Q4 2021 Conference Call

Forward-Looking Statements This communication contains forward-looking statements within the meaning of the U.S. federal securities laws. Forward-looking statements include, without limitation, statements concerning plans, estimates, calculations, forecasts and projections with respect to the anticipated future performance of the Company. These statements are often, but not always, made through the use of words or phrases such as ‘‘may’’, ‘‘might’’, ‘‘should’’, ‘‘could’’, ‘‘predict’’, ‘‘potential’’, ‘‘believe’’, ‘‘expect’’, ‘‘continue’’, ‘‘will’’, ‘‘anticipate’’, ‘‘seek’’, ‘‘estimate’’, ‘‘intend’’, ‘‘plan’’, ‘‘projection’’, ‘‘would’’, ‘‘annualized’’, “target” and ‘‘outlook’’, or the negative version of those words or other comparable words or phrases of a future or forward-looking nature. Forward-looking statements involve estimates and known and unknown risks, and reflect various assumptions and involve elements of subjective judgement and analysis, which may or may not prove to be correct, and which are subject to uncertainties and contingencies outside the control of Byline and its respective affiliates, directors, employees and other representatives, which could cause actual results to differ materially from those presented in this communication. The COVID-19 pandemic is adversely affecting us, our employees, customers, counterparties and third-party service providers, and the ultimate extent of the impacts on our business, financial position, results of operations, liquidity, and prospects is uncertain. Deterioration in general business and economic conditions, including increases in unemployment rates or turbulence in U.S. or global financial markets, could adversely affect our revenues and the values of our assets and liabilities, reduce the availability of funding, and lead to a tightening of credit and further increase stock price volatility. In addition, changes to statutes, regulations, or regulatory policies or practices as a result of, or in response to COVID-19, could affect us in substantial and unpredictable ways. No representations, warranties or guarantees are or will be made by Byline as to the reliability, accuracy or completeness of any forward-looking statements contained in this communication or that such forward-looking statements are or will remain based on reasonable assumptions. You should not place undue reliance on any forward-looking statements contained in this communication. Certain risks and important factors that could affect Byline’s future results are identified in our Annual Report on Form 10-K and other reports we file with the Securities and Exchange Commission, including among other things under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2020. Any forward-looking statement speaks only as of the date on which it is made, and Byline undertakes no obligation to update any forward-looking statement, whether to reflect events or circumstances after the date on which the statement is made, to reflect new information or the occurrence of unanticipated events, or otherwise unless required under the federal securities laws. Due to rounding, numbers presented throughout this document may not add up precisely to the totals provided and percentages may not precisely reflect the absolute figures.

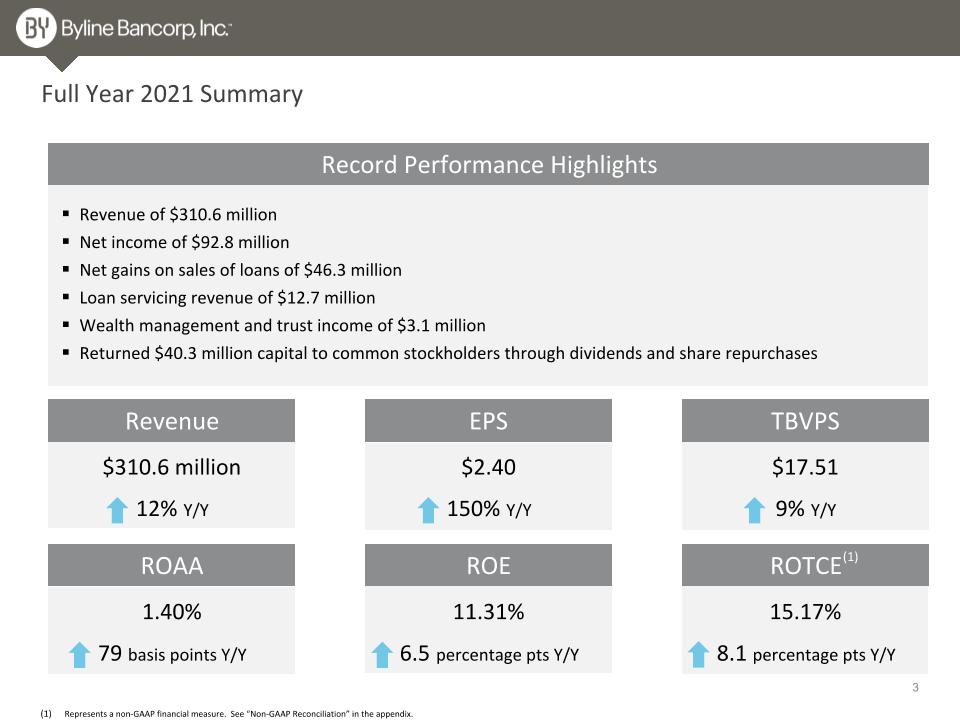

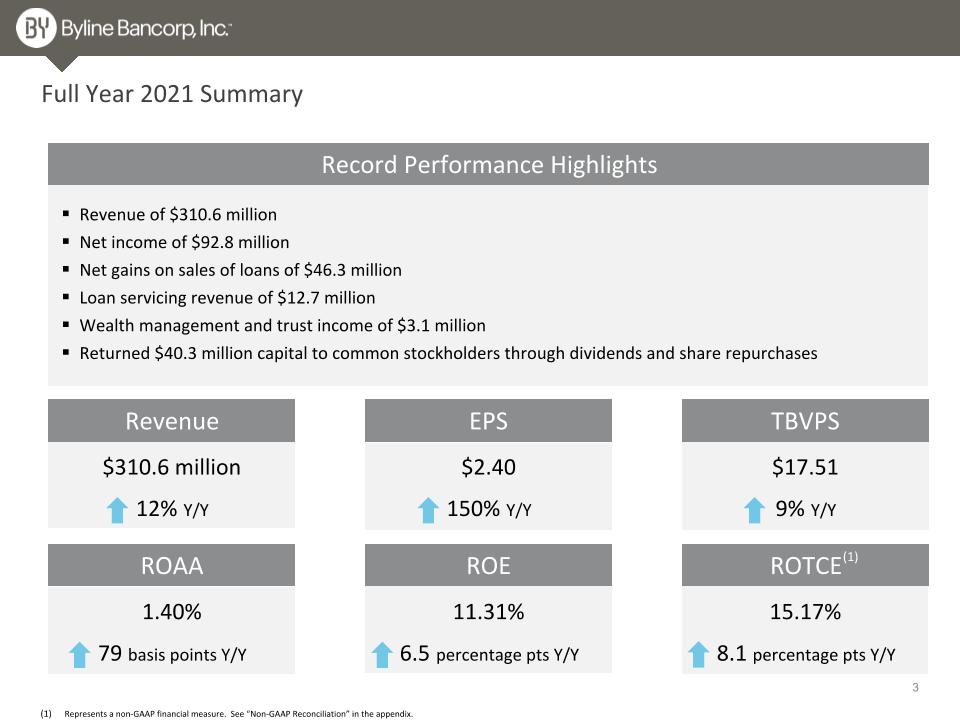

Full Year 2021 Summary Record Performance Highlights Revenue of $310.6 million Net income of $92.8 million Net gains on sales of loans of $46.3 million Loan servicing revenue of $12.7 million Wealth management and trust income of $3.1 million Returned $40.3 million capital to common stockholders through dividends and share repurchases 12% Y/Y Revenue EPS TBVPS $310.6 million 150% Y/Y $2.40 9% Y/Y $17.51 79 basis points Y/Y ROAA ROE ROTCE 1.40% 6.5 percentage pts Y/Y 11.31% 8.1 percentage pts Y/Y 15.17% Represents a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the appendix. (1)

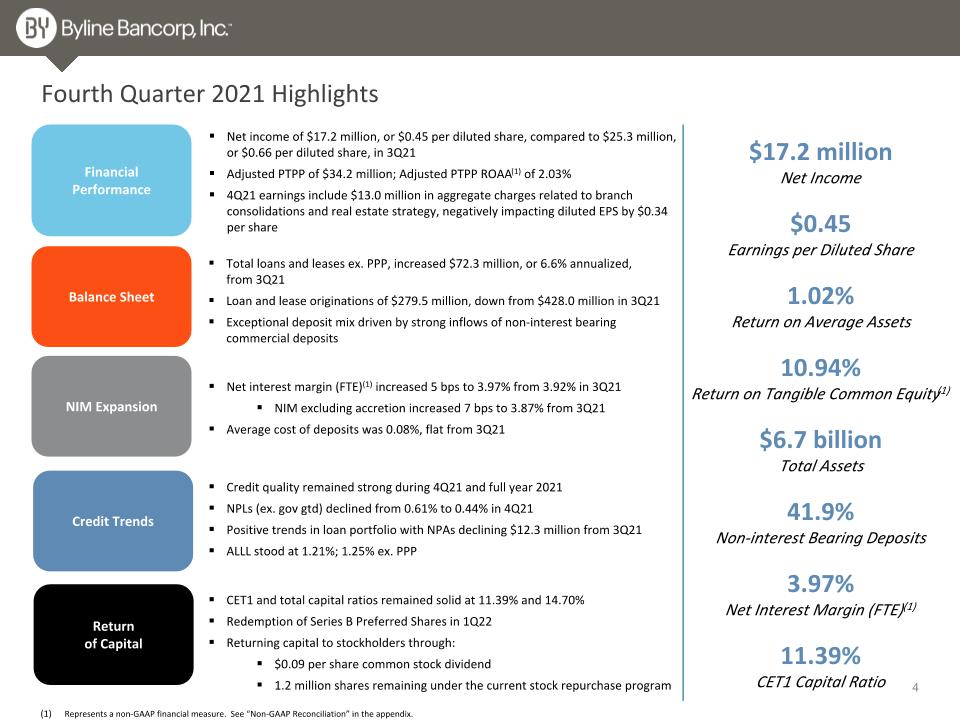

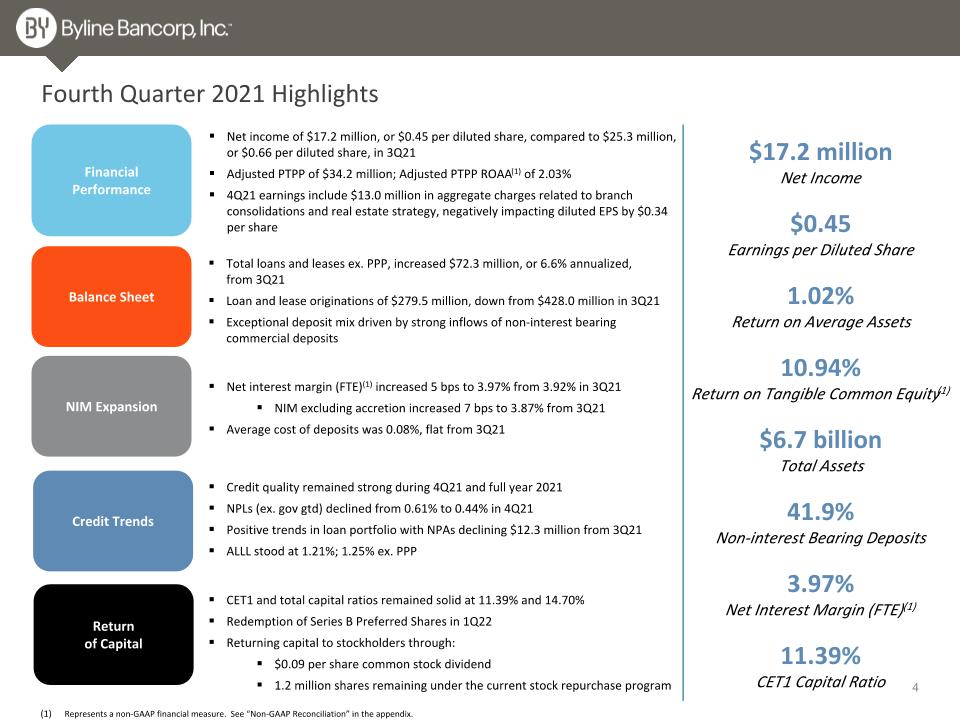

$17.2 million Net Income $0.45 Earnings per Diluted Share 1.02% Return on Average Assets 10.94% Return on Tangible Common Equity(1) $6.7 billion Total Assets 41.9% Non-interest Bearing Deposits 3.97% Net Interest Margin (FTE)(1) 11.39% CET1 Capital Ratio Fourth Quarter 2021 Highlights Balance Sheet Financial Performance Credit Trends Return of Capital Represents a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the appendix. Net income of $17.2 million, or $0.45 per diluted share, compared to $25.3 million, or $0.66 per diluted share, in 3Q21 Adjusted PTPP of $34.2 million; Adjusted PTPP ROAA(1) of 2.03% 4Q21 earnings include $13.0 million in aggregate charges related to branch consolidations and real estate strategy, negatively impacting diluted EPS by $0.34 per share Total loans and leases ex. PPP, increased $72.3 million, or 6.6% annualized, from 3Q21 Loan and lease originations of $279.5 million, down from $428.0 million in 3Q21 Exceptional deposit mix driven by strong inflows of non-interest bearing commercial deposits NIM Expansion Net interest margin (FTE)(1) increased 5 bps to 3.97% from 3.92% in 3Q21 NIM excluding accretion increased 7 bps to 3.87% from 3Q21 Average cost of deposits was 0.08%, flat from 3Q21 Credit quality remained strong during 4Q21 and full year 2021 NPLs (ex. gov gtd) declined from 0.61% to 0.44% in 4Q21 Positive trends in loan portfolio with NPAs declining $12.3 million from 3Q21 ALLL stood at 1.21%; 1.25% ex. PPP CET1 and total capital ratios remained solid at 11.39% and 14.70% Redemption of Series B Preferred Shares in 1Q22 Returning capital to stockholders through: $0.09 per share common stock dividend 1.2 million shares remaining under the current stock repurchase program

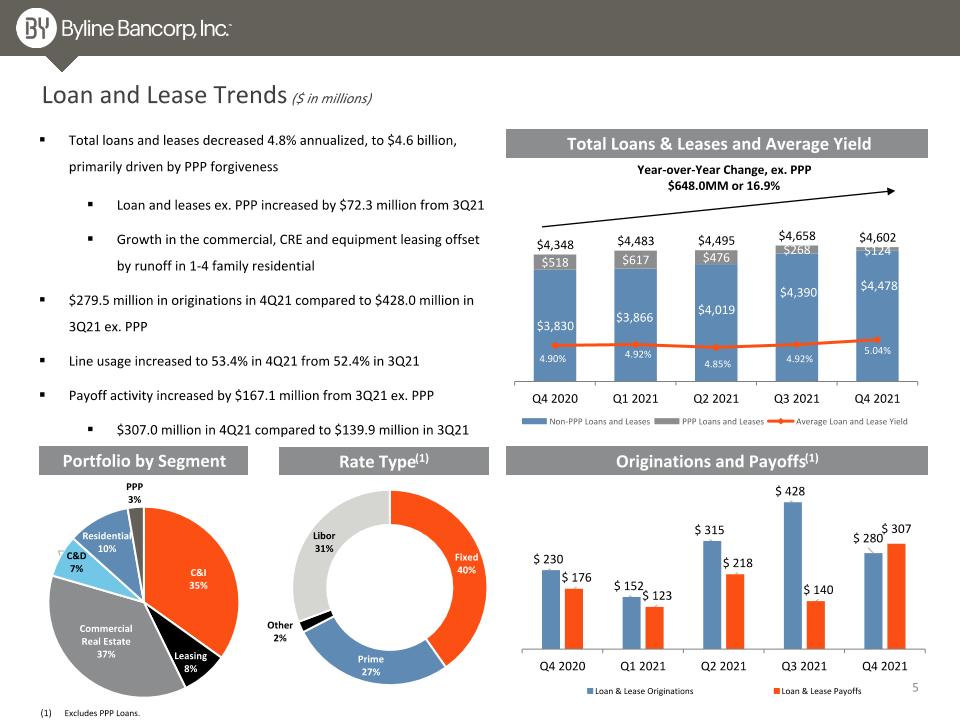

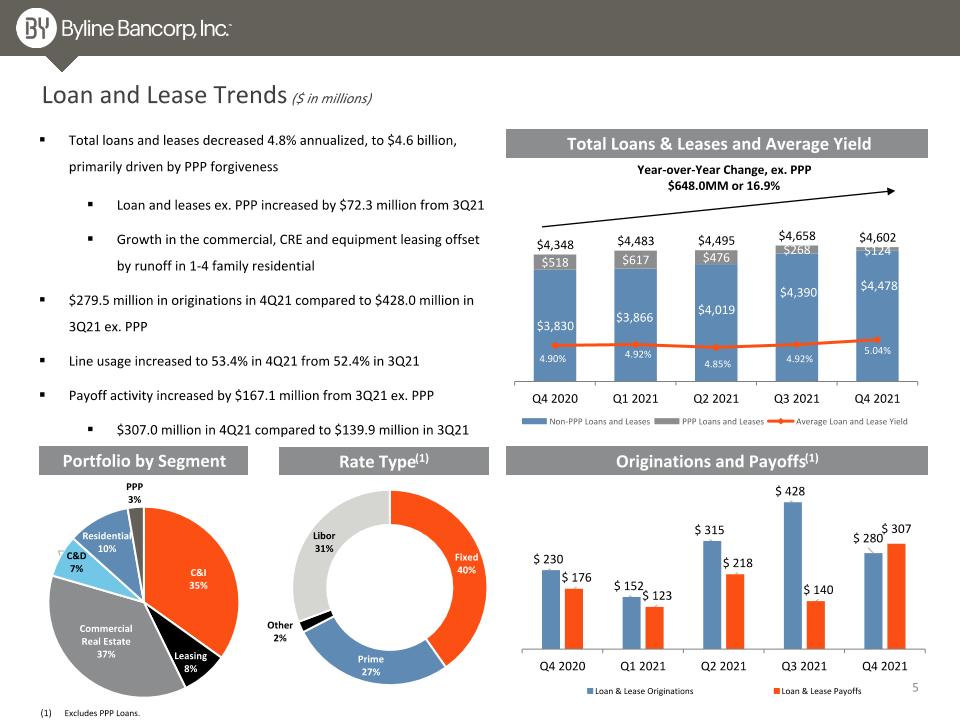

Loan and Lease Trends ($ in millions) Originations and Payoffs(1) Portfolio by Segment Total Loans & Leases and Average Yield Rate Type(1) Year-over-Year Change, ex. PPP $648.0MM or 16.9% Excludes PPP Loans. Total loans and leases decreased 4.8% annualized, to $4.6 billion, primarily driven by PPP forgiveness Loan and leases ex. PPP increased by $72.3 million from 3Q21 Growth in the commercial, CRE and equipment leasing offset by runoff in 1-4 family residential $279.5 million in originations in 4Q21 compared to $428.0 million in 3Q21 ex. PPP Line usage increased to 53.4% in 4Q21 from 52.4% in 3Q21 Payoff activity increased by $167.1 million from 3Q21 ex. PPP $307.0 million in 4Q21 compared to $139.9 million in 3Q21

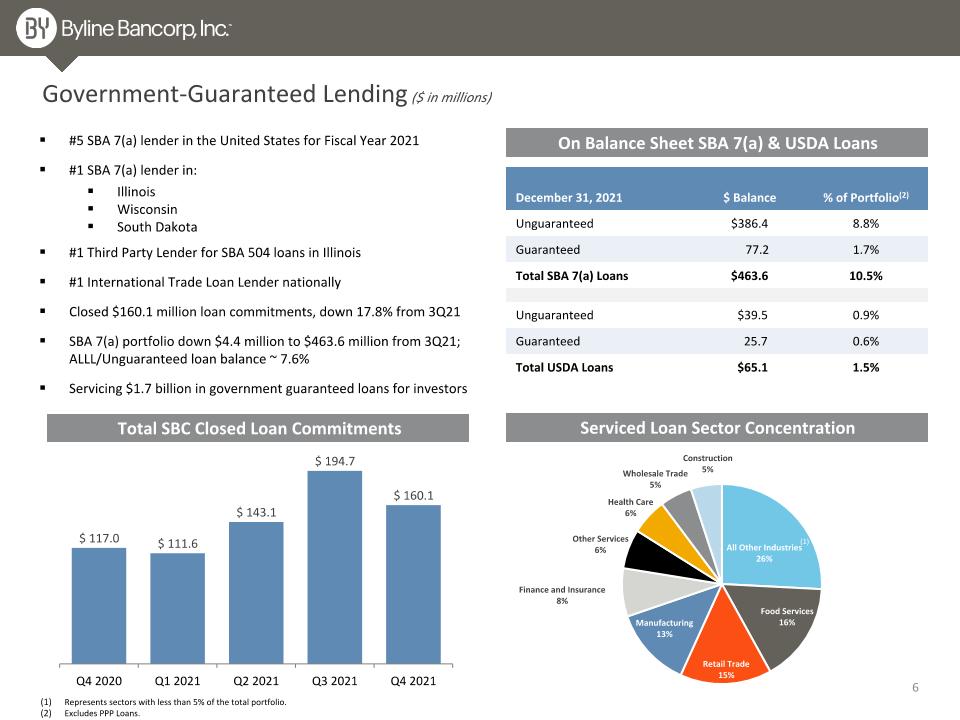

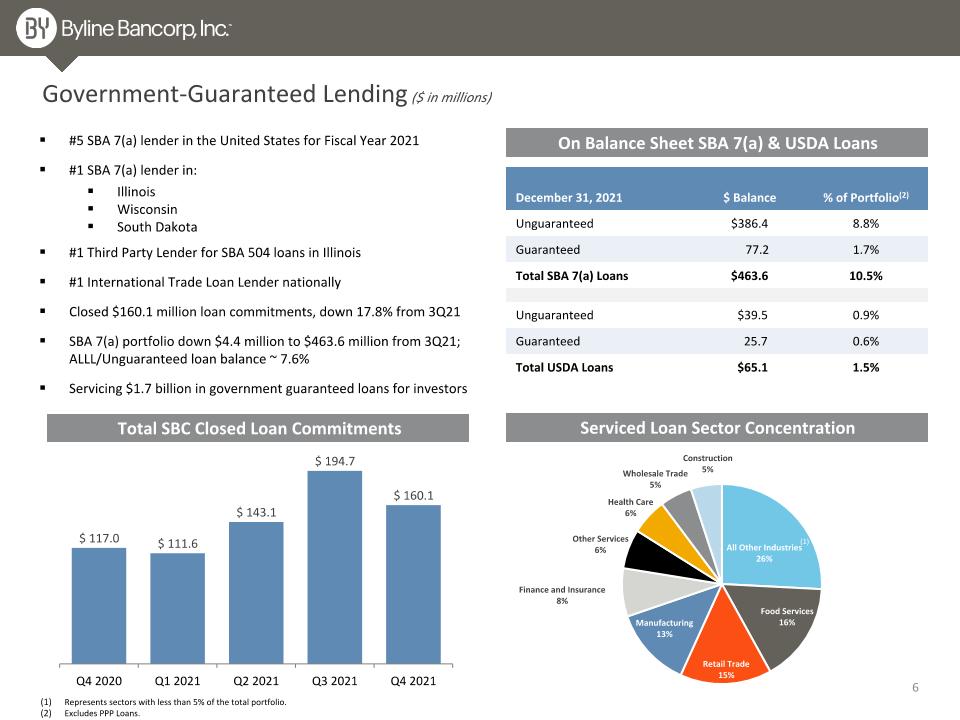

Government-Guaranteed Lending ($ in millions) On Balance Sheet SBA 7(a) & USDA Loans #5 SBA 7(a) lender in the United States for Fiscal Year 2021 #1 SBA 7(a) lender in: Illinois Wisconsin South Dakota #1 Third Party Lender for SBA 504 loans in Illinois #1 International Trade Loan Lender nationally Closed $160.1 million loan commitments, down 17.8% from 3Q21 SBA 7(a) portfolio down $4.4 million to $463.6 million from 3Q21; ALLL/Unguaranteed loan balance ~ 7.6% Servicing $1.7 billion in government guaranteed loans for investors Serviced Loan Sector Concentration Total SBC Closed Loan Commitments December 31, 2021 $ Balance % of Portfolio(2) Unguaranteed $386.4 8.8% Guaranteed 77.2 1.7% Total SBA 7(a) Loans $463.6 10.5% Unguaranteed $39.5 0.9% Guaranteed 25.7 0.6% Total USDA Loans $65.1 1.5% (1) (1) Represents sectors with less than 5% of the total portfolio. Excludes PPP Loans.

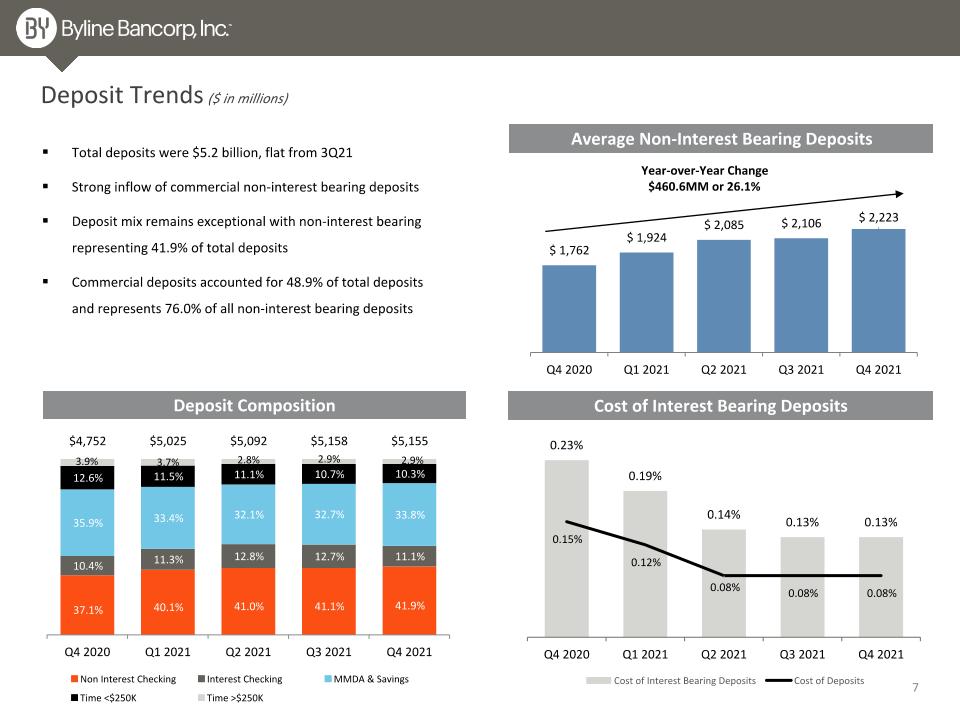

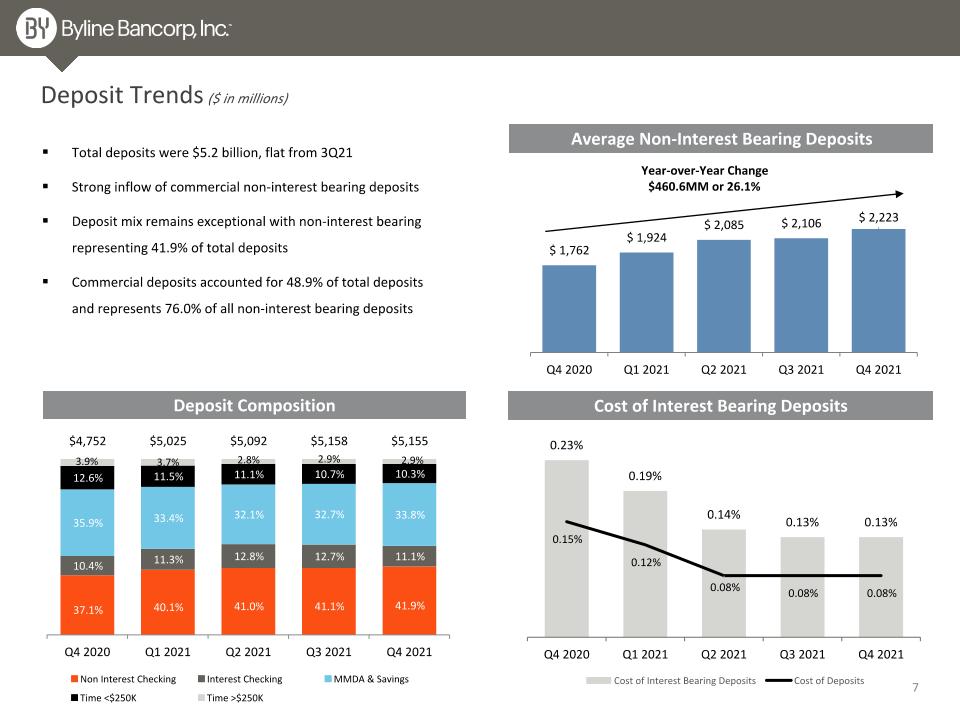

Total deposits were $5.2 billion, flat from 3Q21 Strong inflow of commercial non-interest bearing deposits Deposit mix remains exceptional with non-interest bearing representing 41.9% of total deposits Commercial deposits accounted for 48.9% of total deposits and represents 76.0% of all non-interest bearing deposits Deposit Trends ($ in millions) Average Non-Interest Bearing Deposits Deposit Composition Cost of Interest Bearing Deposits Year-over-Year Change $460.6MM or 26.1%

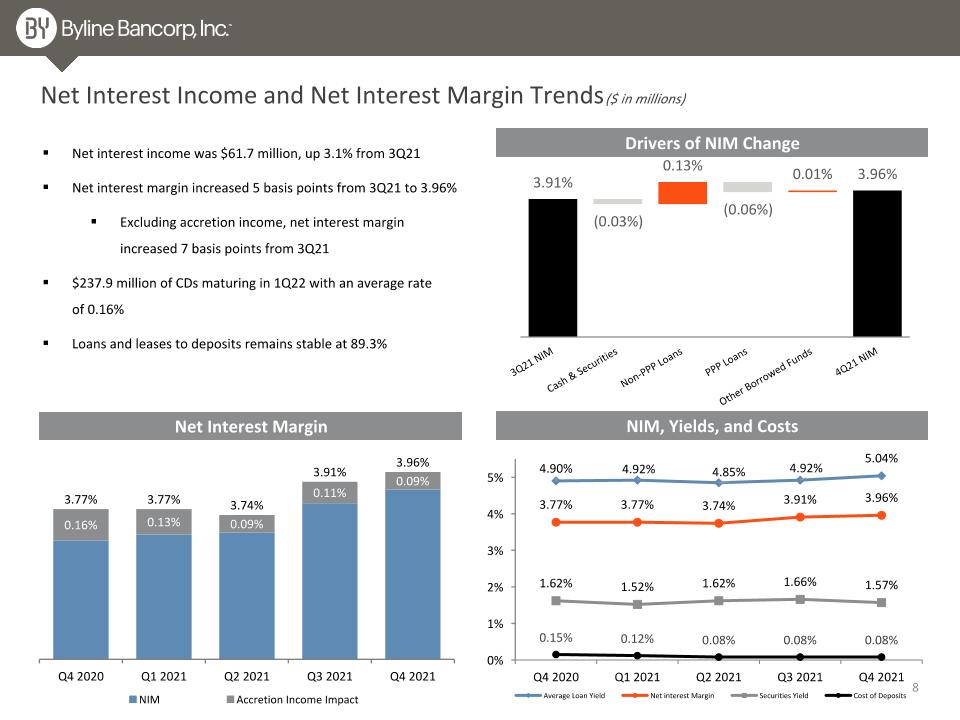

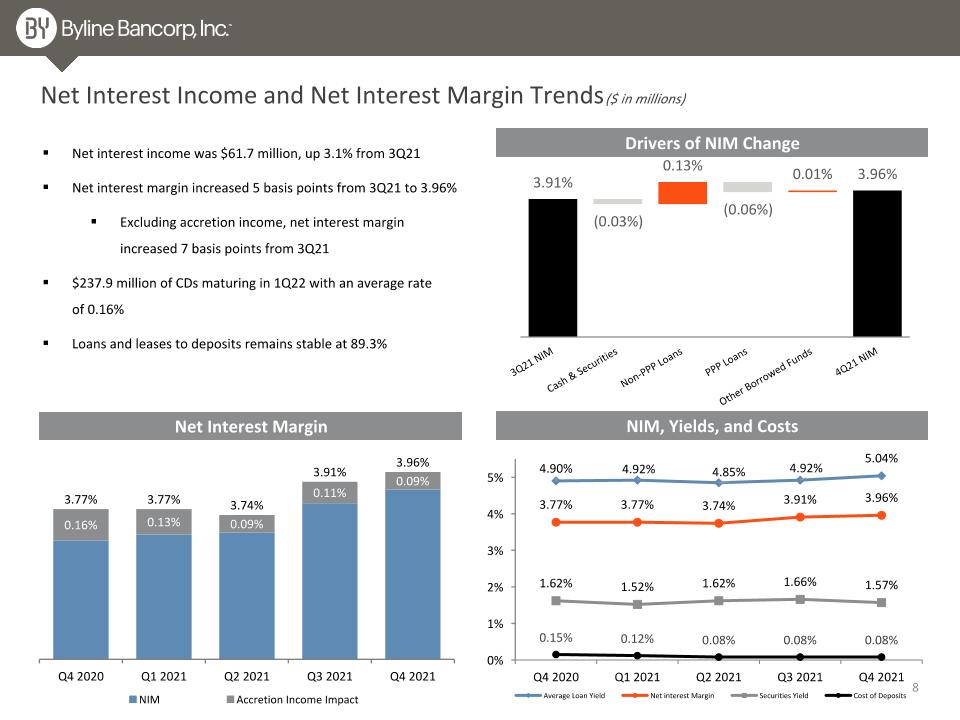

Net Interest Income and Net Interest Margin Trends ($ in millions) Net interest income was $61.7 million, up 3.1% from 3Q21 Net interest margin increased 5 basis points from 3Q21 to 3.96% Excluding accretion income, net interest margin increased 7 basis points from 3Q21 $237.9 million of CDs maturing in 1Q22 with an average rate of 0.16% Loans and leases to deposits remains stable at 89.3% Net Interest Margin Drivers of NIM Change NIM, Yields, and Costs

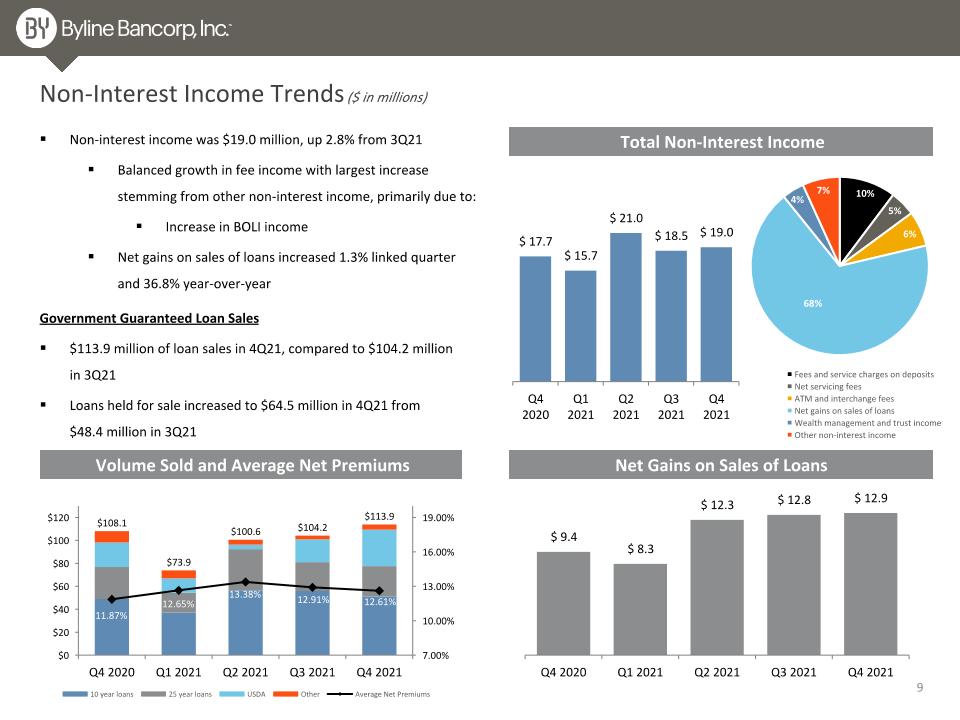

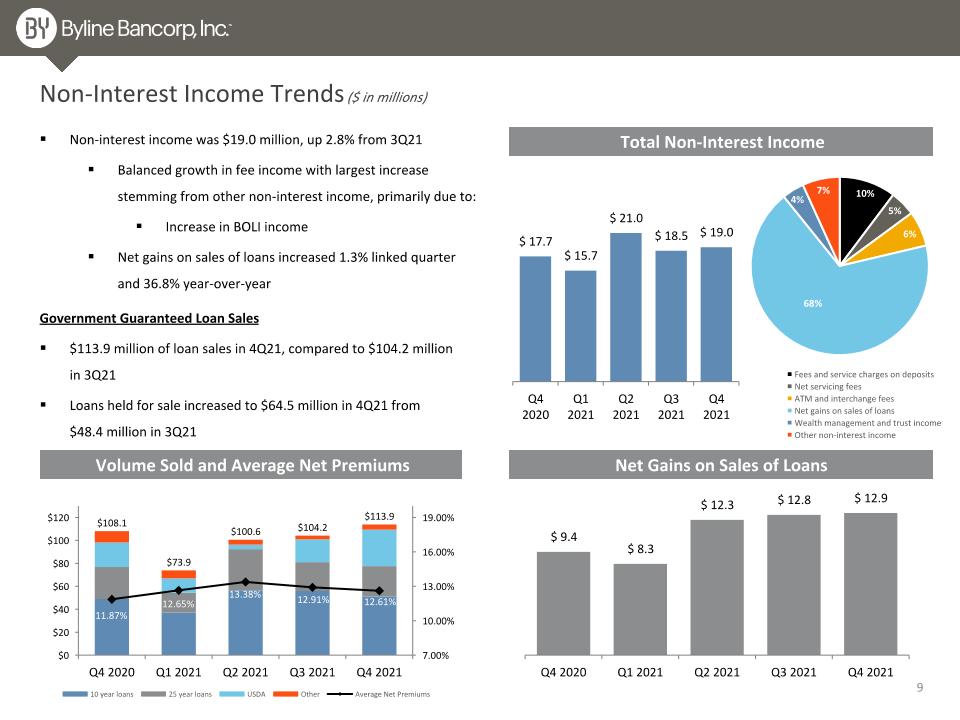

Total Non-Interest Income Non-Interest Income Trends ($ in millions) Non-interest income was $19.0 million, up 2.8% from 3Q21 Balanced growth in fee income with largest increase stemming from other non-interest income, primarily due to: Increase in BOLI income Net gains on sales of loans increased 1.3% linked quarter and 36.8% year-over-year Volume Sold and Average Net Premiums Net Gains on Sales of Loans Government Guaranteed Loan Sales $113.9 million of loan sales in 4Q21, compared to $104.2 million in 3Q21 Loans held for sale increased to $64.5 million in 4Q21 from $48.4 million in 3Q21

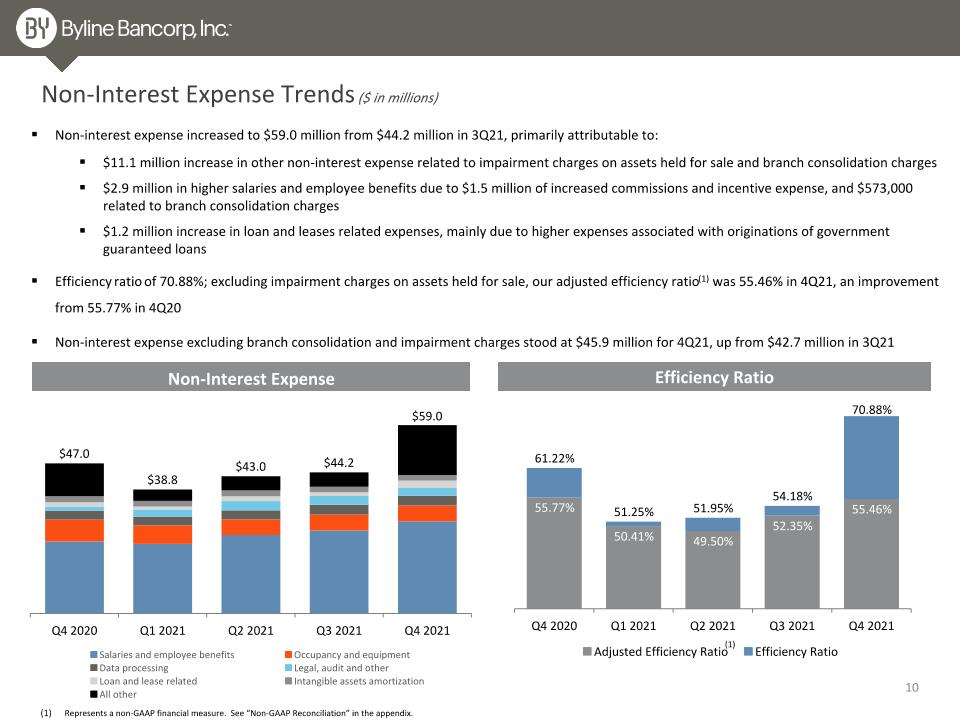

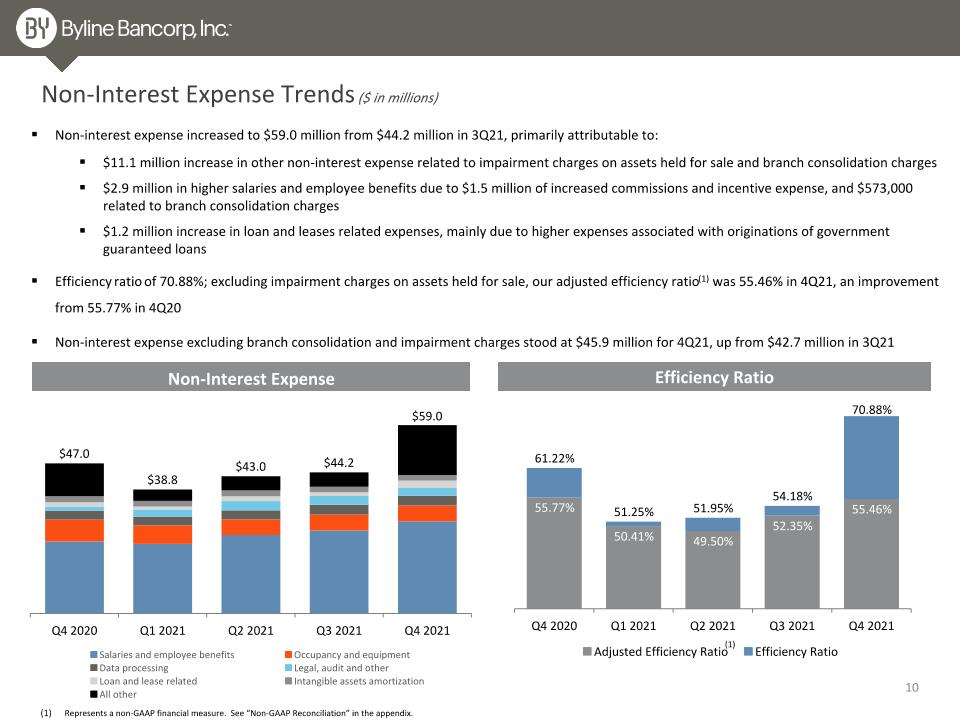

Non-Interest Expense Trends ($ in millions) Non-interest expense increased to $59.0 million from $44.2 million in 3Q21, primarily attributable to: $11.1 million increase in other non-interest expense related to impairment charges on assets held for sale and branch consolidation charges $2.9 million in higher salaries and employee benefits due to $1.5 million of increased commissions and incentive expense, and $573,000 related to branch consolidation charges $1.2 million increase in loan and leases related expenses, mainly due to higher expenses associated with originations of government guaranteed loans Efficiency ratio of 70.88%; excluding impairment charges on assets held for sale, our adjusted efficiency ratio(1) was 55.46% in 4Q21, an improvement from 55.77% in 4Q20 Non-interest expense excluding branch consolidation and impairment charges stood at $45.9 million for 4Q21, up from $42.7 million in 3Q21 Efficiency Ratio Non-Interest Expense (1) Represents a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the appendix.

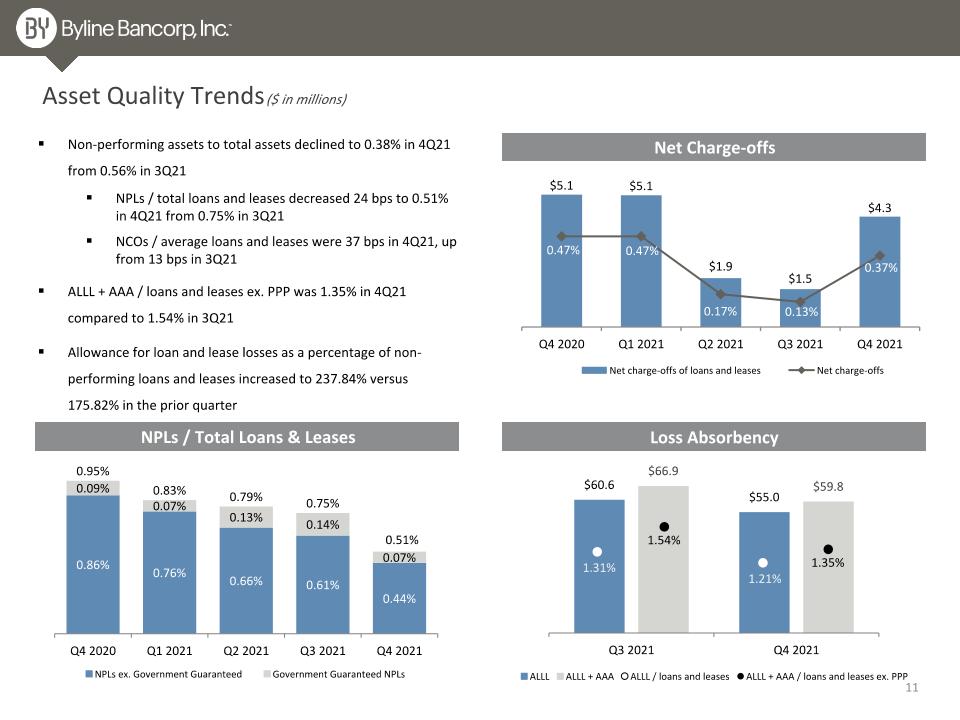

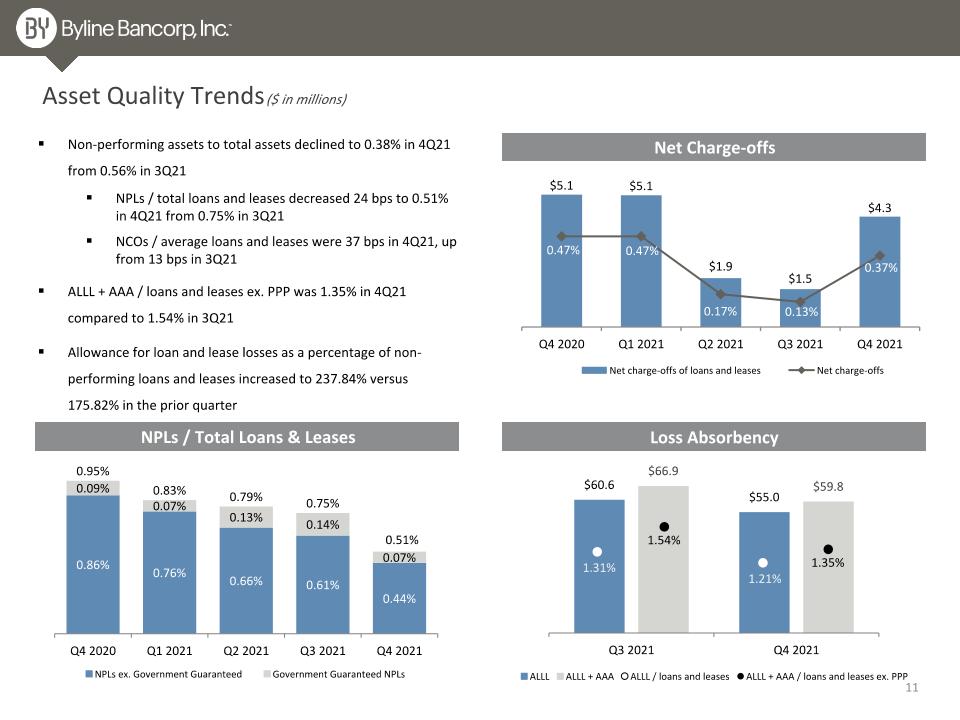

Asset Quality Trends ($ in millions) NPLs / Total Loans & Leases Loss Absorbency 1.31% 1.54% Net Charge-offs Non-performing assets to total assets declined to 0.38% in 4Q21 from 0.56% in 3Q21 NPLs / total loans and leases decreased 24 bps to 0.51% in 4Q21 from 0.75% in 3Q21 NCOs / average loans and leases were 37 bps in 4Q21, up from 13 bps in 3Q21 ALLL + AAA / loans and leases ex. PPP was 1.35% in 4Q21 compared to 1.54% in 3Q21 Allowance for loan and lease losses as a percentage of non-performing loans and leases increased to 237.84% versus 175.82% in the prior quarter 1.21% 1.35%

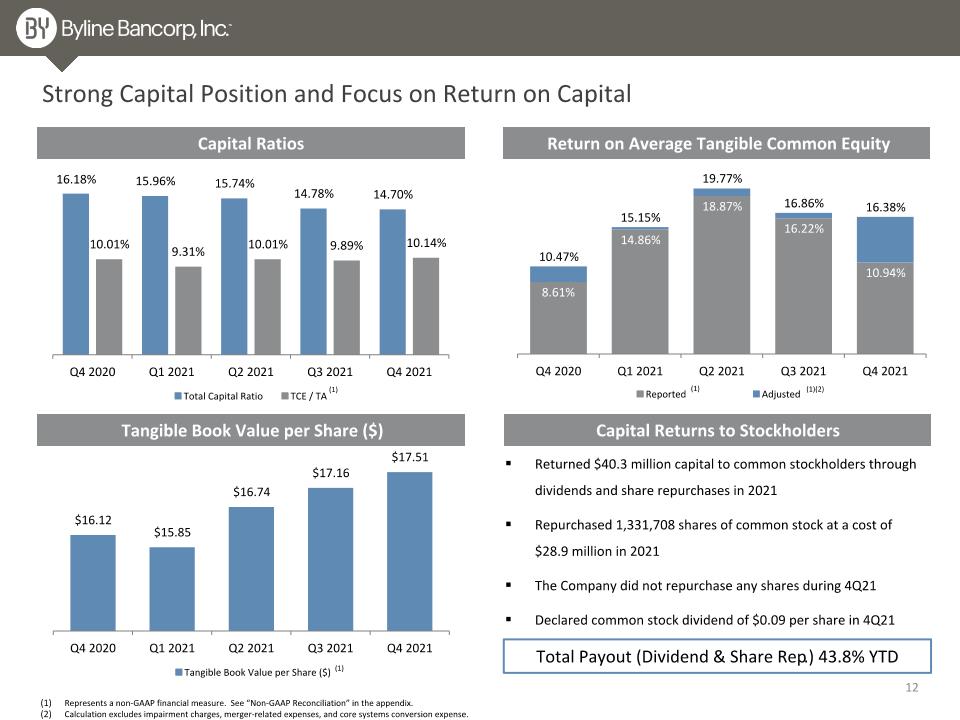

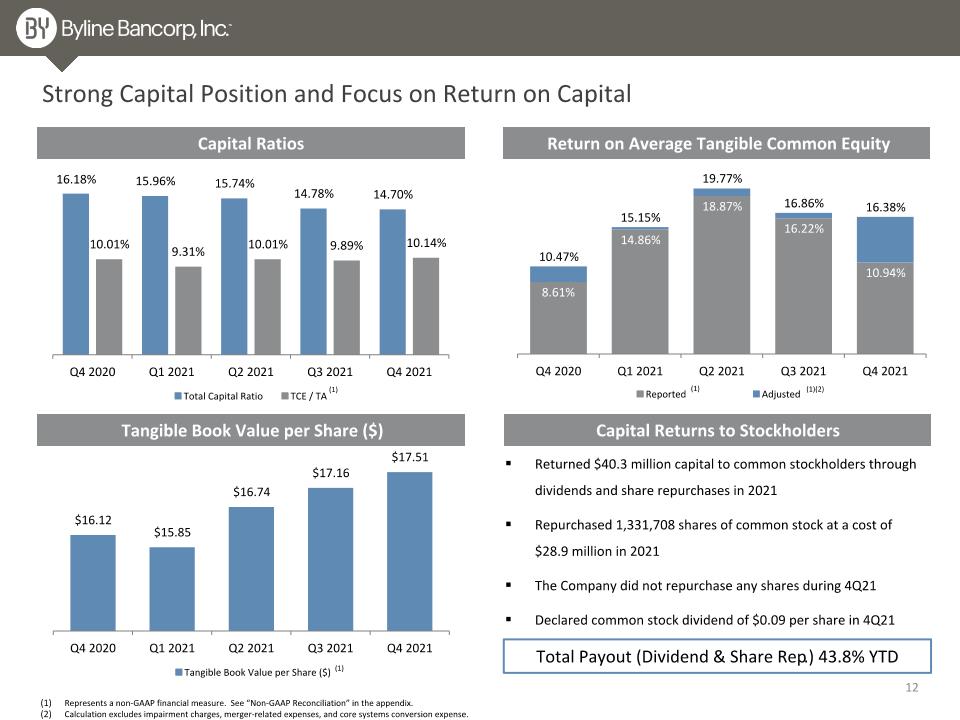

Project Sox Offer Migration Strong Capital Position and Focus on Return on Capital Capital Ratios Return on Average Tangible Common Equity (1) Tangible Book Value per Share ($) (1) (1) Returned $40.3 million capital to common stockholders through dividends and share repurchases in 2021 Repurchased 1,331,708 shares of common stock at a cost of $28.9 million in 2021 The Company did not repurchase any shares during 4Q21 Declared common stock dividend of $0.09 per share in 4Q21 Total Payout (Dividend & Share Rep.) 43.8% YTD (1)(2) Represents a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the appendix. Calculation excludes impairment charges, merger-related expenses, and core systems conversion expense. Capital Returns to Stockholders

2022 Strategic Priorities and Outlook Drive organic commercial loan and deposit growth Continue Investing in Technology to Improve Efficiencies and Enhance Revenue Generation Strategic M&A Opportunities and Team Lift-Outs with Attractive Metrics and Return Profile Increase Return of Capital to Stockholders Continue to Identify Opportunities to Improve Operating Leverage

Appendix

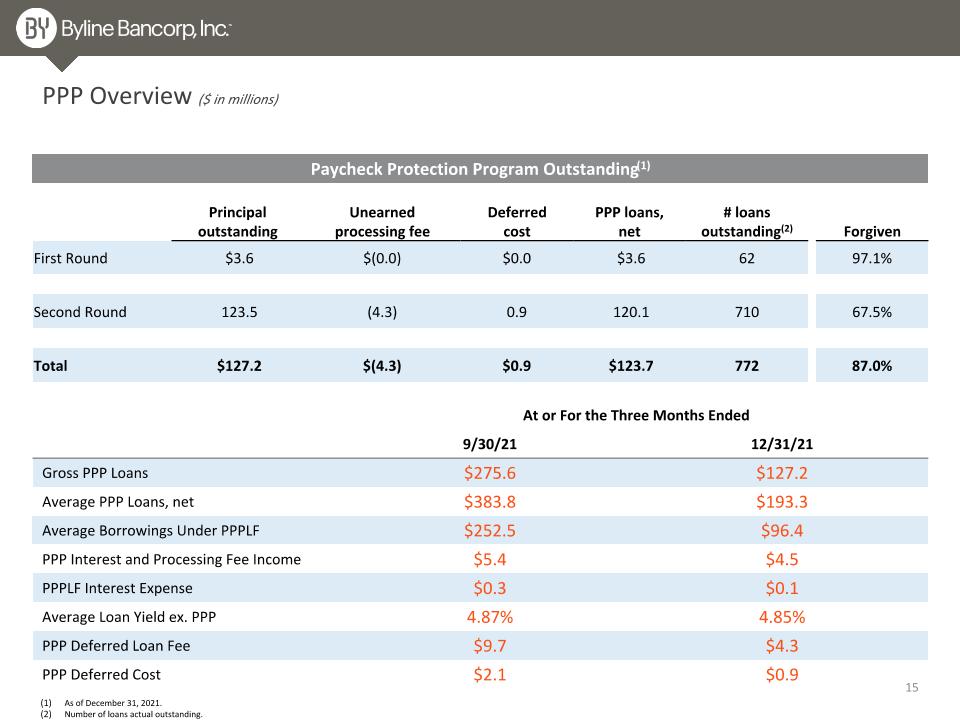

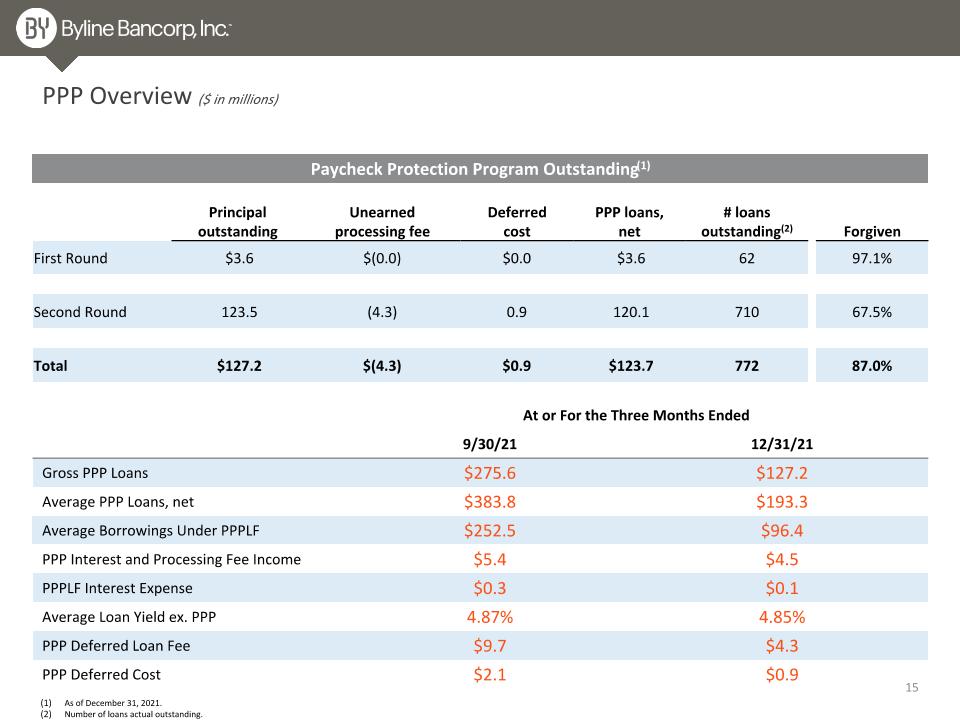

At or For the Three Months Ended 9/30/21 12/31/21 Gross PPP Loans $275.6 $127.2 Average PPP Loans, net $383.8 $193.3 Average Borrowings Under PPPLF $252.5 $96.4 PPP Interest and Processing Fee Income $5.4 $4.5 PPPLF Interest Expense $0.3 $0.1 Average Loan Yield ex. PPP 4.87% 4.85% PPP Deferred Loan Fee $9.7 $4.3 PPP Deferred Cost $2.1 $0.9 Project Sox Offer Migration Paycheck Protection Program Outstanding(1) Principal outstanding Unearned processing fee Deferred cost PPP loans, net # loans outstanding(2) Forgiven First Round $3.6 $(0.0) $0.0 $3.6 62 97.1% Second Round 123.5 (4.3) 0.9 120.1 710 67.5% Total $127.2 $(4.3) $0.9 $123.7 772 87.0% As of December 31, 2021. Number of loans actual outstanding. PPP Overview ($ in millions)

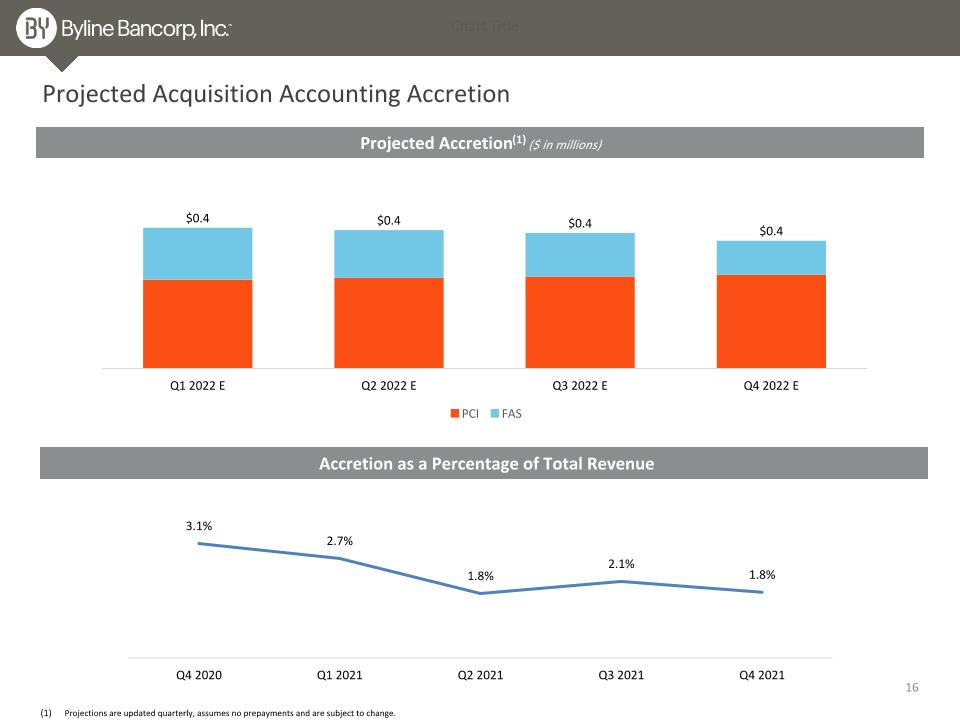

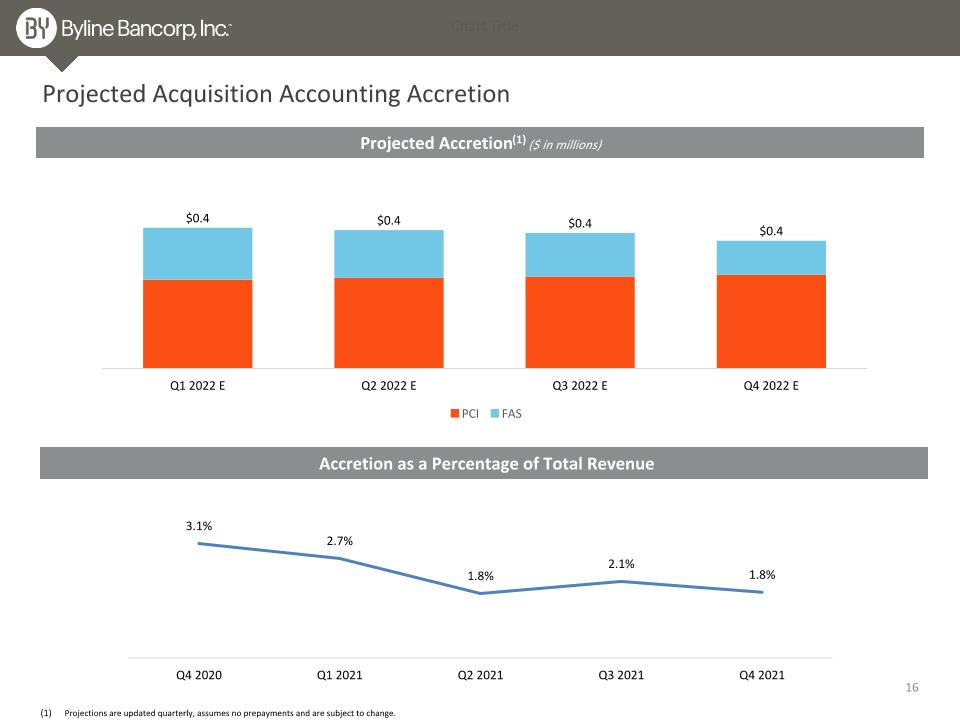

Projected Acquisition Accounting Accretion Projected Accretion(1) ($ in millions) Accretion as a Percentage of Total Revenue Projections are updated quarterly, assumes no prepayments and are subject to change.

As of or For the Three Months Ended (dollars in thousands, except per share data) December 31, September 30, June 30, March 31, December 31, 2021 2021 2021 2021 2020 Income Statement Net interest income $ 61,728 $ 59,845 $ 58,174 $ 56,640 $ 56,020 Provision for loan and lease losses (1,293) 352 (1,969) 4,367 10,236 Non-interest income 19,014 18,495 21,002 15,742 17,690 Non-interest expense 58,968 44,180 42,981 38,842 47,021 Income before provision for income taxes 23,067 33,808 38,164 29,173 16,453 Provision for income taxes 5,878 8,502 9,672 7,375 4,162 Net income 17,189 25,306 28,492 21,798 12,291 Dividends on preferred shares 196 196 195 196 196 Net income available to common stockholders $ 16,993 $ 25,110 $ 28,297 $ 21,602 $ 12,095 Diluted earnings per common share(1) $ 0.45 $ 0.66 $ 0.73 $ 0.56 $ 0.31 Balance Sheet Total loans and leases $ 4,537,128 $ 4,609,228 $ 4,469,457 $ 4,454,620 $ 4,340,535 Total deposits 5,155,047 5,158,278 5,092,195 5,024,540 4,752,031 Tangible common equity(1) 660,386 646,684 637,601 612,475 622,395 Balance Sheet Metrics Loans and leases / total deposits 89.26% 90.29% 88.26% 89.23% 91.51% Tangible common equity / tangible assets(1) 10.11% 9.89% 10.01% 9.31% 10.01% Key Performance Ratios Net interest margin 3.96% 3.91% 3.74% 3.77% 3.78% Efficiency ratio 70.88% 54.18% 51.95% 51.25% 61.22% Adjusted efficiency ratio(1) 55.46% 52.35% 49.50% 50.41% 55.77% Non-interest expense to average assets 3.49% 2.67% 2.57% 2.39% 2.92% Non-interest income to total revenues 23.55% 23.61% 26.53% 21.75% 24.00% Return on average assets 1.02% 1.53% 1.70% 1.34% 0.76% Adjusted return on average assets(1) 1.56% 1.59% 1.78% 1.37% 0.94% Pre-tax pre-provision return on � average assets (1) 1.29% 2.07% 2.16% 2.06% 1.66% Dividend payout ratio on common stock 20.00% 13.64% 8.22% 10.71% 9.68% Tangible book value per common share(1) $ 17.51 $ 17.16 $ 16.74 $ 15.85 $ 16.12 Five Quarter Financial Summary Represents a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the appendix.

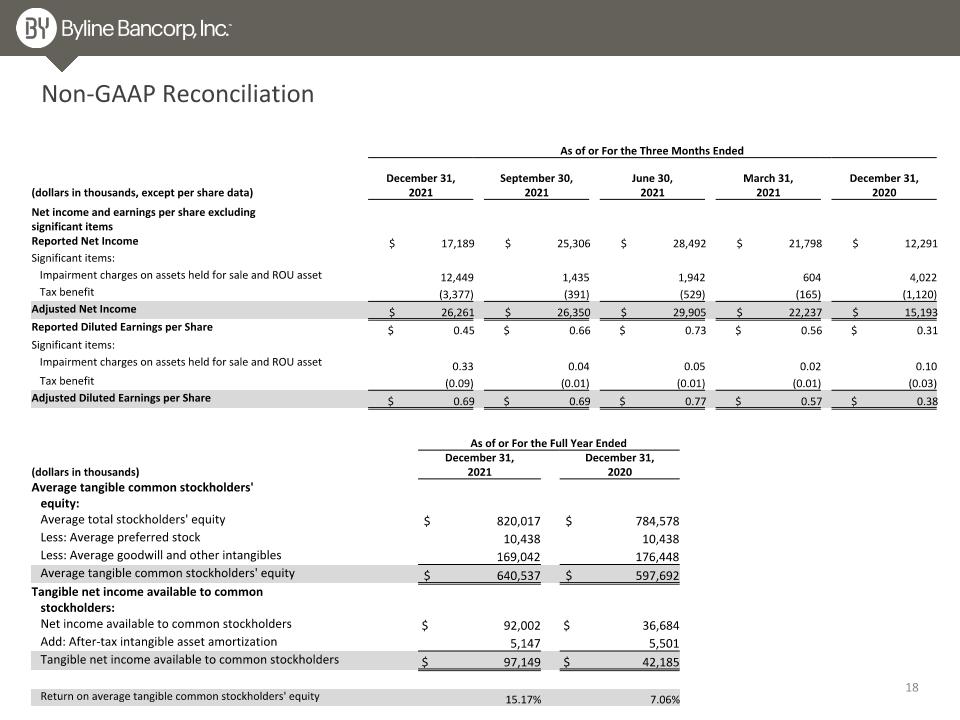

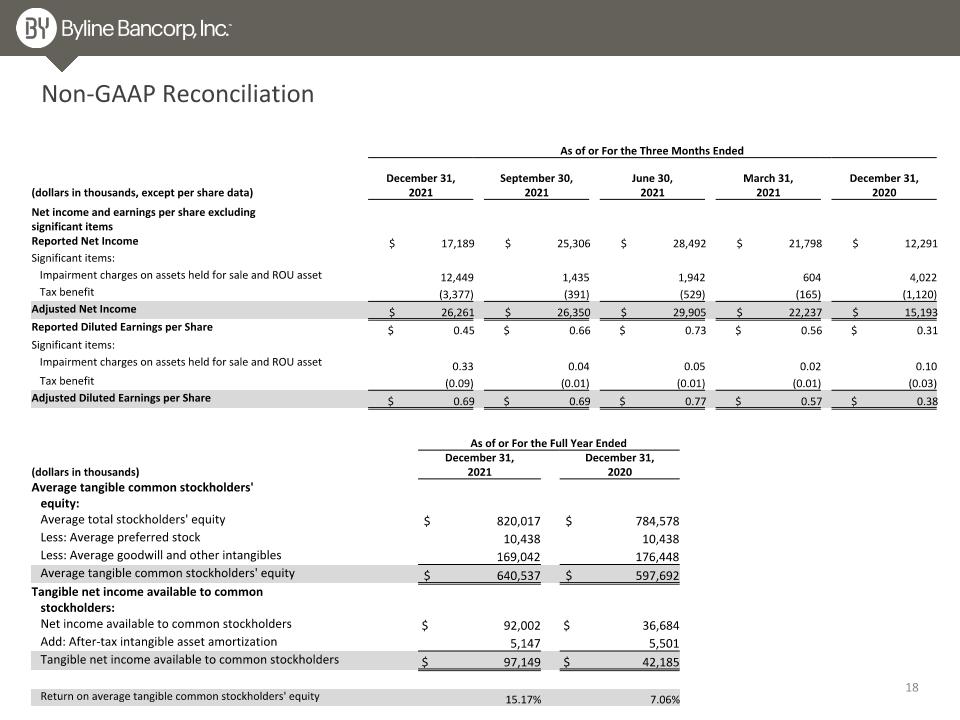

Non-GAAP Reconciliation As of or For the Three Months Ended (dollars in thousands, except per share data) December 31, �2021 September 30, �2021 June 30, �2021 March 31, �2021 December 31, �2020 Net income and earnings per share excluding significant items Reported Net Income $ 17,189 $ 25,306 $ 28,492 $ 21,798 $ 12,291 Significant items: Impairment charges on assets held for sale and ROU asset 12,449 1,435 1,942 604 4,022 Tax benefit (3,377) (391) (529) (165) (1,120) Adjusted Net Income $ 26,261 $ 26,350 $ 29,905 $ 22,237 $ 15,193 Reported Diluted Earnings per Share $ 0.45 $ 0.66 $ 0.73 $ 0.56 $ 0.31 Significant items: Impairment charges on assets held for sale and ROU asset 0.33 0.04 0.05 0.02 0.10 Tax benefit (0.09) (0.01) (0.01) (0.01) (0.03) Adjusted Diluted Earnings per Share $ 0.69 $ 0.69 $ 0.77 $ 0.57 $ 0.38 As of or For the Full Year Ended (dollars in thousands) December 31, �2021 December 31, �2020 Average tangible common stockholders' � equity: Average total stockholders' equity $ 820,017 $ 784,578 Less: Average preferred stock 10,438 10,438 Less: Average goodwill and other intangibles 169,042 176,448 Average tangible common stockholders' equity $ 640,537 $ 597,692 Tangible net income available to common � stockholders: Net income available to common stockholders $ 92,002 $ 36,684 Add: After-tax intangible asset amortization 5,147 5,501 Tangible net income available to common stockholders $ 97,149 $ 42,185 Return on average tangible common stockholders' equity 15.17% 7.06%

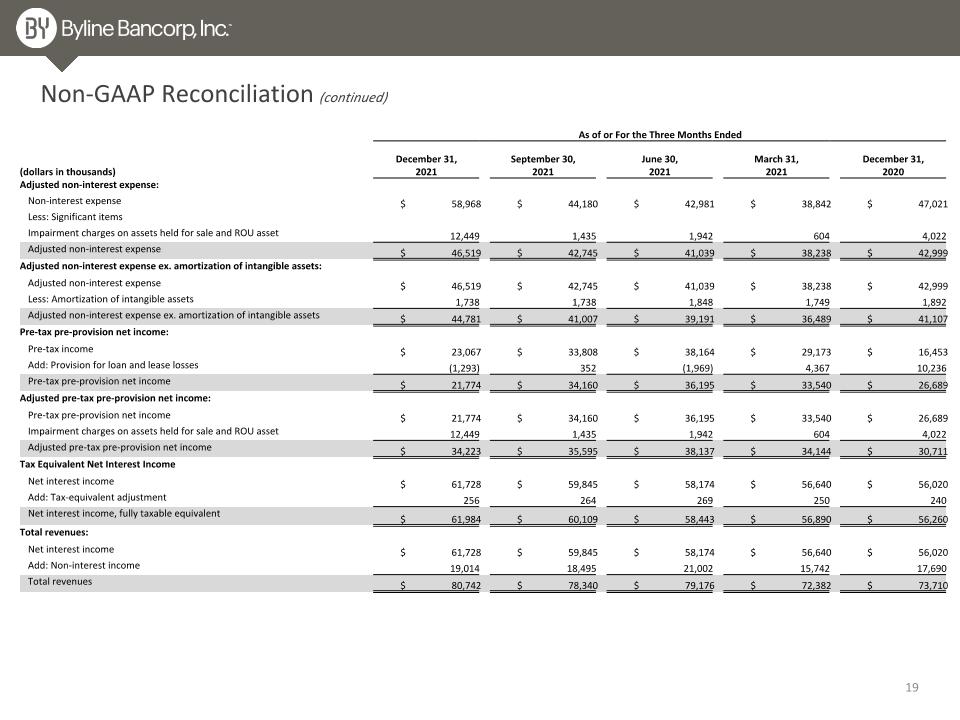

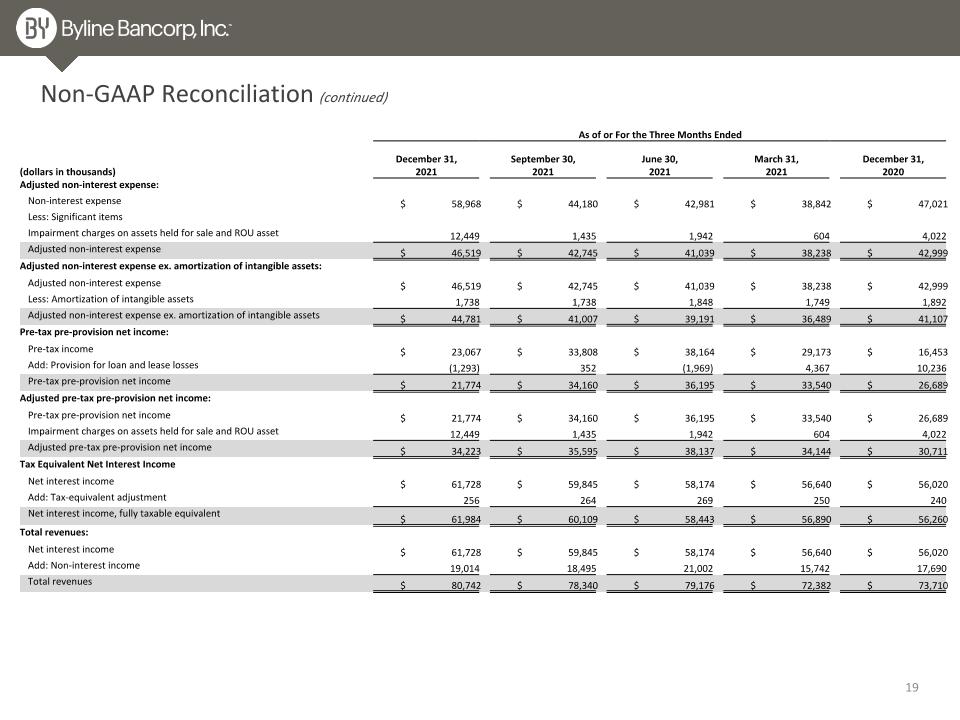

As of or For the Three Months Ended (dollars in thousands) December 31, �2021 September 30, �2021 June 30, �2021 March 31, �2021 December 31, �2020 Adjusted non-interest expense: Non-interest expense $ 58,968 $ 44,180 $ 42,981 $ 38,842 $ 47,021 Less: Significant items Impairment charges on assets held for sale and ROU asset 12,449 1,435 1,942 604 4,022 Adjusted non-interest expense $ 46,519 $ 42,745 $ 41,039 $ 38,238 $ 42,999 Adjusted non-interest expense ex. amortization of intangible assets: Adjusted non-interest expense $ 46,519 $ 42,745 $ 41,039 $ 38,238 $ 42,999 Less: Amortization of intangible assets 1,738 1,738 1,848 1,749 1,892 Adjusted non-interest expense ex. amortization of intangible assets $ 44,781 $ 41,007 $ 39,191 $ 36,489 $ 41,107 Pre-tax pre-provision net income: Pre-tax income $ 23,067 $ 33,808 $ 38,164 $ 29,173 $ 16,453 Add: Provision for loan and lease losses (1,293) 352 (1,969) 4,367 10,236 Pre-tax pre-provision net income $ 21,774 $ 34,160 $ 36,195 $ 33,540 $ 26,689 Adjusted pre-tax pre-provision net income: Pre-tax pre-provision net income $ 21,774 $ 34,160 $ 36,195 $ 33,540 $ 26,689 Impairment charges on assets held for sale and ROU asset 12,449 1,435 1,942 604 4,022 Adjusted pre-tax pre-provision net income $ 34,223 $ 35,595 $ 38,137 $ 34,144 $ 30,711 Tax Equivalent Net Interest Income Net interest income $ 61,728 $ 59,845 $ 58,174 $ 56,640 $ 56,020 Add: Tax-equivalent adjustment 256 264 269 250 240 Net interest income, fully taxable equivalent $ 61,984 $ 60,109 $ 58,443 $ 56,890 $ 56,260 Total revenues: Net interest income $ 61,728 $ 59,845 $ 58,174 $ 56,640 $ 56,020 Add: Non-interest income 19,014 18,495 21,002 15,742 17,690 Total revenues $ 80,742 $ 78,340 $ 79,176 $ 72,382 $ 73,710 Non-GAAP Reconciliation (continued)

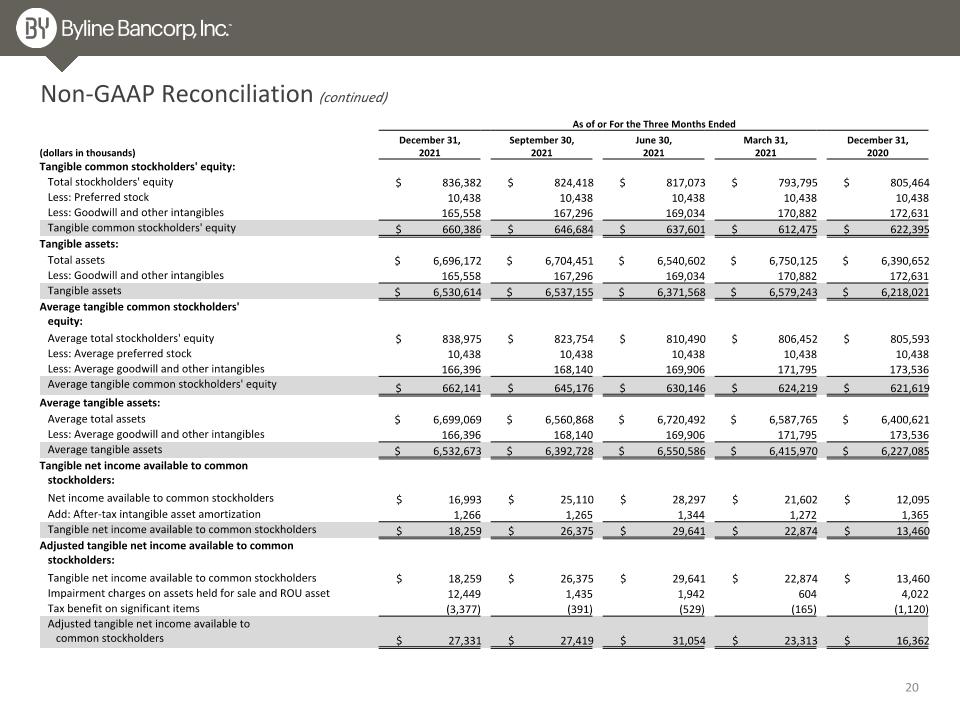

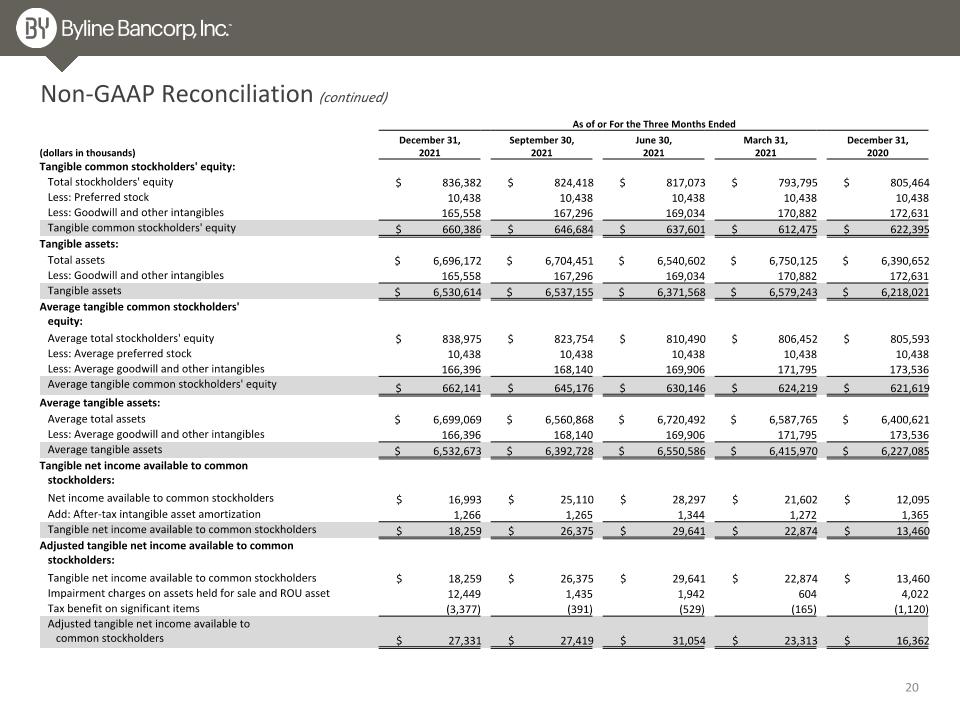

As of or For the Three Months Ended (dollars in thousands) December 31, �2021 September 30, �2021 June 30, �2021 March 31, �2021 December 31, �2020 Tangible common stockholders' equity: Total stockholders' equity $ 836,382 $ 824,418 $ 817,073 $ 793,795 $ 805,464 Less: Preferred stock 10,438 10,438 10,438 10,438 10,438 Less: Goodwill and other intangibles 165,558 167,296 169,034 170,882 172,631 Tangible common stockholders' equity $ 660,386 $ 646,684 $ 637,601 $ 612,475 $ 622,395 Tangible assets: Total assets $ 6,696,172 $ 6,704,451 $ 6,540,602 $ 6,750,125 $ 6,390,652 Less: Goodwill and other intangibles 165,558 167,296 169,034 170,882 172,631 Tangible assets $ 6,530,614 $ 6,537,155 $ 6,371,568 $ 6,579,243 $ 6,218,021 Average tangible common stockholders' � equity: Average total stockholders' equity $ 838,975 $ 823,754 $ 810,490 $ 806,452 $ 805,593 Less: Average preferred stock 10,438 10,438 10,438 10,438 10,438 Less: Average goodwill and other intangibles 166,396 168,140 169,906 171,795 173,536 Average tangible common stockholders' equity $ 662,141 $ 645,176 $ 630,146 $ 624,219 $ 621,619 Average tangible assets: Average total assets $ 6,699,069 $ 6,560,868 $ 6,720,492 $ 6,587,765 $ 6,400,621 Less: Average goodwill and other intangibles 166,396 168,140 169,906 171,795 173,536 Average tangible assets $ 6,532,673 $ 6,392,728 $ 6,550,586 $ 6,415,970 $ 6,227,085 Tangible net income available to common � stockholders: Net income available to common stockholders $ 16,993 $ 25,110 $ 28,297 $ 21,602 $ 12,095 Add: After-tax intangible asset amortization 1,266 1,265 1,344 1,272 1,365 Tangible net income available to common stockholders $ 18,259 $ 26,375 $ 29,641 $ 22,874 $ 13,460 Adjusted tangible net income available to common stockholders: Tangible net income available to common stockholders $ 18,259 $ 26,375 $ 29,641 $ 22,874 $ 13,460 Impairment charges on assets held for sale and ROU asset 12,449 1,435 1,942 604 4,022 Tax benefit on significant items (3,377) (391) (529) (165) (1,120) Adjusted tangible net income available to � common stockholders $ 27,331 $ 27,419 $ 31,054 $ 23,313 $ 16,362 Non-GAAP Reconciliation (continued)

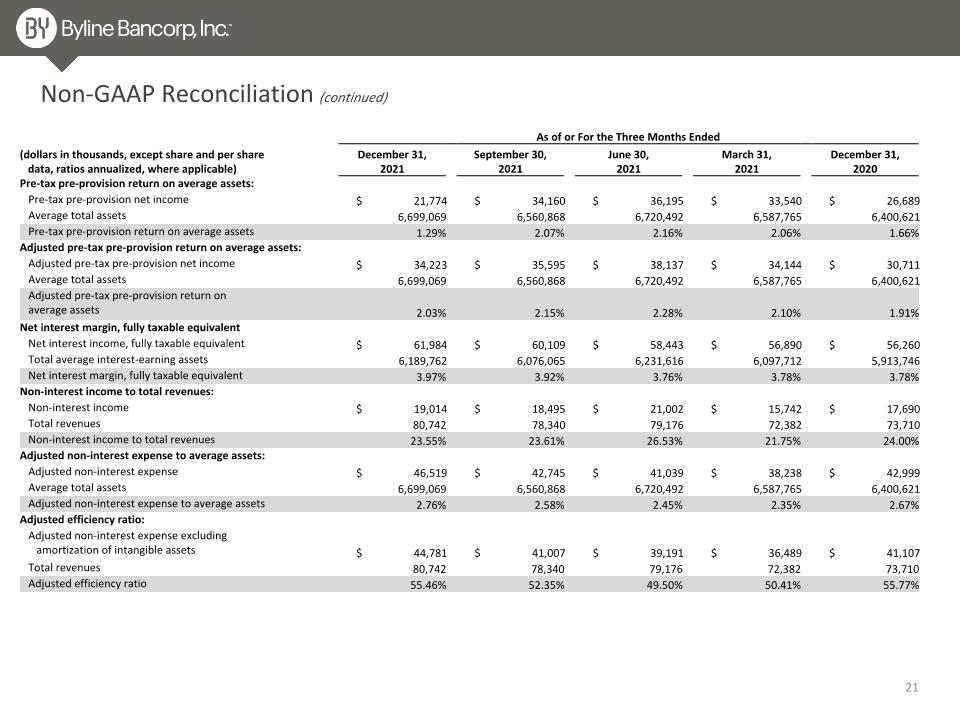

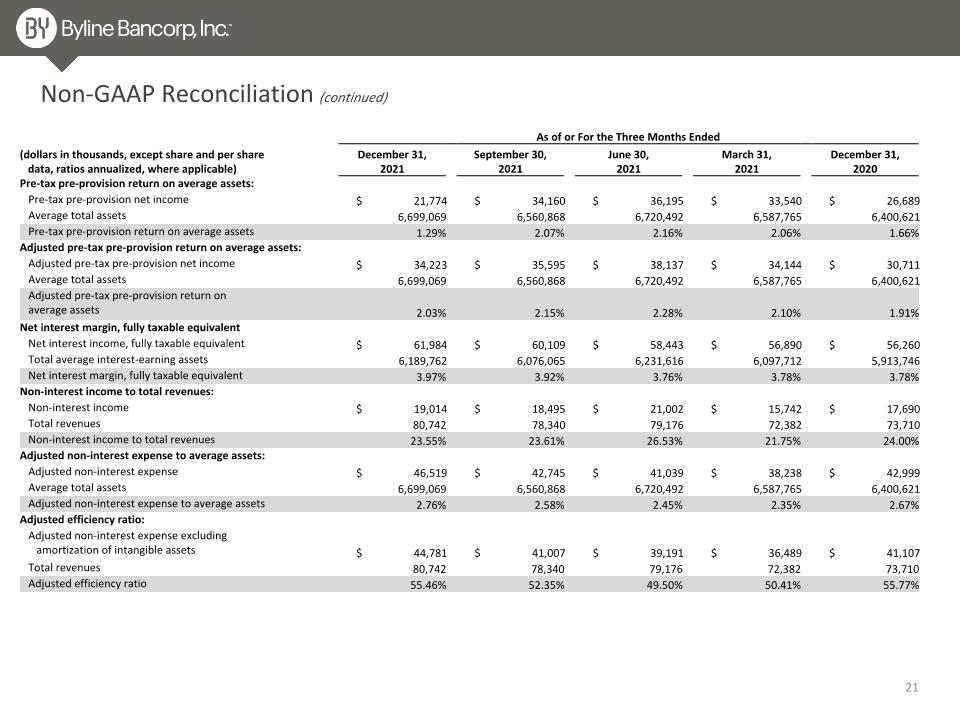

As of or For the Three Months Ended (dollars in thousands, except share and per share � data, ratios annualized, where applicable) December 31, �2021 September 30, �2021 June 30, �2021 March 31, �2021 December 31, �2020 Pre-tax pre-provision return on average assets: Pre-tax pre-provision net income $ 21,774 $ 34,160 $ 36,195 $ 33,540 $ 26,689 Average total assets 6,699,069 6,560,868 6,720,492 6,587,765 6,400,621 Pre-tax pre-provision return on average assets 1.29% 2.07% 2.16% 2.06% 1.66% Adjusted pre-tax pre-provision return on average assets: Adjusted pre-tax pre-provision net income $ 34,223 $ 35,595 $ 38,137 $ 34,144 $ 30,711 Average total assets 6,699,069 6,560,868 6,720,492 6,587,765 6,400,621 Adjusted pre-tax pre-provision return on average assets 2.03% 2.15% 2.28% 2.10% 1.91% Net interest margin, fully taxable equivalent Net interest income, fully taxable equivalent $ 61,984 $ 60,109 $ 58,443 $ 56,890 $ 56,260 Total average interest-earning assets 6,189,762 6,076,065 6,231,616 6,097,712 5,913,746 Net interest margin, fully taxable equivalent 3.97% 3.92% 3.76% 3.78% 3.78% Non-interest income to total revenues: Non-interest income $ 19,014 $ 18,495 $ 21,002 $ 15,742 $ 17,690 Total revenues 80,742 78,340 79,176 72,382 73,710 Non-interest income to total revenues 23.55% 23.61% 26.53% 21.75% 24.00% Adjusted non-interest expense to average assets: Adjusted non-interest expense $ 46,519 $ 42,745 $ 41,039 $ 38,238 $ 42,999 Average total assets 6,699,069 6,560,868 6,720,492 6,587,765 6,400,621 Adjusted non-interest expense to average assets 2.76% 2.58% 2.45% 2.35% 2.67% Adjusted efficiency ratio: Adjusted non-interest expense excluding � amortization of intangible assets $ 44,781 $ 41,007 $ 39,191 $ 36,489 $ 41,107 Total revenues 80,742 78,340 79,176 72,382 73,710 Adjusted efficiency ratio 55.46% 52.35% 49.50% 50.41% 55.77% Non-GAAP Reconciliation (continued)

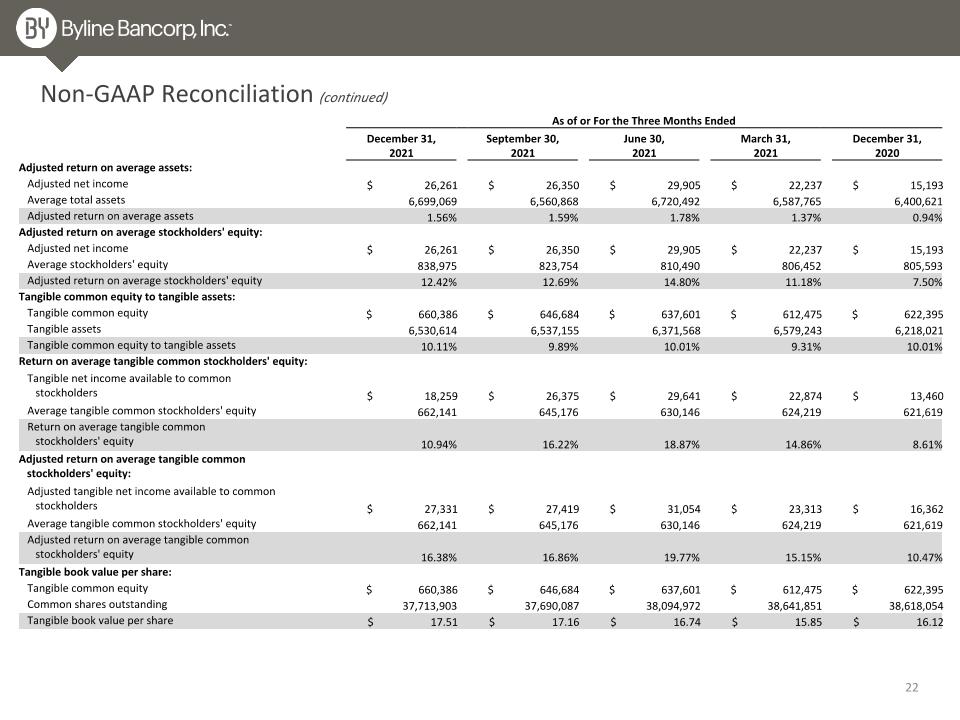

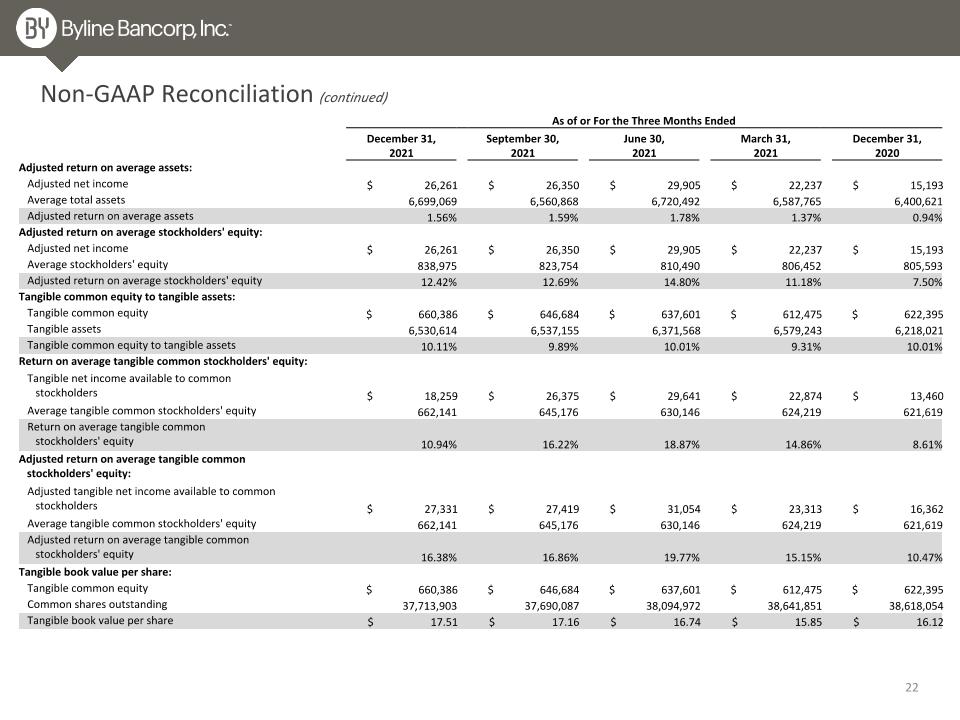

As of or For the Three Months Ended December 31, �2021 September 30, �2021 June 30, �2021 March 31, �2021 December 31, �2020 Adjusted return on average assets: Adjusted net income $ 26,261 $ 26,350 $ 29,905 $ 22,237 $ 15,193 Average total assets 6,699,069 6,560,868 6,720,492 6,587,765 6,400,621 Adjusted return on average assets 1.56% 1.59% 1.78% 1.37% 0.94% Adjusted return on average stockholders' equity: Adjusted net income $ 26,261 $ 26,350 $ 29,905 $ 22,237 $ 15,193 Average stockholders' equity 838,975 823,754 810,490 806,452 805,593 Adjusted return on average stockholders' equity 12.42% 12.69% 14.80% 11.18% 7.50% Tangible common equity to tangible assets: Tangible common equity $ 660,386 $ 646,684 $ 637,601 $ 612,475 $ 622,395 Tangible assets 6,530,614 6,537,155 6,371,568 6,579,243 6,218,021 Tangible common equity to tangible assets 10.11% 9.89% 10.01% 9.31% 10.01% Return on average tangible common stockholders' equity: Tangible net income available to common � stockholders $ 18,259 $ 26,375 $ 29,641 $ 22,874 $ 13,460 Average tangible common stockholders' equity 662,141 645,176 630,146 624,219 621,619 Return on average tangible common � stockholders' equity 10.94% 16.22% 18.87% 14.86% 8.61% Adjusted return on average tangible common � stockholders' equity: Adjusted tangible net income available to common � stockholders $ 27,331 $ 27,419 $ 31,054 $ 23,313 $ 16,362 Average tangible common stockholders' equity 662,141 645,176 630,146 624,219 621,619 Adjusted return on average tangible common � stockholders' equity 16.38% 16.86% 19.77% 15.15% 10.47% Tangible book value per share: Tangible common equity $ 660,386 $ 646,684 $ 637,601 $ 612,475 $ 622,395 Common shares outstanding 37,713,903 37,690,087 38,094,972 38,641,851 38,618,054 Tangible book value per share $ 17.51 $ 17.16 $ 16.74 $ 15.85 $ 16.12 Non-GAAP Reconciliation (continued)