Q3 2019 Financial Results Exhibit 99.1

Forward-Looking Statements This communication contains forward-looking statements within the meaning of the U.S. federal securities laws. Forward-looking statements include, without limitation, statements concerning plans, estimates, calculations, forecasts and projections with respect to the anticipated future performance of the Company. These statements are often, but not always, made through the use of words or phrases such as ‘‘may’’, ‘‘might’’, ‘‘should’’, ‘‘could’’, ‘‘predict’’, ‘‘potential’’, ‘‘believe’’, ‘‘expect’’, ‘‘continue’’, ‘‘will’’, ‘‘anticipate’’, ‘‘seek’’, ‘‘estimate’’, ‘‘intend’’, ‘‘plan’’, ‘‘projection’’, ‘‘would’’, ‘‘annualized’’, “target” and ‘‘outlook’’, or the negative version of those words or other comparable words or phrases of a future or forward-looking nature. Forward-looking statements involve estimates and known and unknown risks, and reflect various assumptions and involve elements of subjective judgement and analysis, which may or may not prove to be correct, and which are subject to uncertainties and contingencies outside the control of Byline and its respective affiliates, directors, employees and other representatives, which could cause actual results to differ materially from those presented in this communication. No representations, warranties or guarantees are or will be made by Byline as to the reliability, accuracy or completeness of any forward-looking statements contained in this communication or that such forward-looking statements are or will remain based on reasonable assumptions. You should not place undue reliance on any forward-looking statements contained in this communication. Certain risks and important factors that could affect Byline’s future results are identified in its Annual Report on Form 10-K and other reports filed with the Securities and Exchange Commission, including among other things under the heading “Risk Factors” in such Annual Report on Form 10-K. Any forward-looking statement speaks only as of the date on which it is made, and Byline undertakes no obligation to update any forward-looking statement, whether to reflect events or circumstances after the date on which the statement is made, to reflect new information or the occurrence of unanticipated events, or otherwise unless required under the federal securities laws.

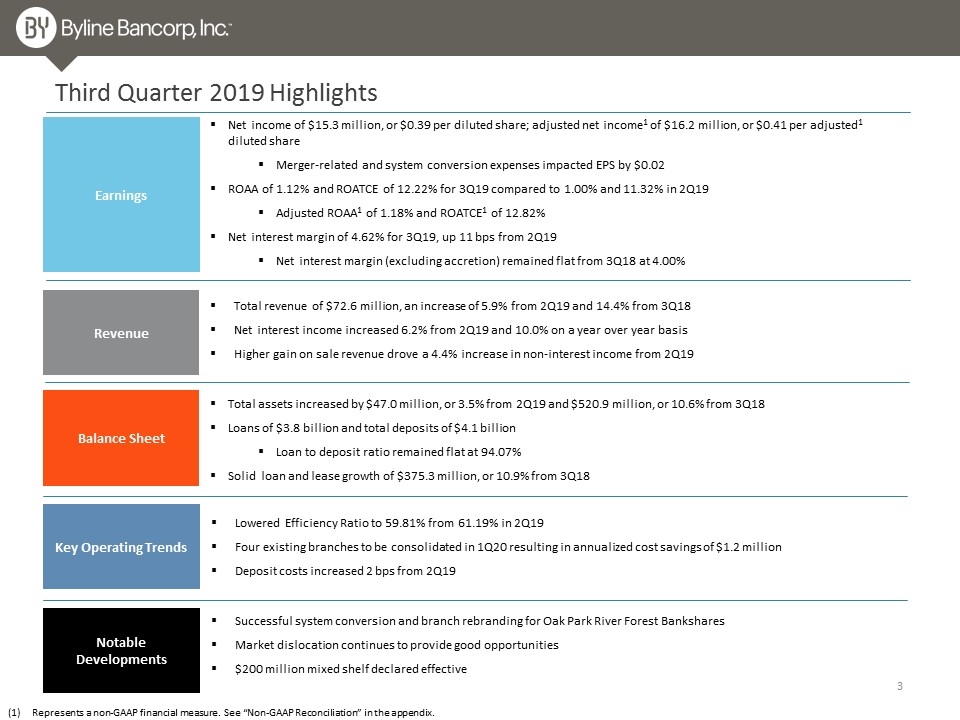

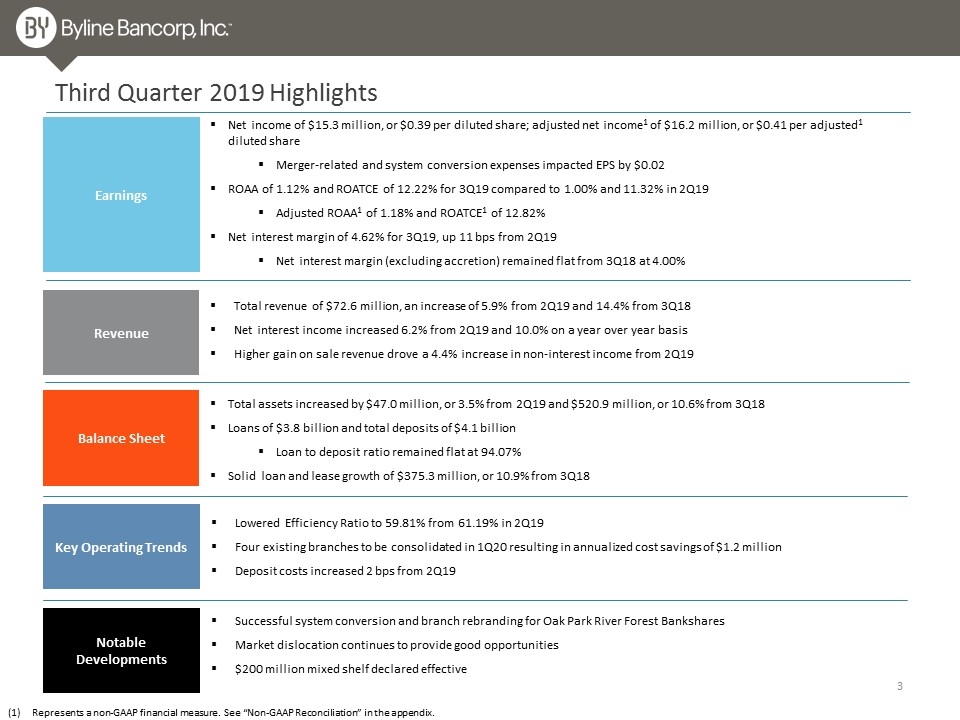

Third Quarter 2019 Highlights Balance Sheet Earnings Revenue Key Operating Trends Total revenue of $72.6 million, an increase of 5.9% from 2Q19 and 14.4% from 3Q18 Net interest income increased 6.2% from 2Q19 and 10.0% on a year over year basis Higher gain on sale revenue drove a 4.4% increase in non-interest income from 2Q19 Lowered Efficiency Ratio to 59.81% from 61.19% in 2Q19 Four existing branches to be consolidated in 1Q20 resulting in annualized cost savings of $1.2 million Deposit costs increased 2 bps from 2Q19 Notable Developments Successful system conversion and branch rebranding for Oak Park River Forest Bankshares Market dislocation continues to provide good opportunities $200 million mixed shelf declared effective Represents a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the appendix. Net income of $15.3 million, or $0.39 per diluted share; adjusted net income1 of $16.2 million, or $0.41 per adjusted1 diluted share Merger-related and system conversion expenses impacted EPS by $0.02 ROAA of 1.12% and ROATCE of 12.22% for 3Q19 compared to 1.00% and 11.32% in 2Q19 Adjusted ROAA1 of 1.18% and ROATCE1 of 12.82% Net interest margin of 4.62% for 3Q19, up 11 bps from 2Q19 Net interest margin (excluding accretion) remained flat from 3Q18 at 4.00% Total assets increased by $47.0 million, or 3.5% from 2Q19 and $520.9 million, or 10.6% from 3Q18 Loans of $3.8 billion and total deposits of $4.1 billion Loan to deposit ratio remained flat at 94.07% Solid loan and lease growth of $375.3 million, or 10.9% from 3Q18

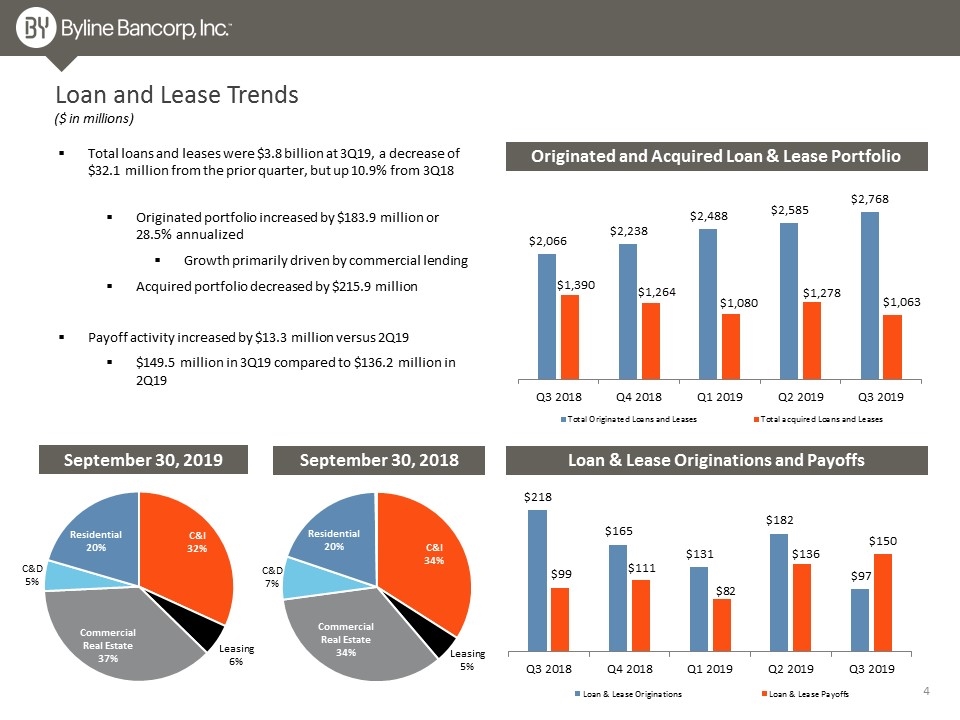

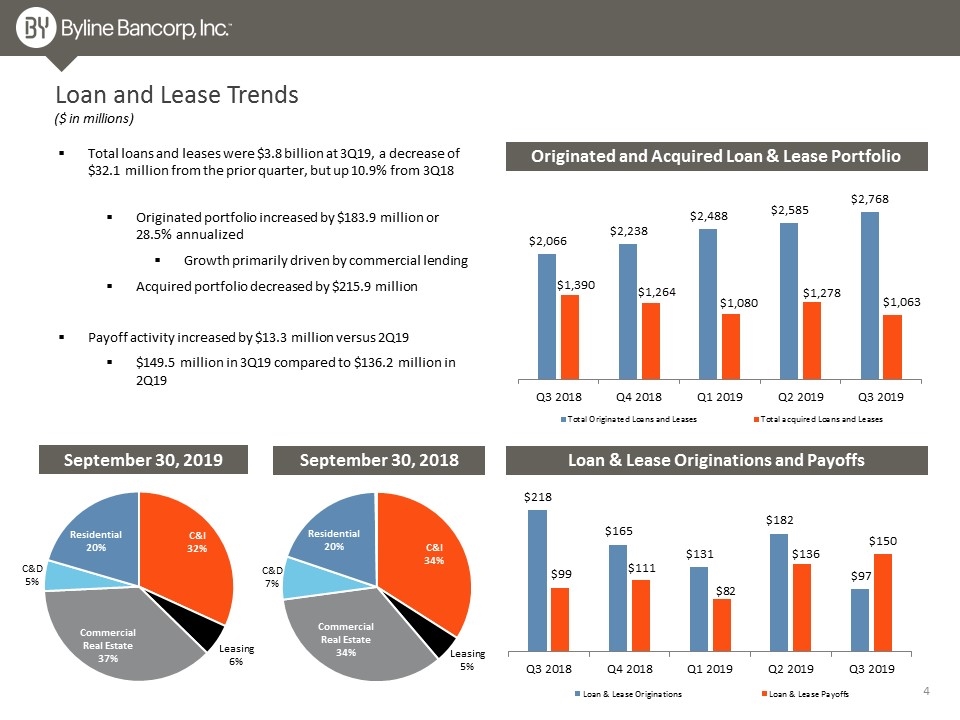

Loan and Lease Trends Loan & Lease Originations and Payoffs September 30, 2018 September 30, 2019 ($ in millions) Originated and Acquired Loan & Lease Portfolio Total loans and leases were $3.8 billion at 3Q19, a decrease of $32.1 million from the prior quarter, but up 10.9% from 3Q18 Originated portfolio increased by $183.9 million or 28.5% annualized Growth primarily driven by commercial lending Acquired portfolio decreased by $215.9 million Payoff activity increased by $13.3 million versus 2Q19 $149.5 million in 3Q19 compared to $136.2 million in 2Q19

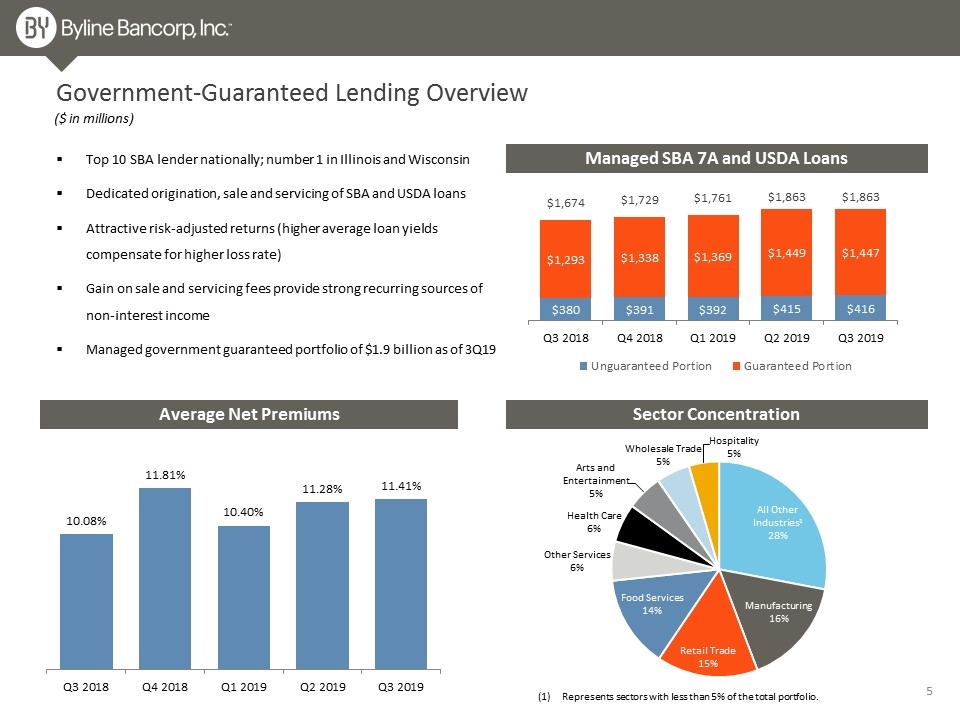

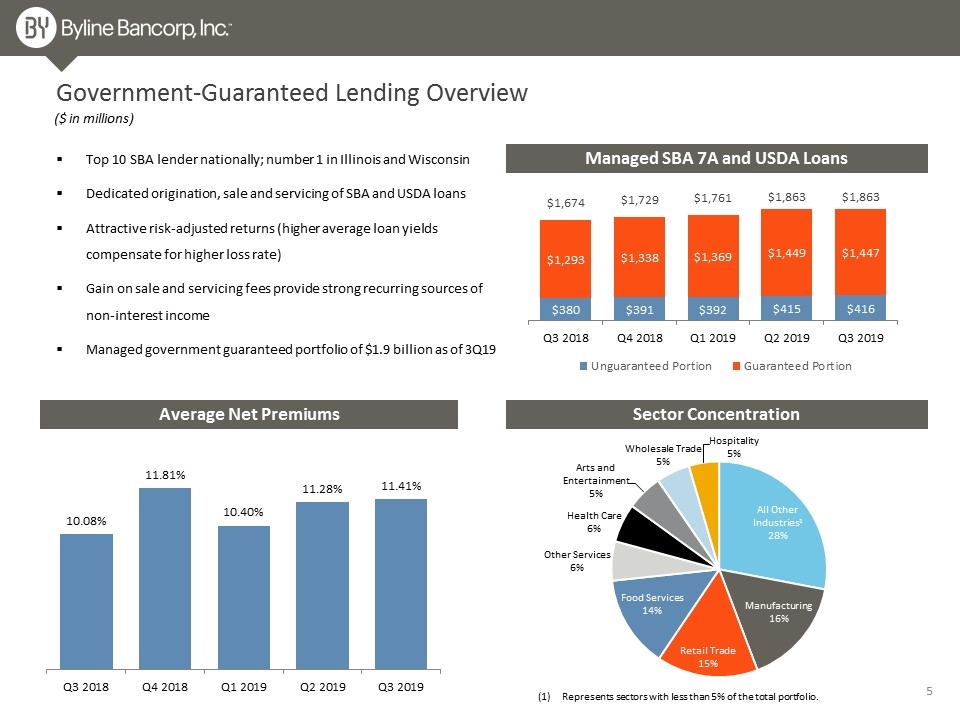

Government-Guaranteed Lending Overview Managed SBA 7A and USDA Loans Top 10 SBA lender nationally; number 1 in Illinois and Wisconsin Dedicated origination, sale and servicing of SBA and USDA loans Attractive risk-adjusted returns (higher average loan yields compensate for higher loss rate) Gain on sale and servicing fees provide strong recurring sources of non-interest income Managed government guaranteed portfolio of $1.9 billion as of 3Q19 Sector Concentration Average Net Premiums Represents sectors with less than 5% of the total portfolio. ($ in millions)

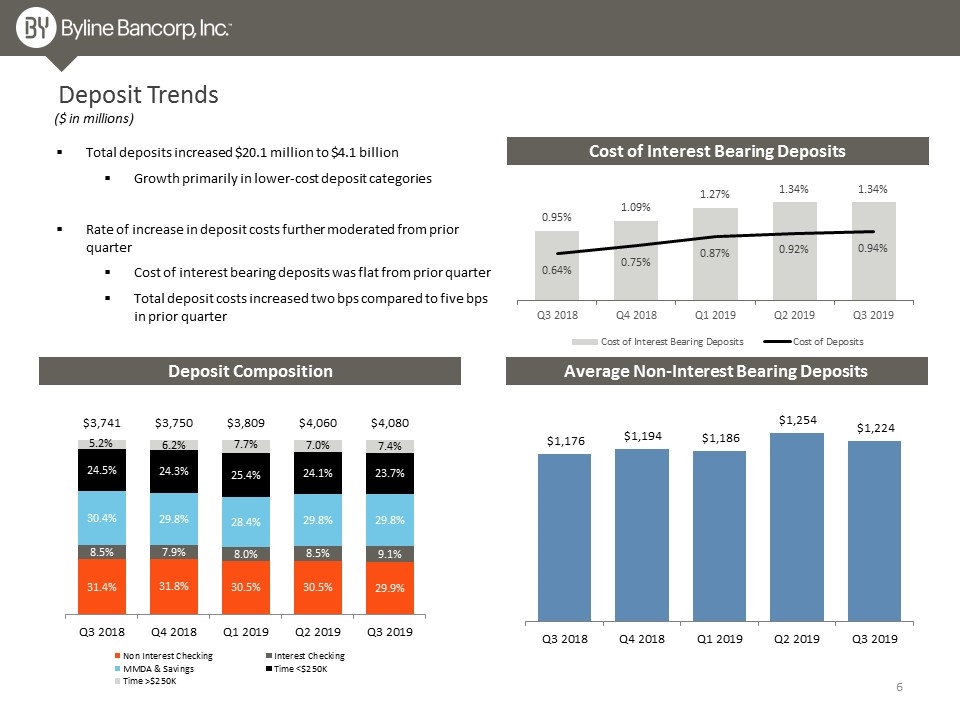

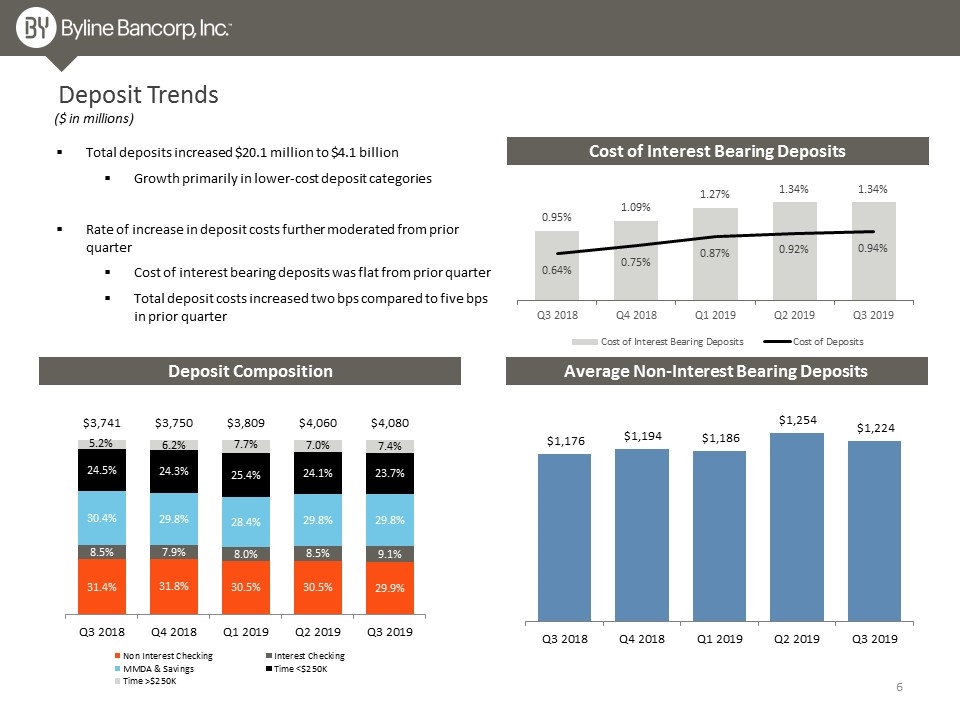

Total deposits increased $20.1 million to $4.1 billion Growth primarily in lower-cost deposit categories Rate of increase in deposit costs further moderated from prior quarter Cost of interest bearing deposits was flat from prior quarter Total deposit costs increased two bps compared to five bps in prior quarter Deposit Trends Average Non-Interest Bearing Deposits ($ in millions) Deposit Composition Cost of Interest Bearing Deposits

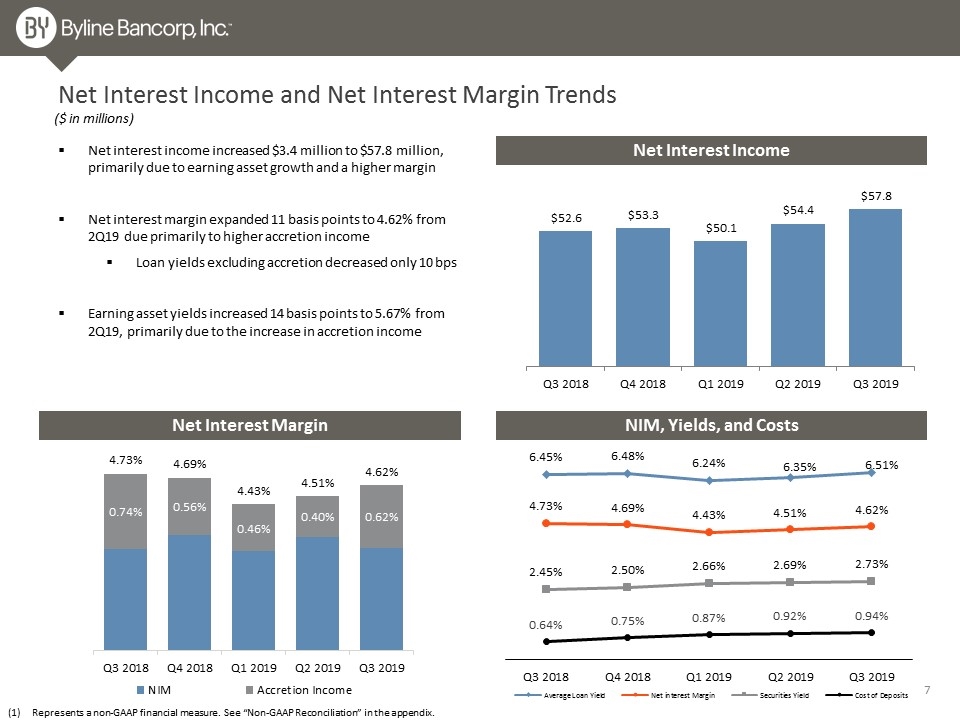

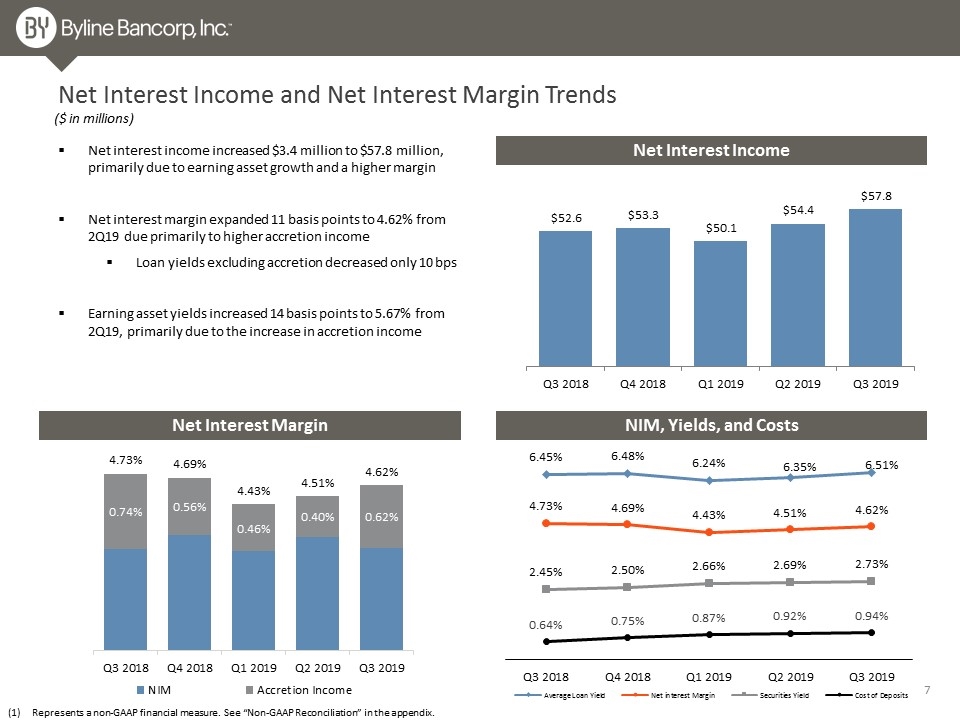

Net Interest Income and Net Interest Margin Trends Net interest income increased $3.4 million to $57.8 million, primarily due to earning asset growth and a higher margin Net interest margin expanded 11 basis points to 4.62% from 2Q19 due primarily to higher accretion income Loan yields excluding accretion decreased only 10 bps Earning asset yields increased 14 basis points to 5.67% from 2Q19, primarily due to the increase in accretion income Net Interest Margin Net Interest Income ($ in millions) NIM, Yields, and Costs Represents a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the appendix.

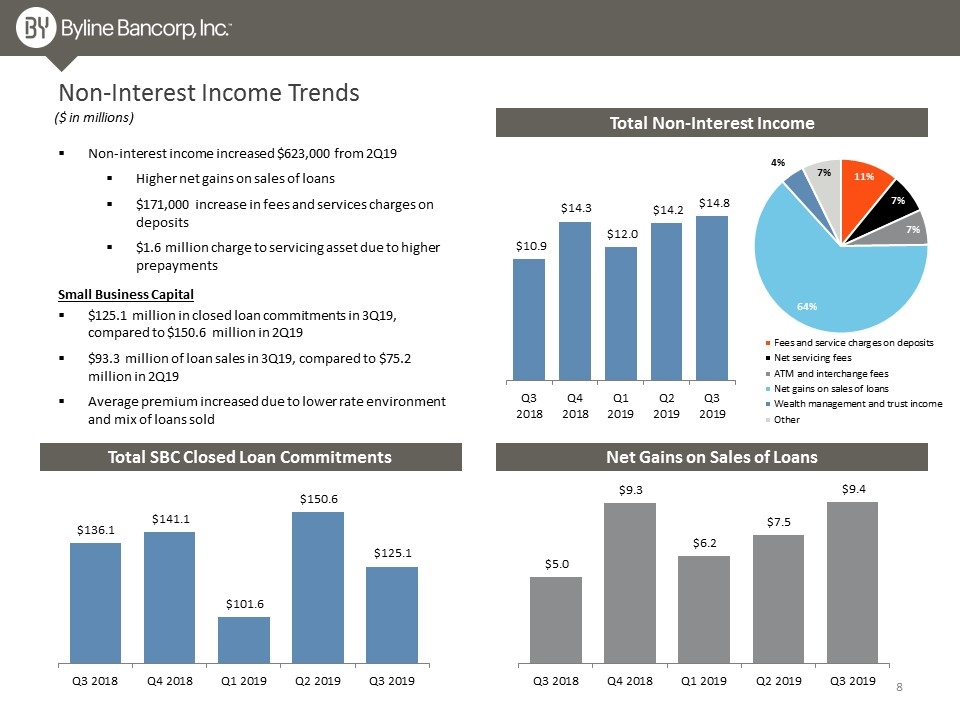

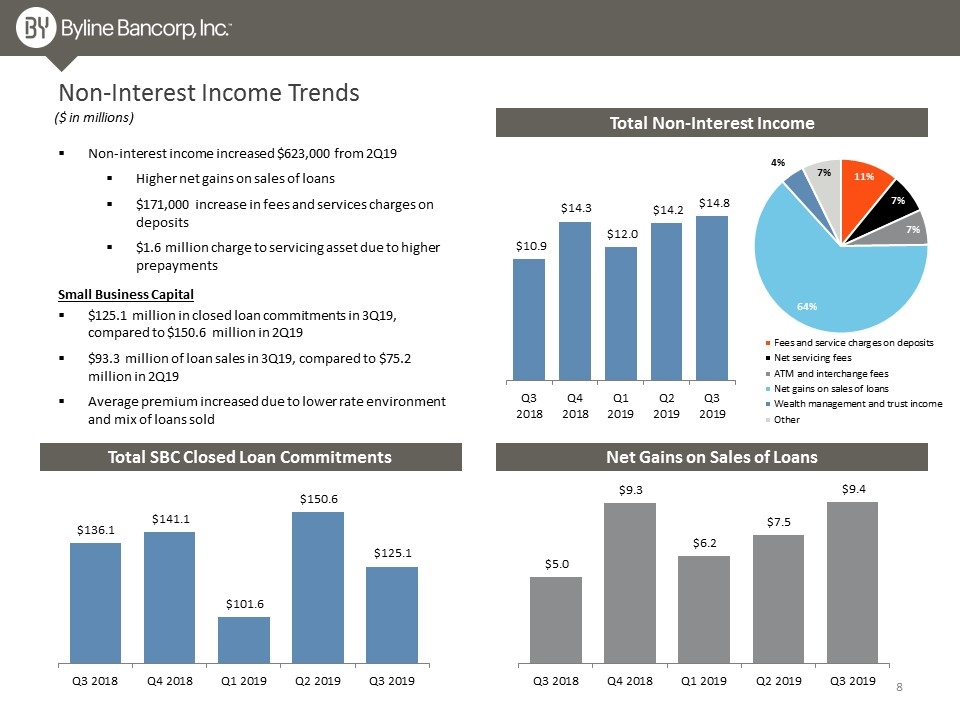

Total Non-Interest Income Non-Interest Income Trends Non-interest income increased $623,000 from 2Q19 Higher net gains on sales of loans $171,000 increase in fees and services charges on deposits $1.6 million charge to servicing asset due to higher prepayments ($ in millions) Total SBC Closed Loan Commitments Net Gains on Sales of Loans $125.1 million in closed loan commitments in 3Q19, compared to $150.6 million in 2Q19 $93.3 million of loan sales in 3Q19, compared to $75.2 million in 2Q19 Average premium increased due to lower rate environment and mix of loans sold Small Business Capital

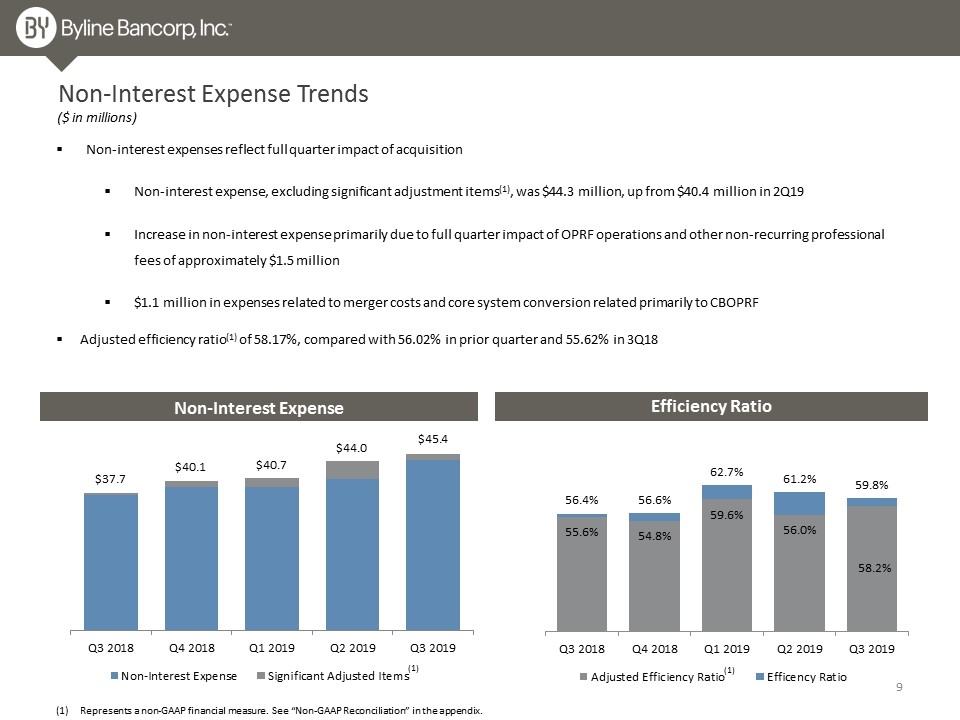

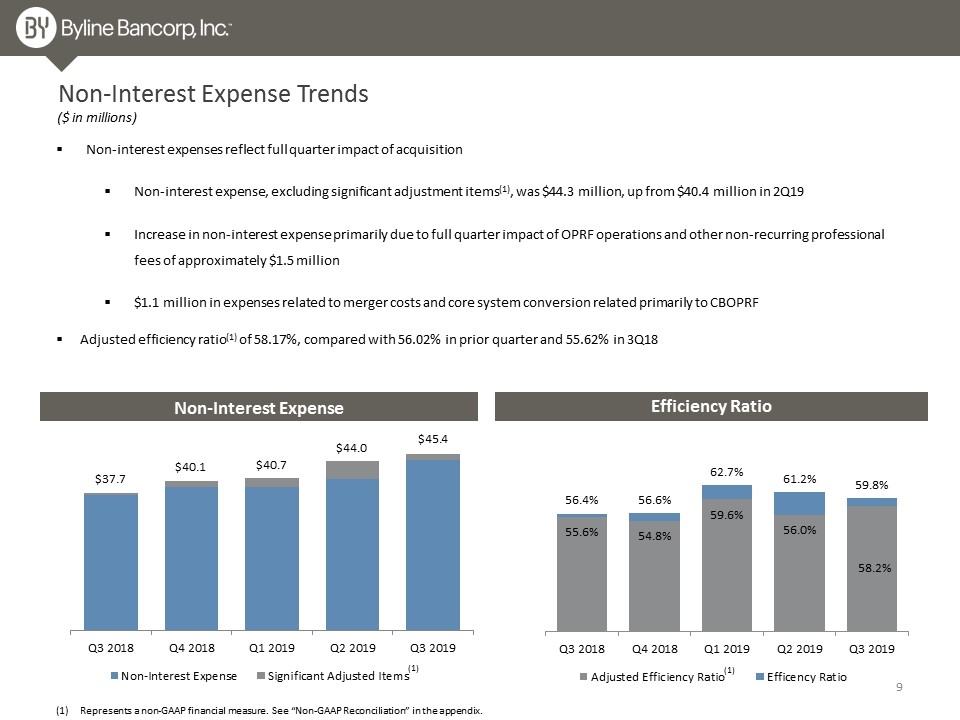

Non-Interest Expense Trends Non-interest expenses reflect full quarter impact of acquisition Non-interest expense, excluding significant adjustment items(1), was $44.3 million, up from $40.4 million in 2Q19 Increase in non-interest expense primarily due to full quarter impact of OPRF operations and other non-recurring professional fees of approximately $1.5 million $1.1 million in expenses related to merger costs and core system conversion related primarily to CBOPRF Adjusted efficiency ratio(1) of 58.17%, compared with 56.02% in prior quarter and 55.62% in 3Q18 ($ in millions) Efficiency Ratio Non-Interest Expense Represents a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the appendix. (1) (1)

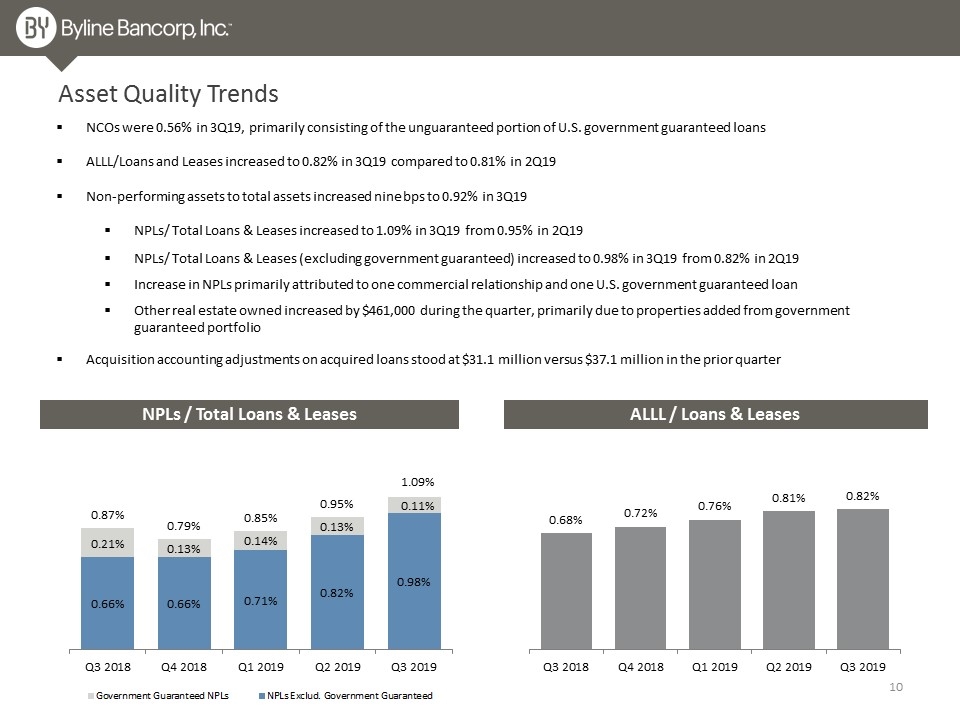

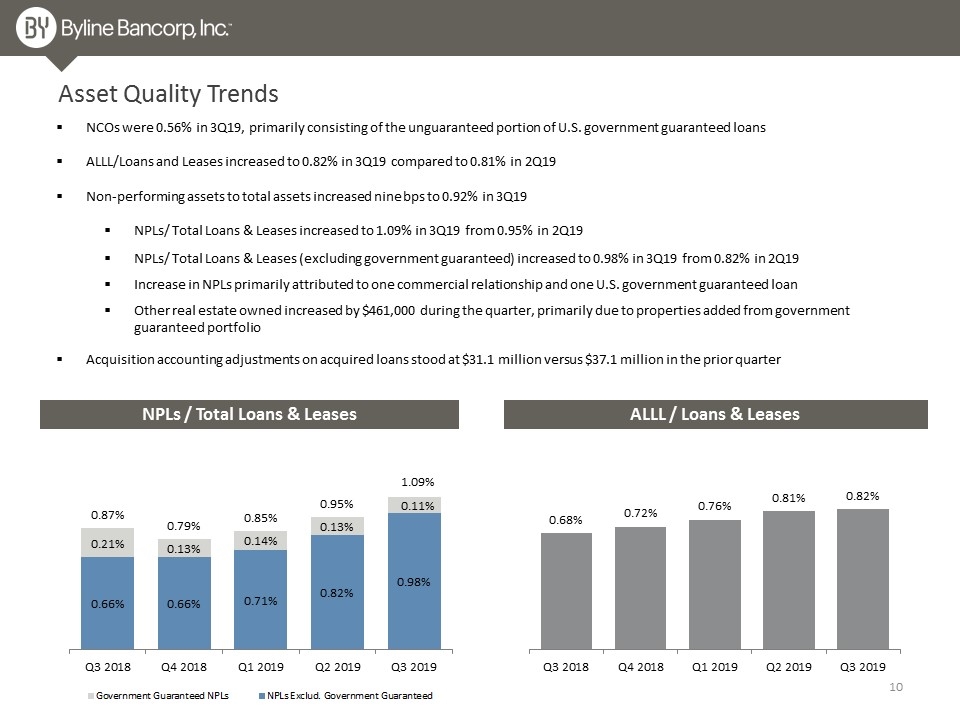

Asset Quality Trends NCOs were 0.56% in 3Q19, primarily consisting of the unguaranteed portion of U.S. government guaranteed loans ALLL/Loans and Leases increased to 0.82% in 3Q19 compared to 0.81% in 2Q19 Non-performing assets to total assets increased nine bps to 0.92% in 3Q19 NPLs/ Total Loans & Leases increased to 1.09% in 3Q19 from 0.95% in 2Q19 NPLs/ Total Loans & Leases (excluding government guaranteed) increased to 0.98% in 3Q19 from 0.82% in 2Q19 Increase in NPLs primarily attributed to one commercial relationship and one U.S. government guaranteed loan Other real estate owned increased by $461,000 during the quarter, primarily due to properties added from government guaranteed portfolio Acquisition accounting adjustments on acquired loans stood at $31.1 million versus $37.1 million in the prior quarter NPLs / Total Loans & Leases ALLL / Loans & Leases

Appendix

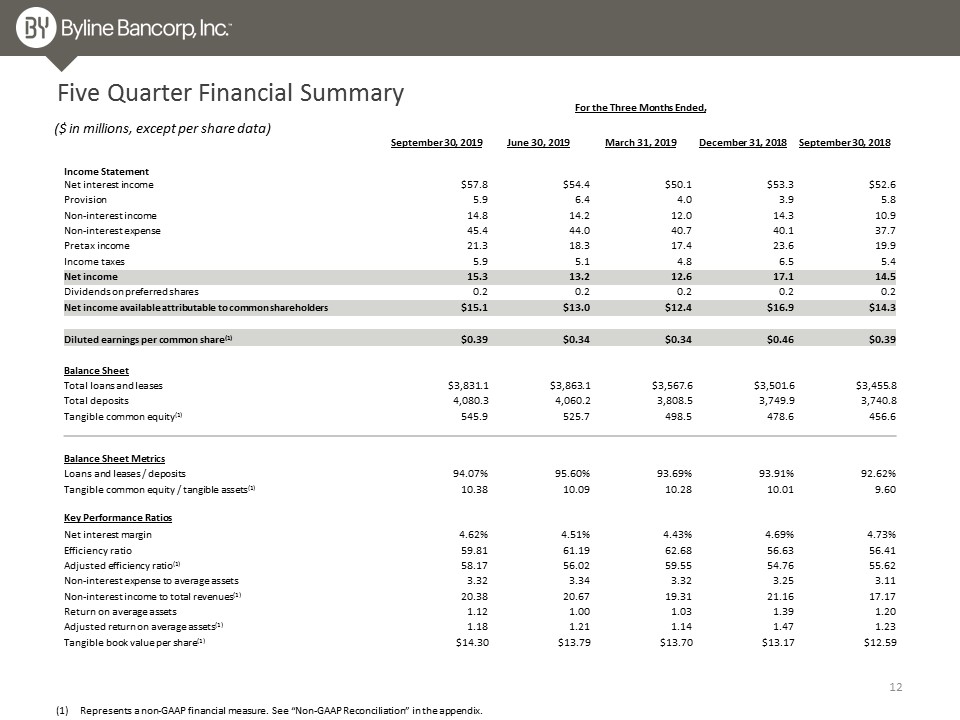

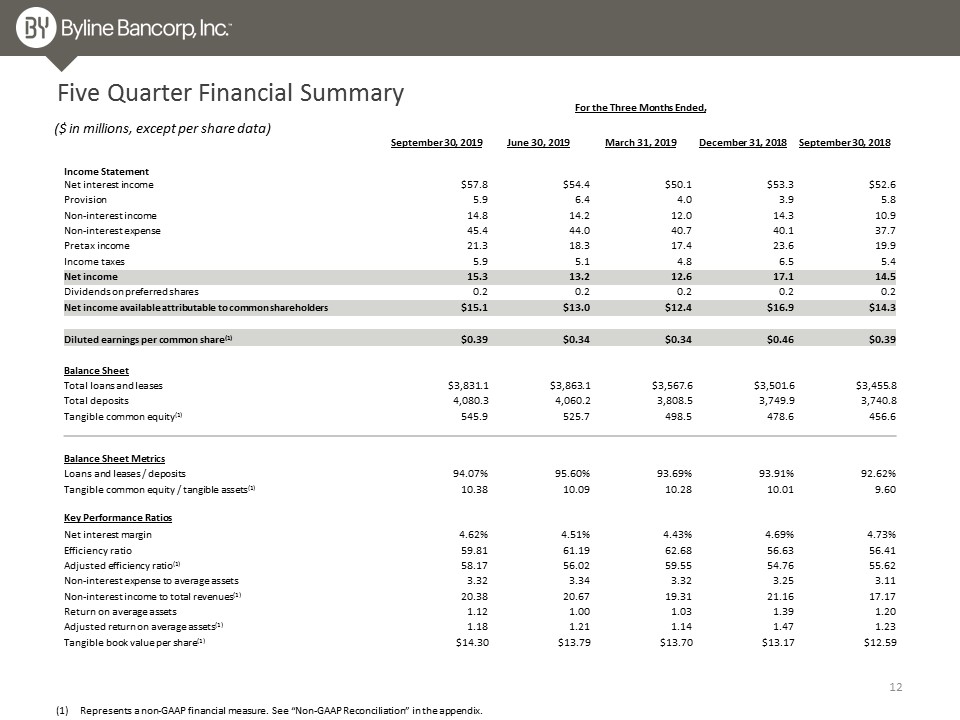

Five Quarter Financial Summary ($ in millions, except per share data) Represents a non-GAAP financial measure. See “Non-GAAP Reconciliation” in the appendix. For the Three Months Ended, September 30, 2019 June 30, 2019 March 31, 2019 December 31, 2018 September 30, 2018 Income Statement Net interest income $57.8 $54.4 $50.1 $53.3 $52.6 Provision 5.9 6.4 4.0 3.9 5.8 Non-interest income 14.8 14.2 12.0 14.3 10.9 Non-interest expense 45.4 44.0 40.7 40.1 37.7 Pretax income 21.3 18.3 17.4 23.6 19.9 Income taxes 5.9 5.1 4.8 6.5 5.4 Net income 15.3 13.2 12.6 17.1 14.5 Dividends on preferred shares 0.2 0.2 0.2 0.2 0.2 Net income available attributable to common shareholders $15.1 $13.0 $12.4 $16.9 $14.3 Diluted earnings per common share(1) $0.39 $0.34 $0.34 $0.46 $0.39 Balance Sheet Total loans and leases $3,831.1 $3,863.1 $3,567.6 $3,501.6 $3,455.8 Total deposits 4,080.3 4,060.2 3,808.5 3,749.9 3,740.8 Tangible common equity(1) 545.9 525.7 498.5 478.6 456.6 Balance Sheet Metrics Loans and leases / deposits 94.07% 95.60% 93.69% 93.91% 92.62% Tangible common equity / tangible assets(1) 10.38 10.09 10.28 10.01 9.60 Key Performance Ratios Net interest margin 4.62% 4.51% 4.43% 4.69% 4.73% Efficiency ratio 59.81 61.19 62.68 56.63 56.41 Adjusted efficiency ratio(1) 58.17 56.02 59.55 54.76 55.62 Non-interest expense to average assets 3.32 3.34 3.32 3.25 3.11 Non-interest income to total revenues(1) 20.38 20.67 19.31 21.16 17.17 Return on average assets 1.12 1.00 1.03 1.39 1.20 Adjusted return on average assets(1) 1.18 1.21 1.14 1.47 1.23 Tangible book value per share(1) $14.30 $13.79 $13.70 $13.17 $12.59

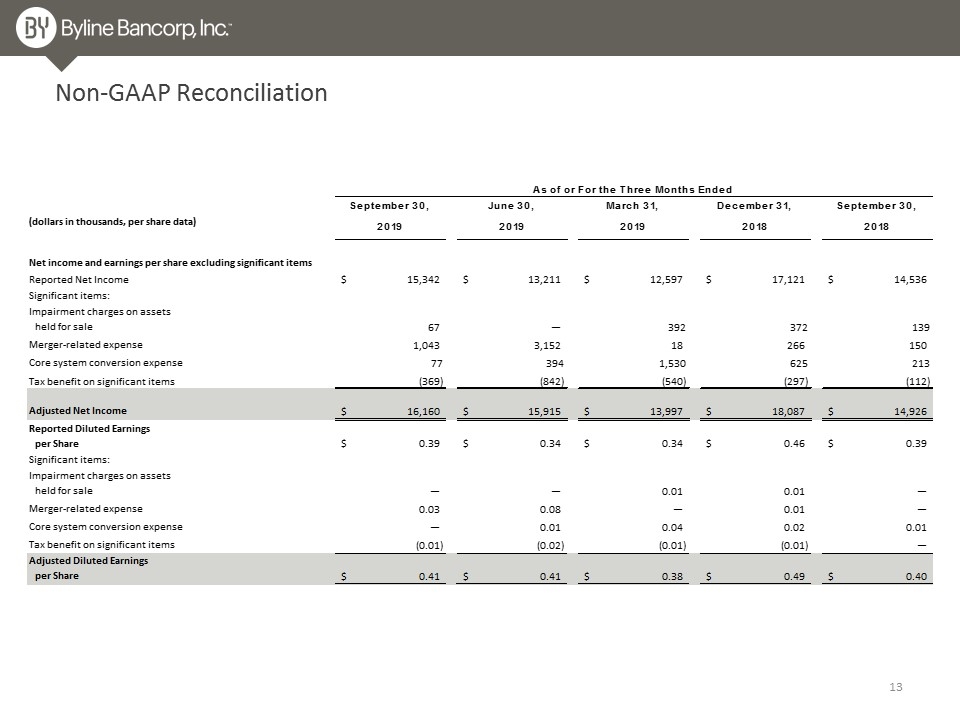

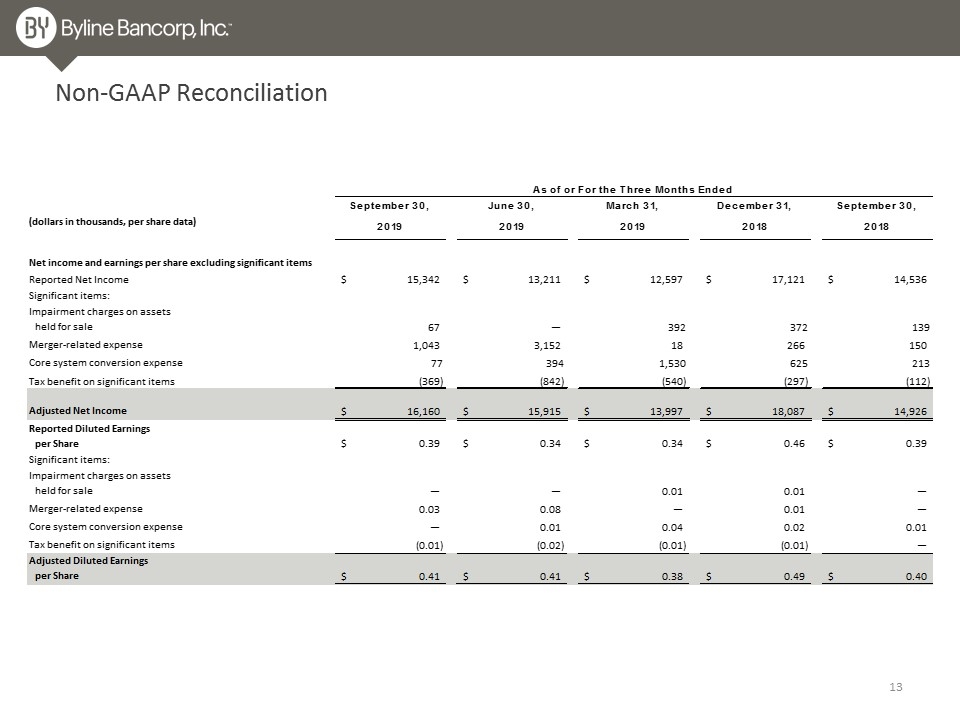

Non-GAAP Reconciliation

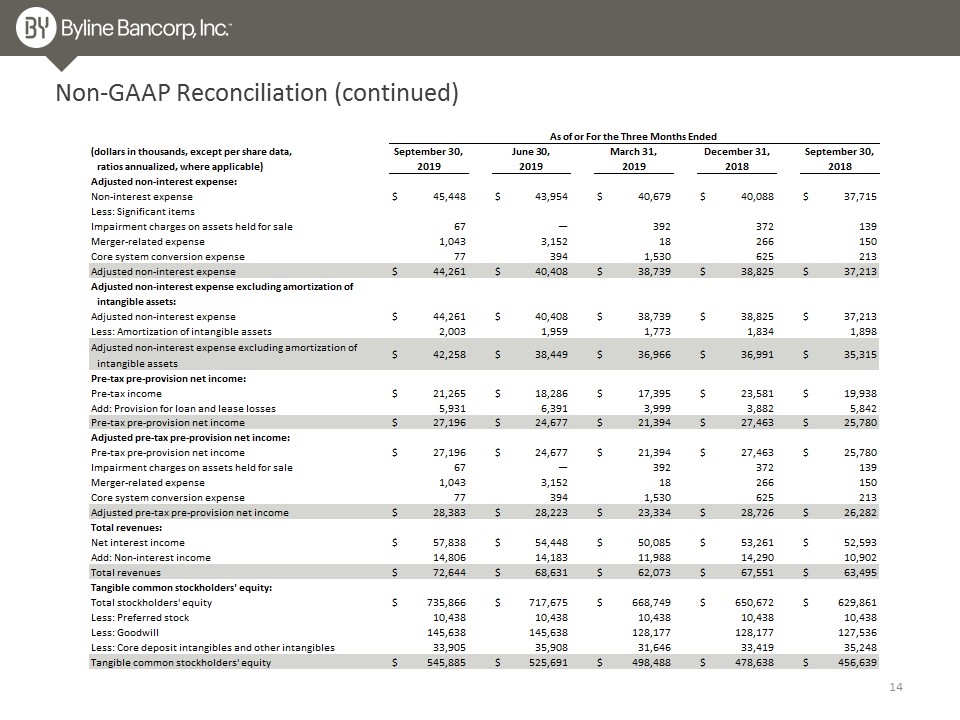

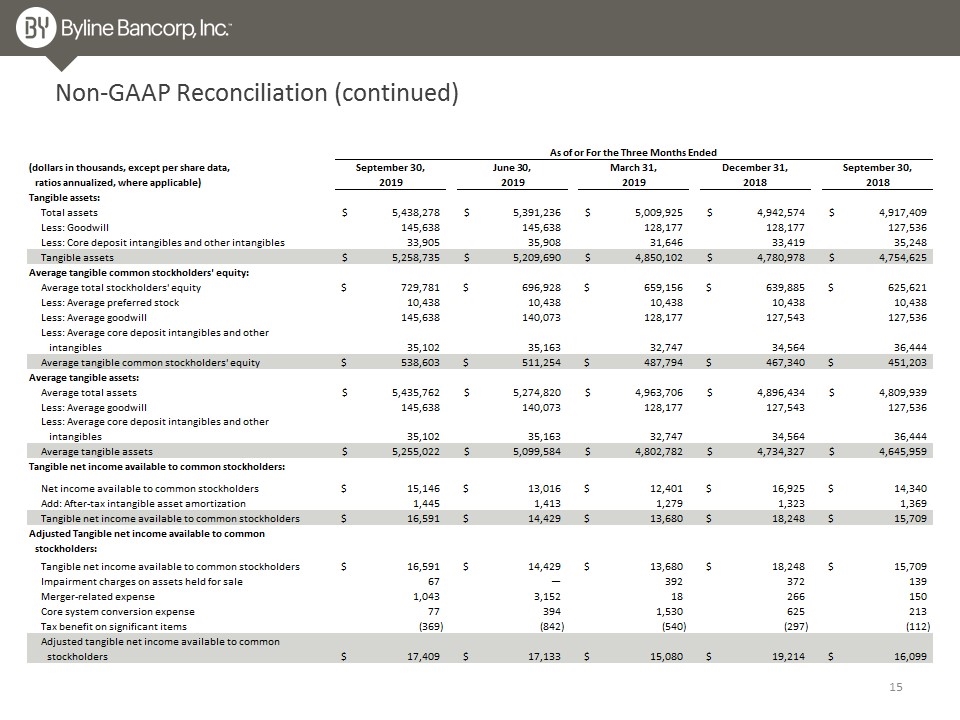

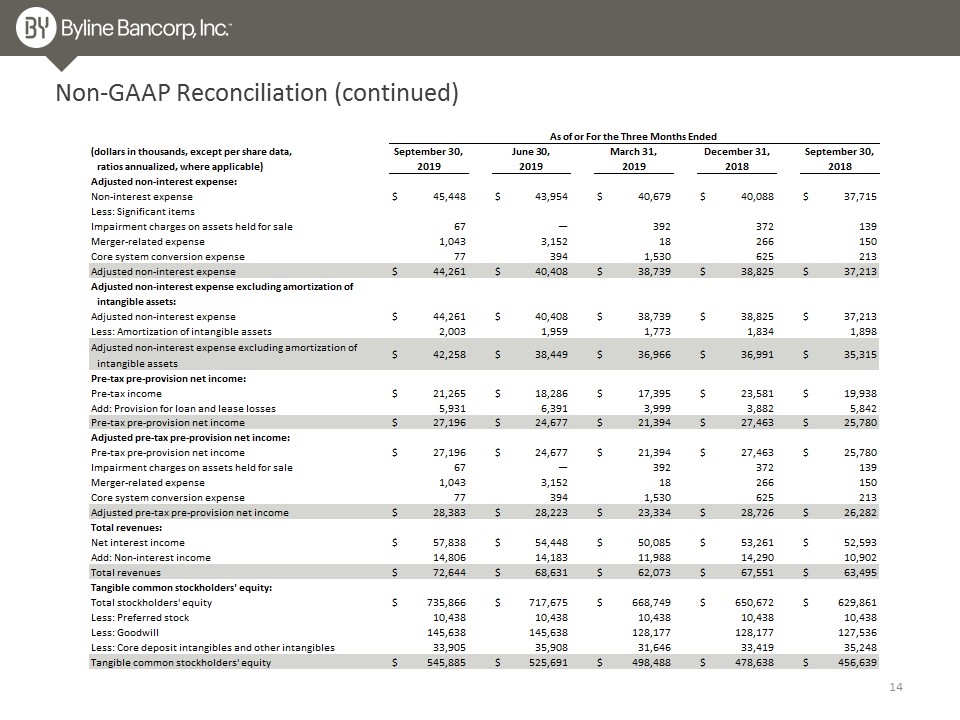

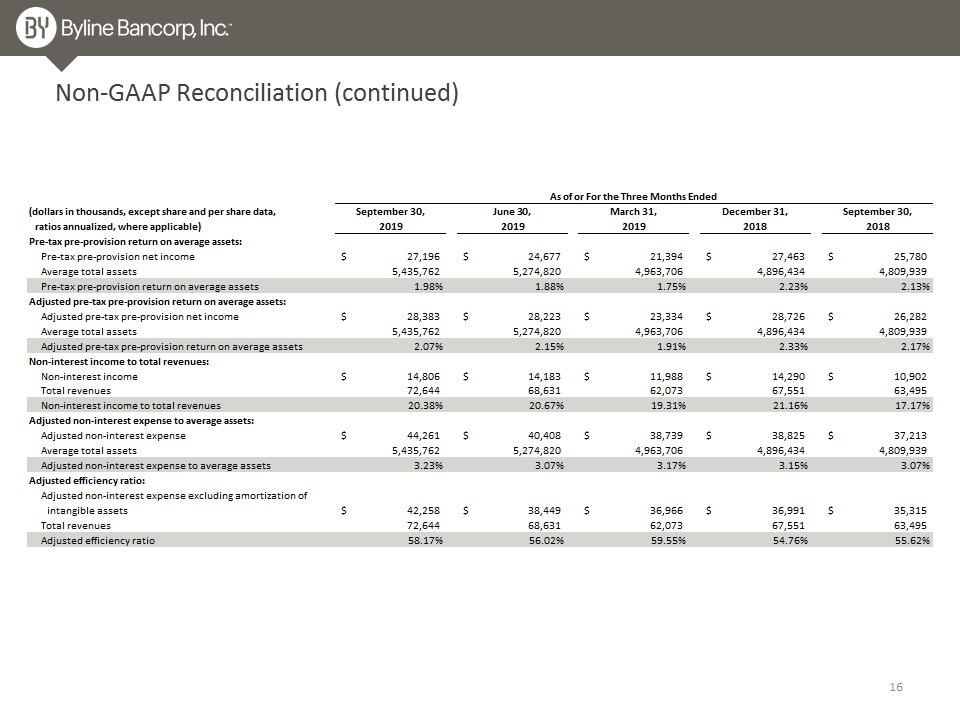

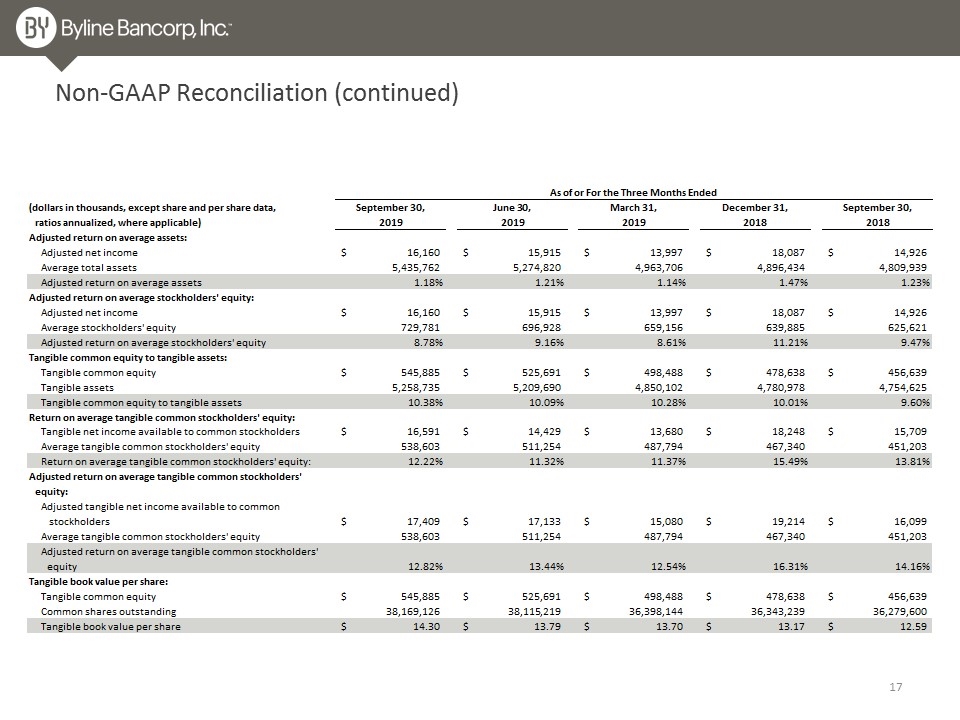

Non-GAAP Reconciliation (continued)

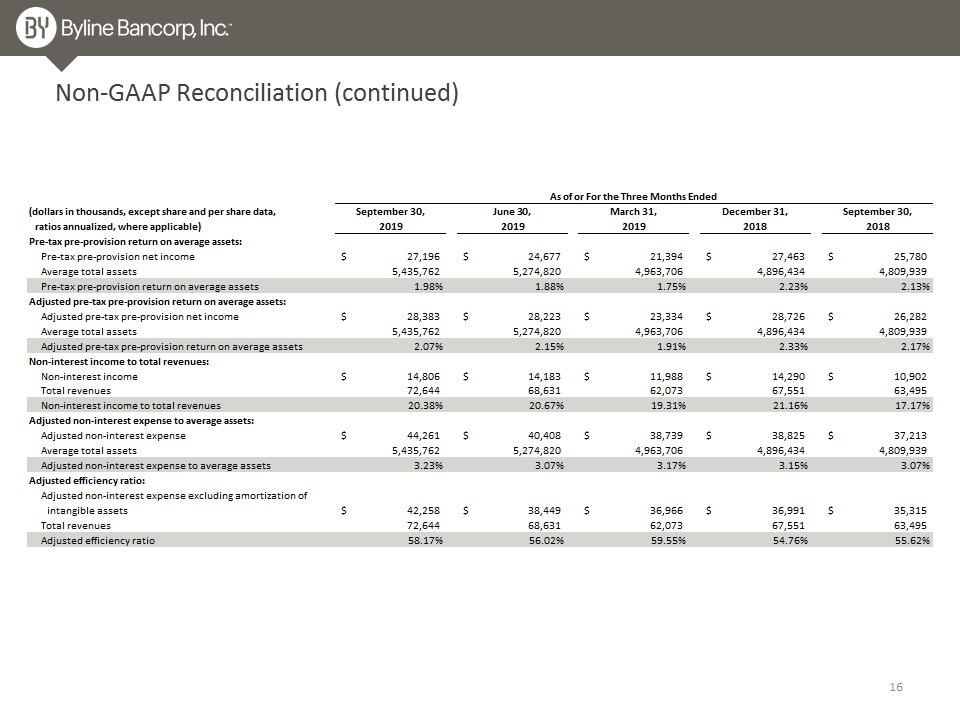

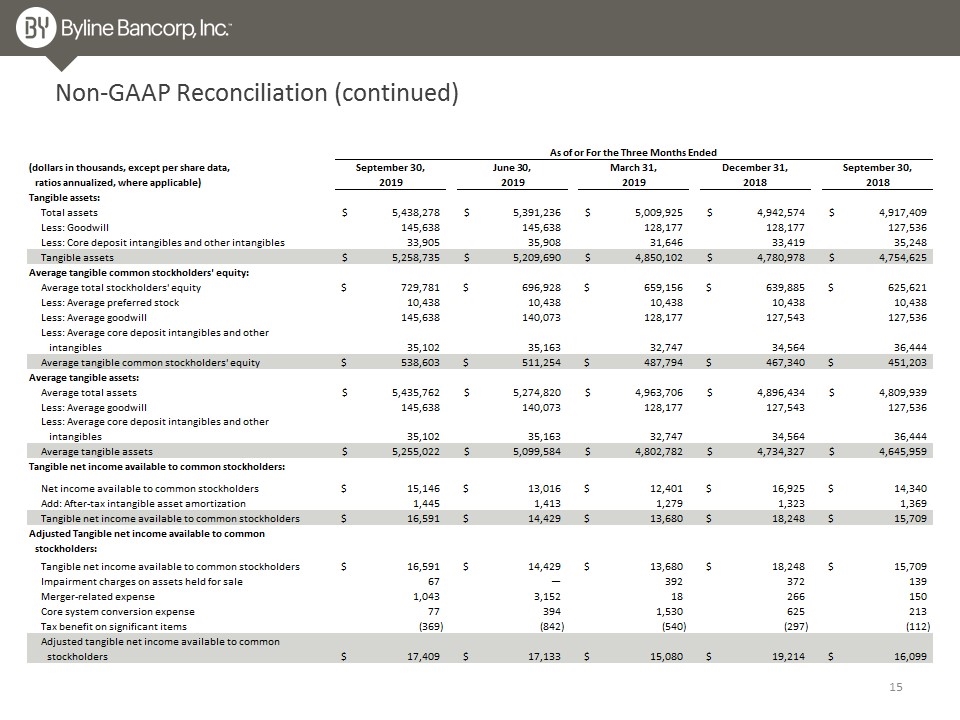

Non-GAAP Reconciliation (continued)

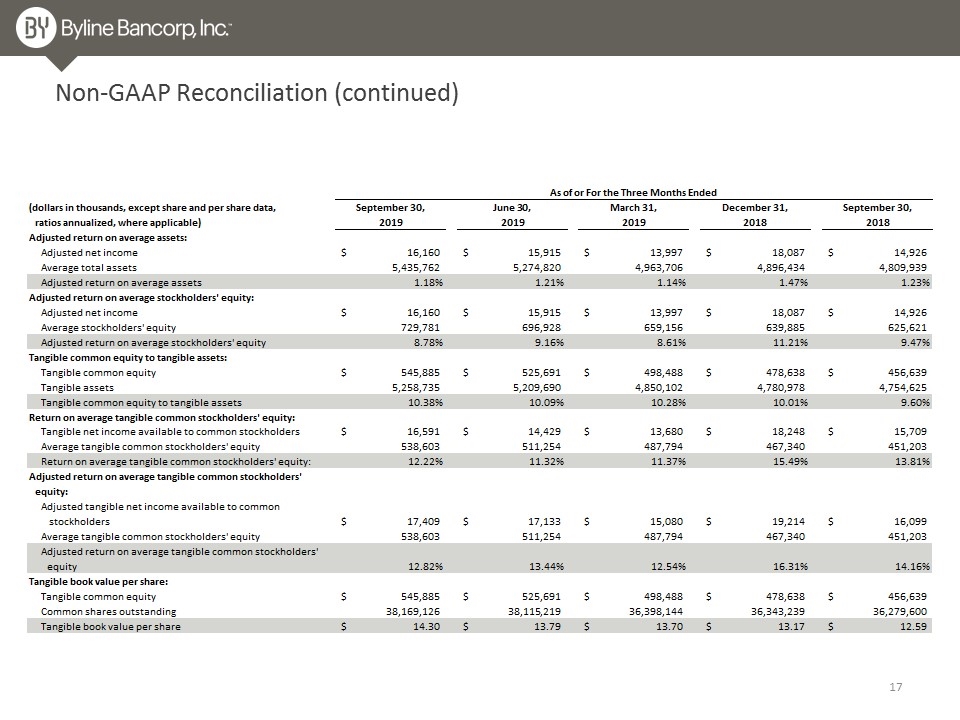

Non-GAAP Reconciliation (continued)

Non-GAAP Reconciliation (continued)