Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:811-23241

AllianzGI Convertible & Income 2024 Target Term Fund

(Exact name of registrant as specified in charter)

1633 Broadway, New York, NY 10019

(Address of principal executive offices) (Zip code)

Scott Whisten – 1633 Broadway, New York, New York 10019

(Name and address of agent for service)

Registrant’s telephone number, including area code:212-739-3367

Date of fiscal year end: February 28

Date of reporting period: February 28, 2019

Table of Contents

Item 1. Report to Shareholders

AllianzGI Convertible & Income 2024 Target Term Fund

AllianzGI Convertible & Income Fund

AllianzGI Convertible & Income Fund II

Annual Report

February 28, 2019

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website (us.allianzgi.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by enrolling at us.allianzgi.com/edelivery.

If you prefer to receive paper copies of your shareholder reports after January 1, 2021, direct investors may inform a Fund at any time. If you invest through a financial intermediary, you should contact your financial intermediary directly. Paper copies are provided free of charge and your election to receive reports in paper will apply to all funds held with the fund complex if you invest directly with a Fund or all funds held in your account if you invest through your financial intermediary.

Table of Contents

Table of Contents

Thomas J. Fuccillo

President & Chief Executive Officer

Dear Shareholder:

The US economic expansion continued during the twelve-month fiscal reporting period ended February 28, 2019. In contrast, economic growth overseas weakened. Over this period, global equities generated mixed results. Meanwhile, the overall US bond market posted a modest gain during the period.

For the 12-month reporting period ended February 28, 2019

| ∎ | AllianzGI Convertible & Income 2024 Target Term Fund returned 4.96% on net asset value (“NAV”) and 3.72% on market price. |

| ∎ | AllianzGI Convertible & Income Fund returned -2.42% on NAV and 2.00% on market price. |

| ∎ | AllianzGI Convertible & Income Fund II returned -2.69% on NAV and 1.14% on market price. |

During the twelve-month period ended February 28, 2019, the Standard & Poor’s (“S&P”) 500 Index, an unmanaged index generally representative of the US stock market, returned 4.68% and the ICE BofA Merrill Lynch High Yield Master II Index, an unmanaged index generally representative of the high yield bond market, returned 4.26%. Convertible securities, which share characteristics of both stocks and bonds, generated even stronger results. The ICE BofA Merrill Lynch All Convertibles All Qualities Index, an unmanaged index generally representative of the convertible securities market, returned 8.33%.

Turning to the US economy, gross domestic product (“GDP”), the value of goods and services produced in the country, which is the broadest measure of economic activity and the principal indicator of economic performance, expanded at a 2.2% annualized pace during the first quarter of 2018. Second quarter 2018 GDP then accelerated to an annual pace of 4.2%, the best reading since the third quarter of 2014. GDP grew at an annual pace of 3.4% during the third quarter of 2018. Finally, the Commerce Department’s initial reading for fourth quarter 2018 GDP growth — released after the reporting period ended — was 2.6%.

After raising interest rates three times in 2017, the US Federal Reserve (the “Fed”) again raised rates at its meetings in March, June, September and December of 2018. The last hike pushed the federal funds rate to a range between 2.25% and 2.50%. The Fed also continued to reduce the size of its balance sheet. At its January 2019 meeting, the Fed indicated that it expected to temper its monetary policy tightening in 2019, although this may change based on incoming economic data.

| 2 | Annual Report | | February 28, 2019 |

Table of Contents

Outlook

Last year was generally a challenging one for investors overall, with poor returns and renewed volatility giving global investors few places to hide, particularly as the year came to a close. The markets seem wary of the growing signs of economic fatigue around the world. Late-cycle fault lines have become more visible: in our view, corporate profit growth may have peaked, fiscal stimulus is waning and central banks are providing less liquidity.

Receive this report electronically and eliminate paper mailings.

To enroll, visit

us.allianzgi.com/edelivery.

We think economic growth around the world is getting patchier and the US is slowing down amid growing fears of a recession. Although the US economy has the potential to deteriorate in 2019, as signaled by a flatter yield curve and weaker housing market, a recession seems unlikely this year. Even if a recession were to happen, we think active investors will still be able to find opportunities by focusing on the fundamentals — including using proprietary research.

Given recent market conditions and concerns about a recession, it is understandable that investors may be nervous that this long but lackluster economic cycle is coming to an end. However, we do not believe it’s finished just yet. So, despite market corrections and volatility, we believe investors should aim to benefit from the long-term power of compounding. In addition, we believe investors should look beyond the immediate news flow and political bluster and instead focus on balance-sheet strengths and other qualities that underpin the sustainability of investments.

On behalf of Allianz Global Investors U.S. LLC, thank you for investing with us. We encourage you to consult with your financial advisor and to visit our website, us.allianzgi.com/closedendfunds, for additional information. We remain dedicated to serving your investment needs.

Sincerely,

|

| Thomas J. Fuccillo |

| President & Chief Executive Officer |

| February 28, 2019 | | Annual Report | 3 |

Table of Contents

AllianzGI Convertible & Income 2024 Target Term Fund / AllianzGI Convertible & Income Fund /AllianzGI Convertible & Income Fund II

February 28, 2019 (unaudited)

AllianzGI Convertible & Income 2024 Target Term Fund

For the period of March 1, 2018 through February 28, 2019, as provided by Douglas G. Forsyth, CFA, Portfolio Manager.

For the twelve-month period ended February 28, 2019, the AllianzGI Convertible & Income 2024 Target Term Fund (the “Fund”) returned 4.96% on net asset value (“NAV”) and 3.72% on market price.

Market Environment

The convertible bond, high-yield bond, and senior secured loan markets produced positive returns over the twelve-month period.

Increased volatility in the fourth quarter of 2018 momentarily disrupted the upward trajectory of risk assets over the twelve month period. After a weak finish to the year the convertible bond, high-yield bond, and senior secured loan markets rebounded sharply in 2019. Factors aiding the recovery included United States and China trade progress, a dovish pivot by the US Federal Reserve (“Fed”) and better-than-feared fourth-quarter financial results.

Against this backdrop, corporate fundamentals continued to improve, with most US companies reporting better-than-expected financial results. In 2018, quarterly earnings growth on a year-over-year basis for the S&P 500 Index averaged more than 20%, according to FactSet Research. Additionally, high-yield credit fundamentals strengthened, continuing a multi-year trend.

The strength of the US economy was supportive of the markets and contrasted overseas slowing. US reports revealed solid growth

throughout the annual period with fourth-quarter GDP growth increasing 2.6% and topping expectations. Unemployment stayed low, industrial production increased and consumer spending was healthy. Not all data were positive; however, auto, housing and semiconductor reports confirmed further easing in these industries.

With the US economy growing above trend, the Fed continued to reduce its balance sheet and, as expected, raised the federal funds rate for a fourth time in 2018 and a ninth time this cycle to a range of 2.25% to 2.50%. The Fed’s posture shifted in the new year, signaling a patient approach toward monetary policy adjustments and indicating balance sheet flexibility.

Portfolio Specifics

The Fund benefited from exposure to convertibles, high-yield bonds and senior secured loans. In addition to providing a positive total return, the Fund also provided a high level of income over the reporting period.

In the convertible bond sleeve, sectors that contributed positively to relative performance were financials, healthcare, and consumer discretionary. On the other hand technology, transportation, and energy sectors pressured relative performance.

In the high-yield bond sleeve, industry exposure that helped relative performance included energy, automotive, and healthcare. Conversely, the financial services, telecommunications, and chemicals industries hindered relative performance.

| 4 | Annual Report | | February 28, 2019 |

Table of Contents

In the senior secured loan sleeve, the top contributing industries included consumer goods, technology & electronics, and retail. The top detracting industries were limited to food & drug retailers and building materials.

Outlook

We believe the US economy and corporate earnings are projected to deliver continued growth in 2019. While some cyclical areas have exhibited weakness, we believe that the overall credit and fundamental profiles of risk assets remain healthy and we believe are not signaling an economic downturn.

We expect US economic activity to slow from above-trend growth to a moderate pace in 2019. Despite some headwinds, we believe that residual impacts of the tax cut, ongoing deregulation efforts and the potential for an infrastructure spending bill support a continuation of economic growth.

The Fed has communicated balance sheet flexibility and a patient approach toward future monetary policy adjustments.

After bottoming in the second quarter of 2016, corporate profits have accelerated through the third quarter of 2018. In 2019, the profit trajectory is still higher, in our view, growth could be less robust given high year-over-year comparisons, US dollar strength and trade uncertainty/tariffs.

AllianzGI Convertible & Income Fund / AllianzGI Convertible & Income Fund II

For the period of March 1, 2018 through February 28, 2019, as provided by Douglas G. Forsyth, CFA, Portfolio Manager.

For the twelve-month period ended February 28, 2019, the AllianzGI Convertible & Income Fund returned-2.42% on net asset value (“NAV”) and 2.00% on market price.

For the twelve-month period ended February 28, 2019, the AllianzGI Convertible & Income Fund II returned-2.69% on NAV and 1.14% on market price.

Market Environment

The convertible and high-yield bond markets produced positive returns over the twelve-month period ended February 28, 2019.

Increased volatility in the fourth quarter of 2018 momentarily disrupted the upward trajectory of risk assets over the twelve month period. After a weak finish to the year the convertible bond and high-yield bond markets rebounded sharply in 2019. Factors aiding the recovery included United States and China trade progress, a dovish pivot by the Fed and better-than-feared fourth-quarter financial results.

Against this backdrop, corporate fundamentals continued to improve, with most US companies reporting better-than-expected financial results. In 2018, quarterly earnings growth on a year-over-year basis for the S&P 500 Index averaged more than 20%, according to FactSet Research. Additionally, high-yield credit fundamentals strengthened, continuing a multi-year trend.

The strength of the US economy was supportive of the markets and contrasted overseas slowing. US reports revealed solid growth throughout the annual period with fourth-quarter GDP growth increasing 2.6% and topping expectations. Unemployment stayed low, industrial production increased and consumer spending was healthy. Not all data were positive; however, auto, housing and semiconductor reports confirmed further easing in these industries.

With the US economy growing above trend, the Fed continued to reduce its balance sheet and, as expected, raised the federal funds rate for a fourth time in 2018 and a ninth time this cycle to a range of 2.25% to 2.50%. The Fed’s posture shifted in the new year, signaling a patient approach toward monetary policy adjustments and indicating balance sheet flexibility.

Portfolio Specifics

The AllianzGI Convertible & Income Fund and the AllianzGI Convertible & Income Fund II achieved their primary goal of providing income over the reporting period.

| February 28, 2019 | | Annual Report | 5 |

Table of Contents

In the convertible sleeve, sectors that contributed positively to relative performance were media and financials. On the other hand, consumer discretionary, technology, and healthcare sectors pressured relative performance.

In the high yield sleeve, industries that aided relative performance were automotive, banking, and metals/miningex-steel. In contrast, financial services, telecommunications, and media services hampered relative performance.

Outlook

We believe the US economy and corporate earnings are projected to deliver continued growth in 2019. While some cyclical areas have exhibited weakness, we believe that the overall credit and fundamental profiles of risk assets remain healthy and we believe are not signaling an economic downturn.

We expect US economic activity to slow from above-trend growth to a moderate pace in 2019. Despite some headwinds, we believe that residual impacts of the tax cut, ongoing deregulation efforts and the potential for an infrastructure spending bill support a continuation of economic growth.

The Fed has communicated balance sheet flexibility and a patient approach toward future monetary policy adjustments.

After bottoming in the second quarter of 2016, corporate profits have accelerated through the third quarter of 2018. In 2019, the profit trajectory is still higher, in our view, growth could be less robust given high year-over-year comparisons, US dollar strength and trade uncertainty/tariffs.

| 6 | Annual Report | | February 28, 2019 |

Table of Contents

AllianzGI Convertible & Income 2024 Target Term Fund

February 28, 2019 (unaudited)

| Total Return(1): | Market Price | NAV | ||||||

1 Year | 3.72% | 4.96% | ||||||

Commencement of Operations (6/30/17) to 2/28/19 | -0.63% | 4.71% | ||||||

| Market Price/NAV Performance: | ||

Commencement of Operations (6/30/17) to 2/28/19

| Market Price/NAV: | ||||

Market Price | $9.00 | |||

NAV(2) | $9.71 | |||

Discount to NAV | -7.31% | |||

Market Price Yield(3) | 6.13% | |||

Leverage(4) | 28.22% | |||

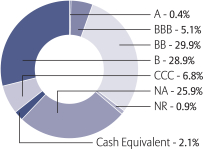

S&P Global Ratings*

(as a % of total investments)

See “Notes to Performance & Statistics” on page 10.

| February 28, 2019 | | Annual Report | 7 |

Table of Contents

Performance & Statistics

AllianzGI Convertible & Income Fund

February 28, 2019 (unaudited)

| Total Return(1): | Market Price | NAV | ||||||

1 Year | 2.00% | -2.42% | ||||||

5 Year | 2.46% | 1.84% | ||||||

10 Year | 18.28% | 15.42% | ||||||

Commencement of Operations (3/31/03) to 2/28/19 | 7.35% | 7.10% | ||||||

| Market Price/NAV Performance: | ||

Commencement of Operations (3/31/03) to 2/28/19

| Market Price/NAV: | ||||

Market Price | $6.24 | |||

NAV(2) | $5.61 | |||

Premium to NAV | 11.23% | |||

Market Price Yield(3) | 8.09% | |||

Leverage(5) | 41.20% | |||

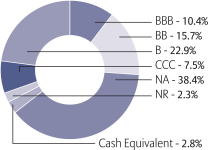

S&P Global Ratings*

(as a % of total investments)

See “Notes to Performance & Statistics” on page 10.

| 8 | Annual Report | | February 28, 2019 |

Table of Contents

Performance & Statistics

AllianzGI Convertible & Income Fund II

February 28, 2019 (unaudited)

| Total Return(1): | Market Price | NAV | ||||||

1 Year | 1.14% | -2.69% | ||||||

5 Year | 0.73% | 1.90% | ||||||

10 Year | 17.91% | 15.63% | ||||||

Commencement of Operations (7/31/03) to 2/28/19 | 6.16% | 6.13% | ||||||

| Market Price/NAV Performance: | ||

Commencement of Operations (7/31/03) to 2/28/19

| Market Price/NAV: | ||||

Market Price | $5.44 | |||

NAV(2) | $5.03 | |||

Premium to NAV | 8.15% | |||

Market Price Yield(3) | 8.25% | |||

Leverage(5) | 41.68% | |||

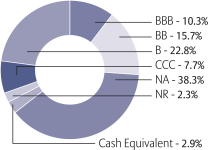

S&P Global Ratings*

(as a % of total investments)

See “Notes to Performance & Statistics” on page 10.

| February 28, 2019 | | Annual Report | 9 |

Table of Contents

Performance and Statistics

AllianzGI Convertible & Income Funds

February 28, 2019 (unaudited)

Notes to Performance & Statistics:

* Credit ratings apply to the underlying holdings of the Funds and not the Funds themselves and are divided into categories ranging from highest to lowest credit quality, determined for purposes of presentations in this report by using ratings provided by S&P Global Ratings (“S&P”). Presentations of credit ratings information in this report use ratings provided by S&P for this purpose, among other reasons, because of the access to background information and other materials provided by S&P, as well as the Funds’ considerations of industry practice. Bonds not rated by S&P, or bonds that do not have a rating available from S&P, or bonds that had a rating withdrawn by S&P are designated as “NR” or “NA”, respectively. Credit quality ratings assigned by a rating agency are subjective opinions, not statements of fact, and are subject to change periodically, even as frequently as daily. Ratings assigned by S&P or another rating agency are not absolute standards of credit quality and do not evaluate market risk. Rating agencies may fail to make timely changes in credit ratings, and an issuer’s current financial condition may be better or worse than a rating indicates. In formulating investment decisions for the Funds, Allianz Global Investors U.S. LLC develops its own analysis of the credit quality and risks associated with individual debt instruments, rather than relying exclusively on rating agencies or third-party research.

(1)Past performance is no guarantee of future results. Total return is calculated by determining the percentage change in NAV or market price (as applicable) in the specified period. The calculation assumes that all dividends and distributions, if any, have been reinvested. Total return does not reflect broker commissions or sales charges in connection with the purchase or sale of Fund shares. Total return for a period of more than one year represents the average annual total return.

Performance at market price will differ from results at NAV. Although market price returns tend to reflect investment results over time, during shorter periods returns at market price can also be influenced by factors such as changing views about the Funds, market conditions, supply and demand for each Fund’s shares, or changes in each Fund’s dividends.

An investment in each Fund involves risk, including the loss of principal. Total return, market price, market price yield and NAV will fluctuate with changes in market conditions. This data is provided for information purposes only and is not intended for trading purposes. Closed-end funds, unlike open-end funds, are not continuously offered. There is a one time public offering and once issued, shares of closed-end funds are traded in the open market through a stock exchange. NAV is equal to total assets attributable to common shareholders less total liabilities divided by the number of common shares outstanding. Holdings are subject to change daily.

(2) The NAV disclosed in the Funds’ financial statements may differ from this NAV due to accounting principles generally accepted in the United States of America.

(3) Market Price Yield is determined by dividing the annualized current (declared March 1, 2019) monthly dividend per common share (comprised of net investment income) by the market price per common share at February 28, 2019.

(4) Represents amounts drawn under the liquidity facility (“Leverage”) outstanding, as a percentage of total managed assets as of February 28, 2019. Total managed assets refer to total assets (including assets attributable to Leverage) minus liabilities (other than liabilities representing Leverage).

(5) Represents Preferred Shares and amounts drawn under the liquidity facility (“Leverage”) outstanding, as a percentage of total managed assets as of February 28, 2019. Total managed assets refer to total assets (including assets attributable to Leverage) minus liabilities (other than liabilities representing Leverage).

| 10 | Annual Report | | February 28, 2019 |

Table of Contents

AllianzGI Convertible & Income 2024 Target Term Fund

February 28, 2019

| Principal Amount (000s) | Value | |||||||||||

| Convertible Bonds & Notes – 52.6% | ||||||||||||

| Biotechnology – 3.5% | ||||||||||||

| $2,000 | Acorda Therapeutics, Inc., 1.75%, 6/15/21 (g) | $1,773,752 | ||||||||||

| 800 | Intercept Pharmaceuticals, Inc., 3.25%, 7/1/23 | 752,049 | ||||||||||

| 3,000 | Ligand Pharmaceuticals, Inc., 0.75%, 5/15/23 (a)(c) | 2,585,493 | ||||||||||

| 1,040 | PTC Therapeutics, Inc., 3.00%, 8/15/22 | 1,061,459 | ||||||||||

| 6,172,753 | ||||||||||||

| Building Materials – 1.5% | ||||||||||||

| 3,000 | Patrick Industries, Inc., 1.00%, 2/1/23 (a)(c)(g) | 2,707,500 | ||||||||||

| Commercial Services – 2.1% | ||||||||||||

| 1,500 | Cardtronics, Inc., 1.00%, 12/1/20 (i) | 1,444,604 | ||||||||||

| 2,500 | Macquarie Infrastructure Corp., 2.00%, 10/1/23 | 2,212,500 | ||||||||||

| 3,657,104 | ||||||||||||

| Computers – 1.1% | ||||||||||||

| 2,300 | Western Digital Corp., 1.50%, 2/1/24 (a)(c)(i) | 2,032,949 | ||||||||||

| Distribution/Wholesale – 1.1% | ||||||||||||

| 2,000 | Titan Machinery, Inc., 3.75%, 5/1/19 | 1,982,468 | ||||||||||

| Diversified Financial Services – 2.7% | ||||||||||||

| 2,000 | Encore Capital Europe Finance Ltd., 4.50%, 9/1/23 | 1,987,486 | ||||||||||

| 3,000 | PRA Group, Inc., 3.00%, 8/1/20 | 2,880,012 | ||||||||||

| 4,867,498 | ||||||||||||

| Electrical Equipment – 1.5% | ||||||||||||

| 3,215 | SunPower Corp., 4.00%, 1/15/23 (i) | 2,590,727 | ||||||||||

| Electronics – 1.1% | ||||||||||||

| 2,000 | OSI Systems, Inc., 1.25%, 9/1/22 | 2,030,000 | ||||||||||

| Energy-Alternate Sources – 3.6% | ||||||||||||

| 1,000 | Green Plains, Inc., 4.125%, 9/1/22 (g) | 933,125 | ||||||||||

| 3,000 | Pattern Energy Group, Inc., 4.00%, 7/15/20 | 2,992,725 | ||||||||||

| 2,500 | Tesla Energy Operations, Inc., 1.625%, 11/1/19 (i) | 2,380,020 | ||||||||||

| 6,305,870 | ||||||||||||

| Engineering & Construction – 1.6% | ||||||||||||

| 1,000 | Dycom Industries, Inc., 0.75%, 9/15/21 (i) | 927,611 | ||||||||||

| 2,000 | Tutor Perini Corp., 2.875%, 6/15/21 | 1,941,122 | ||||||||||

| 2,868,733 | ||||||||||||

| Equity Real Estate Investment Trusts (REITs) – 3.2% | ||||||||||||

| 1,500 | PennyMac Corp., 5.375%, 5/1/20 | 1,490,186 | ||||||||||

| 2,750 | Two Harbors Investment Corp., 6.25%, 1/15/22 | 2,767,685 | ||||||||||

| 1,500 | Western Asset Mortgage Capital Corp., 6.75%, 10/1/22 | 1,425,321 | ||||||||||

| 5,683,192 | ||||||||||||

| Insurance – 1.3% | ||||||||||||

| 2,350 | HCI Group, Inc., 4.25%, 3/1/37 (a) | 2,326,824 | ||||||||||

| Internet – 4.4% | ||||||||||||

| 850 | Boingo Wireless, Inc., 1.00%, 10/1/23 (a)(c) | 749,236 | ||||||||||

| 3,000 | FireEye, Inc., 1.625%, 6/1/35, Ser. B | 2,788,806 | ||||||||||

| 1,500 | Twitter, Inc., 1.00%, 9/15/21 (i) | 1,396,026 | ||||||||||

| 3,000 | Zillow Group, Inc., 1.50%, 7/1/23 (i) | 2,855,412 | ||||||||||

| 7,789,480 | ||||||||||||

| See accompanying Notes to Financial Statements | | February 28, 2019 | | Annual Report | 11 |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income 2024 Target Term Fund

February 28, 2019 (continued)

| Principal Amount (000s) | Value | |||||||||||

| Investment Companies – 4.6% | ||||||||||||

| $2,300 | Goldman Sachs BDC, Inc., 4.50%, 4/1/22 (g) | $2,269,210 | ||||||||||

| Prospect Capital Corp., | ||||||||||||

| 2,875 | 4.95%, 7/15/22 | 2,837,700 | ||||||||||

| 1,465 | 6.375%, 3/1/25 | 1,441,194 | ||||||||||

| 1,500 | TPG Specialty Lending, Inc., 4.50%, 8/1/22 | 1,519,945 | ||||||||||

| 8,068,049 | ||||||||||||

| Media – 1.4% | ||||||||||||

| 3,000 | DISH Network Corp., 2.375%, 3/15/24 (i) | 2,497,383 | ||||||||||

| Oil, Gas & Consumable Fuels – 5.1% | ||||||||||||

| 1,500 | Ensco Jersey Finance Ltd., 3.00%, 1/31/24 (i) | 1,212,193 | ||||||||||

| 2,000 | Helix Energy Solutions Group, Inc., 4.25%, 5/1/22 | 1,975,880 | ||||||||||

| 3,425 | Nabors Industries, Inc., 0.75%, 1/15/24 | 2,411,382 | ||||||||||

| 2,000 | Oasis Petroleum, Inc., 2.625%, 9/15/23 (i) | 1,869,962 | ||||||||||

| 1,650 | PDC Energy, Inc., 1.125%, 9/15/21 (g) | 1,553,237 | ||||||||||

| 9,022,654 | ||||||||||||

| Pharmaceuticals – 1.4% | ||||||||||||

| 2,000 | Dermira, Inc., 3.00%, 5/15/22 | 1,568,750 | ||||||||||

| 1,000 | Jazz Investments I Ltd., 1.50%, 8/15/24 (i) | 968,310 | ||||||||||

| 2,537,060 | ||||||||||||

| Retail – 0.6% | ||||||||||||

| 1,000 | RH, zero coupon, 6/15/23 (a)(c)(i) | 1,015,716 | ||||||||||

| Semiconductors – 3.3% | ||||||||||||

| 1,000 | Cypress Semiconductor Corp., 2.00%, 2/1/23 | 1,031,482 | ||||||||||

| 2,000 | Inphi Corp., 0.75%, 9/1/21 (i) | 2,091,250 | ||||||||||

| 1,750 | Synaptics, Inc., 0.50%, 6/15/22 | 1,612,275 | ||||||||||

| 1,300 | Veeco Instruments, Inc., 2.70%, 1/15/23 (g)(i) | 1,107,829 | ||||||||||

| 5,842,836 | ||||||||||||

| Software – 3.3% | ||||||||||||

| 3,500 | Avaya Holdings Corp., 2.25%, 6/15/23 (a)(c) | 3,097,794 | ||||||||||

| 1,500 | DocuSign, Inc., 0.50%, 9/15/23 (a)(c)(i) | 1,605,000 | ||||||||||

| 1,000 | Envestnet, Inc., 1.75%, 6/1/23 (a)(c)(i) | 1,111,129 | ||||||||||

| 5,813,923 | ||||||||||||

| Telecommunications – 1.1% | ||||||||||||

| 750 | GDS Holdings Ltd., 2.00%, 6/1/25 (a)(c)(i) | 665,129 | ||||||||||

| 1,500 | Infinera Corp., 2.125%, 9/1/24 (i) | 1,265,625 | ||||||||||

| 1,930,754 | ||||||||||||

| Transportation – 3.1% | ||||||||||||

| 2,500 | Air Transport Services Group, Inc., 1.125%, 10/15/24 (i) | 2,518,502 | ||||||||||

| 3,000 | Echo Global Logistics, Inc., 2.50%, 5/1/20 | 2,992,740 | ||||||||||

| 5,511,242 | ||||||||||||

| Total Convertible Bonds & Notes (cost-$94,980,696) | 93,254,715 | |||||||||||

| Corporate Bonds & Notes – 50.4% | ||||||||||||

| Aerospace & Defense – 1.1% | ||||||||||||

| 2,000 | TransDigm, Inc., 6.50%, 7/15/24 (i) | 2,025,000 | ||||||||||

| Auto Components – 0.7% | ||||||||||||

| 1,227 | American Axle & Manufacturing, Inc., 6.625%, 10/15/22 (i) | 1,259,209 | ||||||||||

| 12 | Annual Report | | February 28, 2019 | | See accompanying Notes to Financial Statements |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income 2024 Target Term Fund

February 28, 2019 (continued)

| Principal Amount (000s) | Value | |||||||||||

| Building Materials – 0.6% | ||||||||||||

| $1,000 | Builders FirstSource, Inc., 5.625%, 9/1/24 (a)(c) | $980,000 | ||||||||||

| Chemicals – 0.9% | ||||||||||||

| 1,500 | Chemours Co., 6.625%, 5/15/23 (i) | 1,561,950 | ||||||||||

| Commercial Services – 1.3% | ||||||||||||

| 1,500 | Hertz Corp., 7.625%, 6/1/22 (a)(c)(i) | 1,537,500 | ||||||||||

| 670 | Laureate Education, Inc., 8.25%, 5/1/25 (a)(c)(i) | 726,950 | ||||||||||

| 2,264,450 | ||||||||||||

| Computers – 0.9% | ||||||||||||

| 1,500 | Dell International LLC, 7.125%, 6/15/24 (a)(c)(g)(i) | 1,591,783 | ||||||||||

| Diversified Financial Services – 4.1% | ||||||||||||

| 2,134 | CCF Holdings LLC, PIK 10.75%, 10.75% 12/15/23 (a)(c)(e)(f) | 1,040,092 | ||||||||||

| 2,000 | Community Choice Financial Issuer LLC, 9.00%, 6/15/23 (cost $2,000,000; purchased 9/6/18 ) (a)(c)(h) | 2,002,500 | ||||||||||

| 2,000 | Navient Corp., 7.25%, 9/25/23 (i) | 2,070,000 | ||||||||||

| 2,000 | Springleaf Finance Corp., 8.25%, 10/1/23 | 2,217,500 | ||||||||||

| 7,330,092 | ||||||||||||

| Electric Utilities – 0.6% | ||||||||||||

| 1,000 | NRG Energy, Inc., 6.25%, 5/1/24 (g)(i) | 1,036,050 | ||||||||||

| Engineering & Construction – 0.9% | ||||||||||||

| 1,500 | AECOM, 5.875%, 10/15/24 (i) | 1,577,100 | ||||||||||

| Entertainment – 1.8% | ||||||||||||

| 1,500 | Cedar Fair L.P., 5.375%, 6/1/24 | 1,533,750 | ||||||||||

| 1,500 | International Game Technology PLC, 6.50%, 2/15/25 (a)(c) | 1,603,125 | ||||||||||

| 3,136,875 | ||||||||||||

| Food & Beverage – 0.9% | ||||||||||||

| 1,570 | Albertsons Cos. LLC, 6.625%, 6/15/24 (i) | 1,577,850 | ||||||||||

| Healthcare-Products – 0.8% | ||||||||||||

| 1,500 | Mallinckrodt International Finance S.A., 5.75%, 8/1/22 (a)(c)(i) | 1,417,500 | ||||||||||

| Healthcare-Services – 3.8% | ||||||||||||

| 1,500 | DaVita, Inc., 5.125%, 7/15/24 (i) | 1,488,750 | ||||||||||

| 1,500 | Encompass Health Corp., 5.75%, 11/1/24 | 1,521,075 | ||||||||||

| 1,500 | HCA, Inc., 7.50%, 2/15/22 | 1,648,125 | ||||||||||

| 2,000 | Tenet Healthcare Corp., 8.125%, 4/1/22 (i) | 2,142,500 | ||||||||||

| 6,800,450 | ||||||||||||

| Home Builders – 0.2% | ||||||||||||

| 350 | Lennar Corp., 5.875%, 11/15/24 (i) | 368,813 | ||||||||||

| Internet – 0.9% | ||||||||||||

| 1,500 | Netflix, Inc., 5.875%, 2/15/25 (i) | 1,593,750 | ||||||||||

| Lodging – 1.1% | ||||||||||||

| 2,000 | Wynn Las Vegas LLC, 5.50%, 3/1/25 (a)(c)(i) | 1,998,100 | ||||||||||

| Machinery-Construction & Mining – 1.1% | ||||||||||||

| 2,000 | Terex Corp., 5.625%, 2/1/25 (a)(c) | 1,947,500 | ||||||||||

| Media – 5.4% | ||||||||||||

| 1,500 | CCO Holdings LLC, 5.75%, 1/15/24 (g)(i) | 1,540,312 | ||||||||||

| 1,500 | Clear Channel Worldwide Holdings, Inc., 9.25%, 2/15/24 (a)(c) | 1,576,875 | ||||||||||

| 1,500 | CSC Holdings LLC, 6.75%, 11/15/21 (i) | 1,601,250 | ||||||||||

| See accompanying Notes to Financial Statements | | February 28, 2019 | | Annual Report | 13 |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income 2024 Target Term Fund

February 28, 2019 (continued)

| Principal Amount (000s) | Value | |||||||||||

| Media(continued) | ||||||||||||

| DISH DBS Corp. (i), | ||||||||||||

| $2,000 | 5.875%, 7/15/22 | $1,917,500 | ||||||||||

| 1,000 | 6.75%, 6/1/21 | 1,025,000 | ||||||||||

| 2,000 | Nexstar Broadcasting, Inc., 5.625%, 8/1/24 (a)(c)(i) | 1,990,000 | ||||||||||

| 9,650,937 | ||||||||||||

| Mining – 4.1% | ||||||||||||

| 1,500 | Alcoa Nederland Holding BV, 6.75%, 9/30/24 (a)(c) | 1,591,875 | ||||||||||

| 2,000 | Constellium NV, 6.625%, 3/1/25 (a)(c)(i) | 2,020,000 | ||||||||||

| 2,000 | Hudbay Minerals, Inc., 7.625%, 1/15/25 (a)(c)(i) | 2,082,500 | ||||||||||

| 1,500 | Joseph T. Ryerson & Son, Inc., 11.00%, 5/15/22 (a)(c) | 1,595,625 | ||||||||||

| 7,290,000 | ||||||||||||

| Miscellaneous Manufacturing – 1.0% | ||||||||||||

| 2,000 | Koppers, Inc., 6.00%, 2/15/25 (a)(c)(i) | 1,760,000 | ||||||||||

| Oil, Gas & Consumable Fuels – 5.5% | ||||||||||||

| 2,000 | Callon Petroleum Co., 6.125%, 10/1/24 (i) | 2,025,000 | ||||||||||

| 1,500 | Calumet Specialty Products Partners L.P., 6.50%, 4/15/21 (i) | 1,395,000 | ||||||||||

| 1,500 | Carrizo Oil & Gas, Inc., 6.25%, 4/15/23 (i) | 1,486,875 | ||||||||||

| 1,500 | Chesapeake Energy Corp., 8.00%, 1/15/25 (i) | 1,531,875 | ||||||||||

| 1,535 | CVR Refining LLC, 6.50%, 11/1/22 (g) | 1,573,375 | ||||||||||

| 280 | Noble Holding International Ltd., 7.75%, 1/15/24 (i) | 252,805 | ||||||||||

| 1,500 | Oasis Petroleum, Inc., 6.875%, 3/15/22 (i) | 1,501,875 | ||||||||||

| 9,766,805 | ||||||||||||

| Paper & Forest Products – 1.2% | ||||||||||||

| 2,000 | Mercer International, Inc., 7.375%, 1/15/25 (a)(c) | 2,095,000 | ||||||||||

| Pharmaceuticals – 1.2% | ||||||||||||

| 2,000 | Horizon Pharma USA, Inc., 6.625%, 5/1/23 | 2,070,000 | ||||||||||

| Real Estate – 1.1% | ||||||||||||

| 2,000 | Kennedy-Wilson, Inc., 5.875%, 4/1/24 | 1,977,420 | ||||||||||

| Retail – 1.3% | ||||||||||||

| 2,000 | Conn’s, Inc., 7.25%, 7/15/22 (i) | 1,890,000 | ||||||||||

| 85 | Men’s Wearhouse, Inc., 7.00%, 7/1/22 (i) | 85,637 | ||||||||||

| 370 | Party City Holdings, Inc., 6.625%, 8/1/26 (a)(c) | 365,375 | ||||||||||

| 2,341,012 | ||||||||||||

| Software – 1.4% | ||||||||||||

| 1,500 | Camelot Finance S.A., 7.875%, 10/15/24 (a)(c)(i) | 1,573,515 | ||||||||||

| 1,000 | Rackspace Hosting, Inc., 8.625%, 11/15/24 (a)(c)(i) | 877,500 | ||||||||||

| 2,451,015 | ||||||||||||

| Telecommunications – 5.8% | ||||||||||||

| 2,000 | CenturyLink, Inc., 7.50%, 4/1/24, Ser. Y (i) | 2,120,625 | ||||||||||

| 2,000 | Cincinnati Bell, Inc., 7.00%, 7/15/24 (a)(c)(i) | 1,820,000 | ||||||||||

| 2,000 | Consolidated Communications, Inc., 6.50%, 10/1/22 (i) | 1,875,000 | ||||||||||

| 1,000 | GTT Communications, Inc., 7.875%, 12/31/24 (a)(c)(i) | 867,500 | ||||||||||

| 1,500 | Hughes Satellite Systems Corp., 7.625%, 6/15/21 (i) | 1,612,500 | ||||||||||

| 2,000 | Sprint Corp., 7.125%, 6/15/24 | 2,071,460 | ||||||||||

| 10,367,085 | ||||||||||||

| Transportation – 0.7% | ||||||||||||

| 1,125 | XPO Logistics, Inc., 6.50%, 6/15/22 (a)(c)(i) | 1,148,906 | ||||||||||

| Total Corporate Bonds & Notes (cost-$92,057,417) | 89,384,652 | |||||||||||

| 14 | Annual Report | | February 28, 2019 | | See accompanying Notes to Financial Statements |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income 2024 Target Term Fund

February 28, 2019 (continued)

| Principal Amount (000s) | Value | |||||||||||

| Senior Loans(a)(b) – 32.6% | ||||||||||||

| Aerospace & Defense – 0.8% | ||||||||||||

| $1,496 | TransDigm, Inc., 1 mo. LIBOR + 2.500%, 4.993%, 6/9/23, 2018 Term Loan F | $1,481,014 | ||||||||||

| Automobiles – 0.5% | ||||||||||||

| Winnebago Industries, Inc.,11/8/23, 2017 Term Loan B | ||||||||||||

| 317 | 1 mo. LIBOR + 3.500%, 6.017% | 312,940 | ||||||||||

| 599 | 3 mo. LIBOR + 3.500%, 6.267% | 591,109 | ||||||||||

| 904,049 | ||||||||||||

| Chemicals – 0.5% | ||||||||||||

| 918 | PQ Corporation, 3 mo. LIBOR + 2.500%, 5.244%, 2/8/25, 2018 Term Loan B | 913,817 | ||||||||||

| Commercial Services & Supplies – 0.5% | ||||||||||||

| 945 | Advanced Disposal Services, Inc., 1 Week LIBOR + 2.250%, 4.667%, 11/10/23, Term Loan B3 | 946,024 | ||||||||||

| Communications Equipment – 0.5% | ||||||||||||

| 919 | Plantronics, Inc., 1 mo. LIBOR + 2.500%, 4.993%, 7/2/25, 2018 Term Loan B | 916,776 | ||||||||||

| Computers – 0.8% | ||||||||||||

| 1,496 | Dell International LLC, 1 mo. LIBOR + 2.000%, 4.500%, 9/7/23, 2017 Term Loan B | 1,493,250 | ||||||||||

| Diversified Consumer Services – 1.1% | ||||||||||||

| 1,563 | Laureate Education, Inc., 1 mo. LIBOR + 3.500%, 4/26/24, 2017 Term Loan B (d) | 1,567,352 | ||||||||||

| 396 | ServiceMaster Company, 1 mo. LIBOR + 2.500%, 4.993%, 11/8/23, 2016 Term Loan B | 395,008 | ||||||||||

| 1,962,360 | ||||||||||||

| Diversified Telecommunication Services – 2.0% | ||||||||||||

| 1,496 | CenturyLink, Inc., 1 mo. LIBOR + 2.750%, 5.243%, 1/31/25, 2017 Term Loan B | 1,475,522 | ||||||||||

| 1,000 | Intelsat Jackson Holdings S.A., 1 mo. LIBOR + 3.750, 6.229%, 11/27/23, 2017 Term Loan B3 | 1,001,260 | ||||||||||

| 997 | Sprint Communications, Inc., 1 mo. LIBOR + 2.500, 5.000%, 2/2/24, 1st Lien Term Loan B | 987,073 | ||||||||||

| 3,463,855 | ||||||||||||

| Electrical Equipment – 0.8% | ||||||||||||

| 1,494 | Gates Global LLC, 1 mo. LIBOR + 2.750%, 5.243%, 4/1/24, 2017 USD Repriced Term Loan B | 1,491,429 | ||||||||||

| Entertainment – 1.4% | ||||||||||||

| 1,500 | Formula One, 1 mo. LIBOR + 2.500%, 4.993%, 2/1/24, 2018 USD Term Loan B3 | 1,473,750 | ||||||||||

| 967 | Stars Group Holdings B.V., 3 mo. LIBOR + 3.500%, 6.303%, 7/10/25, 2018 USD Incremental Term Loan | 968,788 | ||||||||||

| 2,442,538 | ||||||||||||

| Food & Staples Retailing – 0.6% | ||||||||||||

| 985 | US Foods, Inc., 1 mo. LIBOR + 2.000%, 4.493%, 6/27/23, 2016 Term Loan B | 980,909 | ||||||||||

| Healthcare-Products – 1.7% | ||||||||||||

| 675 | Greatbatch Ltd., 1 mo. LIBOR + 3.000%, 5.51%, 10/27/22, 2017 1st Lien Term Loan B | 675,829 | ||||||||||

| 1,473 | Mallinckrodt International Finance S.A., 3 mo. LIBOR + 2.750%, 5.553%, 9/24/24, USD Term Loan B | 1,416,497 | ||||||||||

| 985 | Ortho-Clinical Diagnostics SA, 1 mo. LIBOR + 3.250%, 5.752%, 6/30/25, 2018 Term Loan B | 977,012 | ||||||||||

| 3,069,338 | ||||||||||||

| See accompanying Notes to Financial Statements | | February 28, 2019 | | Annual Report | 15 |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income 2024 Target Term Fund

February 28, 2019 (continued)

| Principal Amount (000s) | Value | |||||||||||

| Hotels, Restaurants & Leisure – 4.4% | ||||||||||||

| $990 | 1011778 B.C. Unlimited Liability Company, 1 mo. LIBOR + 2.250%, 4.743%, 2/16/24, Term Loan B3 | $983,579 | ||||||||||

| 995 | AP Gaming I, LLC, 1 mo. LIBOR + 3.500%, 5.993%, 2/15/24, 2018 Incremental Term Loan | 994,981 | ||||||||||

| 915 | Boyd Gaming Corporation, 1 Week LIBOR + 2.250%, 4.664%, 9/15/23, Term Loan B3 | 912,481 | ||||||||||

| 990 | Golden Entertainment, Inc., 1 mo. LIBOR + 3.000%, 5.500%, 10/21/24, 2017 1st Lien Term Loan | 985,050 | ||||||||||

| 985 | Playa Resorts Holding B.V., 1 mo. LIBOR + 2.750%, 5.240%, 4/29/24, 2017 Term Loan B | 965,729 | ||||||||||

| Scientific Games International, Inc., 8/14/24, 2018 Term Loan B5 | ||||||||||||

| 796 | 2 mo. LIBOR + 2.750%, 5.329% | 790,681 | ||||||||||

| 194 | 1 mo. LIBOR + 2.750%, 5.243% | 192,269 | ||||||||||

| 997 | SeaWorld Parks & Entertainment, Inc., 1 mo. LIBOR + 3.000%, 5.493%, 3/31/24, Term Loan B5 | 991,941 | ||||||||||

| 985 | Travelport Finance (Luxembourg) S.a.r.l., 3 mo. LIBOR + 2.500%, 5.184%, 3/17/25, 2018 Term Loan B | 985,727 | ||||||||||

| 7,802,438 | ||||||||||||

| Internet – 1.1% | ||||||||||||

| 985 | Everi Payments, Inc., 1 mo. LIBOR + 3.000%, 5.493%, 5/9/24, Term Loan B | 982,538 | ||||||||||

| 995 | Go Daddy Operating Company, LLC, 1 mo. LIBOR + 2.250%, 4.743%, 2/15/24, 2017 Repriced Term Loan | 994,327 | ||||||||||

| 1,976,865 | ||||||||||||

| Internet Software & Services – 1.6% | ||||||||||||

| 747 | Blucora, Inc., 1 mo. LIBOR + 3.000%, 5.493%, 5/22/24, 2017 Term Loan B | 745,694 | ||||||||||

| EIG Investors Corp., 2/9/23, 2018 1st Lien Term Loan | ||||||||||||

| 6 | 1 mo. LIBOR + 3.750%, 6.229%, 2/9/23 | 6,032 | ||||||||||

| 1,145 | 3 mo. LIBOR + 3.750%, 6.389%, 2/9/23 | 1,142,811 | ||||||||||

| 1,000 | Match Group Inc., 2 mo. LIBOR + 2.500%, 5.090%, 11/16/22, 2017 Term Loan B | 998,755 | ||||||||||

| 2,893,292 | ||||||||||||

| IT Services – 1.1% | ||||||||||||

| 923 | First Data Corporation, 1 mo. LIBOR + 2.000%, 4.490%, 4/26/24, 2024 USD Term Loan | 922,802 | ||||||||||

| 1,000 | Xerox Business Services LLC, 1 mo. LIBOR + 2.500%, 4.993%, 12/7/23, USD Term Loan B | 991,670 | ||||||||||

| 1,914,472 | ||||||||||||

| Leisure Time – 0.6% | ||||||||||||

| 995 | Sabre GLBL, Inc., 1 mo. LIBOR + 2.000%, 4.493%, 2/22/24, 2018 Term Loan B | 993,656 | ||||||||||

| Lodging – 0.9% | ||||||||||||

| 1,500 | Caesars Resort Collection, LLC, 1 mo. LIBOR + 2.750%, 5.243%, 12/22/24, 2017 1st Lien Term Loan B | 1,497,660 | ||||||||||

| Machinery – 2.3% | ||||||||||||

| 1,670 | Gardner Denver, Inc., 1 mo. LIBOR + 2.750%, 5.243%, 7/30/24, 2017 USD Term Loan B | 1,671,456 | ||||||||||

| 990 | Harsco Corporation, 1 mo. LIBOR + 2.250%, 4.750%, 12/6/24, 2017 Term Loan B1 | 988,786 | ||||||||||

| 1,496 | Navistar International Corporation, 1 mo. LIBOR + 3.500%, 6.020%, 11/6/24, 2017 1st Lien Term Loan B | 1,494,980 | ||||||||||

| 4,155,222 | ||||||||||||

| 16 | Annual Report | | February 28, 2019 | | See accompanying Notes to Financial Statements |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income 2024 Target Term Fund

February 28, 2019 (continued)

| Principal Amount (000s) | Value | |||||||||||

| Media – 3.3% | ||||||||||||

| $932 | Gray Television, Inc., 1 mo. LIBOR + 2.250%, 4.764%, 2/7/24, 2017 Term Loan B | $928,361 | ||||||||||

| 993 | Lions Gate Capital Holdings LLC, 1 mo. LIBOR + 2.250%, 4.743%, 3/24/25, 2018 Term Loan B | 990,024 | ||||||||||

| 1,469 | Meredith Corporation, 1 mo. LIBOR + 2.750%, 1/31/25, 2018 Term Loan B (d) | 1,472,106 | ||||||||||

| 997 | Sinclair Television Group Inc., 1 mo. LIBOR + 2.250%, 4.75%, 1/3/24, Term Loan B2 | 995,376 | ||||||||||

| 1,497 | WideOpenWest Finance LLC, 1 mo. LIBOR + 3.250%, 5.731%, 8/18/23, 2017 Term Loan B | 1,478,292 | ||||||||||

| 5,864,159 | ||||||||||||

| Pharmaceuticals – 1.9% | ||||||||||||

| 1,494 | Endo International PLC, 1 mo. LIBOR + 4.250%, 6.750%, 4/29/24, 2017 Term Loan B | 1,498,508 | ||||||||||

| 998 | HLF Financing S.a r.l., 1 mo. LIBOR + 3.250%, 5.743%, 8/18/25, 2018 Term Loan B | 1,000,827 | ||||||||||

| 893 | Lannett Company, Inc., 1 mo. LIBOR + 5.375%, 7.868%, 11/25/22, Term Loan B | 827,199 | ||||||||||

| 3,326,534 | ||||||||||||

| Road & Rail – 0.5% | ||||||||||||

| 868 | YRC Worldwide, Inc., 3 mo. LIBOR + 8.500%, 11.244%, 7/24/22, 2017 Term Loan | 852,348 | ||||||||||

| Specialty Retail – 2.5% | ||||||||||||

| 992 | At Home Holding III Inc., 3 mo. LIBOR + 3.500%, 6.244%, 6/3/22, Term Loan | 977,384 | ||||||||||

| 861 | Burlington Coat Factory Warehouse Corporation, 1 mo. LIBOR + 2.000%, 4.490%, 11/17/24, 2017 Term Loan B5 | 858,917 | ||||||||||

| 990 | Men’s Wearhouse, Inc., 1 mo. LIBOR + 3.250%, 5.759%, 4/9/25, 2018 Term Loan B2 | 987,525 | ||||||||||

| 639 | National Vision, Inc., 1 mo. LIBOR + 2.500%, 4.993%, 11/20/24, 2017 Repriced Term Loan | 638,055 | ||||||||||

| 992 | Party City Holdings Inc., 1 mo. LIBOR + 2.500, 5.000%, 8/19/22, 2018 Term Loan B | 991,351 | ||||||||||

| 4,453,232 | ||||||||||||

| Telecommunications – 0.6% | ||||||||||||

| 995 | SBA Senior Finance II LLC, 1 mo. LIBOR + 2.000%, 4.500%, 4/11/25, 2018 Term Loan B | 987,030 | ||||||||||

| Textiles, Apparel & Luxury Goods – 0.6% | ||||||||||||

| 1,129 | G-III Apparel Group, Ltd., 1 mo. LIBOR + 5.250%, 7.750%, 12/1/22, Term Loan B | 1,135,625 | ||||||||||

| Total Senior Loans (cost-$57,859,772) | 57,917,892 | |||||||||||

| Shares | ||||||||||||

| Common Stock(e)(f)(h)(j) – 0.0% | ||||||||||||

| Banks – 0.0% | ||||||||||||

| 6,549 | CCF Holdings LLC Class A (cost-$0; purchased 12/18/18) | – | * | |||||||||

| 7,142 | CCF Holdings LLC Class B (k) (cost-$0; purchased 12/12/18) | 1 | ||||||||||

| Total Common Stock (cost-$0) | 1 | |||||||||||

| See accompanying Notes to Financial Statements | | February 28, 2019 | | Annual Report | 17 |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income 2024 Target Term Fund

February 28, 2019 (continued)

| Principal Amount (000s) | Value | |||||||||||

| Repurchase Agreements – 3.0% | ||||||||||||

| $5,273 | State Street Bank and Trust Co., dated 2/28/19, 0.50%, due 3/1/19, proceeds $5,273,073; collateralized by U.S. Treasury Notes, 2.50%, due 1/15/22, valued at $5,383,402 including accrued interest (cost-$5,273,000) | $5,273,000 | ||||||||||

| Total Investments(cost-$250,170,885) – 138.6% | 245,830,260 | |||||||||||

| Liabilities in excess of other assets – (38.6)% | (68,511,104 | ) | ||||||||||

| Net Assets – 100.0% | $177,319,156 | |||||||||||

Notes to Schedule of Investments:

| * | Actual amount rounds to less than $1. |

| (a) | Private Placement–Restricted as to resale and may not have a readily available market. Securities with an aggregate value of $112,024,383, representing 63.2% of net assets. |

| (b) | These securities generally pay interest at rates which are periodicallypre-determined by reference to a base lending rate plus a premium. These base lending rates are generally either the lending rate offered by one or more major European banks, such as the “LIBOR” or the prime rate offered by one or more major United States banks, or the certificate of deposit rate. These securities are generally considered to be restricted as the Fund is ordinarily contractually obligated to receive approval from the Agent bank and/or borrower prior to disposition. Remaining maturities of senior loans may be less than the stated maturities shown as a result of contractual or optional payments by the borrower. Such prepayments cannot be predicted with certainty. The interest rate disclosed reflects the rate in effect on February 28, 2019. |

| (c) | 144A–Exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, typically only to qualified institutional buyers. Securities with an aggregate value of $51,779,667, representing 29.2% of net assets. |

| (d) | When-issued or delayed-delivery. To be settled/delivered after February 28, 2019. |

| (e) | Fair-Valued–Securities with an aggregate value of $1,040,093, representing 0.6% of net assets. See Note 1(a) and Note 1(b) in the Notes to Financial Statements. |

| (f) | Level 3 security. See Note 1(a) and Note 1(b) in the Notes to Financial Statements. |

| (g) | All or partial amount segregated for the benefit of the counterparty as collateral for long-term and short-term loan financing. |

| (h) | Restricted. The aggregate cost of such security is $2,000,000. The aggregate value is $2,002,501, representing 1.1% of net assets. |

| (i) | All or a portion of this security is on loan pursuant to the Liquidity Facility (see Note 8). The aggregate value of securities on loan is $60,040,590. |

| (j) | Non-income producing. |

| (k) | Affiliated security. (See Note 9) |

| (l) | Fair Value Measurements–See Note 1(b) in the Notes to Financial Statements. |

| Level 1 – Quoted Prices | Level 2 – Other Significant Observable Inputs | Level 3 – Significant Unobservable Inputs | Value at 2/28/19 | |||||||||||||

Investments in Securities – Assets | ||||||||||||||||

Convertible Bonds & Notes | $ | – | $93,254,715 | $ | – | $93,254,715 | ||||||||||

Corporate Bonds & Notes: | ||||||||||||||||

Diversified Financial Services | – | 6,290,000 | 1,040,092 | 7,330,092 | ||||||||||||

All Other | – | 82,054,560 | – | 82,054,560 | ||||||||||||

Senior Loans | – | 57,917,892 | – | 57,917,892 | ||||||||||||

Common Stock | – | – | 1 | 1 | ||||||||||||

Repurchase Agreements | – | 5,273,000 | – | 5,273,000 | ||||||||||||

Totals | $ | – | $ | 244,790,167 | $ | 1,040,093 | $ | 245,830,260 | ||||||||

| 18 | Annual Report | | February 28, 2019 | | See accompanying Notes to Financial Statements |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income 2024 Target Term Fund

February 28, 2019 (continued)

A roll forward of fair value measurements using significant unobservable inputs (Level 3) for the year ended February 28, 2019, was as follows:

| Beginning Balance 2/28/18 | Purchases | Sales | Accrued Discount (Premiums) | Net Realized Gain (Loss) | ||||||||||||||||

Investments in Securities – Assets | ||||||||||||||||||||

Corporate Bonds & Notes: | ||||||||||||||||||||

Diversified Financial Services | $ – | $1,967,735 | † | $ – | $4,956 | $ – | ||||||||||||||

Common Stock: | ||||||||||||||||||||

Banks | – | – | † | – | – | – | ||||||||||||||

Totals | $ – | $1,967,735 | $ – | $4,956 | $ – | |||||||||||||||

| Net Change in Unrealized Appreciation/ Depreciation | Transfers into Level 3 | Transfers out of Level 3 | Ending Balance 2/28/19 | |||||||||||||

Investments in Securities – Assets | ||||||||||||||||

Corporate Bonds & Notes: | ||||||||||||||||

Diversified Financial Services | $(932,599 | ) | $ – | $ – | $1,040,092 | |||||||||||

Common Stock: | ||||||||||||||||

Banks | 1 | – | – | 1 | ||||||||||||

Totals | $(932,598 | ) | $ – | $ – | $1,040,093 | |||||||||||

| † | Issued via corporate actions. |

The table above may include Level 3 investments that are valued by brokers or independent pricing services. The inputs for these investments are not readily available or cannot be reasonably estimated and are generally those inputs described in Note 1(b).

The following table presents additional information about valuation techniques and inputs used for investments that are measured at fair value and categorized within Level 3 at February 28, 2019:

| Ending Balance 2/28/19 | Valuation Technique Used | Unobservable Inputs | Input Values (Range) | |||||||

Investments in Securities – Assets | ||||||||||

Corporate Bonds & Notes: | ||||||||||

Diversified Financial Services | $1,040,092 | Market and Company Comparables | Implied Price | $48.74 | ||||||

The net change in unrealized appreciation/depreciation of Level 3 investments held at February 28, 2019, was $(932,598). Net change in unrealized appreciation/depreciation is reflected on the Statements of Operations.

Glossary:

| LIBOR | - | London Inter-Bank Offered Rate | ||

| PIK | - | Payment-in-Kind | ||

| REIT | - | Real Estate Investment Trust |

| See accompanying Notes to Financial Statements | | February 28, 2019 | | Annual Report | 19 |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income Fund

February 28, 2019

| Principal Amount (000s) | Value | |||||||||||

| Corporate Bonds & Notes – 37.3% | ||||||||||||

| Aerospace & Defense – 1.0% | ||||||||||||

| $6,975 | TransDigm, Inc., 6.50%, 5/15/25 | $6,975,000 | ||||||||||

| 1,725 | Triumph Group, Inc., 7.75%, 8/15/25 (m) | 1,658,156 | ||||||||||

| 8,633,156 | ||||||||||||

| Auto Components – 0.3% | ||||||||||||

| 2,445 | Goodyear Tire & Rubber Co., 5.00%, 5/31/26 (m) | 2,328,863 | ||||||||||

| Auto Manufacturers – 1.1% | ||||||||||||

| 6,135 | Navistar International Corp., 6.625%, 11/1/25 (a)(b) | 6,356,044 | ||||||||||

| 3,110 | Tesla, Inc., 5.30%, 8/15/25 (a)(b) | 2,779,563 | ||||||||||

| 9,135,607 | ||||||||||||

| Chemicals – 2.3% | ||||||||||||

| 7,500 | Chemours Co., 6.625%, 5/15/23 | 7,809,750 | ||||||||||

| 4,790 | Kraton Polymers LLC, 7.00%, 4/15/25 (a)(b)(m) | 4,867,837 | ||||||||||

| 1,910 | Olin Corp., 5.00%, 2/1/30 | 1,862,250 | ||||||||||

| 5,470 | Tronox, Inc., 6.50%, 4/15/26 (a)(b)(m) | 5,196,500 | ||||||||||

| 19,736,337 | ||||||||||||

| Commercial Services – 1.0% | ||||||||||||

| 8,050 | Cenveo Corp., 6.00%, 5/15/24, (cost-$8,681,747; purchased 3/22/12) (a)(b)(d)(e)(g)(j) | 442,750 | ||||||||||

| 2,540 | Hertz Corp., 7.625%, 6/1/22 (a)(b) | 2,603,500 | ||||||||||

| 3,465 | Laureate Education, Inc., 8.25%, 5/1/25 (a)(b) | 3,759,525 | ||||||||||

| 1,655 | United Rentals North America, Inc., 5.50%, 7/15/25 | 1,696,375 | ||||||||||

| 8,502,150 | ||||||||||||

| Computers – 1.5% | ||||||||||||

| 5,321 | DynCorp International, Inc., PIK 1.50%, 11.875%, 11/30/20 | 5,480,284 | ||||||||||

| 7,180 | Harland Clarke Holdings Corp., 9.25%, 3/1/21 (a)(b)(m) | 7,144,100 | ||||||||||

| 12,624,384 | ||||||||||||

| Distribution/Wholesale – 0.6% | ||||||||||||

| 5,380 | H&E Equipment Services, Inc., 5.625%, 9/1/25 | 5,346,375 | ||||||||||

| Diversified Financial Services – 3.3% | ||||||||||||

| 18,455 | CCF Holdings LLC, PIK 10.75%, 10.75%, 12/15/23 (a)(b)(e)(g) | 8,995,841 | ||||||||||

| 6,000 | Community Choice Financial Issuer LLC, 9.00%, 6/15/23, (cost-$6,000,000; purchased 9/6/18) (a)(b)(j) | 6,007,500 | ||||||||||

| 4,405 | Navient Corp., 7.25%, 9/25/23 (h) | 4,559,175 | ||||||||||

| 4,935 | Springleaf Finance Corp., 8.25%, 10/1/23 | 5,471,681 | ||||||||||

| 2,820 | Travelport Corporate Finance PLC, 6.00%, 3/15/26 (a)(b) | 3,006,825 | ||||||||||

| 28,041,022 | ||||||||||||

| Electric Utilities – 0.6% | ||||||||||||

| 4,920 | NRG Energy, Inc., 6.25%, 5/1/24 | 5,097,366 | ||||||||||

| Electrical Equipment – 0.3% | ||||||||||||

| 2,260 | Energizer Holdings, Inc., 7.75%, 1/15/27 (a)(b)(m) | 2,415,375 | ||||||||||

| Engineering & Construction – 0.9% | ||||||||||||

| 2,835 | AECOM, 5.125%, 3/15/27 | 2,703,881 | ||||||||||

| 5,100 | Tutor Perini Corp., 6.875%, 5/1/25 (a)(b)(m) | 5,074,500 | ||||||||||

| 7,778,381 | ||||||||||||

| 20 | Annual Report | | February 28, 2019 | | See accompanying Notes to Financial Statements |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income Fund

February 28, 2019 (continued)

| Principal Amount (000s) | Value | |||||||||||

| Entertainment – 1.8% | ||||||||||||

| $4,990 | AMC Entertainment Holdings, Inc., 6.125%, 5/15/27 (m) | $4,497,237 | ||||||||||

| 4,000 | Cedar Fair L.P., 5.375%, 6/1/24 | 4,090,000 | ||||||||||

| 3,275 | Eldorado Resorts, Inc., 6.00%, 9/15/26 (a)(b) | 3,348,688 | ||||||||||

| 1,975 | International Game Technology PLC, 6.25%, 1/15/27 (a)(b) | 2,060,172 | ||||||||||

| 1,015 | Stars Group Holdings BV, 7.00%, 7/15/26 (a)(b) | 1,041,197 | ||||||||||

| 15,037,294 | ||||||||||||

| Food & Beverage – 0.2% | ||||||||||||

| 1,525 | Albertsons Cos. LLC, 7.50%, 3/15/26 (a)(b) | 1,578,375 | ||||||||||

| Healthcare-Products – 0.4% | ||||||||||||

| 3,595 | Mallinckrodt International Finance S.A., 5.75%, 8/1/22 (a)(b)(m) | 3,397,275 | ||||||||||

| Healthcare-Services – 2.3% | ||||||||||||

| 2,460 | Centene Corp., 5.375%, 6/1/26 (a)(b) | 2,558,400 | ||||||||||

| 2,835 | Community Health Systems, Inc., 6.25%, 3/31/23 | 2,739,319 | ||||||||||

| 5,430 | DaVita, Inc., 5.125%, 7/15/24 | 5,389,275 | ||||||||||

| 1,730 | Encompass Health Corp., 5.75%, 11/1/24 | 1,754,306 | ||||||||||

| 3,800 | HCA, Inc., 7.50%, 2/15/22 (m) | 4,175,250 | ||||||||||

| 3,500 | Tenet Healthcare Corp., 7.00%, 8/1/25 (m) | 3,521,875 | ||||||||||

| 20,138,425 | ||||||||||||

| Home Builders – 0.3% | ||||||||||||

| 2,285 | Beazer Homes USA, Inc., 8.75%, 3/15/22 | 2,379,256 | ||||||||||

| Insurance – 0.5% | ||||||||||||

| 4,390 | Prudential Financial, Inc., 5.70%, 9/15/48 (converts to FRN on 9/15/28) | 4,341,161 | ||||||||||

| Internet – 0.3% | ||||||||||||

| 2,800 | Netflix, Inc., 5.875%, 2/15/25 (m) | 2,975,000 | ||||||||||

| Iron/Steel – 0.3% | ||||||||||||

| 2,835 | United States Steel Corp., 6.875%, 8/15/25 (m) | 2,806,650 | ||||||||||

| Lodging – 0.5% | ||||||||||||

| 1,300 | Wyndham Hotels & Resorts, Inc., 5.375%, 4/15/26 (a)(b) | 1,321,645 | ||||||||||

| 2,975 | Wynn Las Vegas LLC, 5.50%, 3/1/25 (a)(b) | 2,972,174 | ||||||||||

| 4,293,819 | ||||||||||||

| Machinery-Construction & Mining – 0.5% | ||||||||||||

| 4,695 | Terex Corp., 5.625%, 2/1/25 (a)(b) | 4,571,756 | ||||||||||

| Media – 2.1% | ||||||||||||

| 7,370 | Cablevision Systems Corp., 8.00%, 4/15/20 | 7,740,711 | ||||||||||

| 3,035 | CSC Holdings LLC, 7.75%, 7/15/25 (a)(b)(m) | 3,247,450 | ||||||||||

| 3,740 | Gray Television, Inc., 5.875%, 7/15/26 (a)(b) | 3,786,750 | ||||||||||

| 4,671 | LiveStyle, Inc., 9.625%, 2/1/19, (cost-$4,667,935;purchased 5/7/14-2/26/15) (a)(b)(d)(e)(g)(j)(l) | 5 | ||||||||||

| 2,810 | Meredith Corp., 6.875%, 2/1/26 (c)(m) | 2,916,218 | ||||||||||

| 17,691,134 | ||||||||||||

| Metal Fabricate/Hardware – 0.4% | ||||||||||||

| 3,830 | Park-Ohio Industries, Inc., 6.625%, 4/15/27 | 3,782,125 | ||||||||||

| Mining – 1.4% | ||||||||||||

| 1,135 | Alcoa Nederland Holding BV, 6.125%, 5/15/28 (a)(b) | 1,164,794 | ||||||||||

| 4,405 | Constellium NV, 6.625%, 3/1/25 (a)(b)(m) | 4,449,050 | ||||||||||

| 2,485 | Hudbay Minerals, Inc., 7.625%, 1/15/25 (a)(b) | 2,587,506 | ||||||||||

| 3,950 | Joseph T. Ryerson & Son, Inc., 11.00%, 5/15/22 (a)(b) | 4,201,813 | ||||||||||

| 12,403,163 | ||||||||||||

| See accompanying Notes to Financial Statements | | February 28, 2019 | | Annual Report | 21 |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income Fund

February 28, 2019 (continued)

| Principal Amount (000s) | Value | |||||||||||

| Miscellaneous Manufacturing – 0.3% | ||||||||||||

| $2,945 | Koppers, Inc., 6.00%, 2/15/25 (a)(b) | $2,591,600 | ||||||||||

| Oil, Gas & Consumable Fuels – 3.3% | ||||||||||||

| 2,700 | Calumet Specialty Products Partners L.P., 6.50%, 4/15/21 (m) | 2,511,000 | ||||||||||

| 1,900 | Carrizo Oil & Gas, Inc., 6.25%, 4/15/23 (h)(m) | 1,883,375 | ||||||||||

| 3,265 | Chesapeake Energy Corp., 8.00%, 1/15/25 (h)(m) | 3,334,381 | ||||||||||

| Ensco PLC, | ||||||||||||

| 590 | 5.20%, 3/15/25 | 455,775 | ||||||||||

| 4,660 | 7.75%, 2/1/26 | 3,926,050 | ||||||||||

| 2,835 | NGL Energy Partners L.P., 7.50%, 11/1/23 | 2,937,769 | ||||||||||

| 2,740 | Noble Holding International Ltd., 7.75%, 1/15/24 (m) | 2,473,877 | ||||||||||

| 4,895 | Oasis Petroleum, Inc., 6.875%, 3/15/22 | 4,901,119 | ||||||||||

| 3,370 | Transocean, Inc., 7.50%, 1/15/26 (a)(b) | 3,268,900 | ||||||||||

| 2,285 | USA Compression Partners L.P., 6.875%, 9/1/27 (a)(b) | 2,333,556 | ||||||||||

| 28,025,802 | ||||||||||||

| Paper & Forest Products – 0.2% | ||||||||||||

| 1,775 | Mercer International, Inc., 7.375%, 1/15/25 (a)(b) | 1,859,313 | ||||||||||

| Pharmaceuticals – 1.7% | ||||||||||||

| 1,610 | Bausch Health Americas, Inc., 8.50%, 1/31/27 (a)(b) | 1,671,381 | ||||||||||

| Bausch Health Cos., Inc. (a)(b), | ||||||||||||

| 3,395 | 6.125%, 4/15/25 (m) | 3,276,175 | ||||||||||

| 1,675 | 7.00%, 3/15/24 | 1,769,219 | ||||||||||

| 2,290 | Endo Finance LLC, 5.375%, 1/15/23 (a)(b) | 1,912,150 | ||||||||||

| 5,865 | Horizon Pharma USA, Inc., 6.625%, 5/1/23 | 6,070,275 | ||||||||||

| 14,699,200 | ||||||||||||

| Pipelines – 0.5% | ||||||||||||

| 2,310 | Energy Transfer L.P., 5.50%, 6/1/27 | 2,431,275 | ||||||||||

| Targa Resources Partners L.P. (a)(b), | ||||||||||||

| 980 | 6.50%, 7/15/27 (h) | 1,038,800 | ||||||||||

| 1,070 | 6.875%, 1/15/29 | 1,141,556 | ||||||||||

| 4,611,631 | ||||||||||||

| Real Estate – 0.6% | ||||||||||||

| 5,505 | Kennedy-Wilson, Inc., 5.875%, 4/1/24 | 5,442,849 | ||||||||||

| Retail – 1.0% | ||||||||||||

| 6,480 | Conn’s, Inc., 7.25%, 7/15/22 | 6,123,600 | ||||||||||

| 1,530 | L Brands, Inc., 6.875%, 11/1/35 | 1,327,275 | ||||||||||

| 1,315 | Party City Holdings, Inc., 6.625%, 8/1/26 (a)(b) | 1,298,563 | ||||||||||

| 8,749,438 | ||||||||||||

| Semiconductors – 0.5% | ||||||||||||

| 4,645 | Amkor Technology, Inc., 6.375%, 10/1/22 | 4,691,450 | ||||||||||

| Software – 0.7% | ||||||||||||

| 5,035 | Camelot Finance S.A., 7.875%, 10/15/24 (a)(b) | 5,281,765 | ||||||||||

| 895 | Rackspace Hosting, Inc., 8.625%, 11/15/24 (a)(b)(m) | 785,363 | ||||||||||

| 6,067,128 | ||||||||||||

| Telecommunications – 4.3% | ||||||||||||

| 2,265 | CenturyLink, Inc., 7.50%, 4/1/24, Ser. Y (m) | 2,401,608 | ||||||||||

| 4,080 | Cincinnati Bell, Inc., 7.00%, 7/15/24 (a)(b)(m) | 3,712,800 | ||||||||||

| 9,370 | Consolidated Communications, Inc., 6.50%, 10/1/22 | 8,784,375 | ||||||||||

| 22 | Annual Report | | February 28, 2019 | | See accompanying Notes to Financial Statements |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income Fund

February 28, 2019 (continued)

| Principal Amount (000s) | Value | |||||||||||

| Telecommunications(continued) | ||||||||||||

| $4,290 | Frontier Communications Corp., 10.50%, 9/15/22 | $3,088,800 | ||||||||||

| 2,685 | GTT Communications, Inc., 7.875%, 12/31/24 (a)(b)(m) | 2,329,237 | ||||||||||

| Hughes Satellite Systems Corp., | ||||||||||||

| 1,460 | 6.625%, 8/1/26 (h) | 1,439,925 | ||||||||||

| 4,250 | 7.625%, 6/15/21 | 4,568,750 | ||||||||||

| 7,205 | Sprint Communications, Inc., 11.50%, 11/15/21 | 8,428,409 | ||||||||||

| 1,865 | Sprint Corp., 7.625%, 3/1/26 | 1,939,600 | ||||||||||

| 36,693,504 | ||||||||||||

| Transportation – 0.3% | ||||||||||||

| 2,688 | XPO Logistics, Inc., 6.50%, 6/15/22 (a)(b) | 2,745,120 | ||||||||||

| Total Corporate Bonds & Notes (cost-$344,845,016) | 321,211,484 | |||||||||||

| Convertible Bonds & Notes – 34.5% | ||||||||||||

| Agriculture – 0.7% | ||||||||||||

| 5,665 | Vector Group Ltd., 3 mo. Cash Dividends on Common Stock + 1.75%, 1.75%, 4/15/20 (i) | 5,785,381 | ||||||||||

| Apparel & Textiles – 0.8% | ||||||||||||

| 14,740 | Iconix Brand Group, Inc., 5.75%, 8/15/23 | 6,620,987 | ||||||||||

| Auto Manufacturers – 0.7% | ||||||||||||

| 6,225 | Navistar International Corp., 4.75%, 4/15/19 | 6,237,394 | ||||||||||

| Biotechnology – 1.2% | ||||||||||||

| 9,625 | Intercept Pharmaceuticals, Inc., 3.25%, 7/1/23 | 9,048,087 | ||||||||||

| 1,785 | Verastem, Inc., 5.00%, 11/1/48 (h) | 1,419,405 | ||||||||||

| 10,467,492 | ||||||||||||

| Building Materials – 1.4% | ||||||||||||

| 4,275 | Cemex S.A.B de C.V., 3.72%, 3/15/20 (m) | 4,255,190 | ||||||||||

| 8,820 | Patrick Industries, Inc., 1.00%, 2/1/23 (a)(b) | 7,960,050 | ||||||||||

| 12,215,240 | ||||||||||||

| Chemicals – 0.7% | ||||||||||||

| 10,275 | Aceto Corp., 2.00%, 11/1/20 (d) | 5,702,625 | ||||||||||

| Commercial Services – 1.8% | ||||||||||||

| 10,530 | Huron Consulting Group, Inc., 1.25%, 10/1/19 | 10,358,287 | ||||||||||

| 5,690 | Macquarie Infrastructure Corp., 2.00%, 10/1/23 | 5,035,650 | ||||||||||

| 15,393,937 | ||||||||||||

| Computers – 1.2% | ||||||||||||

| 11,735 | Western Digital Corp., 1.50%, 2/1/24 (a)(b) | 10,372,461 | ||||||||||

| Distribution/Wholesale – 0.8% | ||||||||||||

| 6,600 | Titan Machinery, Inc., 3.75%, 5/1/19 | 6,542,144 | ||||||||||

| Diversified Financial Services – 2.4% | ||||||||||||

| 9,320 | Encore Capital Group, Inc., 3.00%, 7/1/20 | 9,214,852 | ||||||||||

| 12,165 | PRA Group, Inc., 3.00%, 8/1/20 | 11,678,448 | ||||||||||

| 20,893,300 | ||||||||||||

| Electrical Equipment – 1.2% | ||||||||||||

| SunPower Corp., | ||||||||||||

| 3,135 | 0.875%, 6/1/21 | 2,445,259 | ||||||||||

| 9,405 | 4.00%, 1/15/23 | 7,578,784 | ||||||||||

| 10,024,043 | ||||||||||||

| Electronics – 0.9% | ||||||||||||

| 7,890 | OSI Systems, Inc., 1.25%, 9/1/22 | 8,008,350 | ||||||||||

| See accompanying Notes to Financial Statements | | February 28, 2019 | | Annual Report | 23 |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income Fund

February 28, 2019 (continued)

| Principal Amount (000s) | Value | |||||||||||

| Energy-Alternate Sources – 2.9% | ||||||||||||

| $1,995 | Green Plains, Inc., 4.125%, 9/1/22 | $1,861,584 | ||||||||||

| 6,840 | Pattern Energy Group, Inc., 4.00%, 7/15/20 | 6,823,413 | ||||||||||

| 16,800 | Tesla Energy Operations, Inc., 1.625%, 11/1/19 | 15,993,735 | ||||||||||

| 24,678,732 | ||||||||||||

| Engineering & Construction – 0.6% | ||||||||||||

| 5,455 | Tutor Perini Corp., 2.875%, 6/15/21 | 5,294,410 | ||||||||||

| Equity Real Estate Investment Trusts (REITs) – 1.3% | ||||||||||||

| 3,975 | Two Harbors Investment Corp., 6.25%, 1/15/22 | 4,000,563 | ||||||||||

| 7,690 | Western Asset Mortgage Capital Corp., 6.75%, 10/1/22 | 7,307,146 | ||||||||||

| 11,307,709 | ||||||||||||

| Insurance – 2.4% | ||||||||||||

| 11,390 | AXA S.A., 7.25%, 5/15/21 (a)(b) | 10,940,061 | ||||||||||

| 7,945 | MGIC Investment Corp., 9.00%, 4/1/63 (a)(b) | 10,222,656 | ||||||||||

| 21,162,717 | ||||||||||||

| Investment Companies – 1.1% | ||||||||||||

| 9,525 | Prospect Capital Corp., 6.375%, 3/1/25 | 9,370,219 | ||||||||||

| Oil, Gas & Consumable Fuels – 2.2% | ||||||||||||

| 6,540 | Chesapeake Energy Corp., 5.50%, 9/15/26 | 6,006,506 | ||||||||||

| 2,560 | Ensco Jersey Finance Ltd., 3.00%, 1/31/24 (m) | 2,068,810 | ||||||||||

| 2,280 | Nabors Industries, Inc., 0.75%, 1/15/24 | 1,605,241 | ||||||||||

| 9,980 | Whiting Petroleum Corp., 1.25%, 4/1/20 | 9,607,976 | ||||||||||

| 19,288,533 | ||||||||||||

| Pharmaceuticals – 2.1% | ||||||||||||

| 12,190 | Dermira, Inc., 3.00%, 5/15/22 | 9,561,531 | ||||||||||

| 9,855 | Tilray, Inc., 5.00%, 10/1/23 (a)(b) | 8,530,735 | ||||||||||

| 18,092,266 | ||||||||||||

| Pipelines – 2.2% | ||||||||||||

| 24,750 | Cheniere Energy, Inc., 4.25%, 3/15/45 | 18,949,219 | ||||||||||

| Semiconductors – 0.4% | ||||||||||||

| 3,935 | Veeco Instruments, Inc., 2.70%, 1/15/23 | 3,353,313 | ||||||||||

| Software – 3.1% | ||||||||||||

| 5,800 | Avaya Holdings Corp., 2.25%, 6/15/23 (a)(b) | 5,133,487 | ||||||||||

| 15,785 | Avid Technology, Inc., 2.00%, 6/15/20 | 14,364,350 | ||||||||||

| 2,820 | DocuSign, Inc., 0.50%, 9/15/23 (a)(b) | 3,017,400 | ||||||||||

| 3,985 | Synchronoss Technologies, Inc., 0.75%, 8/15/19 | 3,934,713 | ||||||||||

| 26,449,950 | ||||||||||||

| Telecommunications – 1.5% | ||||||||||||

| 7,715 | GDS Holdings Ltd., 2.00%, 6/1/25 (a)(b) | 6,841,955 | ||||||||||

| 7,345 | Infinera Corp., 2.125%, 9/1/24 | 6,197,344 | ||||||||||

| 13,039,299 | ||||||||||||

| Transportation – 0.9% | ||||||||||||

| 4,560 | Echo Global Logistics, Inc., 2.50%, 5/1/20 | 4,548,965 | ||||||||||

| 4,725 | Teekay Corp., 5.00%, 1/15/23 (a)(b) | 3,561,469 | ||||||||||

| 8,110,434 | ||||||||||||

| Total Convertible Bonds & Notes (cost-$306,806,521) | 297,360,155 | |||||||||||

| 24 | Annual Report | | February 28, 2019 | | See accompanying Notes to Financial Statements |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income Fund

February 28, 2019 (continued)

| Shares | Value | |||||||||||

| Convertible Preferred Stock – 24.3% | ||||||||||||

| Banks – 4.3% | ||||||||||||

| 12,080 | Bank of America Corp., 7.25%, Ser. L (f) | $15,655,680 | ||||||||||

| 16,980 | Wells Fargo & Co., 7.50%, Ser. L (f) | 21,785,340 | ||||||||||

| 37,441,020 | ||||||||||||

| Chemicals – 0.9% | ||||||||||||

| 84,135 | International Flavors & Fragrances, Inc., 6.00%, 9/15/21 | 4,201,702 | ||||||||||

| 34,310 | Rayonier Advanced Materials, Inc., 8.00%, 8/15/19, Ser. A | 3,482,122 | ||||||||||

| 7,683,824 | ||||||||||||

| Diversified Financial Services – 0.9% | ||||||||||||

| 154,835 | AMG Capital Trust II, 5.15%, 10/15/37 | 7,914,964 | ||||||||||

| Electric Utilities – 4.8% | ||||||||||||

| 110,160 | CenterPoint Energy, Inc., 7.00%, 9/1/21, Ser. B (m) | 5,756,962 | ||||||||||

| 202,705 | Dominion Energy, Inc., 6.75%, 8/15/19, Ser. A | 9,985,248 | ||||||||||

| 147,670 | NextEra Energy, Inc., 6.123%, 9/1/19 | 8,981,289 | ||||||||||

| 160,380 | Sempra Energy, 6.00%, 1/15/21, Ser. A | 16,634,614 | ||||||||||

| 41,358,113 | ||||||||||||

| Electronic Equipment, Instruments & Components – 1.0% | ||||||||||||

| 101,585 | Belden, Inc., 6.75%, 7/15/19 | 8,486,411 | ||||||||||

| Electronics – 1.2% | ||||||||||||

| 10,110 | Fortive Corp., 5.00%, 7/1/21, Ser. A | 10,521,349 | ||||||||||

| Equity Real Estate Investment Trusts (REITs) – 3.9% | ||||||||||||

| 10,320 | Crown Castle International Corp., 6.875%, 8/1/20, Ser. A | 11,463,764 | ||||||||||

| 56,955 | QTS Realty Trust, Inc., 6.50%, Ser. B (f) | 5,974,010 | ||||||||||

| 631,070 | RLJ Lodging Trust, 1.95%, Ser. A (f) | 15,820,925 | ||||||||||

| 33,258,699 | ||||||||||||

| Gas Utilities – 0.3% | ||||||||||||

| 59,320 | South Jersey Industries, Inc., 7.25%, 4/15/21 | 2,877,020 | ||||||||||

| Hand/Machine Tools – 1.3% | ||||||||||||

| 113,405 | Stanley Black & Decker, Inc., 5.375%, 5/15/20 | 11,013,893 | ||||||||||

| Healthcare-Products – 2.2% | ||||||||||||

| 283,925 | Becton Dickinson and Co., 6.125%, 5/1/20, Ser. A | 17,553,663 | ||||||||||

| 1,295 | Danaher Corp., 4.75%, 4/15/22, Ser. A | 1,325,698 | ||||||||||

| 18,879,361 | ||||||||||||

| Insurance – 2.0% | ||||||||||||

| 158,570 | Assurant, Inc., 6.50%, 3/15/21, Ser. D | 17,290,473 | ||||||||||

| Oil, Gas & Consumable Fuels – 0.2% | ||||||||||||

| 67,960 | Nabors Industries Ltd., 6.00%, 5/1/21 | 1,737,737 | ||||||||||

| Real Estate – 1.3% | ||||||||||||

| 410,065 | Ready Capital Corp., 7.00%, 8/15/23 (m) | 10,768,307 | ||||||||||

| Total Convertible Preferred Stock (cost-$196,679,045) | 209,231,171 | |||||||||||

| Preferred Stock(a)(e)(g)(l) – 1.0% | ||||||||||||

| Media – 1.0% | ||||||||||||

| 3,554 | LiveStyle, Inc., Ser. A | 483,522 | ||||||||||

| 76,572 | LiveStyle, Inc., Ser. B (k) | 7,657,200 | ||||||||||

| 6,750 | LiveStyle, Inc., Ser. B (k) | 67 | ||||||||||

| Total Preferred Stock (cost-$14,596,967) | 8,140,789 | |||||||||||

| See accompanying Notes to Financial Statements | | February 28, 2019 | | Annual Report | 25 |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income Fund

February 28, 2019 (continued)

| Shares | Value | |||||||||||

| Common Stock(e)(g)(k) – 0.1% | ||||||||||||

| Advertising – 0.1% | ||||||||||||

| 173,720 | Affinion Group Holdings, Inc. Class A, (cost-$3,080,312; purchased11/9/15-11/12/15) (j) | $913,767 | ||||||||||

| Aerospace & Defense – 0.0% | ||||||||||||

| 8,295 | Erickson, Inc. (a) | 214,509 | ||||||||||

| Banks – 0.0% | ||||||||||||

| 56,642 | CCF Holdings LLC Class A (j) (cost-$0; purchased 12/18/18) | 6 | ||||||||||

| 21,429 | CCF Holdings LLC Class B (n)(j) (cost-$0; purchased 12/12/18) | 2 | ||||||||||

| 8 | ||||||||||||

| Media – 0.0% | ||||||||||||

| 90,407 | LiveStyle, Inc. (a)(l) | 9 | ||||||||||

| Total Common Stock (cost-$10,187,309) | 1,128,293 | |||||||||||

| Units | ||||||||||||

| Warrants – 0.0% | ||||||||||||

| Media – 0.0% | ||||||||||||

| 19,500 | LiveStyle, Inc., expires 11/30/21, Ser. C (a)(e)(g)(k)(l) (cost-$0) | 2 | ||||||||||

| Principal Amount (000s) | ||||||||||||

| Repurchase Agreements – 2.8% | ||||||||||||

| $24,494 | State Street Bank and Trust Co., dated 2/28/19, 0.50%, due 3/1/19, proceeds $24,494,340; collateralized by U.S. Treasury Notes, 2.50%, due 1/15/22, valued at $24,985,407 including accrued interest (cost-$24,494,000) | 24,494,000 | ||||||||||

| Total Investments(cost-$897,608,858) – 100.0% | 861,565,894 | |||||||||||

| Liabilities in excess of other assets | (35,643,212 | ) | ||||||||||

| Preferred Shares | (323,275,000 | ) | ||||||||||

| Net Assets Applicable to Common Shareholders | $502,647,682 | |||||||||||

Notes to Schedule of Investments:

| (a) | Private Placement–Restricted as to resale and may not have a readily available market. Securities with an aggregate value of $212,887,991, representing 24.7% of total investments. |

| (b) | 144A–Exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, typically only to qualified institutional buyers. Securities with an aggregate value of $204,532,682, representing 23.7% of total investments. |

| (c) | When-issued or delayed-delivery. To be settled/delivered after February 28, 2019. |

| (d) | In default. |

| (e) | Fair-Valued–Securities with an aggregate value of $18,707,680, representing 2.2% of total investments. See Note 1(a) and Note 1(b) in the Notes to Financial Statements. |

| (f) | Perpetual maturity. The date shown, if any, is the next call date. |

| (g) | Level 3 security. See Note 1(a) and Note 1(b) in the Notes to Financial Statements. |

| (h) | All or partial amount segregated for the benefit of the counterparty as collateral for liquidity facility. |

| (i) | In addition to the coupon rate shown, the issuer is expected to pay additional interest based on the actual dividends paid on its common stock. |

| (j) | Restricted. The aggregate cost of such securities is $22,429,994. The aggregate value is $7,364,030, representing 0.9% of total investments. |

| 26 | Annual Report | | February 28, 2019 | | See accompanying Notes to Financial Statements |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income Fund

February 28, 2019 (continued)

| (k) | Non-income producing. |

| (l) | A member of the Fund’s portfolio management team is a member of the board of directors of LiveStyle, Inc. The Fund’s aggregate value of investments in LiveStyle, Inc. represents 1.0% of total investments. |

| (m) | All or a portion of this security is on loan pursuant to the Liquidity Facility (see Note 8). The aggregate value of securities on loan is $24,675,414. |

| (n) | Affiliated security. (See Note 9) |

| (o) | Fair ValueMeasurements-See Note 1(b) in the Notes to Financial Statements. |

| Level 1 – Quoted Prices | Level 2 – Other Significant Observable Inputs | Level 3 – Significant Unobservable Inputs | Value at 2/28/19 | |||||||||||||

Investments in Securities – Assets | ||||||||||||||||

Corporate Bonds & Notes: | ||||||||||||||||

Commercial Services | $ | – | $8,059,400 | $442,750 | $8,502,150 | |||||||||||

Diversified Financial Services | – | 19,045,181 | 8,995,841 | 28,041,022 | ||||||||||||

Media | – | 17,691,129 | 5 | 17,691,134 | ||||||||||||

All Other | – | 266,977,178 | – | 266,977,178 | ||||||||||||

Convertible Bonds & Notes | – | 297,360,155 | – | 297,360,155 | ||||||||||||

Convertible Preferred Stock: | ||||||||||||||||

Diversified Financial Services | – | 7,914,964 | – | 7,914,964 | ||||||||||||

Electronics | – | 10,521,349 | – | 10,521,349 | ||||||||||||

Equity Real Estate Investment Trusts (REITs) | 21,794,935 | 11,463,764 | – | 33,258,699 | ||||||||||||

Gas Utilities | – | 2,877,020 | – | 2,877,020 | ||||||||||||

Hand/Machine Tools | – | 11,013,893 | – | 11,013,893 | ||||||||||||

Healthcare-Products | 1,325,698 | 17,553,663 | – | 18,879,361 | ||||||||||||

All Other | 124,765,885 | – | – | 124,765,885 | ||||||||||||

Preferred Stock | – | – | 8,140,789 | 8,140,789 | ||||||||||||

Common Stock | – | – | 1,128,293 | 1,128,293 | ||||||||||||

Warrants | – | – | 2 | 2 | ||||||||||||

Repurchase Agreements | – | 24,494,000 | – | 24,494,000 | ||||||||||||

Totals | $ | 147,886,518 | $ | 694,971,696 | $ | 18,707,680 | $ | 861,565,894 | ||||||||

A roll forward of fair value measurements using significant unobservable inputs (Level 3) for the year ended February 28, 2019, was as follows:

| Beginning Balance 2/28/18 | Purchases | Sales | Accrued Discount (Premiums) | Net Realized Gain (Loss) | ||||||||||||||||

Investments in Securities – Assets | ||||||||||||||||||||

Corporate Bonds & Notes: | ||||||||||||||||||||

Commercial Services | $ | – | $ | – | $ | – | $ | – | $ | – | ||||||||||

Diversified Financial Services | – | 17,756,756 | † | – | 21,298 | – | ||||||||||||||

Media | – | – | – | – | – | |||||||||||||||

Preferred Stock: | ||||||||||||||||||||

Media | 8,491,167 | – | (650,957 | ) | – | 173,359 | ||||||||||||||

Common Stock: | ||||||||||||||||||||

Advertising | 2,630,121 | – | – | – | – | |||||||||||||||

Aerospace & Defense | 260,380 | – | – | – | – | |||||||||||||||

Banks | – | – | † | – | – | – | ||||||||||||||

Media | 9 | – | – | – | – | |||||||||||||||

Warrants: | ||||||||||||||||||||

Commercial Services | 361 | – | – | †† | – | (246,984 | ) | |||||||||||||

Media | 2 | – | – | – | – | |||||||||||||||