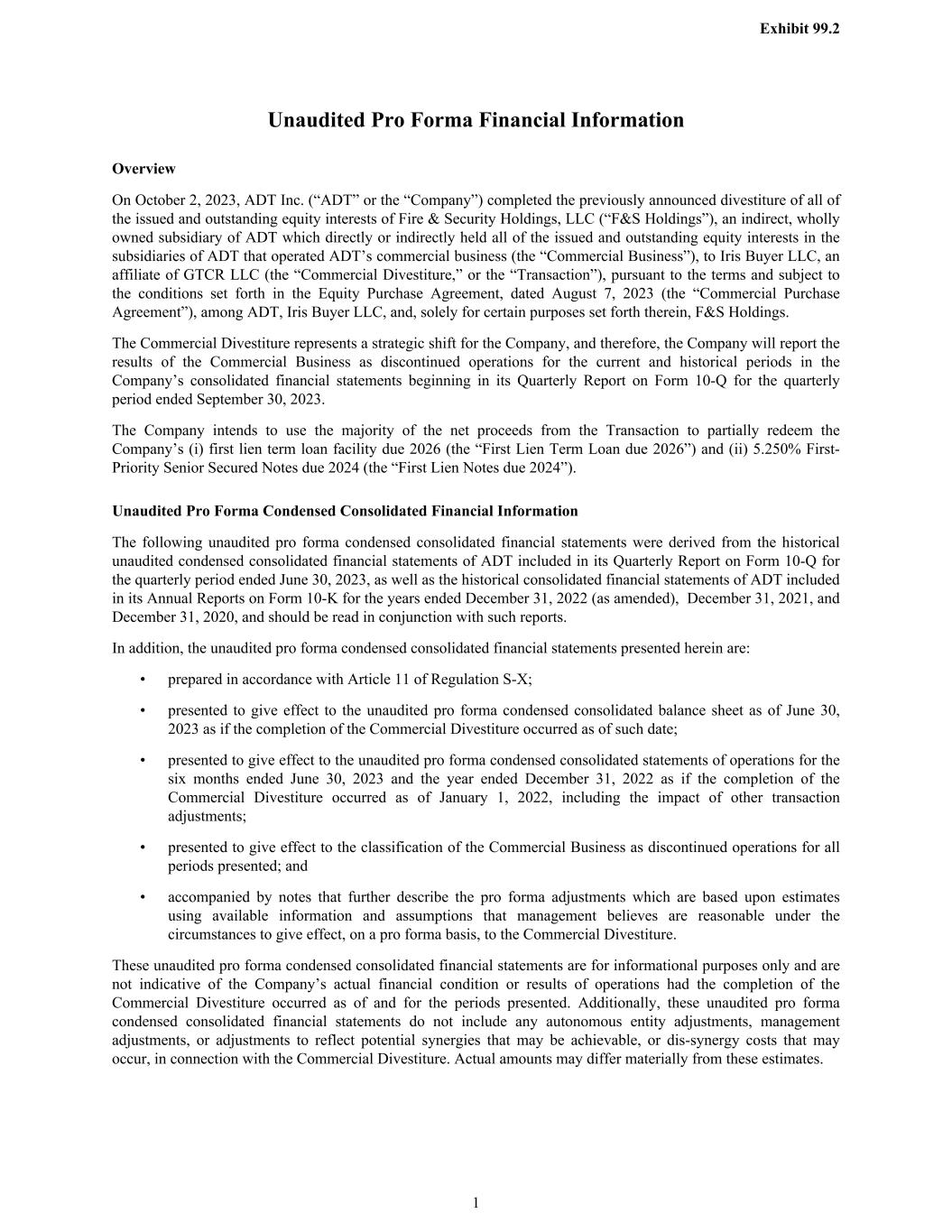

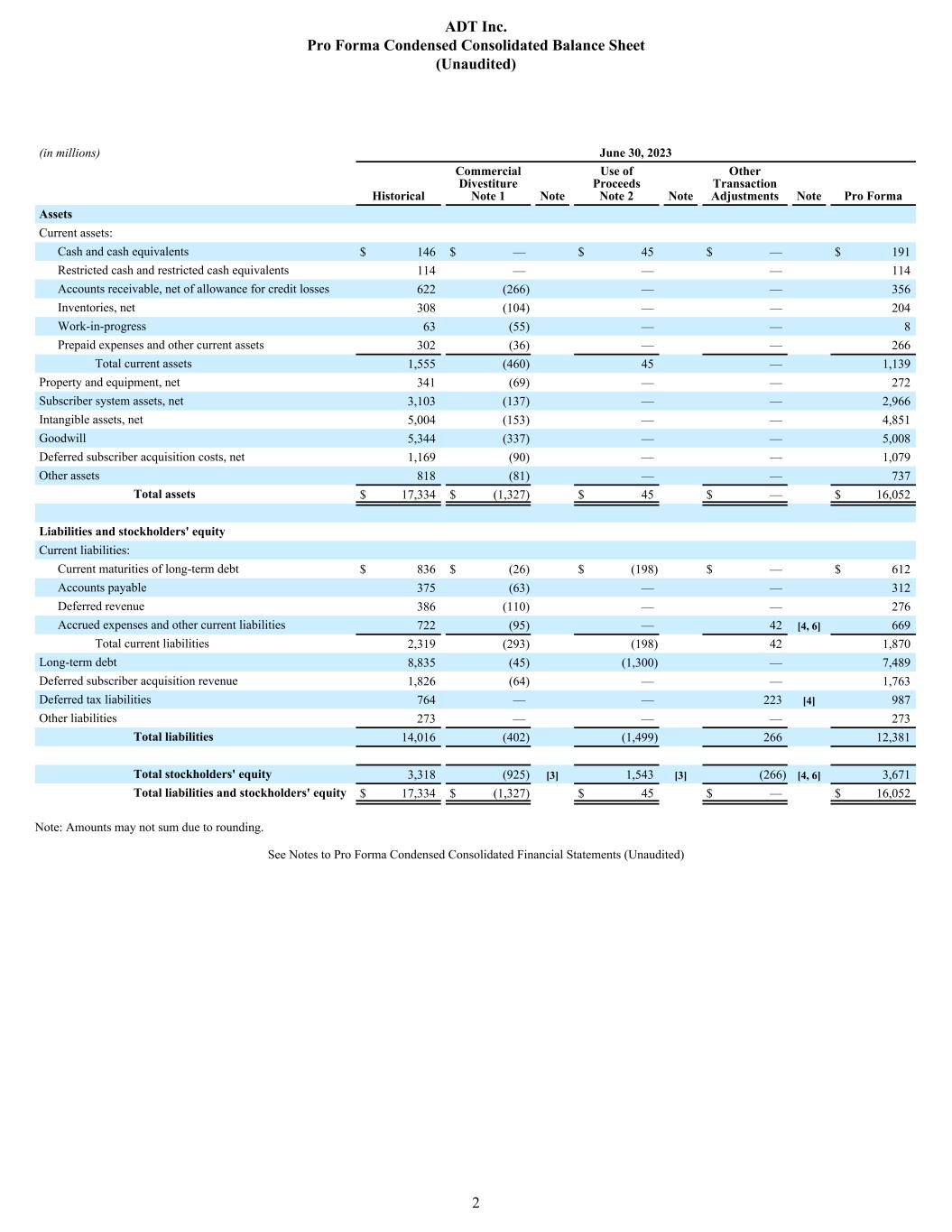

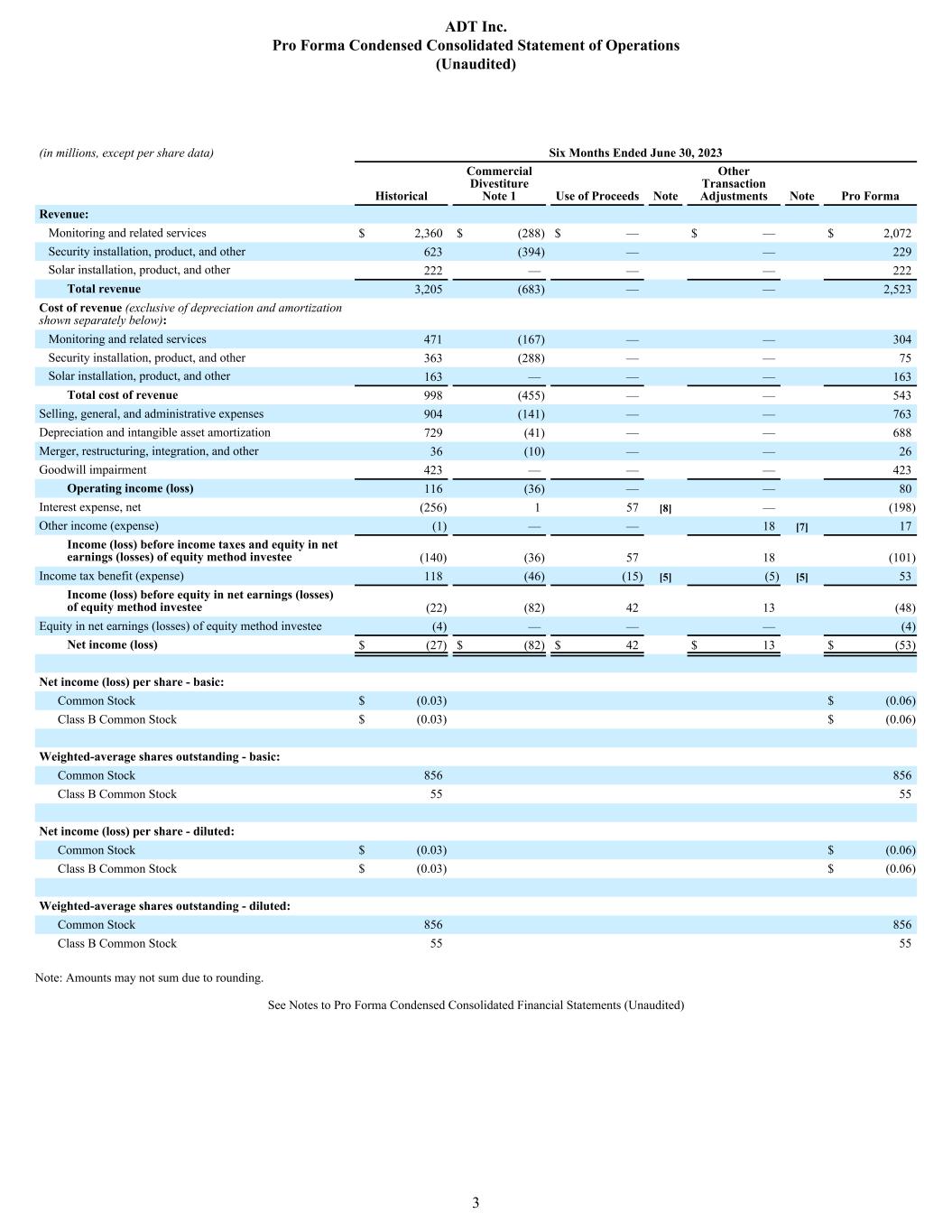

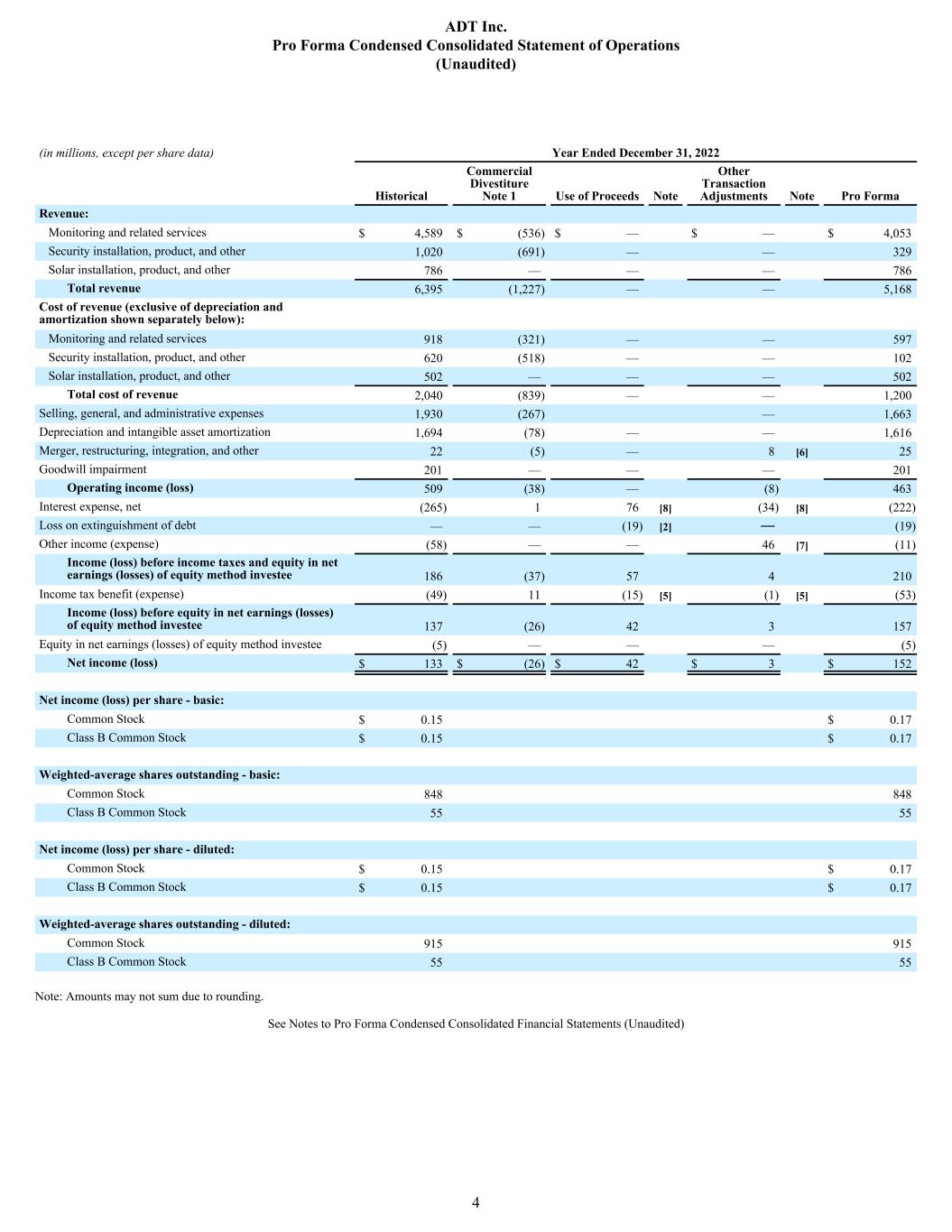

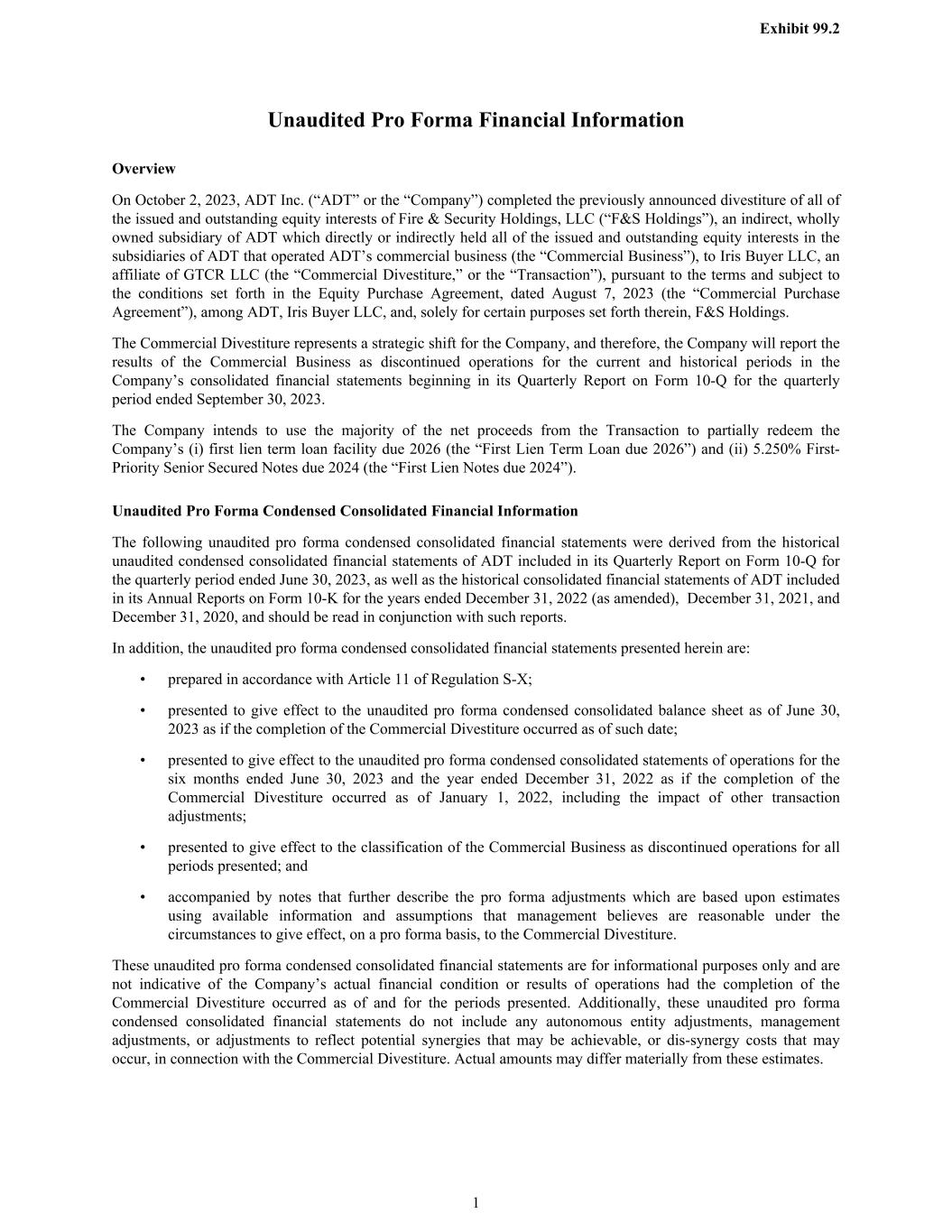

Unaudited Pro Forma Financial Information Overview On October 2, 2023, ADT Inc. (“ADT” or the “Company”) completed the previously announced divestiture of all of the issued and outstanding equity interests of Fire & Security Holdings, LLC (“F&S Holdings”), an indirect, wholly owned subsidiary of ADT which directly or indirectly held all of the issued and outstanding equity interests in the subsidiaries of ADT that operated ADT’s commercial business (the “Commercial Business”), to Iris Buyer LLC, an affiliate of GTCR LLC (the “Commercial Divestiture,” or the “Transaction”), pursuant to the terms and subject to the conditions set forth in the Equity Purchase Agreement, dated August 7, 2023 (the “Commercial Purchase Agreement”), among ADT, Iris Buyer LLC, and, solely for certain purposes set forth therein, F&S Holdings. The Commercial Divestiture represents a strategic shift for the Company, and therefore, the Company will report the results of the Commercial Business as discontinued operations for the current and historical periods in the Company’s consolidated financial statements beginning in its Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2023. The Company intends to use the majority of the net proceeds from the Transaction to partially redeem the Company’s (i) first lien term loan facility due 2026 (the “First Lien Term Loan due 2026”) and (ii) 5.250% First- Priority Senior Secured Notes due 2024 (the “First Lien Notes due 2024”). Unaudited Pro Forma Condensed Consolidated Financial Information The following unaudited pro forma condensed consolidated financial statements were derived from the historical unaudited condensed consolidated financial statements of ADT included in its Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2023, as well as the historical consolidated financial statements of ADT included in its Annual Reports on Form 10-K for the years ended December 31, 2022 (as amended), December 31, 2021, and December 31, 2020, and should be read in conjunction with such reports. In addition, the unaudited pro forma condensed consolidated financial statements presented herein are: • prepared in accordance with Article 11 of Regulation S-X; • presented to give effect to the unaudited pro forma condensed consolidated balance sheet as of June 30, 2023 as if the completion of the Commercial Divestiture occurred as of such date; • presented to give effect to the unaudited pro forma condensed consolidated statements of operations for the six months ended June 30, 2023 and the year ended December 31, 2022 as if the completion of the Commercial Divestiture occurred as of January 1, 2022, including the impact of other transaction adjustments; • presented to give effect to the classification of the Commercial Business as discontinued operations for all periods presented; and • accompanied by notes that further describe the pro forma adjustments which are based upon estimates using available information and assumptions that management believes are reasonable under the circumstances to give effect, on a pro forma basis, to the Commercial Divestiture. These unaudited pro forma condensed consolidated financial statements are for informational purposes only and are not indicative of the Company’s actual financial condition or results of operations had the completion of the Commercial Divestiture occurred as of and for the periods presented. Additionally, these unaudited pro forma condensed consolidated financial statements do not include any autonomous entity adjustments, management adjustments, or adjustments to reflect potential synergies that may be achievable, or dis-synergy costs that may occur, in connection with the Commercial Divestiture. Actual amounts may differ materially from these estimates. Exhibit 99.2 1

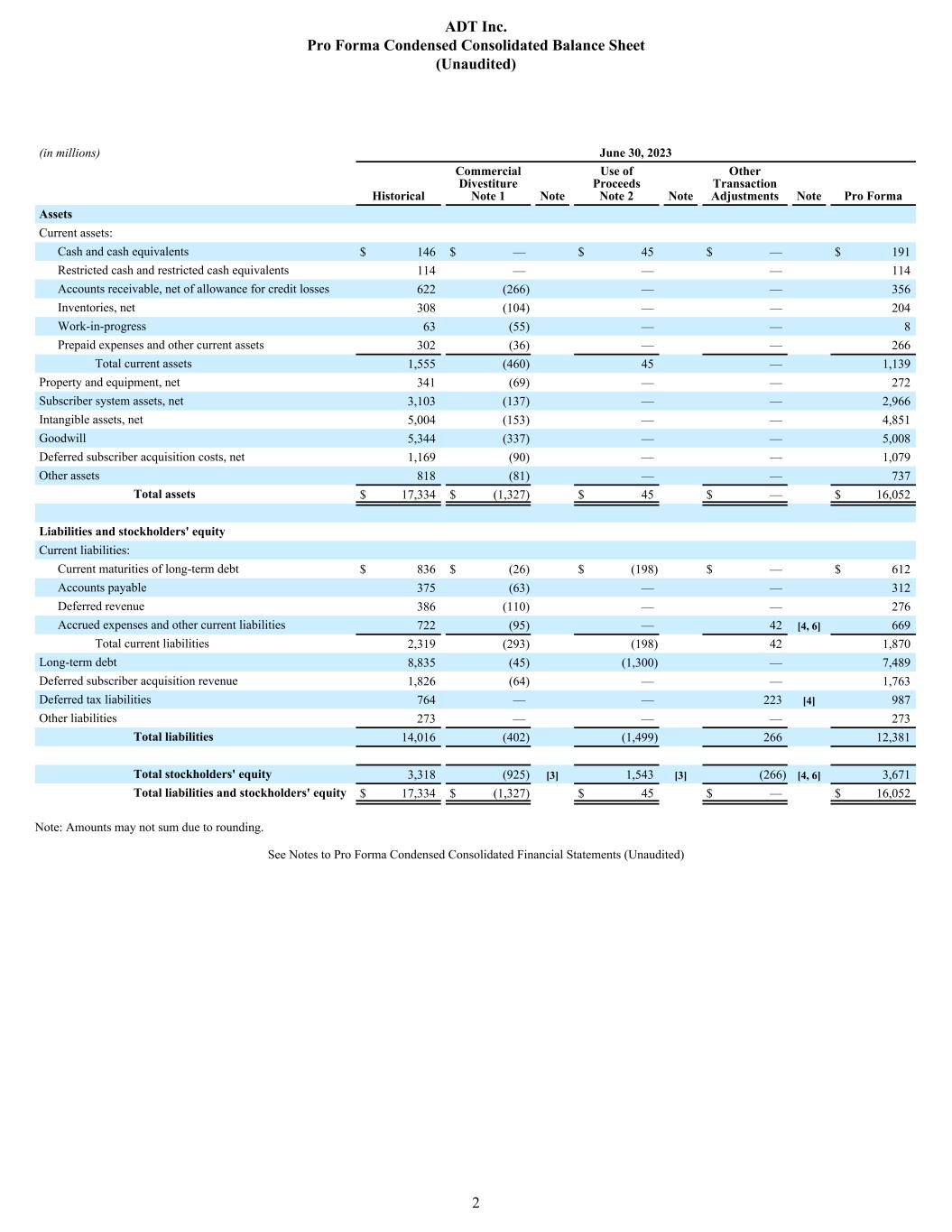

(in millions) June 30, 2023 Historical Commercial Divestiture Note 1 Note Use of Proceeds Note 2 Note Other Transaction Adjustments Note Pro Forma Assets Current assets: Cash and cash equivalents $ 146 $ — $ 45 $ — $ 191 Restricted cash and restricted cash equivalents 114 — — — 114 Accounts receivable, net of allowance for credit losses 622 (266) — — 356 Inventories, net 308 (104) — — 204 Work-in-progress 63 (55) — — 8 Prepaid expenses and other current assets 302 (36) — — 266 Total current assets 1,555 (460) 45 — 1,139 Property and equipment, net 341 (69) — — 272 Subscriber system assets, net 3,103 (137) — — 2,966 Intangible assets, net 5,004 (153) — — 4,851 Goodwill 5,344 (337) — — 5,008 Deferred subscriber acquisition costs, net 1,169 (90) — — 1,079 Other assets 818 (81) — — 737 Total assets $ 17,334 $ (1,327) $ 45 $ — $ 16,052 Liabilities and stockholders' equity Current liabilities: Current maturities of long-term debt $ 836 $ (26) $ (198) $ — $ 612 Accounts payable 375 (63) — — 312 Deferred revenue 386 (110) — — 276 Accrued expenses and other current liabilities 722 (95) — 42 [4, 6] 669 Total current liabilities 2,319 (293) (198) 42 1,870 Long-term debt 8,835 (45) (1,300) — 7,489 Deferred subscriber acquisition revenue 1,826 (64) — — 1,763 Deferred tax liabilities 764 — — 223 [4] 987 Other liabilities 273 — — — 273 Total liabilities 14,016 (402) (1,499) 266 12,381 Total stockholders' equity 3,318 (925) [3] 1,543 [3] (266) [4, 6] 3,671 Total liabilities and stockholders' equity $ 17,334 $ (1,327) $ 45 $ — $ 16,052 Note: Amounts may not sum due to rounding. See Notes to Pro Forma Condensed Consolidated Financial Statements (Unaudited) ADT Inc. Pro Forma Condensed Consolidated Balance Sheet (Unaudited) 2

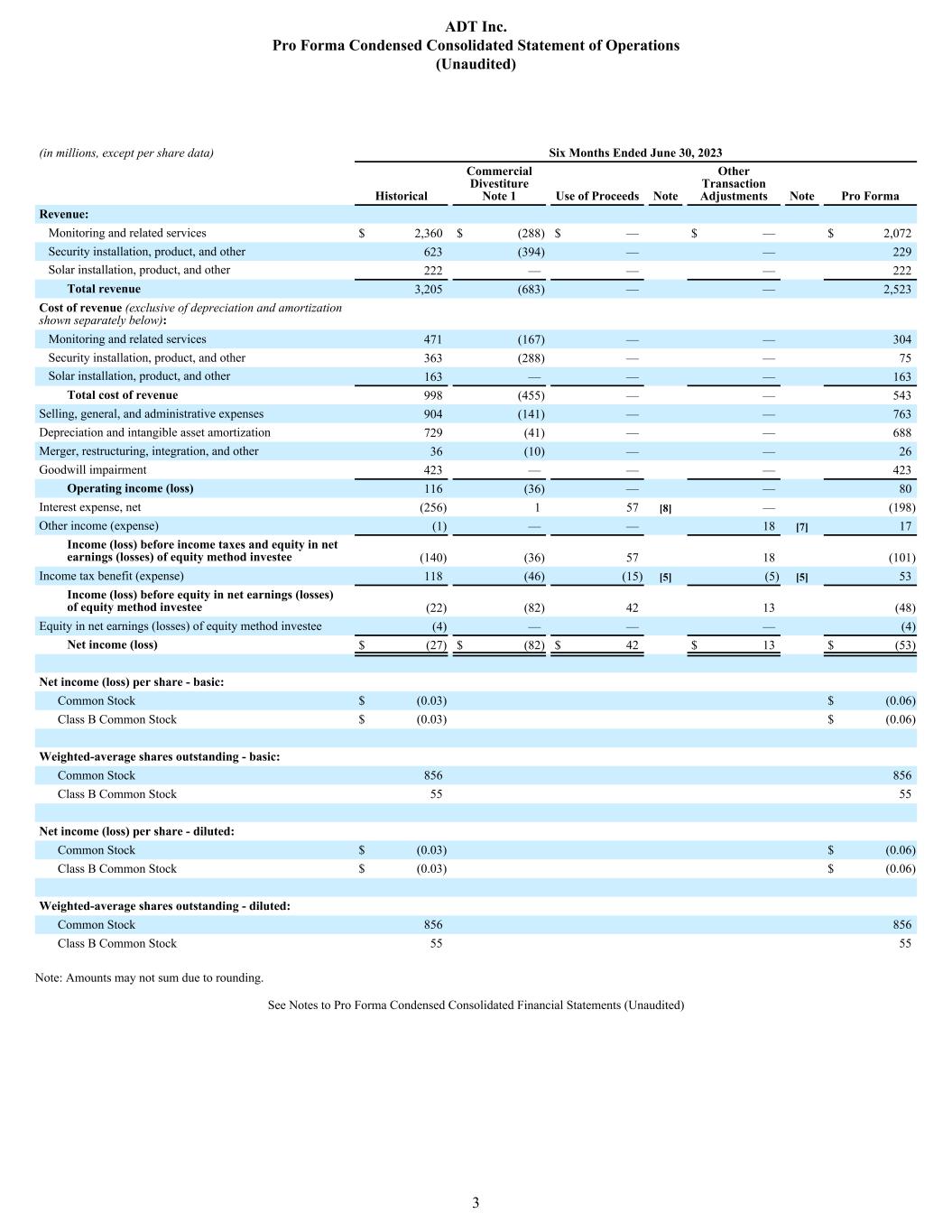

(in millions, except per share data) Six Months Ended June 30, 2023 Historical Commercial Divestiture Note 1 Use of Proceeds Note Other Transaction Adjustments Note Pro Forma Revenue: Monitoring and related services $ 2,360 $ (288) $ — $ — $ 2,072 Security installation, product, and other 623 (394) — — 229 Solar installation, product, and other 222 — — — 222 Total revenue 3,205 (683) — — 2,523 Cost of revenue (exclusive of depreciation and amortization shown separately below): Monitoring and related services 471 (167) — — 304 Security installation, product, and other 363 (288) — — 75 Solar installation, product, and other 163 — — — 163 Total cost of revenue 998 (455) — — 543 Selling, general, and administrative expenses 904 (141) — — 763 Depreciation and intangible asset amortization 729 (41) — — 688 Merger, restructuring, integration, and other 36 (10) — — 26 Goodwill impairment 423 — — — 423 Operating income (loss) 116 (36) — — 80 Interest expense, net (256) 1 57 [8] — (198) Other income (expense) (1) — — 18 [7] 17 Income (loss) before income taxes and equity in net earnings (losses) of equity method investee (140) (36) 57 18 (101) Income tax benefit (expense) 118 (46) (15) [5] (5) [5] 53 Income (loss) before equity in net earnings (losses) of equity method investee (22) (82) 42 13 (48) Equity in net earnings (losses) of equity method investee (4) — — — (4) Net income (loss) $ (27) $ (82) $ 42 $ 13 $ (53) Net income (loss) per share - basic: Common Stock $ (0.03) $ (0.06) Class B Common Stock $ (0.03) $ (0.06) Weighted-average shares outstanding - basic: Common Stock 856 856 Class B Common Stock 55 55 Net income (loss) per share - diluted: Common Stock $ (0.03) $ (0.06) Class B Common Stock $ (0.03) $ (0.06) Weighted-average shares outstanding - diluted: Common Stock 856 856 Class B Common Stock 55 55 Note: Amounts may not sum due to rounding. See Notes to Pro Forma Condensed Consolidated Financial Statements (Unaudited) ADT Inc. Pro Forma Condensed Consolidated Statement of Operations (Unaudited) 3

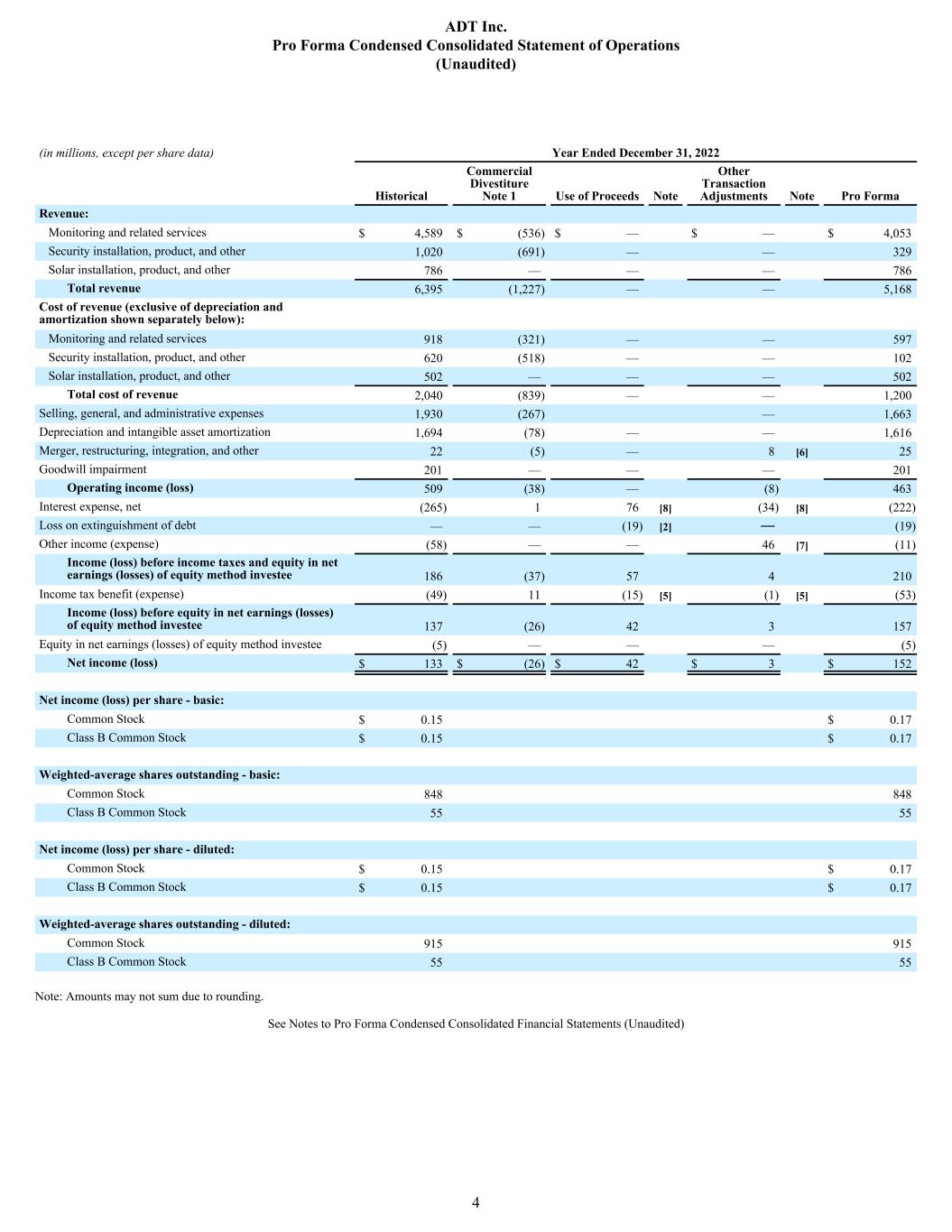

(in millions, except per share data) Year Ended December 31, 2022 Historical Commercial Divestiture Note 1 Use of Proceeds Note Other Transaction Adjustments Note Pro Forma Revenue: Monitoring and related services $ 4,589 $ (536) $ — $ — $ 4,053 Security installation, product, and other 1,020 (691) — — 329 Solar installation, product, and other 786 — — — 786 Total revenue 6,395 (1,227) — — 5,168 Cost of revenue (exclusive of depreciation and amortization shown separately below): Monitoring and related services 918 (321) — — 597 Security installation, product, and other 620 (518) — — 102 Solar installation, product, and other 502 — — — 502 Total cost of revenue 2,040 (839) — — 1,200 Selling, general, and administrative expenses 1,930 (267) — 1,663 Depreciation and intangible asset amortization 1,694 (78) — — 1,616 Merger, restructuring, integration, and other 22 (5) — 8 [6] 25 Goodwill impairment 201 — — — 201 Operating income (loss) 509 (38) — (8) 463 Interest expense, net (265) 1 76 [8] (34) [8] (222) Loss on extinguishment of debt — — (19) [2] — (19) Other income (expense) (58) — — 46 [7] (11) Income (loss) before income taxes and equity in net earnings (losses) of equity method investee 186 (37) 57 4 210 Income tax benefit (expense) (49) 11 (15) [5] (1) [5] (53) Income (loss) before equity in net earnings (losses) of equity method investee 137 (26) 42 3 157 Equity in net earnings (losses) of equity method investee (5) — — — (5) Net income (loss) $ 133 $ (26) $ 42 $ 3 $ 152 Net income (loss) per share - basic: Common Stock $ 0.15 $ 0.17 Class B Common Stock $ 0.15 $ 0.17 Weighted-average shares outstanding - basic: Common Stock 848 848 Class B Common Stock 55 55 Net income (loss) per share - diluted: Common Stock $ 0.15 $ 0.17 Class B Common Stock $ 0.15 $ 0.17 Weighted-average shares outstanding - diluted: Common Stock 915 915 Class B Common Stock 55 55 Note: Amounts may not sum due to rounding. See Notes to Pro Forma Condensed Consolidated Financial Statements (Unaudited) ADT Inc. Pro Forma Condensed Consolidated Statement of Operations (Unaudited) 4

(in millions, except per share data) Year Ended December 31, 2021 Historical Commercial Divestiture Note 1 Pro Forma Revenue: Monitoring and related services $ 4,348 $ (465) $ 3,882 Security installation, product, and other 912 (639) 273 Solar installation, product, and other 47 — 47 Total revenue 5,307 (1,104) 4,203 Cost of revenue (exclusive of depreciation and amortization shown separately below): Monitoring and related services 913 (284) 629 Security installation, product, and other 602 (494) 109 Solar installation, product, and other 35 — 35 Total cost of revenue 1,550 (777) 773 Selling, general, and administrative expenses 1,789 (248) 1,541 Depreciation and intangible asset amortization 1,915 (75) 1,840 Merger, restructuring, integration, and other 38 1 39 Operating income (loss) 15 (5) 10 Interest expense, net (458) 1 (457) Loss on extinguishment of debt (37) — (37) Other income (expense) 8 — 8 Income (loss) before income taxes (471) (5) (476) Income tax benefit (expense) 130 1 132 Net income (loss) $ (341) $ (3) $ (344) Net income (loss) per share - basic: Common Stock $ (0.41) $ (0.42) Class B Common Stock $ (0.41) $ (0.42) Weighted-average shares outstanding - basic: Common Stock 771 771 Class B Common Stock 55 55 Net income (loss) per share - diluted: Common Stock $ (0.41) $ (0.42) Class B Common Stock $ (0.41) $ (0.42) Weighted-average shares outstanding - diluted: Common Stock 771 771 Class B Common Stock 55 55 Note: Amounts may not sum due to rounding. See Notes to Pro Forma Condensed Consolidated Financial Statements (Unaudited) ADT Inc. Pro Forma Condensed Consolidated Statement of Operations (Unaudited) 5

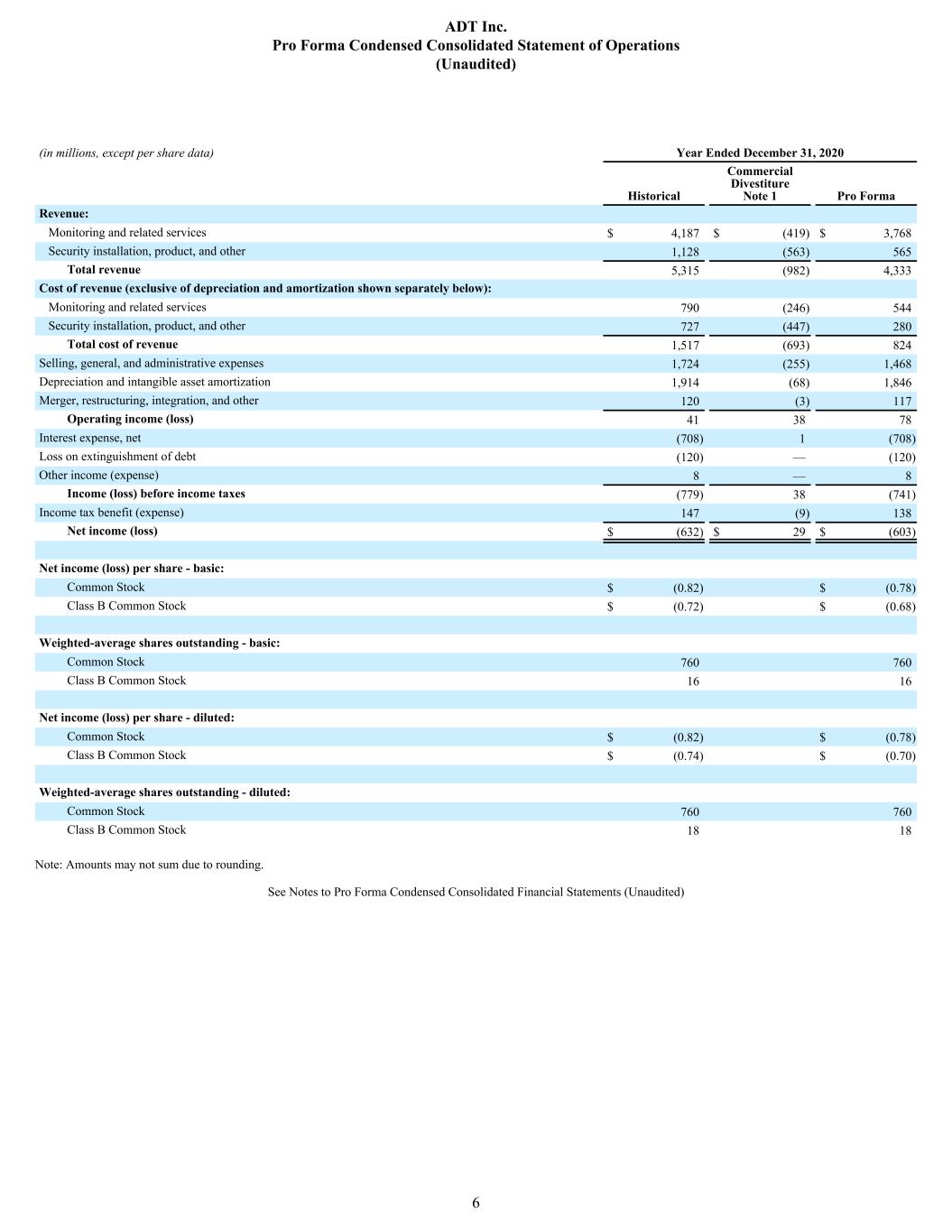

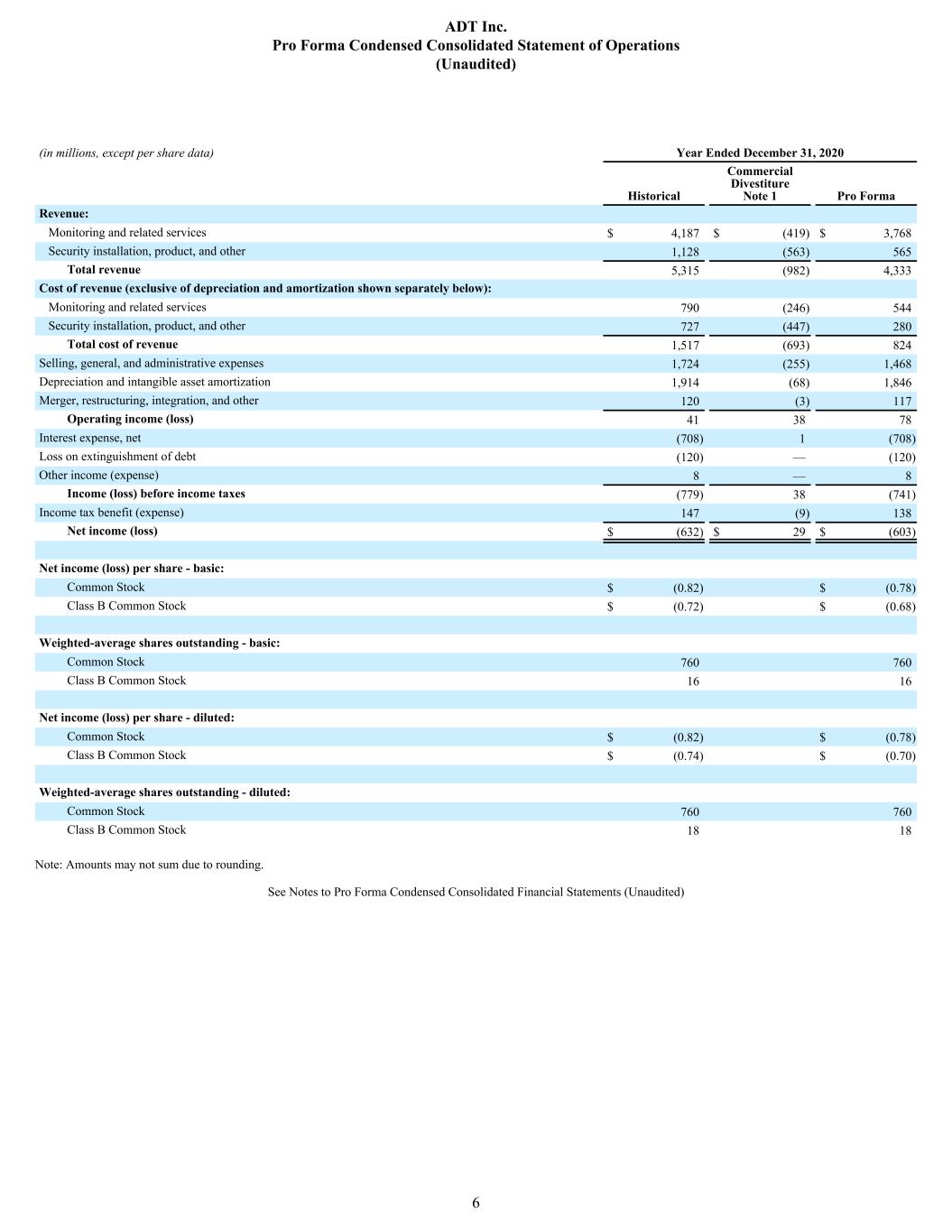

(in millions, except per share data) Year Ended December 31, 2020 Historical Commercial Divestiture Note 1 Pro Forma Revenue: Monitoring and related services $ 4,187 $ (419) $ 3,768 Security installation, product, and other 1,128 (563) 565 Total revenue 5,315 (982) 4,333 Cost of revenue (exclusive of depreciation and amortization shown separately below): Monitoring and related services 790 (246) 544 Security installation, product, and other 727 (447) 280 Total cost of revenue 1,517 (693) 824 Selling, general, and administrative expenses 1,724 (255) 1,468 Depreciation and intangible asset amortization 1,914 (68) 1,846 Merger, restructuring, integration, and other 120 (3) 117 Operating income (loss) 41 38 78 Interest expense, net (708) 1 (708) Loss on extinguishment of debt (120) — (120) Other income (expense) 8 — 8 Income (loss) before income taxes (779) 38 (741) Income tax benefit (expense) 147 (9) 138 Net income (loss) $ (632) $ 29 $ (603) Net income (loss) per share - basic: Common Stock $ (0.82) $ (0.78) Class B Common Stock $ (0.72) $ (0.68) Weighted-average shares outstanding - basic: Common Stock 760 760 Class B Common Stock 16 16 Net income (loss) per share - diluted: Common Stock $ (0.82) $ (0.78) Class B Common Stock $ (0.74) $ (0.70) Weighted-average shares outstanding - diluted: Common Stock 760 760 Class B Common Stock 18 18 Note: Amounts may not sum due to rounding. See Notes to Pro Forma Condensed Consolidated Financial Statements (Unaudited) ADT Inc. Pro Forma Condensed Consolidated Statement of Operations (Unaudited) 6

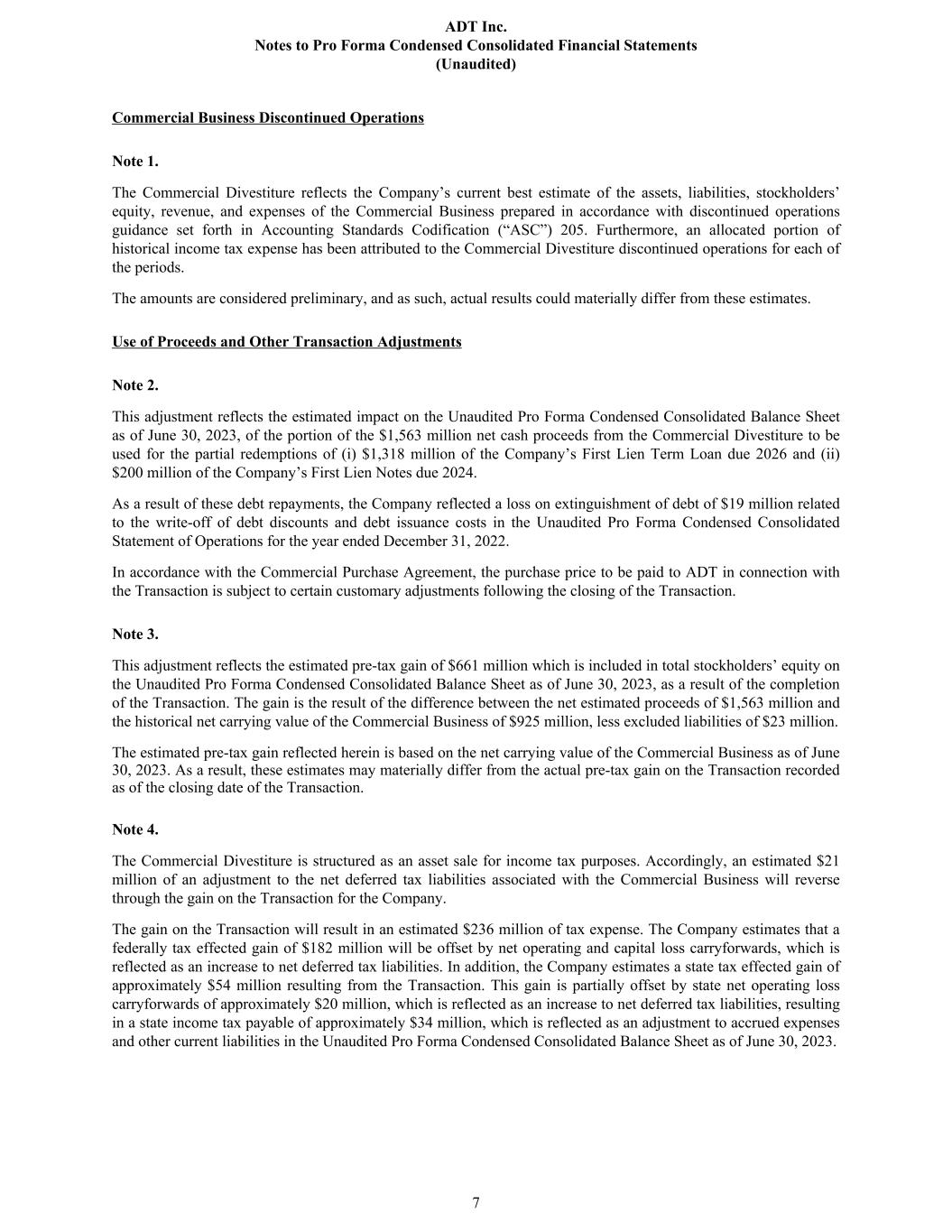

Commercial Business Discontinued Operations Note 1. The Commercial Divestiture reflects the Company’s current best estimate of the assets, liabilities, stockholders’ equity, revenue, and expenses of the Commercial Business prepared in accordance with discontinued operations guidance set forth in Accounting Standards Codification (“ASC”) 205. Furthermore, an allocated portion of historical income tax expense has been attributed to the Commercial Divestiture discontinued operations for each of the periods. The amounts are considered preliminary, and as such, actual results could materially differ from these estimates. Use of Proceeds and Other Transaction Adjustments Note 2. This adjustment reflects the estimated impact on the Unaudited Pro Forma Condensed Consolidated Balance Sheet as of June 30, 2023, of the portion of the $1,563 million net cash proceeds from the Commercial Divestiture to be used for the partial redemptions of (i) $1,318 million of the Company’s First Lien Term Loan due 2026 and (ii) $200 million of the Company’s First Lien Notes due 2024. As a result of these debt repayments, the Company reflected a loss on extinguishment of debt of $19 million related to the write-off of debt discounts and debt issuance costs in the Unaudited Pro Forma Condensed Consolidated Statement of Operations for the year ended December 31, 2022. In accordance with the Commercial Purchase Agreement, the purchase price to be paid to ADT in connection with the Transaction is subject to certain customary adjustments following the closing of the Transaction. Note 3. This adjustment reflects the estimated pre-tax gain of $661 million which is included in total stockholders’ equity on the Unaudited Pro Forma Condensed Consolidated Balance Sheet as of June 30, 2023, as a result of the completion of the Transaction. The gain is the result of the difference between the net estimated proceeds of $1,563 million and the historical net carrying value of the Commercial Business of $925 million, less excluded liabilities of $23 million. The estimated pre-tax gain reflected herein is based on the net carrying value of the Commercial Business as of June 30, 2023. As a result, these estimates may materially differ from the actual pre-tax gain on the Transaction recorded as of the closing date of the Transaction. Note 4. The Commercial Divestiture is structured as an asset sale for income tax purposes. Accordingly, an estimated $21 million of an adjustment to the net deferred tax liabilities associated with the Commercial Business will reverse through the gain on the Transaction for the Company. The gain on the Transaction will result in an estimated $236 million of tax expense. The Company estimates that a federally tax effected gain of $182 million will be offset by net operating and capital loss carryforwards, which is reflected as an increase to net deferred tax liabilities. In addition, the Company estimates a state tax effected gain of approximately $54 million resulting from the Transaction. This gain is partially offset by state net operating loss carryforwards of approximately $20 million, which is reflected as an increase to net deferred tax liabilities, resulting in a state income tax payable of approximately $34 million, which is reflected as an adjustment to accrued expenses and other current liabilities in the Unaudited Pro Forma Condensed Consolidated Balance Sheet as of June 30, 2023. ADT Inc. Notes to Pro Forma Condensed Consolidated Financial Statements (Unaudited) 7

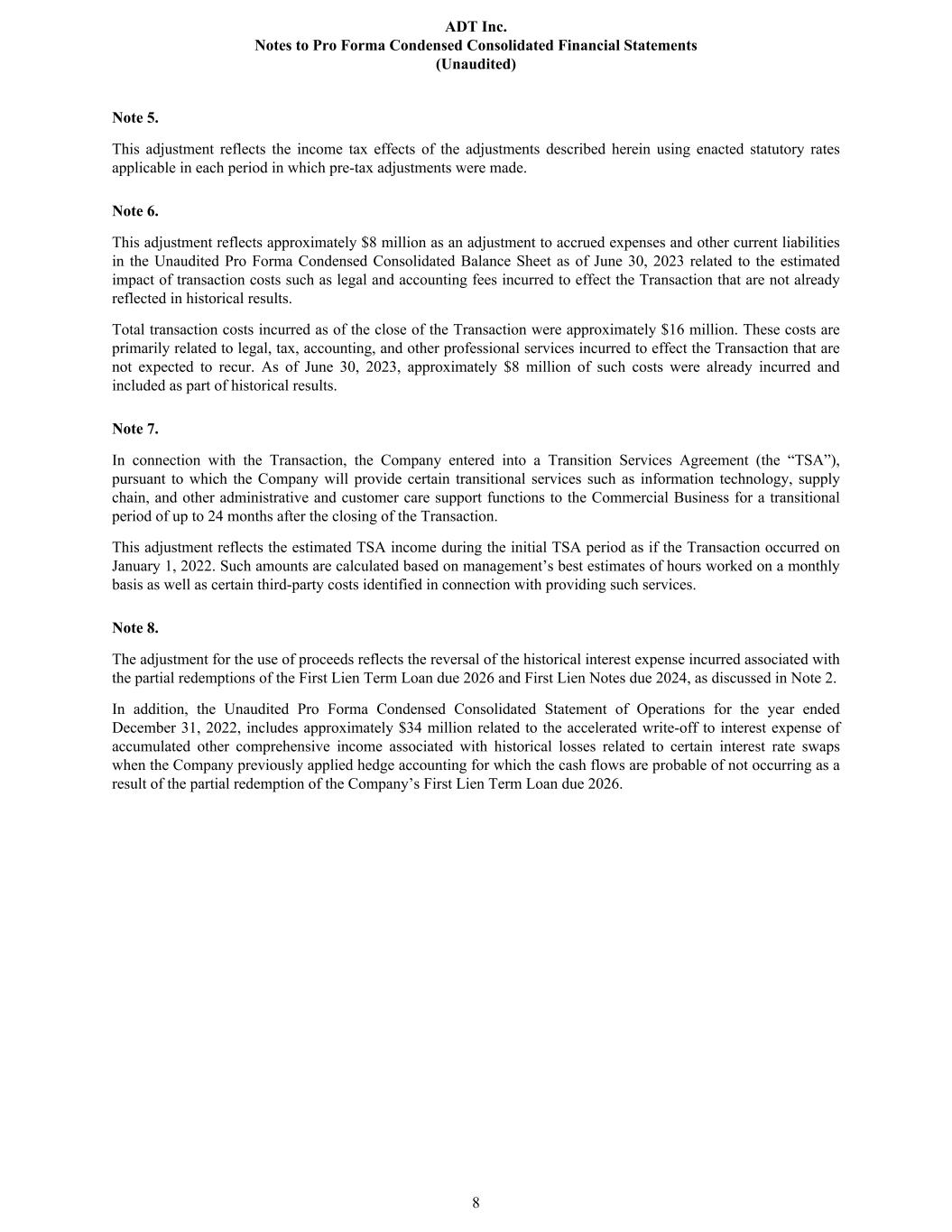

Note 5. This adjustment reflects the income tax effects of the adjustments described herein using enacted statutory rates applicable in each period in which pre-tax adjustments were made. Note 6. This adjustment reflects approximately $8 million as an adjustment to accrued expenses and other current liabilities in the Unaudited Pro Forma Condensed Consolidated Balance Sheet as of June 30, 2023 related to the estimated impact of transaction costs such as legal and accounting fees incurred to effect the Transaction that are not already reflected in historical results. Total transaction costs incurred as of the close of the Transaction were approximately $16 million. These costs are primarily related to legal, tax, accounting, and other professional services incurred to effect the Transaction that are not expected to recur. As of June 30, 2023, approximately $8 million of such costs were already incurred and included as part of historical results. Note 7. In connection with the Transaction, the Company entered into a Transition Services Agreement (the “TSA”), pursuant to which the Company will provide certain transitional services such as information technology, supply chain, and other administrative and customer care support functions to the Commercial Business for a transitional period of up to 24 months after the closing of the Transaction. This adjustment reflects the estimated TSA income during the initial TSA period as if the Transaction occurred on January 1, 2022. Such amounts are calculated based on management’s best estimates of hours worked on a monthly basis as well as certain third-party costs identified in connection with providing such services. Note 8. The adjustment for the use of proceeds reflects the reversal of the historical interest expense incurred associated with the partial redemptions of the First Lien Term Loan due 2026 and First Lien Notes due 2024, as discussed in Note 2. In addition, the Unaudited Pro Forma Condensed Consolidated Statement of Operations for the year ended December 31, 2022, includes approximately $34 million related to the accelerated write-off to interest expense of accumulated other comprehensive income associated with historical losses related to certain interest rate swaps when the Company previously applied hedge accounting for which the cash flows are probable of not occurring as a result of the partial redemption of the Company’s First Lien Term Loan due 2026. ADT Inc. Notes to Pro Forma Condensed Consolidated Financial Statements (Unaudited) 8