Execution Version First Amendment to Amended and Restated Loan and Security Agreement This First Amendment to Amended and Restated Loan and Security Agreement, dated as of December 28, 2021 (this "Amendment"), is entered into among TCG BDC II SPV LLC, as borrower (the "Company"), JPMorgan Chase Bank, National Association, as administrative agent (in such capacity, the "Administrative Agent"), TCG BDC II, Inc., as servicer (the "Servicer"), JPMorgan Chase Bank, National Association, as lender (in such capacity, the "Lender"), and U.S. Bank National Association, as collateral agent (in such capacity, the "Collateral Agent"), collateral administrator (in such capacity, the "Collateral Administrator") and securities intermediary (in such capacity, the "Securities Intermediary"). Reference is hereby made to the Amended and Restated Loan and Security Agreement, dated as of June 2, 2021 (the "Loan and Security Agreement"), among the parties hereto. Capitalized terms used herein and not otherwise defined herein shall have the respective meanings given such terms in the Loan and Security Agreement. WHEREAS, the parties hereto are parties to the Loan and Security Agreement; and WHEREAS, the parties hereto desire to amend the terms of the Loan and Security Agreement in accordance with Section 10.05 thereof as provided for herein; ACCORDINGLY, the parties hereto agree as set forth below. SECTION 1. AMENDMENTS TO THE LOAN AND SECURITY AGREEMENT The Loan and Security Agreement is hereby amended in accordance with Section 10.05 thereof to delete the stricken text (indicated textually in the same manner as the following example: stricken text) and to add the bold and double-underlined text (indicated textually in the same manner as the following example: bold and double-underlined text) as set forth on the changed pages of the Loan and Security Agreement attached as Exhibit A hereto. SECTION 2. MISCELLANEOUS (a) The Lender's execution of this Amendment shall constitute the written consent required under Section 10.05 of the Loan and Security Agreement. (b) The effectiveness of this Amendment to shall be subject to (i) receipt by the Administrative Agent of a fee set forth in the First Amendment Effective Date Letter, dated as of the date hereof, and (ii) receipt by the Administrative Agent of an opinion of counsel for the Company with respect to the enforceability of this Amendment in form and substance reasonably satisfactory to the Administrative Agent. The parties hereto hereby agree that, except as specifically amended herein, the Loan and Security Agreement is and shall continue to be in full force and effect and is hereby ratified and confirmed in all respects. Except as specifically provided herein, the execution, delivery and effectiveness of this Amendment shall not operate as a waiver of any right, power or remedy of any party hereto under the Loan and Security Agreement, or constitute a waiver of any provision of any other agreement. (c) THIS AMENDMENT SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF NEW YORK. Exhibit 10.11

(d) This Amendment may be executed in any number of counterparts by facsimile or other written form of communication, each of which shall be deemed to be an original as against any party whose signature appears thereon, and all of which shall together constitute one and the same instrument. (e) The individual executing this Amendment on behalf of the Company hereby certifies to the Administrative Agent that (i) such individual is a duly authorized officer of the Company and has the authority to make the certifications set forth in the following subclause (ii) and (ii) as of the date of this Amendment, (x) all of the representations and warranties set forth in Section 6.01 of the Loan and Security Agreement are true and correct (subject to any materiality qualifiers set forth therein), (y) no Default, Event of Default or Market Value Event has occurred and (z) the Borrowing Base Test is satisfied. (f) This Amendment shall be effective as of the date of this Amendment first written above. (g) The Collateral Agent, the Collateral Administrator and the Securities Intermediary assume no responsibility for the correctness of the recitals contained herein, and the Collateral Agent, the Collateral Administrator and the Securities Intermediary shall not be responsible or accountable in any way whatsoever for or with respect to the validity, execution or sufficiency of this Amendment and make no representation with respect thereto. In entering into this Amendment, the Collateral Agent, the Collateral Administrator and the Securities Intermediary shall be entitled to the benefit of every provision of the Loan and Agreement relating to the conduct or affecting the liability of or affording protection to the Collateral Agent, the Collateral Administrator and the Securities Intermediary, including their right to be compensated, reimbursed and indemnified in accordance with the terms thereof. The Administrative Agent, by its signature hereto, authorizes and directs the Collateral Agent, the Collateral Administrator and the Securities Intermediary to execute this Amendment.

TCG BDC II SPV LLC First Amendment to Amended and Restated Loan and Security Agreement IN WITNESS WHEREOF, the parties hereto have executed this Amendment as of the day and year first above written. TCG BDC II SPV LLC, as Company By: __________________________________ Name: Title: TCG BDC II, INC., as Servicer By: __________________________________ Name: Title: Thomas Hennigan Chief Financial Officer Thomas Hennigan Chief Financial Officer

JPMORGAN CHASE BANK, NATIONAL ASSOCIATION, as Administrative Agent By: __________________________________ Name: Title: JPMORGAN CHASE BANK, NATIONAL ASSOCIATION, as Lender By: __________________________________ Name: Title: TCG BDC II SPV LLC First Amendment to Amended and Restated Loan and Security Agreement

U.S. BANK NATIONAL ASSOCIATION, as Collateral Agent By: __________________________________ Name: Title: U.S. BANK NATIONAL ASSOCIATION, as Securities Intermediary By: __________________________________ Name: Title: U.S. BANK NATIONAL ASSOCIATION, as Collateral Administrator By: __________________________________ Name: Title TCG BDC II SPV LLC First Amendment to Amended and Restated Loan and Security Agreement

Signature Page to First Amendment to Amended and Restated Loan and Security Agreement Exhibit A Changed Pages to Loan and Security Agreement

Execution Version Conformed through First Amendment to Amended and Restated Loan and Security Agreement, dated as of December 28, 2021 AMENDED AND RESTATED LOAN AND SECURITY AGREEMENT dated as of June 2, 2021 among TCG BDC II SPV LLC The Lenders Party Hereto The Collateral Administrator, Collateral Agent and Securities Intermediary Party Hereto JPMORGAN CHASE BANK, NATIONAL ASSOCIATION, as Administrative Agent and TCG BDC II, INC., as Servicer

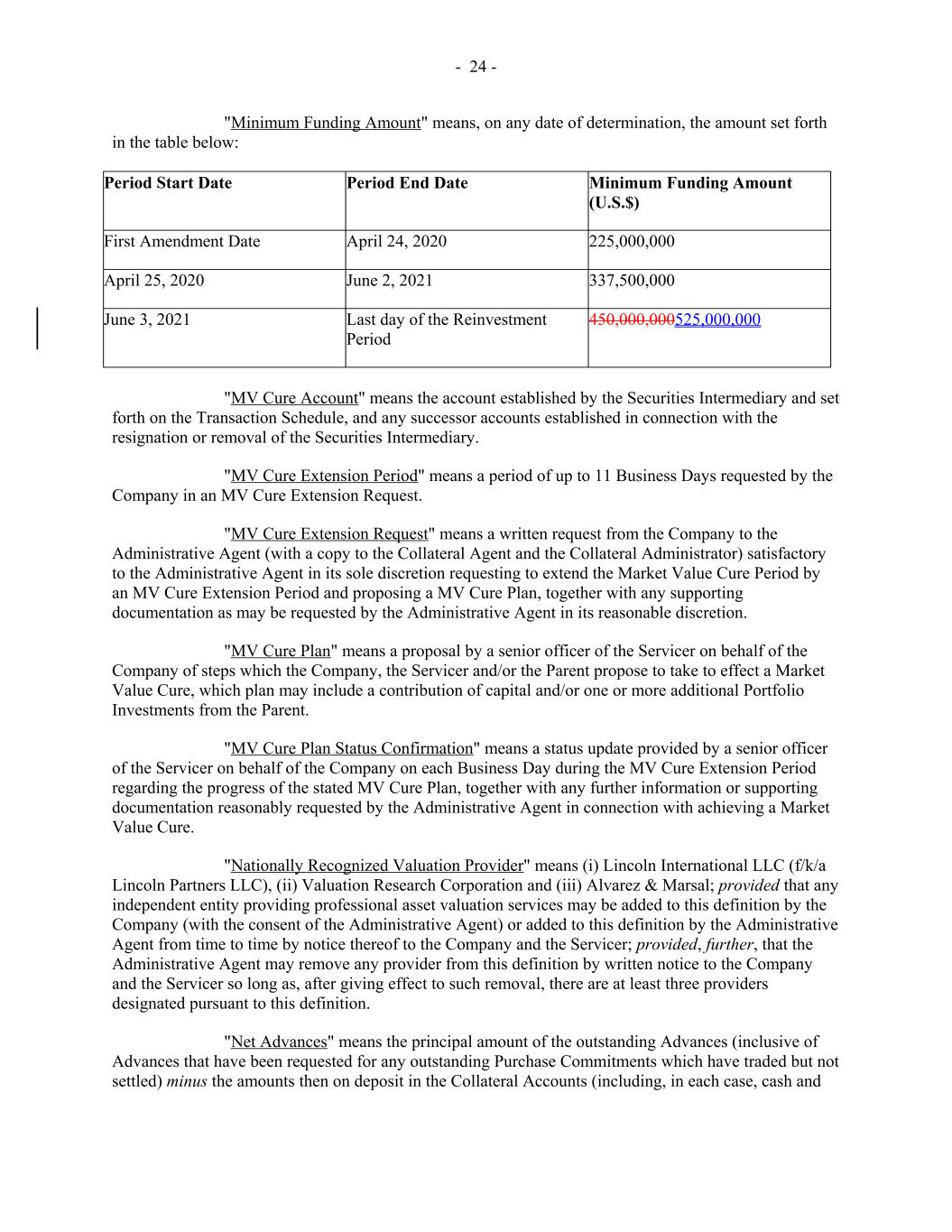

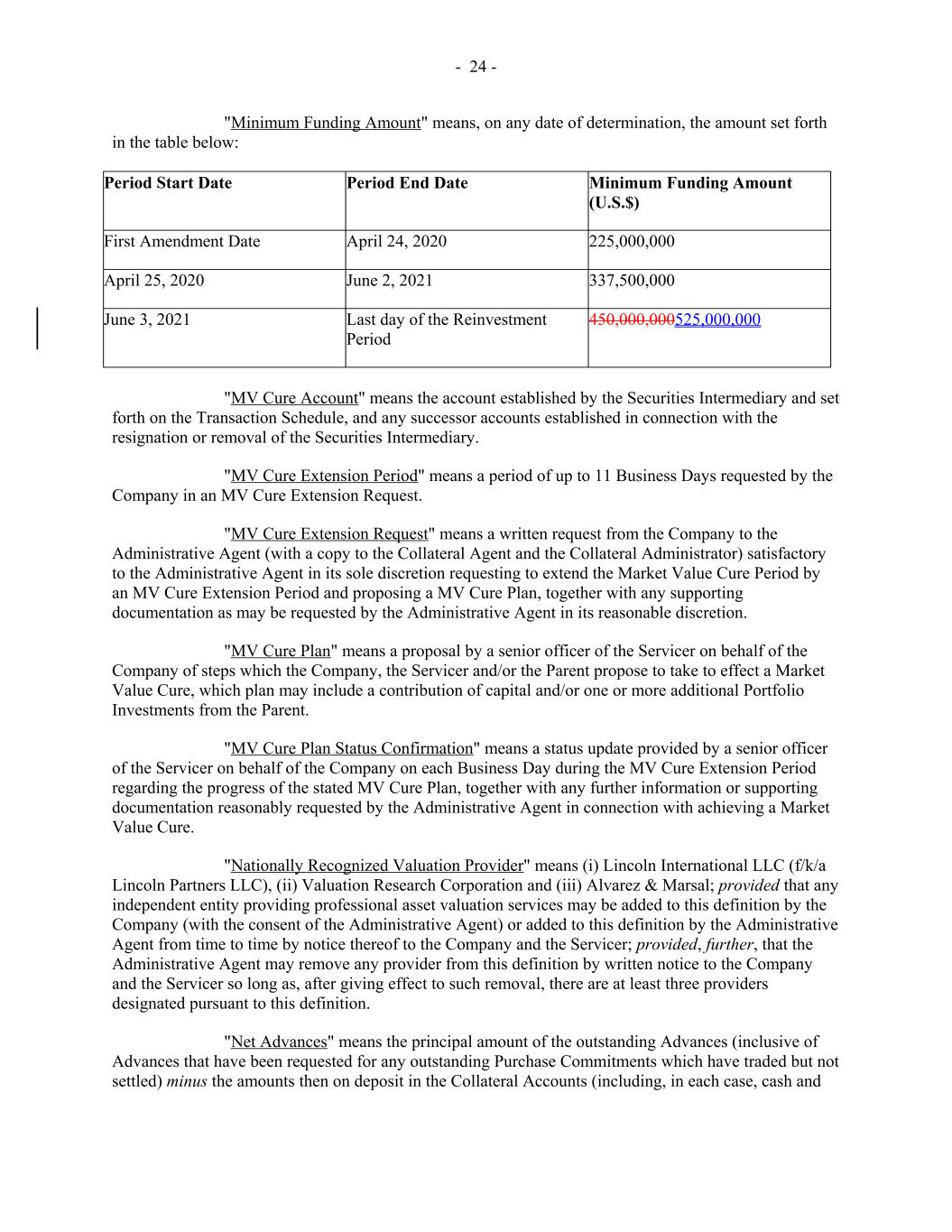

- 24 - "Minimum Funding Amount" means, on any date of determination, the amount set forth in the table below: Period Start Date Period End Date Minimum Funding Amount (U.S.$) First Amendment Date April 24, 2020 225,000,000 April 25, 2020 June 2, 2021 337,500,000 June 3, 2021 Last day of the Reinvestment Period 450,000,000525,000,000 "MV Cure Account" means the account established by the Securities Intermediary and set forth on the Transaction Schedule, and any successor accounts established in connection with the resignation or removal of the Securities Intermediary. "MV Cure Extension Period" means a period of up to 11 Business Days requested by the Company in an MV Cure Extension Request. "MV Cure Extension Request" means a written request from the Company to the Administrative Agent (with a copy to the Collateral Agent and the Collateral Administrator) satisfactory to the Administrative Agent in its sole discretion requesting to extend the Market Value Cure Period by an MV Cure Extension Period and proposing a MV Cure Plan, together with any supporting documentation as may be requested by the Administrative Agent in its reasonable discretion. "MV Cure Plan" means a proposal by a senior officer of the Servicer on behalf of the Company of steps which the Company, the Servicer and/or the Parent propose to take to effect a Market Value Cure, which plan may include a contribution of capital and/or one or more additional Portfolio Investments from the Parent. "MV Cure Plan Status Confirmation" means a status update provided by a senior officer of the Servicer on behalf of the Company on each Business Day during the MV Cure Extension Period regarding the progress of the stated MV Cure Plan, together with any further information or supporting documentation reasonably requested by the Administrative Agent in connection with achieving a Market Value Cure. "Nationally Recognized Valuation Provider" means (i) Lincoln International LLC (f/k/a Lincoln Partners LLC), (ii) Valuation Research Corporation and (iii) Alvarez & Marsal; provided that any independent entity providing professional asset valuation services may be added to this definition by the Company (with the consent of the Administrative Agent) or added to this definition by the Administrative Agent from time to time by notice thereof to the Company and the Servicer; provided, further, that the Administrative Agent may remove any provider from this definition by written notice to the Company and the Servicer so long as, after giving effect to such removal, there are at least three providers designated pursuant to this definition. "Net Advances" means the principal amount of the outstanding Advances (inclusive of Advances that have been requested for any outstanding Purchase Commitments which have traded but not settled) minus the amounts then on deposit in the Collateral Accounts (including, in each case, cash and

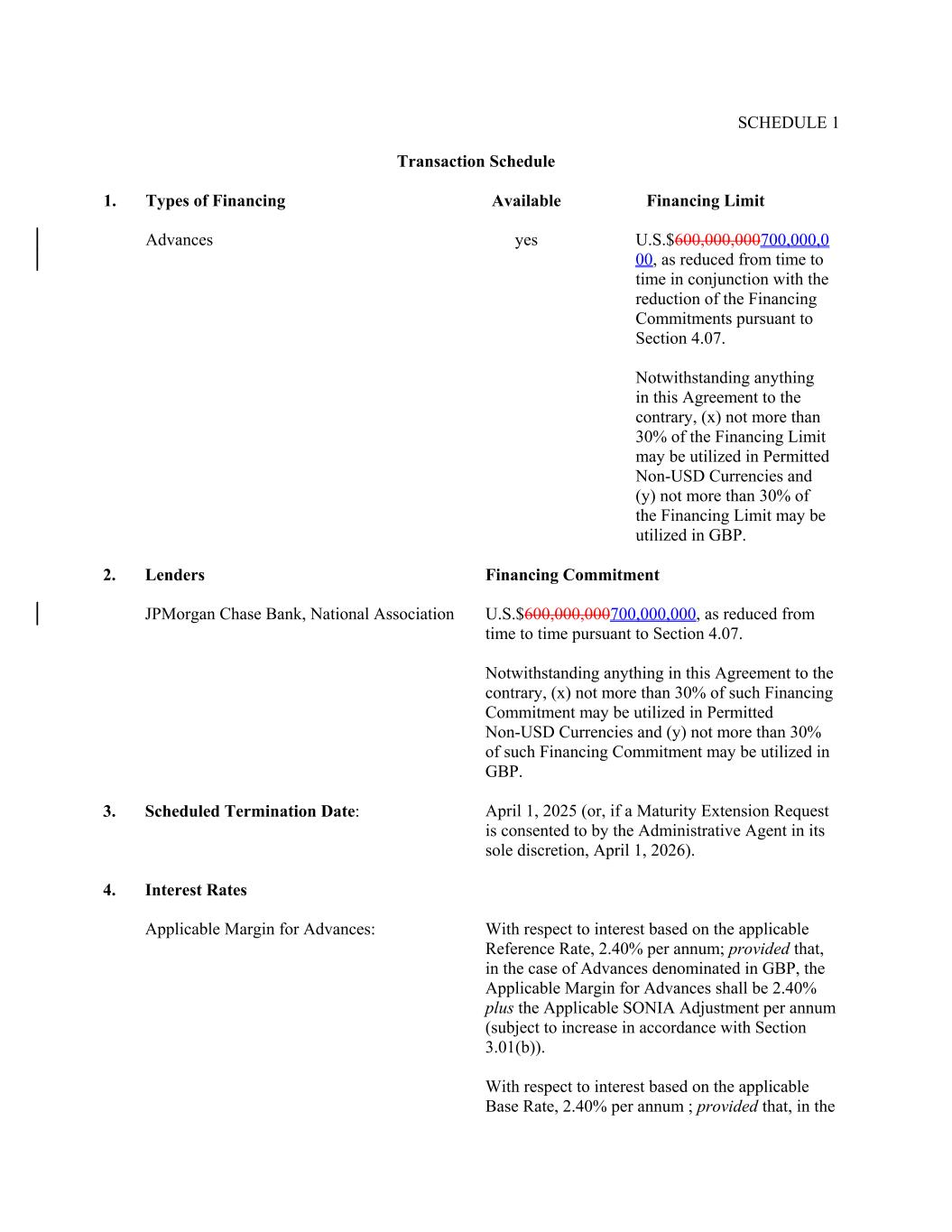

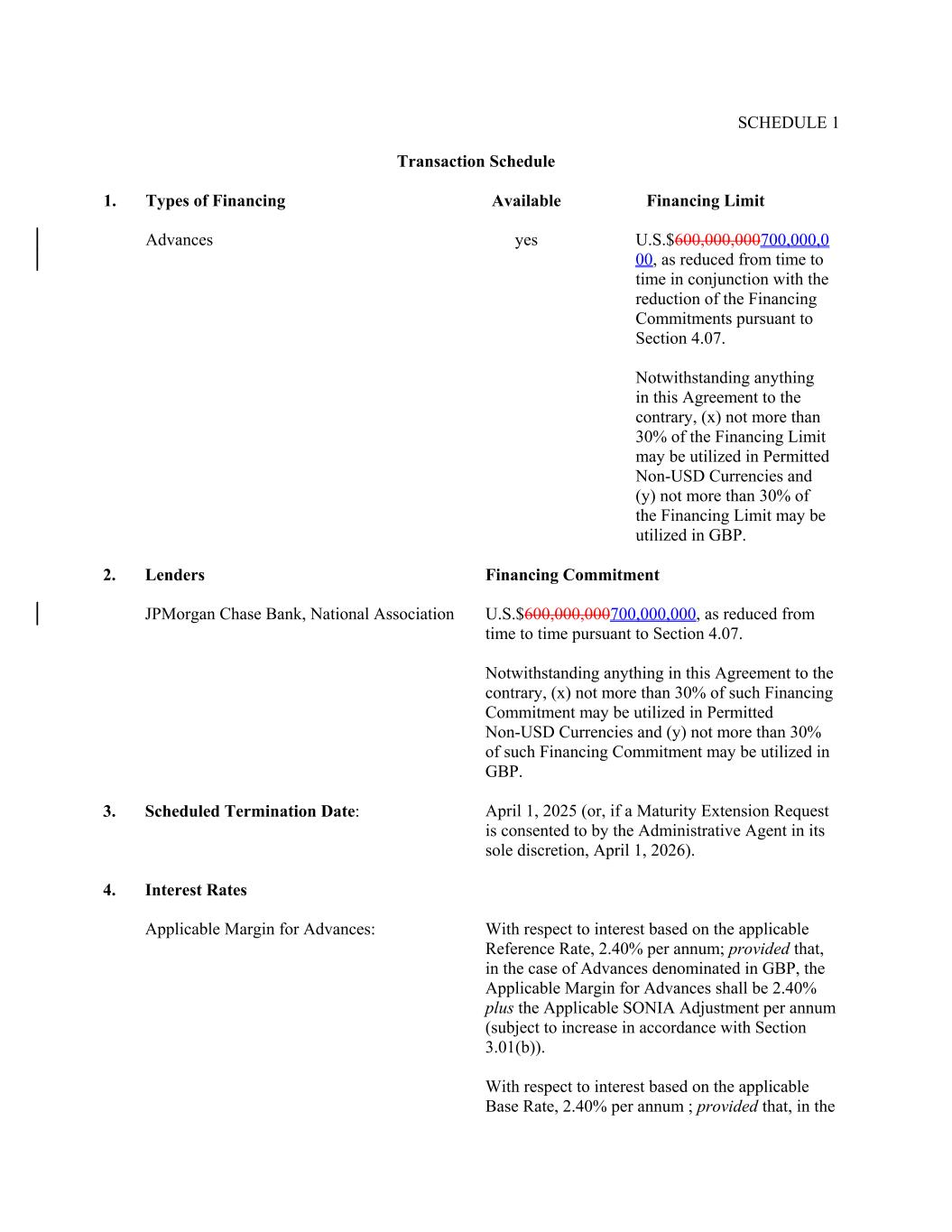

SCHEDULE 1 Transaction Schedule 1. Types of Financing Available Financing Limit Advances yes U.S.$600,000,000700,000,0 00, as reduced from time to time in conjunction with the reduction of the Financing Commitments pursuant to Section 4.07. Notwithstanding anything in this Agreement to the contrary, (x) not more than 30% of the Financing Limit may be utilized in Permitted Non-USD Currencies and (y) not more than 30% of the Financing Limit may be utilized in GBP. 2. Lenders Financing Commitment JPMorgan Chase Bank, National Association U.S.$600,000,000700,000,000, as reduced from time to time pursuant to Section 4.07. Notwithstanding anything in this Agreement to the contrary, (x) not more than 30% of such Financing Commitment may be utilized in Permitted Non-USD Currencies and (y) not more than 30% of such Financing Commitment may be utilized in GBP. 3. Scheduled Termination Date: April 1, 2025 (or, if a Maturity Extension Request is consented to by the Administrative Agent in its sole discretion, April 1, 2026). 4. Interest Rates Applicable Margin for Advances: With respect to interest based on the applicable Reference Rate, 2.40% per annum; provided that, in the case of Advances denominated in GBP, the Applicable Margin for Advances shall be 2.40% plus the Applicable SONIA Adjustment per annum (subject to increase in accordance with Section 3.01(b)). With respect to interest based on the applicable Base Rate, 2.40% per annum ; provided that, in the

- 2 - The aggregate amount of the Advance requested hereby is U.S.$[_________].2(2) [The proposed purchases (if any) relating to this request are as follows:(3) Security Par Price Purchased Interest (if any)] (4) The Currency of the proposed Advance is [USD][CAD][EUR][GBP]. (5) [The Advance is requested to make a Permitted Distribution for the following purpose(s): [__].] (6) With respect to Advances denominated in GBP only, the Applicable SONIA Adjustment in respect of the Advance requested hereby is the [One Month SONIA Adjustment3] [Three Month SONIA Adjustment]. We hereby certify that all conditions [to the Purchase of such Portfolio Investment(s) set forth in Section 1.03 of the Agreement and] to an Advance set forth in Section 2.05 of the Agreement have been satisfied or waived as of the [related Trade Date (and shall be satisfied or waived as of the related Settlement Date) and] Advance date[, as applicable]. Very truly yours, TCG BDC II SPV LLC By__________________________________ Name: Title: 2 Note: The requested Advance shall be in an amount such that, after giving effect thereto and the related purchase of the applicable Portfolio Investment(s) (if any), the Borrowing Base Test is satisfied. 3 Interest payable with respect to an Advance for which the One Month SONIA Adjustment has been selected shall be payable on the fifteenth (15th) calendar day of each month pursuant to Section 3.01(b).