discourage a potential investor from seeking to acquire Class A common stock and, as a result, might harm the market price of that Class A common stock.

In addition, pursuant to the provisions set forth in our charter, our bylaws and the Amended and Restated Stockholders Agreement, dated as of November 13, 2018, by and between us and GE, as amended from time to time, the number of individuals who GE is entitled to designate to our board of directors will be reduced from five to one. GE has informed us that it intends for John G. Rice to remain on our board of directors as its designee. Lorenzo Simonelli and W. Geoffrey Beattie are also expected to continue to serve on our board of directors but not as GE designees. GE will continue to be entitled to designate one person for nomination to our board of directors until such time as GE and its affiliates own less than 20% of the voting power of all classes of our outstanding voting stock.

Although, following the completion of this offering, we will no longer be controlled by GE, our success will remain partially dependent on GE through, among other things, our reliance on the long-term agreements and transition services agreements between the Company and GE and the public perception of our affiliation with GE.

Following the completion of this offering, we will no longer be a majority-owned subsidiary of GE, and the separation from GE could adversely affect our business, financial condition and results of operations.

We market many of our products and services using the “GE” brand name and logo. GE has licensed to us the right to use certain “GE” marks in our corporate name and on the products and services of our business in connection with certain oil and gas activities and other discrete oil and gas segments. The agreements granting the rights to use those marks will terminate 90 days after we cease being a majority-owned subsidiary of GE (subject to certainphase-out provisions). As a consequence of such termination, we will be required to remove the “GE” marks from our corporate name, products and services over a prescribed period of time (subject tophase-out provisions). Upon completion of this offering, we intend to change our corporate name to Baker Hughes Company. Following the name change, our Class A common stock will trade on the New York Stock Exchange under the symbol “BKR.”

While the association with GE provides many benefits, including a strong brand, broad research and development capabilities, elevated status with suppliers and customers, and established relationships with regulators, consistent with our planned name change, we intend to rebrand our business and products or pursue alternative marketing strategies, which could adversely affect our ability to attract new customers or maintain existing business relationships with customers, suppliers and other business partners, all of which could have a material adverse effect on our business, financial condition and results of operations.

In addition, following the completion of this offering, we will no longer be a majority-owned subsidiary of GE, which could adversely affect, among other things, our ability to attract and retain customers. We may be required to provide more favorable pricing and other terms to our customers and take other action to maintain our relationship with existing customers and attract new customers, all of which could have a material adverse effect on our business, financial condition and results of operations. The separation from GE has created, and may continue to create, uncertainty among our customers, suppliers, and other business partners. The potential uncertainty due to the separation or other factors may undermine our business and have a material adverse effect on our financial condition and results of operations, and may cause increased volatility and wide price fluctuations in our stock price.

The market price of our Class A common stock could be materially impacted due to the substantial number of shares of our capital stock eligible for sale in this offering and in any future offerings by GE.

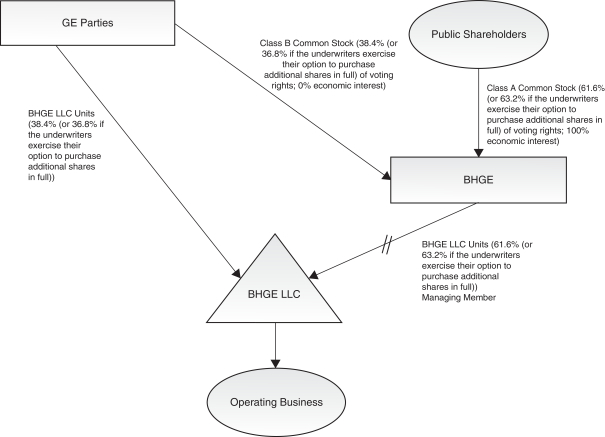

As of September 6, 2019, 516,890,143 shares of our Class A common stock were outstanding (or 1,038,433,238 shares of Class A common stock assuming the full exchange of all outstanding shares of Class B common stock pursuant to the Exchange Agreement). The selling stockholders are offering 115,000,000 shares

S-8