Investor Presentation – December 2021 Exhibit 99.1

Forward-Looking Statements This communication contains forward-looking statements within the meaning of the U.S. federal securities laws. Forward-looking statements include, without limitation, statements concerning plans, estimates, calculations, forecasts and projections with respect to the anticipated future performance of the Company. These statements are often, but not always, made through the use of words or phrases such as ‘‘may’’, ‘‘might’’, ‘‘should’’, ‘‘could’’, ‘‘predict’’, ‘‘potential’’, ‘‘believe’’, ‘‘expect’’, ‘‘continue’’, ‘‘will’’, ‘‘anticipate’’, ‘‘seek’’, ‘‘estimate’’, ‘‘intend’’, ‘‘plan’’, ‘‘projection’’, ‘‘would’’, ‘‘annualized’’, “target” and ‘‘outlook’’, or the negative version of those words or other comparable words or phrases of a future or forward-looking nature. Forward-looking statements involve estimates and known and unknown risks, and reflect various assumptions and involve elements of subjective judgement and analysis, which may or may not prove to be correct, and which are subject to uncertainties and contingencies outside the control of Byline and its respective affiliates, directors, employees and other representatives, which could cause actual results to differ materially from those presented in this communication. The COVID-19 pandemic is adversely affecting us, our employees, customers, counterparties and third-party service providers, and the ultimate extent of the impacts on our business, financial position, results of operations, liquidity, and prospects is uncertain. Deterioration in general business and economic conditions, including increases in unemployment rates or turbulence in U.S. or global financial markets, could adversely affect our revenues and the values of our assets and liabilities, reduce the availability of funding, and lead to a tightening of credit and further increase stock price volatility. In addition, changes to statutes, regulations, or regulatory policies or practices as a result of, or in response to COVID-19, could affect us in substantial and unpredictable ways. No representations, warranties or guarantees are or will be made by Byline as to the reliability, accuracy or completeness of any forward-looking statements contained in this communication or that such forward-looking statements are or will remain based on reasonable assumptions. You should not place undue reliance on any forward-looking statements contained in this communication.

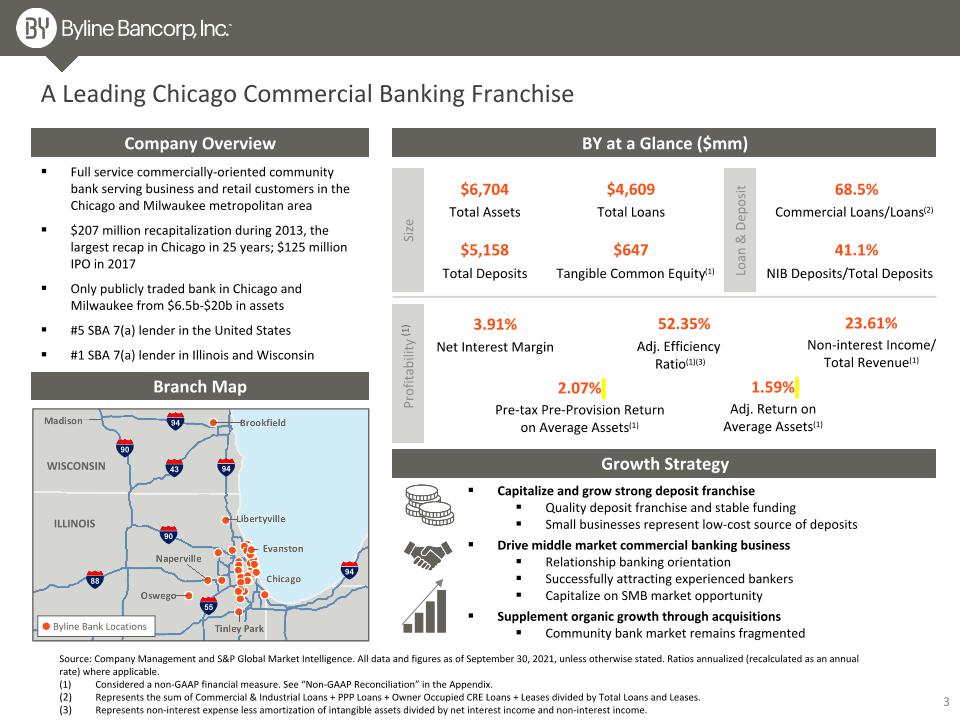

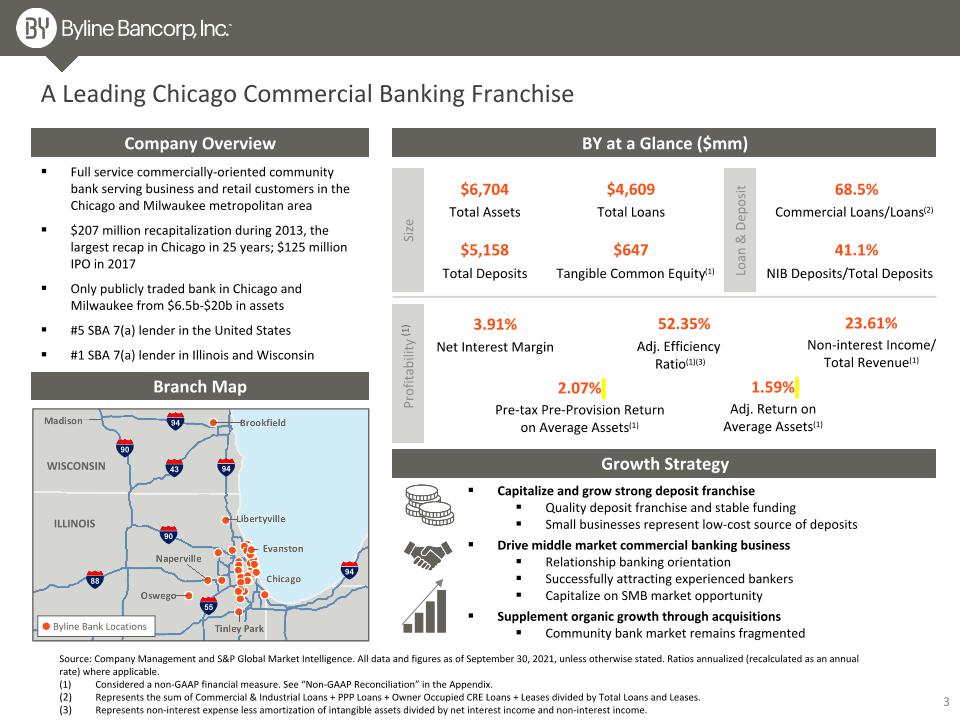

A Leading Chicago Commercial Banking Franchise Loan & Deposit BY at a Glance ($mm) Tangible Common Equity(1) Total Loans $647 $4,609 Total Deposits Total Assets $6,704 $5,158 68.5% Commercial Loans/Loans(2) 41.1% NIB Deposits/Total Deposits Adj. Efficiency Ratio(1)(3) 52.35% Size Company Overview Branch Map Full service commercially-oriented community bank serving business and retail customers in the Chicago and Milwaukee metropolitan area $207 million recapitalization during 2013, the largest recap in Chicago in 25 years; $125 million IPO in 2017 Only publicly traded bank in Chicago and Milwaukee from $6.5b-$20b in assets #5 SBA 7(a) lender in the United States #1 SBA 7(a) lender in Illinois and Wisconsin Profitability Growth Strategy Capitalize and grow strong deposit franchise Quality deposit franchise and stable funding Small businesses represent low-cost source of deposits Drive middle market commercial banking business Relationship banking orientation Successfully attracting experienced bankers Capitalize on SMB market opportunity Supplement organic growth through acquisitions Community bank market remains fragmented 88 90 94 94 94 90 43 55 WISCONSIN ILLINOIS Byline Bank Locations Net Interest Margin 3.91% (1) 23.61% Non-interest Income/ Total Revenue(1) 2.07% Pre-tax Pre-Provision Return on Average Assets(1) 1.59% Adj. Return on Average Assets(1) Source: Company Management and S&P Global Market Intelligence. All data and figures as of September 30, 2021, unless otherwise stated. Ratios annualized (recalculated as an annual rate) where applicable. (1) Considered a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the Appendix. Represents the sum of Commercial & Industrial Loans + PPP Loans + Owner Occupied CRE Loans + Leases divided by Total Loans and Leases. Represents non-interest expense less amortization of intangible assets divided by net interest income and non-interest income.

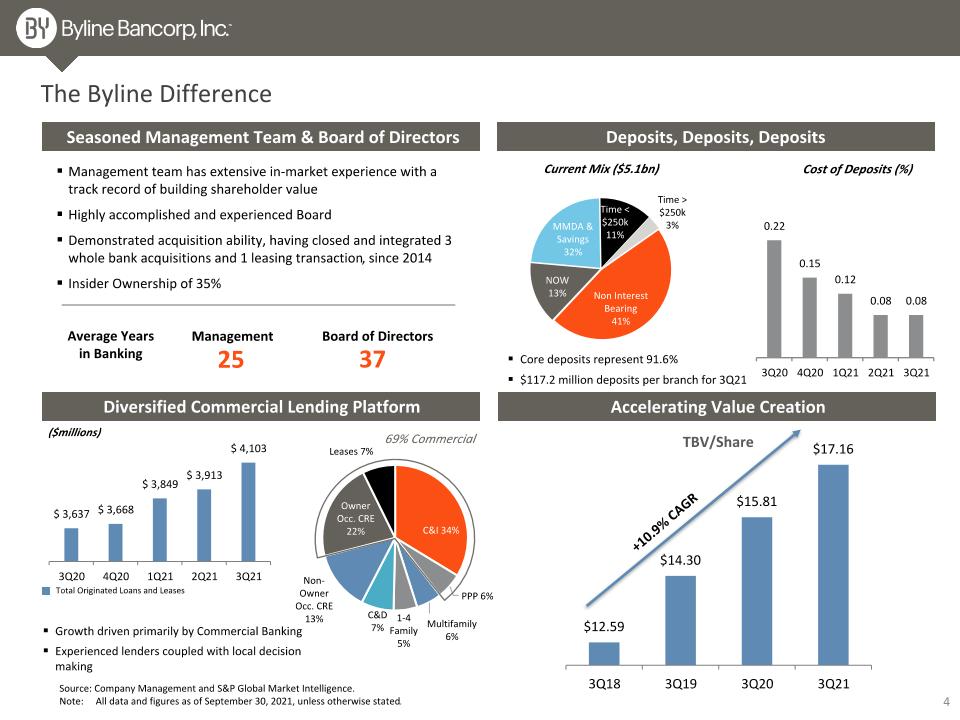

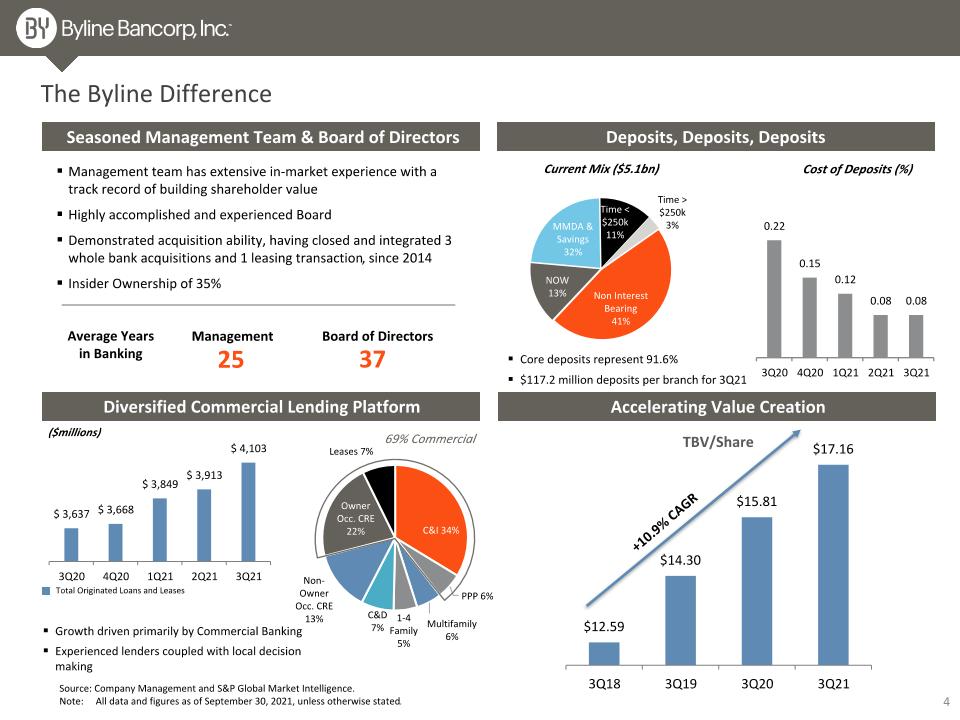

Seasoned Management Team & Board of Directors Deposits, Deposits, Deposits Accelerating Value Creation Diversified Commercial Lending Platform Management team has extensive in-market experience with a track record of building shareholder value Highly accomplished and experienced Board Demonstrated acquisition ability, having closed and integrated 3 whole bank acquisitions and 1 leasing transaction, since 2014 Insider Ownership of 35% Total Originated Loans and Leases The Byline Difference Core deposits represent 91.6% $117.2 million deposits per branch for 3Q21 Growth driven primarily by Commercial Banking Experienced lenders coupled with local decision making ($millions) Current Mix ($5.1bn) Cost of Deposits (%) Average Years in Banking Management Board of Directors 69% Commercial 25 37 +10.9% CAGR Source: Company Management and S&P Global Market Intelligence. Note: All data and figures as of September 30, 2021, unless otherwise stated.

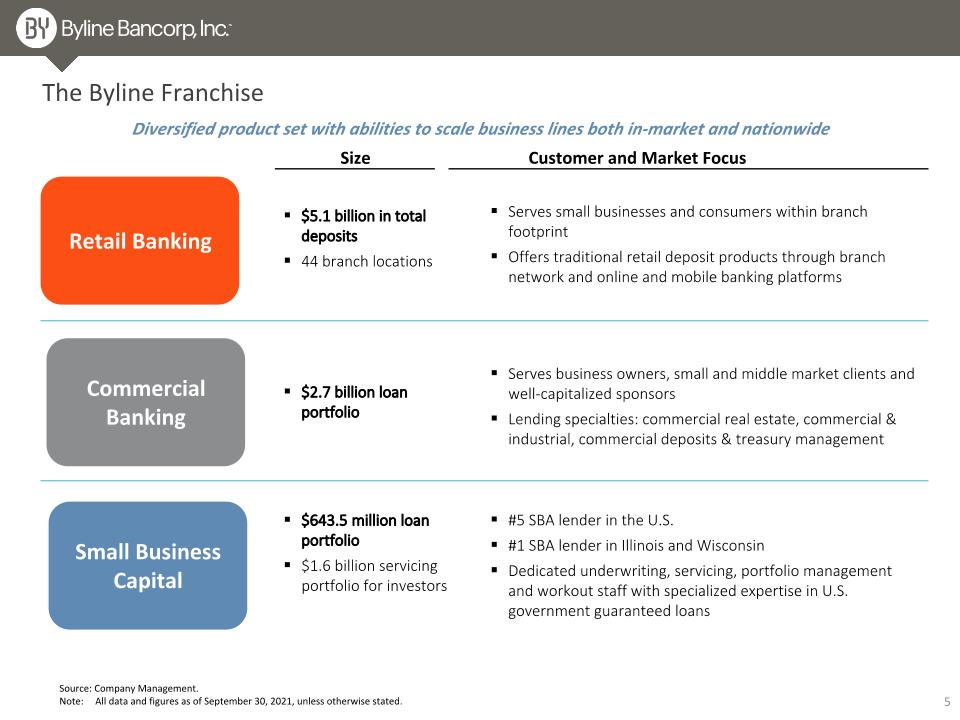

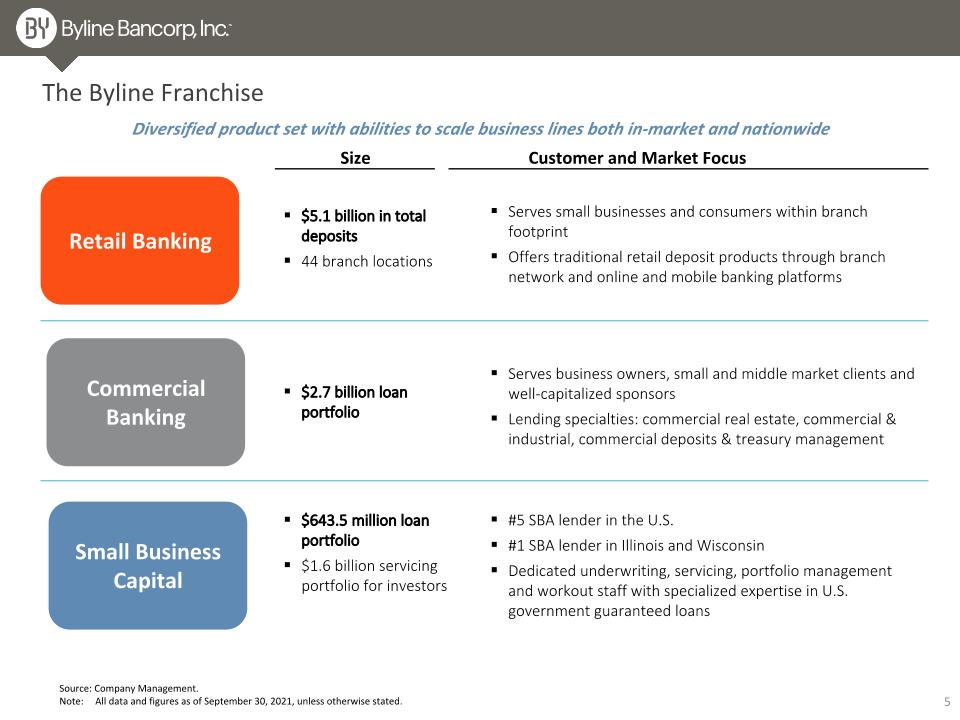

The Byline Franchise Size Customer and Market Focus $5.1 billion in total deposits 44 branch locations Serves small businesses and consumers within branch footprint Offers traditional retail deposit products through branch network and online and mobile banking platforms $2.7 billion loan portfolio Serves business owners, small and middle market clients and well-capitalized sponsors Lending specialties: commercial real estate, commercial & industrial, commercial deposits & treasury management $643.5 million loan portfolio $1.6 billion servicing portfolio for investors #5 SBA lender in the U.S. #1 SBA lender in Illinois and Wisconsin Dedicated underwriting, servicing, portfolio management and workout staff with specialized expertise in U.S. government guaranteed loans Source: Company Management. Note: All data and figures as of September 30, 2021, unless otherwise stated. Diversified product set with abilities to scale business lines both in-market and nationwide Retail Banking Commercial Banking Small Business �Capital

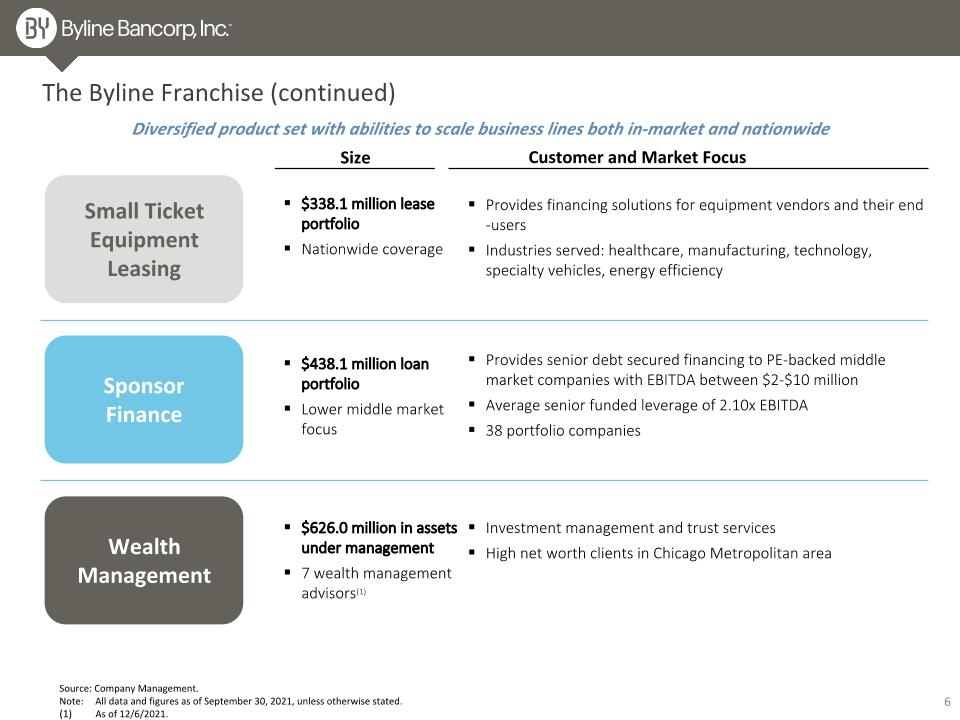

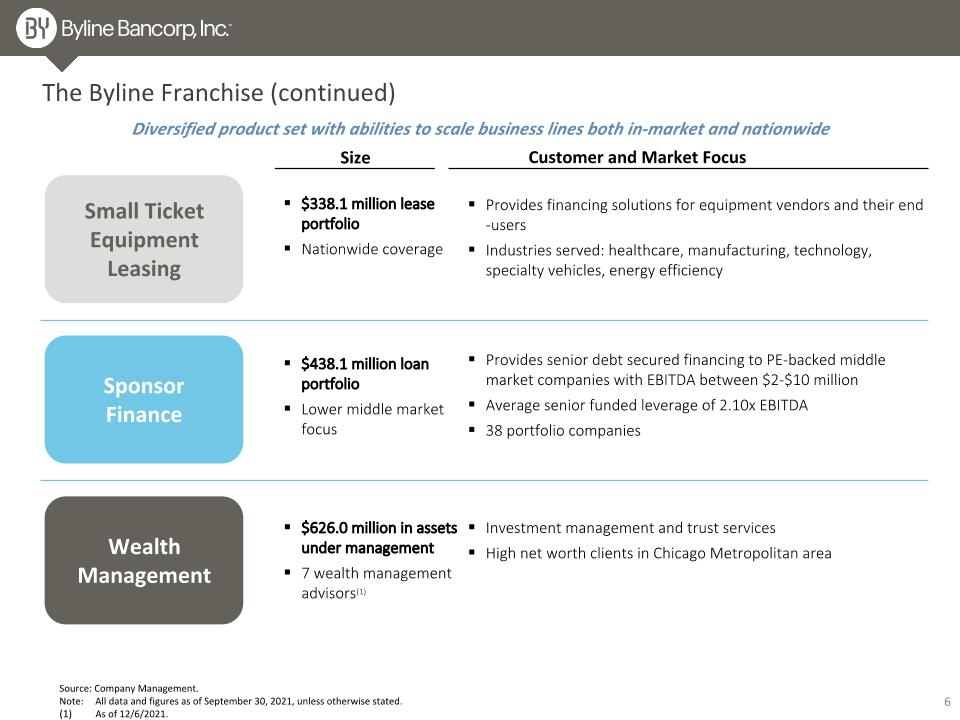

Size Customer and Market Focus $338.1 million lease portfolio Nationwide coverage Provides financing solutions for equipment vendors and their end-users Industries served: healthcare, manufacturing, technology, specialty vehicles, energy efficiency $438.1 million loan portfolio Lower middle market focus Provides senior debt secured financing to PE-backed middle market companies with EBITDA between $2-$10 million Average senior funded leverage of 2.10x EBITDA 38 portfolio companies $626.0 million in assets under management 7 wealth management advisors(1) Investment management and trust services High net worth clients in Chicago Metropolitan area Diversified product set with abilities to scale business lines both in-market and nationwide Small Ticket�Equipment Leasing Sponsor �Finance Wealth Management The Byline Franchise (continued) Source: Company Management. Note: All data and figures as of September 30, 2021, unless otherwise stated. As of 12/6/2021.

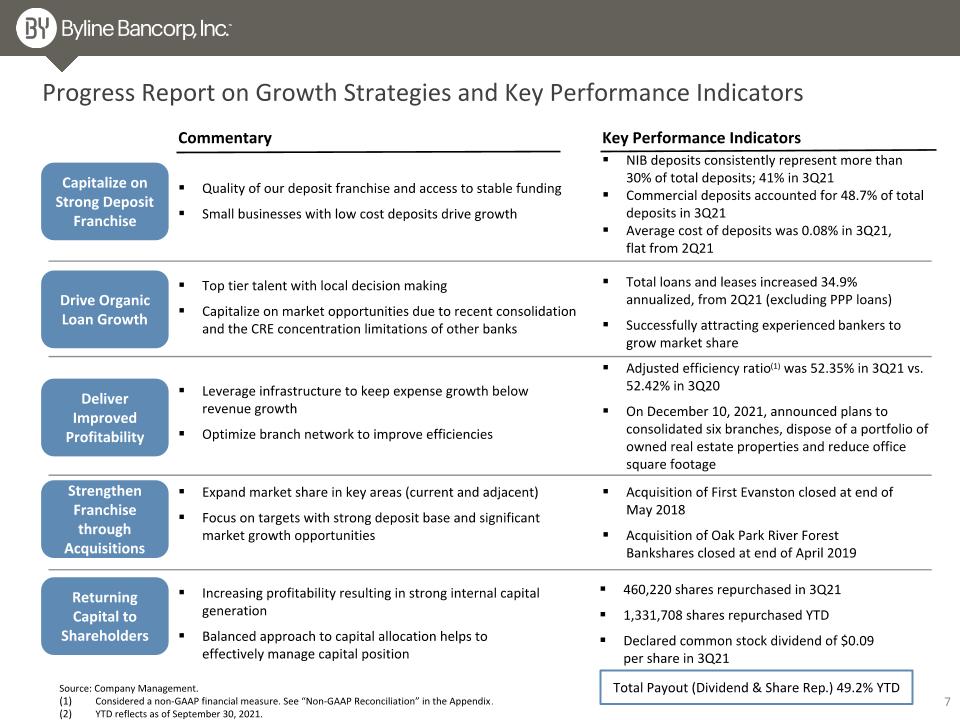

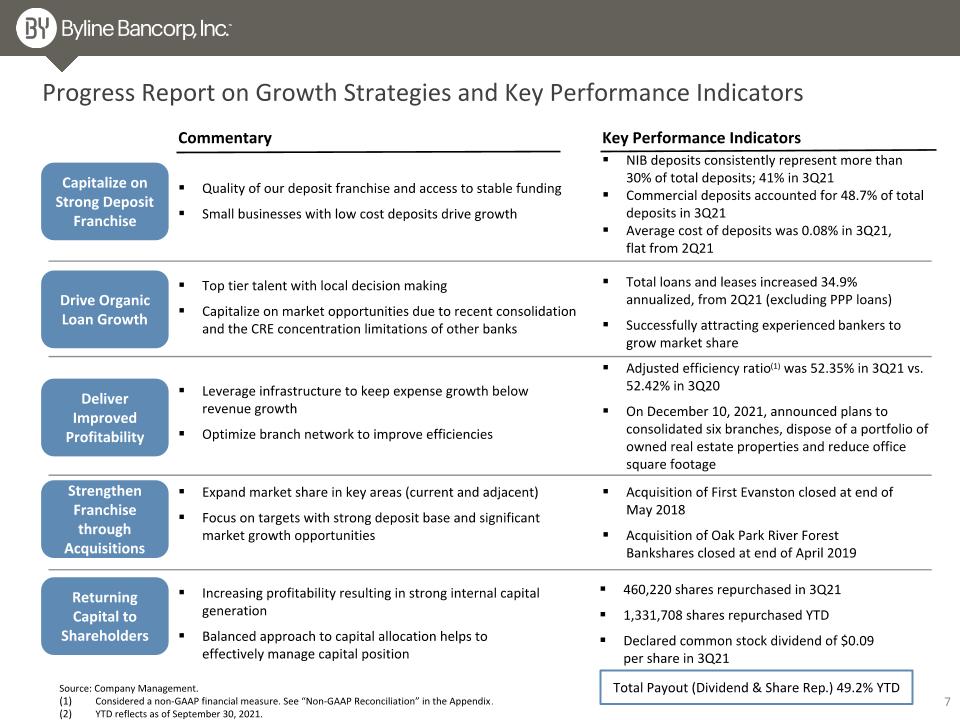

Drive Organic Loan Growth Deliver Improved Profitability Strengthen Franchise through Acquisitions Top tier talent with local decision making Capitalize on market opportunities due to recent consolidation and the CRE concentration limitations of other banks Leverage infrastructure to keep expense growth below revenue growth Optimize branch network to improve efficiencies Expand market share in key areas (current and adjacent) Focus on targets with strong deposit base and significant market growth opportunities Capitalize on Strong Deposit Franchise Quality of our deposit franchise and access to stable funding Small businesses with low cost deposits drive growth Progress Report on Growth Strategies and Key Performance Indicators Commentary Key Performance Indicators NIB deposits consistently represent more than 30% of total deposits; 41% in 3Q21 Commercial deposits accounted for 48.7% of total deposits in 3Q21 Average cost of deposits was 0.08% in 3Q21, flat from 2Q21 Total loans and leases increased 34.9% annualized, from 2Q21 (excluding PPP loans) Successfully attracting experienced bankers to grow market share Adjusted efficiency ratio(1) was 52.35% in 3Q21 vs. 52.42% in 3Q20 On December 10, 2021, announced plans to consolidated six branches, dispose of a portfolio of owned real estate properties and reduce office square footage Acquisition of First Evanston closed at end of May 2018 Acquisition of Oak Park River Forest Bankshares closed at end of April 2019 Returning Capital to Shareholders Increasing profitability resulting in strong internal capital generation Balanced approach to capital allocation helps to effectively manage capital position 460,220 shares repurchased in 3Q21 1,331,708 shares repurchased YTD Declared common stock dividend of $0.09 per share in 3Q21 Total Payout (Dividend & Share Rep.) 49.2% YTD Source: Company Management. Considered a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the Appendix. YTD reflects as of September 30, 2021.

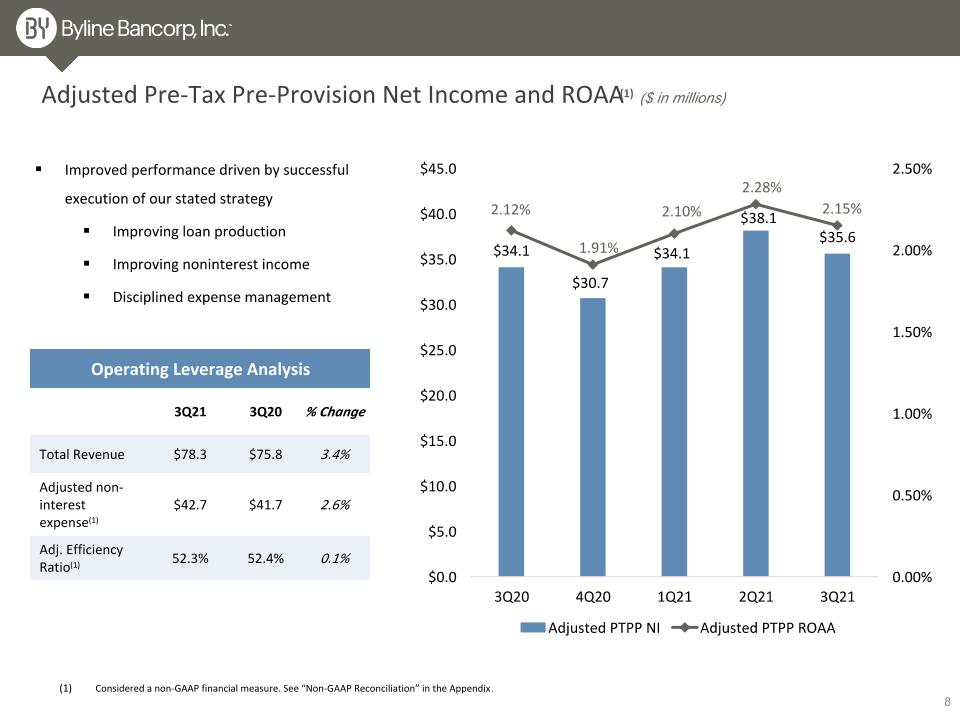

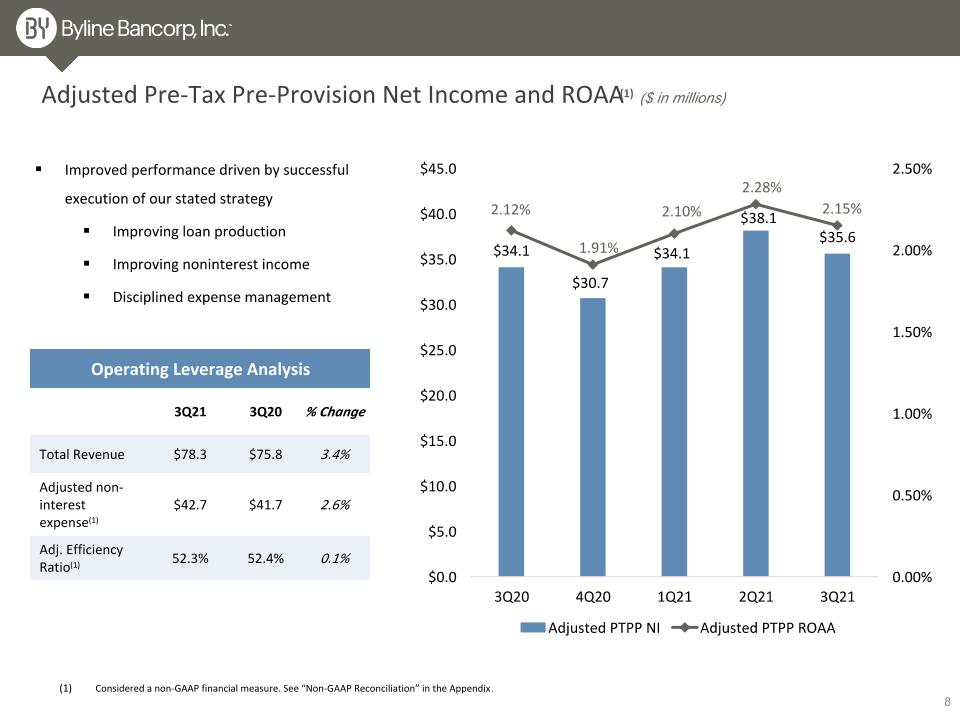

Adjusted Pre-Tax Pre-Provision Net Income and ROAA(1) ($ in millions) Improved performance driven by successful execution of our stated strategy Improving loan production Improving noninterest income Disciplined expense management Operating Leverage Analysis 3Q21 3Q20 % Change Total Revenue $78.3 $75.8 3.4% Adjusted non-interest expense(1) $42.7 $41.7 2.6% Adj. Efficiency Ratio(1) 52.3% 52.4% 0.1% Considered a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the Appendix. 8

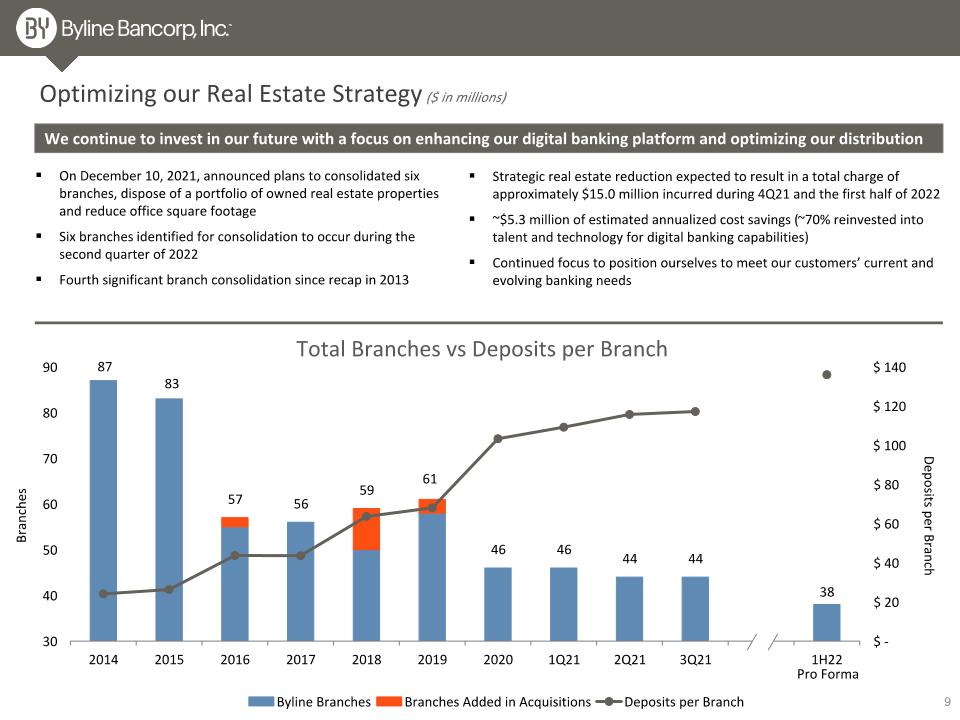

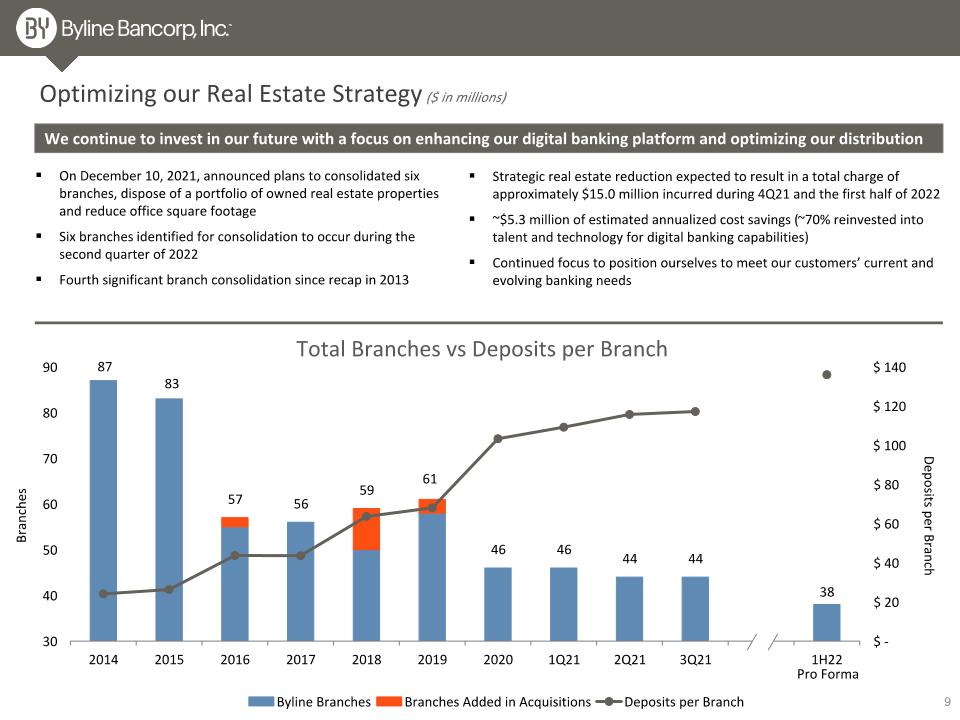

Optimizing our Real Estate Strategy ($ in millions) Pro Forma Branches Deposits per Branch We continue to invest in our future with a focus on enhancing our digital banking platform and optimizing our distribution On December 10, 2021, announced plans to consolidated six branches, dispose of a portfolio of owned real estate properties and reduce office square footage Six branches identified for consolidation to occur during the second quarter of 2022 Fourth significant branch consolidation since recap in 2013 Strategic real estate reduction expected to result in a total charge of approximately $15.0 million incurred during 4Q21 and the first half of 2022 ~$5.3 million of estimated annualized cost savings (~70% reinvested into talent and technology for digital banking capabilities) Continued focus to position ourselves to meet our customers’ current and evolving banking needs 9

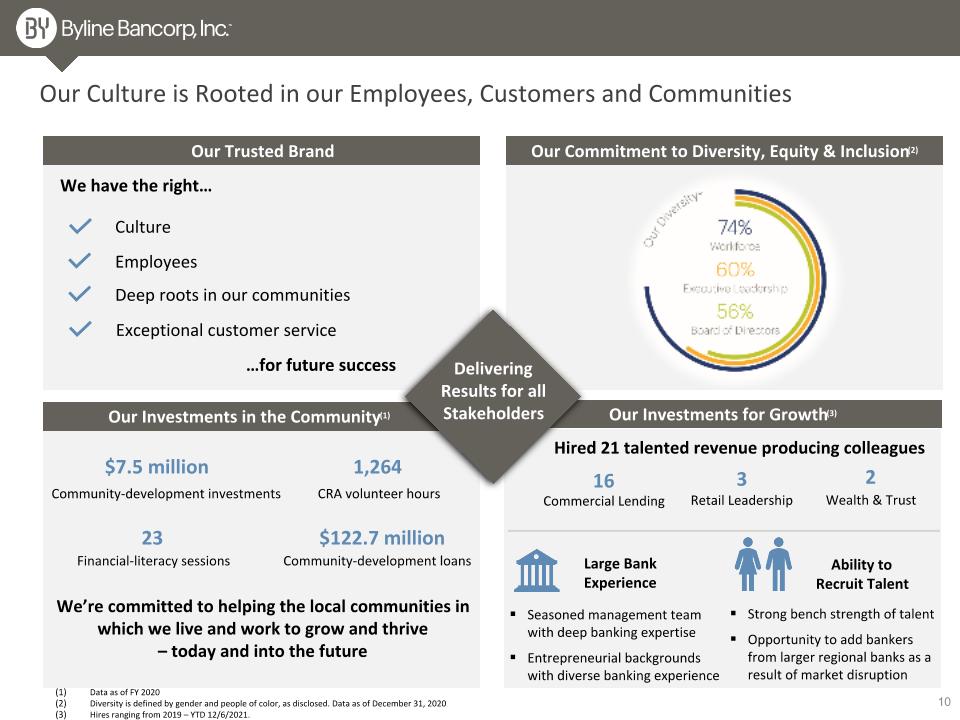

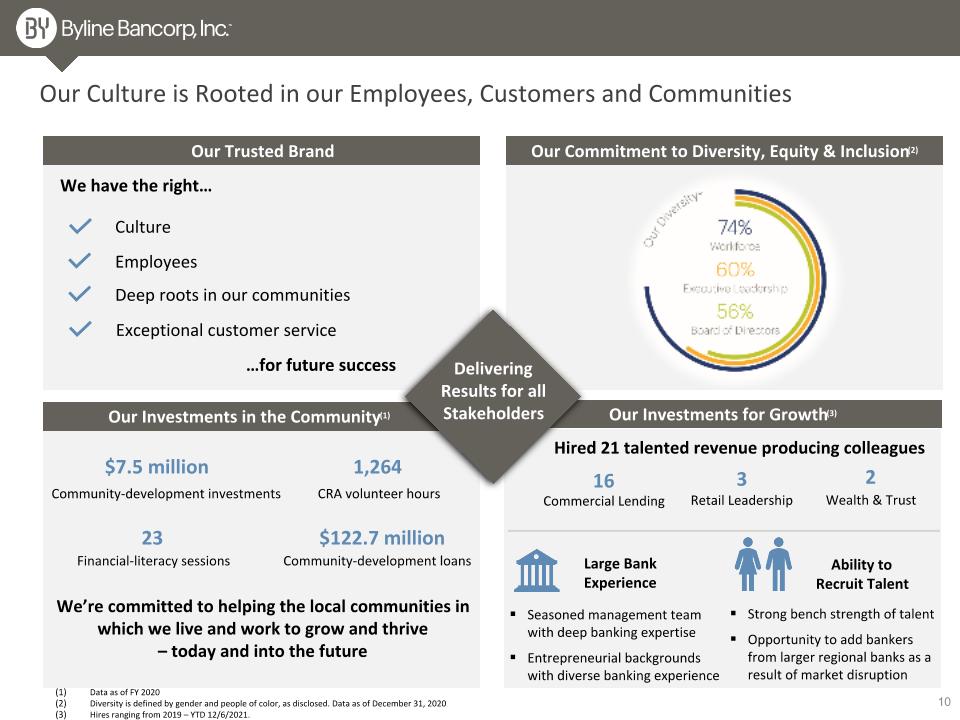

Data as of FY 2020 Diversity is defined by gender and people of color, as disclosed. Data as of December 31, 2020 Hires ranging from 2019 – YTD 12/6/2021. Our Investments in the Community(1) Our Culture is Rooted in our Employees, Customers and Communities Our Trusted Brand Our Commitment to Diversity, Equity & Inclusion(2) Culture We have the right… Employees Deep roots in our communities …for future success Exceptional customer service We’re committed to helping the local communities in which we live and work to grow and thrive – today and into the future Community-development loans CRA volunteer hours $122.7 million 1,264 Financial-literacy sessions Community-development investments $7.5 million 23 Commercial Lending 16 Retail Leadership 3 Large Bank Experience Seasoned management team with deep banking expertise Entrepreneurial backgrounds with diverse banking experience Ability to Recruit Talent Our Investments for Growth(3) Delivering Results for all Stakeholders Hired 21 talented revenue producing colleagues Wealth & Trust 2 Strong bench strength of talent Opportunity to add bankers from larger regional banks as a result of market disruption 10

2021 Strategic Priorities and Outlook Drive organic loan and deposit growth Continue Investing in Technology to Improve Efficiencies and Enhance Revenue Generation Strategic M&A Opportunities and Team Lift-Outs with Attractive Metrics and Return Profile Increase Return of Capital to Stockholders Continue to Identify Opportunities to Improve Operating Leverage

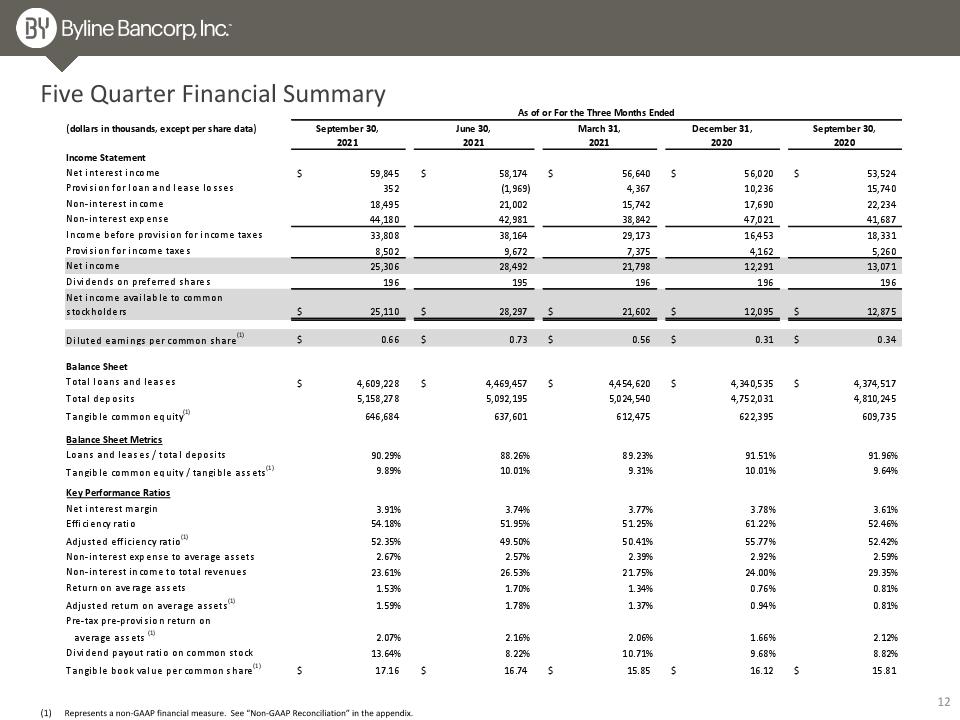

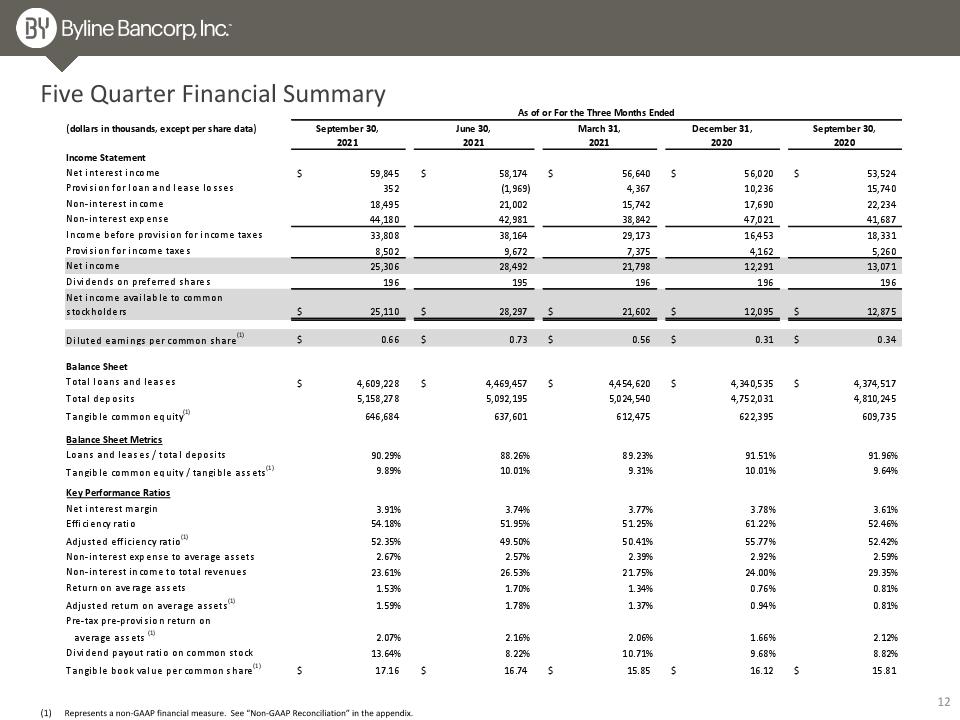

Five Quarter Financial Summary Represents a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the appendix.

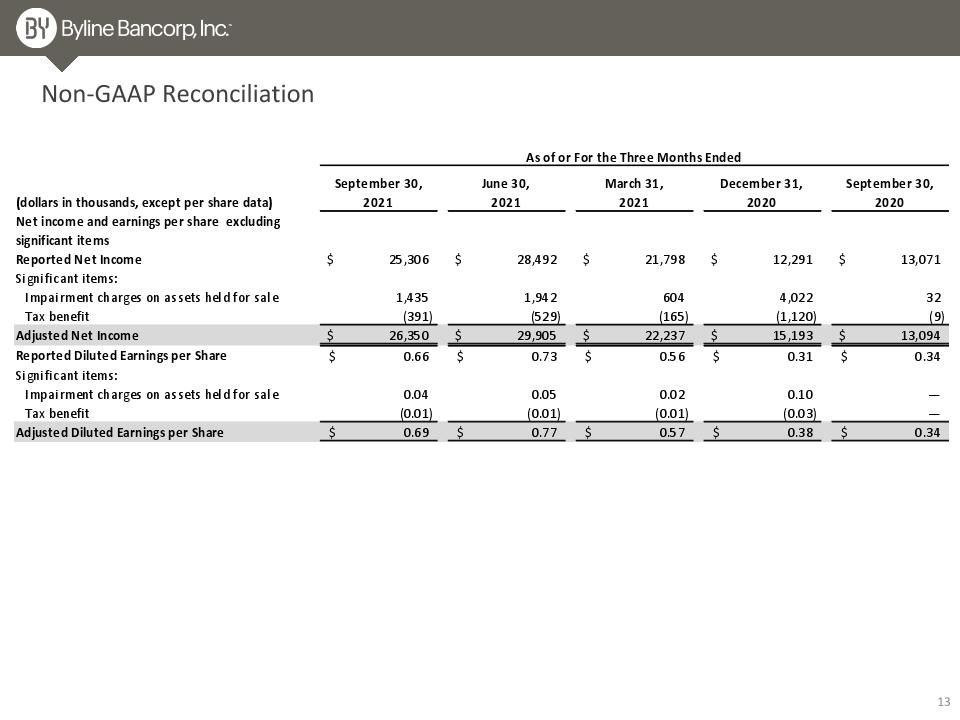

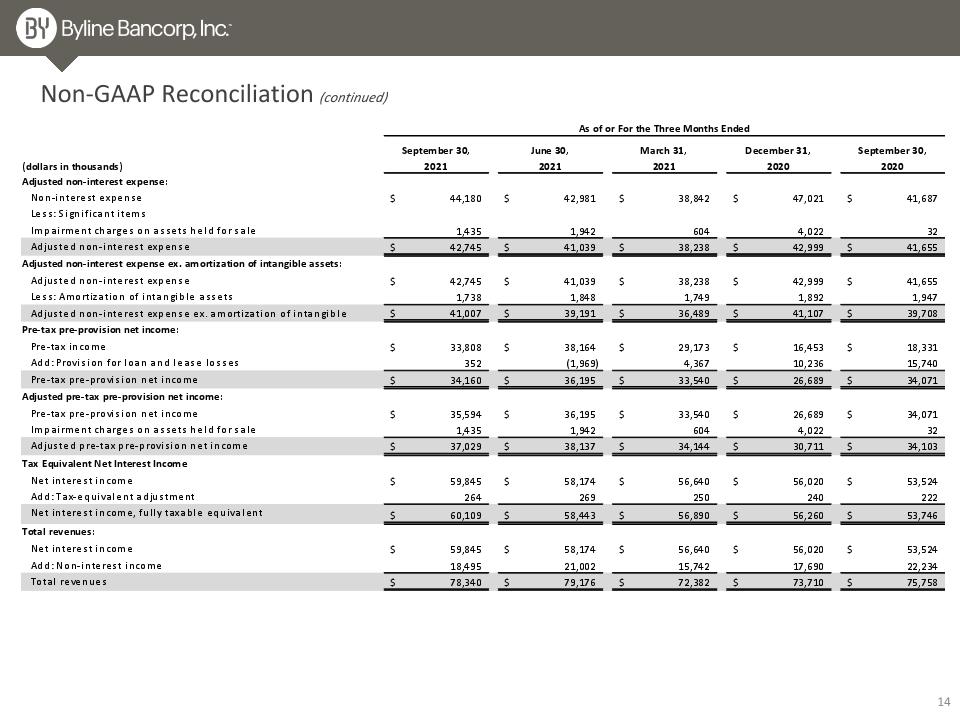

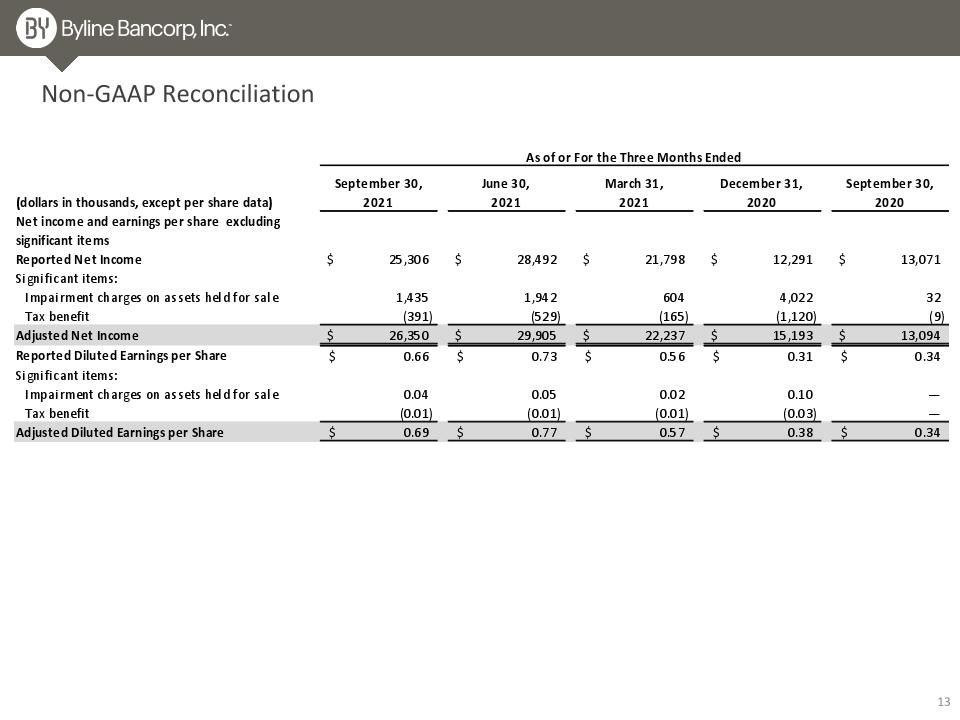

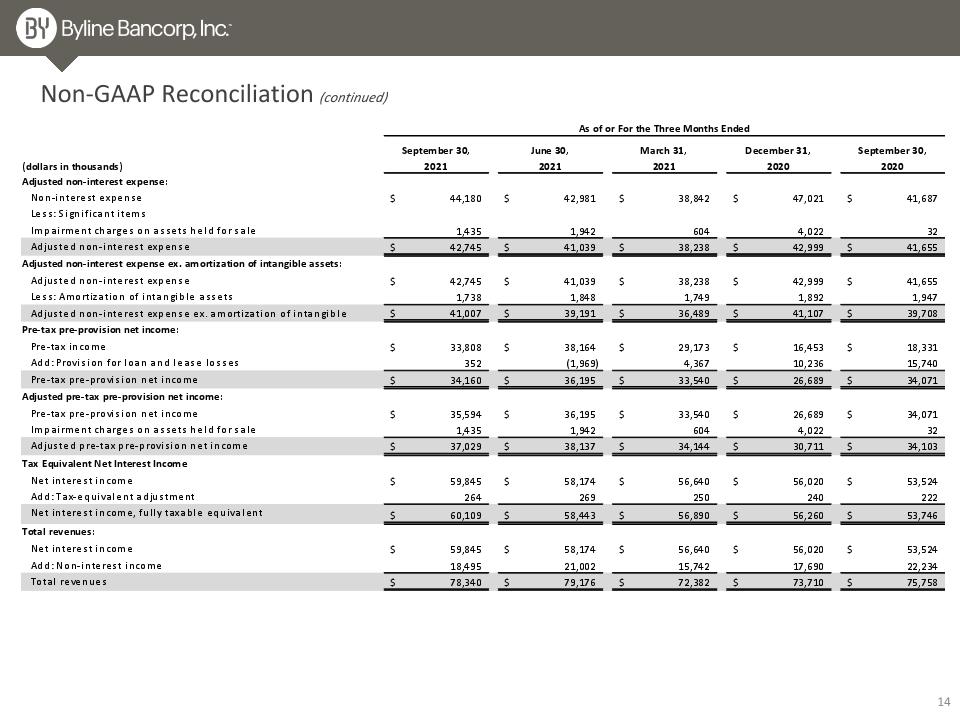

Non-GAAP Reconciliation

Non-GAAP Reconciliation (continued)

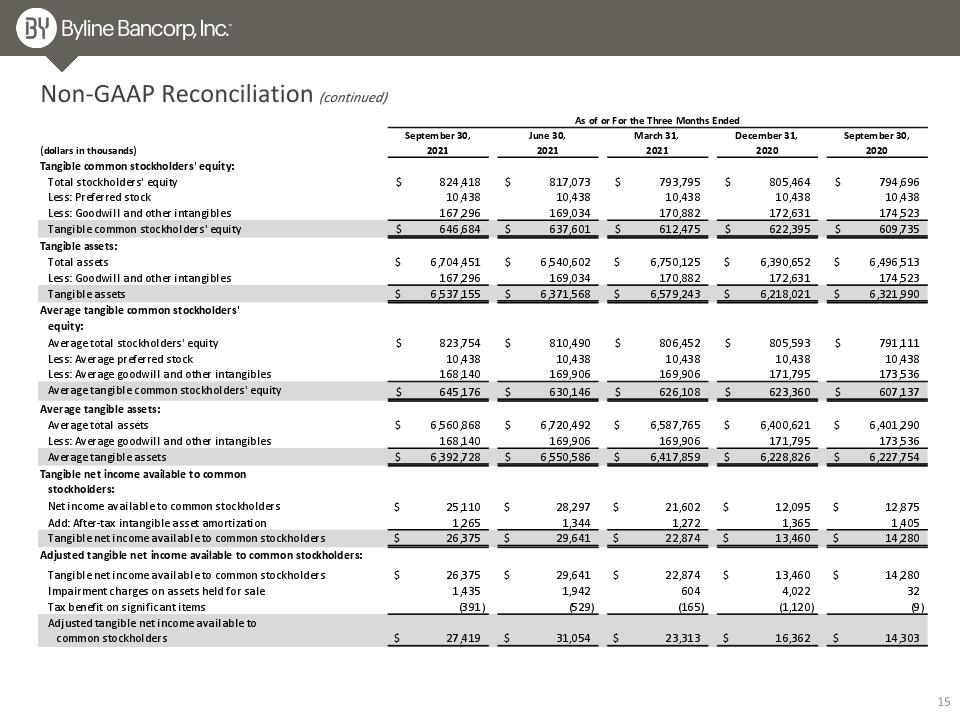

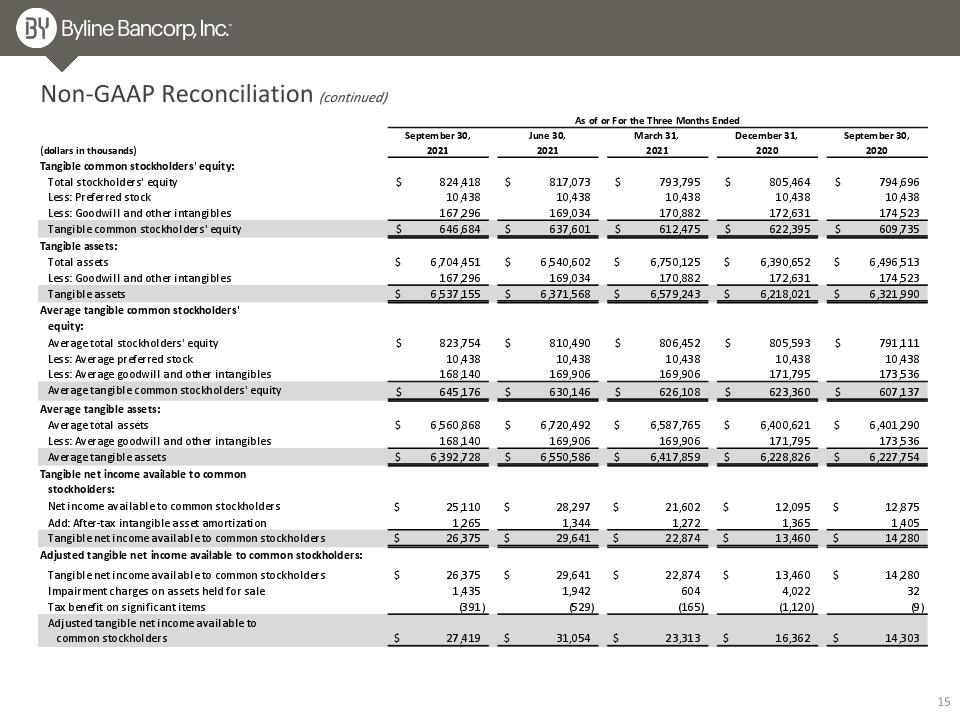

Non-GAAP Reconciliation (continued)

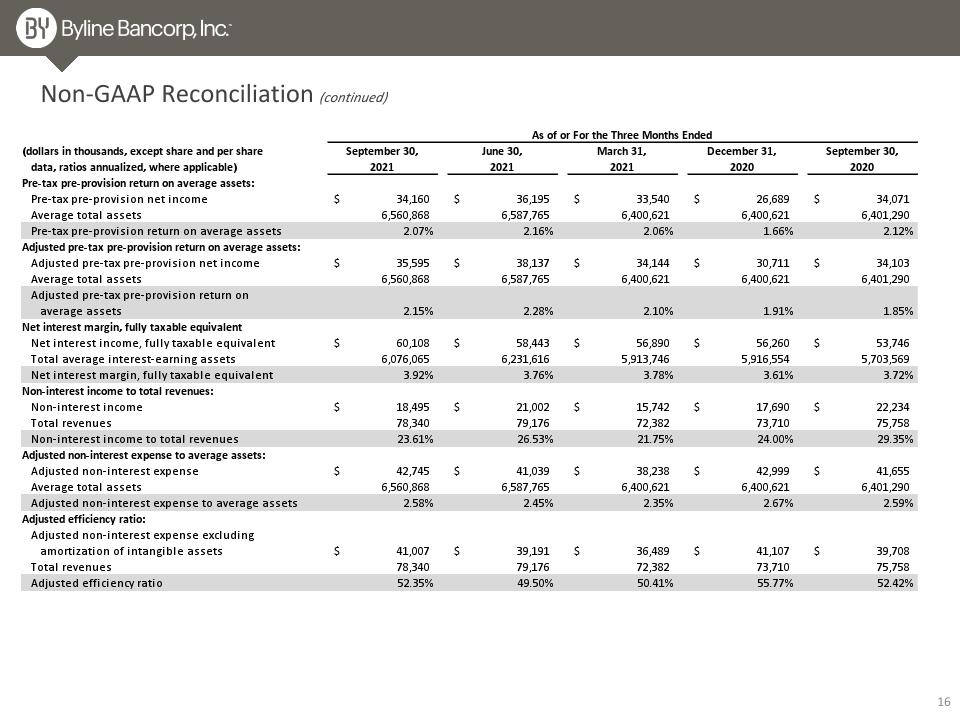

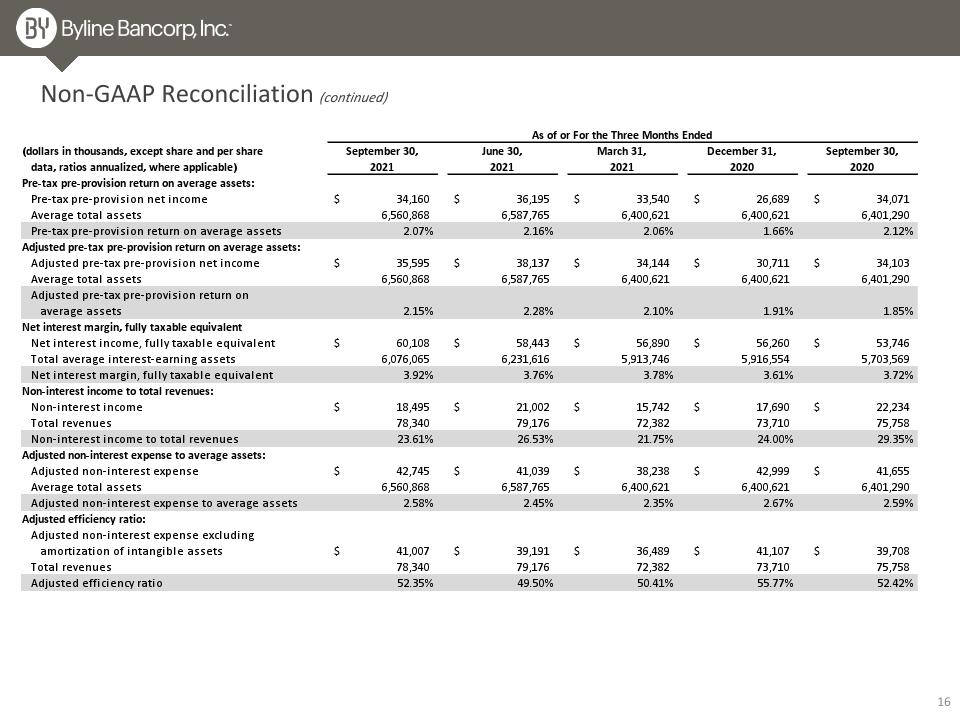

Non-GAAP Reconciliation (continued)

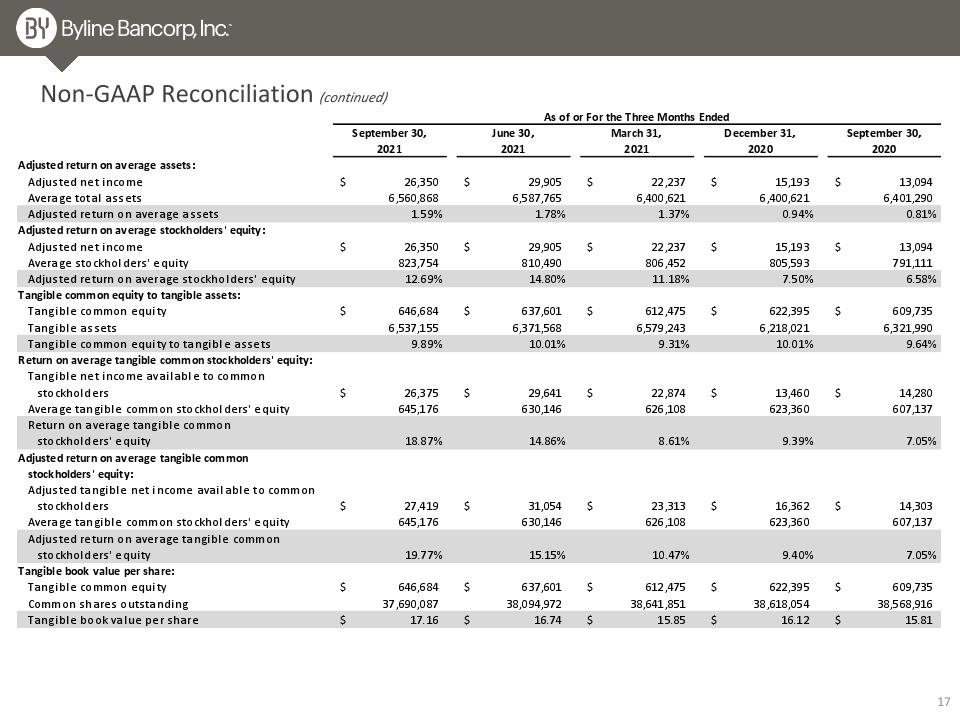

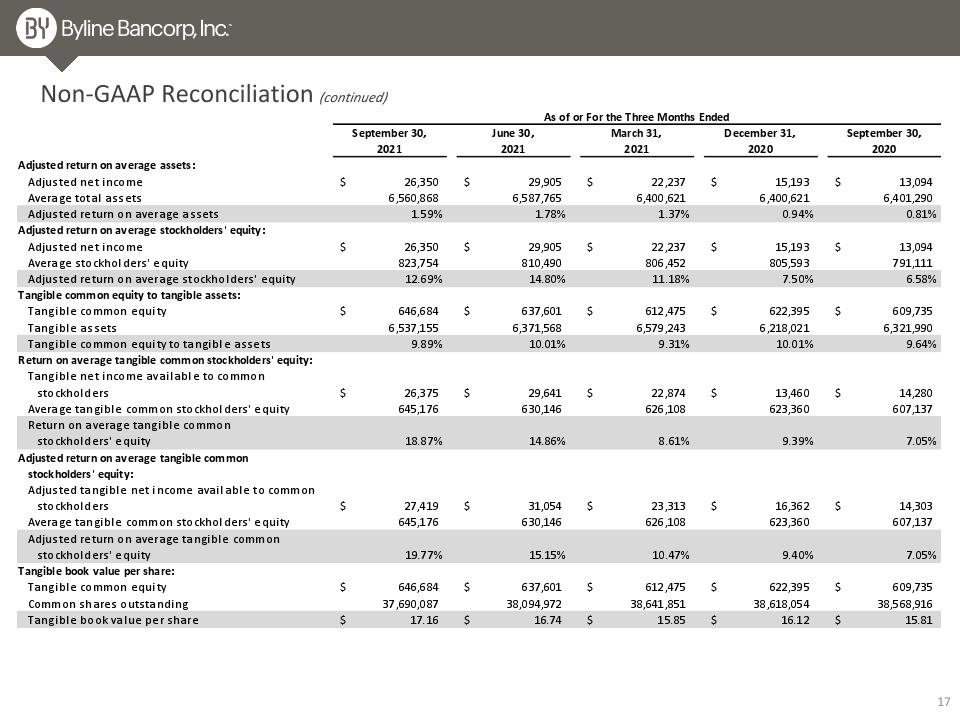

Non-GAAP Reconciliation (continued)