UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

| Filed by the Registrant | ☒ | Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

XAI Octagon Floating Rate & Alternative Income Term Trust

(Name of Registrant as Specified in Its Charters)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

| ☐ | Fee paid previously with preliminary materials: |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

| | | |

XAI Octagon Floating Rate & Alternative Income Term Trust (the “Trust” or “XFLT”) Quarterly Webinar November 30, 2023, at 10:30am Eastern Time This presentation has been prepared by XA Investments LLC (“XAI” or the “Adviser”) in conjunction with Octagon Credit Investors, LLC (“Octagon” or the “Sub - adviser”) solely for information purposes and is not an offer to sell or the solicitation of an offer to buy an interest in any security. XAI serves as the investment adviser to the Trust and is responsible for overseeing the Trust’s overall investment strategy and its implementation. Octagon serves as the investment sub - adviser of the Trust and is responsible for investing the Trust’s assets. XAI is affiliated with XMS Capital Partners, LLC, a FINRA member and SIPC member. Consider the investment objective, risks, charges and expenses of the Trust carefully before investing. An investment in the Trust involves risks and is not appropriate for all investors and is not intended to be a complete investment program. For a summary of the risks associated with an investment in the Trust please see the “XFLT Risk Considerations" beginning on page 39 of this presentation. The Trust is a diversified, closed - end management investment company with limited history of operation. The Trust began operation on September 27, 2017. Shares of closed - end investment companies frequently trade at a discount from their net asset value. Investors should read XFLT’s prospectus and SEC filings (which are publicly available on the EDGAR Database on the SEC website at http://www.sec.gov) carefully before investing in XFLT. Foreside Fund Services, LLC - Distributor

General Disclosures This presentation is intended to be educational in nature and is not for the purpose of recommending a particular investment. The investments discussed may or may not be suitable for the audience of this presentation. Neither XAI nor Octagon is acting as an adviser to the audience members, and audience members should consult their own investment adviser prior to making investment decisions. XA INVESTMENTS LLC | XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) QUARTERLY WEBINAR | 2 From time to time, the Company may have a registration statement relating to one or more of its securities on file with the Securities and Exchange Commission (“SEC”). Any registration statement that has not yet been declared effective by the SEC, and any prospectus relating thereto, is not complete and may be changed. Any securities that are the subject of such a registration statement may not be sold until the registration statement filed with the SEC is effective. Some information in this presentation reflects proprietary research based upon various data sources. In addition, some inform ation cited in this presentation has been taken from third - party sources that are believed to be reliable but which have not been verified for accuracy or completeness. Neither XAI or Octagon, nor their respective affiliates (collectively, the “Investment Managers”), is responsible for errors or omissions from these sources. No representation is made with respect to the accuracy, completeness or timeliness of information and the Investment Managers assume no obligation to update or otherwise revise such information. The Investment Managers make no representation that the information contained in this presentation is accurate or complete, nor do they review or assume any responsibility for any information received from, or created by, any third parties, including the performance data of indexes and benchmarks. Views expressed herein are subject to change without notice. All data concerning returns and satisfaction of performance tests are historical and based on the Investment Managers’ knowledge; as such, they do not represent current performance levels, some or all of which may have changed since the dates referenced herein. This document does not constitute investment, tax, legal, regulatory or accounting advice. Under no circumstances should this document be used or considered as an offer to sell or a solicitation of an offer to buy any security, financial instrument or investment vehicle. Investors are advised to make an independent review regarding the economic benefits and risks of purchasing or selling the financial instruments mentioned in this document and reach their own conclusions regarding the legal, tax, regulatory, accounting and other aspects of any transaction in the financial instrument in relation to their particular circumstances. Investments described herein carry a risk of loss, which could be significant, and that investors should be prepared to bear. Octagon and/or its affiliated companies may make a market or deal as principal in the financial instruments mentioned in this document or in related securities, options or other derivative instruments based on them. In addition, the Investment Managers, their affiliated companies, shareholders, directors, officers and/or employees, may from time to time have long or short positions in the financial instruments, including loans, securities or in options, futures or other derivative instruments based on them. Performance achieved prior to December 31, 2021 is predominantly based on investments that use USD LIBOR as a reference rate. Overnight and 12 - month US dollar LIBOR permanently ceased as of June 30, 2023. 1 - , 3 - , and 6 - month U.S. dollar LIBOR settings will continue to be published using a synthetic methodology until September 2024. As an alternative to LIBOR, the Financial Reporting Council, in conjunction with the Alternative Reference Rates Committee, a steering committee comprised of large U.S. financial institutions, recommended replacing U.S. dollar LIBOR with Secured Overnight Financing Rate (“SOFR”), a new index calculated by reference to short - term repurchase agreements, backed by Treasury securities. There is no guarantee that the performance of individual investments or the syndicated debt and CLO securities markets as a whole during or after the transition period will be consistent with performance achieved during the LIBOR era. Performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. Similar investments likely would produce different results under different economic and market conditions. These materials contain forward - looking statements. Investors should not place undue reliance on forward - looking statements. Actual results could differ materially from those referenced in forward - looking statements for many reasons. Forward - looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions underlying any forward - looking statements will not materialize or will vary significantly from actual results. Variations of assumptions and results may be material. Without limiting the generality of the foregoing, the inclusion of forward - looking statements herein should not be regarded as a representation by the Investment Managers or any of their respective affiliates or any other person of the results that will actually be achieved by the Trust. None of the foregoing persons has any obligation to update or otherwise revise any forward - looking statements, including any revision to reflect changes in any circumstances arising after the date hereof relating to any assumptions or otherwise.

Before We Begin XA INVESTMENTS LLC | XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) QUARTERLY WEBINAR | 3 • Registrants will receive a link to the replay following the webinar. Feel free to share with colleagues. • For additional information on CEFs, please see our website at xainvestments.com under the Knowledge Bank tab. • Submit questions at any time during the presentation using the Q&A box. Click Q&A Enter questions in this box

Steven Perry Vice President XA Investments LLC Kimberly Flynn Managing Director XA Investments LLC Lauren Law Portfolio Manager Octagon Credit Investors, LLC Gr e tchen Lam Senior Portfolio Manager Octagon Credit Investors, LLC Steven Perry is a Vice President at XA Investments focused on product and business development. Steven is responsible for overseeing XFLT’s product management decisions. Previously, Steven worked consulting lenders across the country in the government guarantee lending space at Windsor Advantage. Under his management, he oversaw a portfolio of more than 1,100 loans totaling over $1.3bn. Also, Steven was responsible for building the Portfolio Management and Construction Management Departments at Windsor Advantage. Prior to working at Windsor Advantage, he played five years of professional soccer. Steven received his B.B.A. in Finance from the University of Notre Dame. Kimberly Flynn serves as Managing Director at XA Investments. She is a partner in the firm and responsible for all product and business development activities. Kim is responsible for the firm’s proprietary fund platform and consulting practice. Previously, Kim was Senior Vice President and Head of Product Development for Nuveen Investments’ Global Structured Products Group. In her leadership role at Nuveen, Kim was responsible for asset raising activities through the development of new traditional and alternative investment funds including CEFs, ETFs, UITs and commodity pools. Kim received her M.B.A. degree from Harvard University and her B.B.A. in Finance and Business Economics, Summa Cum Laude, from the University of Notre Dame in 1999. She received her CFA charter in 2005. Ms. Law is a member of Octagon’s Investment Committee and serves as a Portfolio Manager across CLOs, Separately Managed Accounts and Commingled Funds. Ms. Law joined Octagon in 2004. In addition, she helps oversee the Firm’s Structured Credit (CLO debt and equity) investment strategies. Prior to becoming a Portfolio Manager, Ms. Law was an Investment Team Principal whose coverage areas included healthcare, industrials, financials, business services, and the Firm’s CLO debt and equity investments. She holds a Bachelor of Science from Babson College, where she graduated Magna Cum Laude . She received her CFA charter in 2009 . Ms. Lam is a member of Octagon’s Investment Committee and serves as a Portfolio Manager across CLOs, Separately Managed Accounts and Commingled Funds. Ms. Lam oversees the Firm’s Structured Credit (CLO debt & equity) investment strategies. Ms. Lam is also a member of the Firm’s ESG Committee. Prior to becoming a Portfolio Manager, Ms. Lam oversaw Octagon's investments in the software, business services, finance & insurance, paper & packaging, gaming & lodging, homebuilding and real estate industries. She was also responsible for the structured credit exposure held in Octagon’s CLO vehicles. Prior to joining Octagon in 1999, Ms. Lam attended Babson College where she graduated Summa Cum Laude with a B.S. in Investments. She received her CFA charter in 2006. Today’s Speakers XA INVESTMENTS LLC | XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) QUARTERLY WEBINAR | 4

Octagon Credit Overview CREDIT EXPERTS • Exclusive focus is below investment grade credit since 1994. $34.8bn in AUM as of 9/30/23 DISCIPLINED PROCESS • Seasoned investment process rooted in fundamental credit and relative value analysis PEOPLE • Cohesive, experienced, cycle - tested investment team EXPERIENCE • More than 25+ year track record managing and investing in CLO securities I N S T I TUT IO N AL F O CU SED • XFLT, launched in Sept. 2017, was Octagon’s first strategy to be publicly available in a registered fund XA INVESTMENTS LLC | XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) QUARTERLY WEBINAR | 5

Summary of XFLT Proxy Proposals XA INVESTMENTS LLC | XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) QUARTERLY WEBINAR | 6 • On October 25, 2023, the Board of Trustees (the “Board”) of the Trust unanimously approved two proposals (collectively referred to as the “Proposals”), as summarized below. • The Board unanimously recommends that shareholders vote to approve each Proposal at the special meeting of shareholders of the Trust, to be held on December 19, 2023. Shareholders of record at the close of business on October 25, 2023 are entitled to vote at the meeting. Proposal 1 - Approval of Sub - Advisory Agreement • To approve a new investment sub - advisory agreement among the Trust, XAI, and Octagon, to become effective upon the closing of a transaction by Octagon’s parent company that will result in the automatic termination of the current sub - advisory agreement. The terms of the new sub - advisory agreement are substantially identical to the current sub - advisory agreement. Proposal 2 - Amendment of Declaration of Trust to Remove Termination Date • To approve an amendment to the Trust’s Agreement and Declaration of Trust to cause the Trust to become a perpetual fund by eliminating the requirement that it terminate operations on or about December 31, 2029, unless extended as permitted by the Declaration of Trust. Please Vote Your Shares The Trust has filed a proxy statement related to the shareholder meeting with the Securities and Exchange Commission (“SEC”). Because the proxy statement contains important information about the Proposals, the Trust’s shareholders are urged to read the proxy statement and accompanying materials carefully. Shareholders can obtain, free of charge, copies of these documents at the SEC’s website at www.sec.gov and can obtain copies by calling (800) 431 - 9645 or by writing the Trust at 321 North Clark Street, Suite 2430, Chicago, Illinois 60654.

Questions & Topics for the Speakers XA INVESTMENTS LLC | XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) QUARTERLY WEBINAR | 7 1. Please discuss the XFLT financial highlights for the quarter. 2. What has Board governance looked like in the last 12 months? 3. Describe the methods XFLT can use to grow its common share base. 4. Discuss XFLT’s current distribution rate. What percentage of the distributions comprised a return of capital? 5. Can you describe the impact of interest rate increases on XFLT’s portfolio and the trust’s use of leverage? 6. How has the financial performance of loan borrowers trended in the 3Q23? How has this translated into CLO performance? 7. Are any particular loan market industries outperforming or underperforming? What are Octagon’s expectations for loan defaults going forward? 8. Recession fears eased in 3Q23 as inflation came off its peak and GDP remained resilient. How have the loan and CLO tranche markets reacted? Where are loans and CLO debt/equity trading today? 9. New CLO issuance was lower in 2023, in part due to challenging CLO arbitrage for new deals. How has that evolved over the course of the year and what is your outlook for primary CLO issuance and CLO arbitrage in 2024? 10. What is your outlook for the CLO market going forward?

XFLT Financial Highlights XA INVESTMENTS LLC | XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) QUARTERLY WEBINAR | 8 • XFLT has a fiscal year end of September 30 th . Please see XFLT’s Annual Report, Semi - annual Report and quarterly financials at www.XAInvestments.com for more details. • For the fiscal year ended September 30, 2023, net investment income (“NII”) was $0.92 and net realized and unrealized gain on investments was $0.30 per weighted average common share. The total income from investment operations was $1.22. • For the fiscal year ended September 30, 2023, the ratio of NII to average net assets was 14.30% • For the third quarter, XFLT issued 3,296,106 shares of common stock pursuant to the Company’s “at - the - market” offering program for total net proceeds of approximately $22.3mm. • Monthly distributions for the quarter were payable on July 3, August 1, and September 1 in the amounts of $0.085, $0.085 and $0.085, respectively. • $500 m m A U M m ilestone on September 19, 2023. • Weighted Average Current Yields (price) as of 9/30/2023 1 : CLO Equity: 23.52% CLO Debt: 13.01% Loans: 10.33% Bonds: 6.92% Notes: 1. Based on prices sourced by Markit, a third - party pricing service, and are subject to change. Octagon makes no assurances that the prices reflected herein represent the prices at which the Trust’s investments will be liquidated. Any fluctuations in market prices may impact Trust returns. Past performance is not necessarily indicative of future results. Current Yield for CLO equity positions is calculated by Octagon as the sum of all cash distributions paid by the CLO within the past 12 months as of the respective date shown (i.e. LTM), divided by the total purchase price or mark price value of the Trust’s CLO equity positions as of the respective date. Based on this calculation methodology, the Current Yield of these positions, as included in the calculation of Total Portfolio Current Yield, is zero. Total LTM quarterly cash distributions received by the Trust excludes: i) any CLO Equity positions that have been called; and, ii) any CLO Equity position(s) that did not receive a cash distribution at the CLO’s most recent quarterly payment date, however, the purchase cost amount and market value of any such CLO Equity position(s) is reflected in the total purchase cost amount and market value of the Trust’s CLO Equity positions used to calculate the Current Yield. As of September 30, 2023, no Trust holdings qualify for this treatment. Total LTM quarterly cash distributions also excludes outsized par flush distributions executed upon a deal’s reset or refinancing. These distributions and the Current Yield are subject to change on a prospective basis. Yield is not a projection or guarantee of future returns, due to expected changes in asset prices and changing market factors. Performance achieved prior to December 31, 2021 is predominantly based on investments that use USD LIBOR as a reference rate. Overnight and 12 - month US dollar LIBOR permanently ceased as of June 30, 2023. 1 - , 3 - , and 6 - month U.S. dollar LIBOR settings will continue to be published using a synthetic methodology until September 2024. As an alternative to LIBOR, the Financial Reporting Council, in conjunction with the Alternative Reference Rates Committee, recommended replacing LIBOR with SOFR. There is no guarantee that the performance of individual investments or the syndicated debt and CLO securities markets as a whole during or after the transition period will be consistent with performance achieved during the LIBOR era. Performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted.

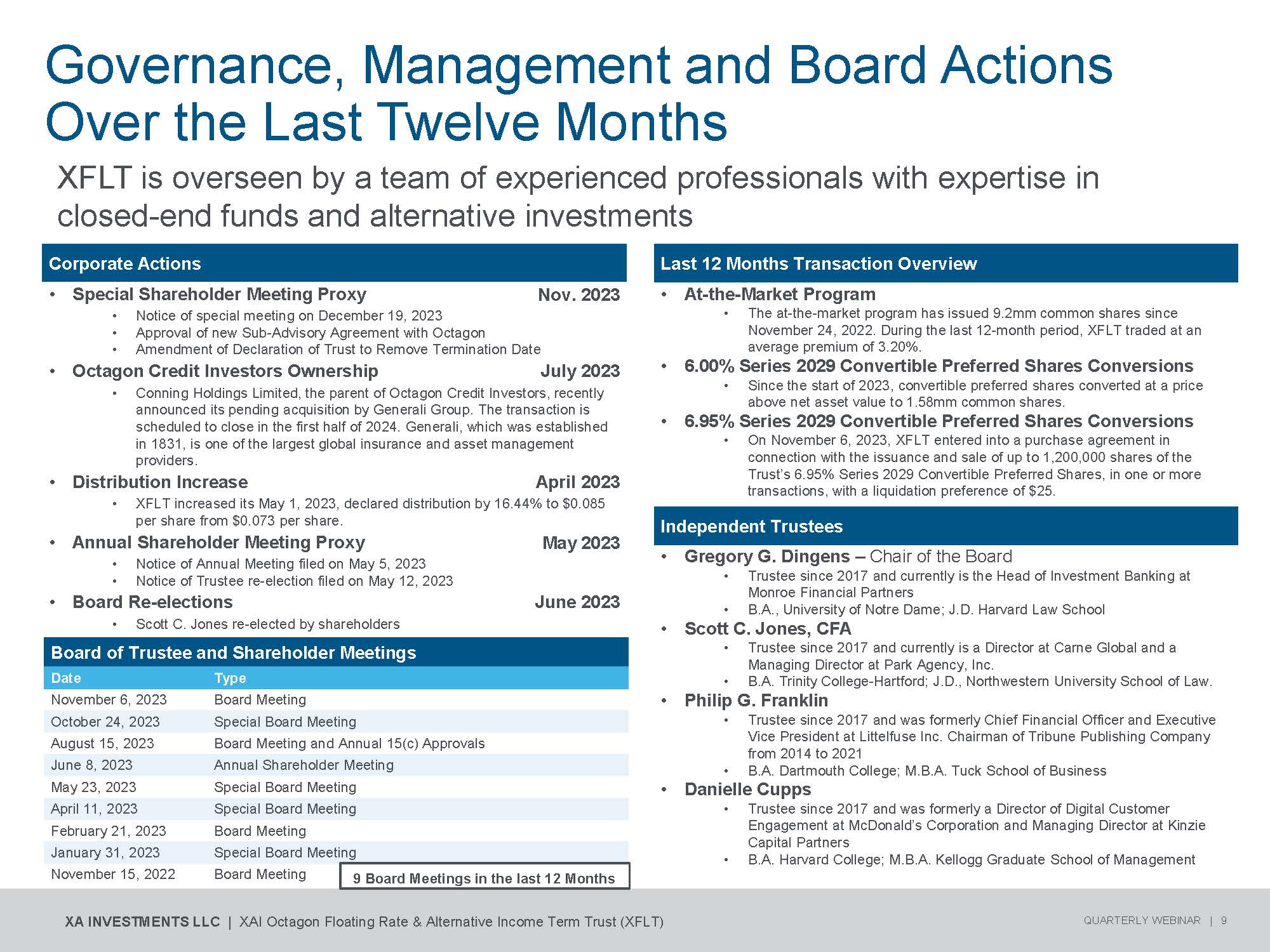

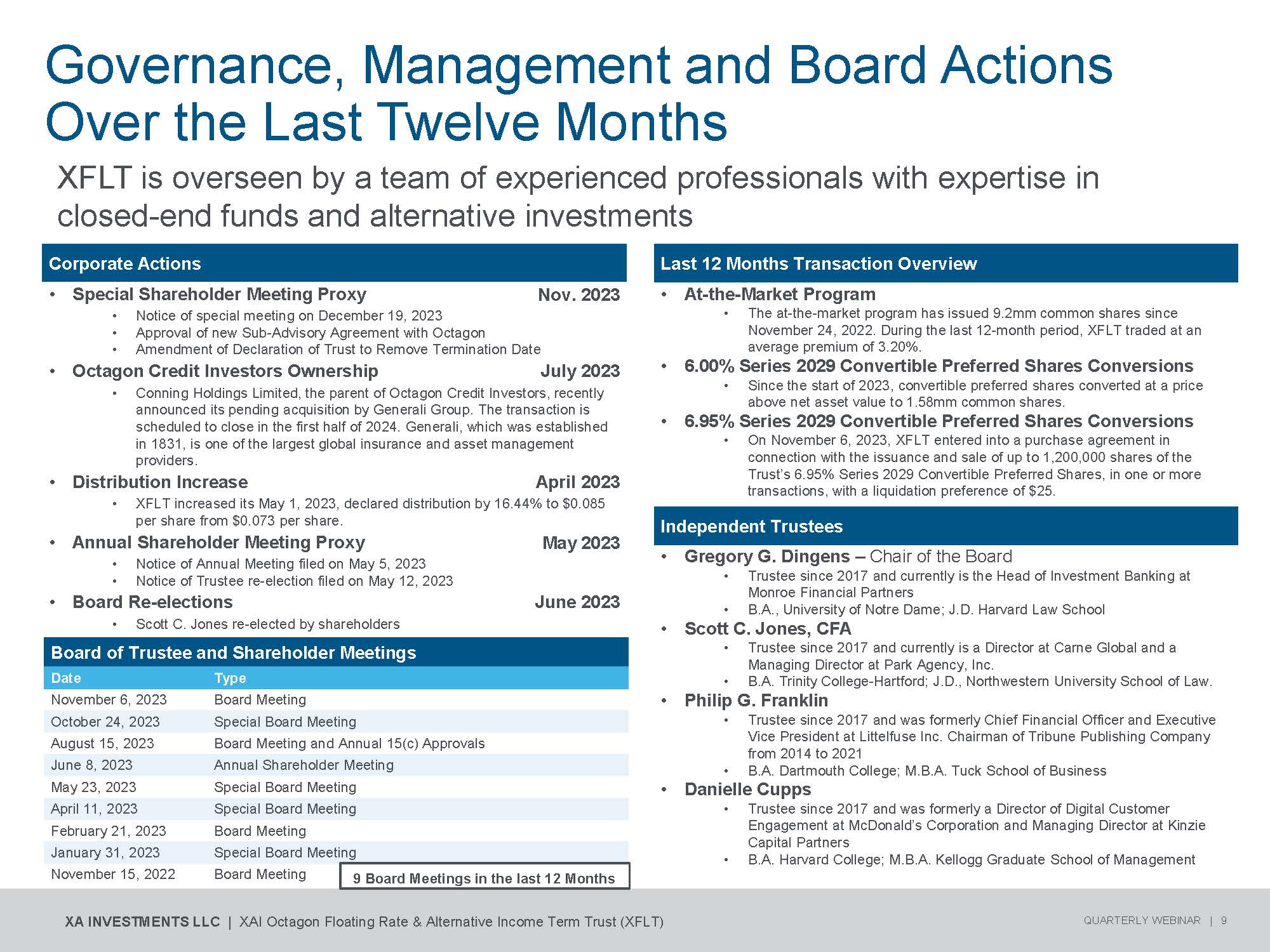

Governance, Management and Board Actions Over the Last Twelve Months XFLT is overseen by a team of experienced professionals with expertise in closed - end funds and alternative investments Last 12 Months Transaction Overview • At - the - Market Program • The at - the - market program has issued 9.2mm common shares since November 24, 2022. During the last 12 - month period, XFLT traded at an average premium of 3.20%. • 6.00% Series 2029 Convertible Preferred Shares Conversions • Since the start of 2023, convertible preferred shares converted at a price above net asset value to 1.58mm common shares. • 6.95% Series 2029 Convertible Preferred Shares Conversions • On November 6, 2023, XFLT entered into a purchase agreement in connection with the issuance and sale of up to 1,200,000 shares of the Trust’s 6.95% Series 2029 Convertible Preferred Shares, in one or more transactions, with a liquidation preference of $25. Independent Trustees • Gregory G. Dingens – Chair of the Board • Trustee since 2017 and currently is the Head of Investment Banking at Monroe Financial Partners • B.A., University of Notre Dame; J.D. Harvard Law School • Scott C. Jones, CFA • Trustee since 2017 and currently is a Director at Carne Global and a Managing Director at Park Agency, Inc. • B.A. Trinity College - Hartford; J.D., Northwestern University School of Law. • Philip G. Franklin • Trustee since 2017 and was formerly Chief Financial Officer and Executive Vice President at Littelfuse Inc. Chairman of Tribune Publishing Company from 2014 to 2021 • B.A. Dartmouth College; M.B.A. Tuck School of Business • Danielle Cupps • Trustee since 2017 and was formerly a Director of Digital Customer Engagement at McDonald’s Corporation and Managing Director at Kinzie Capital Partners • B.A. Harvard College; M.B.A. Kellogg Graduate School of Management Corporate Actions Nov. 2023 • Special Shareholder Meeting Proxy • Notice of special meeting on December 19, 2023 • Approval of new Sub - Advisory Agreement with Octagon • Amendment of Declaration of Trust to Remove Termination Date July 2023 • Octagon Credit Investors Ownership • Conning Holdings Limited, the parent of Octagon Credit Investors, recently announced its pending acquisition by Generali Group. The transaction is scheduled to close in the first half of 2024. Generali, which was established in 1831, is one of the largest global insurance and asset management providers. April 2023 • Distribution Increase • XFLT increased its May 1, 2023, declared distribution by 16.44% to $0.085 per share from $0.073 per share. May 2023 • Annual Shareholder Meeting Proxy • Notice of Annual Meeting filed on May 5, 2023 • Notice of Trustee re - election filed on May 12, 2023 June 2023 • Board Re - elections • Scott C. Jones re - elected by shareholders Board of Trustee and Shareholder Meetings Type Date Board Meeting November 6, 2023 Special Board Meeting October 24, 2023 Board Meeting and Annual 15(c) Approvals August 15, 2023 Annual Shareholder Meeting June 8, 2023 Special Board Meeting May 23, 2023 Special Board Meeting April 11, 2023 Board Meeting February 21, 2023 Special Board Meeting January 31, 2023 s in the last 12 Months Board Meeting 9 Board Meeting November 15, 2022 XA INVESTMENTS LLC | XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) QUARTERLY WEBINAR | 9

XFLT Overview and Top 10 Holdings As of 9/30/2023 Unaudited. Source: XA Investments LLC; ALPS. 1. Quarter - to - date figures ending on 9/30/2023. 2. Holdings are measured as a percentage of market value over the Trust’s total portfolio investments as of 9/30/2023. Holdings may vary and are subject to change without notice. 3. Distribution rates are not performance and are calculated by summing the monthly distributions per share over twelve months and dividing by the NAV or market price, as applicable, as of the latest month - end. Distributions may be comprised of ordinary income, net capital gains, and/or a return of capital (ROC) of your investment in the Trust. To date, a portion of common stock distributions has been estimated to be a return of capital as noted under the Investor Relations section on the Trust’s website. The actual components of the Trust’s distributions for U.S. tax reporting purposes can only be finally determined as of the end of each fiscal year of the Trust and are thereafter reported on Form 1099 - DIV. The Trust’s distributions for fiscal year ended 2023 comprised 100% net income and 0.00% return of capital. The Trust’s distributions for fiscal year ending 2024 will be made available and reported to investors after the end of fiscal year 2024. A distribution comprised in whole or in part by a return of capital does not necessarily reflect the company’s investment performance and should not be confused with “yield” or “income.” Future distributions may consist of a return of capital. Performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. % Portfolio Asset Type Top 10 Holdings 1.59% CLO Equity Elmwood CLO 14 Ltd. 1.38% CLO Equity CARLYLE US CLO 2019 - 4 Ltd. 1.28% CLO Equity Elmwood CLO VII Ltd. 1.08% CLO Equity Rockland Park CLO Ltd. 1.07% CLO Equity Regatta XIX Funding Ltd. 0.97% CLO Equity Elmwood CLO II Ltd. 0.94% CLO Equity Regatta XVIII Funding Ltd. 0.81% CLO Equity Anchorage Capital CLO 13 LLC 0.80% CLO Equity Benefit Street Partners CLO XXV Ltd. 0.80% CLO Equity Elmwood CLO I Ltd. 10.71% Total Top 10 Holdings 2 Summary Trust Characteristics $0.085 Current Distribution (monthly) $507,891,533 Total Managed Assets 15.29% Distribution Rate on NAV 44,653,181 Common Shares Outstanding 14.68% Distribution Rate on Market Price 271,537 Average Daily Volume (in shares) 1 511 Number of Holdings (count) 2 41.40% Total Regulatory Leverage % 87.03% Avg. Asset Price (% of par) 2 6.52% Average Cost of Leverage % 1 7.43 Avg. Effective Maturity (years) 2 $6.67 NAV 9/26/2017 Fund Inception Date $6.95 Market Price Asset Allocation % 2 46.07% 17.00% 1.54% 3.65% 0.06% 2.09% High Yield Secured Second Lien Loans Common Stock Cash & Equivalents 29.59% Senior Secured First Lien Loans CLO Equity CLO Debt XA INVESTMENTS LLC | XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) QUARTERLY WEBINAR | 10

9/30/2 0 23 12/31/ 2 022 3/31/2 0 23 Source: Octagon Credit Investors, LLC; ALPS; Paralel; data as of 9/30/2023. Performance achieved prior to December 31, 2021 is predominantly based on investments that use USD LIBOR as a reference rate. Overnight and 12 - month US dollar LIBOR permanently ceased as of June 30, 2023. 1 - , 3 - , and 6 - month U.S. dollar LIBOR settings will continue to be published using a synthetic methodology until September 2024. As an alternative to LIBOR, the Financial Reporting Council, in conjunction with the Alternative Reference Rates Committee, recommended replacing LIBOR with SOFR. There is no guarantee that the performance of individual investments or the syndicated debt and CLO securities markets as a whole during or after the transition period will be consistent with performance achieved during the LIBOR era. Performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. XFLT Portfolio Composition Over Time 9/30/2023 6/30/2023 3/31/2023 12/31/2022 Asset Allocation 46.07% 43.0% 43.1% 45.6% Senior Secured First Lien Loans 29.59% 32.2% 34.8% 35.2% CLO Equity 17.00% 16.2% 15.7% 14.0% CLO Debt 1.54% 1.8% 2.3% 2.8% Secured Second Lien Loans 3.65% 4.0% 4.1% 2.4% High Yield Bonds 0.06% 0.1% 0.1% 0.1% Common Stock 2.09% 2.8% 0.0% 0.0% Cash & Equivalents Senior Secured First Lien Loans CLO Equity CLO Debt Secured Second Lien Loans High Yield Bonds C o m mon Stock Cash & Equivalents 6/30/2 0 23 XA INVESTMENTS LLC | XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) QUARTERLY WEBINAR | 11

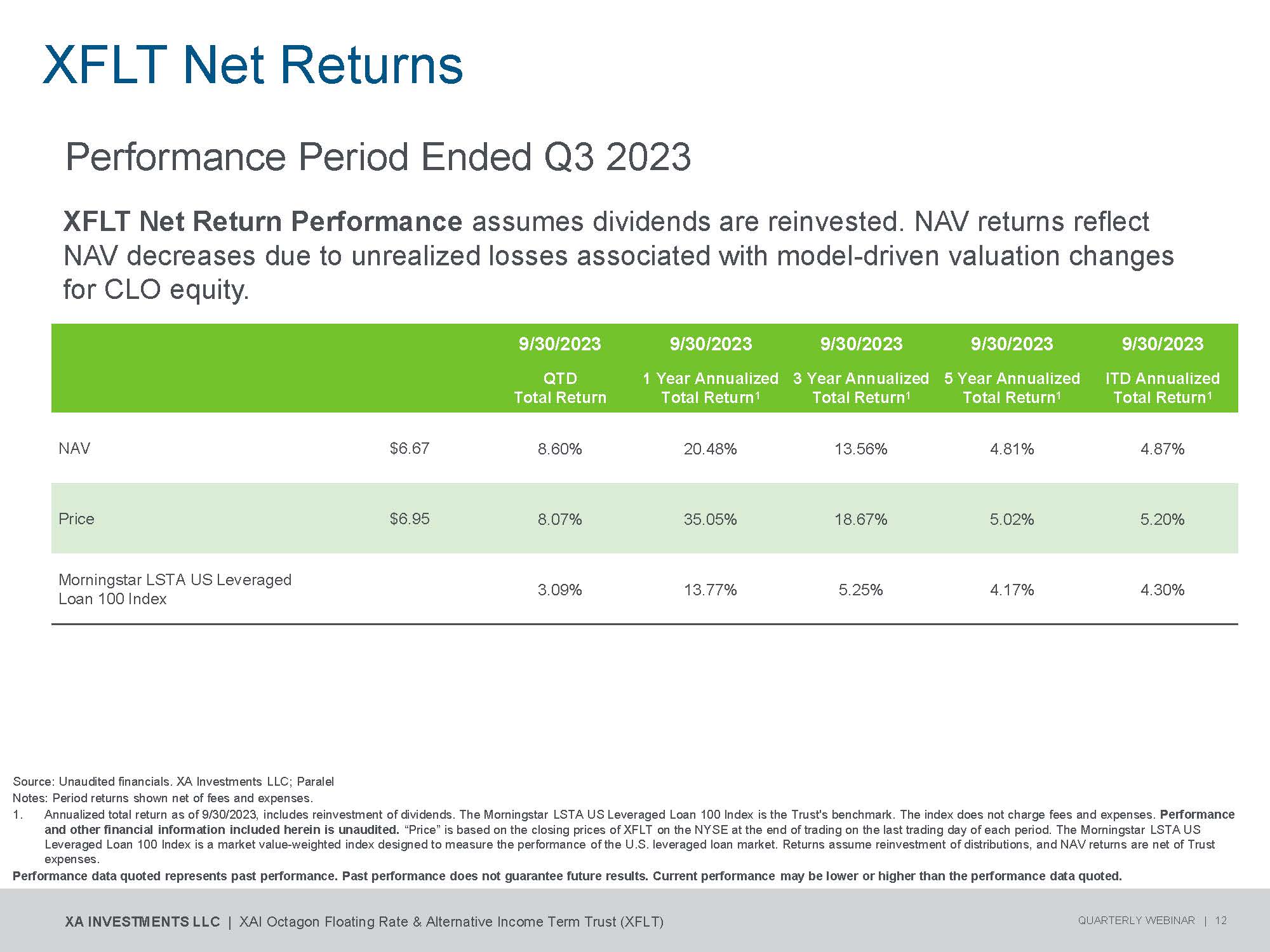

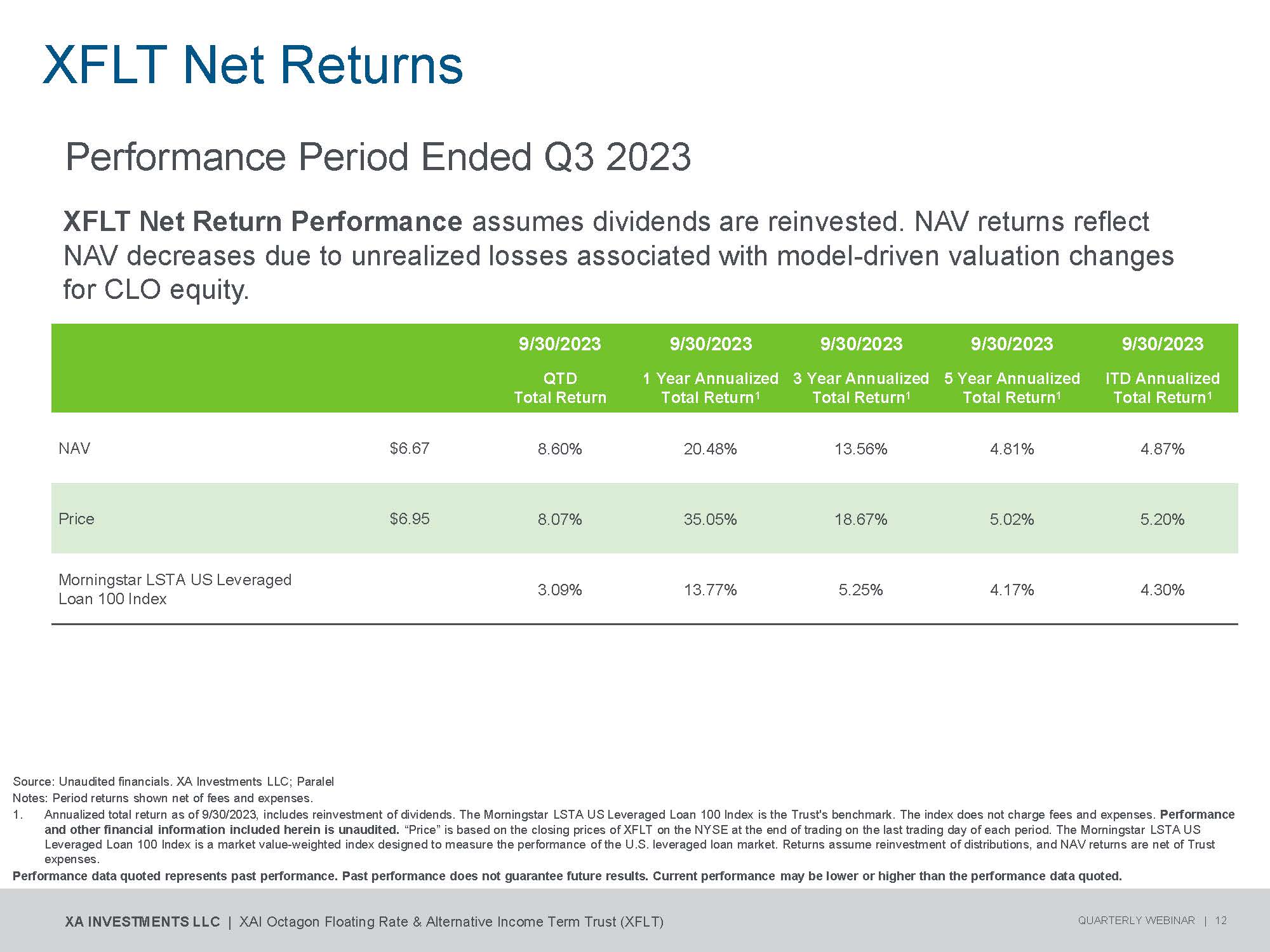

XFLT Net Returns XFLT N et Ret urns Source: Unaudited financials. XA Investments LLC; Paralel Notes: Period returns shown net of fees and expenses. 1. Annualized total return as of 9/30/2023, includes reinvestment of dividends. The Morningstar LSTA US Leveraged Loan 100 Index is the Trust's benchmark. The index does not charge fees and expenses. Performance and other financial information included herein is unaudited. “Price” is based on the closing prices of XFLT on the NYSE at the end of trading on the last trading day of each period. The Morningstar LSTA US Leveraged Loan 100 Index is a market value - weighted index designed to measure the performance of the U.S. leveraged loan market. Returns assume reinvestment of distributions, and NAV returns are net of Trust expenses. Performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. Performance Period Ended Q3 2023 XFLT Net Return Performance assumes dividends are reinvested. NAV returns reflect NAV decreases due to unrealized losses associated with model - driven valuation changes for CLO equity. 9/30/2023 9/30/2023 9/30/2023 9/30/2023 9/30/2023 ITD Annualized Total Return 1 5 Year Annualized Total Return 1 3 Year Annualized Total Return 1 1 Year Annualized Total Return 1 QTD Total Return 4.87% 4.81% 13.56% 20.48% 8.60% $6.67 NAV 5.20% 5.02% 18.67% 35.05% 8.07% $6.95 Price 4.30% 4.17% 5.25% 13.77% 3.09% Morningstar LSTA US Leveraged Loan 100 Index XA INVESTMENTS LLC | XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) QUARTERLY WEBINAR | 12

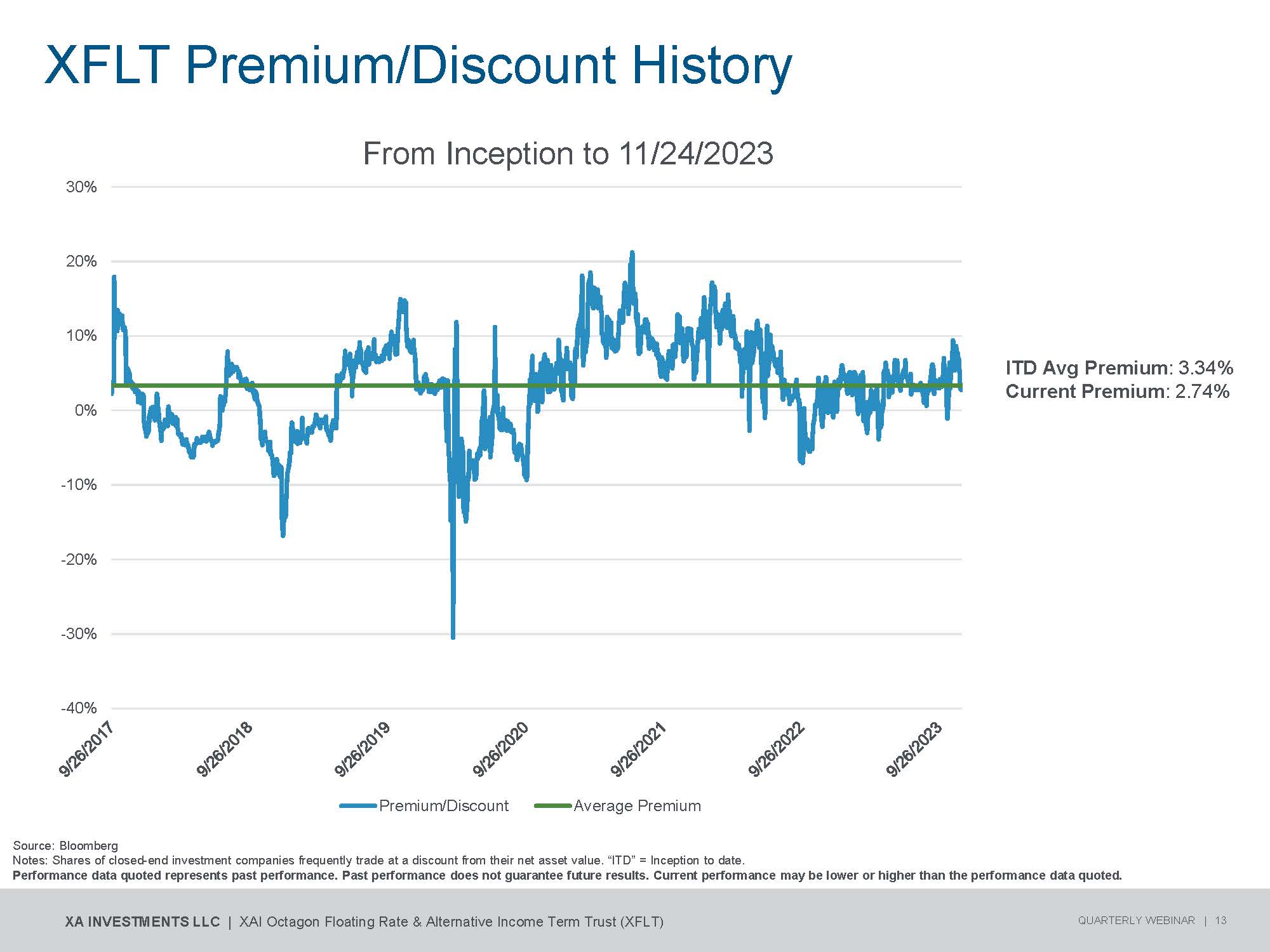

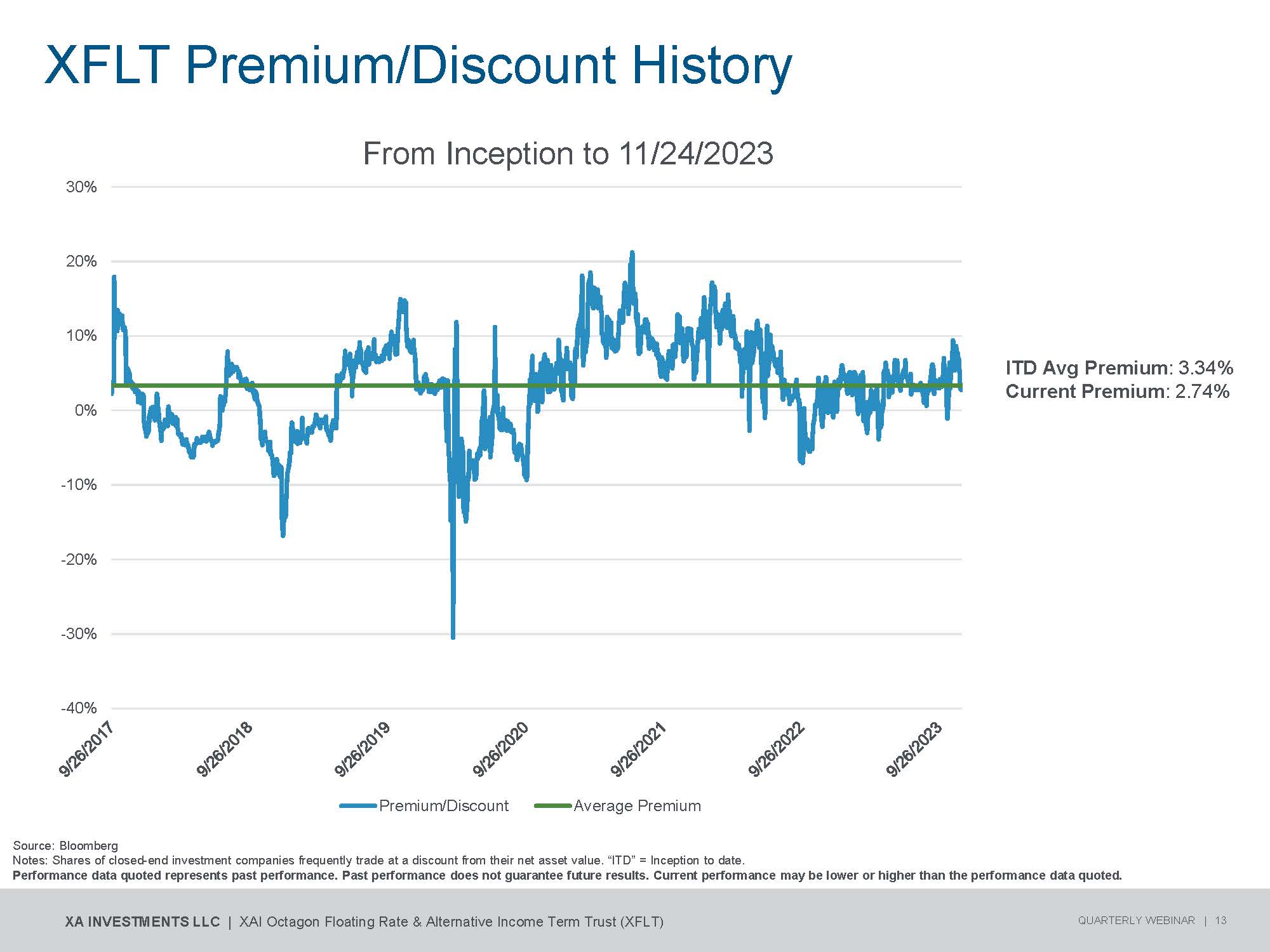

ITD Avg Premium : 3.34% Current Premium : 2.74% XFLT Premium/Discount History From Inception to 11/24/2023 - 4 0 % - 3 0 % - 2 0 % - 1 0 % 0% 1 0 % 2 0 % 3 0 % Premium/Discount Average Premium Source: Bloomberg Notes: Shares of closed - end investment companies frequently trade at a discount from their net asset value. “ITD” = Inception to date. Performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. XA INVESTMENTS LLC | XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) QUARTERLY WEBINAR | 13

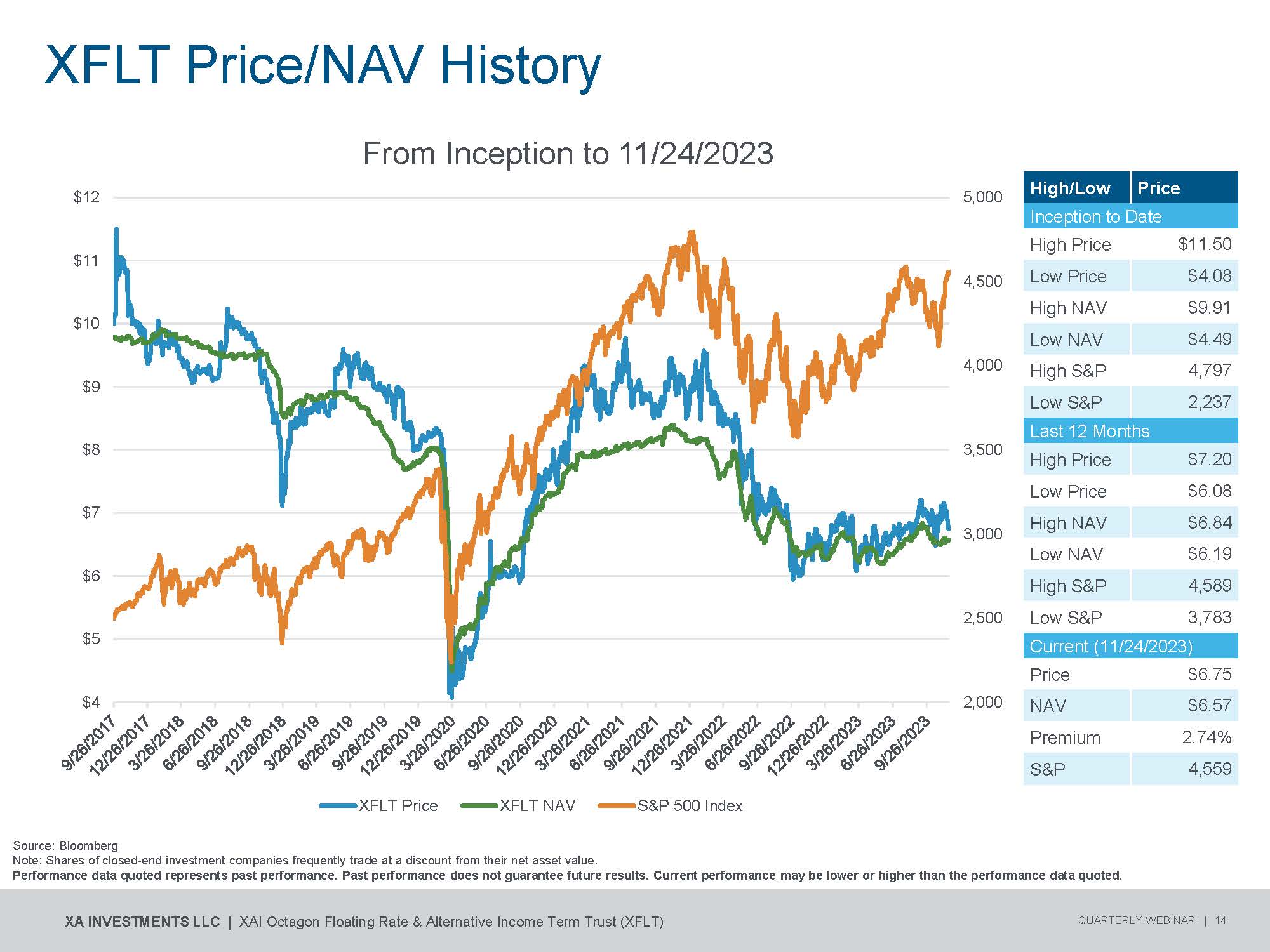

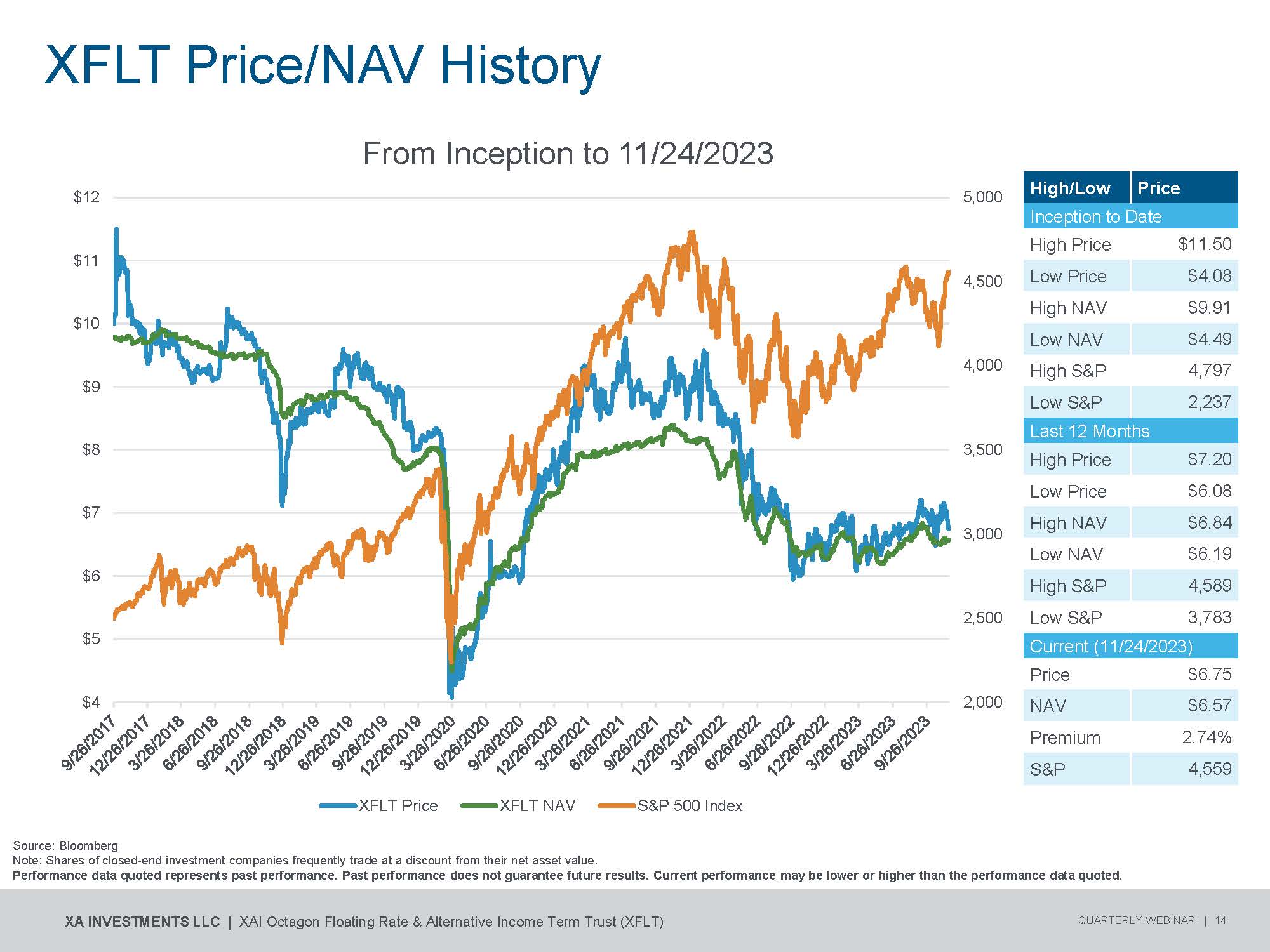

2 , 0 00 2 , 5 00 3 , 0 00 3 , 5 00 4 , 0 00 4 , 5 00 5 , 0 00 $4 $5 $6 $7 $8 $9 $ 1 0 $ 1 1 $ 1 2 XFLT Price XFLT NAV S&P 500 Index Source: Bloomberg Note: Shares of closed - end investment companies frequently trade at a discount from their net asset value. Performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. XA INVESTMENTS LLC | XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) QUARTERLY WEBINAR | 14 From Inception to 11/24/2023 XFLT Price/NAV History Price High/Low Inception to Date $11.50 High Price $4.08 Low Price $9.91 High NAV $4.49 Low NAV 4,797 High S&P 2,237 Low S&P Last 12 Months $7.20 High Price $6.08 Low Price $6.84 High NAV $6.19 Low NAV 4,589 High S&P 3,783 Low S&P Current (11/24/2023) $6.75 Price $6.57 NAV 2.74% Premium 4,559 S&P

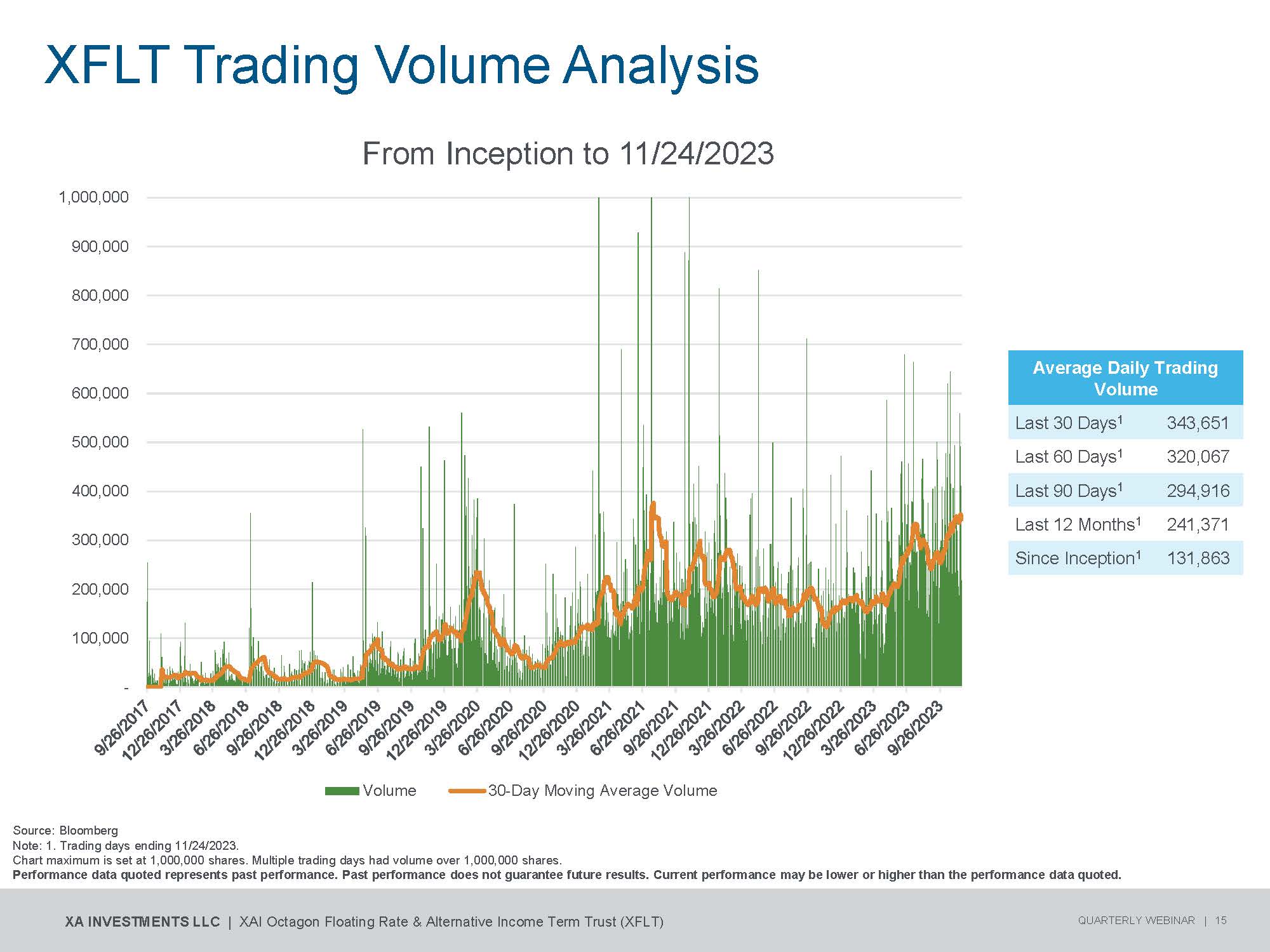

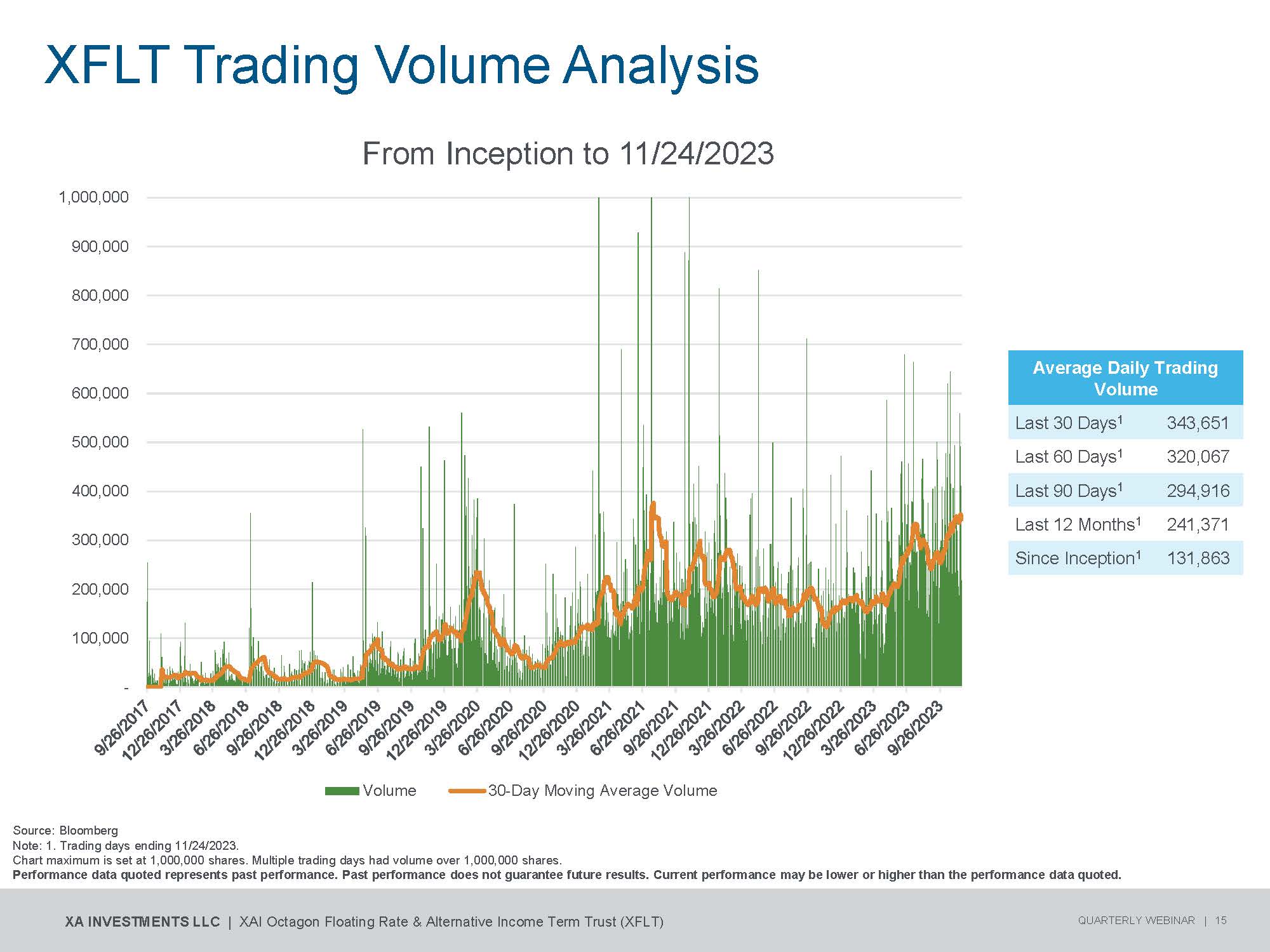

From Inception to 11/24/2023 XF L T T rading V olume Analysis Average Daily Trading Volume 343,651 Last 30 Days 1 320,067 Last 60 Days 1 294,916 Last 90 Days 1 241,371 Last 12 Months 1 131,863 Since Inception 1 1,000,000 900,000 800,000 700,000 600,000 500,000 400,000 300,000 200,000 100,000 - Volume 30 - Day Moving Average Volume Source: Bloomberg Note: 1. Trading days ending 11/24/2023. Chart maximum is set at 1,000,000 shares. Multiple trading days had volume over 1,000,000 shares. Performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. XA INVESTMENTS LLC | XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) QUARTERLY WEBINAR | 15

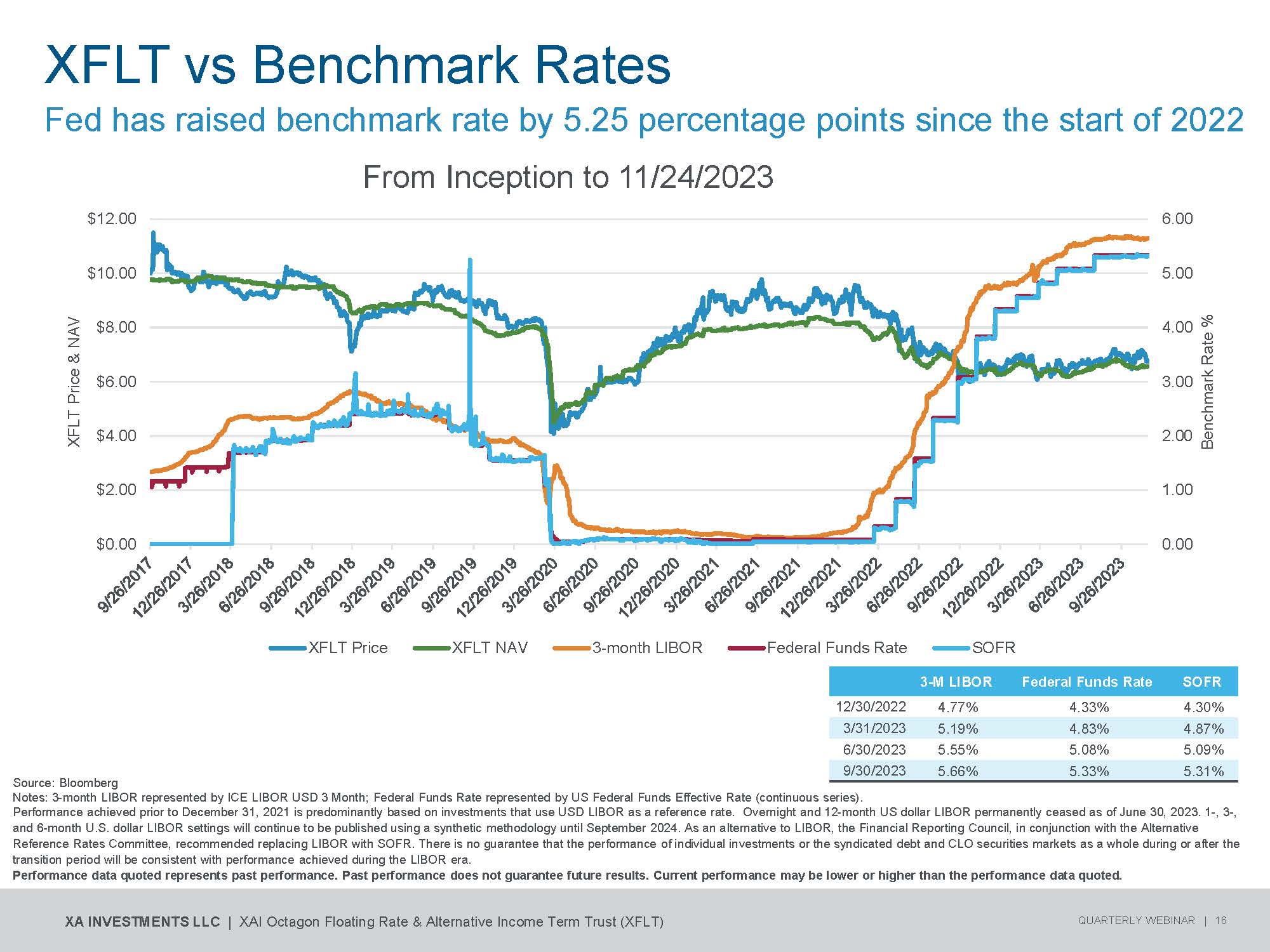

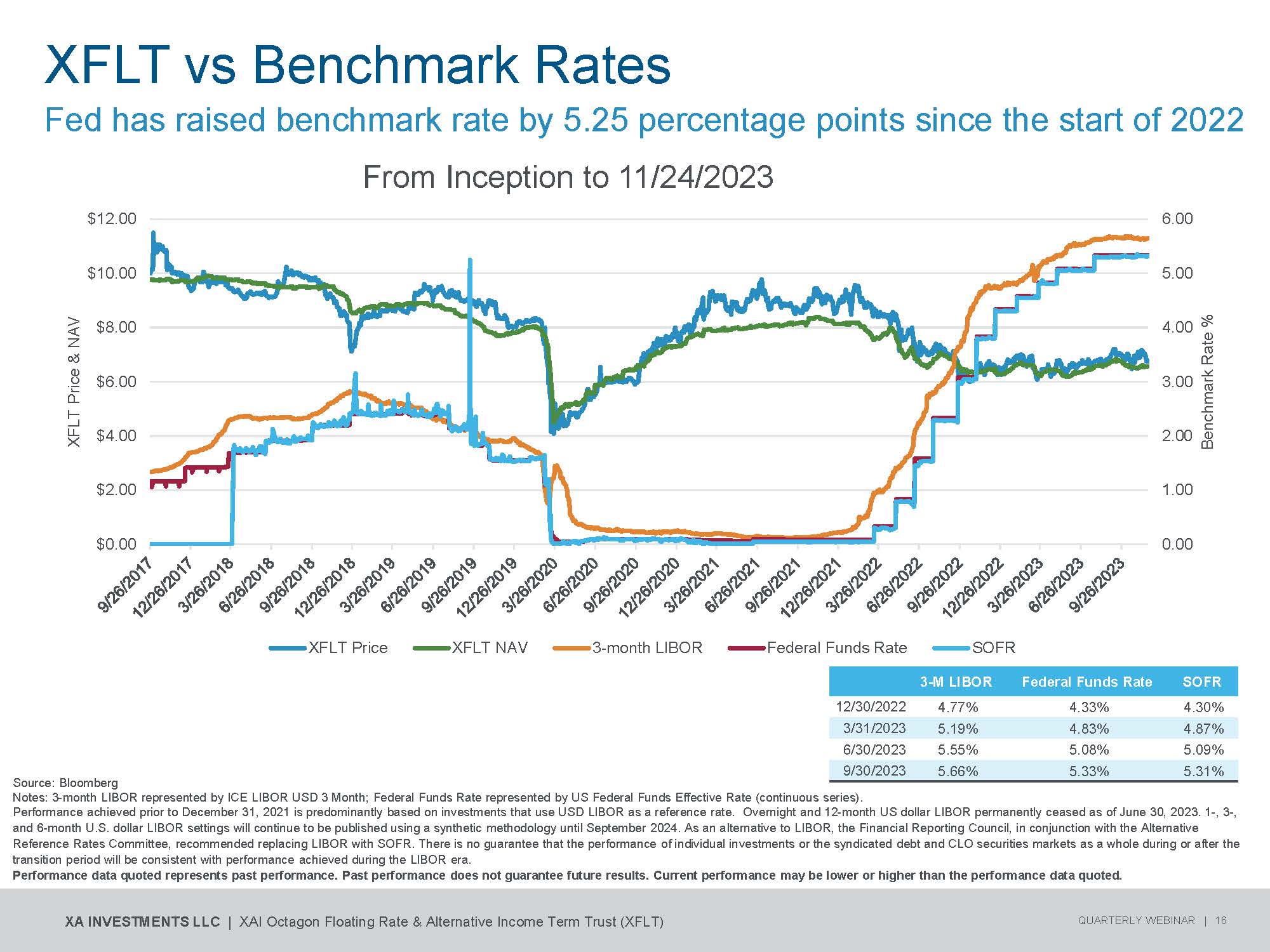

XFLT vs Benchmark Rates Source: Bloomberg Notes: 3 - month LIBOR represented by ICE LIBOR USD 3 Month; Federal Funds Rate represented by US Federal Funds Effective Rate (continuous series). Performance achieved prior to December 31, 2021 is predominantly based on investments that use USD LIBOR as a reference rate. Overnight and 12 - month US dollar LIBOR permanently ceased as of June 30, 2023. 1 - , 3 - , and 6 - month U.S. dollar LIBOR settings will continue to be published using a synthetic methodology until September 2024. As an alternative to LIBOR, the Financial Reporting Council, in conjunction with the Alternative Reference Rates Committee, recommended replacing LIBOR with SOFR. There is no guarantee that the performance of individual investments or the syndicated debt and CLO securities markets as a whole during or after the transition period will be consistent with performance achieved during the LIBOR era. Performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. SOFR Federal Funds Rate 3 - M LIBOR 4.30% 4.33% 4.77% 12/30/2022 4.87% 4.83% 5.19% 3/31/2023 5.09% 5.08% 5.55% 6/30/2023 5.31% 5.33% 5.66% 9/30/2023 Fed has raised benchmark rate by 5.25 percentage points since the start of 2022 From Inception to 11/24/2023 $12.00 6.00 0 . 0 0 1 . 0 0 2. 0 0 3 . 0 0 4 . 0 0 5 . 0 0 $ 0 .0 0 $ 2 .0 0 $ 4 .00 $ 6 .0 0 $ 8 .0 0 $ 1 0 .0 0 Benchmark Rate % XFLT Price & NAV XFLT Pr i c e XFLT NAV 3 - month LIBOR Federal Funds Rate XA INVESTMENTS LLC | XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) QUARTERLY WEBINAR | 16 S O FR

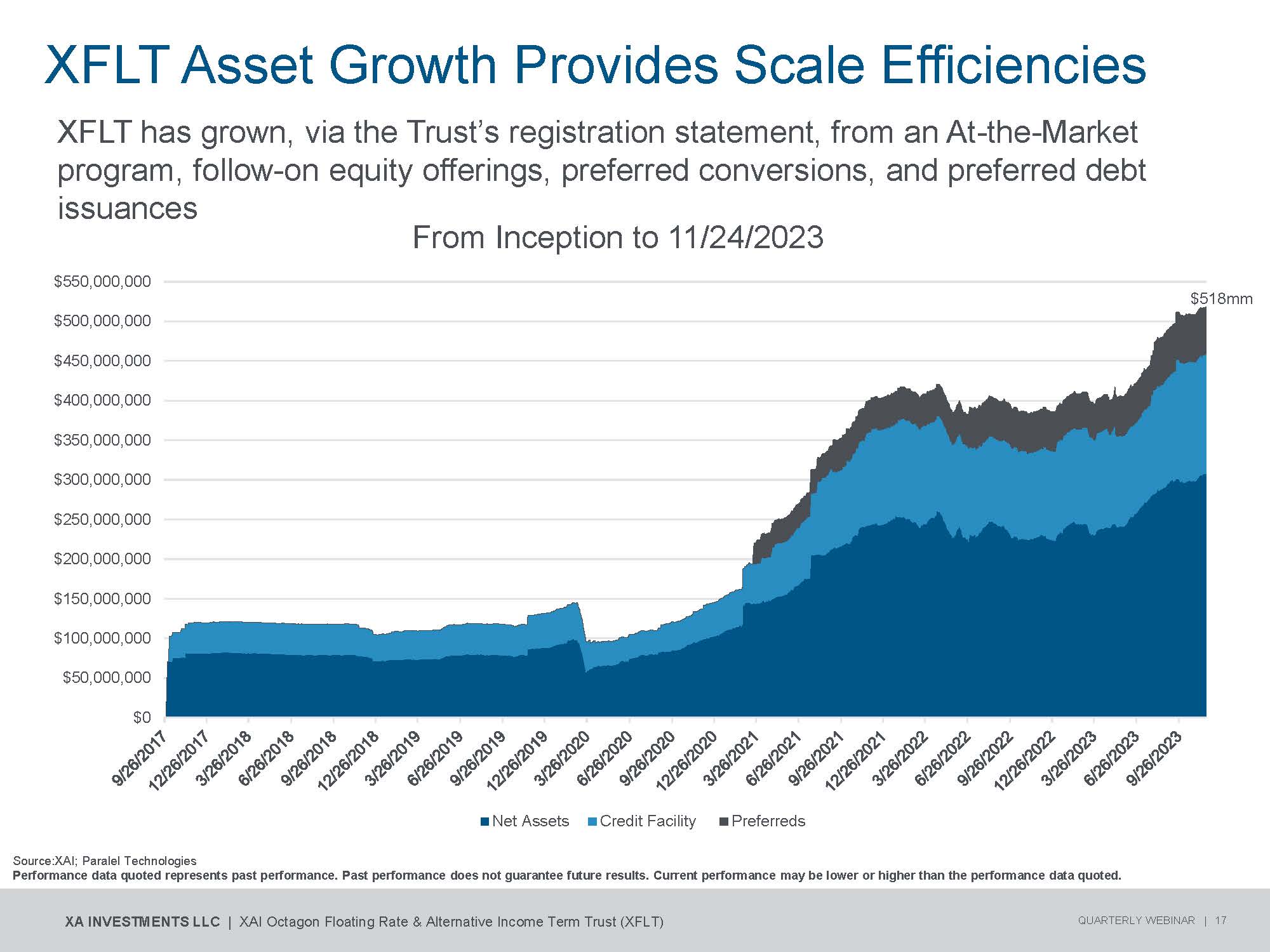

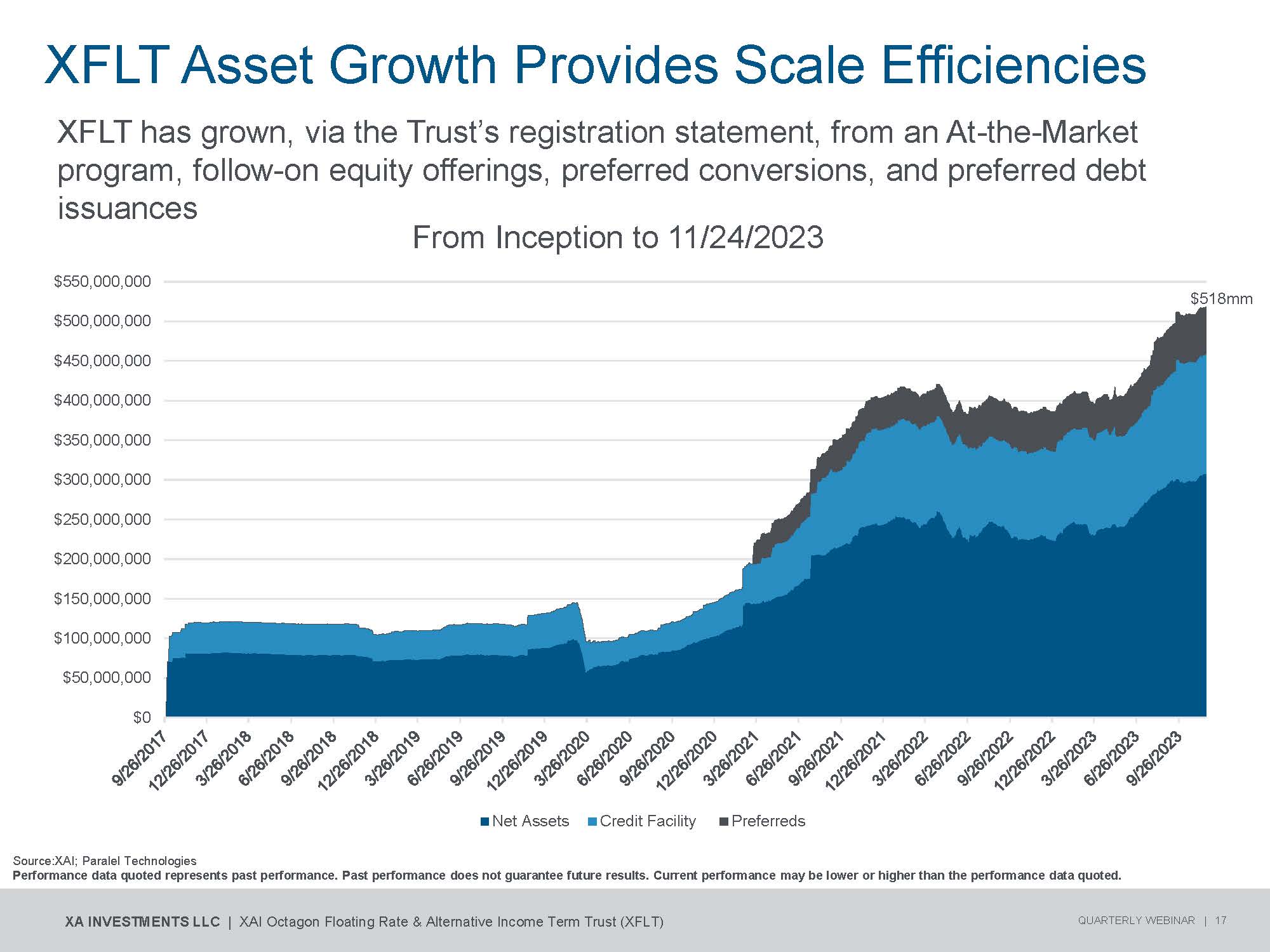

XFLT has grown, via the Trust’s registration statement, from an At - the - Market program, follow - on equity offerings, preferred conversions, and preferred debt issuances From Inception to 11 / 24 / 2023 XF L T Asset G rowth Provides Scale E f ficiencies $518 m m $500,000,000 $450,000,000 $400,000,000 $350,000,000 $300,000,000 $250,000,000 $200,000,000 $150,000,000 $100,000,000 $50,000,000 $0 $550,000,000 Net Assets Credit Facility Preferreds Source:XAI; Paralel Technologies Performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. XA INVESTMENTS LLC | XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) QUARTERLY WEBINAR | 17

XFLT Leverage Sources (as of September 30, 2023) Note 1. As a percent of total managed assets as of 9/30/2023. 2. With a combination of Bank Borrowings and Preferreds, the Trust is allowed to a total leverage limit of up to 50%. 3. Based on Q2 2023 and Q3 2023 average cost of bank borrowings. Preferred Stock Overview 2029 Convertible Preferreds 2 0 26 R etail Preferreds N/A XFLT - PRA NYSE Ticker 6.00% Series 2029 Convertible Preferred Shares 6.50% Series 2026 T erm P re f e r red S h a res Description $20mm $39.9mm Principal $25.00 $24.68 Current Price Per Share 6.00% 6.50% Coupon 6.00% 6.58% Current Yield Quarterly Quarterly Payment Frequency s: Cost of Leverage in Q2 Cost of Leverage in Q3 Regulatory Limit Leverage $ Leverage % 1 Type of Leverage 6.34% 3 6.55% 3 150,350,000 29.60% Bank Borrowings 6.50% 6.50% 39,900,000 7.86% Preferreds (Retail) 6.00% 6.00% 20,000,000 3.94% Preferreds (Convertible) 6.34% 4 6.52% 4 50% 2 210,250,000 41.40% Total Retail Preferred Share Institutional Ownership 21.82% 348,303 Eagle Point Credit Management 16.79% 267,897 Karpus Investment Management 16.03% 255,824 RiverNorth Capital Management 5.01% 80,000 Putnam Investments 4. Represents a weighted average cost of leverage. Performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. XA INVESTMENTS LLC | XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) QUARTERLY WEBINAR | 18 59.65% 952,024 Total Institutional Ownership 100 % 1,596,000 Total Shares Outstanding

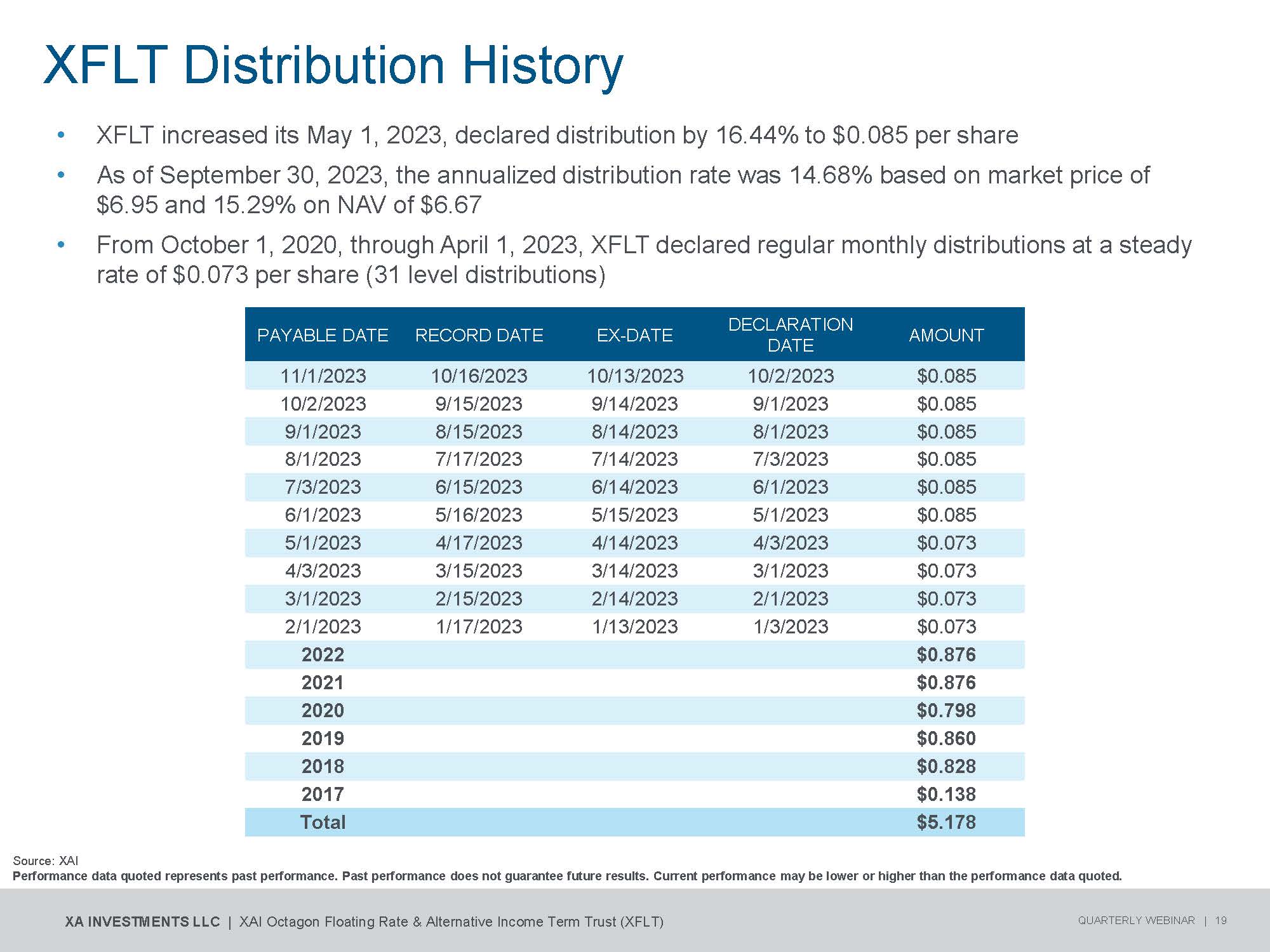

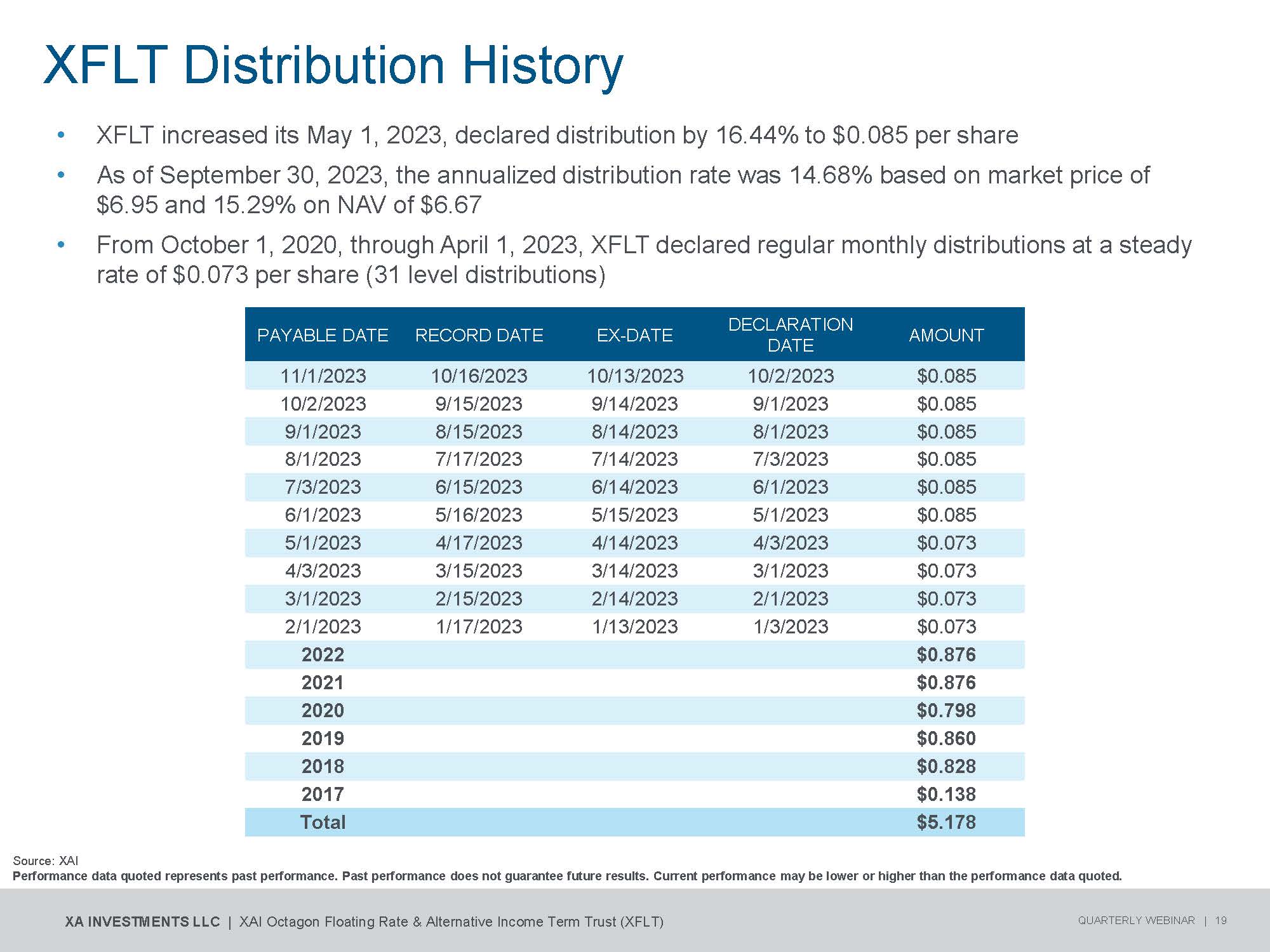

• XFLT increased its May 1, 2023, declared distribution by 16.44% to $0.085 per share • As of September 30, 2023, the annualized distribution rate was 14.68% based on market price of $6.95 and 15.29% on NAV of $6.67 • From October 1, 2020, through April 1, 2023, XFLT declared regular monthly distributions at a steady rate of $0.073 per share (31 level distributions) Source: XAI Performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. XA INVESTMENTS LLC | XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) QUARTERLY WEBINAR | 19 XFLT Distribution History AMOUNT DECLARATION DATE EX - DATE RECORD DATE PAYABLE DATE $0.085 10/2/2023 10/13/2023 10/16/2023 11/1/2023 $0.085 9/1/2023 9/14/2023 9/15/2023 10/2/2023 $0.085 8/1/2023 8/14/2023 8/15/2023 9/1/2023 $0.085 7/3/2023 7/14/2023 7/17/2023 8/1/2023 $0.085 6/1/2023 6/14/2023 6/15/2023 7/3/2023 $0.085 5/1/2023 5/15/2023 5/16/2023 6/1/2023 $0.073 4/3/2023 4/14/2023 4/17/2023 5/1/2023 $0.073 3/1/2023 3/14/2023 3/15/2023 4/3/2023 $0.073 2/1/2023 2/14/2023 2/15/2023 3/1/2023 $0.073 1/3/2023 1/13/2023 1/17/2023 2/1/2023 $0.876 2022 $0.876 2021 $0.798 2020 $0.860 2019 $0.828 2018 $0.138 2017 $5.178 Total

CLO Focused CEFs 1 XFLT Higher, Mainly Preferred Leverage (5 - 8.75%) Combination of Credit Facility and Preferreds (6.52% as of 9/30/2023) Leverage Cost Monthly Estimates; Quarterly Audited Daily NAV Internal, Monthly Estimates; Quarterly Official NAV Independent Third - party Valuations Valuation ~95%+ CLOs ~50% Loans / ~50% CLOs Portfolio Allocation Performance Fees / Higher Management fees 2 No Performance Fee Fees 20.66% (Average of 4 Funds) 14.68% Distribution Rate on M a r k e t Pr ice (9 / 30 / 2023 ) 8.07% (Average of 4 Funds) 2.18% Average Premium LTM (as of 9/30/2023) performance of individual investments or the syndicated debt and CLO securities markets as a whole during or after the transition period will be consistent with performance achieved during the LIBOR era. Performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. XA INVESTMENTS LLC | XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) QUARTERLY WEBINAR | 20 Source: Bloomberg; Company Websites; Adviser ADVs. Notes: 1. Comps include tickers ECC, EIC, OXLC, and OCCI. 2. EIC invests in a mix of CLO debt and equity and has a lower management fee than XFLT and does not charge a performance fee. Distribution rates are not performance and are calculated by summing the monthly distributions per share over twelve months and dividing by the NAV or market price, as applicable, as of the latest month end. Distributions may be comprised of ordinary income, net capital gains, and/or a return of capital (ROC) of your investment in the Trust. To date, a portion of common stock distributions has been estimated to be a return of capital as noted under the Investor Relations section on the Trust’s website. The actual components of the Trust’s distributions for U.S. tax reporting purposes can only be finally determined as of the end of each fiscal year of the Trust and are thereafter reported on Form 1099 - DIV. The Trust’s distributions for fiscal year ended 2023 comprised 100% net income and 0.00% return of capital. The Trust’s distributions for fiscal year ending 2024 will be made available and reported to investors subsequent to the end of fiscal year 2024. A distribution comprised in whole or in part by a return of capital does not necessarily reflect the company’s investment performance and should not be confused with “yield” or “income.” Future distributions may consist of a return of capital. Performance achieved prior to December 31, 2021 is predominantly based on investments that use USD LIBOR as a reference rate. Overnight and 12 - month US dollar LIBOR permanently ceased as of June 30, 2023. 1 - , 3 - , and 6 - month U.S. dollar LIBOR settings will continue to be published using a synthetic methodology until September 2024. As an alternative to LIBOR, the Financial Reporting Council, in conjunction with the Alternative Reference Rates Committee, recommended replacing LIBOR with SOFR. There is no guarantee that the XFLT Comparison with CLO Focused CEFs

4 . 73 % 0% 10% 20% 30% 40% Credit Fundamentals 1. Source: Pitchbook LCD, LLI Default Rates (September 30, 2023). Data for loans represents metrics for the Morningstar LSTA US Leveraged Loan Index (formerly the S&P/LSTA Leveraged Loan Index, the “LLI”). 2. Source: Pitchbook LCD, Morningstar LSTA US Leveraged Loan Index: Current Credit Statistics (June 30, 2023). Data for loans represents metrics for the LLI. 3. Includes issuers with EBITDA greater than $50mm. A VE R A G E L EVE R A G E R A T I O S FO R N E W I SS U E LO A N S 2 , 3 AVERAGE INTEREST COVERAGE OF PUBLIC ISSUERS’ OUTSTANDING LOANS 2,4 D OW N G R A D E PE RC E N T A G E FO R LO A N S ( R OLL IN G 3 - MONTHS) 1 EBITDA GROWTH OF PUBLIC LEVERAGED LOAN ISSUERS 2,4 • EBITDA growth of public companies (weighted toward better - quality BB rated credits) remains positive • Interest coverage and leverage ratios for publicly reporting companies remain healthy by historical standards, though the rapid increase in interest rates poses a heightened risk of earnings deterioration 0 . 0 x 2 . 0 x 4 . 0 x 6 . 0 x 8 . 0 x First Lien Debt/EBITDA Other Sr Debt/EBITDA Second Lien Debt/EBITDA Subordinated Debt/EBITDA 4.1 3.6 4.2 4 .6 4.1 3.9 3.8 4.3 4.6 4.8 5.5 5.8 5.7 5.4 5.6 5.5 5.0 4.6 4 .1 7 . 0 x 6 . 0 x 5 . 0 x 4 . 0 x 3 . 0 x 2 . 0 x 1 . 0 x 0 . 0 x 2015 2016 2017 2018 2019 1 Q 2 0 2 Q 2 0 3 Q 2 0 4 Q 2 0 1 Q 2 1 2 Q 2 1 3 Q 2 1 4 Q 2 1 1 Q 2 2 2 Q 2 2 3Q22 4 Q 2 2 1 Q 2 3 2 Q 2 3 Weighted Average 30% 20% 10% 0% - 10% - 20% - 30% Weighted Average 4. The sample for the latest quarter includes 168 issuers within the LLI that file results publicly, or 14% of the Index. For this analysis, LCD draws its performance metrics and total debt levels from S&P Capital IQ. Performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. XA INVESTMENTS LLC | XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) QUARTERLY WEBINAR | 21

Technical Dynamics R E T A I L LO A N F UN D FLOW S 3 VS . 2 - 10 Y U S T SP R E A D S IN S T I T U T I O N A L N E W I SS U E L EVE R A G E D LO A N V OL U M E 4 QUARTERLY US CLO TOTAL VOLUME 2 Supply and demand outlook appears steady $120B $100B $80B $60B $40B $20B $0B Ne w i s s u e s Re fin an c in g s Re s e t s 300 250 200 150 100 50 0 - 50 - 100 - 150 - $20 - $15 - $10 - $5 $0 $5 $10 $15 2 - 10 Year Treasury Spread (bps) Mutual Fund Flows ($B) $0B $50B $100B $150B $200B M&A Refinancing Dividend Recap 1. Source: Pitchbook LCD, “September Wrap: Loans continue to rally despite losses in other asset classes” (October 2, 2023). 2. Source: Pitchbook LCD, LCD Global CLO Databank (September 30, 2023). 3. Source: Pitchbook LCD, Lipper, Standard & Poor’s Structured Finance Group, JP Morgan, Merrill Lynch, Citigroup, Morningstar LSTA US Leveraged Loan Index (September 30, 2023). O t h e r 4. Source: Pitchbook LCD, “LCD Quarterly Review: Third Quarter 2023, Commentary Charts” (September 30, 2023). Data for loans represents metrics for the Morningstar LSTA US Leveraged Loan Index. Performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. XA INVESTMENTS LLC | XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) QUARTERLY WEBINAR | 22

Strong YTD Performance for Loans Source : Bloomberg, JPMorgan Markets from January 1 , 2023 to September 30 , 2023 . Senior secured loans are represented by the Morningstar LSTA US Leveraged Loan Index, high yield bonds are represented by the ICE/BofA US High Yield Bond Index, TIPS are represented by the Bloomberg US Treasury TIPS 0 - 5 Years Total Return Index, Aggregate Bonds are represented by the Bloomberg US Aggregate Bond Index, which encompasses Investment Grade, taxable fixed - rate bonds, corporate bonds are represented by ICE/BofA US Corporate Index, Municipal Bonds are represented by the Bloomberg Municipal Bond Index 22 + Yr and U . S . Treasury 10.16% 5.97% 1.92% 0.45% - 7.16% - 1.21% - 2.03% - 10% Bonds are represented by the Bloomberg US Treasury Bond 10 - 20 Year Index. An investment cannot be made directly in an index. Holdings in any relevant index may differ materially from holdings in XFLT. Performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. XA INVESTMENTS LLC | XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) QUARTERLY WEBINAR | 23 - 5% 0% 5% 10% As of 9/30/2023, loans are outpacing other credit asset classes on both a YTD and LTM basis YTD PERFORMANCE AS OF 9/30/2023 15% Morningstar LSTA ICE/BofA US High Yield Bloomberg US Treasury ICE/BofA US Corporate Bloomberg US Leveraged Loan Index Index TIPS 0 - 5 Year Index Index Aggregate Bond Index Bloomberg Municipal Bloomberg US Treasury Bond Index Index 10 - 20 Year

XFLT CLO Debt & CLO Equity Portfolio Characteristics 1 1. Represents CLO Debt and CLO Equity positions as of September 30, 2023. 2. Portfolio Statistics are based upon par value. Excludes the following CLO equity position, which has been called: THL Credit Wind River 2016 - 1 CLO, LTD. Totals may not foot to 100% due to rounding. 3. Statistics presented above are calculated on a weighted average basis across the aggregate collateral pools, and reflect the weighted average notional value of underlying collateral as of September 30, 2023. Sources: PORTFOLIO STATISTICS 2 September 2017 Account Inception Date 150 # of Positions 27 # of Collateral Managers 3.7% Average Manager Exposure 12.4% par / 13.3% cost Largest Manager Exposure ORIGINAL RATING % of Cost % of Par 0.4% 0.3% BBB 29.2% 23.2% BB 1.6% 1.3% B 68.8% 75.1% Equity ORIGINAL DEAL VINTAGE % of Cost % of Par 0.4% 0.3% 2013 4.8% 8.1% 2015 3.3% 3.5% 2016 6.4% 6.8% 2017 10.8% 10.6% 2018 19.5% 17.7% 2019 12.5% 10.9% 2020 29.9% 31.5% 2021 11.8% 10.1% 2022 0.6% 0.5% 2023 TOP 10 INDUSTRIES IN UNDERLYING PORTFOLIO: 68.5% 3 TOP 10 OBLIGORS IN UNDERLYING PORTFOLIO: 5.2% 3 13 . 4 % 11 . 2 % 9 . 5 % 9 . 4 % 4.5% 4.5% 4 . 2 % 4 . 0 % 4.0% 3 . 8 % H igh T e ch Healthcare & Pharmaceuticals Banking, Finance, Insurance & Real Estate Services: Business Telecommunications Hotels, Gaming & Leisure Chemicals, Plastics & Rubber Media: Broadcasting & Subscription Construction & Building Services: Consumer 0 . 6 % 0 . 6 % 0 . 6 % 0 . 5 % 0 . 5 % 0 . 5 % 0 . 5 % 0 . 5 % 0 . 5 % 0 . 5 % 1. Medline Industries 2. Altice France 3. UKG 4. Peraton 5. Athenahealth 6. Acrisure 7. TransDigm 8. IRB Holding 9. AssuredPartners Capital 10. Asurion Kanerai / Intex (calculated on October 13, 2023), which utilizes data from the most recent trustee reports for each underlying collateral portfolio comprising the above statistics. Performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. XA INVESTMENTS LLC | XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) QUARTERLY WEBINAR | 24

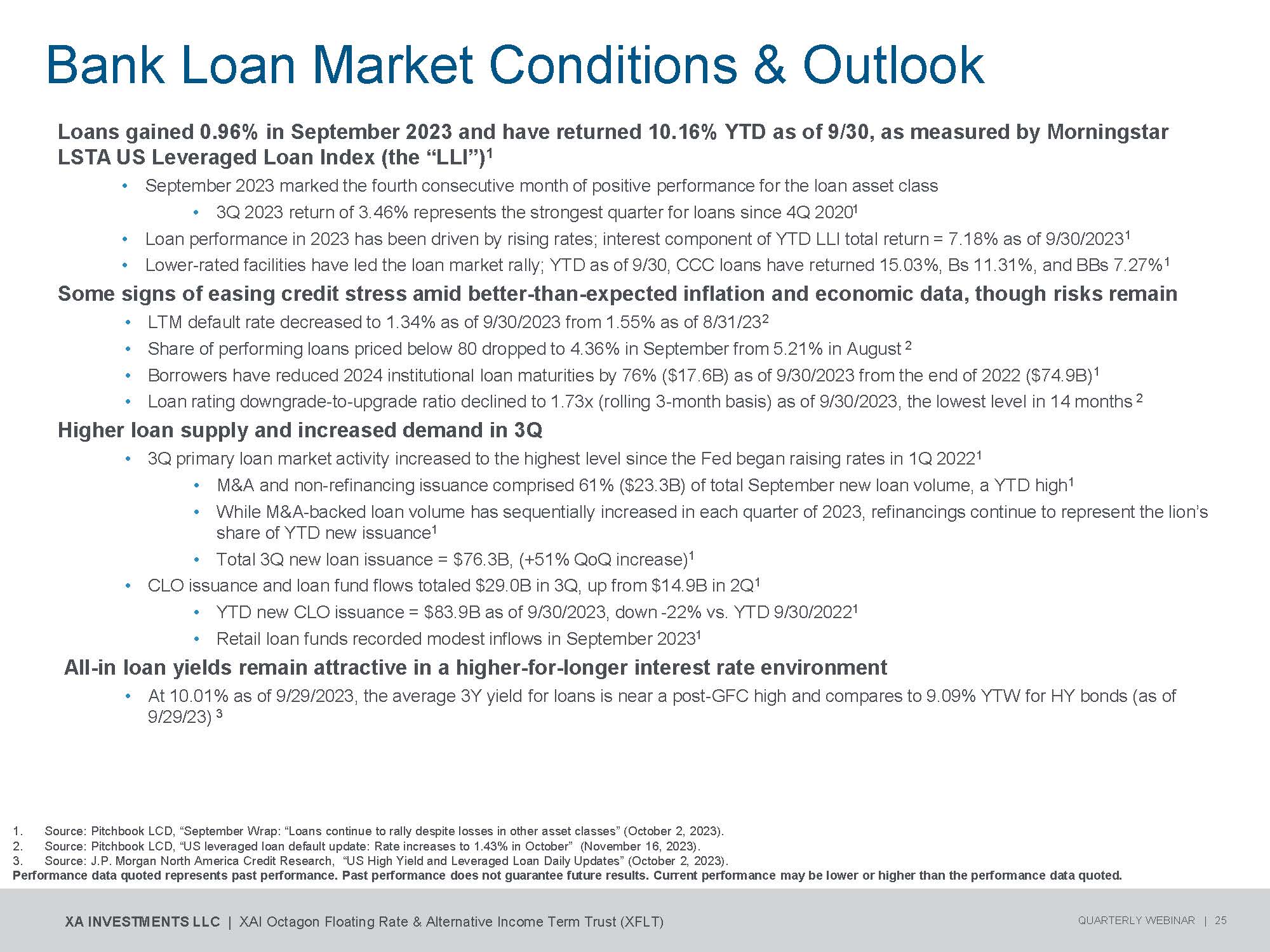

Bank Loan Market Conditions & Outlook 3. Source: J.P. Morgan North America Credit Research, “US High Yield and Leveraged Loan Daily Updates” (October 2, 2023). Performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. XA INVESTMENTS LLC | XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) QUARTERLY WEBINAR | 25 1. Source: Pitchbook LCD, “September Wrap: “Loans continue to rally despite losses in other asset classes” (October 2, 2023). 2. Source: Pitchbook LCD, “US leveraged loan default update: Rate increases to 1.43% in October” (November 16, 2023). Loans gained 0.96% in September 2023 and have returned 10.16% YTD as of 9/30, as measured by Morningstar LSTA US Leveraged Loan Index (the “LLI”) 1 • September 2023 marked the fourth consecutive month of positive performance for the loan asset class • 3Q 2023 return of 3.46% represents the strongest quarter for loans since 4Q 2020 1 • Loan performance in 2023 has been driven by rising rates; interest component of YTD LLI total return = 7.18% as of 9/30/2023 1 • Lower - rated facilities have led the loan market rally; YTD as of 9/30, CCC loans have returned 15.03%, Bs 11.31%, and BBs 7.27% 1 Some signs of easing credit stress amid better - than - expected inflation and economic data, though risks remain • LTM default rate decreased to 1.34% as of 9/30/2023 from 1.55% as of 8/31/23 2 • Share of performing loans priced below 80 dropped to 4.36% in September from 5.21% in August 2 • Borrowers have reduced 2024 institutional loan maturities by 76% ($17.6B) as of 9/30/2023 from the end of 2022 ($74.9B) 1 • Loan rating downgrade - to - upgrade ratio declined to 1.73x (rolling 3 - month basis) as of 9/30/2023, the lowest level in 14 months 2 Higher loan supply and increased demand in 3Q • 3Q primary loan market activity increased to the highest level since the Fed began raising rates in 1Q 2022 1 • M&A and non - refinancing issuance comprised 61% ($23.3B) of total September new loan volume, a YTD high 1 • While M&A - backed loan volume has sequentially increased in each quarter of 2023, refinancings continue to represent the lion’s share of YTD new issuance 1 • Total 3Q new loan issuance = $76.3B, (+51% QoQ increase) 1 • CLO issuance and loan fund flows totaled $29.0B in 3Q, up from $14.9B in 2Q 1 • YTD new CLO issuance = $83.9B as of 9/30/2023, down - 22% vs. YTD 9/30/2022 1 • Retail loan funds recorded modest inflows in September 2023 1 All - in loan yields remain attractive in a higher - for - longer interest rate environment • At 10.01% as of 9/29/2023, the average 3Y yield for loans is near a post - GFC high and compares to 9.09% YTW for HY bonds (as of 9/29/23) 3

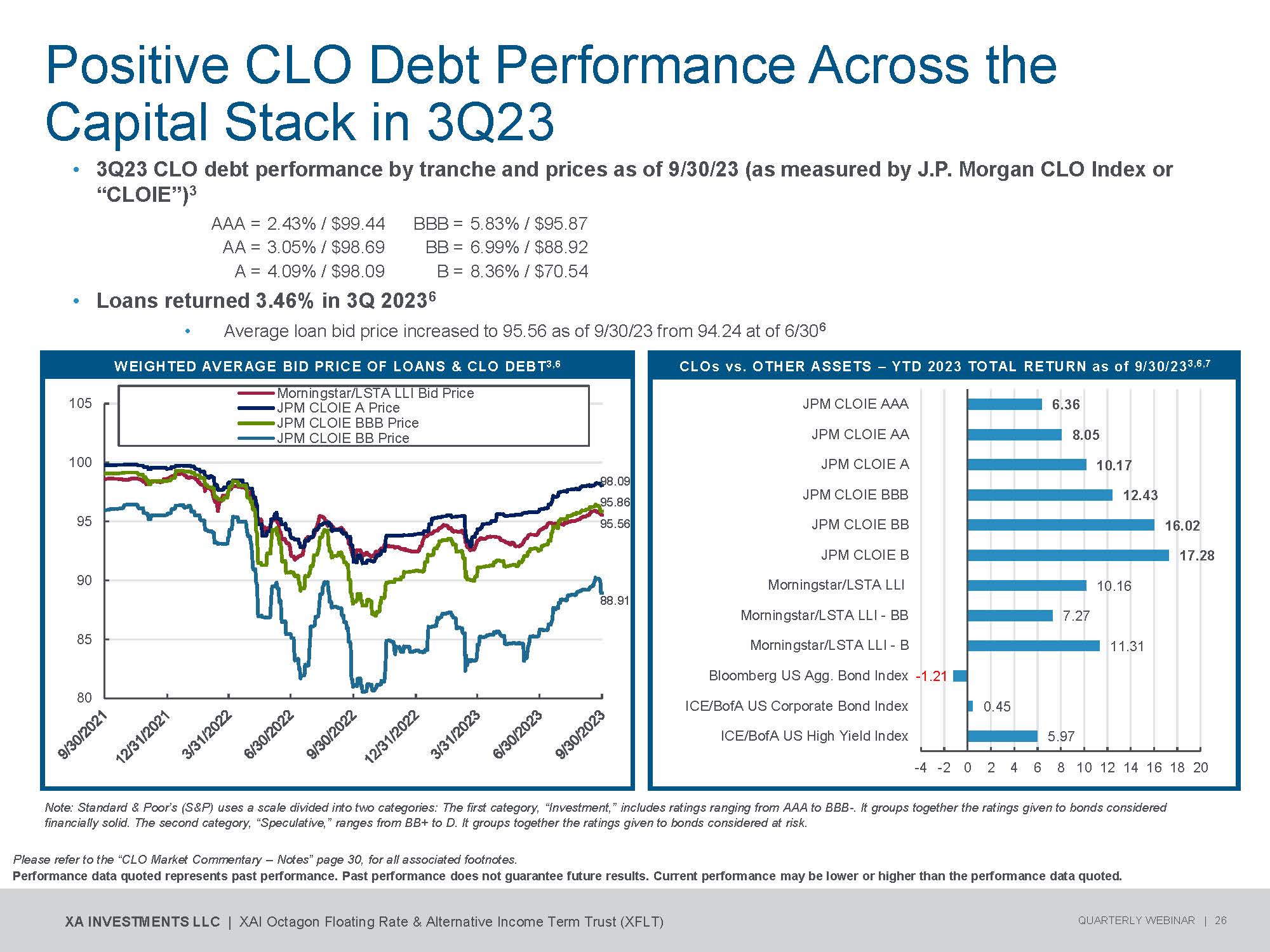

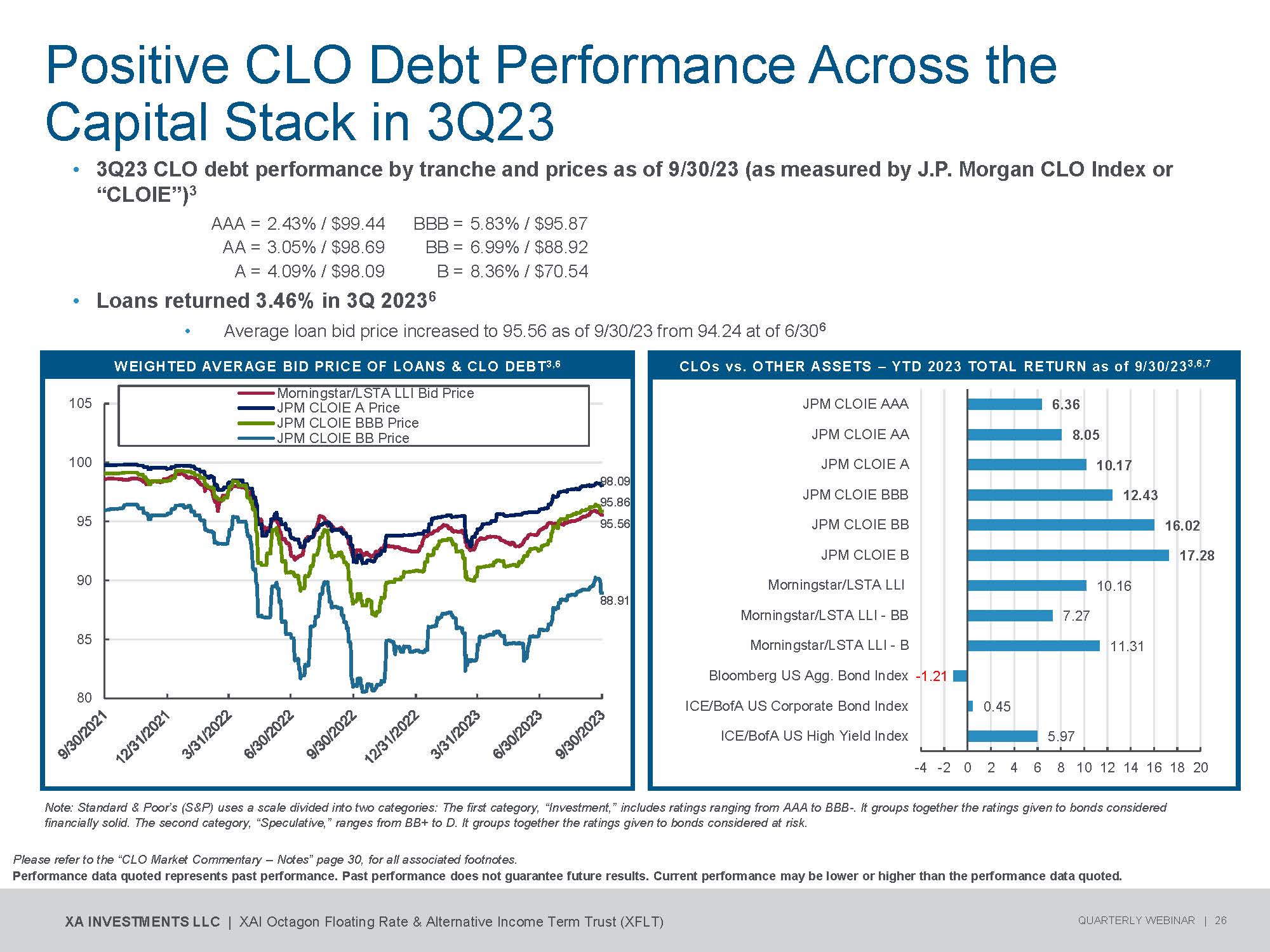

Positive CLO Debt Performance Across the Capital Stack in 3Q23 • 3Q23 CLO debt performance by tranche and prices as of 9/30/23 (as measured by J.P. Morgan CLO Index or “CLOIE”) 3 • Loans returned 3.46% in 3Q 2023 6 • Average loan bid price increased to 95.56 as of 9/30/23 from 94.24 at of 6/30 6 WEIGHTED AVERAGE BID PRICE OF LOANS & CLO DEBT 3,6 CLOs vs. OTHER ASSETS – YTD 2023 TOTAL RETURN as of 9/30/23 3,6,7 5.83% / $95.87 BBB = 2.43% / $99.44 AAA = 6.99% / $88.92 BB = 3.05% / $98.69 AA = 8.36% / $70.54 B = 4.09% / $98.09 A = 80 85 90 95 100 105 Morningstar/LSTA LLI Bid Price JPM CLOIE A Price JPM CLOIE BBB Price JPM CLOIE BB Price 5 . 9 7 Please refer to the “CLO Market Commentary – Notes” page 30, for all associated footnotes. Performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. XA INVESTMENTS LLC | XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) QUARTERLY WEBINAR | 26 0 . 4 5 11 . 3 1 7 . 2 7 10 . 1 6 17 . 2 8 16 . 0 2 ICE/BofA US High Yield Index ICE/BofA US Corporate Bond Index Bloomberg US Agg. Bond Index - 1.21 Morningstar/LSTA LLI - B JPM CLOIE B Morningstar/LSTA LLI Morningstar/LSTA LLI - BB JPM CLOIE AAA 6.36 JPM CLOIE AA 8.05 JPM CLOIE A 10.17 JPM CLOIE BBB 12.43 JPM CLOIE BB - 4 - 2 0 2 4 6 8 10 12 14 16 18 20 Note: Standard & Poor’s (S&P) uses a scale divided into two categories: The first category, “Investment,” includes ratings ranging from AAA to BBB - . It groups together the ratings given to bonds considered financially solid. The second category, “Speculative,” ranges from BB+ to D. It groups together the ratings given to bonds considered at risk. 98 . 0 9 95.8 6 95 . 5 6 88 . 9 1

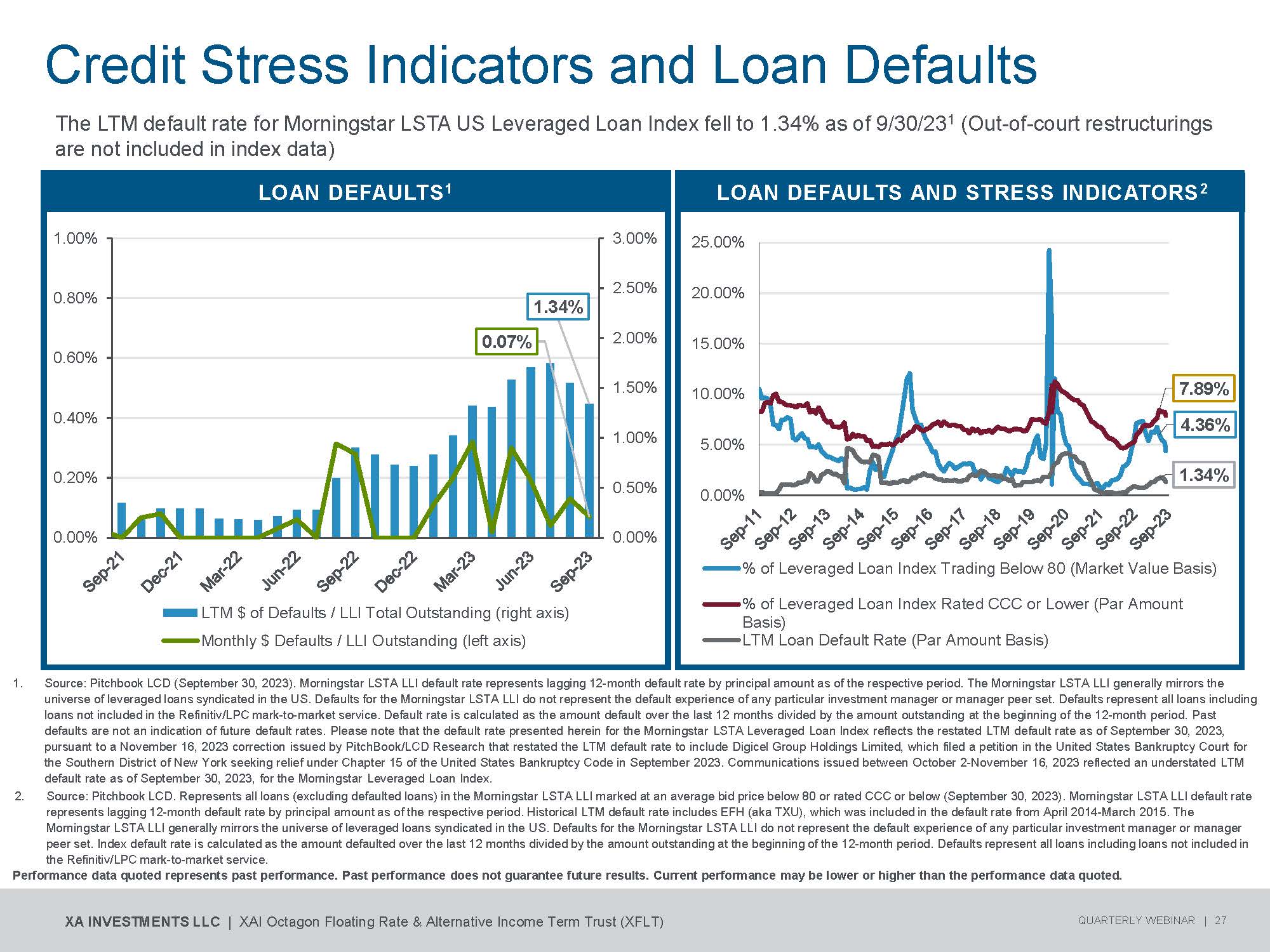

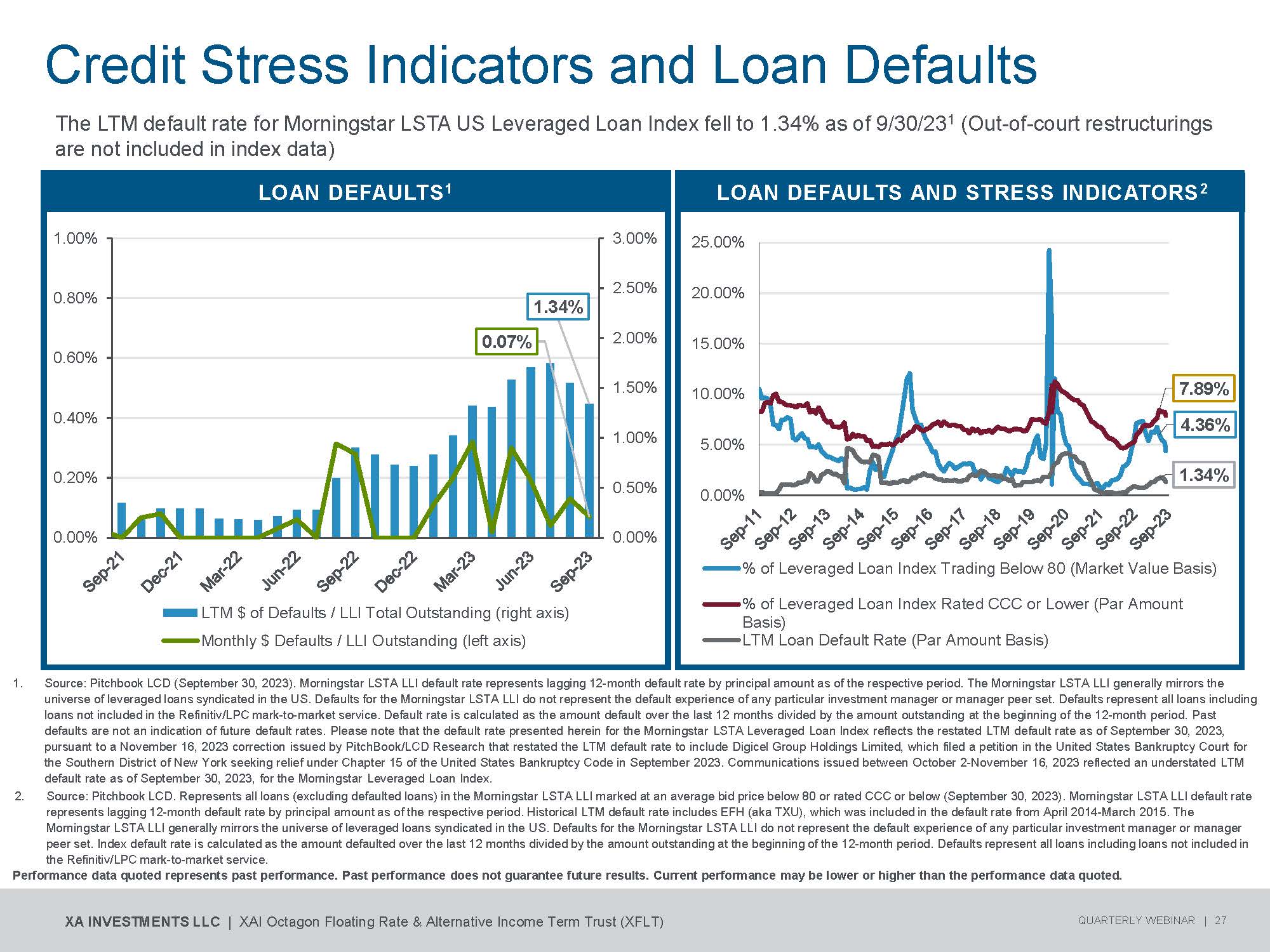

Credit Stress Indicators and Loan Defaults 1. Source: Pitchbook LCD (September 30, 2023). Morningstar LSTA LLI default rate represents lagging 12 - month default rate by principal amount as of the respective period. The Morningstar LSTA LLI generally mirrors the universe of leveraged loans syndicated in the US. Defaults for the Morningstar LSTA LLI do not represent the default experience of any particular investment manager or manager peer set. Defaults represent all loans including loans not included in the Refinitiv/LPC mark - to - market service. Default rate is calculated as the amount default over the last 12 months divided by the amount outstanding at the beginning of the 12 - month period. Past defaults are not an indication of future default rates. Please note that the default rate presented herein for the Morningstar LSTA Leveraged Loan Index reflects the restated LTM default rate as of September 30, 2023, pursuant to a November 16, 2023 correction issued by PitchBook/LCD Research that restated the LTM default rate to include Digicel Group Holdings Limited, which filed a petition in the United States Bankruptcy Court for the Southern District of New York seeking relief under Chapter 15 of the United States Bankruptcy Code in September 2023. Communications issued between October 2 - November 16, 2023 reflected an understated LTM default rate as of September 30, 2023, for the Morningstar Leveraged Loan Index. 2. Source: Pitchbook LCD. Represents all loans (excluding defaulted loans) in the Morningstar LSTA LLI marked at an average bid price below 80 or rated CCC or below (September 30, 2023). Morningstar LSTA LLI default rate represents lagging 12 - month default rate by principal amount as of the respective period. Historical LTM default rate includes EFH (aka TXU), which was included in the default rate from April 2014 - March 2015. The Morningstar LSTA LLI generally mirrors the universe of leveraged loans syndicated in the US. Defaults for the Morningstar LSTA LLI do not represent the default experience of any particular investment manager or manager peer set. Index default rate is calculated as the amount defaulted over the last 12 months divided by the amount outstanding at the beginning of the 12 - month period. Defaults represent all loans including loans not included in The LTM default rate for Morningstar LSTA US Leveraged Loan Index fell to 1.34% as of 9/30/23 1 (Out - of - court restructurings are not included in index data) LOAN DEFAULTS AND STRESS INDICATORS 2 25.00% 20.00% 15.00% 10.00% 7.89% 4.36% 5.00% 1.34% 0.00% % of Leveraged Loan Index Trading Below 80 (Market Value Basis) % of Leveraged Loan Index Rated CCC or Lower (Par Amount Basis) LTM Loan Default Rate (Par Amount Basis) LOAN DEFAULTS 1 1.00% 3.00% 2.50% 0.80% 1.34% 0.07% 2.00% 0.60% 1.50% 0.40% 1.00% 0.20% 0.50% 0.00% 0.00% LTM $ of Defaults / LLI Total Outstanding (right axis) Monthly $ Defaults / LLI Outstanding (left axis) t h e R e fi n itiv/ L P C m ar k - to - m ar k e t s er vice. Performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. XA INVESTMENTS LLC | XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) QUARTERLY WEBINAR | 27

Current Loan Yields are Above Historical Median, Trailing Defaults Remain Low 1. Represents the Yield to Maturity for the Morningstar LSTA LLI. “Long Term Median Yield to Maturity” represents the median of Yield to Maturity at month - end starting January 31, 2010. 2. Represents lagging 12 - month default rate for the Morningstar LSTA Leveraged Loan Index (LLI) by principal amount as of September 30, 2023. Default rate is calculated as the amount default over the last 12 months divided by the amount outstanding at the beginning of the 12 - month period. Represents all loans including loans not included in the Refinitiv/LPC mark - to - market service. Source: LCD News (September 30, 2023). Past defaults are not an indication of future default rates. Please note that the default rate presented herein for the Morningstar LSTA Leveraged Loan Index reflects the restated LTM default rate as of October 31, 2023, pursuant to a November 16, 2023 correction issued by PitchBook/LCD Research that restated the LTM default rate to include Digicel Group Holdings Limited, which filed a petition in the United States Bankruptcy Court for the Southern District of New York seeking relief under Chapter 15 of the United States Bankruptcy Code in September 2023. Communications issued between October 2 - November 16, 2023 reflected an understated LTM default rate as of September 30, 2023, for the Morningstar Leveraged Loan Index. 3. Represents the long - term historical average (beginning in January 2000 ) of the lagging 12 - month default rate for the Morningstar LSTA Leveraged Loan Index by principal amount as of September 30 , 2023 . Default rate is calculated as the amount of default over the last 12 months divided by the amount outstanding at the beginning of the 12 - month period . Represents all loans including loans not included in the Refinitiv/LPC mark - to - market service . Source : LCD News (September 30 , 2023 ) . Past defaults are not an indication of future default rates . 4. Represents the 3 Year Discount Margin for the Morningstar LSTA LLI . “Long Term Median Loan 3 Yr Discount Margin” represents the median of 3 Year Discount Margins at month - end starting January 31 , 2010 . 5. Represents the average of all outstanding 1 and 3 Month LIBOR/SOFR contracts tracked by Markit . Performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. • Average loan yield - to - maturity as of 9/30/2023 = 10.30% vs. long - term median of 5.59% 1 • LTM loan default rate = 1.34% as of 9/30/2023 2 vs. long - term average of 2.6% 3 HISTORICAL LOAN YIELDS AND DEFAULT RATE 1,2,4,5 0 . 00 % 2 . 00 % 4 . 00 % 6 . 00 % 8 . 00 % 10 . 00 % 0 bp s 20 0 bp s 40 0 bp s 60 0 bp s 80 0 bp s 100 0 bp s 1200 bps 12.00% S e p - 1 1 S e p - 1 2 S e p - 2 3 S e p - 1 3 S e p - 1 4 S e p - 1 5 S e p - 1 6 S e p - 1 7 S e p - 1 8 S e p - 1 9 S e p - 2 0 S e p - 2 1 S e p - 2 2 LTM Loan Default Rate 3 Year DM Yield to Maturity LIBOR/SOFR avg. Base Rate XA INVESTMENTS LLC | XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) QUARTERLY WEBINAR | 28

CLO Market Themes & Outlook XA INVESTMENTS LLC | XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) QUARTERLY WEBINAR | 29 Please refer to the “CLO Market Commentary – Notes” page 30, for all associated footnotes. Performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. Pace of new CLO formation accelerated in 3Q 2023; $28B of deals priced during the quarter (vs. $22B in 2Q) 1 • YTD new CLO issuance = $83.9B as of 9/30/2023, down - 22% vs. YTD 9/30/2022 1 • Current forward pipeline suggests primary CLO issuance may remain stable through year - end • Shifting CLO AAA demand may constrain new deal issuance over the near - term Primary CLO spreads broadly tightened in 3Q, 2 though new issue arbitrage remains challenged • Primary CLO liability spreads generally lagged secondary spread levels in 3Q • Average new issue CLO AAA spread tightened to S+189bps in 3Q from S+198bps in 2Q (vs. S+231bps at YE 2022) 2 • Primary AAA spreads for top - tier managers narrowed to YTD tights (inside S+170bps) during 3Q 2 • Primary AAA spread basis between top - tier managers and lower - tier managers compressed in 3Q to 26bps, from 32 bps in 2Q 2 • In 3Q, the weighted average cost of liabilities across the CLO capital stack (S+260bps) compressed by 15bps QoQ 2 • Primary CLO liability spreads have since widened from tights observed in 3Q Risk assets continued to outperform through 3Q, which provided some support for CLO collateral portfolios, though negative loan ratings actions persist • Rate volatility caught up with the loan market towards quarter - end, as returns trended downward towards in the last week of September 2023, particularly for lower - rated assets CLO debt tranches posted positive 3Q returns, and continue to outpace other comparably rated assets on a YTD basis 3,4,5 • CLO AAA tranches have returned 6.36% YTD as of 9/30 3 vs. - 1.43% for AAA corporate bonds 4 • CLO BB tranches have returned 16.02% YTD as of 9/30 3 vs. 4.40% for BB HY bonds 5 • CLO mezzanine tranches (BB, B) have posted the strongest YTD performance of credit assets 3,6,7 “Higher - for longer” expectations should support above - average returns for CLO tranches over the intermediate term • CLO debt yields are currently near historic wides due to elevated base rates

CLO Market Commentary - Notes XA INVESTMENTS LLC | XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) QUARTERLY WEBINAR | 30 1. Source: Pitchbook LCD, “CLO Global Databank” (retrieved from www.lcdcomps.com, October 10, 2023). 2. Source: Pitchbook LCD, “3Q US CLO Wrap: Issuance picks up as arbitrage conditions improve” (September 28, 2023). 3. Source: J.P. Morgan Data Query, as of the stated period/date. Represents the post - crisis J.P. Morgan Collateralized Loan Obligation Index (“CLOIE”). The CLOIE is a benchmark to track the market for US dollar denominated broadly syndicated, arbitrage CLOs. The CLOIE is divided by origination (pre - versus post - crisis) and is broken out further into six original rating classes (AAA, AA, A, BBB, BB, B). It is impossible to invest directly in the index. Past performance is not a predictor of future market performance. 4. Source: J.P. Morgan Data Query (October 17, 2023). Represents performance for JPMorgan JULI US AAA Index from January 1 - September 30, 2023. 5. Source: J.P. Morgan High Yield Bond and Leveraged Loan Market Monitor (October 2, 2023). 6. Sources: Pitchbook Leveraged Commentary & Data (Pitchbook LCD), Morningstar LSTA US Leveraged Loan Index. Represents metrics for the Morningstar LSTA US Leveraged Loan Index (“Morningstar LSTA LLI”) as of the stated date. In conjunction with LCD, the Leveraged Syndications & Trading Association (“LSTA”) developed the Morningstar LSTA LLI, a market - value weighted index designed to measure the performance of the US leveraged loan market, the index universe comprises syndicated, senior secured, US - dollar denominated leveraged loans covered by Morningstar PitchBook/LCD, a Morningstar Company. Loan facilities included in the LLI must have a one year (at inception) minimum term, an initial minimum spread of L/S+125 bps, and a minimum size of $50mm (initially funded). Refinitiv/LPC Mark - to - Market Pricing is used to price each loan in the index. Refinitiv/LPC Mark - to - Market Pricing is based on bid/ask quotes gathered from dealers and is not based upon derived pricing models. The index uses the average bid for its market value calculation. It is not possible to invest directly in this index. Past performance is not a predictor of future market performance. Please note that the performance information presented herein for the Morningstar LSTA US Leveraged Loan Index reflects restated returns for the period June 25, 2022 – February 27, 2023, pursuant to a recent notification issued by PitchBook/LCD Research that a technical error in the calculation of accrued interest for certain securities within the Morningstar Leveraged Loan Indexes dating back to June 25, 2022 had been identified and corrected. Previous communications reflected overstated Morningstar Leveraged Loan Index returns. 7. Bloomberg US Agg Bond Index, ICE BofA US Corporate Bond Index, ICE BofA US HY Index returns sourced from Bloomberg (October 16, 2023). 8. Source: Citi Research, “Global CLO Markets Q4’23 Outlook” (October 4, 2023). 9. Source: J.P. Morgan CLO Research (September 2023). 10. Source: BofA Global Research, “CLO Weekly” (October 16, 2023). 11. Source: Barclays Credit Research, “Equity distributions remained strong during July payment cycle” (August 11, 2023). 12. Source: BofA Global Research, “CLO Weekly” (October 6, 2023).

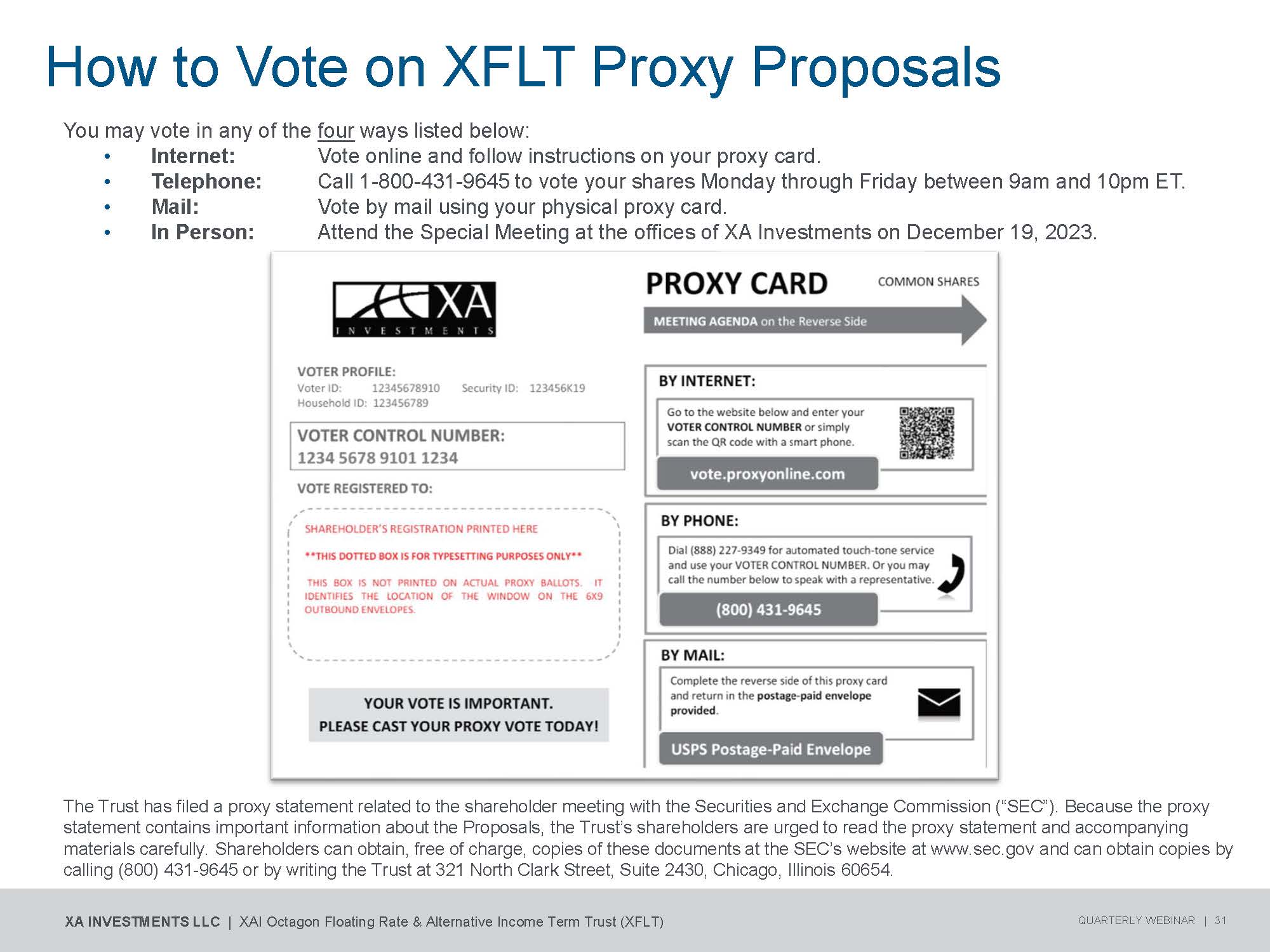

How to Vote on XFLT Proxy Proposals You may vote in any of the four ways listed below: • Internet: • T e l e pho ne : • Mail: • In Person: Vote online and follow instructions on your proxy card. Call 1 - 800 - 431 - 9645 to vote your shares Monday through Friday between 9am and 10pm ET. Vote by mail using your physical proxy card. Attend the Special Meeting at the offices of XA Investments on December 19, 2023. The Trust has filed a proxy statement related to the shareholder meeting with the Securities and Exchange Commission (“SEC”). Because the proxy statement contains important information about the Proposals, the Trust’s shareholders are urged to read the proxy statement and accompanying materials carefully. Shareholders can obtain, free of charge, copies of these documents at the SEC’s website at www.sec.gov and can obtain copies by calling (800) 431 - 9645 or by writing the Trust at 321 North Clark Street, Suite 2430, Chicago, Illinois 60654. XA INVESTMENTS LLC | XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) QUARTERLY WEBINAR | 31

Webinar Questions? Please use the Q&A dropdown indicated below to submit your questions XA INVESTMENTS LLC | XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) QUARTERLY WEBINAR | 32 XAInvestments.com | (888) 903 - 3358 321 North Clark Street Suite 2430 Chicago, IL 60654 Click Q&A Enter questions in this box

Contact Our Team with Questions XAInvestments.com | (888) 903 - 3358 321 North Clark Street Suite 2430 Chicago, IL 60654 Steven Perry X A In v est m ents Vice President, Product Management Kimb e rly Fl y nn X A In v est m ents Managing Director, Alternative Investments Sperry@XAInvestments.com (312) 374 - 6933 Kflynn@XAInvestments.com (312) 374 - 6931 Performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. XA INVESTMENTS LLC | XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) QUARTERLY WEBINAR | 33

XFLT Total Portfolio Holdings and Financials Performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. XA INVESTMENTS LLC | XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) QUARTERLY WEBINAR | 34 Below Investment Grade Securities Risk. The Trust invests primarily in below investment grade credit instruments, which are commonly referred to as “high - yield” securities or “junk” bonds. S&P uses a scale divided into two categories: The first category, “Investment,” includes ratings ranging from AAA to BBB - . It groups together the ratings given to bonds considered financially solid. The second category, “Speculative,” ranges from BB+ to D. S&P groups together the ratings given to bonds considered at risk. Moody’s also uses a two - scale rating approach for long - term obligations: “Investment Grade” rating range from Aaa to Baa3, while “Non - Investment Grade” rating range from Ba1 to C. Moody’s does not rate credit investments below C. A credit instrument is considered below investment grade quality if it is rated below investment grade (that is, below Baa3 by Moody’s or below BBB - by S&P or Fitch) or, if unrated, judged to be below investment grade quality by the Sub - Adviser. Below investment grade credit instruments are often referred to as “high yield” securities or “junk bonds.” Below investment grade credit instruments are regarded as having predominantly speculative characteristics with respect to capacity to pay interest and to repay principal. Rating agencies, such as Moody’s, S&P or Fitch, are private services that provide ratings of the credit quality of debt obligations. Ratings assigned by a rating agency are not absolute standards of credit quality but represent the opinion of the rating agency as to the quality of the obligation. Rating agencies may fail to make timely changes in credit ratings and an issuer’s current financial condition may be better or worse than a rating indicates. To the extent that the issuer of a security pays a rating agency for the analysis of its security, an inherent conflict of interest may exist that could affect the reliability of the rating. Ratings are relative and subjective and, although ratings may be useful in evaluating the safety of interest and principal payments, they do not evaluate the market value risk or liquidity of such obligations. To the extent that the Trust invests in unrated lower grade securities, the Trust’s ability to achieve its investment objective will be more dependent on the Sub - Adviser’s credit analysis than would be the case when the Trust invests in rated securities. Full portfolio holdings and financials are available at: https://xainvestments.com/funds/funds - floating - rate - alternative - income - term - trust - xflt

APPE ND IX APPENDIX: Additional Information, Glossary and Risk Considerations

CLO Considerations Performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. XA INVESTMENTS LLC | XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) QUARTERLY WEBINAR | 36 Is there a CLO equity benchmark index? Currently, no CLO equity index exists and none is expected since CLO equity returns differ by vintage (year of issuance), making index creation challenging. As such, there are no historical returns for the CLO equity marketplace. There are two fairly new CLO debt indices (J.P. Morgan CLO Index and Palmer Square CLO Debt Index) which provide historical post - crisis index return information. What is XFLT’s performance benchmark? Because there is no CLO equity index, XFLT uses the leading senior loan benchmark which is the Morningstar LSTA US Leveraged Loan 100 Index as its performance benchmark. What does the life of a typical CLO look like? What does it mean to reset or refinance a CLO? When refinancing a CLO, the CLO capital stack is replaced at lower spreads, which reduces equity - tranche holders’ cost of leverage and thus increases their return. The portfolio can be refinanced either partially or in full. In a CLO reset, the original deal, including the loans it owns, remains in place and its reinvestment period or maturity is extended to allow the deal to remain outstanding longer. CLOs typically have a four - year reinvestment and once that timeframe is up, there may be restrictions on buying new loans. A CLO can only be reset or refinanced after its non - call period. Life of the Typical CLO Warehouse Period: Underwriting bank provides CLO manager with financing to begin acquiring assets in advance of CLO closing. Equity investors provide first loss capital during the warehouse period Month 1 to Month 6 Pre - closing CLO comes into legal existence Closing Ramp - Up Period: Post - closing, proceeds from CLO debt issuance used to repay warehouse and purchase additional assets Month 1 to Month 3 Post - closing Non - Call Period: Post Year 2, the equity investor(s) may direct original CLO liabilities to be refinanced (prepaid at par) and replaced with new liabilities in order to reduce interest expense Month 4 to Year 4 Reinvestment Period: Collateral manager permitted to actively trade underlying assets to maximize value and ensure portfolio remains in compliance with collateral quality tests. Principal cash flows from underlying loan/bond assets used by the Collateral Manager to purchase new assets Amortization Period: A portion of cash flows from asset amortization, prepayments/repayments, and sales are used to pay down outstanding CLO debt in order of seniority Year 5 to Maturity

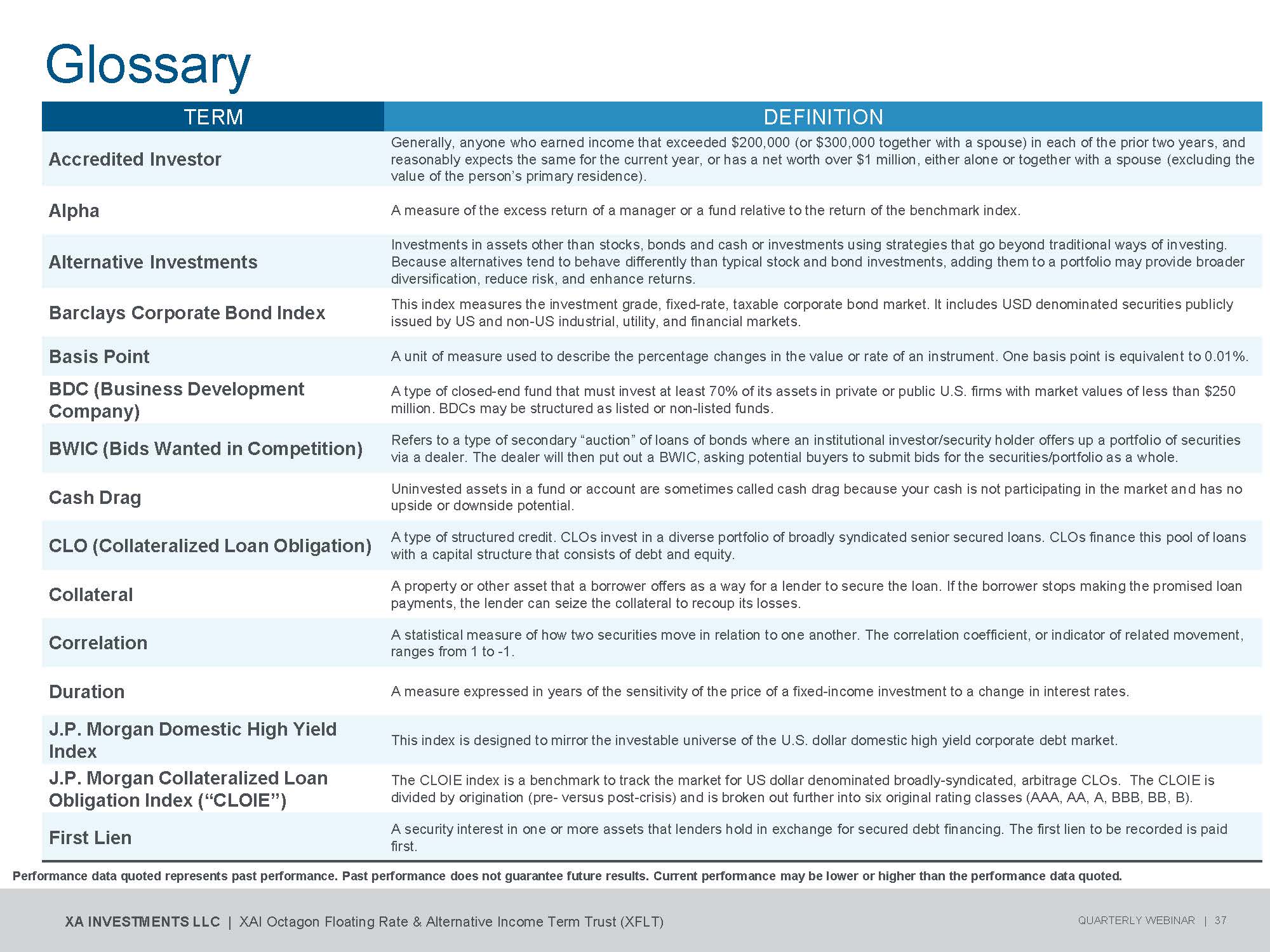

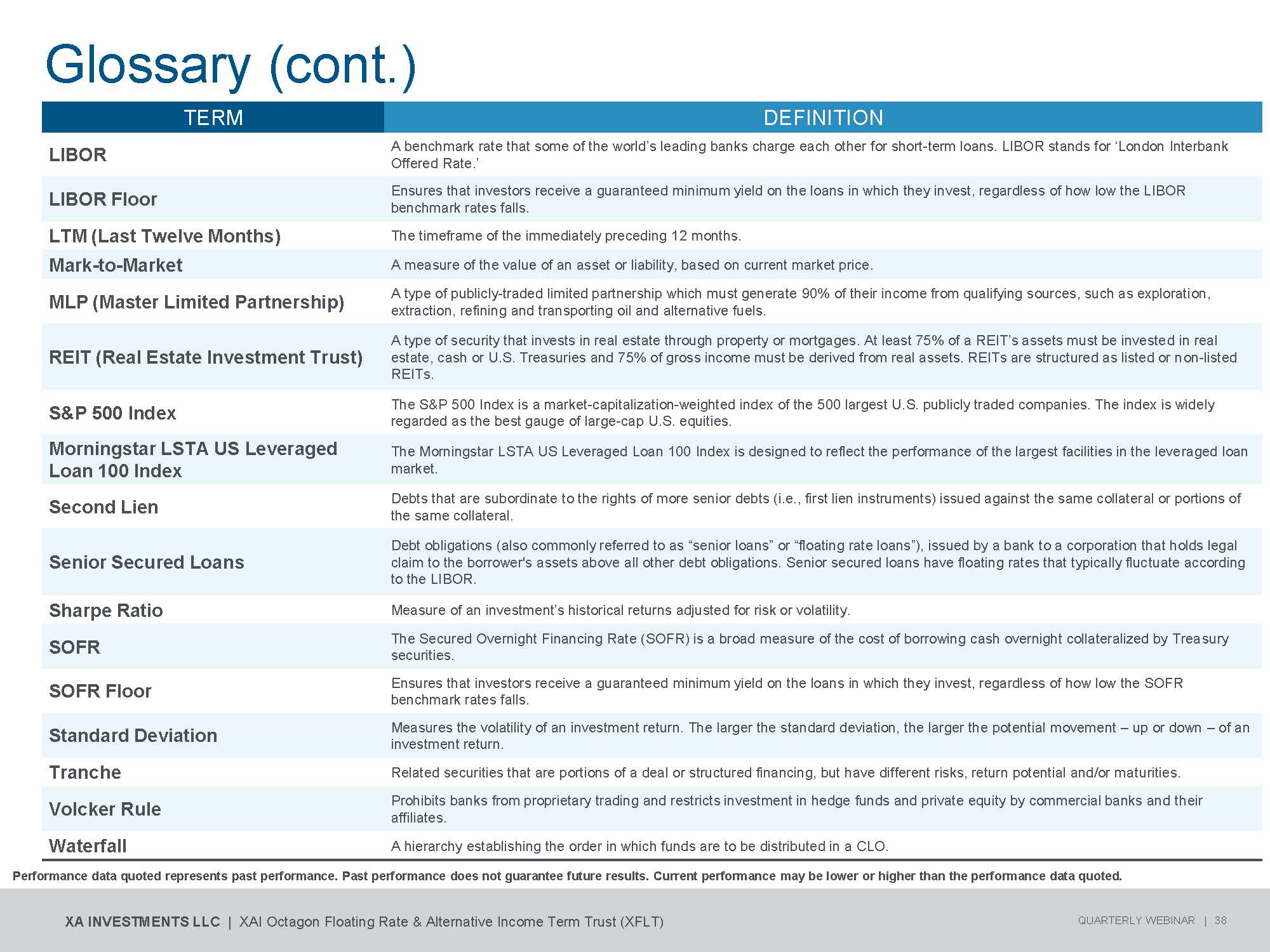

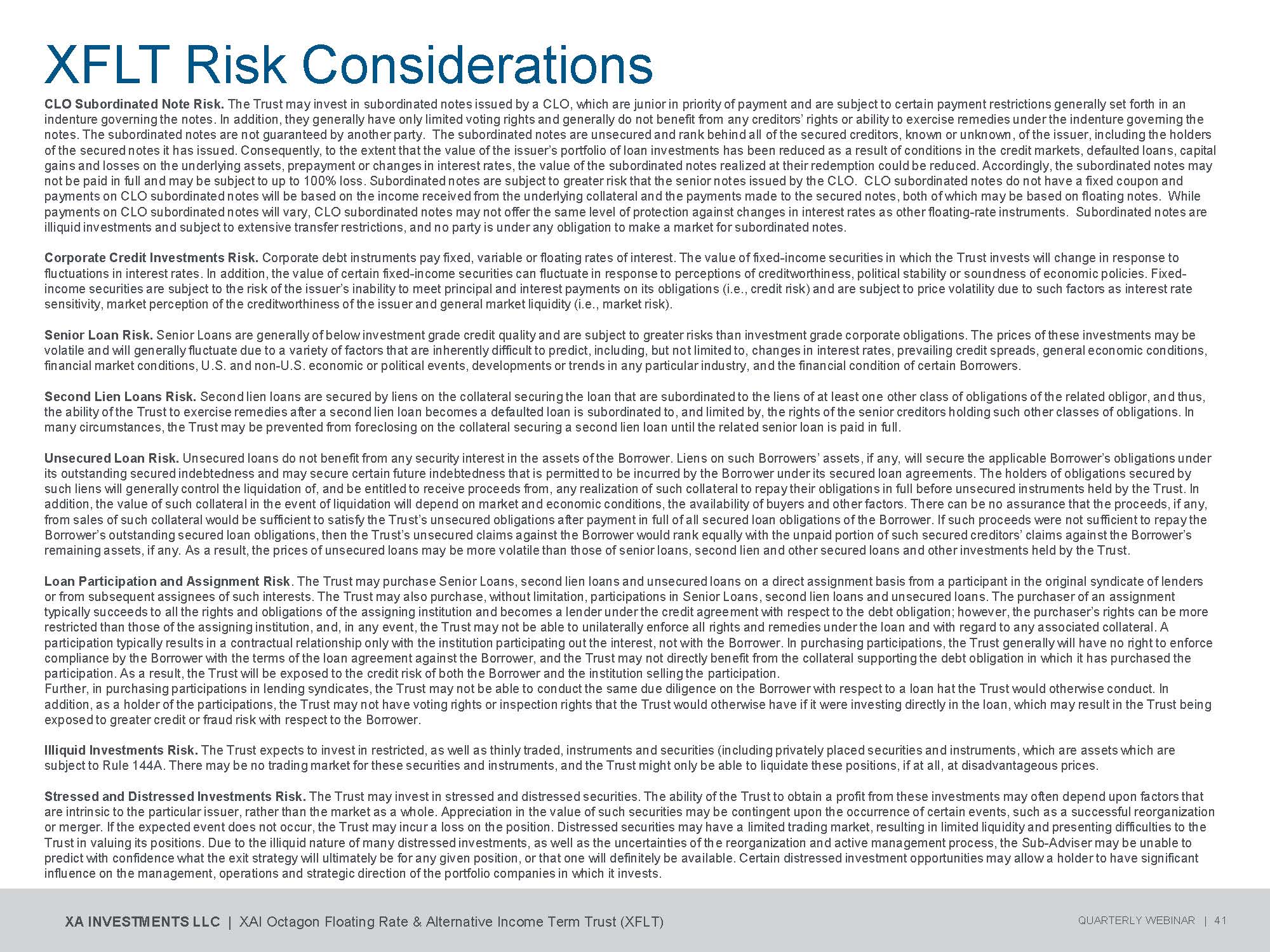

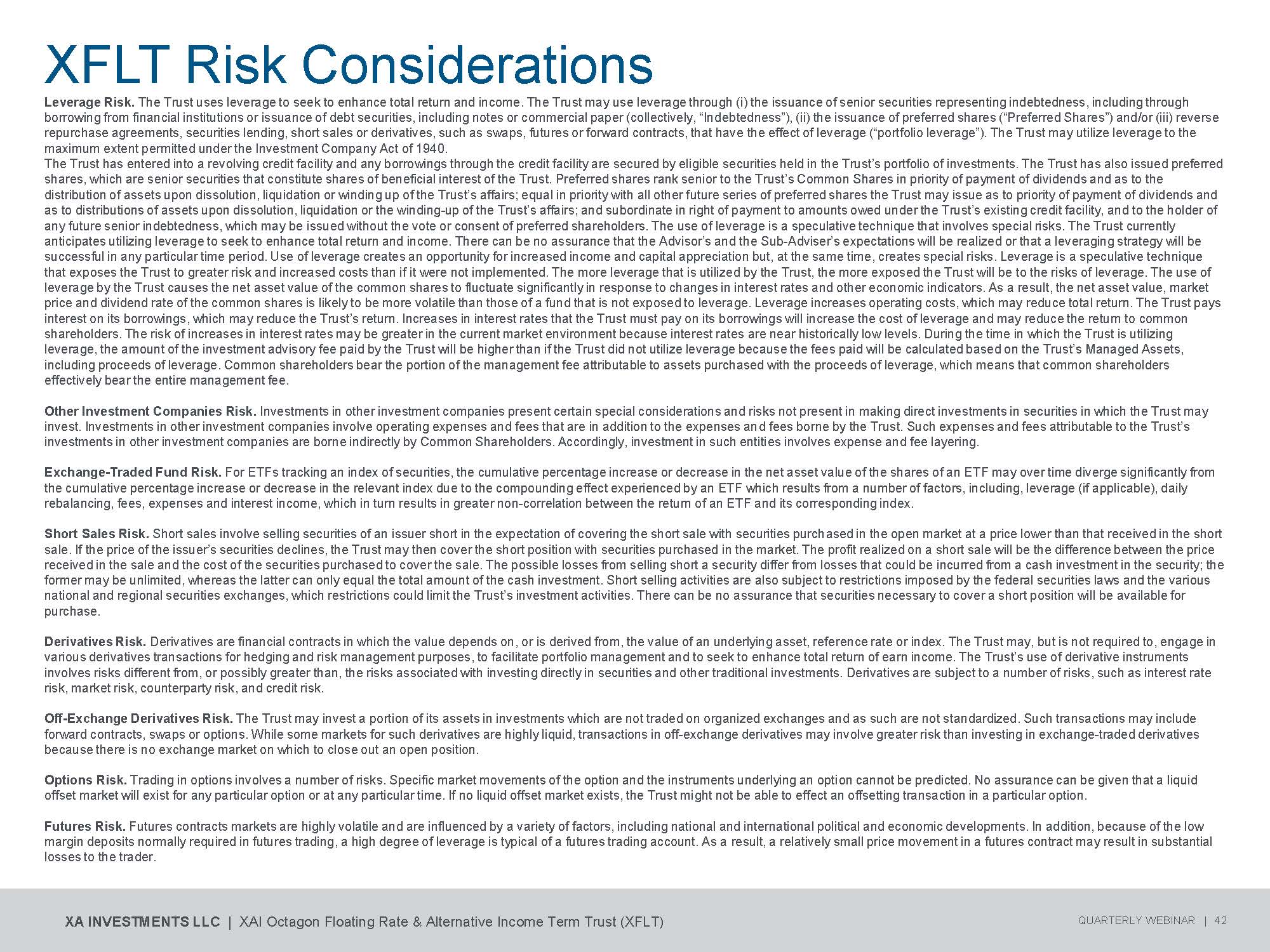

Glossary Performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted. XA INVESTMENTS LLC | XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) QUARTERLY WEBINAR | 37 DEFINITION TERM Generally, anyone who earned income that exceeded $200,000 (or $300,000 together with a spouse) in each of the prior two years, and reasonably expects the same for the current year, or has a net worth over $1 million, either alone or together with a spouse (excluding the value of the person’s primary residence). Accredited Investor A measure of the excess return of a manager or a fund relative to the return of the benchmark index. Alpha Investments in assets other than stocks, bonds and cash or investments using strategies that go beyond traditional ways of investing. Because alternatives tend to behave differently than typical stock and bond investments, adding them to a portfolio may provide broader diversification, reduce risk, and enhance returns. Alternative Investments This index measures the investment grade, fixed - rate, taxable corporate bond market. It includes USD denominated securities publicly issued by US and non - US industrial, utility, and financial markets. Barclays Corporate Bond Index A unit of measure used to describe the percentage changes in the value or rate of an instrument. One basis point is equivalent to 0.01%. Basis Point A type of closed - end fund that must invest at least 70% of its assets in private or public U.S. firms with market values of less than $250 million. BDCs may be structured as listed or non - listed funds. BDC (Business Development Company) Refers to a type of secondary “auction” of loans of bonds where an institutional investor/security holder offers up a portfolio of securities via a dealer. The dealer will then put out a BWIC, asking potential buyers to submit bids for the securities/portfolio as a whole. BWIC (Bids Wanted in Competition) Uninvested assets in a fund or account are sometimes called cash drag because your cash is not participating in the market and has no upside or downside potential. Cash Drag A type of structured credit. CLOs invest in a diverse portfolio of broadly syndicated senior secured loans. CLOs finance this pool of loans with a capital structure that consists of debt and equity. CLO (Collateralized Loan Obligation) A property or other asset that a borrower offers as a way for a lender to secure the loan. If the borrower stops making the promised loan payments, the lender can seize the collateral to recoup its losses. Collateral A statistical measure of how two securities move in relation to one another. The correlation coefficient, or indicator of related movement, ranges from 1 to - 1. Correlation A measure expressed in years of the sensitivity of the price of a fixed - income investment to a change in interest rates. Duration This index is designed to mirror the investable universe of the U.S. dollar domestic high yield corporate debt market. J.P. Morgan Domestic High Yield Index The CLOIE index is a benchmark to track the market for US dollar denominated broadly - syndicated, arbitrage CLOs. The CLOIE is divided by origination (pre - versus post - crisis) and is broken out further into six original rating classes (AAA, AA, A, BBB, BB, B). J.P. Morgan Collateralized Loan Obligation Index (“CLOIE”) A security interest in one or more assets that lenders hold in exchange for secured debt financing. The first lien to be recorded is paid first. First Lien