Exhibit 99.3

PRO FORMA VALUATION REPORT

MUTUAL HOLDING COMPANY

STOCK OFFERING

PDL Community Bancorp | Bronx, New York

PROPOSED HOLDING COMPANY FOR:

Ponce De Leon Federal Bank |Bronx, New York

Dated as of May 5, 2017

1100 North Glebe Road Suite 600

Arlington, Virginia 22201

703.528.1700

rpfinancial.com

May 5, 2017

Board of Directors

Ponce Bank Mutual Holding Company

PDL Community Bancorp

Ponce De Leon Federal Bank

2244 Westchester Avenue

Bronx, New York 10462

Members of the Board of Directors:

At your request, we have completed and hereby provide an independent appraisal (“Appraisal”) of the estimated pro forma market value of the common stock which is to be issued in connection with the stock issuance transaction described below.

This Appraisal is furnished pursuant to the requirements stipulated in the Code of Federal Regulations and has been prepared in accordance with the “Guidelines for Appraisal Reports for the Valuation of Savings and Loan Associations Converting from Mutual to Stock Form of Organization” (the “Valuation Guidelines”) of the Office of Thrift Supervision (“OTS”) and accepted by the Federal Reserve Board (“FRB”), the Office of the Comptroller of the Currency (“OCC”) and the Federal Deposit Insurance Corporation (“FDIC”), and applicable regulatory interpretations thereof.

Description of Plan of Reorganization and Stock Offering

On November 17, 2016, the Board of Directors of Ponce De Leon Federal Bank adopted a plan of reorganization (the “Reorganization”) and on April 7, 2017 the Board of Directors of Ponce De Leon Federal Bank adopted amendment No. 1 to the Reorganization, pursuant to which Ponce De Leon Federal Bank will reorganize into atwo-tier mutual holding company structure. After the Reorganization, PDL Community Bancorp (the “Company”), a federal corporation, will be themid-tier stock holding company and Ponce Bank Mutual Holding Company (the “MHC”), a federally chartered mutual holding company, will be thetop-tier mutual holding company. The Reorganization will be completed as follows:

| | (i) | Ponce De Leon Federal Bank will organize an interim stock savings association as a wholly owned subsidiary (“Interim Bank”); |

| | (ii) | After Interim Bank receives approval from the FDIC for insurance of accounts and the FDIC has issued it a certificate number, Ponce De Leon Federal Bank will transfer pursuant to a purchase and assumption agreement all of its assets and liabilities, except $200,000 in cash, to Interim Bank, and Interim Bank will become the stock savings association resulting from the reorganization, including the purchase and assumption transaction pursuant to the plan (the “Stock Bank”); |

| | |

| Washington Headquarters | | |

| Three Ballston Plaza | | Telephone: (703)528-1700 |

| 1100 North Glebe Road, Suite 600 | | Fax No.: (703)528-1788 |

| Arlington, VA 22201 | | Toll-Free No.: (866)723-0594 |

| www.rpfinancial.com | | E-Mail: mail@rpfinancial.com |

Board of Directors

May 5, 2017

Page 2

| | (iii) | Ponce De Leon Federal Bank will amend its charter and bylaws to read in the form of a federal mutual holding company to become Ponce Bank Mutual Holding Company; |

| | (iv) | Ponce Bank Mutual Holding Company will organize PDL Community Bancorp as a wholly-owned subsidiary, and transfer $1,000 to PDL Community Bancorp in exchange for 100 shares of PDL Community Bancorp common stock; and |

| | (v) | Ponce Bank Mutual Holding Company will transfer all of the initially issued stock of the Stock Bank to PDL Community Bancorp in exchange for additional shares of PDL Community Bancorp common stock, and the Stock Bank will become a wholly-owned subsidiary of PDL Community Bancorp, operating under the name Ponce Bank. |

For purposes of this document, Ponce De Leon Federal Bank will hereinafter be referred to as Ponce Bank or the “Bank”.

Concurrent with the Reorganization, PDL Community Bancorp will issue a majority of its common stock to the MHC and sell a minority of its common stock to the public. At the completion of the public stock offering, the Company will retain up to 50% of the net stock proceeds. The MHC will own a controlling interest in the Company of at least 51%, and the Company will be the sole subsidiary of the MHC. The Company will own 100% of the Bank’s outstanding stock. The Company’s initial activity will be ownership of its subsidiary, Ponce Bank, investment of the net cash proceeds retained at the holding company level and extending a loan to the employee stock ownership plan.

PDL Community Bancorp will offer its common stock in a subscription offering to Eligible Account Holders,Tax-Qualified Plans including Ponce Bank’s employee stock ownership plan (the “ESOP”), Supplemental Eligible Account Holders and Other Members as such terms are defined for purposes of applicable regulatory guidelines governing stock offerings by mutual institutions. To the extent that shares remain available for purchase after satisfaction of all subscriptions received in the subscription offering, the shares may be offered for sale to members of the general public in a community offering and a syndicated community offering. At least 50% of the net proceeds from the stock offering will be invested in Ponce Bank and the balance of the net proceeds will be retained by the Company.

At this time, no other activities are contemplated for the Company other than the ownership of Ponce Bank, a loan to the newly-formed ESOP and reinvestment of the proceeds that are retained by the Company. In the future, PDL Community Bancorp may acquire or organize other operating subsidiaries, diversify into other banking-related activities, pay dividends or repurchase its stock, although there are no specific plans to undertake such activities at the present time.

The Reorganization provides for the establishment of a new charitable foundation (the “Foundation”). The Foundation contribution will be funded with 3.3% of the number of shares of common stock issued in the stock issuance and $200,000 of cash funded by the net proceeds retained by the Company. The purpose of the Foundation is to provide financial support to charitable organizations in the communities in which Ponce Bank operates and to enable those communities to share in the Bank’s long-term growth. The Foundation will be dedicated completely to community activities and the promotion of charitable causes.

Board of Directors

May 5, 2017

Page 3

RP® Financial, LC.

RP® Financial, LC. (“RP Financial”) is a financial consulting firm serving the financial services industry nationwide that, among other things, specializes in financial valuations and analyses of business enterprises and securities, including the pro forma valuation for savings institutions converting frommutual-to-stock form. The background and experience of RP Financial is detailed in ExhibitV-1. We believe that, except for the fee we will receive for the Appraisal, we are independent of the Company, the Bank, the MHC and the other parties engaged by the Bank, the Company or the MHC to assist in the stock conversion process.

Valuation Methodology

In preparing our Appraisal, we have reviewed the regulatory applications of the Company, the Bank and the MHC, including the prospectus as filed with the FRB, the OCC and the Securities and Exchange Commission (“SEC”). We have conducted a financial analysis of the Company, the Bank and the MHC that has included a review of audited financial information for the years ended December 31, 2012 through December 31, 2016, a review of various unaudited information and internal financial reports through March 31, 2017, and due diligence related discussions with the Bank’s management; WeiserMazars LLP, the Bank’s independent auditor; Locke Lord LLP, the Bank’s counsel for the Reorganization and Raymond James Associates, Inc., the Bank’s marketing advisor in connection with the stock offering. All assumptions and conclusions set forth in the Appraisal were reached independently from such discussions. In addition, where appropriate, we have considered information based on other available published sources that we believe are reliable. While we believe the information and data gathered from all these sources are reliable, we cannot guarantee the accuracy and completeness of such information.

We have investigated the competitive environment within which Ponce Bank operates and have assessed Ponce Bank’s relative strengths and weaknesses. We have kept abreast of the changing regulatory and legislative environment for financial institutions and analyzed the potential impact on Ponce Bank and the industry as a whole. We have analyzed the potential effects of the stock offering on Ponce Bank’s operating characteristics and financial performance as they relate to the pro forma market value of PDL Community Bancorp. We have reviewed the economic and demographic characteristics of the Bank’s primary market area. We have compared Ponce Bank’s financial performance and condition with selected publicly-traded thrifts in accordance with the Valuation Guidelines, as well as all publicly-traded thrifts and thrift holding companies. We have reviewed the current conditions in the securities markets in general and the market for thrift stocks in particular, including the market for existing thrift issues and initial public offerings by thrifts and thrift holding companies. We have excluded from such analyses thrifts subject to announced or rumored acquisition, and/or institutions that exhibit other unusual characteristics.

The Appraisal is based on Ponce Bank’s representation that the information contained in the regulatory applications and additional information furnished to us by Ponce Bank and its

Board of Directors

May 5, 2017

Page 4

independent auditor, legal counsel and other authorized agents are truthful, accurate and complete. We did not independently verify the financial statements and other information provided by Ponce Bank, or its independent auditor, legal counsel and other authorized agents nor did we independently value the assets or liabilities of Ponce Bank. The valuation considers Ponce Bank only as a going concern and should not be considered as an indication of Ponce Bank’s liquidation value.

Our appraised value is predicated on a continuation of the current operating environment for Ponce Bank and for all thrifts and their holding companies. Changes in the local, state and national economy, the legislative and regulatory environment for financial institutions and mutual holding companies, the stock market, interest rates, and other external forces (such as natural disasters or significant world events) may occur from time to time, often with great unpredictability and may materially impact the value of thrift stocks as a whole or the value of Ponce Bank’s stock alone. It is our understanding that there are no current plans for selling control of Ponce Bank following completion of the stock offering. To the extent that such factors can be foreseen, they have been factored into our analysis.

The estimated pro forma market value is defined as the price at which PDL Community Bancorp’s common stock, immediately upon completion of the stock offering, would change hands between a willing buyer and a willing seller, neither being under any compulsion to buy or sell and both having reasonable knowledge of relevant facts.

Valuation Conclusion

It is our opinion that, as of May 5, 2017, the estimated aggregate pro forma market value of the shares to be issued immediately following the offering, both shares issued publicly as well as to the MHC, was $139,607,030 at the midpoint, equal to 13,960,703 shares issued at a per share value of $10.00. Pursuant to conversion guidelines, the 15% offering range indicates a minimum value of $118,665,980 and a maximum value of $160,548,080. Based on the $10.00 per share offering price determined by the Board, this valuation range equates to total shares outstanding of 11,866,598 shares at the minimum of the valuation range and 16,054,808 total shares outstanding at the maximum of the valuation range. In the event that the appraised value is subject to an increase, the aggregate pro forma market value may be increased up to a super maximum value of $184,630,290 without a resolicitation. Based on the $10.00 per share offering price, the super maximum value would result in total shares outstanding of 18,463,029. The Board of Directors has established a public offering range such that the public ownership of the Company will constitute a 45.0% ownership interest of the Company prior to the issuance of the shares to the Foundation. Accordingly, the offering range to the public of the minority stock will be $53,399,690 at the minimum, $62,823,160 at the midpoint, $72,246,630 at the maximum and $83,083,620 at the super maximum. Based on the public offering range, and inclusive of the shares issued to the Foundation, the public ownership of the shares will represent 48.3% of the shares issued, with the MHC owning the majority of the shares.

Limiting Factors and Considerations

The valuation is not intended, and must not be construed, as a recommendation of any kind as to the advisability of purchasing shares of the common stock. Moreover, because such

Board of Directors

May 5, 2017

Page 5

valuation is determined in accordance with applicable regulatory guidelines and is necessarily based upon estimates and projections of a number of matters, all of which are subject to change from time to time, no assurance can be given that persons who purchase shares of common stock in the stock offering will thereafter be able to buy or sell such shares at prices related to the foregoing valuation of the estimated pro forma market value thereof. The appraisal reflects only a valuation range as of this date for the pro forma market value of PDL Community Bancorp immediately upon issuance of the stock and does not take into account any trading activity with respect to the purchase and sale of common stock in the secondary market on the date of issuance of such securities or at anytime thereafter following the completion of the stock offering.

RP Financial’s valuation was based on the financial condition and operations of Ponce Bank as of March 31, 2017, the date of the financial data included in the prospectus.

RP Financial is not a seller of securities within the meaning of any federal and state securities laws and any report prepared by RP Financial shall not be used as an offer or solicitation with respect to the purchase or sale of any securities. RP Financial maintains a policy which prohibits RP Financial, its principals or employees from purchasing stock of its client institutions.

This valuation will be updated as provided for in the conversion regulations and guidelines. These updates will consider, among other things, any developments or changes in the financial performance and condition of Ponce Bank, management policies, and current conditions in the equity markets for thrift shares, both existing issues and new issues. These updates may also consider changes in other external factors which impact value including, but not limited to: various changes in the legislative and regulatory environment for financial institutions, the stock market and the market for thrift stocks, and interest rates. Should any such new developments or changes be material, in our opinion, to the valuation of the shares, appropriate adjustments to the estimated pro forma market value will be made. The reasons for any such adjustments will be explained in the update at the date of the release of the update. The valuation will also be updated at the completion of PDL Community Bancorp’s stock offering.

|

| Respectfully submitted, |

|

| RP® FINANCIAL, LC. |

|

|

| Ronald S. Riggins |

| Managing Director |

|

|

| Gregory E. Dunn |

| Director |

| | |

| RP® Financial, LC. | | TABLE OF CONTENTS |

| | i |

TABLE OF CONTENTS

PDL COMMUNITY BANCORP

PONCE BANK

Bronx, New York

| | | | | | |

DESCRIPTION | | PAGE

NUMBER | |

| | |

CHAPTER ONE | | OVERVIEW AND FINANCIAL ANALYSIS | | | | |

| |

Introduction | | | I.1 | |

Plan of Reorganization and Stock Offering | | | I.1 | |

Strategic Overview | | | I.3 | |

Balance Sheet Trends | | | I.5 | |

Income and Expense Trends | | | I.8 | |

Interest Rate Risk Management | | | I.11 | |

Lending Activities and Strategy | | | I.12 | |

Asset Quality | | | I.14 | |

Funding Composition and Strategy | | | I.15 | |

Subsidiary Activities | | | 1.16 | |

Legal Proceedings | | | I.16 | |

| | |

CHAPTER TWO | | MARKET AREA | | | | |

| |

Introduction | | | II.1 | |

National Economic Factors | | | II.1 | |

Market Area Demographics | | | II.5 | |

Local Economy | | | II.7 | |

Unemployment Trends | | | II.8 | |

Market Area Deposit Characteristics and Competition | | | II.9 | |

| | |

CHAPTER THREE | | PEER GROUP ANALYSIS | | | | |

| |

Peer Group Selection | | | III.1 | |

Financial Condition | | | III.5 | |

Income and Expense Components | | | III.8 | |

Loan Composition | | | III.11 | |

Interest Rate Risk | | | III.11 | |

Credit Risk | | | III.14 | |

Summary | | | III.14 | |

| | |

| RP® Financial, LC. | | TABLE OF CONTENTS |

| | ii |

TABLE OF CONTENTS

PDL COMMUNITY BANCORP

PONCE BANK

Bronx, New York

(continued)

| | | | | | |

DESCRIPTION | | PAGE

NUMBER | |

| | |

CHAPTER FOUR | | VALUATION ANALYSIS | | | | |

| |

Introduction | | | IV.1 | |

Appraisal Guidelines | | | IV.1 | |

RP Financial Approach to the Valuation | | | IV.1 | |

Valuation Analysis | | | IV.2 | |

1. Financial Condition | | | IV.3 | |

2. Profitability, Growth and Viability of Earnings | | | IV.4 | |

3. Asset Growth | | | IV.6 | |

4. Primary Market Area | | | IV.6 | |

5. Dividends | | | IV.7 | |

6. Liquidity of the Shares | | | IV.8 | |

7. Marketing of the Issue | | | IV.9 | |

A. The Public Market | | | IV.9 | |

B. The New Issue Market | | | IV.12 | |

C. The Acquisition Market | | | IV.13 | |

8. Management | | | IV.16 | |

9. Effect of Government Regulation and Regulatory Reform | | | IV.17 | |

Summary of Adjustments | | | IV.17 | |

Valuation Approaches: Fully-Converted Basis | | | IV.17 | |

Basis of Valuation- Fully-Converted Pricing Ratios | | | IV.19 | |

1. Price-to-Earnings (“P/E”) | | | IV.19 | |

2. Price-to-Book (“P/B”) | | | IV.22 | |

3. Price-to-Assets (“P/A”) | | | IV.23 | |

Comparison to Publicly-Traded MHCs | | | IV.23 | |

Comparison to Recent MHC Offerings | | | IV.27 | |

Valuation Conclusion | | | IV.27 | |

| | |

| RP® Financial, LC. | | LIST OF TABLES |

| | iii |

LIST OF TABLES

PDL COMMUNITY BANCORP

PONCE BANK

Bronx, New York

| | | | | | |

TABLE

NUMBER | | DESCRIPTION | | PAGE | |

| | |

1.1 | | Historical Balance Sheet Data | | | I.6 | |

1.2 | | Historical Income Statements | | | I.9 | |

| | |

2.1 | | Summary Demographic Data | | | II.6 | |

2.2 | | Primary Market Area Employment Sectors | | | II.7 | |

2.3 | | Market Area Largest Employers | | | II.8 | |

2.4 | | Unemployment Trends | | | II.9 | |

2.5 | | Deposit Summary | | | II.10 | |

2.6 | | Market Area Deposit Competitors – As of June 30, 2016 | | | II.11 | |

| | |

3.1 | | Peer Group of Publicly-Traded Thrifts | | | III.3 | |

3.2 | | Balance Sheet Composition and Growth Rates | | | III.6 | |

3.3 | | Income as a Pct. of Avg. Assets and Yields, Costs, Spreads | | | III.9 | |

3.4 | | Loan Portfolio Composition and Related Information | | | III.12 | |

3.5 | | Interest Rate Risk Measures and Net Interest Income Volatility | | | III.13 | |

3.6 | | Credit Risk Measures and Related Information | | | III.15 | |

| | |

4.1 | | Market Area Unemployment Rates | | | IV.7 | |

4.2 | | Pricing Characteristics and After-Market Trends | | | IV.14 | |

4.3 | | Market Pricing Comparatives | | | IV.15 | |

4.4 | | Fully-Converted Market Pricing Versus Peer Group | | | IV.20 | |

4.5 | | MHC Market Pricing Versus Peer Group | | | IV.21 | |

4.6 | | Calculation of Implied Per Share Data- Incorporating MHC Second Step Conversion | | | IV.25 | |

4.7 | | MHC Institutions Implied Pricing Ratios, Full Conversion Basis | | | IV.26 | |

| | |

| RP® Financial, LC. | | OVERVIEW AND FINANCIAL ANALYSIS |

| | I.1 |

I. OVERVIEW AND FINANCIAL ANALYSIS

Introduction

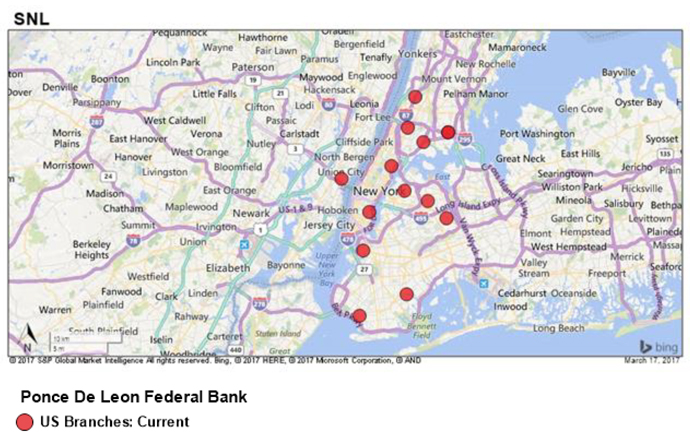

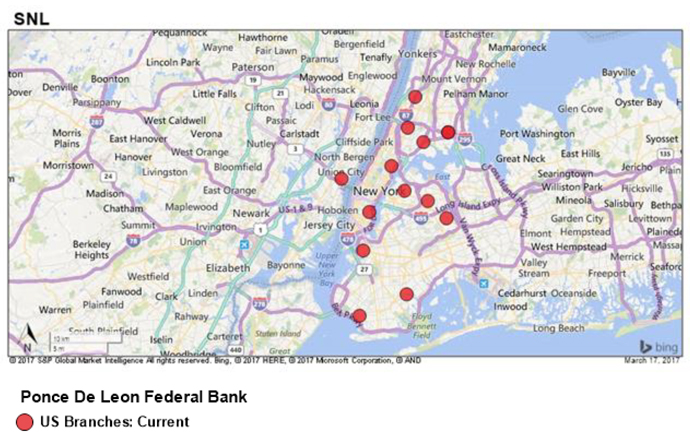

Ponce De Leon Federal Bank, established in 1960, is a federally-chartered mutual savings association headquartered in Bronx, New York. The Bank serves the New York metropolitan area through its headquarters office and 13 full service branch offices. A map of the Bank’s office locations is provided in ExhibitI-1. Ponce Bank is a member of the Federal Home Loan Bank (“FHLB”) system and its deposits are insured up to the maximum allowable amount by the Federal Deposit Insurance Corporation (“FDIC”). As of March 31, 2017, Ponce Bank had total assets of $786.3 million, total deposits of $655.9 million and total equity of $93.5 million equal to 11.89% of total assets. The Bank’s audited financial statements are included by reference as ExhibitI-2.

Plan of Reorganization and Stock Offering

On November 17, 2016, the Board of Directors of Ponce De Leon Federal Bank adopted a plan of reorganization (the “Reorganization”) and on April 7, 2017 the Board of Directors of Ponce De Leon Federal Bank adopted amendment No. 1 to the Reorganization, pursuant to which Ponce De Leon Federal Bank will reorganize into atwo-tier mutual holding company structure. After the Reorganization, PDL Community Bancorp (the “Company”), a federal corporation, will be themid-tier stock holding company and Ponce Bank Mutual Holding Company (the “MHC”), a federally chartered mutual holding company, will be thetop-tier mutual holding company. The Reorganization will be completed as follows:

| | (i) | Ponce De Leon Federal Bank will organize an interim stock savings association as a wholly owned subsidiary (“Interim Bank”); |

| | (ii) | After Interim Bank receives approval from the FDIC for insurance of accounts and the FDIC has issued it a certificate number, Ponce De Leon Federal Bank will transfer pursuant to a purchase and assumption agreement all of its assets and liabilities, except $200,000 in cash, to Interim Bank, and Interim Bank will become the stock savings association resulting from the reorganization, including the purchase and assumption transaction pursuant to the plan (the “Stock Bank”); |

| | (iii) | Ponce De Leon Federal Bank will amend its charter and bylaws to read in the form of a federal mutual holding company to become Ponce Bank Mutual Holding Company; |

| | (iv) | Ponce Bank Mutual Holding Company will organize PDL Community Bancorp as a wholly-owned subsidiary, and transfer $1,000 to PDL Community Bancorp in exchange for 100 shares of PDL Community Bancorp common stock; and |

| | (v) | Ponce Bank Mutual Holding Company will transfer all of the initially issued stock of the Stock Bank to PDL Community Bancorp in exchange for additional shares of PDL Community Bancorp common stock, and the Stock Bank will become a wholly-owned subsidiary of PDL Community Bancorp, operating under the name Ponce Bank. |

| | |

| RP® Financial, LC. | | OVERVIEW AND FINANCIAL ANALYSIS |

| | I.2 |

For purposes of this document, Ponce De Leon Federal Bank will hereinafter be referred to as Ponce Bank or the “Bank”.

Concurrent with the Reorganization, PDL Community Bancorp will issue a majority of its common stock to the MHC and sell a minority of its common stock to the public. At the completion of the public stock offering, the Company will retain up to 50% of the net stock proceeds. The MHC will own a controlling interest in the Company of at least 51%, and the Company will be the sole subsidiary of the MHC. The Company will own 100% of the Bank’s outstanding stock. The Company’s initial activity will be ownership of its subsidiary, Ponce Bank, investment of the net cash proceeds retained at the holding company level and extending a loan to the employee stock ownership plan.

PDL Community Bancorp will offer its common stock in a subscription offering to Eligible Account Holders,Tax-Qualified Plans including Ponce Bank’s employee stock ownership plan (the “ESOP”), Supplemental Eligible Account Holders and Other Members as such terms are defined for purposes of applicable regulatory guidelines governing stock offerings by mutual institutions. To the extent that shares remain available for purchase after satisfaction of all subscriptions received in the subscription offering, the shares may be offered for sale to members of the general public in a community offering and a syndicated community offering. At least 50% of the net proceeds from the stock offering will be invested in Ponce Bank and the balance of the net proceeds will be retained by the Company.

At this time, no other activities are contemplated for the Company other than the ownership of Ponce Bank, a loan to the newly-formed ESOP and reinvestment of the proceeds that are retained by the Company. In the future, PDL Community Bancorp may acquire or organize other operating subsidiaries, diversify into other banking-related activities, pay dividends or repurchase its stock, although there are no specific plans to undertake such activities at the present time.

The Reorganization provides for the establishment of a new charitable foundation (the “Foundation”). The Foundation contribution will be funded with 3.3% of the number of shares of

| | |

| RP® Financial, LC. | | OVERVIEW AND FINANCIAL ANALYSIS |

| | I.3 |

common stock issued in the stock issuance and $200,000 of cash funded by the net proceeds retained by the Company. The purpose of the Foundation is to provide financial support to charitable organizations in the communities in which Ponce Bank operates and to enable those communities to share in the Bank’s long-term growth. The Foundation will be dedicated completely to community activities and the promotion of charitable causes.

Strategic Overview

Ponce Bank maintains a local community banking emphasis, with a primary strategic objective of meeting the borrowing and savings needs of its local customer base. Historically, as a traditional thrift institution, the Bank’s lending activities were concentrated in origination of1-4 family permanent mortgage loans and such loans continue to comprise the largest concentration of the loan portfolio. In recent years, the Bank embarked on a new strategic direction designed to build a full service community banking franchise dedicated to meeting the banking needs of business and retail customers in the communities that are served by the Bank. In connection with the implementation of a full service community banking strategy, the Bank invested in infrastructure and personnel to manage and facilitate growth strategies. Most notably, in support of implementation of a diversified lending strategy, the Bank has been building a team of commercial lenders experienced in developing full service commercial banking relationships in the local market. The Bank’s objective is to fund asset growth primarily through deposit growth, emphasizing growth of lower cost core deposits. Core deposit growth is expected to be in part facilitated by growth of commercial lending relationships, pursuant to which the Bank is seeking to establish a full service banking relationship with its commercial loan customers through offering a full range of commercial loan products that can be packaged with lower cost commercial deposit products.

Investments serve as a supplement to the Bank’s lending activities and the investment portfolio is considered to be indicative of a low risk investment philosophy. U.S. Government and federal agency securities constitute the largest portion of the Bank’s investment portfolio, with other investments consisting of mortgage-backed securities that are guaranteed or insured by government sponsored enterprises (“GSEs”) or backed by GInnie Mae and certificates of deposit (“CDs”) held in other financial institutions.

Deposits have consistently served as the primary funding source for the Bank, with supplemental funding provided by utilization of borrowings as an alternative funding source for purposes of managing funding costs and interest rate risk. CDs constitute the largest portion of the Bank’s deposit base. Borrowings currently held by the Bank consist of FHLB advances.

| | |

| RP® Financial, LC. | | OVERVIEW AND FINANCIAL ANALYSIS |

| | I.4 |

Ponce Bank’s earnings base is largely dependent upon net interest income and operating expense levels. The Bank has experienced some net interest margin compression during the past two years, which has been primarily attributable to a more significant decline in interest-earning assets yields as interest-bearing funding costs have been relatively stable in recent years. Operating expense ratios have trended higher in recent years, primarily in connection with building out the Bank’s commercial lending platform.Non-interest operating income has been a fairly stable but limited contributor to the Bank’s earnings, reflecting limiting diversification intofee-based products and services. The amount of loan loss provisions established has decreased significantly in recent years, which was facilitated by improving trends in the Bank’s credit quality.

The post-offering business plan of the Bank is expected to continue to focus on implementing strategic initiatives to develop and grow a full service community banking franchise. Accordingly, Ponce Bank will continue to be an independent full service community bank, with a commitment to meeting the retail and commercial banking needs of individuals and businesses in the New York metropolitan area.

The Bank’s Board of Directors has elected to complete a public stock offering to sustain growth strategies and facilitate implementation of its strategic plan. The capital realized from the stock offering will increase the Bank’s operating flexibility and allow for additional growth of the balance sheet. The additional funds realized from the stock offering will provide an alternative funding source to deposits and borrowings in meeting the Bank’s future funding needs, which may facilitate a reduction in Ponce Bank’s funding costs. Additionally, Ponce Bank’s higherequity-to-assets ratio will enable the Bank to pursue expansion opportunities. Such expansion would most likely occur through the acquisition of other financial institutions or financial service companies that would increase market penetration in the markets currently served by the Bank or to gain a market presence into nearby complementary markets. At this time, the Bank has no specific plans for expansion. The projected uses of proceeds are highlighted below.

| | • | | The Company. The Company is expected to retain up to 50% of the net offering proceeds. At present, funds at the Company level, net of the loan to the ESOP and the cash contribution to the Foundation, are expected to be primarily invested initially into liquid funds held as a deposit at the Bank. Over time, the |

| | |

| RP® Financial, LC. | | OVERVIEW AND FINANCIAL ANALYSIS |

| | I.5 |

| | funds may be utilized for various corporate purposes, possibly including acquisitions, infusing additional equity into the Bank, repurchases of common stock and the payment of cash dividends. |

| | • | | The Bank. Approximately 50% of the net conversion proceeds will be infused into the Bank. Cash proceeds (i.e., net proceeds less deposits withdrawn to fund stock purchases) infused into the Bank are anticipated to become part of general operating funds and are expected to be primarily utilized to fund loan growth over time. |

Overall, it is the Bank’s objective to pursue controlled growth that will serve to increase returns, while continuing to emphasize management of the overall risk associated with Ponce Bank’s operations.

Balance Sheet Trends

Table 1.1 shows the Bank’s historical balance sheet data for the past five andone-quarter years. From yearend 2012 through March 31, 2017, Ponce Bank’s assets increased at a 0.75% annual rate. Total assets trended lower from yearend 2012 through yearend 2015, which was followed by a healthy increase in assets during 2016 and the first quarter of 2017. Both loans and cash and investments declined during the period of asset shrinkage, while asset growth during 2016 and the first quarter of 2017 was sustained by loan growth. Asset shrinkage and borrowings funded depositrun-off from yearend 2012 through yearend 2015, while deposit growth in 2016 funded asset growth and the pay down of borrowings. Asset growth during the first quarter of 2017 was funded by deposit growth and an increase in borrowings. A summary of Ponce Bank’s key operating ratios for the past five years is presented inExhibit I-3.

Ponce Bank’s loans receivable portfolio increased at a 3.53% annual rate from yearend 2012 through March 31, 2017, in which the loans receivable balance declined from yearend 2012 through yearend 2014 and then increased during the past two andone-quarter years. The most significant loan growth was realized during 2016, and the first quarter of 2017 which was primarily attributable to growth of multi-family loans. Loan growth combined with asset shrinkage provided for an increase in theloans-to-assets ratio from 76.77% at yearend 2012 to 86.17% at March 31, 2017.

Trends in the Bank’s loan portfolio composition since yearend 2012 show that the concentration of1-4 family mortgage loans comprising total loans decreased from 52.67% of total loans receivable at yearend 2012 to 48.60% of total loans receivable at March 31, 2017. Comparatively, from yearend 2012 through March 31, 2017, multi-family increased from 18.16%

| | |

| RP® Financial, LC. | | OVERVIEW AND FINANCIAL ANALYSIS |

| | I.6 |

Table 1.1

Ponce Bank

Historical Balance Sheet Data

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 12/31/12- | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 3/31/17 | |

| | | At December 31, | | | At March 31, | | | Annual. | |

| | | 2012 | | | 2013 | | | 2014 | | | 2015 | | | 2016 | | | 2017 | | | Growth Rate | |

| | | Amount | | | Pct(1) | | | Amount | | | Pct(1) | | | Amount | | | Pct(1) | | | Amount | | | Pct(1) | | | Amount | | | Pct(1) | | | Amount | | | Pct(1) | | | Pct | |

| | | ($000) | | | (%) | | | ($000) | | | (%) | | | ($000) | | | (%) | | | ($000) | | | (%) | | | ($000) | | | (%) | | | ($000) | | | (%) | | | (%) | |

| | | | | | | | | | | | | |

Total Amount of: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Assets | | $ | 761,544 | | | | 100.00 | % | | $ | 730,644 | | | | 100.00 | % | | $ | 706,414 | | | | 100.00 | % | | $ | 703,157 | | | | 100.00 | % | | $ | 744,983 | | | | 100.00 | % | | $ | 786,253 | | | | 100.00 | % | | | 0.75 | % |

Cash and cash equivalents | | | 21,141 | | | | 2.78 | % | | | 12,752 | | | | 1.75 | % | | | 15,849 | | | | 2.24 | % | | | 12,694 | | | | 1.81 | % | | | 11,716 | | | | 1.57 | % | | | 16,504 | | | | 2.10 | % | | | -5.66 | % |

Investment securities/CDs | | | 108,693 | | | | 14.27 | % | | | 102,305 | | | | 14.00 | % | | | 100,574 | | | | 14.24 | % | | | 82,034 | | | | 11.67 | % | | | 52,690 | | | | 7.07 | % | | | 51,937 | | | | 6.61 | % | | | -15.95 | % |

Loans held for sale | | | — | | | | 0.00 | % | | | 5,667 | | | | 0.78 | % | | | 2,707 | | | | 0.38 | % | | | 3,303 | | | | 0.47 | % | | | 2,143 | | | | 0.29 | % | | | 2,143 | | | | 0.27 | % | | | NM | |

Loans receivable, net | | | 584,606 | | | | 76.77 | % | | | 561,623 | | | | 76.87 | % | | | 543,289 | | | | 76.91 | % | | | 567,662 | | | | 80.73 | % | | | 642,148 | | | | 86.20 | % | | | 677,525 | | | | 86.17 | % | | | 3.53 | % |

FHLB stock | | | 1,124 | | | | 0.15 | % | | | 1,596 | | | | 0.22 | % | | | 1,267 | | | | 0.18 | % | | | 1,162 | | | | 0.17 | % | | | 964 | | | | 0.13 | % | | | 2,089 | | | | 0.27 | % | | | 15.70 | % |

Core deposit intangible | | | 564 | | | | 0.07 | % | | | 420 | | | | 0.06 | % | | | 276 | | | | 0.04 | % | | | 132 | | | | 0.02 | % | | | 3 | | | | 0.00 | % | | | 3 | | | | 0.00 | % | | | -70.83 | % |

| | | | | | | | | | | | | |

Deposits | | $ | 666,851 | | | | 87.57 | % | | $ | 627,060 | | | | 85.82 | % | | $ | 599,697 | | | | 84.89 | % | | $ | 599,506 | | | | 85.26 | % | | $ | 643,078 | | | | 86.32 | % | | $ | 655,882 | | | | 83.42 | % | | | -0.39 | % |

Borrowings | | | — | | | | 0.00 | % | | | 11,000 | | | | 1.51 | % | | | 10,000 | | | | 1.42 | % | | | 8,000 | | | | 1.14 | % | | | 3,000 | | | | 0.40 | % | | | 28,000 | | | | 3.56 | % | | | NM | |

| | | | | | | | | | | | | | | | | | | | | | | 0.00 | % | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Equity | | $ | 86,147 | | | | 11.31 | % | | $ | 87,711 | | | | 12.00 | % | | $ | 89,600 | | | | 12.68 | % | | $ | 91,062 | | | | 12.95 | % | | $ | 92,992 | | | | 12.48 | % | | $ | 93,474 | | | | 11.89 | % | | | 1.94 | % |

Tangible equity | | $ | 85,583 | | | | 11.24 | % | | $ | 87,291 | | | | 11.95 | % | | $ | 89,324 | | | | 12.64 | % | | $ | 90,930 | | | | 12.93 | % | | $ | 92,989 | | | | 12.48 | % | | $ | 93,471 | | | | 11.89 | % | | | 2.10 | % |

| | | | | | | | | | | | | |

Loans/Deposits | | | | | | | 87.67 | % | | | | | | | 89.56 | % | | | | | | | 90.59 | % | | | | | | | 94.69 | % | | | | | | | 99.86 | % | | | | | | | 103.30 | % | | | | |

| | | | | | | | | | | | | |

Number of offices | | | 12 | | | | | | | | 13 | | | | | | | | 13 | | | | | | | | 13 | | | | | | | | 13 | | | | | | | | 13 | | | | | | | | | |

| (1) | Ratios are as a percent of ending assets. |

| Sources: | Ponce Bank’s prospectus, audited and unaudited financial statements, SNL Financial and RP Financial calculations. |

| | |

| RP® Financial, LC. | | OVERVIEW AND FINANCIAL ANALYSIS |

| | I.7 |

of total loans receivable to 23.55% of total loans receivable, commercial real estate loans increased from 19.45% of total loans receivable to 20.45% of total loans receivable and construction and land loans increased from 5.00% of total loans receivable to 5.47% of total loans receivable. Over the same time period, the relative concentration of commercial business loans decreased from 4.47% of total loans receivable to 1.81% of total loans receivable, while the Bank’s holdings of consumer loans was nominal throughout the five year period. Additionally, loans held for sale, fluctuated from a zero balance at yearend 2012 to a high of $5.7 million at yearend 2013 and equaled $2.1 million or 0.27% of assets at March 31, 2017.

The intent of the Bank’s investment policy is to provide adequate liquidity and to generate a favorable return within the context of supporting Ponce Bank’s overall credit and interest rate risk objectives. It is anticipated that proceeds retained at the holding company level will be invested into liquid funds held as a deposit at the Bank. Since yearend 2012, the Bank’s level of cash and investment securities (inclusive of FHLB stock) ranged from a low of 8.77% of assets at yearend 2016 to a high of 17.20% of assets at yearend 2012. The decrease in the balance of cash and investments since yearend 2012 was largely related to redeployment of those funds for purposes of funding loan growth during the past two andone-quarter years. U.S. Government and federal agency securities totaling $41.5 million comprised the most significant component of the Bank’s investment portfolio at March 31, 2017. Other investments held by the Bank at March 31, 2017 consisted of mortgage-backed securities ($10.0 million) and CDs ($500,000). As of March 31, 2017, all investments were maintained as available for sale and reflected a net unrealized loss of $344,000. ExhibitI-4 provides historical detail of the Bank’s investment portfolio. As of March 31, 2017, the Bank also held $16.5 million of cash and cash equivalents and $2.1 million of FHLB stock.

Since yearend 2012, Ponce Bank’s funding needs have been addressed through a combination of deposits, borrowings and internal cash flows. From yearend 2012 through March 31, 2017, the Bank’s deposits decreased at a 0.39% annual rate. Deposits declined from yearend 2012 through yearend 2015, which was followed by deposit growth during 2016 and the first quarter of 2017. Overall, deposits as a percent of assets remained fairly stable over the past five andone-quarter years, equaling 87.57% of assets at yearend 2012 and 83.42% of assets at March 31, 2017. CDs account for the largest concentration of the Bank’s deposits and comprised 56.42% of average deposits during first quarter of 2017.

| | |

| RP® Financial, LC. | | OVERVIEW AND FINANCIAL ANALYSIS |

| | I.8 |

Borrowings serve as an alternative funding source for the Bank to address funding needs for growth and to support management of deposit costs and interest rate risk. From yearend 2012 through March 31, 2017, borrowings ranged from a zero balance at yearend 2012 to high of $28.0 million or 3.56% of assets at March 31, 2017. Borrowing held by the Bank at March 31, 2017 consisted of overnight FHLB advances.

The Bank’s equity increased at a 1.94% annual rate from yearend 2012 through March 31, 2017, which was largely attributable to retention of earnings. The increase in equity combined with a comparatively slower rate of asset growth since yearend 2012 provided for a slight increase in the Bank’sequity-to-assets ratio from 11.31% at yearend 2012 to 11.89% at March 31, 2017. Similarly, the Bank’s tangibleequity-to-assets ratio increased from 11.24% at yearend 2012 to 11.89% at March 31, 2017. The Bank maintained a nominal core deposit intangible balance at March 31, 2017. The Bank maintained capital surpluses relative to all of its regulatory capital requirements at March 31, 2017. The addition of stock proceeds will serve to strengthen the Bank’s capital position, as well as support growth opportunities. At the same time, the increase in Ponce Bank’s pro forma capital position will initially depress its ROE.

Income and Expense Trends

Table 1.2 shows the Bank’s historical income statements for the past five years and for the twelve months ended March 31, 2017. The Bank’s reported earnings ranged from a low of $1.2 million or 0.16% of average assets during the twelve months ended March 31, 2017 to a high of $4.1 million or 0.53% of average assets during 2012. Net interest income and operating expenses represent the primary components of the Bank’s recurring earnings, whilenon-operating income has been somewhat of a limited source of earnings for the Bank. Loan loss provisions have had a varied impact on the Bank’s earnings over the past five andone-quarter years.Non-operating gains and losses have not been a factor on the Bank’s earnings over the past five andone-quarter years.

During the period covered in Table 1.2, the Bank’s net interest income to average assets ratio ranged from a low of 3.79% during the twelve months ended March 31, 2017 to a high of 4.14% during 2014. The decline in the Bank’s net interest income ratio since 2014 has been largely attributable to interest rate spread compression that has resulted from a more significant decrease in the yield earned on interest-earnings assets relative to the cost of interest-bearing liabilities. As the result of the prolonged low interest rate environment, the decline in yield earned on less rate sensitive interest-earning assets has become more significant relative to the

| | |

| RP® Financial, LC. | | OVERVIEW AND FINANCIAL ANALYSIS |

| | I.9 |

Table 1.2

Ponce Bank

Historical Income Statements

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the Year Ended December 31, | | | For the Twelve Months

Ended March 31, | |

| | | 2012 | | | 2013 | | | 2014 | | | 2015 | | | 2016 | | | 2017 | |

| | | Amount | | | Pct(1) | | | Amount | | | Pct(1) | | | Amount | | | Pct(1) | | | Amount | | | Pct(1) | | | Amount | | | Pct(1) | | | Amount | | | Pct(1) | |

| | | ($000) | | | (%) | | | ($000) | | | (%) | | | ($000) | | | (%) | | | ($000) | | | (%) | | | ($000) | | | (%) | | | ($000) | | | (%) | |

| | | | | | | | | | | | |

Interest income | | $ | 41,078 | | | | 5.33 | % | | $ | 37,162 | | | | 4.98 | % | | $ | 35,495 | | | | 4.93 | % | | $ | 33,590 | | | | 4.70 | % | | $ | 33,741 | | | | 4.65 | % | | $ | 33,935 | | | | 4.60 | % |

Interest expense | | | (9,504 | ) | | | -1.23 | % | | | (7,701 | ) | | | -1.03 | % | | | (5,730 | ) | | | -0.80 | % | | | (5,650 | ) | | | -0.79 | % | | | (5,936 | ) | | | -0.82 | % | | | (5,998 | ) | | | -0.81 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net interest income | | $ | 31,574 | | | | 4.10 | % | | $ | 29,461 | | | | 3.95 | % | | $ | 29,765 | | | | 4.14 | % | | $ | 27,940 | | | | 3.91 | % | | $ | 27,805 | | | | 3.83 | % | | $ | 27,937 | | | | 3.79 | % |

Provision for loan losses | | | (5,132 | ) | | | -0.67 | % | | | (3,426 | ) | | | -0.46 | % | | | (1,183 | ) | | | -0.16 | % | | | (353 | ) | | | -0.05 | % | | | 57 | | | | 0.01 | % | | | (542 | ) | | | -0.07 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net interest income after provisions | | $ | 26,442 | | | | 3.43 | % | | $ | 26,035 | | | | 3.49 | % | | $ | 28,582 | | | | 3.97 | % | | $ | 27,587 | | | | 3.86 | % | | $ | 27,862 | | | | 3.84 | % | | $ | 27,395 | | | | 3.71 | % |

| | | | | | | | | | | | |

Non-interest operating income | | $ | 3,042 | | | | 0.39 | % | | $ | 3,106 | | | | 0.42 | % | | $ | 2,749 | | | | 0.38 | % | | $ | 2,462 | | | | 0.34 | % | | $ | 2,431 | | | | 0.34 | % | | $ | 2,648 | | | | 0.36 | % |

Operating expense | | | (23,970 | ) | | | -3.11 | % | | | (24,671 | ) | | | -3.31 | % | | | (25,797 | ) | | | -3.59 | % | | | (26,216 | ) | | | -3.67 | % | | | (27,863 | ) | | | -3.84 | % | | | (28,003 | ) | | | -3.80 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net operating income | | $ | 5,514 | | | | 0.72 | % | | $ | 4,470 | | | | 0.60 | % | | $ | 5,534 | | | | 0.77 | % | | $ | 3,833 | | | | 0.54 | % | | $ | 2,430 | | | | 0.34 | % | | $ | 2,040 | | | | 0.28 | % |

| | | | | | | | | | | | |

Net income before tax | | $ | 5,514 | | | | 0.72 | % | | $ | 4,470 | | | | 0.60 | % | | $ | 5,534 | | | | 0.77 | % | | $ | 3,833 | | | | 0.54 | % | | $ | 2,430 | | | | 0.34 | % | | $ | 2,040 | | | | 0.28 | % |

Income tax provision | | | (1,424 | ) | | | -0.18 | % | | | (2,015 | ) | | | -0.27 | % | | | (2,998 | ) | | | -0.42 | % | | | (1,315 | ) | | | -0.18 | % | | | (1,005 | ) | | | -0.14 | % | | | (860 | ) | | | -0.12 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income (loss) | | $ | 4,090 | | | | 0.53 | % | | $ | 2,455 | | | | 0.33 | % | | $ | 2,536 | | | | 0.35 | % | | $ | 2,518 | | | | 0.35 | % | | $ | 1,425 | | | | 0.20 | % | | $ | 1,180 | | | | 0.16 | % |

| | | | | | | | | | | | |

Adjusted Earnings | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | $ | 4,090 | | | | 0.53 | % | | $ | 2,455 | | | | 0.33 | % | | $ | 2,536 | | | | 0.35 | % | | $ | 2,518 | | | | 0.35 | % | | $ | 1,425 | | | | 0.20 | % | | $ | 1,180 | | | | 0.16 | % |

Add(Deduct):Non-operating income | | | 0 | | | | 0.00 | % | | | 0 | | | | 0.00 | % | | | 0 | | | | 0.00 | % | | | 0 | | | | 0.00 | % | | | 0 | | | | 0.00 | % | | | 0 | | | | 0.00 | % |

Tax effect (2) | | | 0 | | | | 0.00 | % | | | 0 | | | | 0.00 | % | | | 0 | | | | 0.00 | % | | | 0 | | | | 0.00 | % | | | 0 | | | | 0.00 | % | | | 0 | | | | 0.00 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted earnings | | $ | 4,090 | | | | 0.53 | % | | $ | 2,455 | | | | 0.33 | % | | $ | 2,536 | | | | 0.35 | % | | $ | 2,518 | | | | 0.35 | % | | $ | 1,425 | | | | 0.20 | % | | $ | 1,180 | | | | 0.16 | % |

| | | | | | | | | | | | |

Expense Coverage Ratio (3) | | | 1.32x | | | | | | | | 1.19x | | | | | | | | 1.15x | | | | | | | | 1.07x | | | | | | | | 1.00x | | | | | | | | 1.00x | | | | | |

Efficiency Ratio (4) | | | 69.27 | % | | | | | | | 75.74 | % | | | | | | | 79.42 | % | | | | | | | 86.35 | % | | | | | | | 92.09 | % | | | | | | | 91.57 | % | | | | |

| (1) | Ratios are as a percent of average assets. |

| (2) | Assumes a 34.0% effective tax rate. |

| (3) | Expense coverage ratio calculated as net interest income before provisions for loan losses divided by operating expenses. |

| (4) | Efficiency ratio calculated as operating expenses divided by the sum of net interest income before provisions for loan losses plusnon-interest operating income. |

| Sources: | Ponce Bank’s prospectus, audited & unaudited financial statements, SNL Financial and RP Financial calculations. |

| | |

| RP® Financial, LC. | | OVERVIEW AND FINANCIAL ANALYSIS |

| | I.10 |

rate paid on more rate sensitive liabilities which had more significant downward repricing earlier in the prevailing interest rate environment. In fact, the Bank’s cost of funds increased slightly during 2016. Partially offsetting decline in yield earned on interest-earning assets during the past two years has been a shift in the Bank’s interest-earning asset composition towards a higher concentration of loans, which earn higher yields relative to investments and short-term liquid funds. Overall, during the past three and one quarter years, the Bank’s interest rate spread ranged declined from a high of 4.26% during 2014 to a low of 3.82% during 2016. For the three months ended March 31, 2017, the Bank’s interest rate spread equaled 3.88% versus an interest rate spread of 4.08% for the year ago quarter. The Bank’s net interest rate spreads and yields and costs for the past five andone-quarter years are set forth in ExhibitI-3 and ExhibitI-5.

Non-interest operating income has been somewhat of a limited contributor to the Bank’s earnings over the past five andone-quarter years, reflecting the Bank’s limited diversification into products and services that generatenon-interest operating income. Revenues derived fromnon-interest income sources is also limited by the relatively high concentration of deposits maintained in CDs, as opposed tofee-based deposit products. Throughout the period shown in Table 1.2,non-interest operating income ranged from a low of $2.4 million or 0.34% of average assets during 2016 to a high of $3.1 million or 0.42% of average assets during 2013. For the twelve months ended March 31, 2017,non-interest operating income amounted to $2.6 million or 0.36% of average assets. Fees and service charges and mortgage banking brokerage commissions constitute the major sources of the Bank’snon-interest operating revenues.

Operating expenses represent the other major component of the Bank’s earnings, ranging from a low of $24.0 million or 3.11% of average assets during 2012 to a high of $28.0 million or 3.80% of average assets during the twelve months ended March 31, 217. The increase in the Bank’s operating expense ratio since 2012 reflects infrastructure that has been put into place to facilitate implementation of the Bank’s strategic plan and, in particular, the additional resources that have been devoted to building the Bank’s full service commercial lending platform.

Overall, during the past five andone-quarter years, the Bank’s expense coverage ratios (net interest income divided by operating expenses) ranged from a low of 1.00x during 2016 and the twelve months ended March 31, 2017 to a high of 1.32x during 2012. Similarly, the Bank’s efficiency ratio (operating expenses as a percent of the sum of net interest income and other

| | |

| RP® Financial, LC. | | OVERVIEW AND FINANCIAL ANALYSIS |

| | I.11 |

operating income) reflected a downward trend in core earnings, based on efficiency ratios of 69.27% and 92.09% during 2012 and 2016, respectively. For the twelve months ended March 31, 2017, the Bank’s efficiency ratio improved slightly to a ratio of 91.57%.

During the period covered in Table 1.2, the amount of loan loss provisions established ranged from a reversal of loan loss provisions of $57,000 or 0.01% of average assets during 2016 to a high of $5.1 million or 0.67% of average assets during 2012. For the twelve months ended March 31, 2017, the Bank reported loan loss provisions of $542,000 or 0.07% of assets. The reduction in loan loss provisions established from 2012 through 2016 was facilitated by improving credit quality trends, including decreases in the amount of net charge-offs recorded. The increase in loan loss provisions established during the most recent twelve month period was related to loan growth, as opposed to deterioration in credit quality. As of March 31, 2017 the Bank maintained loan loss allowances of $10.4 million, equal to 1.51% of total loans receivable and 134.92% of non-accruing loans. ExhibitI-6 sets forth the Bank’s loan loss allowance activity for the past five andone-quarter years.

Over the past five andone-quarter years, the Bank’s effective tax rate ranged from a low of 25.83% during 2012 to a high of 54.17% during fiscal year 2014 and equaled 42.16% during the twelve months ended March 31, 2017. As set forth in the prospectus, the Bank’s marginal effective tax rate is 34.0%.

Interest Rate Risk Management

The Bank’s balance sheet is liability-sensitive in the short-term (less than one year) and, thus, the net interest margin will typically be adversely affected during periods of rising and higher interest rates. Comparatively, the Bank’s net interest margin benefits from a declining interest rate environment. As interest rates have remained at or near historically low levels for an extended period of time, the Bank has experienced interest spread compression as the average yield earned on interest-earning assets has started to decline more relative to the average rate paid on interest-bearing liabilities. As of March 31, 2017, an analysis of the Bank’s net present value (“NPV”) and net interest income indicatedthat in the event of an instantaneous parallel 200 basis point increase in interest rates NPV would decrease by 11.26% and net interest income would decrease by 5.18% in year one (see ExhibitI-7).

The Bank pursues a number of strategies to manage interest rate risk, particularly with respect to seeking to limit the repricing mismatch between interest rate sensitive assets and

| | |

| RP® Financial, LC. | | OVERVIEW AND FINANCIAL ANALYSIS |

| | I.12 |

liabilities. The Bank manages interest rate risk from the asset side of the balance sheet through investing in investment securities with adjustable interest rates, maintaining the investment portfolio as available for sale and emphasizing origination of adjustable rate and shorter term fixed rate loans, for retention in the Bank’s loan portfolio. As of March 31, 2017, of the Bank’s total loans due after March 31, 2018, adjustable rate loans comprised 84.21%% of total loans receivable (see ExhibitI-8). On the liability side of the balance sheet, management of interest rate risk has been pursued through emphasizing growth of lower costing and less interest rate sensitive transaction and savings accounts and seeking to extend CD maturities through offering attractive rates on certain longer term CDs. Transaction and savings account deposits comprised 43.58% of the Bank’s average total deposits during the three months ended March 31, 2017.

The infusion of stock proceeds will serve to further limit the Bank’s interest rate risk exposure, as most of the net proceeds will be redeployed into interest-earning assets and the increase in the Bank’s capital position will lessen the proportion of interest rate sensitive liabilities funding assets.

Lending Activities and Strategy

Historically, Ponce Bank’s lending activities have emphasized1-4 family permanent mortgage loans and such loans continue to comprise the largest concentration of the Bank’s loan portfolio composition. Pursuant to the Bank’s strategic plan, the Bank is pursuing a diversified lending strategy emphasizing commercial real estate/multi-family loans and commercial business loans as the primary areas of targeted loan growth. Other areas of lending diversification for the Bank include construction and land loans, home equity loans and lines of credit and other consumer loans. ExhibitI-9 provides historical detail of Ponce Bank’s loan portfolio composition for the past five andone-quarter years and ExhibitI-10 provides the contractual maturity of the Bank’s loan portfolio by loan type as of March 31, 2017.

1-4 Family Residential Loans. As a portfolio only lender, Ponce Bank presently only offers adjustable rate1-4 family permanent mortgage loans. The Bank generally limits owner-occupied1-4 family loans toloan-to-value (“LTV”) ratio of 80% and investor owned1-4 family loans to a to LTV ratio of 70% on purchases and 65% on refinances. A minimum debt-coverage ratio of 1.2 times is required for investor owned1-4 family loans. Adjustable rate loans offered by the Bank generally have repricing terms of one or five years and are indexed to the comparable term Treasury note. As of March 31, 2017, the Bank’s outstanding balance of1-4 family loans equaled $334.0 million or 48.60% of total loans receivable and consisted of $237.9 million of investor owned loans and $96.1 million of owner occupied loans.

| | |

| RP® Financial, LC. | | OVERVIEW AND FINANCIAL ANALYSIS |

| | I.13 |

Home Equity Loans and Lines of Credit. Included in the Bank’s1-4 family loan portfolio are home equity loans and lines of credit, which totaled $10.0 million at March 31, 2017. Home equity loans are originated with comparable terms as1-4 family permanent mortgage loans. Home equity lines of credit are tied to the prime rate as published inThe Wall Street Journal and are offered for terms of up to a five year draw period followed by a 25 year repayment period. The Bank will originate home equity loans and lines of credit up to a maximum LTV ratio of 75%, inclusive of other liens on the property.

Construction Loans. Construction loans originated by the Bank consist primarily of loans to finance the construction of multi-family properties and, to a lesser extent, to finance the construction of commercial properties and1-4 family residences. Construction loans are generally offered as fixed rate interest only loans during the construction period, which is typically up to 24 months. Construction loans are generally offered up to a maximum LTV ratio of 70% of the appraised value of the completed property. The Bank’s1-4 family construction lending activities consist of originations to professional developers, contractors and builders, and individuals. As of March 31, 2017, the Bank’s outstanding balance of construction loans equaled $37.6 million or 5.47% of total loans receivable.

Commercial Real Estate and Multi-Family Loans. Commercial real estate and multi-family loans consist largely of loans originated by the Bank, which are collateralized by properties in the Bank’s regional lending area. Ponce Bank generally originates commercial real estate and multi-family loans up to a LTV ratio of 75% and generally requires a minimum debt-coverage ratio of 1.3 times. Commercial real estate and multi-family loans are originated with amortization terms of up to 30 years. Loan terms offered on commercial real estate and multi-family loans generally consist of adjustable rate loans, which are indexed to the corresponding FHLB advance rate of the repricing term. Properties securing the commercial real estate and multi-family loan portfolio include office buildings, industrial and warehouse facilities, retail and wholesale facilities, apartments, churches, restaurants, hotels and motels and service facilities (doctor, dentist, beauty, etc.). As of March 31, 2017, the Bank’s outstanding balance of commercial real estate and multi-family loans totaled $302.3 million equal to 44.00% of total loans outstanding and included $161.8 million of multi-family loans.

| | |

| RP® Financial, LC. | | OVERVIEW AND FINANCIAL ANALYSIS |

| | I.14 |

Commercial Business Loans. The commercial business loan portfolio is generated through extending loans to businesses operating in the local market area. Expansion of commercial business lending activities is a desired area of loan growth for the Bank, pursuant to which the Bank is seeking to become a full service community bank to its commercial loan customers through offering a full range of commercial loan products that can be packaged with lower cost commercial deposit products. Commercial business loans offered by the Bank consist of lines of credit and term loans, with terms of generally no more than seven years. Commercial business loans are typically indexed toThe Wall Street Journal prime rate. The commercial business loan portfolio consists substantially of loans secured by business assets such as accounts receivable, inventory, equipment and real estate. As of March 31, 2017, the Bank’s outstanding balance of commercial business loans equaled $12.4 million or 1.81% of total loans receivable.

Consumer Loans. Consumer lending other than home equity lines of credit has been a limited area of lending diversification for the Bank, with such loans consisting of installment loans and loans secured by savings accounts or CDs. As of March 31, 2017, the Bank held $796,000 of consumer loans or 0.12% of total loans receivable.

ExhibitI-11 provides a summary of the Bank’s lending activities over the past five andone-quarter years. Total loans originated ranged from a low of $76.9 million during 2012 to a high of $162.8 million during 2016. Loan originated for the three months ended March 31, 2017 totaled $74.8 million, which was well above the $41.2 million of loans originated during the year ago quarter. The increase in loans originated was primarily driven by increased originations of1-4 family loans, multi-family loans and commercial real estate loans. The Bank was not active in purchasing or selling loans over the past five andone-quarter years, with the exception of selling $838,000 of multi-family loans during 2014 and in 2012 the Bank sold loans totaling $2.4 million consisting of1-4 family loans, multi-family loans and construction and land loans. Following three years of decline from 2012 through 2014, the Bank’s net loan activity showed increases of $24.4 million in 2015, $75.0 million in 2016 and $35.5 million during the three months ended March 31, 2017.

Asset Quality

Historically, the Bank’s lending emphasis on lending in local and familiar markets generally supported maintenance of relatively favorable credit quality measures. However, following the national recession and bursting of the housing bubble in 2008, the Bank

| | |

| RP® Financial, LC. | | OVERVIEW AND FINANCIAL ANALYSIS |

| | I.15 |

experienced elevated levels of problems assets. In recent years, the Bank has taken proactive measures to address credit quality deterioration and significantly reduce the balance ofnon-performing balance assets from peak levels. Over the past five andone-quarter years, Ponce Bank’s balance ofnon-performing assets ranged from a high of $62.8 million or 8.25% of assets at yearend 2012 to a low of $7.7 million or 0.98% of assets at March 31, 2017. As shown in ExhibitI-12,non-performing assets at March 31, 2016 consisted of $7.7 million ofnon-accruing loans.Non-accruing loans held by the Bank at March 31, 2017 were primarily concentrated in1-4 family permanent mortgage loans totaling $4.2 million.

To track the Bank’s asset quality and the adequacy of valuation allowances, the Bank has established detailed asset classification policies and procedures which are consistent with regulatory guidelines. Classified assets are reviewed monthly by senior management and quarterly by the Board. Pursuant to these procedures, when needed, the Bank establishes additional valuation allowances to cover anticipated losses in classified ornon-classified assets. As of March 31, 2017, the Bank maintained loan loss allowances of $10.4 million, equal to 1.51% of total loans receivable and 134.92% ofnon-performing loans.

Funding Composition and Strategy

Deposits have consistently served as the Bank’s primary funding source and at March 31, 2017 deposits accounted for 95.91% of Ponce Bank’s combined balance of deposits and borrowings. ExhibitI-13 sets forth the Bank’s deposit composition for the past three andone-quarter years and ExhibitI-14 provides the interest rate and maturity composition of the CD portfolio at March 31, 2017. CDs constitute the largest component of the Bank’s deposit composition; although, the concentration of CDs comprising total deposits has declined slightly during the past three years, as the result of growth of transaction and savings account deposits and a decrease in CDs. For the three months ended March 31, 2017, the balance of CDs averaged $362.5 million or 56.42% of average deposits, versus comparable measures of $379.9 million and 62.07% of average deposits for 2014. CDs with scheduled maturities of one year or less comprised 43.16% of the Bank’s CDs at March 31, 2017. As of March 31, 2017, jumbo CDs (CD accounts with balances of $100,000 or more) amounted to $232.2 million or 63.54% of total CDs. The Bank did not maintain any brokered deposit as of March 31, 2017.

Transaction and savings account deposits comprised 43.58% of average total deposits during the three months ended March 31, 2017, as compared to 37.93% of average total deposits during 2014. Savings account deposits comprised the largest concentration of the Banks core deposits during the three months ended March 31, 2017, averaging $128.9 million or 46.02% of average core deposits.

| | |

| RP® Financial, LC. | | OVERVIEW AND FINANCIAL ANALYSIS |

| | I.16 |

Borrowings serve as an alternative funding source for the Bank to facilitate management of funding costs and interest rate risk Borrowings totaled $28.0 million at March 31, 2017 and consisted entirely of FHLB advances on an overnight line of credit basis. At March 31, 2017, the FHLB advances had a weighted average interest rate of 1.04%. ExhibitI-15 provides further detail of the Bank’s borrowings activities during the past three andone-quarter years.

Subsidiary Activities

Ponce Bank maintains two wholly-owned subsidiaries: PFS Service Corp, which owns two the Bank’s properties, and Ponce de Leon Mortgage Corp., which is a mortgage banking entity.

Legal Proceedings

The Bank is not currently party to any pending legal proceedings that the Bank’s management believes would have a material adverse effect on the Bank’s financial condition, results of operations or cash flows.

| | |

| RP® Financial, LC. | | MARKET AREA |

| | II.1 |

II. MARKET AREA

Introduction

Headquartered in Bronx, New York, Ponce Bank serves the New York metropolitan area through its headquarters office and 13 full service branch offices The Bank’s branch network covers a four-county market area in New York: Bronx County (4 branches), Queens County (3 branches), Kings County (3 branches) and New York County (2 branches). Ponce Bank also maintains one branch location in Hudson County, New Jersey. ExhibitII-1 provides information on the Bank’s office facilities.

With operations in a major metropolitan area, the Bank’s competitive environment includes a significant number of commercial banks, thrifts and other financial services companies, some of which have a regional or national presence. These institutions also have greater resources at their disposal than the Bank. The New York metropolitan area has a highly developed economy, with a relatively high concentration of highly skilled workers who are employed in a number of different industry clusters including financial services, healthcare and technology.

Future growth opportunities for Ponce Bank depend on the future growth and stability of the local and regional economy, demographic growth trends, and the nature and intensity of the competitive environment. These factors have been briefly examined to help determine the growth potential that exists for the Bank, the relative economic health of the Bank’s market area, and the resultant impact on value.

National Economic Factors

The future success of the Bank’s operations is partially dependent upon various national and local economic trends. In assessing national economic trends over the past few quarters, manufacturing activity picked up slightly in October 2016 with an index reading of 51.9. Comparatively, service sector activity for October expanded at a slower rate with an index reading of 54.8. Employers added 161,000 jobs in October and the unemployment rate for October ticked down to 4.9%, which was due to a decline in the number of people participating in the workforce. Notably, wage gains for October were the strongest since 2009 and, thereby, keeping the Federal Reserve on a pace for a December rate hike. Housing starts jumped 25.5% in October, while existing home sales for October climbed 2.0%. Comparatively, new

| | |

| RP® Financial, LC. | | MARKET AREA |

| | II.2 |

home sales declined 1.9% in October and October pending home sales increased 0.1%. U.S. employers added 178,000 jobs in November and the November unemployment rate fell to a nine-year low of 4.6%. Manufacturing and service sector activity accelerated in November, with respective readings of 53.2 and 57.2. Following a strong October, housing starts declined 18.7% in November. However, existing home sales were up for the third straight month in November, increasing 0.7% which was the highest sales pace since February 2007. Sales of new homes for November showed a healthy increase of 5.2%, while November pending home sales declined 2.5%. Manufacturing activity for December rose to 54.7, hitting its highest level since December 2014, and December service sector activity held steady with a reading of 57.2. The U.S. economy added 156,000 jobs in December and the December unemployment rate ticked up to 4.7%. The pace of home sales slowed in December, as existing home sales for sales decreased 2.8% compared to November. New home sales plunged 10.4% in December compared to the prior month, which was viewed as an indication that affordability challenges were beginning to cut into demand. However, December pending home sales increased 1.6% compared to November. Fourth quarter GDP increased at a 1.9% annual rate (subsequently revised to 2.1%).

Job growth for the first month of 2017 was stronger than expected, as U.S. employers added 227,000 in January 2017. However, the January 2017 unemployment rate for the U.S. edged up to 4.8%, due to more Americans actively seeking employment. Manufacturing activity for January accelerated with a reading of 56.0, while January service sector activity grew at a slightly slower pace with a reading of 56.5. Retail sales for January showed a healthy 0.4% increase from December. Housing starts for January declined 2.6%, which was due to a drop in multi-family construction. Comparatively, January existing home sales increased 3.3%, which was the fastest pace for existing home sales since February 2007. Economic activity in the manufacturing sector expanded in February to a reading of 57.7, while February service sector activity also increased to a reading of 57.6. The U.S. economy added 235,000 jobs in February and the February unemployment rate ticked down to 4.7%. Retail sales for February showed a modest increase of 0.1%. Data for February home sales was mixed, as February new home sales increased 6.1% and February pending home sales jumped 5.5%. Comparatively, February existing homes declined 3.7%. Manufacturing and service sector activity expanded at slightly lower rates with respective readings of 57.2 and 55.2. Job growth for March was less than expected, as U.S. employers added only 98,000 jobs in March. The March unemployment rate edged down to 4.5%. Existing home sales for March rebounded with a.4.4% increase in

| | |

| RP® Financial, LC. | | MARKET AREA |

| | II.3 |

sales, which was the strongest month of sales since February 2007. March new home sales also showed a healthy increase of 5.8%, while pending home sales for March slipped 0.8%. The decrease in March pending home sales was attributable to a low inventory of listings in the affordable price range. First quarter GDP increased at an annual rate of 0.7%, which was the slowest growth since the first quarter of 2014. Manufacturing activity eased in April, with an index reading of 54.8, while April service sector activity accelerated an index reading of 57.5. The U.S. economy added 211,000 jobs in April and the unemployment rate for April fell to 4.4%, which was the lowest unemployment rate since May 2007.

In terms of interest rates trends over the past few quarters, stronger readings for September manufacturing and service sector activity helped to push the10-year Treasury yield above 1.70% inmid-October 2016. Long-term Treasury yields continued to edge higher going into late-October, as signs of inflation ticking up pushed the10-year Treasury yield to its highest level in four months. The Federal Reserve concluded its early-November policy meeting leaving interest rates unchanged, but noted that inflation had increased somewhat and left the door open for a rate increase in December. Interest rates stabilized ahead of the Presidential election and then surged higher following the election, based on expectations that there would be an increase in government spending and apick-up in inflation under the Trump administration. The upward trend in long-term Treasury yields continued through the end of November and into December, in which the10-year Treasury yield rose to a 17-month high of 2.44% on December 1, 2016. Treasury prices continued to slide lower throughmid-December, as the Federal Reserve concluded itstwo-day policy meeting raising its target interest rate by 0.25% and signaled interest rates would rise faster than previously projected based on growing optimism about the strength of the U.S. economy. After hitting amid-December high of 2.60%, the yield on the10-year Treasury eased lower in the closing weeks of 2016.

Long-term Treasury yields edged lower during the first half of January 2017, as the December employment report showed weaker than expected job growth. Treasury yields reversed course in the second half of January, with renewed optimism about the U.S. economy prompting investors to buy stocks and lighten up on their holdings of safer assets such as Treasury bonds. At the start of February, the Federal Reserve concluded itstwo-day policy meeting with no change in its target interest rate and indicated it remained on track to gradually raise short-term interest rates this year. Long-term Treasury yields edged lower following the release of the January jobs report. Interest rates edged higher going into the second half of February, as increases in retail sales, factory output and inflation pointed to a healthy start in

| | |

| RP® Financial, LC. | | MARKET AREA |

| | II.4 |

2017 for the U.S. economy. Growing expectations for higher interest rates pushed Treasury yields higher in early-March, as the Federal Reserve Chairwoman signaled that the Federal Reserve was on course to raise short-term interest rates in the near future. The10-year Treasury yield closed at 2.61% ahead of themid-March meeting of the Federal Reserve, which was its highest yield in over two years. The Federal Reserve concluded itsmid-March meeting by raising the federal funds rate by a quarter point to a range between 0.75% and 1% and signaled that additional gradual rate increases were ahead. Following the Federal Reserve meeting, long-term Treasury yields trended lower during the second half of March.

The rally in Treasury bonds continued during the first half of April 2017, with the10-year Treasury yield declining to a low of 2.18%. Disappointing job growth reflected in the March employment data and investors moving into safe haven assets on news of the U.S. dropping a bomb on an Islamic State target in Afghanistan were noted factors contributing the rally in Treasury bonds. Long-term Treasury yields edged up slightly during the second of half of April and into the first week of May. The Federal Reserve concluded itstwo-day policy meeting inearly-May voting to hold its benchmark rate steady. As of May 5, 2017, the bond equivalent yields for U.S. Treasury bonds with terms of one and ten years equaled 1.10% and 2.36%, respectively, versus comparable year ago yields of 0.51% and 1.76%. ExhibitII-2 provides historical interest rate trends.

Based on the consensus outlook of economists surveyed by The Wall Street Journal in April 2017, GDP growth was projected to increase to 2.3% in 2017. The unemployment rate was forecasted to equal 4.6% in June 2017 and then decline slightly to equal 4.4% in December 2017. An average of 169,000 jobs were projected to be added per month during 2017. On average, the economists forecasted an increase in the federal funds rate to 1.07% in June 2017 and to 1.41% in December 2017. On average, the economists forecasted that the10-year Treasury yield would increase to 2.59% in June 2017 and increase to 2.84% by the end of 2017. The surveyed economists also forecasted home prices would rise 4.8% in 2017 and housing starts were forecasted to continue to trend slightly higher in 2017.