Interlocks and Insider Participation | 16 | |||

Board Processes | 16 | |||

Stockholder Communications | 18 | |||

Compensation Risk Assessment | 18 | |||

PROPOSAL TWO—APPROVAL OF AN AMENDMENT TO OUR RESTATED CERTIFICATE OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT | 19 | |||

Background and Reasons for the Reverse Stock Split | 20 | |||

Certain Risks Associated with the Reverse Stock Split | 20 | |||

Reservation of Right to Abandon the Amendment to our Restated Certificate of Incorporation and the Reverse Stock Split | 21 | |||

Procedure for Implementing the Reverse Stock Split | 21 | |||

Effect of the Reverse Stock Split on Holders of Outstanding Class A Common Stock and Class B Common Stock | 21 | |||

Authorized Shares of Class A Common Stock and Class B Common Stock | 22 | |||

Beneficial Holders of Class A Common Stock and Class B Common Stock (i.e., stockholders who hold in street name) | 23 |

Registered "Book-Entry" Holders of Class A Common Stock and Class B Common Stock (i.e., stockholders that are registered on our transfer agent's books and records but do not hold stock certificates) | 23 | |||

Exchange of Stock Certificates | 23 | |||

Fractional Shares | 24 | |||

Effect of the Reverse Stock Split on Employee Plans, Options and Restricted Stock Units | 24 | |||

No Appraisal Rights | 25 | |||

Accounting Matters | 25 | |||

Material U.S. Federal Income Tax Consequences of the Reverse Stock Split | 25 | |||

Recommendation of our Board of Directors | 27 | |||

PROPOSAL THREE—RATIFICATION OF THE APPOINTMENT OF OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 28 | |||

Principal Accounting Fees and Services | 28 | |||

Recommendation of our Board of Directors | 29 | |||

Report of the Audit Committee of our Board of Directors | 30 | |||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 31 | |||

Section 16(a) Beneficial Ownership Reporting Compliance | 34 | |||

EXECUTIVE COMPENSATION | 35 | |||

Executive Compensation Overview | 35 | |||

Summary Compensation Table | 35 | |||

Narrative to Summary Compensation Table | 37 | |||

Outstanding Equity Awards at Fiscal Year-End | 39 | |||

Equity Compensation Plan Information | 40 | |||

Potential Payments Upon Termination or Change in Control | 40 | |||

Retirement Benefits | 41 | |||

Employee Benefits and Perquisites | 41 | |||

Limitations of Liability and Indemnification | 41 | |||

DIRECTOR COMPENSATION | 43 | |||

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 45 | |||

Policies and Procedures for Related Person Transactions | 45 | |||

Related Person Transactions | 46 | |||

TRANSACTION OF OTHER BUSINESS | 48 | |||

ADDITIONAL INFORMATION | 48 | |||

Procedures for Submitting Stockholder Proposals | 48 |

PRELIMINARY PROXY STATEMENT—SUBJECT TO COMPLETION

PROXY STATEMENT

FOR THE 2019 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD

THURSDAY, JUNE 13, 2019

Our board of directors solicits your proxy on our behalf for the 2019 Annual Meeting of Stockholders (the "Annual Meeting"), and at any postponement or adjournment of the Annual Meeting, for the purposes set forth in this Proxy Statement and the accompanying Notice of Internet Availability of Proxy Materials (the "Notice"). The Annual Meeting will be held at 10:00 a.m., Eastern Time, on Thursday, June 13, 2019 at the offices of Wilmer Cutler Pickering Hale and Dorr LLP, 7 World Trade Center, 250 Greenwich Street, New York, NY 10007. We intend to mail a Notice of Internet Availability of Proxy Materials to stockholders of record and to make this Proxy Statement and accompanying materials available on the internet on or about April [29], 2019.

In this Proxy Statement the terms "Blue Apron," "the company," "we," "us," and "our" refer to Blue Apron Holdings, Inc. The mailing address of our principal executive offices is Blue Apron Holdings, Inc., 40 West 23rd Street, New York, NY 10010. All website addresses set forth in this Proxy Statement are for information only and are not intended to be an active link or to incorporate any website information into this document.

We are an "emerging growth company" under applicable federal securities laws and therefore permitted to take advantage of certain reduced public company reporting requirements. As an emerging growth company, we provide in this Proxy Statement the scaled disclosure permitted under the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, including the compensation disclosures required of a "smaller reporting company," as that term is defined in Rule 12b-2 promulgated under the Securities Exchange Act of 1934, as amended (the "Exchange Act"). In addition, as an emerging growth company, we are not required to conduct votes seeking approval, on an advisory basis, of the compensation of our named executive officers or the frequency with which such votes must be conducted. We may remain an emerging growth company until December 31, 2022, provided that, if the market value of our common stock that is held by non-affiliates exceeds $700 million as of any June 30 before that time or if we have annual gross revenues of $1.07 billion or more in any fiscal year, we would cease to be an emerging growth company as of December 31 of that year.

2

3

4

5

6

PROPOSAL ONE

ELECTION OF DIRECTORS

Number of Directors; Board Structure

Our board of directors is divided into three staggered classes of directors as nearly equal in number as possible. One class is elected each year at the annual meeting of stockholders for a term of three years. The terms of our Class II directors expire at the Annual Meeting. The terms of our Class III directors will expire at the 2020 annual meeting. The terms of our Class I directors will expire at the 2021 annual meeting. Directors are elected to hold office for a three-year term or until the election and qualification of their successors in office, subject to their earlier death, resignation or removal.

Based on the recommendation of our nominating and corporate governance committee, our board of directors has nominated Julie M.B. Bradley and Brian P. Kelley for election as directors to hold office until our 2022 annual meeting of stockholders or until their successors are duly elected and qualified, subject to their earlier death, resignation or removal. Each of the nominees is a current member of our board of directors and has consented to serve if elected.

Unless you direct otherwise through your proxy voting instructions, the persons named as proxies will vote all proxies received"FOR" the election of each nominee. If any nominee is unable or unwilling to serve at the time of the Annual Meeting, the persons named as proxies may vote for a substitute nominee chosen by the members of our board of directors. In the alternative, the proxies may vote only for the remaining nominees, leaving a vacancy on our board of directors. Our board of directors may fill such vacancy at a later date or reduce the size of our board of directors. We have no reason to believe that any of the nominees will be unwilling or unable to serve if elected as a director.

Recommendation of our Board of Directors

The board of directors recommends that you vote "FOR" the election of each of Julie M.B. Bradley and Brian P. Kelley as Class II directors.

7

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

The biographies of each of the director nominees and continuing directors below contain information regarding each such person's service as a director on our board of directors, business experience and other experiences, qualifications, attributes or skills that caused our board of directors and nominating and corporate governance committee to determine that the person should serve as a director of the company. In addition to the information presented below regarding each such person's specific experience, qualifications, attributes and skills that led our board of directors and nominating and corporate governance committee to the conclusion that he or she should serve as a director, we also believe that each of our directors has a reputation for integrity, honesty and adherence to high ethical standards. Each of our directors has demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of service to our company and our board of directors, including a commitment to understanding our business and industry. We also value our directors' experience in relevant areas of business management and on other boards of directors and board committees.

Our corporate governance guidelines also dictate that a majority of our board of directors be comprised of independent directors whom our board of directors has determined have no material relationship with the company and are otherwise "independent" directors under the published listing rules of the New York Stock Exchange ("NYSE").

Below is information, as of April 15, 2019, regarding our director nominees and directors whose terms are continuing after the Annual Meeting.

| Name | Age | Blue Apron Director Since | Independent | Committee Membership | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Directors for election at the 2019 Annual Meeting (Class II) | |||||||||||

| Julie M.B. Bradley | 50 | 2015 | Yes | Audit Committee (Chair) Compensation Committee | |||||||

| Brian P. Kelley | 58 | 2017 | Yes | Audit Committee Nominating and Corporate Governance Committee | |||||||

| Directors with terms expiring at the 2020 Annual Meeting (Class III) | |||||||||||

| Tracy Britt Cool | 35 | 2017 | Yes | Audit Committee Nominating and Corporate Governance Committee | |||||||

| Robert P. Goodman | 58 | 2015 | Yes | Compensation Committee (Chair) | |||||||

| Matthew B. Salzberg | 35 | 2011 | No | — | |||||||

| Nominees with terms expiring at the 2021 Annual Meeting (Class I) | |||||||||||

| Gary R. Hirshberg | 64 | 2016 | Yes | Compensation Committee Nominating and Corporate Governance Committee | |||||||

| Linda F. Kozlowski | 45 | 2019 | No | — | |||||||

Nominees for Election for a Three-Year Term Ending at the 2022 Annual Meeting

Julie M.B. Bradley has been a member of our board of directors since November 2015. From October 2011 to November 2015, she served as senior vice president, chief financial officer, chief accounting officer and treasurer of TripAdvisor, Inc., an online travel planning and booking site. Prior to joining TripAdvisor, from July 2005 to April 2011, Ms. Bradley served as senior vice president, chief financial officer, treasurer and secretary of Art Technology Group, Inc., a provider of e-commerce

8

software solutions and services. Prior to joining Art Technology Group, Ms. Bradley was at Akamai Technologies, Inc., a global provider of cloud services for delivering, optimizing and securing content and business applications over the Internet, from April 2000 to June 2005, most recently serving as vice president of finance. Previously, Ms. Bradley was an accountant with Deloitte LLP. Ms. Bradley has served on the board of directors of Wayfair Inc. since September 2012 and served on the board of directors of Constant Contact, Inc. from June 2015 to February 2016 and on the board of directors of ExactTarget, Inc. from September 2012 to July 2013. Ms. Bradley holds a B.A. degree in economics from Wheaton College and is a certified public accountant. We believe that Ms. Bradley is qualified to serve on our board of directors due to her financial and accounting expertise and her experience in corporate development.

Brian P. Kelley has been a member of our board of directors since April 2017. Mr. Kelley has been a partner at Lindsay Goldberg LLC, a private equity firm, since January 2017. From December 2012 to May 2016, he served as president and chief executive officer of Keurig Green Mountain, Inc., a beverage company which was acquired by JAB Holding Company in March 2016. From April 2007 to November 2012, Mr. Kelley was employed by The Coca-Cola Company, a consumer beverage company, serving as the president of still/non-carbonated beverages and supply chain from April 2007 to August 2012 and president, Coca-Cola Refreshments from August 2012 to November 2012. From July 2002 to April 2007, Mr. Kelley served as president and chief executive officer of Sirva, Inc., a relocation services company. Previously, Mr. Kelley held executive and other positions with Ford Motor Company, General Electric, and Procter & Gamble. Mr. Kelley has served as a member of the board of directors of Keurig Green Mountain since December 2012 and of AMAG Pharmaceuticals, Inc., a pharmaceutical company, from December 2016 to September 2017. Mr. Kelley holds a B.A. degree in economics from the College of the Holy Cross. We believe that Mr. Kelley is qualified to serve on our board of directors due to his experience in the consumer product industry and his experience on other public company boards of directors.

Directors Continuing in Office Until the 2020 Annual Meeting

Tracy Britt Cool has been a member of our board of directors since January 2017. Since November 2014, Ms. Cool has served as chief executive officer of Pampered Chef, a provider of high-quality kitchenware solutions distributed through independent cooking consultants. Ms. Cool joined Berkshire Hathaway, Pampered Chef's parent company, in December 2009 as financial assistant to the chairman. Since June 2013, Ms. Cool has served as a director of The Kraft Heinz Company, one of the largest food and beverage companies in the world, and its predecessor H.J. Heinz Company. Ms. Cool also serves as chair of the following Berkshire Hathaway subsidiaries: Benjamin Moore & Co., a leading manufacturer and retailer of paints and architectural coatings (since June 2012); Larson-Juhl, a manufacturer and distributor of wood and metal framing products (since January 2012); and Oriental Trading Company, a direct merchant of party suppliers, arts and crafts, toys and novelties (since November 2012). From November 2012 to October 2014, Ms. Cool also served as chair of Johns Manville, a manufacturer of commercial and industrial roofing systems, fire-protection systems, thermal and acoustical insulation, glass textile wall coverings and flooring. Ms. Cool holds an A.B. degree in economics from Harvard College and an M.B.A. degree from Harvard Business School. We believe that Ms. Cool is qualified to serve on our board of directors due to her experience as chairman of several Berkshire Hathaway subsidiaries, as well as her insight into financial, investment and other complex subjects.

Robert P. Goodman has been a member of our board of directors since November 2015 and is our lead independent director. Mr. Goodman is a partner at Bessemer Venture Partners, a venture capital firm, and is a managing member of Deer Management Co. LLC, the management company for Bessemer Venture Partners' investment funds, including Bessemer Venture Partners VIII L.P. and Bessemer Venture Partners VIII Institutional L.P. Prior to joining Bessemer in 1998, he founded and

9

served as the chief executive officer of three privately held telecommunications companies. Mr. Goodman served on the board of directors of Millennial Media, Inc. from June 2009 to October 2015, on the board of directors of Broadsoft, Inc. from April 1999 to December 2012 and has also served on the board of directors of a number of private companies in the areas of software, mobile, and communications. Mr. Goodman holds a B.A. degree in Latin American studies from Brown University and an M.B.A. degree from Columbia University. We believe that Mr. Goodman is qualified to serve on our board of directors due to his experience in working with entrepreneurial companies, particularly technology companies, and his experience on boards of directors of both public and private companies.

Matthew B. Salzberg, one of our founders, has served as a member of our board of directors since inception and as chairman of the board of directors since December 2018. Previously, he served as our executive chairman since November 2017. Prior to that, he served as our president and chief executive officer from inception until November 2017 and as chairman of the board of directors since June 2017. He also previously served as our treasurer from inception until January 2017. Before co-founding Blue Apron, Mr. Salzberg was employed as a senior associate by Bessemer Venture Partners, a venture capital firm, from June 2010 to January 2012, and as an analyst by The Blackstone Group, a private equity firm, from June 2005 to June 2008. Mr. Salzberg has served as a member of the board of directors of Embark Veterinary, Inc., a pet genetic testing company, since July 2015 and has also served on the board of directors of various other private companies. Mr. Salzberg holds an A.B. degree in economics from Harvard College and an M.B.A. degree from Harvard Business School. We believe that Mr. Salzberg is qualified to serve on our board of directors due to his extensive knowledge of our company and the industry in which we compete, and his vision and leadership as a co-founder and as our former president and chief executive officer.

Directors Continuing in Office Until the 2021 Annual Meeting

Gary R. Hirshberg has been a member of our board of directors since October 2016. Mr. Hirshberg co-founded Stonyfield Farm, Inc., a producer of organic dairy-related products, in 1983, and served as the company's chief executive officer until January 2012. He currently serves as chairman of Stonyfield Farm, which is now majority-owned by Groupe Danone, a French food product company. Mr. Hirshberg has received numerous awards for corporate and environmental leadership, including twelve honorary degrees, and has served on a variety of nonprofit and corporate boards. Mr. Hirshberg holds a B.A. degree in environmental studies from Hampshire College. We believe that Mr. Hirshberg is qualified to serve on our board of directors due to his experience in founding and building an entrepreneurial company, his knowledge of the organic foods industry and sustainable business practices, and his service on the boards of directors of various private companies in the organic and food industries.

Linda F. Kozlowski has been a member of our board of directors since April 2019. Ms. Kozlowski served as chief operating officer of Etsy, Inc., a global marketplace for unique and creative goods, from May 2016 to December 2018. From October 2012 to December 2015, Ms. Kozlowski served in multiple positions at Evernote Corporation, a mobile app for productivity, including as chief operating officer from May 2015 to December 2015, during which time she oversaw worldwide operations and led cross-functional teams in offices across seven countries. Ms. Kozlowski served as vice president of worldwide operations at Evernote from May 2014 to May 2015, as vice president of international marketing from April 2013 to May 2014, and as director of market development from October 2012 to April 2013. Prior to Evernote, Ms. Kozlowski was director of global marketing and customer experience at Alibaba.com from June 2011 to October 2012, and director of international corporate affairs from July 2009 to June 2011. Ms. Kozlowski currently serves as a member of the board of directors of Ralph Lauren Corporation. Ms. Kozlowski holds a B.A. in corporate communications and journalism from Elon University and an M.A. in journalism and public relations from the University of North Carolina

10

at Chapel Hill. We believe Ms. Kozlowski is qualified to serve on our board of directors due to her experience and various senior management roles in multiple consumer technology organizations and because of her service as our president and chief executive officer.

In addition to Ms. Kozlowski, our president and chief executive officer, who also serves as a director, our executive officers as of April 15, 2019 are:

Timothy S. Bensley, 59, has served as our chief financial officer and treasurer since May 2018. Previously, Mr. Bensley served as chief financial officer of Acosta, Inc., a sales and marketing company for consumer-packaged goods companies, from June 2015 to October 2017. From 1986 to April 2015, Mr. Bensley served in multiple positions at PepsiCo, Inc., a multinational food, snack and beverage company, including chief financial officer of Pepsi Cola North America from 2008 to 2010, chief financial officer of PepsiCo Americas Foods from 2010 to 2012 and senior vice president, global transformation from 2012 to April 2015. Mr. Bensley holds a B.S. degree in engineering from the United States Military Academy at West Point and an M.S. degree in project management from Boston University.

Alan Blake, 57, has served as our chief operating officer since February 2019. Mr. Blake previously served as our chief supply chain officer since June 2018. Prior to that, Mr. Blake served as the chief supply chain officer at Revlon, Inc., a global cosmetics company, from April 2017 to June 2018. From October 2015 to April 2017, Mr. Blake served as executive vice president of global operations at Ventura Foods, LLC, a producer of a wide variety of ingredients for the food service and baking industries. From October 2010 to October 2015, he worked at Campbell Soup Company, a global food company, serving first as vice president of North American manufacturing before becoming vice president of the North American supply chain and United States retail business team. Mr. Blake also served as senior vice president of global production at Brown-Forman Corporation, a spirits and wine company, from 2006 to 2010. Mr. Blake holds a B.S. degree in industrial systems engineering from The Ohio State University and an M.B.A. degree in finance from Xavier University.

Ilia M. Papas, 37, one of our founders, has served as our chief technology officer since February 2012. Before co-founding Blue Apron, Mr. Papas was employed as director, technical architect by Optaros, Inc., an information technology and services company, from September 2006 to February 2012, and as a software engineer by Molecular (now Isobar), a digital agency, from September 2004 to August 2006. Mr. Papas holds a B.A. degree in computer science from Tufts University.

Under the rules of the NYSE, independent directors must comprise a majority of a listed company's board of directors within a specified period of the completion of its initial public offering. In addition, the rules of the NYSE require that, subject to specified exceptions, each member of a listed company's audit, compensation, and nominating and corporate governance committees be independent. Under the rules of the NYSE, a director will only qualify as an "independent director" if, in the opinion of that company's board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Audit committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Exchange Act. In order to be considered independent for purposes of Rule 10A-3, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the board of directors or any other board committee: (1) accept, directly or indirectly, any consulting, advisory or other compensatory fee from the listed company or any of its subsidiaries or (2) be an affiliated person of the listed company or any of its subsidiaries.

11

At least annually, our board of directors will evaluate all relationships between us and each director in light of relevant facts and circumstances for the purposes of determining whether a material relationship exists that might signal a potential conflict of interest or otherwise interfere with such director's ability to satisfy his or her responsibilities as an independent director. Based on this evaluation, our board of directors will make an annual determination of whether each director is independent within the meaning of the independence standards of the NYSE, the Securities and Exchange Commission ("SEC") and of our applicable board committees.

Our board of directors has determined that each of Mses. Bradley and Cool and Messrs. Goodman, Hirshberg and Kelley is an "independent director" as defined under the rules of the NYSE. Our board of directors also has determined that Ms. Bradley, Ms. Cool and Mr. Kelley, who comprise our audit committee, Ms. Bradley, Mr. Goodman and Mr. Hirshberg, who comprise our compensation committee, and Ms. Cool, Mr. Hirshberg and Mr. Kelley, who comprise our nominating and corporate governance committee, satisfy the independence standards for such committees established by the SEC and the rules of the NYSE, as applicable. In making such determinations, our board of directors considered the relationships that each such non-employee director has with our company and all other facts and circumstances our board of directors deemed relevant in determining independence, including the beneficial ownership of our capital stock by each non-employee director and any institutional stockholder with which he or she is affiliated.

Our corporate governance guidelines provide that the roles of chairman of the board and chief executive officer may be separated or combined. Our board of directors has considered its leadership structure and determined that, at this time, the roles of chairman of the board of directors and chief executive officer should be separate. Separating the chairman and the chief executive officer positions allows our chief executive officer, Ms. Kozlowski, to focus on running the business, while allowing our chairman of the board of directors, Mr. Salzberg, to lead our board in its fundamental role of providing advice to and oversight of management. As our board of directors has determined that each of our directors, other than Ms. Kozlowski and Mr. Salzberg, is independent, our board of directors believes that the independent directors provide effective oversight of management. In addition, Mr. Goodman serves as our lead independent director. As lead independent director, Mr. Goodman presides over periodic meetings of our independent directors, serves as a liaison between our chairman and the independent directors, and performs such additional duties as our board of directors may otherwise determine and delegate. Our board of directors believes that its leadership structure is appropriate because it strikes an effective balance between strategic development and independent leadership and management oversight in the board process.

We have adopted a written code of conduct and ethics that applies to our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A current copy of the code of conduct and ethics is posted under the heading "Corporate Governance—Governance Documents" on the Investor Relations section of our website, which is located at investors.blueapron.com. If we make any substantive amendments to, or grant any waivers from, the code of conduct and ethics we will disclose the nature of such amendment or waiver on our website or in a Current Report on Form 8-K to the extent required by applicable law, the rules of the SEC or the rules of the NYSE.

12

Corporate Governance Guidelines

Our board of directors has adopted corporate governance guidelines to assist in the exercise of its duties and responsibilities and to serve the best interests of our company and our stockholders. The guidelines provide, among other things, that:

A copy of the corporate governance guidelines is posted under the heading "Corporate Governance—Governance Documents" on the Investor Relations section of our website, which is located at investors.blueapron.com.

Our board of directors meets on a regularly scheduled basis during the year to review significant developments affecting us and to act on matters requiring its approval. It also holds special meetings when important matters require action between scheduled meetings. Members of senior management regularly attend meetings to report on and discuss their areas of responsibility. Our board of directors held five meetings (including regularly scheduled and special meetings) during the fiscal year ended December 31, 2018.

During 2018, each director attended at least 75% of the aggregate of (i) the total number of meetings of our board of directors held during the period for which he or she has been a director and (ii) the total number of meetings held by all committees of our board of directors upon which he or she served during the periods that he or she served. Our board of directors periodically holds executive sessions of the independent directors. Executive sessions do not include employee directors or directors who do not qualify as independent under NYSE and SEC rules.

It is our policy that members of our board of directors are encouraged to attend annual meetings of our stockholders. During 2018, six of our directors attended our annual meeting of stockholders.

Our amended and restated by-laws provide that our board of directors may delegate responsibility to committees. Our board of directors has three standing committees: the audit committee, the compensation committee and the nominating and corporate governance committee. Our board of directors has also adopted a written charter for each of the three standing committees. Each committee charter is available under the heading "Corporate Governance—Governance Documents" on the Investor Relations section of our website, which is located at investors.blueapron.com.

13

Audit Committee

Our audit committee's responsibilities include:

All audit services and all non-audit services, other than de minimis non-audit services, to be provided to us by our independent registered public accounting firm must be approved in advance by our audit committee.

The members of our audit committee are Ms. Bradley (chair), Ms. Cool and Mr. Kelley. Our board of directors has determined that each member of our audit committee meets the requirements for financial literacy under the applicable rules and regulations of the SEC and the NYSE. Our board of directors has designated Ms. Bradley as an "audit committee financial expert," as defined under the applicable rules of the SEC.

Our audit committee held five meetings during the fiscal year ended December 31, 2018. Our audit committee operates under a written charter adopted by our board of directors, a current copy of which is available under the heading "Corporate Governance—Governance Documents" on the Investor Relations section of our website, which is located at investors.blueapron.com.

Compensation Committee

Our compensation committee's responsibilities include:

14

Typically, our compensation committee meets quarterly and with greater frequency if necessary. The agenda for each meeting is usually developed by our compensation committee, in consultation with our president and chief executive officer and our chief financial officer. Our compensation committee meets regularly in executive session. Our president and chief executive officer may not participate in, or be present during, any deliberations or determinations of our compensation committee regarding his compensation or individual performance objectives. Our compensation committee has the authority to obtain, at our expense, advice and assistance from compensation consultants and internal and external legal, accounting or other advisors and other external resources that our compensation committee considers necessary or appropriate in the performance of its duties. Our compensation committee may select, or receive advice from, a compensation consultant, legal counsel or other adviser to the compensation committee, other than in-house legal counsel and certain other types of advisers, only after assessing the independence of such person in accordance with SEC and NYSE requirements that bear upon the adviser's independence; however, there is no requirement that any adviser be independent.

The members of our compensation committee are Mr. Goodman (chair), Ms. Bradley and Mr. Hirshberg. Our compensation committee held five meetings during the fiscal year ended December 31, 2018. Our compensation committee operates under a written charter adopted by our board of directors, a current copy of which is available under the heading "Corporate Governance—Governance Documents" on the Investor Relations section of our website, which is located at investors.blueapron.com.

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee's responsibilities include:

The members of our nominating and corporate governance committee are Mr. Hirshberg (chair), Ms. Cool and Mr. Kelley. Our nominating and corporate governance committee held three meetings during the fiscal year ended December 31, 2018. Our nominating and corporate governance committee operates under a written charter adopted by our board of directors, a current copy of which is available under the heading "Corporate Governance—Governance Documents" on the Investor Relations section of our website, which is located at investors.blueapron.com.

Our compensation committee may, in its sole discretion, retain or obtain the advice of one or more compensation consultants. Our compensation committee has engaged Compensia, Inc., a national management consulting firm ("Compensia"), as its independent compensation consultant, to provide comparative data on executive compensation practices in our industry, to assist our compensation

15

committee in developing an appropriate list of peer companies, and to advise on our executive compensation program generally. Our compensation committee also engaged Compensia for recommendations and review of non-employee director compensation in 2018 and 2019.

Although our compensation committee considers the advice and recommendations of independent compensation consultants as to our executive compensation program, our compensation committee ultimately makes its own decisions about these matters. In the future, we expect that our compensation committee will continue to engage independent compensation consultants to provide additional guidance on our executive compensation programs and to conduct further competitive benchmarking against a peer group of publicly traded companies.

Our compensation committee will review information regarding the independence and potential conflicts of interest of any compensation consultant it may engage, taking into account, among other things, the factors set forth in the NYSE listing rules. With respect to services provided in 2018, our compensation committee concluded that the engagement of Compensia did not raise any conflict of interest. Outside of services provided for the compensation committee, Compensia provided nominal additional services to us in 2018 related to benchmarking data with respect to certain executive and non-executive positions in an effort to ensure that our compensation was competitive so that we could attract, reward, motivate and retain our employees. The total amount paid to Compensia in connection with these additional engagements was less than $120,000 in 2018.

Compensation Committee Interlocks and Insider Participation

None of our executive officers serves as a member of the board of directors or compensation committee, or other committee serving an equivalent function, of any entity that has one or more executive officers who serve as members of our board of directors or our compensation committee. None of the members of our compensation committee is an officer or employee of our company, nor have they ever been an officer or employee of our company.

Oversight of Risk

Our board of directors oversees our risk management processes directly and through its committees. Our management is responsible for risk management on a day-to-day basis. The role of our board of directors and its committees is to oversee the risk management activities of our management. They fulfill this duty by discussing with management the policies and practices utilized by management in assessing and managing risks and providing input on those policies and practices. In general, our board of directors oversees risk management activities relating to business strategy, acquisitions, capital allocation, organizational structure and certain operational risks; our audit committee oversees risk management activities related to financial controls and legal and compliance risks; our nominating and corporate governance committee oversees risk management activities relating to the composition of our board of directors; and our compensation committee oversees risk management activities relating to our compensation policies and practices and management succession planning. Each committee reports to the full board of directors on a regular basis, including reports with respect to each committee's risk oversight activities as appropriate. In addition, because risk issues often overlap, committees from time to time request that the full board of directors discuss particular risks.

Director Nomination Process

Our board of directors is responsible for selecting its own members. Our board of directors delegates the selection and nomination process to our nominating and corporate governance

16

committee, with the expectation that other members of our board of directors, and of management, will be requested to take part in the process as appropriate.

The process followed by our nominating and corporate governance committee to identify and evaluate director candidates may include requests to members of our board of directors and others for recommendations, evaluation of the performance on our board of directors and its committees of any existing directors being considered for nomination, consideration of biographical information and background material relating to potential candidates and, particularly in the case of potential candidates who are not then serving on our board of directors, interviews of selected candidates by members of our nominating and corporate governance committee and our board of directors.

Generally, our nominating and corporate governance committee identifies candidates for director nominees in consultation with management, through the use of search firms or other advisors, through the recommendations submitted by stockholders or through such other methods as our nominating and corporate governance committee deems to be helpful to identify candidates. Once candidates have been identified, our nominating and corporate governance committee confirms that the candidates meet all of the minimum qualifications for director nominees established by our nominating and corporate governance committee.

Our nominating and corporate governance committee may gather information about the candidates through interviews, detailed questionnaires, comprehensive background checks or any other means that our nominating and corporate governance committee deems to be appropriate in the evaluation process. Our nominating and corporate governance committee then discusses and evaluates the qualities and skills of each candidate, both on an individual basis and taking into account the overall composition and needs of our board of directors. Based on the results of the evaluation process, our nominating and corporate governance committee recommends candidates for our board of directors' approval as director nominees for election to our board of directors. In considering whether to recommend any particular candidate for inclusion in our board of directors' slate of recommended director nominees, our nominating and corporate governance committee applies the criteria set forth in our corporate governance guidelines described above under "Corporate Governance Guidelines." Consistent with these criteria, our nominating and corporate governance committee expects every nominee to have the following attributes or characteristics, among others: integrity, honesty, adherence to high ethical standards, business acumen, good judgment and a commitment of service to the company, including a commitment to understand our business and industry. Our nominating and corporate governance committee considers the value of diversity when selecting nominees, and believes that our board of directors, taken as a whole, should embody a diverse set of skills, experiences and abilities. The nominating and corporate governance committee does not make any particular weighting of diversity or any other characteristic in evaluating nominees and directors.

All of the Class II director nominees are currently members of our board of directors. The biographies of such director nominees under the heading "Nominees for Election for a Three-Year Term Ending at the 2022 Annual Meeting" in this Proxy Statement indicate the experience, qualifications, attributes and skills of each of the director nominees that led our nominating and corporate governance committee and our board of directors to conclude he or she should continue to serve as a director of our company. Our nominating and corporate governance committee and our board of directors believe that each of the nominees has the individual attributes and characteristics required of a director of our company, and that the nominees as a group possess the skill sets and specific experience desired of our board of directors as a whole.

Following the resignation of Kenneth A. Fox from our board of directors, effective as of February 28, 2019, the size of our board of directors was reduced from eight to seven members. Our nominating and corporate governance committee intends to seek to identify one or more additional persons who can complement the expertise and experience of our existing directors. After it identifies

17

any such director candidates, our nominating and corporate governance committee would recommend such candidates to our board of directors for appointment to our board. The timing of such appointments, if any, cannot be determined at this time.

Stockholders may recommend individuals for consideration by our nominating and corporate governance committee and board of directors as potential director candidates by submitting their names, together with appropriate biographical information and background materials, and information with respect to the stockholder or group of stockholders making the recommendation, including the number of shares of capital stock owned by such stockholder or group of stockholders, to our Secretary at Blue Apron Holdings, Inc., 40 West 23rd Street, New York, NY 10010. The specific requirements for the information that is required to be provided for such recommendations to be considered are specified in our amended and restated by-laws and must be received by us no later than the date referenced below under the heading "Procedures for Submitting Stockholder Proposals." Assuming that appropriate biographical and background material has been provided on a timely basis, our nominating and corporate governance committee will evaluate stockholder-recommended candidates by following substantially the same process, and applying substantially the same criteria, as it follows for candidates submitted by others.

Stockholders also have the right under our amended and restated by-laws to directly nominate director candidates, without any action or recommendation on the part of the nominating and corporate governance committee or our board of directors, by following the procedures set forth below under the heading "Procedures for Submitting Stockholder Proposals."

In evaluating proposed director candidates, our nominating and corporate governance committee may consider, in addition to the minimum qualifications and other criteria approved by our board of directors from time to time, all facts and circumstances that it deems appropriate or advisable, including, among other things, the skills of the proposed director candidate, his or her depth and breadth of professional experience or other background characteristics, his or her independence and the needs of our board of directors.

Stockholders or other interested parties may contact our board of directors or one or more of our directors with issues or questions about Blue Apron, by mailing correspondence to our General Counsel and Secretary at 40 West 23rd Street, New York, NY 10010. Our legal team will review incoming communications directed to our board of directors and, if appropriate, will forward such communications to the appropriate member(s) of the board of directors or, if none is specified, to the chairman of our board of directors. For example, we will generally not forward a communication that is primarily commercial in nature, is improper or irrelevant, or is a request for general information about Blue Apron.

We believe that although a portion of the compensation provided to our executive officers and other employees is performance-based, our executive compensation program does not encourage excessive or unnecessary risk taking. This is primarily due to the fact that our compensation programs are designed to encourage our executive officers and other employees to remain focused on both short-term and long-term strategic goals, in particular in connection with our pay-for-performance compensation philosophy that applies to our executive officers. In addition, we believe that the equity compensation component of our executive compensation program assists in protecting against excessive or unnecessary risk taking by providing our executives with a strong link to our long-term performance, creating an ownership culture and helping to align the interests of our executives and our stockholders. As a result, we do not believe that our compensation programs are reasonably likely to have a material adverse effect on us.

18

PROPOSAL TWO

APPROVAL OF AN AMENDMENT TO OUR RESTATED CERTIFICATE OF INCORPORATION TO

EFFECT A REVERSE STOCK SPLIT

We are seeking stockholder approval for an amendment to our restated certificate of incorporation to effect a reverse stock split (the "Reverse Stock Split") of our issued and outstanding Class A common stock and Class B common stock using a ratio of not less than 1-for-5 and not more than 1-for-15, with the split ratio and the implementation and timing of such Reverse Stock Split to be determined in the discretion of our board of directors. The split ratio will be the same for the Class A common stock and the Class B common stock. As further described below, if this proposal is approved, our board of directors may determine to effect the Reverse Stock Split at any time prior to the date of the company's 2020 annual meeting of stockholders.

The form of the amendment to our restated certificate of incorporation to effect the Reverse Stock Split is attached as Appendix A to this Proxy Statement. Approval of the proposal would permit (but not require) our board of directors to effect the Reverse Stock Split using a split ratio of not less than 1-for-5 and not more than 1-for-15, with the exact split ratio to be set within this range as determined by our board of directors in its sole discretion, provided that the board of directors must determine to effect the Reverse Stock Split and such amendment must be filed with the Secretary of State of the State of Delaware no later than the date of the company's 2020 annual meeting of stockholders. If our board of directors determines to implement the Reverse Stock Split, the exact split ratio of the Reverse Stock Split will be determined by the board of directors prior to the effective time of the Reverse Stock Split and will be publicly announced prior to such effective time. We believe that enabling our board of directors to set the split ratio of the Reverse Stock Split within the specified range and within the specified time period will provide us with the flexibility to implement the Reverse Stock Split in a manner and at a time designed to maximize the anticipated benefits for our stockholders. In determining a split ratio for the Reverse Stock Split, if any, following the receipt of stockholder approval, our board of directors may consider, among other things, factors such as:

Our board of directors reserves the right to elect to abandon the Reverse Stock Split if it determines, in its sole discretion, that the Reverse Stock Split is no longer in the best interests of our company and our stockholders.

Depending on the split ratio for the Reverse Stock Split determined by our board of directors, no fewer than every five and no more than every fifteen shares of issued and outstanding Class A common stock will be combined into one share of Class A common stock, and no fewer than every five and no more than every fifteen shares of issued and outstanding Class B common stock will be combined into one share of Class B common stock. The amendment to our restated certificate of incorporation to effect the Reverse Stock Split will not change the number of authorized shares of Class A common stock, Class B common stock, Class C capital stock or preferred stock, or the par value of the Class A

19

common stock, Class B common stock, Class C capital stock or preferred stock. We currently have no outstanding shares of Class C capital stock or preferred stock.

Background and Reasons for the Reverse Stock Split

The primary purpose for effecting the Reverse Stock Split, should our board of directors choose to effect it, would be to increase the per share price of our Class A common stock.

In determining to seek authorization for the Reverse Stock Split, our board of directors considered that the implementation of a reverse stock split is likely to increase the trading price of our Class A common stock as a result of the reduction in the number of shares outstanding. Our board of directors believes that the increased market price of our Class A common stock expected as a result of implementing the Reverse Stock Split may improve marketability and liquidity of our Class A common stock and may encourage interest and trading in our Class A common stock.

For example, some investors may prefer to invest in stocks that trade at a per share price range more typical of companies listed on the NYSE, and certain institutional investors may be prohibited in their investment charters from purchasing stocks that trade below certain minimum price levels. In addition, brokerage firms may be reluctant to recommend lower-priced stocks to their clients. Further, brokerage commissions paid by investors, as a percentage of a total transaction, tend to be higher for lower-priced stocks. As a result, certain investors may also be dissuaded from purchasing lower-priced stocks. Authorizing our board of directors to effect the Reverse Stock Split, and thereby increase the trading price of our Class A common stock, may help reduce these concerns.

In addition, the listing requirements of the NYSE require that, among other things, the average closing price of our Class A common stock may not be less than $1.00 over a consecutive 30-trading day period. We have remained in compliance with this NYSE listing requirement since our initial public offering and continue to be compliant as of April [29], 2019. However, if we were to fail to comply with this listing requirement, it would result in our Class A common stock being delisted from the NYSE if we are not able to resume compliance with the NYSE's listing requirements within the applicable cure period. Our failure to remain in compliance with the NYSE's listing requirements, and any subsequent failure to resume compliance with the NYSE's listing requirements within the applicable cure period, could negatively impact our company and holders of our Class A common stock.

Our board of directors believes it is in the best interests of our company and our stockholders to proactively authorize the board of directors to effect the Reverse Stock Split in order to increase the per share trading price of our Class A common stock. This authorization would permit us to effect the Reverse Stock Split if our board of directors determines that it will improve our ability to continue complying with the NYSE listing requirements or if implementing the Reverse Stock Split becomes necessary to resume compliance with the NYSE's listing requirements within the applicable cure period and maintain our listing on the NYSE.

Certain Risks Associated with the Reverse Stock Split

Reducing the number of outstanding shares of our Class A common stock through the Reverse Stock Split is intended, absent other factors, to increase the per share trading price of our Class A common stock. However, other factors, such as our financial results, market conditions and the market perception of our business, may adversely affect the trading price of our Class A common stock. As a result, there can be no assurance that the Reverse Stock Split, if completed, will result in the intended benefits described above, that the trading price of our Class A common stock will increase following the Reverse Stock Split, that the trading price of our Class A common stock will not decrease in the future or that we will remain in or be able to resume compliance with the NYSE listing requirements. Additionally, we cannot assure you that the trading price per share of our Class A common stock after

20

a Reverse Stock Split will increase in proportion to the reduction in the number of shares of our Class A common stock and Class B common stock outstanding before the Reverse Stock Split. Accordingly, the total market capitalization of our Class A common stock after the Reverse Stock Split may be lower than the total market capitalization before the Reverse Stock Split, including for reasons unrelated to the Reverse Stock Split.

The proposed Reverse Stock Split may decrease the liquidity of our common stock and result in higher transaction costs. The liquidity of our common stock may be negatively impacted by the Reverse Stock Split, given the reduced number of shares that would be outstanding after the Reverse Stock Split, particularly if the per share trading price does not increase as a result of the Reverse Stock Split. In addition, if the Reverse Stock Split is implemented, it may result in some stockholders owning "odd lots" of less than 100 shares of Class A common stock or Class B common stock. Odd lot shares may be more difficult to sell, and brokerage commissions and other costs of transactions in odd lots may be higher than the costs of transactions in "round lots" of even multiples of 100 shares. Accordingly, the Reverse Stock Split may not achieve the desired results of increasing marketability of our common stock as described above.

Reservation of Right to Abandon the Amendment to our Restated Certificate of Incorporation and the Reverse Stock Split

Our board of directors reserves the right to abandon the amendment to our restated certificate of incorporation described in this Proposal Two without further action by our stockholders at any time before the effective time of the Reverse Stock Split, even if stockholders approve such amendment at the Annual Meeting, if it determines, in its sole discretion, that the Reverse Stock Split is no longer in the best interest of our company and our stockholders. By voting in favor of the amendment to our restated certificate of incorporation, stockholders are also expressly authorizing the board of directors to determine not to proceed with, and abandon, a reverse stock split if it should so decide.

Procedure for Implementing the Reverse Stock Split

If our board of directors elects to implement the Reverse Stock Split, the Reverse Stock Split will become effective upon the filing with the Secretary of State of the State of Delaware of a certificate of amendment to our restated certificate of incorporation, in the form attached as Appendix A. The exact timing of the filing of the certificate of amendment and the effectiveness of the Reverse Stock Split will be determined by our board of directors, in its sole discretion, provided that in no event shall the filing of the certificate of amendment effecting the Reverse Stock Split occur after the date of the company's 2020 annual meeting of stockholders. In addition, our board of directors reserves the right, notwithstanding stockholder approval of this Proposal Two and without further action by the stockholders, to elect not to proceed with the Reverse Stock Split if, at any time prior to the filing or effectiveness of a certificate of amendment to our restated certificate of incorporation to effect the Reverse Stock Split, our board of directors, in its sole discretion, determines that it is no longer in the best interests of our company and our stockholders to proceed with the Reverse Stock Split. If we do not file a certificate of amendment effecting the Reverse Stock Split with the Secretary of State of the State of Delaware on or before the date of the company's 2020 annual meeting of stockholders, our board of directors will be deemed to have abandoned the Reverse Stock Split.

Effect of the Reverse Stock Split on Holders of Outstanding Class A Common Stock and Class B Common Stock

If our board of directors elects to implement the Reverse Stock Split, the split ratio will be the same for the Class A common stock and the Class B common stock. Depending on the split ratio for the Reverse Stock Split determined by our board of directors, a minimum of every five and a maximum of every fifteen shares of issued and outstanding Class A common stock will be combined into one new

21

share of Class A common stock, and a minimum of every five and a maximum of every fifteen shares of issued and outstanding Class B common stock will be combined into one new share of Class B common stock. Based on the [ · ] shares of Class A common stock and [ · ] shares of Class B common stock issued and outstanding as of the Record Date, immediately following the Reverse Stock Split we would have approximately [ · ] shares of Class A common stock and [ · ] shares of Class B common stock issued and outstanding if the split ratio for the Reverse Stock Split is 1-for-5, and [ · ] shares of Class A common stock and [ · ] shares of Class B common stock issued and outstanding if the split ratio for the Reverse Stock Split is 1-for-15. Any other split ratio selected within such range would result in a number of shares of Class A common stock and Class B common stock issued and outstanding of between [ · ] and [ · ] shares of Class A common stock and [ · ] and [ · ] shares of Class B common stock.

The actual number of shares issued and outstanding after giving effect to the Reverse Stock Split, if implemented, will depend on the split ratio for the Reverse Stock Split that is ultimately determined by our board of directors.

The Reverse Stock Split will affect all holders of our Class A common stock and Class B common stock uniformly and will not affect any stockholder's percentage ownership interest in our company, except that, as described below under "—Fractional Shares," record holders of Class A common stock and Class B common stock otherwise entitled to a fractional share as a result of the Reverse Stock Split will receive cash in lieu of such fractional share. In addition, the Reverse Stock Split will not affect any stockholder's proportionate voting power (subject to the treatment of fractional shares). The Reverse Stock Split will also not affect the conversion provisions of the Class B common stock, which will remain convertible into Class A common stock on a share-for-share basis in accordance with our restated certificate of incorporation.

After the effective time of the Reverse Stock Split, our Class A common stock will have a new Committee on Uniform Securities Identification Procedures (CUSIP) number, which is a number used to identify our equity securities, and stock certificates with the older CUSIP number will need to be exchanged for stock certificates with the new CUSIP number by following the procedures described below. After the Reverse Stock Split, we will continue to be subject to the periodic reporting and other requirements of the Exchange Act.

Authorized Shares of Class A Common Stock and Class B Common Stock

If our board of directors elects to implement the Reverse Stock Split, the Reverse Stock Split will not change the number of authorized shares of our Class A common stock and Class B common stock under our restated certificate of incorporation. Because the number of shares of issued and outstanding Class A common stock and Class B common stock will decrease as a result of the Reverse Stock Split, the number of shares of Class A common stock and Class B common stock available for issuance will increase if this Proposal Two is approved by our stockholders and if our board of directors implements the Reverse Stock Split. Currently, we are authorized to issue up to a total of 2,185,000,000 shares of capital stock, consisting of 1,500,000,000 shares of Class A common stock, 175,000,000 shares of Class B common stock, 500,000,000 shares of Class C capital stock and 10,000,000 shares of preferred stock. Except for the shares issuable upon the exercise or vesting of outstanding options and restricted stock units, we do not currently have any plans, proposals or arrangement to issue any of our authorized but unissued shares of Class A common stock or Class B common stock.

By increasing the number of authorized but unissued shares of Class A common stock and Class B common stock, the Reverse Stock Split could, under certain circumstances, have an anti-takeover effect, although this is not the intent of the board of directors. For example, it may be possible for the board of directors to delay or impede a takeover or transfer of control of our company by causing such additional authorized but unissued shares to be issued to holders who might side with the board of

22

directors in opposing a takeover bid that the board of directors determines is not in the best interests of our company or our stockholders. The Reverse Stock Split, therefore, may have the effect of discouraging unsolicited takeover attempts. By potentially discouraging initiation of any such unsolicited takeover attempts, the Reverse Stock Split may limit the opportunity for our stockholders to dispose of their shares at the higher price generally available in takeover attempts or that may be available under a merger proposal. The Reverse Stock Split may have the effect of permitting our current management, including the current board of directors, to retain its position, and place it in a better position to resist changes that stockholders may wish to make if they are dissatisfied with the conduct of our company's business. However, the board of directors is not aware of any attempt to take control of our company and the board of directors has not approved the Reverse Stock Split with the intent that it be utilized as a type of anti-takeover device.

Beneficial Holders of Class A Common Stock and Class B Common Stock (i.e., stockholders who hold in street name)

If our board of directors elects to implement the Reverse Stock Split, then, for purposes of implementing the Reverse Stock Split, we intend to treat shares held by stockholders through a bank, broker, custodian or other nominee in the same manner as registered stockholders whose shares are registered in their names. Banks, brokers, custodians or other nominees will be instructed to effect the Reverse Stock Split for their beneficial holders holding our Class A common stock and Class B common stock in street name. However, these banks, brokers, custodians or other nominees may have different procedures than registered stockholders for processing the Reverse Stock Split. Stockholders who hold shares of our Class A common stock and Class B common stock with a bank, broker, custodian or other nominee and who have any questions in this regard are encouraged to contact their banks, brokers, custodians or other nominees.

Registered "Book-Entry" Holders of Class A Common Stock and Class B Common Stock (i.e., stockholders that are registered on our transfer agent's books and records but do not hold stock certificates)

Certain of our registered holders of Class A common stock and Class B common stock may hold some or all of their shares electronically in book-entry form with our transfer agent. These stockholders do not have stock certificates evidencing their ownership of Class A common stock and Class B common stock. They are, however, provided with a periodic statement reflecting the number of shares registered in their accounts.

Stockholders who hold shares electronically in book-entry form with our transfer agent will not need to take further action to receive whole shares of post-Reverse Stock Split Class A common stock and Class B common stock, because the exchange will be automatic.

Exchange of Stock Certificates

If the Reverse Stock Split is effected, stockholders holding certificated shares (i.e., shares represented by one or more physical stock certificates) will be requested to exchange their old stock certificate(s) ("Old Certificate(s)") for shares held in book-entry form through the Depository Trust Company's Direct Registration System representing the appropriate number of whole shares of our Class A common stock or Class B common stock, as applicable, resulting from the Reverse Stock Split. Stockholders of record upon the effective time of the Reverse Stock Split will be furnished the necessary materials and instructions for the surrender and exchange of their Old Certificate(s) at the appropriate time by our transfer agent, Computershare. Stockholders will not have to pay any transfer fee or other fee in connection with such exchange. As soon as practicable after the effective time of the Reverse Stock Split, our transfer agent will send a transmittal letter to each stockholder advising such holder of the procedure for surrendering Old Certificate(s) in exchange for new shares held in

23

book-entry form. Your Old Certificate(s) representing pre-split shares cannot be used for either transfers or deliveries. Accordingly, you must exchange your Old Certificate(s) in order to effect transfers or deliveries of your shares.

YOU SHOULD NOT SEND YOUR OLD CERTIFICATES NOW. YOU SHOULD SEND THEM ONLY IF WE EFFECT A REVERSE STOCK SPLIT AND YOU RECEIVE A LETTER OF TRANSMITTAL FROM OUR TRANSFER AGENT.

As soon as practicable after the surrender to our transfer agent of any Old Certificate(s), together with a properly completed and duly executed transmittal letter and any other documents our transfer agent may specify, our transfer agent will have its records adjusted to reflect that the shares represented by such Old Certificate(s) are held in book-entry form in the name of such person.

Until surrendered as contemplated herein, a stockholder's Old Certificate(s) shall be deemed at and after the effective time of the Reverse Stock Split to represent the number of whole shares of our Class A common stock or Class B common stock, as applicable, resulting from the Reverse Stock Split.

Any stockholder whose Old Certificate(s) have been lost, destroyed or stolen will be entitled to new shares in book-entry form only after complying with the requirements that we and our transfer agent customarily apply in connection with lost, stolen or destroyed certificates.

No service charges, brokerage commissions or transfer taxes shall be payable by any holder of any Old Certificate, except that if any book-entry shares are to be issued in a name other than that in which the Old Certificate(s) are registered, it will be a condition of such issuance that (1) the person requesting such issuance must pay to us any applicable transfer taxes or establish to our satisfaction that such taxes have been paid or are not payable, (2) the transfer complies with all applicable federal and state securities laws, and (3) the surrendered certificate is properly endorsed and otherwise in proper form for transfer.

Any stockholder who wants to continue holding certificated shares may request new certificate(s) from our transfer agent.

If our board of directors elects to implement the Reverse Stock Split, fractional shares will not be issued. Stockholders of record and stockholders who hold their shares through a bank, broker, custodian or other nominee who would otherwise hold fractional shares of our Class A common stock or Class B common stock as a result of the Reverse Stock Split will be entitled to receive cash (without interest and subject to applicable withholding taxes) in lieu of such fractional shares. Each such stockholder will be entitled to receive an amount in cash equal to the fraction of one share to which such stockholder would otherwise be entitled multiplied by the closing price per share of the Class A Common Stock on the New York Stock Exchange at the close of business on the trading day preceding the date of the effective time of the Reverse Stock Split.