Q2 2022 Conference Call

Forward-Looking Statements This communication contains forward-looking statements within the meaning of the U.S. federal securities laws. Forward-looking statements include, without limitation, statements concerning plans, estimates, calculations, forecasts and projections with respect to the anticipated future performance of the Company. These statements are often, but not always, made through the use of words or phrases such as ‘‘may’’, ‘‘might’’, ‘‘should’’, ‘‘could’’, ‘‘predict’’, ‘‘potential’’, ‘‘believe’’, ‘‘expect’’, ‘‘continue’’, ‘‘will’’, ‘‘anticipate’’, ‘‘seek’’, ‘‘estimate’’, ‘‘intend’’, ‘‘plan’’, ‘‘projection’’, ‘‘would’’, ‘‘annualized’’, “target” and ‘‘outlook’’, or the negative version of those words or other comparable words or phrases of a future or forward-looking nature. Forward-looking statements involve estimates and known and unknown risks, and reflect various assumptions and involve elements of subjective judgement and analysis, which may or may not prove to be correct, and which are subject to uncertainties and contingencies outside the control of Byline and its respective affiliates, directors, employees and other representatives, which could cause actual results to differ materially from those presented in this communication. No representations, warranties or guarantees are or will be made by Byline as to the reliability, accuracy or completeness of any forward-looking statements contained in this communication or that such forward-looking statements are or will remain based on reasonable assumptions. You should not place undue reliance on any forward-looking statements contained in this communication. Certain risks and important factors that could affect Byline’s future results are identified in our Annual Report on Form 10-K and other reports we file with the Securities and Exchange Commission, including among other things under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2021. Any forward-looking statement speaks only as of the date on which it is made, and Byline undertakes no obligation to update any forward-looking statement, whether to reflect events or circumstances after the date on which the statement is made, to reflect new information or the occurrence of unanticipated events, or otherwise unless required under the federal securities laws. Due to rounding, numbers presented throughout this document may not add up precisely to the totals provided and percentages may not precisely reflect the absolute figures.

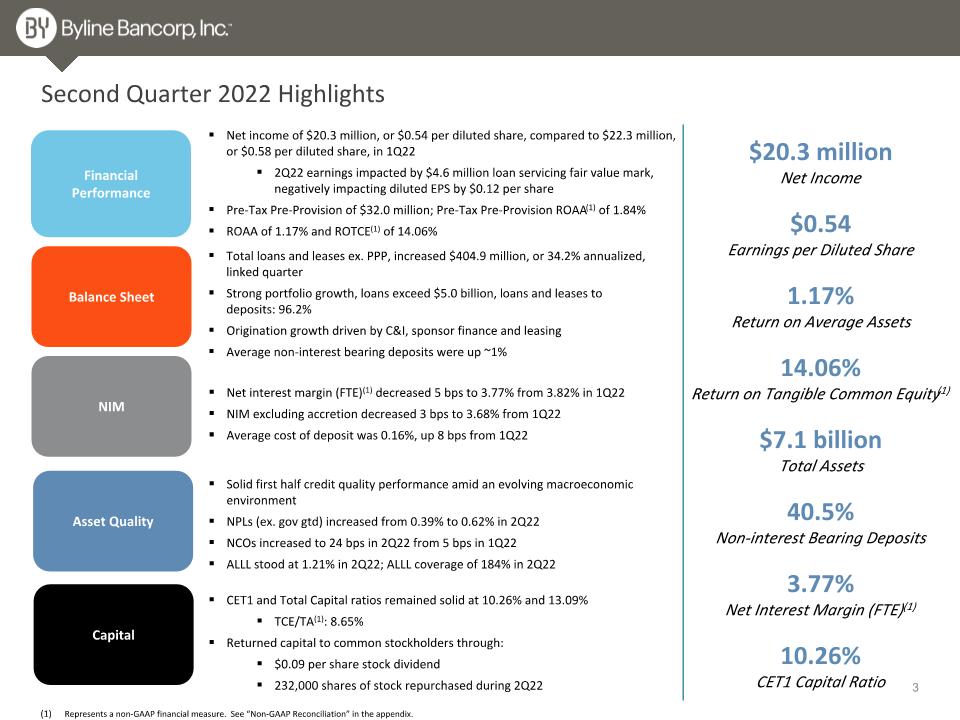

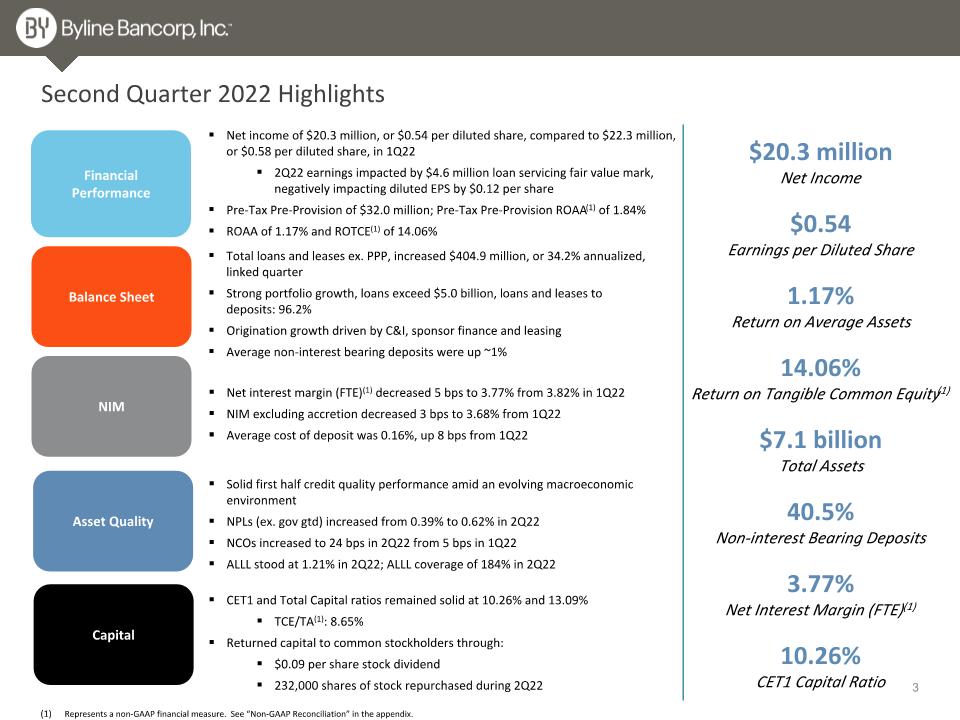

$20.3 million Net Income $0.54 Earnings per Diluted Share 1.17% Return on Average Assets 14.06% Return on Tangible Common Equity(1) $7.1 billion Total Assets 40.5% Non-interest Bearing Deposits 3.77% Net Interest Margin (FTE)(1) 10.26% CET1 Capital Ratio Second Quarter 2022 Highlights Balance Sheet Financial Performance Asset Quality Capital Represents a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the appendix. Net income of $20.3 million, or $0.54 per diluted share, compared to $22.3 million, or $0.58 per diluted share, in 1Q22 2Q22 earnings impacted by $4.6 million loan servicing fair value mark, negatively impacting diluted EPS by $0.12 per share Pre-Tax Pre-Provision of $32.0 million; Pre-Tax Pre-Provision ROAA(1) of 1.84% ROAA of 1.17% and ROTCE(1) of 14.06% Total loans and leases ex. PPP, increased $404.9 million, or 34.2% annualized, linked quarter Strong portfolio growth, loans exceed $5.0 billion, loans and leases to deposits: 96.2% Origination growth driven by C&I, sponsor finance and leasing Average non-interest bearing deposits were up ~1% NIM Net interest margin (FTE)(1) decreased 5 bps to 3.77% from 3.82% in 1Q22 NIM excluding accretion decreased 3 bps to 3.68% from 1Q22 Average cost of deposit was 0.16%, up 8 bps from 1Q22 Solid first half credit quality performance amid an evolving macroeconomic environment NPLs (ex. gov gtd) increased from 0.39% to 0.62% in 2Q22 NCOs increased to 24 bps in 2Q22 from 5 bps in 1Q22 ALLL stood at 1.21% in 2Q22; ALLL coverage of 184% in 2Q22 CET1 and Total Capital ratios remained solid at 10.26% and 13.09% TCE/TA(1): 8.65% Returned capital to common stockholders through: $0.09 per share stock dividend 232,000 shares of stock repurchased during 2Q22

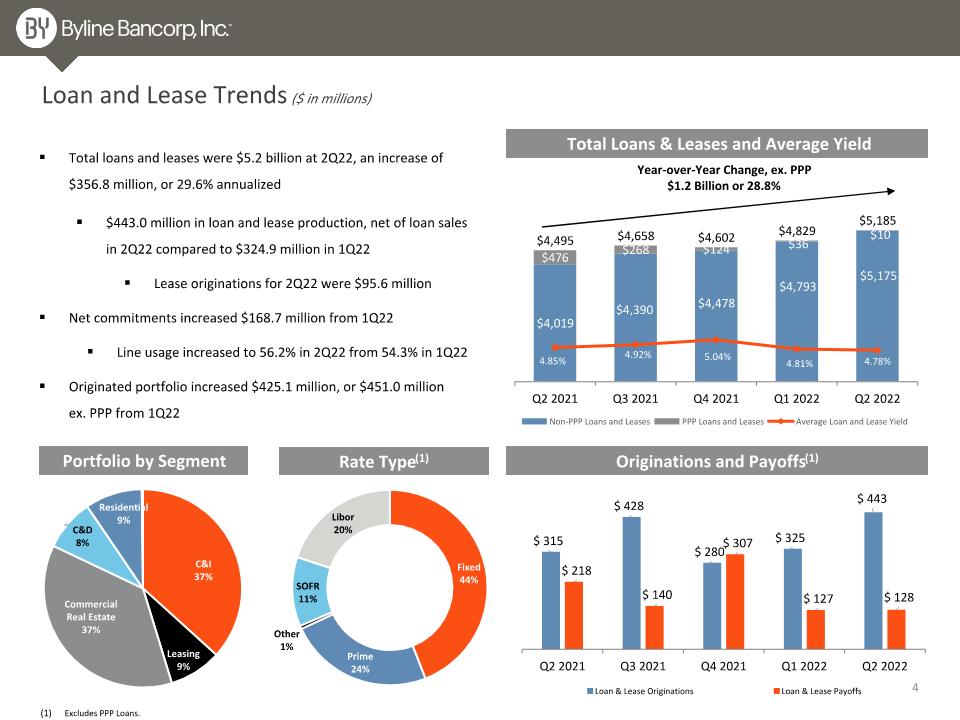

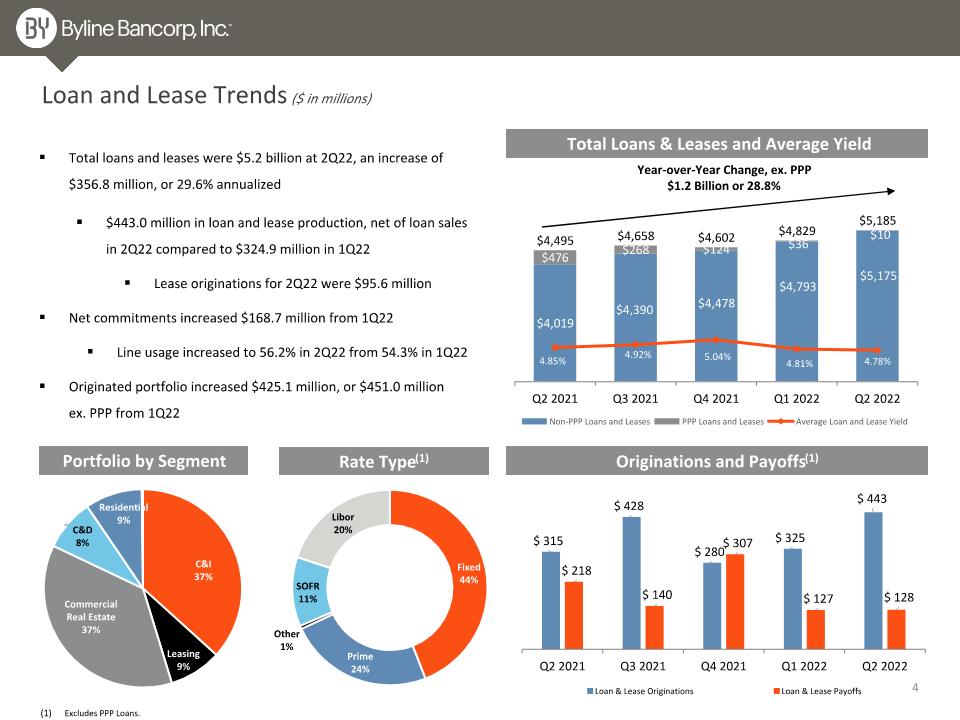

Loan and Lease Trends ($ in millions) Originations and Payoffs(1) Portfolio by Segment Total Loans & Leases and Average Yield Rate Type(1) Year-over-Year Change, ex. PPP $1.2 Billion or 28.8% Excludes PPP Loans. Total loans and leases were $5.2 billion at 2Q22, an increase of $356.8 million, or 29.6% annualized $443.0 million in loan and lease production, net of loan sales in 2Q22 compared to $324.9 million in 1Q22 Lease originations for 2Q22 were $95.6 million Net commitments increased $168.7 million from 1Q22 Line usage increased to 56.2% in 2Q22 from 54.3% in 1Q22 Originated portfolio increased $425.1 million, or $451.0 million ex. PPP from 1Q22

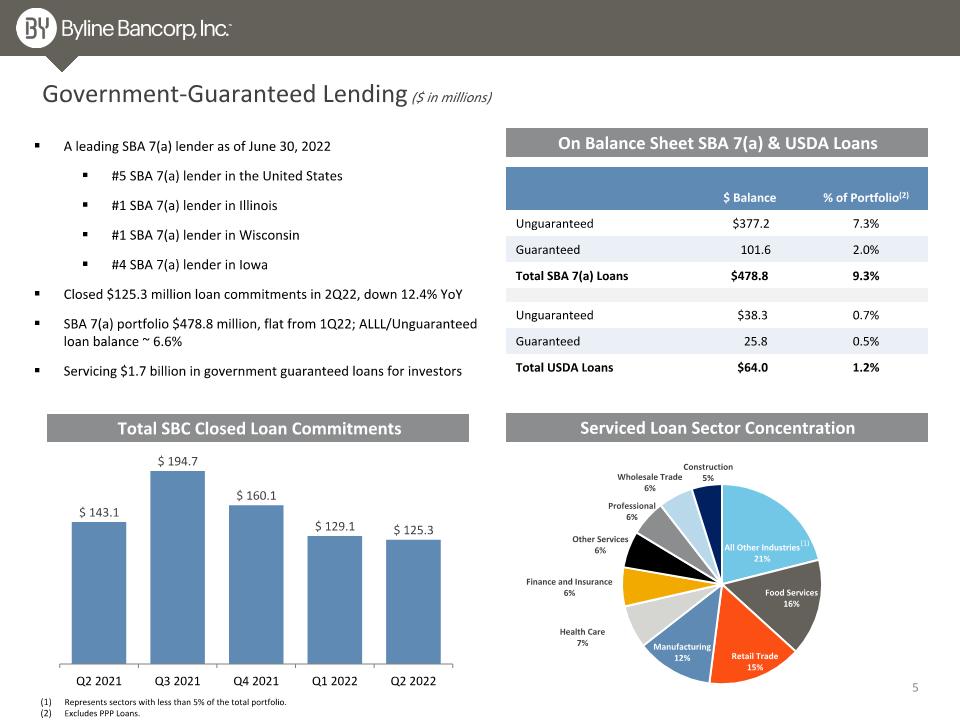

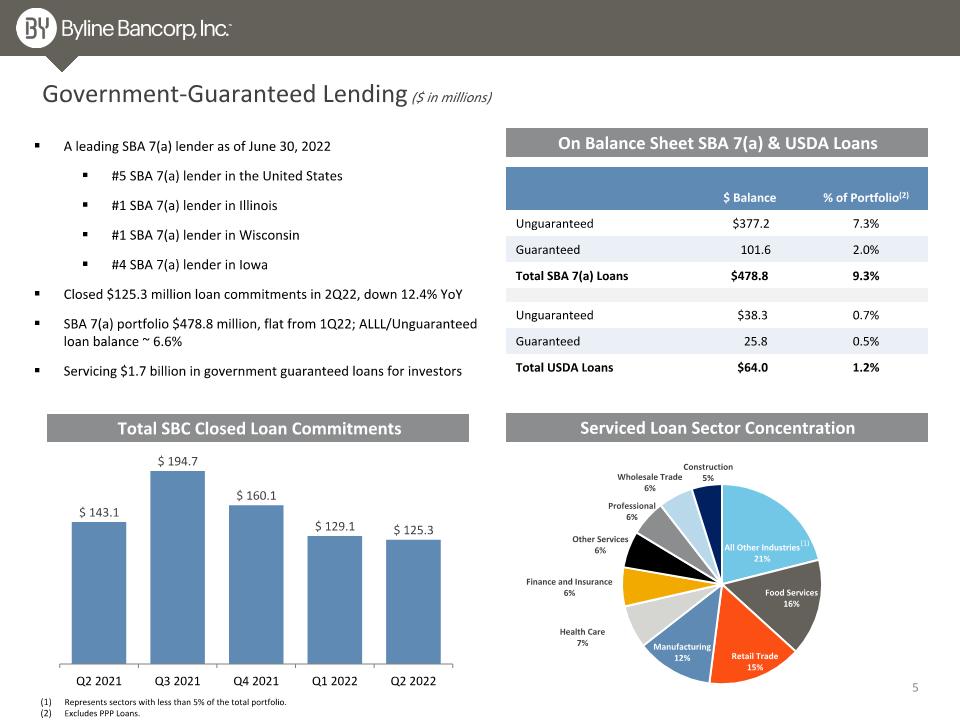

Government-Guaranteed Lending ($ in millions) On Balance Sheet SBA 7(a) & USDA Loans A leading SBA 7(a) lender as of June 30, 2022 #5 SBA 7(a) lender in the United States #1 SBA 7(a) lender in Illinois #1 SBA 7(a) lender in Wisconsin #4 SBA 7(a) lender in Iowa Closed $125.3 million loan commitments in 2Q22, down 12.4% YoY SBA 7(a) portfolio $478.8 million, flat from 1Q22; ALLL/Unguaranteed loan balance ~ 6.6% Servicing $1.7 billion in government guaranteed loans for investors Serviced Loan Sector Concentration Total SBC Closed Loan Commitments $ Balance % of Portfolio(2) Unguaranteed $377.2 7.3% Guaranteed 101.6 2.0% Total SBA 7(a) Loans $478.8 9.3% Unguaranteed $38.3 0.7% Guaranteed 25.8 0.5% Total USDA Loans $64.0 1.2% (1) (1) Represents sectors with less than 5% of the total portfolio. Excludes PPP Loans.

Total deposits were $5.4 billion, down 2.6% from 1Q22 Average non-interest-bearing deposits grew slightly linked quarter and remain stable at $2.3 billion Deposit mix remains exceptional with non-interest bearing representing 40.5% of total deposits Commercial deposits accounted for 48.0% of total deposits and represent 76.3% of all non-interest bearing deposits Deposit Trends ($ in millions) Average Non-Interest Bearing Deposits Deposit Composition Cost of Interest Bearing Deposits Year-over-Year Change $180.4MM or 8.6%

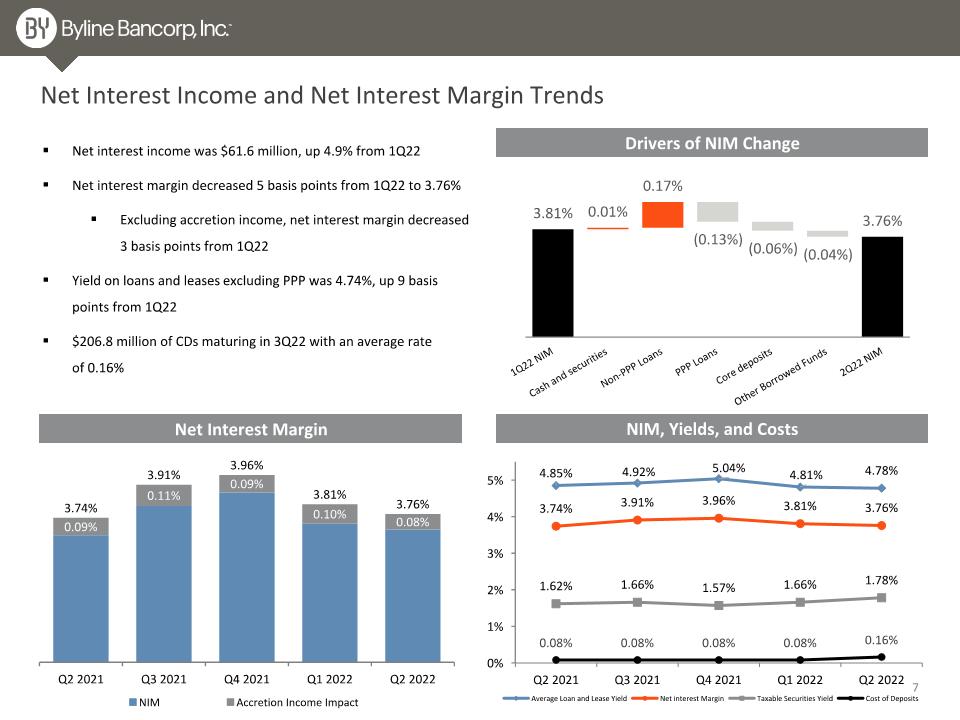

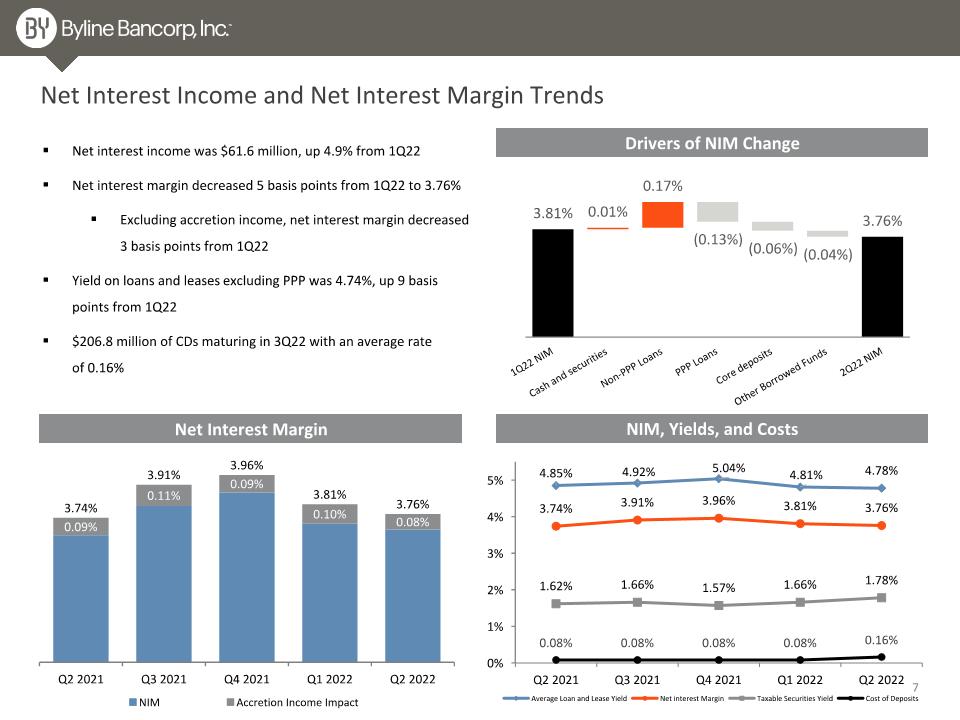

Net Interest Income and Net Interest Margin Trends Net interest income was $61.6 million, up 4.9% from 1Q22 Net interest margin decreased 5 basis points from 1Q22 to 3.76% Excluding accretion income, net interest margin decreased 3 basis points from 1Q22 Yield on loans and leases excluding PPP was 4.74%, up 9 basis points from 1Q22 $206.8 million of CDs maturing in 3Q22 with an average rate of 0.16% Net Interest Margin Drivers of NIM Change NIM, Yields, and Costs

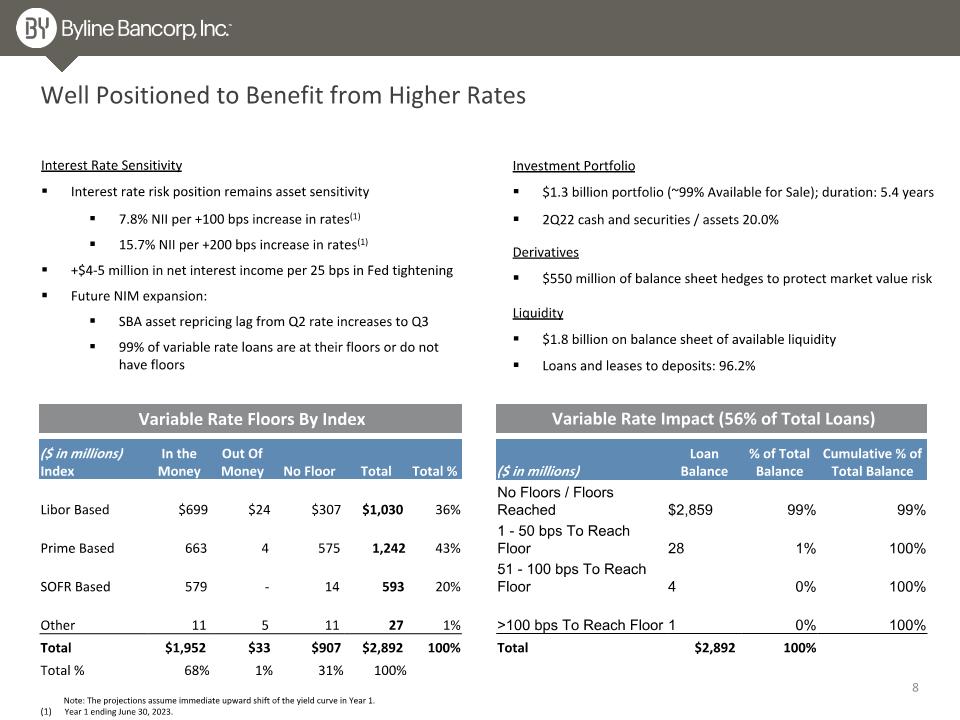

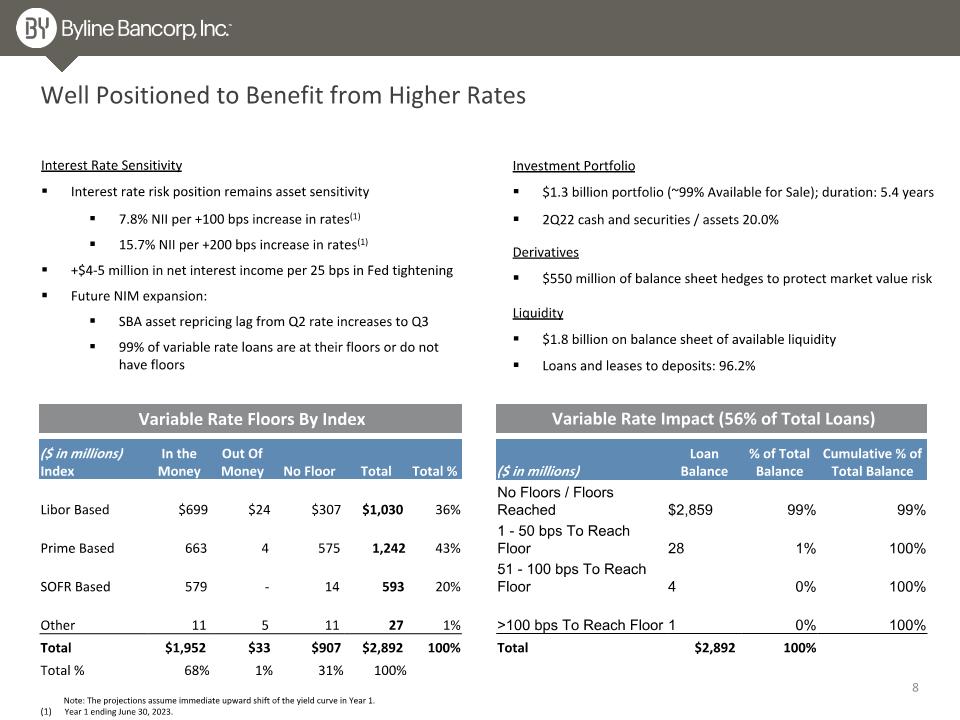

Interest Rate Sensitivity Interest rate risk position remains asset sensitivity 7.8% NII per +100 bps increase in rates(1) 15.7% NII per +200 bps increase in rates(1) +$4-5 million in net interest income per 25 bps in Fed tightening Future NIM expansion: SBA asset repricing lag from Q2 rate increases to Q3 99% of variable rate loans are at their floors or do not have floors Well Positioned to Benefit from Higher Rates Variable Rate Floors By Index Variable Rate Impact (56% of Total Loans) ($ in millions) Index In the Money Out Of Money No Floor Total Total % Libor Based $699 $24 $307 $1,030 36% Prime Based 663 4 575 1,242 43% SOFR Based 579 - 14 593 20% Other 11 5 11 27 1% Total $1,952 $33 $907 $2,892 100% Total % 68% 1% 31% 100% ($ in millions) Loan Balance % of Total Balance Cumulative % of Total Balance No Floors / Floors Reached $2,859 99% 99% 1 - 50 bps To Reach Floor 28 1% 100% 51 - 100 bps To Reach Floor 4 0% 100% >100 bps To Reach Floor 1 0% 100% Total $2,892 100% Note: The projections assume immediate upward shift of the yield curve in Year 1. Year 1 ending June 30, 2023. Investment Portfolio $1.3 billion portfolio (~99% Available for Sale); duration: 5.4 years 2Q22 cash and securities / assets 20.0% Derivatives $550 million of balance sheet hedges to protect market value risk Liquidity $1.8 billion on balance sheet of available liquidity Loans and leases to deposits: 96.2%

Total Non-Interest Income Non-Interest Income Trends ($ in millions) Non-interest income was $14.2 million, a decrease of $5.3 million from 1Q22 $4.6 million loan servicing asset revaluation charge due to higher discount rates Lower premiums resulting in a decrease in net gains on sales of loans Volume Sold and Average Net Premiums Net Gains on Sales of Loans Government Guaranteed Loan Sales $118.5 million of guaranteed loans sold in 2Q22, compared to $102.3 million in 1Q22 Loans held for sale decreased to $17.3 million in 2Q22 from $39.5 million in 1Q22 9

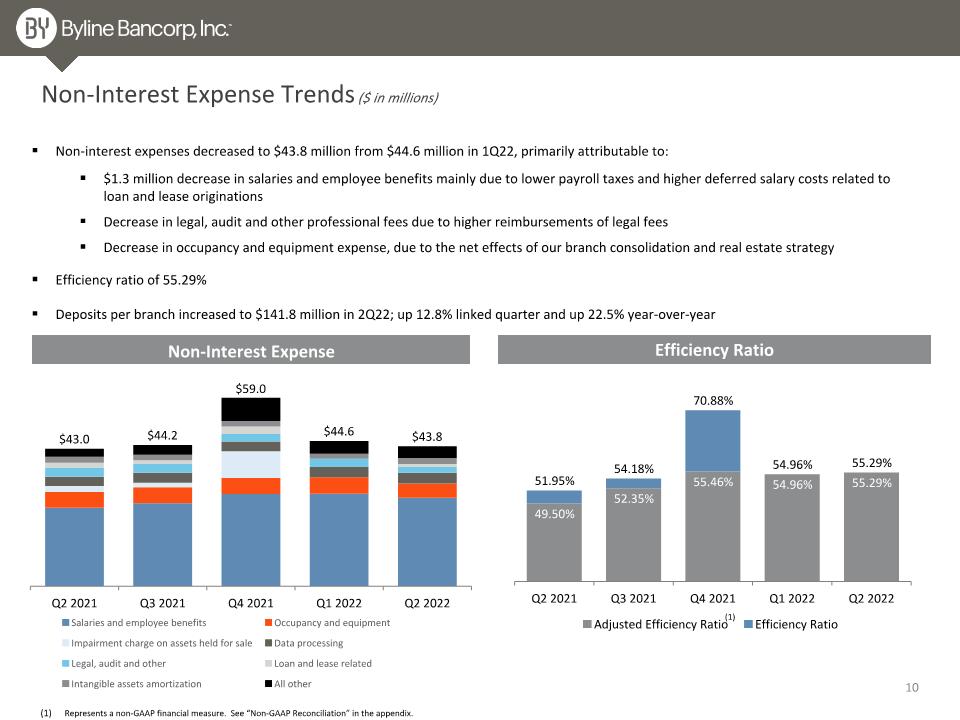

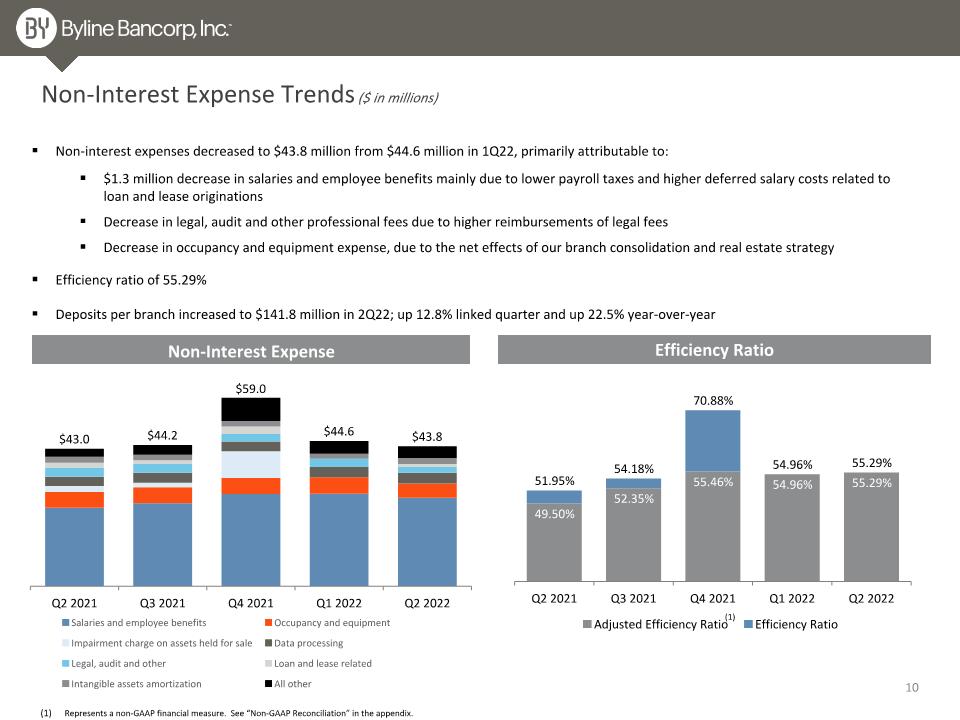

Non-Interest Expense Trends ($ in millions) Non-interest expenses decreased to $43.8 million from $44.6 million in 1Q22, primarily attributable to: $1.3 million decrease in salaries and employee benefits mainly due to lower payroll taxes and higher deferred salary costs related to loan and lease originations Decrease in legal, audit and other professional fees due to higher reimbursements of legal fees Decrease in occupancy and equipment expense, due to the net effects of our branch consolidation and real estate strategy Efficiency ratio of 55.29% Deposits per branch increased to $141.8 million in 2Q22; up 12.8% linked quarter and up 22.5% year-over-year Efficiency Ratio Non-Interest Expense (1) Represents a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the appendix.

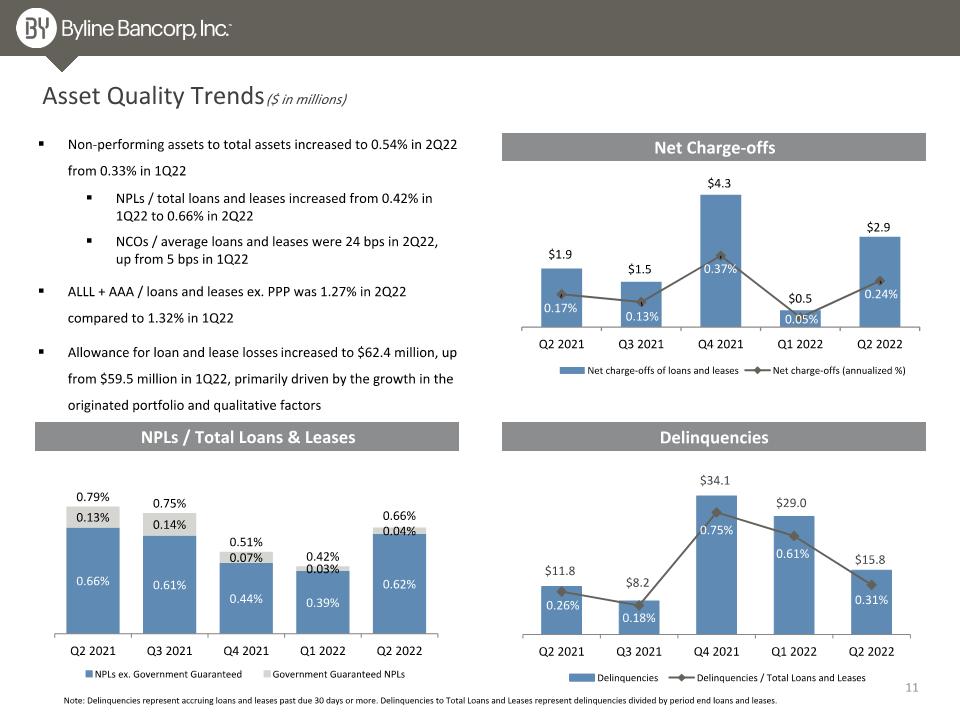

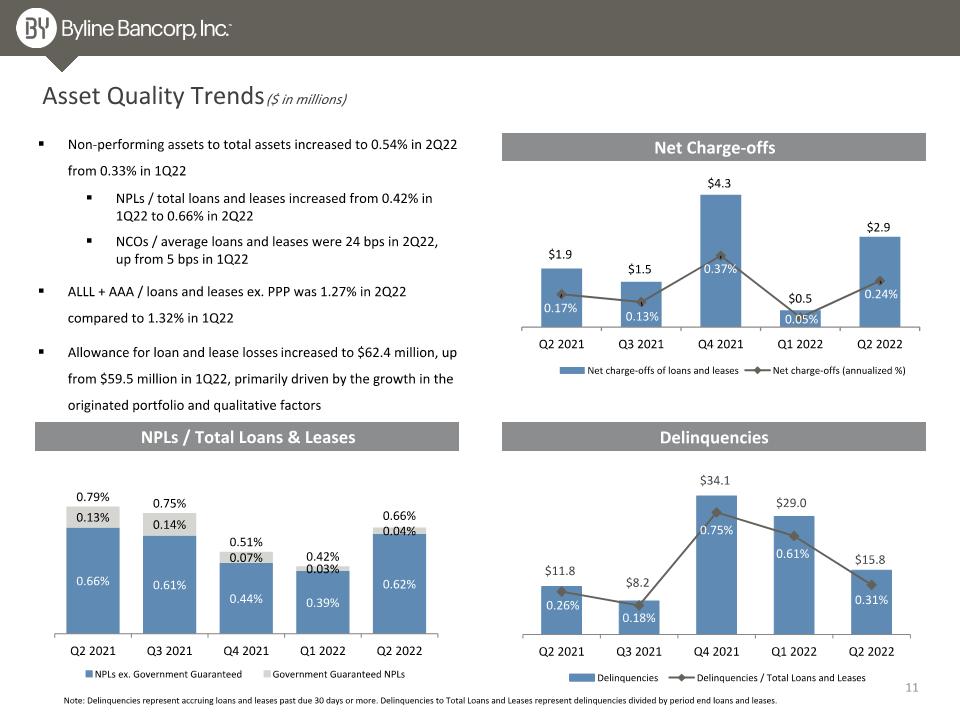

Asset Quality Trends ($ in millions) NPLs / Total Loans & Leases Delinquencies Net Charge-offs Non-performing assets to total assets increased to 0.54% in 2Q22 from 0.33% in 1Q22 NPLs / total loans and leases increased from 0.42% in 1Q22 to 0.66% in 2Q22 NCOs / average loans and leases were 24 bps in 2Q22, up from 5 bps in 1Q22 ALLL + AAA / loans and leases ex. PPP was 1.27% in 2Q22 compared to 1.32% in 1Q22 Allowance for loan and lease losses increased to $62.4 million, up from $59.5 million in 1Q22, primarily driven by the growth in the originated portfolio and qualitative factors Note: Delinquencies represent accruing loans and leases past due 30 days or more. Delinquencies to Total Loans and Leases represent delinquencies divided by period end loans and leases.

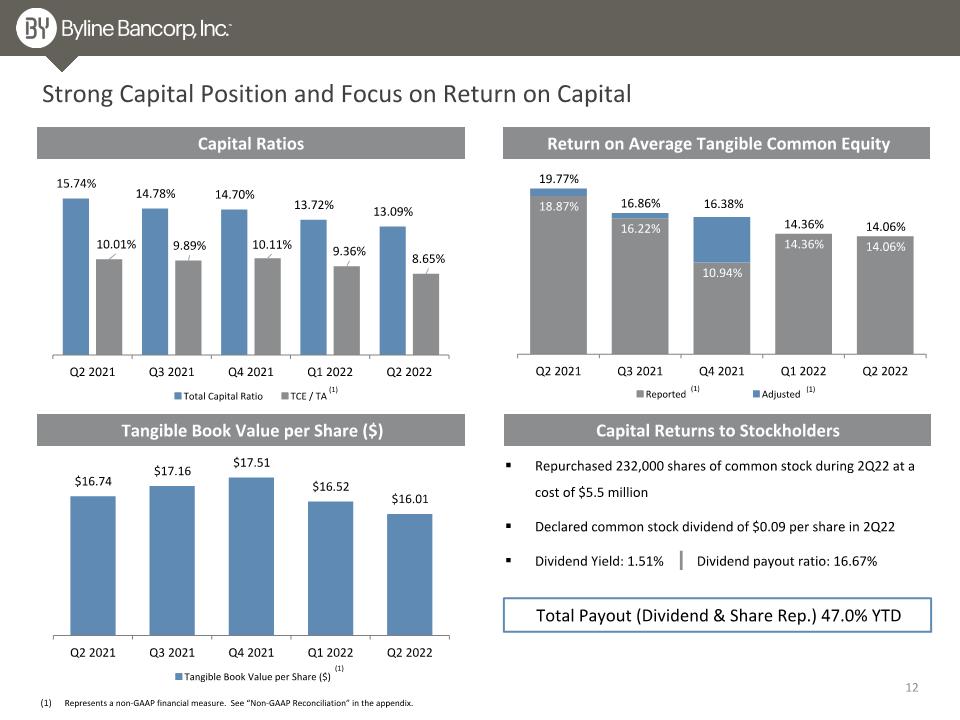

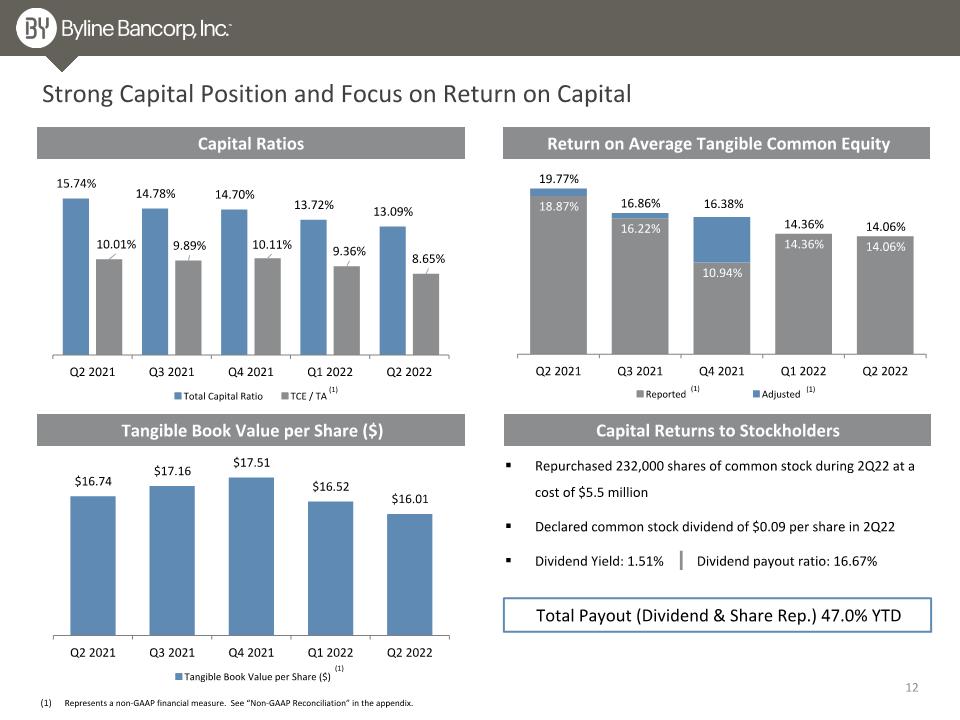

Project Sox Offer Migration Strong Capital Position and Focus on Return on Capital Capital Ratios Return on Average Tangible Common Equity (1) Tangible Book Value per Share ($) (1) (1) Repurchased 232,000 shares of common stock during 2Q22 at a cost of $5.5 million Declared common stock dividend of $0.09 per share in 2Q22 Dividend Yield: 1.51% Dividend payout ratio: 16.67% Total Payout (Dividend & Share Rep.) 47.0% YTD (1) Represents a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the appendix. Capital Returns to Stockholders

2022 Strategic Priorities and Near-Term Outlook Commercial banking focus through organic loan, lease and deposit growth Low to mid teen loan growth for 2022 Investing in digital capabilities and automation Online deposit account opening for businesses - second half of 2022 / nCino loan origination enhancements Strategic M&A opportunities and team lift-outs with attractive metrics and return profile Continue the return of capital to stockholders Continue to identify opportunities to improve operating leverage Disciplined expense management Achieve enhanced profitability metrics Driven by increasing earning asset mix and well positioned for rising interest rates

Appendix

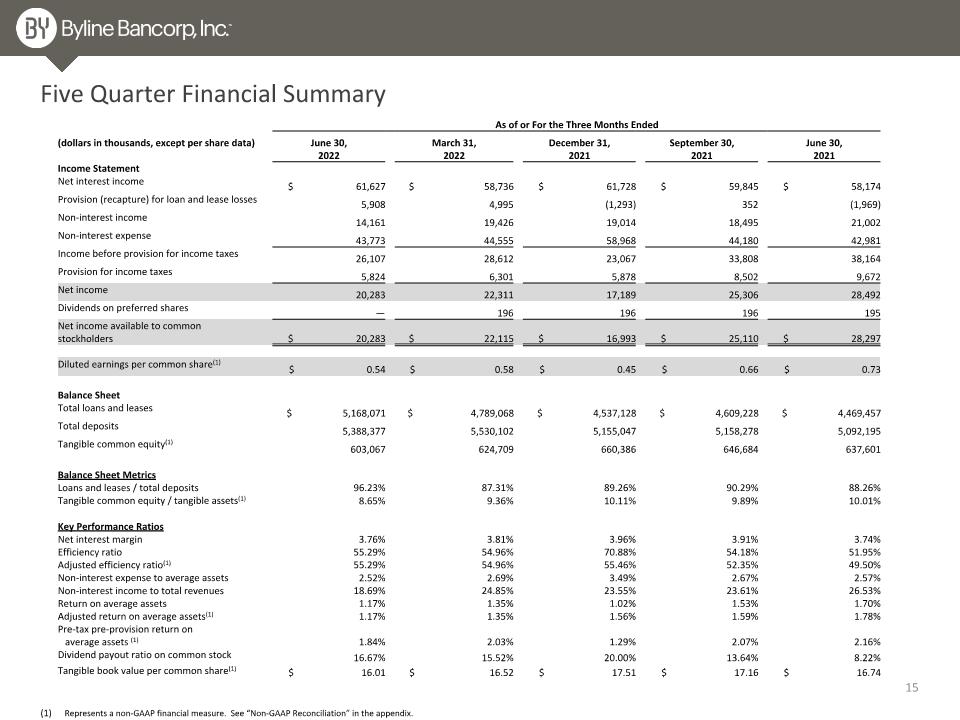

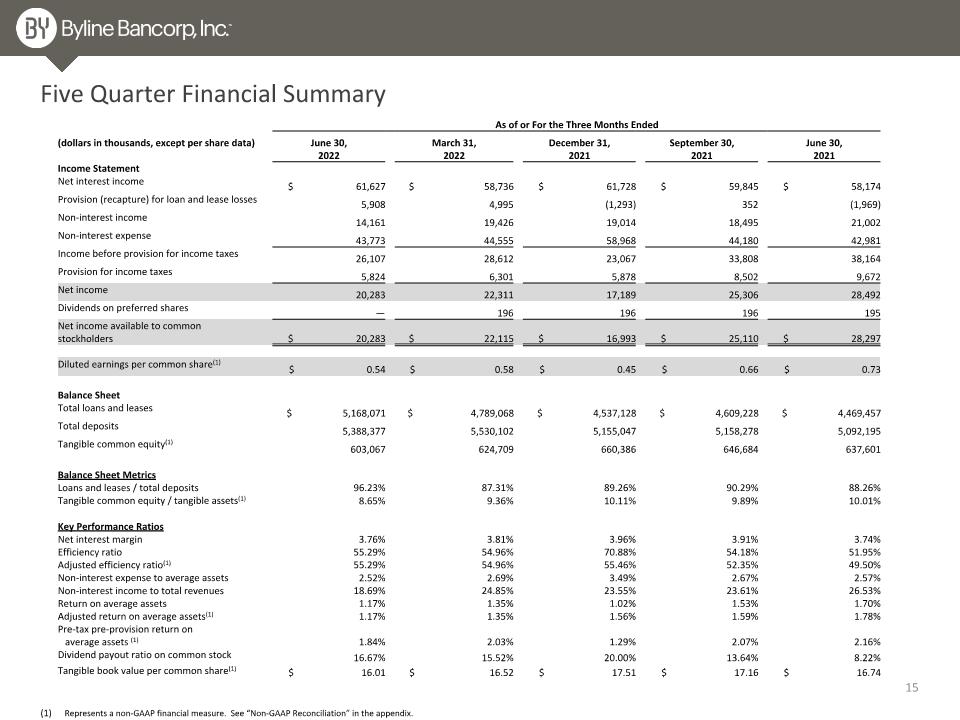

Five Quarter Financial Summary Represents a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the appendix. As of or For the Three Months Ended (dollars in thousands, except per share data) June 30, March 31, December 31, September 30, June 30, 2022 2022 2021 2021 2021 Income Statement Net interest income $ 61,627 $ 58,736 $ 61,728 $ 59,845 $ 58,174 Provision (recapture) for loan and lease losses 5,908 4,995 (1,293) 352 (1,969) Non-interest income 14,161 19,426 19,014 18,495 21,002 Non-interest expense 43,773 44,555 58,968 44,180 42,981 Income before provision for income taxes 26,107 28,612 23,067 33,808 38,164 Provision for income taxes 5,824 6,301 5,878 8,502 9,672 Net income 20,283 22,311 17,189 25,306 28,492 Dividends on preferred shares — 196 196 196 195 Net income available to common stockholders $ 20,283 $ 22,115 $ 16,993 $ 25,110 $ 28,297 Diluted earnings per common share(1) $ 0.54 $ 0.58 $ 0.45 $ 0.66 $ 0.73 Balance Sheet Total loans and leases $ 5,168,071 $ 4,789,068 $ 4,537,128 $ 4,609,228 $ 4,469,457 Total deposits 5,388,377 5,530,102 5,155,047 5,158,278 5,092,195 Tangible common equity(1) 603,067 624,709 660,386 646,684 637,601 Balance Sheet Metrics Loans and leases / total deposits 96.23% 87.31% 89.26% 90.29% 88.26% Tangible common equity / tangible assets(1) 8.65% 9.36% 10.11% 9.89% 10.01% Key Performance Ratios Net interest margin 3.76% 3.81% 3.96% 3.91% 3.74% Efficiency ratio 55.29% 54.96% 70.88% 54.18% 51.95% Adjusted efficiency ratio(1) 55.29% 54.96% 55.46% 52.35% 49.50% Non-interest expense to average assets 2.52% 2.69% 3.49% 2.67% 2.57% Non-interest income to total revenues 18.69% 24.85% 23.55% 23.61% 26.53% Return on average assets 1.17% 1.35% 1.02% 1.53% 1.70% Adjusted return on average assets(1) 1.17% 1.35% 1.56% 1.59% 1.78% Pre-tax pre-provision return on � average assets (1) 1.84% 2.03% 1.29% 2.07% 2.16% Dividend payout ratio on common stock 16.67% 15.52% 20.00% 13.64% 8.22% Tangible book value per common share(1) $ 16.01 $ 16.52 $ 17.51 $ 17.16 $ 16.74

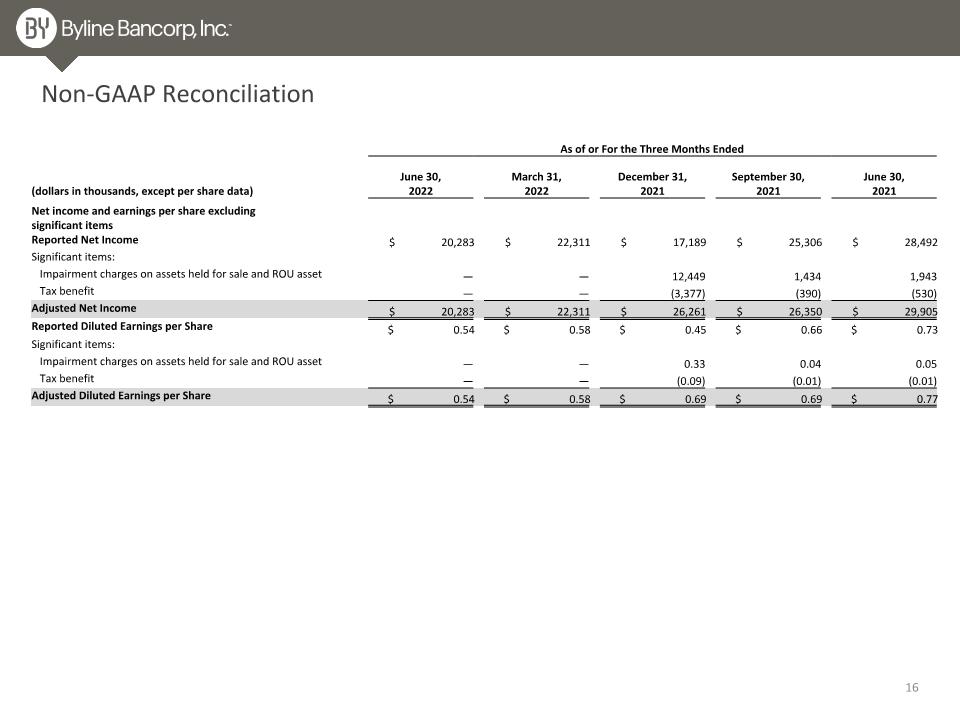

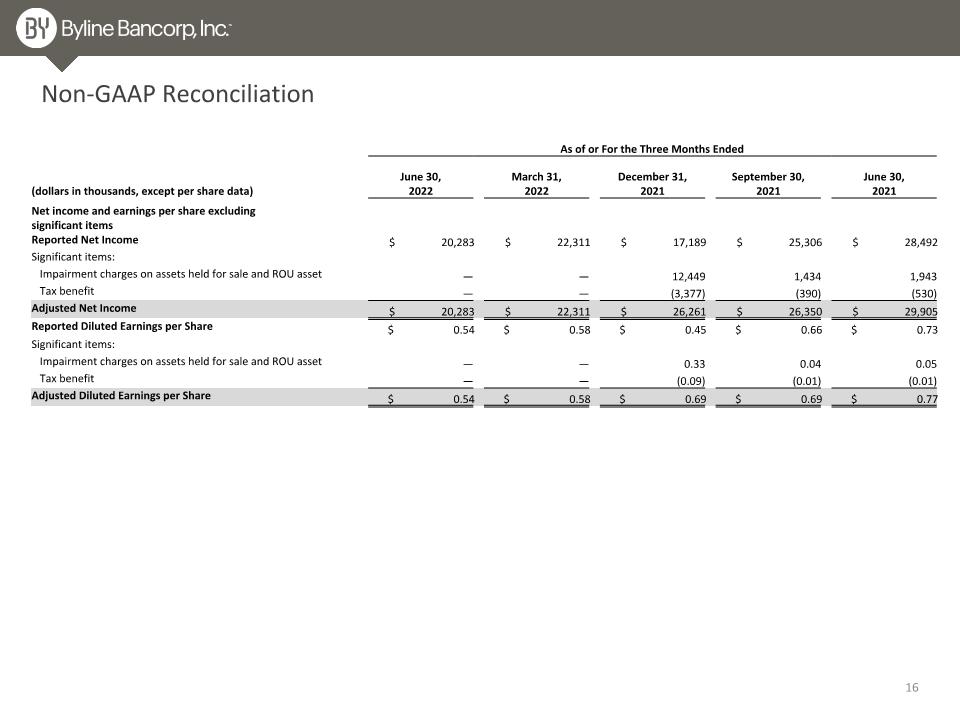

As of or For the Three Months Ended (dollars in thousands, except per share data) June 30, �2022 March 31, �2022 December 31, �2021 September 30, �2021 June 30, �2021 Net income and earnings per share excluding significant items Reported Net Income $ 20,283 $ 22,311 $ 17,189 $ 25,306 $ 28,492 Significant items: Impairment charges on assets held for sale and ROU asset — — 12,449 1,434 1,943 Tax benefit — — (3,377) (390) (530) Adjusted Net Income $ 20,283 $ 22,311 $ 26,261 $ 26,350 $ 29,905 Reported Diluted Earnings per Share $ 0.54 $ 0.58 $ 0.45 $ 0.66 $ 0.73 Significant items: Impairment charges on assets held for sale and ROU asset — — 0.33 0.04 0.05 Tax benefit — — (0.09) (0.01) (0.01) Adjusted Diluted Earnings per Share $ 0.54 $ 0.58 $ 0.69 $ 0.69 $ 0.77 Non-GAAP Reconciliation

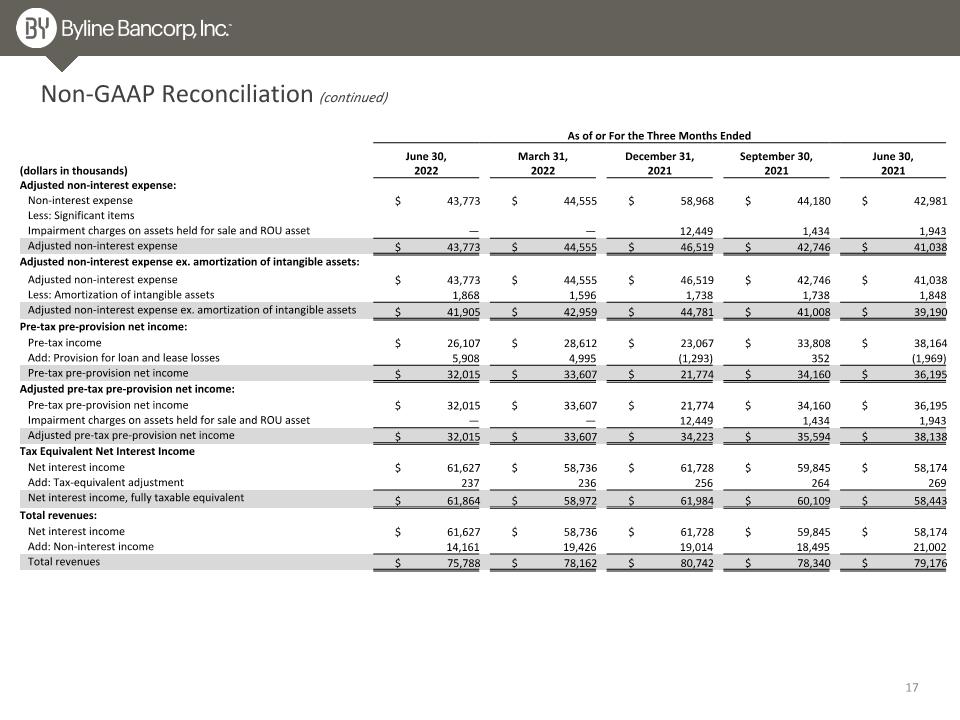

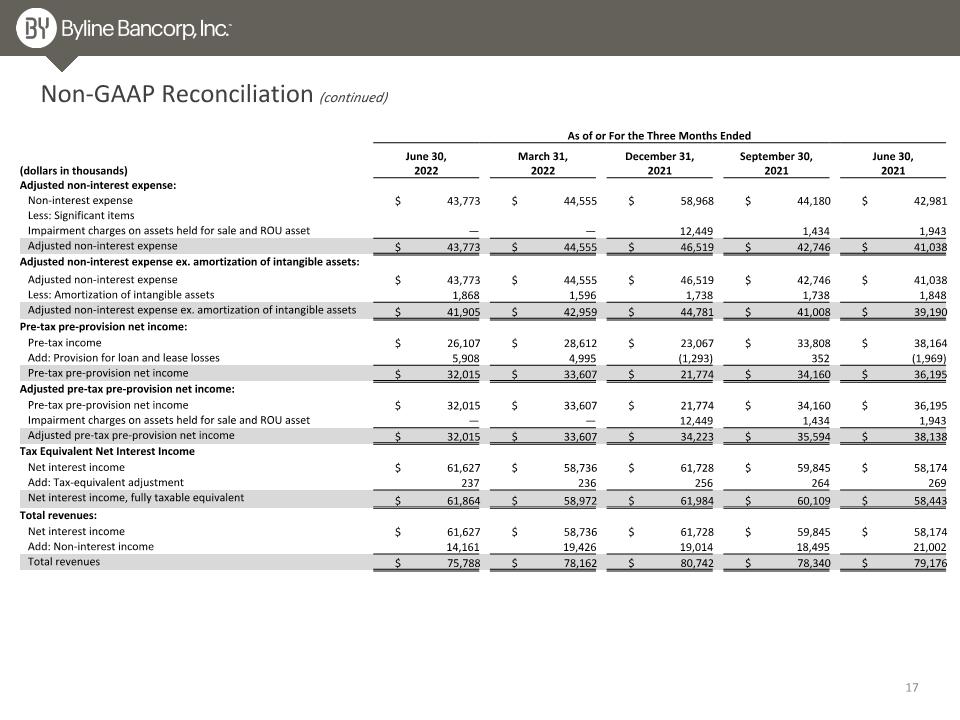

As of or For the Three Months Ended (dollars in thousands) June 30, �2022 March 31, �2022 December 31, �2021 September 30, �2021 June 30, �2021 Adjusted non-interest expense: Non-interest expense $ 43,773 $ 44,555 $ 58,968 $ 44,180 $ 42,981 Less: Significant items Impairment charges on assets held for sale and ROU asset — — 12,449 1,434 1,943 Adjusted non-interest expense $ 43,773 $ 44,555 $ 46,519 $ 42,746 $ 41,038 Adjusted non-interest expense ex. amortization of intangible assets: Adjusted non-interest expense $ 43,773 $ 44,555 $ 46,519 $ 42,746 $ 41,038 Less: Amortization of intangible assets 1,868 1,596 1,738 1,738 1,848 Adjusted non-interest expense ex. amortization of intangible assets $ 41,905 $ 42,959 $ 44,781 $ 41,008 $ 39,190 Pre-tax pre-provision net income: Pre-tax income $ 26,107 $ 28,612 $ 23,067 $ 33,808 $ 38,164 Add: Provision for loan and lease losses 5,908 4,995 (1,293) 352 (1,969) Pre-tax pre-provision net income $ 32,015 $ 33,607 $ 21,774 $ 34,160 $ 36,195 Adjusted pre-tax pre-provision net income: Pre-tax pre-provision net income $ 32,015 $ 33,607 $ 21,774 $ 34,160 $ 36,195 Impairment charges on assets held for sale and ROU asset — — 12,449 1,434 1,943 Adjusted pre-tax pre-provision net income $ 32,015 $ 33,607 $ 34,223 $ 35,594 $ 38,138 Tax Equivalent Net Interest Income Net interest income $ 61,627 $ 58,736 $ 61,728 $ 59,845 $ 58,174 Add: Tax-equivalent adjustment 237 236 256 264 269 Net interest income, fully taxable equivalent $ 61,864 $ 58,972 $ 61,984 $ 60,109 $ 58,443 Total revenues: Net interest income $ 61,627 $ 58,736 $ 61,728 $ 59,845 $ 58,174 Add: Non-interest income 14,161 19,426 19,014 18,495 21,002 Total revenues $ 75,788 $ 78,162 $ 80,742 $ 78,340 $ 79,176 Non-GAAP Reconciliation (continued)

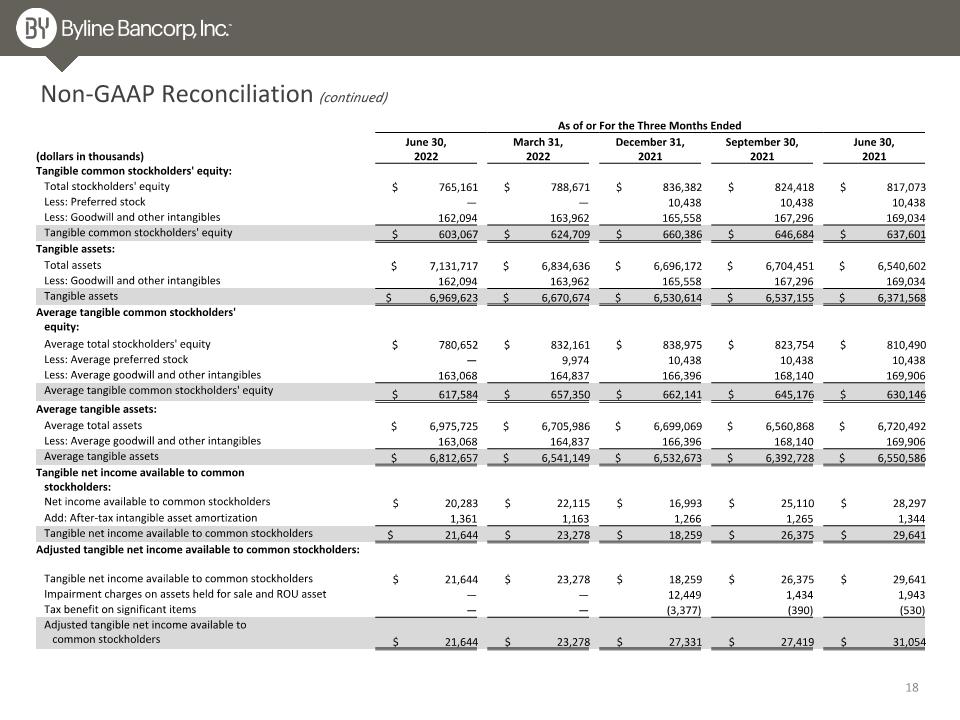

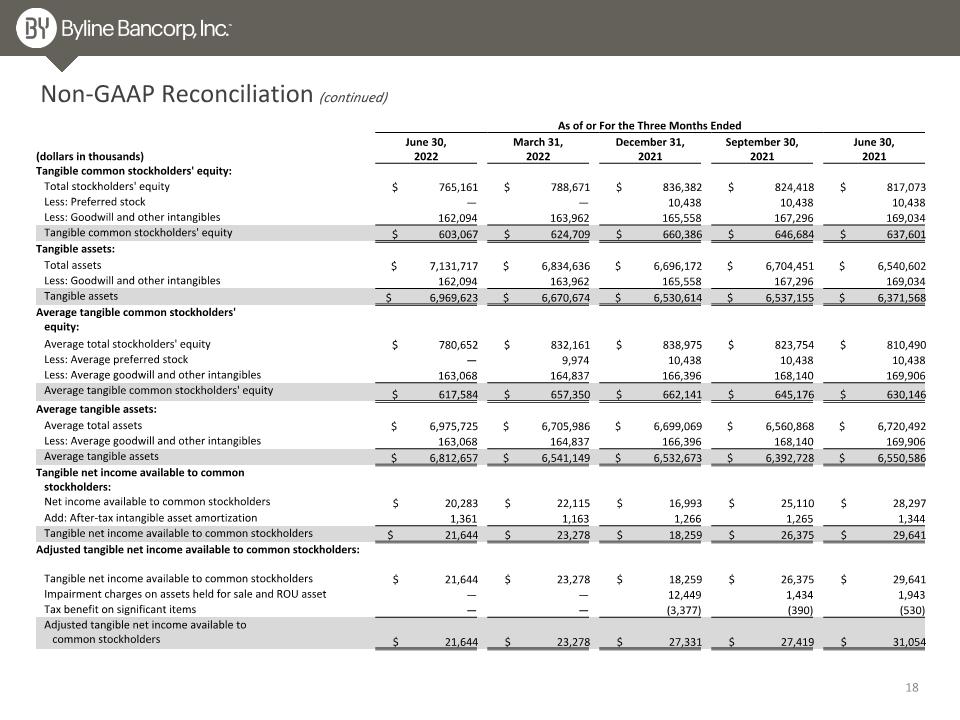

Non-GAAP Reconciliation (continued) As of or For the Three Months Ended (dollars in thousands) June 30, �2022 March 31, �2022 December 31, �2021 September 30, �2021 June 30, �2021 Tangible common stockholders' equity: Total stockholders' equity $ 765,161 $ 788,671 $ 836,382 $ 824,418 $ 817,073 Less: Preferred stock — — 10,438 10,438 10,438 Less: Goodwill and other intangibles 162,094 163,962 165,558 167,296 169,034 Tangible common stockholders' equity $ 603,067 $ 624,709 $ 660,386 $ 646,684 $ 637,601 Tangible assets: Total assets $ 7,131,717 $ 6,834,636 $ 6,696,172 $ 6,704,451 $ 6,540,602 Less: Goodwill and other intangibles 162,094 163,962 165,558 167,296 169,034 Tangible assets $ 6,969,623 $ 6,670,674 $ 6,530,614 $ 6,537,155 $ 6,371,568 Average tangible common stockholders' � equity: Average total stockholders' equity $ 780,652 $ 832,161 $ 838,975 $ 823,754 $ 810,490 Less: Average preferred stock — 9,974 10,438 10,438 10,438 Less: Average goodwill and other intangibles 163,068 164,837 166,396 168,140 169,906 Average tangible common stockholders' equity $ 617,584 $ 657,350 $ 662,141 $ 645,176 $ 630,146 Average tangible assets: Average total assets $ 6,975,725 $ 6,705,986 $ 6,699,069 $ 6,560,868 $ 6,720,492 Less: Average goodwill and other intangibles 163,068 164,837 166,396 168,140 169,906 Average tangible assets $ 6,812,657 $ 6,541,149 $ 6,532,673 $ 6,392,728 $ 6,550,586 Tangible net income available to common � stockholders: Net income available to common stockholders $ 20,283 $ 22,115 $ 16,993 $ 25,110 $ 28,297 Add: After-tax intangible asset amortization 1,361 1,163 1,266 1,265 1,344 Tangible net income available to common stockholders $ 21,644 $ 23,278 $ 18,259 $ 26,375 $ 29,641 Adjusted tangible net income available to common stockholders: Tangible net income available to common stockholders $ 21,644 $ 23,278 $ 18,259 $ 26,375 $ 29,641 Impairment charges on assets held for sale and ROU asset — — 12,449 1,434 1,943 Tax benefit on significant items — — (3,377) (390) (530) Adjusted tangible net income available to � common stockholders $ 21,644 $ 23,278 $ 27,331 $ 27,419 $ 31,054

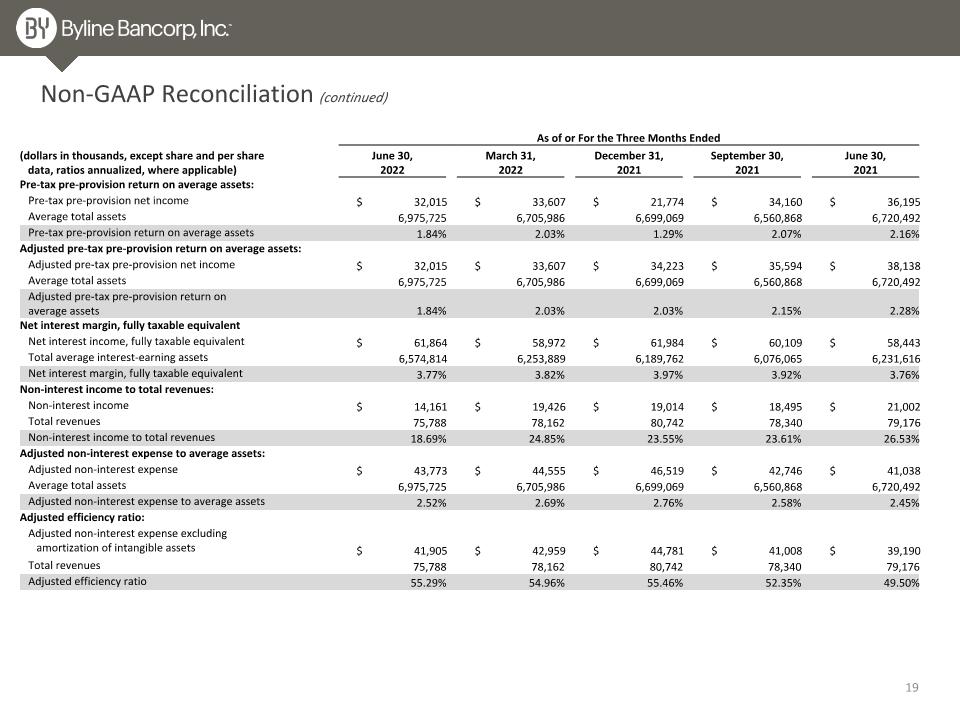

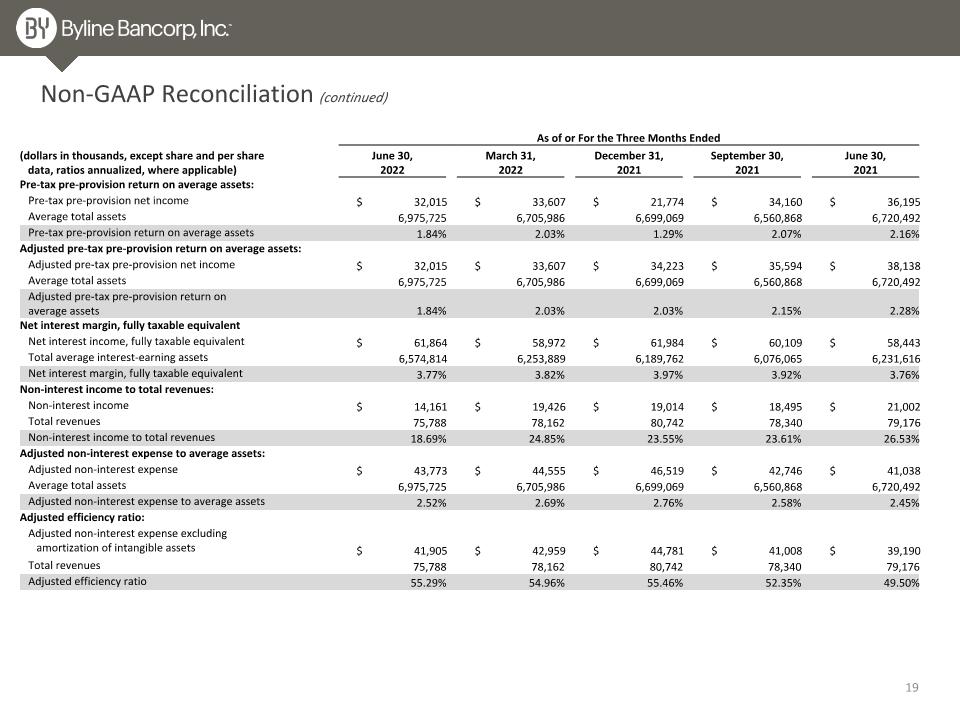

As of or For the Three Months Ended (dollars in thousands, except share and per share � data, ratios annualized, where applicable) June 30, �2022 March 31, �2022 December 31, �2021 September 30, �2021 June 30, �2021 Pre-tax pre-provision return on average assets: Pre-tax pre-provision net income $ 32,015 $ 33,607 $ 21,774 $ 34,160 $ 36,195 Average total assets 6,975,725 6,705,986 6,699,069 6,560,868 6,720,492 Pre-tax pre-provision return on average assets 1.84% 2.03% 1.29% 2.07% 2.16% Adjusted pre-tax pre-provision return on average assets: Adjusted pre-tax pre-provision net income $ 32,015 $ 33,607 $ 34,223 $ 35,594 $ 38,138 Average total assets 6,975,725 6,705,986 6,699,069 6,560,868 6,720,492 Adjusted pre-tax pre-provision return on average assets 1.84% 2.03% 2.03% 2.15% 2.28% Net interest margin, fully taxable equivalent Net interest income, fully taxable equivalent $ 61,864 $ 58,972 $ 61,984 $ 60,109 $ 58,443 Total average interest-earning assets 6,574,814 6,253,889 6,189,762 6,076,065 6,231,616 Net interest margin, fully taxable equivalent 3.77% 3.82% 3.97% 3.92% 3.76% Non-interest income to total revenues: Non-interest income $ 14,161 $ 19,426 $ 19,014 $ 18,495 $ 21,002 Total revenues 75,788 78,162 80,742 78,340 79,176 Non-interest income to total revenues 18.69% 24.85% 23.55% 23.61% 26.53% Adjusted non-interest expense to average assets: Adjusted non-interest expense $ 43,773 $ 44,555 $ 46,519 $ 42,746 $ 41,038 Average total assets 6,975,725 6,705,986 6,699,069 6,560,868 6,720,492 Adjusted non-interest expense to average assets 2.52% 2.69% 2.76% 2.58% 2.45% Adjusted efficiency ratio: Adjusted non-interest expense excluding � amortization of intangible assets $ 41,905 $ 42,959 $ 44,781 $ 41,008 $ 39,190 Total revenues 75,788 78,162 80,742 78,340 79,176 Adjusted efficiency ratio 55.29% 54.96% 55.46% 52.35% 49.50% Non-GAAP Reconciliation (continued)

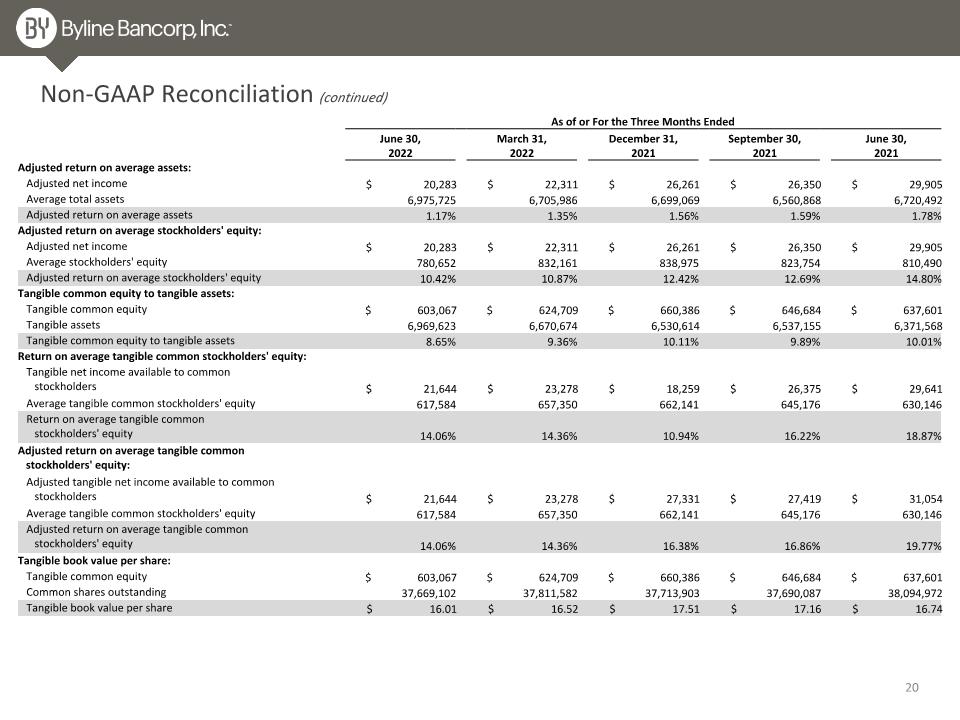

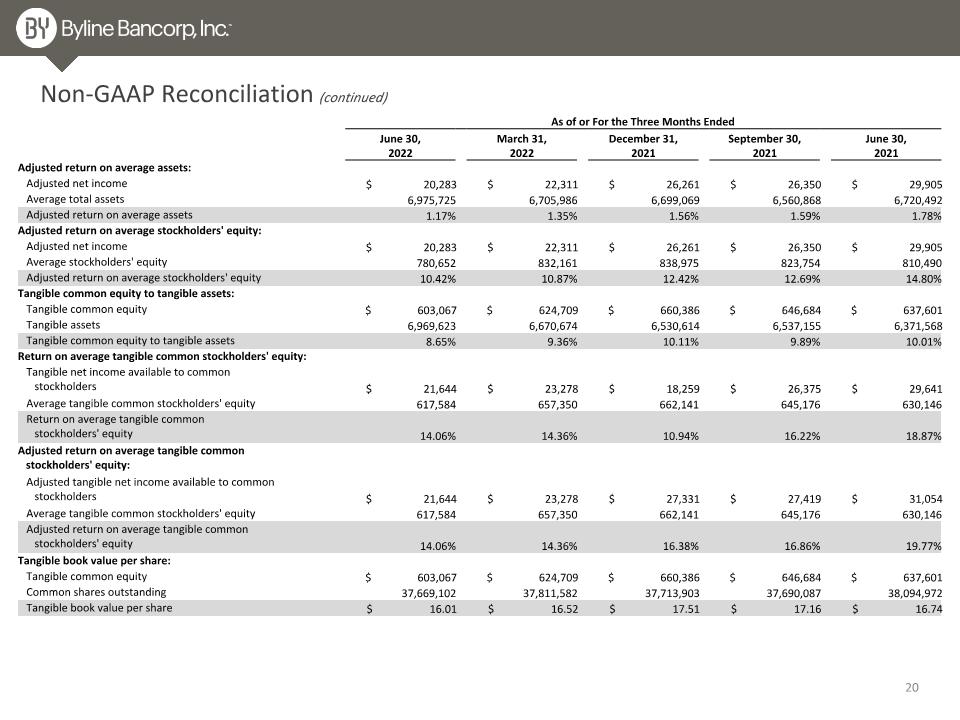

Non-GAAP Reconciliation (continued) As of or For the Three Months Ended June 30, �2022 March 31, �2022 December 31, �2021 September 30, �2021 June 30, �2021 Adjusted return on average assets: Adjusted net income $ 20,283 $ 22,311 $ 26,261 $ 26,350 $ 29,905 Average total assets 6,975,725 6,705,986 6,699,069 6,560,868 6,720,492 Adjusted return on average assets 1.17% 1.35% 1.56% 1.59% 1.78% Adjusted return on average stockholders' equity: Adjusted net income $ 20,283 $ 22,311 $ 26,261 $ 26,350 $ 29,905 Average stockholders' equity 780,652 832,161 838,975 823,754 810,490 Adjusted return on average stockholders' equity 10.42% 10.87% 12.42% 12.69% 14.80% Tangible common equity to tangible assets: Tangible common equity $ 603,067 $ 624,709 $ 660,386 $ 646,684 $ 637,601 Tangible assets 6,969,623 6,670,674 6,530,614 6,537,155 6,371,568 Tangible common equity to tangible assets 8.65% 9.36% 10.11% 9.89% 10.01% Return on average tangible common stockholders' equity: Tangible net income available to common � stockholders $ 21,644 $ 23,278 $ 18,259 $ 26,375 $ 29,641 Average tangible common stockholders' equity 617,584 657,350 662,141 645,176 630,146 Return on average tangible common � stockholders' equity 14.06% 14.36% 10.94% 16.22% 18.87% Adjusted return on average tangible common � stockholders' equity: Adjusted tangible net income available to common � stockholders $ 21,644 $ 23,278 $ 27,331 $ 27,419 $ 31,054 Average tangible common stockholders' equity 617,584 657,350 662,141 645,176 630,146 Adjusted return on average tangible common � stockholders' equity 14.06% 14.36% 16.38% 16.86% 19.77% Tangible book value per share: Tangible common equity $ 603,067 $ 624,709 $ 660,386 $ 646,684 $ 637,601 Common shares outstanding 37,669,102 37,811,582 37,713,903 37,690,087 38,094,972 Tangible book value per share $ 16.01 $ 16.52 $ 17.51 $ 17.16 $ 16.74