Lender Presentation November 13th, 2018 Exhibit 99.1

Disclaimer This presentation (the “Presentation”) has been prepared by ADT Inc. (the “Company”) on behalf of Prime Security Services Borrower, LLC (the “Borrower”), a wholly owned subsidiary, in connection with the syndication of the Borrower’s Incremental 1st Lien Senior Secured Term Loan Facility (the “Facility”), solely for informational purposes. The information contained in this Presentation has been prepared to assist prospective lenders in conducting their own evaluation of the Company and the Facility and does not purport to be complete or to contain all of the information that a prospective lender may require. Prospective lenders should conduct their own investigation and analysis of the Company and of the information set forth in this Presentation. The Company makes no representation or warranty as to the accuracy, reliability, reasonableness or completeness of this information and shall not have any liability for any representations regarding information contained in, or for any omission from, this Presentation or any other written or oral communications transmitted to the recipient in the course of its evaluation of the Company and the Facility. The Company and its affiliates, representatives and advisors expressly disclaim any and all liability based, in whole or in part, on the information contained in this Presentation (which only speak as of the date identified on the cover page of this Presentation), errors therein or omissions therefrom. Neither the Company nor any of its affiliates, representatives or advisors intends to update or otherwise revise the information contained herein to reflect circumstances existing after the date identified on the cover page of this Presentation or to reflect the occurrence of future events even if any or all of the assumptions, judgments and estimates on which the information contained herein is based are shown to be in error. Unless otherwise specified herein, the financial information, financial ratios and related projections and estimates contained herein give effect to the incurrence of the Facility and the payment of the purchase price for the Red Hawk acquisition, but do not give effect to the acquisition of Red Hawk or the use of proceeds of the Facility for general corporate purposes.

Forward Looking Statements & Non-GAAP Measures ADT has made statements in this presentation and other reports, filings, and other public written and verbal announcements that are forward-looking and therefore subject to risks and uncertainties. All statements, other than statements of historical fact, included in this document are, or could be, “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and are made in reliance on the safe harbor protections provided thereunder. These forward-looking statements relate to anticipated financial performance, management’s plans and objectives for future operations, business prospects, outcome of regulatory proceedings, market conditions, use of proceeds of the Facility and other matters. Any forward-looking statement made in this presentation speaks only as of the date on which it is made. ADT undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise. Forward-looking statements can be identified by various words such as “expects,” “intends,” “will,” “anticipates,” “believes,” “confident,” “continue,” “propose,” “seeks,” “could,” “may,” “should,” “estimates,” “forecasts,” “might,” “goals,” “objectives,” “targets,” “planned,” “projects,” and similar expressions. These forward-looking statements are based on management’s current beliefs and assumptions and on information currently available to management. ADT cautions that these statements are subject to risks and uncertainties, many of which are outside of ADT’s control, and could cause future events or results to be materially different from those stated or implied in this document, including among others, risk factors that are described in the Company’s Annual Report on Form 10-K and other filings with the Securities and Exchange Commission, including the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained therein. Adjusted EBITDA, Adjusted EBITDA margin, Covenant Adjusted EBITDA (Pre-SAC), Free Cash Flow, Free Cash Flow before special items, Adjusted Net Income, and the leverage ratios are non-GAAP financial measures. Reconciliations from GAAP to non-GAAP financial measures can be found in the appendix. Amounts on subsequent pages may not add due to rounding. Forward Looking Statements Non-GAAP Measures

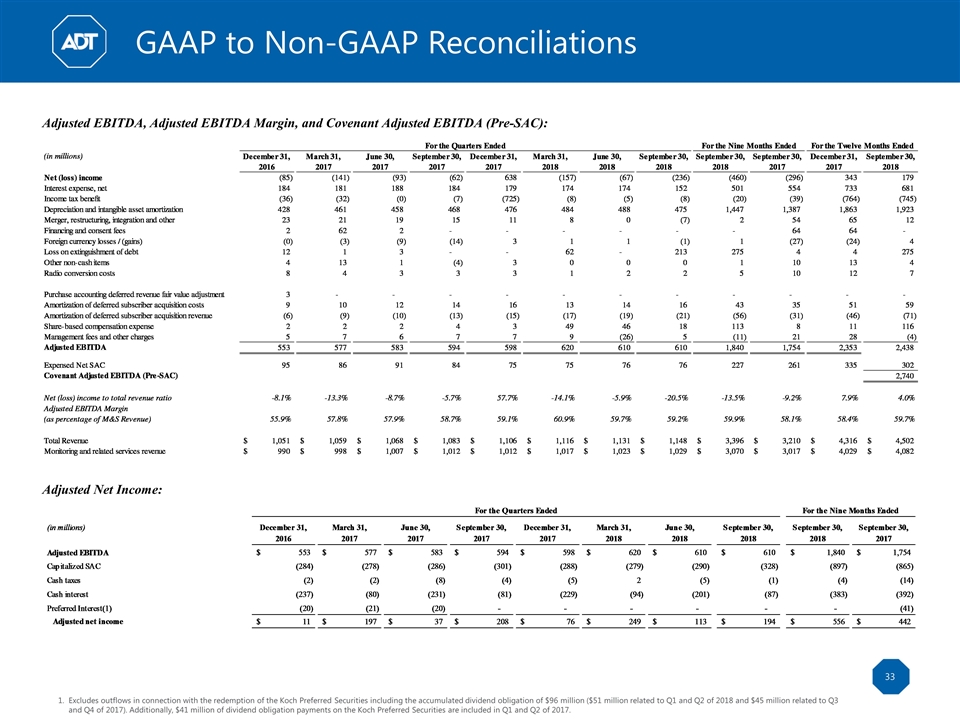

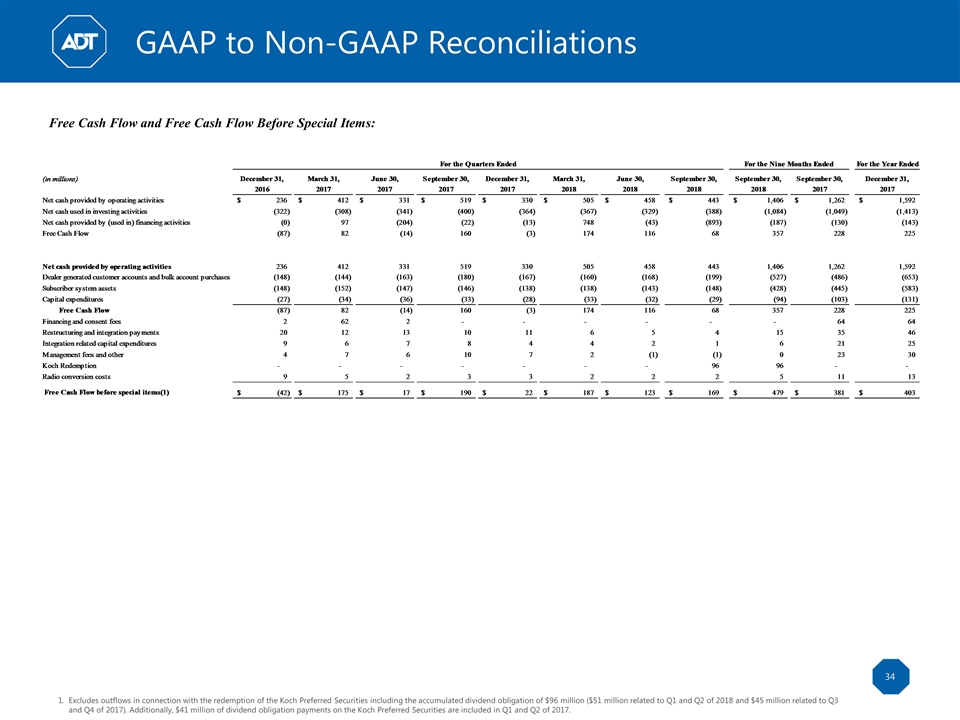

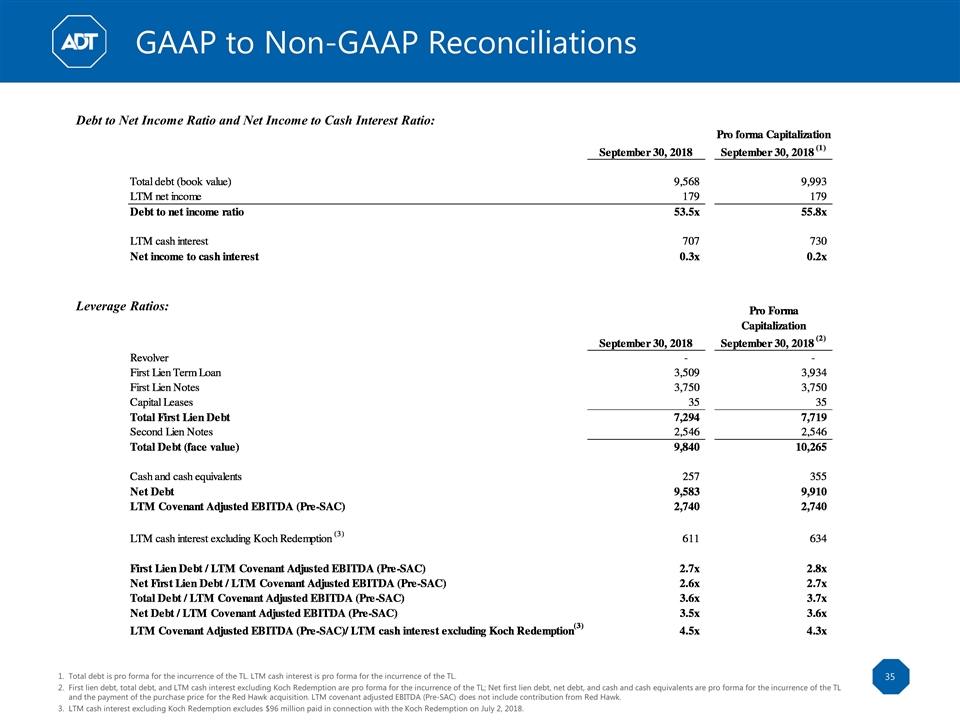

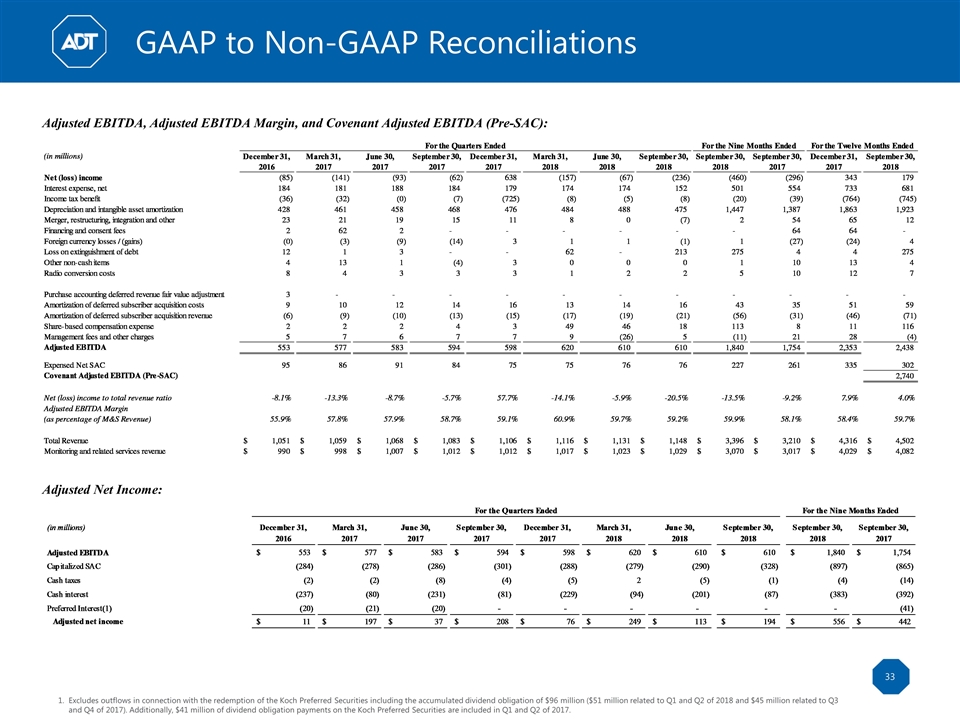

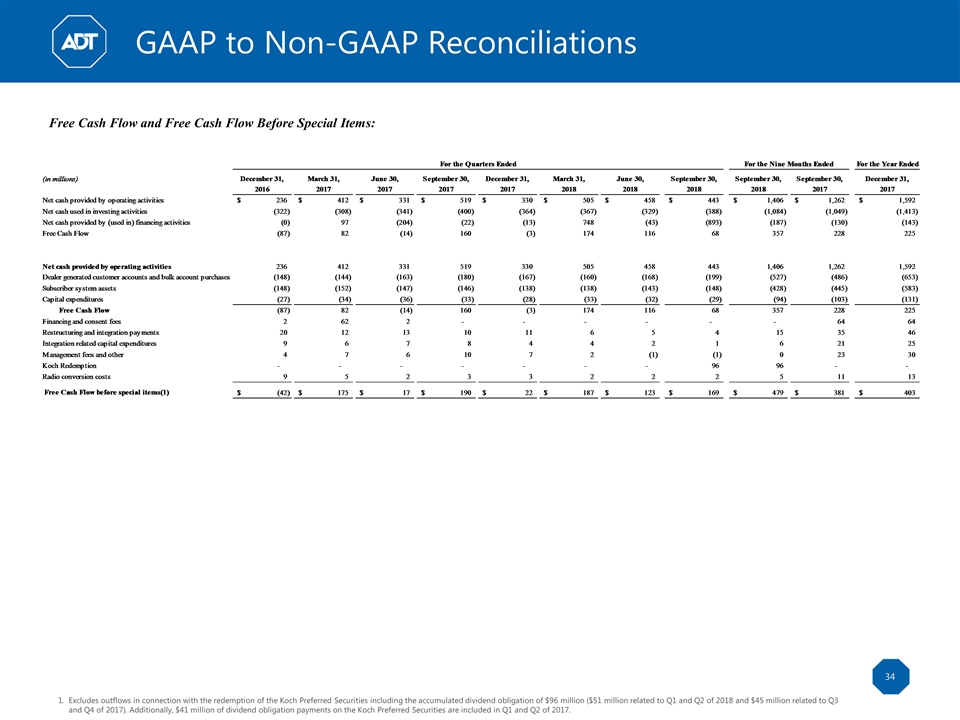

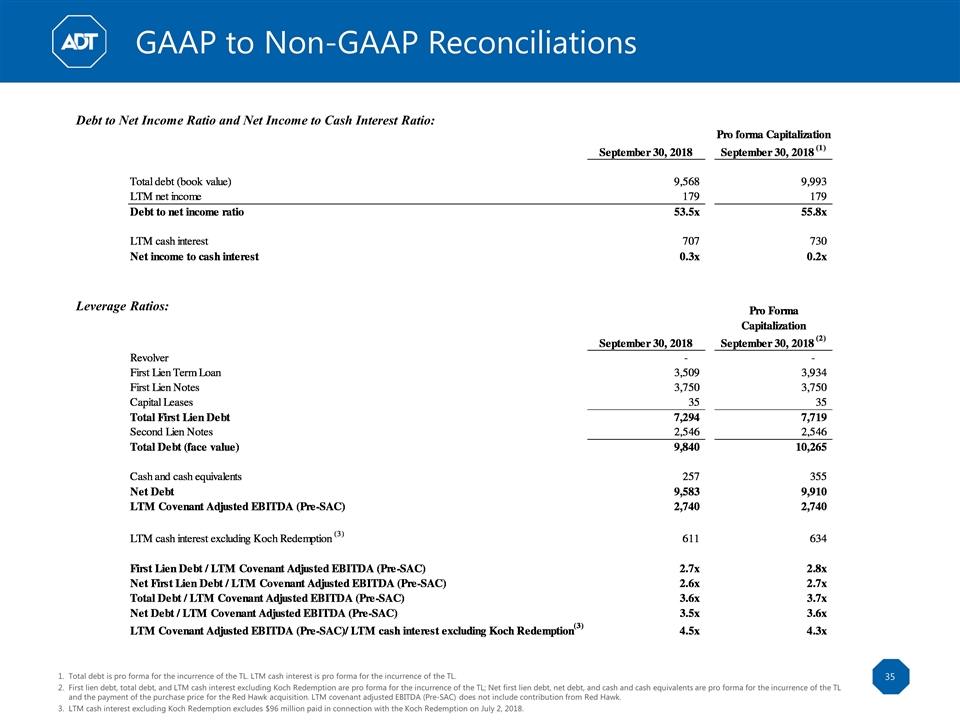

Non-GAAP Measures To provide investors with additional information in connection with our results as determined by generally accepted accounting principles in the United States (“GAAP”), we disclose the following non-GAAP financial measures: Adjusted EBITDA, Adjusted EBITDA margin, Covenant Adjusted EBITDA (Pre-SAC), Free Cash Flow, Free Cash Flow before special items, Adjusted Net Income, and various leverage ratios. These measures are not financial measures calculated in accordance with GAAP, and should not be considered as a substitute for net income, operating income, cash flows, or any other measure calculated in accordance with GAAP, and may not be comparable to similarly titled measures reported by other companies. Adjusted EBITDA and Covenant Adjusted EBITDA (Pre-SAC) We believe that the presentation of Adjusted EBITDA is appropriate to provide additional information to investors about certain non-cash items and about unusual items that we do not expect to continue at the same level in the future, as well as other items. Further, we believe Adjusted EBITDA provides a meaningful measure of operating profitability because we use it for evaluating our business performance, making budgeting decisions, and comparing our performance against that of other peer companies using similar measures. We use Covenant Adjusted EBITDA (Pre-SAC) as a supplemental measure of our performance and ability to service debt and incur additional debt. Covenant Adjusted EBITDA (Pre-SAC) is also important in measuring certain other restrictions imposed on Borrower and its subsidiaries such as their ability to make investments, distribute dividends, and pledge some or all of their assets. We define Adjusted EBITDA as net income or loss adjusted for (i) interest, (ii) taxes, (iii) depreciation and amortization, including depreciation of subscriber system assets and other fixed assets and amortization of dealer and other intangible assets, (iv) amortization of deferred costs and deferred revenue associated with subscriber acquisitions, (v) share-based compensation expense, (vi) purchase accounting adjustments under GAAP, (vii) merger, restructuring, integration, and other, (viii) financing and consent fees, (ix) foreign currency gains/losses, (x) losses on extinguishment of debt, (xi) radio conversion costs, (xii) management fees and other charges, and (xiii) other non-cash items. Covenant Adjusted EBITDA (Pre-SAC) also is adjusted for costs in our statement of operations associated with the acquisition of customers, net of revenue associated with the sale of equipment (Expensed Net SAC). There are material limitations to using Adjusted EBITDA and Covenant Adjusted EBITDA (Pre-SAC). Adjusted EBITDA and Covenant Adjusted EBITDA (Pre-SAC) do not take into account certain significant items, including depreciation and amortization, interest, taxes, and other adjustments which directly affect our net income or loss. These limitations are best addressed by considering the economic effects of the excluded items independently, and by considering Adjusted EBITDA and Covenant Adjusted EBITDA (Pre-SAC) in conjunction with net income or loss as calculated in accordance with GAAP. The Adjusted EBITDA discussion above is also applicable to its margin measure, which is calculated as Adjusted EBITDA as a percentage of monitoring and related services revenue. Free Cash Flow We define Free Cash Flow as cash from operating activities less cash outlays related to capital expenditures. We define capital expenditures to include purchases of property, plant, and equipment; subscriber system asset additions; and accounts purchased through our network of authorized dealers or third parties outside of our authorized dealer network. In arriving at Free Cash Flow, we subtract cash outlays related to capital expenditures from cash from operating activities because they represent long-term investments that are required for normal business activities. As a result, subject to the limitations described below, Free Cash Flow is a useful measure of our cash available to repay debt, make other investments, and pay dividends. Free Cash Flow adjusts for cash items that are ultimately within management’s discretion to direct, and therefore, may imply that there is less or more cash that is available than the most comparable GAAP measure. Free Cash Flow is not intended to represent residual cash flow for discretionary expenditures since debt repayment requirements and other non-discretionary expenditures are not deducted. These limitations are best addressed by using Free Cash Flow in combination with the GAAP cash flow numbers. Free Cash Flow before special items We define Free Cash Flow before special items as Free Cash Flow adjusted for (i) acquisitions, (ii) integrations, (iii) restructuring, (iv) Koch Redemption, and (v) other payments or receipts that may mask the operating results or business trends of the Company. As a result, subject to the limitations described below, Free Cash Flow before special items is a useful measure of our cash available to repay debt, make other investments, and pay dividends. Free Cash Flow before special items adjusts for cash items that are ultimately within management’s discretion to direct, and therefore, may imply that there is less or more cash that is available than the most comparable GAAP measure. Free Cash Flow before special items is not intended to represent residual cash flow for discretionary expenditures since debt repayment requirements and other non-discretionary expenditures are not deducted. These limitations are best addressed by using Free Cash Flow before special items in combination with the GAAP cash flow numbers. Adjusted Net Income Adjusted Net Income is a non-GAAP measure that we present to provide additional information to investors about our operating performance. We define Adjusted Net Income as Adjusted EBITDA less (i) capitalized subscriber acquisition costs, (ii) cash taxes, and (iii) cash interest, including interest on our preferred securities and excluding outflows in connection with the Koch Redemption. Given our capital intensive business model, high debt levels, and the fact we are a low cash income tax paying Company due to our significant net operating loss, the Company uses this measure to reflect the cash portion of such adjusted items mentioned above to further evaluate our operational performance. There are material limitations to using Adjusted Net Income. Adjusted Net Income does not fully take into account certain significant items, including depreciation and amortization, interest, taxes, and other adjustments which directly affect our net income or loss. These limitations are best addressed by considering the economic effects of the excluded items independently, and by considering Adjusted Net Income in conjunction with net income or loss as calculated in accordance with GAAP. Leverage Ratios Leverage ratios include first lien debt, net first lien debt, total debt, and net debt all as compared to Covenant Adjusted EBITDA (Pre-SAC) calculated on a trailing twelve month basis (LTM Covenant Adjusted EBITDA (Pre-SAC)). Net first lien debt and net debt are calculated as first lien debt and total debt, respectively, less cash and cash equivalents. The Company also presents LTM Covenant Adjusted EBITDA (Pre-SAC) to cash interest excluding Koch Redemption. Cash interest excluding Koch Redemption excludes amounts associated with the redemption of the Koch Preferred Securities on July 2, 2018. Leverage ratios are useful measures of the Company’s credit position and progress towards leverage targets. Refer to the discussion on Adjusted EBITDA and Covenant Adjusted EBITDA (Pre-SAC) for a description of the differences between the most comparable GAAP measure. The calculation is limited in that the Company may not always be able to use cash to repay debt on a dollar-for-dollar basis. Financial Outlook The Company is not providing a quantitative reconciliation of our financial outlook for Adjusted EBITDA and Free Cash Flow before special items to net income (loss) and net cash provided by operating activities, which are their corresponding GAAP measures because these GAAP measures that we exclude from our non-GAAP financial outlook are difficult to reliably predict or estimate without unreasonable effort due to their dependence on future uncertainties, such as special items discussed above under the heading — Non-GAAP Measures “Adjusted EBITDA” and “Free Cash Flow before special items.” Additionally, information that is currently not available to the Company could have a potentially unpredictable and potentially significant impact on its future GAAP financial results.

Call Participants Brad Aston Managing Director, Barclays Dan Bresingham Chief Administrative Officer, ADT Jim DeVries President, ADT Jeff Likosar Chief Financial Officer, ADT

Agenda Transaction Overview Red Hawk Overview ADT Update Appendix

Transaction Overview

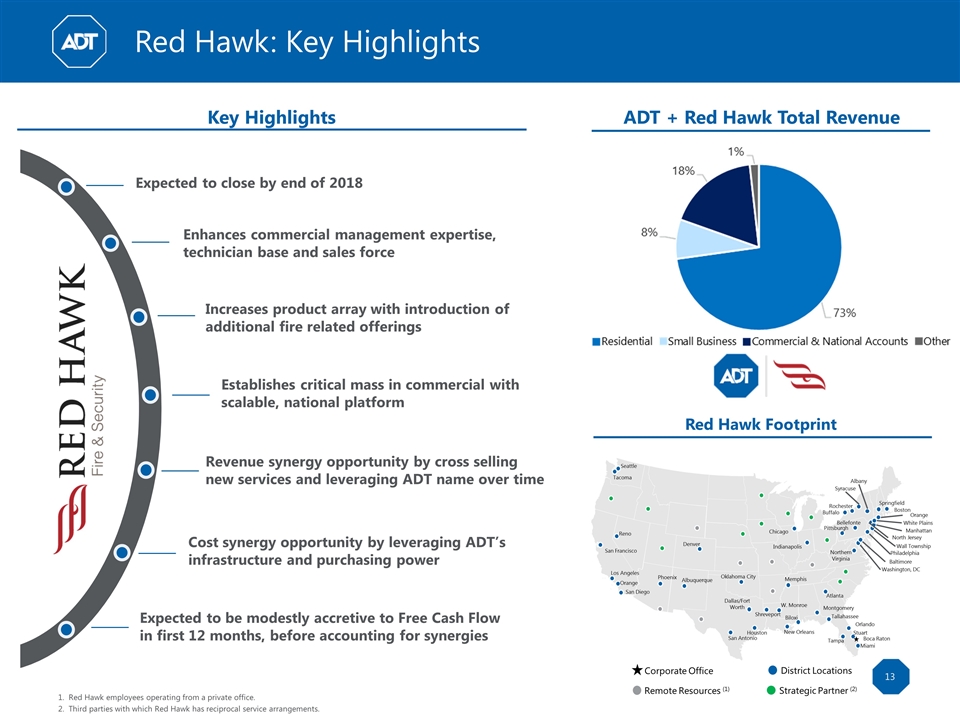

Transaction Overview On October 24th, certain subsidiaries of ADT Inc. (“ADT” or the “Company”) signed a definitive acquisition agreement to acquire Red Hawk Fire & Security (“Red Hawk”) for a purchase price of $317.5 million Red Hawk, which is expected to generate approximately $300 million of revenues in 2018, designs, engineers, installs, integrates, monitors, and services a broad portfolio of life safety and security solutions using the latest technologies and advanced systems integration for enterprise level access control, video surveillance systems and physical security equipment The acquisition adds immediate scale to ADT’s commercial offering and expands the existing product portfolio to include mission-critical fire and security solutions ADT will finance the acquisition through available cash and a portion of a $425 million Incremental 1st Lien Term Loan (the “TL”) (1), which is expected to be fungible with the Borrower’s existing 1st Lien Term Loan The TL will be offered at a dollar price of 99.50 – 99.75 All other terms and conditions of the Borrower’s existing 1st Lien Term Loan will remain unchanged The Company intends to use the remaining net proceeds of the TL that are not required to fund the Red Hawk acquisition, after giving effect to available funds on the closing date of the acquisition, for general corporate purposes, which may include the refinancing, redemption or repurchase of outstanding indebtedness Pro forma for the incurrence of the TL and the payment of the purchase price for the Red Hawk acquisition, 1st Lien Net Leverage and Total Net Leverage will be 2.7x and 3.6x, respectively, based on LTM 9/30/18 Covenant Adjusted EBITDA (Pre-SAC) of $2,740 million (2) Commitments for the TL will be due on November 19th, 2018 To be incurred by Prime Security Services Borrower, LLC (the “Borrower”), the borrower under the current credit agreement. Does not include contribution from Red Hawk.

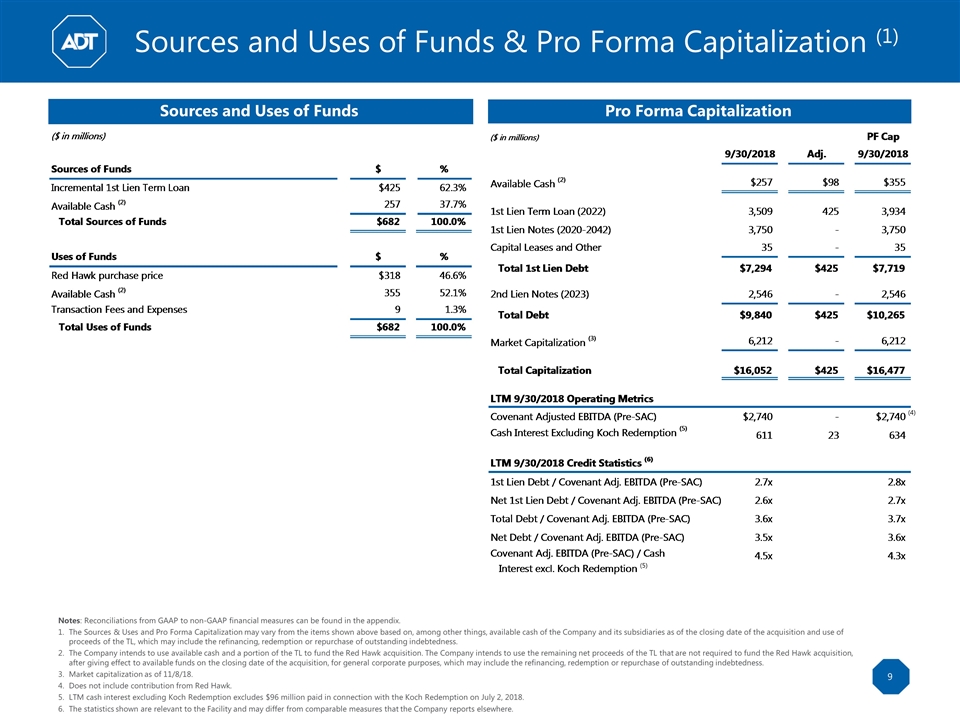

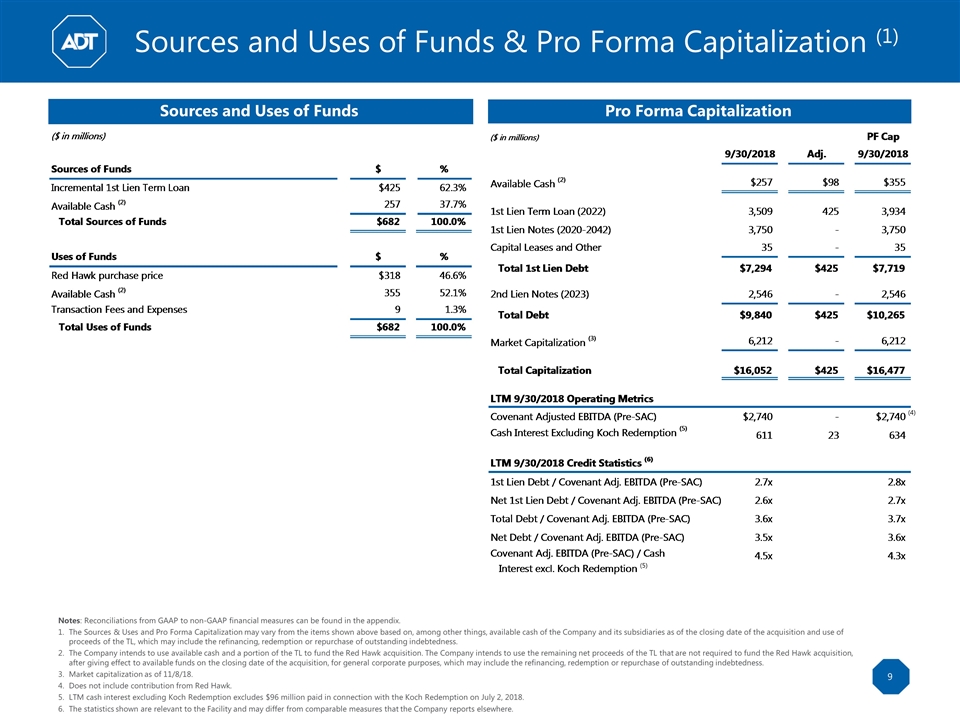

Sources and Uses of Funds & Pro Forma Capitalization (1) Pro Forma Capitalization Sources and Uses of Funds (4) Notes: Reconciliations from GAAP to non-GAAP financial measures can be found in the appendix. The Sources & Uses and Pro Forma Capitalization may vary from the items shown above based on, among other things, available cash of the Company and its subsidiaries as of the closing date of the acquisition and use of proceeds of the TL, which may include the refinancing, redemption or repurchase of outstanding indebtedness. The Company intends to use available cash and a portion of the TL to fund the Red Hawk acquisition. The Company intends to use the remaining net proceeds of the TL that are not required to fund the Red Hawk acquisition, after giving effect to available funds on the closing date of the acquisition, for general corporate purposes, which may include the refinancing, redemption or repurchase of outstanding indebtedness. Market capitalization as of 11/8/18. Does not include contribution from Red Hawk. LTM cash interest excluding Koch Redemption excludes $96 million paid in connection with the Koch Redemption on July 2, 2018. The statistics shown are relevant to the Facility and may differ from comparable measures that the Company reports elsewhere. (5)

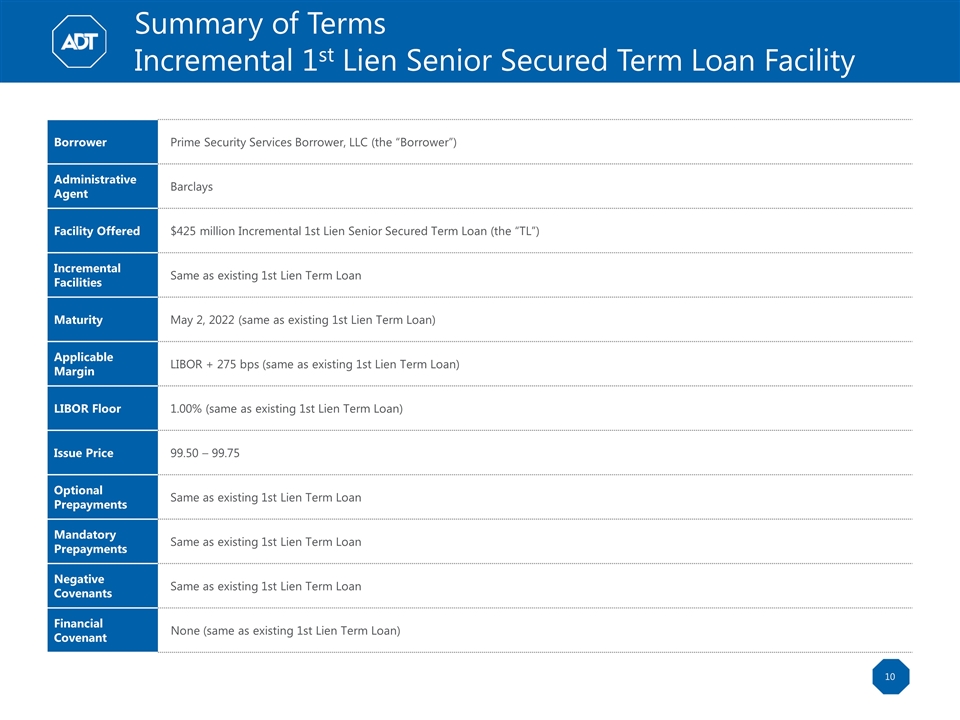

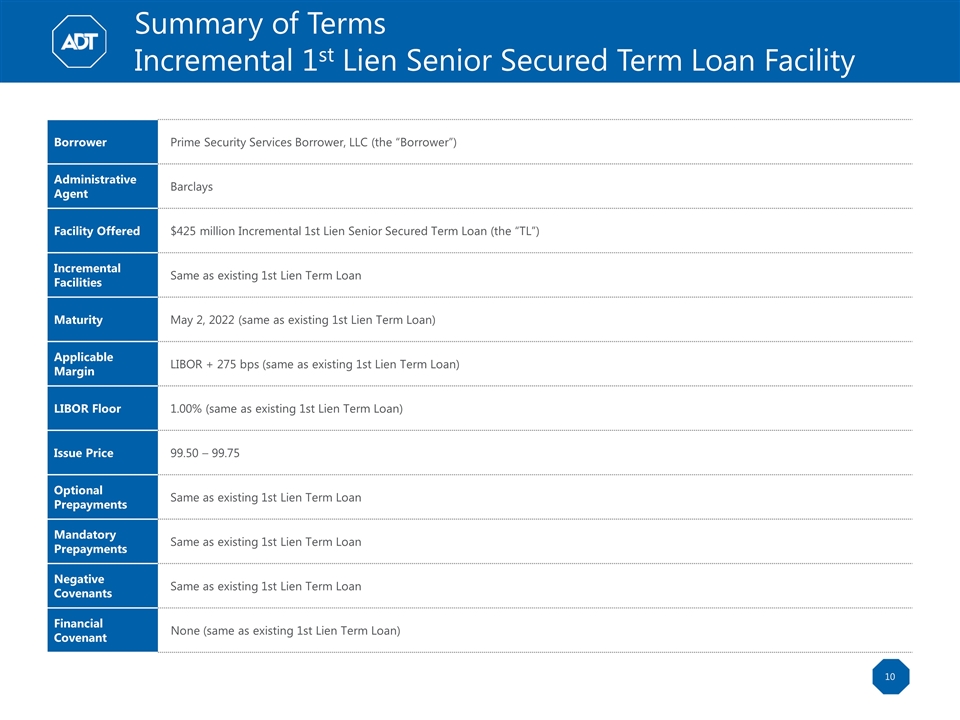

Summary of Terms Incremental 1st Lien Senior Secured Term Loan Facility Borrower Prime Security Services Borrower, LLC (the “Borrower”) Administrative Agent Barclays Facility Offered $425 million Incremental 1st Lien Senior Secured Term Loan (the “TL”) Incremental Facilities Same as existing 1st Lien Term Loan Maturity May 2, 2022 (same as existing 1st Lien Term Loan) Applicable Margin LIBOR + 275 bps (same as existing 1st Lien Term Loan) LIBOR Floor 1.00% (same as existing 1st Lien Term Loan) Issue Price 99.50 – 99.75 Optional Prepayments Same as existing 1st Lien Term Loan Mandatory Prepayments Same as existing 1st Lien Term Loan Negative Covenants Same as existing 1st Lien Term Loan Financial Covenant None (same as existing 1st Lien Term Loan)

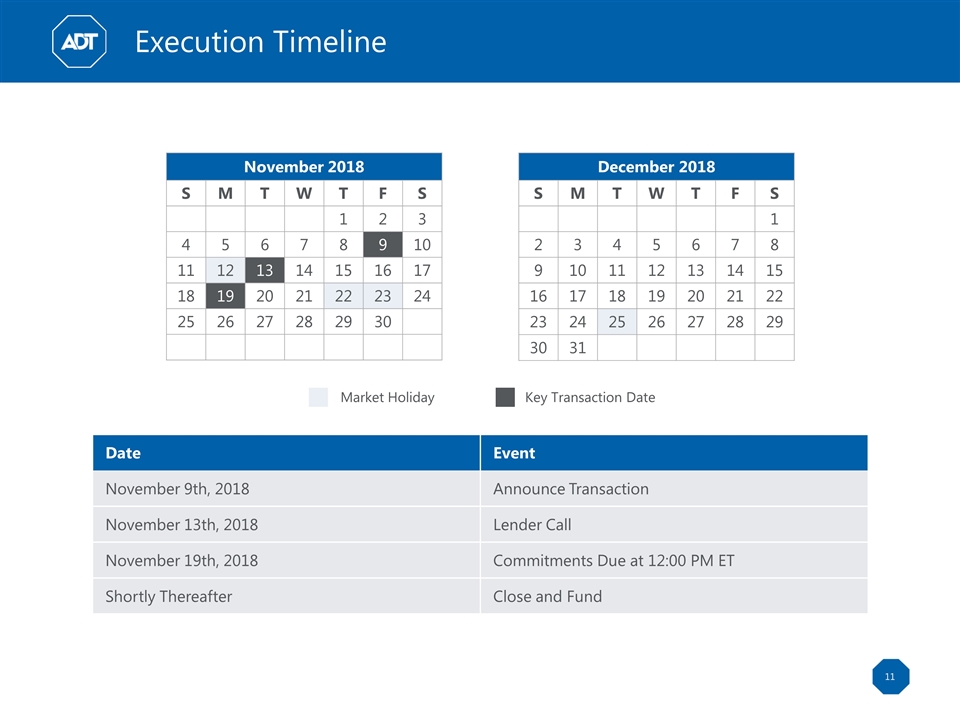

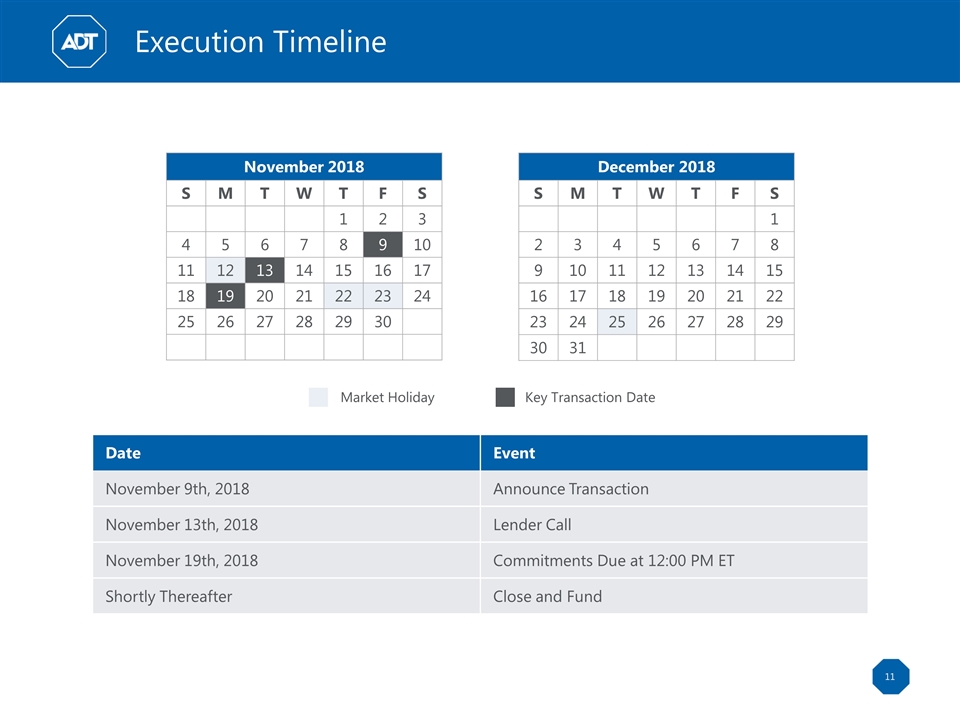

December 2018 S M T W T F S 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 Execution Timeline Date Event November 9th, 2018 Announce Transaction November 13th, 2018 Lender Call November 19th, 2018 Commitments Due at 12:00 PM ET Shortly Thereafter Close and Fund November 2018 S M T W T F S 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 Market Holiday Key Transaction Date

Red Hawk Overview

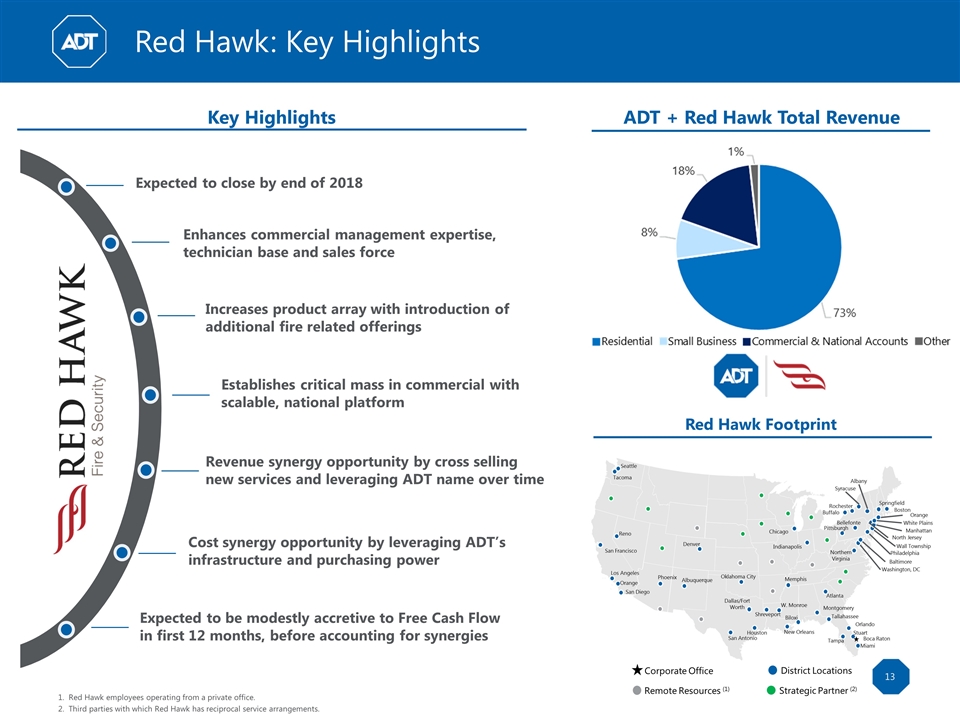

Red Hawk: Key Highlights Red Hawk employees operating from a private office. Third parties with which Red Hawk has reciprocal service arrangements. Key Highlights Revenue synergy opportunity by cross selling new services and leveraging ADT name over time Expected to be modestly accretive to Free Cash Flow in first 12 months, before accounting for synergies Enhances commercial management expertise, technician base and sales force Increases product array with introduction of additional fire related offerings Cost synergy opportunity by leveraging ADT’s infrastructure and purchasing power Establishes critical mass in commercial with scalable, national platform Expected to close by end of 2018 Seattle Tacoma Reno San Francisco Los Angeles Orange San Diego Phoenix Denver Albuquerque San Antonio Dallas/Fort Worth Houston Chicago Indianapolis Shreveport W. Monroe New Orleans Oklahoma City Biloxi Pittsburgh Buffalo Rochester Syracuse Albany Montgomery Tampa Miami Boca Raton Stuart Orlando Tallahassee Memphis Atlanta Northern Virginia Washington, DC Baltimore Bellefonte Philadelphia Wall Township North Jersey Manhattan White Plains Orange Boston Springfield Red Hawk Footprint Corporate Office District Locations Remote Resources (1) Strategic Partner (2) ADT + Red Hawk Total Revenue

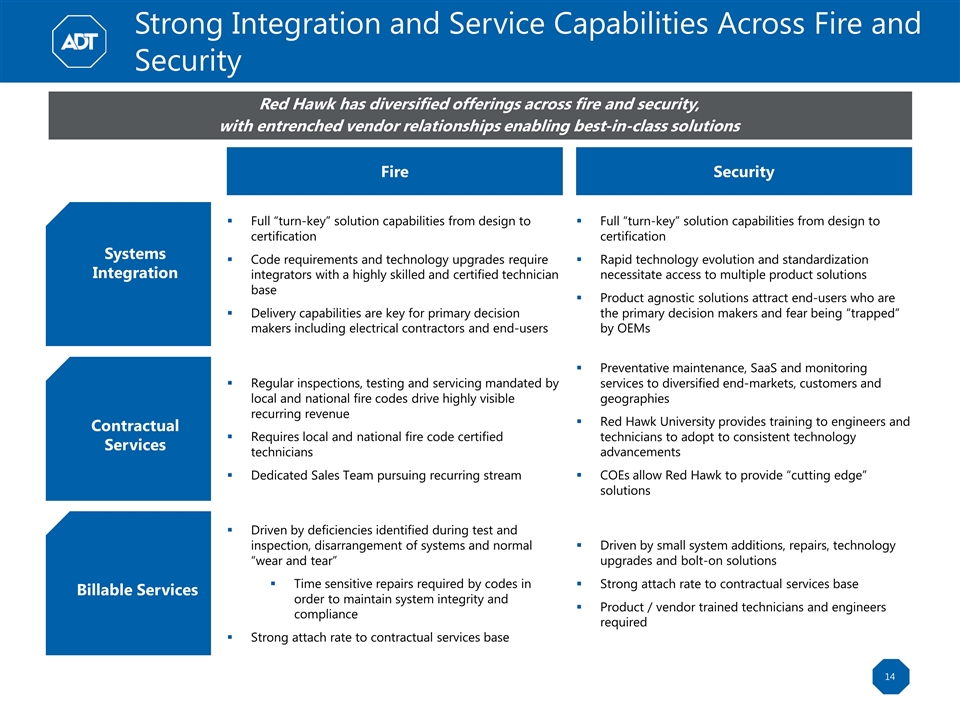

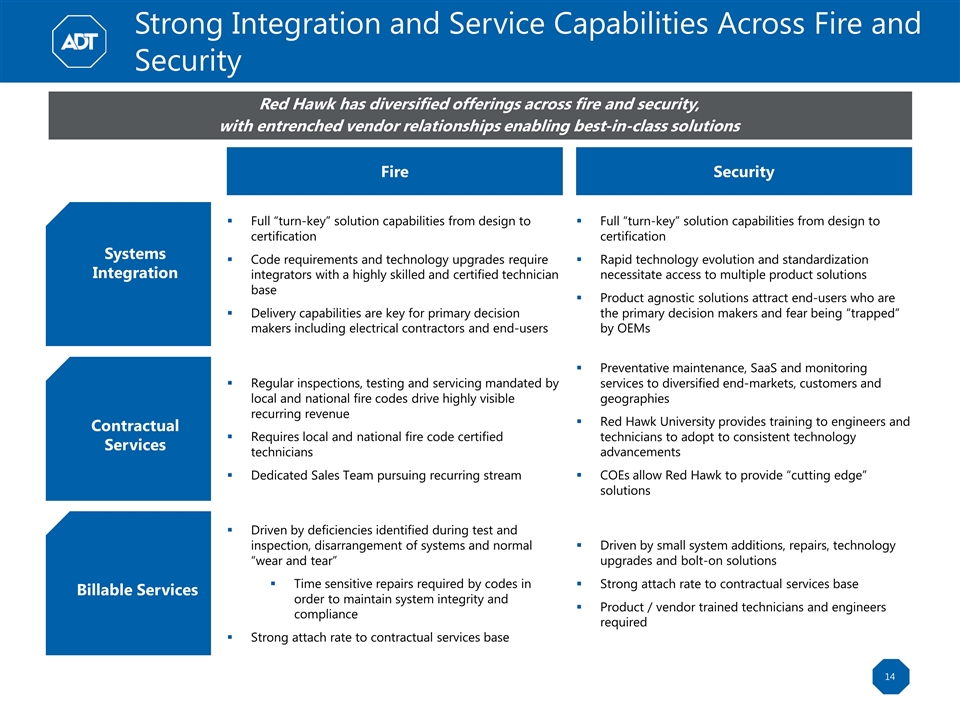

Strong Integration and Service Capabilities Across Fire and Security Systems Integration Contractual Services Billable Services Red Hawk has diversified offerings across fire and security, with entrenched vendor relationships enabling best-in-class solutions Fire Security Full “turn-key” solution capabilities from design to certification Code requirements and technology upgrades require integrators with a highly skilled and certified technician base Delivery capabilities are key for primary decision makers including electrical contractors and end-users Regular inspections, testing and servicing mandated by local and national fire codes drive highly visible recurring revenue Requires local and national fire code certified technicians Dedicated Sales Team pursuing recurring stream Driven by deficiencies identified during test and inspection, disarrangement of systems and normal “wear and tear” Time sensitive repairs required by codes in order to maintain system integrity and compliance Strong attach rate to contractual services base Full “turn-key” solution capabilities from design to certification Rapid technology evolution and standardization necessitate access to multiple product solutions Product agnostic solutions attract end-users who are the primary decision makers and fear being “trapped” by OEMs Preventative maintenance, SaaS and monitoring services to diversified end-markets, customers and geographies Red Hawk University provides training to engineers and technicians to adopt to consistent technology advancements COEs allow Red Hawk to provide “cutting edge” solutions Driven by small system additions, repairs, technology upgrades and bolt-on solutions Strong attach rate to contractual services base Product / vendor trained technicians and engineers required

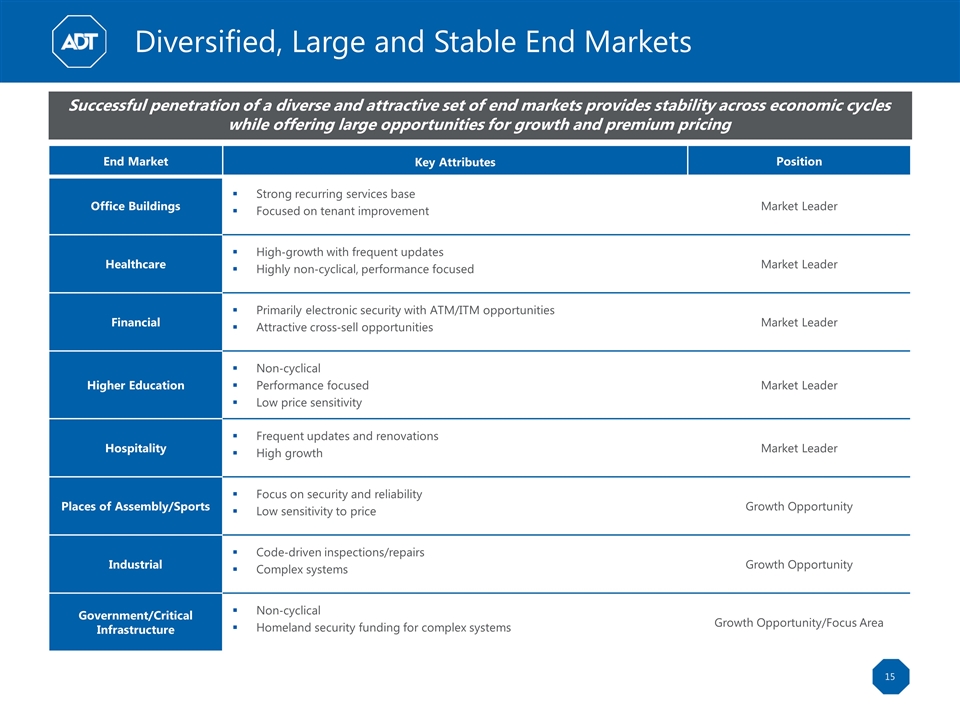

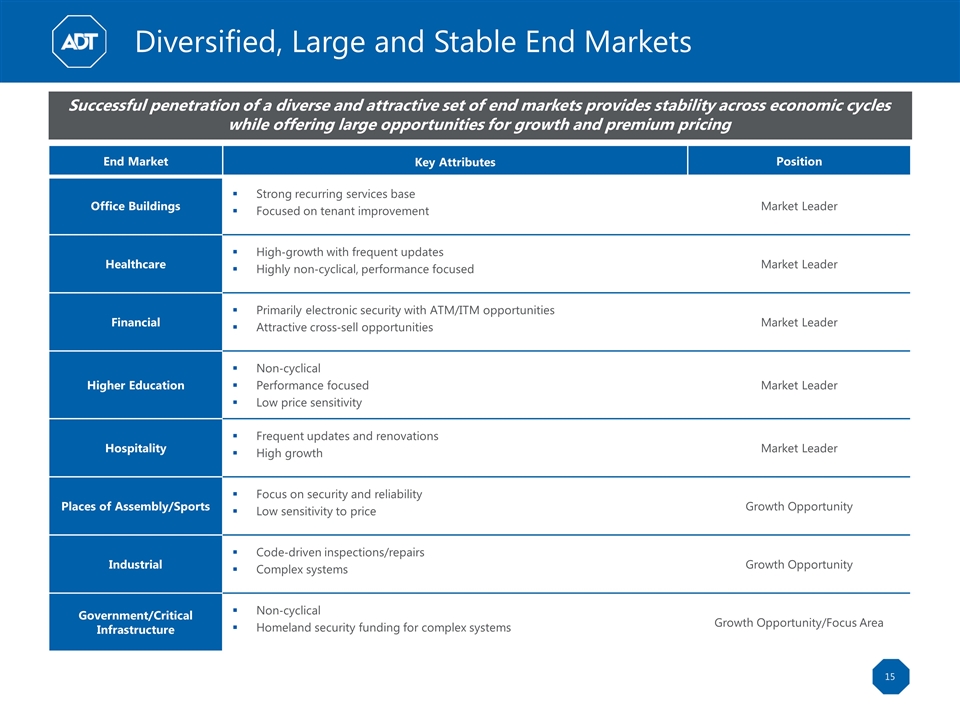

Diversified, Large and Stable End Markets End Market Key Attributes Position Office Buildings Strong recurring services base Focused on tenant improvement Market Leader Healthcare High‐growth with frequent updates Highly non‐cyclical, performance focused Market Leader Financial Primarily electronic security with ATM/ITM opportunities Attractive cross‐sell opportunities Market Leader Higher Education Non‐cyclical Performance focused Low price sensitivity Market Leader Hospitality Frequent updates and renovations High growth Market Leader Places of Assembly/Sports Focus on security and reliability Low sensitivity to price Growth Opportunity Industrial Code‐driven inspections/repairs Complex systems Growth Opportunity Government/Critical Infrastructure Non‐cyclical Homeland security funding for complex systems Growth Opportunity/Focus Area Successful penetration of a diverse and attractive set of end markets provides stability across economic cycles while offering large opportunities for growth and premium pricing

ADT Update

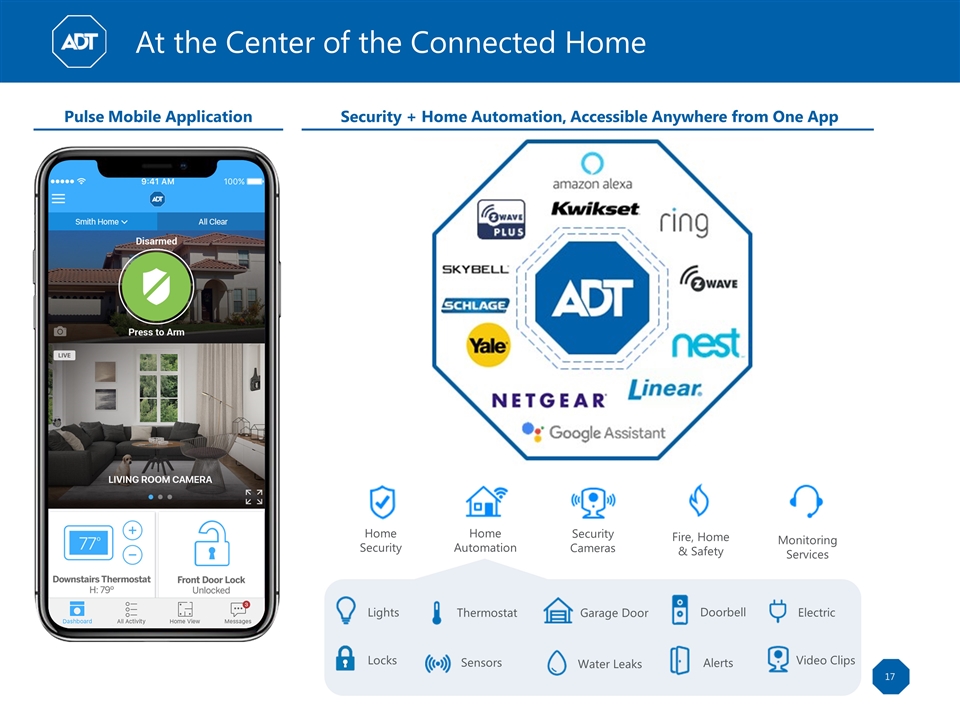

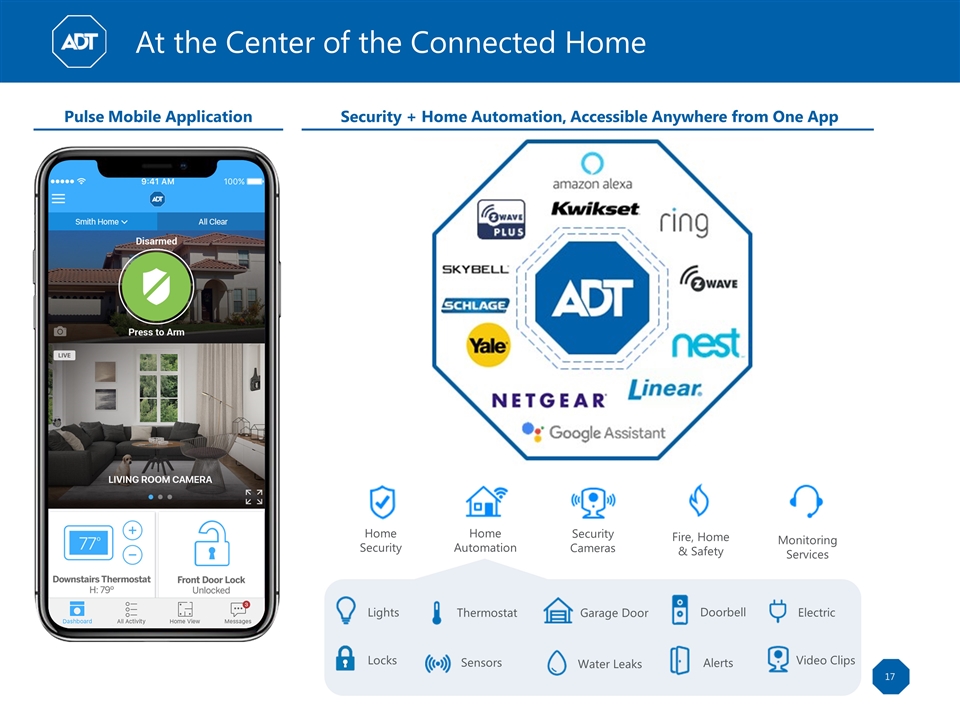

At the Center of the Connected Home Pulse Mobile Application Security + Home Automation, Accessible Anywhere from One App Home Security Home Automation Security Cameras Fire, Home & Safety Monitoring Services Lights Thermostat Garage Door Doorbell Electric Locks Sensors Water Leaks Alerts Video Clips

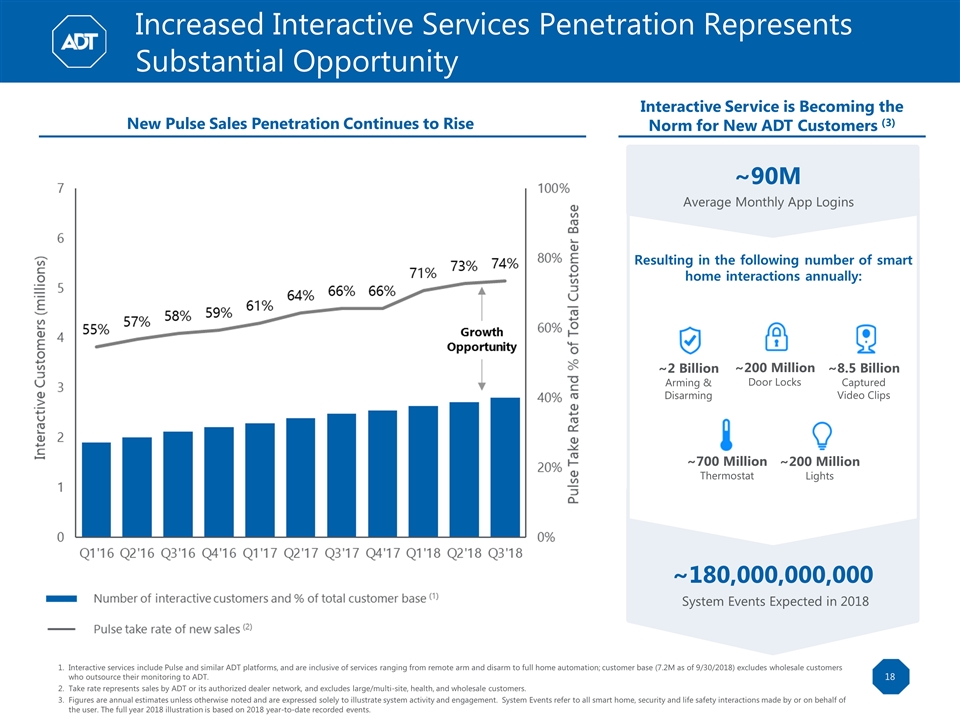

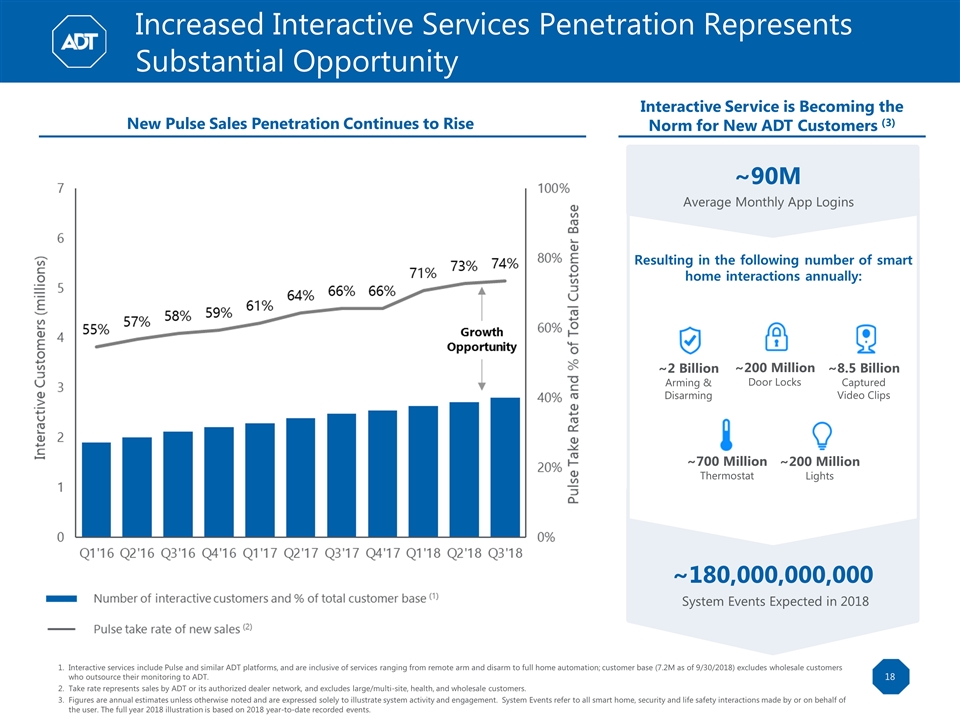

Increased Interactive Services Penetration Represents Substantial Opportunity Interactive services include Pulse and similar ADT platforms, and are inclusive of services ranging from remote arm and disarm to full home automation; customer base (7.2M as of 9/30/2018) excludes wholesale customers who outsource their monitoring to ADT. Take rate represents sales by ADT or its authorized dealer network, and excludes large/multi-site, health, and wholesale customers. Figures are annual estimates unless otherwise noted and are expressed solely to illustrate system activity and engagement. System Events refer to all smart home, security and life safety interactions made by or on behalf of the user. The full year 2018 illustration is based on 2018 year-to-date recorded events. ~90M Interactive Service is Becoming the Norm for New ADT Customers (3) Average Monthly App Logins ~180,000,000,000 System Events Expected in 2018 Resulting in the following number of smart home interactions annually: ~2 Billion Arming & Disarming ~200 Million Door Locks ~8.5 Billion Captured Video Clips ~700 Million Thermostat ~200 Million Lights New Pulse Sales Penetration Continues to Rise

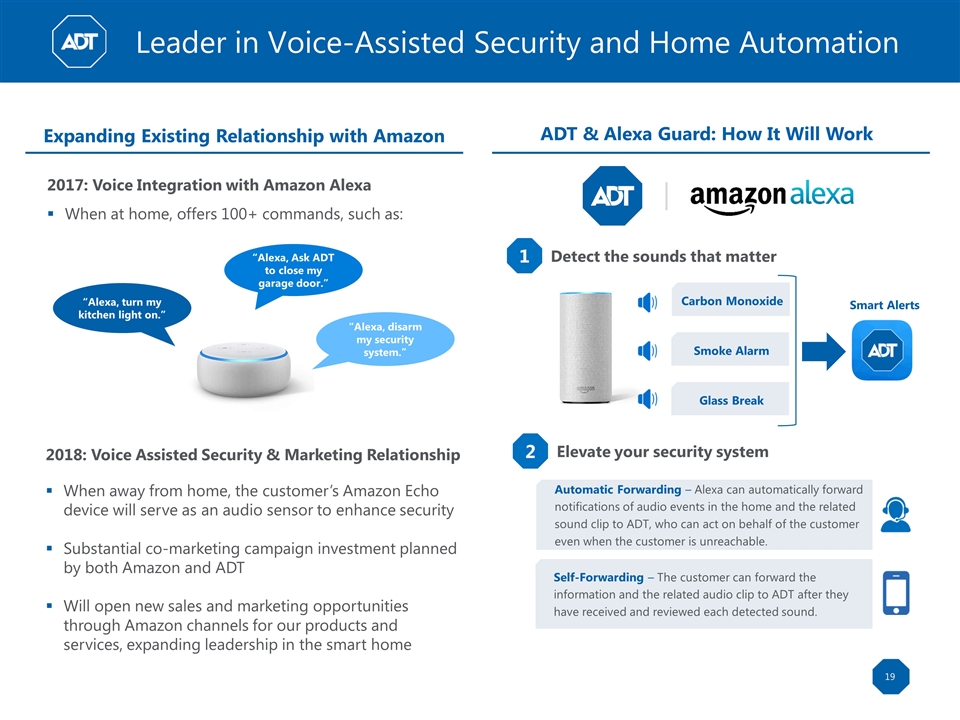

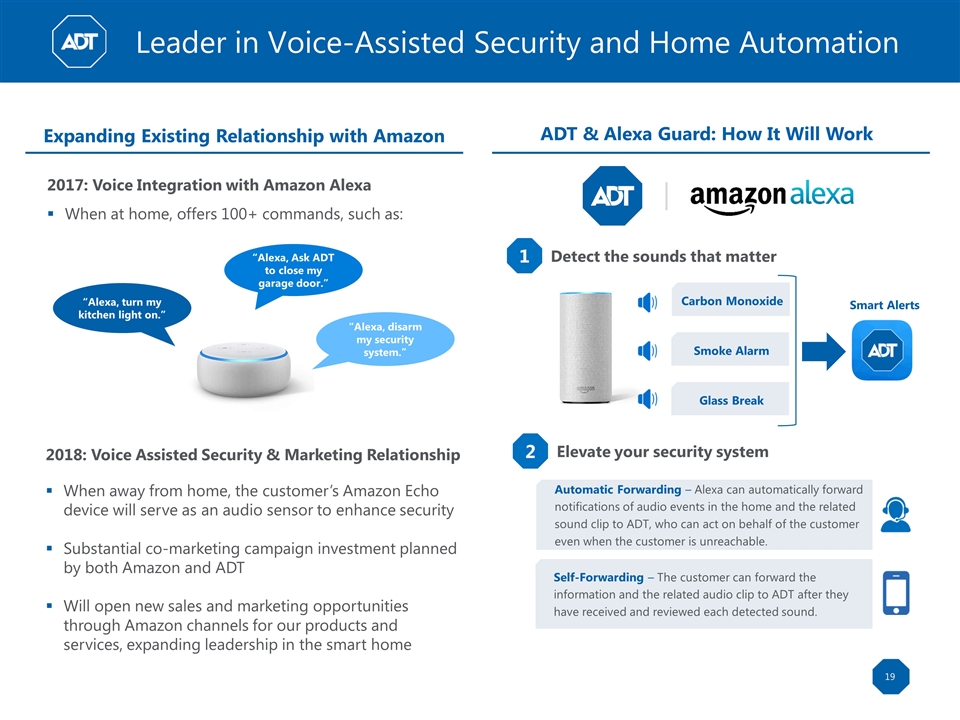

Leader in Voice-Assisted Security and Home Automation Automatic Forwarding – Alexa can automatically forward notifications of audio events in the home and the related sound clip to ADT, who can act on behalf of the customer even when the customer is unreachable. Carbon Monoxide Smoke Alarm Glass Break Self-Forwarding – The customer can forward the information and the related audio clip to ADT after they have received and reviewed each detected sound. Smart Alerts 2017: Voice Integration with Amazon Alexa When at home, offers 100+ commands, such as: “Alexa, turn my kitchen light on.” “Alexa, Ask ADT to close my garage door.” “Alexa, disarm my security system.” 2018: Voice Assisted Security & Marketing Relationship When away from home, the customer’s Amazon Echo device will serve as an audio sensor to enhance security Substantial co-marketing campaign investment planned by both Amazon and ADT Will open new sales and marketing opportunities through Amazon channels for our products and services, expanding leadership in the smart home Detect the sounds that matter 1 2 Elevate your security system Expanding Existing Relationship with Amazon ADT & Alexa Guard: How It Will Work

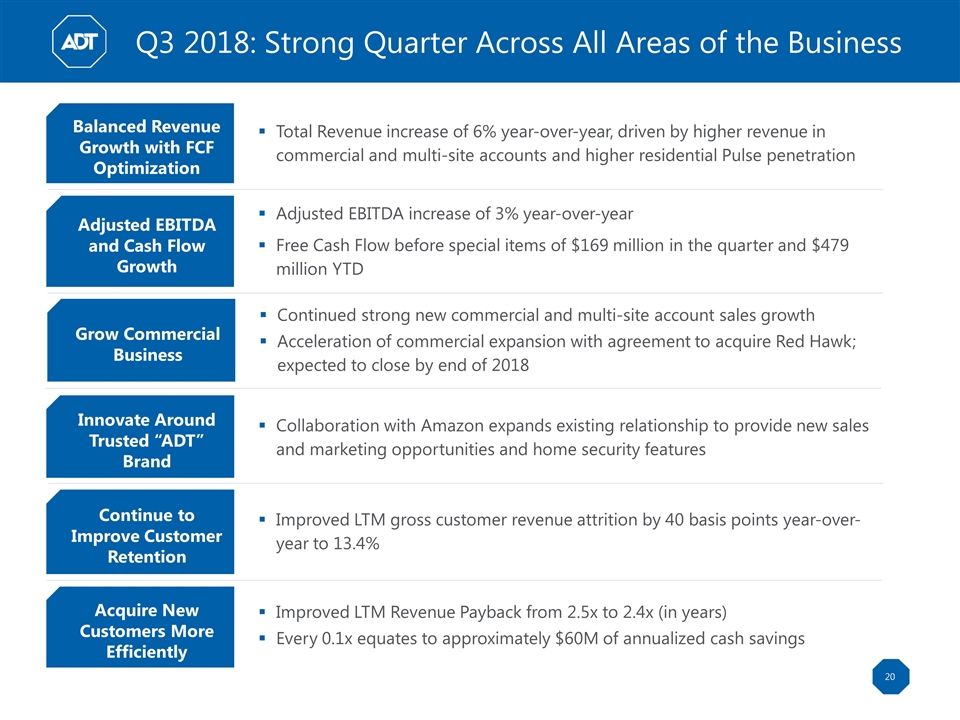

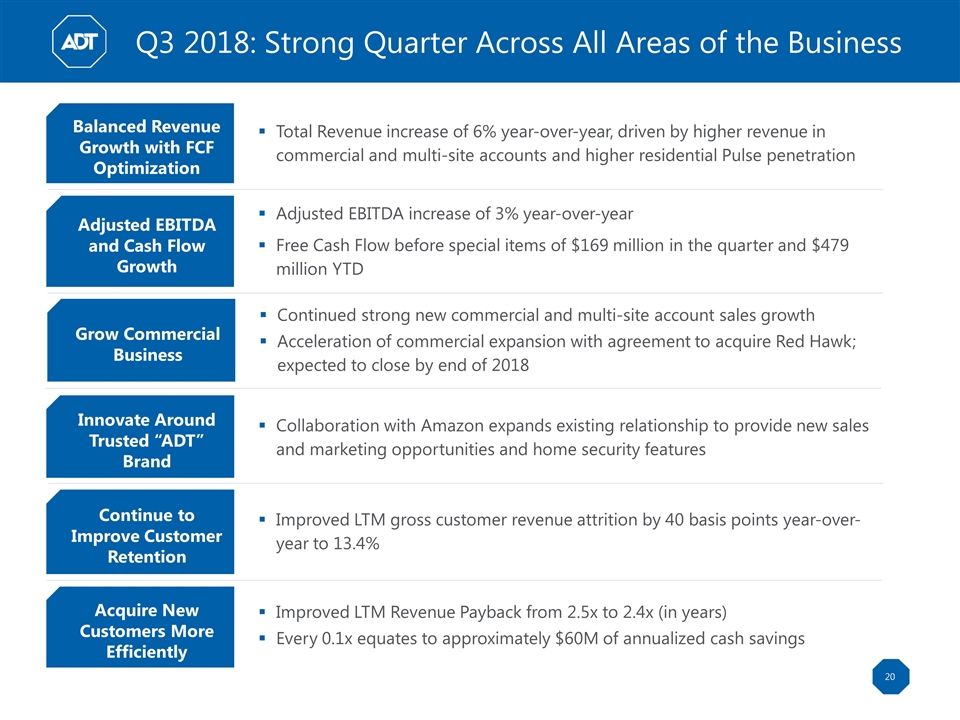

Q3 2018: Strong Quarter Across All Areas of the Business Balanced Revenue Growth with FCF Optimization Adjusted EBITDA and Cash Flow Growth Grow Commercial Business Total Revenue increase of 6% year-over-year, driven by higher revenue in commercial and multi-site accounts and higher residential Pulse penetration Adjusted EBITDA increase of 3% year-over-year Free Cash Flow before special items of $169 million in the quarter and $479 million YTD Continued strong new commercial and multi-site account sales growth Acceleration of commercial expansion with agreement to acquire Red Hawk; expected to close by end of 2018 Innovate Around Trusted “ADT” Brand Collaboration with Amazon expands existing relationship to provide new sales and marketing opportunities and home security features Continue to Improve Customer Retention Acquire New Customers More Efficiently Improved LTM gross customer revenue attrition by 40 basis points year-over-year to 13.4% Improved LTM Revenue Payback from 2.5x to 2.4x (in years) Every 0.1x equates to approximately $60M of annualized cash savings

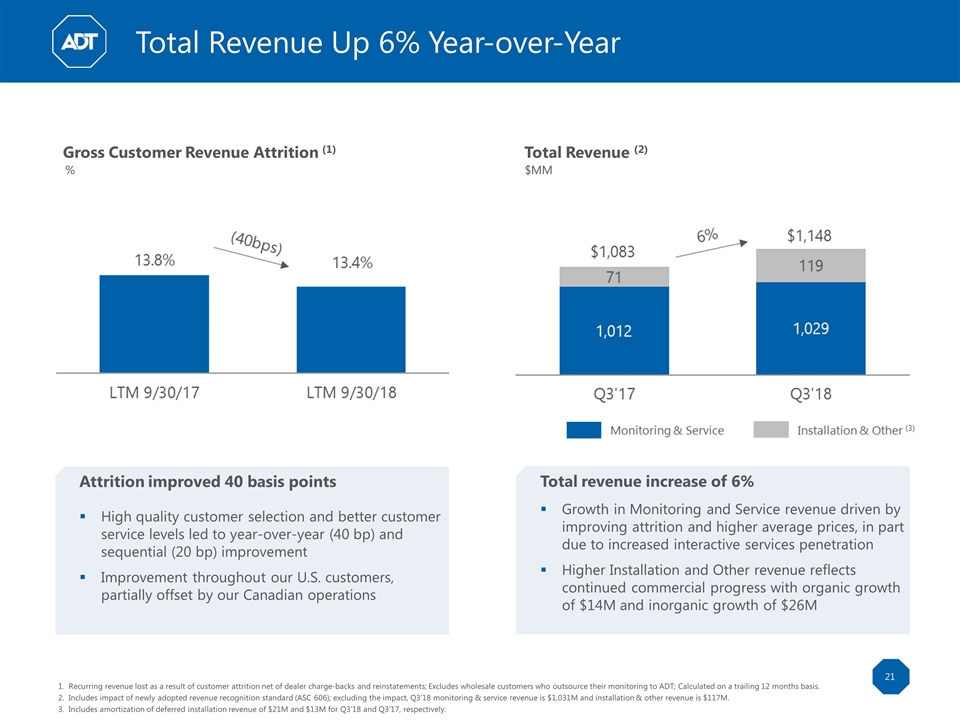

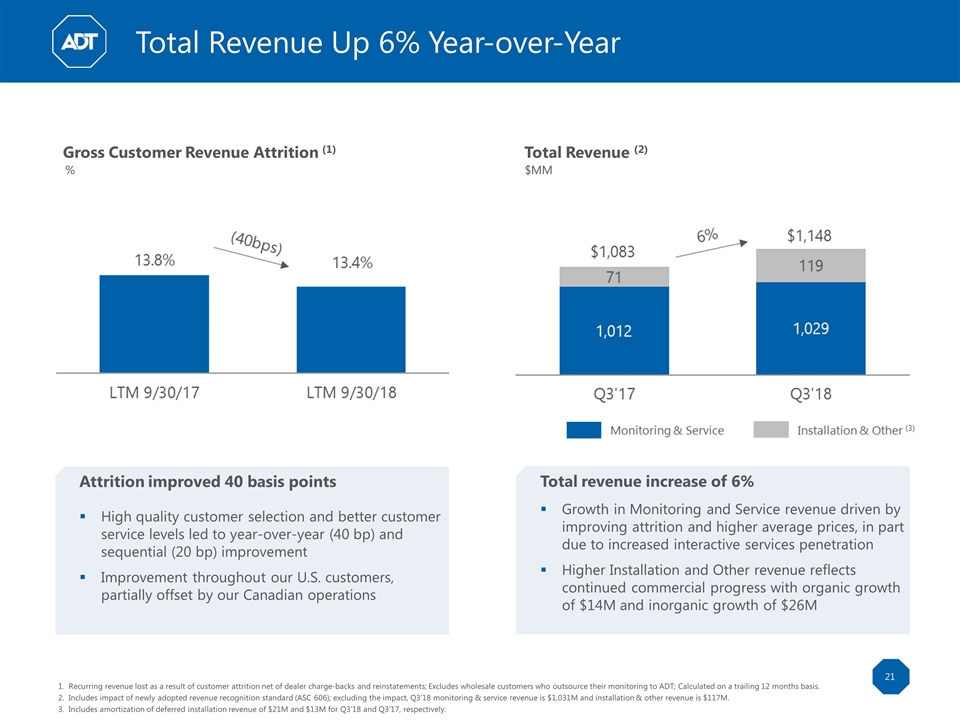

Total Revenue Up 6% Year-over-Year Recurring revenue lost as a result of customer attrition net of dealer charge-backs and reinstatements; Excludes wholesale customers who outsource their monitoring to ADT; Calculated on a trailing 12 months basis. Includes impact of newly adopted revenue recognition standard (ASC 606); excluding the impact, Q3’18 monitoring & service revenue is $1,031M and installation & other revenue is $117M. Includes amortization of deferred installation revenue of $21M and $13M for Q3’18 and Q3’17, respectively. Attrition improved 40 basis points High quality customer selection and better customer service levels led to year-over-year (40 bp) and sequential (20 bp) improvement Improvement throughout our U.S. customers, partially offset by our Canadian operations Total revenue increase of 6% Growth in Monitoring and Service revenue driven by improving attrition and higher average prices, in part due to increased interactive services penetration Higher Installation and Other revenue reflects continued commercial progress with organic growth of $14M and inorganic growth of $26M Total Revenue (2) Gross Customer Revenue Attrition (1) % $MM

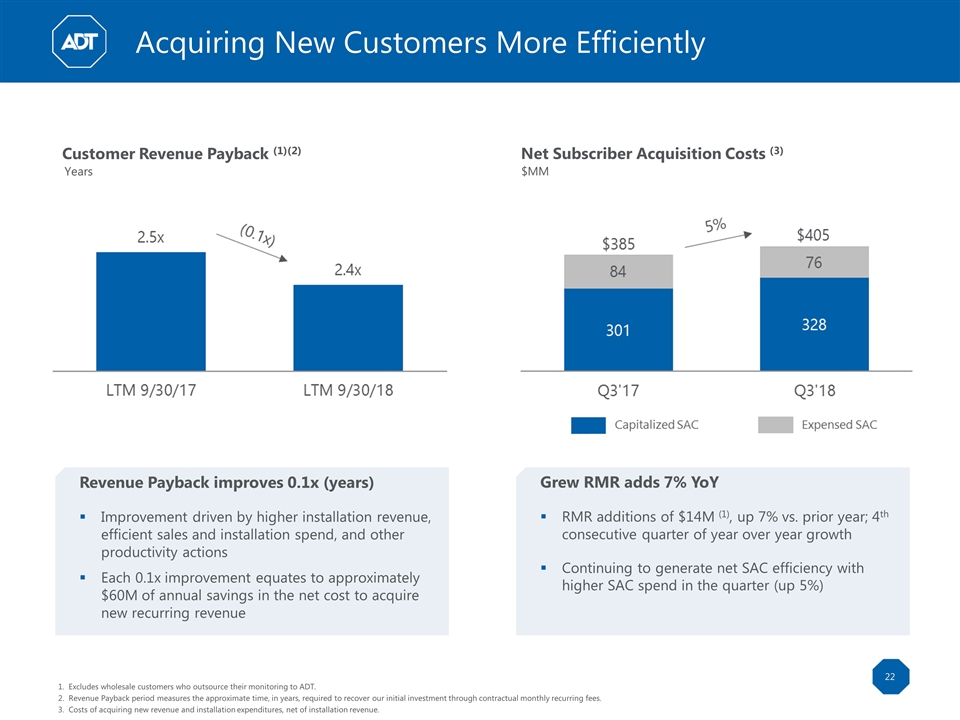

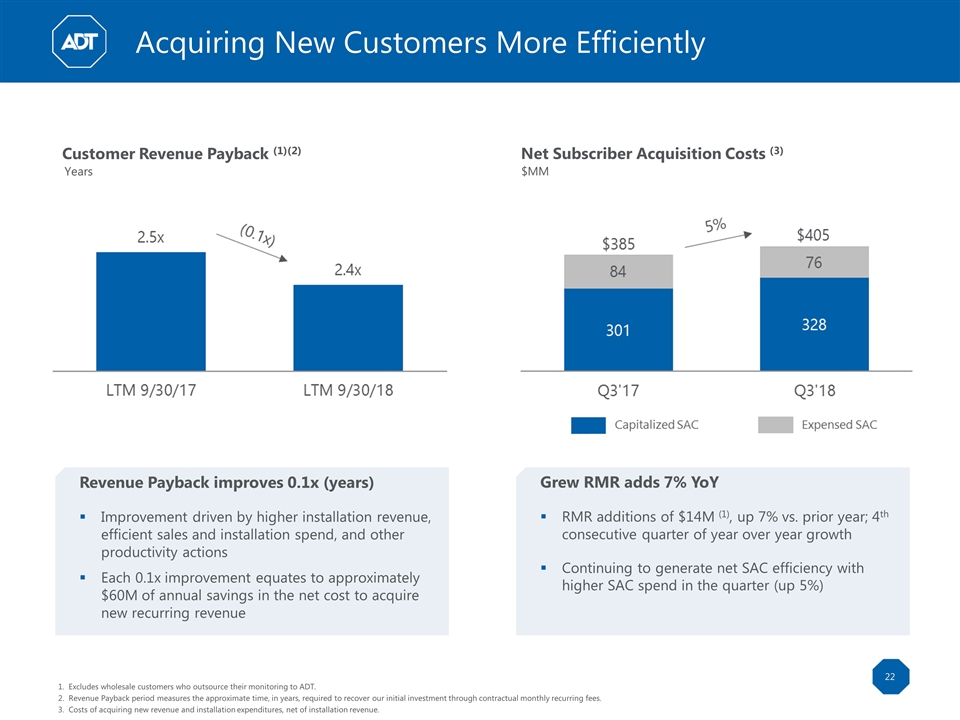

Acquiring New Customers More Efficiently Excludes wholesale customers who outsource their monitoring to ADT. Revenue Payback period measures the approximate time, in years, required to recover our initial investment through contractual monthly recurring fees. Costs of acquiring new revenue and installation expenditures, net of installation revenue. Revenue Payback improves 0.1x (years) Improvement driven by higher installation revenue, efficient sales and installation spend, and other productivity actions Each 0.1x improvement equates to approximately $60M of annual savings in the net cost to acquire new recurring revenue Grew RMR adds 7% YoY RMR additions of $14M (1), up 7% vs. prior year; 4th consecutive quarter of year over year growth Continuing to generate net SAC efficiency with higher SAC spend in the quarter (up 5%) Net Subscriber Acquisition Costs (3) Customer Revenue Payback (1)(2) Years $MM

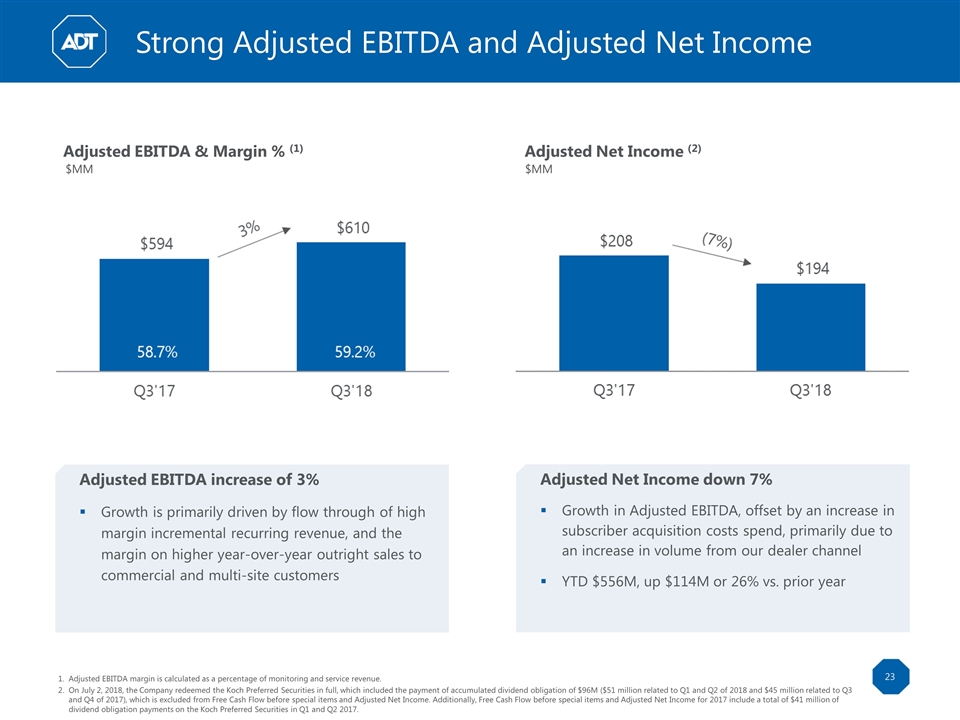

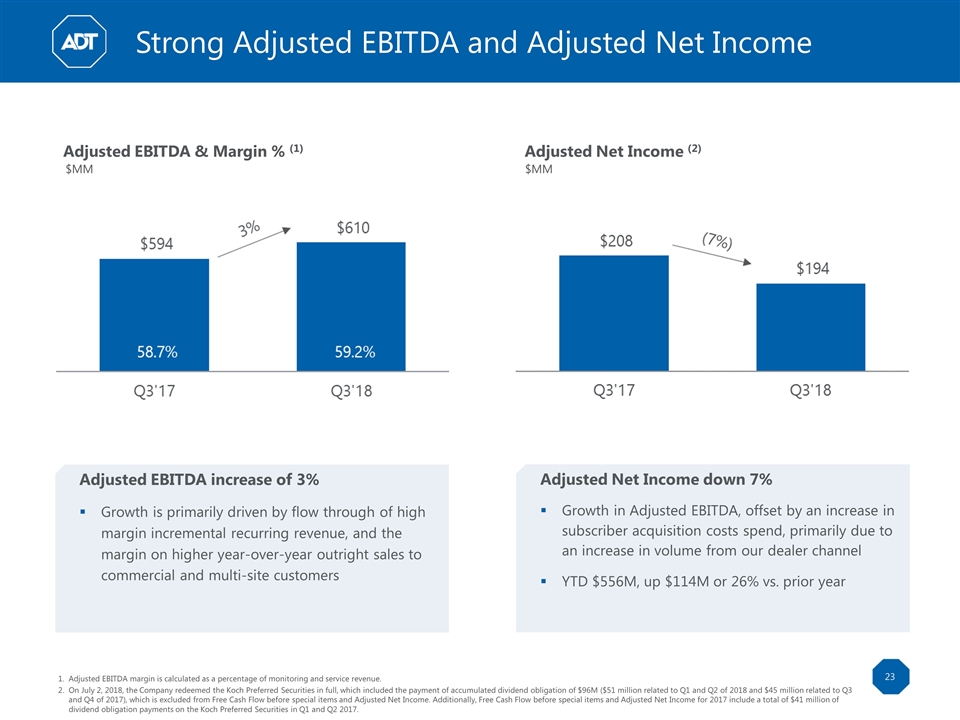

Strong Adjusted EBITDA and Adjusted Net Income Adjusted EBITDA margin is calculated as a percentage of monitoring and service revenue. On July 2, 2018, the Company redeemed the Koch Preferred Securities in full, which included the payment of accumulated dividend obligation of $96M ($51 million related to Q1 and Q2 of 2018 and $45 million related to Q3 and Q4 of 2017), which is excluded from Free Cash Flow before special items and Adjusted Net Income. Additionally, Free Cash Flow before special items and Adjusted Net Income for 2017 include a total of $41 million of dividend obligation payments on the Koch Preferred Securities in Q1 and Q2 2017. Adjusted Net Income down 7% Growth in Adjusted EBITDA, offset by an increase in subscriber acquisition costs spend, primarily due to an increase in volume from our dealer channel YTD $556M, up $114M or 26% vs. prior year Adjusted EBITDA increase of 3% Growth is primarily driven by flow through of high margin incremental recurring revenue, and the margin on higher year-over-year outright sales to commercial and multi-site customers Adjusted Net Income (2) Adjusted EBITDA & Margin % (1) $MM $MM

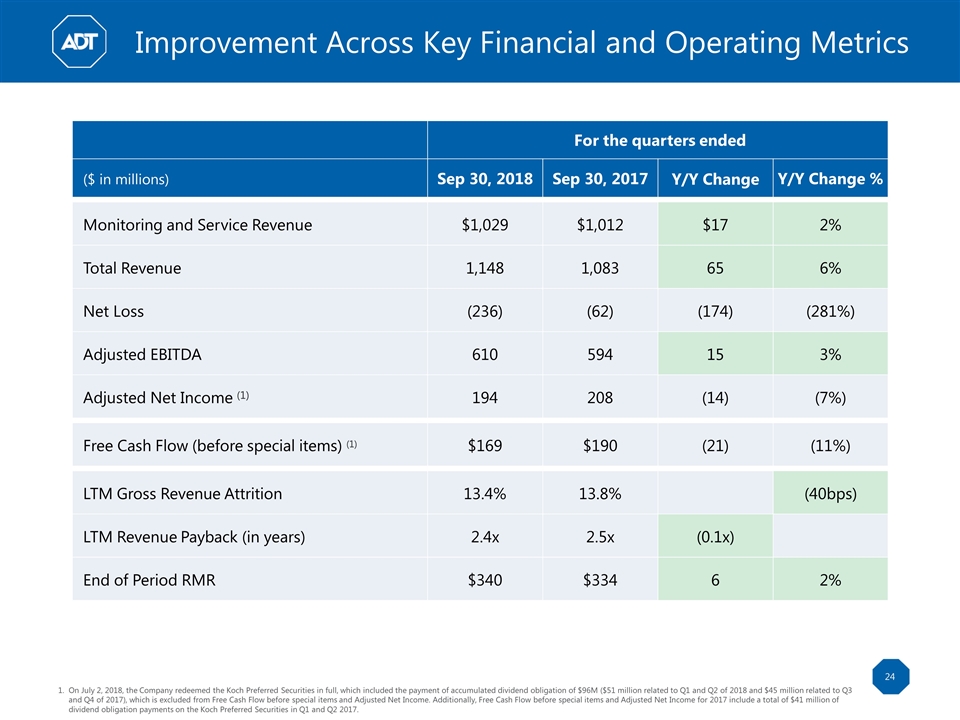

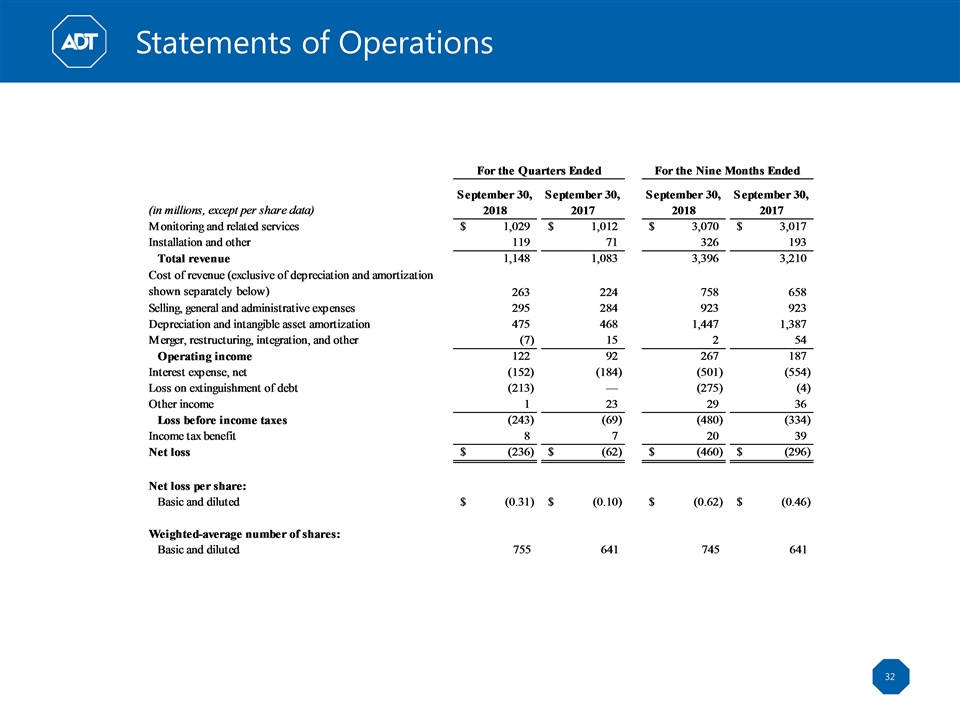

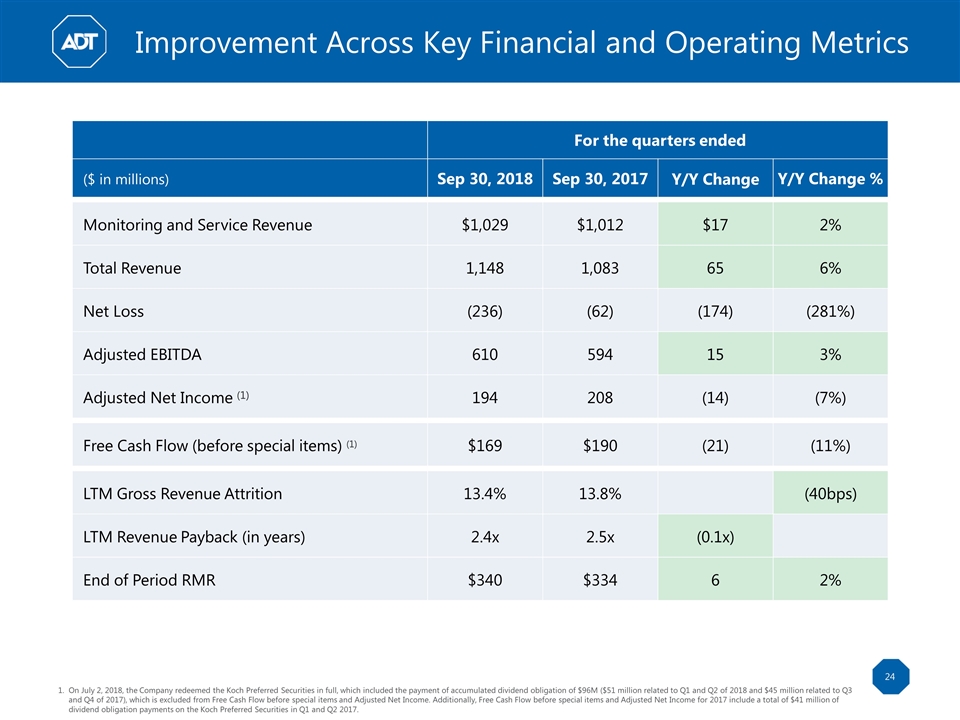

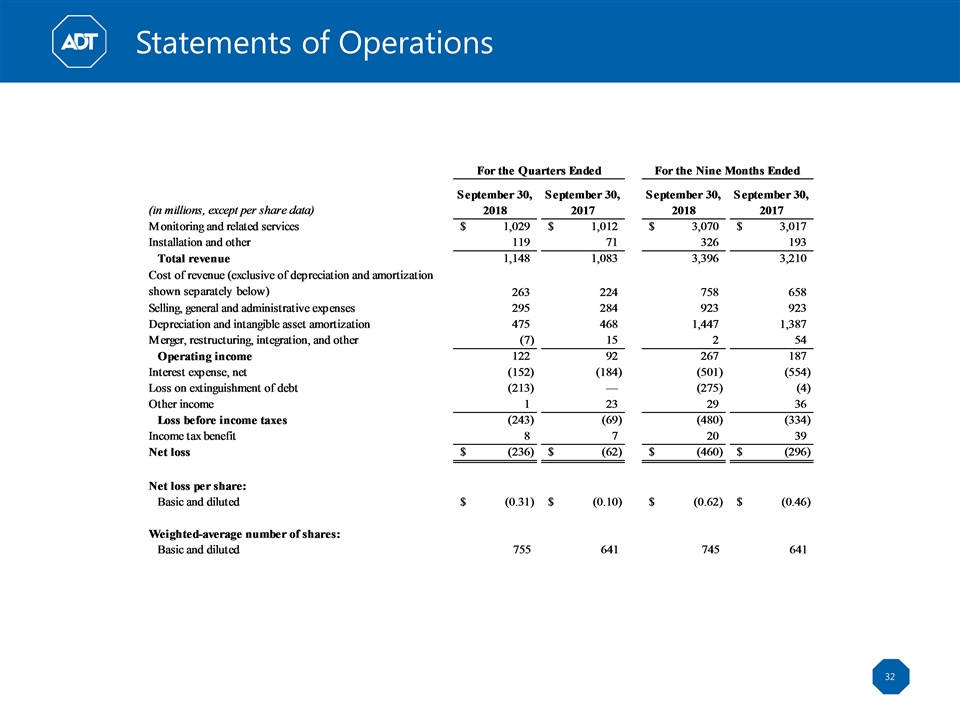

Improvement Across Key Financial and Operating Metrics For the quarters ended ($ in millions) Sep 30, 2018 Sep 30, 2017 Y/Y Change Y/Y Change % Monitoring and Service Revenue $1,029 $1,012 $17 2% Total Revenue 1,148 1,083 65 6% Net Loss (236) (62) (174) (281%) Adjusted EBITDA 610 594 15 3% Adjusted Net Income (1) 194 208 (14) (7%) Free Cash Flow (before special items) (1) $169 $190 (21) (11%) LTM Gross Revenue Attrition 13.4% 13.8% (40bps) LTM Revenue Payback (in years) 2.4x 2.5x (0.1x) End of Period RMR $340 $334 6 2% On July 2, 2018, the Company redeemed the Koch Preferred Securities in full, which included the payment of accumulated dividend obligation of $96M ($51 million related to Q1 and Q2 of 2018 and $45 million related to Q3 and Q4 of 2017), which is excluded from Free Cash Flow before special items and Adjusted Net Income. Additionally, Free Cash Flow before special items and Adjusted Net Income for 2017 include a total of $41 million of dividend obligation payments on the Koch Preferred Securities in Q1 and Q2 2017.

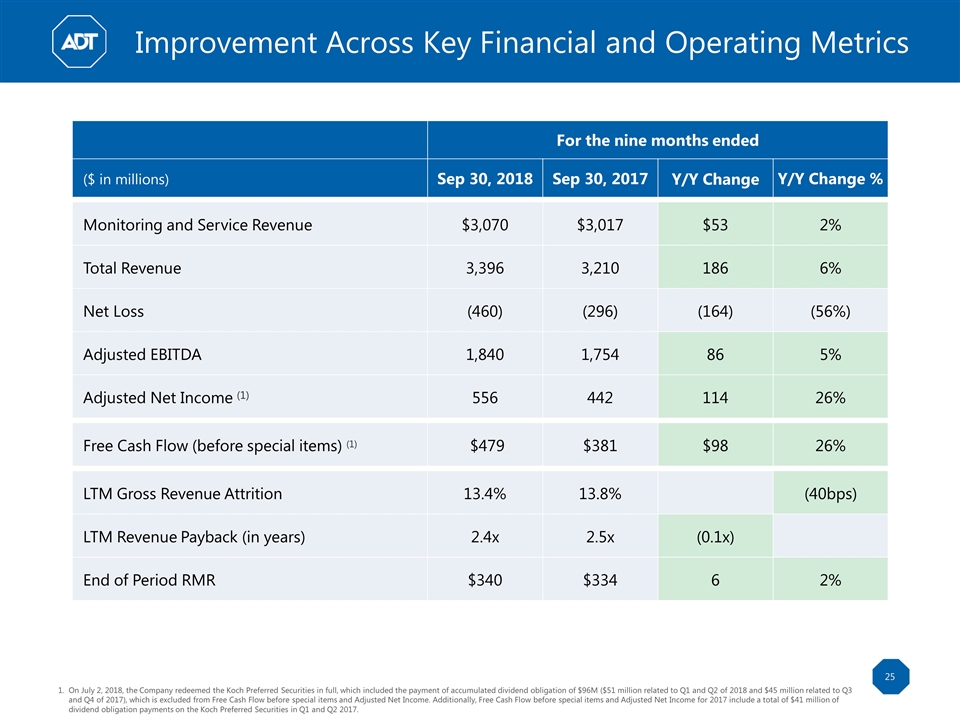

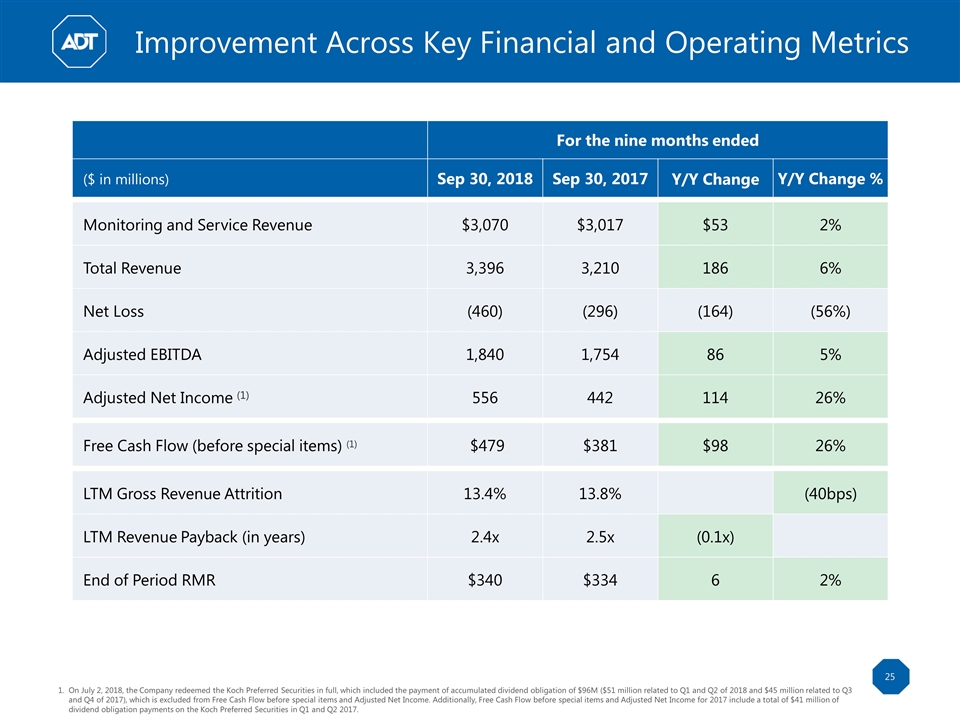

Improvement Across Key Financial and Operating Metrics On July 2, 2018, the Company redeemed the Koch Preferred Securities in full, which included the payment of accumulated dividend obligation of $96M ($51 million related to Q1 and Q2 of 2018 and $45 million related to Q3 and Q4 of 2017), which is excluded from Free Cash Flow before special items and Adjusted Net Income. Additionally, Free Cash Flow before special items and Adjusted Net Income for 2017 include a total of $41 million of dividend obligation payments on the Koch Preferred Securities in Q1 and Q2 2017. For the nine months ended ($ in millions) Sep 30, 2018 Sep 30, 2017 Y/Y Change Y/Y Change % Monitoring and Service Revenue $3,070 $3,017 $53 2% Total Revenue 3,396 3,210 186 6% Net Loss (460) (296) (164) (56%) Adjusted EBITDA 1,840 1,754 86 5% Adjusted Net Income (1) 556 442 114 26% Free Cash Flow (before special items) (1) $479 $381 $98 26% LTM Gross Revenue Attrition 13.4% 13.8% (40bps) LTM Revenue Payback (in years) 2.4x 2.5x (0.1x) End of Period RMR $340 $334 6 2%

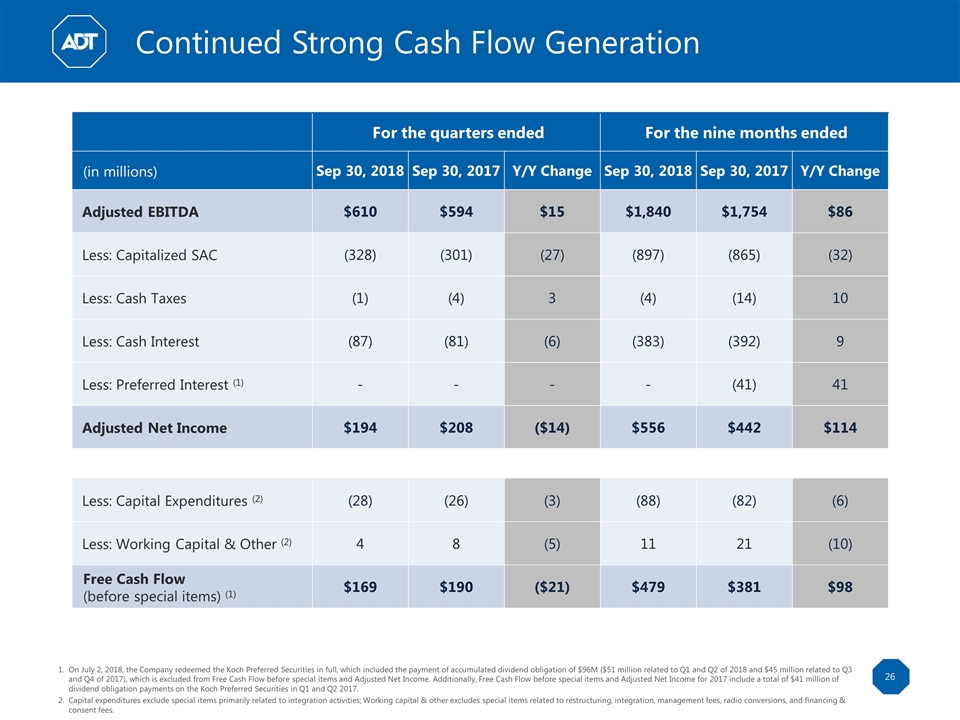

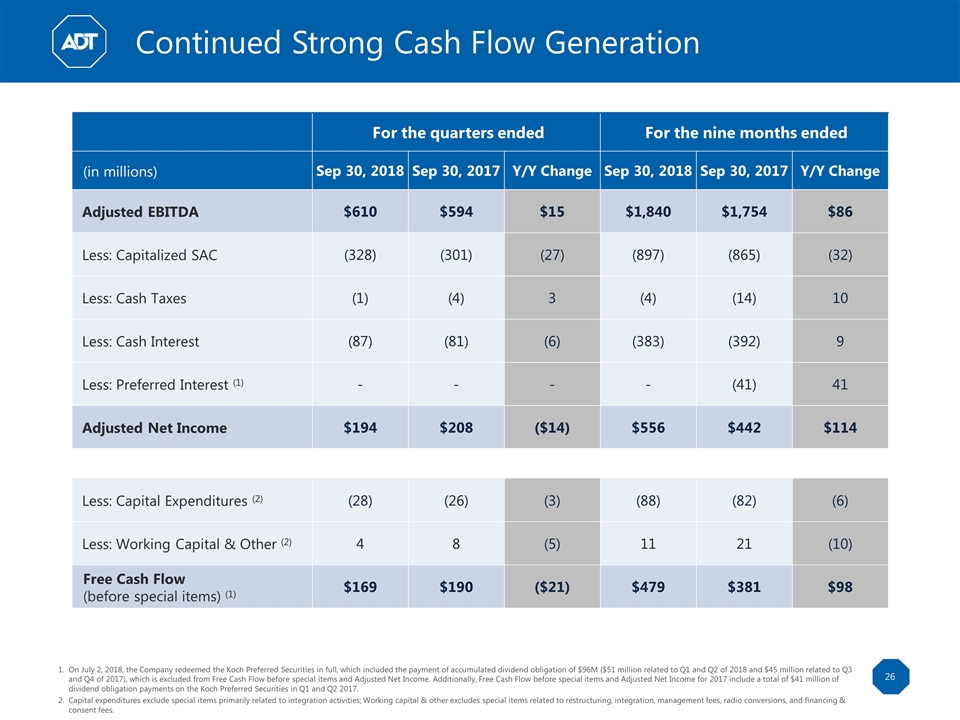

Continued Strong Cash Flow Generation For the quarters ended For the nine months ended (in millions) Sep 30, 2018 Sep 30, 2017 Y/Y Change Sep 30, 2018 Sep 30, 2017 Y/Y Change Adjusted EBITDA $610 $594 $15 $1,840 $1,754 $86 Less: Capitalized SAC (328) (301) (27) (897) (865) (32) Less: Cash Taxes (1) (4) 3 (4) (14) 10 Less: Cash Interest (87) (81) (6) (383) (392) 9 Less: Preferred Interest (1) - - - - (41) 41 Adjusted Net Income $194 $208 ($14) $556 $442 $114 Less: Capital Expenditures (2) (28) (26) (3) (88) (82) (6) Less: Working Capital & Other (2) 4 8 (5) 11 21 (10) Free Cash Flow (before special items) (1) $169 $190 ($21) $479 $381 $98 On July 2, 2018, the Company redeemed the Koch Preferred Securities in full, which included the payment of accumulated dividend obligation of $96M ($51 million related to Q1 and Q2 of 2018 and $45 million related to Q3 and Q4 of 2017), which is excluded from Free Cash Flow before special items and Adjusted Net Income. Additionally, Free Cash Flow before special items and Adjusted Net Income for 2017 include a total of $41 million of dividend obligation payments on the Koch Preferred Securities in Q1 and Q2 2017. Capital expenditures exclude special items primarily related to integration activities; Working capital & other excludes special items related to restructuring, integration, management fees, radio conversions, and financing & consent fees.

Raising FY 2018 Financial Guidance Excludes wholesale customers who outsource their monitoring to ADT; calculated on a trailing 12 months basis. Before special items; On July 2, 2018, the Company redeemed the Koch Preferred Securities in full, which included the payment of accumulated dividend obligation of $96M ($51 million related to Q1 and Q2 of 2018 and $45 million related to Q3 and Q4 of 2017), which is excluded from Free Cash Flow before special items and Adjusted Net Income. Additionally, Free Cash Flow before special items and Adjusted Net Income for 2017 include a total of $41 million of dividend obligation payments on the Koch Preferred Securities in Q1 and Q2 2017. Gross Customer Revenue Attrition (1) % Total Revenue $MM Adjusted EBITDA $MM Free Cash Flow (2) $MM

Q&A

Appendix

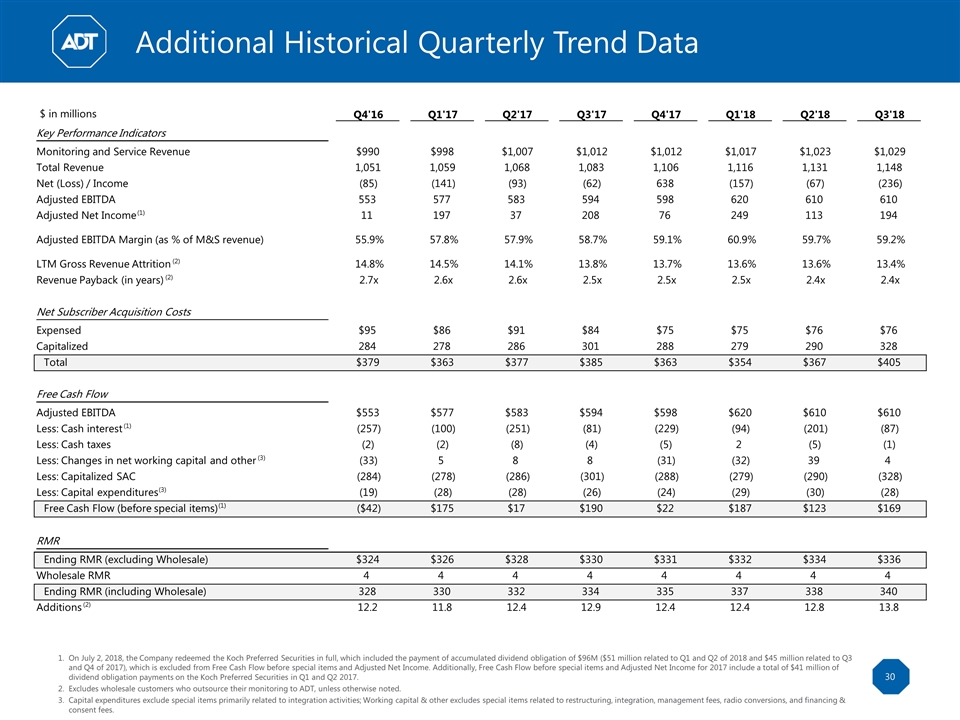

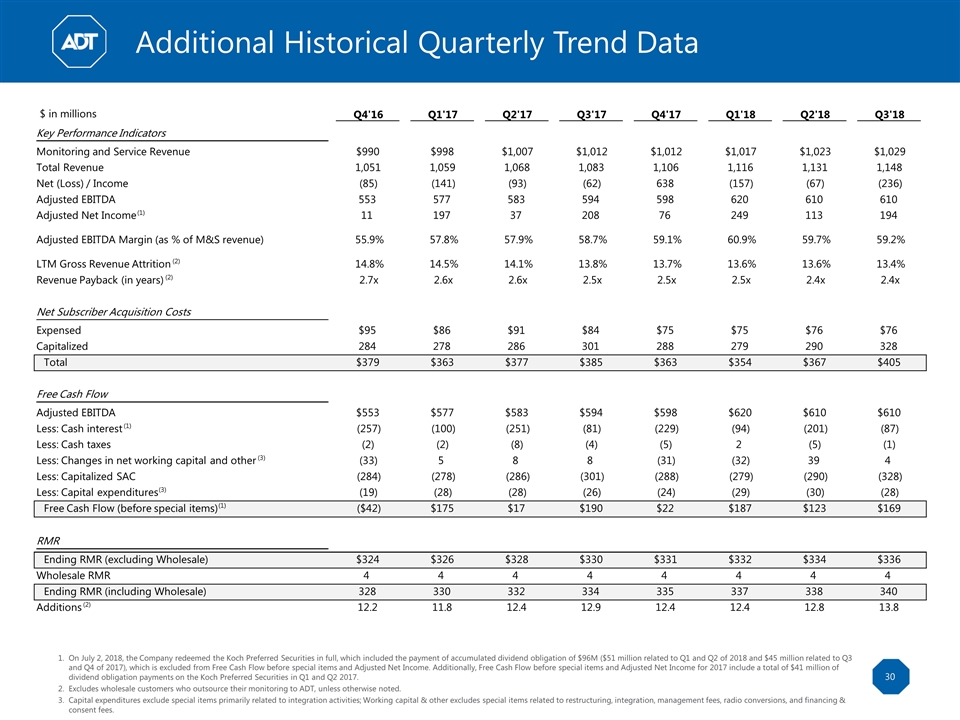

Additional Historical Quarterly Trend Data On July 2, 2018, the Company redeemed the Koch Preferred Securities in full, which included the payment of accumulated dividend obligation of $96M ($51 million related to Q1 and Q2 of 2018 and $45 million related to Q3 and Q4 of 2017), which is excluded from Free Cash Flow before special items and Adjusted Net Income. Additionally, Free Cash Flow before special items and Adjusted Net Income for 2017 include a total of $41 million of dividend obligation payments on the Koch Preferred Securities in Q1 and Q2 2017. Excludes wholesale customers who outsource their monitoring to ADT, unless otherwise noted. Capital expenditures exclude special items primarily related to integration activities; Working capital & other excludes special items related to restructuring, integration, management fees, radio conversions, and financing & consent fees. $ in millions Q4'16 Q1'17 Q2'17 Q3'17 Q4'17 Q1'18 Q2'18 Q3'18 Key Performance Indicators Monitoring and Service Revenue $990 $998 $1,007 $1,012 $1,012 $1,017 $1,023 $1,029 Total Revenue 1,051 1,059 1,068 1,083 1,106 1,116 1,131 1,148 Net (Loss) / Income (85) (141) (93) (62) 638 (157) (67) (236) Adjusted EBITDA 553 577 583 594 598 620 610 610 Adjusted Net Income (1) 11 197 37 208 76 249 113 194 Adjusted EBITDA Margin (as % of M&S revenue) 55.9% 57.8% 57.9% 58.7% 59.1% 60.9% 59.7% 59.2% LTM Gross Revenue Attrition (2) 14.8% 14.5% 14.1% 13.8% 13.7% 13.6% 13.6% 13.4% Revenue Payback (in years) (2) 2.7x 2.6x 2.6x 2.5x 2.5x 2.5x 2.4x 2.4x Net Subscriber Acquisition Costs Expensed $95 $86 $91 $84 $75 $75 $76 $76 Capitalized 284 278 286 301 288 279 290 328 Total $379 $363 $377 $385 $363 $354 $367 $405 Free Cash Flow Adjusted EBITDA $553 $577 $583 $594 $598 $620 $610 $610 Less: Cash interest (1) (257) (100) (251) (81) (229) (94) (201) (87) Less: Cash taxes (2) (2) (8) (4) (5) 2 (5) (1) Less: Changes in net working capital and other (3) (33) 5 8 8 (31) (32) 39 4 Less: Capitalized SAC (284) (278) (286) (301) (288) (279) (290) (328) Less: Capital expenditures (3) (19) (28) (28) (26) (24) (29) (30) (28) Free Cash Flow (before special items) (1) ($42) $175 $17 $190 $22 $187 $123 $169 RMR Ending RMR (excluding Wholesale) $324 $326 $328 $330 $331 $332 $334 $336 Wholesale RMR 4 4 4 4 4 4 4 4 Ending RMR (including Wholesale) 328 330 332 334 335 337 338 340 Additions (2) 12.2 11.8 12.4 12.9 12.4 12.4 12.8 13.8

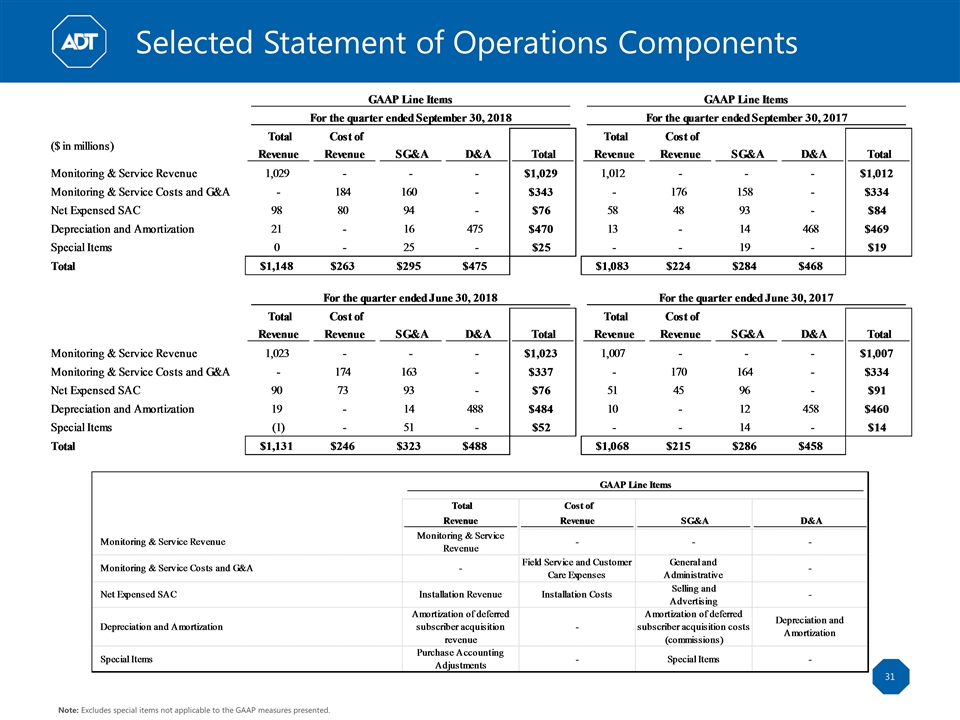

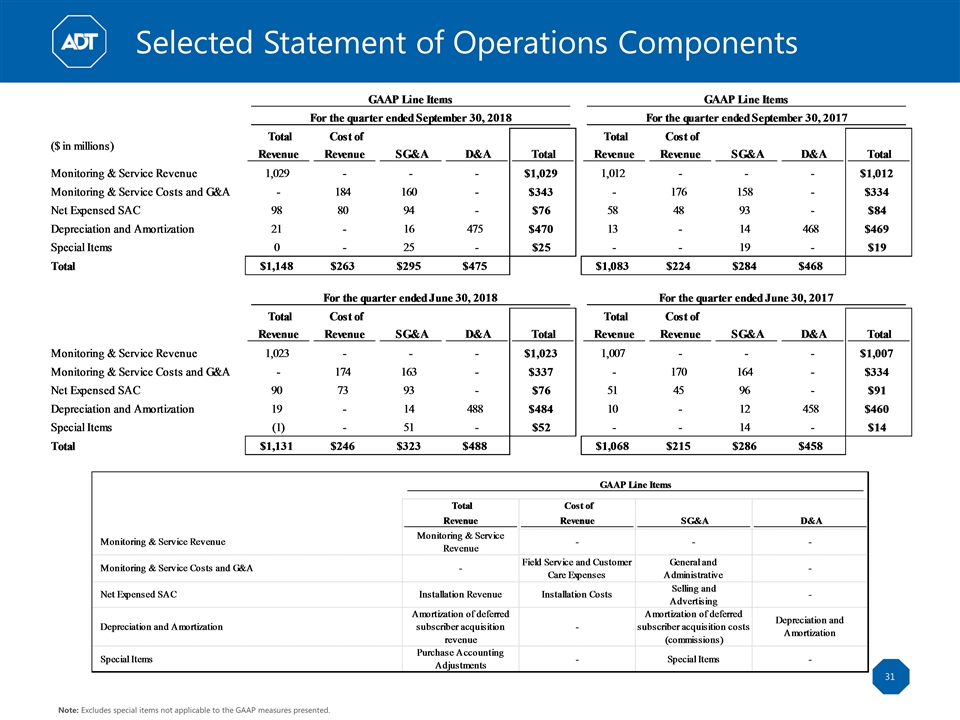

Selected Statement of Operations Components Note: Excludes special items not applicable to the GAAP measures presented.

Statements of Operations

GAAP to Non-GAAP Reconciliations Excludes outflows in connection with the redemption of the Koch Preferred Securities including the accumulated dividend obligation of $96 million ($51 million related to Q1 and Q2 of 2018 and $45 million related to Q3 and Q4 of 2017). Additionally, $41 million of dividend obligation payments on the Koch Preferred Securities are included in Q1 and Q2 of 2017. Adjusted EBITDA, Adjusted EBITDA Margin, and Covenant Adjusted EBITDA (Pre-SAC): Adjusted Net Income:

GAAP to Non-GAAP Reconciliations Free Cash Flow and Free Cash Flow Before Special Items: Excludes outflows in connection with the redemption of the Koch Preferred Securities including the accumulated dividend obligation of $96 million ($51 million related to Q1 and Q2 of 2018 and $45 million related to Q3 and Q4 of 2017). Additionally, $41 million of dividend obligation payments on the Koch Preferred Securities are included in Q1 and Q2 of 2017.

GAAP to Non-GAAP Reconciliations Total debt is pro forma for the incurrence of the TL. LTM cash interest is pro forma for the incurrence of the TL. First lien debt, total debt, and LTM cash interest excluding Koch Redemption are pro forma for the incurrence of the TL; Net first lien debt, net debt, and cash and cash equivalents are pro forma for the incurrence of the TL and the payment of the purchase price for the Red Hawk acquisition. LTM covenant adjusted EBITDA (Pre-SAC) does not include contribution from Red Hawk. LTM cash interest excluding Koch Redemption excludes $96 million paid in connection with the Koch Redemption on July 2, 2018. Debt to Net Income Ratio and Net Income to Cash Interest Ratio: Leverage Ratios: