- ADT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

ADT (ADT) DEF 14ADefinitive proxy

Filed: 11 Apr 23, 4:17pm

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

| ☒ | No fee required. | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and0-11. | |||

| Letter from the Chairman of the Board |  |

Dear Fellow Stockholders,

On behalf of ADT’s Board of Directors, I look forward to welcoming you to our 2023 annual meeting.

Over the last several years, the team at ADT has transformed and reshaped the company, while creating a diversified, scaled business that is well-positioned to accelerate growth. Working closely with management, the Board continued to exercise its role in overseeing the execution and refinement of the company’s strategy. In nearly every Board meeting, we discuss the company’s long-term strategy and progress against strategic objectives, allowing us to debate assumptions and offer additional perspectives. | We continue to evaluate our own performance and composition regularly, remaining mindful of the need for the Board to possess a wide range of skills, qualifications, backgrounds and tenure. Across these aspects and others, we look to enhance diversity in the boardroom and in the past year we were pleased to welcome two new members to our Board – Bill Lewis, a designee of Apollo, and Paul Smith, an independent director and designee of State Farm.

As we look forward to 2023, the Board welcomes your engagement. We encourage you to share suggestions and concerns with us. In particular, we encourage you to review this proxy statement and vote in the upcoming meeting.

As always, we deeply appreciate your support of our company.

Sincerely,

Marc Becker | |||||||||

Our foundation of good governance practices has served us well and will continue to do so into the future.

| ||||||||||

|

| Letter from the President and Chief Executive Officer |  |

Dear Fellow Stockholders,

It’s an extraordinary time for all of us at ADT – 2022 was one of the best years in the company’s history as we strengthened our foundation and advanced the transformation of our company from a traditional security company towards an innovative business poised to accelerate growth in new markets. Our strong customer focus allowed us to deliver full year results in line with or exceeding our initial financial outlook while setting records in customer retention, recurring monthly revenue balance and revenue payback.

Our business is centered on the foundational belief that everyone deserves to feel safe. Every day we are bringing peace of mind to our customers through our unrivaled safety, premium experience and innovative offerings as we deliver on our mission of Safe, Smart, and Sustainable.

Safe: We protect what matters most

Smart: We deliver customer-focused products, technologies, and services

Sustainable: We make life better for the customers and communities we serve | As we look to 2023 and beyond, our top objective is to delight and protect our customers through our offerings in smart home and residential security, commercial security, and residential solar. We remain obsessively focused on customer satisfaction to drive strong brand loyalty and increased customer retention. Customer response to our new offerings of Google Nest products has been strong and we continue to deepen our partnership with Google. And through a ground-breaking new partnership with State Farm, we are looking to improve the homeowner experience by leveraging ADT’s smart home security expertise to predict and prevent common household perils.

Our mission is designed to deliver superior results for all stakeholders – our stockholders, our employees and the customers and communities we serve. We’re excited for the next chapters in the story of this iconic 148-year old company.

Sincerely,

Jim DeVries |

TABLE OF CONTENTS

Table of Contents

| 28 | ||||

| 29 | ||||

| 29 | ||||

| 30 | ||||

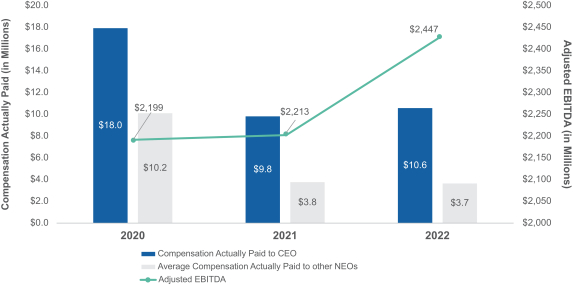

Non-GAAP Measures – Adjusted EBITDA and Adjusted Free Cash Flow | 31 | |||

| 32 | ||||

| 32 | ||||

| 33 | ||||

| 33 | ||||

| 33 | ||||

| 34 | ||||

| 34 | ||||

| 34 | ||||

| 34 | ||||

| 35 | ||||

| 35 | ||||

| 35 | ||||

| 35 | ||||

| 36 | ||||

| REPORT OF THE COMPENSATION COMMITTEE | 36 | |||

| 37 | ||||

| 38 | ||||

| 38 | ||||

| 39 | ||||

| 41 | ||||

| 43 | ||||

| 45 | ||||

| 45 | ||||

| 46 | ||||

Severance Payments and Benefits under Employment Arrangements with NEOs | 46 | |||

| 47 | ||||

Equity Awards—Treatment upon Termination (Not in Connection with a Change in Control) | 49 | |||

| 49 | ||||

| PAY RATIO DISCLOSURE | 52 | |||

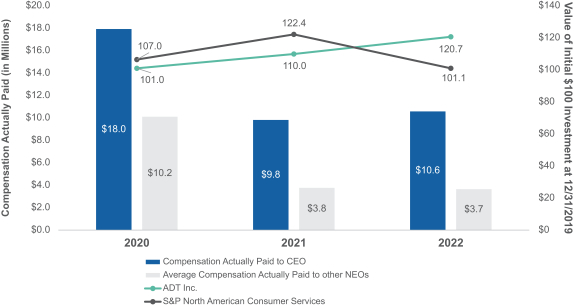

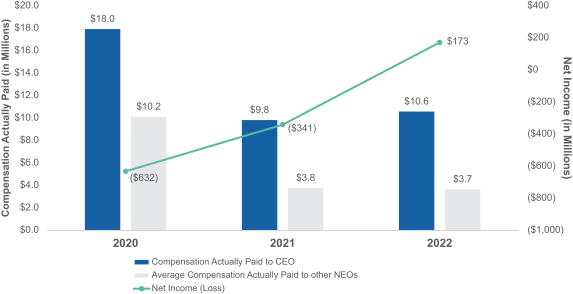

| PAY VERSUS PERFORMANCE | 52 | |||

| 52 | ||||

| COMPENSATION OF NON-EMPLOYEE DIRECTORS | 56 | |||

| 2023 PROXY STATEMENT | |||

TABLE OF CONTENTS

| 2023 PROXY STATEMENT |  | |||

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Notice of Annual Meeting of Stockholders

Meeting Agenda

| ||||||||

➊ Election of directors. | ➋ Advisory vote to approve

| ➌ Ratification of appointment of independent registered public accounting firm. | ||||||

In addition, to transact such other business as may properly come before ADT Inc. (the “Company”) at its Annual Meeting of Stockholders, or any postponement or adjournment thereof (the “Annual Meeting”).

| ||||||||

When Wednesday, May 24, 2023 8:30 a.m. EDT

Where Virtual Meeting

Who Can Vote at the Annual Meeting All stockholders of record at the close of business on March 29, 2023, the record date for this year’s Annual Meeting, are entitled to attend and to vote on all items properly presented at the Annual Meeting. We refer to the holders of our Common Stock (the “Common Stock”) as our Common Stockholders. We refer to the holders of our Class B Common Stock as our Class B Common Stockholders. We refer to all of the holders of our Common Stock and Class B Common Stock together as “stockholders” in our proxy materials. Class B Common Stockholders are not entitled to vote on the election of directors.

Date of Mailing We are mailing a notice of the Annual Meeting (and, for those who request it, a paper copy of this proxy statement and the enclosed form of proxy) to our stockholders on or about April 11, 2023.

| Record Date Close of business, March 29, 2023.

How to Vote If you are a stockholder on the record date, you may vote by following the instructions for voting in the Notice. If you receive paper copies of these proxy materials, you can vote by completing, signing and dating the proxy card you received from us and returning it in the enclosed envelope.

You may also vote via the Internet by following the instructions for voting in the Notice. If you vote online, by phone or by mailing in a proxy card, you or your legally appointed proxy may still attend the Annual Meeting.

| We are pleased to announce that the Company will conduct its Annual Meeting on the above date and time by live audio webcast in lieu of an in-person meeting. The Company’s Board of Directors (the “Board of Directors” or the “Board”) believes this meeting format will enhance and facilitate attendance by providing convenient access for all of our stockholders. You will be able to attend the Annual Meeting, vote and submit your questions during the meeting by visiting https://www.proxydocs.com/ADT and submit online voting by visiting https://www.proxypush.com/ADT.

We have planned and designed the meeting to encourage stockholder participation, protect stockholder rights, and promote transparency.

Dated: April 11, 2023

By order of the Board of Directors

David W. Smail Executive Vice President, Chief Legal Officer and Secretary | ||||||||||||||||

| By Telephone In the U.S. or Canada, you can vote your shares toll-free by calling 1-866-390-9971.

| |||||||||||||||||

| By Mail You can vote by mail by marking, dating, and signing your proxy card or voting instruction form and returning it in the postage-paid envelope.

| |||||||||||||||||

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be Held on May 24, 2023 The Notice of 2023 Annual Meeting (the “Notice”), Proxy Statement, and 2022 Annual Report and the means to vote by Internet are available at www.proxypush.com/ADT.

|  | By Internet You can vote your shares online at www.proxypush.com/ADT. | ||||||||||||||||

| By Tablet or Smartphone You can vote your shares with your tablet or smartphone by scanning the QR code.

| |||||||||||||||||

| 2023 PROXY STATEMENT | 1 | ||

PROPOSAL 1 — ELECTION OF DIRECTORS

PROPOSAL 1

Election of Directors

|

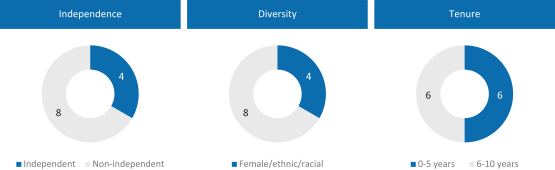

Directors of the Company hold office until the third succeeding annual meeting of stockholders following their election and until the election and qualification of their successors. Under the Company’s amended and restated bylaws (the “Bylaws”) and amended and restated certificate of incorporation (the “Certificate of Incorporation”), the Board of Directors can change the number of directors comprising the entire Board of Directors so long as the number is not more than 15. The Board of Directors currently consists of 12 directors.

All of the nominees are members of the current Board of Directors. If any nominee for election to the Board of Directors should be unable to accept their nomination or election as a director, which is not expected, your proxy may be voted for a substitute or substitutes designated by the Board of Directors, or the number of directors constituting the Board of Directors may be reduced in accordance with the Company’s Bylaws and Certificate of Incorporation.

Directors will be elected by the holders of a plurality of the voting power of the holders of our common stock (the “Common Stock”) of the Company present in person or represented by proxy at the Annual Meeting and entitled to vote. Abstentions and broker non-votes will not be counted for purposes of the election of directors. Under our Certificate of Incorporation, holders of Class B Common Stock are not entitled to vote for the election of directors.

| 2 | 2023 PROXY STATEMENT |  | ||

PROPOSAL 1 — ELECTION OF DIRECTORS

DIRECTOR SKILLS, BACKGROUND AND EXPERIENCE

|  |  |  |  |  |  |

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||

Skills and Qualifications | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Executive Experience: Directors who have held leadership positions in public companies provide insight into the best practices and challenges of leading complex organizations. | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | 11 | ||||||||||||||||||||||||||||||||||||||||

Public Company Board Experience: Directors with previous public company board experience help to enhance the Board’s corporate governance practices. | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | 11 | ||||||||||||||||||||||||||||||||||||||||

Human Capital Experience: Directors who have experience in human capital management assist in reviewing our efforts to recruit, retain and develop top talent. | ● | ● | ● | ● | ● | ● | ● | 7 | ||||||||||||||||||||||||||||||||||||||||||||

Sales/ Marketing/ Brand Management Experience: Directors with experience in sales, marketing and brand management provide insights into the Company’s sales and marketing process and ways to increase the value of our brand in the marketplace. | ● | ● | ● | ● | 4 | |||||||||||||||||||||||||||||||||||||||||||||||

Technology/ Cybersecurity Experience: Directors who have expertise in technology fields are particularly important given the Company’s focus on technology innovation and data privacy. | ● | ● | 2 | |||||||||||||||||||||||||||||||||||||||||||||||||

Finance & Accounting Experience: Directors with advanced understanding of finance and accounting provide meaningful oversight of the Company’s financial reporting and control environment, and assessment of its financial performance and stockholder return. | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | 12 | |||||||||||||||||||||||||||||||||||||||

M&A and Corporate Strategy Experience: Directors who have expertise in M&A and corporate strategy provide insight into assessing M&A opportunities for a strategic fit, strong value creation potential and clear execution capacity. | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | 12 | |||||||||||||||||||||||||||||||||||||||

Background | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Director Since | 2016 | 2018 | 2017 | 2018 | 2022 | 2022 | 2016 | 2016 | 2022 | 2016 | 2018 | 2021 | ||||||||||||||||||||||||||||||||||||||||

Independent | ● | ● | ● | ● | ||||||||||||||||||||||||||||||||||||||||||||||||

Age | 50 | 60 | 50 | 58 | 34 | 66 | 57 | 36 | 60 | 51 | 66 | 59 | ||||||||||||||||||||||||||||||||||||||||

Gender | M | M | F | F | M | M | M | M | M | M | M | F | ||||||||||||||||||||||||||||||||||||||||

Race/ethnicity | ||||||||||||||||||||||||||||||||||||||||||||||||||||

African American | ● | ● | ||||||||||||||||||||||||||||||||||||||||||||||||||

White/Caucasian | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||||||||||||||||||||||||||

Committee Composition | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Audit Committee | ● | Chair | ● | |||||||||||||||||||||||||||||||||||||||||||||||||

Compensation Committee | Chair | ● | ● | |||||||||||||||||||||||||||||||||||||||||||||||||

Executive Committee | Chair | ● | ● | |||||||||||||||||||||||||||||||||||||||||||||||||

Nominating and Corporate Governance Committee | Chair | ● | ● | |||||||||||||||||||||||||||||||||||||||||||||||||

| 2023 PROXY STATEMENT | 3 | ||

PROPOSAL 1 — ELECTION OF DIRECTORS

The Board of Directors recommends that the Common Stockholders vote FOR the election of the nominees for Class III directors listed below.

| ||||

Class III Directors

The term of the following four Class III directors will expire at the Annual Meeting. Messrs. Becker and Rayman, and Mses. Drescher and Zarmi are the only nominees for election at the Annual Meeting for a term that will expire at the 2026 Annual Meeting of Stockholders and until each of their successors has been duly elected and qualified.

Marc E. Becker | ||

Age: 50

Director Since: 2016

Committees: • Compensation (Chair) • Executive (Chair) • Nominating and Corporate Governance (Chair) |

Marc E. Becker is the chairman of our Board of Directors (the “Chairman”) and a designee of funds managed by affiliates of Apollo Global Management, Inc. (together with its subsidiaries and affiliates, “Apollo” or the “Sponsor”). Mr. Becker joined Apollo in 1996 and is a Partner based in New York. Prior to joining Apollo in 1996, Mr. Becker was employed by Smith Barney Inc. within its Investment Banking division. Mr. Becker is actively involved in a number of non-profit organizations and serves as a Board member of Reno de Medici S.p.A., SHC Services, Inc. (d/b/a Supplemental Health Care), Chairman Emeritus of the board of directors of the TEAK Fellowship, Honorary Chairman of the board of directors of Park Avenue Synagogue and is a member of the Board of Trustees of The Jewish Museum. Previously, Mr. Becker has also served on the board of directors of OneMain Holdings Inc. and Sun Country Airlines Holdings, Inc. Mr. Becker graduated cum laude with a BS in Economics from the University of Pennsylvania’s Wharton School of Business. | |

Stephanie Drescher | ||

Age: 50

Director Since: 2017

|

Stephanie Drescher is a member of our Board of Directors and a designee of Apollo. Ms. Drescher is the Chief Client and Product Development Officer at Apollo and is a member of the firm’s Management Committee. Prior to joining Apollo in 2004, Ms. Drescher was employed by JP Morgan for ten years, primarily in its Alternative Investment group. Ms. Drescher has served on the board of directors of the JP Morgan Venture Capital Funds I and II, JP Morgan Corporate Finance Funds I and II, JP Morgan Private Investments Inc., and Allied Waste. Ms. Drescher is currently on the board of directors of Daphne Tech Holdings LLC, The Student Leadership Network and the board of observers of iCapital. Ms. Drescher graduated summa cum laude, Phi Beta Kappa from Barnard College of Columbia University and earned her MBA from Columbia Business School. | |

| 4 | 2023 PROXY STATEMENT |  | ||

PROPOSAL 1 — ELECTION OF DIRECTORS

Reed B. Rayman | ||

Age: 36

Director Since: 2016

Committees • Compensation • Executive

|

Reed B. Rayman is a member of our Board of Directors and a designee of Apollo. Mr. Rayman is a Partner at Apollo, focused on private equity investing in the technology, media and security services sectors. Mr. Rayman serves on the board of directors of College Parent Holdings GP, LLC (parent of Yahoo), Western Digital Corporation, Edgio, Inc., Shutterfly Holdings, Inc. (parent of Shutterfly), Aspen Holdco, LLC (parent of Coinstar), ecoATM Parent, LLC, and Camaro Parent, LLC (parent of CareerBuilder). He previously served on the board of directors of Redbox Entertainment Inc. Prior to joining Apollo in 2010, Mr. Rayman was a member of the Principal Strategies Group at Goldman Sachs and previously was a member of the Industrials Investment Banking group at Goldman Sachs. Mr. Rayman is actively involved with the TEAK Fellowship as a mentor and serves on the Young Professionals Board; he also serves on the Private Equity Executive Council of the UJA Federation of New York. Mr. Rayman graduated cum laude from Harvard with an AB in Economics. |

Sigal Zarmi | ||

Age: 59

Director Since: 2021

INDEPENDENT

Committees • Audit |

Sigal Zarmi is a member of our Board of Directors. Ms. Zarmi has over 30 years of experience in large scale digital transformation, technology operations, strategic planning, leadership and talent development. She is currently a Senior Advisor at the Boston Consulting Group, Inc., a global management consulting firm. Prior to that, she served as International CIO and Global Head of Transformation for Morgan Stanley. Prior to Morgan Stanley, Ms. Zarmi was Vice Chairman—Global and US CIO of PwC, and before that, CIO of GE Capital, Americas, where she spent 18 years in various executive technology and operations leadership positions. Ms. Zarmi also serves on the board of directors of Hashicorp, Inc., an infrastructure software company, Global Atlantic Financial Group, a life insurance and reinsurance company, and GoDaddy, Inc., a domain registrant. Ms. Zarmi was inducted into The CIO Hall of Fame in 2021 for her contributions and her leadership in digital transformation and advancing diversity in STEM. Under her leadership Morgan Stanley was named to Fast Company Best Workplaces for Innovators three years in a row. Ms. Zarmi holds an MBA from Columbia University in New York City and a B.S. in Engineering from the Technion—Israel Institute of Technology in Haifa, Israel. |

| 2023 PROXY STATEMENT | 5 | ||

PROPOSAL 1 — ELECTION OF DIRECTORS

Class I Directors

The term of the following four Class I directors will expire at the 2024 Annual Meeting of Stockholders.

James D. DeVries | ||

Age: 60

Director Since: 2018

President and Chief Executive Officer

Committees: • Executive • Nominating and Corporate Governance |

James D. DeVries is a member of our Board of Directors and President and Chief Executive Officer (“CEO”) of ADT. Mr. DeVries joined the Company in 2016 as Executive Vice President and Chief Operating Officer and was appointed as our President in September 2017 and as our CEO in December 2018. Prior to joining ADT, he spent nearly a decade at Allstate Insurance Company, serving as Executive Vice President of Operations as well as Executive Vice President and Chief Administrative Officer, with responsibility for real estate and administration, human resources, and procurement. Mr. DeVries has also held various executive and management roles at Principal Financial Group, Ameritech, Quaker Oats Company, and Andrew Corporation.

Currently, Mr. DeVries serves on the boards of ABM, a leading provider of integrated facility services and solutions, and Amsted Industries Inc., a diversified global manufacturer of industrial components. He is a past board member of the Human Resources Management Association of Chicago, the Chicago Public Library Foundation, and the Boys & Girls Clubs of Central Iowa. Mr. DeVries holds a bachelor’s degree from Trinity International University, a master’s degree from Loyola University, and a Master of Business Administration from the Kellogg School of Management at Northwestern University. | |

Tracey R. Griffin | ||

Age: 58

Director Since: 2018

INDEPENDENT

Committees • Audit • Compensation |

Tracey R. Griffin is a member of our Board of Directors. Ms. Griffin is the former Chief Financial Officer and Chief Operating Officer of Framebridge, Inc., an online and retail custom framing brand. Prior to her position at Framebridge, Ms. Griffin served as Chief Financial Officer of Austin-based lifestyle retail brand Kendra Scott, from September 2018 to November 2019. Prior to that, Ms. Griffin served as Chief Financial Officer of PANDORA Americas, a global affordable jewelry brand, from February 2016 to September 2018, following her tenure as Chief Operating Officer from October 2014 to February 2016. In these roles at PANDORA, Ms. Griffin was responsible for implementing and overseeing strategic growth initiatives across the company, including its expansion into Latin America. Prior to that, she served as a Senior Partner at McKinsey & Company, a global management consulting firm, where she focused on retail and consumer goods clients. Ms. Griffin currently serves on the board of directors of The Children’s Place, a specialty, mall-based retailer, where she also sits on the Human Capital Committee. In addition, Ms. Griffin sits on the non-profit organization Partnership for a Healthier America, where she is the Chairman of the Finance and Audit Committee and has previously served on the Board and Strategy Committee of the United Negro College Fund (UNCF). Ms. Griffin received her BS in Finance from Georgetown University and an MBA from the Stanford Graduate School of Business. |

| 6 | 2023 PROXY STATEMENT |  | ||

PROPOSAL 1 — ELECTION OF DIRECTORS

Benjamin Honig | ||

Age: 34

Director Since: 2022 |

Benjamin Honig is a member of our Board of Directors and a board designee of certain investors (the “Co-Investors”) in our indirect parent entities other than Apollo and was designated by an affiliate of Temasek International (USA) LLC (“Temasek”). Mr. Honig has worked at Temasek, a global investment company, since 2013, investing in technology, media, healthcare, and business services companies. In his role at Temasek, Mr. Honig currently serves as a member of the board of directors of Horizon Media Holdings, LLC, a media agency, and as a board observer of Creative Artists Agency (CAA) Holdings, LLC, a talent agency, and National Veterinary Associates (NVA), a global pet care organization. He was also closely involved in investments made by Temasek including Virtu Financial, Inc., EMC Corp., VMware, Inc., Dell Technologies, Inc., and Harry’s, Inc. From 2010 to 2013, Mr. Honig was employed by Credit Suisse as an investment banker in the Mergers & Acquisitions department. Mr. Honig graduated magna cum laude with a BA in Economics from Cornell University. |

Lee J. Solomon | ||

Age: 51

Director Since: 2016 |

Lee J. Solomon is a member of our Board of Directors and a designee of Apollo. Mr. Solomon is a Partner at Apollo Private Equity having joined in 2009. Previously, Mr. Solomon was an executive in the media industry, and prior to that, he served as a Principal at Grosvenor Park, which was a joint venture with Fortress Investment Group. Prior to that, he was the Executive Vice President of Business Affairs for Helkon Media. Mr. Solomon serves on the board of directors of Legend Pictures, LLC, CMG Holdings, Inc. (d/b/a Cox Media Group), Aspen Holdco, LLC (parent of Coinstar), ecoATM Parent, LLC, College Parent Holdings GP, LLC (parent of Yahoo!) and Colonnade Acquisition Corp. II. He previously served on the board of directors of AP NMT JV Newco B.V. (parent of Endemol Shine Group), Redbox Entertainment Inc., Terrier Gamut Holdings, Inc. and Mood Media Corporation. Mr. Solomon received his MBA from The Stern School of Business at New York University and graduated from the University of Rochester with a BA in Economics and Political Science. |

Class II Directors

The term of the following four Class II directors will expire at the 2025 Annual Meeting of Stockholders.

William M. Lewis, Jr. | ||

Age: 66

Director Since: 2022 |

William M. Lewis, Jr. is a member of our Board of Directors and a designee of Apollo. Mr. Lewis joined Apollo Global Management in November 2021 as a Partner and member of the Management Committee. Prior to joining Apollo, Mr. Lewis was a Managing Director and Chairman of Investment Banking at Lazard Ltd. which he joined in 2004. At Lazard, Mr. Lewis advised corporations on corporate and financial matters, including leveraged buyouts and other M&A activity. In addition, Mr. Lewis chaired the Firm’s Global Investment Banking Managing Director Promotion Committee. Mr. Lewis serves on the board of Ariel Alternatives, LLC and formerly served on the boards of Freddie Mac, Darden Restaurants and Lazard Ltd. He graduated with honors from Harvard College with an AB in Economics and he obtained an MBA from Harvard Business School. |

| 2023 PROXY STATEMENT | 7 | ||

PROPOSAL 1 — ELECTION OF DIRECTORS

Eric L. Press | ||

Age: 57

Director Since: 2016

Committees • Nominating and Corporate Governance

|

Eric L. Press is a member of our Board of Directors and a designee of Apollo. Mr. Press is a Partner at Apollo, having joined in 1998. In his time with Apollo, he has been involved in many of the firm’s investments in basic industrials, metals, lodging/gaming/leisure and financial services. Prior to joining Apollo, Mr. Press worked at the law firm of Wachtell, Lipton, Rosen & Katz, specializing in mergers, acquisitions, restructurings and related financing transactions. Prior thereto, Mr. Press was a consultant with The Boston Consulting Group, a management consulting firm focused on corporate strategy. Mr. Press serves on the board of directors of Apollo Commercial Real Estate Finance, Inc., Knight Health Holdings, LLC d/b/a ScionHealth and DSB Parent L.P. (parent of LifePoint Health Inc.). He previously served on the board of directors of Lottomatica S.p.A (f/k/a Gamenet Group S.p.A), Princimar Chemical Holdings, LLC, PlayAGS, Inc., Triton Maritime III Corp., Triton Maritime IV Corp, Rodeph Sholom School and Constellis Holdings, Inc. He graduated magna cum laude from Harvard College with an AB in Economics and Yale Law School, where he was a Senior Editor of the Yale Law Journal. |

Paul J. Smith | ||

Age: 60

INDEPENDENT

Director Since: 2022 |

Paul J. Smith is a member of our Board of Directors and a designee of State Farm Fire & Casualty Company (“State Farm”). Mr. Smith is Executive Vice President and Chief Operating Officer of State Farm with responsibility for the Property & Casualty and Life product lines along with Enterprise Technology. Currently, he also leads enterprise transformation efforts work to position State Farm for future growth. Mr. Smith joined State Farm in 1988 working in a variety of finance and operational positions. Since 2009, Mr. Smith has been a member of senior leadership, serving in various roles as Chief Financial Officer, EVP, Property and Casualty and EVP, Technology and Innovation. Mr. Smith is also a director of State Farm Investment Management Corp. and State Farm VP Management Corp. Mr. Smith received a bachelor’s degree in Accounting from the University of Wisconsin at Eau Claire and is a graduate of The General Managers Program at Harvard Business School. |

Matthew E. Winter | ||

Age: 66

Director Since: 2018

INDEPENDENT

Committees • Audit (Chair)

|

Matthew E. Winter is a member of our Board of Directors. Mr. Winter was the President of The Allstate Corporation from January 2015 to February 2018, and prior to that, served as the President, Allstate Personal Lines for The Allstate Corporation from January 2013 to January 2015. Mr. Winter joined The Allstate Corporation in 2009 as President and Chief Executive Officer of Allstate Financial. Mr. Winter also serves on the board of directors and the Audit and Compensation Committees of H&R Block Inc., a tax preparation company, and on the board of directors and Compensation Committee and Finance, Investment & Risk Management Committee of the Hartford Financial Services Group, an investment and insurance company. Mr. Winter holds a Bachelor of Science degree from the University of Michigan, a Juris Doctor degree from the Albany Law School of Union University, and a Master of Laws degree from the University of Virginia School of Law. |

| 8 | 2023 PROXY STATEMENT |  | ||

CORPORATE GOVERNANCE

CORPORATE GOVERNANCE

Controlled Company

Our Common Stock is listed on the New York Stock Exchange (“NYSE”). As Apollo controls more than 50% of the combined voting power of the Company, we are considered a “controlled company” for the purposes of that exchange’s rules and corporate governance standards. We have availed ourselves of the “controlled company” exception under the NYSE rules, which exempts us from certain requirements, including the requirements that we have a majority of independent directors on our Board of Directors and that the Compensation Committee of our Board of Directors (the “Compensation Committee”) and Nominating and Corporate Governance Committee of our Board of Directors (the “Nominating and Corporate Governance Committee”) be comprised entirely of independent directors. The Audit Committee of our Board of Directors (the “Audit Committee”) is comprised entirely of independent members.

If at any time we cease to be a “controlled company” under the NYSE rules, the Board of Directors will take all action necessary to comply with the applicable NYSE rules, including appointing a majority of independent directors to the Board of Directors and ensuring that our Compensation Committee and our Nominating and Corporate Governance Committee are comprised entirely of independent directors, subject to a permitted “phase-in” period.

Director Independence

We have availed ourselves of the “controlled company” exception under the NYSE rules, which exempts us from certain requirements, including that we have a majority of independent directors on our Board of Directors (see “Corporate Governance—Controlled Company”). No director qualifies as independent unless the Board of Directors affirmatively determines that the director has no material relationship with the Company (either directly or as a partner, stockholder or officer of an organization that has a relationship with the Company). The Board of Directors broadly considers all relevant facts and circumstances relative to independence and considers the issue not merely from the standpoint of the director, but also from the viewpoint of persons or organizations with which the director has an affiliation. Material relationships can include commercial, industrial, banking, consulting, legal, accounting, charitable and familial relationships (among others). In accordance with the NYSE listing standards, the Board of Directors considers the following categorical standards of director independence, according to which independent directors:

| • | Are not, nor have been within the last three years, an employee of the listed company, nor is an immediate family member of such director currently, nor has been within the last three years, an executive officer, of the listed company; |

| • | Have not received, nor has an immediate family member who has received, during any twelve-month period within the last three years, more than $120,000 in direct compensation from the listed company, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service); |

| • | (a) Are not a current partner or employee of a firm that is the listed company’s internal or external auditor; (b) does not have an immediate family member who is a current partner of such a firm; (c) does not have an immediate family member who is a current employee of such a firm and personally works on the listed company’s audit; or (d) were not, and do not have an immediate family member who was, within the last three years, a partner or employee of such a firm and personally worked on the listed company’s audit within that time; |

| • | Are not, and do not have an immediate family member who is, or have been within the last three years, employed as an executive officer of another company where any of the listed company’s present executive officers at the same time serves or served on that company’s compensation committee; |

| • | Are not a current employee, or an immediate family member is not a current executive officer, of a company that has made payments to, or received payments from, the listed company for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1 million, or 2% of such other company’s consolidated gross revenues; and |

| 2023 PROXY STATEMENT | 9 | ||

CORPORATE GOVERNANCE

| • | Do not accept, directly or indirectly, any consulting, advisory, or other compensatory fee from the issuer or any subsidiary thereof. |

The listing standards of the NYSE and the rules of the Securities and Exchange Commission (the “SEC”) require the members of a company’s audit committee to be independent. As a “controlled company,” the majority of our Board of Directors is not required to be independent.

The Board of Directors has determined that Ms. Griffin, Mr. Smith, Mr. Winter and Ms. Zarmi are our independent directors, as such term is defined by the applicable rules and regulations of the NYSE and that Ms. Griffin, Mr. Winter and Ms. Zarmi are also independent as defined by the applicable rules and regulations of the SEC and the NYSE for service on the various committees of the Board on which they currently serve. In considering Mr. Smith’s independence, the Audit Committee and the Board of Directors considered the relationship between the Company and State Farm. Our Audit Committee is comprised of Ms. Griffin, Mr. Winter, who serves as chair, and Ms. Zarmi.

Board of Directors Leadership Structure and Board’s Role in Risk Oversight

The Board of Directors has an oversight role, as a whole and also at the committee level, in overseeing management of the Company’s risks. The Board of Directors regularly reviews information regarding our credit, liquidity, and operations, as well as the risks associated with each, and takes an active role at the Board level in reviewing our enterprise risk management (“ERM”) process. The Board’s evaluation of the Company’s ERM practices is a continual process, with a formal review conducted with management on an annual basis. In order to provide the Board with an appropriate ERM overview, management interviews senior executives from all functions and segments of the Company, undertakes desktop research, utilizes consulting services provided by Gartner Enterprise Risk Management, and follows the 2017 COSO ERM framework structure and procedures. The Board has designated the Audit Committee as being responsible for direct oversight of the ERM process. The Company’s Vice President of Risk, Governance, and Internal Audit provides a quarterly update to the Audit Committee on program progress and any material changes that have occurred in the Company’s risk environment and the Chair of the Audit Committee reports any significant updates to the full Board quarterly. The Audit Committee and then the full Board also review, on an annual basis, a formal ERM report, including a comprehensive risk register of risks faced across the Company’s operations, a Risk Appetite Statement, and actions to mitigate top risks facing the Company. In addition, as one component of the Company’s disclosure controls, management discusses risk with and receives updates from the leadership team on a quarterly basis regarding any new risks that have been identified.

The Compensation Committee is responsible for overseeing the management of risks relating to employee compensation plans and arrangements, and the Audit Committee is responsible for overseeing the management of financial risks, which also more broadly encompasses enterprise risk management, including compliance, cybersecurity, privacy and related risks, as well as the Company’s environmental, social, and governance (“ESG”) strategies, policies and public disclosures. While each committee is responsible for evaluating certain risks, and overseeing the management of such risks, the entire Board of Directors is regularly informed through committee reports about such risks. The Company also has a designated Chief Compliance Officer who reports to the Executive Vice President, Chief Legal Officer and Secretary of the Company. The Chief Compliance Officer provides quarterly reports to the Audit Committee.

The Chairman of our Board of Directors and our CEO are currently separate. Our Board of Directors does not currently have a policy as to whether the role of Chairman of our Board of Directors and the CEO should be separate. Our Board of Directors believes that the Company and its stockholders are best served by maintaining the flexibility to determine whether the Chairman and CEO positions should be separated or combined at a given point in time in order to provide appropriate leadership for us at that time. In addition, our Board of Directors does not currently have a policy as to whether an independent director may be appointed as lead director.

The Board of Directors understands that no single approach to board leadership is universally accepted and that the appropriate leadership structure may vary based on several factors, such as a company’s size, industry, operations, history and culture. Accordingly, our Board of Directors, with the assistance of the Nominating and Corporate Governance Committee, assesses its leadership structure in light of these factors and the current environment to achieve the optimal model for us and for our stockholders.

| 10 | 2023 PROXY STATEMENT |  | ||

CORPORATE GOVERNANCE

We believe that our current Board of Directors leadership structure is appropriate and serves the interests of the Company and its stockholders based on the Company’s specific facts and circumstances at this time. In reaching this conclusion, we considered, among other things, the composition and diverse skillset of the Board of Directors, the tenure of the directors with the Company and their overall experience in the business and working with the Chairman and the executive management group, and the ability of the Board, as currently constituted and managed, to ask challenging questions and further develop the Company’s strategic vision. We also considered the Company’s risk oversight policies and practices to promote more focused and sustained attention to critical areas. These policies and procedures permit and encourage each member to take an active role in all discussions, while also being designed to ensure that different committees develop specific subject matter risk expertise and have focused oversight responsibilities and the ability to act quickly if necessary in their corresponding areas. Our Chairman currently serves on all committees other than the Audit Committee and provides an important connection and integration across various aspects of the Board and the Company. This structure of developing focused expertise that feeds up to an informed and engaged full Board is reflected in the Company’s disclosure controls and procedures as well, particularly, although not exclusively, with regard to the Company’s disclosures around risks, trends and uncertainties. Specific disclosures are produced or reviewed and updated by subject matter experts at the Company before being considered by our internal legal and SEC reporting teams, with those inputs then being communicated to our management disclosure committee. Each of our Board committees is authorized by its charter to consult at its discretion with any experts or advisors that it feels would be helpful, and similarly our disclosure committee led by the Company’s Vice President, Chief Accounting Officer and Controller, may consult with internal or external advisors as it deems appropriate in seeking to ensure that our senior management, including our CEO and Chief Financial Officer, receive the information they need to make timely decisions about the Company’s required disclosures. To ensure full information and robust communication, our Audit Committee receives regular reports about the Company’s disclosures from our Chief Financial Officer and from our Chief Accounting Officer.

We will continue to review the appropriateness of these Board and risk oversight systems and structures. In case we determine that we should change our leadership structure, we will provide prompt notice to our stockholders, as required under the circumstances.

Board of Directors Meetings and Committees

In fiscal 2022, the Board of Directors held eight meetings. During the past fiscal year, all directors attended at least 75% of the meetings of the Board of Directors and of the committees on which they served.

Recent representative discussion topics of the Board of Directors included:

| • | The Company’s mission, strategic imperatives and vision, as well as short-term and long-term objectives in light of such mission, strategy and vision. |

| • | The Company’s strategic initiatives, including with respect to the acceleration of capital efficient growth, maintaining a market leadership position, brand management, go-to-market initiatives, innovation in products and offerings and the development of the Company’s ADT+ platform, and prioritizing the customer experience. |

| • | The Company’s Investor Day presentation and the introduction of multi-year goals. |

| • | Budget in light of key strategic investment areas, product innovation, information technology infrastructure transformation, and progress toward the Company’s multi-year goals. |

| • | M&A and strategic partnership activity, including the Company’s ongoing strategic relationship with Google and its more recent investment by and strategic partnership with State Farm, the Company’s prior acquisition of Sunpro Solar and related integration activities, and various strategic tuck-in acquisitions across the business. The Board of Directors discussed the proposed strategic partnership with and investment in the Company by State Farm and its significance to the Company’s strategic initiatives during multiple meetings prior to the consummation of the relationship. |

| • | The Company’s self-tender offer for its Common Stock. |

| 2023 PROXY STATEMENT | 11 | ||

CORPORATE GOVERNANCE

| • | Cybersecurity, including a tabletop exercise attended by members of the Audit Committee during which key stakeholders reviewed real-world scenarios in order to evaluate and test readiness and response capabilities; facilitate discussions around strategies, effectiveness, and gaps; and suggest improvements for consideration in readiness and response. |

| • | ERM and associated risk mitigation efforts, including the approval of a company-wide Risk Appetite Statement. |

| • | The Company’s ESG and corporate responsibility initiatives, as well as related public disclosures such as the Company’s CDP Climate Change Questionnaire. |

| • | Certain capital structure and cost of funds considerations and actions. |

| • | Reviews by each committee Chairperson of the matters discussed during their most recent committee meetings, together with any committee-recommended actions for the consideration of the Board of Directors. |

The Board of Directors has four committees:

| • | Audit; |

| • | Compensation; |

| • | Executive; and |

| • | Nominating and Corporate Governance. |

Each of these committees operates under written charters which are available at the Company’s website at https:// investor.adt.com/ by opening the “Governance” tab, clicking on “Governance Documents,” and clicking on the name of the respective committee charter. Committee charters are also available in print upon the written request of any stockholder. The current committee membership of our Board of Directors is as follows:

Name | Audit Committee | Compensation Committee | Executive Committee | Nominating and Corporate Governance Committee | ||||

Marc E. Becker |  |  |  | |||||

James D. DeVries |  |  | ||||||

Tracey R. Griffin |  |  | ||||||

Eric L. Press |  | |||||||

Reed B. Rayman |  |  | ||||||

Matthew E. Winter |  | |||||||

Sigal Zarmi |  | |||||||

= Member

= Member  = Committee Chair

= Committee Chair

Audit Committee

In fiscal 2022, the Audit Committee held six meetings. Our Audit Committee consists of Mr. Winter (Chair), Ms. Griffin and Ms. Zarmi. Our Board of Directors has determined that each of Ms. Griffin, Mr. Winter and Ms. Zarmi qualify as an “audit committee financial expert” as such term is defined in Item 407(d)(5) of Regulation S-K and that each of Ms. Griffin, Mr. Winter and Ms. Zarmi are independent as independence is defined in Rule 10A-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and under the NYSE listing standards. The principal duties and responsibilities of our Audit Committee include the following:

| • | To oversee and monitor our accounting, tax, treasury, financial reporting, external reporting, and asset-safeguarding policies and processes; |

| 12 | 2023 PROXY STATEMENT |  | ||

CORPORATE GOVERNANCE

| • | To oversee and monitor the integrity of our financial statements and internal controls; |

| • | To oversee and monitor the independence, qualifications, performance, and compensation of our independent auditor; |

| • | To oversee and monitor the performance of our internal audit function; |

| • | To discuss, oversee, and monitor policies with respect to risk assessment and risk management; |

| • | To discuss with management our information technology and cybersecurity risks and concerns on an annual basis, and more frequently if and as needed; |

| • | To oversee and monitor our compliance with legal and regulatory requirements and the implementation and effectiveness of our compliance and ethics programs; |

| • | To review and evaluate any actual or potential conflict of interest regarding a related person transaction; |

| • | To oversee, monitor and engage with management regarding our ESG strategy, policies and public disclosures; |

| • | To conduct investigations the Audit Committee deems appropriate; |

| • | To prepare the annual Audit Committee report to be included in our annual proxy statement; and |

| • | To provide regular reports to the Board of Directors. |

The Audit Committee has the authority to retain counsel and advisors to fulfill its responsibilities and duties and to form and delegate authority to subcommittees.

Recent representative discussion topics of the Audit Committee included:

| • | Disclosure, internal control implications and integration considerations relating to the Company’s various M&A activities, including the extensive SOX 404 internal controls preparation work related to the integration of the Company’s prior acquisition of Sunpro Solar. |

| • | The Company’s ongoing strategic relationship with Google LLC (“Google”) and its more recent investment by and strategic partnership with State Farm. |

| • | The Company’s self-tender offer for its Common Stock. |

| • | The Company’s ERM framework, objectives and governance, including a recommendation to the Board of Directors with respect to a company-wide Risk Appetite Statement. |

| • | Disclosures relating to ESG, corporate responsibility and related metrics, the Company’s CDP Climate Change Questionnaire, and the Company’s ongoing ESG program. |

| • | Information technology operation risks, cybersecurity, and information technology infrastructure transformation. |

| • | Financing transactions considered by the Company and the Company’s capital structure. |

| • | Tax and Treasury operations and ongoing strategies. |

| • | Compliance and ethics matters, including Code of Conduct training. |

| • | Data management and privacy programs. |

| • | The Company’s supply chain and 3G replacement program. |

| • | The Company’s Investor Day presentation and the introduction of multi-year goals. |

| • | Environmental, health and safety practices. |

| • | Business continuity governance and disaster recovery management. |

| • | Review of regulatory and legislative developments impacting the Company and industry. |

| • | Significant legal matters being addressed by the Company. |

| • | The Company’s periodic filings and other public disclosures. |

| 2023 PROXY STATEMENT | 13 | ||

CORPORATE GOVERNANCE

Executive Committee

Our Executive Committee of the Board of Directors (the “Executive Committee”) consists of Messrs. Becker (Chair), DeVries, and Rayman. In fiscal 2022, the Executive Committee held no meetings. Subject to certain exceptions, the Executive Committee generally may exercise all of the powers and duties of the Board of Directors when the Board of Directors is not in session, or when it is impractical to call a special meeting of the Board of Directors, and to implement the policy decisions of the Board of Directors. The Executive Committee serves at the pleasure of our Board of Directors. This committee and any of its members may continue to serve or be changed once our Sponsor no longer owns a controlling interest in us.

Compensation Committee

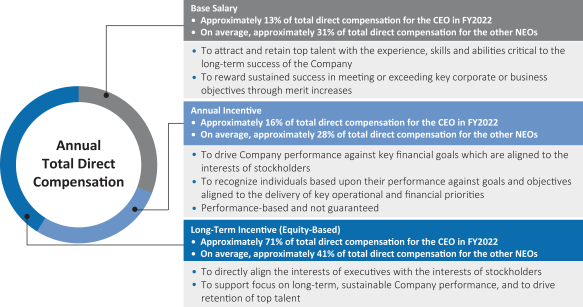

In fiscal 2022, the Compensation Committee held three meetings. During 2022, our Compensation Committee consisted of Messrs. Becker (Chair) and Rayman, Mr. Andrew Africk (until May 25, 2022), and Ms. Griffin (from May 25, 2022 onward). The principal duties and responsibilities of the Compensation Committee include the following:

| • | Review and determine the Company’s compensation strategy to ensure it is appropriate to attract, retain and motivate senior management and other key employees; |

| • | Review and determine the Company’s executive compensation philosophy, policies and programs that in the Committee’s judgment support the Company’s overall business strategy and review and discuss, at least annually, the material risks associated with executive compensation structure, policies and programs to determine whether such structure, policies and programs encourage excessive risk-taking and to evaluate compensation policies and practices that could mitigate any such risk; |

| • | On an annual basis, review and approve the corporate goals and objectives relevant to the compensation of the Company’s CEO and other executive officers, evaluate each such individual’s performance in light of those goals and objectives, and determine and approve each such individual’s compensation based on such evaluation; |

| • | Review and approve the Company’s incentive compensation, equity-based plans and pension plans; |

| • | Review and approve any employment agreement or compensatory transaction with an executive officer of the Company involving compensation in excess of $120,000 per year; |

| • | Establish and periodically review policies concerning perquisite benefits; |

| • | Develop and recommend to the Board for approval a CEO and executive officer succession plan; and |

| • | Prepare an annual Compensation Committee report and take such other actions as are necessary and consistent with respect to the Company’s public disclosures, governing law and the Company’s organizational documents. |

Recent representative discussion topics of the Compensation Committee included:

| • | Corporate goals and objectives relevant to the compensation of and a determination of the compensation for the CEO and other executive officers and consideration of long-term stockholder value. |

| • | The evaluation of compensation performance goals and incentive plan structure and related impact on risk-taking by senior executives and employees. |

| • | Policies designed to foster alignment between management and our stockholders. |

| • | Consideration of the appropriate peer group for compensation and talent acquisition purposes. |

| • | Director compensation. |

| • | New disclosure rules and requirements as they relate to compensation-related matters. |

| • | Results of our Say on Pay vote and published reports by third parties who evaluate the Company’s compensation practices. |

| • | Stock ownership guidelines. |

| 14 | 2023 PROXY STATEMENT |  | ||

CORPORATE GOVERNANCE

We have elected to avail ourselves of the “controlled company” exception under the NYSE rules, which exempts us from the requirement that we have a Compensation Committee comprised entirely of independent directors.

Nominating and Corporate Governance Committee

Our Board of Directors established a Nominating and Corporate Governance Committee. In fiscal 2022, the Nominating and Corporate Governance Committee held two meetings. Our Nominating and Corporate Governance Committee consists of Messrs. Becker (Chair), DeVries, and Press. The principal duties and responsibilities of the Nominating and Corporate Governance Committee include the following:

| • | To identify individuals qualified to become members of the Board of Directors, consistent with criteria approved by the Board; |

| • | To recommend to the Board for approval director nominees, consistent with the criteria approved by the Board, and recommend to the Board the director nominees for the next annual meeting of stockholders or to fill vacancies on the Board; |

| • | To develop and periodically assess the Company’s policies and procedures with respect to the consideration of director nominees submitted by stockholders of the Company and review the qualifications of such candidates pursuant to these policies and procedures; |

| • | To develop and recommend to the Board for approval the criteria for Board membership; |

| • | To review stockholder proposals affecting corporate governance and to make recommendations to the Board accordingly; |

| • | To develop and recommend to the Board for approval corporate governance guidelines applicable to the Company; and |

| • | To oversee the evaluation of the Board, its committees, and management. |

Recent representative discussion topics of the Nominating and Corporate Governance Committee included:

| • | Review of certain governance matters, such as the continued adequacy of the Company’s Board Governance Principles (the “Board Governance Principles”). |

| • | Review and recommendations regarding nominees for election as Directors and with respect to the independence of Directors. |

| • | Assessment of the effectiveness of the Board of Directors and committees of the Board of Directors in providing proper governance and oversight. |

| • | Review of regulatory and legislative developments impacting the Company and industry. |

We have elected to avail ourselves of the “controlled company” exception under the NYSE rules, which exempts us from the requirement that we have a Nominating and Corporate Governance Committee comprised entirely of independent directors.

Compensation Committee Interlocks and Insider Participation

Members of the Compensation Committee during 2022 included Mr. Andrew Africk, who retired from the Board in May 2022, Ms. Griffin, who joined the Compensation Committee in May 2022, and Messrs. Becker and Rayman. None of the members of the Compensation Committee in 2022 were, at any time during 2022 or at any other time, an officer or employee of the Company.

None of our executive officers has served as a member of the board of directors, or as a member of the compensation committee or similar committee, of any entity that has one or more executive officers who served on our Board of Directors or Compensation Committee during 2022.

Except as described in the section entitled “Certain Relationships and Related Person Transactions” below, none of the members of the Compensation Committee had or has any relationships with us that are required to be disclosed under Item 404 of Regulation S-K.

| 2023 PROXY STATEMENT | 15 | ||

CORPORATE GOVERNANCE

Identifying and Evaluating Candidates for the Board of Directors

In considering possible candidates to serve on the Board of Directors, the Nominating and Corporate Governance Committee will take into account all appropriate qualifications, qualities and skills in the context of the current make-up of the Board of Directors and will consider the entirety of each candidate’s credentials, including, among other things, their individual background, experience and knowledge. In addition, the Nominating and Corporate Governance Committee will evaluate each nominee according to the following criteria:

| • | Nominees should have a reputation for integrity, honesty and adherence to high ethical standards; |

| • | Nominees should have demonstrated business acumen, experience and ability to exercise sound judgments in matters that relate to the current and long-term objectives of the Company and should be willing and able to contribute positively to the decision-making process of the Company; |

| • | Nominees should have a commitment to understand the Company and its industry and to regularly attend and participate in meetings of the Board and its committees; |

| • | Nominees should have the interest and ability to understand the sometimes conflicting interests of the various constituencies of the Company, which include stockholders, employees, customers, governmental units, creditors and the general public and to act in the interests of all stockholders; |

| • | Nominees should not have, nor appear to have, a conflict of interest that would impair the nominee’s ability to represent the interests of all the Company’s stockholders and to fulfill the responsibilities of a director; and |

| • | Nominees shall not be discriminated against on the basis of race, religion, national origin, sex, gender identity, sexual orientation, age, disability, political affiliation or any other basis proscribed by law. The value of diversity on the Board should be considered. |

The Company has in place Board Governance Principles which are considered when reviewing and evaluating candidates for the Board of Directors. The Nominating and Corporate Governance Committee reviews these Board Governance Principles annually.

In addition, our Board Governance Principles address over-boarding and in order to provide sufficient time for informed participation in their Board responsibilities, any non-management directors who are employed as CEO of a publicly traded company are required to limit their external directorships of other public companies to one; non-management directors who are otherwise executive officers of a public company are required to limit their external directorships of other public companies to one; non-management directors who are not fully employed are required to limit their external directorships of other public companies to three; and our CEO is required to limit his service on public company boards to no more than two. The Nominating and Corporate Governance Committee is notified of the intention of directors and the CEO to serve on another for-profit public or private company board of directors, and the committee reviews the possibility for conflicts of interest or time constraints and may object to such placement in which event the full Board shall determine the disposition of the matter.

Stockholders may recommend director candidates for consideration by the Nominating and Corporate Governance Committee. To have a candidate considered by the Nominating and Corporate Governance Committee, our Bylaws require a stockholder to submit the recommendation in writing and must include the following information:

| • | The name and address of the stockholder, as they appear on the Company’s books and records, and evidence of the stockholder’s ownership of Company stock, including the class or series and number of shares owned and the length of time of ownership; |

| • | A description of all arrangements or understandings between the stockholder and each candidate pursuant to which the nomination is being made; |

| • | The name of the candidate, the candidate’s resume or a listing of his or her qualifications to be a director of the Company and the person’s consent to be named as a director if nominated by the Board of Directors; and |

| 16 | 2023 PROXY STATEMENT |  | ||

CORPORATE GOVERNANCE

| • | Such other materials or information regarding each proposed candidate required under the Bylaws of the Company and as would be required to be included in a proxy statement under the rules of the SEC if such candidate had been nominated by the Board of Directors. |

Each such recommendation must be sent to the Secretary of the Company at ADT Inc., 1501 Yamato Road, Boca Raton, FL 33431 and must be received within the time indicated below under “When are stockholder proposals due for consideration at next year’s annual meeting?” The Nominating and Corporate Governance Committee will evaluate stockholder-recommended director candidates in the same manner as it evaluates director candidates identified by other means.

Corporate Governance Guidelines

Our Board of Directors has adopted a code of business conduct and ethics (the “Code of Conduct”) that applies to all of our directors, officers, and employees, and is intended to comply with the relevant listing requirements for a code of conduct as well as qualify as a “code of ethics” as defined by the rules of the SEC. The Code of Conduct contains general guidelines for conducting our business consistent with the highest standards of business ethics. The Company also maintains an ethics hotline as set forth in our Code of Conduct so that any suspected violation of our Code of Conduct can be reported confidentially, without fear of reprisal. We intend to disclose future amendments to certain provisions of our Code of Conduct, or waivers of such provisions applicable to any principal executive officer, principal financial officer, principal accounting officer and controller, or persons performing similar functions, and our directors, on our website at https://investor.adt.com/. The Code of Conduct is made available on our website.

We have Board Governance Principles that address significant issues of corporate governance and set forth procedures by which our managers and Board of Directors carry out their respective responsibilities. The principles are available for viewing on our website at https://investor.adt.com/. We will also provide the Board Governance Principles, free of charge, to stockholders who request them. Such requests should be directed to our Secretary at ADT Inc., 1501 Yamato Road, Boca Raton, FL 33431.

Environmental, Social and Governance Initiatives

We recognize the importance of corporate responsibility and have established the following ESG Commitment Statement which guides the integration of our ESG initiatives into our business:

Our commitment to respect the environment, promote social responsibility, and lead with responsible

governance is fundamental to who we are and guides our safe, smart and sustainable business practices.

We have also tracked our ESG initiatives in internal annual and periodic reporting. In 2022 we published to our website our 2021 ESG Report reflecting certain of our ESG initiatives. We have continued to include disclosure of our corporate ESG initiatives in our 2022 Annual Report on Form 10-K, and we will publish to our website during the second quarter of 2023 our 2022 Corporate ESG Report, which will include as an appendix our 2022 Sustainability Accounting Standards Board Index Report. These reports can be found on our investor relations website at https://investor.adt.com/.

Executive Sessions of Non-Management Directors

The non-management directors of the Company meet in executive sessions without management on a regular basis. Under the Company’s Board Governance Principles, the Chairman presides at such executive sessions (the “Presiding Director”). In the absence of the Presiding Director, the non-management directors will designate another director who is present to preside over such executive sessions.

| 2023 PROXY STATEMENT | 17 | ||

CORPORATE GOVERNANCE

Apollo Approval of Certain Matters and Rights to Nominate Certain Directors

As long as funds affiliated with or managed by Apollo beneficially own a majority of our outstanding common stock, Apollo will be able to control all matters requiring stockholder approval, including the election of Directors, amendment of our Certificate of Incorporation, and certain corporate transactions. See “Certain Relationships and Related Person Transactions.”

Compensation Risk Assessment

We believe that the performance goals and incentive plan structures generally established under the Company’s executive, annual and long-term incentive programs would not contribute to excessive risk-taking by our senior executives or employees. The approved goals under our incentive programs are consistent with our financial operating plans and strategies, and these programs are discussed and reviewed by the Compensation Committee. The Company’s compensation systems are balanced, rewarding both short-term and long-term performance, and its performance goals are team-oriented, with an individual component, and include measurable factors and objective criteria. The Compensation Committee is actively engaged in setting compensation systems, monitoring those systems during the year and using discretion in making rewards, as necessary. As a result of the procedures and practices described above, the Compensation Committee believes that the Company’s compensation policies and practices for its employees do not encourage risk-taking that is reasonably likely to have a material adverse effect on the Company. This conclusion is based on a risk assessment that was performed by management in conjunction with Pearl Meyer & Partners, LLC (“Pearl Meyer”) and presented to and reviewed with the Compensation Committee at its October 2022 meeting.

Communications with the Board of Directors

Stockholders and other interested parties desiring to communicate directly with the full Board of Directors, the Audit Committee, the non-management directors as a group or with any individual director or directors may do so by sending such communication in writing addressed to the attention of the intended recipient(s), c/o Secretary and Chief Legal Officer, ADT Inc., 1501 Yamato Road, Boca Raton, FL 33431. Interested parties may communicate anonymously and/or confidentially if they desire. All communications received that relate to accounting, internal accounting controls or auditing matters will be referred to the chairman of the Audit Committee unless the communication is otherwise addressed. Other communications received will be forwarded as appropriate to the director or directors.

Director Attendance at Annual Meeting

The Company encourages all of our directors to attend each Annual Meeting of Stockholders. Eight of our directors attended the 2022 Annual Meeting of Stockholders.

| 18 | 2023 PROXY STATEMENT |  | ||

EXECUTIVE OFFICERS

EXECUTIVE OFFICERS

The names of the current executive officers of the Company (and their respective ages as of the date of this proxy statement) are set forth below. Each of our executive officers is re-elected annually by our Board of Directors.

Name | Age | Position | ||

James D. DeVries | 60 | President and Chief Executive Officer and Director | ||

Kenneth J. Porpora | 46 | Executive Vice President and Chief Financial Officer | ||

Jeffrey A. Likosar | 52 | President, Corporate Development and Chief Transformation Officer | ||

Daniel M. Bresingham | 51 | Executive Vice President, Commercial | ||

Jamie E. Haenggi | 53 | Executive Vice President, Solar | ||

Harriet K. Harty | 56 | Executive Vice President and Chief Administrative Officer | ||

DeLu Jackson | 50 | Executive Vice President and Chief Marketing Officer | ||

David W. Smail | 57 | Executive Vice President, Chief Legal Officer and Secretary | ||

Wayne Thorsen | 50 | Executive Vice President and Chief Business Officer | ||

Donald M. Young | 58 | Executive Vice President and Chief Operating Officer | ||

James D. DeVries. For the biography of James D. DeVries, please see “Class I Directors.”

Kenneth J. Porpora | ||

Kenneth J. Porpora has served as our Executive Vice President and Chief Financial Officer since August, 2022. He is responsible for all finance functions, including financial planning and analysis, treasury, operational finance, financial reporting, internal audit, tax, and investor relations. Mr. Porpora is the immediate past Executive Vice President, Finance, a position he held from May 2021 to August 2022, and prior to that he served as our Senior Vice President, Chief Growth Officer from December 2018 to May 2021. Mr. Porpora has been with ADT for nearly 25 years, holding leadership roles across finance, sales, marketing, and operations. Mr. Porpora received his bachelor’s degree in Finance from Florida Atlantic University.

Jeffrey A. Likosar | ||

Jeffrey A. Likosar has served as our President, Corporate Development and Chief Transformation Officer since August 2022. Prior to that, and from April 2021, Mr. Likosar was our Chief Financial Officer and President, Corporate Development. From March 2018 to April 2021, Mr. Likosar was our Executive Vice President, Chief Financial Officer and Treasurer, and from February 2017 to March 2018, Mr. Likosar was our Executive Vice President and Chief Financial Officer. Mr. Likosar is currently responsible for corporate strategy, business development, partnerships, pricing and product strategy, and organizational transformation. Before joining ADT, from February 2014 to September 2016, Mr. Likosar served as CFO at Gardner Denver, a leading global provider of high quality industrial equipment, technologies and services to a broad and diverse customer base through a family of highly recognized brands. Prior to that, Mr. Likosar served in various executive finance roles at Dell Inc., a privately owned multinational computer technology company, and at GE, where he held executive finance roles across the Appliances, Plastics, and Aviation Divisions. Mr. Likosar holds a bachelor’s degree in Business Administration from the University of North Carolina at Chapel Hill, Kenan-Flagler Business School.

| 2023 PROXY STATEMENT | 19 | ||

EXECUTIVE OFFICERS

Daniel M. Bresingham | ||

Daniel M. Bresingham is our Executive Vice President, Commercial. Previously, Mr. Bresingham served as our Executive Vice President and Chief Administrative Officer from March 2018 to December 2018. From September 2017 to March 2018, Mr Bresingham was our Executive Vice President, Chief Administrative Officer and Treasurer, and from April 2016 to September 2017, Mr. Bresingham was our Treasurer and Assistant Secretary. Prior to that, Mr. Bresingham served as our Chief Financial Officer of Prime Security Services Borrower, LLC, a subsidiary of the Company. Mr. Bresingham has held leadership roles in the security industry since 2004, as Controller at HSM Security (now Stanley) as well as CFO of Stanley Convergent Security Solutions and Protection One Alarm Monitoring, Inc. (“Protection One”). Prior to joining the industry, he held positions at Arthur Anderson, PwC, and Universal Access. Mr. Bresingham holds a Bachelor of Science in Accounting from the University of Illinois, a Master of Business Administration from the University of Chicago and is a certified public accountant and certified internal auditor.

Jamie E. Haenggi | ||

Jamie E. Haenggi has served as our Executive Vice President, Solar since December 2022. From September 2017 to December 2022, Ms. Haenggi has held senior roles at ADT, including Chief Sales and Marketing Officer, Chief Growth Officer and Chief Customer Officer. With nearly 30 years of experience in the security and telecom industries, Ms. Haenggi is recognized as a leader who builds cultures that inspire world-class customer service and team engagement. Prior to joining ADT in 2016, Ms. Haenggi was Chief Marketing & Customer Experience Officer at Protection One and Chief Marketing Officer and Vice President of Customer Experience at Vonage, Inc., a leading communications solution provider. Ms. Haenggi also led sales and marketing departments at ADT in previous years as well as at Holmes Protection Group and National Guardian Corporation. Ms. Haenggi currently serves on the board of directors for Enphase Energy and the Board of Visitors for Taylor University. Ms. Haenggi holds a Bachelor of Arts degree in International Relations and Japanese from the University of Minnesota. She has been honored in the Marketing Hall of Femme and is a multi-year SAMMY Industry Marketing Award winner.

Harriet K. Harty | ||

Harriet K. Harty has served as our Executive Vice President and Chief Administrative Officer since February 2022. Ms. Harty was our Senior Vice President and Chief Administrative Officer from July 2020 to February 2022. Ms. Harty is a senior business executive with a strong combination of financial acumen, operational excellence and human resources expertise. Prior to joining ADT in July 2020, Ms. Harty served roughly 25 years at Allstate in various leadership roles, including as their Chief Human Resources Officer, and, just prior to ADT, served as the Executive Vice President and Chief Human Resources Officer at Sompo International. Ms. Harty also served as an advisory board member for After School Matters and has served as a Board Member for Women Employed. She earned a Master of Business Administration in Marketing from the University of Illinois at Chicago and a Bachelor of Science in Accountancy from Northeastern Illinois University in Chicago. She is also a Certified Public Accountant.

DeLu Jackson | ||

DeLu Jackson has served as our Executive Vice President and Chief Marketing Officer since February 2023, where he leverages his over 20 years of marketing and brand leadership with the world’s most recognizable brands to drive ADT’s transformation forward. From September 2021 to February 2023, Mr. Jackson served as our Senior Vice President, Chief Marketing Officer. Prior to joining ADT, he served as Vice President, Precision Marketing at Conagra Brands from August 2017 to September 2021, where he was responsible for integrated marketing, e-commerce, brand strategy, and advertising. Mr. Jackson’s career includes senior roles for domestic and international brands, including Kellogg Company, McDonald’s, Audi, Nissan and Subaru. Mr. Jackson serves as a board member of Latham Group, Inc. Mr. Jackson holds a Master of Business Administration from the NYU Stern School of Business and a Bachelor of Arts in Politics from Princeton University.

| 20 | 2023 PROXY STATEMENT |  | ||

EXECUTIVE OFFICERS

David W. Smail | ||

David W. Smail has served as our Executive Vice President, Chief Legal Officer and Secretary since February 2019 and has more than 25 years of experience in the U.S. and internationally, including 10 years of law firm corporate and securities transactional practice, and more than 15 years in public company general counsel roles. From August 2015 to September 2018, he served as Executive Vice President & Chief Legal Officer for Scientific Games Corporation, a leading developer and provider of technology-based products, systems, platforms and services for the global gaming and lottery industries. Prior to that he held the role of Executive Vice President & General Counsel at Morgans Hotel Group, an international hospitality company, and previously was Executive Vice President and Group General Counsel of global advertising and communications services group Havas S.A. He also was a partner in the international law firm Hogan Lovells (previously Hogan & Hartson). He received a J.D. cum laude from Harvard Law School and a B.A. summa cum laude in Biology and French from Macalester College.

Wayne Thorsen | ||