As filed with the Securities and Exchange Commission on June 9, 2017

Registration No. 333-217662

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORMS-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Advantage Solutions Inc.

(Exact name of registrant as specified in its charter)

| | | | |

| Delaware | | 7389 | | 38-3934401 |

| (State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

18100 Von Karman Avenue, Suite 1000

Irvine, CA 92612

(949)797-2900

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Tanya Domier

Chief Executive Officer

18100 Von Karman Avenue, Suite 1000

Irvine, CA 92612

(949)797-2900

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| | | | |

Howard A. Sobel Michael A. Treska Latham & Watkins LLP 650 Town Center Drive, 20th Floor Costa Mesa, CA 92626 Telephone: (714)540-1235 Fax: (714)755-8290 | | Brian Stevens Bryce Robinson 18100 Von Karman Avenue, Suite 1000 Irvine, CA 92612 Telephone: (949)797-2900 Fax: (949)797-9112 | | Christopher M. Forrester Merritt S. Johnson Shearman & Sterling LLP 1460 El Camino Real, 2nd Floor Menlo Park, CA 94025 Telephone: (650)838-3600 Fax: (650)838-5173 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is apost-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is apost-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, anon-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule12b-2 of the Exchange Act.

| | | | | | |

| Large accelerated filer ☐ | | Accelerated filer ☐ | | Non-accelerated filer ☒ | | Smaller reporting company ☐ |

| | | | | | Emerging growth company ☐ |

| | | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. | | ☐ |

CALCULATION OF REGISTRATION FEE

| | | | |

|

Title of each class of securities to be registered | | Proposed maximum aggregate offering price(1)(2) | | Amount of registration fee(3) |

Common stock, par value $0.01 per share | | $100,000,000.00 | | $11,590.00 |

|

|

| (1) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | Includes the offering price of shares of common stock that may be sold if the option to purchase additional shares of common stock solely to cover over-allotments granted by the Registrant to the underwriters is exercised. |

| (3) | The Registrant previously paid $11,590.00 on May 4, 2017 in connection with the initial filing of this Registration Statement. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities, and we are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated June 9, 2017

PROSPECTUS

Shares

Common Stock

This is an initial public offering of shares of common stock of Advantage Solutions Inc.

We are offering all of the shares to be sold in the offering.

Prior to this offering, there has been no public market for the common stock. It is currently estimated that the initial public offering price per share will be between $ and $ . We intend to list the common stock on the New York Stock Exchange under the symbol “ADV.”

Following this offering, we will be a “controlled company” within the meaning of the corporate governance rules of the New York Stock Exchange. After the completion of this offering, Karman Topco L.P. will own approximately % of our common stock (or approximately % if the underwriters exercise in full their option to purchase additional shares). The equity interests of Karman Topco L.P. are owned by equity funds affiliated with or advised by CVC Capital Partners, Leonard Green & Partners, Juggernaut Capital Partners, and Centerview Capital, as well as by certain members of our management.

See “Risk Factors” on page 21 to read about factors you should consider before buying shares of the common stock.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| | | | | | | | |

| | | Per Share | | | Total | |

Initial public offering price | | $ | | | | $ | | |

Underwriting discount(1) | | $ | | | | $ | | |

Proceeds, before expenses, to Advantage Solutions Inc. | | $ | | | | $ | | |

| (1) | See “Underwriting” for a description of the compensation payable to the underwriters. |

To the extent that the underwriters sell more than shares of common stock, the underwriters have the option to purchase up to an additional shares from us at the initial price to the public less the underwriting discount.

The underwriters expect to deliver the shares against payment in New York, New York on , 2017.

| | |

| Goldman Sachs & Co. LLC | | Morgan Stanley |

Prospectus dated , 2017

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. We and the underwriters have not authorized anyone to provide you with different information. We are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our common stock.

For investors outside the United States: Neither we nor the underwriters have taken any action to permit this offering or the possession or distribution of this prospectus to occur in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside the United States. See “Underwriting.”

i

PROSPECTUS SUMMARY

This summary highlights certain significant aspects of our business and this offering. This is a summary of information contained elsewhere in this prospectus, is not complete, and does not contain all of the information that you should consider before investing in our common stock. You should carefully read the entire prospectus, including the information presented under the sections entitled “Risk Factors” and “Special Note Regarding Forward-Looking Statements” and our consolidated financial statements and the related notes thereto included elsewhere in this prospectus, before making a decision to invest in our common stock. This summary contains forward-looking statements that involve risks and uncertainties. Our actual results may differ significantly from future results contemplated in the forward-looking statements as a result of certain factors such as those set forth in the sections entitled “Risk Factors” and “Special Note Regarding Forward-Looking Statements.”

In this prospectus, unless otherwise stated or the context otherwise requires, the “Company,” “we,” “our,” and “us” refer to Advantage Solutions Inc., a Delaware corporation, and its subsidiaries.

Our Company

We are a leading business solutions provider to consumer goods manufacturers and retailers. Our customizable suite of technology-enabled sales and marketing solutions is designed to help manufacturers and retailers across a broad range of channels drive consumer demand, increase sales, and achieve operating efficiencies. Through our sales segment, we serve as a strategic intermediary between consumer goods manufacturers and their retailer partners. Our sales associates prepare and present to retailers the business case to increase distribution of manufacturers’ products and optimize how they are displayed, priced, and promoted. We also makein-store visits to ensure such products are adequately stocked and properly displayed. Through our marketing segment, we develop marketing programs for manufacturers and retailers that are designed to influence shoppers on their paths to, and at the point of, purchase using our proprietary insights on shopper behavior, analytics, brand knowledge, and understanding of manufacturer and retailer strategies. In 2016, we provided services to over 2,000 manufacturers for products located at more than 200,000 retail locations.

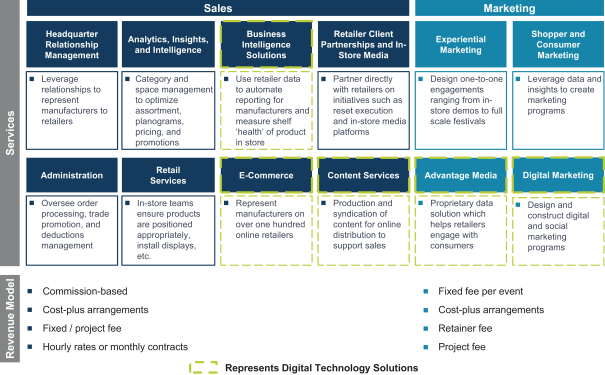

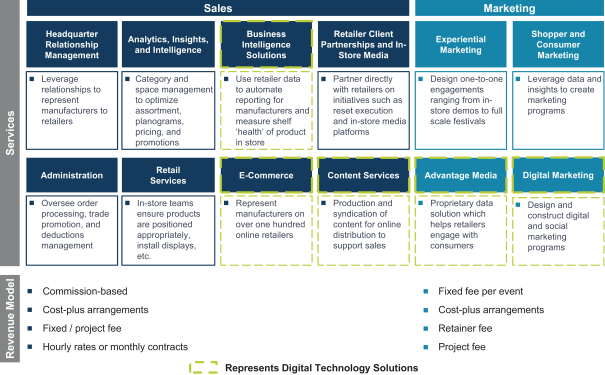

Our sales services primarily include:

| | • | | Headquarter Relationship Management. We act as a representative of our consumer goods manufacturer clients and facilitate relationships with retailers across a range of matters, including business development and sales planning efforts. We prepare customized, data-driven business plans on behalf of our manufacturer clients and present the business case to increase distribution of their products, and optimize the shelf placement, pricing, and promotion of their products, to our extensive network of industry contacts spanning retailer buying organizations and senior executive ranks. |

| | • | | Analytics, Insights, and Intelligence. To support our sales efforts, we field a team of over 300 analytics professionals who practice what our industry refers to as category and space management. These professionals analyze consumer purchase and retailer data to identify opportunities to increase the sales of our clients’ products and categories. |

| | • | | Administration. Our associates handle key back-office functions such as receiving and processing purchase orders. We also manage trade promotion programs executed between clients and retailers. |

1

| | • | | Retail Services. We deploy teams in retail locations to support manufacturers’in-store sales strategies. Our associates conduct both cyclical andad hoc store visits to manage product availability and positioning, implement promotions, installpoint-of-purchase displays, and perform other value-added merchandising services. |

| | • | | Retailer Client Partnerships andIn-Store Media Programs. We serve select retailers as their exclusive provider, and other retailers as theirnon-exclusive provider, ofin-store reset work. We also perform compliance audits andin-store product assembly work, and manage a wide variety of media, merchandising, and display platforms for retailers. |

| | • | | Digital Technology. We offer technology solutions that drive efficiencies for consumer goods manufacturers and retailers. For example, one of our technology solutions automates critical reporting and provides insights that allow clients to make revenue-optimizing decisions regardingin-store operations and workflows. Additionally, oure-commerce capabilities cover a comprehensive set of services, including content development, brand reputation management, and representation of consumer goods manufacturers to online retailers. |

Our marketing services primarily include:

| | • | | Experiential Marketing. We design and executein-person consumer engagements ranging fromin-store product sampling and demo programs to large-scale events such as grand openings, product launch events, and festivals. |

| | • | | Shopper and Consumer Marketing. For manufacturer clients, we analyze shopper behavior and apply our deep retailer knowledge and expertise to offer planning, execution, and measurement of insight-based, retailer-specific promotions that target a retailer’s specific shoppers to drive product sales. Manufacturers also hire us for national consumer promotions, which are designed to stimulate demand for, and awareness of, their products more broadly. |

| | • | | Digital Marketing. Using advanced analytics, our digital marketing teams provide a wide range of services to clients, including: digital advertising; interactive design and development across mobile, tablet, and desktop; application development; content management solutions; paid media, including search engine marketing, programmatic, and direct media; and social media development and management. |

| | • | | Advantage Media. We offer targeted media solutions powered by our proprietary data management platform. |

We serve leading manufacturers across a range of consumer product categories, including packaged foods, beverages, perishables, health and beauty care, and consumer electronics. We also maintain deep relationships with retailers across various channels, including traditional retail (which includes grocery, drug, mass, convenience, club, and natural/specialty), foodservice, ande-commerce.

Our clients vary in terms of size and growth profile, ranging from some of the world’s largest consumer goods manufacturers, including Mars, PepsiCo, and Smucker’s, to smaller regional players and emerging brands. While our client base has been predominantly comprised of consumer goods manufacturers, over the past ten years we have increased our offerings to retailers, particularly in the areas of designing and managingin-store events platforms, merchandising, and other labor-based services, such as data collection, product assembly,new-store setups, and remodels. More recently, we have also begun to offer our marketing services to industries beyond consumer goods manufacturing and retail, such as automotive, entertainment, and travel.

2

We believe that our strategic insights, flexible, service-oriented approach, and superior execution have helped us cultivate long-standing relationships with our clients. We help our clients increase sales and reduce costs by leveraging our industry expertise, network of relationships, and scale to develop and execute strategies that fuel our clients’ growth and allow them to focus on their core competencies. Dechert-Hampe & Company, or Dechert-Hampe, an independent consulting firm, estimated in a recent study that outsourcing direct retail coverage teams to a syndicated model may save manufacturers between 45% and 50%. Moreover, that same study includes an estimate that replacing a direct sales team with headquarter representation from an outsourcing partner may save manufacturers between 35% and 50%. We work closely with our clients to identify the combinations of services that best meet their sales and marketing objectives and strive to address the related challenges they face in a customized way.

Eleven of our top 15 clients by revenues in 2016 have been clients for over ten years, with the remaining four clients being new business wins in the last ten years. Since 2009, we have had an average revenue-weighted client retention rate of approximately 99%. We define average revenue-weighted client retention rate as prior year total revenues less annual revenues from lost clients in that period, divided by prior year total revenues. We believe this high level of retention demonstrates that we are deeply embedded in our clients’ operations and that we execute mission critical sales and marketing functions on their behalf.

We maintain over 120 offices located throughout the United States and Canada. Our geographic footprint allows us to execute our strategies on a local, regional, or national level. We have in excess of 50,000 associates who provide us with the resources and scale to provide broad-reaching and cost-efficient solutions to our clients. Our offices are strategically located near our manufacturer and retailer clients, with many of our associates working directly at manufacturers’ or retailers’ offices. This presence provides us with deeper insight into client strategies, systems, and operations and gives our associates more direct access to key decision makers, allowing them to deliver our value-enhancing services in a more tailored and effective manner. While the majority of our business is currently concentrated in the United States and Canada, through our strategic international investments, we maintain a platform in select markets throughout Africa, Asia, Australia, and Europe through which we can service the global needs of multinational manufacturers.

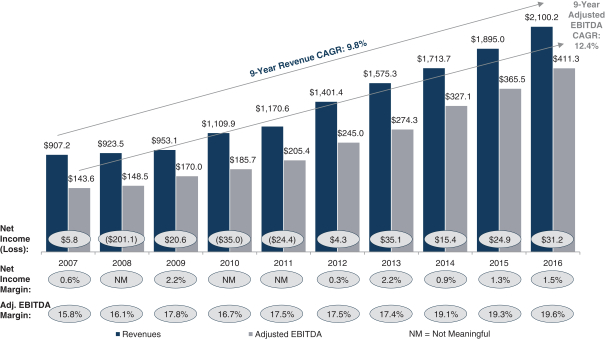

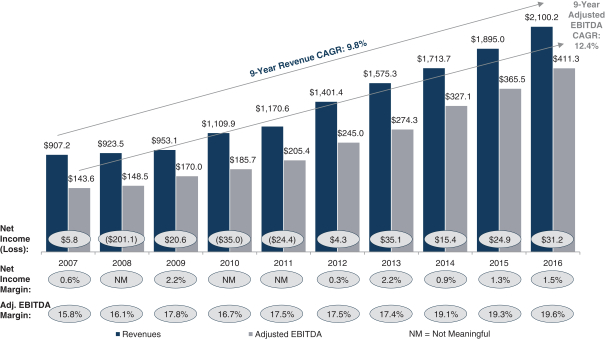

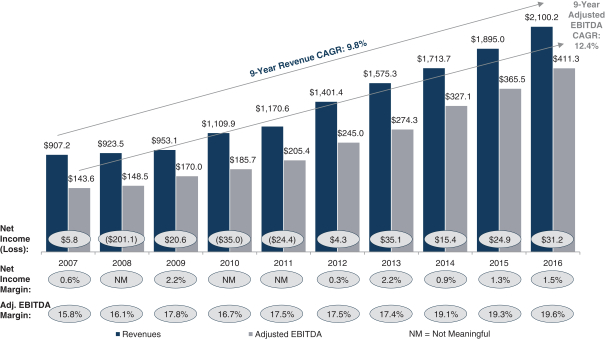

Our business has demonstrated an ability to consistently grow revenues and Adjusted EBITDA over time and through economic cycles. In 2016, we generated $2,100.2 million in revenues, $31.2 million of net income, $128.2 million of Adjusted Net Income, and $411.3 million of Adjusted EBITDA. Our revenues and Adjusted EBITDA in 2016 reflect a compound annual growth rate, or CAGR, of 9.8% and 12.4%, respectively, since 2007. See “Summary Consolidated Financial and Other Data” for a reconciliation of each of Adjusted EBITDA and Adjusted Net Income to net income (loss).

3

We believe that the consistency in the growth of our business is attributable to a variety of factors, including: the stability of the end markets we serve, as a significant portion of our revenues is tied to the sales of a broad group ofnon-discretionary consumer goods; the diversity of the services we offer across a variety of distribution channels; and the critical nature of the services we provide to our clients. Additionally, our services-based operations provide us with a capital-efficient business model that requires limited reinvestment in the form of capital expenditures and working capital. The consistency of our operating results as well as our strong cash flow profile provide us with a high degree of financial flexibility, which enables us to strategically deploy capital to increase stockholder value.

Our Historical Financial Performance ($ in millions)

Note: Revenues, net loss, and Adjusted EBITDA for the year ended December 31, 2010 presented above represent the mathematical addition of the audited results of a successor entity for the period from December 17, 2010 to December 31, 2010, and the audited results of a predecessor entity for the period from January 1, 2010 to December 16, 2010, following an acquisition of Advantage Sales & Marketing Inc. by AGS Topco Holdings, L.P. and its private equity sponsor, Apax Partners, on December 16, 2010. We refer to this transaction as the 2010 Acquisition. Revenues, net income, and Adjusted EBITDA for Pro Forma 2014 (as defined, “Summary Consolidated Financial and Other Data”) presented above give effect to the pro forma adjustments attributable to the 2014 Topco Acquisition (as defined below) that are described in “Unaudited Pro Forma Condensed Consolidated Statement of Operations” and “Non-GAAP Financial Measures” and are based upon available information and certain assumptions that we believe are reasonable.

In the three months ended March 31, 2017, we generated $508.5 million in revenues, a net loss of $9.2 million, $16.9 million of Adjusted Net Income, and $75.7 million of Adjusted EBITDA. See “Summary Consolidated Financial and Other Data” for a reconciliation of each of Adjusted EBITDA and Adjusted Net Income to net loss.

4

Our Market Opportunity

We compete in several large and growing markets for outsourced business services targeting the sales, marketing, and technology needs of consumer goods manufacturers and retailers.

Dechert-Hampe estimates that the market for the traditional outsourced sales services offered through our sales segment in the United States was approximately $7.9 billion in 2016 and has grown at a CAGR of approximately 4.8% over the last four years. Historically, the outsourced sales services industry has grown consistently, largely driven by the steady expansion of the broader U.S. consumer goods market and the growth in penetration of outsourced services with consumer goods manufacturers. Over the past two decades, the industry has experienced meaningful consolidation. Today, the U.S. industry operates with three national firms consisting of Acosta, Inc., CROSSMARK, Inc., and us. We and Acosta, Inc. have the most significant industry market share. Based on our 2016 U.S. sales services revenues and industry data provided by Dechert-Hampe, we estimate that we account for approximately 16% of the sales services market in the United States by revenues. Other than the three national firms, the industry remains fragmented, comprised of smaller independent agencies that offer services on a more regional level or are focused on a specific channel (e.g., foodservice) or specific service (e.g., merchandising projects and resets).

We have an opportunity to increase our sales commission-based revenues in the growinge-commerce consumer packaged goods, or CPG, channel. Dechert-Hampe estimates thate-commerce CPG sales in the United States were approximately $38.0 billion in 2016, up from approximately $20.0 billion in 2015, an increase of 90%. In addition, Dechert-Hampe estimates that the market for the business intelligence technology solutions offered through our sales segment in the United States was approximately $43.6 billion in 2016, up from approximately $39.1 billion in 2015, an increase of 11.5%. The market for our technology solutions has grown rapidly as manufacturers and retailers have looked for solutions that drive efficiencies in operations by helping them analyze data for more effective decision-making, and support the growing need to distribute, manage, and advertise products effectively in thee-commerce channel. We expect the market for technology solutions to continue to grow at a rapid rate as these trends continue.

Dechert-Hampe estimates that the market for the experiential, shopper, and consumer marketing services offered through our marketing segment in the United States was approximately $11.1 billion in 2015 and has grown at a CAGR of approximately 26% over the last three years. The market for these marketing services has grown with increased manufacturer and retailer awareness and understanding of the greater effectiveness of properly targeted marketing strategies. These strategies aim to influence shoppers with meaningful messages and experiences along their paths to purchase, particularly whilein-store and at thepoint-of-purchase. Dechert-Hampe estimates that overall marketing spend in these service areas will grow approximately 17% from 2016 to 2021, primarily driven by manufacturers’ and retailers’ desire to influence shoppers to purchase products with memorable content and experiences. The industry for these services remains highly fragmented and consists of a large number of specialized and diversified agencies.

Dechert-Hampe estimates that the market for the social, media, and digital technology solutions, including those offered through our marketing segment, in the United States was approximately $11.7 billion in 2015 and has grown at a CAGR of approximately 18% over the last three years. The market for these solutions has grown with the increasing influence of digital in consumers’ shopping routines, causing manufacturers and retailers to integrate digital, social, and mobile marketing techniques into their marketing plans. We expect the market for these solutions to continue to grow rapidly as manufacturers and retailers seek to create effective, integrated multi-channel marketing

5

campaigns that deliver compelling content and experiences to influence shopper behavior across all mediums.

We believe that growth in the several markets in which we compete is driven by a number of prevailing industry trends:

| | • | | Outsourced business services are in increasing demand as manufacturers and retailers continue to seek effective and cost-efficient operational solutions. |

| | • | | Small andmid-sized consumer brands are rising in popularity and require a deeper level of outsourced support for key sales and marketing functions. |

| | • | | The proliferation of e-commerce has driven retailers to pursue strategies to differentiate theirin-store shopping experience. |

| | • | | The proliferation of e-commerce has driven manufacturers to seek solutions that support the growth of their business in this channel. |

Within this industry environment, we believe we are advantageously positioned because of our expertise, diverse and customizable suite of services, relationships, national footprint, and scale.

Our Competitive Strengths

We believe the following strengths differentiate us within our industry and have contributed to our sustained success:

Leading National Provider with Significant Scale and Infrastructure that Would Be Difficult to Replicate

We are a leading national provider of technology-enabled sales and marketing services, as measured by revenues, in the markets in which we operate. With over 37,000 associates regularly providing services within retail locations and 3,400 associates working on behalf of manufacturers and retailers at or near their headquarters or regional buying offices, we are one of the largest national providers of sales and marketing services. We have spent decades developing a reputation for providing high quality service and superior execution, grounded in our data-driven insights. We believe that our scale provides us with significant competitive advantages by allowing us to differentiate the value of the services we provide to our clients by:

| | • | | offering a broad suite of capabilities that allows us to create flexible, customizable, multi-service solutions that meet our clients’ evolving needs, from small regional businesses to large multinational corporations; |

| | • | | providing the expertise, experience, andin-market presence necessary to deliver flexible, centrally coordinated, local, regional, or national execution of large and complex labor-based services; |

| | • | | building, training, and managing the deployment of our large workforce to serve our clients’ needs more efficiently than they could with their own employees; |

| | • | | leveraging the significant volume of products that we market on behalf of our manufacturer clients and our proximity and connectivity to retailers to influence retailer decision makers; and |

| | • | | investing in technology and data that enable our talented associates to better support our clients’ businesses. |

6

Our scale affords us efficiencies to deliver solutions that are more effective and cost-efficient than those provided by smaller competitors or internal manufacturer and retailer teams, allowing us to grow both our clients’top-line revenues and bottom-line profits. We believe this attractively positions us to retain existing clients and win new business, which, in turn, further increases our scale and associated competitive advantages.

Strategic Intermediary Benefiting from Self-Reinforcing Network Effects

We occupy an important industry position where we serve as a strategic intermediary between consumer goods manufacturers and retailers, creating value for both parties. Due to the breadth and depth of our manufacturer representation across key categories and departments, we are among the largest supplier partners to many retailers. Our size gives us access and influence with key retailer decision makers that smaller agencies and many manufacturers cannot secure on their own, which, in turn, helps us secure additional manufacturer representations. This self-reinforcing “network effect” has helped us grow to become an important strategic partner to both manufacturers and retailers. We have focused on strengthening the value we can provide to our network by investing in technology andin-market talent that, through our proximity to manufacturer clients and retailers, gives us direct visibility into strategies and systems and better positions us to support clients’ and retailers’ businesses.

Broad Suite of Complementary Services and Technology Solutions Tailored to Client Needs

Based on the insights we have gained as a strategic intermediary between manufacturers and retailers, we have built what we believe to be one of the industry’s broadest suites of technology-enabled sales and marketing services, allowing our associates to create coordinated, innovative, multi-service solutions designed to achieve our clients’ sales and marketing objectives.

In response to our clients’ needs, we have expanded our offering from purely sales services to include marketing services, leveraging our expertise, network of relationships, data, insights, and technology to differentiate our solutions. We began our marketing business in 2000 after we observed the challenges our clients were experiencing while using traditional marketing agencies that were not effectively connecting brand marketing strategies, sales planning efforts, and retailer strategies. More recently, we have begun building a complementary suite of sellable technology solutions designed to address several major business drivers in our industry, including the continuous push for operational efficiency, e-commerce channel expansion, and the need to optimize online andin-store execution capabilities.

Talented Associates and Performance-Based Culture

We believe that our talented associates and performance-based culture are important competitive advantages. We have a results-driven team of leaders who average more than 20 years of experience in the consumer, sales, marketing, and technology industries.

We have made significant investments in training and leadership programs to ensure we remain an attractive career choice for associates at every level. Our employee programs are complemented by our performance-based culture that we believe differentiates us from our competitors. Our culture is built on both internal and external transparency and accountability for results. We set clear objectives with our associates, analyze score-card performance, and reward associates who outperform. We strive to encourage and empower our associates to be proactive, creative, and entrepreneurial in providing solutions for our clients. We believe our encouragement and empowerment has driven the

7

history of service innovation that has fueled our growth, and that our commitment to results and continuous improvement produces long-term relationships with our clients that typically increase in scale and scope over time.

Differentiated and Proprietary Technology Infrastructure

Our proprietary technology infrastructure enables our associates to provide differentiated services that help us grow manufacturers’ and retailers’ businesses by leveraging data-driven insights to develop winning sales and marketing strategies and enable more effective and more efficientin-store execution.

Our technology supports our associates across a range of functions, including a proprietary analytics software suite that helps our associates analyze and apply vast amounts of industry data in the selling process and automate reporting. Our business and category managers use this software to quickly and efficiently develop insight-based sales plans for our clients.

Furthermore, our retail services associates use tablets with proprietary software that help them optimize their workflow and store-level activities. This enables them to utilize proprietary applications to perform functions such as recommending promotional display programs to store managers and illustrating potential store-level sales impact of their recommendations.

Strong, Long-Term Relationships with Leading Manufacturers and Retailers

We maintain strategic relationships with a diversified base of over 2,000 consumer goods manufacturers and retailers, including iconic brands at manufacturers such as Mars, PepsiCo, and Smucker’s, and leading retailers such as Albertsons, Kroger, Sam’s Club, and Walmart. We maintain long-term, multi-service relationships with our largest clients, and have a tenure of over ten years with 11 of our top 15 clients. We view our relationships with our clients as long-term strategic collaborations, which provide us with a stable and consistent revenue base due to mutually aligned incentives and a partnership dynamic. This approach has led to low levels of client attrition, as evidenced by our average revenue-weighted client retention rate of 99% since 2009.

Proven Acquisition and Integration Capabilities

We have a successful track record of sourcing, executing, and integrating acquisitions that expand our service capabilities, sales channels, and geographic markets. Since 2014, we have acquired 40 businesses, which have dramatically expanded our capabilities in digital and social marketing, extended our sales services into thee-commerce channel, and expanded our footprint into Europe and other international markets such as Africa, Asia, and Australia through our strategic partnership with Smollan. We maintain a highly disciplined approach to acquisitions, and have a proven history of acquiring businesses at attractive prices, achieving meaningful synergies, and meeting or exceeding our internal performance goals for the acquired businesses.

Our Growth Strategies

Our competitive strengths and industry leadership enable us to pursue numerous growth opportunities. We intend to continue our growth through the following strategies:

Grow Our Client Relationships

Expand Existing Client Relationships

We have cultivated long-term, multi-service relationships across a diverse set of manufacturers and retailers. As we have broadened our service offerings, we have succeeded in expanding our client

8

relationships. We believe significant opportunities remain to increase service penetration within our existing client base across our technology-enabled sales and marketing solutions. The long-term nature of our client relationships allows us to identify expansion opportunities and positions us to actively develop customized service arrangements to broaden the scope of those relationships.

Continue to Win New Clients and Retailer Accounts

We have a strong track record of securing business from new clients. Over the last five years we have won approximately 50 new client accounts and experiential marketing platforms with annual revenues between $500,000 and $40 million per account. In aggregate, the annualized revenues resulting from these wins are approximately $320 million. Of those accounts, approximately 20% are attributed to increased outsourcing among consumer goods manufacturers and retailers, and approximately 80% are attributed to consumer goods manufacturers and retailers switching from competitors. Moreover, as we expand the industries we serve to areas such as healthcare, financial services, and automotive, and our addressable market continues to grow, we believe that we will continue to succeed in generating new business.

Pursue Channel Expansion and New Industry Opportunities

We believe thee-commerce channel will be a growth opportunity, and that our existing competencies and capabilities position us well to succeed as the channel becomes more meaningful for our clients and the categories we represent. Many of the core competencies that allow us to add value for clients in traditional retail channels are as relevant to effective sales and marketing in thee-commerce channel as they are inbrick-and-mortar retail channels. In addition, we have added talent and capabilities dedicated to selling, marketing, and merchandising clients’ products in thee-commerce channel.

Outside of the consumer goods manufacturing industry and traditional retail channel, we believe there is an opportunity to sell our services to companies in other industries that we believe are underserved, such as automotive, education, entertainment, healthcare, specialty pet, and travel.

Continue to Enhance Our Solutions and Expand Into Logical Adjacencies

We believe that we have a significant opportunity to leverage our position as a strategic intermediary between manufacturers and retailers to develop new and innovative outsourced solutions.

We have recently developed digital technology solutions to help consumer goods manufacturers and retailers find operational efficiencies; create, produce, and distribute compelling content; and successfully market their products in an increasingly omni-channel environment. We believe there is an opportunity for further development in this area.

We also believe there is an opportunity to develop new value-added marketing services. The marketing capabilities we have added over the past five years include a paid search marketer, two digital marketing agencies, and a dedicated media solutions team specializing in targeted mobile advertising. As marketing spend migrates away from television, where traditional ad agencies have historically held competitive advantages, toward the disciplines where we have built our reputation and can differentiate our services through our understanding and connectivity to retail (i.e., promotional, shopper, and digital marketing), we believe we are well-positioned to add value for clients with new demand creation services such as brand identity, content, and packaging design.

9

Furthermore, there are adjacent industries in which our ability to build, manage, and train large technology-enabled service- and process-oriented teams would give us a competitive advantage.

Pursue Additional Strategic and Financially Attractive Acquisitions

We have a track record of successfully identifying, acquiring, and integrating businesses that expand our solutions offering, sales channels, and geographic markets, while achieving synergies and outperforming our performance objectives. Using our disciplined approach for screening and evaluating potential opportunities, we intend to continue to seek strategically and financially attractive acquisition targets that provide us with new capabilities and drive long-term stockholder value.

Further Develop Our International Platform

We believe that growing our international presence will allow us to offer integrated outsourcing solutions for multinational manufacturers and to provide those clients a single strategic partner with an understanding of their global businesses. While the majority of our business is currently concentrated in the United States and Canada, we have made strategic international investments that have provided us with growth opportunities in several markets throughout Africa, Asia, Australia, and Europe. As we deepen our penetration of these existing markets and enter new geographies, we expect to focus on acquiring knowledge of local market dynamics while also leveraging our deep understanding of how to create a consolidated platform to service the outsourcing needs of large clients.

Utilize Technology and Scale to Drive Efficiencies in Operations

We believe our scale and continued investment in technology enable us to achieve operational excellence and capture productivity improvements. We consider technological innovation to be a critical component of our strategy, allowing us to provide superior execution at scale and deliver data-driven insights to grow our clients’ businesses. We believe that with our talent, entrepreneurial culture, and willingness to invest in our future, we are positioned to continue to develop new technologies that will differentiate our service offering from our competitors.

Recent Developments

On May 2, 2017, we amended our First Lien Credit Agreement (as defined in “Description of Indebtedness”) to incur an additional $225.0 million of First Lien Term Loans (as defined in “Description of Indebtedness”), and to extend the maturity date with respect to $150.0 million of our Revolving Credit Facility (as defined in “Description of Indebtedness”). See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Description of Credit Facilities” and “Description of Indebtedness.”

Risks Related to Our Business

Investing in our common stock involves substantial risk. You should carefully consider all of the information in this prospectus prior to investing in our common stock. There are several risks related to our business that are described under “Risk Factors” elsewhere in this prospectus. Among these important risks are the following:

| | • | | risks relating to our associates, including changes to labor laws or wage or job classification regulations, including minimum wage, market-driven wage increases, and our ability to hire, timely train, and retain talented individuals for our workforce while maintaining our corporate culture; |

10

| | • | | our business and results of operations are affected by developments with and policies of retailers that are out of our control; |

| | • | | we need to continue to generate significant operating cash flow in order to fund acquisitions and to service our debt; |

| | • | | consolidation in the industries we serve could put pressure on the pricing of our services; |

| | • | | our ability to identify attractive acquisition targets, acquire them at attractive prices, and successfully integrate the acquired businesses; |

| | • | | our ability to acquire new clients and retain and grow existing clients, including managing business conflicts among competing brands; |

| | • | | our ability to successfully develop and maintain relevant omni-channel services for our clients, protect our intellectual property, and adapt to technological change; |

| | • | | our three largest client relationships comprise a significant portion of our revenues; and |

| | • | | we are controlled by Karman Topco L.P., whose economic and other interests in our business may be different from yours. |

Basis of Presentation

References to ‘‘revenues’’ in this prospectus represent total revenues, inclusive of revenues from related and unrelated third parties.

Unless indicated otherwise, the information included in this prospectus (1) assumes no exercise by the underwriters of the option to purchase up to an additional shares of common stock and (2) reflects the restatement of our certificate of incorporation on , 2017 to effect, among other things, a -for-one stock split of our common stock and an increase in our authorized capital stock to shares of common stock. Numerical figures included in this prospectus have been subject to rounding adjustments.

Numerical figures shown as totals in various tables may not be arithmetic aggregations of the figures that precede them. In addition, we round certain percentages and amounts presented in this prospectus to the nearest whole number. As a result, figures expressed in total and as percentages in the text may not total 100% or, as applicable, when aggregated may not be the arithmetic aggregation of the amounts or percentages that precede them.

Corporate Information

We are a corporation initially formed under the laws of the State of Delaware on June 13, 2014 under the name Karman Holding Corp. solely for the purpose of the 2014 Topco Acquisition (as defined below). From June 13, 2014 to July 25, 2014, the Company had no operations or expenses. Operations commenced on July 25, 2014.

On July 25, 2014, the Company acquired Advantage Sales & Marketing Inc., or the 2014 Topco Acquisition, from AGS Topco Holdings, L.P. and its private equity sponsor, Apax Partners. As a result of the 2014 Topco Acquisition, Advantage Sales & Marketing Inc. became a wholly owned indirect subsidiary of the Company, which is a wholly owned direct subsidiary of Karman Topco L.P., or

11

Karman Topco. From an accounting perspective, the 2014 Topco Acquisition represented a recapitalization of our equity interests by equity funds affiliated with or advised by CVC Capital Partners, Leonard Green & Partners, Juggernaut Capital Partners, and Centerview Capital. Accordingly, the assets and liabilities acquired were recorded at fair value for the interests acquired by our new investors and the results of our operations prior to the 2014 Topco Acquisition have been presented as our Predecessor period. The units of Karman Topco are held by such equity funds, as well as by members of the Company’s management. Through its ownership of our common stock, Karman Topco controls us, and after this offering will continue to control us. Throughout this prospectus, we refer to CVC Capital Partners, Leonard Green & Partners, Juggernaut Capital Partners, and Centerview Capital collectively as the Sponsors.

On March 16, 2016, the Company changed its name from “Karman Holding Corp.” to “Advantage Solutions Inc.”

Our corporate headquarters are located at 18100 Von Karman Avenue, Suite 1000, Irvine CA 92612. Our telephone number is (949)797-2900. Our principal website address iswww.advantagesolutions.net. The information on any of our websites is deemed not to be incorporated in this prospectus or to be part of this prospectus.

12

The Offering

Issuer | Advantage Solutions Inc. |

Common stock offered | shares |

Underwriters’ option to purchase additional shares of common stock | shares |

Common stock to be outstanding after this offering | shares (or shares if the underwriters exercise their option to purchase additional shares in full). |

Use of proceeds | We estimate that the net proceeds to us from this offering, after deducting the underwriting discount and estimated offering expenses payable by us, will be approximately $ million (or approximately $ million if the underwriters exercise in full their option to purchase additional shares), assuming the shares are offered at $ per share, the midpoint of the estimated price range set forth on the cover of this prospectus. |

| | We intend to use the net proceeds that we receive from this offering to repay borrowings outstanding under our Second Lien Term Loans (as defined in “Description of Indebtedness”). |

Directed share program | The underwriters have reserved for sale, at the initial public offering price, up to approximately shares of our common stock being offered for sale to our directors, director nominees, officers, and full-time associates, certain persons affiliated with Smollan, our international strategic partner, and certain other persons associated with such officers, as designated by us. We will offer these shares to the extent permitted under applicable regulations. The number of shares available for sale to the general public in this offering will be reduced to the extent these persons purchase reserved shares. Any reserved shares not purchased will be offered by the underwriters to the general public on the same terms as the other shares. |

Controlled company | Following this offering, we will be a “controlled company” within the meaning of the corporate governance rules of the New York Stock Exchange and therefore will be exempt from certain of the corporate governance listing requirements of New York Stock Exchange. See “Management—Corporate Governance.” |

13

Dividend policy | We currently intend to retain all available funds and any future earnings for use in the operation of our business, and therefore we do not currently expect to pay any cash dividends on our common stock. Any future determination to pay dividends will be at the discretion of our board of directors and will depend upon our results of operations, financial condition, capital requirements, and other factors that our board of directors deems relevant. The payment of cash dividends is restricted under the terms of the agreements governing our debt and our ability to pay dividends may also be restricted by the terms of any future credit agreement or any securities we or our subsidiaries may issue. See “Dividend Policy.” |

Risk factors | Investing in shares of our common stock involves a high degree of risk. See “Risk Factors” beginning on page 21 of this prospectus for a discussion of factors you should carefully consider before investing in shares of our common stock. |

Proposed New York Stock Exchange symbol | “ADV” |

The number of shares of our common stock to be outstanding after this offering is based on shares of our common stock outstanding as of March 31, 2017 and excludes shares of common stock reserved as of the closing date of this offering for future issuance under our 2017 Incentive Award Plan and shares of common stock reserved as of the closing date of this offering for future issuance under our 2017 Employee Stock Purchase Plan, each of which we plan to adopt in connection with this offering.

Unless otherwise indicated, this prospectus reflects and assumes no exercise by the underwriters of their option to purchase additional shares of our common stock in connection with this offering.

14

Summary Consolidated Financial and Other Data

The following table presents certain of our historical financial data. Advantage Sales & Marketing Inc. is the predecessor of the issuer, Advantage Solutions Inc., for financial reporting purposes. Unless otherwise stated or the context otherwise requires, any reference hereinafter to the “Successor” reflects the operations of Advantage Solutions Inc. after July 25, 2014, the date of the 2014 Topco Acquisition, and any reference to the “Predecessor” refers to the operations of Advantage Sales & Marketing Inc. on or prior to the date of the 2014 Topco Acquisition. The 2014 Topco Acquisition was accounted for using the acquisition method. Under this method, the purchase price of an acquisition is allocated to the underlying assets acquired and liabilities assumed based upon their estimated fair values at the date of acquisition.

The consolidated statements of operations of the Successor for the years ended December 31, 2016 and 2015, the period from July 26, 2014 to December 31, 2014, and the Predecessor period from January 1, 2014 to July 25, 2014 are derived from the audited consolidated financial statements included elsewhere in this prospectus. The condensed consolidated statements of operations for the three months ended March 31, 2017 and 2016 are derived from our unaudited interim financial statements included elsewhere in this prospectus. We have prepared the unaudited interim financial statements on the same basis as the audited financial statements and have included, in our opinion, all normal recurring adjustments that we consider necessary for a fair presentation of the financial information set forth in those statements. The unaudited pro forma condensed consolidated financial information is derived from the Predecessor and Successor audited historical financial statements and should be read together with those financial statements and related notes contained therein, which are included elsewhere in this prospectus. The results of operations for the periods presented below are not necessarily indicative of the results to be expected for any future period and the results for any interim period are not necessarily indicative of the results that may be expected for a full fiscal year.

The unaudited pro forma condensed consolidated statement of operations for the year ended December 31, 2014 gives effect to the 2014 Topco Acquisition as if such transaction had occurred on January 1, 2014, which presentation we refer to as Pro Forma 2014. See “Unaudited Pro Forma Condensed Consolidated Statement of Operations” for a complete description of the adjustments and assumptions underlying the unaudited pro forma condensed consolidated statement of operations.

15

The following information should also be read together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Selected Consolidated Financial Data” and our consolidated financial statements and related notes appearing elsewhere in this prospectus.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Successor | | | Predecessor | | | | |

| | | Three Months Ended

March 31, | | | Year Ended

December 31, | | | Period From

July 26, 2014

to

December 31,

2014 | | | Period From

January 1,

2014 to

July 25,

2014 | | | Pro Forma

2014(1)

| |

| | | 2017 | | | 2016 | | | 2016 | | | 2015 | | | | |

| | | (Unaudited) | | | | | | | | | | | | | | | (Unaudited) | |

(in thousands, except share and per share data) | | | | | | | | | | | | | | | | | | | | | |

Revenues | | $ | 508,468 | | | $ | 458,276 | | | $ | 2,100,235 | | | $ | 1,895,046 | | | $ | 808,075 | | | $ | 905,646 | | | $ | 1,713,721 | |

| | | | | | | |

Cost of revenues | | | 413,153 | | | | 370,368 | | | | 1,611,285 | | | | 1,454,255 | | | | 601,649 | | | | 715,104 | | | | 1,316,753 | |

Selling, general, and administrative | | | 26,668 | | | | 23,025 | | | | 97,542 | | | | 72,224 | | | | 59,540 | | | | 141,300 | | | | 64,903 | |

Depreciation and amortization | | | 42,894 | | | | 42,639 | | | | 170,260 | | | | 164,584 | | | | 68,683 | | | | 75,271 | | | | 154,315 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total expenses | | | 482,715 | | | | 436,032 | | | | 1,879,087 | | | | 1,691,063 | | | | 729,872 | | | | 931,675 | | | | 1,535,971 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating income (loss) | | | 25,753 | | | | 22,244 | | | | 221,148 | | | | 203,983 | | | | 78,203 | | | | (26,029 | ) | | | 177,750 | |

Interest expense, net | | | 41,362 | | | | 44,066 | | | | 167,360 | | | | 160,895 | | | | 84,227 | | | | 83,896 | | | | 156,200 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(Loss) income before income taxes | | | (15,609 | ) | | | (21,822 | ) | | | 53,788 | | | | 43,088 | | | | (6,024 | ) | | | (109,925 | ) | | | 21,550 | |

(Benefit from) provision for income taxes | | | (6,406 | ) | | | (8,821 | ) | | | 22,623 | | | | 18,202 | | | | 3,861 | | | | (20,826 | ) | | | 6,159 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net (loss) income | | | (9,203 | ) | | | (13,001 | ) | | | 31,165 | | | | 24,886 | | | | (9,885 | ) | | | (89,099 | ) | | | 15,391 | |

Less: net income (loss) attributable to noncontrolling interests | | | 147 | | | | (37 | ) | | | (984 | ) | | | 292 | | | | 54 | | | | 116 | | | | 170 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net (loss) income attributable to stockholder of Advantage Solutions Inc. | | $ | (9,350 | ) | | $ | (12,964 | ) | | $ | 32,149 | | | $ | 24,594 | | | $ | (9,939 | ) | | $ | (89,215 | ) | | $ | 15,221 | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net (loss) income per share of common stock: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Basic | | | (93,502 | ) | | | (129,645 | ) | | | 321,486 | | | | 245,946 | | | | (99,385 | ) | | | | | | | 152,205 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Diluted | | | (93,502 | ) | | | (129,645 | ) | | | 321,486 | | | | 245,946 | | | | (99,385 | ) | | | | | | | 152,205 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Weighted-average number of shares of common stock: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Basic | | | 100 | | | | 100 | | | | 100 | | | | 100 | | | | 100 | | | | | | | | 100 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Diluted | | | 100 | | | | 100 | | | | 100 | | | | 100 | | | | 100 | | | | | | | | 100 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

16

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Successor | | | Predecessor | | | | |

| | | Three Months

Ended

March 31, | | | Year Ended

December 31, | | | Period From

July 26,

2014 to

December 31,

2014 | | | Period From

January 1,

2014 to

July 25,

2014 | | | Pro Forma

2014(1) | |

| (in thousands) | | 2017 | | | 2016 | | | 2016 | | | 2015 | | | | |

| | | (Unaudited) | | | | | | | | | | | | | | | (Unaudited) | |

Other Financial Data (unaudited): | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA(2) | | $ | 75,723 | | | $ | 68,376 | | | $ | 411,250 | | | $ | 365,490 | | | $ | 175,645 | | | $ | 151,490 | | | $ | 327,135 | |

M&A Adjusted EBITDA(2) | | | | | | | | | | $ | 422,050 | | | $ | 375,782 | | | | | | | | | | | $ | 335,323 | |

Adjusted Net Income(3) | | $ | 16,889 | | | $ | 9,735 | | | $ | 128,188 | | | $ | 105,647 | | | $ | 49,056 | | | $ | 11,763 | | | $ | 89,693 | |

| (1) | Presented to give pro forma effect to the adjustments attributable to the 2014 Topco Acquisition that are described in “Unaudited Pro Forma Condensed Consolidated Statement of Operations” and are based upon available information and certain assumptions that we believe are reasonable. |

| (2) | Adjusted EBITDA and M&A Adjusted EBITDA are supplemental financial measures of our operating performance that are not recognized under generally accepted accounting principles in the United States, or GAAP. Adjusted EBITDA means net income (loss) before (i) interest expense, net, (ii) (benefit from) provision for income taxes, (iii) depreciation, (iv) amortization of intangible assets, (v) our sponsors’ management fees and equity-based compensation expense, (vi) fair value adjustments of contingent consideration related to acquisitions, (vii) acquisition-related expenses, (viii) EBITDA for economic interests in investments, net, (ix) restructuring expenses, (x) litigation expenses, and (xi) other adjustments that management believes are helpful in evaluating our operating performance. |

M&A Adjusted EBITDA means Adjusted EBITDA for a given year as further adjusted to give pro forma effect to the results associated with acquisitions made during such period as if each acquisition had been completed as of the first day of the period presented. M&A Adjusted EBITDA includes information of acquired businesses prior to their acquisition by us which we believe to be accurate; however, this information has been derived from financial information that was not prepared by us. As a result, our independent registered public accounting firm have not audited, reviewed, compiled, or performed any procedures with respect to such information and, accordingly, do not express an opinion or any other form of assurance with respect thereto. Such amounts have not been prepared in accordance with the requirements ofRegulation S-X relating to the presentation of pro forma financial information, are presented for illustrative purposes only, and do not purport to be indicative of the contribution these acquired businesses would have made to our Adjusted EBITDA had they been included in our operations for the relevant period.

Generally, the companies we acquire do not have audited financial statements. In calculating M&A Adjusted EBITDA, we analyze the historical operating performance of an acquired business and may make certain adjustments to the acquired business’ unaudited financial results. These adjustments, which are intended to present such financial results similar to our calculation of Adjusted EBITDA, include additions or subtractions to the acquired business’ EBITDA to reflect the ongoing operating results of a given acquired business exclusive of any anticipated synergies (e.g., normalization of owner compensation, removal of equity distributions, management fees, or other non-recurring items). We do not intend for these adjustments to reflect cost savings that may occur as a result of the integration of the acquired businesses into our operations. While these adjustments are inherently subjective in nature, we believe that they are helpful in comparing our operating results year over year.

We supplementally present Adjusted EBITDA and M&A Adjusted EBITDA because they are key operating measures used by us and our board of directors to assess our financial performance. These measures adjust for items that we believe do not reflect the ongoing operating performance of our business, such as certain noncash items, unusual or infrequent items or items that change from period to period without any material relevance to our operating performance. We evaluate these measures in conjunction with our results according to GAAP because we believe they provide a more complete understanding of factors and trends affecting our business than GAAP measures alone. Furthermore, the agreements governing our indebtedness contain covenants and other tests based on measures substantially similar to Adjusted EBITDA. Neither Adjusted EBITDA nor M&A Adjusted EBITDA should be considered as an alternative for our most directly comparable measure presented on a GAAP basis.

17

A reconciliation of net (loss) income to Adjusted EBITDA and M&A Adjusted EBITDA is provided in the following table:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Successor | | | Predecessor | | | | |

| | | Three Months

Ended

March 31, | | | Year Ended

December 31, | | | Period From July 26,

2014 to

December 31,

2014 | | | Period From

January 1,

2014 to

July 25,

2014 | | | Pro Forma

2014(a) | |

| (in thousands) | | 2017 | | | 2016 | | | 2016 | | | 2015 | | | | |

| | | (Unaudited) | | | | | | | | | | | | | | | (Unaudited) | |

Net (loss) income | | $ | (9,203 | ) | | $ | (13,001 | ) | | $ | 31,165 | | | $ | 24,886 | | | $ | (9,885 | ) | | $ | (89,099 | ) | | $ | 15,391 | |

Add: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest expense, net | | | 41,362 | | | | 44,066 | | | | 167,360 | | | | 160,895 | | | | 84,227 | | | | 83,896 | | | | 156,200 | |

(Benefit from) provision for income taxes | | | (6,406 | ) | | | (8,821 | ) | | | 22,623 | | | | 18,202 | | | | 3,861 | | | | (20,826 | ) | | | 6,159 | |

Depreciation and amortization | | | 42,894 | | | | 42,639 | | | | 170,260 | | | | 164,584 | | | | 68,683 | | | | 75,271 | | | | 154,315 | |

Sponsors’ management fee and equity-based compensation expense(b) | | | 1,406 | | | | 1,812 | | | | 7,622 | | | | 7,463 | | | | 2,201 | | | | 831 | | | | 3,032 | |

Fair value adjustments related to contingent consideration related to acquisitions(c) | | | 2,739 | | | | (2,228 | ) | | | (841 | ) | | | (31,305 | ) | | | — | | | | (11,979 | ) | | | (11,979 | ) |

Acquisition-related expenses(d) | | | 2,474 | | | | 3,119 | | | | 10,368 | | | | 9,857 | | | | 26,563 | | | | 113,860 | | | | 4,486 | |

EBITDA for economic interests in investments(e) | | | 457 | | | | 610 | | | | 1,778 | | | | 1,426 | | | | (5 | ) | | | (464 | ) | | | (469 | ) |

Restructuring expenses(f) | | | — | | | | 180 | | | | 1,890 | | | | 5,498 | | | | — | | | | — | | | | — | |

Litigation expenses(g) | | | — | | | | — | | | | (975 | ) | | | 3,984 | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA | | $ | 75,723 | | | $ | 68,376 | | | | 411,250 | | | | 365,490 | | | $ | 175,645 | | | $ | 151,490 | | | | 327,135 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Add: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Acquisitions(h) | | | | | | | | | | | 10,800 | | | | 10,292 | | | | | | | | | | | | 8,188 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

M&A Adjusted EBITDA | | | | | | | | | | $ | 422,050 | | | $ | 375,782 | | | | | | | | | | | $ | 335,323 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | (a) | Presented to give pro forma effect to the adjustments attributable to the 2014 Topco Acquisition that are described in “Unaudited Pro Forma Condensed Consolidated Statement of Operations” and are based upon available information and certain assumptions that we believe are reasonable. |

| | (b) | Represents the management fees and reimbursements for expenses paid to affiliates of certain of the Sponsors pursuant to a management services agreement in the three months ended March 31, 2017 and 2016, the years ended December 31, 2016 and 2015 and the period from July 26, 2014 to December 31, 2014, and the management fees and reimbursements for expenses paid to affiliates of Predecessor’s sponsor, Apax Partners, in the period from January 1, 2014 to July 25, 2014 under a prior management services agreement that was terminated in connection with the 2014 Topco Acquisition. At the completion of this offering, the management services agreement with the Sponsors will terminate, and we will be obligated to make a final payment of $4.0 million to affiliates of certain of the Sponsors. Also represents expenses related to equity-based compensation associated with grants of units of Karman Topco made to one of the Sponsors, who provides services to us. |

| | (c) | Represents adjustments to the estimated fair value of our contingent consideration liabilities related to our acquisitions, excluding the present value accretion recorded in interest expense, net, for the applicable periods. See Note 7 to our consolidated financial statements for the year ended December 31, 2016 for additional information. |

| | (d) | Represents fees and costs associated with changes in our and the Predecessor’s equity ownership and activities related to our acquisitions. Transaction fees related to the change in equity ownership consist of professional services fees including legal, accounting, and other consultants, equity compensation that vested upon the completion of the 2014 Topco Acquisition, bonus compensation payments related to the 2014 Topco Acquisition, and fair value lease amortization resulting from the purchase accounting related to the 2014 Topco Acquisition. Acquisition-related costs are comprised of professional fees, including due diligence and integration activities. |

| | (e) | Represents additions of $1.3 million, $1.1 million, $4.4 million, $2.5 million, zero and zero to reflect our proportional share of Adjusted EBITDA related to our equity method investments and a reduction of $0.9 million, $0.5 million, $2.6 million, $1.1 million, $0.0 million and $0.5 million to remove the Adjusted EBITDA related to the minority ownership percentage of the entities that we fully consolidate in our financial statements for the three months ended March 31, 2017 and 2016, the years ended December 31, 2016 and 2015, the period from July 26, 2014 to December 31, 2014, and the period from January 1, 2014 to July 25, 2014, respectively. |

| | (f) | Represents fees and costs associated with various internal reorganization activities among our consolidated entities. |

| | (g) | Represents legal settlements that are unusual or infrequent costs associated with our operating activities. |

| | (h) | Reflects the portion of Adjusted EBITDA generated by acquisitions completed in a given period prior to the acquisition date and therefore not captured in our consolidated financial statements for the applicable period. |

18

| (3) | Adjusted Net Income is anon-GAAP financial measure. Adjusted Net Income means net income (loss) before (i) our sponsors’ management fees and equity-based compensation expense, (ii) fair value adjustments of contingent consideration related to acquisitions, (iii) acquisition-related expenses, (iv) restructuring expenses, (v) litigation expenses, (vi) amortization of intangible assets, (vii) other adjustments that management believes are helpful in evaluating our operating performance, and (viii) related tax adjustments. |

We supplementally present Adjusted Net Income because we use it as a supplemental measure to evaluate the performance of our business in a way that also considers our ability to generate profit without the impact of items that we do not believe are indicative of our operating performance or are unusual or infrequent in nature and aid in the comparability of our performance from period to period. Adjusted Net Income should not be considered as an alternative for our most directly comparable measure presented on a GAAP basis.

A reconciliation of net (loss) income to Adjusted Net Income is provided in the following table:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Successor | | | Predecessor | | | | |

| | | Three Months

Ended

March 31, | | | Year Ended

December 31, | | | Period From

July 26,

2014 to

December 31,

2014 | | | Period From

January 1,

2014 to

July 25,

2014 | | | Pro Forma

2014(a) | |

| (in thousands) | | 2017 | | | 2016 | | | 2016 | | | 2015 | | | | |

| | | (Unaudited) | | | | | | | | | | | | | | | (Unaudited) | |

Net (loss) income | | $ | (9,203 | ) | | $ | (13,001 | ) | | $ | 31,165 | | | $ | 24,886 | | | $ | (9,885 | ) | | $ | (89,099 | ) | | $ | 15,391 | |

Add: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Sponsors’ management fee and equity-based compensation expense(b) | | | 1,406 | | | | 1,812 | | | | 7,622 | | | | 7,463 | | | | 2,201 | | | | 831 | | | | 3,032 | |

Fair value adjustments related to contingent consideration related to acquisitions(c) | | | 2,739 | | | | (2,228 | ) | | | (841 | ) | | | (31,305 | ) | | | — | | | | (11,979 | ) | | | (11,979 | ) |

Acquisition-related expenses(d) | | | 2,474 | | | | 3,119 | | | | 10,368 | | | | 9,857 | | | | 26,563 | | | | 113,860 | | | | 4,486 | |

Restructuring expenses(e) | | | — | | | | 180 | | | | 1,890 | | | | 5,498 | | | | — | | | | — | | | | — | |

Litigation expenses(f) | | | — | | | | — | | | | (975 | ) | | | 3,984 | | | | — | | | | — | | | | — | |

Amortization of intangible assets(g) | | | 35,522 | | | | 34,380 | | | | 138,502 | | | | 134,679 | | | | 56,220 | | | | 59,654 | | | | 126,235 | |

Tax adjustments related tonon-GAAP

adjustments(h) | | | (16,049 | ) | | | (14,527 | ) | | | (59,543 | ) | | | (49,415 | ) | | | (26,043 | ) | | | (61,504 | ) | | | (47,472 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted Net Income | | $ | 16,889 | | | $ | 9,735 | | | $ | 128,188 | | | $ | 105,647 | | | $ | 49,056 | | | $ | 11,763 | | | $ | 89,693 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | (a) | Presented to give pro forma effect to the adjustments attributable to the 2014 Topco Acquisition that are described in “Unaudited Pro Forma Condensed Consolidated Statement of Operations” and are based upon available information and certain assumptions that we believe are reasonable. |

| | (b) | Represents the management fees and reimbursements for expenses paid to affiliates of certain of the Sponsors pursuant to a management services agreement in the three months ended March 31, 2017 and 2016, the years ended December 31, 2016 and 2015 and the period from July 26, 2014 to December 31, 2014, and the management fees and reimbursements for expenses paid to affiliates of Predecessor’s sponsor, Apax Partners, in the period from January 1, 2014 to July 25, 2014 under a prior management services agreement that was terminated in connection with the 2014 Topco Acquisition. At the completion of this offering, the management services agreement with the Sponsors will terminate, and we will be obligated to make a final payment of $4.0 million to affiliates of certain of the Sponsors. Also represents expenses related to equity-based compensation associated with grants of units of Karman Topco made to one of the Sponsors, who provides services to us. |

| | (c) | Represents adjustments to the estimated fair value of our contingent consideration liabilities related to our acquisitions, excluding the present value accretion recorded in interest expense, net, for the applicable periods. See Note 7 to our consolidated financial statements for the year ended December 31, 2016 for additional information. |

| | (d) | Represents fees and costs associated with changes in our and the Predecessor’s equity ownership and activities related to our acquisitions. Transaction fees related to the change in equity ownership consist of professional services fees including legal, accounting, and other consultants, equity compensation that vested upon the completion of the 2014 Topco Acquisition, bonus compensation payments related to the 2014 Topco Acquisition, and fair value lease amortization resulting from the purchase accounting related to the 2014 Topco Acquisition. Acquisition-related costs are comprised of professional fees, including due diligence and integration activities. |

| | (e) | Represents fees and costs associated with various internal reorganization activities among our consolidated entities. |

| | (f) | Represents legal settlements that are unusual or infrequent costs associated with our operating activities. |

| | (g) | Represents the amortization of intangible assets recorded in connection with the 2014 Topco Acquisition and our other acquisitions. |

| | (h) | Reflects the application of U.S. federal and state enterprise tax rates to our Adjusted Net Income adjustments of 38.9% in the three months ended March 31, 2017, 38.9% in 2016, 39.0% in 2015, 39.0% for the period from July 26, 2014 to December 31, 2014 and 39.0% for the period from January 1, 2014 to July 25, 2014 to the 2014 Topco Acquisition. |

19

Reconciliation of Net Income (Loss) to Adjusted EBITDA for the Years Ended December 31, 2007 through December 31, 2013

The following table presents a reconciliation of net income (loss) of Predecessor to Adjusted EBITDA for the years ended December 31, 2007 through December 31, 2013. Except as described in the following table and the accompanying footnotes, net income (loss) and the other financial data included in the following table (other than Adjusted EBITDA) are derived from our audited financial statements for such periods that are not included or incorporated by reference in this prospectus.

For more definitions of, and information regarding Adjusted EBITDA and other considerations associated withnon-GAAP financial measures refer to “—Summary Consolidated Financial and Other Data.”

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year ended December 31, | |

| (in thousands) | | 2013 | | | 2012 | | | 2011 | | | 2010(a)

(unaudited) | | | 2009 | | | 2008 | | | 2007 | |

Net income (loss) | | $ | 35,072 | | | $ | 4,253 | | | $ | (24,442 | ) | | $ | (34,984 | ) | | $ | 20,622 | | | $ | (201,052 | ) | | $ | 5,790 | |

Add: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Impairment of definite lived intangibles(b) | | | — | | | | — | | | | — | | | | — | | | | 26,199 | | | | 255,211 | | | | 6,290 | |

Interest expense, net | | | 106,020 | | | | 112,426 | | | | 106,738 | | | | 96,606 | | | | 45,989 | | | | 59,213 | | | | 69,403 | |

Provision for (benefit from) income taxes | | | 17,922 | | | | (8,106 | ) | | | (8,471 | ) | | | (50 | ) | | | 16,538 | | | | (13,074 | ) | | | 10,294 | |

Depreciation and amortization | | | 126,648 | | | | 144,912 | | | | 124,644 | | | | 57,566 | | | | 60,234 | | | | 53,189 | | | | 51,110 | |

Sponsors’ management

fee(c) | | | 1,724 | | | | 1,855 | | | | 1,771 | | | | 758 | | | | 668 | | | | 931 | | | | 665 | |

Fair value adjustments related to contingent consideration(d) | | | (2,278 | ) | | | — | | | | — | | | | — | | | | (290 | ) | | | (5,879 | ) | | | — | |

Acquisition-related costs(e) | | | 2,547 | | | | 719 | | | | 5,115 | | | | 65,754 | | | | — | | | | — | | | | — | |

EBITDA for economic interests in investments(f) | | | (13,355 | ) | | | (11,107 | ) | | | 84 | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA | | $ | 274,300 | | | $ | 244,952 | | | $ | 205,439 | | | $ | 185,650 | | | $ | 169,960 | | | $ | 148,539 | | | $ | 143,552 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |