- ADT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

CORRESP Filing

ADT (ADT) CORRESPCorrespondence with SEC

Filed: 27 Sep 22, 12:00am

September 27, 2022

VIA EDGAR

Division of Corporation Finance

Office of Mergers & Acquisitions

Securities and Exchange Commission

100 F Street N.E.

Washington, D.C. 20549

Attention: Michael Killoy

David Plattner

| Re: | ADT Inc. |

Schedule TO-I

Filed September 12, 2022

File No. 005-90825

Dear Messrs. Killoy and Plattner:

On behalf of our client, ADT Inc. (the “Company”), we are submitting this letter in response to the written comments of the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”), dated September 19, 2022 (the “Comment Letter”), with respect to the Tender Offer Statement on Schedule TO-I (SEC File No. 005-90825) (the “Tender Offer Statement”) filed by the Company with the Commission on September 12, 2022. In connection with this letter responding to the Staff’s comment, we are filing Amendment No. 1 to the Tender Offer Statement with the Commission.

Set forth below are the headings and text of the comments raised in the Comment Letter, followed by the Company’s responses thereto. Capitalized terms used in this letter but not defined herein have the meaning given to such terms in the Tender Offer Statement.

Offer to Purchase

General

| 1. | We note that the Offer is being made for what appear to be two separate classes of stock, the Common Stock and the Class B Common Stock. The elective combining of multiple classes of shares into a single class by the Company, however, is inconsistent with the framework and disclosure requirements of Rule 13e-4 of the Exchange Act and Regulations 14D and 14E. The federal securities law requirements regulating tender offers apply on a class-by-class basis. It is also unclear why the Offer is being made at all for Class B Common Stock, which, in any event, will not be tendered into the Offer, according to the disclosure. Please advise and/or revise. |

Response: The Company respectfully advises the Staff that under Section 4.02(e) of the Company’s Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”), subject to the restrictions set forth therein, shares of Common Stock and Class B Common Stock are required to have the same rights and privileges and rank equally, share ratably and be identical in all respects, including, among other things, being treated equally by the Company in any share repurchase pursuant to a tender offer. As a result, the Company is required to offer to purchase both shares of Common Stock and shares of Class B Common Stock in the Offer. Therefore, notwithstanding the Google Commitment, the Company is required to offer to purchase shares of Class B Common Stock in addition to shares of Common Stock in the Offer to comply with the requirements of the Certificate of Incorporation.

Under Section 4.02(d)(i) of the Certificate of Incorporation, each share of Class B Common Stock is convertible into one share of Common Stock, at the option of the holder thereof, at any time following the earlier of (a) the expiration or early termination of applicable waiting periods under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (“HSR Clearance”), required prior to such holder’s conversion of all such shares of Class B Common Stock, and (b) to the extent HSR Clearance is not required prior to such holder’s conversion of such shares of Class B Common Stock, the date that such holder owns such shares of Class B Common Stock.

In response to the Staff’s comment, the Company has amended and supplemented the Tender Offer Statement to clarify that holders of Class B Common Stock may not directly tender shares of Class B Common Stock in the Offer and to more precisely state that (i) the Company is offering to purchase up to 133,333,333 shares of Common Stock (including shares of Common Stock issuable upon conversion of shares of Class B Common Stock by the holder thereof) and (ii) holders of Class B Common Stock may only participate in the Offer if they convert shares of Class B Common Stock into shares of Common Stock prior to tendering in the Offer. The Company believes that the Offer, as revised in accordance with the foregoing, is in compliance with the framework and disclosure requirements of Rule 13e-4 of the Exchange Act and Regulations 14D and 14F.

2

Further, the Company respectfully advises the Staff that, as disclosed in the Offer to Purchase, Google owns all of the issued and outstanding shares of Class B Common Stock and has agreed not to tender any shares of Class B Common Stock (including any shares of Common Stock issuable upon the conversion of such shares of Class B Common Stock) in the Offer pursuant to the Google Commitment.

Important, page ii

| 2. | We note the following statement: “If, after a good faith effort, we cannot comply with the applicable law, the Offer will not be made to, nor will tenders be accepted from or on behalf of, the holders of shares residing in that jurisdiction.” While offer materials need not be disseminated into jurisdictions where such a distribution would be impermissible, please remove the implication that tendered shares will not be accepted from all shareholders. See Rule 13e-4(f)(8)(i) and guidance in Section II.G.1 of Exchange Act Release No. 34-58597 (September 19, 2008). Please also make any conforming changes to similar statements in the Offer to Purchase and in any exhibits to the Schedule TO. |

Response: In response to the Staff’s comment, the Company has amended and supplemented the Tender Offer Statement to revise the statement noted in the Staff’s comment and similar statements in the Offer to Purchase and the exhibits to the Schedule TO. The specific changes appear in:

| • | the second full paragraph on page (ii) of the Offer to Purchase; |

| • | the second sentence of the first paragraph under the subheading “17. Miscellaneous” on page 45 of the Offer to Purchase; |

| • | the first sentence of the third paragraph on page 3 of the Letter to Clients (Exhibit (a)(1)(E)); and |

| • | the third sentence of the second paragraph under the subheading “Tax Implications” on page 6 of the Notice to Certain Holders of Stock Options (Exhibit (a)(1)(F)). |

Summary Term Sheet, page 1

| 3. | We note the disclosure on page 3 that states, “The maximum aggregate purchase price of Shares repurchased in the Offer will be $1.2 billion.” Please remove the reference to “maximum” or otherwise clarify, as the $1.2 billion figure is not only a maximum but appears to be the settled aggregate purchase price, period. |

Response: In response to the Staff’s comment, the Company has amended and supplemented the Tender Offer Statement to delete the reference to “maximum” in the response to the question, “How will the Company pay for the Shares?” on page 3 of the Offer to Purchase.

3

| 4. | At the top of page 6, we note the following statement: “Shares of Class B Common Stock that we acquire in the Offer will be canceled, retired and eliminated from the shares of capital stock that the Company is authorized to issue under its articles of incorporation.” Such statement is confusing in light of the sentence that follows: “No shares of Class B Common Stock will be purchased in the Offer as a result of the Google Commitment.” We note the same disclosure on page 17. Please advise and/or revise. |

Response: In response to the Staff’s comment, the Company has amended and supplemented the Tender Offer Statement to delete the second sentence of each of the first full paragraph of page 6 of the Offer to Purchase and of the first full paragraph on page 17 of the Offer to Purchase.

| 5. | On page 6, in response to the question, “What happens if more than 133,333,333 Shares are tendered?,” please disclose that, given the intention of Apollo to tender all of its 608,927,824 shares, the Offer is expected to be not only fully subscribed, but in fact significantly oversubscribed, which will have a very significant impact on proration. |

Response: In response to the Staff’s comment, the Company has amended and supplemented the Tender Offer Document to revise the response to the question, “What happens if more than 133,333,333 Shares are tendered?” on page 6 of the Offer to Purchase.

Conditions of the Offer, page 26

| 6. | We note the following statement: “The conditions referred to above are for our sole benefit and may be asserted by us regardless of the circumstances giving rise to any condition, and may be waived by us, in whole or in part, at any time and from time to time... Our failure at any time to exercise any of the foregoing rights will not be deemed a waiver of any right, and each such right will be deemed an ongoing right that may be asserted at any time prior to the Expiration Time.” This language suggests that if a condition is “triggered” and the Company fails to assert the condition, it will not lose the right to assert the condition at a later time. Please note that when a condition is triggered and the offeror wishes to proceed with the offer anyway, we believe that this decision constitutes a waiver of the triggered condition(s). Depending on the materiality of the waived condition and the number of days remaining in the offer, the offeror may be required to extend the offer and circulate new disclosure to security holders. Please confirm the Company’s understanding in your response letter. In addition, when an offer condition is triggered by events that occur during the offer period and before the expiration of the offer, the offeror should inform holders how it intends to proceed immediately, rather than waiting until the end of the offer period, unless the condition is one where satisfaction of the condition may be determined only upon expiration. Please confirm the Company’s understanding in your response letter. |

4

Response: The Company confirms its understanding that: (i) if a condition is triggered and the Company wishes to proceed with the Offer anyway, this decision constitutes a waiver of the triggered conditions, and depending on the materiality of the waived condition and the number of days remaining in the Offer, the Company may be required to extend the Offer and circulate new disclosure to holders in such circumstance and (ii) if an Offer condition is triggered by events that occur during the Offer period and before the Expiration Time, the Company should inform holders of how it intends to proceed promptly and will not wait until the end of the Offer period, unless the condition is one where satisfaction of the condition may be determined only upon the Expiration Time.

* * *

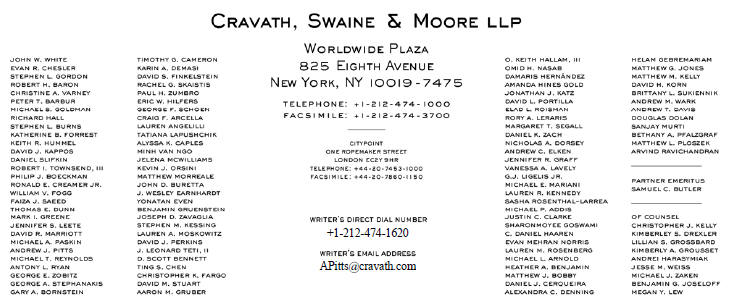

Please contact me at (212) 474-1620 with any questions or comments you may have regarding the responses contained in this letter.

Sincerely, |

/s/ Andrew J. Pitts |

Andrew J. Pitts |

cc: David Smail

Executive Vice President,

Chief Legal Officer and Secretary

ADT Inc.

1501 Yamato Road

Boca Raton, Florida 33431

5