UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-K

ANNUAL REPORT PURSUANT TO

REGULATION A OF THE SECURITIES ACT OF 1933

For the fiscal year ended December 31, 2018

NowRx, Inc.

(Exact name of registrant as specified in its charter)

Commission File Number:024-10792

| Delaware | 27-4286597 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| 2224 Old Middlefield Way Mountain View, California (Address of principal executive offices) | 94043 (Zip Code) |

(650) 386-5761

Registrant’s telephone number, including area code

Series A Preferred Stock

(Title of each class of securities issued pursuant to Regulation A)

In this report, the term “NowRx,” “we,” “us” or “the company” refers to NowRx, Inc.

This report may contain forward-looking statements and information relating to, among other things, the company, its business plan and strategy, and its industry. These forward-looking statements are based on the beliefs of, assumptions made by, and information currently available to the company’s management. When used in this report, the words “estimate,” “project,” “believe,” “anticipate,” “intend,” “expect” and similar expressions are intended to identify forward-looking statements, which constitute forward looking statements. These statements reflect management’s current views with respect to future events and are subject to risks and uncertainties that could cause the company’s actual results to differ materially from those contained in the forward-looking statements. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. The company does not undertake any obligation to revise or update these forward-looking statements to reflect events or circumstances after such date or to reflect the occurrence.

| 2 |

Item 1. Business

THE COMPANY’S BUSINESS

Overview

NowRx was founded with the goal of developing software, artificial intelligence, robotics and logistics to create the most convenient retail pharmacy service available, including free same-day delivery for prescription medications. For urgent medications, expedited one-hour delivery is available for an additional $5 charge. NowRx operates from within a “virtual pharmacy” location, a low-cost, highly automated, micro-fulfilment center that employs end-to-end robotic dispensing (“One-Click Fill”SM) and an artificially intelligent chat bot to provide a more efficient and effective pharmacy experience for busy customers and their physicians. Medications are hand delivered by trained NowRx drivers in plug-in electric vehicles. By eliminating the dependency on retail space, NowRx is able to maintain fixed overhead costs that are substantially lower than traditional pharmacy providers with retail storefronts on busy streets. Further margin advantages are provided by robotics and software automation. For added convenience, customers can manage their prescriptions through the NowRx mobile app, text, intelligent chat bots, phone, or through virtual voice-activated assistants such as Google Home.

|  |  | ||

| Robotic Dispensing Unit | NowRx App | Google Home |

NowRx responds to an obvious market need—solving the inconvenience of traditional brick and mortar pharmacies by providing all of the same pharmacy services, along with the additional benefit of safe, reliable delivery directly to the customer’s door free of charge. With NowRx, customers can conveniently manage their existing prescriptions, upload new prescriptions and even consult with a licensed pharmacist – all without ever having to leave their home or make a trip to a local pharmacy. No need to visit the pharmacy to obtain a prescription medication; no need for transportation to the pharmacy, or to stand in long lines, or to wait for the prescription to be filled. Recent studies have shown the median pharmacy wait time was 45 minutes1, and a second trip to the pharmacy was required 33% of the time.2 Customers can also use the app to easily set daily reminders to minimize the risk of missing a medication dose and to automatically request an upcoming refill order.

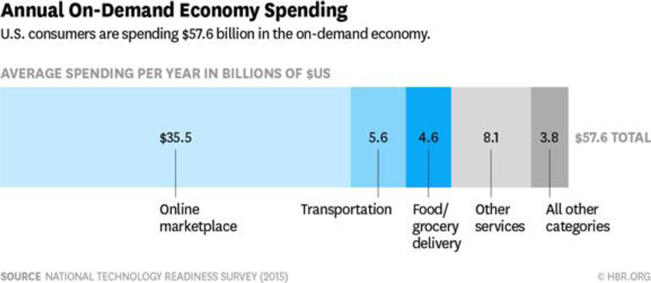

With free-same day delivery and one-hour expedited delivery, NowRx is part of a much broader global trend towards services delivered directly to customers home rapidly and free, a trend recently described as the on-demand economy. The size and rapid growth of the on-demand economy clearly shows that consumers are attracted by the user experience, added convenience and other benefits it provides. Recent studies show on-demand services have already moved beyond early adopters and are gaining traction among mainstream consumers who require that platforms be user-friendly, safe and fast.3

1 “Wait Time for Filling Rx”, Boehringer Ingelheim Pharmaceuticals, 2013.

2“% Who Had to Return To or Got To a Different Pharmacy at Least Once in Past Year”, Boehringer Ingelheim Pharmaceuticals, 2013.

3 “The On-Demand Economy is Growing, and Not Just for the Young and Wealthy”, Harvard Business Review, April 2016.

| 3 |

NowRx also offers advantages over mail-order pharmacies, which are able to save customers trips to the pharmacy under certain circumstances, but can be confusing to use and are inherently unable to address many important pharmacy needs, including: first time prescriptions; urgent and refrigerated medications; or others not permitted to be sent through the mail such as narcotics and other DEA-controlled medications. We believe NowRx combines the best of current pharmacy offerings to create an exciting new pharmacy solution. Several of the NowRx services are designed to also make the prescription process more convenient for physicians who also can be frustrated by the bottlenecks and inefficiencies in the pharmacy process, including our automated manufacturer coupon software that automatically identifies and applies available manufacturer coupons without the physicians having to manage physical coupons, and a streamlined insurance prior authorization process that reduces the amount of time physicians and their staff spend obtaining insurance approvals for drugs not on the health plan formularies.

We plan to establish multiple locations in strategic patient-dense areas across the country. As of December 31, 2018, the company’s service area covers the Mountain View locality in the Bay Area, where we launched our first micro-fulfilment center in January 2016. During 2019, we seek to expand within the Bay Area, to Daly City, South San Francisco and Morgan Hill, as well as the Los Angeles/Orange County area, by establishing additional micro-fulfilment centers to support those localities. We entered into 4 additional long-term office space leases, to execute on this strategy, 3 of which were signed during the fourth quarter of 2018, and 1 in January 2019. Three of these leases are for new micro-fulfilment centers in northern California and 1 in Southern California. As of December 31, 2018, one of these 4 new locations was issued a pharmacy permit, with the permits for the remaining 3 locations still pending. Our longer-term strategy is to expand to additional West Coast areas, including Seattle and San Diego, and ultimately to the rest of the country. Any expansion plans will be based on the competitive landscape, partnerships, continued access to expansion capital and other strategic considerations.

NowRx was incorporated in Delaware under the name YouRx, Inc. on February 19, 2015 and changed its name to NowRx, Inc. on May 19, 2015. We also do business under the names NowRx Express and NowRx Specialty.

Industry Trends

On-Demand Economy

NowRx is responding to the rapidly increasing consumer demand for services delivered same-day and managed by convenience of mobile apps, chat bots and voice-activated assistants. The on-demand economy is attracting more than 22.4 million consumers annually and $57.6 billion in spending3. Recent studies show on-demand services have already moved beyond early adopters and are gaining traction among mainstream consumers who require that platforms be user-friendly, safe and fast. We believe it’s just a matter of time before few people will be standing in traditional pharmacy lines.

| 4 |

The on-demand economy is also rapidly expanding across the global economy. According to Crowd Companies, a firm that tracks on-demand platform businesses, more than 280 companies provide on-demand goods and services across sixteen industries today. This is up from only 76 companies operating in just six industries two years ago. There are numerous recent examples of major corporations entering on-demand markets; such as GM’s partnership with Lyft, and hotel giant Accor’s recent acquisition of Airbnb competitor Onefinestay.4

Traditional Pharmacy Industry

Traditional retail pharmacy is a $260 billion industry, with approximately 61,700 retail pharmacy locations in the United States dispensing more than 4 billion prescriptions annually.5 The rate of sales growth in the United States has slowed in recent years, driven by a decline in new blockbuster drugs, a longer FDA approval process, drug safety concerns, higher copayments and an increase in the use of generic drugs, which are less expensive but generate higher gross margins. New drug development in the next few years is expected to be concentrated in specialty prescriptions, which are targeted toward a specific disease state. These drugs are often complex and expensive. We expect prescription usage to continue to grow in the coming years due to the aging U.S. population, increased life expectancy, "baby boomers" continuing to become eligible for the federally funded Medicare prescription program and new drug therapies.

Generic prescription drugs continue to help lower overall costs for customers and third-party payors. We believe the utilization of existing generic pharmaceuticals will continue to increase, although the pace of introduction of new generic drugs is expected to slow. In general, generic versions of drugs generate lower sales dollars per prescription, but higher gross profit dollars, as compared with patent-protected brand name drugs. The impact on retail pharmacy gross profit dollars can be significant in the first several months after a generic version of a drug is first allowed to compete with the branded version, which is generally referred to as a “generic conversion.” In any given year, the number of major brand name drugs that undergo a conversion from branded to generic status can vary and the timing of generic conversions can be difficult to predict, which can have a significant impact on retail pharmacy sales and gross profit dollars.

4 “The On-Demand Economy is Growing, and Not Just for the Young and Wealthy”, Harvard Business Review, April 2016.

5 “The 2018 Economic Report on US Pharmacies and Pharmacy Benefit Managers”, Pembroke Consulting, February 2018.

| 5 |

Industry Consolidation and New Entrants

In recent years, the pharmacy industry and pharmacy-related health insurance providers have experienced substantial consolidation involving several blockbuster mergers and acquisitions: 1) $69 billion merger of CVS Health and Aetna, 2) CIGNA’s $52 billion acquisition of Express Scripts, 3) Walgreens’ acquisition of 1,932 Rite Aid stores for $4.4 billion. Some of these transactions represent a significant increase in vertical integration between pharmacies that distribute medications and the insurance plans and their network managers (Pharmacy Benefit Managers, or PBMs), that determine the reimbursements to pharmacies.

Another potentially significant transaction was Amazon’s acquisition of Pillpack, a startup company focused on mail delivery pharmacy for patients with multiple, long-term medications. Pillpack emphasizes the organization of medications for patients using industry standard “strip packaging” that organizes patients’ medications in a strip of multi-dose pouches, a technology that has been widely available in the pharmacy industry for more than a decade.

We believe these recent industry developments represent a somewhat predictable reaction to changing consumer behavior and rapidly increasing demand for more speed and convenience in pharmacy. While industry consolidation by the largest players has potential to increase competition for consumers and increased pricing pressures, we believe these same conditions also create opportunity for agile, technology-driven players that can rapidly adapt and sustainably differentiate their offerings to consumers leveraging technology and innovative business models and processes.

Products and Services

As an on-demand pharmacy, NowRx offers all of the same medication prescription services as a traditional retail pharmacy but does so remotely from a low cost, highly automated micro-fulfilment center (“virtual pharmacy”), providing free same-day delivery of prescription drugs and some over-the-counter medications. For an additional $5.00, the company provides delivery within 1 hour of placing an order for in-stock pharmaceuticals; a choice that may be important if a drug is needed urgently.

We offer our services through the NowRx app, by text, by telephone and through voice-activated virtual assistants such as Google Home. Customers can download the NowRx app and complete their profile, including providing details of their health insurance plan and payment method, and delivery address information. Once a customer has completed their profile, they can instruct their doctors to send their prescriptions directly to NowRx when e-prescribing. The customer is then notified via the app that their prescription has been received and verified with their insurance company; the amount of the copay; and that the prescription will be delivered to the address of their choice the same day at no cost. With a single click the customer confirms the order. Alternatively, customers can scan a paper prescription securely through the NowRx app or transfer existing prescriptions from other pharmacies.

For a prescription covered by an insurance health plan (also known as a “third-party payor”), we collect from the customer the co-payment amount dictated by the third-party payor. If there is no third-party payor, we charge the customer a cash price that is set based on our own competitive pricing plan. As a service to our customers, NowRx also applies available manufacturer coupons, often doing so electronically and automatically without the customer having to perform any action or handle any paper coupon cards. We accept payments using a variety of methods, including cash, checks, credit and debit cards and health savings plans. Physicians are able to send prescriptions to NowRx through electronic prescribing, fax, the NowRx app or telephone.

Services provided include fulfilling new prescriptions or refills, transferring prescriptions from other pharmacies, and application of drug manufacturer coupons. The latter service is especially useful since many traditional pharmacies do not have the capability of automatically handling coupon driven prescription orders. NowRx also provides reminders through the app and text messages to help customers remember to take medications and to process refills, to help promote better health and wellness. The NowRx app also has a secure video chat feature that allows customers to conveniently speak to a NowRx pharmacist from a private location of their own choosing.

As part of the company’s comprehensive approach to pharmacy, services are also provided to prescribing physicians, including: coordination and assistance with pre-authorization requests that arise when third-party insurance providers request additional information before approving a reimbursement claim; maintaining and communicating real-time status of prescription fulfillment and delivery to patient; and communicating decision support information such as available drug substitutions and/or drug interaction information. Information regarding fulfillment and delivery is available through a proprietary, secure web-based physician portal, accessible by the physician smart phone or desktop computer.

| 6 |

The company uses employees and occasionally third-party delivery firms to deliver to a customer’s home or office. Drivers utilize the NowRx driver-side app, Wheels, that provides optimized routing logistics, special handling instructions and customer contact information, as well as, capture of signature and identification information. In instances in which a customer provides a scanned copy of their prescription, delivery personnel collect the original prescription prior to completing the delivery. Delivery personnel also collect cash payments when a customer does not make payment through the app or online. The company collects customer signature at the point of delivery through the Wheels app. When a customer is not present for signature, deliveries can be rerouted or arrangements can be made to leave the delivery, capture time and GPS stamped photo image of the delivered medication, and secure digital signature subsequently as proof of receipt by customer.

Suppliers

As a licensed pharmacy, NowRx purchases pharmaceutical products through wholesalers, then sells those products to patients, and then receives its revenue in the form of reimbursements from the patient’s insurance health plans, drug manufacturer coupons and from the patients themselves in the form of co-pays or cash payments. We purchase approximately 90% of our pharmaceutical products from McKesson, with the remainder supplied by Independent Pharmacy Cooperative (“IPC”). Orders are placed with McKesson at the end of each workday and those ordered items are delivered to NowRx the next business morning via truck delivery. IPC delivers products via UPS to NowRx. If our relationship with McKesson or IPC were disrupted, we could temporarily have difficulty filling prescriptions for branded and generic drugs until we execute a replacement wholesaler agreement or develop and implement self-distribution processes. There are several well-established wholesalers that are competitors to McKesson, including AmerisourceBergen Corp, Cardinal Health, Inc., and several smaller companies. We believe we could obtain and qualify alternative sources for substantially all of the prescription drugs we sell on an acceptable basis, and accordingly that the impact of any disruption would be temporary

Customers

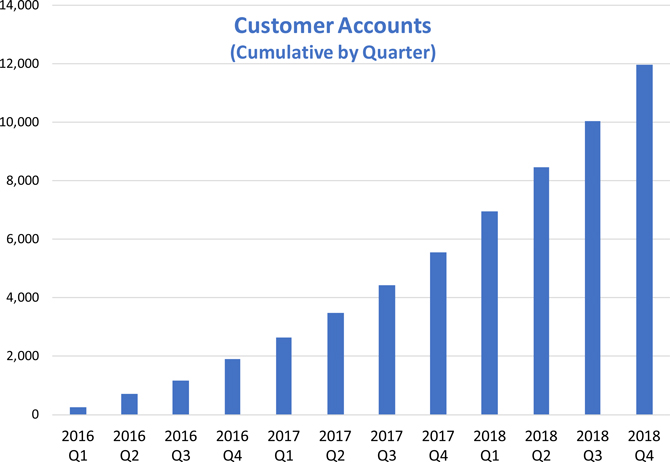

During 2018, we filled approximately 41,834 prescriptions. As of December 31, 2018, NowRx has more than

15,297 customers. A portion of our customers order one or more prescriptions each and every month, whereas some of our other customers order only one prescription every few months. During 2018 our typical customer averaged 1.7 prescriptions and $159 revenue per month throughout the year. The loss of any one customer would not have a material adverse impact on our results of operations.

The following table illustrates (a) on the left axis the growth in total number of customers since the company commenced operations and projects near-term growth assuming that the rate of growth continues and (b) on the right axis the total number of new customers added each quarter since the company commenced operations and projects near-term growth assuming that the company acquires new customers at the same rate.

Third-party Payors

We enter into contracts with third-party payors (such as insurance companies, prescription benefit management companies, government agencies, private employers or other managed care providers) that agree to pay for all or a portion of a customer's eligible prescription purchases based on negotiated and contracted reimbursement rates for each prescription drug included in the third-party payor’s formulary. We collect from the customer any amount that remains due after reimbursement from third-party payors, if any. Reimbursement amounts from third-party payors are recorded as accounts receivable until payment is received, typically 20-45 days after the prescription is filled.

In 2018, 87% of our net sales involved prescription medications eligible for reimbursement by third-party health insurance payors. Health insurance reimbursements are managed by intermediaries called Pharmacy Benefit Managers, or PBMs. Furthermore, NowRx is part of a Pharmacy Service Organization Administrator, or PSAO, called Healthmart Atlas (formerly called Access Health). Healthmart Atlas aggregates reimbursements from one of the larger PBMs, Express Scripts, along with several other PBMs. During 2018, third-party health insurance reimbursements remitted through Healthmart Atlas accounted for approximately 30% of our net sales.

| 7 |

Technology

NowRx has developed and deployed a comprehensive suite of technologies, including the following:

Unified Communication Layer: Virtual Assistants, Mobile App and Chat Bots

NowRx has developed an extensive communication layer that unifies communication from customers from across a variety of modalities, including mobile app, chat bot that interacts with native mobile texting, and voice-activated voice assistants such as Google Home, where NowRx is one of the few HIPPA-compliant healthcare application approved to manage prescriptions via voice. Customers can interact with NowRx using any of these communication modalities to manage new prescriptions and refills and receive helpful daily reminders.

“One Click FillSM”: Fully Integrated, End-to-end Robotic Dispensing

NowRx has developed a proprietary software method of interfacing with a commercially available robotic dispensing system allowing automated dispensing of refill requests with the press of one button on the mobile app by the customer (“One-Click FillSM”). Similarly, automated dispensing can be triggered by chat bot or voice-activated assistant command. Transfer requests from other pharmacies can also be made by the user via the app, chat bot or voice-activated assistant. Using Internet Protocol, these requests are automatically routed to the NowRx location where the robot performs automatic medication filling (sort, count, bottle, label and cap) without human intervention. A licensed pharmacist verifies every prescription before packaging for delivery, in accordance with regulations.

Delivery Logistics Layer and Opportunistic Refill Processing

NowRx has developed an extensive logistics platform and dashboard to optimize delivery routes based on traffic, geography and driver load. Furthermore, a large portion of medications are refilled and delivered to customers at regular intervals, usually once per month on or about the same day of the month (“ordinary refill queue”). However, refills may be opportunistically processed and delivered several days early, when permitted by the insurance health plan (typically 7 days in advance), to optimize delivery efficiency as measured by the number of refills delivered to the same neighborhood on the same day. As an illustration, if a new or refill prescription request is scheduled for delivery today to a certain neighborhood, the ordinary refill queue is scanned for any refills destined for the same neighborhood albeit several days in the future (“opportunistic refill”). These opportunistic refills are thus processed several days earlier than originally scheduled, thereby optimizing today’s deliveries to the target neighborhood, resulting in a lower cost delivery. As is always the case with deliveries, the customer is contacted first to confirm that an earlier delivery is acceptable.

| 8 |

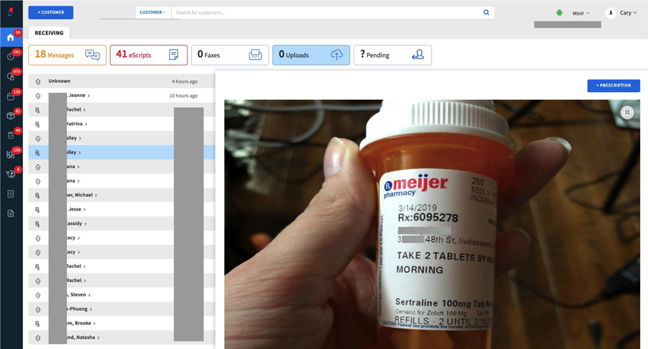

Screenshot of bottle image after robotic fill.

Screenshot of prospective customer requesting change to NowRx pharmacy.

| 9 |

Screenshot of logistics and route planning.

Future Development

Patient Analytics: NowRx Medication Adherence IndexSM

NowRx is developing a method to improve the consistency with which patients adhere to their prescription plans (“medication adherence”). Patient frustration with the pharmacy process contributes to delays or postponement of medication regimes, non-adherence and in some cases prescription abandonment. Non-adherence is common. 110 million prescriptions are abandoned each year.6 For chronic disease patients, it is estimated that between 20% and 30% of prescriptions are never filled and up to 50% of medications are not taken as prescribed. Failure to follow prescriptions causes some 125,000 deaths per year and up to 10% of all hospitalizations. Medication non-adherence has been estimated to cause between $100 billion to $289 billion in waste to the U.S. healthcare system.7 One study found that 35% of patients who failed to fill their prescriptions cite the following reasons: 1) too busy to go to pharmacy, or too inconvenient, 2) forgot, or 3) lack of transportation.8 Patients that fail to adhere to their medication regimes, particularly those medications for chronic health conditions such as heart disease, diabetes and COPD, sometimes risk critical health episodes that lead to emergency healthcare services (hospitalizations, emergency rooms, or urgent care facilities). We believe it is possible to identify which patients are more likely to become non-adherent. NowRx intends to utilize data analytics and machine learning to calculate the NowRx Medication Adherence IndexSM, which will trigger additional communication and service protocols, such as additional text messages, phone calls from a pharmacist or coordination with a physician, to help improve medication adherence.

6 “Understanding Prescription Abandonment”, CVS, 2008.

7 “Interventions to Improve Adherence to Self-administered Medications for Chronic Diseases in the United States: A Systematic Review”, Annals of Internal Medicine.

8 “The Consent and Prescription Compliance (COPRECO) Study”, Academy of Emerging Medication, 2008.

| 10 |

Mastering “The Last Mile of Healthcare”

Pharmacy represents a key entry point into the healthcare system for many customers. In fact, there are few aspects of healthcare that do not at some point intersect with pharmacy. Pharmacy data is some of the most valuable healthcare data available and we receive this data in its raw form, directly from physicians. In this way, we think about NowRx as a technology and Big Data company, and we plan to continue to develop advanced technologies across a wide array of pharmacy applications. All use of aggregate data is strictly subject to all applicable HIPAA and other privacy laws. In addition, pharmacists rank very high as authority figures in the healthcare planning for many customers. We believe there is an opportunity for technology-enabled, delivery-based pharmacies to become “health hubs” of the future, offering a platform to deploy additional healthcare services directly to customers, wherever they consume their healthcare services: at home, online or on their smartphone.

Wholesale Spot Purchasing Automation

Drug prices on the wholesale market have a high degree of variability. Each drug compound is available from multiple manufacturers, sold by a variety of wholesalers, each with their own individual price, which varies daily. Most pharmacies do not have sufficient staff resources to check all of the price variations each day in order to find the lowest price, and as a result frequently overpay for their inventory. NowRx’s software system automatically analyzes prices across several wholesalers, manufacturers and drug formulation, and identify the lowest price each day, thereby optimizing wholesale purchases and increasing gross margins.

Marketing

NowRx focuses marketing on two areas: the physician referral channel and direct-to-consumer. We market to physicians utilizing marketing representatives who visit directly with physicians and their staff to promote the benefits of NowRx not only to their patients but also to the physician’s office itself. Physicians obtain several benefits from the NowRx service, including reduced office resources spent managing patient prescriptions, streamlined insurance plan approvals including pre-authorizations, and more consistent application of drug coupons, all of which reduce the number of inbound calls to physicians, reduce time spent by physicians’ staff speaking with customers, drive higher patient satisfaction and potentially better patient health outcomes. NowRx also markets directly to healthcare facilities such as assisted living facilities that generate high volume prescription orders from multiple patients, and local hospitals, both of which are especially resource efficient marketing channels. As for direct-to-consumer marketing, we have continued to strengthen our presence on social media sites such as Facebook, as well as more traditional consumer marketing methods such as radio and TV. As the company scales up and achieves broad-based consumer recognition in any given region, we will increasingly focus on consumer driven marketing, both digital and traditional, in the pursuit of revenue growth.

In the fourth quarter of 2018, the company increased spending on direct-to-consumer digital, radio and cable TV advertising, as reflected by the higher sales and marketing expense in our financial statements. We intend to continue increasing spend moderately throughout 2019 as we attempt to increase market share in the areas surrounding our new micro-fulfilment centers.

| 11 |

Market Opportunity

We believe retail pharmacy is a $260 billion industry on the brink of total transformation – a transformation the leading competitors are ill-equipped to address. We believe recent trends in the on-demand economy clearly demonstrate that the historic pharmacy model of requiring “in-store pickup” is becoming outdated, as consumers are increasingly demanding more services delivered the same-day or even same-hour. The large players in the industry are currently committed financially to a business model that is fundamentally dependent on customers coming into stores to pick up their prescriptions and then buying additional items such as over-the-counter drugs and sundries. In 2017, there were approximately 63,500 traditional pharmacies that dispensed 5.8 billion 30-day prescriptions.9 The traditional pharmacy model with expansive retail space offering other products beyond prescription medications (such as over-the-counter medications and sundries) creates a strong financial incentive for large pharmacy chains to maintain their in-store pickup model for the upsell opportunity. We believe adopting a free same-day delivery necessarily reduces the upsell opportunity created by in-store foot traffic and thereby undermines the financial viability of the thousands of brick and mortar locations that are the backbone of the industry (i.e., industry disruption10). Furthermore, we believe the reliance on extensive retail infrastructure by the large pharmacy chains and the apparent lack of automation technology, places them at a significant competitive disadvantage in attempting the NowRx free same-day delivery model. In fact, recent attempts at same-day delivery by several industry leaders come with a charge of $8.99 to the customer or $4.99 for next day delivery, a model we believe will be a non-starter for most mainstream pharmacy customers1112. Notwithstanding the foregoing, we believe that the large chain store pharmacies will ultimately be compelled to provide a free same-day delivery model but are likely to do so through acquisitions or strategic partnerships with existing players such as NowRx that will have already developed systems, processes, automation software and other technology optimized from the ground up for free same-day delivery . Acquisition or strategic partnership can be a much easier path of entry for a legacy player since it can substantially reduce the technology risk. This result could serve NowRx shareholders well since it affords the company another opportunity for a liquidity event beyond a potential eventual initial public offering, particular if there are competing acquisition offers from existing players as well as new technology-based entrants such as Amazon or Uber. We cannot assure you, however, that any such acquisition or IPO will take place.

Competition

The retail pharmacy industry is highly competitive and going through rapid changes as it grapples with increasing consumer demand for better customer service including same-day delivery. NowRx competes with, among others, other startups in the on-demand prescription drug delivery space, retail drugstore chains, independently owned drugstores, wellness offerings and mail order pharmacies. We compete on the basis of convenience and customer service that is made possible through our new model for pharmacy based on efficient, highly automated micro-fulfilment centers powered by robotics, AI-powered chat bots, other software automation, and logistics all optimized for free same-day delivery and one-hour, expedited delivery. We intend to continue establishing a unique brand known for the ultimate in pharmacy convenience and dependability. We believe continued consolidation of the drugstore industry, new entrants like Amazon, and the aggressive discounting of generic drugs by mass merchandisers will further increase competitive pressures in the industry.

Startups

We are aware of several startups in the same-day prescription drug delivery space, including Alto Pharmacy, Capsule and NimbleRx, with the latter having recently cancelled the majority of their pharmacy licenses in California, indicating a change or pivot in strategy. Alto Pharmacy is located in the San Francisco Bay Area and emphasizes fertility and HIV in its marketing. Capsule currently serves the New York City area. Several of these competitors have raised significant venture capital rounds of funding. We believe we are the most technologically advanced pharmacy solution on the market and offer the most customer-centric and reliable on-demand service available.

Large Chain Pharmacies

The strategy of national pharmacy chains is fundamentally based on in-store upsell opportunities (over-the-counter and sundries). Any move by the pharmacy chains into free delivery would necessarily decrease customer foot traffic, undermine their upsell opportunities, and jeopardize the financial results of their expansive retail infrastructure. Free delivery of prescription drugs will inevitably disrupt their existing business model. We believe that ultimately the large chain pharmacies will be compelled by virtue of consumer demand to enter the on-demand, free same-day delivery space and likely will do so by acquiring existing players such as NowRx. As such, NowRx is building its business with the possibility of such a sale in mind, positioning itself to assure that its back-office infrastructure, its technology, and its delivery platform, are robust enough to support a business with thousands of highly efficient and automated locations. While there can be no assurance that a large pharmacy chain will seek to acquire the company, we believe this approach will make the company highly attractive to a large strategic buyer.

9 “The 2018 Economic Report on US Pharmacies and Pharmacy Benefit Managers”, Pembroke Consulting, February 2018.

10“The innovator's dilemma: when new technologies cause great firms to fail”, Christensen, Clayton M, 1997.

11 “CVS expands same-day prescription delivery nationwide”, CNBC, April 4, 2019.

12 “Walgreens launches next-day prescription delivery with FedEx to compete with Amazon”, CNBC, December 6, 2018.

| 12 |

Mail Order Pharmacies

Mail-order pharmacy is a $135 billion market. The number of prescriptions being filled by mail-order pharmacies has been in decline the last several years, losing market share to retail chains and independent pharmacies13 Mail is an inexpensive and fairly convenient service, but by its very nature it is not an immediate or same-day service. It does not address “same-day fill” prescriptions, which is the $260 billion market that NowRx is addressing. Furthermore, acute, refrigerated (antibiotics, insulin, etc.) and controlled medications (schedule II narcotics, psychotropics, etc.), and first-time prescriptions that require pharmacist consultation, are better suited for local, retail or on-demand pharmacy dispensing.

Amazon and Other New Entrants

In 2018, Amazon acquired PillPack, an online pharmacy that ships through the mail drugs packaged in pre-sorted doses, but does not provide same-day delivery. Similar to other mail-order businesses, Pillpack has a small number of pharmacy locations distributed strategically across the United States: Manchester, NH, Miami, FL, Brooklyn, NY, Phoenix, AZ and Austin, TX – situated to promote consistent mail delivery to most or all parts of the United States. These pharmacy locations can deliver to customers outside of these states using out-of-state pharmacy licenses. Deliveries to out-of-state customers takes several days, in some cases up to 2 weeks.14 In order to provide same-day and even same-hour delivery, pharmacy fulfilment centers must be located near customers, and each facility is required by regulations to maintain its own pharmacy inventory on location, with licensed pharmacists on premises during business hours. We believe that while it is possible Amazon is going to eventually target same-day delivery pharmacy, Pillpack is decidedly a mail delivery pharmacy without the required licenses, infrastructure, systems or processes required to provide same-day delivery. Amazon may build the necessary requirements for same-day delivery but we believe they are currently targeting mail delivery and further, they would have to add substantially to the current Pillpack offering to achieve same-day delivery.

We believe NowRx has ample runway to build our business before and if Amazon enters the same-day pharmacy delivery space. In addition, pharmacy is a very high touch, intense customer service business, with pharmacy customers having very little tolerance for any lapses in service. As a healthcare business, pharmacy also involves personal health information and therefore, a high degree of security and customer trust. Other new, unknown entrants may also enter this space.

Employees

At December 31, 2018, we have 23 full-time employees and 2 part-time employees working out of our headquarters in Mountain View, California, including 4 licensed pharmacists.

Intellectual Property

The company does not currently hold any patents or trademarks. The company has filed a provisional patent covering several areas of our technology discussed above under “ — Technology.” This provisional patent filing was registered with the US Patent Office on January 17, 2018 with serial no. 62618154. The provisional patent was converted into a utility patent on January 17, 2019 with serial no. 16249899

Research and Development

In 2017 and 2018, we spent $2,518 and $266,140, respectively, for research and development.

13 “The 2018 Economic Report on US Pharmacies and Pharmacy Benefit Managers”, Pembroke Consulting, February 2018.

14 See Pillpack’s FAQ on the PillPack website: https://help.pillpack.com/hc/en-us/articles/360002110727-What-to-expect-from-your-first-shipment.

| 13 |

Regulation

Our business is subject to federal, state and local laws, regulations, and administrative practices concerning the provision of and payment for health care services, including, without limitation: federal, state and local licensure and registration requirements concerning the operation of pharmacies and the practice of pharmacy; Medicare, Medicaid and other publicly financed health benefit plan regulations prohibiting kickbacks, beneficiary inducement and the submission of false claims; the ACA; regulations of the FDA and the DEA, including regulations governing the purchase, sale, storing and dispensing of controlled substances and other products, as well as regulations promulgated by state and other federal agencies concerning automated outbound contacts such as phone calls, text messages and emails.

NowRx is licensed by the DEA and the state of California. Our existing pharmacies are regulated by the state of California. As we expand our operations within California and in other states, each micro-fulfilment center will constitute a pharmacy, which will require a separate state license, and the company will become subject to additional states’ licensure and registration requirements.

Our business is also subject to patient privacy and other obligations, including responsibility imposed by HIPAA. As a covered entity, we are required to implement privacy standards, train our employees on the permitted uses and disclosures of protected health information, provide a notice of privacy practice to our customers and permit customers to access and amend their records and receive an accounting of disclosures of protected health information. We are also subject to federal and state privacy and data security laws with respect to our receipt, use and disclosure by us of personally identifiable information, which laws require us to provide appropriate privacy and security safeguards for such information.

In addition, in connection with the operation of our distribution center, we are subject to laws and regulations relating to the protection of the environment and health and safety matters, including those governing the management and disposal of hazardous substances and the cleanup of contaminated sites.

The Medicare Part D program has undergone significant legislative and regulatory changes since its inception and continues to attract a high degree of legislative and regulatory scrutiny. The applicable government rules and regulations are expected to continue to evolve in the future.

| 14 |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion of our financial condition and results of operations should be read in conjunction with our financial statements and the related notes included in this report. The following discussion contains forward-looking statements that reflect our plans, estimates, and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements. Unless otherwise indicated, the latest results discussed below are as of December 31, 2018.

Overview

The company is an on-demand pharmacy, leveraging the latest in software technology, artificial intelligence, robotics and logistics to provide free same-day delivery of prescription medications, thereby avoiding the need to ever visit the pharmacy. NowRx was founded in February 2015 and commenced operations and revenue generation in January 2016. In 2015 the company was focused on obtaining its pharmacy licenses, developing the technology for the pharmacy platform and the mobile app, and establishing its first pharmacy location.

The company’s net sales consist of payments for prescription and some over-the-counter (“OTC”) items. For a prescription medication covered by a third party payor, such as an insurance company, a pharmacy benefit management (“PBM”) company or a manufacturer coupon plan, the company receives a portion of its revenues from the patient, in the form of a co-payment paid or charged at the time the prescription is filled, and the remainder as a reimbursement from the third-party payor, at contracted prices. For prescription medications not covered by a third-party payor, the payment is collected entirely from the patient. The company records the amounts subject to reimbursement in accounts receivable until payment is received, typically 20-45 days after the prescription is filled. Cost of goods sold consists primarily of prescription and OTC medications that are acquired from wholesale suppliers.

Our net sales, gross profit margin and gross profit are impacted by, among other things, the percentage of prescriptions that we fill that are generic versus brand name, the rate at which new generic and brand name drugs are introduced to the market, the mix of business between prescription medications and OTC items, and variations in wholesale pricing. Because any number of factors outside of our control can affect timing for a generic conversion, we face substantial uncertainty in predicting when such conversions will occur and what effect they will have on particular future periods. Further consolidation among generic manufacturers coupled with changes in the number of major brand name drugs anticipated to undergo a conversion from branded to generic status may also result in gross margin pressures within the industry. We continuously face reimbursement pressure from PBM companies and other commercial third-party payors. In addition, plan changes with rate adjustments often occur in January and our reimbursement arrangements may provide for rate adjustments at prescribed intervals during their term. We experienced lower reimbursement rates as a percentage of revenue in fiscal 2018 as compared to the same period in the prior year. Wholesale pricing plans provide volume discounts that present an opportunity to increase gross margins as we grow our business. Increasing the percentage of revenue contributed by OTC items can also expand margins, as OTC items typically have higher margins than prescription medications. Longer-term, we expect downward pressure on reimbursements to be offset by improvements in wholesale volume discounting and increased OTC sales. However there is significant uncertainty in predicting the result of these offsetting factors on margins.

Results of operations

Year ended December 31, 2018 Compared to Year ended December 31, 2017

The company’s net sales for the year ended December 31, 2018 were $4,743,075, an increase of $2,245,408, or 89.9%, from net sales of $2,497,667 in 2017. This increase is attributable to a significant increase in number of customers. Cost of goods sold was $4,108,233 in 2018, resulting in gross profit of $634,842, and a gross margin of 13.4%. This compares to cost of goods sold totaling $2,162,965, gross profit of $334,702, and a gross margin of 13.4% in 2017. The company sold 41,834 prescription orders in 2018, as compared to 20,772 prescription orders in 2017. Average revenue per prescription and average gross profit per prescription in 2018 were $113.38 and $15.17, respectively. In 2017, average revenue per prescription was $120.34 and average gross profit per prescription was $16.11. The company’s mix of business, brand name drug vs. generic drug, was slightly more weighted towards generic drugs in 2018 as compared to 2017, which generally have lower revenue per prescription, similar margin percentage, and lower average gross profit per prescription as compared to brand name products. While the company does not anticipate dramatic change in the mix of business in the near term, new contracts from wholesaler arrangements, drug manufacturers, health facilities or other partners could have significant impact in its mix of business and/or margins.

| 15 |

The company’s operating expenses consist of general and administrative, sales and marketing, depreciation, and research and development expenses. Operating expenses in 2018 were $3,514,435, compared to $1,351,086 in 2017, an increase of $2,163,349, or 160.1%, resulting from the company’s expanding operations to meet increased customer demand.

General and administrative expenses represented the largest component of this increase, from $1,218,349 in 2017 to $2,677,727 in 2018, as:

| · | the company’s payroll increased from $789,140, to $1,826,659 as it increased executive compensation in line with early stage startups and added 10 employees, |

| · | legal and professional services increased from $42,061 to $96,938, |

| · | lease arrangements increased from $56,194 to $109,027, |

| · | travel expenses decreased from $54,071 to $44,763, and |

| · | delivery costs increased from $276,883 to $600,340. |

We anticipate that our general and administrative expenses will continue to increase as we continue to grow and expand geographically. To execute on our plan to establish multiple locations in strategic patient-dense areas, we will need to lease additional space. For instance, in 2018, we extended our lease for our first micro-fulfillment site in Mountain View for an additional 3-year period and entered into a 5-year lease in San Jose, California and a 3-year lease for additional space in Mountain View to establish micro-fulfillment centers. In the fourth quarter of 2018, we entered into additional leases for space in Santa Ana and Burlingame, California, and in 2019 we entered into an additional lease in Mountain View.

Sales and marketing expenses grew 356.1% from $118,307 in 2017 to $539,623 in 2018 as the company increased marketing efforts to raise awareness among physicians, health facilities and consumers, including the recruiting and hiring of 2 new sales representatives in 2018, and marketing to prospective investors for the Regulation A Offering (see below). The company used a portion of the net proceeds of the Regulation A Offering on marketing, including advertising and hiring sales representatives, to drive further sales. The company continues to invest in sales and marketing, including direct-to-consumer marketing, which will result in a significant increase in these costs in future periods.

Research and development expenses increased from $2,518 in 2017 to $266,140 in 2018. The company used a significant portion of the net proceeds of the Regulation A Offering on developing a proprietary pharmacy management system, which will require ongoing research and development costs to maintain and further develop.

Other expenses consist of interest expense, which amounted to $121,308 in 2018, compared to $76,497 in 2017, as the company accrued or paid interest on outstanding convertible securities and inventory financing. See “—Liquidity and Capital Resources – Indebtedness.”

As a result of the foregoing factors, the company’s net loss was $3,000,901 in 2018, a 174.6% increase from a net loss of $1,092,881 in 2017.

Liquidity and Capital Resources

As of December 31, 2018, the company’s cash and equivalents was $4,253,065. To date, the company has not made any profits and is still a “development stage company.” The company has recorded losses from the time of its inception in the total amount of $4,963,557.

| 16 |

In accordance with ASU No. 2014-15 Presentation of Financial Statements – Going Concern (subtopic 205-40), our management evaluates whether there are conditions or events, considered in the aggregate, that raise substantial doubt about our ability to continue as a going concern within one year after the date that the audited financial statements are issued. We have incurred substantial losses since our inception and we expect to continue to incur operating losses in the near-term. We expect that we will need to raise additional capital to meet anticipated cash requirements for the 18-month period following the final closing date of the Regulation A Offering in September 2018. In addition, we regularly consider fundraising opportunities and will determine the timing, nature and amount of financings based upon various factors, including market conditions and our operating plans. As we have done historically, we may again in the future elect to finance operations by selling equity or debt securities or borrowing money. If we raise funds by issuing equity securities, dilution to stockholders may result. Any equity securities issued may also provide for rights, preferences or privileges senior to those of holders of our common and preferred stock. If additional funding is required, we cannot assure you that additional funds will be available to us on acceptable terms on a timely basis, if at all, or that we will generate sufficient cash from operations to adequately fund our operating needs. If we are unable to raise additional capital or generate sufficient cash from operations to adequately fund our operations, we will need to curtail planned activities to reduce costs. Doing so will likely have an unfavorable effect on our ability to execute on our business plan, and have an adverse effect on our business, results of operations and future prospects.

Regulation A Offering; Issuance of Series A Preferred Stock

On March 30, 2018, the company commenced an offering pursuant to Regulation A under the Securities Act of 1933, as amended (the “Regulation A Offering”). In the Regulation A Offering, the company offered to sell up to 3,500,000 shares of its Series A Preferred Stock, convertible into shares of Common Stock, at a price of $2.00 per share. The company completed the Regulation A Offering in September 2018. As of December 31, 2018, the company issued 3,499,878 shares of Series A Preferred Stock in the Regulation A Offering, which provided net cash proceeds after total offering expenses and commissions of $6,352,845. In conjunction with this offering, the company issued 163,451 shares of Series A Preferred Stock valued at $326,900, to SI Securities, LLC, its sole and exclusive placement agent in connection with the Regulation A Offering, in addition to offering expenses and commissions. The company used a portion of the net proceeds to hire additional sales personnel, purchase additional equipment and furnishings for its new fulfillment centers, pay security deposits in connection with the 3 new leases executed in 2018 and develop the next phase of its proprietary software.

The company held its first closing in connection with the Regulation A Offering on April 24, 2018, in which it received gross proceeds in excess of $1 million. The initial closing of the Regulation A Offering constituted a qualified financing for purposes of the SAFE securities, the KISS agreements and the Crowd Notes, all of which were converted into shares of the company’s Series A Preferred Stock at that date.

Issuances of SAFE and KISS securities and Crowd Notes

Between July 2015 and November 2016, the company entered into simple agreements for future equity (“SAFE securities”) with investors, including Cary Breese and Sumeet Sheokand, in reliance on Section 4(a)(2) of the Securities Act, for total proceeds of $1,027,500. During 2017 and 2018, the company issued additional SAFE securities in the principal amount of $207,446 and $595,000, respectively. The SAFE securities did not bear interest and had no maturity date. The proceeds of this offering were used for general business purposes.

In 2016, the company entered into KISS agreements (Keep it Simple Security) with investors for total proceeds of $50,000. In 2017 and 2018, the company issued additional KISS securities for total proceeds of $939,819 and $485,000, respectively. The instruments were to mature 24 months after issuance and bore 5% interest per annum. Each of these offerings were made in reliance on Regulation D under the Securities Act. The proceeds were used for general business purposes.

On March 11, 2017, the company issued $209,230 in Crowd Notes pursuant to Regulation Crowdfunding and Regulation D under the Securities Act (the “crowdfunding offering”). The Crowd Notes had no maturity date and bore 5% interest per annum. In connection with the crowdfunding offering, which was conducted on a portal affiliated with SI Securities, LLC, the company issued to SI Securities, LLC an additional $39,412 in Crowd Notes. This $39,412 in Crowd Notes represented a combination of the fees due to SI Securities, LLC as compensation for the crowdfunding offering and a previous offering conducted under Regulation D, for which SI Securities, LLC was issued warrants that were voided prior to the crowdfunding offering, with the understanding that the fees would be combined and paid in total as Crowd Notes. The proceeds were used for general business purposes.

On April 24, 2018, the company held its first closing in connection with the Regulation A Offering in which it received gross proceeds in excess of $1 million. The initial closing of the Regulation A Offering constituted a qualified financing for purposes of the SAFE securities, the KISS agreements and the Crowd Notes, all of which were converted into a total of 5,178,301 shares of the company’s Series A Preferred Stock at that date.

| 17 |

Indebtedness

On December 21, 2016, the company entered into an inventory financing arrangement of $62,100 with Kabbage, an inventory financier. The loan was secured by all assets of the company, bore an interest rate of 24.04% per annum, and was payable over six months for a total repayment of $66,447. The loan was paid in full in June 2017. In August and December 2017, the company entered into additional inventory financing arrangements with Kabbage for a total of $88,300, which bore interest at a rate of approximately 24% per annum. The inventory financing loan was paid in full in 2018.

In April 2018, the company extended the operating lease agreement for its office space in Mountain View, California for an additional 3 years. In connection with entering into the extension and as security deposit for the landlord, the company secured an irrevocable letter of credit with Silicon Valley Bank for $60,000 to the benefit of the landlord. To establish this facility, the Company placed $60,000 in a deposit account with Silicon Valley Bank. At December 31, 2018, the facility has not been drawn down and the company remains current with its lease payments.

The company currently has no material commitments for capital expenditures. The company maintains inventory used in the normal course of business, and had $446,325 of inventory on hand as of December 31, 2018.

Trend Information

Margin trends

The company has several initiatives underway to increase gross margins and improve operating margins, as follows:

| · | Pharmacy Management System – The company historically utilized an “off-the-shelf” industry software system to manage pharmacy operations. Management and our technology team have analyzed several areas of inefficiencies in industry pharmacy management systems that cause higher than necessary labor costs for filling prescriptions. With the net proceeds from the Regulation A Offering, the company developed what it believes is a next-generation, proprietary pharmacy management system, which it expects over time will significantly reduce labor costs per prescription order while providing substantial improvements in customer service. |

| · | Optimized Robotic Dispensing – The company has more than a year of experience with a robotic dispensing system, the usage of which is currently below capacity. As order volume grows and the company further enhances its own proprietary pharmacy management system, we believe there is an opportunity to increase the efficiency and utility of the robot to reduce labor costs per order. |

| · | Pharmacy Refill Process Optimization – The company is developing proprietary algorithms to opportunistically process refills in advance of customary refill date, based on geographic location, in order to optimize delivery routing and reduce delivery costs per order. See “The Company’s Business – Technology — Delivery Logistics Layer and Opportunistic Refill Processing.” |

| · | Reduced Delivery Expense per Order – As the company increases revenue and customer volume per geography, the customer density increases and the run time per delivery is reduced, increasing the number of orders delivered per driver-hour and reducing the delivery cost per order. |

| · | Wholesale Volume Discounts – Wholesale pharmaceutical suppliers offer discounts for increasing volume of purchases and longer-term contracts. As we grow our business, management anticipates being able to purchase products at a reduced cost. |

| · | Increased OTC sales – Many OTC products on average have a larger gross margin than the average prescription medication. Management intends to increase OTC as a percentage of sales over time, increasing average revenue per order (“basket size”) as well as increasing the overall gross margin for the company. |

| · | Medication Synchronization – Many customers have multiple prescription medications that refill monthly, but often at times such that the refill dates fall on different days of the month causing multiple trips to the same customer’s house per month. By synchronizing medications, with the customer’s approval, to refill on the same day of the month, delivery efficiency can be enhanced, reducing delivery costs per order. |

| 18 |

Order trends

The company seeks to continually grow the number of orders and its revenues by focusing on two initiatives:

| · | Increase sales and marketing through a combination of direct consumer advertising and sales representatives, which has generated steady growth from inception in the number of prescriptions, the number of referring physicians, and in revenues. A portion of the net proceeds of the Regulation A Offering will continue to be allocated to increased sales and marketing efforts. |

| · | The company intends to add new pharmacy locations. The company anticipates that raising the maximum amount sought in the Regulation A Offering will permit it to establish as many as 7 new locations, which we plan to accomplish by year-end 2019. We anticipate that as the company expands into new geographies it will experience growth rates and other business performance metrics equal to or better than those achieved at the company’s initial service area. Even if we are able to meet our projected timeline for establishing new geographies, these operations may not generate the anticipated growth in customers, orders and revenues at the pace that we project. Management believes that, given the growth pattern of revenues since inception through December 31, 2018, and, assuming we increase marketing expenditures with a portion of the net proceeds from the Regulation A Offering, it is likely that revenues will continue to increase. Even if we are able to meet our projected timeline for establishing the new geographies, these operations may not generate the anticipated growth in customers, orders, revenue and profit(loss) at the pace that we project. |

| 19 |

Item 3. Directors and Officers

Directors, Executive Officers and Significant Employees

The company’s executive officers and directors are listed below. The executive officers are full-time employees.

| Name | Position | Age | Date Appointed to Current Position | |||

| Executive Officers | ||||||

| Cary Breese | Chief Executive Officer, Chief Financial Officer | 52 | June 24, 2015 | |||

| Sumeet Sheokand | Chief Technology Officer | 44 | June 24, 2015 | |||

| Directors | ||||||

| Cary Breese | Director | 52 | June 24, 2015 | |||

| Sumeet Sheokand | Director | 44 | June 24, 2015 | |||

| Barry Karlin | Director | 64 | January 2, 2018 | |||

| Significant Employee | ||||||

| Melissa Bostock | Pharmacist-in-Charge | 37 | October 15, 2015 |

Cary Breese, CEO and Co-founder

Cary Breese has served as the company’s CEO and CFO since the formation of the company in 2015. Prior to founding NowRx, Cary was CEO of GenieDB, a venture-funded tech startup that provided distributed MySQL database-as-a-service to enterprises, from 2012 until 2014. At GenieDB, Cary maintained overall responsibility for all operations, financing, marketing and sales. From 2011 to 2015, Cary was also a founding member and CFO of Frost Data Capital, a Big Data new company incubator and venture fund focused on new innovations in data management, data analytics and internet of things. Cary also was CEO of a successful financial tech company, Trafalgar Insurance Services, which he acquired in March 2003 and then led through financial turnaround and ultimate sale to a large regional financial services firm. Cary holds a Bachelor of Science degree in Electrical Engineering from Drexel University, and holds an ACAS designation from the Casualty Actuarial Society, a professional society whose members have demonstrated expertise in finance, economics, insurance and risk management.

Sumeet Sheokand, CTO and Co-founder

Sumeet Sheokand has served as the company’s CTO, a position in which Sumeet since the formation of the company in 2015. During 2014, Sumeet was involved with a startup incubator as an Entrepreneur-in-Residence. He also consulted with a top-3 US telecom provider to build their social media customer listener platform. Sumeet was CTO of GenieDB from 2012 until 2014, where he was responsible for all technology and software. Prior to joining GenieDB, Sumeet worked in technology management in a number of enterprises. Sumeet holds an undergraduate degree in Electrical and Computer Engineering from National Institute of Technology Kurukshetra, India, and a Masters of Business and Administration from UCLA Anderson School of Management.

Melissa Bostock, Pharmacist-in-Charge

Melissa Bostock has served as NowRx’s Pharmacist-in-Charge since the company began operations in November 2015. Prior to joining NowRx, Melissa was Pharmacy Executive Team Manager at Target, from July 2012 to November 2015. Melissa holds a BS degree in Microbiology and a Master of Public Health degree in Community Health, from UCLA, and holds a Doctor of Pharmacy from University of California, San Francisco.

| 20 |

Barry Karlin, Director

Barry Karlin joined the Board in January 2018. Since May 2014, he has been a private investor in real estate, high technology, and healthcare companies, and regularly consults to private equity firms as well as to public and privately held wealth management companies, primarily in the healthcare services sector. Barry was the founder, Chairman and CEO of Prospira PainCare, a physician-based rollup of pain management practices, from August 2012 to May 2014. He was also the founder, Chairman and CEO of CRC Health Group from 1995 to 2010, a specialized behavioral healthcare treatment provider in the United States, Canada and the United Kingdom. In 2000, Barry founded eGetgoing, which offered treatment through live, audio/video based online technology. He served as Chairman and CEO before eGetgoing was acquired by CRC in 2002. He previously cofounded and served as Chairman and CEO of Navigation Technologies, formerly served as a general partner at a venture firm specializing in the wireless communications industry and served as a strategy management consultant; first with Strategic Decisions Group (1981 – 1984) and subsequently with Decision & Risk Analysis, Inc. (1991 – 1995). Barry has received numerous awards including Ernst & Young 2008 Northern California Regional Entrepreneur of the Year in Life Sciences, Silicon Valley Business Journal 2002 award for Fastest Growing Private Company, Certificate of Special Congressional Recognition in 2005 and the California Association of Drug Abuse Counselors award for exceptional contribution to the addiction community. He received his Ph.D. and M.S. from Stanford University in the Department of Engineering-Economic-Systems (specialty in Decision Sciences) and a B.S. in Electrical Engineering from the University of Witwatersrand in South Africa.

Compensation of Directors and Executive Officers

For the fiscal year ended December 31, 2018, we compensated our three highest-paid directors and executive officers as follows:

| Name | Capacities in which compensation was received | Cash compensation | Other compensation | Total compensation | ||||||||||

| Cary Breese | CEO | $ | 215,537 | $ | 0 | $ | 215,537 | |||||||

| Sumeet Sheokand | CTO | $ | 208,474 | $ | 0 | $ | 208,474 | |||||||

| Barry Karlin | Director | $ | 48,514 | $ | 0 | $ | 48,514 | |||||||

Other than cash compensation, health benefits and stock options, no other compensation was provided to the executive officers, including in their capacity as directors of the company.

| 21 |

Item 4. Security Ownership of Management and Certain Securityholders

The following table sets out, as of December 31, 2018, the voting securities of the company that are owned by executive officers and directors, and other persons holding more than 10% of any class of the company’s voting securities, or having the right to acquire those securities. The table assumes that all options and warrants have vested. The company’s voting securities include all shares of Common Stock and, upon the amendment of the amended certificate of incorporation immediately prior to the closing of this offering, all shares of Preferred Stock.

| Name and address of beneficial owner | Title of class | Amount and nature of beneficial ownership | Amount and nature of beneficial ownership acquirable | Percent of class | ||||||||||

| Cary Breese 6 Trapani Laguna Niguel, CA 92677 | Common Stock | 3,617,600 | 0 | 42.42 | % | |||||||||

| Sumeet Sheokand 995 W. Homestead Road Sunnyvale, CA 94087 | Common Stock | 3,182,400 | 0 | 37.32 | % | |||||||||

| Barry Karlin 120 Atherton Ave Atherton, CA 94027 | Common Stock | 1,700,000 | (1) | 0 | 19.94 | % | ||||||||

| All current officers and directors as a group (3 people) | Common Stock | 8,500,000 | 0 | 99.68 | % | |||||||||

| All current officers and directors as a group (3 people) | Series A Preferred Stock | 445,229 | 0 | 5.04 | % | |||||||||

(1) All shares are owned by The Karlin Family Trust, of which Mr. Karlin is the trustee. As trustee, he exercises voting control over all shares.

Item 5. Interest of Management and Others in Certain Transactions

The company’s co-founders and an employee extended financing of $65,000 and $25,000, respectively, in 2015 to the company through SAFE securities. In 2016, that employee provided an additional $10,000 of SAFE financing. The balances on all these securities were converted during 2018 to shares Series A Preferred Stock, as discussed in Item 2 under “— Issuances of SAFE and KISS securities and Crowd Notes.”

The company reimburses the CEO for an apartment on a month-to-month basis. Rent is $1,677 per month and is available for reimbursement monthly.

Item 6. Other Information

None

| 22 |

Item 7. Financial Statements

NowRx, Inc.

A Delaware Corporation

Financial Statements and Independent Auditor’s Report

December 31, 2018 and 2017

| 23 |

NowRx, Inc.

TABLE OF CONTENTS

| Page | |

| INDEPENDENT AUDITOR’S REPORT | 1-2 |

| FINANCIAL STATEMENTS AS OF DECEMBER 31, 2018 AND DECEMBER 31, 2017 | |

| Balance Sheets | 3 |

| Statements of Operations | 4 |

| Statements of Changes in Stockholders’ Equity/(Deficit) | 5 |

| Statements of Cash Flows | 6 |

| Notes to Financial Statements | 7-21 |

| -1- |

Going Concern

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As disclosed in Note 3 of the financial statements, the Company has not yet generated profits and has an accumulated deficit. These matters raise substantial doubt about the Company’s ability to continue as a going concern. Management’s plans in regard to these matters are also described in Note 3. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

| |

| Spokane, Washington | |

| April 30, 2019 |

| -2- |

BALANCE SHEETS

As of December 31, 2018 and 2017

| December 31, | December 31, | |||||||

| 2018 | 2017 | |||||||

| ASSETS | ||||||||

| Current Assets: | ||||||||

| Cash and equivalents | $ | 4,253,065 | $ | 52,212 | ||||

| Accounts receivable, net | 356,316 | 269,788 | ||||||

| Inventory | 446,325 | 239,768 | ||||||

| Prepaid expense | 52,452 | 4,750 | ||||||

| Deposits | 15,000 | 19,898 | ||||||

| Total Current Assets | 5,123,158 | 586,416 | ||||||

| Other non-current assets | 175,050 | - | ||||||

| Property and equipment, net | 383,553 | 165,927 | ||||||

| TOTAL ASSETS | $ | 5,681,761 | $ | 752,343 | ||||

| LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) | ||||||||

| Current Liabilities: | ||||||||

| Accounts payable | $ | 325,471 | $ | 122,015 | ||||

| Accrued liabilities | 264,024 | 27,232 | ||||||

| Accrued interest | - | 38,930 | ||||||

| Short-term inventory financing | - | 68,925 | ||||||

| KISS liability, current portion | - | 50,000 | ||||||

| Total Current Liabilities | 589,495 | 307,102 | ||||||

| Non-Current Liabilities: | ||||||||

| SAFE liability | - | 1,234,960 | ||||||

| Crowd Notes | - | 191,024 | ||||||

| KISS liability, net of current portion | - | 948,479 | ||||||

| Total Non-Current Liabilities | - | 2,374,463 | ||||||

| Total Liabilities | 589,495 | 2,681,565 | ||||||

| Stockholders' Equity (Deficit): | ||||||||

| Series A Preferred Stock, $0.00001 par value, 10,000,000 shares authorized, 8,841,630 and 0 shares issued and outstanding, liquidation preferences of $17,683,260 and $0 as of December 31, 2018 and 2017, all respectively. | 88 | - | ||||||

| Common stock, $0.00001 par value, 20,000,000 shares authorized, 8,500,000 and 8,500,000 shares issued and outstanding, 5,843,750 and 5,489,583 vested as of December 31, 2018 and 2017, all respectively. | 85 | 85 | ||||||

| Additional paid-in capital | 10,055,650 | 33,349 | ||||||

| Accumulated deficit | (4,963,557 | ) | (1,962,656 | ) | ||||

| Total Stockholders' Equity (Deficit) | 5,092,266 | (1,929,222 | ) | |||||

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) | $ | 5,681,761 | $ | 752,343 | ||||

See accompanying notes, which are an integral part of these financial statements.

| -3- |

STATEMENTS OF OPERATIONS

For the years ended December 31, 2018 and 2017

| 2018 | 2017 | |||||||

| Sales, net | $ | 4,743,075 | $ | 2,497,667 | ||||

| Cost of goods sold | (4,108,233 | ) | (2,162,965 | ) | ||||

| Gross profit | 634,842 | 334,702 | ||||||

| Operating Expenses: | ||||||||

| General and administrative | 2,677,727 | 1,218,349 | ||||||

| Sales and marketing | 539,623 | 118,307 | ||||||

| Depreciation expense | 30,945 | 11,912 | ||||||

| Research and development | 266,140 | 2,518 | ||||||

| Total Operating Expenses | 3,514,435 | 1,351,086 | ||||||

| Loss from operations | (2,879,593 | ) | (1,016,384 | ) | ||||

| Other Expenses: | ||||||||

| Interest expense | (121,308 | ) | (76,497 | ) | ||||

| Total Other Expenses | (121,308 | ) | (76,497 | ) | ||||

| Net Loss | $ | (3,000,901 | ) | $ | (1,092,881 | ) | ||

| Weighted-average vested common shares outstanding: | ||||||||

| - Basic and Diluted | 5,666,752 | 3,895,833 | ||||||

| Net loss per common share | ||||||||

| - Basic and Diluted | $ | (0.53 | ) | $ | (0.28 | ) | ||

See accompanying notes, which are an integral part of these financial statements.

| -4- |

STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

For the years ended December 31, 2018 and 2017

| Series A Preferred Stock | Common Stock | Total Stockholders' | ||||||||||||||||||||||||||

| Number of Shares | Amount | Number of Shares | Amount | Additional Paid-In Capital | Accumulated Deficit | Equity (Deficit) | ||||||||||||||||||||||

| Balance at December 31, 2016 | - | $ | - | 8,500,000 | $ | 85 | $ | 765 | $ | (869,775 | ) | $ | (868,925 | ) | ||||||||||||||

| Stock-based compensation | - | - | - | - | 32,584 | - | 32,584 | |||||||||||||||||||||

| Net loss | - | - | - | - | - | (1,092,881 | ) | (1,092,881 | ) | |||||||||||||||||||

| Balance at December 31, 2017 | - | - | 8,500,000 | 85 | 33,349 | (1,962,656 | ) | (1,929,222 | ) | |||||||||||||||||||

| Issuance of preferred stock for cash | 3,499,878 | 35 | - | - | 6,999,721 | - | 6,999,756 | |||||||||||||||||||||

| Issuance of preferred stock as broker commission | 163,451 | 2 | - | - | 326,900 | - | 326,902 | |||||||||||||||||||||

| Offering costs | - | - | - | - | (973,813 | ) | - | (973,813 | ) | |||||||||||||||||||

| Conversion of SAFE agreements | 2,540,006 | 25 | - | - | 1,829,935 | - | 1,829,960 | |||||||||||||||||||||

| Conversion of KISS notes | 2,206,195 | 22 | - | - | 1,571,006 | - | 1,571,028 | |||||||||||||||||||||

| Conversion of Crowd Notes | 432,100 | 4 | - | - | 258,134 | - | 258,138 | |||||||||||||||||||||

| Exercise of stock option | - | - | 27,500 | - | 1,375 | - | 1,375 | |||||||||||||||||||||

| Repurchase of common stock from founders | - | - | (1,700,000 | ) | 17 | - | - | 17 | ||||||||||||||||||||

| Reissuance of common stock | - | - | 1,700,000 | (17 | ) | - | - | (17 | ) | |||||||||||||||||||

| Stock-based compensation | - | - | - | - | 9,043 | - | 9,043 | |||||||||||||||||||||

| Net loss | - | - | - | - | - | (3,000,901 | ) | (3,000,901 | ) | |||||||||||||||||||

| Balance at December 31, 2018 | 8,841,630 | $ | 88 | 8,527,500 | $ | 85 | $ | 10,055,650 | $ | (4,963,557 | ) | $ | 5,092,266 | |||||||||||||||

See accompanying notes, which are an integral part of these financial statements.

| -5- |

STATEMENTS OF CASH FLOWS

For the years ended December 31, 2018 and 2017

| 2018 | 2017 | |||||||

| Cash Flows from Operating Activities | ||||||||

| Net Loss | $ | (3,000,901 | ) | $ | (1,092,881 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Depreciation and amortization | 30,945 | 11,912 | ||||||

| Stock-based compensation | 9,043 | 32,584 | ||||||

| Note issued as compensation | 39,412 | - | ||||||

| Loan discount amortization | 49,547 | 25,540 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Change in receivables | (86,528 | ) | (141,236 | ) | ||||

| Change in inventory | (206,557 | ) | (141,774 | ) | ||||

| Change in prepaid expenses | (47,702 | ) | (4,750 | ) | ||||

| Change in deposits | 4,898 | (6,000 | ) | |||||

| Change in other non-current asset | (175,050 | ) | - | |||||

| Change in accounts payable and accrued liabilities | 439,428 | 70,674 | ||||||

| Change in accrued interest | 27,594 | 38,693 | ||||||

| Net Cash Used in Operating Activities | (2,915,871 | ) | (1,207,238 | ) | ||||

| Cash Flows from Investing Activities | ||||||||

| Purchases of property and equipment | (248,571 | ) | (134,317 | ) | ||||

| Net Cash Used in Investing Activities | (248,571 | ) | (134,317 | ) | ||||