Q2 2021 Conference Call Exhibit 99.2

Forward-Looking Statements This communication contains forward-looking statements within the meaning of the U.S. federal securities laws. Forward-looking statements include, without limitation, statements concerning plans, estimates, calculations, forecasts and projections with respect to the anticipated future performance of the Company. These statements are often, but not always, made through the use of words or phrases such as ‘‘may’’, ‘‘might’’, ‘‘should’’, ‘‘could’’, ‘‘predict’’, ‘‘potential’’, ‘‘believe’’, ‘‘expect’’, ‘‘continue’’, ‘‘will’’, ‘‘anticipate’’, ‘‘seek’’, ‘‘estimate’’, ‘‘intend’’, ‘‘plan’’, ‘‘projection’’, ‘‘would’’, ‘‘annualized’’, “target” and ‘‘outlook’’, or the negative version of those words or other comparable words or phrases of a future or forward-looking nature. Forward-looking statements involve estimates and known and unknown risks, and reflect various assumptions and involve elements of subjective judgement and analysis, which may or may not prove to be correct, and which are subject to uncertainties and contingencies outside the control of Byline and its respective affiliates, directors, employees and other representatives, which could cause actual results to differ materially from those presented in this communication. The COVID-19 pandemic is adversely affecting us, our employees, customers, counterparties and third-party service providers, and the ultimate extent of the impacts on our business, financial position, results of operations, liquidity, and prospects is uncertain. Deterioration in general business and economic conditions, including increases in unemployment rates or turbulence in U.S. or global financial markets, could adversely affect our revenues and the values of our assets and liabilities, reduce the availability of funding, and lead to a tightening of credit and further increase stock price volatility. In addition, changes to statutes, regulations, or regulatory policies or practices as a result of, or in response to COVID-19, could affect us in substantial and unpredictable ways. No representations, warranties or guarantees are or will be made by Byline as to the reliability, accuracy or completeness of any forward-looking statements contained in this communication or that such forward-looking statements are or will remain based on reasonable assumptions. You should not place undue reliance on any forward-looking statements contained in this communication. Certain risks and important factors that could affect Byline’s future results are identified in our Annual Report on Form 10-K and other reports we file with the Securities and Exchange Commission, including among other things under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2020. Any forward-looking statement speaks only as of the date on which it is made, and Byline undertakes no obligation to update any forward-looking statement, whether to reflect events or circumstances after the date on which the statement is made, to reflect new information or the occurrence of unanticipated events, or otherwise unless required under the federal securities laws. Due to rounding, numbers presented throughout this document may not add up precisely to the totals provided and percentages may not precisely reflect the absolute figures.

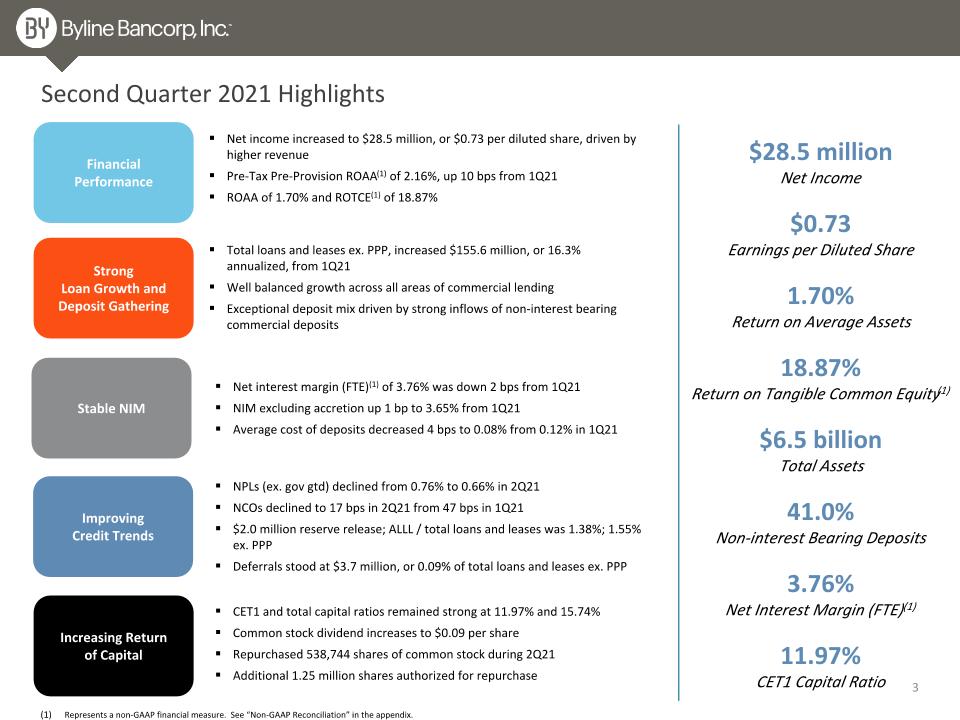

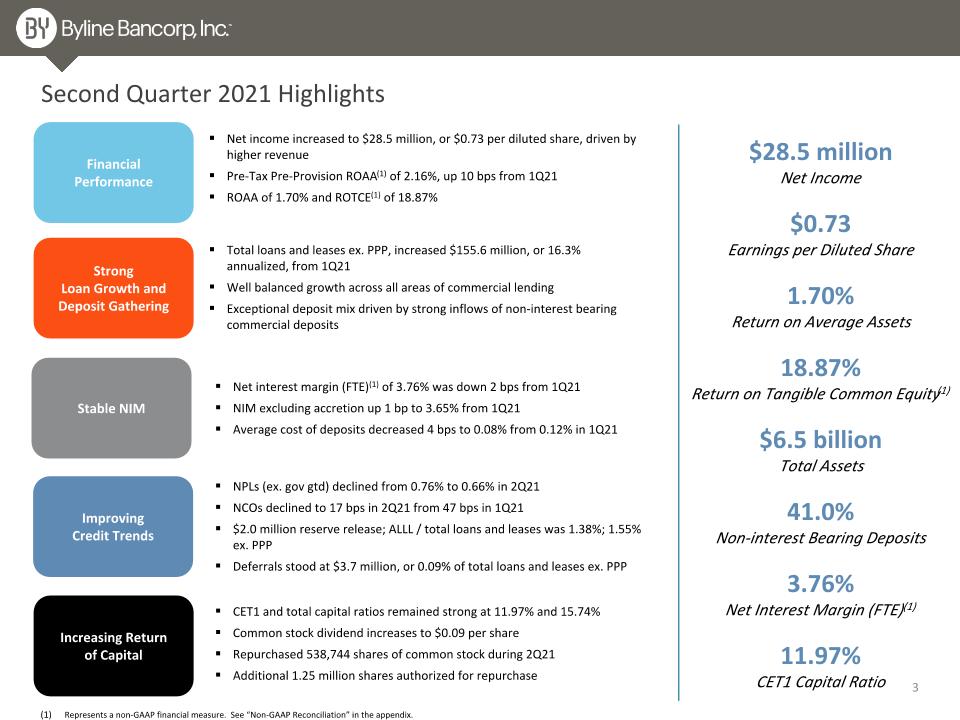

Second Quarter 2021 Highlights Strong Loan Growth and Deposit Gathering Financial Performance Improving Credit Trends Increasing Return of Capital Represents a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the appendix. Net income increased to $28.5 million, or $0.73 per diluted share, driven by higher revenue Pre-Tax Pre-Provision ROAA(1) of 2.16%, up 10 bps from 1Q21 ROAA of 1.70% and ROTCE(1) of 18.87% Total loans and leases ex. PPP, increased $155.6 million, or 16.3% annualized, from 1Q21 Well balanced growth across all areas of commercial lending Exceptional deposit mix driven by strong inflows of non-interest bearing commercial deposits Stable NIM $28.5 million Net Income $0.73 Earnings per Diluted Share 1.70% Return on Average Assets 18.87% Return on Tangible Common Equity(1) $6.5 billion Total Assets 41.0% Non-interest Bearing Deposits 3.76% Net Interest Margin (FTE)(1) 11.97% CET1 Capital Ratio Net interest margin (FTE)(1) of 3.76% was down 2 bps from 1Q21 NIM excluding accretion up 1 bp to 3.65% from 1Q21 Average cost of deposits decreased 4 bps to 0.08% from 0.12% in 1Q21 NPLs (ex. gov gtd) declined from 0.76% to 0.66% in 2Q21 NCOs declined to 17 bps in 2Q21 from 47 bps in 1Q21 $2.0 million reserve release; ALLL / total loans and leases was 1.38%; 1.55% ex. PPP Deferrals stood at $3.7 million, or 0.09% of total loans and leases ex. PPP CET1 and total capital ratios remained strong at 11.97% and 15.74% Common stock dividend increases to $0.09 per share Repurchased 538,744 shares of common stock during 2Q21 Additional 1.25 million shares authorized for repurchase

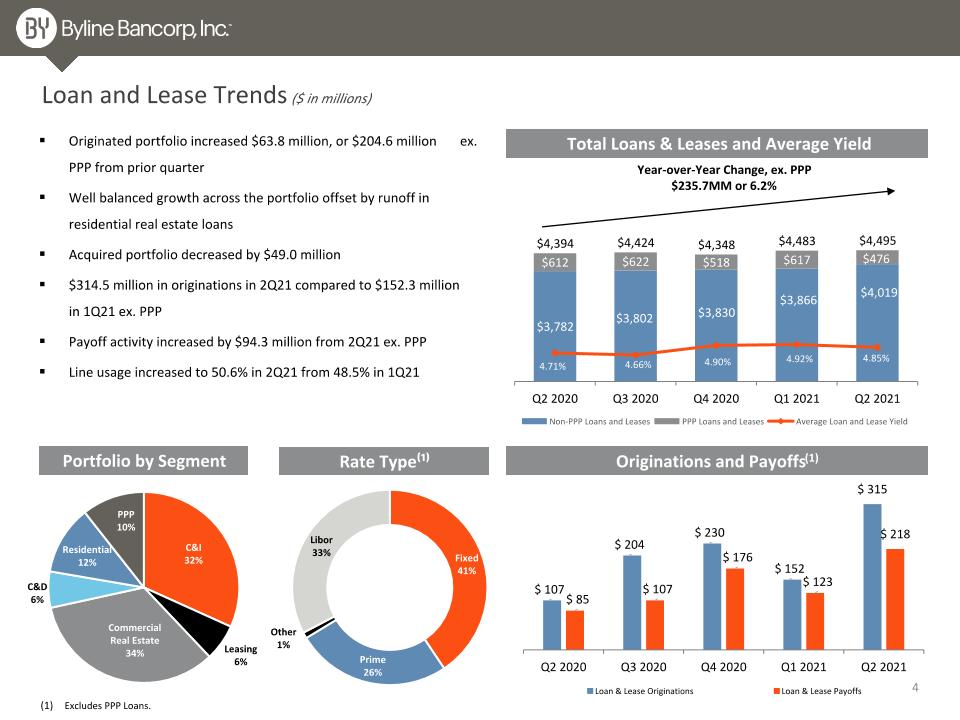

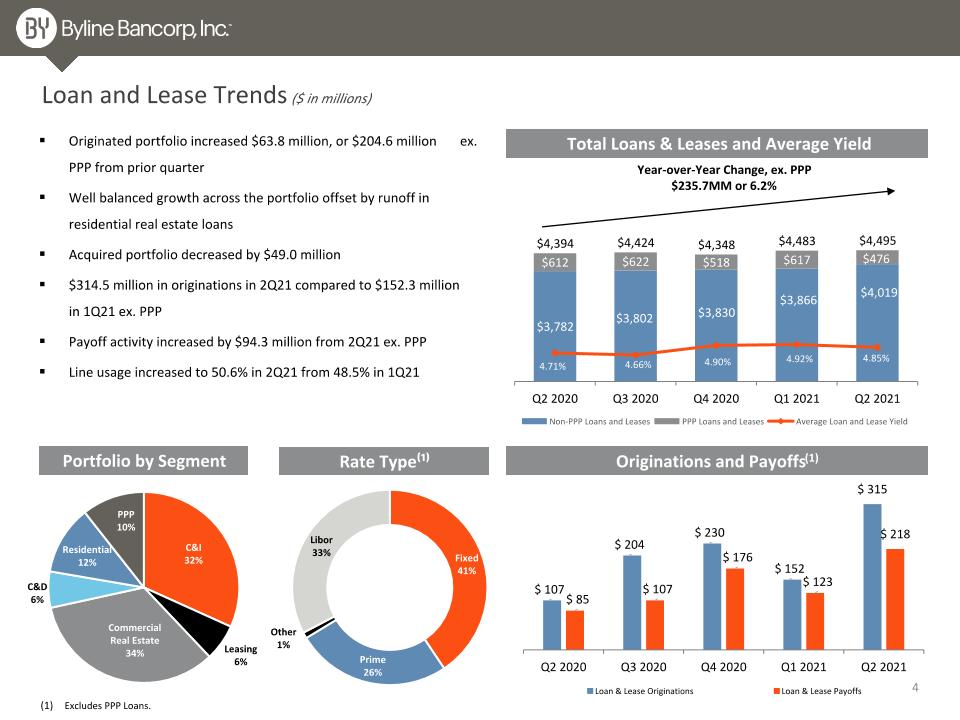

Loan and Lease Trends ($ in millions) Originations and Payoffs(1) Portfolio by Segment Total Loans & Leases and Average Yield Originated portfolio increased $63.8 million, or $204.6 million ex. PPP from prior quarter Well balanced growth across the portfolio offset by runoff in residential real estate loans Acquired portfolio decreased by $49.0 million $314.5 million in originations in 2Q21 compared to $152.3 million in 1Q21 ex. PPP Payoff activity increased by $94.3 million from 2Q21 ex. PPP Line usage increased to 50.6% in 2Q21 from 48.5% in 1Q21 Rate Type⁽¹⁾ Year-over-Year Change, ex. PPP $235.7MM or 6.2% Excludes PPP Loans.

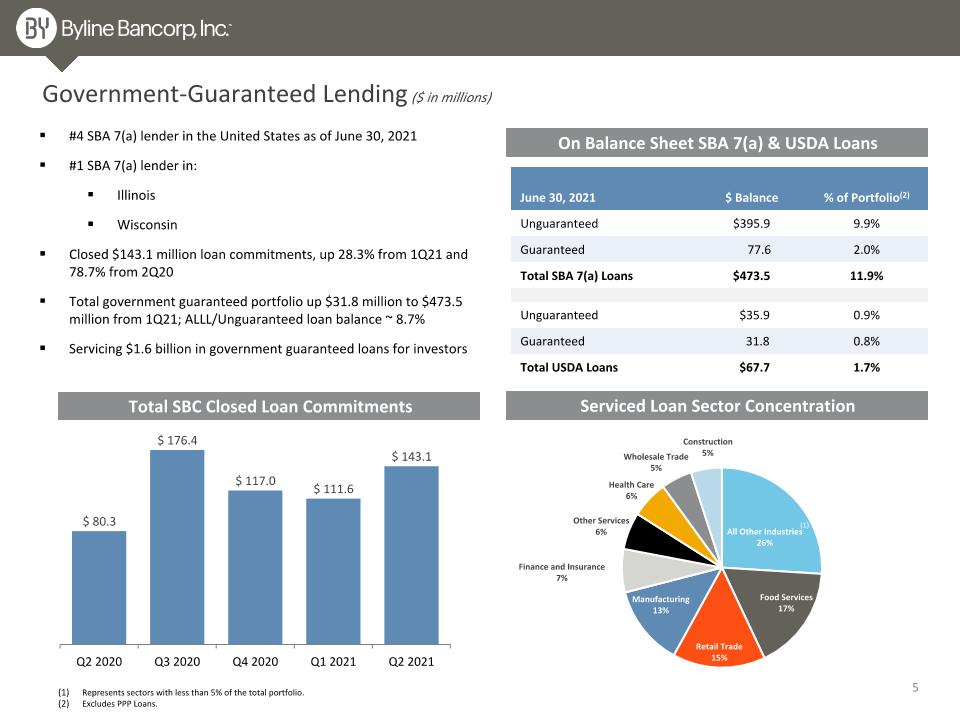

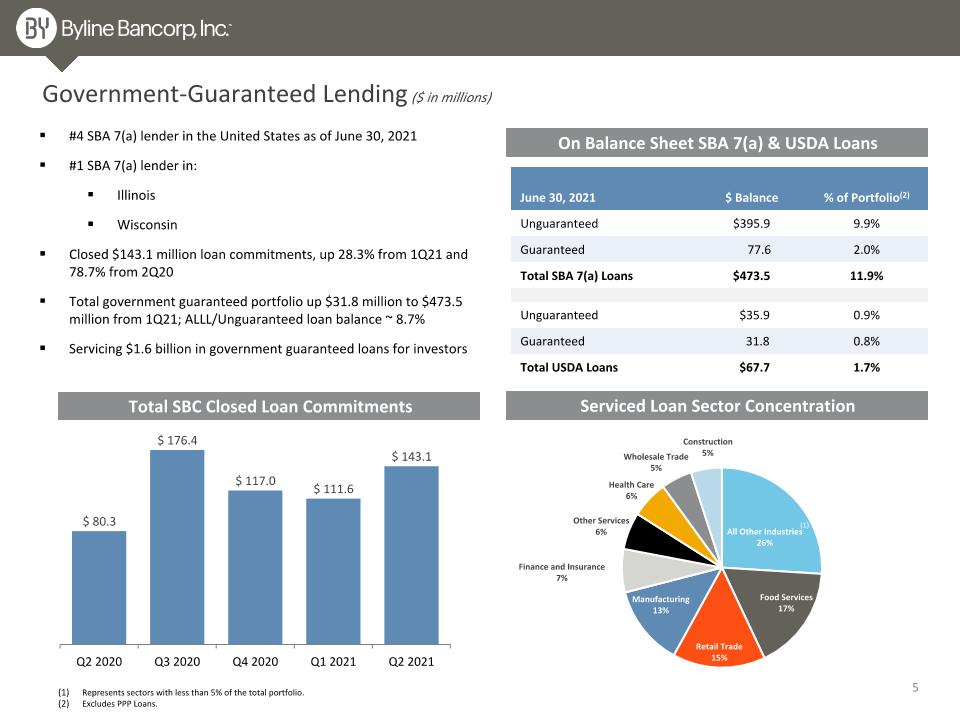

Government-Guaranteed Lending ($ in millions) On Balance Sheet SBA 7(a) & USDA Loans #4 SBA 7(a) lender in the United States as of June 30, 2021 #1 SBA 7(a) lender in: Illinois Wisconsin Closed $143.1 million loan commitments, up 28.3% from 1Q21 and 78.7% from 2Q20 Total government guaranteed portfolio up $31.8 million to $473.5 million from 1Q21; ALLL/Unguaranteed loan balance ~ 8.7% Servicing $1.6 billion in government guaranteed loans for investors Serviced Loan Sector Concentration Total SBC Closed Loan Commitments June 30, 2021 $ Balance % of Portfolio(2) Unguaranteed $395.9 9.9% Guaranteed 77.6 2.0% Total SBA 7(a) Loans $473.5 11.9% Unguaranteed $35.9 0.9% Guaranteed 31.8 0.8% Total USDA Loans $67.7 1.7% (1) Represents sectors with less than 5% of the total portfolio. Excludes PPP Loans. (1)

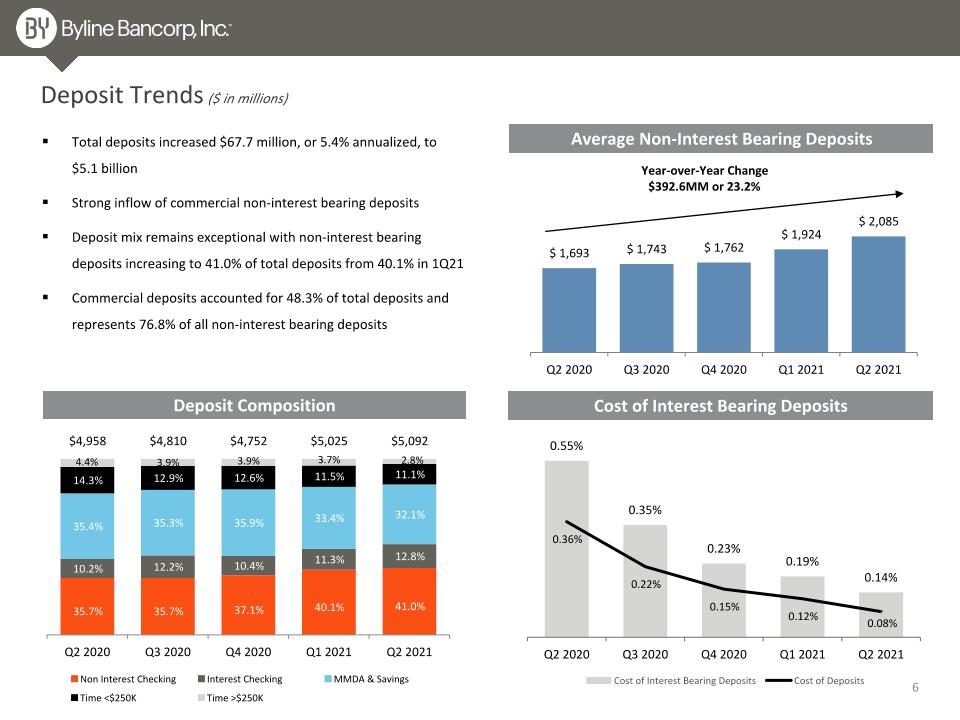

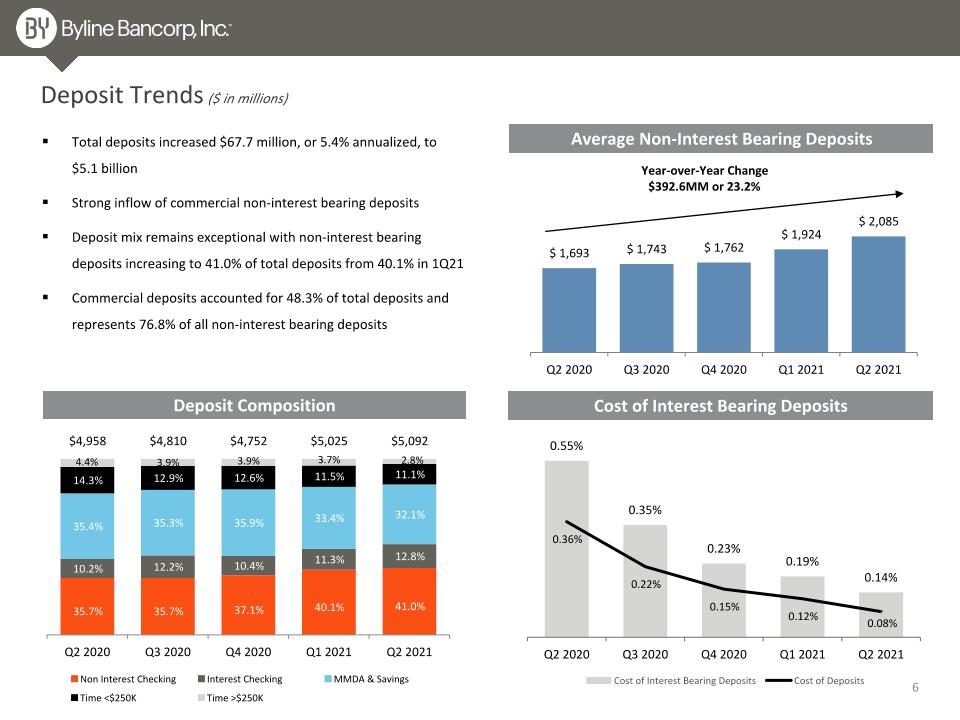

Total deposits increased $67.7 million, or 5.4% annualized, to $5.1 billion Strong inflow of commercial non-interest bearing deposits Deposit mix remains exceptional with non-interest bearing deposits increasing to 41.0% of total deposits from 40.1% in 1Q21 Commercial deposits accounted for 48.3% of total deposits and represents 76.8% of all non-interest bearing deposits Deposit Trends ($ in millions) Average Non-Interest Bearing Deposits Deposit Composition Cost of Interest Bearing Deposits Year-over-Year Change $392.6MM or 23.2%

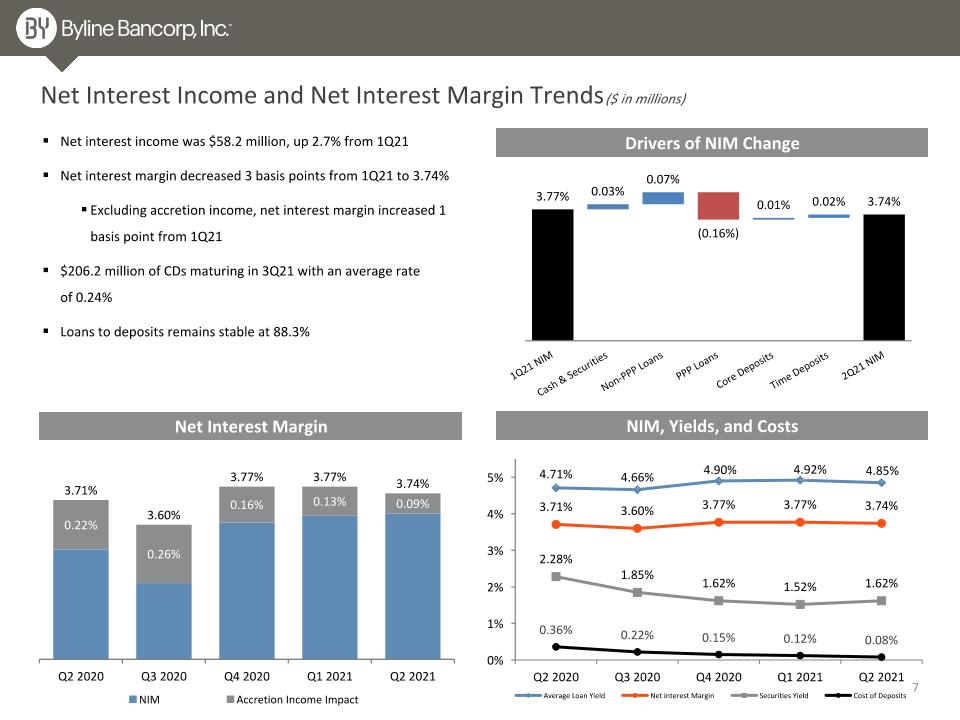

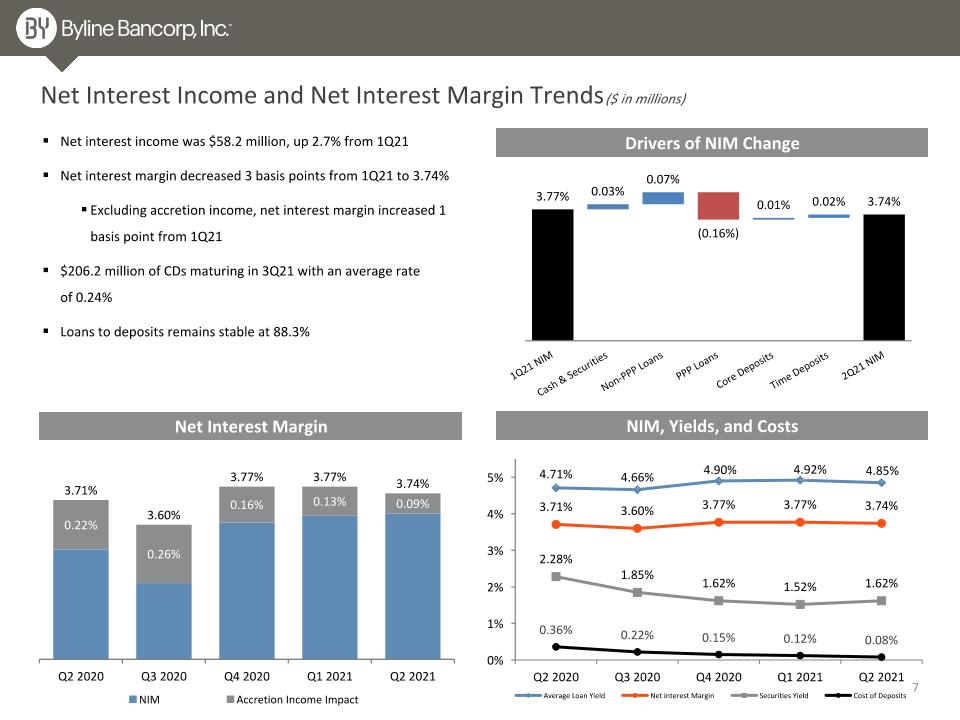

Net Interest Income and Net Interest Margin Trends ($ in millions) Net interest income was $58.2 million, up 2.7% from 1Q21 Net interest margin decreased 3 basis points from 1Q21 to 3.74% Excluding accretion income, net interest margin increased 1 basis point from 1Q21 $206.2 million of CDs maturing in 3Q21 with an average rate of 0.24% Loans to deposits remains stable at 88.3% Net Interest Margin Drivers of NIM Change NIM, Yields, and Costs

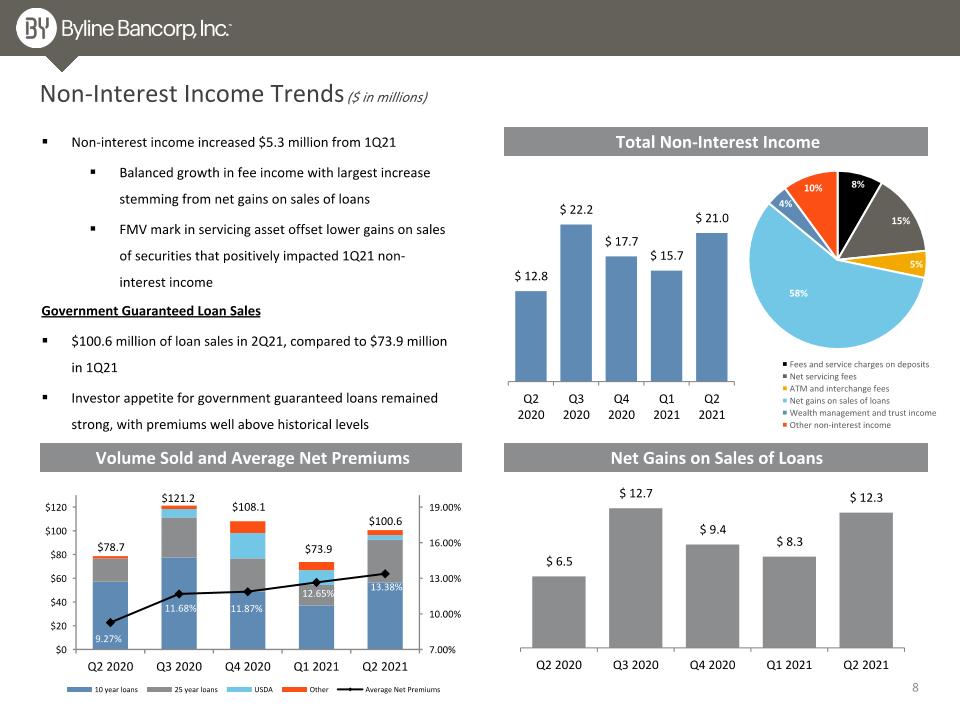

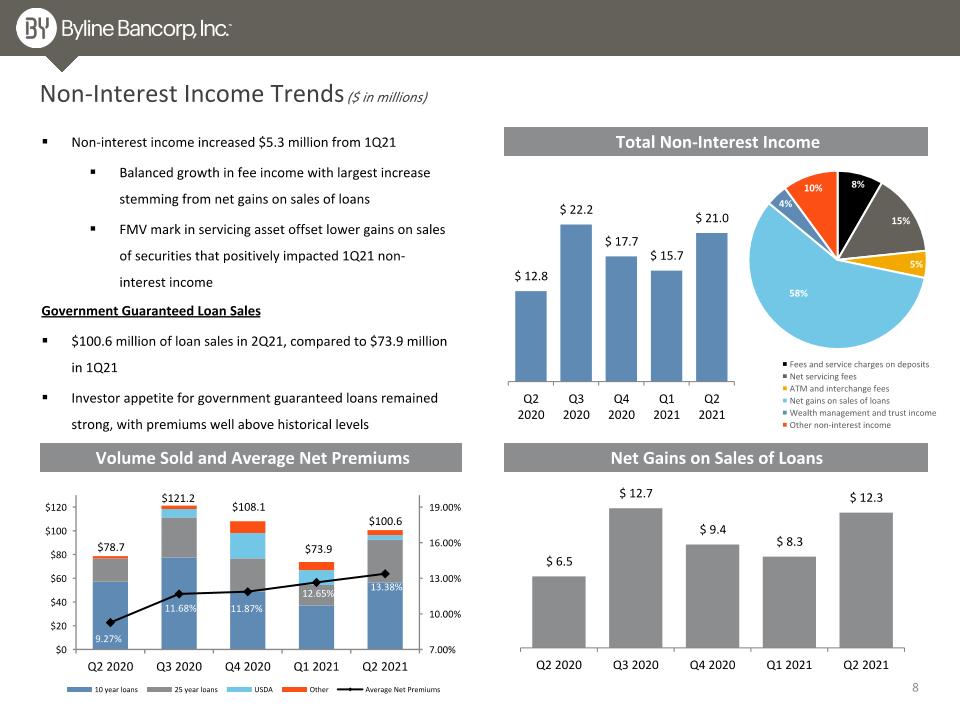

Total Non-Interest Income Non-Interest Income Trends ($ in millions) Non-interest income increased $5.3 million from 1Q21 Balanced growth in fee income with largest increase stemming from net gains on sales of loans FMV mark in servicing asset offset lower gains on sales of securities that positively impacted 1Q21 non-interest income Volume Sold and Average Net Premiums Net Gains on Sales of Loans Government Guaranteed Loan Sales $100.6 million of loan sales in 2Q21, compared to $73.9 million in 1Q21 Investor appetite for government guaranteed loans remained strong, with premiums well above historical levels

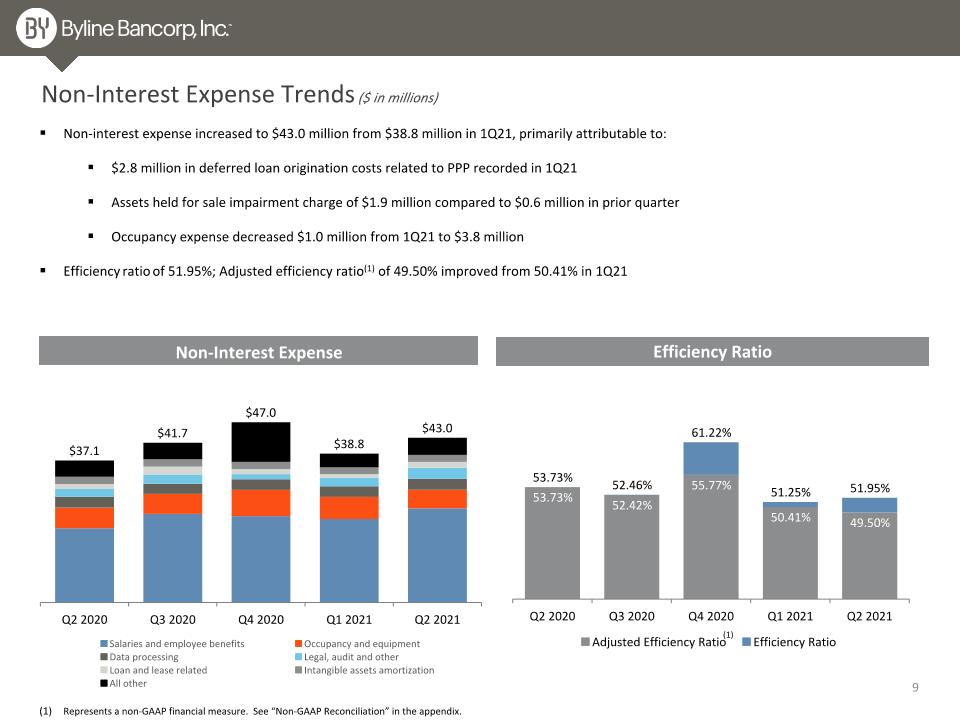

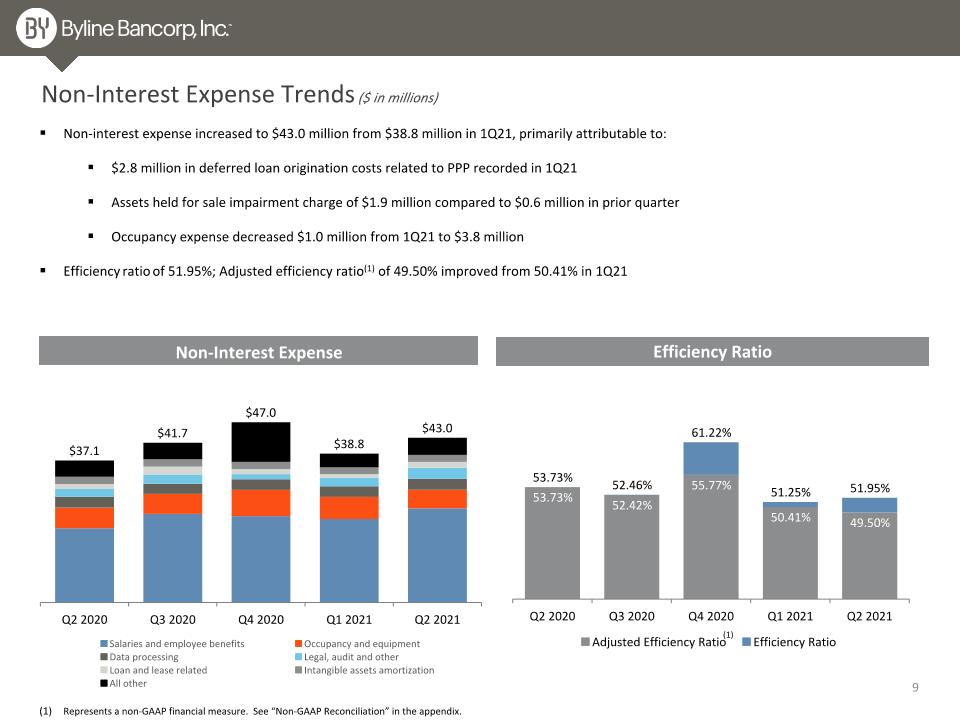

Non-Interest Expense Trends ($ in millions) Non-interest expense increased to $43.0 million from $38.8 million in 1Q21, primarily attributable to: $2.8 million in deferred loan origination costs related to PPP recorded in 1Q21 Assets held for sale impairment charge of $1.9 million compared to $0.6 million in prior quarter Occupancy expense decreased $1.0 million from 1Q21 to $3.8 million Efficiency ratio of 51.95%; Adjusted efficiency ratio(1) of 49.50% improved from 50.41% in 1Q21 Efficiency Ratio Non-Interest Expense Represents a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the appendix. (1)

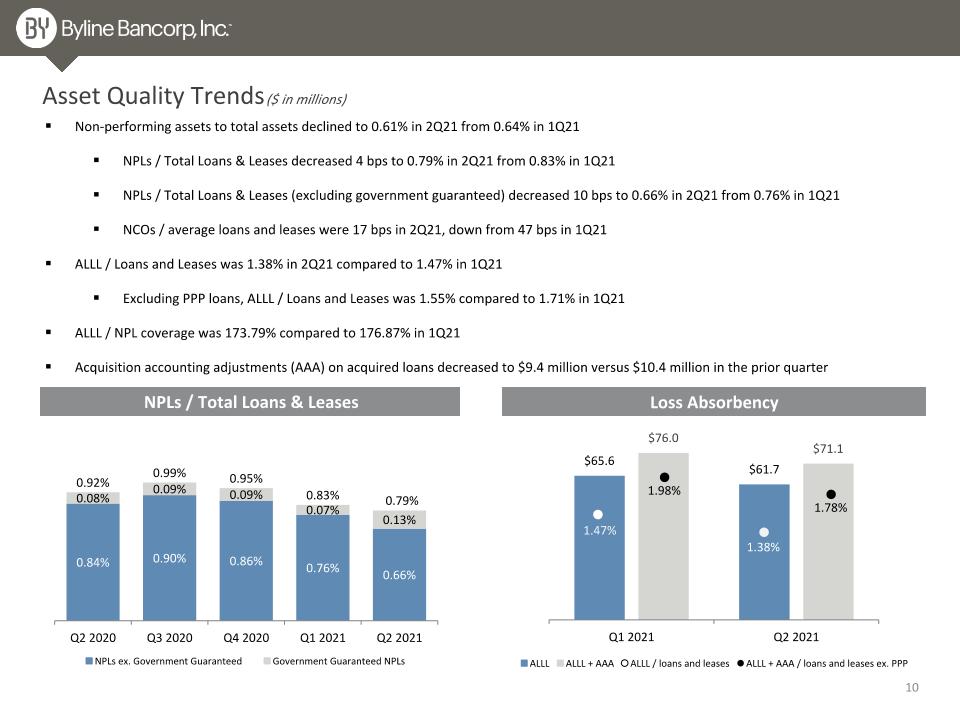

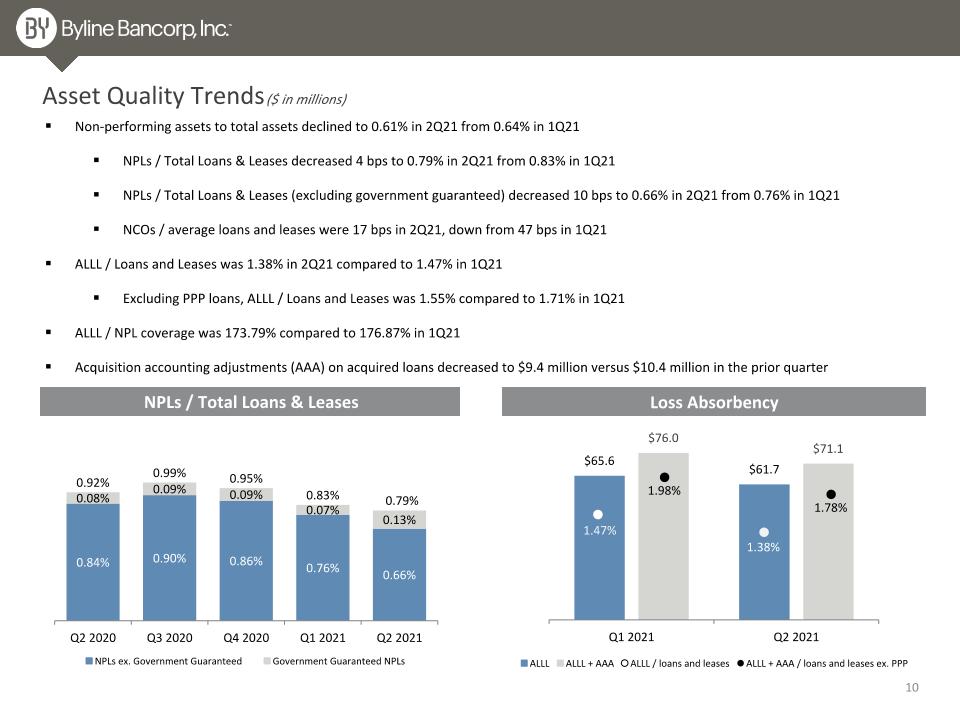

Asset Quality Trends ($ in millions) Non-performing assets to total assets declined to 0.61% in 2Q21 from 0.64% in 1Q21 NPLs / Total Loans & Leases decreased 4 bps to 0.79% in 2Q21 from 0.83% in 1Q21 NPLs / Total Loans & Leases (excluding government guaranteed) decreased 10 bps to 0.66% in 2Q21 from 0.76% in 1Q21 NCOs / average loans and leases were 17 bps in 2Q21, down from 47 bps in 1Q21 ALLL / Loans and Leases was 1.38% in 2Q21 compared to 1.47% in 1Q21 Excluding PPP loans, ALLL / Loans and Leases was 1.55% compared to 1.71% in 1Q21 ALLL / NPL coverage was 173.79% compared to 176.87% in 1Q21 Acquisition accounting adjustments (AAA) on acquired loans decreased to $9.4 million versus $10.4 million in the prior quarter NPLs / Total Loans & Leases Loss Absorbency 1.47% 1.98% 1.38% 1.78%

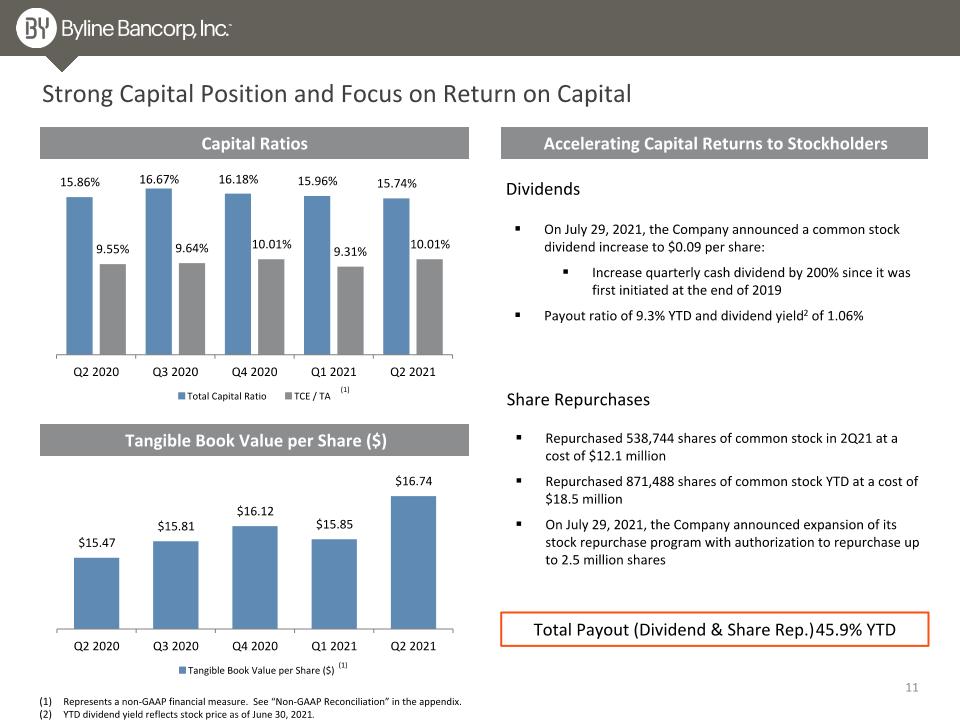

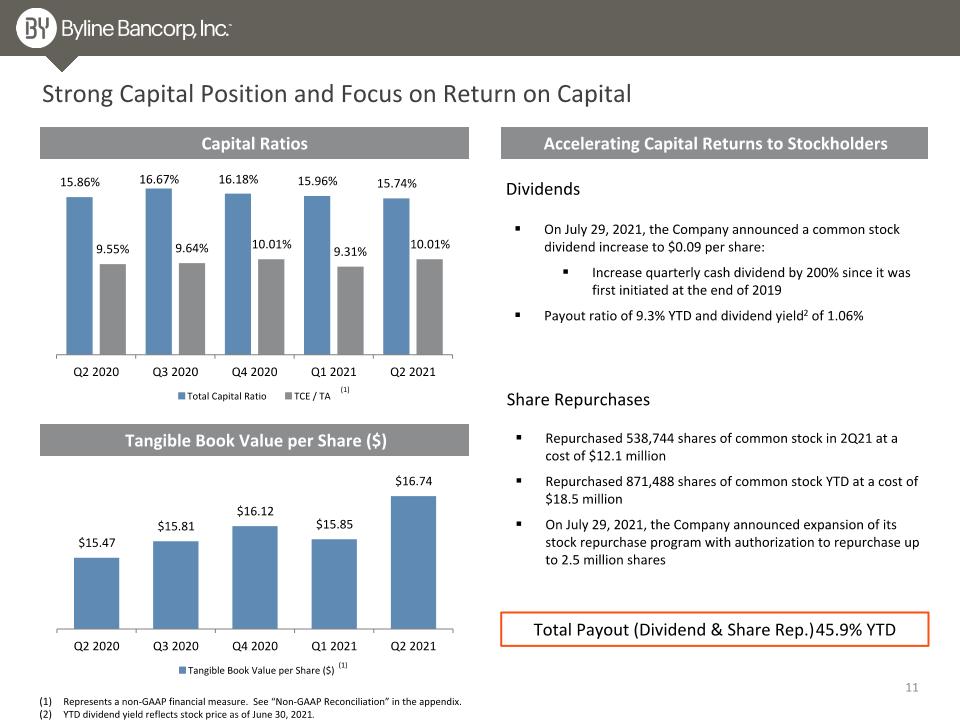

Repurchased 538,744 shares of common stock in 2Q21 at a cost of $12.1 million Repurchased 871,488 shares of common stock YTD at a cost of $18.5 million On July 29, 2021, the Company announced expansion of its stock repurchase program with authorization to repurchase up to 2.5 million shares Project Sox Offer Migration Strong Capital Position and Focus on Return on Capital Capital Ratios Accelerating Capital Returns to Stockholders Represents a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the appendix. YTD dividend yield reflects stock price as of June 30, 2021. (1) Dividends Share Repurchases Tangible Book Value per Share ($) On July 29, 2021, the Company announced a common stock dividend increase to $0.09 per share: Increase quarterly cash dividend by 200% since it was first initiated at the end of 2019 Payout ratio of 9.3% YTD and dividend yield2 of 1.06% Total Payout (Dividend & Share Rep.) 45.9% YTD (1)

2021 Strategic Priorities and Outlook Drive organic loan and deposit growth Continue Investing in Technology to Improve Efficiencies and Enhance Revenue Generation Strategic M&A Opportunities and Team Lift-Outs with Attractive Metrics and Return Profile Increase Return of Capital to Stockholders Continue to Identify Opportunities to Improve Operating Leverage

Appendix

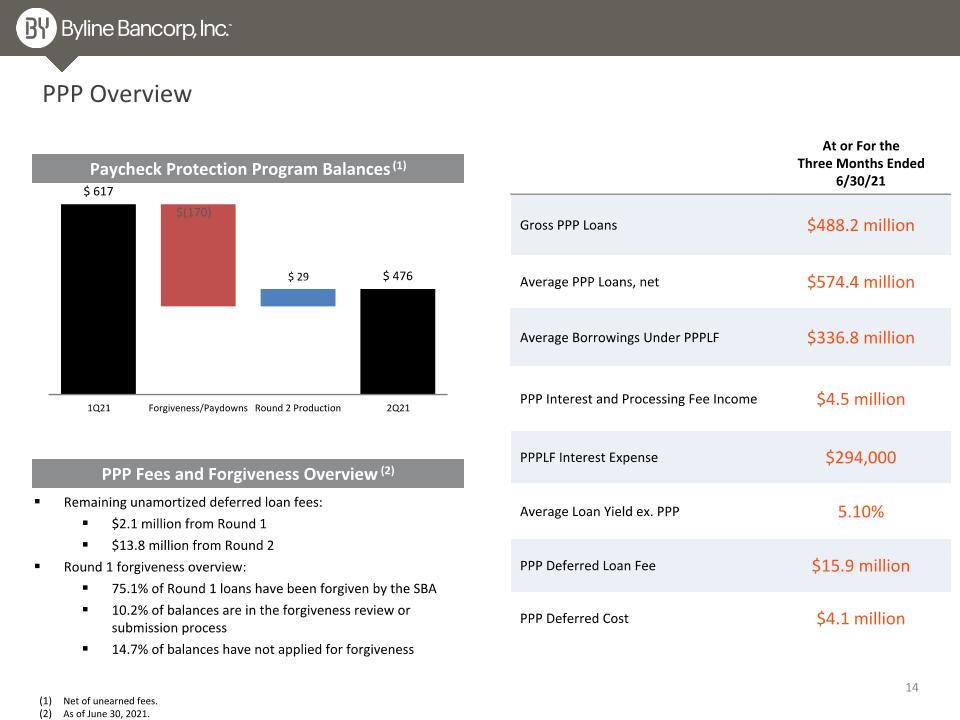

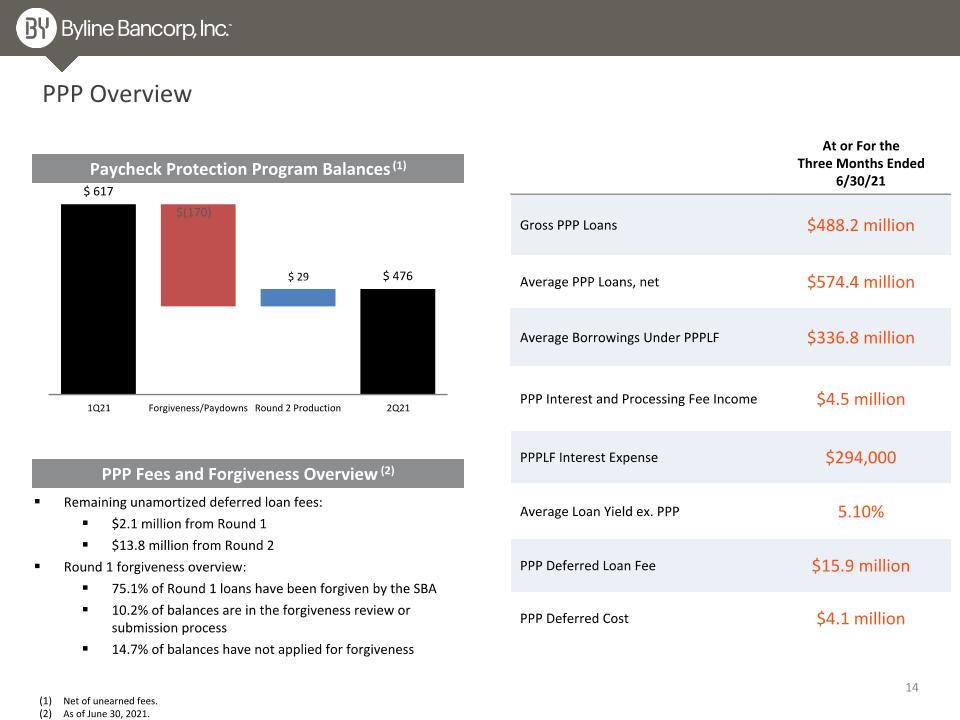

Project Sox Offer Migration PPP Overview Net of unearned fees. As of June 30, 2021. Paycheck Protection Program Balances (1) PPP Fees and Forgiveness Overview (2) At or For the Three Months Ended 6/30/21 Gross PPP Loans $488.2 million Average PPP Loans, net $574.4 million Average Borrowings Under PPPLF $336.8 million PPP Interest and Processing Fee Income $4.5 million PPPLF Interest Expense $294,000 Average Loan Yield ex. PPP 5.10% PPP Deferred Loan Fee $15.9 million PPP Deferred Cost $4.1 million Remaining unamortized deferred loan fees: $2.1 million from Round 1 $13.8 million from Round 2 Round 1 forgiveness overview: 75.1% of Round 1 loans have been forgiven by the SBA 10.2% of balances are in the forgiveness review or submission process 14.7% of balances have not applied for forgiveness $(170)

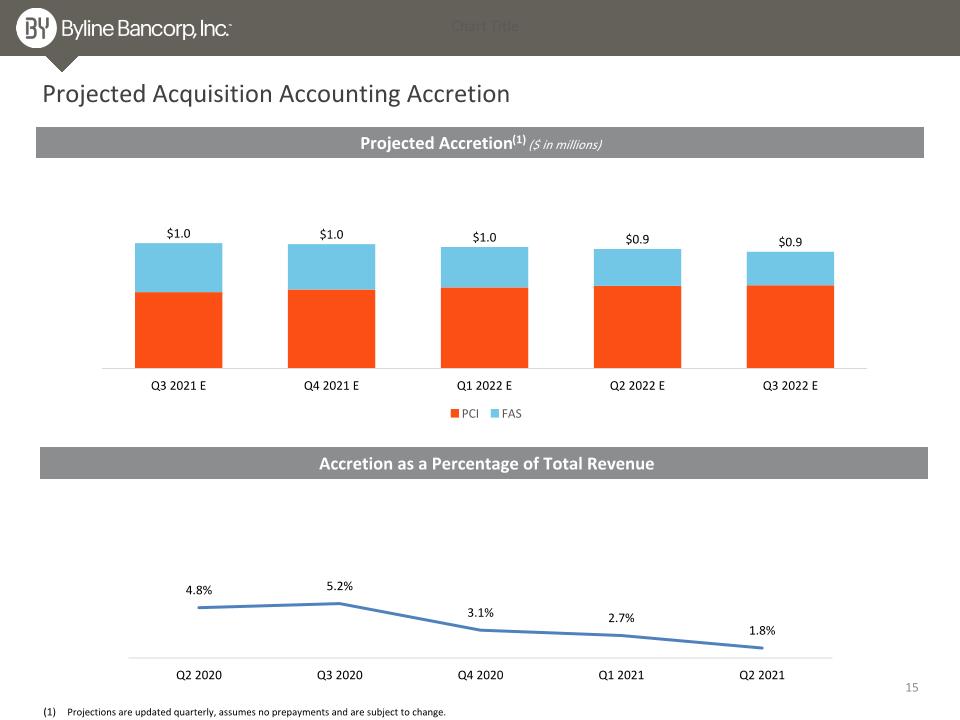

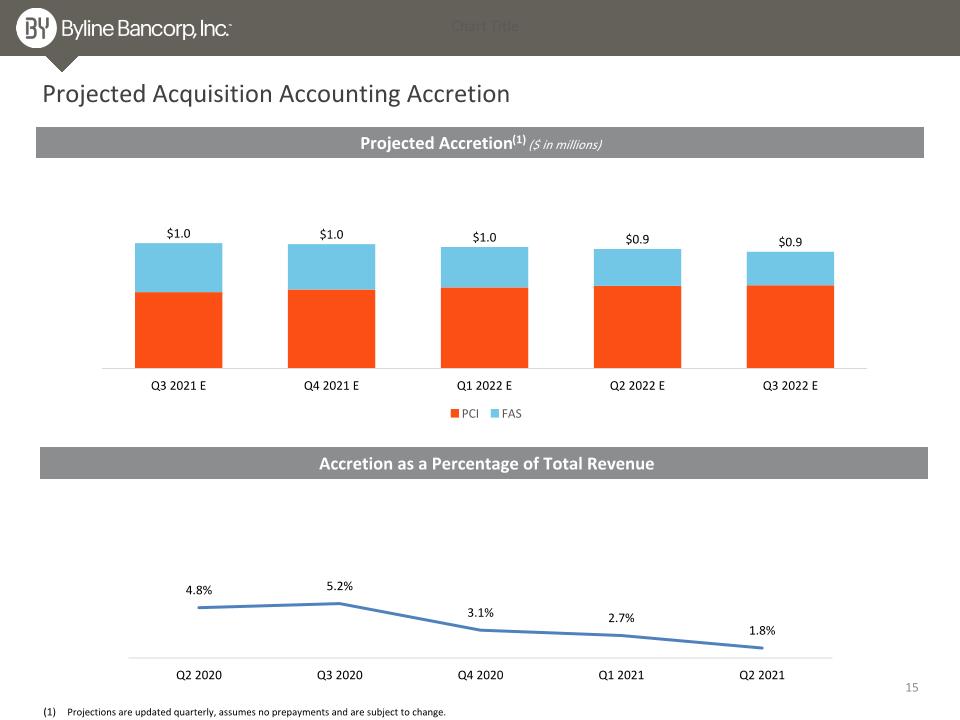

Projected Acquisition Accounting Accretion Projected Accretion(1) ($ in millions) Accretion as a Percentage of Total Revenue Projections are updated quarterly, assumes no prepayments and are subject to change.

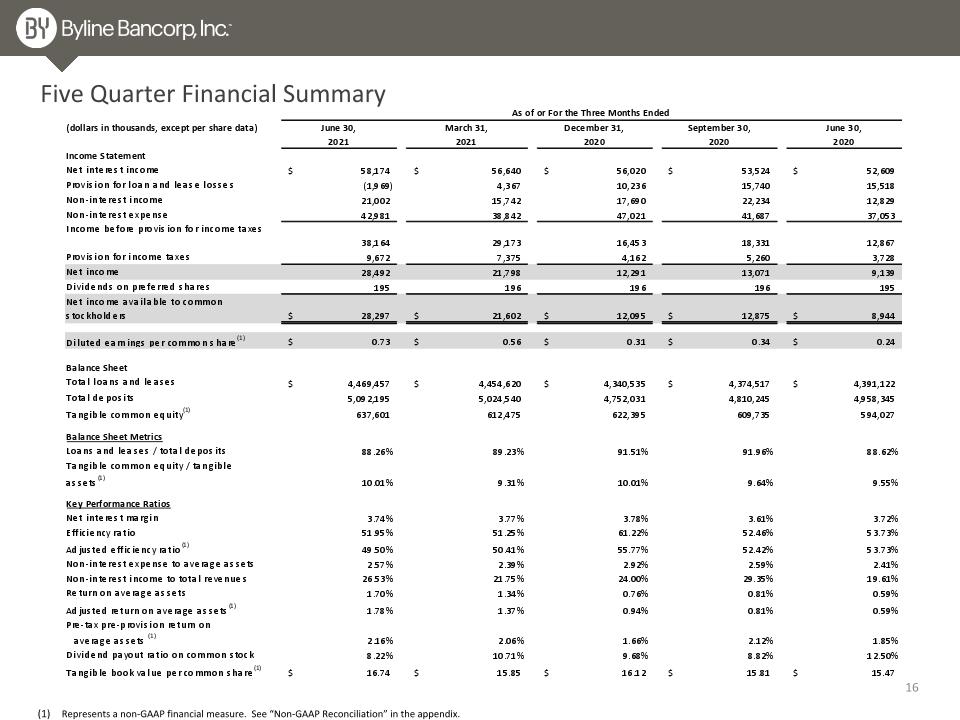

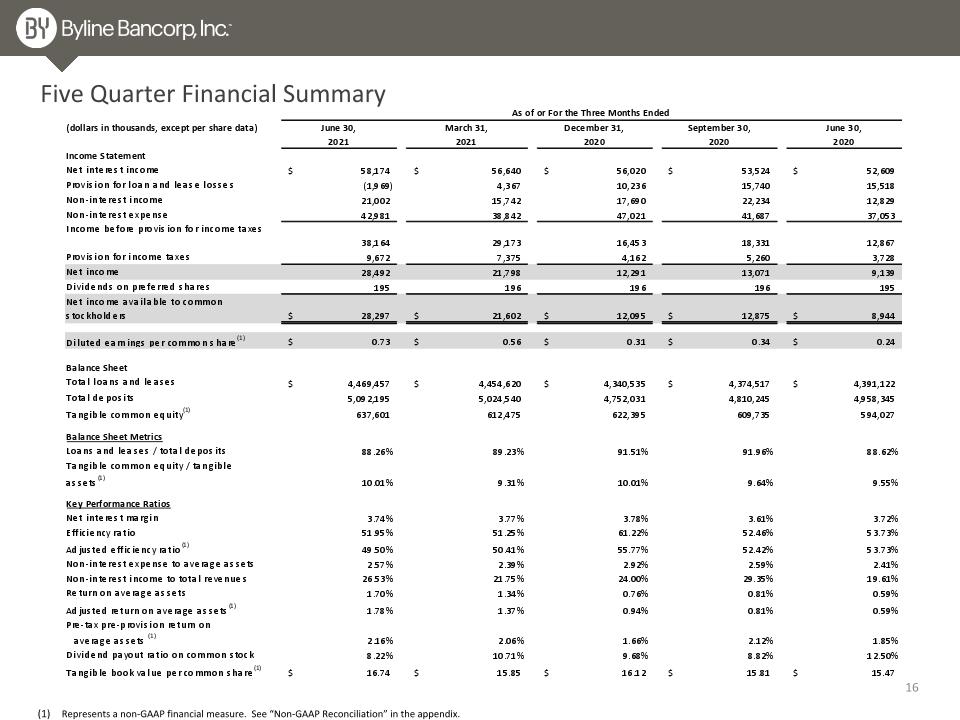

Five Quarter Financial Summary Represents a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the appendix.

Non-GAAP Reconciliation

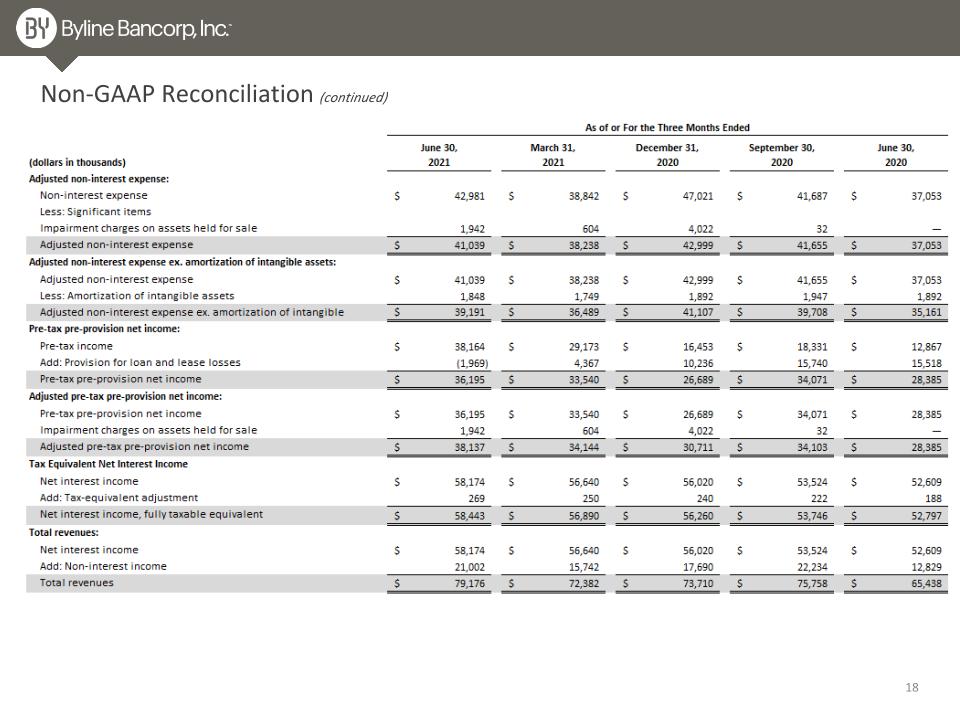

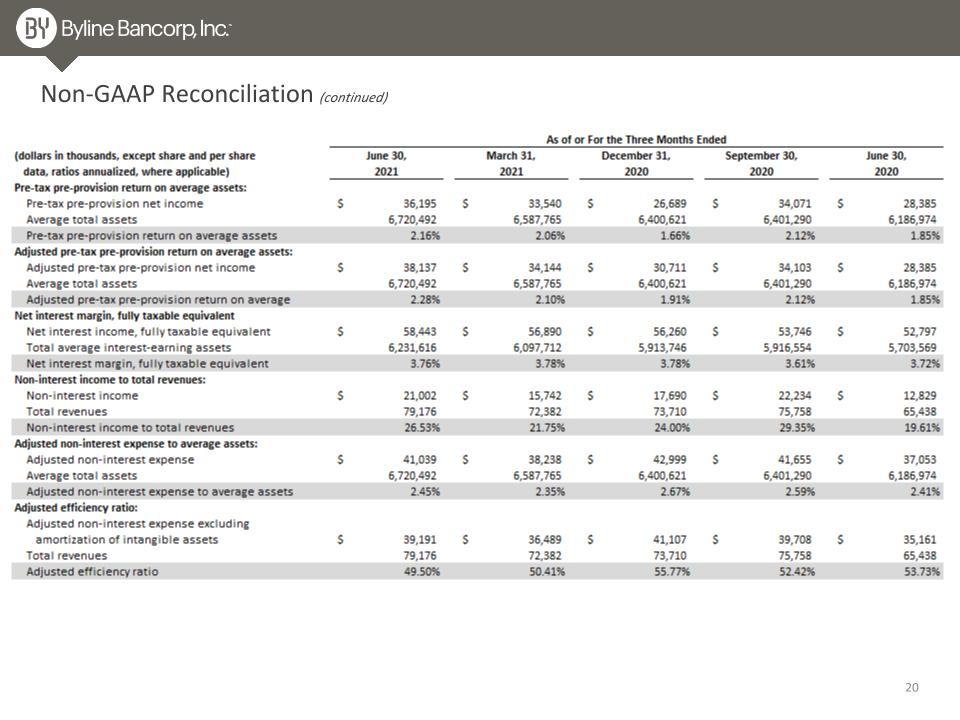

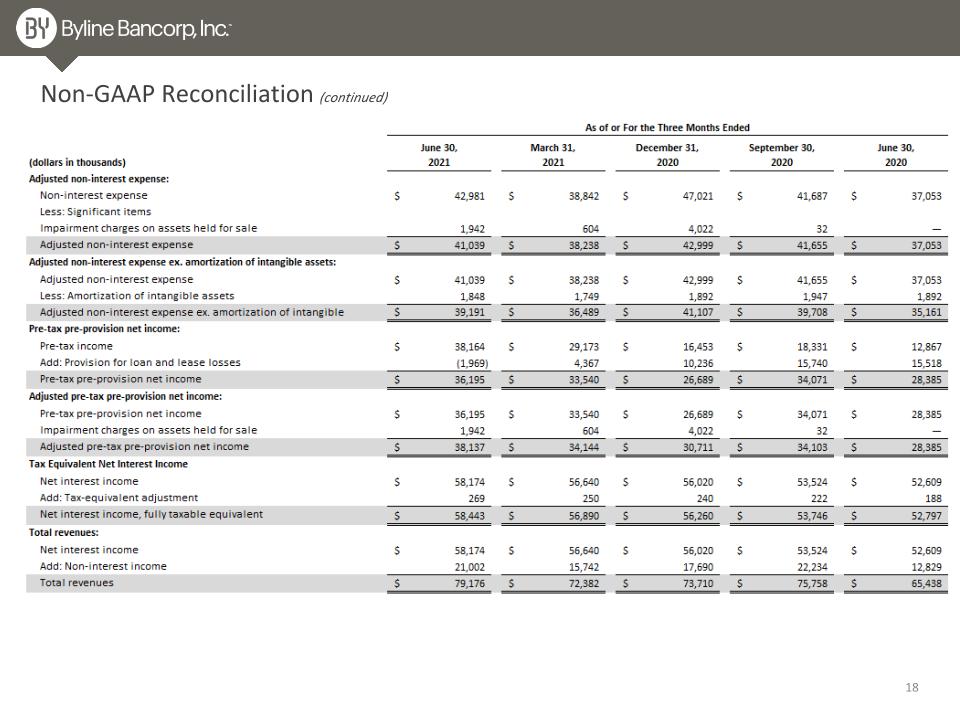

Non-GAAP Reconciliation (continued)

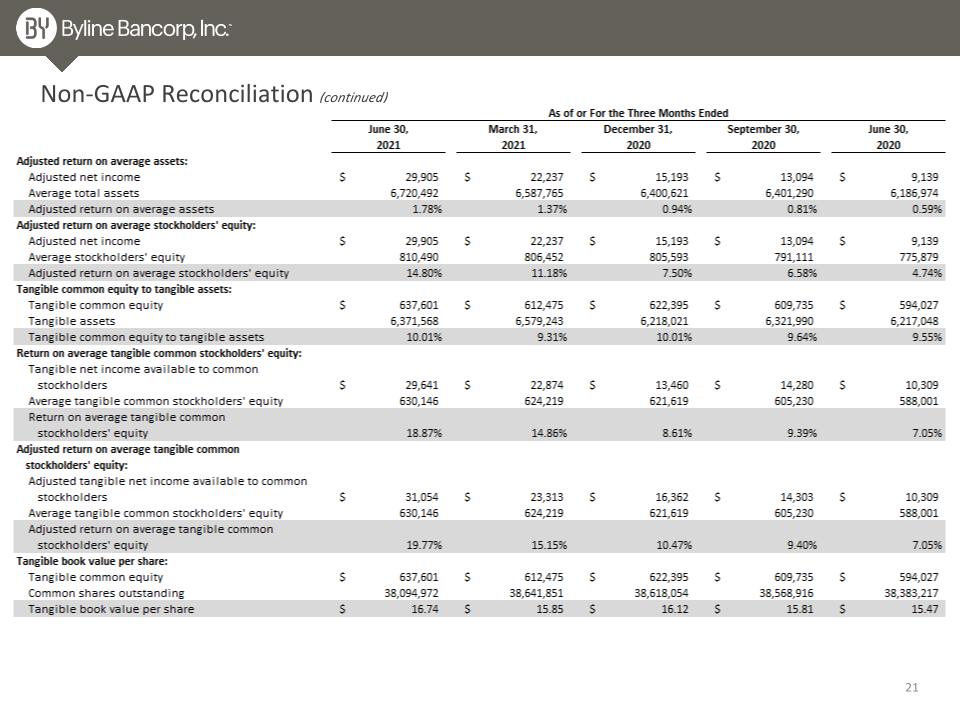

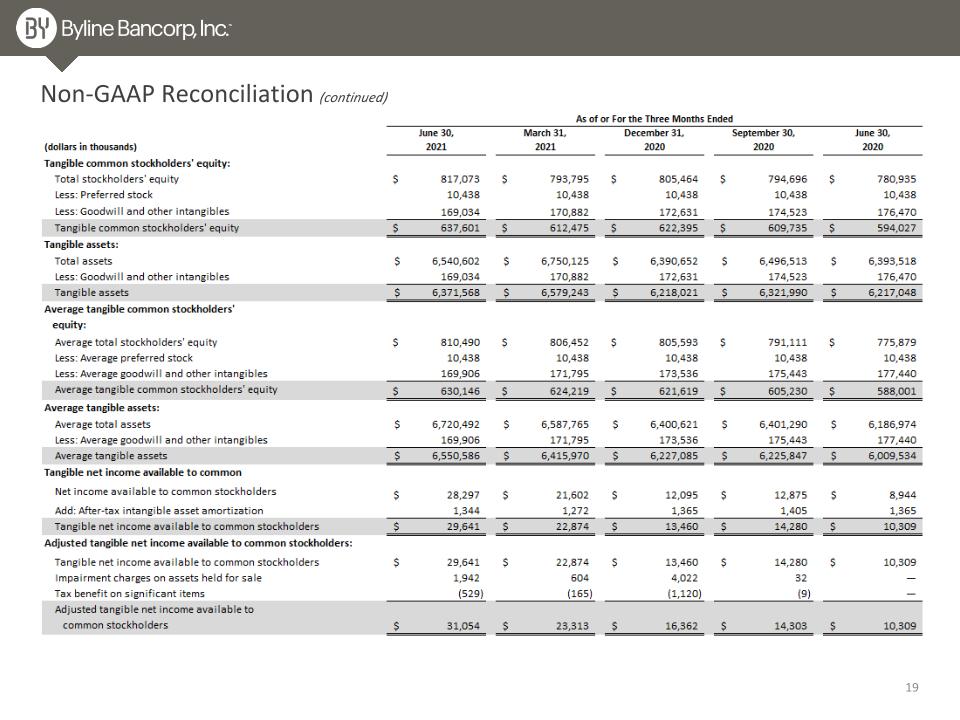

Non-GAAP Reconciliation (continued)

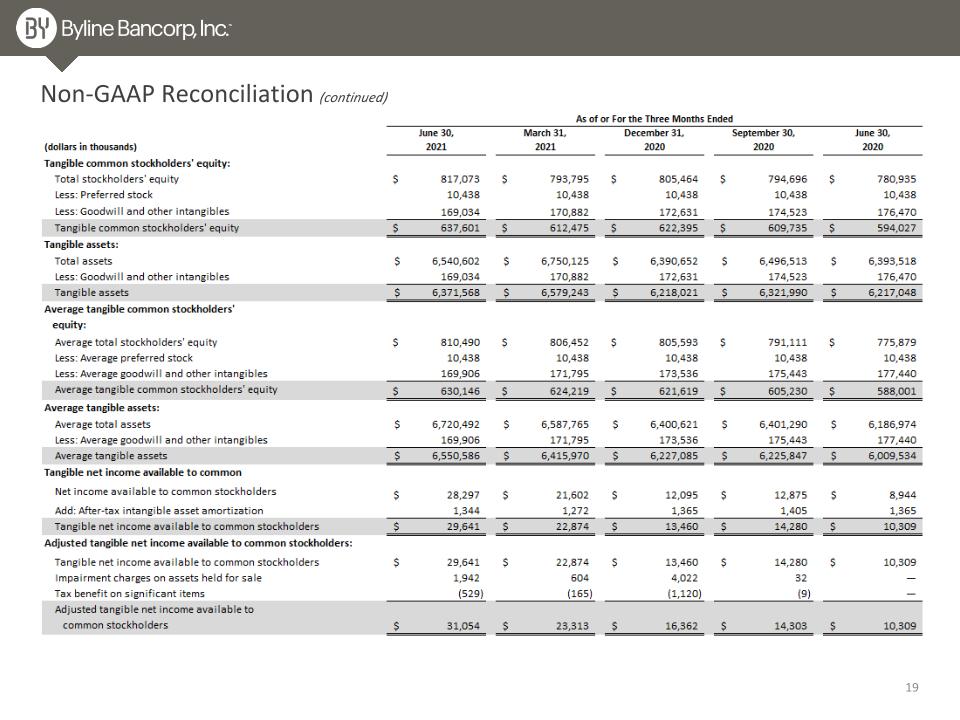

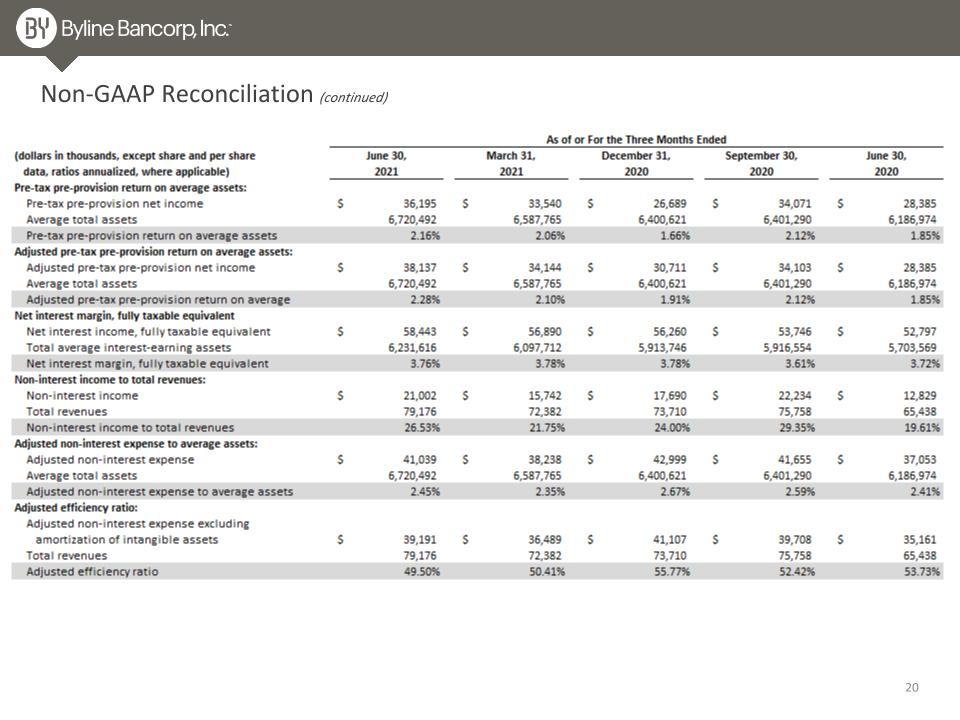

Non-GAAP Reconciliation (continued)

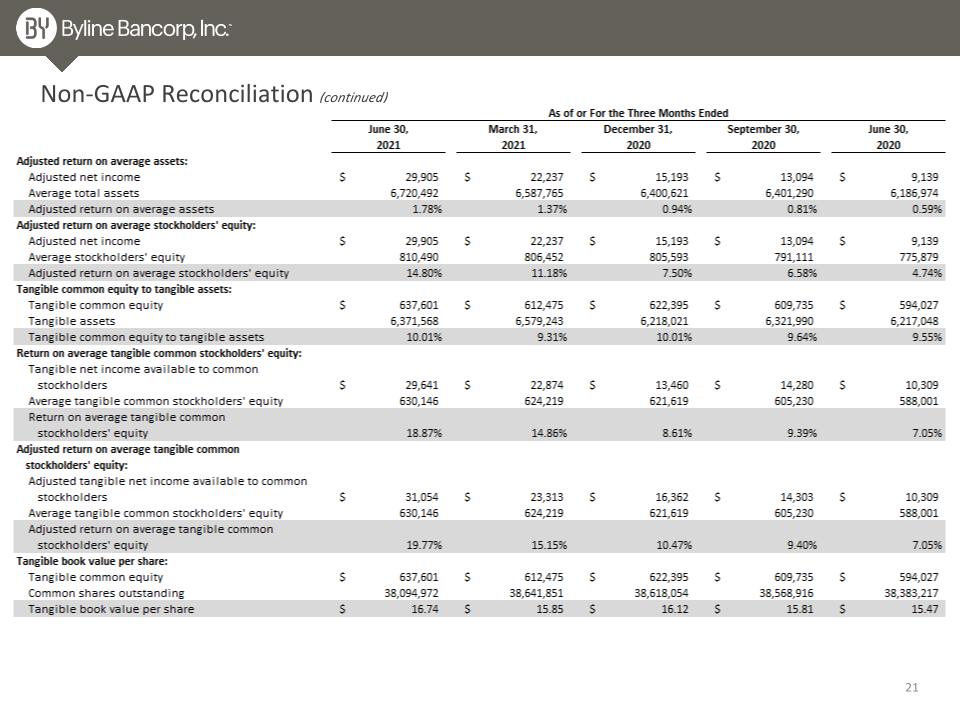

Non-GAAP Reconciliation (continued)