Exhibit 10.5

EXECUTION VERSION

CONFIDENTIAL

MASTER MANAGEMENT SERVICES AGREEMENT

Effective as of December 10, 2016

by and among

ROYAL RESOURCES L.P.

RIVERBEND NATURAL RESOURCES, L.P.

BLACKSTONE MANAGEMENT PARTNERS, LLC

and

RIVERBEND OIL & GAS, L.L.C.

Table of Contents

| SECTION 1. DEFINITIONS; CONSTRUCTION | | 1 |

| | | |

| SECTION 2. APPOINTMENT AND DUTIES OF THE MANAGER; SERVICES | | 5 |

| | | |

| SECTION 3. EMPLOYEES OF THE MANAGER | | 7 |

| | | |

| SECTION 4. PROHIBITED ACTIVITIES | | 7 |

| | | |

| SECTION 5. STANDARD OF CARE | | 7 |

| | | |

| SECTION 6. PROCUREMENT OF GOODS AND SERVICES BY PARTIES; AFFILIATE TRANSACTIONS | | 7 |

| | | |

| SECTION 7. SERVICE PROVIDER INFORMATION | | 7 |

| | | |

| SECTION 8. NO COMMINGLING OF ASSETS | | 8 |

| | | |

| SECTION 9. INSURANCE | | 8 |

| | | |

| SECTION 10. MANAGER EXPENSES; INVOICING | | 8 |

| | | |

| SECTION 11. BOOKS, RECORDS AND REPORTING | | 10 |

| | | |

| SECTION 12. BUDGETS | | 11 |

| | | |

| SECTION 13. LIMITATIONS ON LIABILITY; INDEMNIFICATION | | 12 |

| | | |

| SECTION 14. TERM AND TERMINATION; TRANSITION | | 15 |

| | | |

| SECTION 15. CONFIDENTIALITY | | 17 |

| | | |

| SECTION 16. NONSOLICIT | | 18 |

| | | |

| SECTION 17. ASSIGNMENT; BINDING EFFECT | | 18 |

| | | |

| SECTION 18. INDEPENDENT CONTRACTOR; NO JOINT VENTURE | | 19 |

| | | |

| SECTION 19. GOVERNING LAW; SEVERABILITY | | 19 |

| | | |

| SECTION 20. JUDICIAL PROCEEDINGS | | 19 |

| | | |

| SECTION 21. NO WAIVER; CUMULATIVE REMEDIES | | 20 |

| | | |

| SECTION 22. NOTICES | | 20 |

| | | |

| SECTION 23. COMPLIANCE | | 21 |

| | | |

| SECTION 24. ENTIRE AGREEMENT; AMENDMENTS | | 22 |

| | | |

| SECTION 25. COUNTERPARTS | | 22 |

| | | |

| SECTION 26. HEADINGS | | 22 |

| | | |

| SECTION 27. NO RECOURSE | | 22 |

MASTER MANAGEMENT SERVICES AGREEMENT

This MASTER MANAGEMENT SERVICES AGREEMENT is made and entered into on March __, 2017, and deemed to be effective as of, December 10, 2016 (as amended or supplemented from time to time in accordance herewith, this “Agreement”), by and between Royal Resources L.P., a Delaware limited partnership (“Royal”), Riverbend Natural Resources, L.P., a Delaware limited partnership (the “Opportunities Partnership”), Blackstone Management Partners, LLC a Delaware limited liability company (“Blackstone”), and Riverbend Oil & Gas, L.L.C., a Texas limited liability company (the “Manager”).

RECITALS

WHEREAS, Royal, the Opportunities Partnership, Blackstone and the Manager entered into that certain Master Management Services Agreement, dated as of December 9, 2013 (the “Original MSA”);

WHEREAS, the Original MSA expired by its terms as of December 9, 2016 and the Parties desire to enter into this Agreement to reflect the Services to be provided by the Manager to Royal, the Opportunities Partnership and each Additional Service Entity, if any, and the obligations of the Parties with respect thereto, effective as of December 10, 2016;

WHEREAS, certain Manager Parties were issued equity interests in Royal which have vested in full in accordance with their respective Equity Plans (the “Vested Incentive Interests”); and

WHEREAS, Blackstone and Royal desire to amend the Second Amended and Restated Limited Partnership Agreement of Royal, dated December 9, 2013 in accordance with Exhibit C attached hereto, to provide certain of the Manager Parties additional incentives to perform the Services by granting such Manager Parties additional equity interests in Royal to vest pursuant to the terms of the Class C Equity Plan of Royal, as amended in accordance with Exhibit C (the “Additional Incentive Interests”).

NOW THEREFORE, in consideration of the mutual covenants herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows:

SECTION 1.DEFINITIONS; CONSTRUCTION.

(a) The following capitalized terms as used in this Agreement have the respective

meanings set forth below:

“Action” has the meaning set forth in Section 13(b).

“Additional Incentive Interests” has the meaning set forth in the Recitals.

“Additional Royal Investments” means any acquisition of oil and gas assets or related interests by Royal or any of its subsidiaries that is consummated after the date hereof.

“Additional Service Entity” has the meaning set forth in Section 2(c).

“Affiliate” means, in respect of a person, each entity that, directly or indirectly, controls, is controlled by or is under common control with such person.

“Agreement” has the meaning set forth in the Preamble.

“Allocable Overhead Costs” has the meaning set forth in Section 10(a).

“Audit Right” has the meaning set forth in Section 11(b). “Blackstone” has the meaning set forth in the Preamble.

“Blackstone Group” shall mean Blackstone, the Service Entities and each of their respective Affiliates.

“Budget” has the meaning set forth in Section 12(a)(i).

“Cause” has the meaning set forth in each applicable Equity Plan.

“Confidential Information” means all confidential and proprietary information (irrespective of the form of communication) obtained by or on behalf of the Manager about the Blackstone Group, any portfolio company of Blackstone or its Affiliates, any Investment of the Service Entities, the business of any Service Entity or otherwise in connection with this Agreement, other than information which (i) was or becomes generally available to the public other than as a result of a breach of this Agreement by the Manager, (ii) was or becomes available to the Manager from a source other than members of the Blackstone Group or their respective representatives, provided that such source is not known by the Manager to be bound by a confidentiality agreement with, or other obligation of secrecy to, a member of the Blackstone Group prior to disclosure to the Manager, or (iii) was independently developed by the Manager without violating any of the Manager’s obligations under this Agreement (including the activities pertaining thereto).

“Expense Statement” has the meaning set forth in Section 10(d).

“Equity Plan” means any of (i) the Class C Equity Plan pursuant to the Limited Partnership Agreement of Royal, (ii) the Series C Equity Plan pursuant to the Limited Partnership Agreement of the Opportunities Partnership or (iii) the equity plan of an Additional Service Entity, if any.

“FCPA” has the meaning set forth in Section 23(b).

“Good Reason” has the meaning set forth in each applicable Equity Plan. “Indemnified Party” has the meaning set forth in Section 13(b).

“Investments” means, as of any date, the assets and businesses of a Service Entity for which the Manager provides Services, directly or indirectly, pursuant to the terms of this Agreement.

“knowledge” and “knowingly” mean, in respect of the Manager or any of its Affiliates, the actual knowledge of the senior managers of the Manager (including, without limitation, the Manager Control Parties) with oversight responsibility for the applicable personnel or subject matter, after reasonable investigation by such senior manager consistent with their oversight responsibility.

“Liabilities” has the meaning set forth in Section 13(b).

“Malfeasance” means (i) with respect to the Manager, (A) any act or omission by it or its Affiliates (for this purpose only, not including employees, agents and subcontractors of the Manager) that constitutes fraud, willful misconduct, gross negligence or bad faith in connection with the activities under this Agreement, (B) the publishing of any oral or written statements about any member of the Blackstone Group that are malicious, obscene, threatening, harassing, intimidating or discriminatory and which are designed to result in material harm to any member of Blackstone Group; provided, however, that the foregoing restrictions shall not apply to with respect to Manager’s communication with federal, state or local governmental agencies as may be legally required or otherwise protected by law; or (C) a material breach of Section 15 of this Agreement, or any of the foregoing described in (A) through (C) of an employee, agent or subcontractor of the Manager or its Affiliates that the Manager, after obtaining knowledge of the act or omission and a reasonable opportunity to remedy such act or omission, knowingly permits or knowingly condones, and (ii) with respect to any person other than Manager, either (A) any act or omission by such person which constitutes fraud, willful misconduct, gross negligence or bad faith in connection with the activities under this Agreement, (B) the publishing of any oral or written statements about any member of the Blackstone Group that are malicious, obscene, threatening, harassing, intimidating or discriminatory and which are designed to result in material harm to any member of Blackstone Group; provided, however, that the foregoing restrictions shall not apply to with respect to such person’s communication with federal, state or local governmental agencies as may be legally required or otherwise protected by law; or (C) a material breach of Section 15 or (x) any act or omission by such person’s Affiliate which constitutes fraud, willful misconduct, gross negligence or bad faith in connection with the activities under this Agreement, (y) the publishing of any oral or written statements about any member of the Blackstone Group by such person’s Affiliate that are malicious, obscene, threatening, harassing, intimidating or discriminatory and which are designed to result in material harm to any member of Blackstone Group; provided, however, that the foregoing restrictions shall not apply to with respect to such person’s communication with federal, state or local governmental agencies as may be legally required or otherwise protected by law; or (z) a material breach of Section 15 of this Agreement by such person’s Affiliate, so long as such person knowingly permitted or knowingly condoned such act or omission by its Affiliate.

“Manager” has the meaning set forth in the Preamble.

“Manager Control Party” means any of Randolph Newcomer, Jr., Scott Rice, Mark Dutcher and Irene Deck, so long as each is an employee of the Manager or any of its Affiliates, and “Manager Control Parties” means collectively, all of such persons.

“Manager Expenses” has the meaning set forth in Section 10(a).

“Manager Parties” means the Manager and its employees (including the Manager Control Parties).

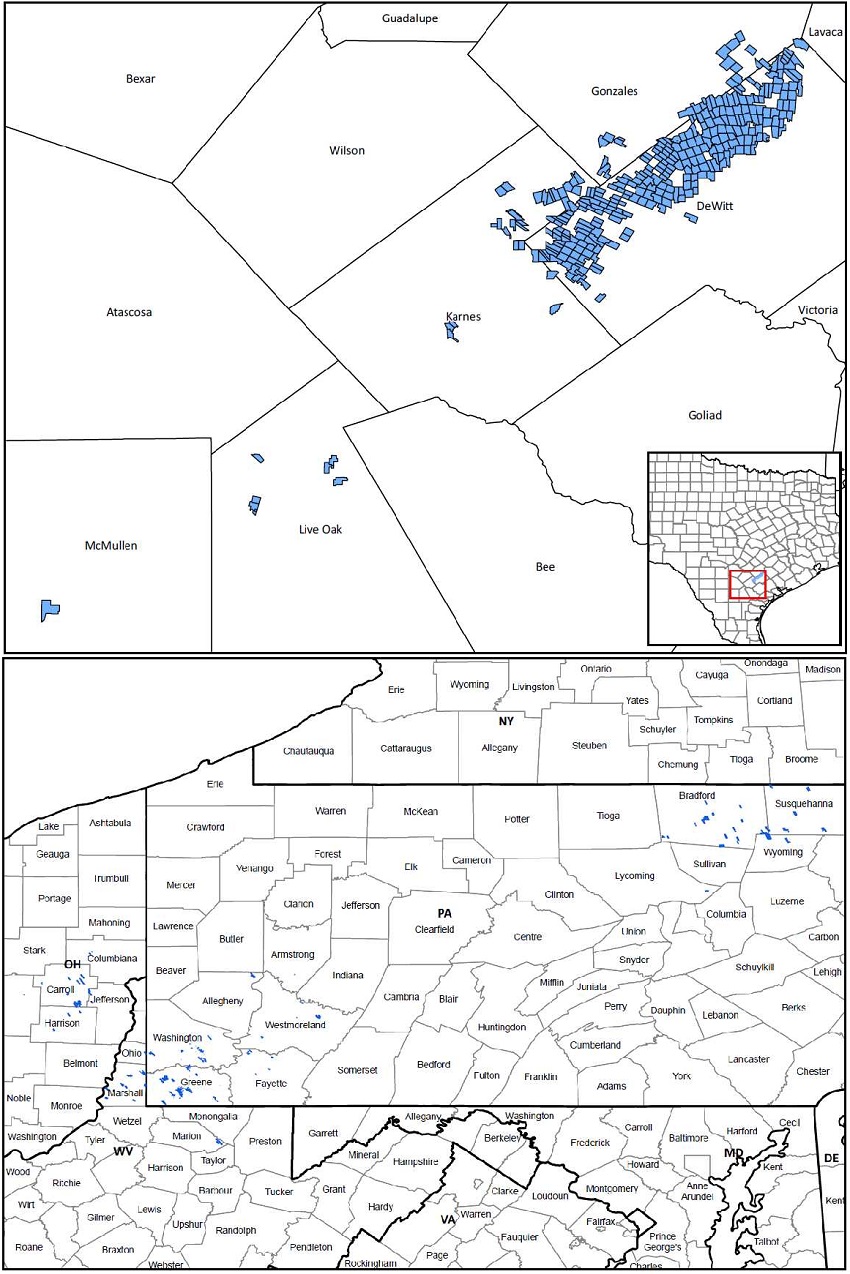

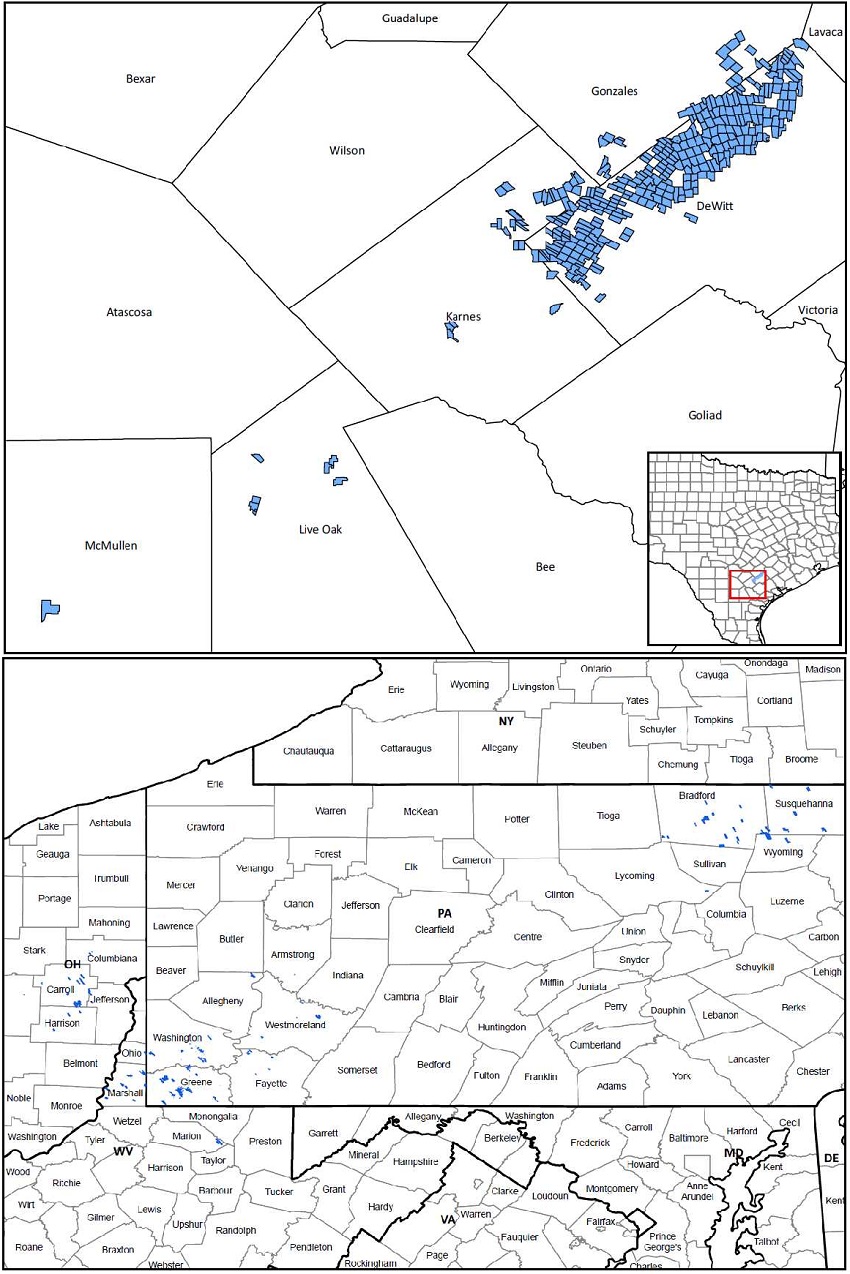

“Opportunities” means any opportunity to acquire an interest in (whether by lease, purchase, farm-in, acquisition, swap, development, reversion or otherwise) mineral interests (whether leased or unleased) and/or royalty interests to the extent such interests are partially or wholly within the blue area shown on Exhibit B hereto (which, for the avoidance of doubt will terminate and have no further force or effect upon the termination of this Agreement); provided, further, that the term “Opportunities” shall not include (x) those transactions set forth on Exhibit C to the Limited Partnership Agreement of the Opportunities Partnership, dated as of December 9, 2013 and (y) any working interests.

“Opportunities Partnership” has the meaning set forth in the Preamble.

“Opportunities Partnership General Partner” means Riverbend Natural Resources GP, LLC, a Delaware limited liability company.

“Out of Pocket Expenses” has the meaning set forth in Section 10(a).

“Parties” means, collectively, Royal, the Opportunities Partnership, the Manager, Blackstone and each Additional Service Entity that becomes a party to this Agreement in accordance with Section 2(c) (each, individually, a “Party”).

“Quarterly Report” has the meaning set forth in Section 11(c). “Royal” has the meaning set forth in the Preamble.

“Royal General Partner” means Royal Resources GP L.L.C., a Delaware limited liability company.

“Service Entities” means Royal, the Opportunities Partnership and any Additional Service Entity that becomes a party to this Agreement in accordance with Section 2(c), and each of their respective subsidiaries, and “Service Entity” means any one of the foregoing.

“Services” means those services, (i) with respect to the business of Royal and its subsidiaries, set forth in Schedule I, (ii) with respect to the Opportunities Partnership and its subsidiaries, set forth in Schedule II and (iii) with respect to an Additional Service Entity and its subsidiaries, as agreed by the Manager and such Additional Service Entity, in each case as may be modified from time to time pursuant to Section 2, or as the Service Entity (or its general partner acting on its behalf) and the Manager reasonably determine may be necessary or useful for the day-to-day management, monitoring and operation of the businesses of such Service Entity from time to time.

“Vested Incentive Interests” has the meaning set forth in the Recitals.

(b) Unless the context requires otherwise: (i) the singular form of nouns, pronouns and verbs include the plural and vice-versa; (ii) the terms “include,” “includes” and “including” and words of like import will be deemed to be followed by the words “without limitation”; and(iii) the terms “hereof,” “herein” and “hereunder” refer to this Agreement as a whole and not to any particular provision of this Agreement.

SECTION 2.APPOINTMENT AND DUTIES OF THE MANAGER; SERVICES.

(a)Royal Services. Pursuant to the terms of and conditions of this Agreement and the Budget, Royal hereby engages the Manager to perform the Services set forth in Schedule I and to provide all personnel not otherwise provided by Royal reasonable and necessary to perform such Services, and the Manager hereby accepts such engagement and agrees to (i) perform such Services consistent with the terms and conditions of this Agreement and (ii) provide any personnel not otherwise provided by Royal as may be reasonable and necessary to perform such Services. Following the date hereof, in the event Royal consummates any Additional Royal Investments, upon the election of Royal General Partner and with the mutual consent of the Manager, the scope of the Services set forth in Schedule I shall be expanded to encompass any additional Services reasonably required with respect to such Additional Royal Investments and the Budget, both to the extent required, shall be revised in accordance with Section 12(b).

(b)Opportunities Partnership Services. Pursuant to the terms of and conditions of this Agreement and the Budget, the Opportunities Partnership hereby engages the Manager to perform the Services set forth in Schedule II and to provide all personnel not otherwise provided by the Opportunities Partnership reasonable and necessary to perform such Services, and the Manager hereby accepts such engagement and agrees to (i) perform such Services consistent with the terms and conditions of this Agreement and (ii) provide any personnel not otherwise provided by the Opportunities Partnership as may be reasonable and necessary to perform the Services.

(c) Additional Service Entities. If, after the date hereof, Blackstone identifies any Affiliate of Blackstone or additional investment opportunity for which Blackstone desires the Manager to provide Services (each, an “Additional Service Entity”), (i) such Additional Service Entity shall enter into a customary joinder to this Agreement which shall define the Services mutually agreed to by Blackstone and the Manager to be provided (including any additional insurance requirements), the Manager's consent to such additional Services not to be unreasonably withheld, conditioned or delayed, and provide that such Services will be furnished pursuant to the terms of this Agreement, (ii) Blackstone and the Manager will use commercially reasonable efforts to agree on such additional compensation to Manager (including but not limited to additional incentive or other equity interests) for providing Services to such Additional Service Entity, (iii) such Additional Service Entity and the Manager will agree to an appropriate budget for such Additional Service Entity and, to the extent required, an amended Budget and (iv) the Manager shall allocate any Allocable Overhead Costs reflected in the Budget between the existing Service Entities and such Additional Service Entity in accordance with the policies and procedures provided by Blackstone to Manager from time to time, and such Allocable Overhead Costs and other budgeted expenses shall be paid in accordance with Section 10.

(d)Allocation of Resources. During the term of this Agreement, the Manager and the Manager Control Parties shall provide the Services pursuant to this Agreement and allocate a sufficient amount of their time, focus, resources and effort as the Manager and such Manager Control Parties may determine is necessary to perform such Services under the then-current Budget agreed to by the Parties (attached hereto as Exhibit A and which shall go into effect onJanuary 1, 2017), which allocation to the Services relative to the amount of time allocated to providing services to third parties shall be commensurate with the Services required in accordance with the Budget; provided, that, such allocation to the Services shall be, at all times, greater than 50% of time allocated to providing services to all third parties, including Blackstone. To the extent that the Manager or the Manager Control Parties are providing the Services in a manner such that the Budget materially understates or overstates the amount of time, focus, resources and effort allocated to providing the Services, then the Parties will promptly amend any applicable budgets as necessary in order to accurately reflect the actual amount of time, focus, resources and effort allocated to the Services with (i) any amounts paid in respect of any such overstatements to be offset against payments made in connection with the applicable subsequent budget(s) and (ii) any deficient amounts not paid in respect to any understatements to be paid in connection with the applicable subsequent budgets.

(e)Referral of Opportunities. For so long as the Manager is providing Services to Royal and/or the Opportunities Partnership, the Manager and each of its Affiliates (including the Manager Control Parties) shall present to Blackstone all potential Opportunities of which it becomes aware and shall (i) not acquire any Opportunities for their own account or (ii) otherwise compete with the business of the Service Entities within the blue area shown on Exhibit B hereto, but only to the extent such Service Entities are operating within such blue area. Notwithstanding the preceding sentence, if any Opportunity is presented to Blackstone by written notice and Blackstone does not approve and intend to pursue in good faith such Opportunity within 10 calendar days following the date of such notice, then the Manager, any Manager Control Party or any of their respective Affiliates may pursue such Opportunity (including competing with the Service Entities) only with the prior written consent of Blackstone. To the extent Blackstone elects to pursue such Opportunity through any of the Service Entities, Blackstone and the Manager will (x) jointly pursue such Opportunity; provided, that, Manager’s involvement in such Opportunity shall be at the sole discretion of Blackstone; (y) use commercially reasonable efforts to agree on additional compensation to Manager pursuant to such joint pursuit of any such Opportunity (including but not limited to additional incentive or other equity interests and/or opportunities for co-investment) and (z) use commercially reasonable efforts to agree on any necessary amendments to the Budget for providing Services to the relevant Service Entities in pursuit of, and following the consummation of, such Opportunity, as applicable.

(f)Authority for Acquisitions. The Manager shall not cause any Service Entity to consummate an acquisition of any assets without the prior consent of such Service Entity’s general partner and compliance with the applicable Budget.

(g)Suspension of Services. Subject to the Parties making provision for compliance with existing contractual obligations with respect to any Investments, the Service Entity for which any Services are being provided may temporarily or permanently exclude any particular service from the scope of the Services upon at least thirty (30) days’ notice to the Manager.

SECTION 3.EMPLOYEES OF THE MANAGER. The Manager shall select, employ, pay compensation to, supervise and direct all personnel and employees of the Manager necessary for the performance of the Services, in each case in accordance with the terms of the Budget. Notwithstanding the foregoing, (i) Blackstone shall have the right to approve the identification or addition of any employee or personnel of the Manager providing the Servicesand any proposed compensation or terms and conditions thereof, as well as the inclusion of such compensation in the Budget and (ii) after prior consultation with the Manager, Blackstone may at any time, in its sole discretion with or without cause, direct that the Manager remove any particular employee or agent of the Manager from provision of the Services, and, following any such removal and the payment of all amounts properly owed to such employee or agent as of the date of such removal, the salary and other costs related to such employee or agent shall be excluded from the calculation of Allocable Overhead Costs or Out of Pocket Expenses, as applicable. Notwithstanding the foregoing, the Manager (i) shall not terminate any Manager Control Party without Cause without the prior written consent of Blackstone and (ii) shall use its commercially reasonable efforts to cure any circumstances which would constitute Good Reason with respect to any Manager Control Party.

SECTION 4.PROHIBITED ACTIVITIES. The Manager shall not undertake any activity which would (i) violate any applicable law or regulation in any material respect which would result in adverse consequences for any Service Entity, (ii) violate, in any material respect, any contracts, leases, orders, security instruments and other agreements to which, to the Manager’s knowledge, a member of the Blackstone Group or any of its Investments is bound or (iii) in any manner intentionally disparage the reputation of any member of the Blackstone Group.

SECTION 5.STANDARD OF CARE. The Manager shall perform the Services in accordance with any non-conflicting instructions (provided that, if the Manager receives conflicting instructions from Blackstone or any Service Entity it shall promptly notify Blackstone of such conflict and Blackstone shall provide subsequent non-conflicting instructions, which shall be controlling) issued to the Manager by Blackstone or the Service Entities and with that degree of care, diligence and skill that a reasonably prudent manager involved in the identifying, development, assessment or execution of investments in oil and gas interests comparable to those of the Service Entities. The Manager shall perform all Services in accordance with the applicable Budget and use its commercially reasonable efforts to control Out of Pocket Expenses.

SECTION 6.PROCUREMENT OF GOODS AND SERVICES BY PARTIES; AFFILIATE TRANSACTIONS.The Parties hereby agree that in discharging their respective obligations hereunder, the Manager may, subject to the terms of this Section 6 and the other provisions of this Agreement, engage any qualified third party to perform the Services (or any part of the Services) on its behalf solely with the prior written consent of the Service Entities for which such Services will be provided; provided that (i) the Manager acts prudently in selecting and appointing any such person and regularly reviews and monitors any Services performed by such person, (ii) in no case shall the performance of Services by such person relieve the Manager of its obligations hereunder and (iii) any Services performed by such person shall be performed in a manner consistent with the standard of care applicable to the Manager set forth in Section 5. The expenses incurred pursuant to this Section 6 shall be included in, and be consistent with, the Budget of each Service Entity, as applicable.

SECTION 7.SERVICE PROVIDER INFORMATION.It is contemplated by the Parties that, during the term of this Agreement, the Parties will be required to provide each other certain notices, information and data necessary for the Manager to perform the Services and for the Parties to perform their respective obligations under this Agreement. The Manager shall bepermitted to rely on any information or data provided by the Service Entities, Blackstone and any of their respective Affiliates, directors, employees, or agents or other representatives identified by the Service Entities and Blackstone, to the Manager in connection with the performance of its duties and provision of Services under this Agreement, except to the extent that the Manager has actual knowledge that such information or data is inaccurate or incomplete.

SECTION 8.NO COMMINGLING OF ASSETS. To the extent the Manager shall have charge or possession of any of the Blackstone Group’s assets in connection with the provision of the Services pursuant to this Agreement, the Manager shall (a) hold such assets in the name and for the benefit of the appropriate member of the Blackstone Group and (b) separately maintain, and not commingle, such assets with any assets of the Manager or any other person.

SECTION 9.INSURANCE. The Manager shall obtain and maintain during the term of this Agreement, from insurers who are acceptable to the Opportunities Partnership, insurance coverages with respect to the Services to be performed for the Opportunities Partnership in the types and minimum limits as the Manager and the Opportunities Partnership determine to be appropriate and with such terms as are consistent with standard practice in the oil and gas industry or as may be agreed by the Parties; provided that all expenses, including premium and deductibles, related to such insurance coverages shall be deemed Out of Pocket Expenses allocable to the Opportunities Partnership for the purposes hereof. The Manager agrees that (i) it will consult with the Opportunities Partnership prior to obtaining any such insurance coverage, (ii) it will provide the Opportunities Partnership, upon the Opportunities Partnership’s request from time to time or at any time, with certificates of insurance evidencing such insurance coverage and (iii) upon request of the Opportunities Partnership, it shall furnish the Opportunities Partnership with copies of the policies providing for such insurance coverage. Except with respect to workers’ compensation coverage, the policies shall name the Manager and the Opportunities Partnership as insureds or additional insureds and, if permitted by the insurers, shall contain waivers by the insurers of any and all rights of subrogation to pursue any claims or causes of action against Manager and the Opportunities Partnership.

SECTION 10.MANAGER EXPENSES; INVOICING.

(a)Expenses. Subject to Section 12(c)(i) and to the extent not otherwise reimbursed or paid to the Manager by a third party or another Service Entity, each of Royal, the Opportunities Partnership and each Additional Service Entity shall pay or reimburse the Manager, as applicable, for (i) all reasonable documented out-of-pocket third party expenses reasonably incurred by the Manager for the benefit of such Service Entity which are not included in the Budget (“Out of Pocket Expenses”); provided that the Manager shall provide an accounting and reconciliation of Out of Pocket Expenses payable by such Service Entity on a quarterly basis; provided further, that in no event shall the Manager be authorized to incur Out of Pocket Expenses in excess of five percent (5%) of the portion of the Budget allocable to such fiscal quarter, without Blackstone’s prior approval and (ii) such Service Entity’s pro rata portion of the documented reasonable general and administrative overhead costs of the Manager that are incurred in accordance with the Budget and that are allocated to such Service Entity pursuant to Section 10(b) (“Allocable Overhead Costs” and together with the Out of Pocket Expenses, collectively, the “Manager Expenses”); provided that, the Allocable Overhead Costs attributable to any Service Entity do not exceed the applicable amounts set forth in the Budget that areallocated to such Service Entity pursuant to Section 10(b) (or such other limits as may be agreed to by the general partner of such Service Entity from time to time). Notwithstanding anything to the contrary provided herein, Manager shall not be deemed to be in breach of the terms of this Agreement due to the incurrence of Out of Pocket Expenses by a Service Entity in excess of five percent (5%) of the portion of the Budget allocable to such fiscal quarter to the extent such Out of Pocket Expenses are incurred pursuant to an agreement entered into by Blackstone without consultation with Manager and for which Manager does not supervise pursuant to the terms of this Agreement.

(b)Allocation of Costs. Each Expense Statement shall set forth the Manager’s proposed good faith allocation of all Out of Pocket Expenses and Allocable Overhead Costs between the Service Entities. Blackstone shall approve such proposed calculation in its sole discretion or propose an alternate allocation which shall thereafter be deemed the appropriate allocation of such costs and expenses.

(c)Payments to the Manager. On or before the first day of each quarterly period, each Service Entity shall pay to the Manager in advance the projected amount of Allocable Overhead Costs that will be owed by such Service Entity for such quarterly period, which projection shall be based on the amount set forth in the Budget and with the allocation determined pursuant to Section 10(b) for such quarterly period (but which may be adjusted by such amounts as the Parties may mutually agree in order to account for discrepancies, if any, between the Allocable Overhead Costs actually expended in a prior monthly period, as reflected on the Expense Statement, and the amounts previously funded by the Service Entities for such quarterly period). The Manager shall submit to each Service Entity on a quarterly basis a summary relating to the incurrence of any Out of Pocket Expenses for the preceding quarter and a reconciliation with the Budget and, within ten days following the receipt thereof, such Service Entity shall either (i) subject to Section 10(a) above, reimburse Manager for such Out of Pocket Expenses to the extent the Manager has previously paid such Out of Pocket Expenses from its own funds, or (ii) directly pay to the invoicing party such Out of Pocket Expenses. Royal shall, on the date hereof, advance to Manager funds for the first fiscal quarter of 2017, to include budgeted quarterly expenses and third-party expenses as reasonably agreed between Royal and Manager, in respect of the Manager Expenses to be incurred during such period, the entire amount of which, notwithstanding anything to the contrary in this Section 10, shall be allocated to Royal.

(d)Billing Statements. The Manager shall prepare a quarterly statement for each Service Entity for each quarterly period setting forth the Manager Expenses allocated to such Service Entity and relating to such quarterly period and any adjustment necessary to correct prior billings (each, an “Expense Statement”) and shall submit such Expense Statement to the applicable Service Entity within thirty (30) days of the end of the applicable quarterly period. The Expense Statement shall also provide reasonably detailed documentation supporting the billed Manager Expenses.

(e) Billing Dispute Resolution. If any Service Entity disputes any expense or expenses included on the Expense Statement, including on the ground that the same was not a reasonable or appropriate cost incurred by the Manager in connection with the Services, the Manager shall be promptly notified of the exceptions taken; provided that, with respect to any disputed third party invoice for Out of Pocket Expenses, such Service Entity shall pay theundisputed portion of such invoice. The Manager and the Service Entities shall use their commercially reasonable efforts to resolve the payment dispute within sixty (60) days after notice of such dispute. If the payment dispute is not resolved within such 60-day period, the applicable Service Entity and the Manager shall promptly submit such dispute to binding arbitration pursuant to the rules and procedures of the American Arbitration Association and use their respective commercially reasonable efforts to cause a neutral arbitrator to resolve the dispute on an expedited basis, and in any event as soon as practicable. The provisions of this Section 10(e) shall survive the expiration or earlier termination of this Agreement.

(f)Obligations Several. The obligations of payment set forth in this Section 10 are several and not joint, and each Service Entity shall be individually liable to Manager for the payments required to be made by such Service Entity to the Manager hereunder. Blackstone and its Affiliates, other than the Service Entities, shall have no liability with respect to payments required to be made hereunder.

SECTION 11.BOOKS, RECORDS AND REPORTING.

(a)Books and Records. The Manager shall maintain accurate books and records regarding the performance of the Services and its calculation of the Manager Expenses in accordance with, and for the periods required by, generally applicable accounting practices and applicable law. The Service Entities shall assist the Manager with the preparation of all financial statements for which the Manager is required to prepare either by applicable law, by this Agreement or at the reasonable request of any Service Entity.

(b)Audit Right. At any time during the term of this Agreement, any Service Entity or Blackstone shall have the right, exercisable at its option and expense, to review and copy the books and records maintained by the Manager relating to the Service Entities, their respective businesses and the Services and, if necessary to verify the performance by the Manager of its obligations under this Agreement, and to audit and examine such books and records (the “Audit Right”); provided that in no event shall the Audit Right be construed as extending to the books and records of the Manager relating to any business conducted by the Manager that is not reasonably related to the Service Entities and the Services. The Service Entities and Blackstone may exercise the Audit Right from time to time during normal business hours through such auditors as the Service Entities or Blackstone may determine in their sole discretion by providing reasonable prior written notice to the Manager. To the extent any Service Entity or Blackstone exercises its Audit Right, it shall use its commercially reasonable efforts to conduct such audit or examination in a manner that minimizes inconvenience and disruption to the Manager. The Service Entities and Blackstone shall be limited to exercising the Audit Right twice per calendar year unless the Manager otherwise consents to a more frequent exercise of the Audit Right. The Audit Right shall not extend to the books and records of the Manager relating to general and administrative overhead costs of the Manager for any quarter unless such expenses allocated to any Service Entity exceed by more than five percent (5%) the quarterly budgeted amounts with respect to such Service Entity for such quarter.

(c)Following the date hereof, the Manager shall prepare (i) those financial and operational reports as a Service Entity may request from time to time and as further described in the Schedules to this Agreement and (ii) a quarterly report for each calendar quarter (the “Quarterly Report”), which shall be submitted to Blackstone, Royal General Partner,Opportunities Partnership General Partner and the general partner of each Additional Service Entity within thirty (30) days of the end of each such calendar quarter. Each Quarterly Report shall include the following information in the aggregate and with respect to each Service Entity:

(i) a reconciliation report setting forth any material discrepancies or variances between (x) amounts included in the operating statement and/or report of financial condition of the Service Entity for such quarterly period and year-to-date and (y) the budgeted or projected amounts, as reflected in the Budgets, for the corresponding periods to which such amounts relate;

(ii)a summary of the operating and financial performance of the Service Entities for such quarterly period and year-to-date, including a discussion of any material discrepancies or variances described in the preceding clause (i); and

(iii) such other information as Blackstone or the Service Entities shall reasonably request, including any information required in order for Blackstone or the Service Entities to enter into financing or hedging arrangements or perform its obligations thereunder.

SECTION 12.BUDGETS.

(a)Budget. Blackstone and the Manager have agreed to the budget for the general and administrative overhead costs of the Manager (which includes annual salaries and bonuses, office space, general and administration expenses and other customary overhead costs but in no event shall include any Out of Pocket Expenses or incentive equity granted by a Service Entity to any employee or Affiliate of the Manager) as well as the expense budget for the Service Entities with sufficient allocation of cost between each Service Entity that is set forth on Exhibit A for the period beginning on January 1, 2017 and ending on December 31, 2017. Thereafter, no later than four weeks prior to the commencement of the next twelve-month period, the Manager shall prepare and submit to Blackstone for approval the report for such twelve-month period and, with respect to such report, include:

(i) a semi-annual general and administrative overhead costs budget for the Manager (which, for the avoidance of doubt, shall not include Out of Pocket Expenses) for the next twelve month period (such budget and each budget set forth on Exhibit A, as each may be amended or modified from time to time with the approval of Blackstone and the Manager, a “Budget”);

(ii) a reconciliation report setting forth any material variances between (x) amounts included in the Budget and (y) the then-expected amounts for the full, current twelve-month period; and

(iii) a line-item allocation of all general and administrative overhead costs set forth in the Budget calculated on the basis of the resources allocated by Manager in providing the Services to each Service Entity and in accordance with Section 10(b).

(b) Additional Services. To the extent (i) Royal consummates any Additional Royal Investments, (ii) an Additional Service Entity consummates an investment not then contemplated in the current operating Budget for such Additional Service Entity or (iii) Blackstone or theService Entities request that the Manager perform additional services not listed on Schedule I or Schedule II or otherwise contemplated by the then current Budget, the Manager and Blackstone shall agree upon an amended Budget, solely to the extent required in connection with any such additional investment.

(c)Certain Budget Matters.

(i) The Manager shall use its commercially reasonable efforts to perform the Services in accordance with the Budget and shall notify Blackstone promptly if at any time the actual performance of the Manager is anticipated to deviate in any material respect from the applicable Budget (where “material respect” mean any deviation of more than 10% from material line items set forth in such Budget). In the event of a material anticipated deviation from a Budget, the Manager shall update the Budget and promptly submit such updated Budget to Blackstone for approval, which approval shall not be unreasonably withheld, conditioned or delayed; provided that, disapproval of a deviation from a material line item set forth in such Budget that is less than 10% of the amount of such line item set forth in the applicable Budget shall be deemed unreasonable for purposes of this Section 12(c)(i).

(ii) Notwithstanding the foregoing, from time to time and at any time, by providing written advance notice to the Manager, Blackstone or the Service Entities may require the Manager to seek their prior consent (written or otherwise) with respect to the incurrence of any commitments or expenses in connection with a specific project or expenditure.

SECTION 13.LIMITATIONS ON LIABILITY; INDEMNIFICATION.

(a)To the fullest extent permitted by law, neither the Manager nor any of its Affiliates, nor the officers, directors, employees, partners, stockholders, members or agents of any of the foregoing, shall be liable to any member of the Blackstone Group for any losses sustained or liabilities incurred as a result of any act or omission taken or not taken by the Manager or any such other person in performing or otherwise relating to the Services (including any liability for any acts or omissions of its Affiliates) to the extent (i) the act or failure to act of the Manager or such other person was in good faith and in a manner such person believed to be in, or not contrary to, the best interests of the Blackstone Group, and (ii) the conduct of the Manager or such other person did not constitute Malfeasance. The Manager shall not be liable to any member of the Blackstone Group for any action taken by any third party provider to the Blackstone Group, provided the Manager has selected and monitored such third party provider as provided in Section 6.

(b) To the fullest extent permitted by law, each Service Entity, severally and not jointly, hereby agrees to indemnify and hold harmless the Manager and each of its Affiliates (and all directors, officers, partners, employees, stockholders, members and agents (to the extent agreed by the Manager) of the foregoing) (each, an “Indemnified Party”) to the fullest extent permitted by law from and against any and all losses, claims, demands, costs, damages, liabilities, reasonable expenses of any nature (including reasonable costs of investigation and reasonable attorneys’ fees and disbursements), judgments, fines, settlements and other amounts, of any nature whatsoever, known or unknown, liquidated or unliquidated (collectively,“Liabilities”) arising from any and all claims, demands, actions, suits or proceedings, whether civil, criminal, administrative or investigative, in which the Indemnified Party may be involved, or threatened to be involved as a party or otherwise, relating to the Services or the performance or nonperformance of any act concerning the activities of the Manager hereunder (each, an “Action”), except to the extent the act or failure to act of the Indemnified Party (i) was not in good faith or not in a manner such Indemnified Party believed to be in, or not contrary to, the best interests of the Blackstone Group or the Service Entities or (ii) constituted Malfeasance; and provided, further, that that no Indemnified Party shall be entitled to indemnification with respect to any claim or dispute between the Parties (or their Affiliates) relating to a breach by such Indemnified Party of this Agreement (excluding any breach of the standard of care for performing the Services which does not constitute Malfeasance), or for any breach of any confidentiality obligation to a third party that is not at the express direction of Blackstone or the Service Entities. The termination of an action, suit or proceeding by judgment, order, settlement or upon a plea of nolo contendere or its equivalent shall not, in and of itself, create a presumption or otherwise constitute evidence that the Indemnified Party is not entitled to indemnification hereunder. The Indemnified Party will give Blackstone and the applicable Service Entities prompt notice of any Action, setting forth therein in reasonable detail the basis for such Action (and will provide Blackstone such information with respect thereto that Blackstone and the applicable Service Entities may reasonably request), and the applicable Service Entities shall have the right to undertake the defense of any Action brought by a third party by counsel chosen by it and reasonably satisfactory to the Indemnified Party; provided, however, that the Indemnified Party will reasonably cooperate with the applicable Service Entities in defending such Action. If a Service Entity undertakes such defense in respect of such third party Action, the Indemnified Party shall have the right to participate in the defense thereof and to employ counsel, at its own expense, separate from the counsel employed by such Service Entity, it being understood that such Service Entity shall control such defense and any settlement of the Action.

(c)If a Service Entity shall have assumed the defense of the third party Action, such Service Entity shall not consent to the entry of judgment, admit any liability with respect to, or settle, compromise or discharge, such third party Action without the Indemnified Party’s prior written consent (which consent shall not be unreasonably withheld) unless: (x) there is no finding or admission of any violation of applicable law or any violation of the rights of any person and no effect on any other claims that may be made against the Indemnified Party or any of its Affiliates; (y) there is no imposition of a consent order, decree or injunction that would restrict the future activity of the Indemnified Party or its Affiliates; and (z) the sole relief provided is monetary damages that are concurrently paid in full by the indemnifying party and a full and complete release is provided to the Indemnified Party and its Affiliates.

(d) Subject to the provisions of Section 13(b), expenses incurred by an Indemnified Party in defending any Action for which indemnification is expressly granted pursuant to Section 13 shall be advanced by the appropriate Service Entities prior to any judgment or settlement of such Action (but not during any appeal therefrom) entered by any court of competent jurisdiction which includes a finding that such Indemnified Party’s conduct constituted Malfeasance or was otherwise not entitled to indemnification hereunder in respect thereof, but only if prior to making an advance such Service Entities have received a written commitment by or on behalf of the Indemnified Party to repay such advances to the extent that, and at such time as, it has been determined by a final, non-appealable judgment or settlement entered by any court of competent jurisdiction that (a) the act or failure to act of the Indemnified Party was not in good faith or notin a manner it believed to be in, or not contrary to, the best interests of Blackstone and the Service Entities, or (b) the Indemnified Party’s conduct constituted Malfeasance.

(e)Notwithstanding anything in this Agreement to the contrary, the Service Entities shall not be liable to any Indemnified Party, and the Manager and the other Indemnified Parties shall not be liable to the Service Entities, for punitive, special, exemplary or consequential damages, including damages for loss of profits, loss of use or revenue or losses by reason of cost of capital, arising out of or relating to this Agreement or the transactions contemplated hereby, regardless of whether based on contract, tort (including negligence), strict liability, violation of any applicable deceptive trade practices act or similar law or any other legal or equitable principle, and the Manager and the Service Entities hereby release each other from liability for any such damages; provided, however, that the foregoing shall not apply to any such damages that the Manager or any other Indemnified Party is required to pay to a third party and that otherwise would have been within the scope of the indemnification provided in Section 13(b) above.

(f) If there is a reasonable probability that an Action brought by a third party may materially and adversely affect the Indemnified Party other than as a result of money damages or other money payments, the Indemnified Party shall have the absolute right, at its own cost and expense, to defend, compromise or settle such Action; provided, however, that if such Action is settled without the appropriate Service Entities’ consent (not to be unreasonably withheld), the Indemnified Party shall be deemed to have waived all rights hereunder against the Service Entities for Liabilities arising out of such Action.

(g)In the event that any employee of the Manager engages in Malfeasance, the Manager shall, promptly upon the Manager having knowledge of such Malfeasance, (i) notify Blackstone and the Service Entities, (ii) take appropriate action to discipline and, if requested by Blackstone or the Service Entities and permissible in accordance with applicable law, immediately terminate such employee’s provision of the Services to the Service Entities; provided, however, that, such employee shall forfeit any Additional Incentive Interests and/or Vested Incentive Interests (whether vested or unvested) granted to such employee and (iii) if any Manager Control Party knowingly permits or knowingly condones such employee’s Malfeasance, indemnify and reimburse the appropriate Service Entities in full in cash for any liabilities, costs, expenses or losses incurred as a result of such Malfeasance, including any costs incurred in the termination of employment and/or discipline of such employee or personnel. For the avoidance of doubt, any amount payable pursuant to Section 13(g)(iii) shall be the sole responsibility of the Manager and shall not be charged to, or otherwise subject to reimbursement from, any Service Entity. Notwithstanding anything to the contrary contained herein, if a claim of Malfeasance with respect to an employee of the Manager is not asserted by Blackstone or a Service Entity by the earlier of (x) the 60th day following the termination of such employee, or (y) the 60th day following the termination of this Agreement, then, notwithstanding anything to the contrary in the Equity Plans, such alleged Malfeasance shall not result in the forfeiture of the Additional Incentive Interests; provided, however, that if such alleged Malfeasance is a result of the actions described in part (i)(A), (ii)(A) or (ii)(C)(x) of the definition of Malfeasance, such 60-day period described in (x) and (y) of this sentence shall be extended to the second anniversary of the applicable termination.

(h) The provisions of this Section 13 shall survive any termination of this Agreement for six (6) years.

(i) The obligations of the Service Entities under this Section 13 are several and not joint. For the avoidance of doubt, no member of the Blackstone Group, other than the Service Entities, shall have any liability to any person pursuant to this Section 13.

SECTION 14.TERM AND TERMINATION; TRANSITION.

(a) Unless earlier terminated in accordance with Section 14(b), this Agreement shall automatically terminate and have no further force and effect on the date which is two (2) years from the date of this Agreement; provided that, at any time prior to the initial termination of this Agreement, but in no event later than November 1, 2018, Blackstone may, in its sole discretion, elect for the term of this Agreement to be extended for an additional one (1) year, and upon such election this Agreement shall continue in full force and effect during such additional period.

(b)This Agreement may be terminated as follows:

(i)by Blackstone with respect to the entirety of this Agreement or by a Service Entity with respect to such Service Entity (A) at any time upon 30 days prior written notice to the Manager for any reason or (B) if the Manager has breached in any material respect this Agreement and such breach, if reasonably curable, is not cured within thirty (30) days after the Manager’s receipt of written notice of such breach from Blackstone or a Service Entity or such longer period of time (not to exceed 90 days) as may reasonably be required to cure such breach (provided that the Manager takes reasonable actions to attempt to cure such breach as soon as reasonably practicable and proceeds with due diligence to cure such breach);

(ii) by the Manager (A) with respect to the entirety of this Agreement at any time after December 10, 2017 but prior to December 10, 2018, upon 30 days prior written notice to Blackstone; provided, however, that upon any termination pursuant to this Section 14(b)(ii)(A), any and all Additional Incentive Interests (whether vested or unvested) granted to the Manager Parties in relation to this Agreement only shall be forfeited but not any Vested Incentive Interests, (B) with respect to the entirety of this Agreement at any time after December 10, 2018, upon 30 days prior written notice to Blackstone; provided, however, that upon any termination pursuant to this Section 14(b)(ii)(B), any and all Additional Incentive Interests (whether vested or unvested) granted to the Manager Parties in relation to this Agreement after December 10, 2018 only shall be forfeited, but not any Additional Incentive Interests earned up to December 10, 2018 nor any Vested Incentive Interests or (C) with respect to any Service Entity, upon written notice to such Service Entity if such Service Entity has breached in any material respect this Agreement, the Manager did not cause such Service Entity to commit such breach and such breach, if reasonably curable, is not cured within 30 days after such Service Entity’s receipt of notice of such breach or such longer period of time (not to exceed 90 days) as may reasonably be required to cure such breach (provided that such Service Entity takes reasonable actions to attempt to cure such breach as soon as reasonably practicable and proceeds with due diligence to cure such breach); provided, however, that the foregoing shall not apply to bona fide disputes concerning the amountor applicability of a Manager Expense or any claim for indemnity or advancement of expenses hereunder; or

(iii) automatically with respect to the entirety of this Agreement so long as such event is not caused by a Service Entity materially breaching its obligations under Section 10, if the Manager makes a general assignment for the benefit of its creditors, institutes proceedings to be adjudicated voluntarily bankrupt, consents to the filing of a petition for bankruptcy against it, is adjudicated by a court of competent jurisdiction as being bankrupt or insolvent, seeks reorganization under any bankruptcy law or consents to the filing of a petition seeking such reorganization or has a decree entered against it by a court of competent jurisdiction appointing a receiver, liquidator, trustee or assignee in bankruptcy or insolvency.

(c)Upon any termination of this Agreement in accordance with this Section 14, all rights and obligations under this Agreement shall cease except for (i) rights or obligations that are expressly stated to survive a termination of this Agreement and (ii) liabilities and obligations that have accrued prior to such termination, including the obligation to pay any amounts that have become due and payable prior to, or in connection with, such termination, including the obligation to pay any portion of the Manager Expenses that has accrued prior to such termination, regardless of whether any such portions have otherwise become payable; provided that in the event that a Service Entity disputes any such amount, including on the ground that the same was not a reasonable or appropriate cost incurred by the Manager in connection with the Services, the undisputed portion shall be paid and the disputed portion shall be dealt with in the manner provided in Section 10(e). For the avoidance of doubt, upon any termination of this Agreement in accordance with this Section 14, any Additional Incentive Interests granted in relation to this Agreement only will cease to vest following the end of the transition services period identified pursuant to Section 14(d) below. Notwithstanding anything to the contrary contained herein, in addition to other payments to be made pursuant to this Section 14, for 90 days after the termination of this Agreement pursuant to Section 14(b)(i)(A), Blackstone and the Service Entities, as applicable, shall pay Manager in accordance with the then current Budget agreed to by the Parties and the payment terms hereof; provided, however, that Manager shall not incur additional Out of Pocket Expenses during such 90 day term; provided, further, that no such payment shall be due to Manager if this Agreement is terminated pursuant to the sale of any of the Services Entities.

(d) Upon any termination of this Agreement, if requested by Blackstone or the terminating Service Entity in writing prior to such termination, the Manager shall, for a period of six months following the termination (or, if shorter, such period as Blackstone or the terminating Service Entity may identify in writing delivered to the Manager prior to such termination), (A) provide Blackstone and the terminating Service Entity reasonable assistance to transition the Manager’s duties under this Agreement to one or more successor manager(s) designated by Blackstone or the terminating Service Entity and (B) continue to provide such Services as Blackstone or the terminating Service Entity (or its successor(s)) may reasonably request in order to operate and maintain the Investments until the transition of each such Service to the successor manager(s) has been completed. In providing transition services hereunder, Manager shall use the same degree of care used in performing the Services in accordance with this Agreement. The terminating Service Entity will reimburse Manager for its Manager Expenses in connection withsuch transition services in accordance with Section 10, and the other terms of this Agreement shall continue to apply with respect to the provision of such transition services.

SECTION 15.CONFIDENTIALITY.

(a)Protection of Confidential Information. The Manager Parties agree that all Confidential Information shall be kept confidential by them and shall not be disclosed by it in any manner whatsoever; provided, however, that (i) any such Confidential Information may be disclosed by the Manager solely to its managers, directors, partners, employees, advisors, counsel, accountants, agents or any of its Affiliates who need to know such information for the purpose of the Manager’s provision of the Services or otherwise complying with its obligations under this Agreement (it being understood that the Manager will inform such persons of the confidential nature of such information, will direct and cause them to agree to treat such information in accordance with the terms hereof and will be liable for any breach of this Section 15 by any such person), (ii) any disclosure of Confidential Information may be made by the Manager to the extent Blackstone or a Service Entity consents in writing and (iii) the Manager may disclose Confidential Information to the extent required by law or in response to legal process, applicable governmental regulations or governmental agency request, but only that portion of such Confidential Information which, in the opinion of the Manager’s counsel, is required or would be required to be furnished to avoid liability for contempt or the suffering of other material judicial or governmental penalty or censure; provided that, the Manager notifies Blackstone and the Service Entities of its obligation to provide such Confidential Information prior to disclosure (unless notification is prohibited by applicable law, regulation or court order) and the Manager cooperates to protect the confidentiality of such Confidential Information.

(b)Ownership. All Confidential Information belongs to Blackstone and the Service Entities. Any permitted use or disclosure of any Confidential Information by the Manager Parties shall not be deemed to represent an assignment or grant of any right, title or interest in such Confidential Information.

(c)Remedies. The Parties agree and acknowledge that any unauthorized use of Confidential Information by the Manager Parties would result in irreparable harm to the Blackstone Group. Therefore, if any Manager Party breaches any of its obligations with respect to this Section 15, Blackstone and the Service Entities, in addition to any rights and remedies it may have, shall be entitled to seek equitable, including injunctive, relief to protect its Confidential Information, without any requirement of posting a bond or other security.

(d)Return of Confidential Information. Upon termination of this Agreement for any reason, the Manager shall, and shall cause its employees and representatives to, promptly return to Blackstone and the Service Entities all Confidential Information, including all copies thereof, in its possession or control, or destroy or purge its own system and files of any such Confidential Information (to the extent practicable) and deliver to Blackstone a written certificate signed by an officer of the Manager that such destruction and purging have been carried out.

(e) Publicity. No Manager Party shall, without the prior written consent of Blackstone, disclose to any third party the existence of this Agreement (or the parties hereto and terms hereof) or that Blackstone has any interest in any of the Service Entities. All press releases or other public communications of any nature whatsoever relating to the business of any ServiceEntity, and the method of the release for publication thereof, shall be subject to the prior written consent of Blackstone in all respects.

(f)Survival. The provisions of this Section 15 shall survive the termination of this Agreement for a period of three years thereafter, unless any Confidential Information is subject to a longer-termed confidentiality agreement with a third party, in which case this Section 15 shall survive as to such Confidential Information until the expiration or earlier termination of such agreement.

(g)Permitted Disclosure. A Manager Party may disclose (i) the existence of this Agreement and/or (ii) the identity of the Parties to this Agreement to potential investors in the Manager or to any financial advisors, accountants, attorneys or similar representatives of the Manager or its Affiliates; provided, further, that such Manager Party will make such potential investor or representative aware of the confidential nature of this Agreement and the identity of the Parties. For the avoidance of doubt, a Manager Party may not disclose any terms and conditions of this Agreement whatsoever.

SECTION 16.NONSOLICIT. During the term of this Agreement and for twelve (12) months thereafter, Blackstone and the Service Entities hereby agree that, without obtaining the prior written consent of the Manager, Blackstone, the Services Entities and their respective Affiliates will not, directly or indirectly, solicit, interfere with or endeavor to entice away, offer to employ or employ any of the current officers, employees or any person who is known by Blackstone, the Services Entities and their respective Affiliates to be, after due inquiry, consultants of the Manager, so long as they are employed or engaged by the Manager and, in each case, to the extent such officer, employee or consultant has spent a significant portion of his or her professional time during the last six (6) months on matters relating to the Services rendered under this Agreement or if Blackstone, the Services Entities or any of their respective Affiliates first became aware of such officer or employee through the Manager or the provision of the Services; provided, that, nothing in this Section 16 shall apply to any officer, employee or consultant who (i) responds to general solicitations of employment or solicitations by recruiting firms, in each case, not specifically directed towards employees of the Manager, (ii) contacts Blackstone, the Services Entities or their respective Affiliates of his or her own initiative and without any direct solicitation from Blackstone, the Services Entities or their respective Affiliates, (iii) was terminated by Manager or (iv) no longer is an officer, employee or consultant of the Manager at the time discussions are initiated.

SECTION 17.ASSIGNMENT; BINDING EFFECT.

(a)No Party to this Agreement shall have the right to assign or otherwise transfer its rights or obligations under this Agreement (by operation of law or otherwise), except with the prior written consent of the other Parties hereto, and any attempted assignment, transfer or delegation (except as provided herein) without such prior written consent shall be voidable at the sole option of such other Party; provided that, Blackstone and the Service Entities may assign any of their rights or obligations hereunder to any of their Affiliates without the Manager’s consent.

(b) Nothing expressed or mentioned in this Agreement is intended or shall be construed to give any other person other than the parties hereto and their respective permittedsuccessors and assigns any legal or equitable right, remedy or claim under, in or in respect of, this Agreement or any provision herein contained; provided that the Indemnified Parties are express, intended third party beneficiaries of Section 13, to the extent set forth therein.

(c)The Parties represent that the persons executing this Agreement on behalf of their respective organizations have specific and express authority to execute this Agreement on behalf of their respective organizations and that the respective organizations intend to be legally bound.

SECTION 18.INDEPENDENT CONTRACTOR; NO JOINT VENTURE. In providing the services contemplated hereunder, the Manager is acting as and shall be considered an independent contractor. Neither Manager, the Manager Control Parties nor any other employees or representatives of Manager are entitled to participate in any compensation or benefit scheme of any member of the Blackstone Group, except as may be explicitly provided for in the organizational documents (and any related agreements) of such entities. Nothing contained in this Agreement shall be construed as creating any partnership or other form of joint venture or enterprise between any member of the Blackstone Group, any of the Service Entities or their respective Affiliates and the Manager or impose any liability as such on any of them. This Agreement confers no rights upon a Party except those expressly granted in this Agreement.

SECTION 19.GOVERNING LAW; SEVERABILITY.

(a)This Agreement and the rights and obligations of the Parties under this Agreement shall be governed by, and construed and interpreted in accordance with, the law of the State of Delaware, without regard to otherwise governing principles of conflicts of law. In addition to any remedies at law, or expressly set forth herein, the Parties acknowledge that each Party shall be permitted, to the extent possible under Delaware law, to pursue equitable remedies in respect of any breach of the terms of this Agreement, including, without limitation, the right to enforce such terms specifically notwithstanding the availability of adequate money damages.

(b)If any provision of this Agreement (other than Section 27, which shall not be severable under any circumstances) is held to be illegal, invalid or unenforceable under present or future laws effective during the term of this Agreement, such provision shall be fully severable; this Agreement shall be construed and enforced as if such illegal, invalid or unenforceable provision had never comprised a part of this Agreement; and the remaining provisions of this Agreement shall remain in full force and effect and shall not be affected by the illegal, invalid or unenforceable provision or by its severance from this Agreement. Furthermore, in lieu of each such illegal, invalid or unenforceable provision, there shall be added automatically as a part of this Agreement a provision as similar in terms to such illegal, invalid or unenforceable provision as may be possible and be legal, valid and enforceable.

SECTION 20.JUDICIAL PROCEEDINGS.

(a) In any judicial proceeding involving any dispute, controversy or claim arising out of or relating to this Agreement, each of the Parties irrevocably and unconditionally submits to the exclusive jurisdiction of the state and federal courts located in the State of Delaware for any actions, suits or proceedings arising out of or relating to or concerning this Agreement. In any such judicial proceeding, the Parties agree that in addition to any method for the service ofprocess permitted or required by such courts, to the fullest extent permitted by law, service of process may be made by delivery provided pursuant to the directions in Section 22.

(b) EACH OF THE PARTIES HEREBY WAIVES TRIAL BY JURY IN ANY JUDICIAL PROCEEDING INVOLVING ANY DISPUTE, CONTROVERSY OR CLAIM ARISING OUT OF OR RELATING TO THIS AGREEMENT OR RELATING TO THE PARTNERSHIP OR ITS OPERATIONS.

SECTION 21.NO WAIVER; CUMULATIVE REMEDIES. No failure to exercise and no delay in exercising, on the part of any party hereto, any right, remedy, power or privilege hereunder shall operate as a waiver thereof; nor shall any single or partial exercise of any right, remedy, power or privileges hereunder preclude any other or further exercise thereof or the exercise of any other right, remedy, power or privilege. The rights, remedies, powers and privileges herein provided are cumulative and not exclusive of any rights, remedies, powers and privileges provided by law. No waiver of any provision hereto shall be effective unless it is in writing and is signed by the party asserted to have granted such waiver.

SECTION 22.NOTICES. Any notice or other communication hereunder will, unless otherwise expressly provided, be sufficiently given if in writing and delivered (whether by registered mail, return receipt requested, or by a nationally-recognized overnight courier, or by electronic mail with a copy to follow promptly by registered mail):

| (i) | In the case of a notice to the Manager, addressed as follows: |

Riverbend Oil & Gas, L.L.C.

One Allen Center

500 Dallas, Suite 1250

Houston, Texas 77002

Attention: Randolph Newcomer, Jr.

With a copy (which shall not constitute notice) to:

Locke Lord LLP

2800 JPMorgan Chase Tower

600 Travis

Houston, Texas 77002

Attention: Mitchell Tiras

mtiras@lockelord.com

| (ii) | In the case of a notice to any Service Entity or Blackstone, addressed as follows: |

c/o Blackstone Management Partners L.L.C.

Attention: Chris Placca

345 Park Avenue Avenue

New York, NY 10154

with a copy (which shall not constitute notice) to:

Kirkland & Ellis LLP

Attn: Andrew T. Calder

Rhett Van Syoc

600 Travis Street, Suite 3300

Houston, TX 77002

E-mail: andrew.calder@kirkland.com

rhett.vansyoc@kirkland.com

SECTION 23.COMPLIANCE.

(a)The Manager represents and warrants that the Manager is not subject to any contractual or other obligation that would limit or prohibit the Manager’s ability to provide the Services, including, without limitation, any non-compete or other obligations that the Manager may owe to any third-party. The Manager agrees that as the Manager undertakes the Services and is engaged by the Service Entities pursuant to the terms of this Agreement, the Manager shall not, and shall ensure that none of its directors, officers, agents, employees or other persons associated with or acting on behalf of the Manager or any of its Affiliates shall not, violate in any material respect any law, regulation, agreement or other obligation the Manager or any such person may be subject to or bound by from time to time.

(b)The Manager has not made and will not make, and none of its Affiliates and, to the knowledge of the Manager, none of its directors, officers, agents, employees or other person associated with or acting on behalf of the Manager or any of its Affiliates have made or will make (i) any unlawful contribution, gift, or provide any entertainment to any foreign or U.S. government official or employee; (ii) any payment or take any action that violates or would be in violation of any provision of any federal, state or local or other applicable domestic or foreign law, rule or regulation regarding illegal payments or corrupt practices, or any provision of the U.S. Foreign Corrupt Practices Act of 1977 (the “FCPA”) (in the case of the FCPA, if any of such persons had been or were subject to the FCPA, even if they are not currently so subject); or (iii) any bribe, rebate, payoff, influence payment, kickback or other unlawful payment.

(c)The operations of the Manager and its Affiliates are and have been conducted at all times in compliance with the financial recordkeeping and reporting requirements of the U.S. Currency and Foreign Transactions Reporting Act of 1970, as amended, and with the money laundering statutes of all other applicable jurisdictions, the rules and regulations thereunder and any related or similar rules, regulations or guidelines, issued, administered or enforced by any governmental agency and no action, suit or proceeding by or before any court or governmental agency, authority or body or any arbitrator involving the Manager or any of its Affiliates with respect to such laws is pending or, to the knowledge of the Manager, threatened.

(d)The Manager is not, and none of its Affiliates and, to the knowledge of the Manager, none of its directors, officers, agents, employees, affiliate or other person associated with or acting on behalf of the Manager or any of its Affiliates are, currently subject to any U.S. sanctions administered by the Office of Foreign Assets Control of the U.S. Department of the Treasury.

(e) The Manager agrees to certify the Manager’s compliance with the provisions of this Section 23 if requested by Blackstone or a Service Entity from time to time during the term of this Agreement.

SECTION 24.ENTIRE AGREEMENT; AMENDMENTS. This Agreement constitutes the entire agreement of the Parties with respect to the subject matter hereof and supersedes all prior contracts or agreements with respect to such matters, whether oral or written. No amendments, changes or modifications to this Agreement shall be valid unless they are in writing and signed by a duly authorized representative of each of the Parties. No waiver of any right under this Agreement shall be valid unless in writing and signed by a duly authorized representative of each of the Parties waiving such right.

SECTION 25.COUNTERPARTS. This Agreement may be executed in any number of counterparts (including facsimile counterparts), all of which together shall constitute a single instrument. It shall not be necessary that any counterpart be signed by each of the Parties so long as each counterpart shall be signed by one or more of the Parties and so long as the other Parties shall sign at least one counterpart.

SECTION 26.HEADINGS.The headings of the sections of this Agreement have been inserted for convenience of reference only and shall not be deemed part of this Agreement.

SECTION 27.NO RECOURSE. This Agreement may only be enforced against, and any claims or causes of action that may be based upon, arise out of or relate to this Agreement, or the negotiation, execution or performance of this Agreement may only be made against the entities that are expressly identified as parties hereto and no Affiliates of any Party shall have any liability for any obligations or liabilities of the parties to this Agreement or for any claim (whether in tort, contract or otherwise) based on, in respect of, or by reason of the transactions contemplated hereby or in respect of any oral representations made or alleged to be made in connection herewith.

Executed as of the date first set forth above.

| RIVERBEND OIL & GAS, L.L.C. |

| | | | |

| | By: | /s/Randolph Newcomer, Jr. |

| | | Name: | Randolph Newcomer, Jr. |

| | | Title: | President |

| | BLACKSTONE MANAGEMENT PARTNERS L.L.C. |

| | | |

| | By: | /s/Angelo G. Acconcia |

| | Name: | Angelo G. Acconcia |

| | Title: | Senior Managing Director |

| | | |

| | ROYAL RESOURCES L.P. |

| | | |

| | By: Royal Resources GP L.L.C., its general partner |

| | | |

| | By: | /s/Angelo G. Acconcia |

| | Name: | Angelo G. Acconcia |

| | Title: | President |

| | | |

| | RIVERBEND NATURAL RESOURCES, L.P. |

| | | |

| | By: Riverbend Natural Resources GP, LLC, its general partner |

| | | |

| | By: | /s/Angelo G. Acconcia |

| | Name: | Angelo G. Acconcia |

| | Title: | President |

SCHEDULE I

ROYAL SERVICES

This Schedule sets forth below certain Services that are expected to or may be required in connection with the business of Royal. The Manager shall consult with and advise Blackstone and Royal and Royal General Partner with respect to the applicability of the following Services to the business of Royal and its subsidiaries and, as applicable and unless otherwise directed by Royal General Partner, shall provide those Services. It is contemplated that the Manager, with the approval of Blackstone and compliance with the Budget, may employ the personnel necessary to provide certain of these Services directly.

The provision of any Services shall in all respects be subject to the terms and conditions set forth in this Agreement.

General Services

All management services that are reasonable, necessary or useful for the day-to-day management, monitoring and operation of the business of Royal and its subsidiaries.

Additional Royal Investments

| | ● | Perform diligence, investigate and analyze potential Additional Royal Investments. |

| | ● | Structure Additional Royal Investments and conduct negotiations on behalf of Royal with third parties in connection with such Additional Royal Investments. |

Preparation for a Potential Sale

| | ● | Compile and prepare all materials and documentation required to pursue and consummate a potential sale or initial public offering of Royal and/or its subsidiaries and their respective assets. |