UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-K

ANNUAL REPORT

ANNUAL REPORT PURSUANT TO REGULATION A OF THE SECURITIES ACT OF 1933

For the fiscal year ended December 31, 2018

| NEURMEDIX, INC. |

| (Exact name of registrant as specified in its charter) |

| Delaware | | 47-2860346 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | |

11601 Wilshire Blvd, Suite 1100 Los Angeles, California | | 90025 |

| (Address of principal executive offices) | | (Zip Code) |

(310) 444-4321

Registrant’s telephone number, including area code

Part II.

USE OF MARKET AND INDUSTRY DATA

This Annual Report on Form 1-K includes market and industry data that we have obtained from third-party sources, including industry publications, as well as industry data prepared by our management on the basis of its knowledge of and experience in the industries in which we operate (including our management’s estimates and assumptions relating to such industries based on that knowledge). Management has developed its knowledge of such industries through its experience and participation in these industries. While our management believes the third-party sources referred to in this Annual Report are reliable, neither we nor our management have independently verified any of the data from such sources referred to in this Annual Report or ascertained the underlying economic assumptions relied upon by such sources. Furthermore, internally prepared and third-party market prospective information, in particular, are estimates only and there will usually be differences between the prospective and actual results, because events and circumstances frequently do not occur as expected, and those differences may be material. Also, references in this Annual Report to any publications, reports, surveys or articles prepared by third parties should not be construed as depicting the complete findings of the entire publication, report, survey or article. The information in any such publication, report, survey or article is not incorporated by reference in this Annual Report.

Forward Looking Statements

This Annual Report on Form 1-K (the “Annual Report”) of NeurMedix, Inc., a Delaware corporation (“NeurMedix,” the “Company,” “we,” “us”or “our”), contains certain forward-looking statements that are subject to various risks and uncertainties. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “outlook,” “seek,” “anticipate,” “estimate,” “approximately,” “believe,” “could,” “project,” “predict,” or other similar words or expressions. Forward-looking statements are based on certain assumptions, discuss future expectations, describe future plans and strategies, contain financial and operating projections or state other forward-looking information. Our ability to predict results or the actual effect of future events, actions, plans or strategies is inherently uncertain. Although we believe that the expectations reflected in our forward-looking statements are based on reasonable assumptions, our actual results and performance could differ materially from those set forth or anticipated in our forward-looking statements. Factors that could have a material adverse effect on our forward-looking statements and upon our business, results of operations, financial condition, funds derived from operations, cash flows, liquidity and prospects include, but are not limited to, the factors referenced in the NeurMedix Offering Circular filed pursuant to Regulation A, dated July 19, 2018 (the “Offering Circular”).

Readers are cautioned not to place undue reliance on any of these forward-looking statements, which reflect our views as of the date of this report. The matters summarized below and elsewhere in this report could cause our actual results and performance to differ materially from those set forth or anticipated in forward-looking statements. Accordingly, we cannot guarantee future results or performance. Furthermore, except as required by law, we are under no duty to, and we do not intend to, update any of our forward-looking statements after the date of this report, whether as a result of new information, future events or otherwise.

Use of Market and Industry Data

This Annual Report includes market and industry data that we have obtained from third-party sources, including industry publications, as well as industry data prepared by our management on the basis of its knowledge of and experience in the industry in which we operate (including our management’s estimates and assumptions relating to such industries based on that knowledge). While our management believes the third-party sources referred to in this Annual Report are reliable, neither we nor our management has independently verified any of the data from such sources referred to in this Annual Report or ascertained the underlying economic assumptions relied upon by such sources. Furthermore, internally prepared and third-party market prospective information, in particular, are estimates only, and there will usually be differences between the prospective and actual results because events and circumstances frequently do not occur as expected, and those differences may be material. Also, references in this Annual Report any publications, reports, surveys or articles prepared by third parties should not be construed as depicting the complete findings of the entire publication, report, survey or article. The information in any such publication, report, survey or article is not incorporated by reference in this Annual Report.

Item 1. Business

NeurMedix, Inc., is a “virtual” biotechnology company based in San Diego, California, with experienced leadership, near-term clinical data readouts, a therapeutic and development focus on unmet medical needs in neurological diseases, and a capital efficient business model. We are developing compelling product candidates with novel, first-in-class mechanism of action (“MOA”), human clinical safety database, clinical activity demonstrated in metabolic disease. We are developing multiple therapeutic product opportunities in neurological diseases and have retained all global development and marketing rights. We are currently conducting an offering pursuant to regulation a (Tier 2) to raise up to $49,999,998 in gross proceeds (the “Offering”).

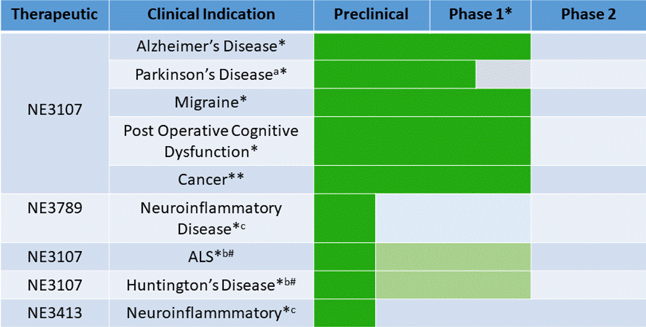

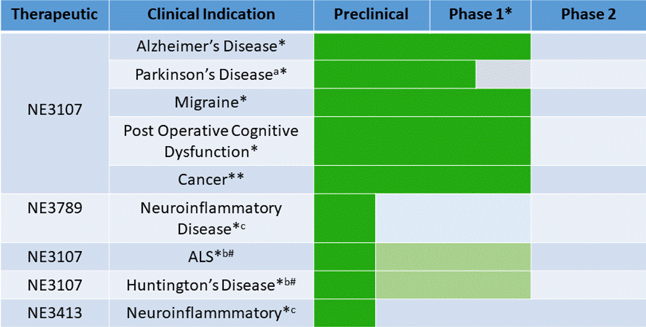

Our product candidate, NE3107, has demonstrated activity in a wide variety of pre-clinical inflammatory disease models, and completed three Phase I, two Phase I/II, and one Phase II clinical studies. NeurMedix has an open IND with the FDA DMEP and intends to initiate studies in cognitively impaired type 2 diabetes subjects, and is positioned to file INDs with the FDA DNP for clinical trials for the treatment of patients with Alzheimer’s disease, Parkinson’s disease, migraine, and post-operative cognitive dysfunction (“POCD”). Further studies are contemplated for amyotrophic lateral sclerosis (also known as “ALS” or “Lou Gehrig’s Disease”), Huntington’s disease, Alzheimer’s disease, and encephalitis. NE3107 is our most developed drug candidate, and its application to various diseases, we believe is a first-in-class therapeutic for neurological disease targeting disorders with significant unmet medical needs. Our focus is on diseases with tremendous unmet medical needs in order to expedite Food and Drug Administration (“FDA”) approvals and commercialization, minimize capital requirements and optimize shareholder value.

A large body of scientific literature has identified neuroinflammation as a critical underlying factor in the initiation and perpetuation of neurodegeneration. The literature also indicates that extracellular signaling-regulated kinase (“ERK”) and nuclear factor kappa-light-chain-enhancer of activated B cells’ (“NF-kB”) hyperactivation (a prolonged state of activation generally associated with aberrant signaling pathological outcome) causes the inflammation. NE3107 binds to ERK and inhibits hyperactivation of inflammatory signaling pathways. The general mechanisms of neuroinflammation and neurodegeneration are common to all neuroinflammatory diseases, although inflammatory signals can arise, often through poorly understood mechanisms, to create unique perturbations to specific areas of the brain, which give rise to the variety of neurological disorders. Moreover, general mechanisms of inflammation and inflammatory signaling pathways are similar in the periphery and the central nervous system (“CNS”). Thus, as inflammation in general is important to neurological disease in general, NE3107’s anti-inflammatory activity in models of systemic inflammatory disease is highly relevant to potential activity against neuroinflammation, and provides mechanistic rationale in support of neurological indications. Glial cell activation and recruitment of peripheral inflammatory cells to sites of neuroinflammation are also general features of neuroinflammation, and are greatly influenced by ERK and NF-kB hyperactivation, and thus potentially susceptible to the modulating activity of NE3107. Both ERK and NF-kB have important homeostatic functions, so that non-specific inhibition of ERK and NF-kB can result in systemic and CNS toxicities. All evidence to date, which includes safety data from animal and human studies and biochemical analysis of animal tissues, indicates NE3107 acts selectively against ERK and NF-kB hyperactivation, and does not impede homeostatic ERK and NF-kB activity. Importantly, in contrast to the majority of approved anti-inflammatory compounds there was no evidence of NE3107 immunosuppressive activity in multiplein vitro and animal studies.

Over the past twenty years, there has been a vast amount of scientific research on the association of type 2 diabetes, insulin resistance, neuroinflammation, and Alzheimer’s disease. A large body of evidence now exists that shows how inflammation causes insulin resistance in the brain. Brain insulin resistance has deleterious effects on many aspects of brain energy homeostasis and neuron function, which include the formation of neurofibrillary tangles, increased oxidative stress, decreased cognition, and increased neurodegeneration. Importantly, type 2 diabetes, i.e. systemic insulin resistance, hyperinsulinemia, and chronic hyperglycemia, also contribute to neuroinflammation and altered glucose homeostasis in the brain through alterations in blood-brain barrier permeability to glucose and inflammatory cells. In obese, inflamed human subjects (the profile of approximately 50% of type 2 diabetics), NE3107 reduced insulin resistance, and improved post-prandial glucose disposal. In this target population of type 2 diabetes, NE3107 also decreased C-reactive protein (“CRP”), a measure of systemic inflammation, and the high variation in glucose disposal parameters that is associated with metabolic dysregulation. In glucose-intolerant pre-diabetics with evidence of systemic inflammation, NE3107 improved glucose disposal parameters, so that the subjects were no longer pre-diabetic while receiving NE3107 treatment. NE3107 activity against type 2 diabetes and insulin resistance has also been observe in animal models, which show that the drug’s effects against insulin resistance and improvements in glucose homeostasis are mediated by anti-inflammatory activity against ERK and NF-kB hyperactivation. NE3107’s activity against type 2 diabetes/ insulin resistance strongly suggests the drug may have use against Alzheimer’s disease and neuroinflammatory diseases in general.

In addition to clinical evaluation, NE3107 has been evaluated in a wide variety of models of systemic inflammation and neuroinflammatory disease. Because ERK and NF-kB signaling mechanisms are generally similar between systemic inflammatory and neuroinflammatory conditions, the anti-inflammatory activity observed in these studies provides supporting rationale for treatment of neuroinflammatory disease. Additionally, the observation of NE3107 anti-inflammatory activityin vitro and in a wide variety of tissue types (hepatic, adipose, muscle, and lymphatic), supports the notion that NE3107’s activity does not have a tissue specific limitation.

NE3107 has been evaluated in 12 models of systemic inflammatory disease in peer-reviewed publications. Major conclusions from the studies are followed by a brief summary.

NE3107 (HE3286) significantly reduced disease, joint destruction and inflammation in the mouse collagen-induced arthritis model

Publication Details: Auci, et al., 2007, A new orally bioavailable synthetic androstene inhibits collagen-induced arthritis in the mouse. Androstene hormones as regulators of regulatory T cells. Ann N Y Acad Sci 1110: 630. This study was initiated in August, 2006. This study was performed under the direction of Prof. Helena Offner, Department of Neurology, Oregon Health and Science University, Portland, Oregon, USA. Arthritis was induced in DBA/1Lac/J mice by immunization with an emulsion of bovine type II collagen and Mycobacterium tuberculosis, and monitored for disease progression. Compared to vehicle control mice, treatment with 25-50 mg HE3286 (beginning at disease onset) resulted in a significant decrease in disease score (evident by day 21 post-onset, p < 0.05).

NE3107 (HE3286) significantly decreased disease, inflammation and joint destruction in the mouse collagen-induced arthritis model

Publication Details: Offner, et al., 2009, An orally Bioavailable synthetic analog of an active dehydroepiandrostene metabolite reduces established disease in rodent models of rheumatoid arthritis. J Pharmacol Exp Ther 329: 1100. This study was initiated in September, 2006. Arthritis was induced in DBA/1Lac/J mice by immunization with an emulsion of bovine type II collagen and Mycobacterium tuberculosis, and monitored for disease progression. Compared to vehicle control mice, treatment with 25-50 mg HE3286 (beginning at disease onset) resulted in a significant decrease in disease score (evident by day 21 post-onset, p < 0.001). HE3286 reduced joint inflammation, synovial proliferation and erosion as evaluated by histology. Treatment with HE3286 compared to vehicle controls was associated with a doubling of T regulatory cells in the spleen. Mice treated with HE3286 showed dramatic decreases in the splenocyte culture production of proinflammatory cytokines tumor necrosis factor alpha, Interleukins-6, -17 and -23 compared to vehicle control mice.

NE3107 (HE3286) significantly decreased inflammatory mediators and reduced disease in the mouse collagen antibody-induced arthritis model

Publication Details: Offner, et al., 2009, An orally Bioavailable synthetic analog of an active dehydroepiandrostene metabolite reduces established disease in rodent models of rheumatoid arthritis. J Pharmacol Exp Ther 329: 1100. This study was initiated in March, 2007, and performed under the direction of Dr. Gary Firestein, Division of Rheumatology, Allergy and Immunology, University of California, San Diego. Male DBA/1Lac/J mice were injected with a bovine collagen type II antibody cocktail and treated with intraperitoneal lipopolysaccharide two days later. The next day, daily treatment with vehicle or HE3286 was initiated. Arthritic severity of each joint was scored, and extra articular tissue was collected for inflammatory mediator RNA analysis. HE3286 treatment significantly reduced the arthritis score in five days (p < 0.05) compared to vehicle, and with 80 mg/kg HE3286, arthritis was virtually absent throughout the experiment. HE3286 showed a dose-dependent decrease in joint interleukin-6 and matrix metalloproteinase-3 inflammatory mediators, compared to vehicle controls.

NE3107 (HE3286) significantly reduced nuclear factor kappa B (NFkB) activation by lipopolysaccharide in mice

Publication Details: Offner, et al., 2009, An orally Bioavailable synthetic analog of an active dehydroepiandrostene metabolite reduces established disease in rodent models of rheumatoid arthritis. J Pharmacol Exp Ther 329: 1100. This study was initiated in September, 2006 and performed under the direction of Dominick Auci, Ph.D. at Hollis- Eden Pharmaceuticals, San Diego, CA. ICR mice were treated with HE3286 or vehicle, followed by intraperitoneal challenge with lipopolysaccharide. Splenocytes were lysed and assayed for phospho- nuclear factor kappa B (NFkB) p65 using an enzyme-linked immunosorbent assay. NFkB activation was reduced by treatment with HE3286 compared to vehicle control (p < 0.001).

NE3107 (HE3286) significantly decreased disease in the Wistar rat model of ulcerative colitis

Publication Details: Ahlem, et al., 2009 A novel synthetic steroid as an oral treatment for autoimmune disease, Ann N Y Ac ad Sci 1173: 781. This study was performed under the direction of Prof. Ferdinando Nicoletti at the Department of Biomedical Sciences, School of Medicine, University of Catania, Italy. The study was initiated in September, 2007. Rats were treated with 2,4-dinitrobenzene sulfonic acid to induce colitis and mucosal necrosis in the colons of all challenged animals. Compared to the vehicle control, animals treated with HE3286 (10 mg/kg, but not 30 mg/kg) had significantly reduced mucosal damage (p = 0.023), and were comparable to the positive control, sulfasalazine (p = 0.037 compared to vehicle control). HE3286 (10 mg/kg)-treated animals showed significant reductions in colon weight compared to the vehicle control (p = 0.005), whereas the positive control did not.

NE3107 (HE3286) decreased disease (statistical trend) in the SJL/J mouse model of experimental autoimmune encephalitis (EAE)

Publication Details: Ahlem, et al., 2009 A novel synthetic steroid as an oral treatment for autoimmune disease, Ann N Y Ac ad Sci 1173: 781. This study was performed under the direction of Prof. Ferdinando Nicoletti at the Department of Biomedical Sciences, School of Medicine, University of Catania, Italy. The study was initiated in November, 2007. Mice were immunized with an emulsion of proteolipid protein 139-151 and Mycobacterium tuberculosis H37RA. Vehicle control mice developed clinical signs of EAE (8 of 8 mice, average disease score 41.5, mortality 2 of 8). Mice treated with HE3286 had a statistical trend for attenuated disease (2 of 8 mice, average score 14.9 p = 0.071, no mortality). After cessation of treatment with HE3286, the treatment effect persisted compared to the vehicle control group.

NE3107 (HE3286) significantly decreased lung myeloperoxidase in a mouse lung injury model

Publication Details: Conrad, et al., 2010, HE3286, an oral synthetic steroid, treats lung inflammation in mice without immune suppression. J Inflammation 7:52. This study was initiated in March, 2006, and performed under the direction of Dr. Douglas Conrad, VA San Diego Healthcare System, San Diego, CA. Mice were treated with HE3286 or vehicle via oral gavage prior to intratrachael lipopolysaccharide challenge. After 48 hours, inflammatory mediators in bronchoaveolar lavage samples were measured by enzyme-linked immunosorbent assay. Treatment with HE3286 significantly decreased myeloperoxidase compared to vehicle control (p = 0.0249).

NE3107 (HE3286) significantly decreased disease in a mouse carrageenan-induced pleurisy model

Publication Details: Conrad, et al., 2010, HE3286, an oral synthetic steroid, treats lung inflammation in mice without immune suppression. J Inflammation 7:52. This study was initiated in October, 2004, and performed under the direction of Prof. Ferdinando Nicoletti at the Department of Biomedical Sciences, School of Medicine, University of Catania, Italy. CD1 mice were pretreated with hE3286 or vehicle, and subsequently challenged with carrageenan injected into the pleural cavity. After 4 hours, the pleural exudate volumes and numbers of neutrophils were measured. HE3286 (40 mg/kg) significantly decreased the pleural neutrophils compared to vehicle control (p < 0.05), and was comparable to the positive control (polyclonal anti-tumor necrosis factor alpha).

NE3107 (HE3286) significantly decreased spontaneous type 1 autoimmune diabetes in a non-obese diabetic (NOD) mouse model

Publication Details: Kosiewicz, et al., 2011, HE3286, an orally bioavailable synthetic analogue of an active DHEA metabolite suppresses spontaneous autoimmune diabetes in the NOD mouse, Eur J Pharmacol 658: 257. This study was initiated in April 2008, and performed under the direction of Prof. Ferdinando Nicoletti at the Department of Biomedical Sciences, School of Medicine, University of Catania, Italy. In this early treatment model, NOD mice were treated with HE3286 or vehicle from 15 to 25 weeks of age. Glucose levels were monitored weekly. HE3286 treated mice had a significantly lower incidence at week 25 (p = 0.007) compared to vehicle controls.

NE3107 (HE3286) significantly decreased type 1 autoimmune diabetes at onset in a NOD mouse model

Publication Details: Kosiewicz, et al., 2011, HE3286, an orally bioavailable synthetic analogue of an active DHEA metabolite suppresses spontaneous autoimmune diabetes in the non-obese diabetic (“NOD”) mouse, Eur J Pharmacol 658: 257. One arm of this study was initiated in January 2007, and performed under the direction of Prof. Ferdinando Nicoletti at the Department of Biomedical Sciences, School of Medicine, University of Catania, Italy. A second arm was initiated in September, 2008, and performed under the direction of Prof. Michelle Kosiewicz, Department of Microbiology and Immunology, Univ. Louisville, Louisville, KY. In this late treatment model, NOD mice were treated with HE3286 or vehicle, daily for 6 weeks, starting two days after the first incidence of autoimmune diabetes in the colony. Glucose levels were monitored weekly. Late treatment with HE3286 significantly decreased the incidence of autoimmune diabetes (p = 0.005) compared to vehicle control. Histological analysis revealed that HE3286 markedly decreased the incidence of insulitis (p = 0.02) compared to vehicle control. Lymphocytes from the pancreatic lymphnodes and spleen were isolated and assayed for T cell phenotypes. HE3286 treatment significantly decreased the destructive Th1 and Th17 response. Interferon-gamma production was decreased in spleen (p = 0.03) and pancreatic lymphocytes (p = 0.08) compared to vehicle control, IL-17 production was decreased in spleen and pancreatic lymphocytes (p = 0.001 each), and serum IL-17 was significantly decreased (p = 0.006) compared to vehicle controls.

NE3107 (HE3286) significantly decreased type 2 diabetes in mouse models of obesity-induced inflammation and diabetes, and reduces inflammatory mediators

Publication Details: Wang, et al., 2010, Amelioration of glucose intolerance by the synthetic androstene HE3286: Link to inflammatory pathways. J Pharmacol Exp Ther 333: 70. This study was initiated in March, 2007, and was performed under the direction of Dr. Jaime Flores-Riveros, Hollis-Eden Pharmaceuticals, Inc., San Diego, CA. Compared to vehicle control, HE3286 significantly suppressed development of hyperglycemia in 8 week old (p < 0.05) and 6 week old (p < 0.01)db/db mice. HE3286 significantly reduced glucose intolerance (glucose and insulin levels, p < 0.05 each compared to vehicle controls) in 6 week olddb/db mice. HE3286 reduced glucose intolerance in obese, insulin-resistant (diet-induced obesity) mice (p < 0.01) and in genetically obeseob/ob mice (p<0.01) compared to vehicle controls. These changes were accompanied by decreases in proinflammatory macrophage activation markers (p < 0.05), compared to vehicle controls. HE3286 decreased serum chemokines and hyperinsulemia inob/ob mice (p<0.05). HE3286 was shown to decrease the activation and nuclear localization of p65 nuclear factor kappa B (NFkB).

NE3107 (HE3286) significantly attenuated inflammation and insulin resistance in diabetic fatty rats

Publication Details: Lu, et al., 2010, A new antidiabetic compound attenuates inflammation and insulin resistance in Zucker diabetic fatty rats, Am J Physiol Endocrinol Metab 298: E1036. This study was initiated in May, 2007, and performed under the direction of Prof. Jerrold Olefsky, Department of Medicine, Univ. California, San Diego. In primary intraperitoneal mouse macrophages, HE3286 significantly decreased inflammatory pathways stimulated by lipopolysaccharide including activation of nuclear factor kappa B (NFkB) phospho-extracellular receptor kinase (p-ERK), and associated signal transduction pathways compared to vehicle. HE3286 also significantly decreased proinflammatory chemokines and cytokines compared to vehicle. These changes also significantly decreased proinflammatory macrophage chemotaxis. In treated Zucker diabetic fatty rats, HE3286 treatment significantly decreased glucose insulin, glycerol and free fatty acid levels compared to vehicle. Using euglycemic hyperinsulinemic clamp studies, HE3286 was shown to significantly improve glucose sensitivity. In these rats, HE3286 decreased inflammatory macrophage chemotaxis into fat depots and the levels of tissue cytokines tumor necrosis factor alpha and interleukin 1-beta.

NE3107 (HE3286) binds to extracellular kinase-1 and -2

Publication Details: Reading, et al., 2012, Molecular targets for 17a-ethynyl-5-androstene-3b,7b,17b-triol, an anti-inflammatory agent derived from the human metabolome. PLoS ONE 7(2) e32147. This study was initiated in July 2009, and performed under the direction of Steven White, Ph.D., Hollis-Eden Pharmaceuticals, Inc., San Diego, CA. Using extracts from mouse macrophage cells, proteins that bound to immobilized HE3286, but not to a closely related structure, were identified in experiments using stable isotope labeling in culture and mass spec/mass spec analyses. Amongst other proteins, HE3286 was shown to bind to proteins involved in inflammation signaling pathways: extracellular kinase 1 and 2 (ERK1 and ERK2).

The above studies were conducted in rodents, and therefore the translation of the activities to human subjects was not yet demonstrated.

The following two clinical studies were conducted to evaluate the translation of animal data to human subjects:

NE3107 (HE3286) significantly improved insulin sensitivity in obese, inflamed, impaired glucose tolerance human subjects.

Publication Details: Reading, et al., 2013, A synthetic anti-inflammatory sterol improves insulin sensitivity in insulin-resistant obese impaired glucose tolerance subjects. Obesity 21 E343. This Phase I study was initiated in October, 2007, and sponsored by Hollis-Eden Pharmaceuticals, Inc. HE3286 improved insulin sensitivity in insulin-resistant obese impaired glucose tolerance subjects, evidenced by hyperinsulinemic, euglycemic clamp studies (p = 0.009 vs. placebo). This Phase I clinical study demonstrated that animal studies showing HE3286 improved insulin sensitivity in obese, inflamed insulin resistance translated to humans.

NE3107 (HE3286) significantly decreased insulin resistance, increased the frequency of patients with decreased day 84 hemoglobin A1c in metformin-treated type 2 diabetic subjects, and decreased day 112 HbA1c in treatment-naïve diabetic subjects

Publication Details: Reading, et al., 2013, an anti-inflammatory sterol decreased obesity-related inflammation-induced insulin resistance and metabolic dysregulation. Mediators of Inflammation 2013 814989. This Phase II study was initiated in July, 2008, and was sponsored by Hollis-Eden Pharmaceuticals, Inc. In addition, HE3286 improved hematopoietic and metabolic regulation and 1,5-anhydroglucitol retention (a surrogate of postprandial glucose) in type 2 diabetic subjects compared to placebo. This study demonstrated that data obtained in diabetic animals translated to human subjects.

Studies in Animal Models of Neuroinflammatory Disease

In addition to models of systemic inflammatory disease, NE3107 has been evaluated in six models of neuroinflammation, four of which have been published in peer reviewed scientific journals. Two studies were sponsored by the Michael J. Fox Foundation for Parkinson’s Research (“MJFF”). These studies established that NE3107 freely penetrates the blood-brain-barrier (the drug enters the brain), and is active against neuroinflammation.

| 1. | Unpublished Report: Anti-Parkinson and anti-dyskinetic efficacy studies of HE3286 in a MPTP non-human primate model of Parkinson’s disease. This study was sponsored by MJFF, and conducted by Dr. Ingrid Philippens at the Biomedical Primate Research Centre, Rijswijk, The Netherlands. The study was initiated in January 2013. Summary of results: NE3107 decreased clinical signs of Parkinson’s disease, decreased susceptibility to LID, enhanced activity in combination with L-dopa, and decreased neurodegeneration. |

This study evaluated NE3107 in marmoset monkeys treated with the neurotoxin 1-methyl-4-phenyl-1,2,3,6-tetrahydropyridine (“MPTP”), which kills dopamine producing cells and initiates a prolonged neuroinflammatory condition, which produces a disease very similar to Parkinson’s disease in humans. NE3107 (30 mg/kg) was administered orally once daily for 14 weeks (to the end of the study) to one group of 6 monkeys beginning 11 days after completion of MPTP treatments. A second group of 6 MPTP treated monkeys was treated with oral amantadine, and a third group of 6, also MPTP treated, was given placebo. NE3107 activity against Parkinson’s symptoms was evident within the first 24 hours after starting therapy and continued to be observed until the study termination. NE3107 activity against parkinsonism was greater than amantadine in comparison to placebo. Three weeks after starting therapy, all monkeys received oral L-dopa to induce dyskinesia (“LID”). LID was less evident in NE3107 treated monkeys compared to amantadine and placebo treated animals. The animals were sacrificed at the end of the study so that brain tissue could be evaluated for neurodegeneration. NE3107 treated animals had approximately twice as many tyrosine hydroxylase expressing neurons in the dopamine producing region of the brain (substantia nigra) compared to placebo (p=0.0108) and more surviving neurons than amantadine, but the difference was not as great. The results of this study showed that NE3107’s anti-inflammatory activity was effective in reducing clinical signs of Parkinson’s disease, and NE3107 also decreased susceptibility to LID. NE3107 treated animals also had less clinical signs of disease when given L-dopa, compared to the combination of amantadine plus L-dopa, or L-dopa plus placebo. As disease progression is linked to neurodegeneration, the observed decrease in neurodegeneration in NE3107 treated animals suggests NE3107 may slow Parkinson’s disease progression in humans. Overall the results suggest NE3107 may have pro-motoric activity in humans with Parkinson’s, and that NE3107 may decrease LID susceptibility and enhance L-dopa activity and slow disease progression. Some of the early results from this study were presented in a poster by Ingrid Philippens at the Society for Neuroscience meeting in San Diego, November 2013.

| 2. | Publication: Nicoletti, F., et al., 17alpha-Ethynyl-androst-5-ene-3beta,7beta,17beta-triol (HE3286) Is Neuroprotective and Reduces Motor Impairment and Neuroinflammation in a Murine MPTP Model of Parkinson's Disease. Parkinsons Dis, 2012. 2012: p. 969418. This study was sponsored by MJFF and conducted in 2011. Evaluation of NE3107 blood-brain-barrier permeability (“BBB”) was conducted by MPI Research (Mattawan, MI and MicroConstants, San Diego, CA); the MPTP model was conducted by Dr. Ferdinando Nicoletti at Catania University, Catania, IT. Summary of results: NE3107 exhibited pro-motoric activity similar to L-dopa, decreased expression of inflammatory mediators in the brain, and decreased neurodegeneration. |

The evaluation of BBB permeability showed that NE3107 freely penetrated the BBB, with no indication of an efflux mechanism. To evaluate NE3107 activity in this model of Parkinson’s disease, mice were briefly treated with MPTP to kill dopamine producing cells. Groups of mice were treated with oral NE3107 (40 mg/kg), placebo, and L-dopa in various combinations for 4 days, evaluated for drug effects on motor function, and then sacrificed to obtain brain tissue to measure inflammatory mediators and neurodegeneration. MPTP treatment significantly decreased motor activity, and NE3107 restored motor activity to the same extent as treatment with L-dopa. The combination of NE3107 and L-dopa was not more effective than either NE3107 or L-dopa alone. NE3107 significantly decreased expression of inflammatory mediators, interleukin 1b (IL-1b, decreased 33%), tumor necrosis factor alpha (TNF-a, decreased 40%), and inducible nitric oxide (iNOS, decreased 20%) compared to placebo. NE3107 also significantly increased surviving hydroxylase positive neurons by 17%. While the MPTP model of Parkinson’s in mice is not considered as robust in predicting activity in humans as the primate model above, overall, the results of this study show that NE3107 can enter the brain at pharmacologically relevant concentrations and exert activity consistent with results in the monkey MPTP model. The results of the moue model suggest NE3107 may be useful to treat parkinsonism in humans and slow the progression of Parkinson’s disease.

| 3. | Publication: Lambert WS, C.B., Formichella CR, Sappington RM, Ahlem C, Calkins DJ, Oral Delivery of a Synthetic Sterol Reduces Axonopathy and Inflammation in a Rodent Model of Glaucoma. Frontiers in Neuroscience, 2017. 11(45). This study was sponsored by Harbor Therapeutics and conducted in 2013, with immunohistochemical analysis of tissues continuing through 2016. The study was performed in the laboratory of Dr. David Calkins at Vanderbilt University, Nashville, TN. Summary of results: NE3107 decreased neurodegeneration, decreased markers of pathogenic inflammation, but did not inhibit homeostatic NFkB activation. |

This study evaluated NE3107 neuroprotective and anti-inflammatory activity in a model of glaucoma that closely mimics the neurodegenerative and neuroinflammatory response to elevated intraocular pressure (“IOP”), which occurs in the retina and optic nerve of humans with glaucoma. IOP was elevated approximately 30% above normal in one eye of test animals by intraocular injection of polystyrene microbeads, while the other eye was injected with a salt solution, which does not affect IOP. Immediately after microbead injection, the rats were divided into three groups for four weeks of once daily oral treatment with 100 mg/kg NE3107, 20 mg/kg NE3107, or placebo. IOP was measured periodically. Two days before the end of the study, animals were anesthetized and both eyes of each were injected with cholera toxin subunit B (“CTB”). CTB is taken up by retinal ganglia cells and transported through the optic nerve axons to the superior colliculus region of the brain. The amount of CTB transported is a function of neuron health, such that stressed neurons in the early stages of neurodegeneration transport less CTB. This deficit in transport occurs before more overt signs of neurodegeneration can be observed. The animals were sacrificed to obtain tissues from the retina, optic nerve, and superior colliculus. Immunohistochemical methods were used to quantify CTB transport and inflammatory cells and markers of inflammation. NE3107 had no effect on IOP, but countered the inflammatory effects of elevated IOP in the retina and optic nerve. Elevated IOP decreased CTB axonal transport in placebo animals approximately 43% compared to fellow eyes that received saline injections. NE3107 at the highest dose almost completely prevented (94% of microbead saline control) the loss of axonal transport of CTB compare. The lower dose of NE3107 was approximately 85% as effective as the high dose. Compared to vehicle, NE3107 increased brain-derived neurotrophic factor (“BDNF”) in the optic nerve head and retina, while decreasing inflammatory and pathogenic proteins associated with elevated IOP compared to vehicle treatment. Especially important among the results was evidence of decreased microglial activation. Treatment with HE3286also increased nuclear localization of the transcription factor NFkB in collicular and retinal neurons (homeostatic function), but decreased NFkB in glial nuclei in the optic nerve head (anti-inflammatory). Overall, these results indicate that NE3107 decreases neurodegeneration, has anti-inflammatory activity in the CNS, and decreases microglial activation, widely recognized as a major driver of neuroinflammation and neurodegeneration. The results also show that NE3107 decreases the inflammatory activity of NFkB, but does not interfere with NFkB homeostatic function, which in neurons promotes neuron survival.

| 4. | Publication: Khan, R.S., et al., HE3286 reduces axonal loss and preserves retinal ganglion cell function in experimental optic neuritis. Invest Ophthalmol Vis Sci, 2014. 55(9): p. 5744-51. This study was sponsored by the University of Pennsylvania, and conducted in 2013 in the laboratory of Dr. Kenneth Shindler at the University of Pennsylvania. Summary of results: Compared to placebo, NE3107 decreased vision loss, attenuated inflammation, demyelination, optic nerve axonal loss, and retinal ganglion loss. |

This study evaluated NE3107 in a mouse model of optic neuritis, which in humans is an autoimmune neuroinflammatory condition of the optic nerve that can occur in the early stages of multiple sclerosis. Experimental autoimmune encephalomyelitis (“EAE”) was induced in groups of female mice with myelin oligodendrocyte glycoprotein peptide immunization. Mice were treated daily with intraperitoneal injection of placebo (saline) or 40 mg/kg NE3107 from day 1 (24 h post-immunization) and continued until sacrifice at day 40 post-immunization. Disease severity was monitored by EAE score and visual function (optokinetic responses, OKR). After 40 days the mice were sacrificed and retinal and optic nerve tissue was collected for evaluation of neuroinflammatory markers. NE3107 had a small but statistically significant effect to delay the onset of EAE symptoms compared to vehicle (day 12 vs. day 17, P<0.05). Compared to vehicle, NE3107 significantly improved optokinetic responses (visual function, P<0.001)), decreased inflammatory cell (Iba1 positive) infiltration (P<0.001) into the optic nerve and attendant demyelination (P<0.001). NE3107 also reduced neurodegeneration as assessed by preservation of neurofilament content of the optic nerve (P<0.01) and a small, but significant decrease in the loss of retinal cell ganglia from the temporal retinal quadrant (P<0.05). Overall, these study results are consistent with results in models of Parkinson’s and glaucoma, which demonstrated NE3107 activity against neuroinflammation and neurodegeneration.

| 5. | Unpublished Report: Anti-inflammatory treatment of drug resistant epilepsy with HE3286. This study was sponsored by the Epilepsy Foundation, and conducted in 2013 in the laboratory of Dr. Annamaria Vezzani at the Mario Negri Institute for Pharmacological research in Milan, Italy. Summary of results: in a mouse model of acute seizure, NE3107 significantly reduced the number of seizures and time in ictal activity (time in seizures). NE3107 did not reduce any aspect of seizure frequency or severity in an experimental (unvalidated) model of chronic seizure. |

In the acute seizure model, kainic acid was injected unilaterally into the left hippocampus (7ng/0.5µL) in freely moving C57BL6N mice. NE3107 (40mg/kg) or placebo were injected intraperitoneally 30 minutes before kainic acid. Acute electroencephalogram (“EEG”) seizures were measured in a 3 h period following kainate injection. The mice were not sacrificed after the acute seizure observations, and were preserved for evaluation in model of chronic seizures. NE3107 decreased the number of seizures and time in ictal activity approximately 50% (p<0.01), but did not affect time to seizure onset, average seizure duration, or time between seizures. Mice from the acute seizure phase of the study were used to observe potential NE3107 activity against chronic seizures, which develop approximately 2 months after hippocampal kainic acid injection. Two months after kainic acid injection, mice received twice daily injections of 20 mg/kg NE3107 or placebo for 9 days, during which EEG was continuously monitored. NE3107 had no anti-seizure activity in this model. Overall, the results in the acute seizure model may support additional nonclinical investigations to better understand if any translation to a meaningful clinical indication exists. The results from the unvalidated chronic seizure model suggest that positive data from other seizure models would be needed before contemplating clinical trials in epilepsy.

| 6. | Published Report: Ahlem, C., et al., HE3286: a novel synthetic steroid as an oral treatment for autoimmune disease. Ann N Y Acad Sci, 2009. 1173: p. 781-90. This study was sponsored by Hollis-Eden Pharmaceuticals, and was conducted in 2007-2008 by Dr. Ferdinando Nicoletti in his laboratory at the University of Catania, Catania, IT. Summary of results from experimental autoimmune encephalomyelitis (EAE) investigation: NE3107 in a dose responsive manner significantly delayed onset of disease and reduced clinical signs of EAE. NE3107’s activity was not diminished by co-administration of the estrogen receptor antagonist, ICI 182780. |

This study evaluated NE3107 against EAE in mice, which is an autoimmune disease resembling multiple sclerosis in humans. EAE was induced in mice by injection of myelin sheath peptide (myelin proteolipid, PLP). The autoimmune disease process was allowed to proceed until the appearance of clinical signs (approximately day 8-13 days) before initiating therapy with oral 40 or 4 mg/kg NE3107, or placebo for approximately 4 weeks. Another group of mice treated with 40 mg/kg NE3107 were also treated contemporaneously with injections of 10 mg/kg of an estrogen receptor antagonist, ICI 182780 to see if the estrogen receptor was involved in NE3107’s mechanism of action. Compared to vehicle, the 40 mg/kg dose of NE3107 delayed disease onset by 6 days (18.7 vs. 12.4), reduced incidence (100% vs. 70%) and decreased the cumulative disease score 13.1 vs. 16.9). The ICI compound had no effect on NE3107 activity or intrinsic activity against EAE when administered alone, but was effect as an estrogen receptor antagonist as indicated by decreased uterine weights compared to vehicle. Overall, the results from this study suggest NE3107 is active against inflammatory autoimmune processes in the CNS, and this activity is independent of estrogen receptor activity. This study was not designed to determine if the observed anti-inflammatory activity was directed at glial cells within the CNS or peripheral inflammatory cell infiltrating into the CNS.

Clinical Trials

With the acquisition of assets from Harbor Therapeutics (originally Hollis-Eden Pharmaceuticals), NeurMedix gained all rights, data, and full control of an open IND with the FDA DMEP. Clinical trials of NE3107 activity in pre-diabetic and type 2 diabetes subjects were performed under this IND by Hollis-Eden. NeurMedix has not filed an IND or conducted a clinical trial as of the date this offering was prepared. NE3107, previously designated HE3286, was investigated by Hollis-Eden Pharmaceuticals in a total of 176 subjects in six clinical studies from 2006 to 2010. The cumulative exposure to date totals 20.9 subject/patient years. Six clinical studies have been completed to date. Two Phase I studies and the human clinical safety data from all studies are directly applicable to neuroinflammation clinical trials in the FDA DNP. The two Phase I studies, Study HE3286-100, which measured NE3107 safety, pharmacokinetics, and drug metabolism, is applicable to any clinical development plan, including anticipated neuroinflammation clinical trials, and Study HE3286-102, which measured drug safety, pharmacokinetics, and peripheral anti-inflammatory activity, is also applicable to any clinical development plan, especially involving treatment of neuroinflammatory disease. Clinical trial HE3286-102 measured glucose disposal parameters, insulin resistance, and inflammation in a pre-diabetic population with evidence of systemic inflammation. Clinical trial HE3286-401 measured glucose disposal parameters in type 2 diabetes, with a subset of the patients (approximately 50%) having the obese inflamed phenotype in which NE3107 anti-inflammatory was shown to be active against features of type 2 diabetes. NeurMedix plans to submit data from these two trials to the FDA DNP in support of Alzheimer’s disease investigations, but at the time this document was prepared has not discussed this data or its potential impact on IND submissions or clinical trial design with the FDA DNP. All four of these studies were conducted by the previous owner of the technology, Hollis-Eden Pharmaceuticals. Dr. Christopher Reading and Clarence Ahlem were involved in study design and analysis and publication of results as employees of Hollis-Eden Pharmaceuticals. The drug has been well tolerated and exhibited an excellent safety profile in all HE3286/NE3107 trials conducted to date. Previous clinical experience with NE3107 is summarized below:

Study HE3286-100

Study HE3286-100 was conducted under IND #77,339 (Division of Metabolism and Endocrinology Products), was initiated in May 2007 and completed in July, 2007, and was sponsored by Hollis-Eden Pharmaceuticals, Inc. It was a phase I, single blind, placebo-controlled, dose escalation study of the safety, tolerance and pharmacokinetics of HE3286 when administered orally to healthy adult subjects. It was conducted by dgd (Diabetes and Glandular Disease) Research, Inc. San Antonio, TX, USA. Trial size was 34 subjects. Primary objectives of the study were safety and tolerance of HE3286 and determination of the pharmacokinetic profile of HE3286 during the fasted state and the potential food effect on drug exposure. SAFETY: There were 13 treatment emergent adverse events (AEs) categories observed in two or more subjects receiving HE3286. Eight of these were also observed in placebo subjects. The remaining five were grade 1 blood calcium increased, grade 1 blood creatinine increased, grade 1 blood potassium decreased, grade 1 blood sodium decreased, and grade 1 dizziness, all considered unrelated to study drug by the investigator. No deaths occurred in the study. The results indicated that HE3286 was safe and well tolerated. All safety data was submitted to the IND. Analysis of pharmacokinetics parameters indicated HE3286 was orally bioavailable in humans, with comparable pharmacokinetics in males and females. Drug exposure, approximately 10 ng.h/mL per administered milligram was dose proportional up to 100 mg (highest dose tested), was not decreased by food, or altered by dividing the dose for twice daily administration. The terminal drug half-life was approximately 6-8 h. An extensive analysis of drug metabolites in these subjects indicated that all drug metabolites had been previously observed in nonclinical safety studies in rats and dogs.

Study HE3286-102

Study HE3286-102 was conducted under IND #77,339 (Division of Metabolism and Endocrinology Products), was initiated in October 2007 and completed in October, 2009, and was sponsored by Hollis-Eden Pharmaceuticals, Inc. It was a Phase I, double-blind, placebo-controlled, dose ranging study of the safety, tolerance, pharmacokinetics and potential activity of HE3286 when administered orally to obese adult subjects for 28 days. An additional cohort of type 2 diabetic subjects was added by amendment for safety evaluation. The study was conducted at two sites: dgd Research, San Antonio, TX, USA, and Pennington Biomedical Research Center, Baton Rouge, LA, USA. Trial size was 35 obese healthy subjects and 13 type 2 diabetic subjects. The primary objectives were safety and tolerance of placebo and five dose levels of HE3286 (4 mg, 5 mg, 10 mg, 20 mg and 40 mg) when administered orally over 28 days, pharmacokinetic (“PK”) profiles of HE3286 at different dose levels after 28 days of dosing, potential activity of HE3286 to decrease insulin resistance, and safety and tolerance of HE3286 (10 mg) when administered orally over 28 days to subjects with type 2 diabetes mellitus. SAFETY: There were two SAEs in the obese healthy subjects receiving HE3286. Blood amylase was increased (grade 3, considered possibly related to study drug by the investigator) two weeks after the last 20 mg HE3286 dose, in a subject that had elevated amylase prior to treatment, and this SAE resolved by the next assessment. Lymphocyte count was decreased in a subject two weeks after the last 20 mg HE3286 dose (grade 3, considered possible related to study drug by the investigator) and this SAE resolved by the next assessment. Three type 2 diabetes subjects experienced SAEs. Lipase was elevated (grade 3 considered, unrelated to study drug by the investigator) in a subject four weeks after the last 10 mg HE3286 dose. One subject had elevated blood glucose increased (grade 3, considered unrelated to study drug by the investigator) after 10 mg HE3286 treatment; this subject had an episode of elevated blood glucose (grade 3) prior to the first HE3286 treatment. This subject also had glucose in urine (grade 3, considered unrelated to study drug) two weeks after the last 10 mg HE3286 dose; this subject had an episode of glucose in urine (grade 3) prior to the first HE3286 treatment. In addition to the above SAEs, there were 26 categories of treatment emergent AEs observed in two or more obese healthy subjects receiving HE3286. Twenty of these were also observed in the obese placebo subjects. The remaining six were Blood cholesterol increased in four subjects (grade 1 in two subjects in the 5 mg HE3286 cohort and two subjects in the 10 mg HE3286 cohort), Red blood cells urine in three subjects (grade 1 in two subjects and grade 2 in one subject in the 10 mg HE3286 cohort), Toothache in two subjects (grade 1 in two subjects in the 20 mg cohort), Dizziness in two subjects (one grade 1 in the 5 mg cohort and one grade 2 in the 10 mg cohort subjects), and Sinus congestion in two subjects (grade 1 in two subjects in the 5 mg cohort). In addition to the above SAEs, there were 14 categories of treatment emergent AEs observed in 2 or more T2DM subjects in this open label 10 mg HE3286 cohort. Twelve of these were also observed in the obese healthy placebo subjects in this study. The remaining two were Blood cholesterol increased in 2 subjects (grade 1), Glucose urine in four subjects (grade 1 in two subjects and grade two in one subject). HE3286 was considered to be safe and well tolerated when administered to obese healthy subjects or subjects with type 2 diabetes. There was no trend in AEs to differentiate between placebo- and HE3286-treated subjects, nor was there an increase in AEs with dose escalation. No patient died while on study. All safety data was submitted to the IND. Pharmacokinetics in this population did not differ from subjects in trial HE3286-100. HE3286 was shown to improve insulin sensitivity in obese subjects in this study (see publication details above).

Study HE3286-0103

Study HE3286-0103 was conducted under IND #77,339 (Division of Metabolism and Endocrinology Products), was initiated in July 2009 and completed in July, 2010, and was sponsored by Hollis-Eden Pharmaceuticals, Inc. It was a Phase I, open label study of the safety tolerance and assessment of HE3286 in Insulin sensitivity and hepatic glucose production when administered orally to obese insulin-resistant adult subjects for 28 days. The study was conducted at Pennington Biomedical Research Center, Baton Rouge, LA, USA. The trial size was 6 subjects. The primary objectives were safety and tolerance of 29 mg (10 mg BID) of HE3286 and the activity of HE3286 on insulin sensitivity and hepatic glucose production in obese insulin-resistant subjects. SAFETY: Blood triglycerides were increased in one subject (grade 3, assessed as unrelated to study drug by the investigator) in one subject four weeks after the last 20 mg HE3286 dose. There were 6 categories of treatment emergent adverse events occurring in two or more subjects receiving HE3286 (increases in blood bicarbonate, calcium, glucose, triglycerides and uric acid, and decreases in blood sodium and in haemoglobin). No deaths occurred in the study. Administration of HE3286 was found to be safe and well tolerated in the study. All safety data was submitted to the IND. Technical difficulties in two-stage hyperinsulinemic euglycemic isotopic glucose clamp studies did not allow firm conclusions regarding hepatic glucose production and insulin resistance.

Study HE3286-0201

Study HE3286-0201 was conducted under IND #79,315 (Division of Anesthesia, Analgesia and Rheumatology Products), was initiated in August 2008 and completed in June 2009, and was sponsored by Hollis-Eden Pharmaceuticals, Inc. It was a Phase I/II, open label, dose ranging study of the safety, tolerance, pharmacokinetics and potential activity of HE3286 when administered orally for 29 days to patients with rheumatoid arthritis on a stable dose of methotrexate. The study was conducted by Impact Clinical Trials, Beverly Hills, CA, USA. The trial size was 14 subjects. The primary objectives of the study were safety and tolerance of HE3286 (10 mg, 20 mg, 40 mg) when administered orally daily over 29 days to patients with Rheumatoid Arthritis receiving a stable dose of methotrexate, pharmacokinetic and metabolism profiles of methotrexate and HE3286 at different dose levels during 29 days of dosing, and potential anti-inflammatory activity of HE3286 in patients with rheumatoid arthritis. SAFETY: Abdominal upper pain (grade 3, considered unrelated to study drug by the investigator) occurred in a subject with history of gastrointestinal reflux disease. Lipase was increased (grade 3, considered possibly related to study drug by the investigator) in a subject 9 days after the last 40 mg dose of HE3286. Blood creatinine phosphokinase was increased (grade 3, considered unrelated to study drug by the investigator) in a subject four weeks after the last 10 mg HE3286 dose with an episode of increased creatinine phosphokinase (grade 3) prior to the first HE3286 dose. The most frequent treatment emergent AEs occurring in two or more subjects in this study were grade 1 blood increases in cholesterol (one at 10 mg, three at 20 mg, and one at 40 mg), and in lactate dehydrogenase (two at 10 mg, one at 20 mg and one at 40 mg). No deaths occurred in the study. Administration of HE3286 was found to be safe and well tolerated in the study. All safety data was submitted to the IND. There was no evidence of drug interaction between HE3286 and methotrexate. HE3286 pharmacokinetics in subjects receiving methotrexate were similar to normal subjects; HE3286 did not alter methotrexate pharmacokinetics. There was insufficient information in this small drug-drug interaction study to reach a conclusion regarding anti-inflammatory activity in rheumatoid arthritis subjects.

Study HE3286-0301

Study HE3286-0301 was conducted under IND #79,334 (Division of Gastroenterology Products), was initiated in January 2008 and completed in July, 2009, and was sponsored by Hollis-Eden Pharmaceuticals, Inc. It was a Phase I/II double blind, randomized, placebo-controlled, dose ranging study of the safety, tolerance, pharmacokinetics and activity of HE3286 when administered orally to patients with active, mild-to-moderate ulcerative colitis. The study was conducted in 11 study centers: Univ. Louisville, Louisville, KY; Scripps Clinic Torrey Pines, La Jolla, CA; Shafran Gastroenterology Center, Winter Park, FL; Atlanta Gastroenterology Assoc., Atlanta, GA; Rocky Mountain Gastroenterology, (Dr. Golf), Golden CO; Rocky Mountain Gastroenterology Center, (Dr. Trouillet), Golden, CO; Adv. Clin. Res., Anaheim, CA; Texas Tech U HSC, Lubbock, TX; Adobe Gastroenterology Res. Tucson AZ; Capital Gastro Medical Group, Roseville, CA; and Rocky Mountain Clin Res. Golden, CO. The trial size was 27 subjects. The primary objectives were safety, tolerance and pharmacokinetics of placebo and four dose levels of HE3286 when administered orally for 28 days, and activity of HE3286 on the signs and symptoms of active mild-to-moderate ulcerative colitis. SAFETY: One subject receiving 5 mg HE3286 developed chest pain and pneumonia (grade 2, considered unrelated to study drug by the investigator). One subject receiving 5 mg HE3286 exhibited decreased lymphocyte count (grade 3, considered unrelated to study drug by the investigator) that resolved before the next assessment. One subject had a Lipase increase (grade 3, considered possibly related to study drug by the investigator) that resolved before the next assessment. One subject receiving 5 mg HE3286 developed a grade 2 ulcerative colitis flare (grade 2, considered possibly related to the study drug by the investigator) that resolved completely. Of the 16 categories of treatment emergent AEs in two or more HE3286 subjects, nine occurred in placebo. In addition to the SAEs above, the remaining seven were increased blood amylase in two subjects (grade 1 [10 and 20 mg HE3286]), lipase in four subjects (grade 1 [10 mg and two 20 mg]), decreased sodium in two subjects (grade 1 [10 and 20 mg HE3286]) and lymphocytes in three subjects (grade 1 [5 mg], grade 2 [10 mg]), red blood cells urine in three subjects (grade 1 [10 mg] and grade 2 [10 mg HE3286]), colitis ulcerative in three subjects (grade 1 [20 mg], grade 2 [5 and 10 mg HE3286]), and upper respiratory tract infection in two subjects (grade 1 [5 mg] and grade 2 [10 mg]). Of these, the increased blood amylase in the 10 mg HE3286, and increased lipase in the 10 mg, HE3286 subject were considered possibly related to HE3286. There were no deaths in this study. Administration of HE3286 was found to be safe and well tolerated in this study. All safety data was submitted to the IND. Estimates of drug exposure with a sparse sampling schedule indicated that pharmacokinetics in this population was similar normal subjects. Due to the failure to detect early ulcerative colitis flares at screening, the population was not optimal for analysis of activity of HE3286 in mild-to moderate UC.

Study HE3286-0401

Study HE3286-0401 was conducted under IND #77,339 (Division of Metabolism and Endocrinology Products), was initiated in July 2008 and completed in January, 2010, and was sponsored by Hollis-Eden Pharmaceuticals, Inc. It was a Phase II, double blind, randomized, placebo-controlled study of the safety, tolerance and activity of HE3286 when administered orally for 12 weeks to adult patients with type 2 diabetes mellitus. The study was conducted in 21 study centers: Dgd Research, Inc. San Antonio, TX, USA; Impact Clinical Trials (Dr. Hazan), Beverly Hills, CA, USA; Impact Clinical Trials (Dr. Madoff), Los Angeles, CA, USA; Impact Clinical Trials (Dr. Lowe), Los Angeles, CA, USA; National Research Center, Los Angeles, CA, USA; Novellus Research Sites (Dr. Heller), La Jolla, CA, USA; NuLife Clinical Research, Inc., Anaheim, CA, USA; Associated Pharmaceutical Research Center, Inc., Buena Park, CA, USA; MedCenter Investigation, Inc., Fair Oaks, CA, USA; Medical Research Incorporated of Las Vegas, Las Vegas, NV, USA; Research Center of Fresno, Inc., Orange, CA, USA; Texas Tech University Health Sciences Center, El Paso, TX, USA; Clinical Trials Research, Sacramento, CA, USA; Synergy Clinical Research, National City, CA, USA; Time Clinical Research, La Palma, CA, USA; Translational Research Grp. Inc., Philadelphia, PA, USA; Novellus Research Sites (Dr. Ratniewski), La Jolla, CA, USA; Radiant Research (Dr. Berwald), Seattle, WA, USA; Radiant Research (Dr. Adams), Seattle, WA, USA; Clinical Investigation Specialists, Gumee, IL, USA; Apex Medical Research; Chicago, IL, USA. The trial size was 94 subjects. The primary objectives were change in hemoglobin A1c (HbA1c) from baseline to week 12 in the HE3286 treated group when compared to the placebo group; safety and tolerance of HE3286 10 mg per day (5 mg twice daily (BID)) compared to placebo from baseline to week 12. The secondary objectives were the effect of HE3286 on fasting blood glucose over time; the effect of HE3286 on lipids (cholesterol, HDL, LDL, TG, etc.) over time; the effect of HE3286 on insulin sensitivity (insulin, C-peptide, HOMA2, fructosamine, etc.) over time; and the effect of HE3286 on serum cytokines, adipokines and chemokines and LPS stimulated PBMC inflammatory cytokine expression. SAFETY: There were four SAEs in HE3286 subjects, one of which was a lab error, and another due to a criminal attack. One (Grade 3 Blood amylase increased) was considered possibly related to HE3286 by the investigator. One subject experienced a blood amylase increase (grade 3, considered unrelated to study drug by the investigator) in a 10 mg HE3286 subject with elevated amylase (grade 1) prior to HE3286 administration, and returned to grade 1 at the next assessment. There were 12 treatment emergent AE categories observed in two or more subjects receiving HE3286. Ten of these were also observed in placebo subjects. The remaining two categories were: two grade 1 and one grade 2 hemoglobin decreased in three metformin + 10 mg HE3286 subjects, and grade 2 back pain in two metformin + 10 mg HE3286 subjects. Each of these AEs were considered as unrelated to the study drug by the investigators. No deaths occurred in the study. Administration of HE3286 was found to be safe and well tolerated in the study. All safety data was submitted to the IND. Although the existing data at the time of the initiation of this study argued that HE3286 would improve insulin sensitivity only in obese, inflamed, insulin-resistant subjects, the sponsor decided to include all subjects (obese and non-obese, inflamed and non-inflamed, and insulin resistant and insulin-sensitive) in this study. Because of this, the primary objective of decreasing hemoglobin A1c in all HE3286-treated subjects was not obtained. The primary objective of safety and tolerability was met. Analysis of the clinical data revealed that HE3286 did have a significant effect on 1,5-anhydroglucitol (a surrogate of postprandial glucose), meeting the secondary objective of activity on glucose levels, and significant effects on insulin sensitivity in the target populations (obese and inflamed). Due to financial constraints of the sponsor, the collection and analysis of cytokines, adipokines, chemokines and LPS stimulated peripheral blood inflammatory cytokine expression was curtailed. See the publication details above for more information.

We believe that we have obtained all worldwide patent and related intellectual property rights to the NE3107 therapies, which we believe will significantly enhance shareholder value . Our patent protection extends to 2034, and will be lengthened by extensions and successor molecules in development.

NE3107, administered orally in a pill, penetrates the blood-brain barrier, stays in the brain long enough to register its desired effect, and to date has not demonstrated significant toxicity in animal studies at up to 40 times the human dose. No drug related, clinically significant side effects have been observed in human studies. NE3107 has no intrinsic interaction with neurotransmitter receptors, but instead acts on inflammatory signaling pathways that influence or modify the course of neuroinflammatory diseases. In this manner NE3107 acts indirectly against the manifestation of disease symptoms, in contrast to drugs that directly interfere with nerve signal transmission (such as a narcotic pain reliever) or directly stimulate or block the activity of neurotransmitter receptors (such as L-dopa acting to directly aid movement in Parkinson’s disease). The general term for this indirect mechanism of activity is disease modifying. Disease modifying agents for neurological conditions are desirable treatment options because they are generally believed to alter disease progression, and associated with less toxicity and fewer side effects than conventional neuro-active drugs. Neuroinflammation promotes neurological disease and is a major factor in neurodegeneration. NE3107 decreases neuroinflammation, and the scientific literature strongly supports the belief that this may slow disease progression for diseases such as Alzheimer’s and Parkinson’s disease, although this has not been demonstrated for NE3107 in humans.

Based on ’NE3107's anti-inflammatory activity and MOA, we are currently targeting four distinct diseases. One of these, namely, Post-Operative Cognitive Dysfunction (“POCD”), may receive the FDA’s “Breakthrough” designation. This designation is applicable when there aren’t any drugs approved to treat the disease, and the disease represents a significant unmet medical need. It is possible that demonstration of efficacy in a single study could lead to commercial approval with a requirement for follow-up studies post approval. The third, L-dopa Induced Dyskinesia (“LID”), a highly debilitating aspect of Parkinson’s disease, has received “Orphan drug” status. ERK’s hyper activation is necessary for LID; hence NE3107’s efficacy in LID in the primate study. The fourth disease we are targeting is Migraine Prophylaxis, and we are currently planning to conduct a Phase II prophylactic migraine study. ERK’s hyper activation is also implicated in the scientific literature to cause migraines. If efficacious, NE3107 will fulfill a great need for a safe, oral, prophylactic migraine medication, which remains largely unmet by current medications.

We currently have three early pre-clinical stage product candidates in addition to NE3107, all of which will require extensive preclinical and clinical evaluation, regulatory review and approval, significant marketing efforts and substantial investment before such product candidates and any successors could provide us with any revenue. As a result, if we do not successfully develop, achieve regulatory approval, and commercialize NE3107, we will be unable to generate any revenue for many years, if at all. We do not anticipate that we will generate revenue for at least several years, and we do not anticipate achieving profitability for at least several years after generating material revenue, if at all. If we are unable to generate revenue, we will not become profitable, and we may be unable to continue our operations.

NE3107 for Alzheimer’s Disease

Alzheimer's disease is a progressive neurodegenerative disease characterized by the progressive decline of memory, cognitive functions, and changes in behavior and personality. Alzheimer’s disease is the one of the leading causes of death in the United States, especially for those aged 65 and older. The cost of patient care for Alzheimer’s disease is estimated near $260 billion for 2017, and that amount is expected to rise dramatically in the next decade.

Alzheimer’s disease is associated with type 2 diabetes and insulin resistance epidemiologically, and scientific research has revealed a complex intertwining of altered insulin signaling and glucose utilization in type 2 diabetes that has many deleterious effects on brain energy production, cognition, and neuron survival. Although glucose transport into neurons is not entirely insulin dependent (within the brain, basal glucose transport is constitutively active), insulin resistance reduces signaling in several downstream pathways that are important to the regulation of stress kinase activation, cell survival, mitochondria glucose utilization, oxidative stress and cognition. Systemic type 2 diabetes effects also alter blood-brain barrier permeability to decrease glucose availability to neurons and increase infiltration of inflammatory cells. There are many scientific reports describing decreased neurodegeneration and enhanced cognition though improved insulin signaling in Alzheimer’s disease animal models. Importantly, there are recent reports suggesting that the mechanism of action of one of the most widely used drugs for type 2 diabetes, metformin, may actually increase susceptibility to neurodegenerative disease. The clinical observation of this was reported from a large study in Taiwan, which if confirmed elsewhere would suggest an even greater need for new, safe, insulin-sensitizing drugs to combat Alzheimer’s disease and neuroinflammation.

Because NE3107 has already demonstrated clinical activity against type 2 diabetes and insulin resistance, it is well positioned for clinical investigation of its potential to slow disease progression and improve cognition in insulin resistant subjects with Alzheimer’s disease, or at risk of developing Alzheimer’s disease or dementia of a less specific nature. NE3107’s prior experience with the FDA DMEP provides an opportunity to rapidly initiate trials in Alzheimer’s disease susceptible subjects. We note that NE3107’s safety, side effect, and drug-drug interaction profile is favorable, but NE3107’s experience in subjects greater than 65 years of age is limited, and thus a conservative clinical trial model for accessing older subjects, while simultaneously collecting safety data, should be expected, and access to subjects older than 65 YOA may be limited by the FDA until sufficient safety data is collected. We have no evidence in our prior clinical experience or animal studies to suggest accumulating the required safety information will be problematic.

We have not yet discussed Alzheimer’s disease clinical trial design with the FDA DNEP or DNP. We anticipate pursuing a multi-center, placebo controlled, Phase II/a trial design to evaluate several hundred subjects with type 2 diabetes with mild cognitive impairment (MCI) or at immediate risk for developing Alzheimer’s disease, treated for 6 to 12 months, measuring safety and comparing one or two dose levels of NE3107 to placebo for effects on glucose disposal, insulin resistance, and cognitive parameters as a combination of primary and secondary endpoints. The details of the trial will be determined through consultations with the FDA and our medical, biostatistical, and scientific advisors. The large size of the Alzheimer’s disease market and the enormous socioeconomic need to prevent and slow Alzheimer’s disease can be expected to drive a major increase in valuation if NeurMedix can demonstrate significant clinical activity.

NE3107 for Post-Operative Cognitive Dysfunction

Post-Operative Cognitive Dysfunction (“POCD”) is a syndrome of durable cognitive impairment commonly observed in the elderly following major surgery, which is typically several months to several years in duration. POCD is defined by a drop in cognitive performance on a set of neuropsychological tests from before to after surgery, and is usually associated with post-operative mortality and rapid progression of Alzheimer’s disease. While patient age is best predictor of susceptibility (with the most concern for patients over sixty years of age), the type of anesthesia, intraoperative stress, and underlying neurodegenerative disease may be additional risk factors. Accumulating research indicates POCD is driven by neuroinflammation and major surgery greatly increases systemic and neuroinflammation. Few anti-inflammatory agents have an appropriate side effect profile for application to POCD, where immunosuppression, drug-drug interactions and potential for anti-coagulant activity are critical considerations, and glucocorticoids are not effective and are associated with cognitive decline.

We believe effective treatment for POCD is a major unmet medical need, particularly in the United States where more than 16 Million people over the age of sixty undergo major surgery each year. Since up to 40% of the population may be susceptible to POCD and there are no approved medications, and existing drugs do not provide significant protection or lack broad applicability, treatments for POCD, such as NE3107, may be eligible for accelerated approval from the FDA. It is our belief that a POCD treatment would be initiated prior to surgery and is envisioned to be continued for at least several months, possibly years. We believe NE3107’s activity and safety profile is well suited to perioperative and chronic use in a geriatric population, because NE3107 has anti-inflammatory activity against peripheral and central inflammation, the drug also has very low potential for toxicity, is not immunosuppressive, has no intrinsic neuropharmacological activity, has very low potential for drug-drug interactions, and NE3107 has no effect on coagulation.

Clinically, we believe there is a market opportunity for NE3107 as a treatment or POCD for a number of reasons. The characterization and prevention of POCD is a major clinical research effort at Duke University Medical Center (“DUMC”), which has ongoing non-interventional studies of the relationship between peripheral and central nervous system (“CNS”) inflammatory markers and POCD. The contemplated trial designs would add NE3107 intervention to a POCD characterization study in non-cardiac major surgery, using the oldest subjects possible to increase POCD susceptibility and decrease the number of subjects needed to decrease cost and time. In addition to supporting the use of NE3107 in POCD, the clinical evaluation would yield objective anti-inflammatory data that would be valuable for development of other neuroinflammatory indications and partnering and should cause a major valuation inflection.

NE3107 for Parkinson’s Disease

Our rationale for NE3107 to treat Parkinson’s disease is based on the premise that immunomodulatory mechanisms that are attenuated by NE3107 drive pathophysiology in Parkinson’s disease. We initiated investigations in Parkinson’s disease because of the well-established link between Parkinson’s disease and activated microglia and neuroinflammation. Our research has demonstrated that NE3107 is efficacious in rodent and primate Parkinson’s disease models. We obtained a Michael J. Fox Foundation (“MJFF”) grant to study BBB permeability, motor activity, and neurodegeneration in mice (4-day MPTP model), and another MJFF grant to study activity against parkinsonism, LID, and neurodegeneration in monkeys (14-week MPTP model). Our study in mice showed excellent BBB penetration, mobility improvement equal to L-dopa, decreased brain inflammatory markers, and decreased neuron stress/death. Our study in monkeys showed decreased parkinsonism, decreased LID development, and decreased neurodegeneration. The fact that NE3107 showed a decreased development of LID, is extremely promising because LID is a highly debilitating aspect of Parkinson’s disease. Furthermore, in a marmoset model, NE3107 decreased the development of dyskinesia (abnormal involuntary movement scale or “AIMS”), without decreasing the beneficial activity of L-dopa. Our research has shown that:

| ● | NE3107 monotherapy improves clinical scores, comparable to L-dopa in mice; |

| ● | NE3107 + L-dopa improves clinical score, mobility, and apathy greater than L-dopa alone or amantadine + L-dopa in marmosets; |

| ● | NE3107 decreases the development of L-dopa induced dyskinesias in marmosets; and |

| ● | NE3107 decreases neuron death (neuroprotection) in marmosets, which correlates to slowing clinical progression. |

We believe the marketplace opportunity for NE3107 in the treatment of Parkinson’s disease to be significant. There is currently an unmet medical need for safe, efficacious interventions to: (i) improve motor symptomatic therapies with lower dyskinesia induction liability; (ii) prevent development of dyskinesias; (iii) slow disease progression; and (iv) treat cognitive impairment. Statistics indicate there are approximately 2.5 million people with Parkinson’s disease in the United States, Europe and Japan, and the expectation is that the number of people with Parkinson’s disease is expected to double in the next fifteen (15) years or so. As a result, we believe the treatment of Parkinson’s disease to be a multi-billion-dollar market opportunity. Set forth below is a summary of our current Parkinson’s disease development plan:

| Parkinson’s Disease Development Plan |

| Therapeutic | Clinical Indication | Trial Phase & Duration |

| NE3107 | L-dopa Interaction and motoric activity study | Phase IB, Trial duration: 6 – 9 months |

| | Dyskinesia prevention | Phase II, Trial duration: 12 – 18 months |

| | Disease modification | Phase III/IV, Trial duration: 2 – 3 years |

NE3107 for Migraine Prophylaxis

Migraine is a neuroinflammatory condition. Migraine pathophysiology is mediated, in part, by the neuro-active peptide, calcitonin-gene related peptide (“CGRP”), which exerts its activity through inflammatory signaling mechanisms that can be diminished by NE3107’s activity against ERK hyperactivation (“p-ERK”). Migraine headache is experienced by 17% of women and 6% of men and migraine prevention is the ultimate migraine therapy. Both large and small pharmaceutical companies are pursuing prevention strategies based on anti-CGRP antibodies, which are high cost, must be injected and achieve about 50% reduction in 50% of the population, leaving a large opportunity for an oral, moderately priced therapy with a safe and unique mechanism of action. The total migraine market was estimated to be in excess of $4.5 Billion in 2016, and there’s been significant merger and acquisition activity in the migraine therapy space in recent years.

NE3107 for Hematological Cancers