1Q23 Earnings Presentation Exhibit 99.2

2 Forward-Looking Statements Forward-Looking Statements This communication contains forward-looking statements within the meaning of the U.S. federal securities laws. Forward-looking statements include, without limitation, statements concerning plans, estimates, calculations, forecasts and projections with respect to the anticipated future performance of the Company. These statements are often, but not always, made through the use of words or phrases such as ‘‘may’’, ‘‘might’’, ‘‘should’’, ‘‘could’’, ‘‘predict’’, ‘‘potential’’, ‘‘believe’’, ‘‘expect’’, ‘‘continue’’, ‘‘will’’, ‘‘anticipate’’, ‘‘seek’’, ‘‘estimate’’, ‘‘intend’’, ‘‘plan’’, ‘‘projection’’, ‘‘would’’, ‘‘annualized’’, “target” and ‘‘outlook’’, or the negative version of those words or other comparable words or phrases of a future or forward-looking nature. Forward-looking statements involve estimates and known and unknown risks, and reflect various assumptions and involve elements of subjective judgement and analysis, which may or may not prove to be correct, and which are subject to uncertainties and contingencies outside the control of Byline and its respective affiliates, directors, employees and other representatives, which could cause actual results to differ materially from those presented in this communication. No representations, warranties or guarantees are or will be made by Byline as to the reliability, accuracy or completeness of any forward-looking statements contained in this communication or that such forward-looking statements are or will remain based on reasonable assumptions. You should not place undue reliance on any forward-looking statements contained in this communication. Certain risks and important factors that could affect Byline’s future results are identified in our Annual Report on Form 10-K and other reports we file with the Securities and Exchange Commission, including among other things under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022. Any forward-looking statement speaks only as of the date on which it is made, and Byline undertakes no obligation to update any forward-looking statement, whether to reflect events or circumstances after the date on which the statement is made, to reflect new information or the occurrence of unanticipated events, or otherwise unless required under the federal securities laws. Due to rounding, numbers presented throughout this document may not add up precisely to the totals provided and percentages may not precisely reflect the absolute figures. Current Expected Credit Loss (“CECL”) Adoption On December 31, 2022, the Company adopted CECL and applied it retrospectively to the period beginning January 1, 2022 using the modified retrospective method of accounting. Results for reporting periods beginning after September 30, 2022 are presented under the new standard, while prior quarters previously reported are recast as if the new standard had been applied since January 1, 2022.

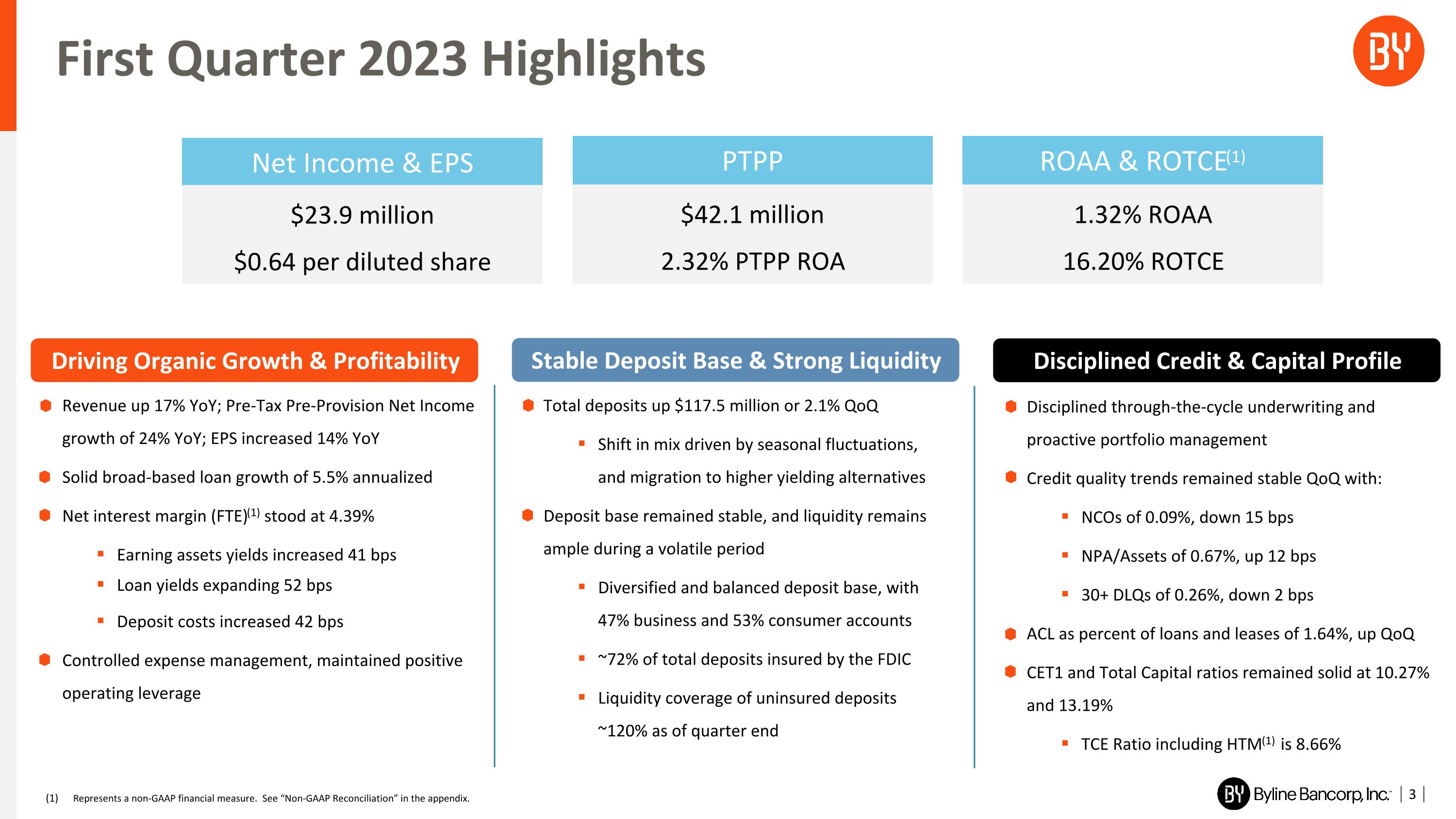

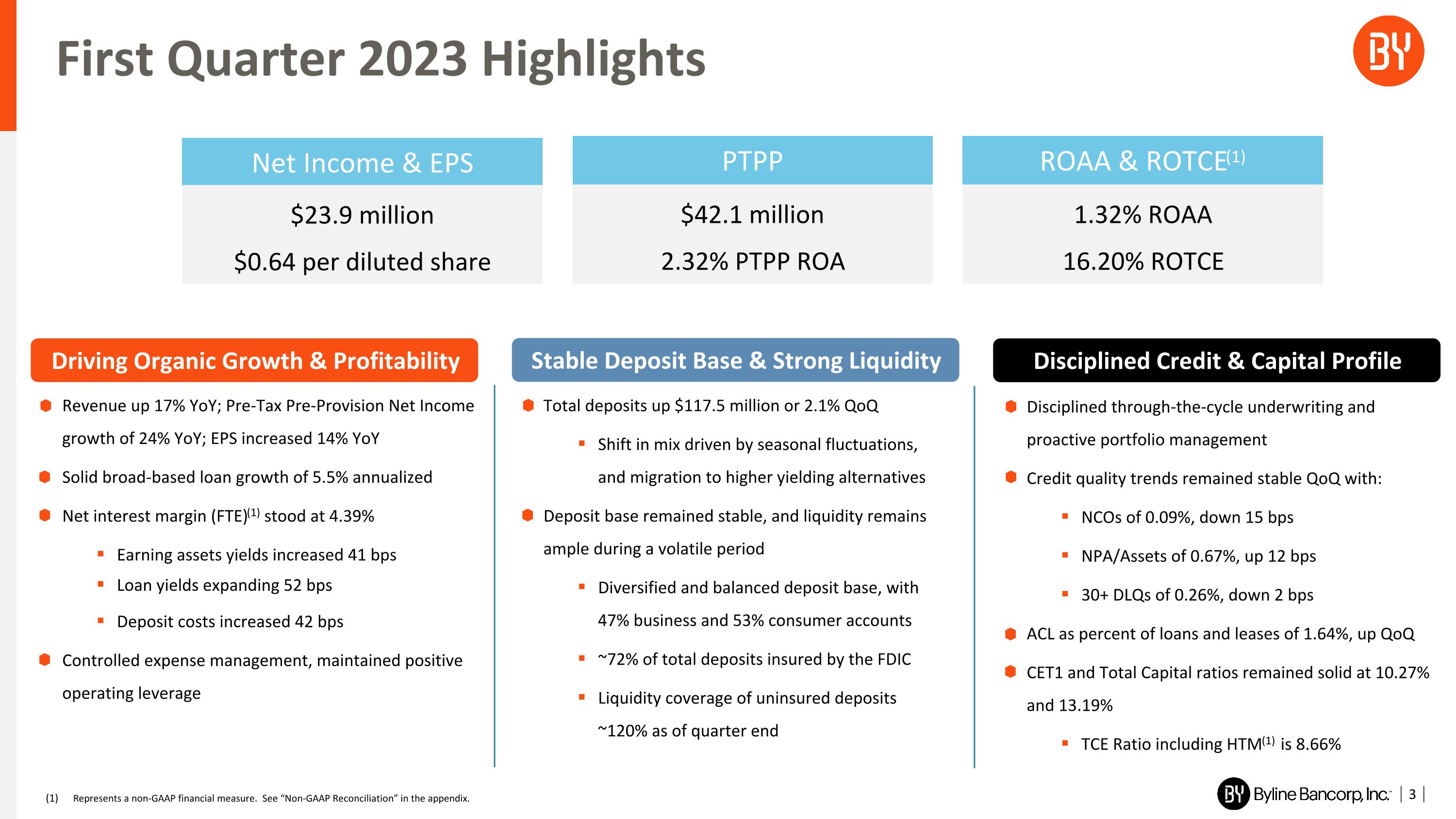

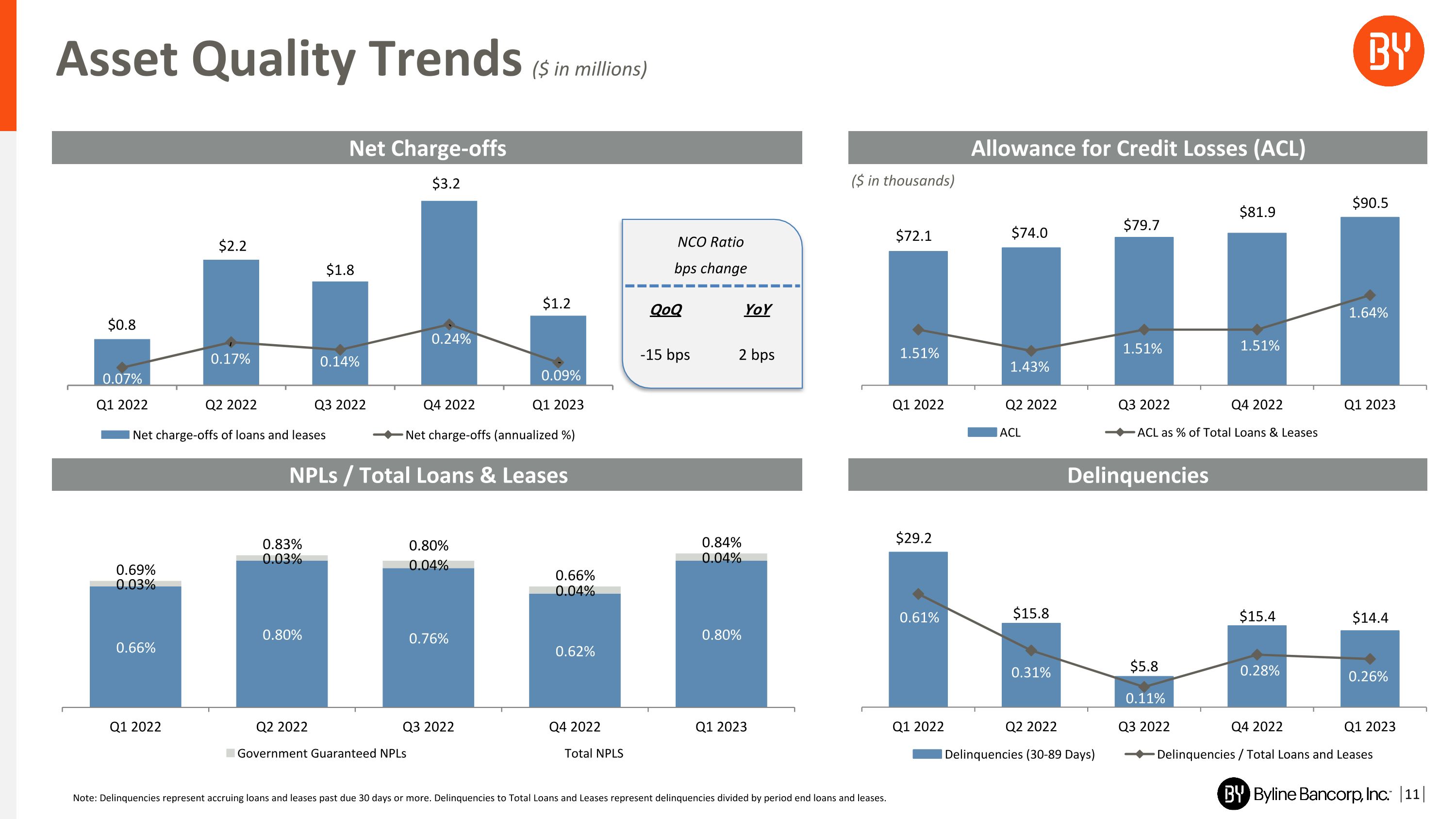

Total deposits up $117.5 million or 2.1% QoQ Shift in mix driven by seasonal fluctuations, and migration to higher yielding alternatives Deposit base remained stable, and liquidity remains ample during a volatile period Diversified and balanced deposit base, with 47% business and 53% consumer accounts ~72% of total deposits insured by the FDIC Liquidity coverage of uninsured deposits ~120% as of quarter end ROAA & ROTCE(1) PTPP Net Income & EPS First Quarter 2023 Highlights $0.64 per diluted share $23.9 million 16.20% ROTCE 1.32% ROAA 2.32% PTPP ROA $42.1 million Driving Organic Growth & Profitability Stable Deposit Base & Strong Liquidity Disciplined Credit & Capital Profile Revenue up 17% YoY; Pre-Tax Pre-Provision Net Income growth of 24% YoY; EPS increased 14% YoY Solid broad-based loan growth of 5.5% annualized Net interest margin (FTE)(1) stood at 4.39% Earning assets yields increased 41 bps Loan yields expanding 52 bps Deposit costs increased 42 bps Controlled expense management, maintained positive operating leverage 3 Represents a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the appendix. Disciplined through-the-cycle underwriting and proactive portfolio management Credit quality trends remained stable QoQ with: NCOs of 0.09%, down 15 bps NPA/Assets of 0.67%, up 12 bps 30+ DLQs of 0.26%, down 2 bps ACL as percent of loans and leases of 1.64%, up QoQ CET1 and Total Capital ratios remained solid at 10.27% and 13.19% TCE Ratio including HTM(1) is 8.66%

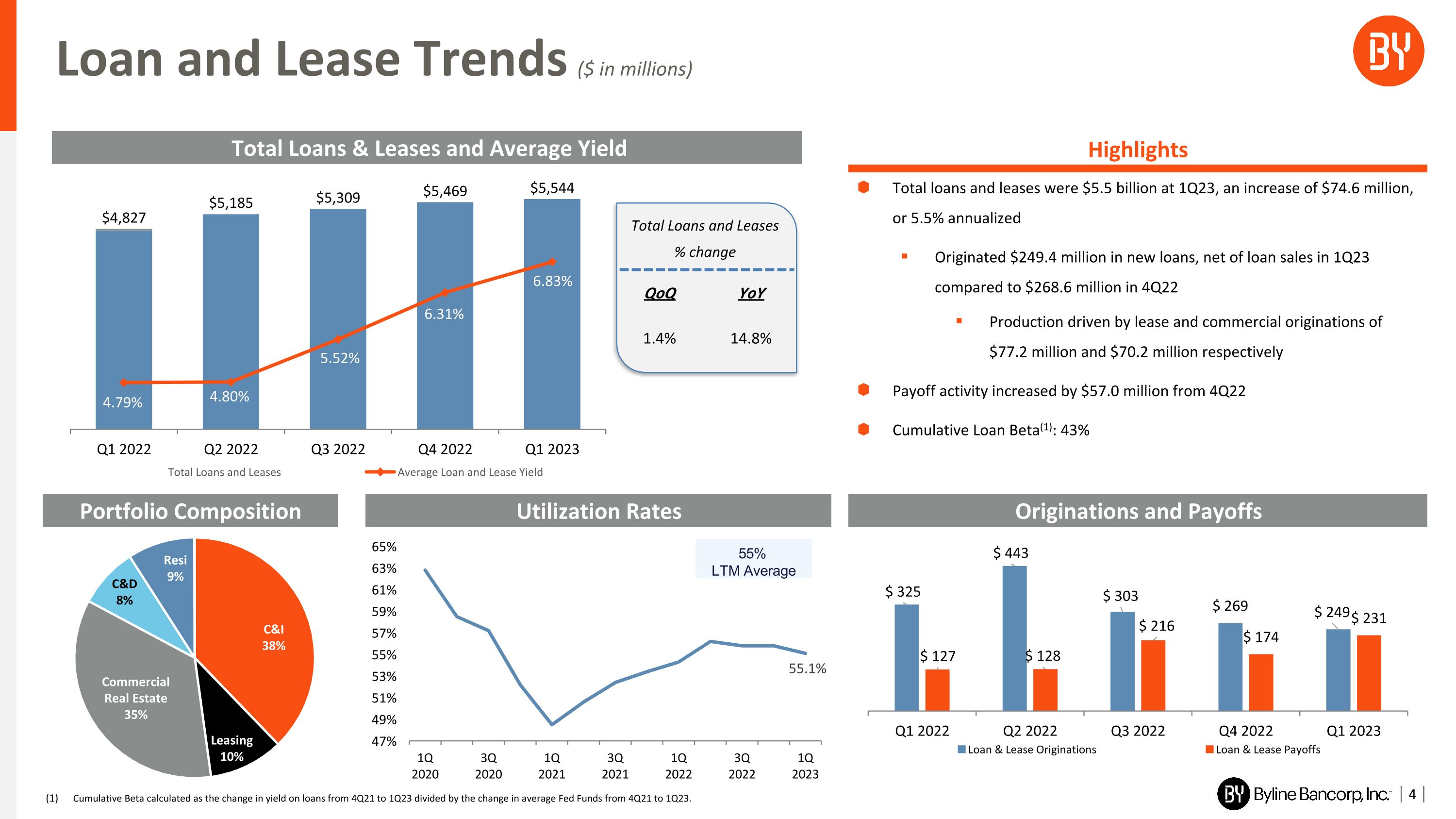

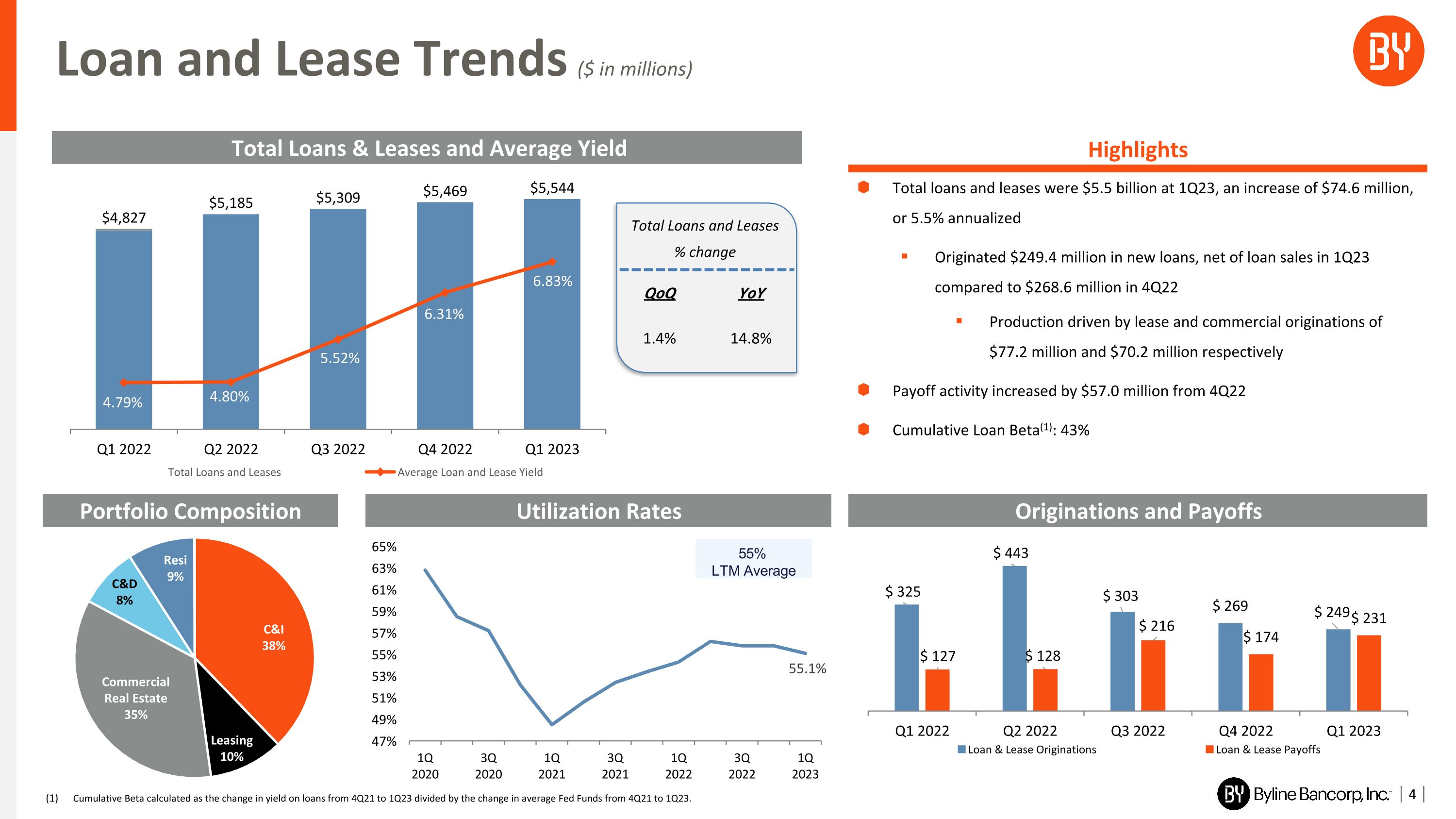

Loan and Lease Trends ($ in millions) Total Loans & Leases and Average Yield Portfolio Composition Total loans and leases were $5.5 billion at 1Q23, an increase of $74.6 million, or 5.5% annualized Originated $249.4 million in new loans, net of loan sales in 1Q23 compared to $268.6 million in 4Q22 Production driven by lease and commercial originations of $77.2 million and $70.2 million respectively Payoff activity increased by $57.0 million from 4Q22 Cumulative Loan Beta(1): 43% Highlights Total Loans and Leases % change QoQ YoY 1.4% 14.8% Utilization Rates 55% LTM Average Originations and Payoffs Cumulative Beta calculated as the change in yield on loans from 4Q21 to 1Q23 divided by the change in average Fed Funds from 4Q21 to 1Q23. 4

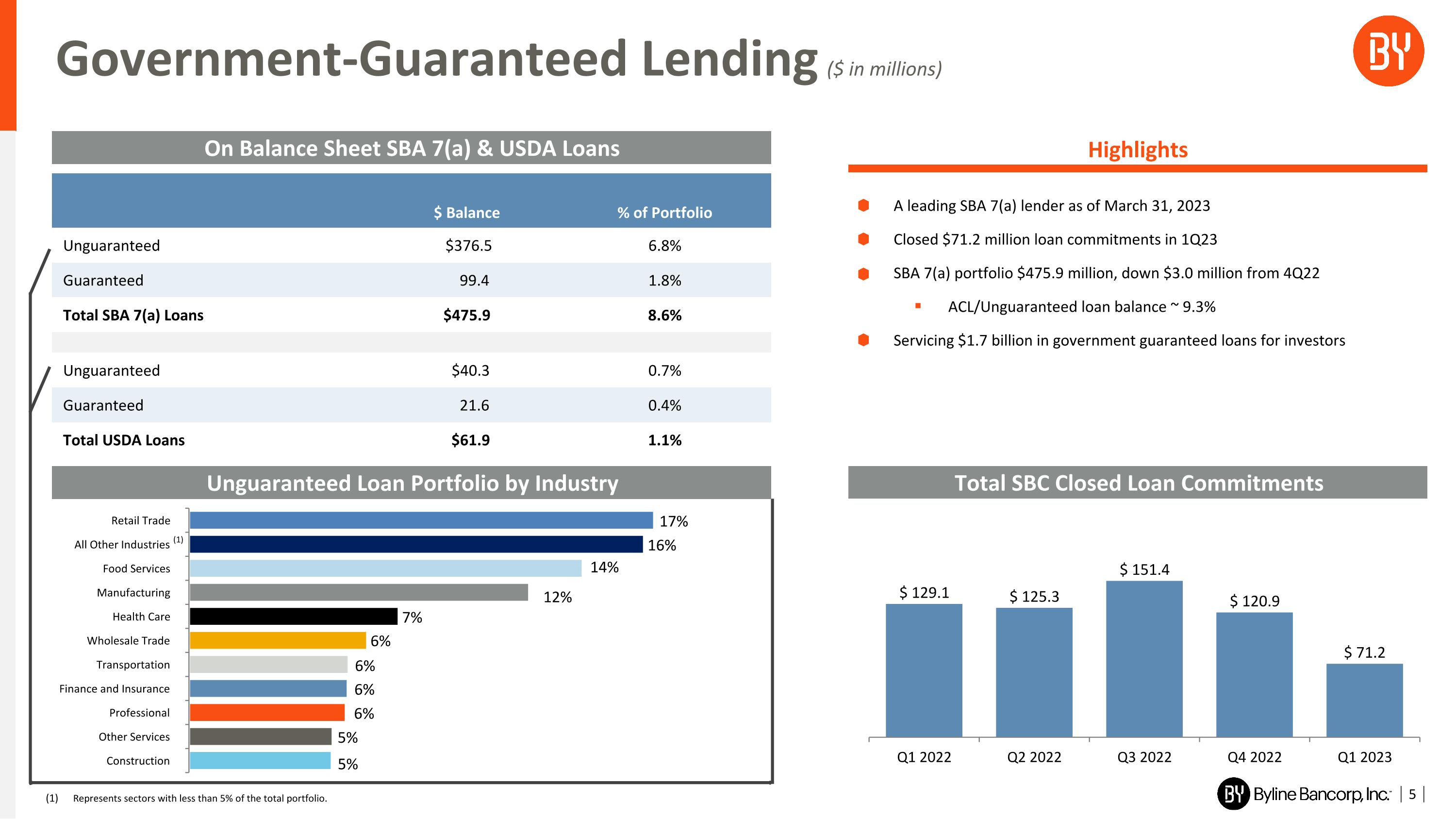

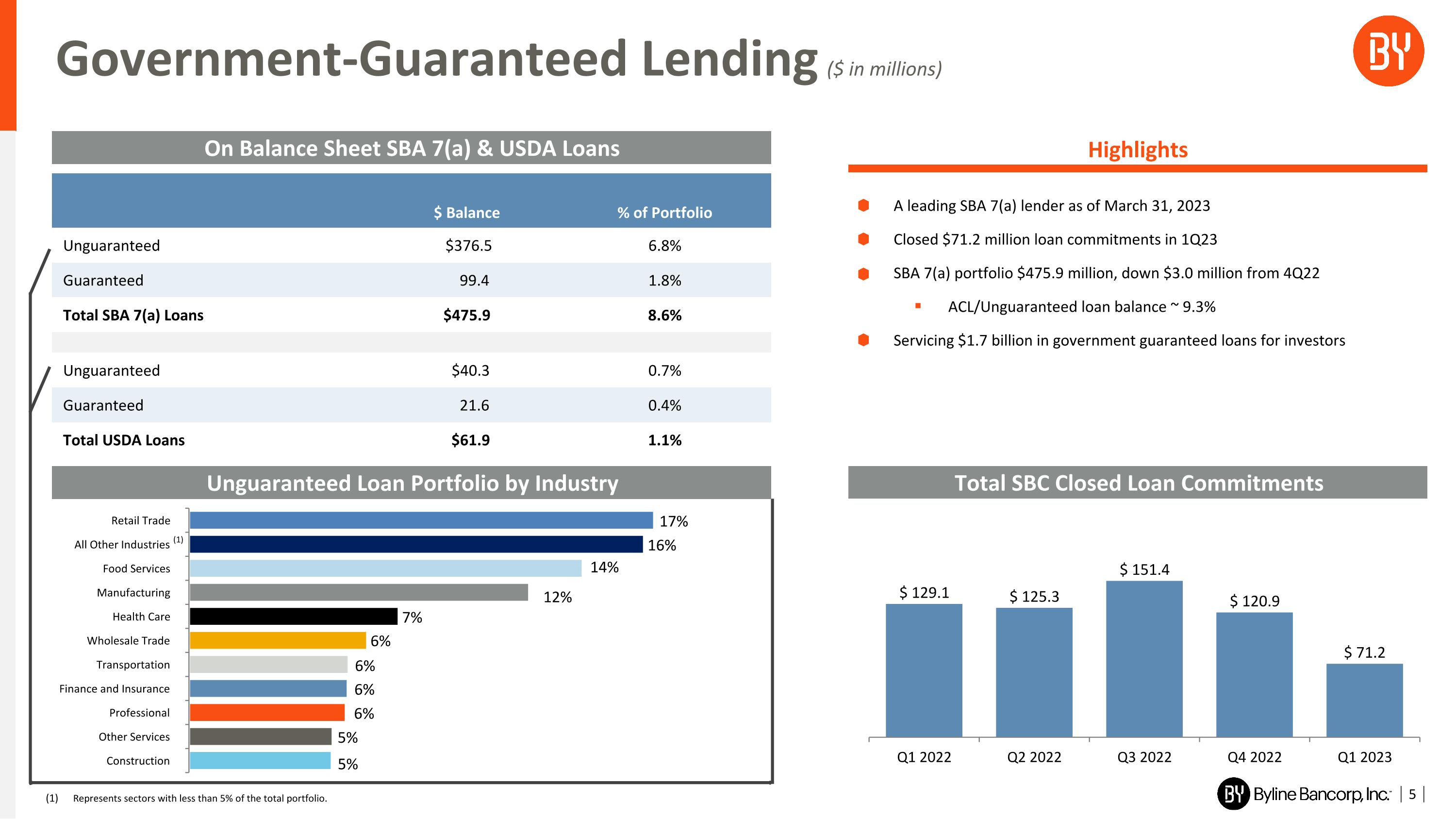

(1) $ Balance % of Portfolio Unguaranteed $376.5 6.8% Guaranteed 99.4 1.8% Total SBA 7(a) Loans $475.9 8.6% Unguaranteed $40.3 0.7% Guaranteed 21.6 0.4% Total USDA Loans $61.9 1.1% Unguaranteed Loan Portfolio by Industry A leading SBA 7(a) lender as of March 31, 2023 Closed $71.2 million loan commitments in 1Q23 SBA 7(a) portfolio $475.9 million, down $3.0 million from 4Q22 ACL/Unguaranteed loan balance ~ 9.3% Servicing $1.7 billion in government guaranteed loans for investors Government-Guaranteed Lending ($ in millions) On Balance Sheet SBA 7(a) & USDA Loans Total SBC Closed Loan Commitments Highlights Represents sectors with less than 5% of the total portfolio. 5

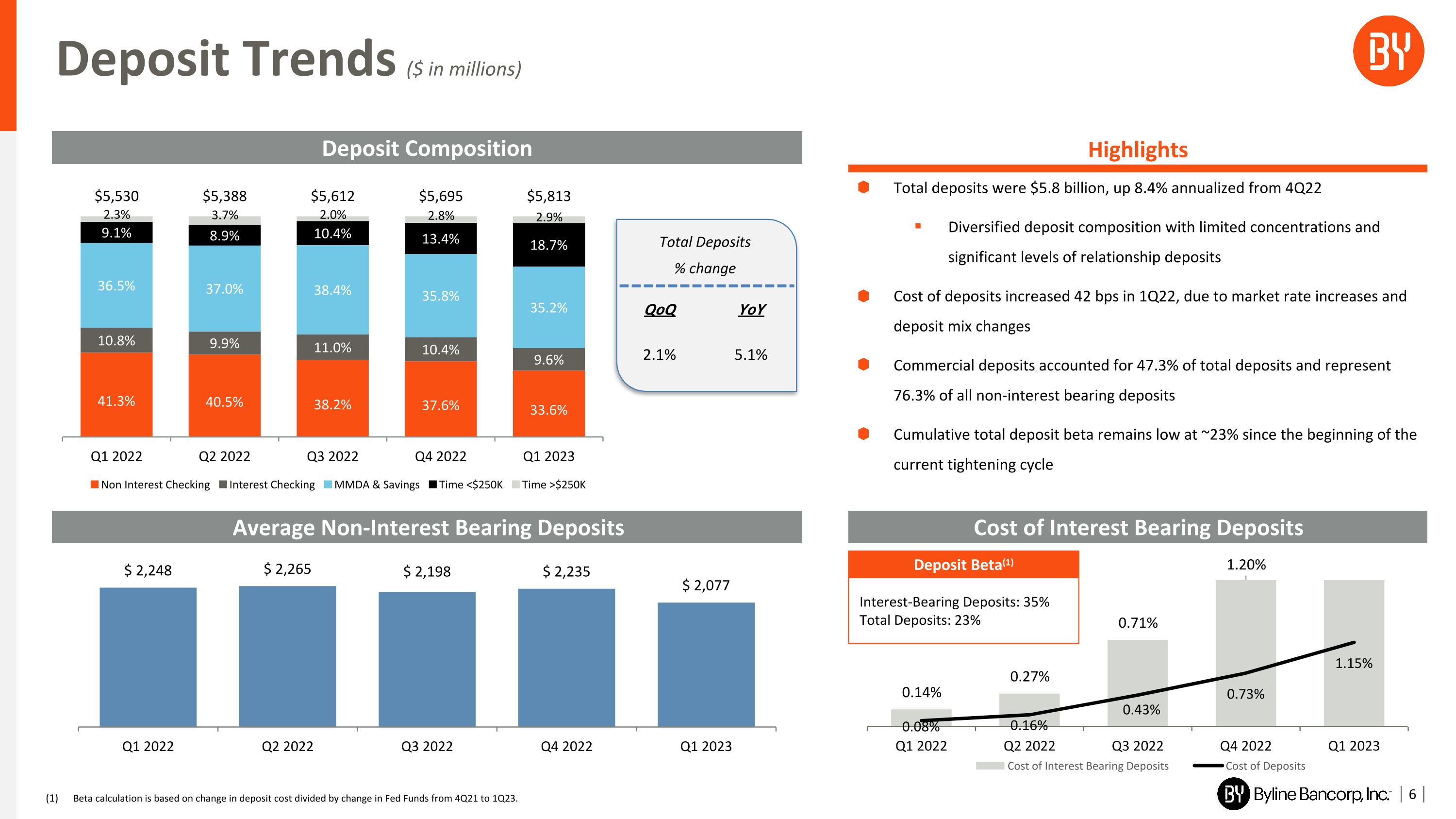

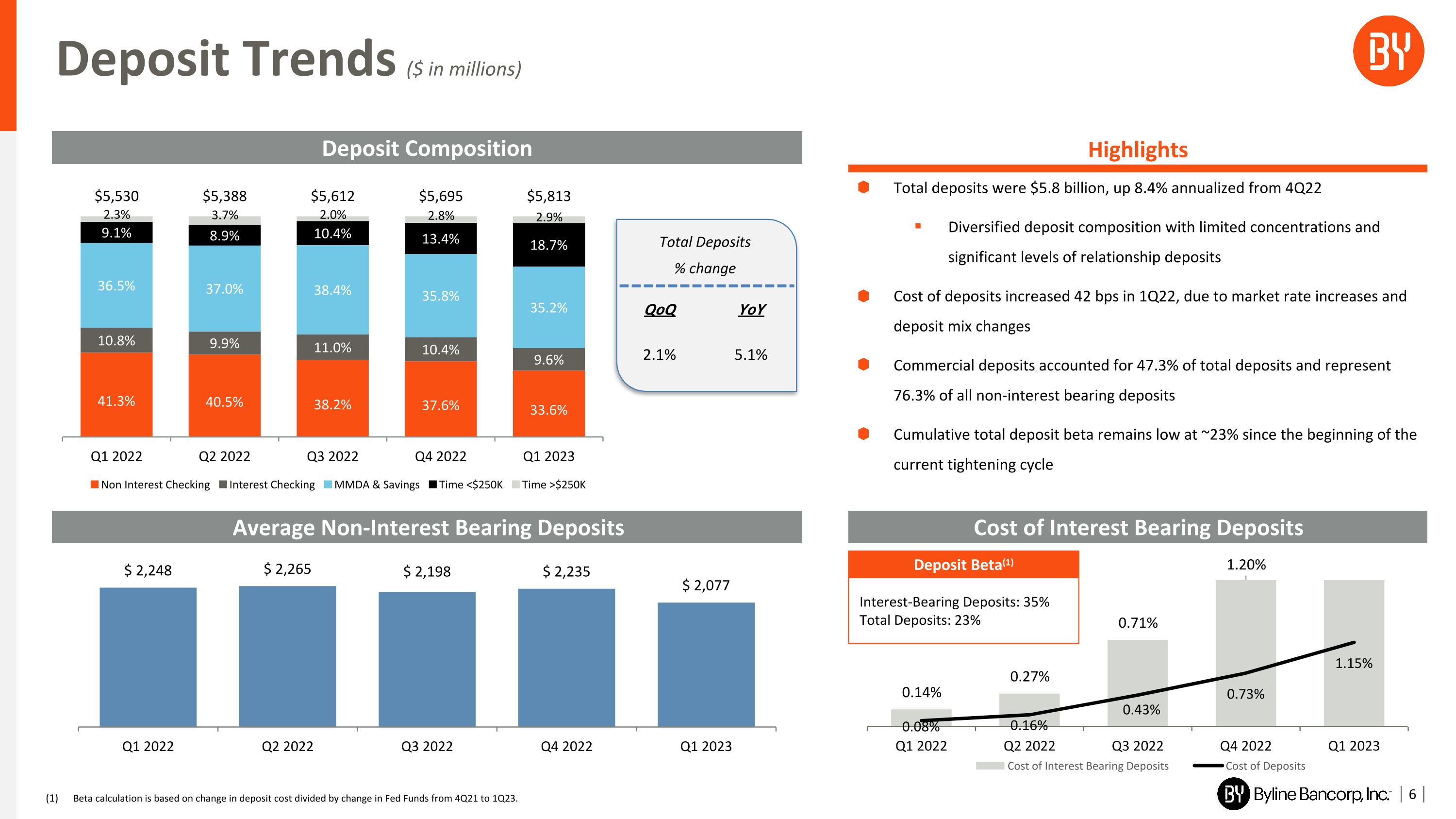

Cost of Interest Bearing Deposits Total deposits were $5.8 billion, up 8.4% annualized from 4Q22 Diversified deposit composition with limited concentrations and significant levels of relationship deposits Cost of deposits increased 42 bps in 1Q22, due to market rate increases and deposit mix changes Commercial deposits accounted for 47.3% of total deposits and represent 76.3% of all non-interest bearing deposits Cumulative total deposit beta remains low at ~23% since the beginning of the current tightening cycle Deposit Trends ($ in millions) Deposit Composition Highlights Average Non-Interest Bearing Deposits Deposit Beta(1) Interest-Bearing Deposits: 35% Total Deposits: 23% 6 Beta calculation is based on change in deposit cost divided by change in Fed Funds from 4Q21 to 1Q23. Total Deposits % change QoQ YoY 2.1% 5.1%

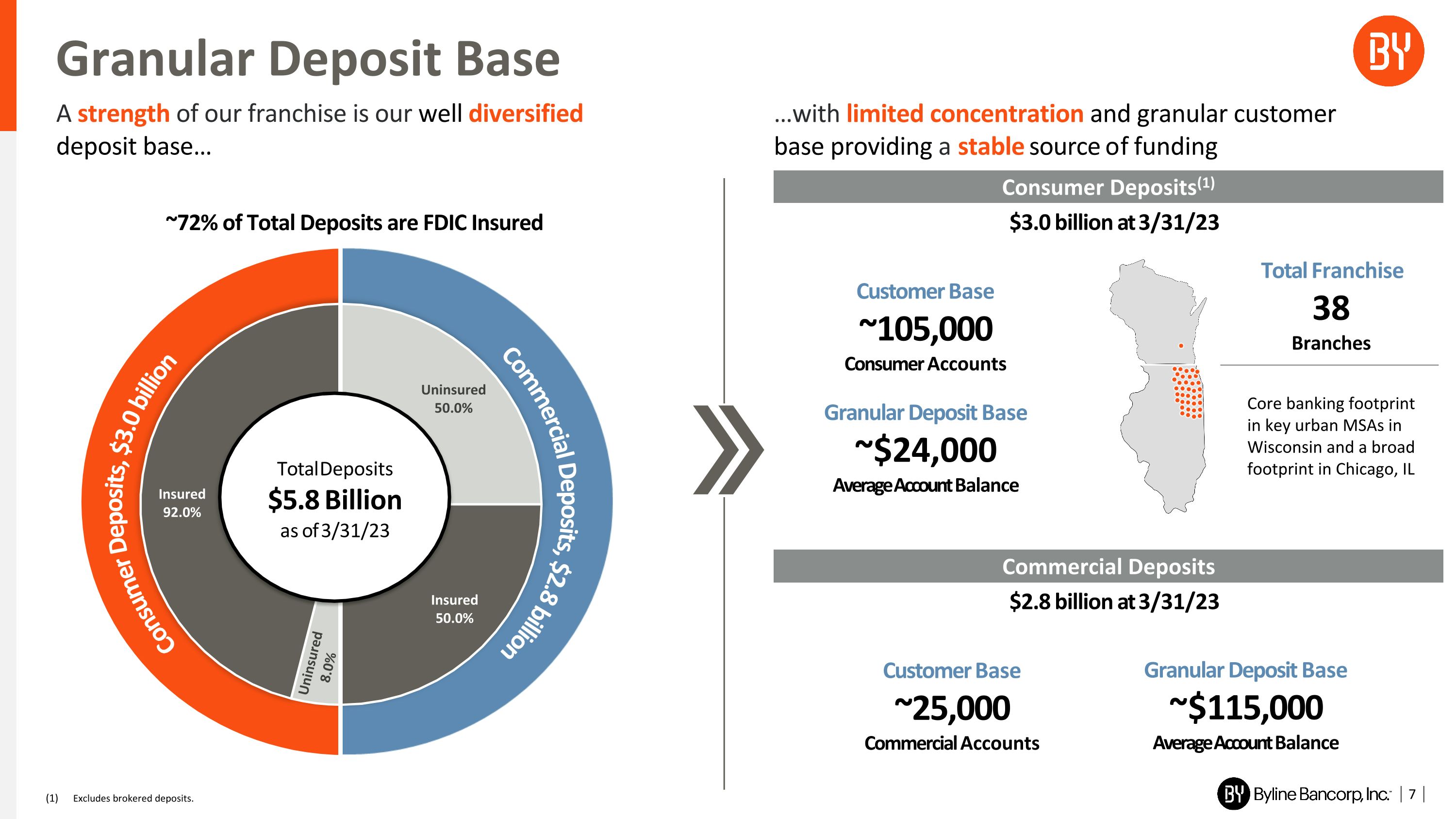

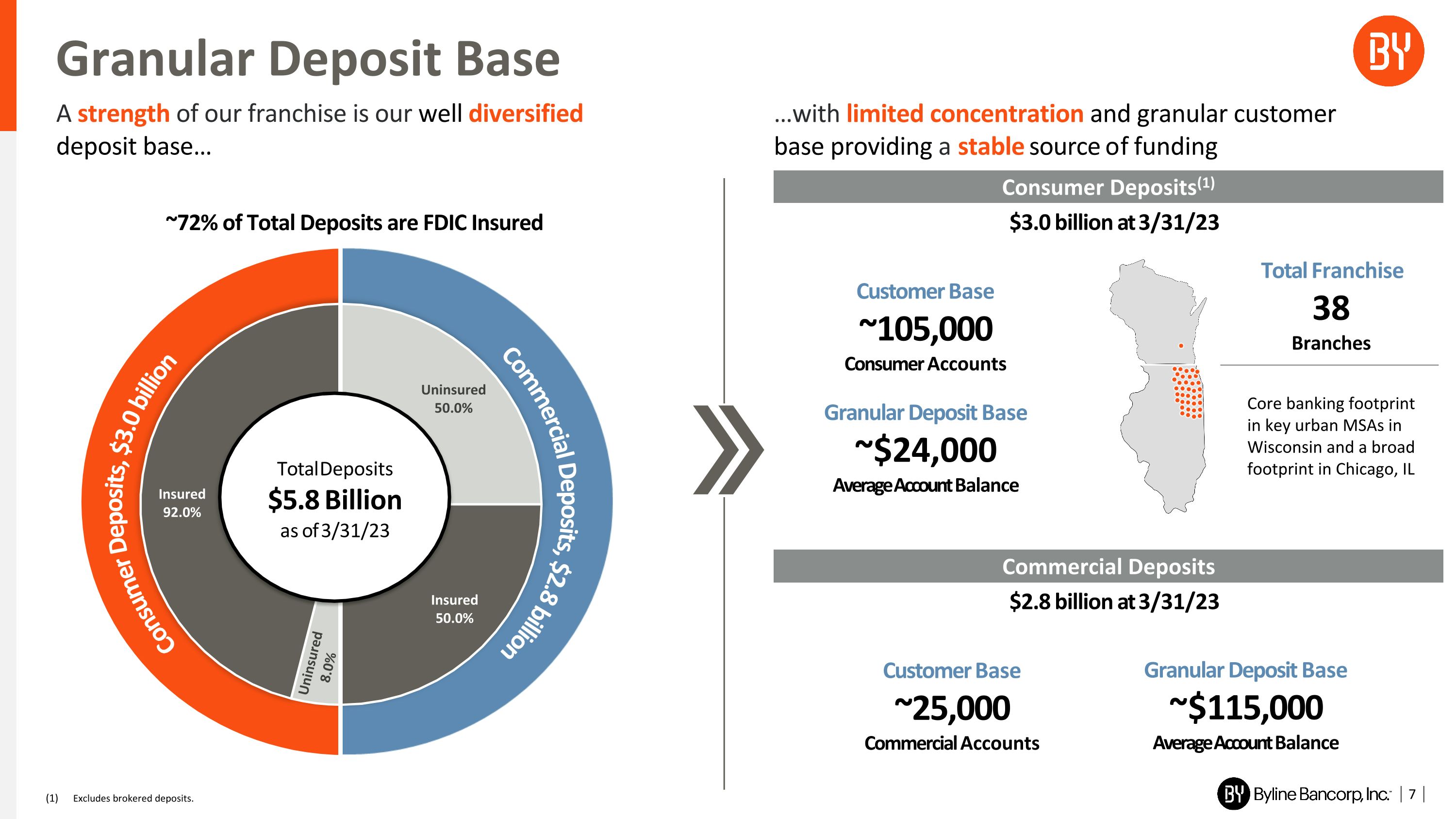

Granular Deposit Base 7 Consumer Deposits, $3.1 billion Commercial Deposits, $2.8 billion ~72% of Total Deposits are FDIC Insured …with limited concentration and granular customer base providing a stable source of funding Consumer Deposits(1) $3.0 billion at 3/31/23 Granular Deposit Base ~$24,000 Average Account Balance Customer Base ~105,000 Consumer Accounts Total Franchise 38 Branches Commercial Deposits $2.8 billion at 3/31/23 Granular Deposit Base ~$115,000 Average Account Balance Customer Base ~25,000 Commercial Accounts Consumer Deposits, $3.0 billion Commercial Deposits, $2.8 billion Uninsured 8.0% d Total Deposits $5.8 Billion as of 3/31/23 Core banking footprint in key urban MSAs in Wisconsin and a broad footprint in Chicago, IL A strength of our franchise is our well diversified deposit base… Excludes brokered deposits.

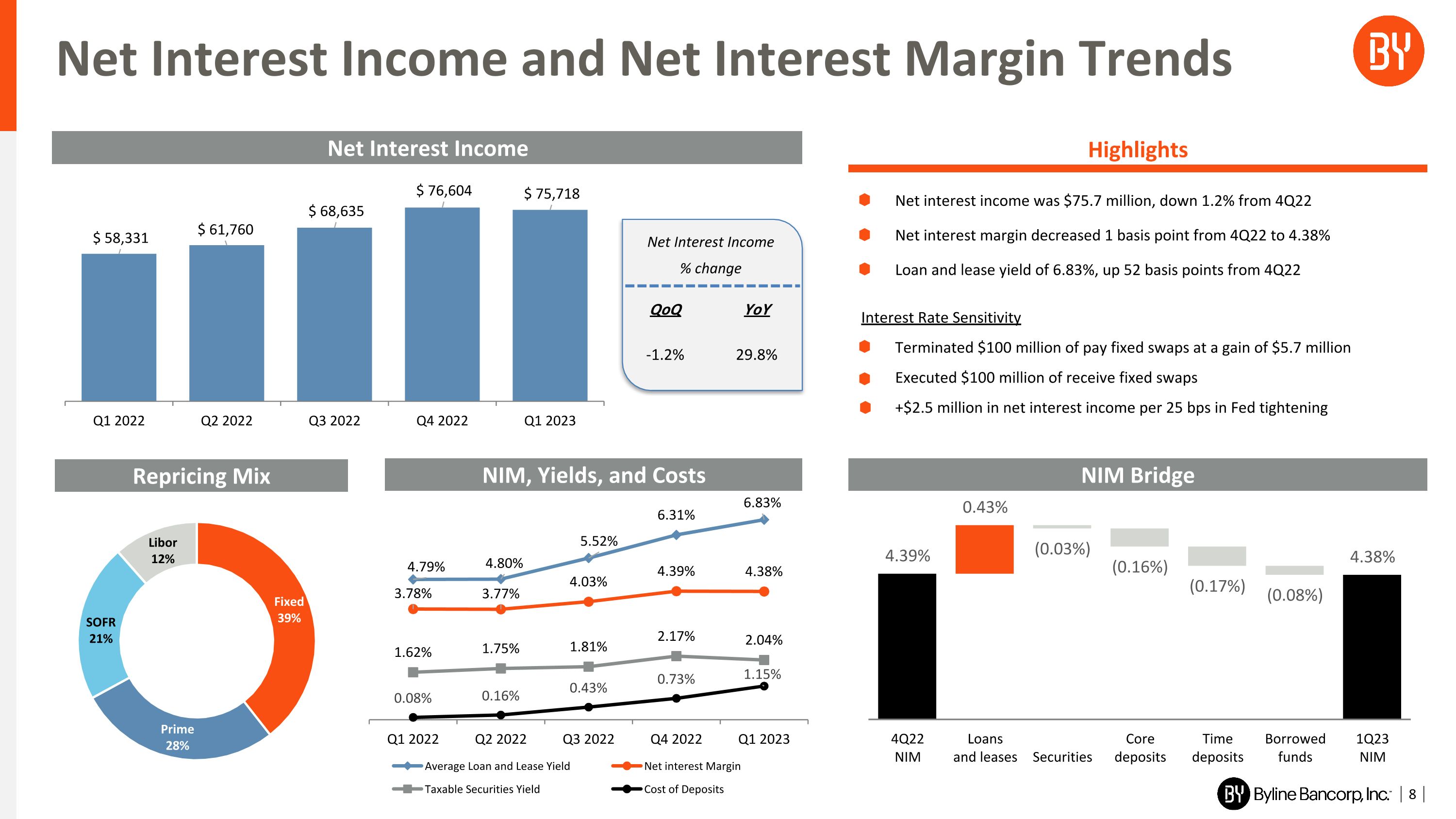

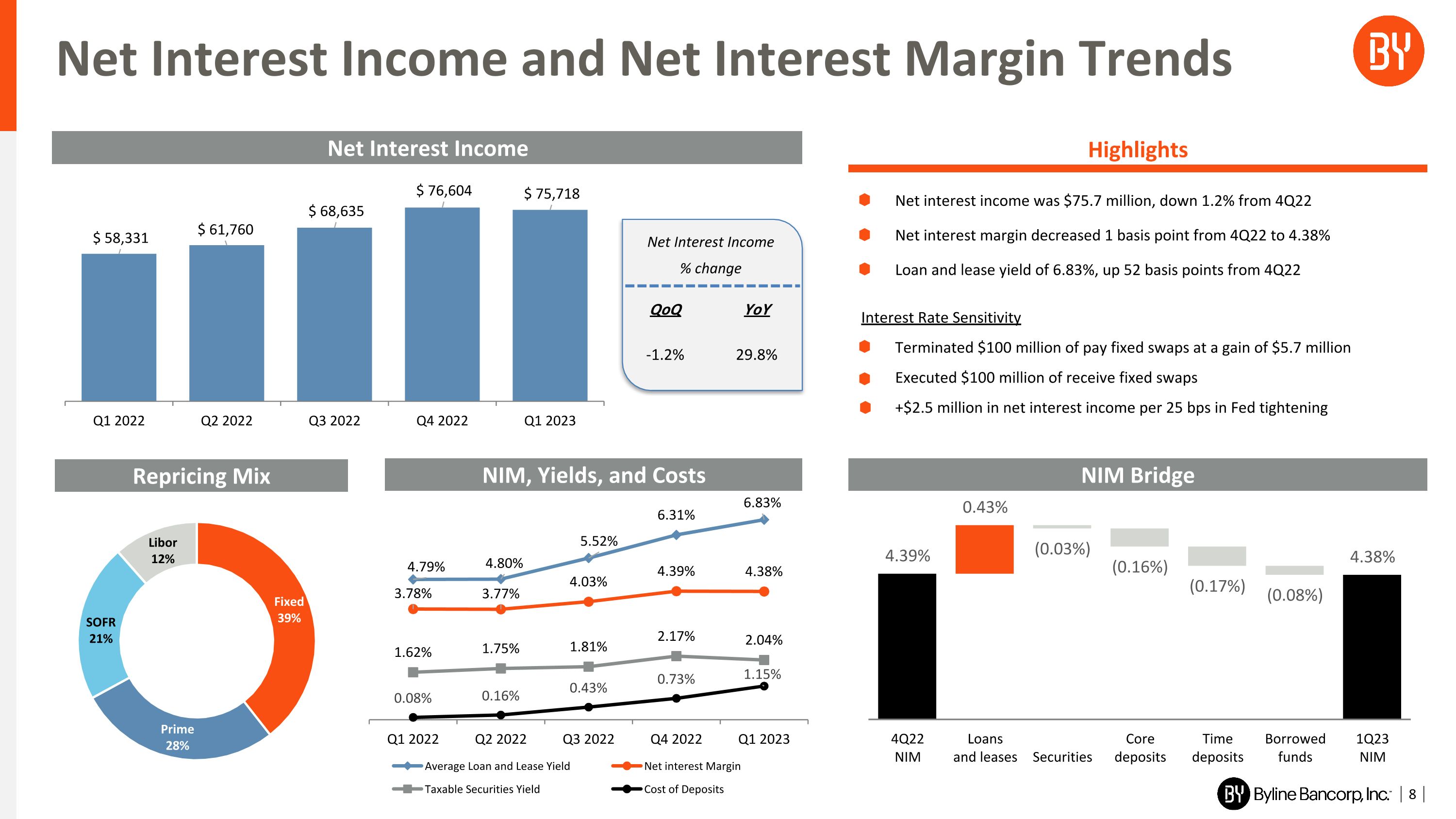

Net interest income was $75.7 million, down 1.2% from 4Q22 Net interest margin decreased 1 basis point from 4Q22 to 4.38% Loan and lease yield of 6.83%, up 52 basis points from 4Q22 Interest Rate Sensitivity Terminated $100 million of pay fixed swaps at a gain of $5.7 million Executed $100 million of receive fixed swaps +$2.5 million in net interest income per 25 bps in Fed tightening NIM Bridge Net Interest Income and Net Interest Margin Trends Net Interest Income Highlights NIM, Yields, and Costs 8 Net Interest Income % change QoQ YoY -1.2% 29.8% Repricing Mix

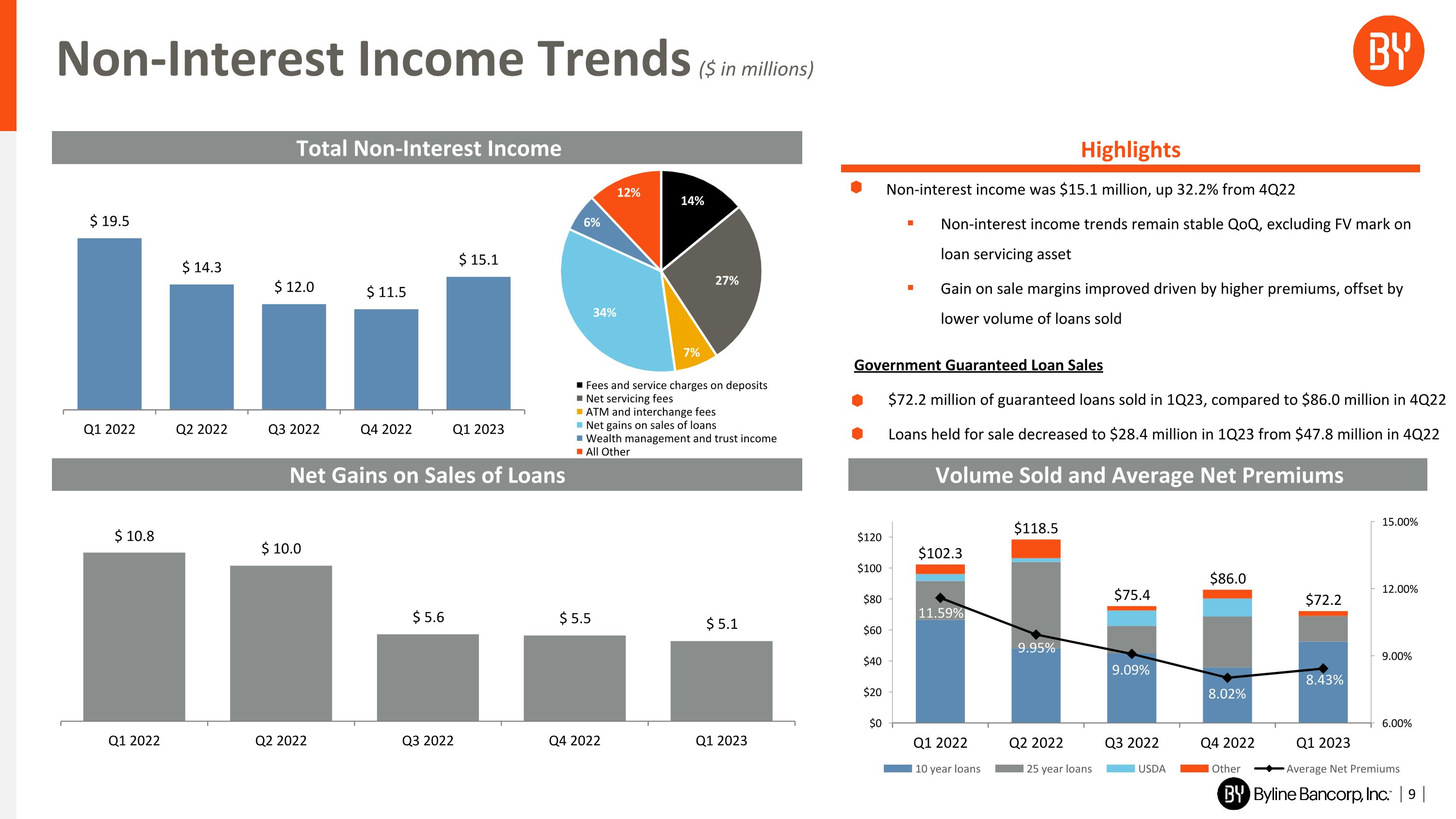

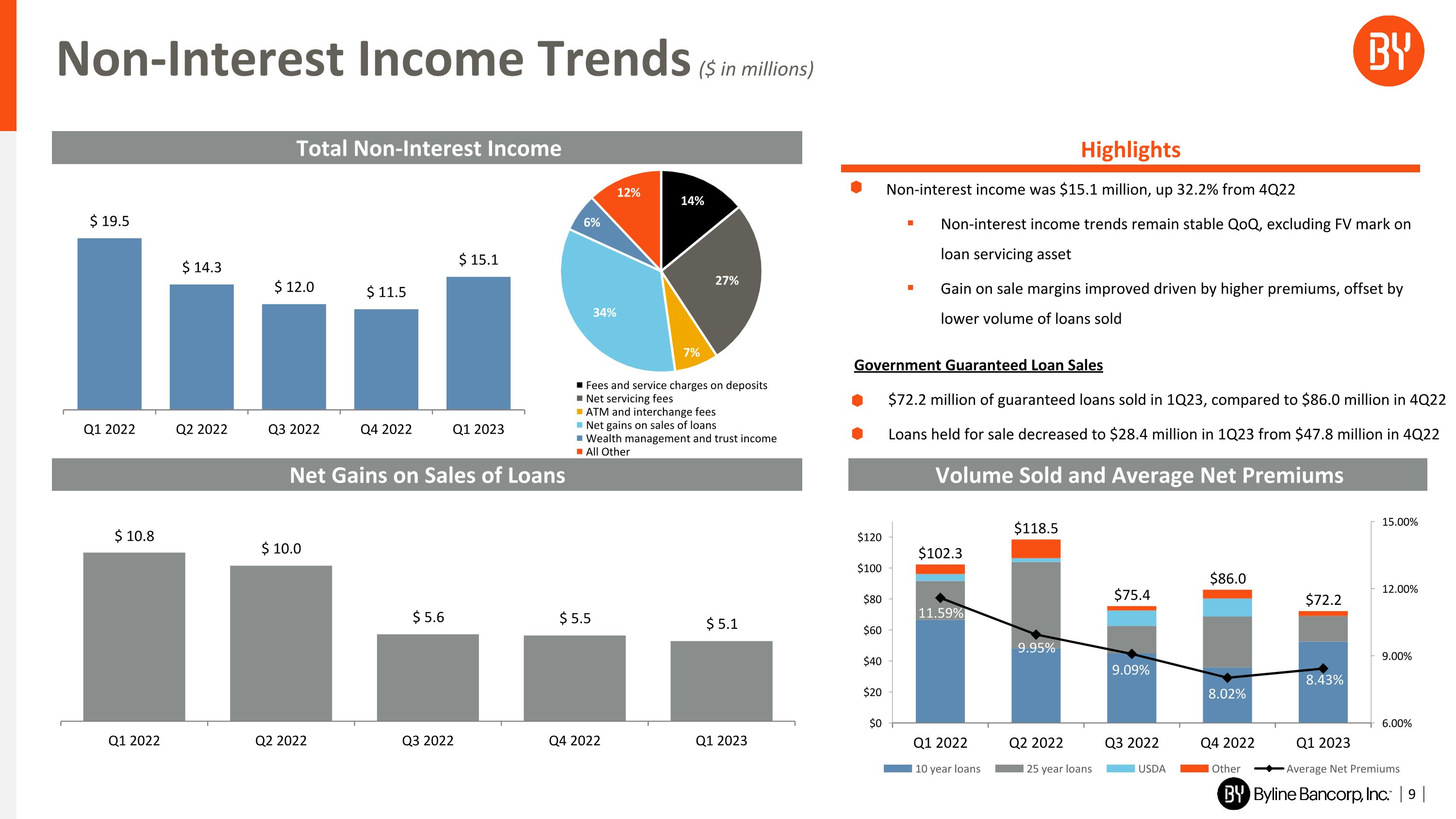

Government Guaranteed Loan Sales $72.2 million of guaranteed loans sold in 1Q23, compared to $86.0 million in 4Q22 Loans held for sale decreased to $28.4 million in 1Q23 from $47.8 million in 4Q22 Non-interest income was $15.1 million, up 32.2% from 4Q22 Non-interest income trends remain stable QoQ, excluding FV mark on loan servicing asset Gain on sale margins improved driven by higher premiums, offset by lower volume of loans sold Volume Sold and Average Net Premiums Non-Interest Income Trends ($ in millions) Total Non-Interest Income Highlights Net Gains on Sales of Loans 9

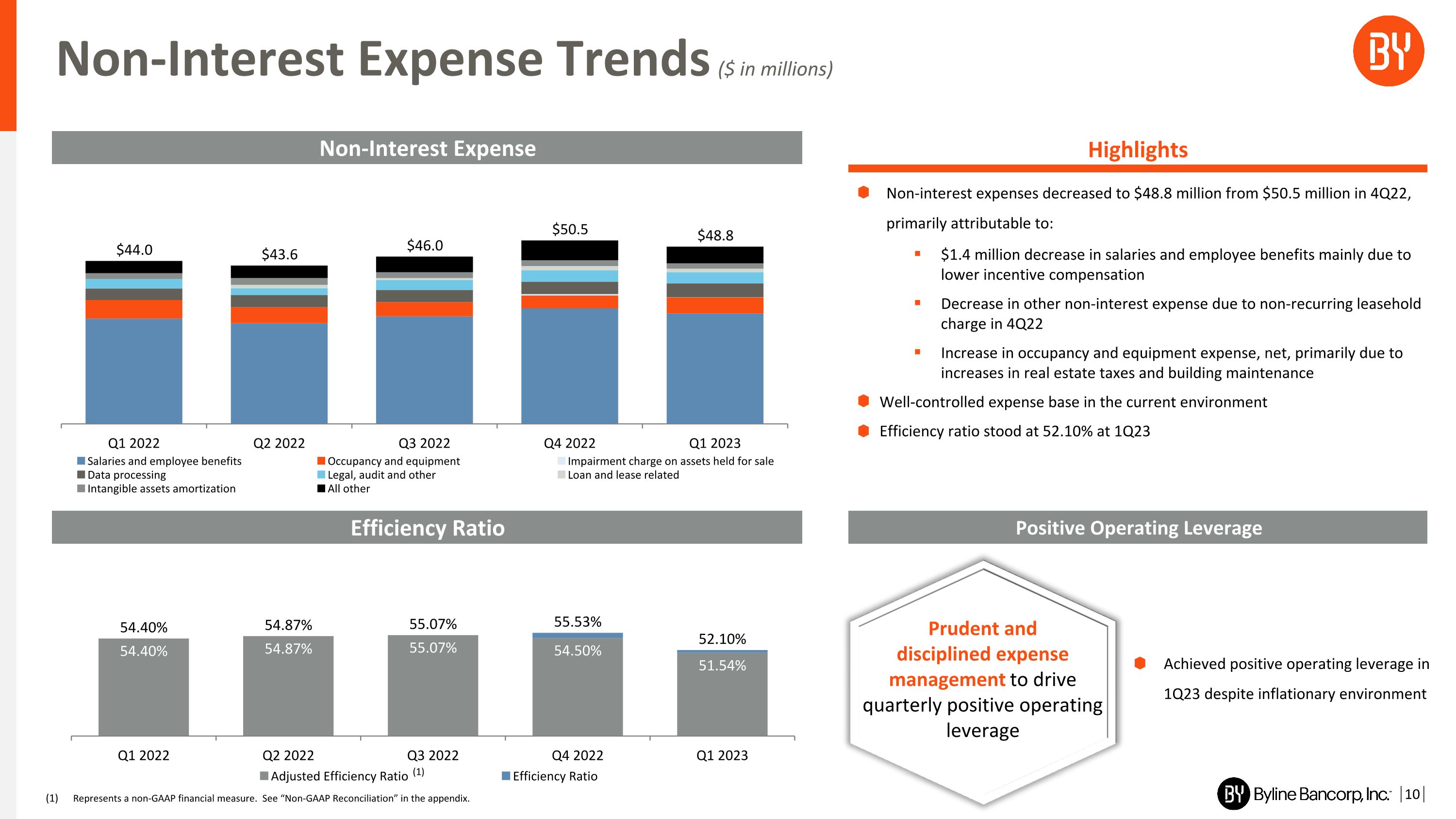

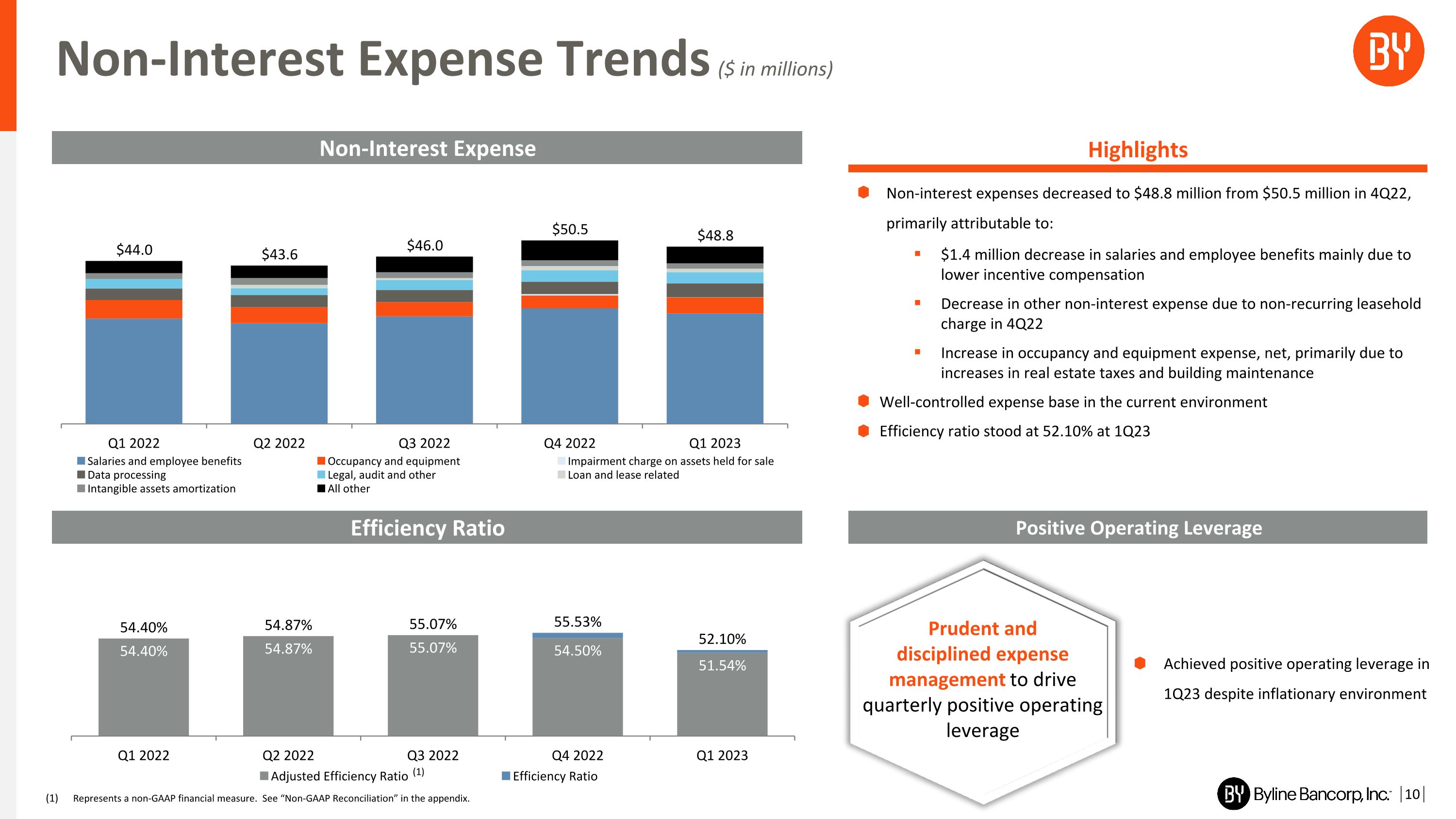

(1) Non-interest expenses decreased to $48.8 million from $50.5 million in 4Q22, primarily attributable to: $1.4 million decrease in salaries and employee benefits mainly due to lower incentive compensation Decrease in other non-interest expense due to non-recurring leasehold charge in 4Q22 Increase in occupancy and equipment expense, net, primarily due to increases in real estate taxes and building maintenance Well-controlled expense base in the current environment Efficiency ratio stood at 52.10% at 1Q23 Positive Operating Leverage Non-Interest Expense Trends ($ in millions) Non-Interest Expense Highlights Efficiency Ratio 10 Represents a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the appendix. Achieved positive operating leverage in 1Q23 despite inflationary environment Prudent and disciplined expense management to drive quarterly positive operating leverage

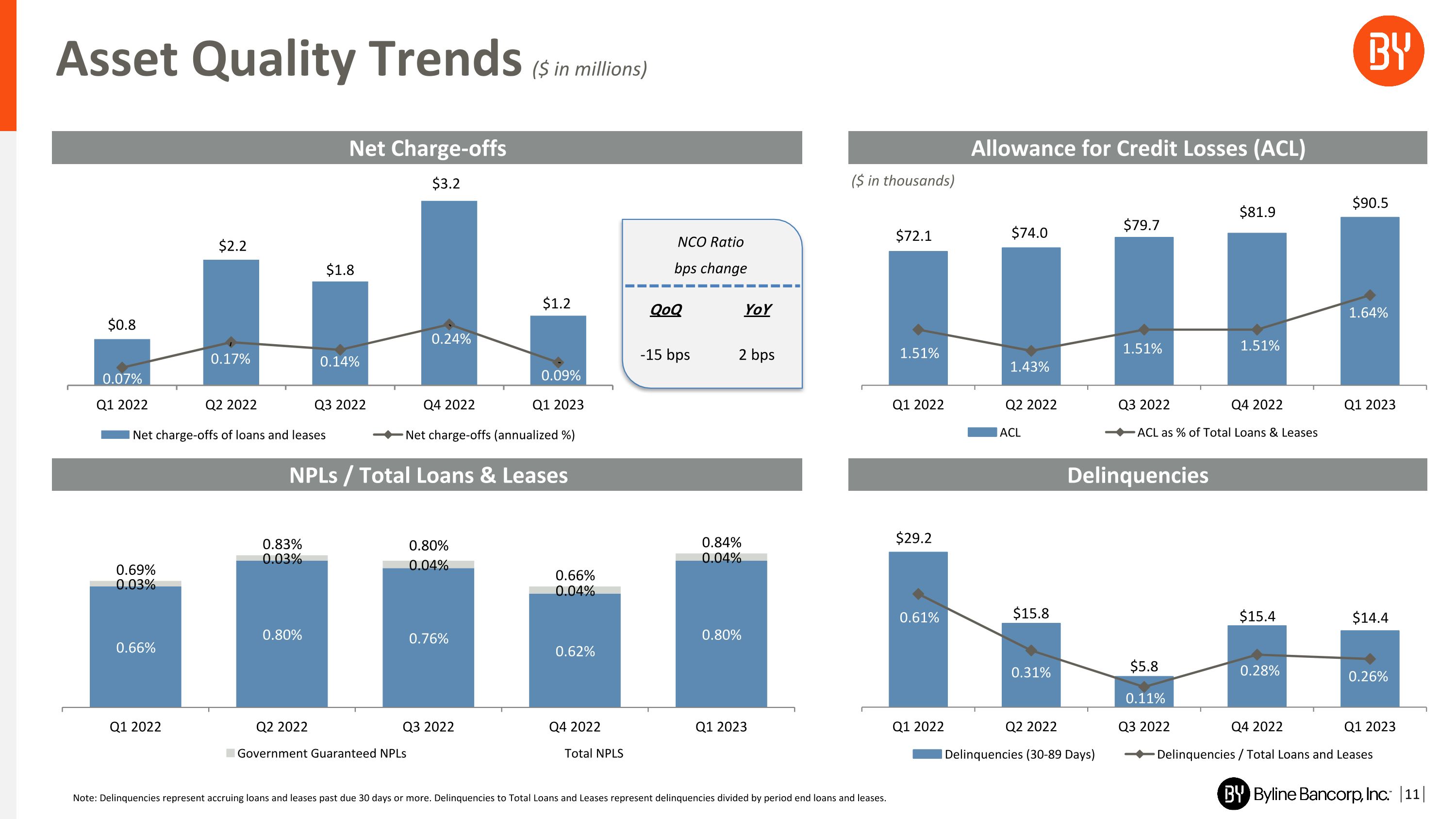

Note: Delinquencies represent accruing loans and leases past due 30 days or more. Delinquencies to Total Loans and Leases represent delinquencies divided by period end loans and leases. Delinquencies Asset Quality Trends ($ in millions) Net Charge-offs NPLs / Total Loans & Leases 11 NCO Ratio bps change QoQ YoY -15 bps 2 bps Allowance for Credit Losses (ACL) ($ in thousands)

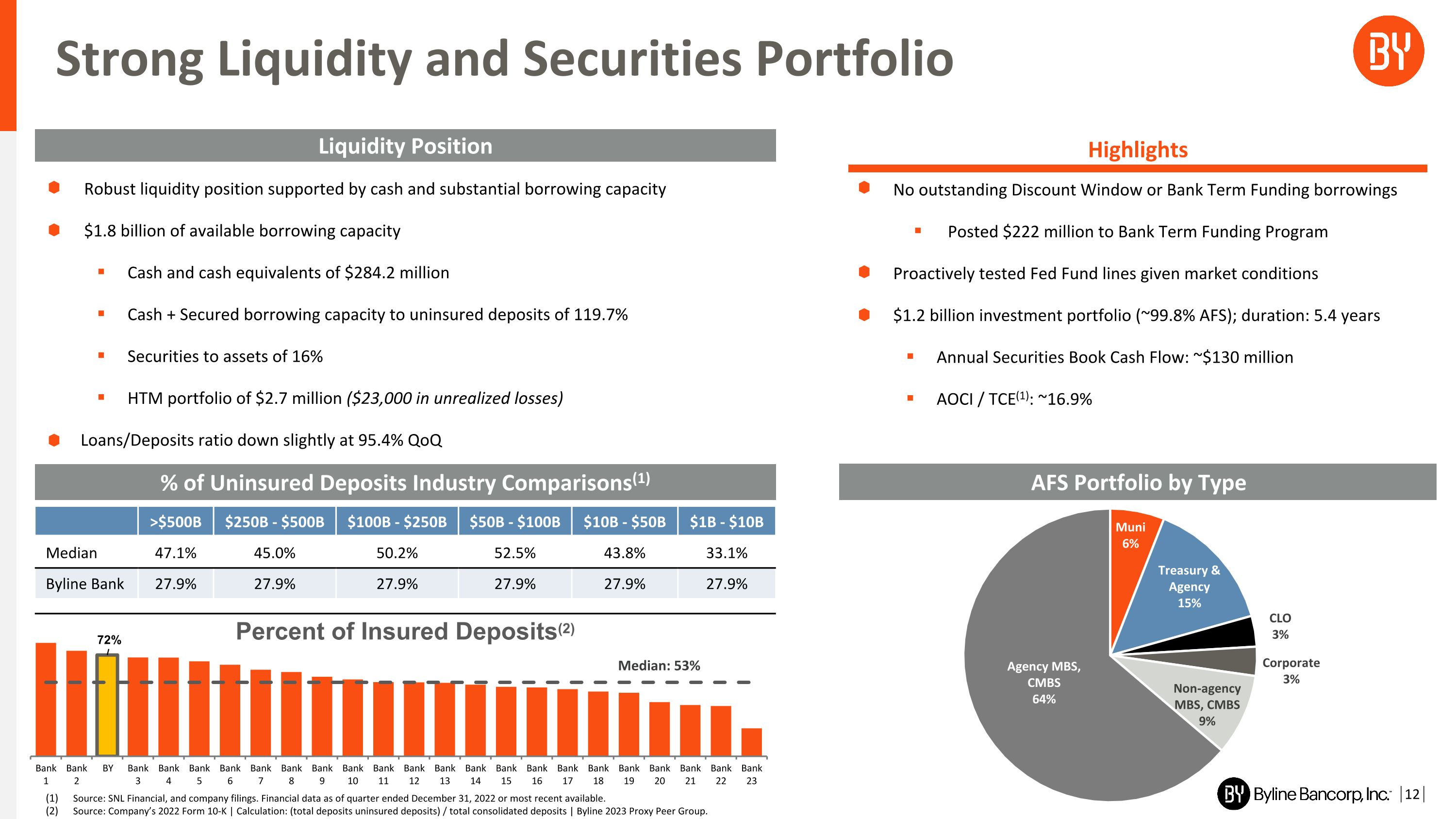

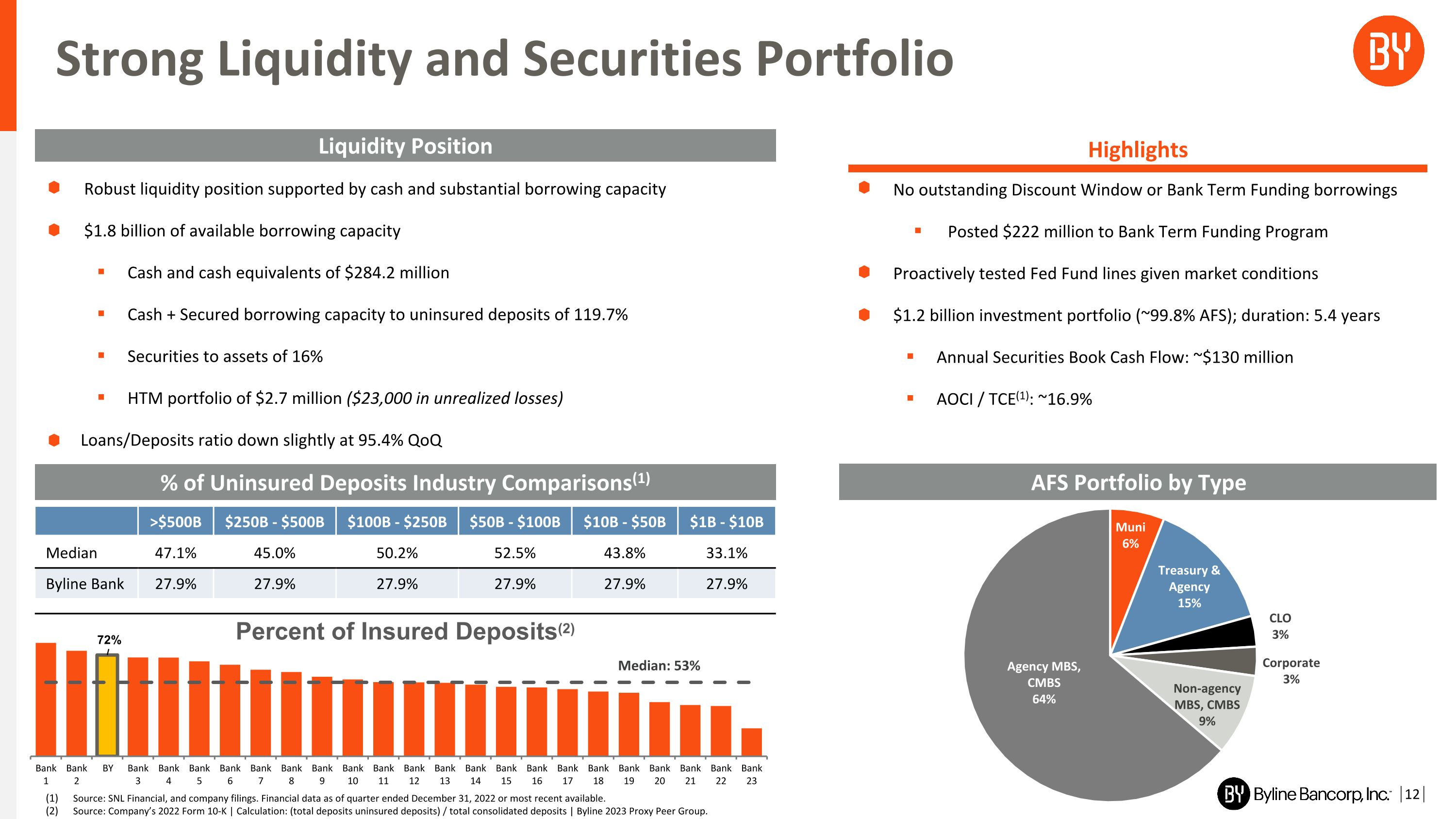

Median: 53% Percent of Insured Deposits(2) Liquidity Position Strong Liquidity and Securities Portfolio Robust liquidity position supported by cash and substantial borrowing capacity $1.8 billion of available borrowing capacity Cash and cash equivalents of $284.2 million Cash + Secured borrowing capacity to uninsured deposits of 119.7% Securities to assets of 16% HTM portfolio of $2.7 million ($23,000 in unrealized losses) Loans/Deposits ratio down slightly at 95.4% QoQ % of Uninsured Deposits Industry Comparisons(1) >$500B $250B - $500B $100B - $250B $50B - $100B $10B - $50B $1B - $10B Median 47.1% 45.0% 50.2% 52.5% 43.8% 33.1% Byline Bank 27.9% 27.9% 27.9% 27.9% 27.9% 27.9% 12 Source: SNL Financial, and company filings. Financial data as of quarter ended December 31, 2022 or most recent available. Source: Company’s 2022 Form 10-K | Calculation: (total deposits uninsured deposits) / total consolidated deposits | Byline 2023 Proxy Peer Group. AFS Portfolio by Type No outstanding Discount Window or Bank Term Funding borrowings Posted $222 million to Bank Term Funding Program Proactively tested Fed Fund lines given market conditions $1.2 billion investment portfolio (~99.8% AFS); duration: 5.4 years Annual Securities Book Cash Flow: ~$130 million AOCI / TCE(1): ~16.9% Highlights

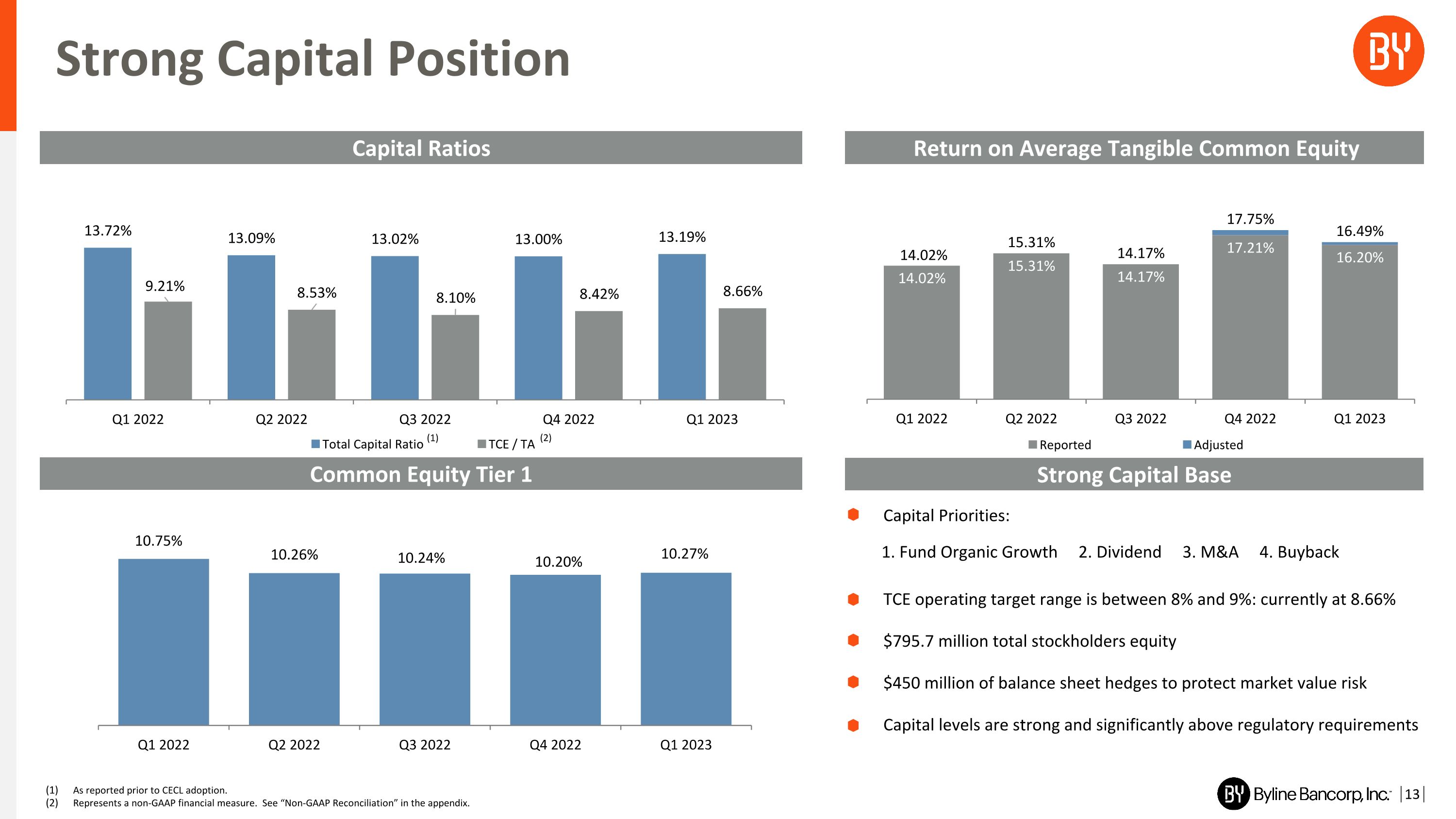

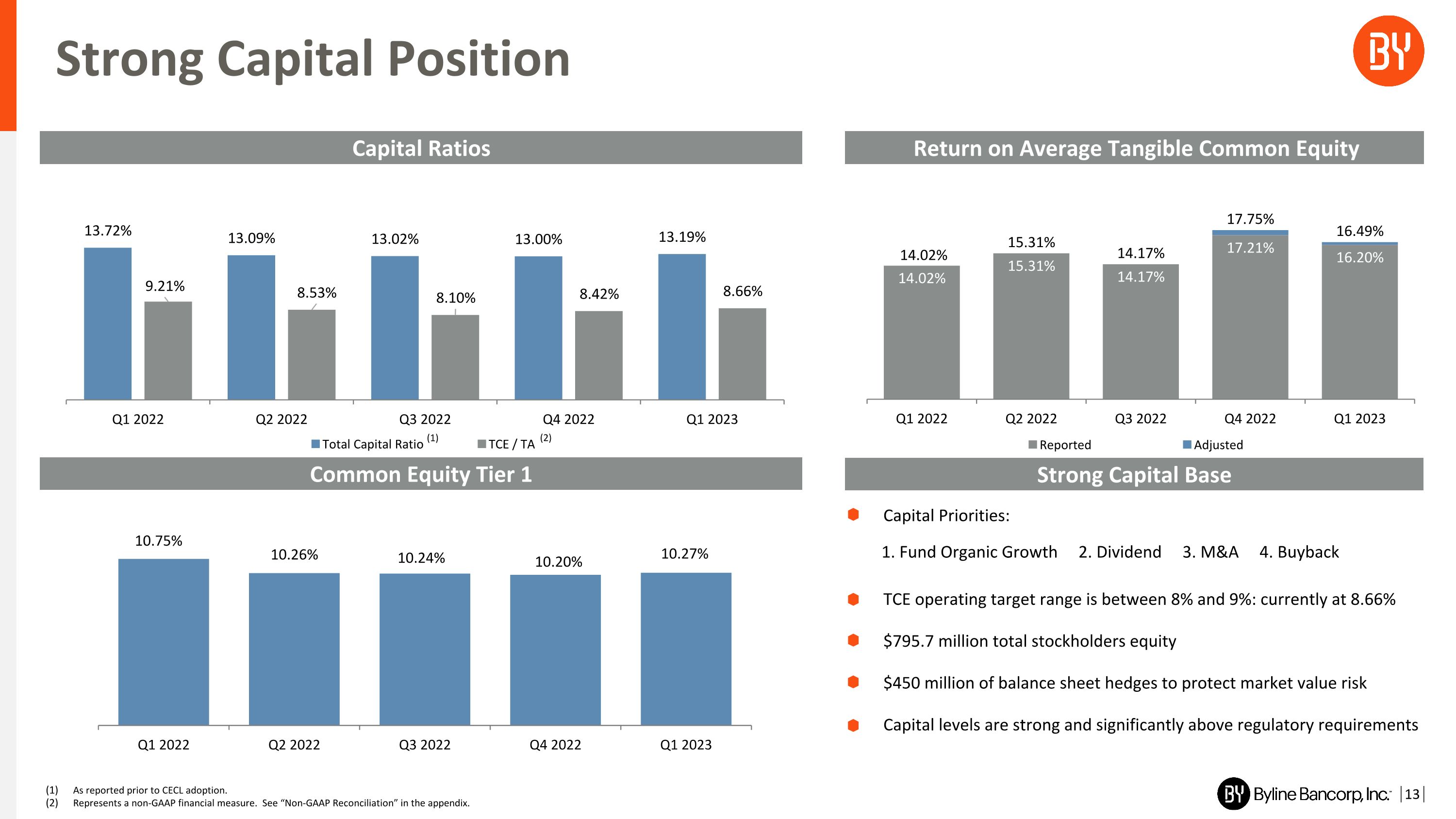

(2) (1) Return on Average Tangible Common Equity Strong Capital Position Capital Ratios 13 As reported prior to CECL adoption. Represents a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the appendix. Strong Capital Base Common Equity Tier 1 Capital Priorities: TCE operating target range is between 8% and 9%: currently at 8.66% $795.7 million total stockholders equity $450 million of balance sheet hedges to protect market value risk Capital levels are strong and significantly above regulatory requirements 1. Fund Organic Growth 2. Dividend 3. M&A 4. Buyback

2023 Strategic Priorities and Near-Term Outlook Commercial banking strategy focused on organic loan and deposit growth Maintain credit discipline and strong asset quality Investing in digital capabilities and automation Opportunistic M&A and talent additions Maintain a strong balance sheet and capital flexibility Disciplined loan and deposit pricing 14

1Q23 Earnings Presentation Appendix

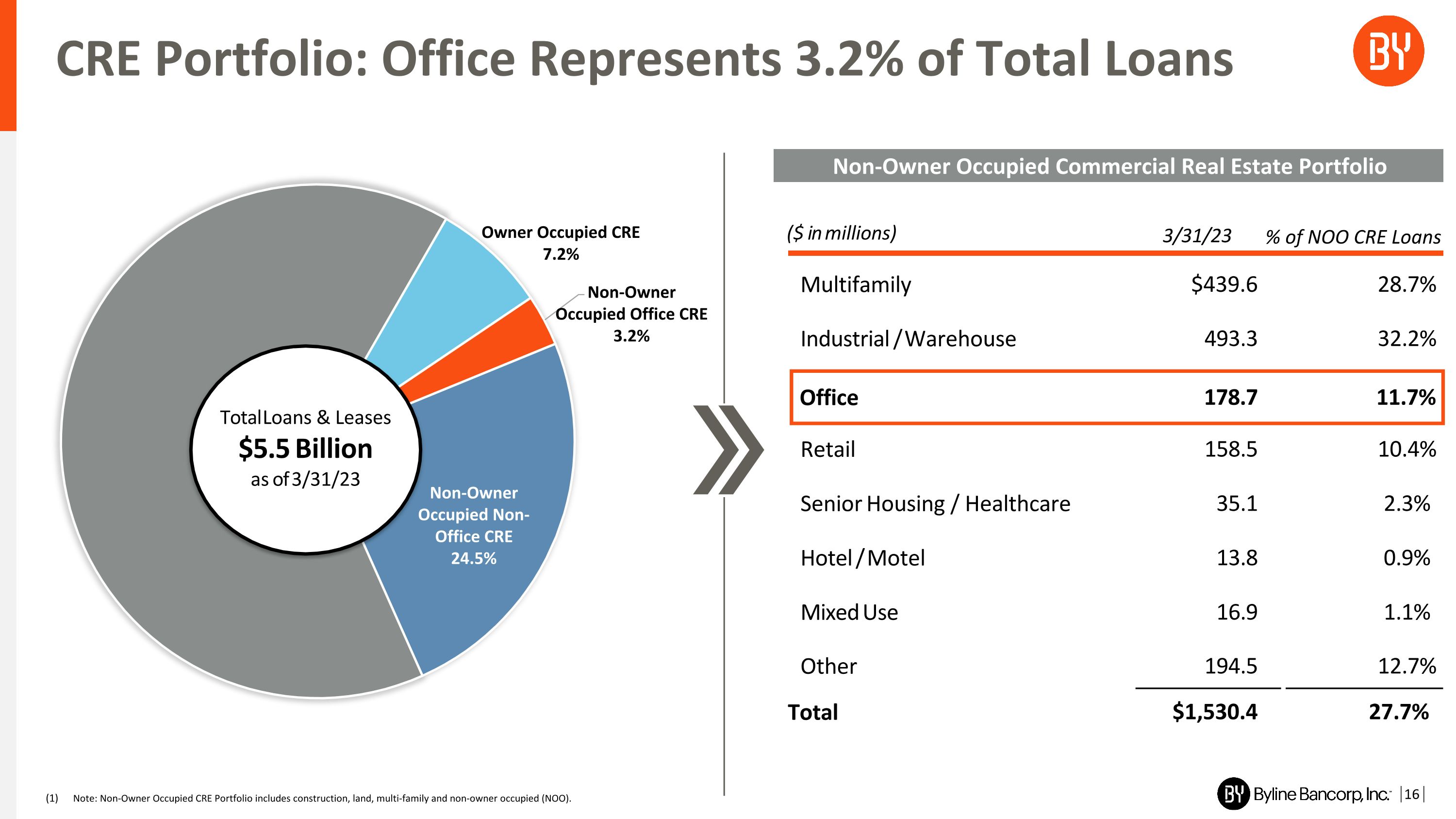

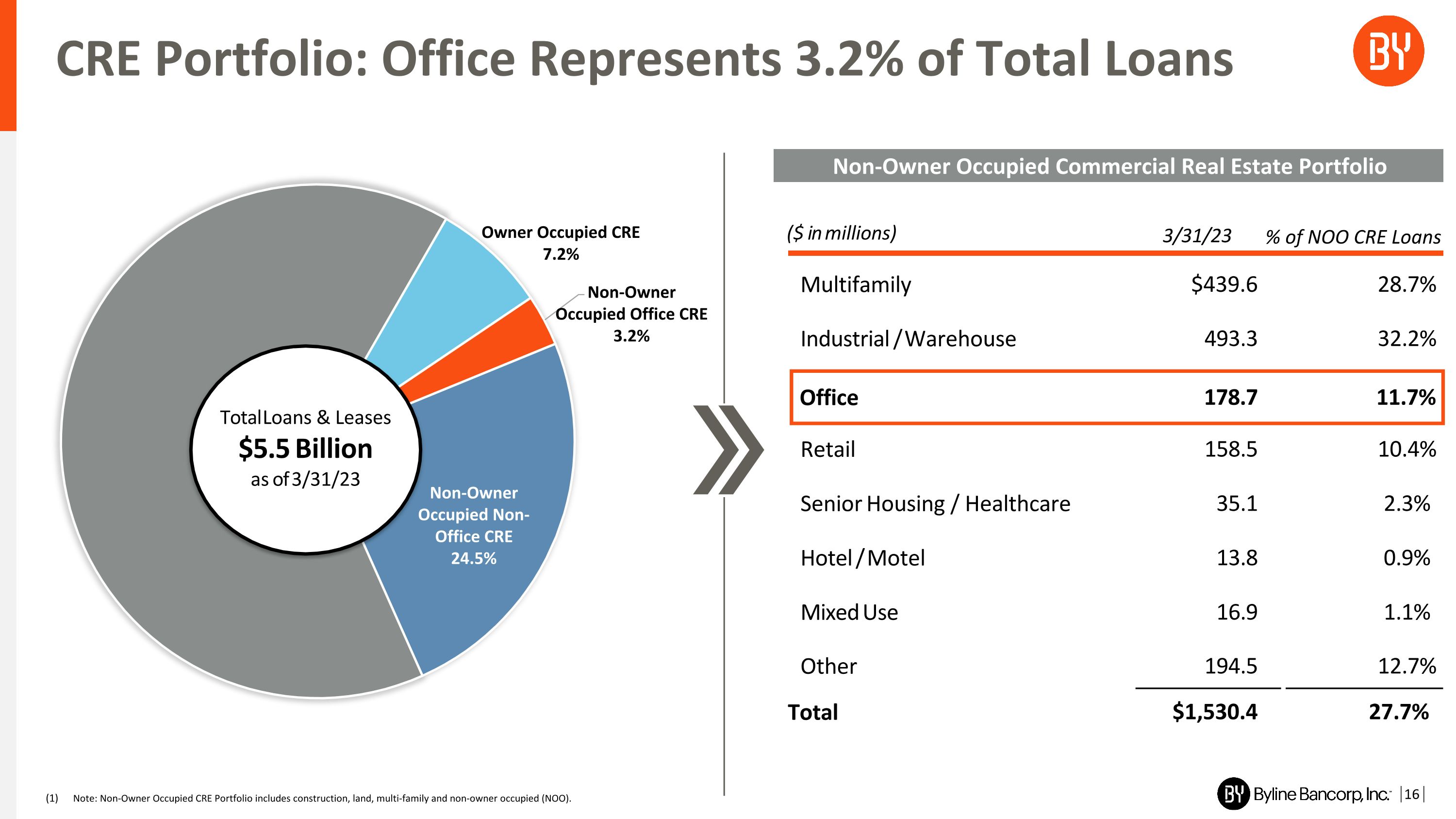

CRE Portfolio: Office Represents 3.2% of Total Loans 16 Non-Owner Occupied Commercial Real Estate Portfolio d Total Loans & Leases $5.5 Billion as of 3/31/23 ($ in millions) 3/31/23 Multifamily $439.6 28.7% Industrial / Warehouse 493.3 32.2% Office 178.7 11.7% Retail 158.5 10.4% Senior Housing / Healthcare 35.1 2.3% Hotel / Motel 13.8 0.9% Mixed Use 16.9 1.1% Other 194.5 12.7% Total $1,530.4 27.7% % of NOO CRE Loans Note: Non-Owner Occupied CRE Portfolio includes construction, land, multi-family and non-owner occupied (NOO).

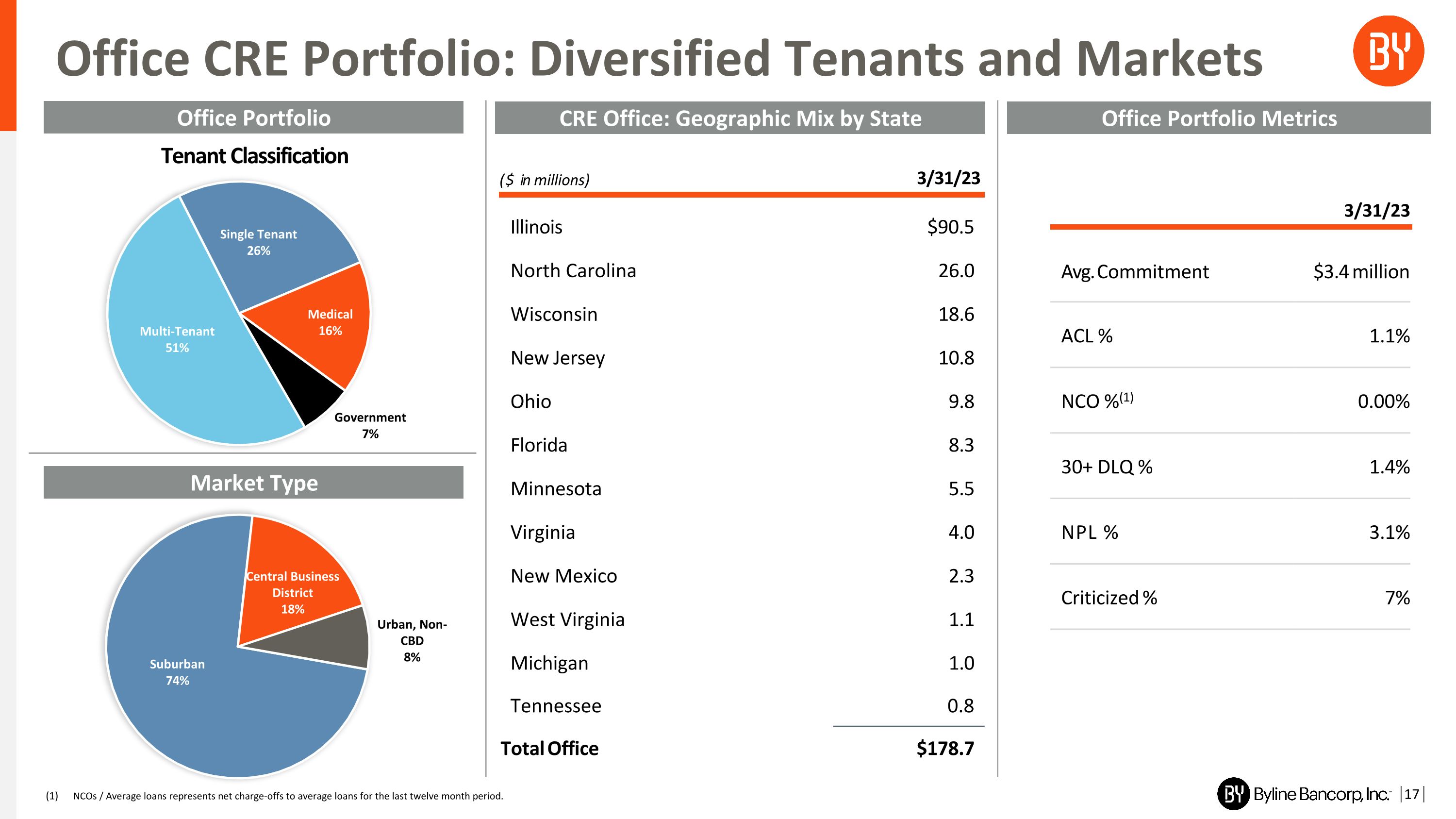

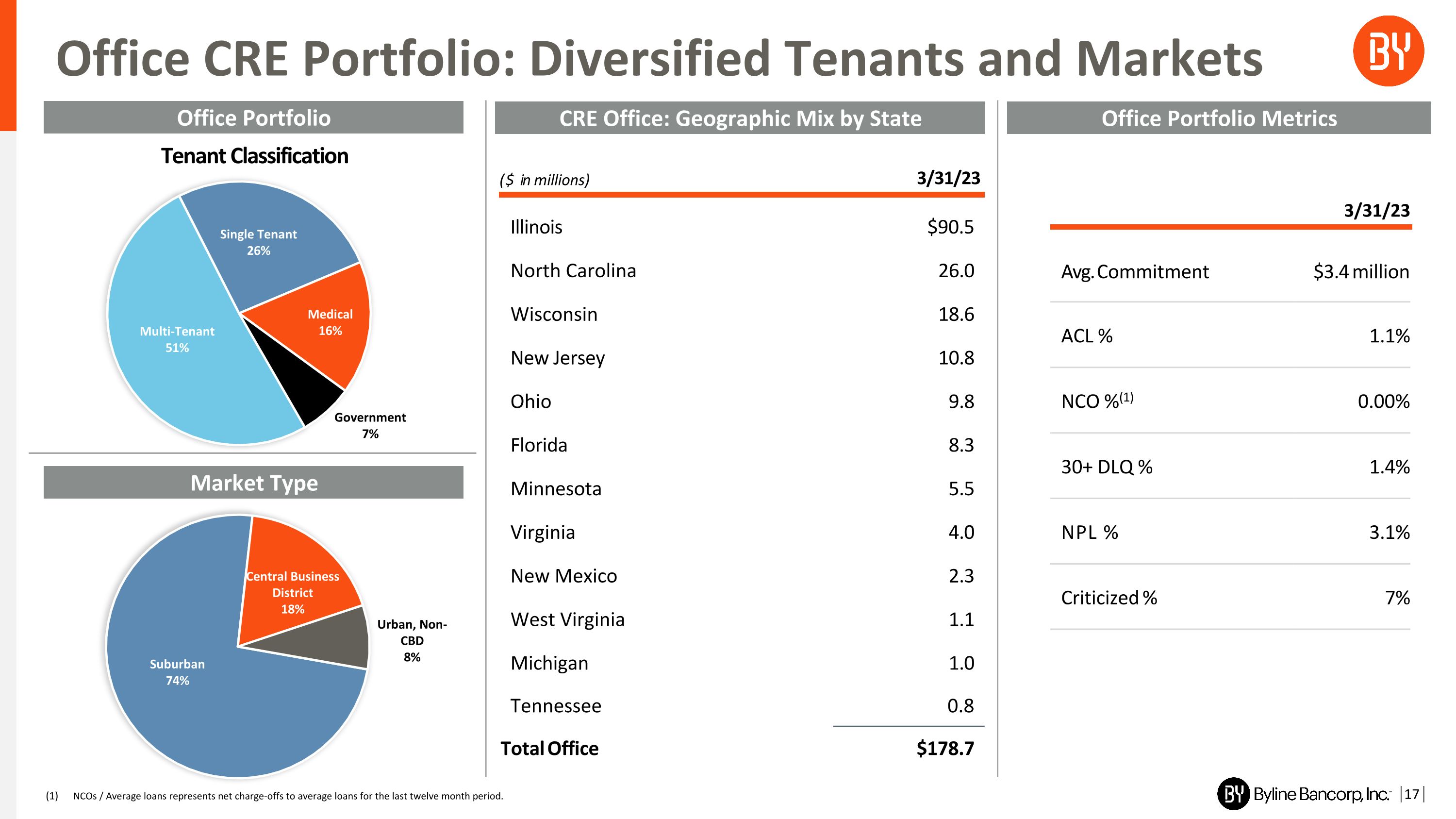

Office CRE Portfolio: Diversified Tenants and Markets NCOs / Average loans represents net charge-offs to average loans for the last twelve month period. Tenant Classification ($ in millions) 3/31/23 Illinois $90.5 North Carolina 26.0 Wisconsin 18.6 New Jersey 10.8 Ohio 9.8 Florida 8.3 Minnesota 5.5 Virginia 4.0 New Mexico 2.3 West Virginia 1.1 Michigan 1.0 Tennessee 0.8 Total Office $178.7 3/31/23 Avg. Commitment $3.4 million ACL % 1.1% NCO %(1) 0.00% 30+ DLQ % 1.4% NPL % 3.1% Criticized % 7% CRE Office: Geographic Mix by State Office Portfolio Metrics Office Portfolio Market Type 17

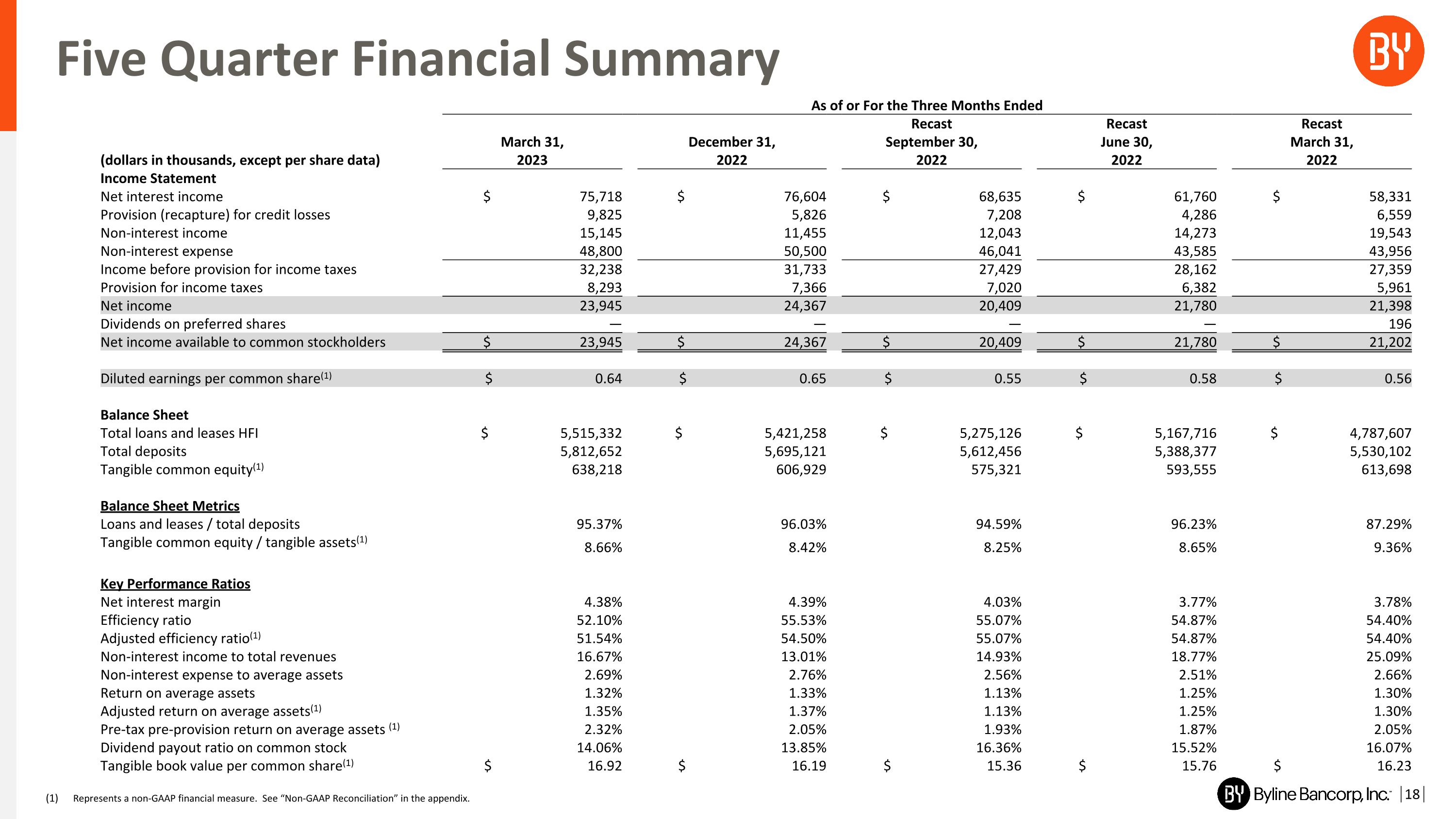

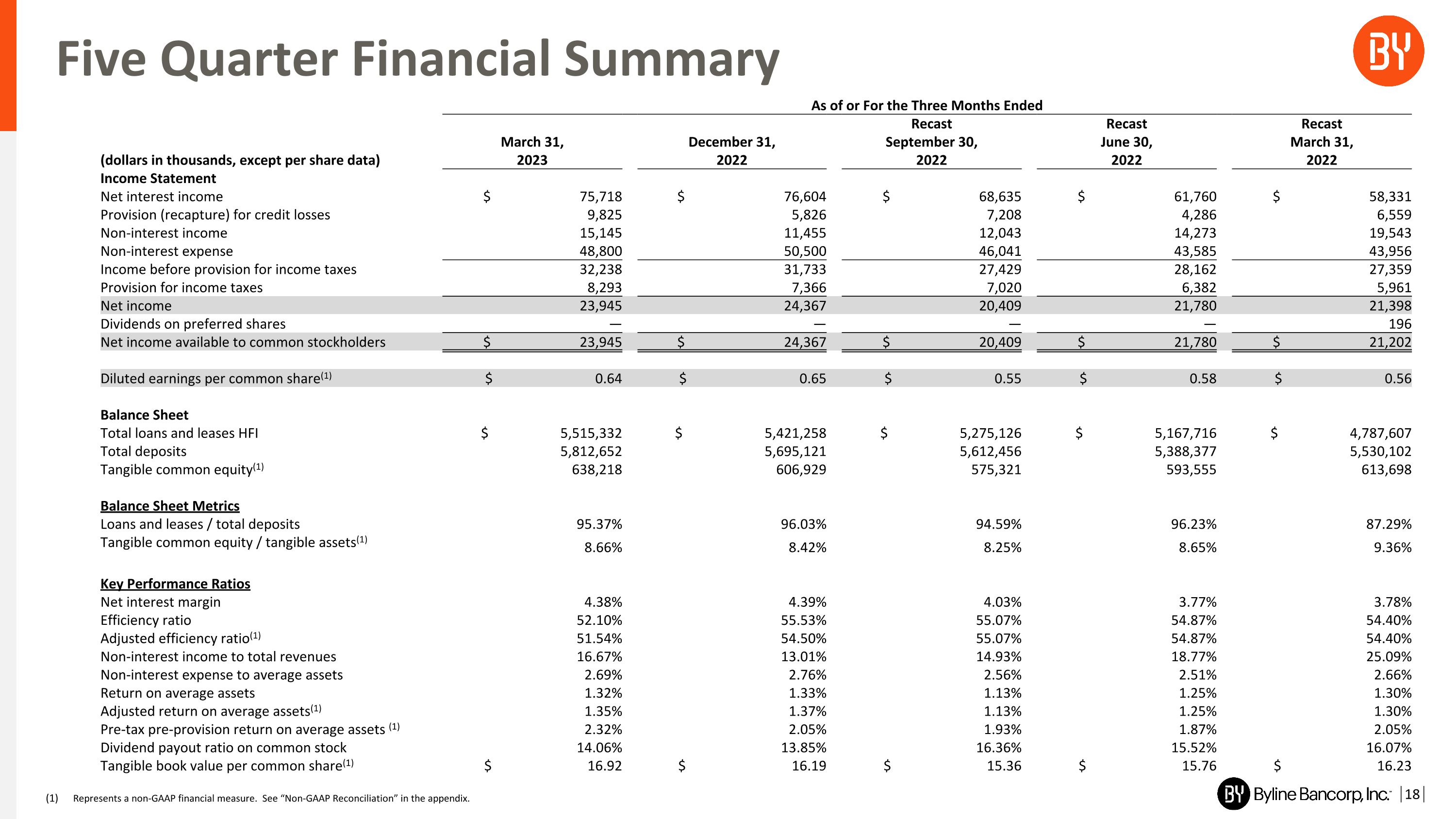

Five Quarter Financial Summary 18 Represents a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the appendix. As of or For the Three Months Ended Recast Recast Recast March 31, December 31, September 30, June 30, March 31, (dollars in thousands, except per share data) 2023 2022 2022 2022 2022 Income Statement Net interest income $ 75,718 $ 76,604 $ 68,635 $ 61,760 $ 58,331 Provision (recapture) for credit losses 9,825 5,826 7,208 4,286 6,559 Non-interest income 15,145 11,455 12,043 14,273 19,543 Non-interest expense 48,800 50,500 46,041 43,585 43,956 Income before provision for income taxes 32,238 31,733 27,429 28,162 27,359 Provision for income taxes 8,293 7,366 7,020 6,382 5,961 Net income 23,945 24,367 20,409 21,780 21,398 Dividends on preferred shares — — — — 196 Net income available to common stockholders $ 23,945 $ 24,367 $ 20,409 $ 21,780 $ 21,202 Diluted earnings per common share(1) $ 0.64 $ 0.65 $ 0.55 $ 0.58 $ 0.56 Balance Sheet Total loans and leases HFI $ 5,515,332 $ 5,421,258 $ 5,275,126 $ 5,167,716 $ 4,787,607 Total deposits 5,812,652 5,695,121 5,612,456 5,388,377 5,530,102 Tangible common equity(1) 638,218 606,929 575,321 593,555 613,698 Balance Sheet Metrics Loans and leases / total deposits 95.37% 96.03% 94.59% 96.23% 87.29% Tangible common equity / tangible assets(1) 8.66% 8.42% 8.25% 8.65% 9.36% Key Performance Ratios Net interest margin 4.38% 4.39% 4.03% 3.77% 3.78% Efficiency ratio 52.10% 55.53% 55.07% 54.87% 54.40% Adjusted efficiency ratio(1) 51.54% 54.50% 55.07% 54.87% 54.40% Non-interest income to total revenues 16.67% 13.01% 14.93% 18.77% 25.09% Non-interest expense to average assets 2.69% 2.76% 2.56% 2.51% 2.66% Return on average assets 1.32% 1.33% 1.13% 1.25% 1.30% Adjusted return on average assets(1) 1.35% 1.37% 1.13% 1.25% 1.30% Pre-tax pre-provision return on average assets (1) 2.32% 2.05% 1.93% 1.87% 2.05% Dividend payout ratio on common stock 14.06% 13.85% 16.36% 15.52% 16.07% Tangible book value per common share(1) $ 16.92 $ 16.19 $ 15.36 $ 15.76 $ 16.23

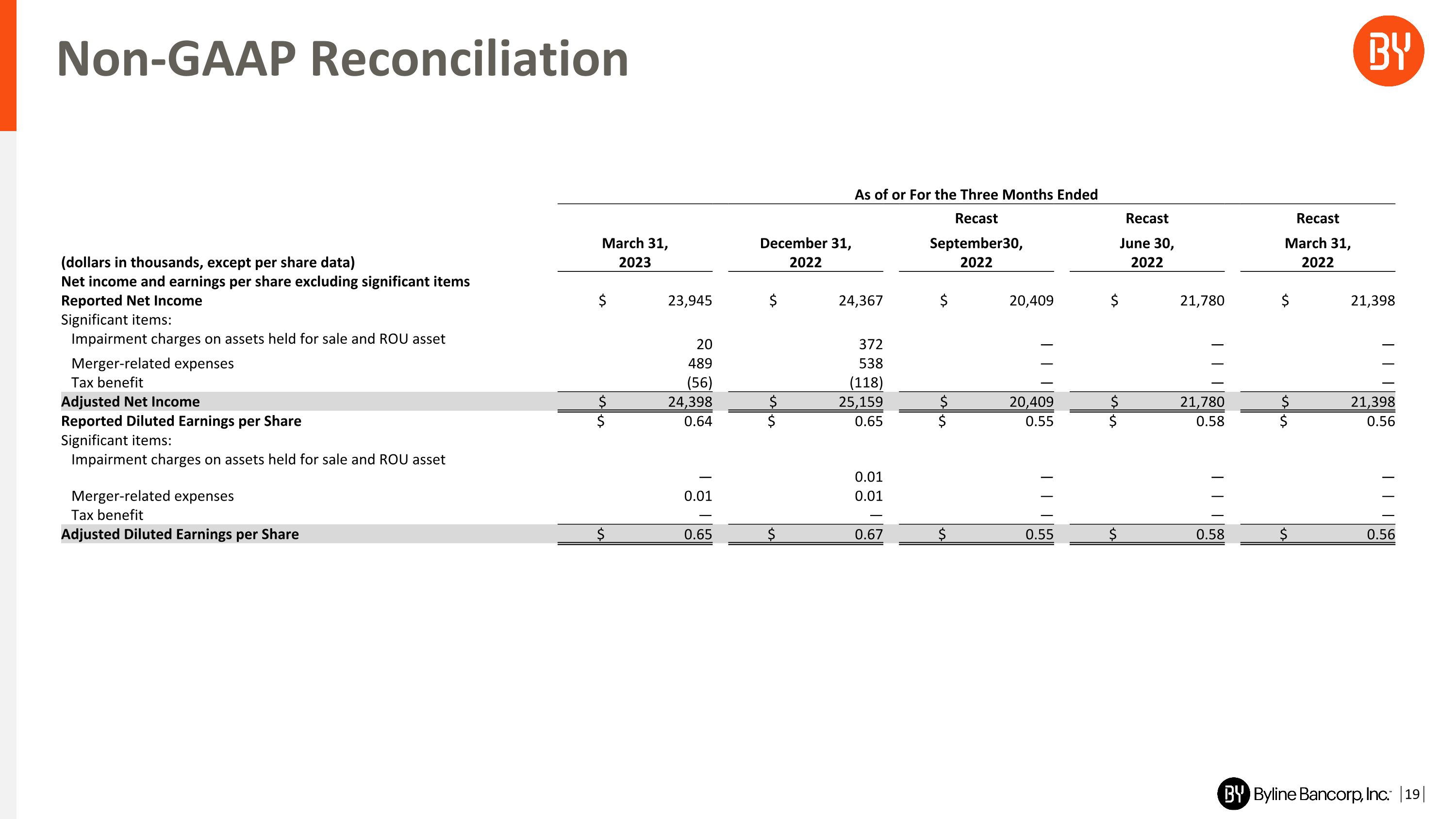

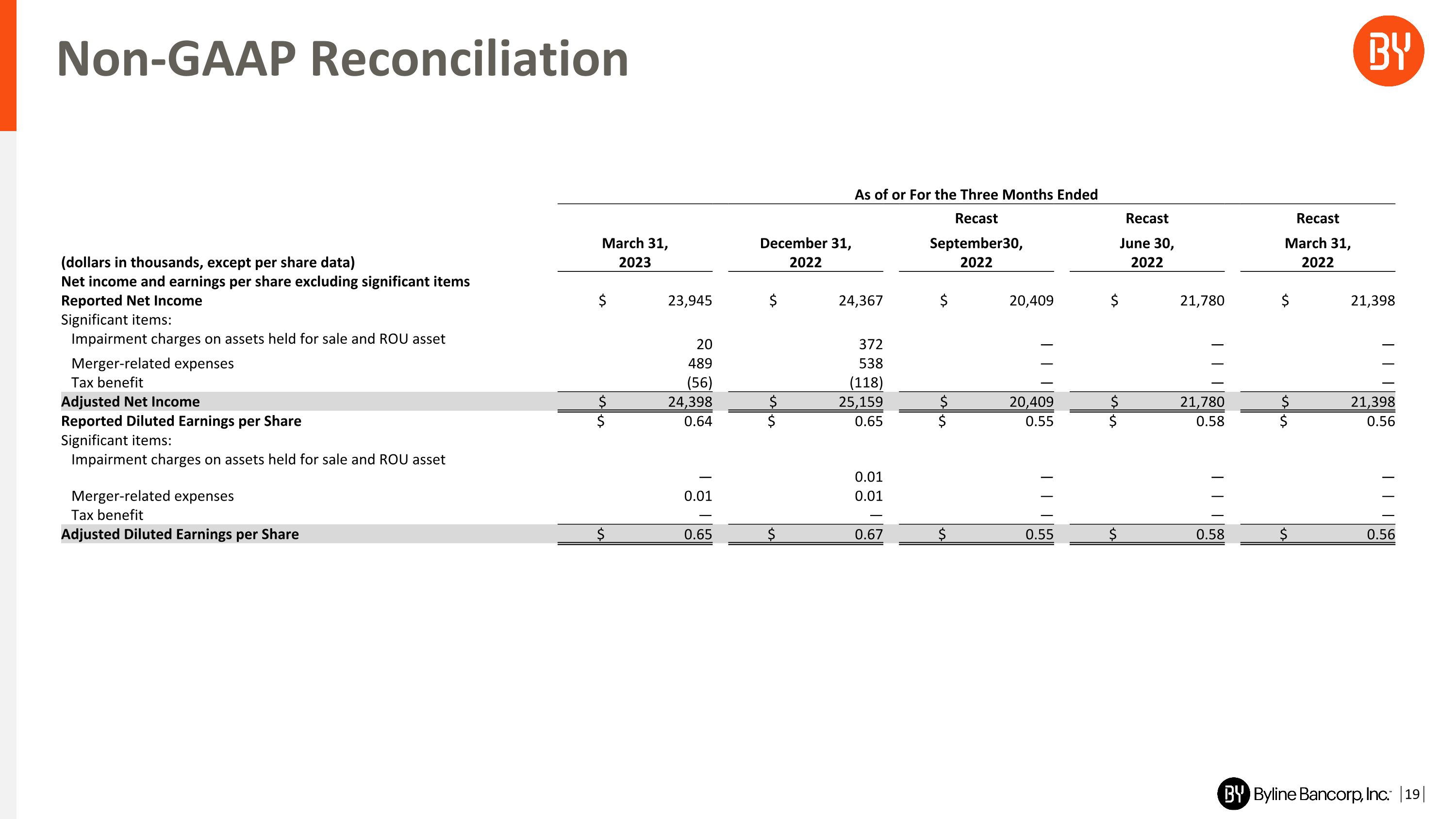

Non-GAAP Reconciliation 19 As of or For the Three Months Ended Recast Recast Recast (dollars in thousands, except per share data) March 31, �2023 December 31, �2022 September30, �2022 June 30, �2022 March 31, �2022 Net income and earnings per share excluding significant items Reported Net Income $ 23,945 $ 24,367 $ 20,409 $ 21,780 $ 21,398 Significant items: Impairment charges on assets held for sale and ROU asset 20 372 — — — Merger-related expenses 489 538 — — — Tax benefit (56) (118) — — — Adjusted Net Income $ 24,398 $ 25,159 $ 20,409 $ 21,780 $ 21,398 Reported Diluted Earnings per Share $ 0.64 $ 0.65 $ 0.55 $ 0.58 $ 0.56 Significant items: Impairment charges on assets held for sale and ROU asset — 0.01 — — — Merger-related expenses 0.01 0.01 — — — Tax benefit — — — — — Adjusted Diluted Earnings per Share $ 0.65 $ 0.67 $ 0.55 $ 0.58 $ 0.56

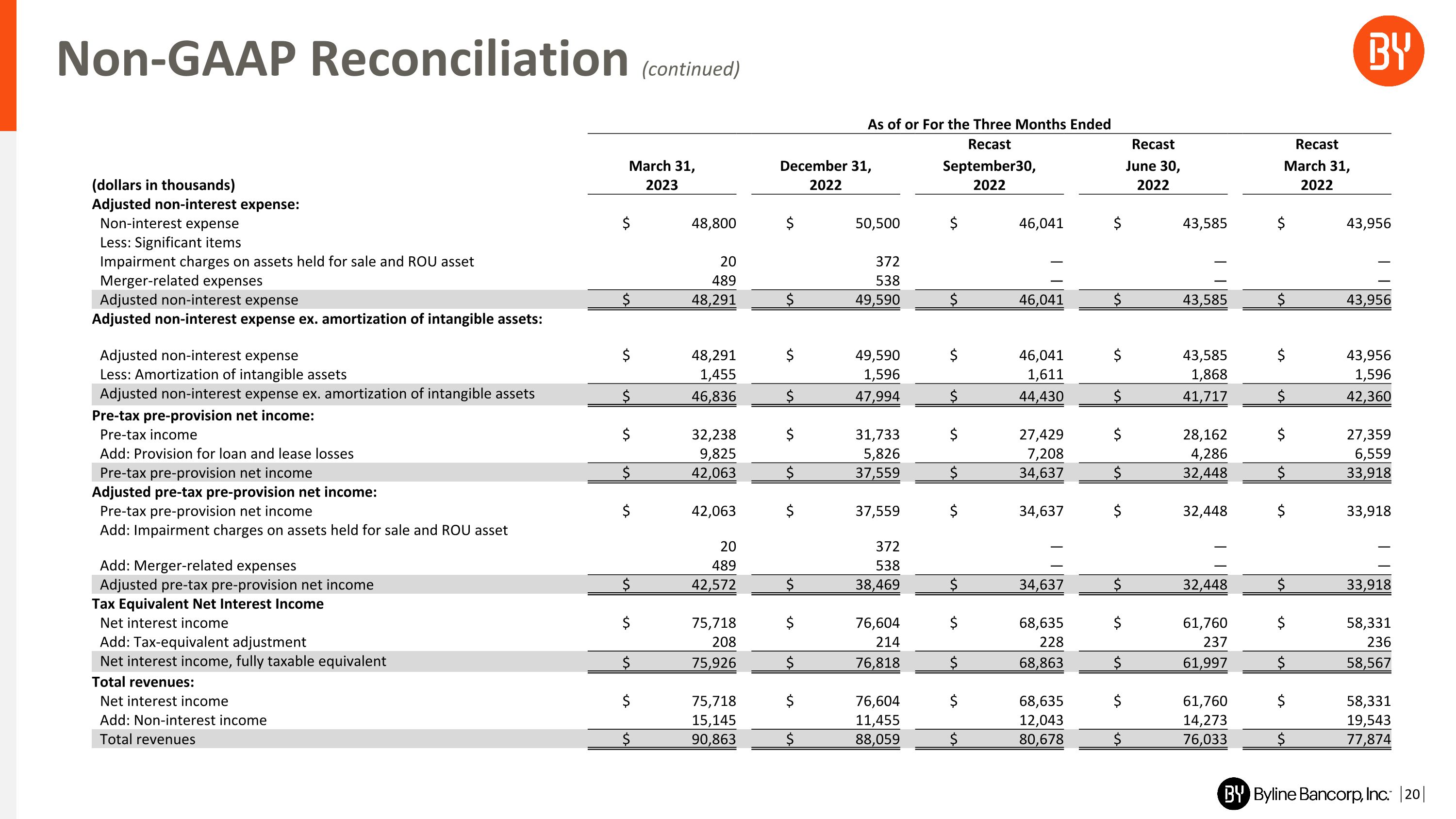

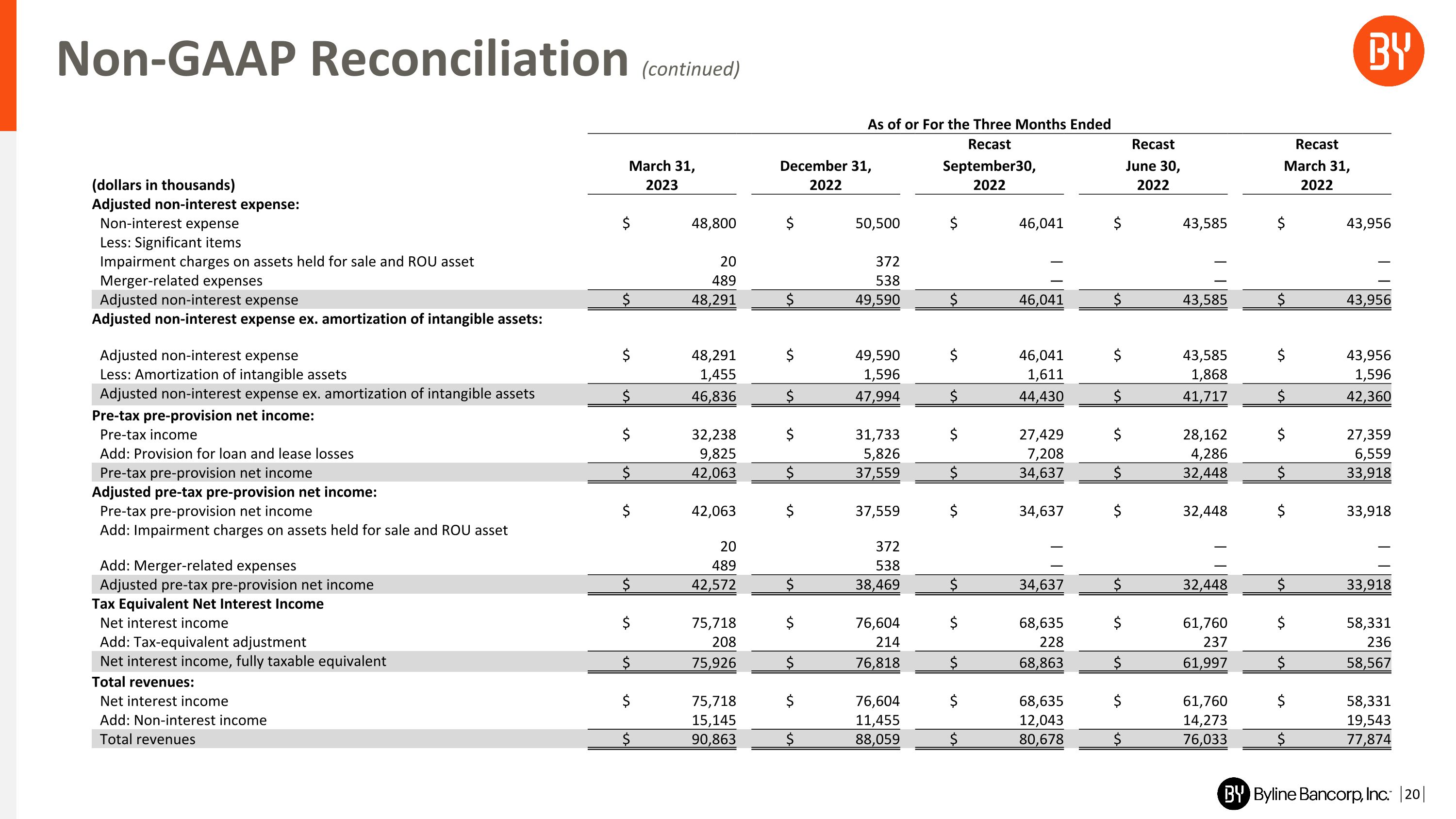

Non-GAAP Reconciliation (continued) 20 As of or For the Three Months Ended Recast Recast Recast (dollars in thousands) March 31, �2023 December 31, �2022 September30, �2022 June 30, �2022 March 31, �2022 Adjusted non-interest expense: Non-interest expense $ 48,800 $ 50,500 $ 46,041 $ 43,585 $ 43,956 Less: Significant items Impairment charges on assets held for sale and ROU asset 20 372 — — — Merger-related expenses 489 538 — — — Adjusted non-interest expense $ 48,291 $ 49,590 $ 46,041 $ 43,585 $ 43,956 Adjusted non-interest expense ex. amortization of intangible assets: Adjusted non-interest expense $ 48,291 $ 49,590 $ 46,041 $ 43,585 $ 43,956 Less: Amortization of intangible assets 1,455 1,596 1,611 1,868 1,596 Adjusted non-interest expense ex. amortization of intangible assets $ 46,836 $ 47,994 $ 44,430 $ 41,717 $ 42,360 Pre-tax pre-provision net income: Pre-tax income $ 32,238 $ 31,733 $ 27,429 $ 28,162 $ 27,359 Add: Provision for loan and lease losses 9,825 5,826 7,208 4,286 6,559 Pre-tax pre-provision net income $ 42,063 $ 37,559 $ 34,637 $ 32,448 $ 33,918 Adjusted pre-tax pre-provision net income: Pre-tax pre-provision net income $ 42,063 $ 37,559 $ 34,637 $ 32,448 $ 33,918 Add: Impairment charges on assets held for sale and ROU asset 20 372 — — — Add: Merger-related expenses 489 538 — — — Adjusted pre-tax pre-provision net income $ 42,572 $ 38,469 $ 34,637 $ 32,448 $ 33,918 Tax Equivalent Net Interest Income Net interest income $ 75,718 $ 76,604 $ 68,635 $ 61,760 $ 58,331 Add: Tax-equivalent adjustment 208 214 228 237 236 Net interest income, fully taxable equivalent $ 75,926 $ 76,818 $ 68,863 $ 61,997 $ 58,567 Total revenues: Net interest income $ 75,718 $ 76,604 $ 68,635 $ 61,760 $ 58,331 Add: Non-interest income 15,145 11,455 12,043 14,273 19,543 Total revenues $ 90,863 $ 88,059 $ 80,678 $ 76,033 $ 77,874

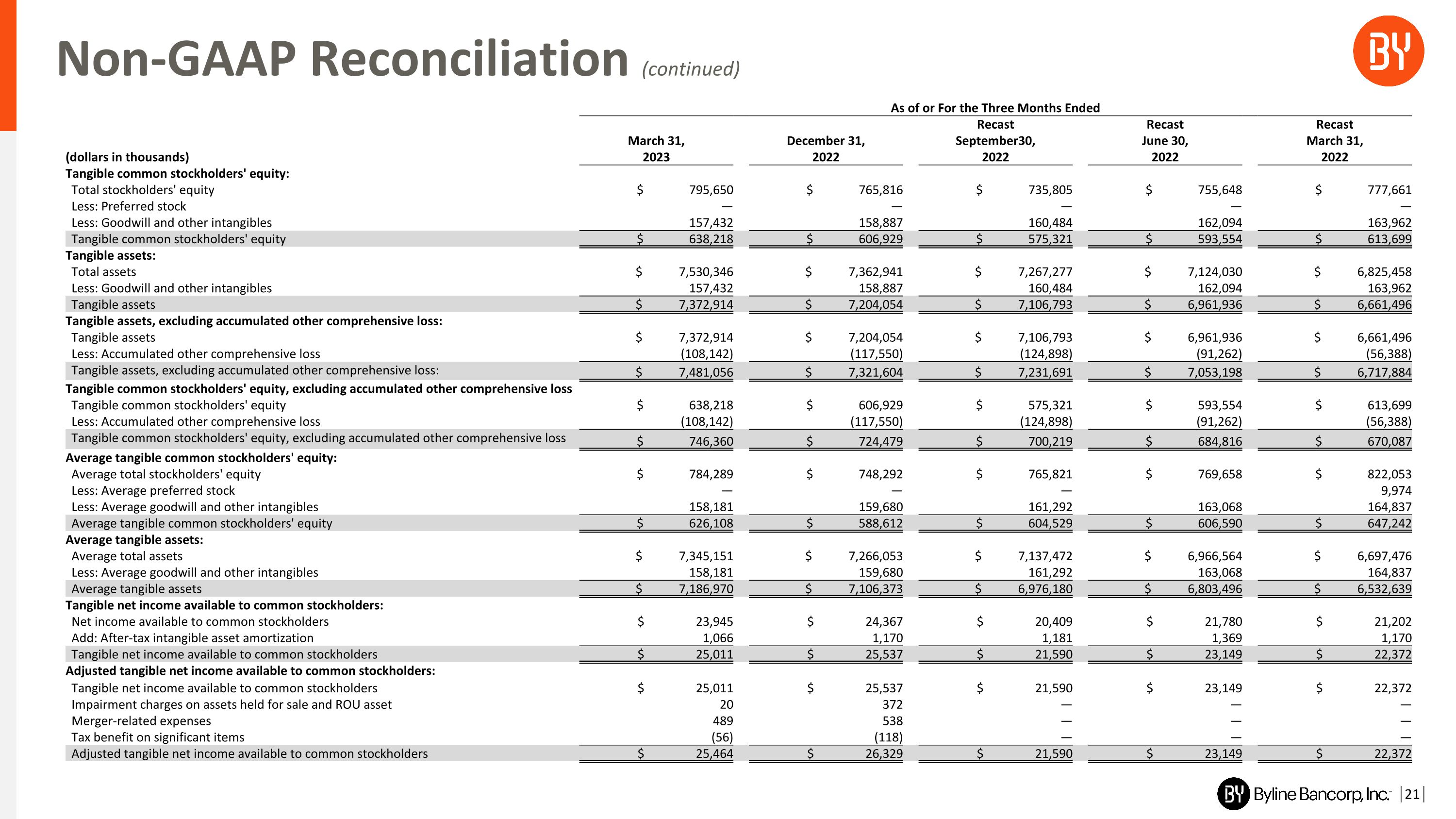

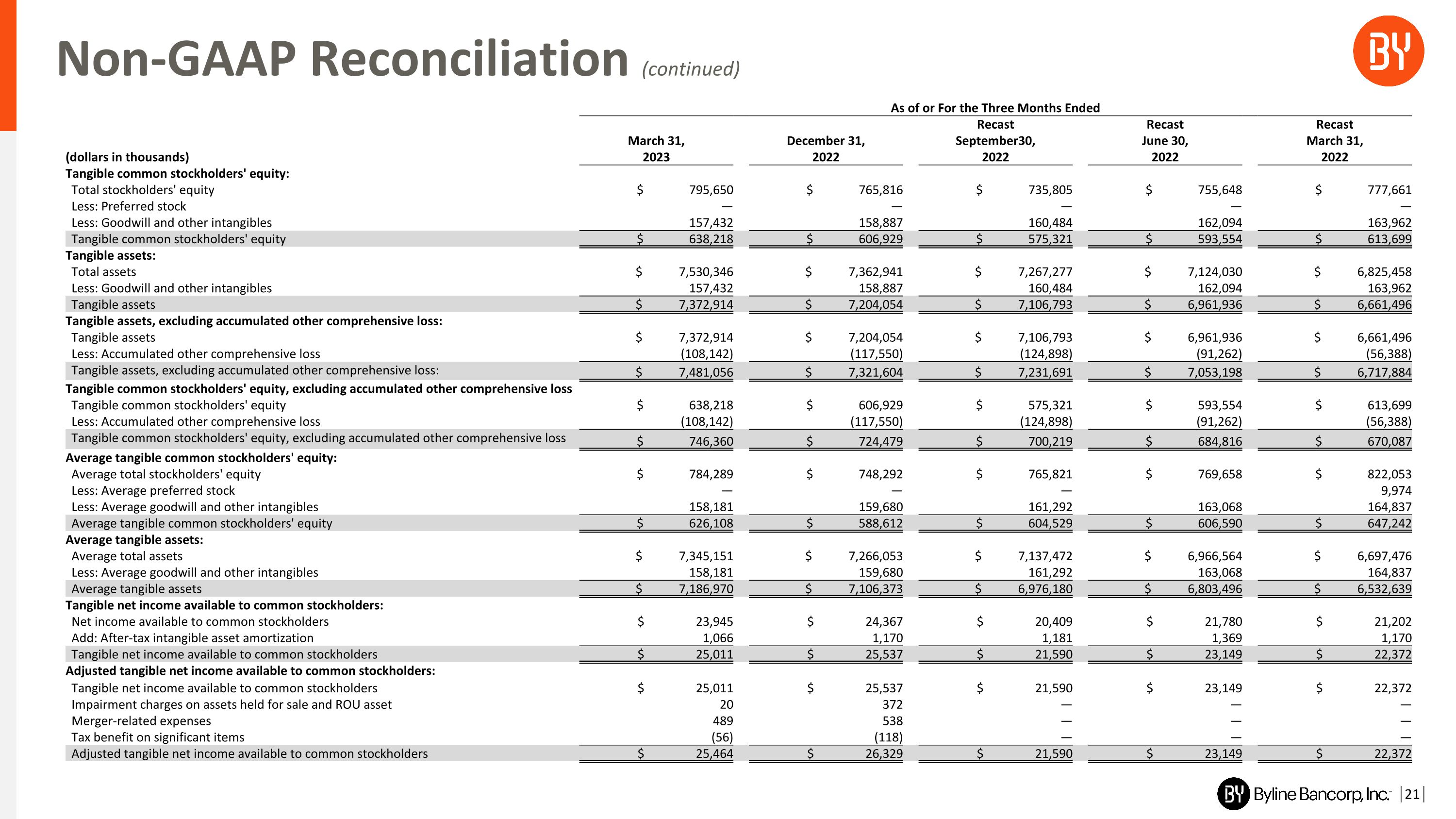

Non-GAAP Reconciliation (continued) 21 As of or For the Three Months Ended Recast Recast Recast (dollars in thousands) March 31, �2023 December 31, �2022 September30, �2022 June 30, �2022 March 31, �2022 Tangible common stockholders' equity: Total stockholders' equity $ 795,650 $ 765,816 $ 735,805 $ 755,648 $ 777,661 Less: Preferred stock — — — — — Less: Goodwill and other intangibles 157,432 158,887 160,484 162,094 163,962 Tangible common stockholders' equity $ 638,218 $ 606,929 $ 575,321 $ 593,554 $ 613,699 Tangible assets: Total assets $ 7,530,346 $ 7,362,941 $ 7,267,277 $ 7,124,030 $ 6,825,458 Less: Goodwill and other intangibles 157,432 158,887 160,484 162,094 163,962 Tangible assets $ 7,372,914 $ 7,204,054 $ 7,106,793 $ 6,961,936 $ 6,661,496 Tangible assets, excluding accumulated other comprehensive loss: Tangible assets $ 7,372,914 $ 7,204,054 $ 7,106,793 $ 6,961,936 $ 6,661,496 Less: Accumulated other comprehensive loss (108,142) (117,550) (124,898) (91,262) (56,388) Tangible assets, excluding accumulated other comprehensive loss: $ 7,481,056 $ 7,321,604 $ 7,231,691 $ 7,053,198 $ 6,717,884 Tangible common stockholders' equity, excluding accumulated other comprehensive loss Tangible common stockholders' equity $ 638,218 $ 606,929 $ 575,321 $ 593,554 $ 613,699 Less: Accumulated other comprehensive loss (108,142) (117,550) (124,898) (91,262) (56,388) Tangible common stockholders' equity, excluding accumulated other comprehensive loss $ 746,360 $ 724,479 $ 700,219 $ 684,816 $ 670,087 Average tangible common stockholders' equity: Average total stockholders' equity $ 784,289 $ 748,292 $ 765,821 $ 769,658 $ 822,053 Less: Average preferred stock — — — 9,974 Less: Average goodwill and other intangibles 158,181 159,680 161,292 163,068 164,837 Average tangible common stockholders' equity $ 626,108 $ 588,612 $ 604,529 $ 606,590 $ 647,242 Average tangible assets: Average total assets $ 7,345,151 $ 7,266,053 $ 7,137,472 $ 6,966,564 $ 6,697,476 Less: Average goodwill and other intangibles 158,181 159,680 161,292 163,068 164,837 Average tangible assets $ 7,186,970 $ 7,106,373 $ 6,976,180 $ 6,803,496 $ 6,532,639 Tangible net income available to common stockholders: Net income available to common stockholders $ 23,945 $ 24,367 $ 20,409 $ 21,780 $ 21,202 Add: After-tax intangible asset amortization 1,066 1,170 1,181 1,369 1,170 Tangible net income available to common stockholders $ 25,011 $ 25,537 $ 21,590 $ 23,149 $ 22,372 Adjusted tangible net income available to common stockholders: Tangible net income available to common stockholders $ 25,011 $ 25,537 $ 21,590 $ 23,149 $ 22,372 Impairment charges on assets held for sale and ROU asset 20 372 — — — Merger-related expenses 489 538 — — — Tax benefit on significant items (56) (118) — — — Adjusted tangible net income available to common stockholders $ 25,464 $ 26,329 $ 21,590 $ 23,149 $ 22,372

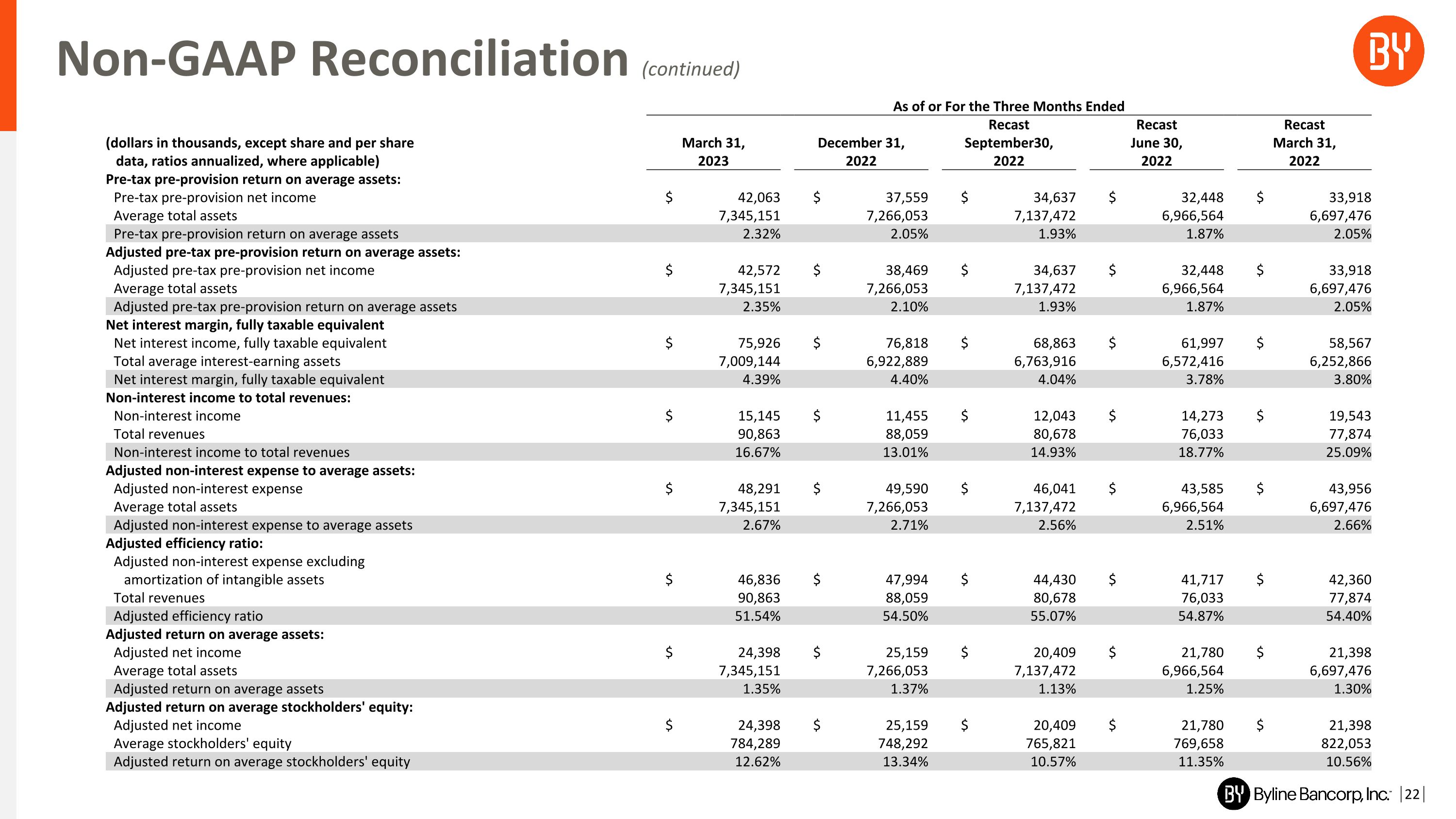

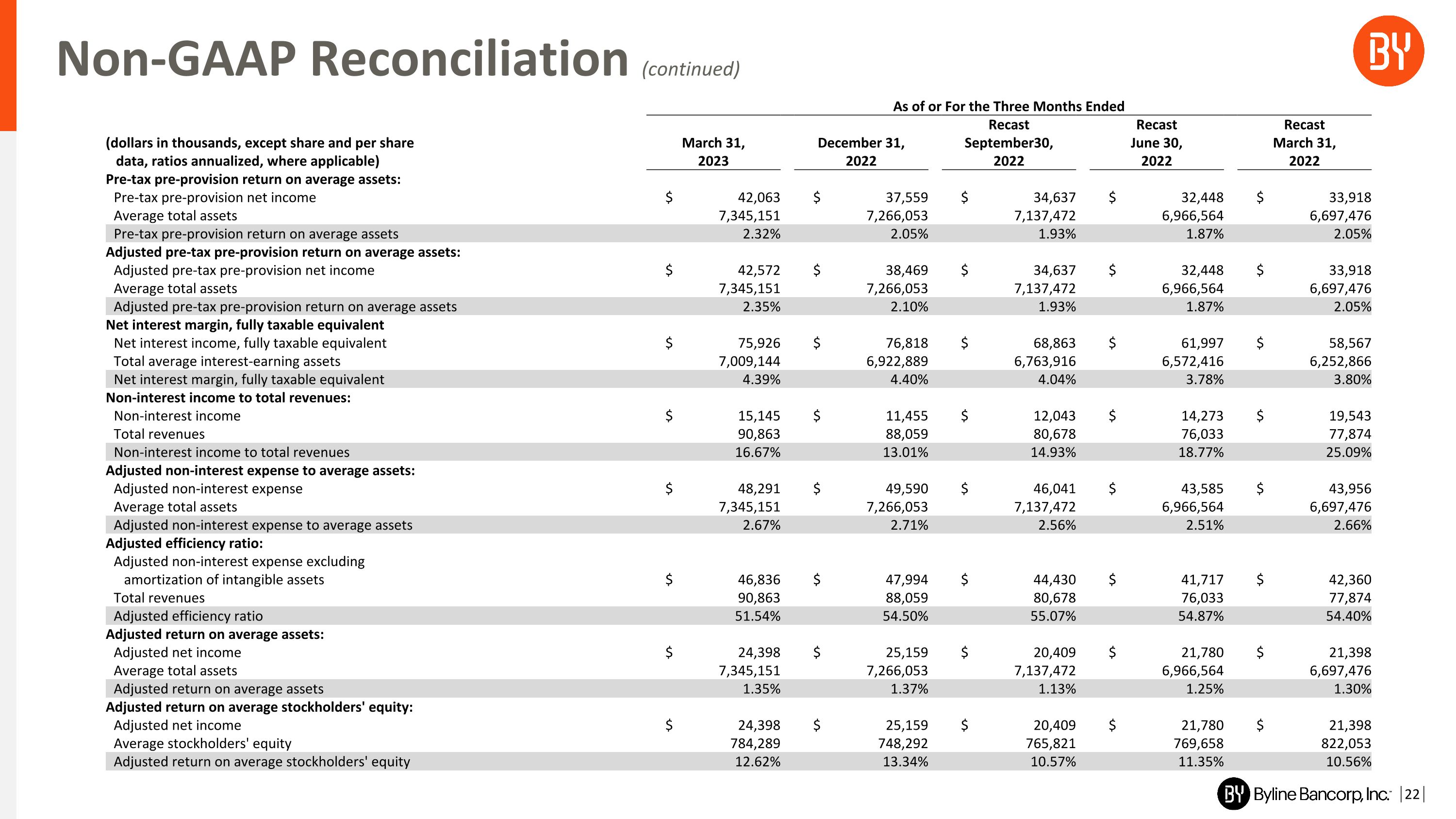

Non-GAAP Reconciliation (continued) 22 As of or For the Three Months Ended Recast Recast Recast (dollars in thousands, except share and per share � data, ratios annualized, where applicable) March 31, �2023 December 31, �2022 September30, �2022 June 30, �2022 March 31, �2022 Pre-tax pre-provision return on average assets: Pre-tax pre-provision net income $ 42,063 $ 37,559 $ 34,637 $ 32,448 $ 33,918 Average total assets 7,345,151 7,266,053 7,137,472 6,966,564 6,697,476 Pre-tax pre-provision return on average assets 2.32% 2.05% 1.93% 1.87% 2.05% Adjusted pre-tax pre-provision return on average assets: Adjusted pre-tax pre-provision net income $ 42,572 $ 38,469 $ 34,637 $ 32,448 $ 33,918 Average total assets 7,345,151 7,266,053 7,137,472 6,966,564 6,697,476 Adjusted pre-tax pre-provision return on average assets 2.35% 2.10% 1.93% 1.87% 2.05% Net interest margin, fully taxable equivalent Net interest income, fully taxable equivalent $ 75,926 $ 76,818 $ 68,863 $ 61,997 $ 58,567 Total average interest-earning assets 7,009,144 6,922,889 6,763,916 6,572,416 6,252,866 Net interest margin, fully taxable equivalent 4.39% 4.40% 4.04% 3.78% 3.80% Non-interest income to total revenues: Non-interest income $ 15,145 $ 11,455 $ 12,043 $ 14,273 $ 19,543 Total revenues 90,863 88,059 80,678 76,033 77,874 Non-interest income to total revenues 16.67% 13.01% 14.93% 18.77% 25.09% Adjusted non-interest expense to average assets: Adjusted non-interest expense $ 48,291 $ 49,590 $ 46,041 $ 43,585 $ 43,956 Average total assets 7,345,151 7,266,053 7,137,472 6,966,564 6,697,476 Adjusted non-interest expense to average assets 2.67% 2.71% 2.56% 2.51% 2.66% Adjusted efficiency ratio: Adjusted non-interest expense excluding � amortization of intangible assets $ 46,836 $ 47,994 $ 44,430 $ 41,717 $ 42,360 Total revenues 90,863 88,059 80,678 76,033 77,874 Adjusted efficiency ratio 51.54% 54.50% 55.07% 54.87% 54.40% Adjusted return on average assets: Adjusted net income $ 24,398 $ 25,159 $ 20,409 $ 21,780 $ 21,398 Average total assets 7,345,151 7,266,053 7,137,472 6,966,564 6,697,476 Adjusted return on average assets 1.35% 1.37% 1.13% 1.25% 1.30% Adjusted return on average stockholders' equity: Adjusted net income $ 24,398 $ 25,159 $ 20,409 $ 21,780 $ 21,398 Average stockholders' equity 784,289 748,292 765,821 769,658 822,053 Adjusted return on average stockholders' equity 12.62% 13.34% 10.57% 11.35% 10.56%

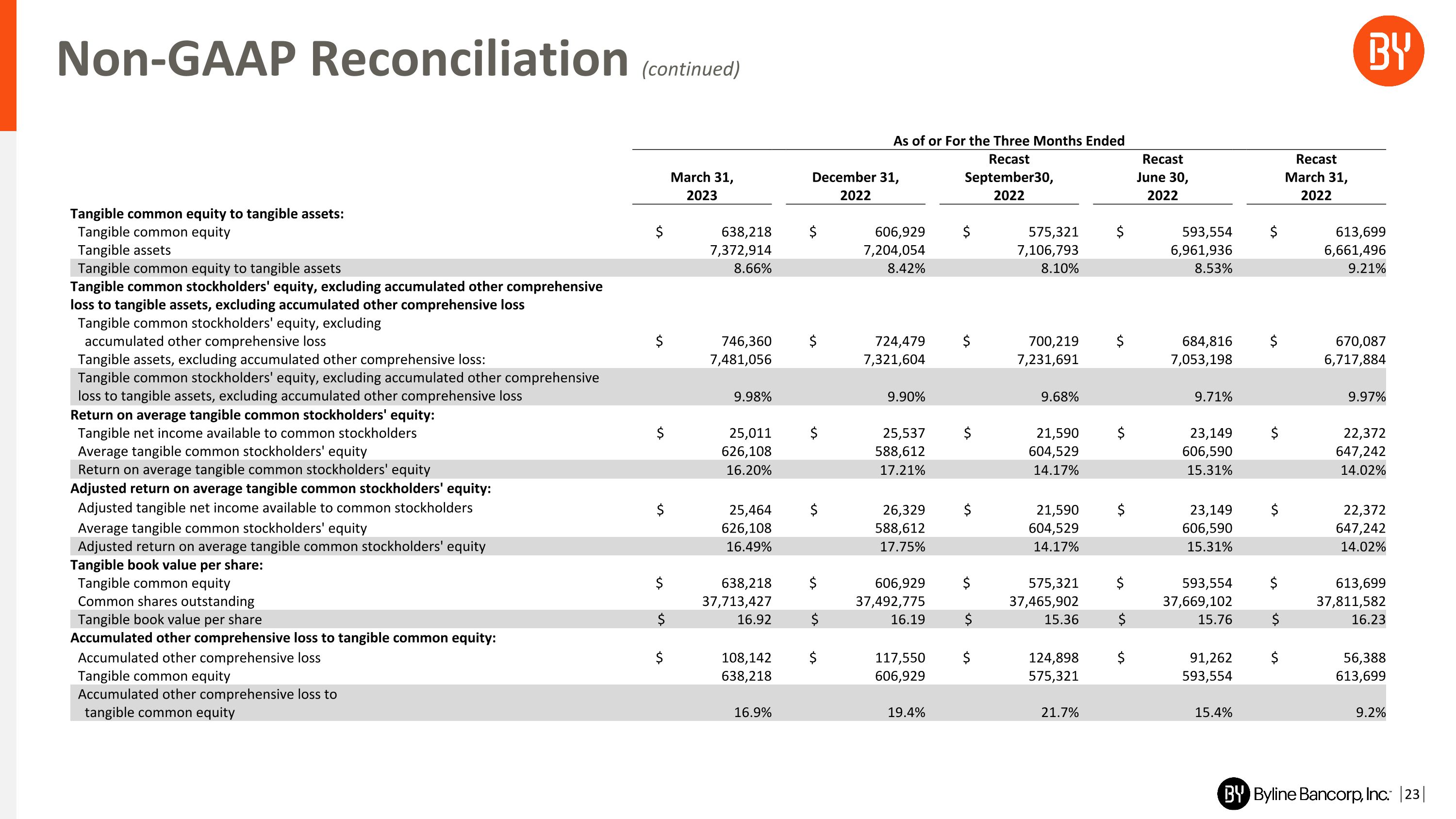

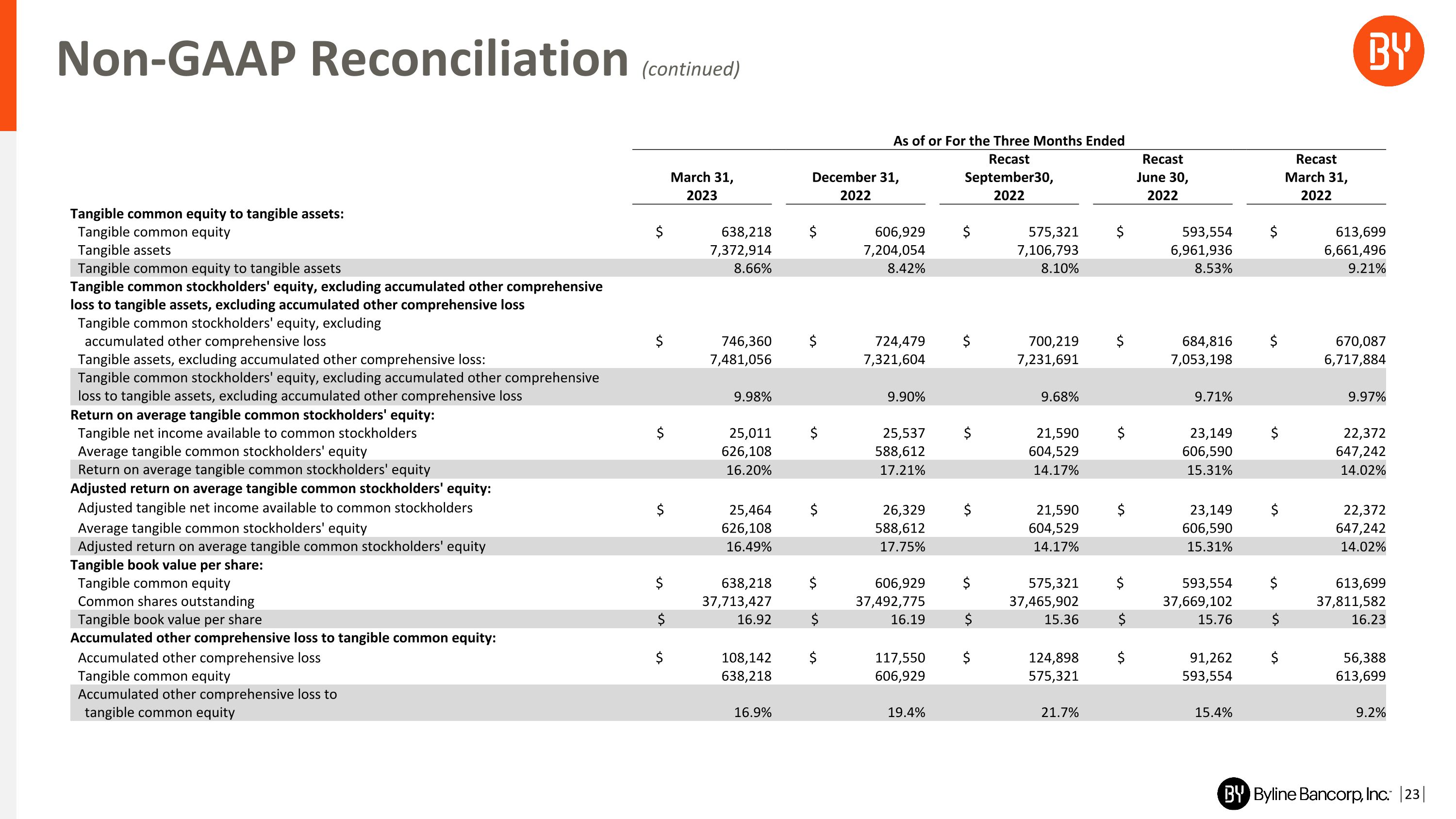

Non-GAAP Reconciliation (continued) 23 As of or For the Three Months Ended Recast Recast Recast March 31, �2023 December 31, �2022 September30, �2022 June 30, �2022 March 31, �2022 Tangible common equity to tangible assets: Tangible common equity $ 638,218 $ 606,929 $ 575,321 $ 593,554 $ 613,699 Tangible assets 7,372,914 7,204,054 7,106,793 6,961,936 6,661,496 Tangible common equity to tangible assets 8.66% 8.42% 8.10% 8.53% 9.21% Tangible common stockholders' equity, excluding accumulated other comprehensive loss to tangible assets, excluding accumulated other comprehensive loss Tangible common stockholders' equity, excluding � accumulated other comprehensive loss $ 746,360 $ 724,479 $ 700,219 $ 684,816 $ 670,087 Tangible assets, excluding accumulated other comprehensive loss: 7,481,056 7,321,604 7,231,691 7,053,198 6,717,884 Tangible common stockholders' equity, excluding accumulated other comprehensive loss to tangible assets, excluding accumulated other comprehensive loss 9.98% 9.90% 9.68% 9.71% 9.97% Return on average tangible common stockholders' equity: Tangible net income available to common stockholders $ 25,011 $ 25,537 $ 21,590 $ 23,149 $ 22,372 Average tangible common stockholders' equity 626,108 588,612 604,529 606,590 647,242 Return on average tangible common stockholders' equity 16.20% 17.21% 14.17% 15.31% 14.02% Adjusted return on average tangible common stockholders' equity: Adjusted tangible net income available to common stockholders $ 25,464 $ 26,329 $ 21,590 $ 23,149 $ 22,372 Average tangible common stockholders' equity 626,108 588,612 604,529 606,590 647,242 Adjusted return on average tangible common stockholders' equity 16.49% 17.75% 14.17% 15.31% 14.02% Tangible book value per share: Tangible common equity $ 638,218 $ 606,929 $ 575,321 $ 593,554 $ 613,699 Common shares outstanding 37,713,427 37,492,775 37,465,902 37,669,102 37,811,582 Tangible book value per share $ 16.92 $ 16.19 $ 15.36 $ 15.76 $ 16.23 Accumulated other comprehensive loss to tangible common equity: Accumulated other comprehensive loss $ 108,142 $ 117,550 $ 124,898 $ 91,262 $ 56,388 Tangible common equity 638,218 606,929 575,321 593,554 613,699 Accumulated other comprehensive loss to � tangible common equity 16.9% 19.4% 21.7% 15.4% 9.2%