UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 SCHEDULE 14A (RULE 14a-101) SCHEDULE 14A INFORMATION Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐ Check the appropriate box: ☐ Preliminary Proxy Statement. ☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)). ☐ Definitive Proxy Statement. ☐ Definitive Additional Materials. ☒ Soliciting Material Pursuant to §240.14a-12. TCG BDC II, Inc. (Name of Registrant as Specified In Its Charter) (Name of Person(s) Filing Proxy Statement, if other than the Registrant) Payment of Filing Fee (Check the appropriate box): ☒ No fee required. ☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. (1) Title of each class of securities to which transaction applies: (2) Aggregate number of securities to which transaction applies: (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): (4) Proposed maximum aggregate value of transaction: (5) Total fee paid: ☐ Fee paid previously with preliminary materials. ☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. (1) Amount Previously Paid: (2) Form, Schedule or Registration Statement No.: (3) Filing Party: (4) Date Filed:

1 TCG BDC II, Inc. Shareholder Vote: Conversion to Perpetual Vehicle October 2021

2 Important Information Forward-Looking Statements This presentation contains forward-looking statements that involve substantial risks and uncertainties, including statements regarding the completion of certain contemplated transactions by TCG BDC II, Inc. (the “Company,” “TCG BDC II” or “BDC II”), statements regarding the anticipated filings and approvals relating to a special meeting of TCG BDC II’s stockholders (the “Special Meeting”), and statements regarding the completion of certain other transactions. The use of words such as “anticipates,” “believes,” “intends,” “plans,” “expects,” “projects,” “estimates,” “will,” “should,” “may” and similar expressions identify any such forward-looking statements. These forward-looking statements are not guarantees of future performance or events and are subject to various risks and uncertainties. Certain factors could cause actual results, conditions and events to differ materially from those projected or anticipated, including the uncertainties associated with (i) the timing or likelihood of the completion of the contemplated transactions, (ii) the timing or likelihood of the commencement and/or completion of any tender offer, (iii) the percentage of TCG BDC II stockholders voting in favor of the stockholder proposals to be considered at the Special Meeting (the “Stockholder Proposals”), (iv) the possibility that TCG BDC II may fail to obtain the requisite stockholder approval for one or more of the Stockholder Proposals, (v) regulatory factors, (vi) and other factors enumerated in TCG BDC II’s filings with the U.S. Securities and Exchange Commission (the “SEC”). You should not place undue reliance on such forward-looking statements, which speak only as of the date of this presentation. Neither TCG BDC II nor any of its affiliates undertake any obligation to update any forward-looking statements made herein, unless required by law. You should, therefore, not rely on these forward-looking statements as representing the views of TCG BDC II or any of its affiliates as of any date subsequent to the date of this presentation. You should read this presentation and the documents referenced in this presentation completely and with the understanding that actual future events and results may be materially different from expectations. All forward-looking statements included in this communication are qualified by these cautionary statements. Additional Information and Where to Find It In connection with the contemplated transactions, including seeking to obtain TCG BDC II stockholder approval in connection with the Stockholder Proposals, TCG BDC II plans to file a definitive proxy statement on Schedule 14A relating to the Special Meeting (the “Proxy Statement”) with the SEC and deliver it to TCG BDC II stockholders. The Proxy Statement will contain important information about TCG BDC II, any contemplated transactions and related matters. This presentation is not a substitute for the Proxy Statement or for any other document that TCG BDC II or another party may file with the SEC and send to TCG BDC II’s stockholders in connection with the contemplated transactions. This communication is for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. STOCKHOLDERS OF TCG BDC II ARE URGED TO READ THE PROXY STATEMENT, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS THERETO, AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT TCG BDC II, THE PROPOSED TRANSACTIONS AND RELATED MATTERS. Investors and security holders will be able to obtain the documents filed with the SEC free of charge at the SEC’s website, http://www.sec.gov. Participants in the Solicitation TCG BDC II, its directors, certain of its executive officers and certain employees and officers of Carlyle Global Credit Investment Management L.L.C. and its affiliates may be deemed to be participants in the solicitation of proxies in connection with the Stockholder Proposals and contemplated transactions. Information about the directors and executive officers of TCG BDC II is set forth in its proxy statement for its 2021 Annual Meeting of Stockholders, which was filed with the SEC on April 27, 2021. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of the TCG BDC II stockholders in connection with the Stockholder Proposals will be contained in the Proxy Statement when such document becomes available. This document may be obtained free of charge from the sources indicated above. No Offer or Solicitation This presentation is not, and under no circumstances is it to be construed as, a prospectus or an advertisement. Nothing in this communication shall constitute an offer to sell, or a solicitation of an offer to buy, any securities and this communication should not be interpreted or construed as such. Any offers, solicitations or offers to buy, or any sales of securities will be made in accordance with the registration requirements of the Securities Act of 1933, as amended, or an exemption therefrom.

3 Carlyle is requesting that shareholders review the detailed terms of the potential transaction, which will be set forth in a definitive proxy statement filed by BDC II with the SEC • TCG BDC II, Inc. (“TCG BDC II”) is a private BDC managed by Carlyle Global Credit Investment Management L.L.C. (“Carlyle”), whose investment period expires in September 2022 • With no other action, the vehicle is expected to return investor capital over the course of 2023 – 2027 as the portfolio’s loans repay • Certain investors have expressed a desire to continue investing in the vehicle • Carlyle is presenting a transaction that we believe is mutually beneficial to both shareholders who desire to remain invested AND those who wish to seek full or partial liquidity over time • The transaction, if approved, would convert TCG BDC II into a “perpetual,” private vehicle, with regular, enhanced investor liquidity mechanisms at NAV • In connection with the transaction – which has been approved by TCG BDC II’s Board and its Independent Directors – TCG BDC II is seeking approval to convert the vehicle by an affirmative vote of a majority of the outstanding shares • In connection with the conversion, TCG BDC II is also seeking to amend and restate its investment advisory agreement with Carlyle, which also requires the vote of a “majority of the outstanding voting securities,” as defined in the Investment Company Act of 1940 Situation Overview Note: Return of capital under either “no action” or “yes vote” scenarios is subject to a variety of assumptions and may be impacted by future market conditions or other factors; either positively or negatively. Tender offer acceptance subject to approval of TCG BDC II’s board, among other factors. Note: TCG BDC II fund term ends November 2025 but includes two potential one-year extensions (subject to Board approval). Further extensions would require a Shareholder vote.

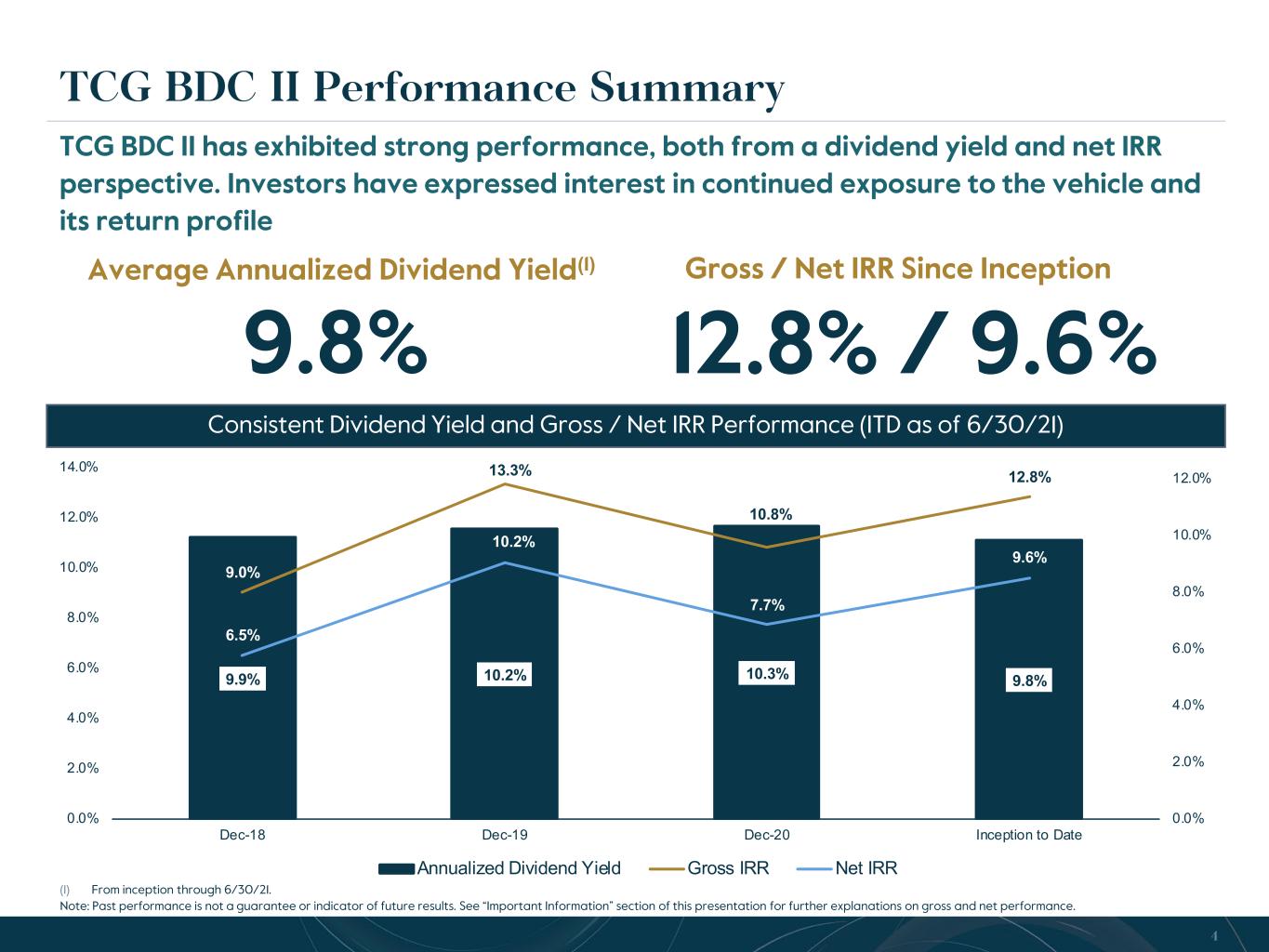

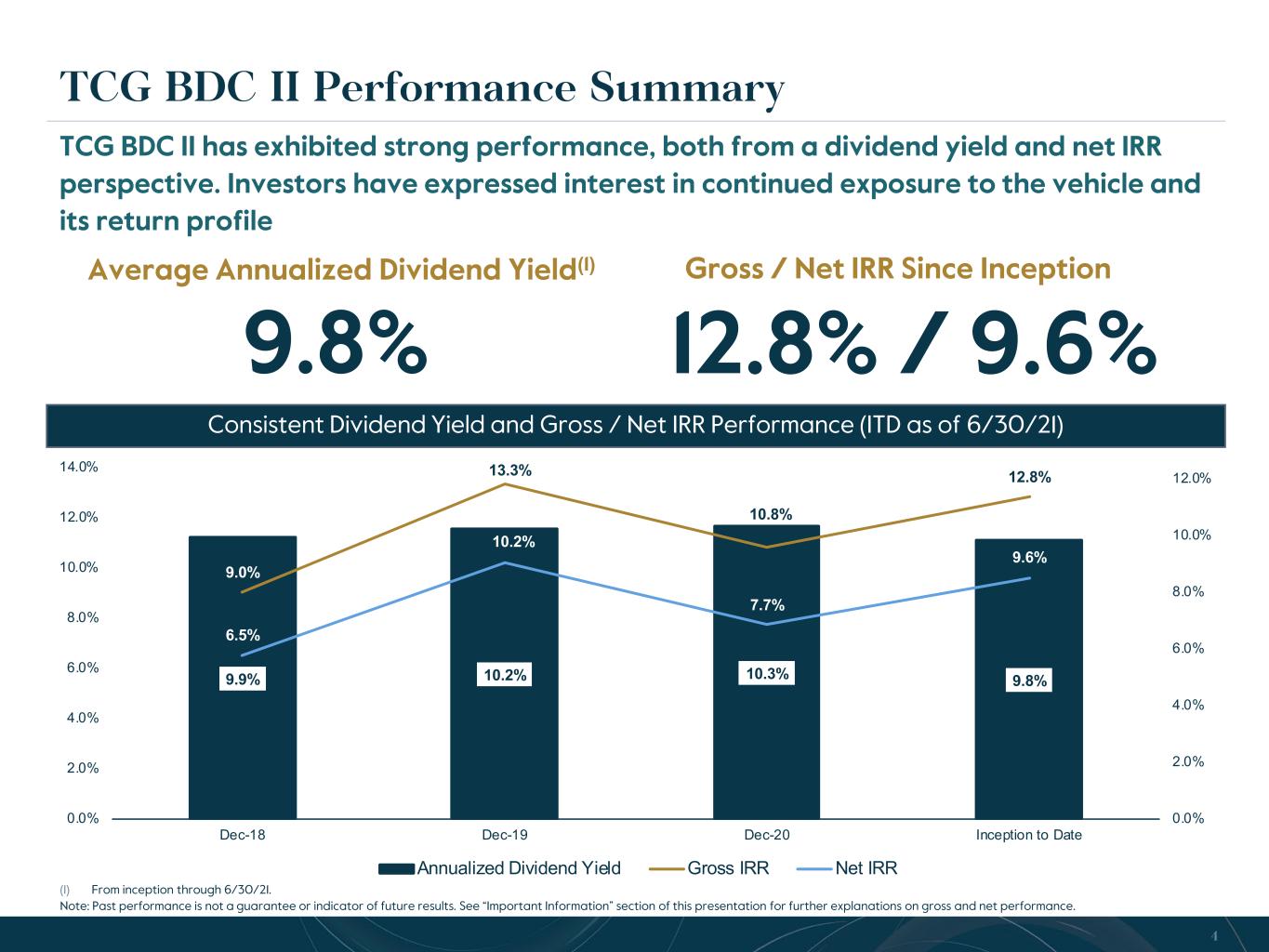

4 TCG BDC II Performance Summary Average Annualized Dividend Yield(1) Gross / Net IRR Since Inception Consistent Dividend Yield and Gross / Net IRR Performance (ITD as of 6/30/21) 9.8% 12.8% / 9.6% 9.9% 10.2% 10.3% 9.8% 9.0% 13.3% 10.8% 12.8% 6.5% 10.2% 7.7% 9.6% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% Dec-18 Dec-19 Dec-20 Inception to Date Annualized Dividend Yield Gross IRR Net IRR TCG BDC II has exhibited strong performance, both from a dividend yield and net IRR perspective. Investors have expressed interest in continued exposure to the vehicle and its return profile (1) From inception through 6/30/21. Note: Past performance is not a guarantee or indicator of future results. See “Important Information” section of this presentation for further explanations on gross and net performance.

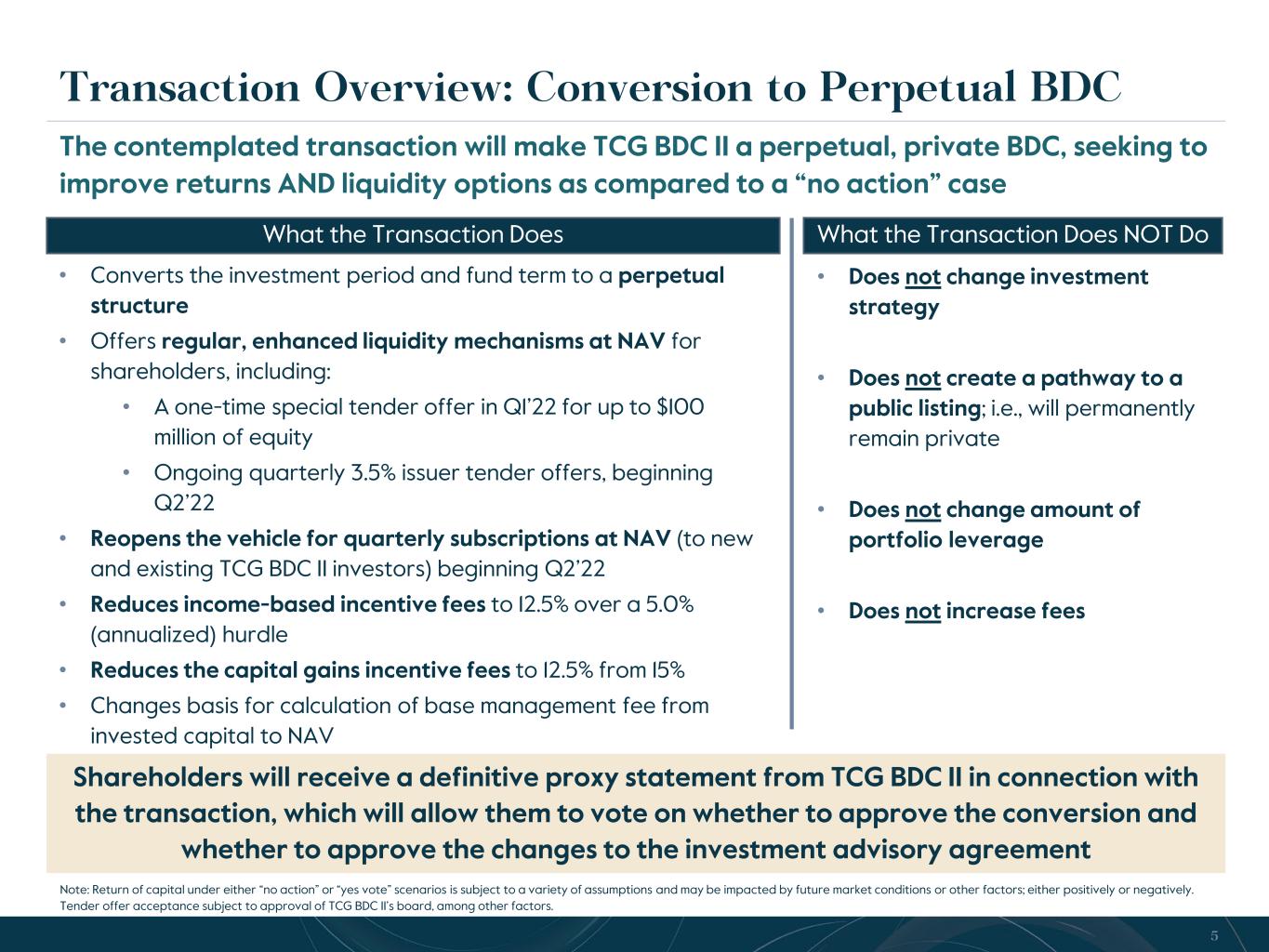

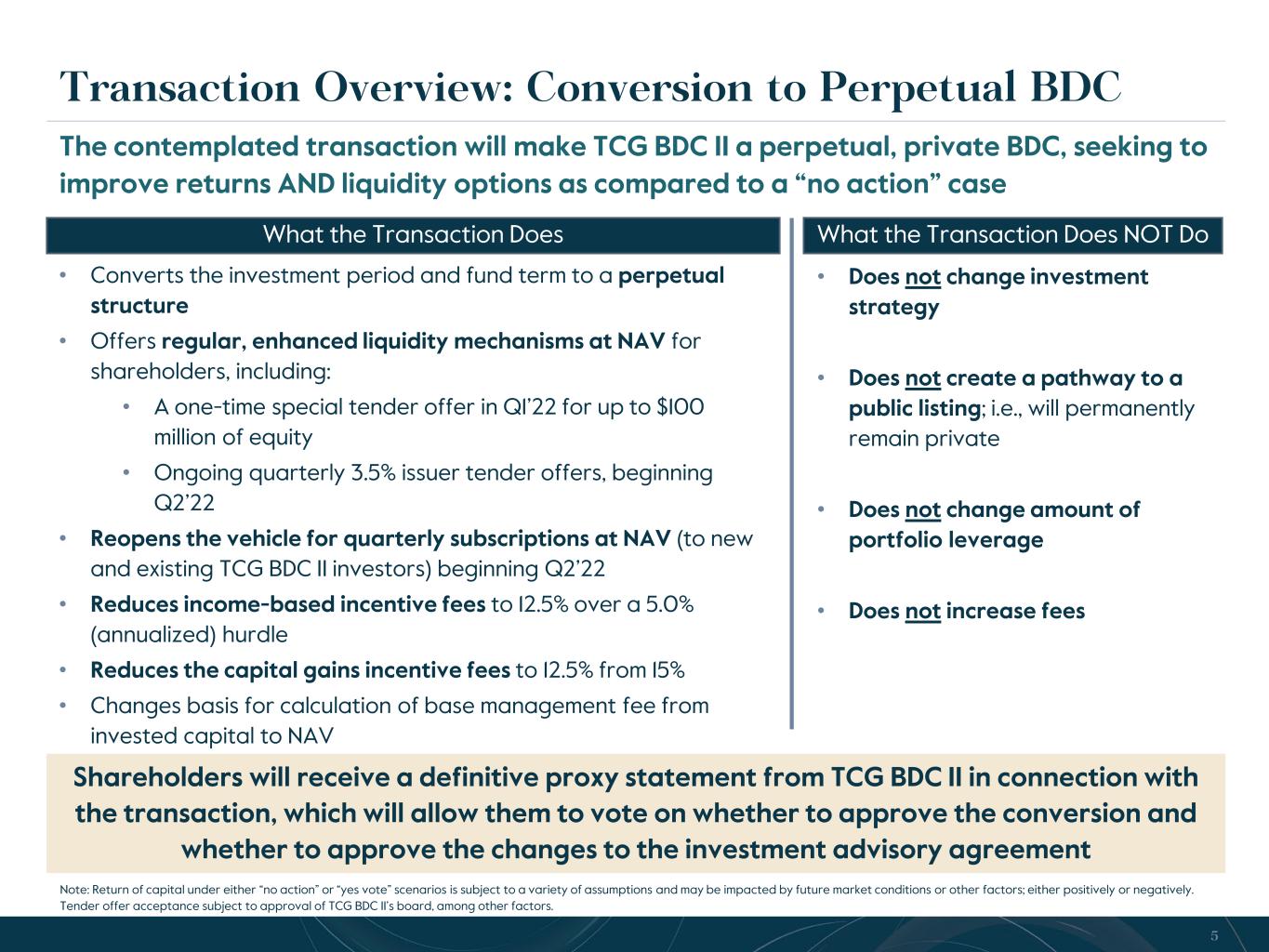

5 Transaction Overview: Conversion to Perpetual BDC What the Transaction Does What the Transaction Does NOT Do • Converts the investment period and fund term to a perpetual structure • Offers regular, enhanced liquidity mechanisms at NAV for shareholders, including: • A one-time special tender offer in Q1’22 for up to $100 million of equity • Ongoing quarterly 3.5% issuer tender offers, beginning Q2’22 • Reopens the vehicle for quarterly subscriptions at NAV (to new and existing TCG BDC II investors) beginning Q2’22 • Reduces income-based incentive fees to 12.5% over a 5.0% (annualized) hurdle • Reduces the capital gains incentive fees to 12.5% from 15% • Changes basis for calculation of base management fee from invested capital to NAV • Does not change investment strategy • Does not create a pathway to a public listing; i.e., will permanently remain private • Does not change amount of portfolio leverage • Does not increase fees The contemplated transaction will make TCG BDC II a perpetual, private BDC, seeking to improve returns AND liquidity options as compared to a “no action” case Shareholders will receive a definitive proxy statement from TCG BDC II in connection with the transaction, which will allow them to vote on whether to approve the conversion and whether to approve the changes to the investment advisory agreement Note: Return of capital under either “no action” or “yes vote” scenarios is subject to a variety of assumptions and may be impacted by future market conditions or other factors; either positively or negatively. Tender offer acceptance subject to approval of TCG BDC II’s board, among other factors.

6 Merits and Considerations for All Shareholders Investors Who Wish to Remain Invested Maintain capital deployment in well performing portfolio Expect enhanced yield profile from avoiding inefficiencies of wind-down Gain future optionality on earlier liquidity (i.e., ongoing quarterly tenders) Receive benefit of lower incentive fee rates Investors Who Want Liquidity Access substantial, earlier liquidity via tenders than otherwise possible in “no action” case Expect enhanced yield profile from avoiding inefficiencies of wind-down Receive benefit of lower incentive fee rates We believe the transaction provides various benefits to all shareholders Carlyle believes that there is a better path forward, which has the potential to enhance value for all TCG BDC II shareholders Note: Return of capital under either “no action” or “yes vote” scenarios is subject to a variety of assumptions and may be impacted by future market conditions or other factors; either positively or negatively. Tender offer acceptance subject to approval of TCG BDC II’s board, among other factors.

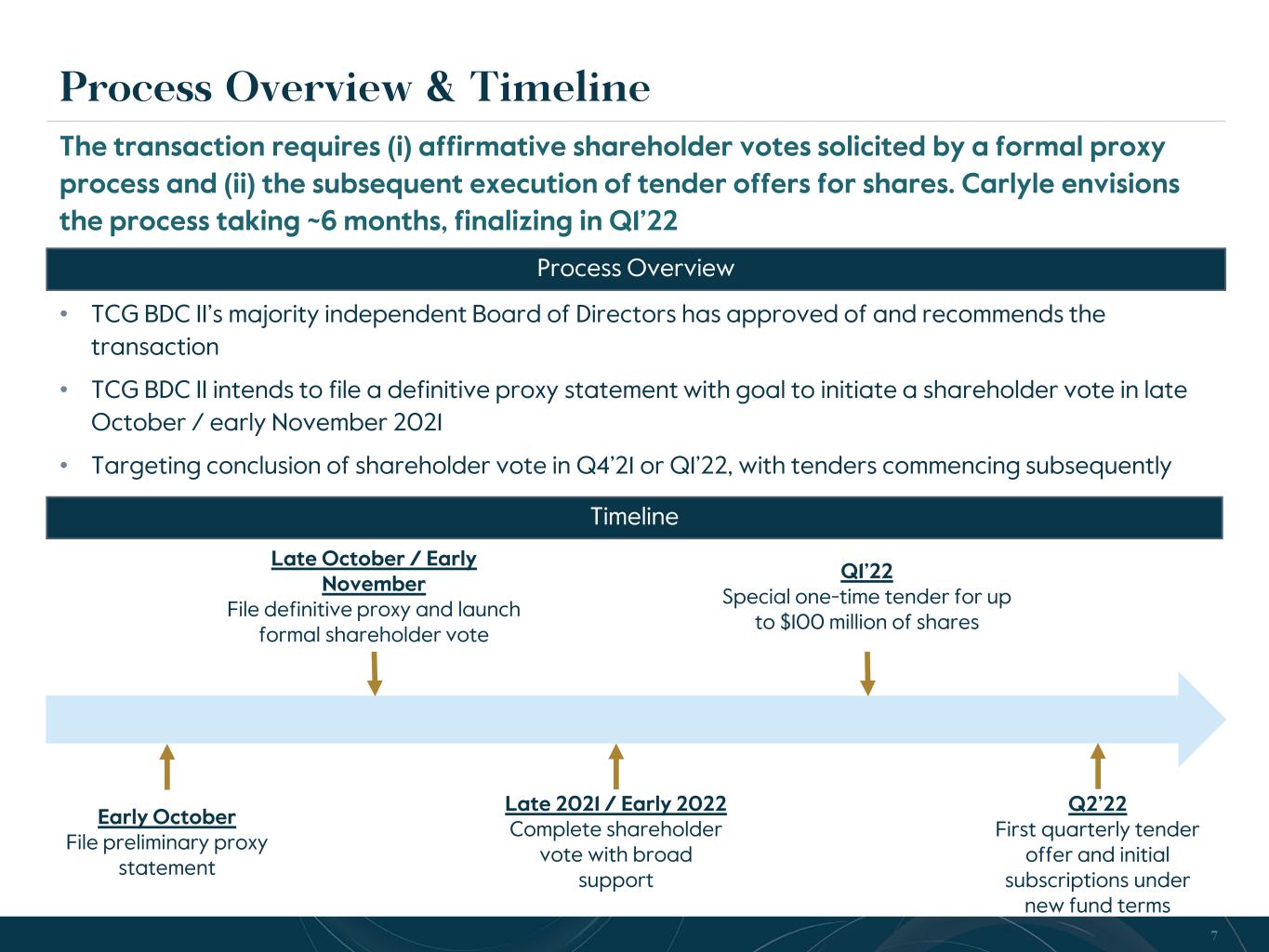

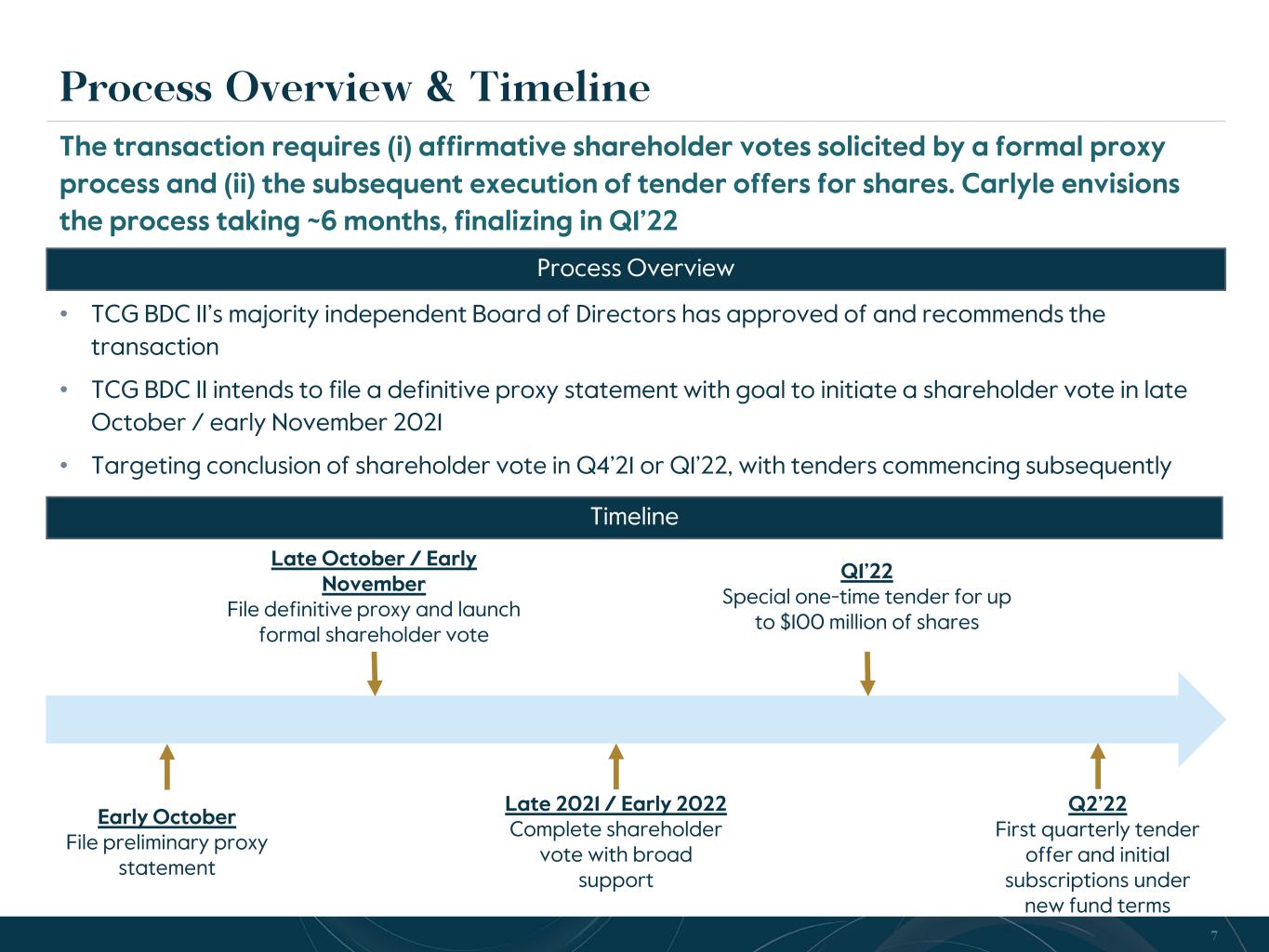

7 • TCG BDC II’s majority independent Board of Directors has approved of and recommends the transaction • TCG BDC II intends to file a definitive proxy statement with goal to initiate a shareholder vote in late October / early November 2021 • Targeting conclusion of shareholder vote in Q4’21 or Q1’22, with tenders commencing subsequently • Special “one-time” tender in Q1’22, followed by first regular issuer quarterly tender in Q2’22 Process Overview & Timeline Process Overview Timeline Early October File preliminary proxy statement Late October / Early November File definitive proxy and launch formal shareholder vote Late 2021 / Early 2022 Complete shareholder vote with broad support Q1’22 Special one-time tender for up to $100 million of shares Q2’22 First quarterly tender offer and initial subscriptions under new fund terms The transaction requires (i) affirmative shareholder votes solicited by a formal proxy process and (ii) the subsequent execution of tender offers for shares. Carlyle envisions the process taking ~6 months, finalizing in Q1’22

8 Appendix

9 TCG BDC II Overview Key Terms (Current) Portfolio Summary (as of 6/30/21) • Inception: September 2017 • Investment Period Expiration: September 2022 • End of Fund Term : November 2025 (pre-extension) • Management Fee: 1.0% on invested equity • Income And Capital Gain-Based Incentive Fees: 15.0% over a 7.0% (annualized) hurdle • Target Leverage: ~0.9x TCG BDC II is focused on delivering current income from a diversified portfolio of stable and defensive directly-originated private credit assets • Funded / Unfunded Commitments: $2.1 bn / $141 mm • Total Equity Commitment: ~$1.2 bn (85% called) • Investments / Portfolio Companies: 122 / 90 DIVERSIFICATION BY BORROWER DIVERSIFICATION BY INDUSTRY 25% 26% 49% Top 10 Investments Next 11-25 Investments Remaining Investments 82% 16% 2% First Lien Debt Second Lien Debt Equity Investments 13% 9% 9% 8% 8% 7%6% 5% 5% 4% 28% Software Aerospace & Defense Banking, Finance, Insurance & RE High Tech Industries Business Services Healthcare & Pharma Containers, Packaging & Glass Hotel, Gaming & Leisure Beverage, Food & Tobacco Portfolio Diversification (as of 6/30/21) Note: TCG BDC II fund term ends November 2025 but includes two potential one-year extensions (subject to Board approval) that would extend the fund term to November 2027. Further extensions would require a Shareholder vote.

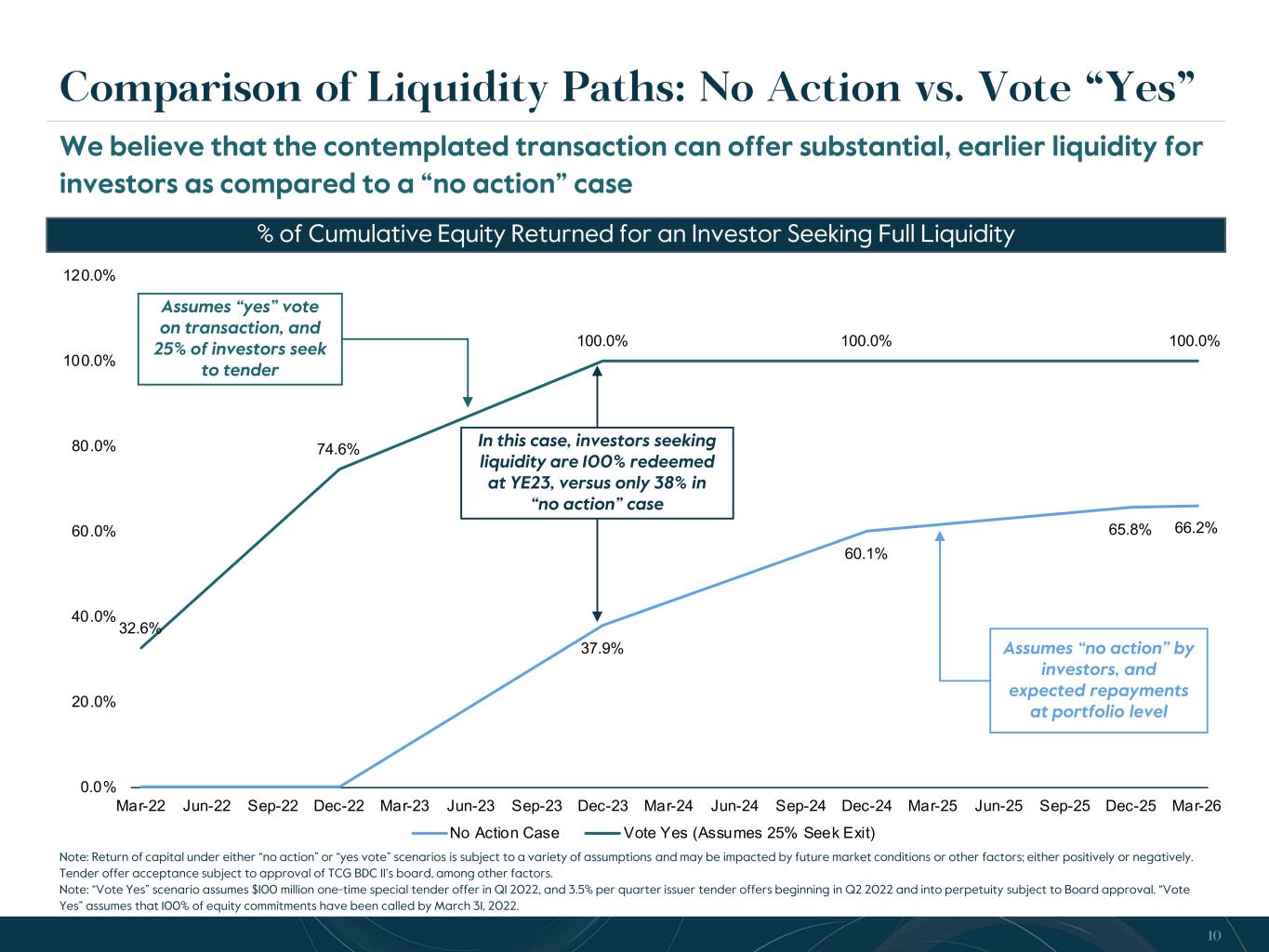

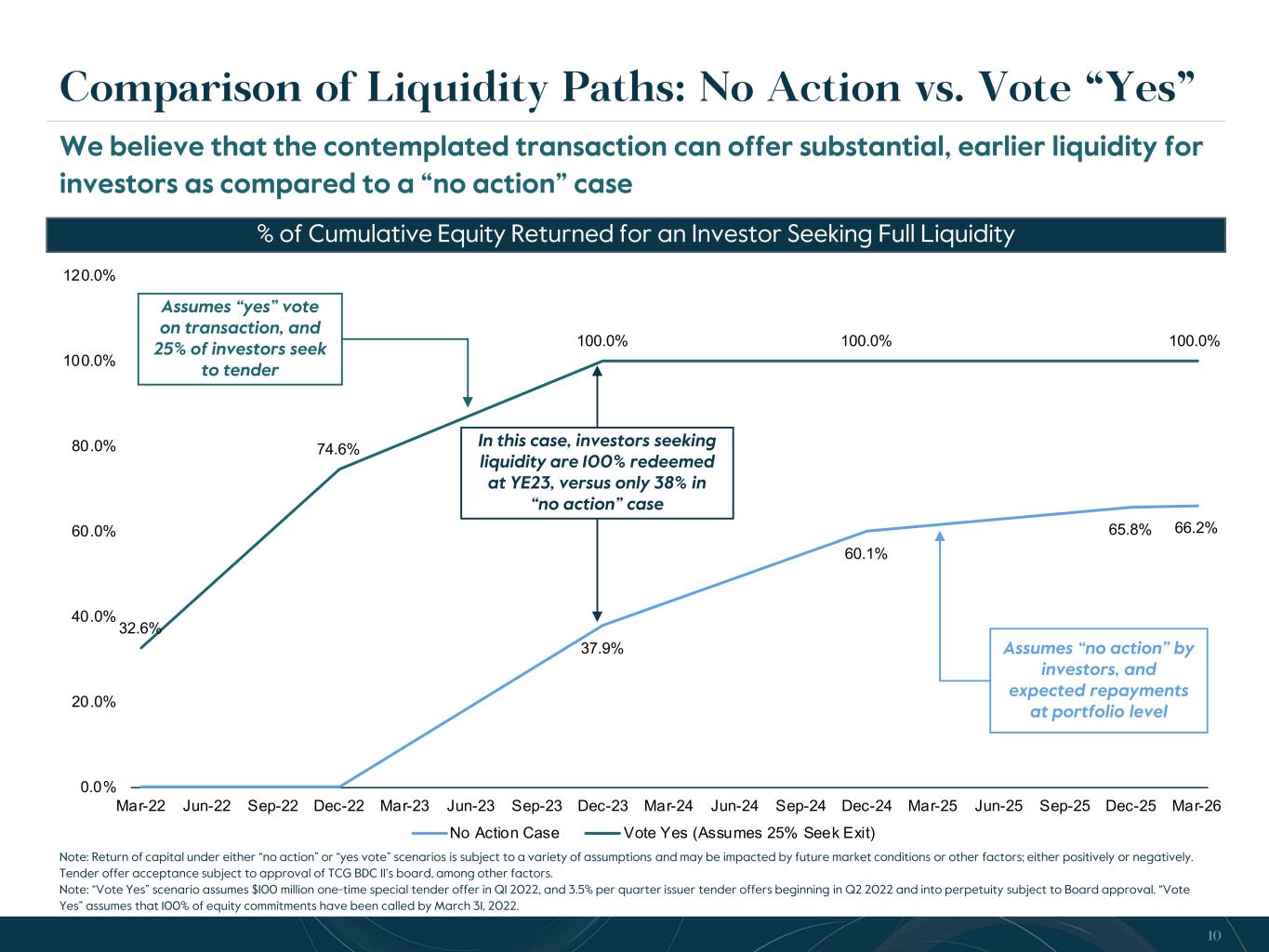

10 37.9% 60.1% 65.8% 66.2% 32.6% 74.6% 100.0% 100.0% 100.0% 0.0% 20.0% 40.0% 60.0% 80.0% 100.0% 120.0% Mar-22 Jun-22 Sep-22 Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Mar-24 Jun-24 Sep-24 Dec-24 Mar-25 Jun-25 Sep-25 Dec-25 Mar-26 No Action Case Vote Yes (Assumes 25% Seek Exit) Comparison of Liquidity Paths: No Action vs. Vote “Yes” Note: Return of capital under either “no action” or “yes vote” scenarios is subject to a variety of assumptions and may be impacted by future market conditions or other factors; either positively or negatively. Tender offer acceptance subject to approval of TCG BDC II’s board, among other factors. Note: “Vote Yes” scenario assumes $100 million one-time special tender offer in Q1 2022, and 3.5% per quarter issuer tender offers beginning in Q2 2022 and into perpetuity subject to Board approval. “Vote Yes” assumes that 100% of equity commitments have been called by March 31, 2022. We believe that the contemplated transaction can offer substantial, earlier liquidity for investors as compared to a “no action” case % of Cumulative Equity Returned for an Investor Seeking Full Liquidity Assumes “yes” vote on transaction, and 25% of investors seek to tender Assumes “no action” by investors, and expected repayments at portfolio level In this case, investors seeking liquidity are 100% redeemed at YE23, versus only 38% in “no action” case

11 Please contact us with questions: L. Allison Rudary, Investor Relations allison.rudary@carlyle.com (212) 813-4756

12 Important Information This presentation (“Presentation”) prepared by Carlyle Global Credit Investment Management L.L.C. (together with its affiliates, “Carlyle”), is provided for information purposes only and is not an offer to sell or solicitation of an offer to buy interests in any fund or investment program sponsored by Carlyle. Such offer or solicitation to buy interests (“Interests”) in any fund or investment account sponsored by Carlyle (“Fund”) is made only through the Fund’s confidential private placement memorandum (the “Memorandum”). The information contained in this Presentation is superseded by, and is qualified in its entirety by the Memorandum. Carlyle makes no representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein. Certain information contained herein has been obtained from published and non-published sources prepared by third parties. While such information is believed to be reliable, Carlyle does not assume any responsibility for the accuracy or completeness of the information, which is based on matters as they exist as of the date of this Presentation and not as of any future date. Associated Risks. An investment in the Fund entails a high degree of risk and no assurance can be given that the Fund’s investment objective will be achieved or that investors will receive a return on their capital. Each prospective investor should consult its own legal, accounting and tax advisors as to the legal, business, tax and related matters concerning the information contained in this Presentation in order to make an independent determination and consequences of a potential investment in the Fund, including federal, state, local and foreign tax consequences. Past performance is not necessarily indicative of future results, and there can be no assurance that targeted returns will be achieved, that the Fund will achieve comparable results, or that the Fund will be able to implement its investment strategy or achieve its investment objective. Please see the Risk Factors and Potential Conflicts of Interest section of the Memorandum for the risks associated with this Fund, as well as in the Fund’s SEC filings. Certain Definitions. Unless otherwise indicated, all internal rates of return (“IRRs”), multiples of invested capital (“MOICs”) and dividend yields are presented on a “gross” basis, i.e., they do not reflect any carried interest, management fees, taxes, transaction costs and other expenses (“Fees & Expenses”) to be borne by certain and/or all investors, which will reduce returns and, in the aggregate, are expected to be substantial. Any “net” performance information is after deduction for such Fees & Expenses. An investment is considered realized when the investment fund has completely exited, and ceases to own an interest in, the investment. An investment is considered partially realized when the total proceeds received in respect of such investment, including dividends, interest or other distributions and/or return of capital represents at least 50% of invested capital and such investment is not yet fully realized. For a description of such Fees & Expenses, please see the Memorandum and Part II of Form ADV maintained by Carlyle’s registered investment advisor, Carlyle Global Credit Investment Management L.L.C., a copy of which will be furnished to each investor prior to its admission to a Fund. Prospective investors, upon request, may obtain a hypothetical illustration of the effect of such Fees & Expenses on returns. Unregistered Status. The Interests have not been registered under the U.S. Securities Act of 1933, as amended (the “Securities Act”), the securities laws of any other state or the securities laws of any other jurisdiction, nor is such registration contemplated. The Interests will be offered and sold in the United States under the exemption provided by Section 4(a)(2) of the Securities Act and Regulation D promulgated thereunder. The Interests will be offered outside the United States in reliance upon the exemption from registration provided by Regulation D or Regulation S promulgated under the Securities Act and other exemptions of similar import in the laws of the states and jurisdictions where the offering will be made. Valuations. For purposes of this Presentation, the valuation of our investments is determined in accordance with the terms of ASC 820, Fair Value Measurement. Generally, Carlyle values its investments at their market price if market quotations are readily available, with a discount in the case of restricted securities. In the absence observable market prices, valuations may incorporate management’s own assumptions and involve a significant degree of judgment, taking into consideration a combination of internal and external factors, including the appropriate risk adjustments for non-performance and liquidity risks. Investments for which market prices are not observable include private investments in the equity of operating companies, real estate properties, certain debt positions or CLOs. Valuations of non-US denominated unrealized investments are calculated in the applicable local currency and converted to U.S. dollars as of the relevant valuation date and accordingly, include the effects, if any, in movements in currency exchange rates.

13 Important Information (Cont’d) References to portfolio companies are provided solely to illustrate the application of Carlyle’s investment process, and are not and should not be considered a recommendation of any particular security or portfolio company. To ensure compliance with Internal Revenue Circular 230, you are hereby notified that any discussion of tax matters set forth in this Presentation was written in connection with the promotion or marketing of the transactions or matters addressed herein and was not intended or written to be used, and cannot be used by any prospective investor, for the purpose of avoiding tax-related penalties under federal, state or local tax law. Each prospective investor should seek advice based on its particular circumstances from an independent tax advisor. Prospective investors will be given the opportunity to ask questions and are encouraged to contact Carlyle to discuss the procedures and methodologies used to calculate the investment returns, as well as any terms and conditions of any Fund offering. Where applicable, this Presentation has been distributed by TCG Capital Markets L.L.C., a broker dealer registered with the U.S. Securities and Exchange Commission (“SEC”) and member of the Financial Industry Regulatory Authority (“FINRA”). Related financial products and services are only available to investors deemed to be “qualified purchasers” as defined in Section 2(a)(51) of the Investment Company Act of 1940, as amended, and “accredited investors” as defined in Regulation D of the Securities Act. When TCG Capital Markets presents a strategy or product to a prospective investor, TCG Capital Markets does not determine whether an investment in the strategy or product is in the best interests of, or is suitable for, the investor. Investors should exercise their own judgment and/or consult with a professional advisor prior to investing in any Carlyle strategy or product. In the United Kingdom, this Presentation is only being distributed to and is only directed at (i) investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”), (ii) high net worth companies, and other persons to whom it may lawfully be communicated, falling within Article 49(2)(a) to (d) of the Order, or (iii) any other person to whom it may lawfully communicated, (all such persons together being referred to as “relevant persons”). Any investment to which this Presentation relates is only available to, and any invitation, offer or agreement to subscribe, purchase or otherwise acquire such investments will be engaged in only with, relevant persons. Any person who is not a relevant person should not act or rely on this document or any of its contents. Transmission of this information to any other person in the U.K. is unauthorized and may contravene the Financial Services and Markets Act of 2000. CECP Advisors LLP is not acting for you and does not regard you as a customer or a client. It will not be responsible to you for providing protections afforded to clients of Carlyle or be advising you on the relevant transaction. MARKETING IN AND FROM THE DUBAI INTERNATIONAL FINANCIAL CENTRE (‘DIFC’): This Presentation has been distributed to you by Carlyle MENA Investment Advisors Limited which is duly licensed and regulated by the Dubai Financial Services Authority (the “DFSA”). Related financial products or services are only available to “Professional Clients” and must not, therefore, be delivered to, or relied on by any other type of person. This Presentation and associated materials have been provided to you for your exclusive use. This document is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution would be unlawful under the applicable laws of such jurisdiction. Any distribution, by whatever means, of this document and related material to persons other than those referred to above is strictly prohibited. The Presentation relates to the Partnership, which is not subject to any form of regulation or approval by the DFSA. The DFSA has no responsibility for reviewing or verifying the Presentation or other documents in connection with the Partnership. Accordingly, the DFSA has not approved the Presentation or any other associated documents nor taken any steps to verify the information set out in the Presentation, and has no responsibility for it. The Interests are illiquid and subject to significant restrictions on their resale. Prospective investors should conduct their own due diligence on the Interests. If you do not understand the contents of the Presentation, you should consult an authorized financial adviser. SPECIAL NOTICE TO PROSPECTIVE INVESTORS IN SWITZERLAND: The representative and paying agent of the Fund in Switzerland is Société Générale, Paris, Zurich Branch, Talacker 50, 8001 Zurich. In Switzerland, this Presentation is only being made to, and directed at, qualified investors, as defined in the Swiss Collective Investment Schemes Act of 23 June 2006, as amended and its implementing ordinance.

14