Investor Presentation – July 2018 Exhibit 99.1

Forward Looking Statements This communication contains forward-looking statements within the meaning of the U.S. federal securities laws. Forward-looking statements include, without limitation, statements concerning plans, estimates, calculations, forecasts and projections with respect to the anticipated future performance of the Company and its business. These statements are often, but not always, made through the use of words or phrases such as ‘‘may’’, ‘‘might’’, ‘‘should’’, ‘‘could’’, ‘‘predict’’, ‘‘potential’’, ‘‘believe’’, ‘‘expect’’, ‘‘continue’’, ‘‘will’’, ‘‘anticipate’’, ‘‘seek’’, ‘‘estimate’’, ‘‘intend’’, ‘‘plan’’, ‘‘projection’’, ‘‘would’’, ‘‘annualized’’, “target” and ‘‘outlook’’, or the negative version of those words or other comparable words or phrases of a future or forward-looking nature. Forward-looking statements reflect various assumptions and involve elements of subjective judgment and analysis, which may or may not prove to be correct, and which are subject to uncertainties and contingencies outside the control of Byline and its respective affiliates, directors, employees and other representatives, which could cause actual results to differ materially from those presented in this communication. No representations, warranties or guarantees are or will be made by Byline as to the reliability, accuracy or completeness of any forward-looking statements contained in this communication or that such forward-looking statements are or will remain based on reasonable assumptions. You should not place undue reliance on any forward-looking statements contained in this communication. Forward-looking statements speak only as of the date they are made, and we assume no obligation to update any of these statements in light of new information, future events or otherwise unless required under the federal securities laws.

Transparent & Executable Growth Strategy The Bank Chicago Deserves Seasoned Management Team & Board of Directors Diversified Commercial Lending Platform Disciplined Credit Risk Management Framework Deposits, Deposits, Deposits Franchise Highlights 1 2 3 4 5 6

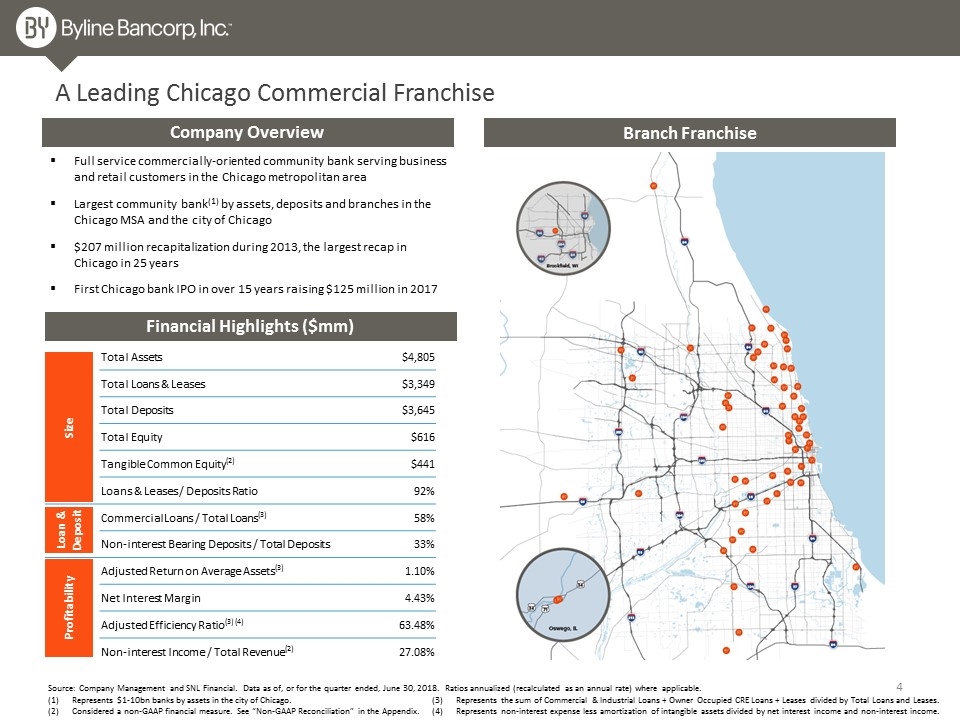

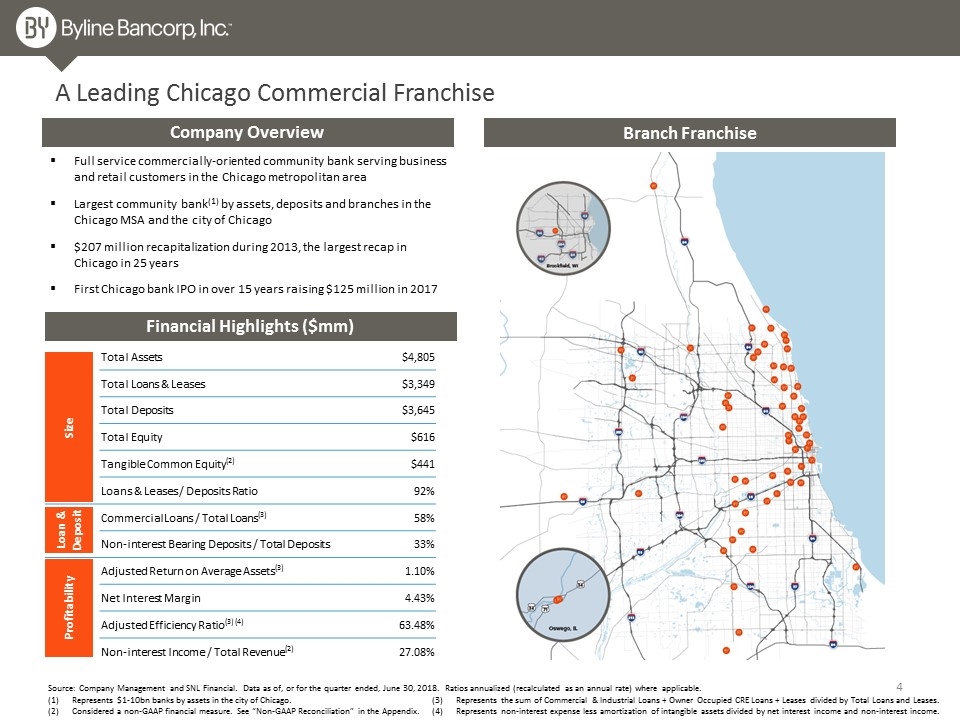

Total Assets $4,805 Total Loans & Leases $3,349 Total Deposits $3,645 Total Equity $616 Tangible Common Equity(2) $441 Loans & Leases / Deposits Ratio 92% Commercial Loans / Total Loans(3) 58% Non-interest Bearing Deposits / Total Deposits 33% Adjusted Return on Average Assets(3) 1.10% Net Interest Margin 4.43% Adjusted Efficiency Ratio(3) (4) 63.48% Non-interest Income / Total Revenue(2) 27.08% A Leading Chicago Commercial Franchise Company Overview Full service commercially-oriented community bank serving business and retail customers in the Chicago metropolitan area Largest community bank(1) by assets, deposits and branches in the Chicago MSA and the city of Chicago $207 million recapitalization during 2013, the largest recap in Chicago in 25 years First Chicago bank IPO in over 15 years raising $125 million in 2017 Source: Company Management and SNL Financial. Data as of, or for the quarter ended, June 30, 2018. Ratios annualized (recalculated as an annual rate) where applicable. Financial Highlights ($mm) Size Loan & Deposit Profitability (2) (2) (3) Branch Franchise Represents the sum of Commercial & Industrial Loans + Owner Occupied CRE Loans + Leases divided by Total Loans and Leases. Represents non-interest expense less amortization of intangible assets divided by net interest income and non-interest income. Represents $1-10bn banks by assets in the city of Chicago. Considered a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the Appendix.

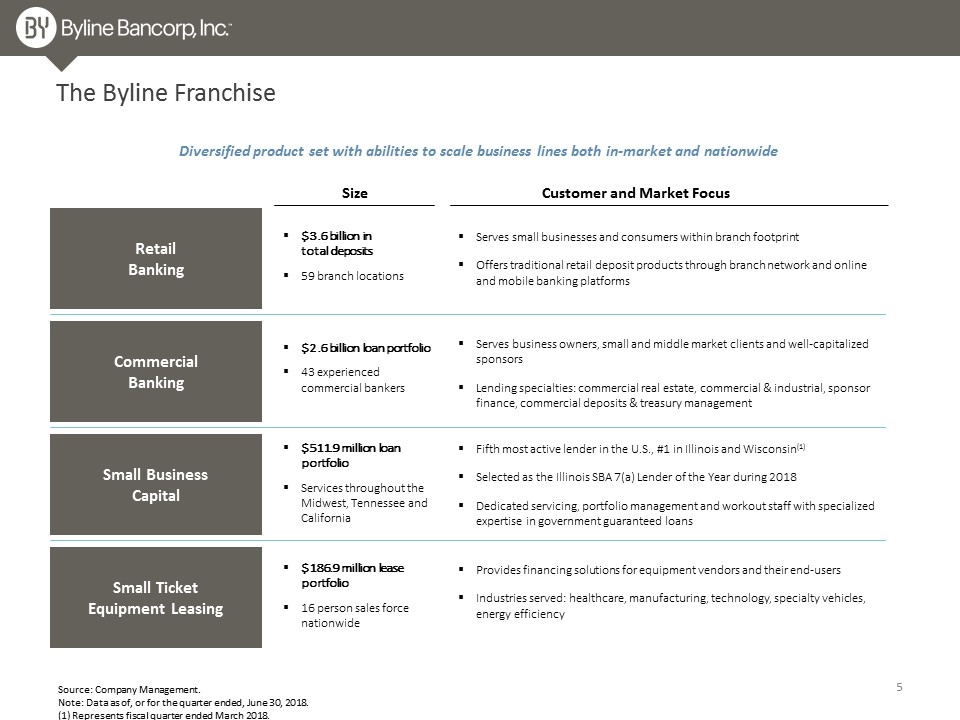

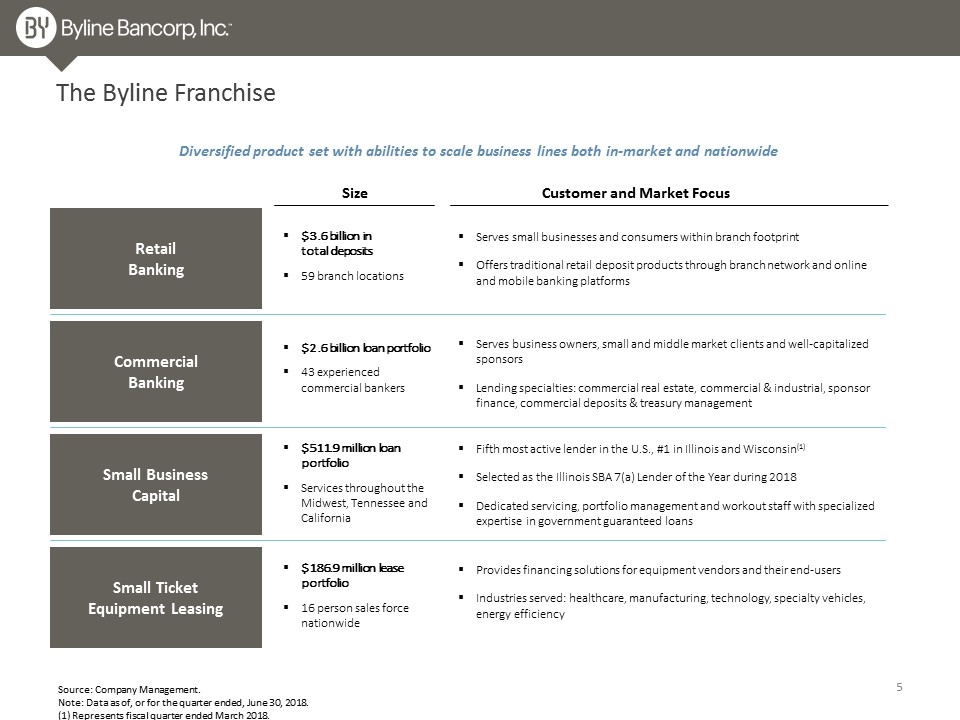

The Byline Franchise Retail Banking Commercial Banking Small Business Capital Small Ticket Equipment Leasing Diversified product set with abilities to scale business lines both in-market and nationwide Size Customer and Market Focus $3.6 billion in total deposits 59 branch locations Serves small businesses and consumers within branch footprint Offers traditional retail deposit products through branch network and online and mobile banking platforms $2.6 billion loan portfolio 43 experienced commercial bankers Serves business owners, small and middle market clients and well-capitalized sponsors Lending specialties: commercial real estate, commercial & industrial, sponsor finance, commercial deposits & treasury management $511.9 million loan portfolio Services throughout the Midwest, Tennessee and California Fifth most active lender in the U.S., #1 in Illinois and Wisconsin(1) Selected as the Illinois SBA 7(a) Lender of the Year during 2018 Dedicated servicing, portfolio management and workout staff with specialized expertise in government guaranteed loans $186.9 million lease portfolio 16 person sales force nationwide Provides financing solutions for equipment vendors and their end-users Industries served: healthcare, manufacturing, technology, specialty vehicles, energy efficiency Source: Company Management. Note: Data as of, or for the quarter ended, June 30, 2018. (1) Represents fiscal quarter ended March 2018.

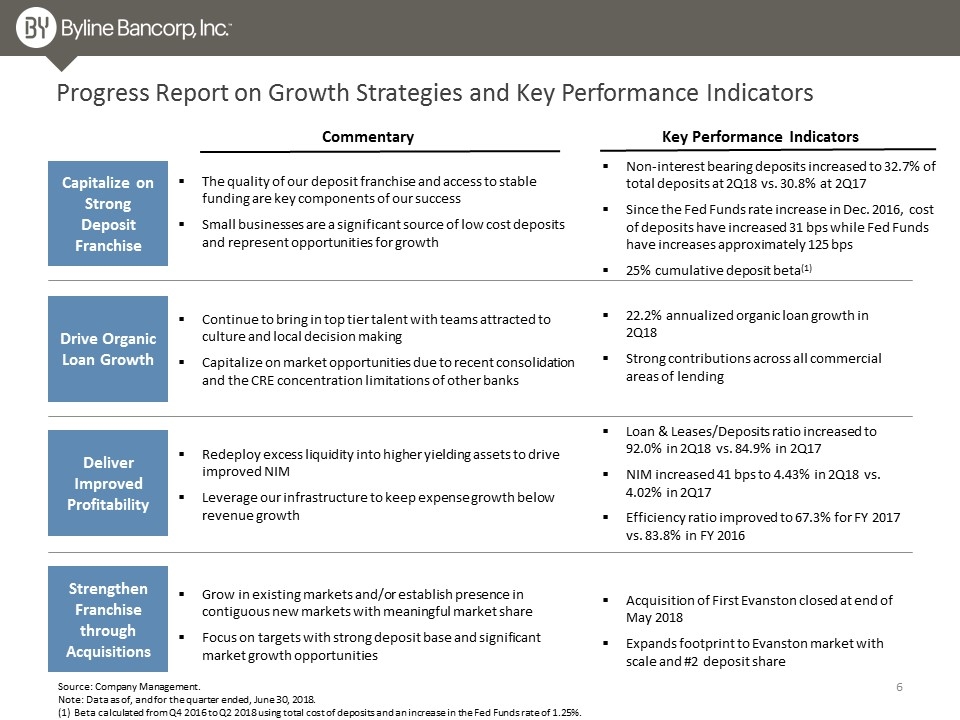

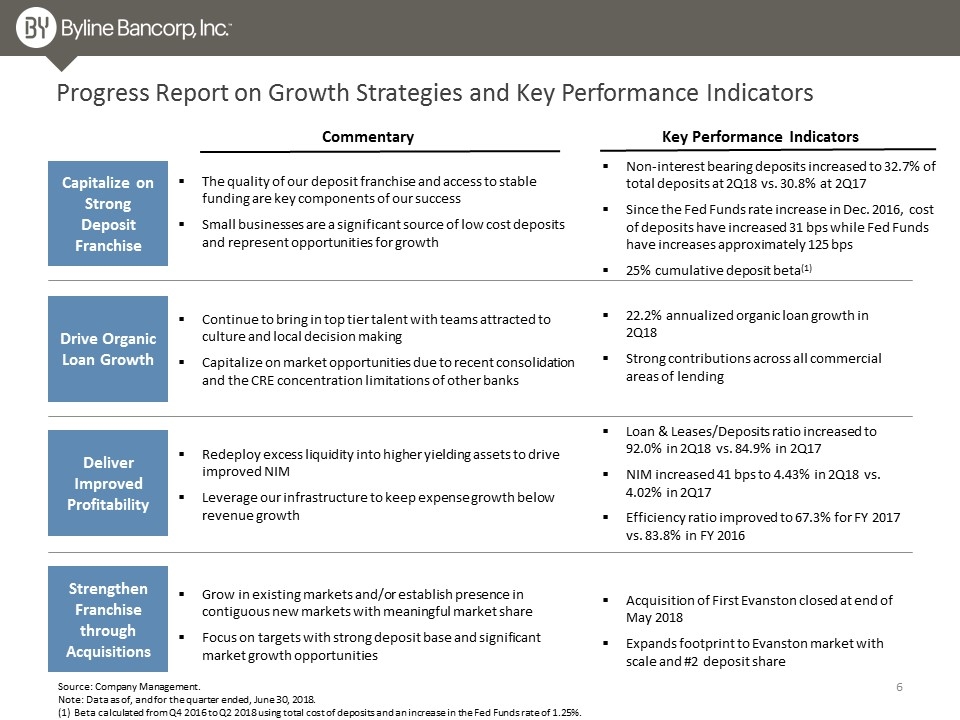

Drive Organic Loan Growth Deliver Improved Profitability Strengthen Franchise through Acquisitions Continue to bring in top tier talent with teams attracted to culture and local decision making Capitalize on market opportunities due to recent consolidation and the CRE concentration limitations of other banks Redeploy excess liquidity into higher yielding assets to drive improved NIM Leverage our infrastructure to keep expense growth below revenue growth Grow in existing markets and/or establish presence in contiguous new markets with meaningful market share Focus on targets with strong deposit base and significant market growth opportunities Capitalize on Strong Deposit Franchise The quality of our deposit franchise and access to stable funding are key components of our success Small businesses are a significant source of low cost deposits and represent opportunities for growth Progress Report on Growth Strategies and Key Performance Indicators Commentary Key Performance Indicators Non-interest bearing deposits increased to 32.7% of total deposits at 2Q18 vs. 30.8% at 2Q17 Since the Fed Funds rate increase in Dec. 2016, cost of deposits have increased 31 bps while Fed Funds have increases approximately 125 bps 25% cumulative deposit beta(1) 22.2% annualized organic loan growth in 2Q18 Strong contributions across all commercial areas of lending Loan & Leases/Deposits ratio increased to 92.0% in 2Q18 vs. 84.9% in 2Q17 NIM increased 41 bps to 4.43% in 2Q18 vs. 4.02% in 2Q17 Efficiency ratio improved to 67.3% for FY 2017 vs. 83.8% in FY 2016 Acquisition of First Evanston closed at end of May 2018 Expands footprint to Evanston market with scale and #2 deposit share Source: Company Management. Note: Data as of, and for the quarter ended, June 30, 2018. (1) Beta calculated from Q4 2016 to Q2 2018 using total cost of deposits and an increase in the Fed Funds rate of 1.25%.

Second Quarter 2018 Results

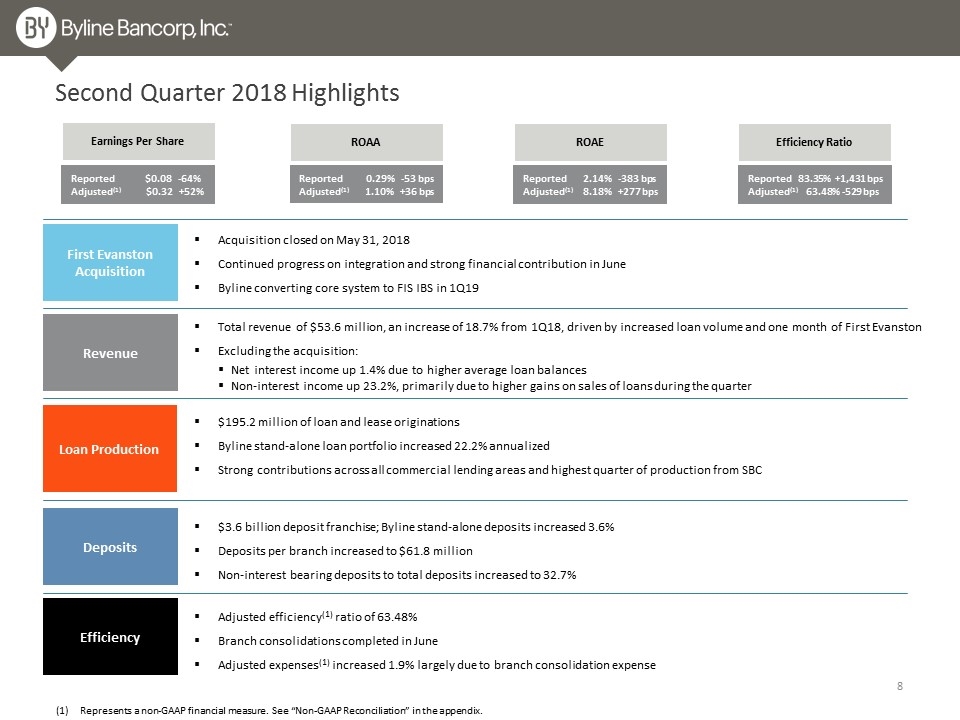

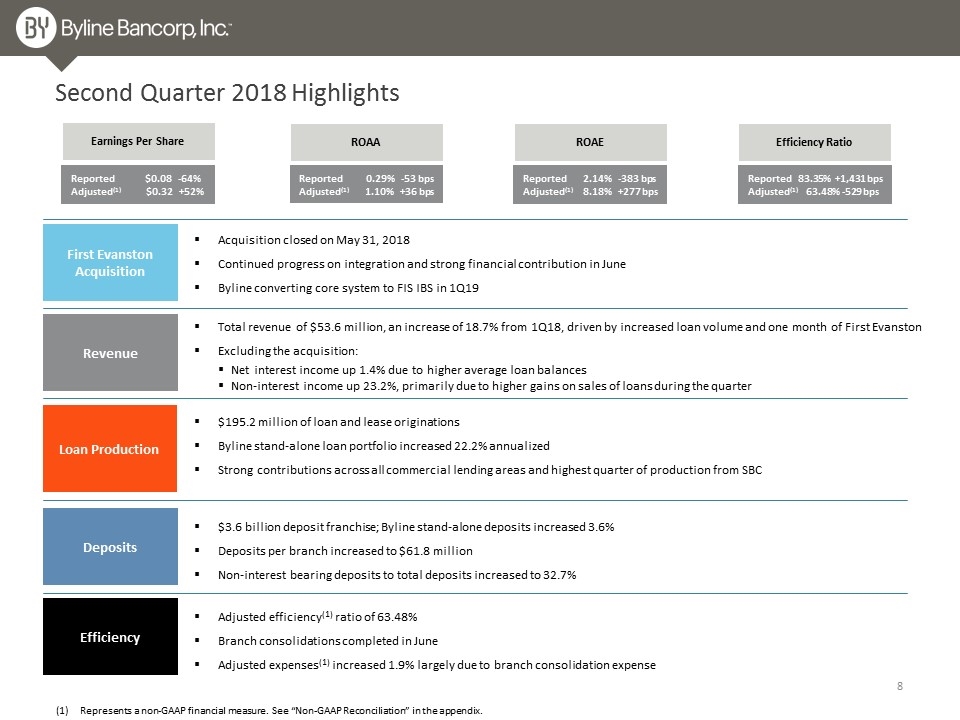

Second Quarter 2018 Highlights Loan Production First Evanston Acquisition Revenue Deposits $195.2 million of loan and lease originations Byline stand-alone loan portfolio increased 22.2% annualized Strong contributions across all commercial lending areas and highest quarter of production from SBC Total revenue of $53.6 million, an increase of 18.7% from 1Q18, driven by increased loan volume and one month of First Evanston Excluding the acquisition: Net interest income up 1.4% due to higher average loan balances Non-interest income up 23.2%, primarily due to higher gains on sales of loans during the quarter $3.6 billion deposit franchise; Byline stand-alone deposits increased 3.6% Deposits per branch increased to $61.8 million Non-interest bearing deposits to total deposits increased to 32.7% Efficiency Acquisition closed on May 31, 2018 Continued progress on integration and strong financial contribution in June Byline converting core system to FIS IBS in 1Q19 Adjusted efficiency(1) ratio of 63.48% Branch consolidations completed in June Adjusted expenses(1) increased 1.9% largely due to branch consolidation expense Represents a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the appendix. Earnings Per Share Reported $0.08 -64% Adjusted(1) $0.32 +52% ROAA ROAE Efficiency Ratio Reported 0.29% -53 bps Adjusted(1) 1.10% +36 bps Reported 2.14% -383 bps Adjusted(1) 8.18% +277 bps Reported 83.35% +1,431 bps Adjusted(1) 63.48% -529 bps

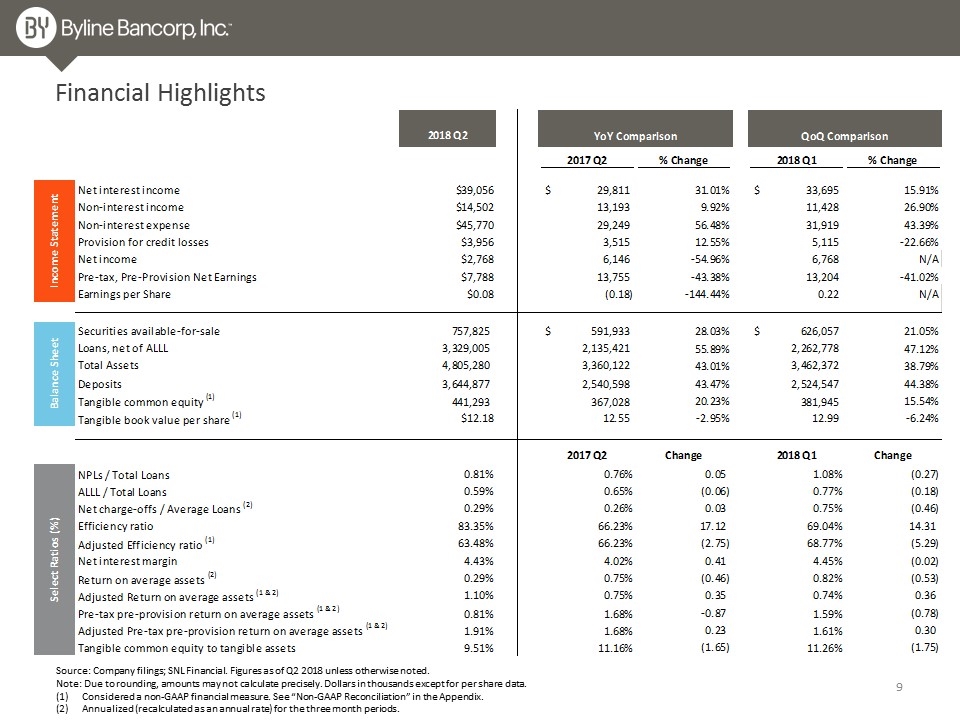

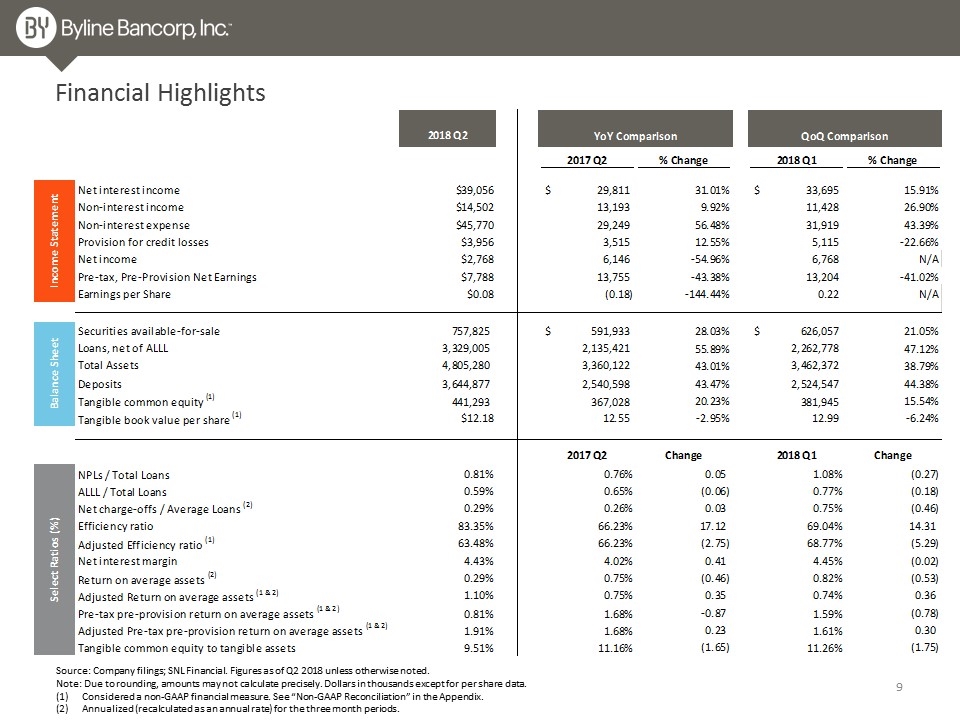

Financial Highlights Source: Company filings; SNL Financial. Figures as of Q2 2018 unless otherwise noted. Note: Due to rounding, amounts may not calculate precisely. Dollars in thousands except for per share data. Considered a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the Appendix. Annualized (recalculated as an annual rate) for the three month periods.

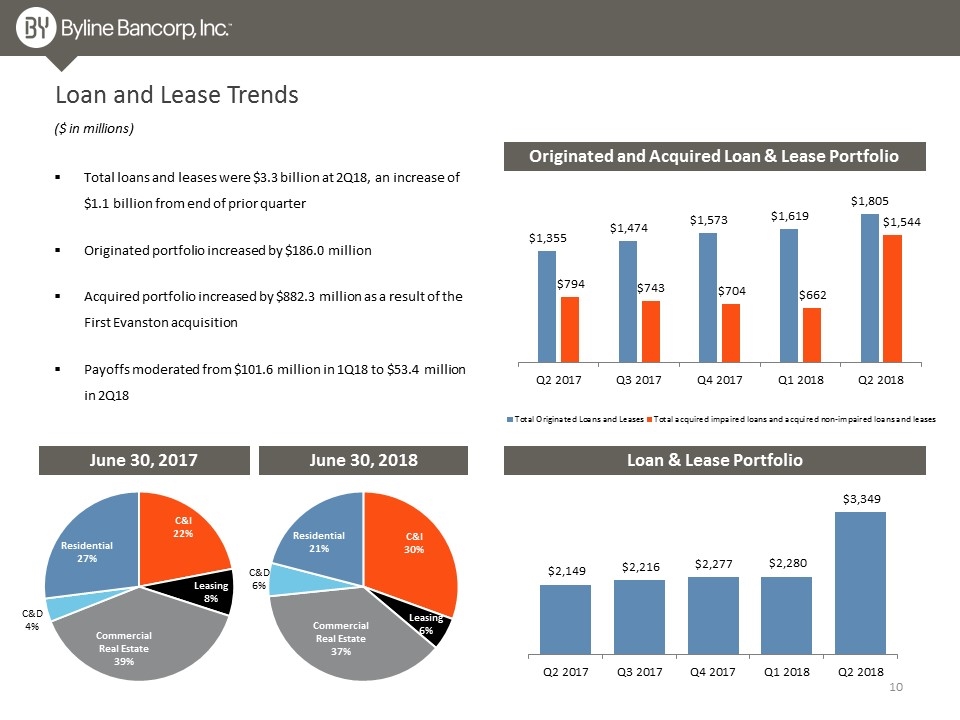

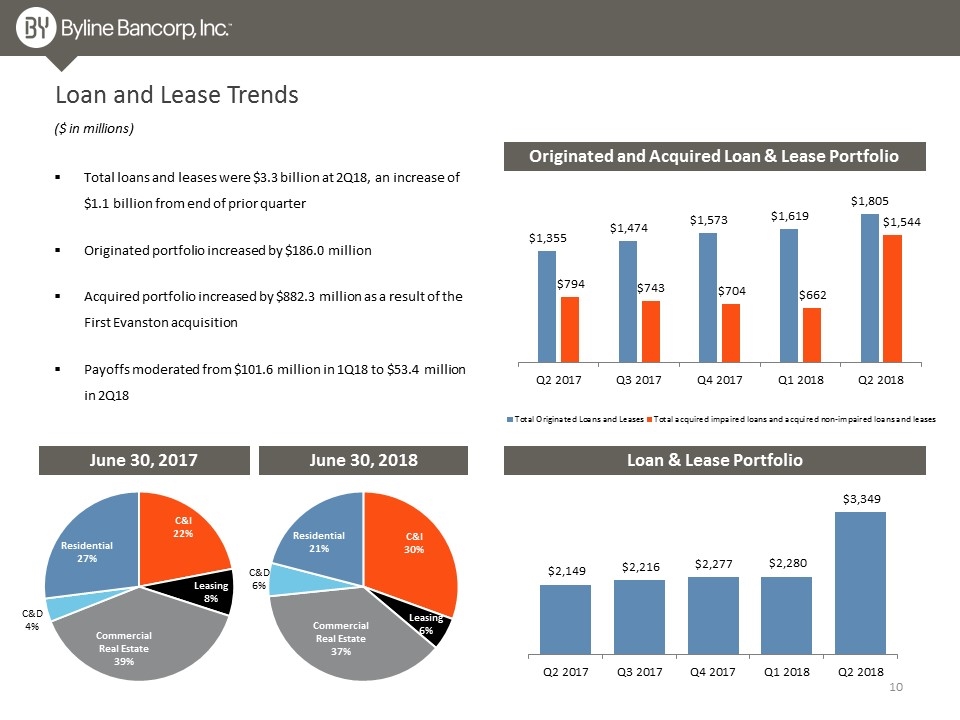

Loan and Lease Trends Loan & Lease Portfolio June 30, 2017 June 30, 2018 ($ in millions) Originated and Acquired Loan & Lease Portfolio Total loans and leases were $3.3 billion at 2Q18, an increase of $1.1 billion from end of prior quarter Originated portfolio increased by $186.0 million Acquired portfolio increased by $882.3 million as a result of the First Evanston acquisition Payoffs moderated from $101.6 million in 1Q18 to $53.4 million in 2Q18

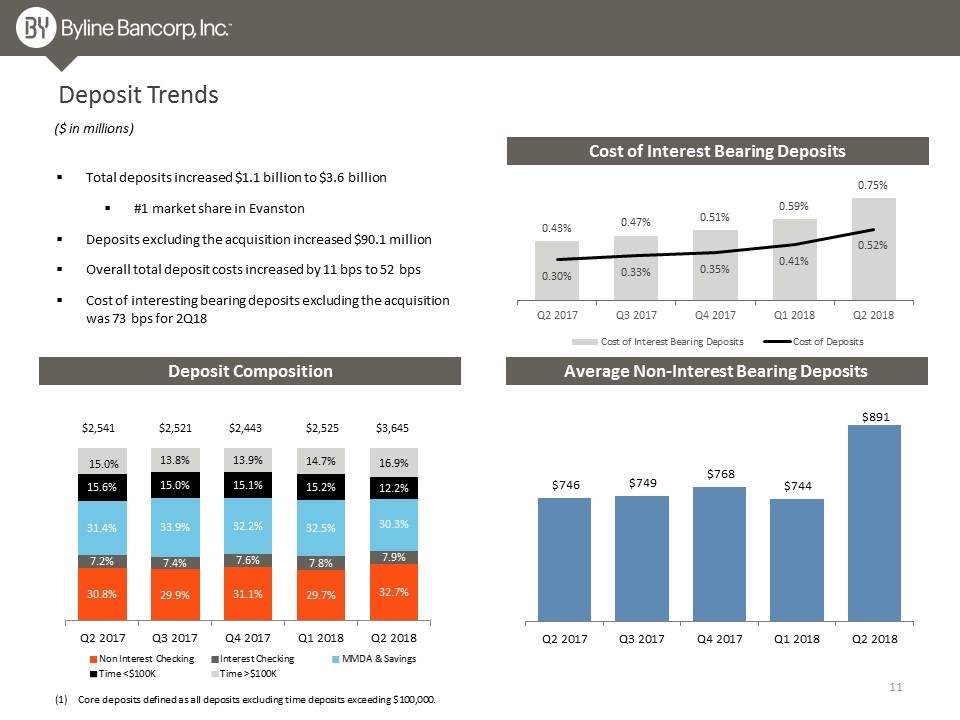

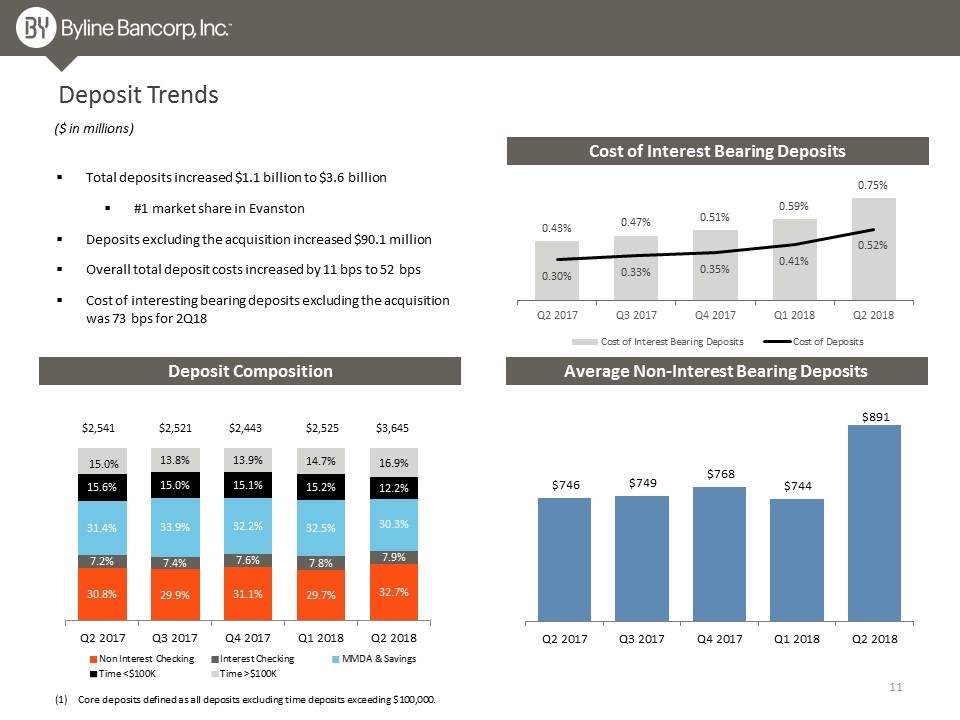

Total deposits increased $1.1 billion to $3.6 billion #1 market share in Evanston Deposits excluding the acquisition increased $90.1 million Overall total deposit costs increased by 11 bps to 52 bps Cost of interesting bearing deposits excluding the acquisition was 73 bps for 2Q18 Deposit Trends Average Non-Interest Bearing Deposits ($ in millions) Deposit Composition (1) Core deposits defined as all deposits excluding time deposits exceeding $100,000. $2,521 $2,443 $3,645 $2,541 Cost of Interest Bearing Deposits $2,525

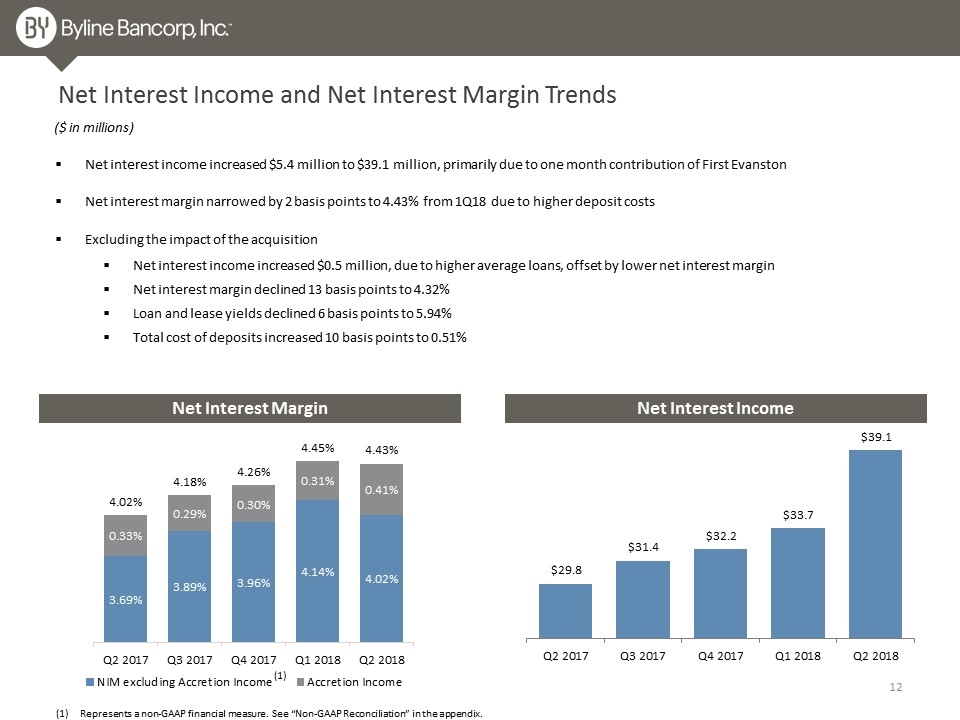

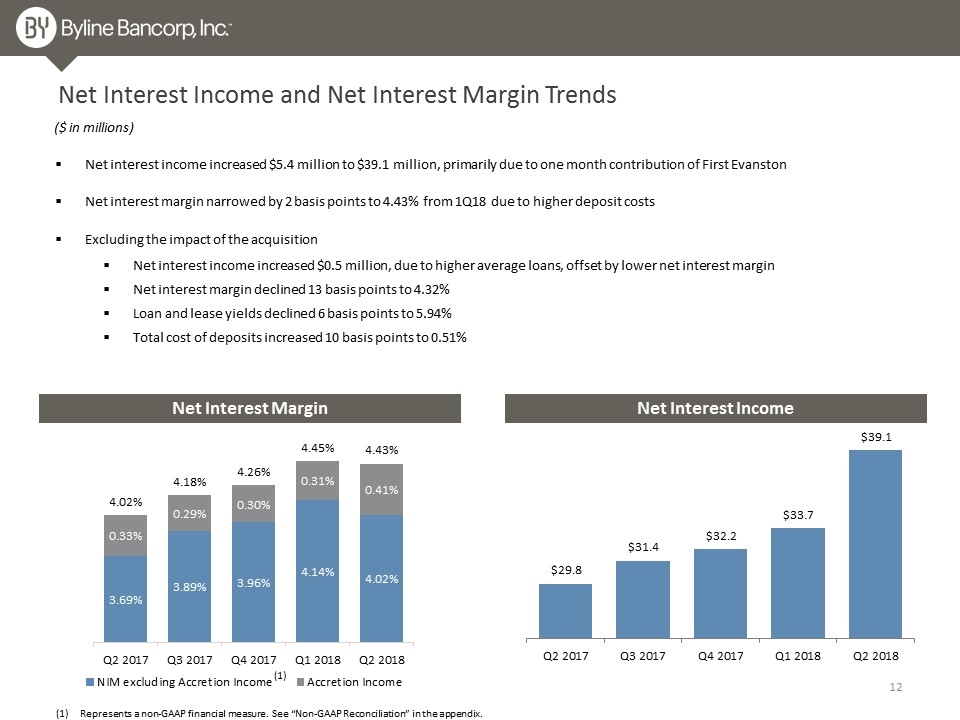

Net Interest Income and Net Interest Margin Trends Net interest income increased $5.4 million to $39.1 million, primarily due to one month contribution of First Evanston Net interest margin narrowed by 2 basis points to 4.43% from 1Q18 due to higher deposit costs Excluding the impact of the acquisition Net interest income increased $0.5 million, due to higher average loans, offset by lower net interest margin Net interest margin declined 13 basis points to 4.32% Loan and lease yields declined 6 basis points to 5.94% Total cost of deposits increased 10 basis points to 0.51% Net Interest Margin Net Interest Income Represents a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the appendix. ($ in millions) (1)

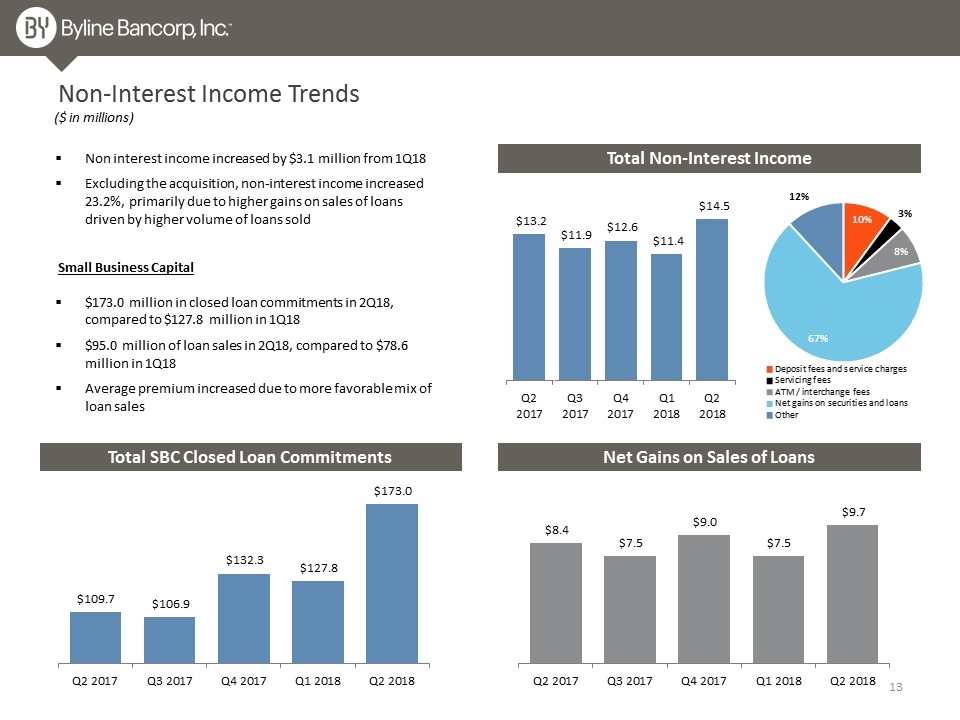

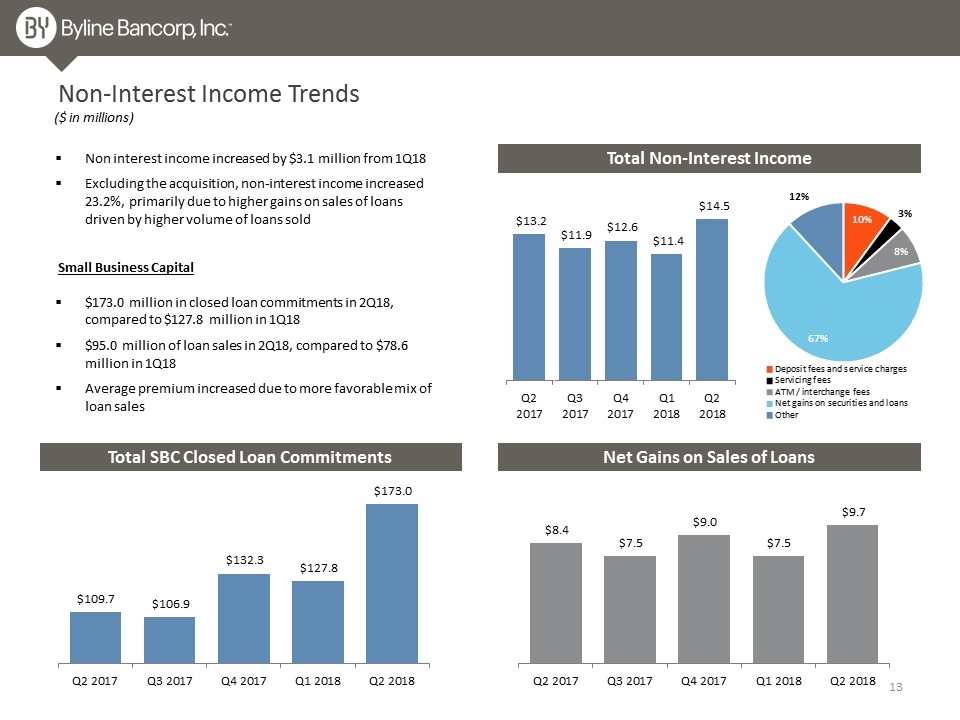

Total Non-Interest Income Non-Interest Income Trends Non interest income increased by $3.1 million from 1Q18 Excluding the acquisition, non-interest income increased 23.2%, primarily due to higher gains on sales of loans driven by higher volume of loans sold ($ in millions) Total SBC Closed Loan Commitments Net Gains on Sales of Loans $173.0 million in closed loan commitments in 2Q18, compared to $127.8 million in 1Q18 $95.0 million of loan sales in 2Q18, compared to $78.6 million in 1Q18 Average premium increased due to more favorable mix of loan sales Small Business Capital

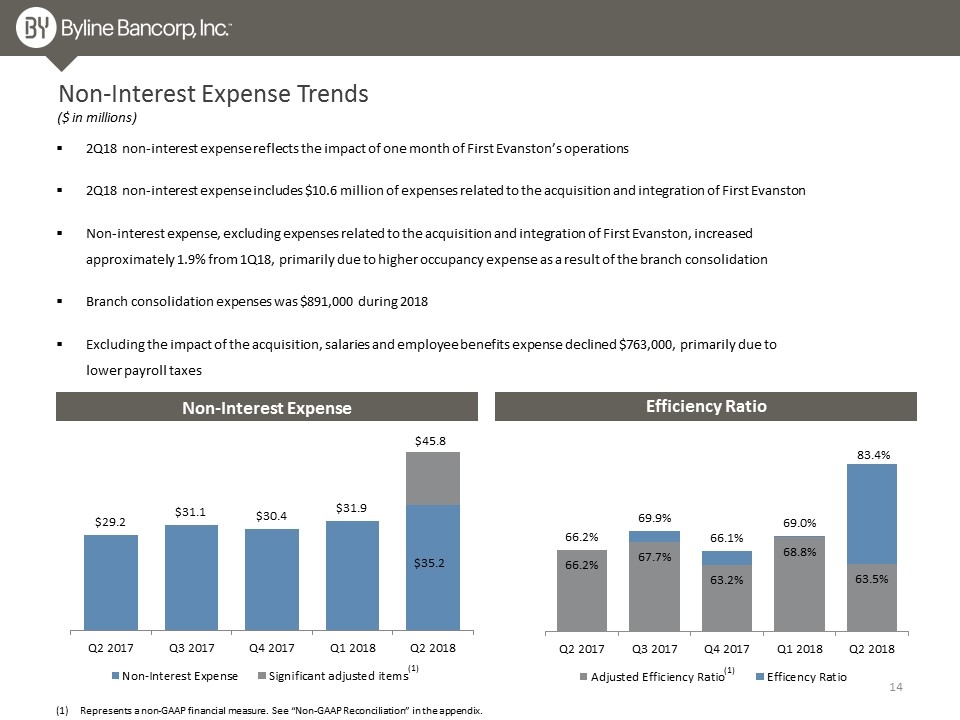

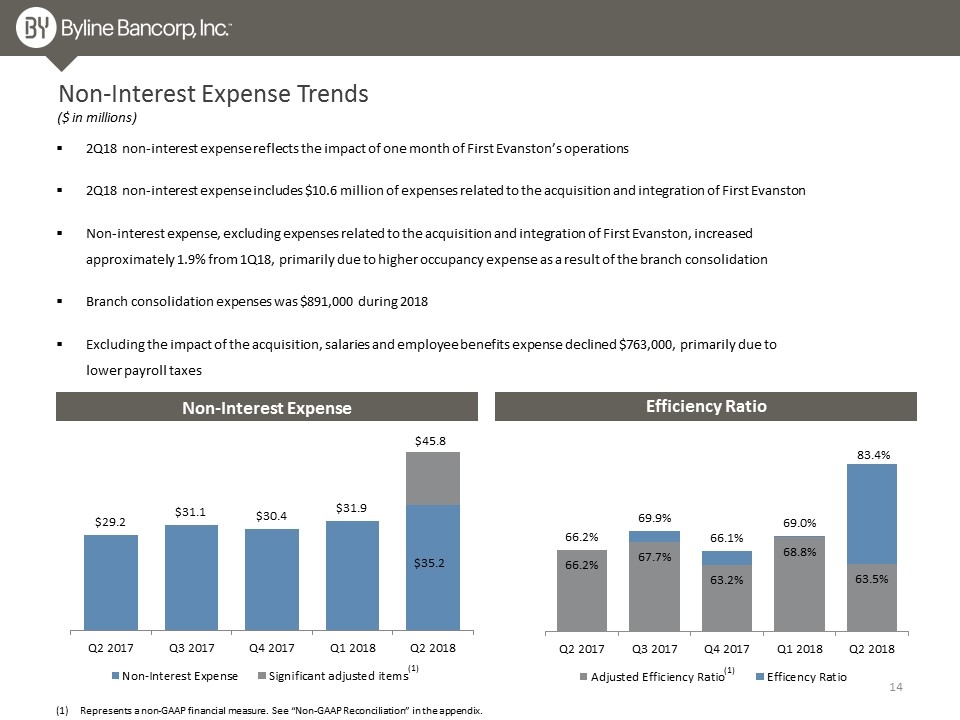

Non-Interest Expense Trends 2Q18 non-interest expense reflects the impact of one month of First Evanston’s operations 2Q18 non-interest expense includes $10.6 million of expenses related to the acquisition and integration of First Evanston Non-interest expense, excluding expenses related to the acquisition and integration of First Evanston, increased approximately 1.9% from 1Q18, primarily due to higher occupancy expense as a result of the branch consolidation Branch consolidation expenses was $891,000 during 2018 Excluding the impact of the acquisition, salaries and employee benefits expense declined $763,000, primarily due to lower payroll taxes ($ in millions) Efficiency Ratio Non-Interest Expense Represents a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the appendix. (1) (1)

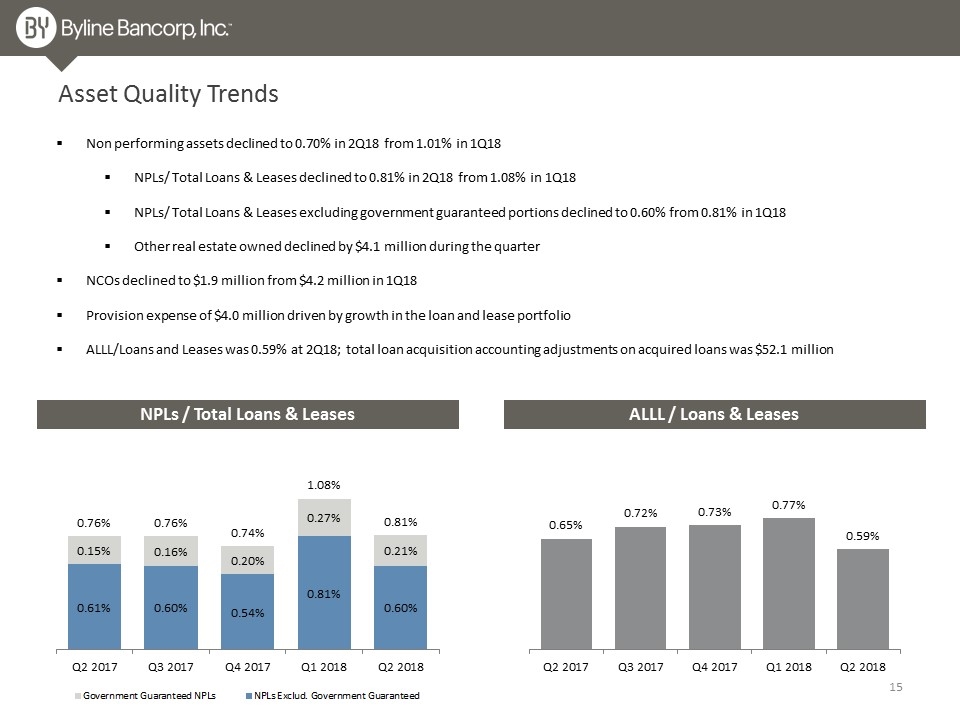

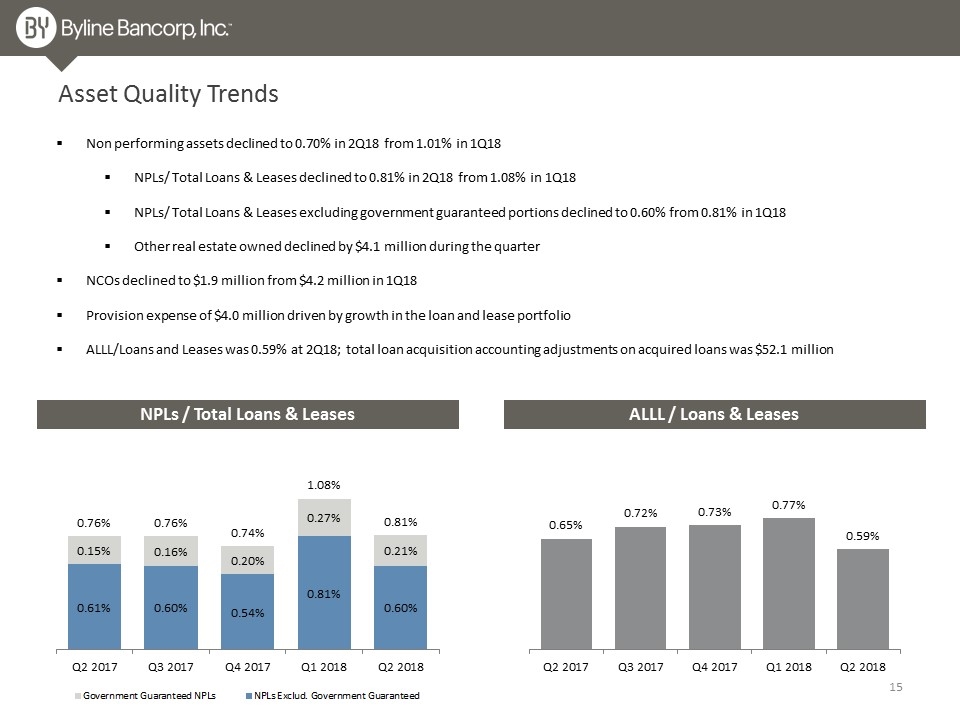

Asset Quality Trends Non performing assets declined to 0.70% in 2Q18 from 1.01% in 1Q18 NPLs/ Total Loans & Leases declined to 0.81% in 2Q18 from 1.08% in 1Q18 NPLs/ Total Loans & Leases excluding government guaranteed portions declined to 0.60% from 0.81% in 1Q18 Other real estate owned declined by $4.1 million during the quarter NCOs declined to $1.9 million from $4.2 million in 1Q18 Provision expense of $4.0 million driven by growth in the loan and lease portfolio ALLL/Loans and Leases was 0.59% at 2Q18; total loan acquisition accounting adjustments on acquired loans was $52.1 million NPLs / Total Loans & Leases ALLL / Loans & Leases

Acquisition of First Evanston Bancorp, Inc. Building on our leading branch & deposit footprint in Chicago

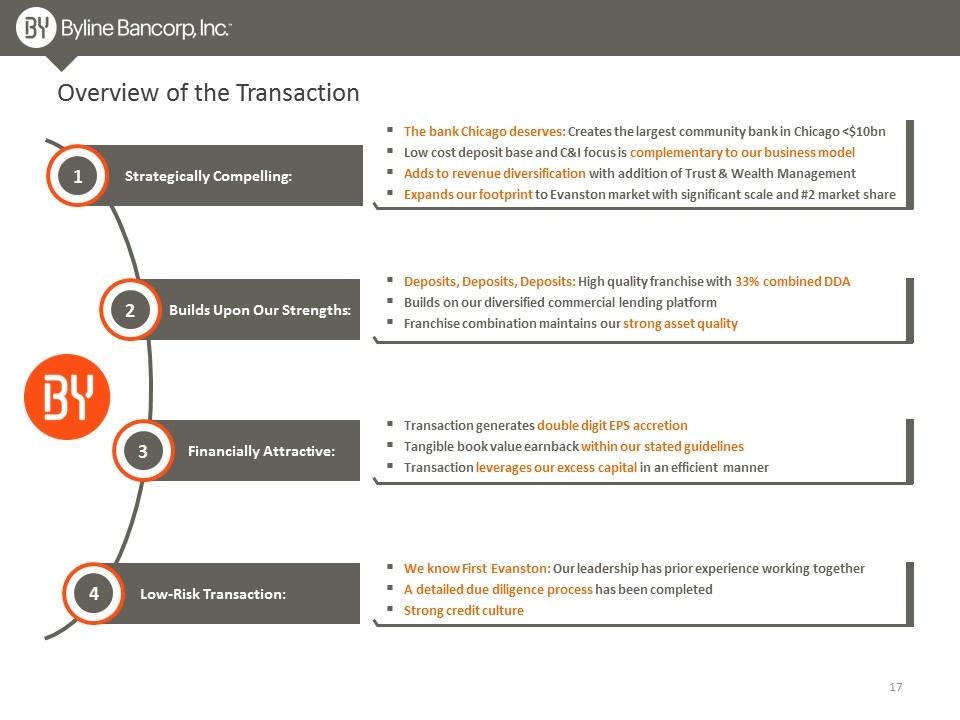

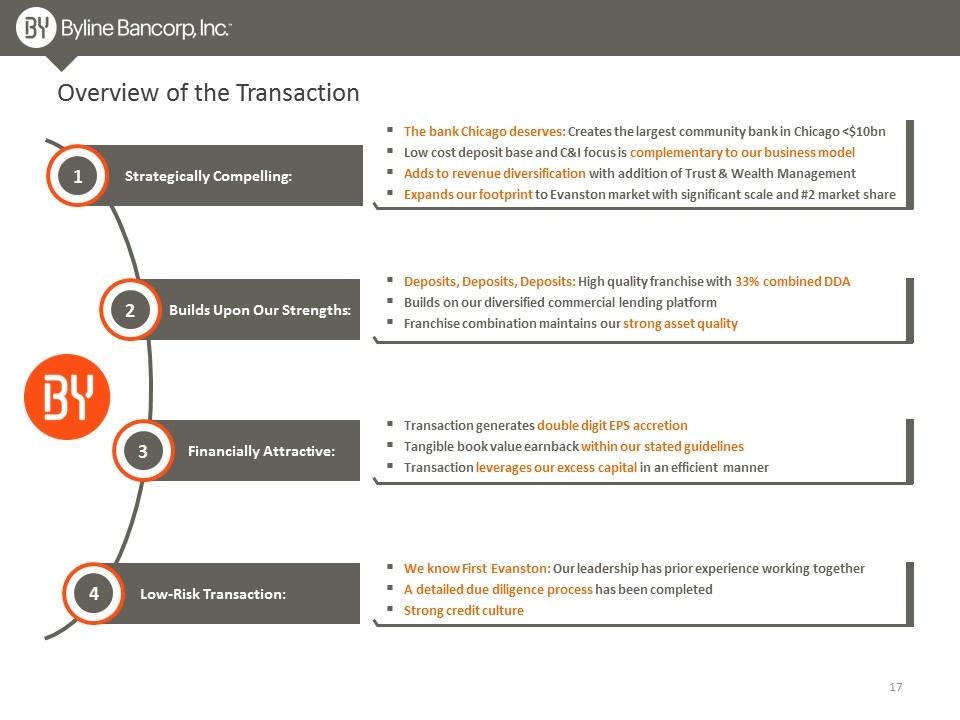

Low-Risk Transaction: Strategically Compelling: Financially Attractive: Builds Upon Our Strengths: Overview of the Transaction 1 2 3 4 The bank Chicago deserves: Creates the largest community bank in Chicago <$10bn Low cost deposit base and C&I focus is complementary to our business model Adds to revenue diversification with addition of Trust & Wealth Management Expands our footprint to Evanston market with significant scale and #2 market share Transaction generates double digit EPS accretion Tangible book value earnback within our stated guidelines Transaction leverages our excess capital in an efficient manner We know First Evanston: Our leadership has prior experience working together A detailed due diligence process has been completed Strong credit culture Deposits, Deposits, Deposits: High quality franchise with 33% combined DDA Builds on our diversified commercial lending platform Franchise combination maintains our strong asset quality

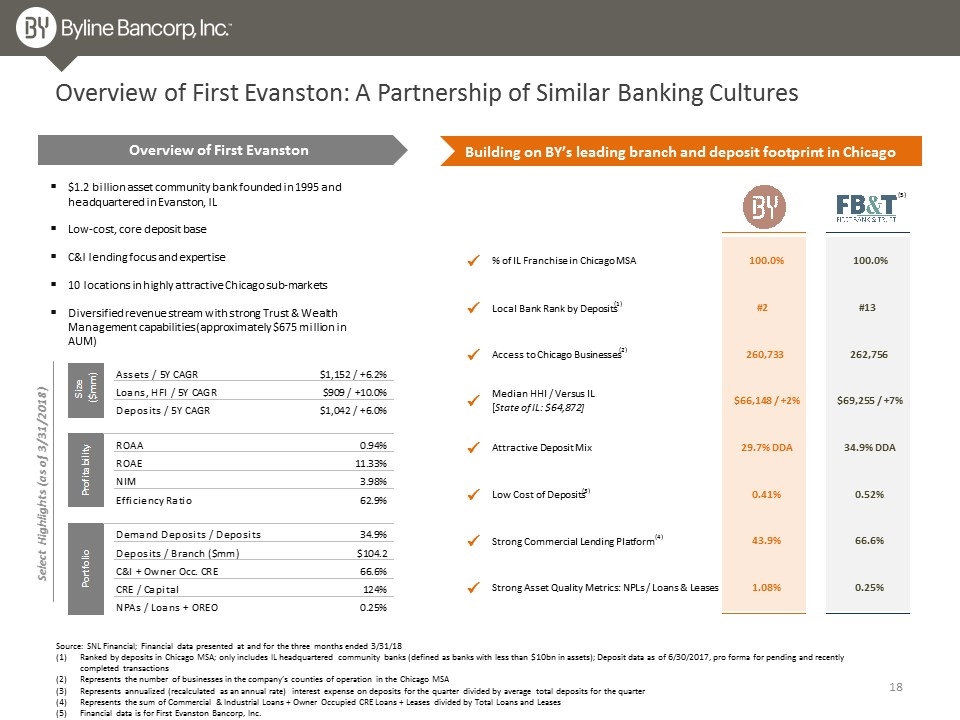

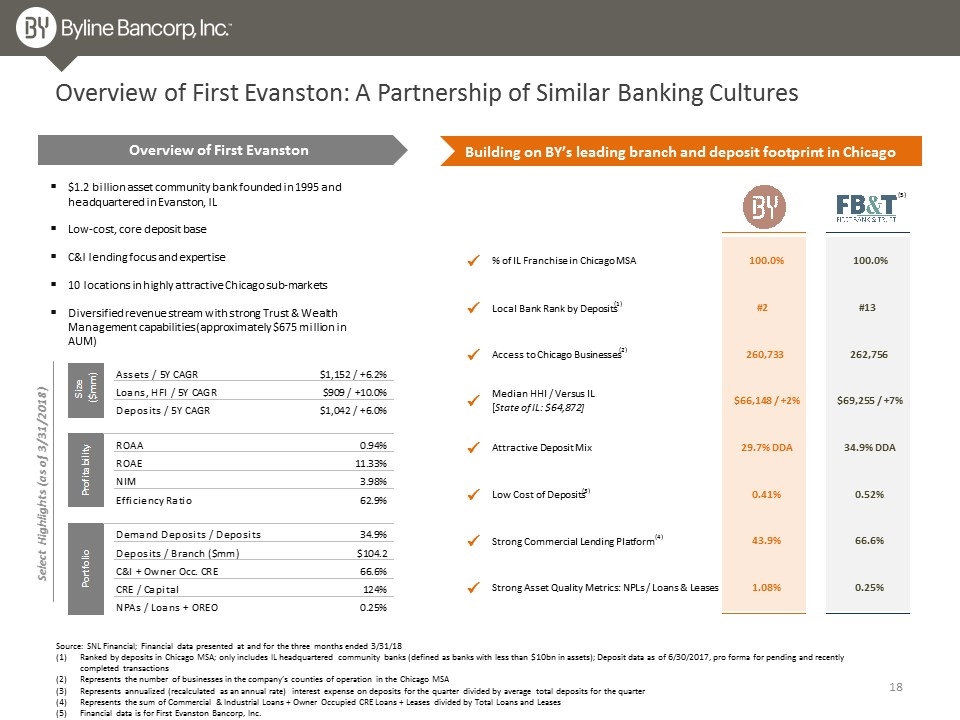

Source: SNL Financial; Financial data presented at and for the three months ended 3/31/18 Ranked by deposits in Chicago MSA; only includes IL headquartered community banks (defined as banks with less than $10bn in assets); Deposit data as of 6/30/2017, pro forma for pending and recently completed transactions Represents the number of businesses in the company’s counties of operation in the Chicago MSA Represents annualized (recalculated as an annual rate) interest expense on deposits for the quarter divided by average total deposits for the quarter Represents the sum of Commercial & Industrial Loans + Owner Occupied CRE Loans + Leases divided by Total Loans and Leases Financial data is for First Evanston Bancorp, Inc. Overview of First Evanston: A Partnership of Similar Banking Cultures $1.2 billion asset community bank founded in 1995 and headquartered in Evanston, IL Low-cost, core deposit base C&I lending focus and expertise 10 locations in highly attractive Chicago sub-markets Diversified revenue stream with strong Trust & Wealth Management capabilities (approximately $675 million in AUM) Building on BY’s leading branch and deposit footprint in Chicago Select Highlights (as of 3/31/2018) Overview of First Evanston (5) ü % of IL Franchise in Chicago MSA 100.0% 100.0% ü Local Bank Rank by Deposits (1) #2 #13 ü Access to Chicago Businesses (2) 260,733 262,756 ü Median HHI / Versus IL [ State of IL: $64,872] $66,148 / +2% $69,255 / +7% ü Attractive Deposit Mix 29.7% DDA 34.9% DDA ü Low Cost of Deposits (3) 0.41% 0.52% ü Strong Commercial Lending Platform (4) 43.9% 66.6% ü Strong Asset Quality Metrics: NPLs / Loans & Leases 1.08% 0.25%

Appendix

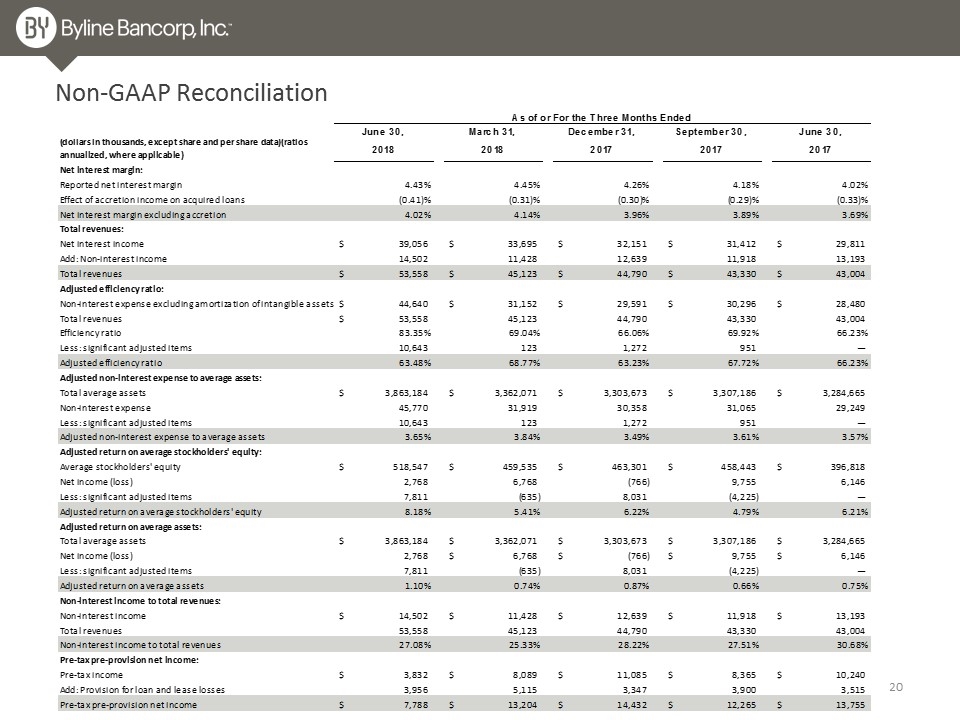

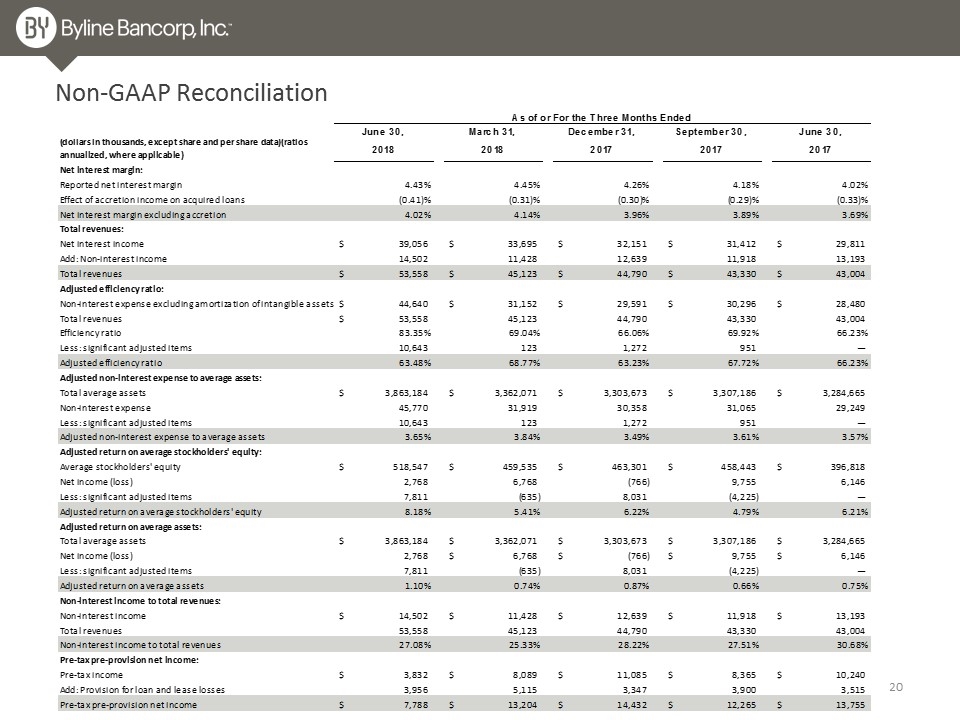

Non-GAAP Reconciliation

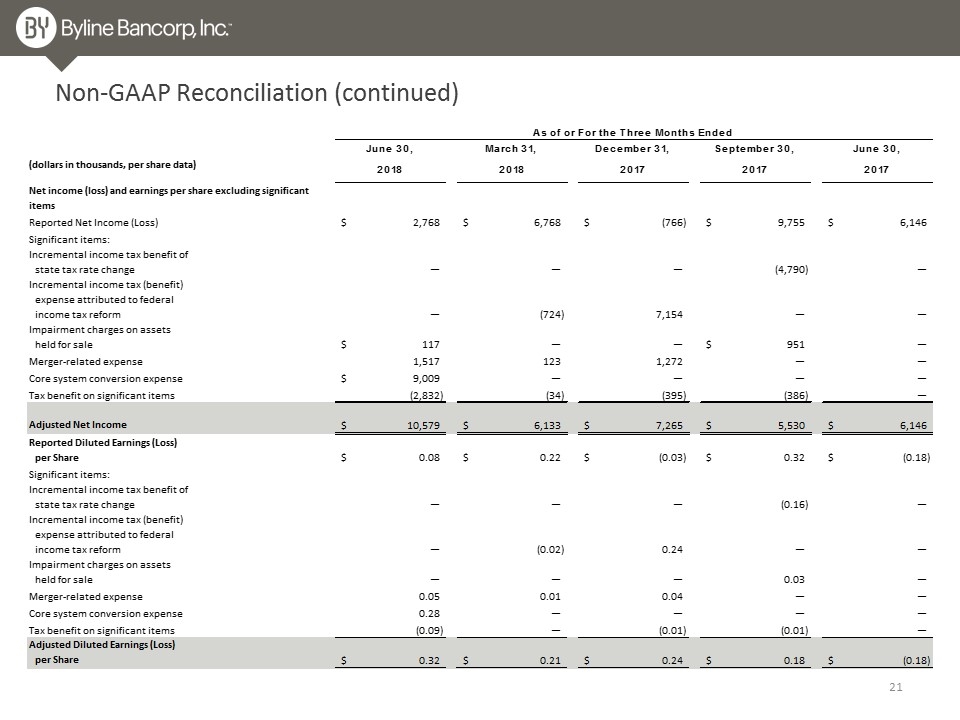

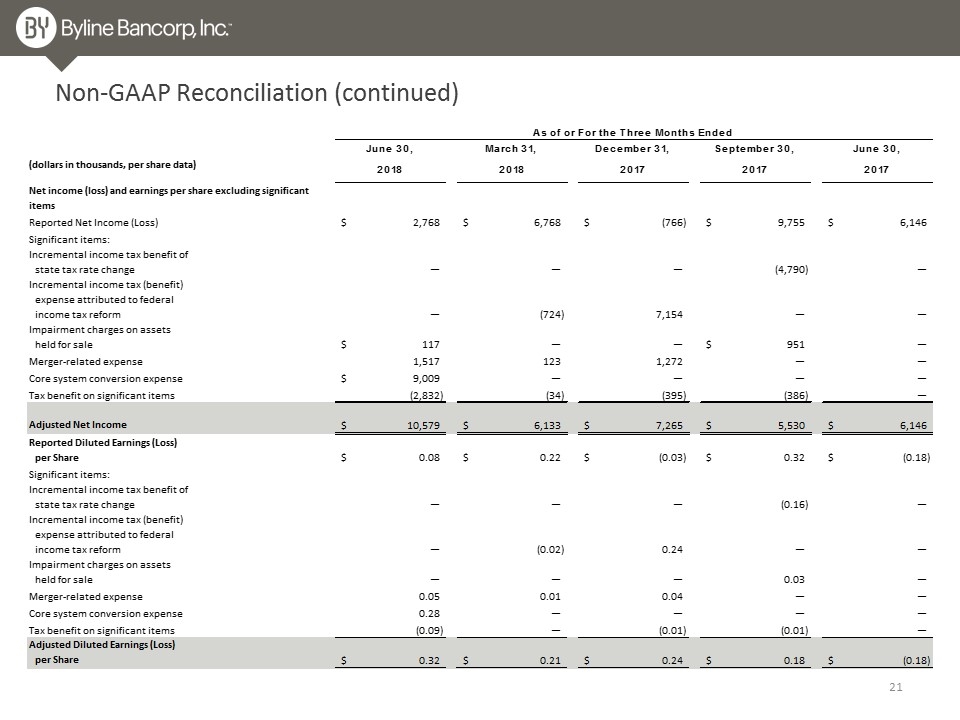

Non-GAAP Reconciliation (continued)

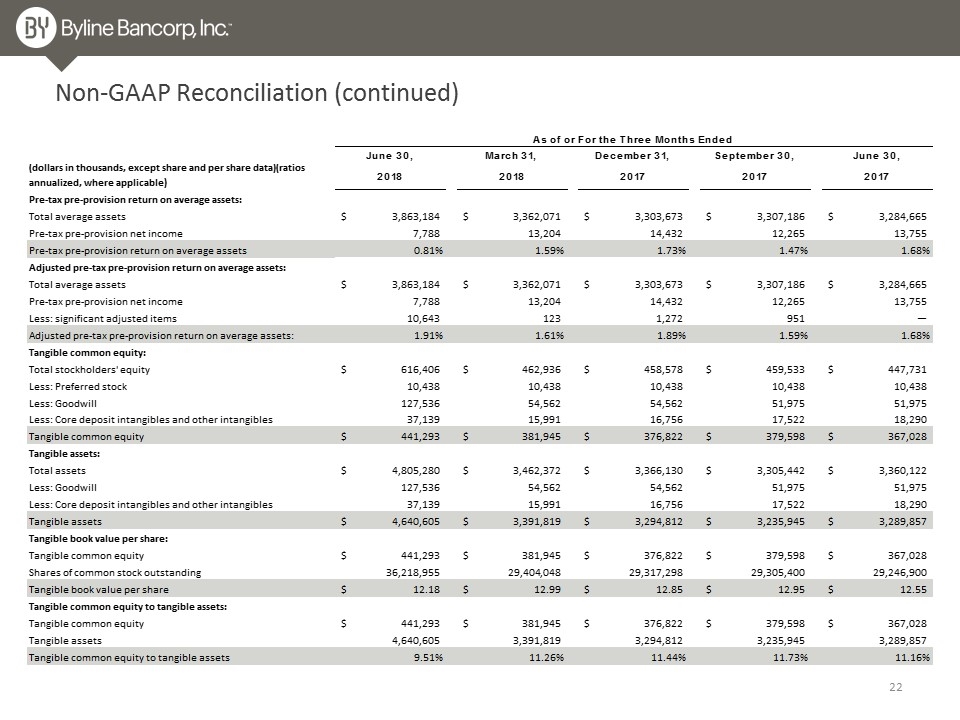

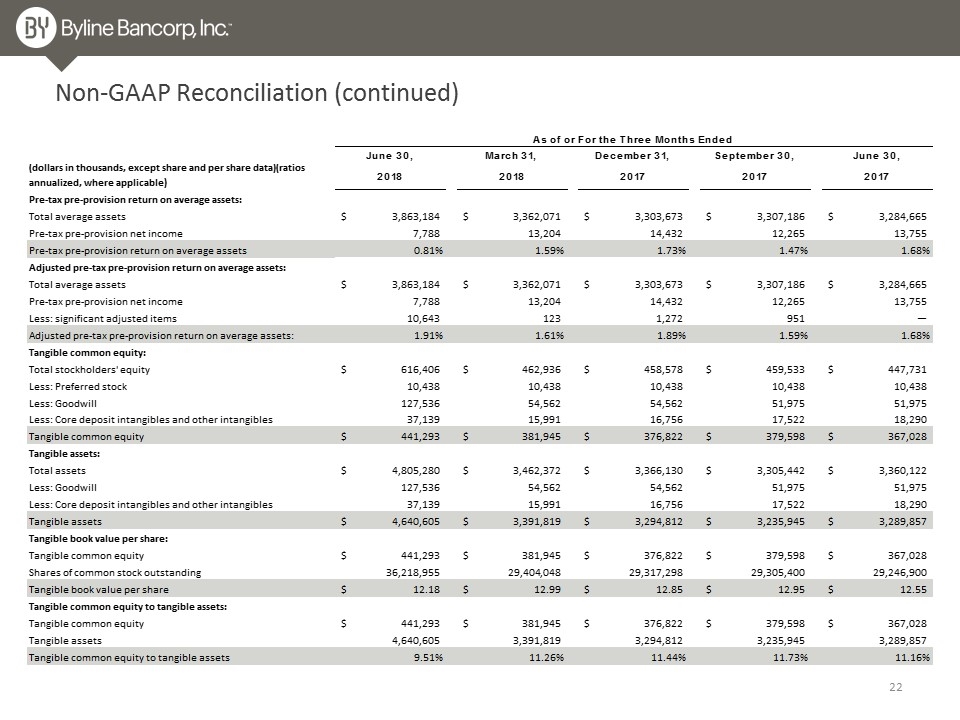

Non-GAAP Reconciliation (continued)