Exhibit 99.2

Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis of our company’s financial condition and results of operations should be read in conjunction with our consolidated financial statements and the related notes included elsewhere in this report. This discussion contains forward-looking statements that involve risks and uncertainties. Actual results and the timing of selected events could differ materially from those anticipated in these forward-looking statements as a result of various factors.

Special Note Regarding Forward-looking Statements

This report contains forward-looking statements. All statements contained in this report other than statements of historical fact, including statements regarding our future results of operations and financial position, our business strategy and plans, and our objectives for future operations, are forward-looking statements. The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” and similar expressions are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in the “Risk Factors” section. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the future events and trends discussed in this report may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

Business Overview

Farmmi, Inc. (“FMI” or the “Company”) is a holding company incorporated under the laws of the Cayman Islands on July 28, 2015. Acting through its subsidiaries, the Company is engaged in processing and distributing dried edible mushrooms, mainly Shiitake and Mu Er mushrooms, and trading other agricultural products such as rice and edible oil.

Ms. Yefang Zhang, as the sole shareholder of FarmNet Limited which is the sole shareholder of FMI, and her husband Mr. Zhengyu Wang, a director of FMI, are the ultimate shareholders of FMI (“Controlling Shareholders”). The Company completed a reorganization of its legal structure (“Reorganization”) in preparation for its planned initial public offering.

The Reorganization involved the incorporation of FMI, a Cayman Islands holding company; the incorporation of Farmmi International Limited (“Farmmi International”), a Hong Kong company; the incorporation of Hangzhou Suyuan Agriculture Technology Co., Ltd. (“Suyuan Agriculture”), a PRC company; the incorporation of Farmmi (Hangzhou) Enterprise Management Co., Ltd. (“Farmmi Enterprise”) and Lishui Farmmi Technology Co., Ltd. (“Farmmi Technology”), two new wholly foreign-owned entities (“WFOE”) formed by Farmmi International under the laws of China; and the equity transfer of Suyuan Agriculture, Zhejiang Forest Food Co., Ltd. (“Forest Food”) and Zhejiang FLS Mushroom Co., Ltd. (“FLS Mushroom”) (collectively, the “Transferred Entities”) from the controlling shareholders Zhengyu Wang and Yefang Zhang (“Controlling Shareholders”).

On July 5, 2016 and August 10, 2016, Zhengyu Wang transferred all of his equity interests in Suyuan Agriculture to Farmmi Enterprise and Farmmi Technology with each owning 50% of Suyuan Agriculture. On November 24, 2016, Zhengyu Wang, the controlling shareholder of Forest Food transferred 96.15% of his interest in Forest Food to Suyuan Agriculture. On October 24, 2016, Zhengyu Wang, the controlling shareholder of FLS Mushroom transferred 100% of his interest in FLS Mushroom to Suyuan Agriculture. After the Reorganization, FMI, the ultimate holding company, owns 100% equity interest of Suyuan Agriculture and FLS Mushroom, and 96.15% equity interest of Forest Food. The remaining 3.85% equity interest of Forest Food is owned by a minority interest shareholder.

1

On September 18, 2016, Suyuan Agriculture entered into a series of contractual agreements with Zhengyu Wang, the owner of Hangzhou Nongyuan Network Technology Co., Ltd. (“Nongyuan Network”) and Nongyuan Network. Nongyuan Network is a company incorporated on December 8, 2015 that focuses on the development of network marketing and provides a network platform for sales of agriculture products. These agreements include Exclusive Management Consulting and Technology Service Agreement, Proxy Agreement, Equity Pledge Agreement and Executive Call Option Agreement. Pursuant to these agreements, Suyuan Agriculture has the exclusive rights to provide to Nongyuan Network consulting services related to business operation and management. All the above contractual agreements obligate Suyuan Agriculture to absorb all of the loss from Nongyuan Network’s activities and entitle Suyuan Agriculture to receive all of its residual returns. In essence, Suyuan Agriculture has gained effective control over Nongyuan Network. Therefore, the Company believes that Nongyuan Network should be considered as Variable Interest Entity (“VIE”) under the Statement of Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 810 “Consolidation”. Accordingly, the accounts of this entity are consolidated with those of Suyuan Agriculture.

Since FMI and its subsidiaries are effectively controlled by the same Controlling Shareholders before and after the Reorganization, they are considered under common control. The above-mentioned transactions were accounted for as a recapitalization. The consolidation of FMI and its subsidiaries has been accounted for at historical cost and prepared on the basis as if the aforementioned transactions had become effective as of the beginning of the first period presented in the accompanying consolidated financial statements.

On December 26, 2017, Zhejiang Farmmi Food Co., Ltd. (“Farmmi Food”) was established under the laws of the PRC. Initially Farmmi Food was wholly owned by Farmmi Technology. In January 2018, the share ownership was transferred to Suyuan Agriculture. In May 2018, Farmmi Food received its food production permit and began operation.

On March 22, 2019, Lishui Farmmi E-Commerce Co., Ltd. (“Farmmi E-Commerce”) was established under the laws of the PRC. Nongyuan Network and Suyuan Agriculture owns 98% and 2% of interests in Farmmi E-Commerce, respectively.

FMI, Farmmi international, Farmmi Enterprise, Farmmi Technology, Suyuan Agriculture, Forest Food, FLS Mushroom, Nongyuan Network, Farmmi Food, and Farmmi E-Commerce (herein collectively referred to as the “Company”) are engaged in processing and distributing dried Shiitake mushrooms and Mu Er mushrooms, which uses modern food processing technology to develop a series of safe, nutritious and healthy products. In order to provide green, organic, healthy forest food to global customers, the Company cooperates with family farms to promote standardized cultivation and production so it can ensure high quality of edible fungi raw materials. The Company has also established industrial production workshop and fully implemented the Hazard Analysis Critical Control Point (“HACCP”) international food safety and health management system. We have also obtained BRC certification issued by Intertek Certification Ltd to certify we meet the BRC Global Standard for Food Safety, and Food Safety Management System Certificate issued by China Quality Certification Centre to certify we meet the GB/T 22000-2006/ISO 22000:2005 standard.

2

We currently produce and/or sell the following categories of agricultural products: Shiitake mushrooms, Mu Er mushrooms, other edible fungi and other agricultural products. We do not grow fungi, but purchase dried edible fungi from third party suppliers, mainly from family farms, and two co-operatives representing family farms, Jingning Liannong Trading Co. Ltd. (“JLT”) and Qingyuan Nongbang Mushroom Industry Co., Ltd. (“QNMI”). JLT and QNMI are two companies in Lishui area where our facilities are located. They are co-operatives representing family farms which plant and provide edible fungi. JLT and QNMI themselves do not have any facility and do not process any fungi. They are established to share resources such as procurement information and to enjoy the advantage of economy of scale. After we select and filter the dried edible fungi for specific size and better quality, we may further dehydrate them again, as deemed necessary, to ensure the uniform level of dryness of our products. We then package the fungi products for sale. The only products we process and package are edible fungi. We process and package all of our edible fungi products at our own processing facilities. For other agricultural products, such as rice and edible oil, we purchase them from third-party suppliers, and sell these products at our online store Farmmi Liangpin Market (the consumers can download the corresponding mobile application from www.farmmi.com for shopping). Mainly through distributors, we offer gourmet dried mushrooms to domestic and overseas retail supermarkets, produce distributors and foodservice distributors and operators. We have become an enterprise with advanced processing equipment and business management experience, and we pride ourselves on consistently producing quality mushrooms and serving our customers with a high level of commitment.

Currently, we estimate that approximately 90% of our products are sold in China to domestic distributors and the remaining 10% are sold internationally, including USA, Japan, Canada and other countries, through distributors. In addition, in order to enhance our e-commerce marketing presence, we developed our own e-commerce websites www.farmmi.com and www.farmmi88.com. We are also testing a few offline stores in Hangzhou to expand our brand presence and revenue growth.

Our total revenues for the six months ended March 31, 2019 increased by $1.37 million or 10.51%, compared to the same period in 2018. We expect our sales of edible fungi products will continue to grow in the coming years, as the consumption of fungi products in China has been rising significantly and has become one of the most important parts of planting industry. Meanwhile, although China has the most production of edible fungi, consumption of edible fungi per capita is much lower than other countries such as USA and Japan. Therefore, there is great potential for the sales of edible fungi in the Chinese market as well as the international market. We believe our sales will continue to grow in the future with our increased brand awareness, which will grow along with demand for edible fungi products.

3

Growth Strategy

Increasing our market share — the premium quality of our products has been long recognized by our customers. People’s increasing awareness of healthy dietary will likely lead to increased demand of our products. Our development plan mainly focuses on developing high-quality agricultural products market. Through our continued efforts of building e-commerce platform, expansion to international market, and building stable relationship with suppliers, we expect to expand our product lines and improve our brand awareness and customer loyalty, to meet the demands of market and customers, and improve our sales performance.

Expansion of our sources of supply, productivity and sales network — to meet the increasing demand, we emphasize cooperation with major suppliers as well as small family farms to ensure the quantity and quality of raw materials. While expanding supply resource, we also plan to increase our processing capability and upgrade production facilities to increase productivity. In addition to our present sales network, we intend to invest more in our online stores, continue to train our employees, upgrade relevant information technology and supply chain system, with the goal of making an integrated sales network with an international approach.

Securing high quality raw materials with competitive price — to meet the increasing demand for our products, we have been increasing our cooperation with major suppliers, with whom we have been working together for many years, to secure the quality and quantity of our raw materials. We also have dedicated teams that constantly visit and communicate with the family farm suppliers, to monitor the quality and quantity of raw materials. By working closely with our suppliers throughout the planting seasons, we have been providing such suppliers technical support to secure the stable supply of our raw materials. With our deep understanding of the edible fungi market, we have been able to purchase raw materials of premium quality at favorable prices. Edible fungi can be stored for a long time after simple processing, therefore we have been purchasing edible fungi when we expect their purchase price to increase, and store them to fulfill future sales orders. This strategy has been proven effective and will continue to be used by us as a cost control method.

Factors Affecting Our Results of Operations

Government Policy May Impact our Business and Operating Results

We have not seen any impact of unfavorable government policy upon our business in recent years. However, our business and operating results will be affected by China’s overall economic growth and government policies. Unfavorable changes in government policies could affect the demand for our products and could materially and adversely affect our results of operations. Our edible fungi products are currently eligible for certain favorable government tax incentive and other incentives, any future changes in the government’s policy upon edible fungi industry may have a negative effect on our operations.

4

Price Inelasticity of Raw Materials May Reduce Our Profit

As a processor of edible fungi, we rely on a continuous and stable supply of edible fungi raw materials to ensure our operation and expansion. The price of edible fungi may be inelastic when we wish to purchase supplies, resulting in an increase in raw material prices and thus reduce our profit. In addition, although we compete primarily the high-end market which puts more emphasize on the flavor, texture and quality of our products, we risk losing customers by increasing our selling prices.

Competition in Edible Fungi Industry

Although we have a lot of competitive advantages, such as premium product quality, stable and experienced factory employees, favorable production locations within proximity of significant mushroom planting bases and strong relationships with our significant suppliers, we face a series of challenges.

Our products face competition from a number of companies operating in the vicinity. One of the largest competitors has high sales volume, which enables this competitor to purchase and sell edible fungi at a relatively lower price. Another major competitor has much larger plants and warehouses than we have and its main product is Mu Er mushrooms with different sorts and qualities. Competition from these two major competitors may prevent us from increasing our revenue.

On the other hand, although we believe we distinguish our Company from competitors on the basis of product quality, the edible fungi industry is fragmented and subject to relatively low barriers of entry. Many of our competitors can provide products at relatively lower prices to increase their supplies which may affect our profit margins as we seek to compete with them.

At last, we have devoted significant resources to build and develop one of our online stores, Farmmi Jicai and Farmmi Liangpin Market. We plan to expand these two online stores. While this strategy may offer new opportunities to our Company, it is also a new venture and is impacted by many other factors. Farmmi Jicai and Farmmi Liangpin Market are not well known by consumers yet, and we do not have rich experience in e-commerce operation. As a result, we have no guarantee that we will be successful in this new expansion. If we do not manage our expansion effectively, our business prospects could be impaired.

Economy and Politics

Our ability to be successful in China depends in part on our awareness of trends in politics that may affect our company, including, for example, government initiatives that would either encourage or discourage programs and companies that produce healthy foods or efforts to increase export of agricultural products. In addition, we must be aware of political situations in destination countries of our products, particularly if such countries take action to stifle importation of food products from abroad.

5

Trend Information

We have noted the existence of the following trends since October 2018, all of which are likely to affect our business to the extent they continue in the future:

China’s edible fungi industry is growing, both in absolute terms and in market share.

Through its development of enoki mushroom industrialization technology in the 1960s, Japan became the world leader in mushroom farming. As other countries’ fungi farming technology improved, China began to supplant Japan and now became the largest worldwide edible mushroom producer. China’s growth has outpaced worldwide production growth rates. While China’s growth rates in the past much higher than world growth rates, it appears to be moving from rapid expansion to a more mature industry.

As the table below illustrates, our sales volume of Shiitake mushroom for the six months ended March 31, 2019 was approximately 662 tons. This number represents an increase of 61 tons compared with 601 tons sales volume for the same period of fiscal 2018. In the meanwhile, our sales volume of Mu Er for the six months ended March 31, 2019 was approximately 419 tons. This number represents an increase of 68 tons compared with 351 tons sales volume for the same period of fiscal 2018. The increased sales of Shiitake mushroom and Mu Er was primarily due to the increased sales orders we received on our online stores. As China’s mushroom industry is moving from rapid expansion to a more mature stage, we expect the effect of industry growth on promoting our sales volume will decrease.

| Period | Shiitake (tons) | Mu Er (tons) | ||||||

| Oct-18 | 93 | 69 | ||||||

| Nov-18 | 122 | 74 | ||||||

| Dec-18 | 158 | 13 | ||||||

| Jan-19 | 95 | 139 | ||||||

| Feb-19 | 33 | 12 | ||||||

| Mar-19 | 161 | 112 | ||||||

| Total sales volume for six month ended March 31, 2019 | 662 | 419 | ||||||

6

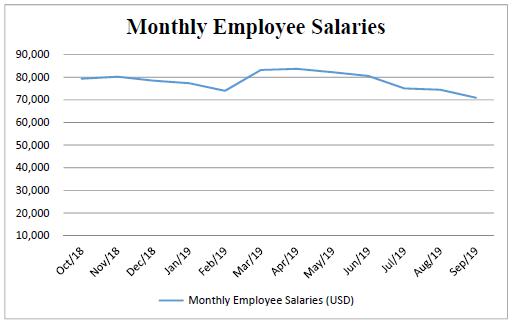

Our aggregate employee salaries have been relatively stable.

During the period of October 2018 to September 2019, our monthly salary expense was as follows:

The decrease in monthly employee salaries of February was mainly due to the Chinese New Year Holiday, when some employees took extended unpaid leaves during the holiday period. The increase in monthly employee salaries of March was mainly due to the increased over-time salaries as more sales orders were received after the Chinese New Year Holiday, as well as new employees hired in March. Monthly salaries after March remained relatively stable with a slight decrease, fluctuating within roughly 5%. We expect salary expense to stay stable but with slightly increase in the future, due to the expansion of our operations and inflation.

Raw material costs have been relatively stable.

With our deep understanding of the edible fungi market, constant market research, and communication with our suppliers, we have been able to obtain favorable price for premium raw materials. With increased sales orders we receive, we need to purchase additional raw materials to meet the new demand. We expect the raw material costs in fiscal year 2020 will be relatively stable, fluctuating between 5% and 6% comparing with fiscal year 2019.

During the period from October 2018 to September 2019, the average monthly unit price per ton for Shiitake and Mu Er we purchased were as follows:

7

We anticipate that for fiscal year 2020, the average unit price of Shiitake and Mu Er we purchase will be about $9,400 per ton and $9,500 per ton, respectively. The stable raw material costs contribute to our stable gross margin. We expect our gross margin will be slightly higher in fiscal year 2020 than in fiscal year 2019.

We expect the agriculture industry in China will become increasingly reliant on Internet sales.

Government initiatives such as the concept of “Internet+” articulated by Premier Li Keqiang beginning in 2015, reflect the government’s push to incorporate Internet and other information technology in conventional industries. One of the specific applications of this concept has been “Internet + Agriculture”, which reflects the increased use of technology both in the growing and sales sides of farming.

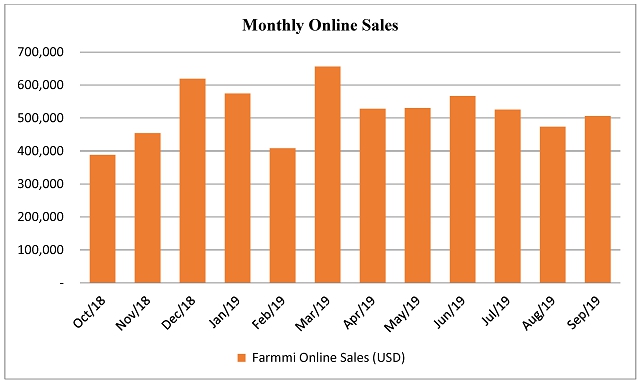

In addition, we have seen shifts of Chinese consumers to purchase products — including food products like ours — online. We have been building our online store Farmmi Liangpin Market (now called Farmmi Jicai) in response to this trend, and this online store mainly targets on small wholesale clients, such as restaurants and retailers. Since its launch in December 2016, our online sales have been increasing rapidly. In September 2018, we started another Farmmi Liangpin Market online store, which mainly facing individual customers and started to generate revenue since October 2018. Besides selling edible mushrooms, this store also sells other agricultural products, such as rice, edible oil and other local specialty food products from different provinces of China.

During the six months ended March 31, 2019, our online sales accounted for 21.53% of our total sales. For the six months ended March 31, 2019, our aggregate online sales were $3,098,425.27, an increase by 415.7% compared with online sales for the same period in 2018, and the average monthly online sales were $516,404. The following chart shows our online sales for each month from October 2018 to March 2019:

8

The online sales during the six months ended March 31, 2019 increased significantly as compared to the same period of last year. Monthly sales in October 2018 and February 2019 were lower mainly due to system maintenance for our online platform during the China National Day and Chinese New Year holiday. Monthly sales in December 2018 and January 2019 was higher mainly attributable to the increased orders we received, as our customers usually purchase more products in advance to prepare for the Chinese New Year. In addition, monthly sales reached to the peak in March 2019, due to the increased customer orders resulted from an online promotion campaign we carried out during the month. And our monthly online sales remained relatively stable from April onwards.

Increased sales to China Forest.

China Forest, one of the biggest edible fungi exporters in China, has been one of our major customers since 2016. Our sales to China Forest for the six months ended March 31, 2019 totaled $9,425,737, a decrease of 12.30% from $10,747,891 for the same period in 2018, mainly due to the decreased sales volume of Shiitake mushroom. Our sales of Shiitake mushroom to China Forest for the six months ended March 31, 2019 totaled 448 tons, a decrease of 7.12% from 482 tons for the same period in 2018. However, the sales orders of Shiitake mushroom from China Forest increased in second half of fiscal year 2019, and total sales orders of Shiitake mushroom in fiscal year 2019 were higher than last year. On the other hand, our sales of Mu Er to China Forest for the six months ended March 31, 2019 were 328 tons, an increase of 3.74% from 316 tons for the same period in 2018.

9

Critical Accounting Policies and Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires the use of estimates and assumptions that affect the reported amounts of assets and liabilities, revenues and expenses, and related disclosures in the financial statements. Critical accounting policies are those accounting policies that may be material due to the levels of subjectivity and judgment necessary to account for highly uncertain matters or the susceptibility of such matters to change, and that have a material impact on financial condition or operating performance. While we base our estimates and judgments on our experience and on various other factors that we believe to be reasonable under the circumstances, actual results may differ from these estimates under different assumptions or conditions. We believe the following critical accounting policies used in the preparation of our financial statements require significant judgments and estimates. For additional information relating to these and other accounting policies, see Note 2 to our unaudited condensed consolidated financial statements included elsewhere in this report.

Use of Estimates

In preparing the consolidated financial statements in conformity with US GAAP, management makes estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the dates of the consolidated financial statements, as well as the reported amounts of revenues and expenses during the reporting year. Significant items subject to such estimates and assumptions include the useful lives of property and equipment; allowances pertaining to the allowance for doubtful accounts and advances to suppliers; the valuation of inventories; the valuation of beneficial conversion feature of the convertible notes; and the valuation of deferred tax assets.

Revenue Recognition

On October 1, 2018, the Company adopted Accounting Standards Update (“ASU”) 2014-09 Revenue from Contracts with Customers (“ASC Topic 606”) using the modified retrospective method for contracts that were not completed as of October 1, 2018. The adoption of this standard did not have a material impact on the Company’s consolidated financial statements, and no adjustments to opening retained earnings were made as the Company’s revenue was recognized based on the amount of consideration expected to be received in exchange for satisfying the performance obligations.

10

ASC 606 requires the use of a new five-step model to recognize revenue from customer contracts. The five-step model requires that the Company (i) identify the contract with the customer, (ii) identify the performance obligations in the contract, (iii) determine the transaction price, including variable consideration to the extent that it is probable that a significant future reversal will not occur, (iv) allocate the transaction price to the respective performance obligations in the contract, and (v) recognize revenue when (or as) the Company satisfies the performance obligation. The application of the five-step model to the revenue streams compared to the prior guidance did not result in significant changes in the way the Company records its revenue. The Company has assessed the impact of the guidance by reviewing its existing customer contracts and current accounting policies and practices to identify differences that will result from applying the new requirements, including the evaluation of its performance obligations, transaction price, customer payments, transfer of control and principal versus agent considerations. All of the Company’s contracts have a single performance obligation satisfied at a point in time and the transaction price is stated in the contract, usually as a price per ton. Based on the assessment, the Company concluded that there was no change to the timing and pattern of revenue recognition for its current revenue streams in scope of Topic 606 and therefore there was no material changes to the Company’s consolidated financial statements upon adoption of ASC 606.

The contract assets and contract liabilities are recorded on the unaudited condensed consolidated balance sheets as accounts receivable and advance from customers as of March 31, 2019 and September 30, 2018. For the six months ended March 31, 2019 and 2018, revenue recognized from performance obligations related to prior periods was insignificant.

Refer to Note 15 — Segment reporting for details of revenue segregation of our Unaudited Condensed Consolidated Financial Statements.

Receivables

Trade receivables are carried at the original invoiced amount less a provision for any potential uncollectible amounts. Provisions are applied to trade receivables where events or changes in circumstances indicate that the balance may not be collectible. The identification of doubtful accounts requires the use of judgment and estimates of management. Our management must make estimates of the collectability of our accounts receivable. Management specifically analyzes accounts receivable, historical bad debts, customer creditworthiness, current economic trends and changes in our customer payment terms when evaluating the adequacy of the allowance for doubtful accounts.

Inventory

The Company values its inventories at the lower of cost, determined on a weighted average basis, or net realizable value. The Company reviews its inventories periodically to determine if any reserves are necessary for potential obsolescence or if the carrying value exceeds net realizable value.

11

Recent accounting pronouncements

In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842). The main objective is to increase transparency and comparability among organizations by recognizing lease assets and lease liabilities on the balance sheet and disclosing key information about leasing arrangements. The ASU is effective for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years, for (1) public business entities, (2) not-for-profit entities that have issued, or are conduit bond obligors for, securities that are traded, listed, or quoted on an exchange or an over-the-counter market, and (3) employee benefit plans that file financial statements with the SEC. For all other entities, the ASU is effective for fiscal years beginning after December 15, 2019, and interim periods within fiscal years beginning after December 15, 2020. Early adoption is permitted for all entities. The Company is currently evaluating the impact of this new standard on its financial statements and related disclosures. The Company has estimated that the adoption of this AUS will not have material impact on the results of the operations and cash flows, however, it may have a material impact on the consolidated balance sheets. As required by this ASU, the Company will record the right of use assets and operating lease liabilities on the consolidated balance sheets.

12

In November 2017, the FASB issued ASU 2017-14, Income Statement—Reporting Comprehensive Income (Topic 220), Revenue Recognition (Topic 605), and Revenue from Contracts with Customers (Topic 606), which amends certain aspects of the new revenue recognition standard. This standard will be effective for fiscal years beginning after December 15, 2018. The Company expects that the adoption of this ASU will not have a material impact on the Company’s unaudited condensed consolidated financial statements.

In February 2018, the FASB issued ASU 2018-02, Income Statement—Reporting Comprehensive Income (Topic 220). The amendments in this update allow a reclassification from accumulated other comprehensive income to retained earnings for stranded tax effects resulting from the Tax Cuts and Jobs Act. Consequently, the amendments eliminate the stranded tax effects resulting from the Tax Cuts and Jobs Act and will improve the usefulness of information reported to financial statement users. However, because the amendments only relate to the reclassification of the income tax effects of the Tax Cuts and Jobs Act, the underlying guidance that requires that the effect of a change in tax laws or rates be included in income from continuing operations is not affected. The amendments in this update also require certain disclosures about stranded tax effects. The guidance is effective for fiscal years beginning after December 15, 2018 with early adoption permitted, including interim periods within those years. The Company expects that the adoption of this ASU would not have a material impact on the Company’s unaudited condensed consolidated financial statements.

13

In August 2018, the FASB issued ASU 2018-13, “Fair Value Measurement (Topic 820): Disclosure Framework – Changes to the Disclosure Requirements for Fair Value Measurement,” to improve the effectiveness of disclosures in the notes to financial statements related to recurring or nonrecurring fair value measurements by removing amounts and reasons for transfers between Level 1 and Level 2 of the fair value hierarchy, the policy for timing of transfers between levels, and the valuation processes for Level 3 fair value measurements. The new standard requires disclosure of the range and weighted average of significant unobservable inputs used to develop Level 3 fair value measurements. The amendments in this update are effective for all entities for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2019. The Company expects that the adoption of this ASU will not have a material impact on the Company’s unaudited condensed consolidated financial statements.

The Company does not believe other recently issued but not yet effective accounting standards, if currently adopted, would have a material effect on the unaudited condensed consolidated financial position, statements of operations and cash flows.

14

Results of Operations for the Six Months Ended March 31, 2019 and 2018

Overview

The following table summarizes our results of operations for the six months ended March 31, 2019 and 2018:

| Six Months Ended March 31 | Variance | |||||||||||||||

| 2019 | 2018 | Amount | % | |||||||||||||

| Revenues | $ | 14,388,187 | $ | 13,020,037 | $ | 1,368,150 | 10.51 | % | ||||||||

| Cost of revenues | 11,845,025 | 10,920,758 | 924,267 | 8.46 | % | |||||||||||

| Gross profit | 2,543,162 | 2,099,279 | 443,883 | 21.14 | % | |||||||||||

| Selling and distribution expenses | 281,213 | 90,684 | 190,529 | 210.10 | % | |||||||||||

| General and administrative expenses | 876,746 | 731,008 | 145,738 | 19.94 | % | |||||||||||

| Income from operations | 1,385,203 | 1,277,587 | 107,616 | 8.42 | % | |||||||||||

| Interest income | 451 | 376 | 75 | 19.95 | % | |||||||||||

| Interest expense | (1,527,302 | ) | (86,138 | ) | (1,441,164 | ) | 1,673.09 | % | ||||||||

| Other income (expense), net | (1,583 | ) | 7,452 | (9,035 | ) | (121.24 | )% | |||||||||

| Income (loss) before income taxes | (143,231 | ) | 1,199,277 | (1,342,508 | ) | (111.94 | )% | |||||||||

| Provision for income taxes | 27,860 | 1,591 | 26,269 | 1,651.10 | % | |||||||||||

| Net income (loss) | $ | (171,091 | ) | $ | 1,197,686 | $ | (1,368,777 | ) | (114.29 | )% | ||||||

15

Revenue

Currently, we have three main types of revenue streams deriving from our three major product categories: Shiitake, Mu Er and other edible fungi and other agricultural products.

The following table sets forth the breakdown of our revenues for the six months ended March 31, 2019 and 2018, respectively:

| Six Months Ended March 31 | Variance | |||||||||||||||||||||||

| 2019 | % | 2018 | % | Amount | % | |||||||||||||||||||

| Shiitake | $ | 8,346,344 | 58.01 | % | $ | 7,972,621 | 61.24 | % | $ | 373,723 | 4.69 | % | ||||||||||||

| Mu Er | 5,167,414 | 35.91 | % | 4,833,461 | 37.12 | % | 333,953 | 6.91 | % | |||||||||||||||

| Other edible fungi and other agricultural products | 874,429 | 6.08 | % | 213,955 | 1.64 | % | 660,474 | 308.70 | % | |||||||||||||||

| Total Amount | $ | 14,388,187 | 100.00 | % | $ | 13,020,037 | 100.00 | % | $ | 1,368,150 | 10.51 | % | ||||||||||||

Total revenues for the six months ended March 31, 2019 increased by $1,368,150, or 10.51%, to $14,388,187 from $13,020,037 for the same period of last year.

Revenue from sales of Shiitake increased by $373,723, or 4.69%, to $8,346,344 for the six months ended March 31, 2019 from $7,972,621 for the same period of last year, mainly due to the increased sales volume of our Shiitake products, from 601 tons for the six months ended March 31, 2018 to 662 tons for the six months ended March 31, 2019, while unit sales price for Shiitake remained stable.

Revenue from sales of Mu Er increased by $333,953, or 6.91%, to $5,167,414 for the six months ended March 31, 2019 from $4,833,461 for the same period of last year, mainly due to the increased sales volume of our Mu Er products. Sales volume of Mu Er increased to 419 tons for the six months ended March 31, 2019 from 351 tons for the same period of last year. The volume increase was partially offset by a lower average selling price. Average unit sales price of Mu Er decreased by 5.51%, which changed in line with the price of raw materials. As a result of the increased competition amongst the local suppliers. the Company was able to purchase raw materials from suppliers at lower prices during the six months ended March 31, 2019.

Revenue from sales of other edible fungi and other agricultural products increased by $660,474, or 308.70%, to $874,429 for the six months ended March 31, 2019 from $213,955 for the same period of last year. The increase was primarily due to the increased online sales of the products, including high-end edible fungi. The sales volume increased to 28 tons for the six months ended March 31, 2019 from 7 tons for the same period of last year. After the completion of software development and payment system upgrades in March 2018, the Company reorganized its operating team to put greater effort into advertising activities in order to enhance brand awareness and attract more customers. As a result, online sales increased significantly in the six months ended March 31, 2019.

16

Cost of Revenue

The following table sets forth the breakdown of the Company’s cost of revenue for the six months ended March 31, 2019 and 2018, respectively:

| Six Months Ended March 31 | Variance | |||||||||||||||||||||||

| 2019 | % | 2018 | % | Amount | % | |||||||||||||||||||

| Shiitake | $ | 6,885,006 | 58.12 | % | $ | 6,697,781 | 61.33 | % | $ | 187,225 | 2.80 | % | ||||||||||||

| Mu Er | 4,295,736 | 36.27 | % | 4,040,814 | 37.00 | % | 254,922 | 6.31 | % | |||||||||||||||

| Other edible fungi and other agricultural products | 664,283 | 5.61 | % | 182,163 | 1.67 | % | 482,120 | 264.66 | % | |||||||||||||||

| Total Amount | $ | 11,845,025 | 100.00 | % | $ | 10,920,758 | 100.00 | % | $ | 924,267 | 8.46 | % | ||||||||||||

Cost of revenues increased by $924,267, or 8.46%, to $11,845,025 for the six months ended March 31, 2019 from $10,920,758 for the same period of last year.

Cost of revenues of Shiitake increased by $187,225 or 2.80%, to $6,885,006 for the six months ended March 31, 2019 from $6,697,781 for the same period of last year. While the purchase volume increased in line with sales, the average unit cost of Shiitake remained stable. Cost of revenues of Mu Er increased by $254,922, or 6.31%, to $4,295,736 for the six months ended March 31, 2019 from $4,040,814 for the same period of last year. As mentioned above,due to the increased competition amongst the local suppliers, we were able to purchase raw materials from suppliers at lower prices. As a result, the average unit cost of Mu Er decreased by 6.07% in the six months ended March 31, 2019 as compared to the same period last year. Cost of revenues of other edible fungi and agricultural products increased by $482,120, or 264.66%, to $664,283 for the six months ended March 31, 2019 from $182,163 for the same period of last year. The percentage of the variance in costs was proportional to the percentage of the variance in sales due to the stable gross margin of our products.

Gross Profit

The following table sets forth the breakdown of the Company’s gross profit for the six months ended March 31, 2019 and 2018, respectively:

| Six Months Ended March 31 | Variance | |||||||||||||||||||||||

| 2019 | % | 2018 | % | Amount | % | |||||||||||||||||||

| Shiitake | $ | 1,461,338 | 57.46 | % | $ | 1,274,840 | 60.73 | % | $ | 186,498 | 14.63 | % | ||||||||||||

| Mu Er | 871,678 | 34.28 | % | 792,647 | 37.76 | % | 79,031 | 9.97 | % | |||||||||||||||

| Other edible fungi and other agricultural products | 210,146 | 8.26 | % | 31,792 | 1.51 | % | 178,354 | 561.00 | % | |||||||||||||||

| Total Amount | $ | 2,543,162 | 100.00 | % | $ | 2,099,279 | 100.00 | % | $ | 443,883 | 21.14 | % | ||||||||||||

17

Overall gross profit increased by $443,883, or 21.14%, to $2,543,162 for the six months ended March 31, 2019 from $2,099,279 for the same period of the last fiscal year. Gross profit from sales of Shiitake increased by $186,498, or 14.63%, to $1,461,338 for the six months ended March 31, 2019 from $1,274,840 for the same period of last year. Gross profit from sales of Mu Er increased by $79,031, or 9.97%, to $871,678 for the six months ended March 31, 2019 from $792,647 for the same period of last year. Gross profit from sales of other edible fungi and agricultural products increased by $178,354, or 561.00%, to $210,146 for the six months ended March 31, 2019 from $31,792 for the same period of last year. The increased gross profit was led by increased sales for the six months of fiscal year 2019 ended March 31, 2019, as compared to the prior period.

Overall gross margin increased by 1.56 percentage points to 17.68% for the six months ended March 31, 2019 from 16.12% for the same period of last year. The increase in overall gross margin was primarily due to more revenue generated from the Company’s online shopping platforms. Sales made through the online shopping platforms have higher gross margin than traditional sales.

Selling and Distribution Expenses

Selling and distribution expenses increased by $190,529, or 210.10%, to $281,213 for the six months ended March 31, 2019 from $90,684 for the same period of last year, primarily due to the increased advertising and marketing expenses as the Company focused on the promotion for the Company’s online platforms, as well as the increased shipping expenses along with the increased sales volume during the six months ended March 31, 2019, as compared to the same period of last year.

General and Administrative Expenses

General and administrative expenses increased by $145,738, or 19.94%, to $876,746 for the six months ended March 31, 2019 from $731,008 for the same period of last year. The increase was primarily attributable to the increased payroll expenses, as the Company expanded its team to support the business growth.

Interest Expense

Interest expense was $1,527,302 for the six months ended March 31, 2019, as compared to $86,138 for the same period of last year. The increase in interest expense was primarily attributable to the amortization of debt issuance costs and interest expense incurred for the senior convertible notes during the six months ended March 31, 2019.

Provision for Income Taxes

For the six months ended March 31, 2019 and 2018, our income tax expense was $27,860 and $1,591, respectively. The low-income tax expense was primarily due to an income tax incentive the Company received from the tax authority of Lishui City. During the six months ended March 31, 2019, FLS Mushroom and Farmmi Food received a temporary income tax break from the local tax authority of Lishui City, for engaging in agricultural industry. Management expects that the Company will continue to enjoy the tax break going forward.

18

A total net income of $1.5 million and $1.7 million was exempt from income tax for the six months ended March 31, 2019 and 2018, respectively. The aggregate amount of our tax holiday was approximately $0.37 million and $0.42 million for the six months ended March 31, 2019 and 2018, respectively. From April 1, 2019 to December 31, 2019, we expect to enjoy the tax exemption for 95% of our taxable income. The summary is below:

| Exempted Net Income | Tax holiday | |||

| October 1, 2015 – September 30, 2016 | RMB 7.8 million (approximately $1.2 million) | RMB 1.87 million (approximately $0.28 million) | ||

| October 1, 2016 – September 30, 2017 | RMB 23.71 million (approximately $3.5 million) | RMB 5.9 million (approximately $0.87 million) | ||

| October 1, 2017 – September 30, 2018 | RMB 25.38 million (approximately $3.9 million) | RMB 6.3 million (approximately $0.97 million) | ||

| October 1, 2018 – March 31, 2019 | RMB 10.19 million (approximately $1.5 million) | RMB 2.5 million (approximately $0.37 million) | ||

| April 1, 2019 – December 31, 2019 | 95% of Taxable Income |

Net Income (loss)

As a result of the factors described above, our net loss was $171,091 for the six months ended March 31, 2019, an increase of $1,368,777 from net income of $1,197,686 for the same period of fiscal year 2018.

Liquidity and Capital Resources

We are a holding company incorporated in the Cayman Islands. We may need dividends and other distributions on equity from our PRC subsidiaries to satisfy our liquidity requirements. Current PRC regulations permit our PRC subsidiaries to pay dividends to us only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, our PRC subsidiaries are required to set aside at least 10% of their respective accumulated profits each year, if any, to fund certain reserve funds until the total amount set aside reaches 50% of their respective registered capital. Our PRC subsidiaries may also allocate a portion of its after-tax profits based on PRC accounting standards to employee welfare and bonus funds at their discretion. These reserves are not distributable as cash dividends.

Further, although instruments governing the current debts incurred by our PRC subsidiaries do not have restrictions on their abilities to pay dividends or make other payments to us, the lender may impose such restriction in the future. As a result, our ability to distribute dividends largely depends on earnings from our PRC subsidiaries and their ability to pay dividends out of earnings. Management believes that our current cash, cash flows provided by operating activities, and access to loans will be sufficient to meet our working capital needs for at least the next 12 months. We intend to continue to carefully execute our growth plans and manage market risk.

19

As of March 31, 2019 and September 30, 2018, we had cash on hand in the amount of $5,338,219 and $4,925,165, respectively. Total current assets as of March 31, 2019 amounted to $30,408,865, an increase of $9,069,231 compared to $21,339,634 at September 30, 2018. The increase in total current assets at March 31, 2019 compared to September 30, 2018 was mainly due to the increase in accounts receivable, net and advance to suppliers. Current liabilities amounted to $8,529,057 at March 31, 2019, in comparison to $2,221,900 at September 30, 2018. This increase of current liabilities was mainly attributable to the increase in convertible notes payable.

Indebtedness. As of March 31, 2019, we incurred $1,490,070 of short-term bank loans and $655,631 of long-term bank loans. Beside these loans, we did not have any finance leases or purchase commitments, guarantees or other material contingent liabilities. In addition, on November 1, 2018, we issued and sold an aggregate of $7.5 million of senior convertible notes due April 1, 2020 and warrants to purchase an aggregate of 800,000 of the Company’s Ordinary Shares.

Off-Balance Sheet Arrangements. We have not entered into any financial guarantees or other commitments to guarantee the payment obligations of any third parties. In addition, we have not entered into any derivative contracts that are indexed to our own shares and classified as shareholders’ equity, or that are not reflected in our consolidated financial statements. Furthermore, we do not have any retained or contingent interest in assets transferred to an unconsolidated entity that serves as credit, liquidity or market risk support to such entity. Moreover, we do not have any variable interest in any unconsolidated entity that we provide financing, liquidity, market risk or credit support to or engages in hedging or research and development services with us.

Capital Resources. The primary drivers and material factors impacting our liquidity and capital resources include our ability to generate sufficient cash flows from our operations and renew commercial bank loans, as well as proceeds from equity and debt financing, to ensure our future growth and expansion plans. On February 21, 2018, we announced the closing of our initial public offering of 1,680,000 ordinary shares at a price to the public of $4.00 per share for a total of $6,720,000 in gross proceeds. As of March 31, 2019, we had total assets of $31.2 million, which includes cash of $5.3 million, accounts receivable of $14.0 million, advance to suppliers of $8.5 million and inventory of $1.9 million, working capital of $21.9 million, and total equity of $22.7 million.

Working Capital. Total working capital as of March 31, 2019 amounted to $21,879,808, compared to $19,117,734 as of September 30, 2018.

Capital Needs. Our capital needs include our daily working capital needs and capital needs to finance the development of our business. We have established effective collection procedures of our accounts receivable, and have been able to realize or receive the refund of the advances to suppliers in the past. Our management believes that income generated from our current operations can satisfy our daily working capital needs over the next 12 months. We may also raise additional capital through public offerings or private placements to finance our business development and to consummate any merger or acquisition, if necessary.

20

Cash Flows

The following table provides detailed information about our net cash flows for the six months ended March 31, 2019 and 2018.

| For the six months ended March 31, | ||||||||

| 2019 | 2018 | |||||||

| Net cash used in operating activities | $ | (5,916,038 | ) | $ | (3,352,025 | ) | ||

| Net cash used in investing activities | (104,110 | ) | (2,782 | ) | ||||

| Net cash provided by financing activities | 6,707,429 | 6,154,135 | ||||||

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | 225,773 | 77,547 | ||||||

| Net increase in cash, cash equivalents and restricted cash | 913,054 | 2,876,875 | ||||||

| Cash, cash equivalents and restricted cash, beginning of period | 5,525,165 | 2,590,539 | ||||||

| Cash, cash equivalents and restricted cash, end of period | $ | 6,438,219 | $ | 5,467,414 | ||||

Operating Activities

Net cash used in operating activities was $5,916,038 for the six months ended March 31, 2019. This was an increase of $2,564,013 compared to net cash used in operating activities of $3,352,025 for the six months ended March 31, 2018. The increase in net cash used in operating activities was primarily attributable to net loss of $171,091, an increase of $5,096,374 in accounts receivable and an increase of $2,437,474 in advances to suppliers.

Investing Activities

For the six months ended March 31, 2019, net cash used in investing activities amounted to $104,110 as compared to net cash used in investing activities of $2,782 for the same period of 2018. The increase of $101,328 was primarily due to an increase of $97,764 in purchase of intangible assets.

Financing Activities

Net cash provided by financing activities amounted to $6,707,429 for the six months ended March 31, 2019, as compared to net cash provided by financing activities of $6,154,135 for the same period in 2018. The increase of $553,294 in net cash provided by financing activities was mainly due to an increase of $7,500,000 in gross proceeds from the issuance of convertible notes, a decrease of $1,147,549 in direct costs disbursed from Initial Public Offering proceeds, partially offset by a decrease of $7,728,000 in gross proceeds from Initial Public Offering in the prior period.

21